|

|

市場調査レポート

商品コード

1491987

臭素の世界市場:誘導体別、用途別、エンドユーザー別、地域別 - 予測(~2029年)Bromine Market by Derivative (Organobromine, Clear Brine Fluids and Hydrogen Bromide), Application (Flame Retardants, PTA Synthesis, Water Treatment & Biocides, HBR Flow Batteries), End-user & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 臭素の世界市場:誘導体別、用途別、エンドユーザー別、地域別 - 予測(~2029年) |

|

出版日: 2024年06月04日

発行: MarketsandMarkets

ページ情報: 英文 336 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の臭素の市場規模は、2024年の26億米ドルから2029年までに33億米ドルに達し、2024年~2029年にCAGRで4.6%の成長が見込まれます。

市場成長の大きな要因の1つは、世界中での火災安全規制および基準の重視です。臭素系難燃剤は、電子、テキスタイル、自動車、建設産業で使用される材料の燃焼性を低下させます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 金額(100万米ドル/10億米ドル)、数量(キロトン) |

| セグメント | 誘導体、用途、地域 |

| 対象地域 | 北米、西欧、中欧・東欧、アジア太平洋、南米、中東・アフリカ |

「有機臭素セグメントが予測期間に最大のシェアを占める見込みです。」

アジア太平洋、ラテンアメリカ、中東などの新興経済圏からの需要が増加しており、地理的な拡大が見られます。これらの地域では工業化、都市化、インフラ開発が急速に進んでおり、さまざまな産業で有機臭素化合物の需要が高まっています。

「難燃剤セグメントが予測期間に最大の市場シェアを占める見込みです。」

厳しい火災安全基準を満たし、熱安定性、耐久性、環境持続性などの望ましい特性を提供する高性能難燃材料への需要が高まっています。臭素系難燃剤は、材料の完全性を維持しながら難燃性を付与する効果で知られており、さまざまな用途で好ましい選択肢となっています。

「アジア太平洋が予測期間に臭素市場の最大のシェアを占める見込みです。」

環境規制と持続可能性への懸念が、同地域の臭素の市場力学を形成しつつあります。規制機関は、臭素系難燃剤の潜在的な環境と健康に対する影響から、その使用に関してより厳しい規範を課しています。このため、代替難燃剤へのシフトが進み、環境汚染を減らす臭素含有製品のリサイクルに注目が集まっています。

当レポートでは、世界の臭素市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 臭素市場の企業にとって魅力的な機会

- 臭素市場:誘導体別

- アジア太平洋の臭素市場:誘導体別、国別

- 臭素市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

第6章 産業動向

- ケーススタディ分析

- 臭素の使用とリサイクル

- ヨーロッパにおける臭素系難燃剤が廃プラスチックのリサイクルに与える影響

- 臭化アンモニウムが綿織物の難燃性に与える影響

- 主な会議とイベント(2024年~2025年)

- さまざまな製品量の発売戦略

- 臭素の製品量に関する発売戦略

- 臭素の需給均衡の崩壊

- 平均販売価格分析

- 臭素系難燃剤:概要

- イントロダクション

- 臭素系難燃剤

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向と混乱

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- エコシステム/市場マップ

- 規制情勢

- 特許分析

- 主なステークホルダーと購入基準

- 投資と資金調達のシナリオ

第7章 臭素市場:誘導体別

- イントロダクション

- 有機臭素

- 透明塩水

- 臭化水素

第8章 臭素市場:エンドユーザー別

- イントロダクション

- 石油・ガス

- 自動車

- 電気・電子

- 農業

- 製薬

- 化粧品

- テキスタイル

- その他

第9章 臭素市場:用途別

- イントロダクション

- 難燃剤

- 水処理・殺生物剤

- 水銀排出抑制

- 石油・ガス掘削

- 臭化水素フロー電池

- PTA合成

- 農薬

- プラズマエッチング

- 医薬品

- ブチルゴム

- その他の用途

第10章 臭素市場:地域別

- イントロダクション

- アジア太平洋

- アジア太平洋に対する不況の影響

- 中国

- 日本

- インド

- 韓国

- 台湾

- その他のアジア太平洋

- 北米

- 北米に対する不況の影響

- 米国

- カナダ

- メキシコ

- 西欧

- 西欧に対する不況の影響

- ドイツ

- フランス

- 英国

- その他の西欧

- 中欧・東欧

- 中欧・東欧に対する不況の影響

- ロシア

- トルコ

- その他の中欧・東欧

- 中東・アフリカ

- 中東・アフリカに対する不況の影響

- GCC諸国

- サウジアラビア

- アラブ首長国連邦

- その他のGCC諸国

- 南アフリカ

- その他の中東・アフリカ

- 南米

- 南米に対する不況の影響

- ブラジル

- アルゼンチン

- その他の南米

第11章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 市場上位5社の収益分析

- 市場シェア分析:臭素市場(2023年)

- ブランド/製品の比較分析

- ICL GROUP LTD

- ALBEMARLE CORPORATION

- TOSOH CORPORATION

- LANXESS AG

- TETRA TECHNOLOGIES INC.

- 企業評価マトリクス:主要企業(2023年)

- 企業フットプリント分析

- 企業評価マトリクス:スタートアップ/中小企業(2023年)

- 競合ベンチマーキング

- 臭素メーカーの評価と財務指標

- 競合シナリオと動向

第12章 企業プロファイル

- イントロダクション

- 主要企業

- ICL GROUP LIMITED

- ALBEMARLE CORPORATION

- LANXESS AG

- TOSOH CORPORATION

- GULF RESOURCES INC.

- TETRA TECHNOLOGIES, INC.

- TATA CHEMICALS LIMITED

- HINDUSTAN SALTS LIMITED

- HONEYWELL INTERNATIONAL INC.

- ARCHEAN CHEMICAL INDUSTRIES LTD

- AGROCEL INDUSTRIES PVT LTD.

- PEREKOP BROMINE FACTORY

- SATYESH BRINECHEM PVT. LTD.

- その他の企業

- MORRE-TEC INDUSTRIES INC.

- SHANDONG YUYUAN GROUP CO., LTD.

- SHANDONG HAIWANG CHEMICAL CO., LTD.

- SHANDONG HAIHUA GROUP CO., LTD.

- SHANDONG OCEAN CHEMICAL CO., LTD.

- SHANDONG WEIFANG LONGWEI INDUSTRIAL CO., LTD.

- SHANDONG RUNKE CHEMICAL ENGINEERING CO., LTD.

- DHRUV CHEM INDUSTRIES

- SHANDONG LUBEI CHEMICAL CO., LTD.

- SHANDONG HAOYUAN GROUP

- CHEMCON SPECIALITY CHEMICALS LTD.

- SANGFROID CHEMICALS PVT. LTD.

- CHEMADA INDUSTRIES LTD.

- VINYL KFT.

第13章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 臭素市場の相互接続市場

- 難燃剤市場:タイプ別

- アルミニウム三水和物(ATH)

- 酸化アンチモン

- 臭素系難燃剤

- 塩素系難燃剤

- リン系難燃剤

- 窒素系難燃剤

- その他

第14章 付録

The global bromine market will rise from USD 2.6 billion in 2024 to USD 3.3 billion by 2029, at a CAGR of 4.6% from 2024 to 2029. One significant driver of bromine market growth is the increasing emphasis on fire safety regulations and standards globally. Bromine-based flame retardants reduce the flammability of materials used in electronics, textiles, automotive, and construction industries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/USD Billion) and Volume (Kiloton) |

| Segments | Derivative, Application, and Region |

| Regions covered | North America, Western Europe, Eastern & Central Europe, Asia Pacific, South America, and Middle East & Africa, |

"The organobromine segment is projected to hold maximum share during the forecast period."

The organobromine segment is anticipated to hold the maximum share. It is witnessing geographical expansion, with increasing demand from emerging economies in regions such as Asia Pacific, Latin America, and the Middle East. Rapid industrialization, urbanization, and infrastructure development in these regions drive the demand for organobromine compounds across various industries.

"The flame retardant segment is projected to hold maximum market share during the forecast period."

The flame retardant segment is expected to hold the maximum share during the forecast period. There is a growing demand for high-performance flame retardant materials that meet stringent fire safety standards and offer other desirable properties such as thermal stability, durability, and environmental sustainability. Bromine-based flame retardants are known for their effectiveness in imparting flame resistance while maintaining material integrity, making them preferred choices in various applications.

"Asia Pacific is projected to hold the maximum market share of the bromine market during the forecast period."

The Asia Pacific bromine industry has been studied in China, Japan, India, South Korea, Taiwan, and the Rest of the region. Environmental regulations and sustainability concerns are increasingly shaping the bromine market dynamics in the area. Regulatory bodies impose stricter norms regarding using brominated flame retardants due to their potential environmental and health impacts. This has led to a shift towards alternative flame retardants and an increased focus on recycling bromine-containing products to reduce environmental pollution.

Breakdown of primary interviews for the report on the bromine market

- By Company Type: Tier 1 - 40%, Tier 2 - 20%, and Tier 3 - 40%

- By Designation: C-level Executives - 20%, Directors - 50%, and Others - 30%

- By Region: North America - 20%, Europe - 40%, Asia Pacific - 30%, South America - 5%, Middle East & Africa- 5%

Some of the leading manufacturers of bromine profiled in this report include ICL Group Ltd. (Israel), Albemarle Corporation (US), LANXESS AG (Germany), Tosoh Corporation (Japan), TETRA Technologies, Inc. (US), TATA Chemicals Ltd. (India), Hindustan Salts Ltd. (India), Honeywell International Inc. (US), Gulf Resources, Inc. (China), Agrocel Industries Pvt Ltd. (India), Satyesh Brinechem Pvt. Ltd. (India) and others.

Research Coverage

The report defines, segments, and projects the bromine market size-based derivative, application, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as new product development, agreements, acquisitions, and expansions they undertake in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the bromine market and its segments. This report is also expected to help stakeholders understand the market's competitive landscape, gain insights to improve the position of their businesses and develop suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical drivers (Increasing demand for flame retardants in electronics, consumer goods, and textile industries), restraints (Emergence of non-halogenated flame retardants), opportunities (Increasing use of bromine in flow batteries), and challenges (Significant fluctuations in oil & gas prices) influencing the growth of the bromine market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the bromine market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the bromine market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the bromine market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ICL Group Ltd. (Israel), Albemarle Corporation (US), LANXESS AG (Germany), Tosoh Corporation (Japan), TETRA Technologies, Inc. (US), TATA Chemicals Ltd. (India), Hindustan Salts Ltd. (India), Honeywell International Inc. (US), Gulf Resources, Inc. (China), Agrocel Industries Pvt Ltd. (India), Satyesh Brinechem Pvt. Ltd. (India) among others in the bromine market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 BROMINE MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

- TABLE 2 BROMINE MARKET, BY DERIVATIVE: INCLUSIONS AND EXCLUSIONS

- TABLE 3 BROMINE MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

- TABLE 4 BROMINE MARKET, BY REGION: INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 BROMINE MARKET SEGMENTATION

- 1.4.2 REGIONS COVERED

- FIGURE 2 BROMINE MARKET: REGIONS COVERED

- 1.4.3 YEARS CONSIDERED

- 1.4.4 CURRENCY CONSIDERED

- 1.4.5 UNITS CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 BROMINE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary participants

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- FIGURE 4 BREAKDOWN OF INTERVIEWS WITH EXPERTS BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.2.2 DEMAND-SIDE APPROACH

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 ASSUMPTIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 5 BROMINE MARKET SNAPSHOT

- FIGURE 8 ORGANOBROMINE DERIVATIVE TO DOMINATE MARKET IN 2024

- FIGURE 9 FLAME RETARDANTS APPLICATION LED MARKET IN 2023

- FIGURE 10 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BROMINE MARKET

- FIGURE 11 GROWING DEMAND FOR FLAME RETARDANTS AND OIL & GAS DRILLING TO DRIVE MARKET DURING FORECAST PERIOD

- 4.2 BROMINE MARKET, BY DERIVATIVE

- FIGURE 12 HYDROGEN BROMIDE TO BE FASTEST-GROWING DERIVATIVE SEGMENT DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC BROMINE MARKET, BY DERIVATIVE AND COUNTRY

- FIGURE 13 ORGANOBROMINE AND CHINA ACCOUNTED FOR LARGEST MARKET SHARE

- 4.4 BROMINE MARKET, BY KEY COUNTRY

- FIGURE 14 CHINA, INDIA, AND JAPAN TO OFFER LUCRATIVE OPPORTUNITIES DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BROMINE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of bromine compounds to mitigate mercury emission

- 5.2.1.2 Growing demand for flame retardants in electronics, consumer goods, and textile industries

- FIGURE 16 GLOBAL VALUATION OF RETAIL APPAREL (TEXTILE) INDUSTRY

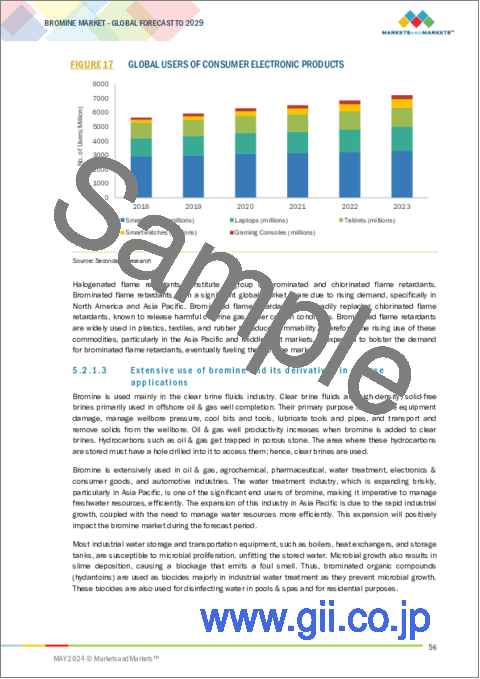

- FIGURE 17 GLOBAL USERS OF CONSUMER ELECTRONIC PRODUCTS

- 5.2.1.3 Extensive use of bromine and its derivatives in diverse applications

- 5.2.1.4 Increased use of bromine as disinfectants

- 5.2.2 RESTRAINTS

- 5.2.2.1 Toxicological effects of brominated compounds

- 5.2.2.2 Emergence of non-halogenated flame retardants

- 5.2.2.3 Restriction on brominated flame retardants by European Union

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Recycling of bromine products

- 5.2.3.2 Increasing use of bromine in flow batteries

- 5.2.4 CHALLENGES

- 5.2.4.1 Significant fluctuations in oil & gas prices

- FIGURE 18 CRUDE OIL PRICES, USD/BARREL (2013-2023)

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 PORTER'S FIVE FORCES ANALYSIS: BROMINE MARKET

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS

- 6.1 CASE STUDY ANALYSIS

- 6.1.1 BROMINE USE AND RECYCLING

- 6.1.1.1 Objective

- 6.1.1.2 Solution statement

- 6.1.2 IMPACT OF BROMINATED FLAME RETARDANTS ON RECYCLING OF WASTE PLASTICS IN EUROPE

- 6.1.2.1 Objective

- 6.1.2.2 Solution statement

- 6.1.3 EFFECT OF AMMONIUM BROMIDE ON FLAME RETARDANCY IN COTTON FABRIC

- 6.1.3.1 Objective

- 6.1.3.2 Solution statement

- 6.1.1 BROMINE USE AND RECYCLING

- 6.2 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 7 BROMINE MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- 6.3 LAUNCH STRATEGIES FOR VARIOUS PRODUCT VOLUMES

- 6.3.1 LAUNCH STRATEGIES FOR PRODUCT VOLUMES OF BROMINE

- TABLE 8 DIFFERENT LAUNCH STRATEGIES

- 6.3.2 DISRUPTION IN BROMINE SUPPLY-DEMAND EQUILIBRIUM

- 6.3.2.1 Bromine oversupply scenario: Excess production resulted in declining prices

- 6.3.2.2 Bromine supply-crunch scenario: Facility closures in China led to elevated bromine prices

- 6.4 AVERAGE SELLING PRICE ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS

- FIGURE 20 AVERAGE SELLING PRICES OF BROMINE OFFERED BY KEY PLAYERS (USD/TON)

- FIGURE 21 AVERAGE SELLING PRICE OF BROMINE, BY REGION (USD/TON)

- TABLE 9 AVERAGE PRICE OF BROMINE, BY REGION (USD/TON)

- TABLE 10 AVERAGE PRICE OF BROMINE, BY DERIVATIVE (USD/TON)

- TABLE 11 AVERAGE PRICE OF BROMINE, BY APPLICATION (USD/TON)

- 6.5 BROMINATED FLAME RETARDANTS: OVERVIEW

- 6.5.1 INTRODUCTION

- 6.5.2 BROMINATED FLAME RETARDANTS

- TABLE 12 MARKET SHARE OF BROMINATED FLAME RETARDANTS

- TABLE 13 END USE OF BROMINATED FLAME RETARDANTS

- FIGURE 22 CURRENT SCENARIO ON PRODUCTION AND CONSUMPTION OF BROMINATED FLAME RETARDANTS IN DIFFERENT REGIONS

- 6.6 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS: BROMINE MARKET

- 6.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 REVENUE SHIFT AND NEW REVENUE POCKETS FOR BROMINE MANUFACTURERS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGY

- FIGURE 25 INDUSTRIAL-SCALE PRODUCTION FOR BROMINE

- 6.8.2 COMPLEMENTARY TECHNOLOGY

- 6.8.3 ADJACENT TECHNOLOGY

- 6.9 ECOSYSTEM/MARKET MAP

- FIGURE 26 ECOSYSTEM MAP: BROMINE MARKET

- TABLE 14 BROMINE MARKET: ECOSYSTEM

- 6.10 REGULATORY LANDSCAPE

- TABLE 15 BFR INCLUSION INTO STOCKHOLM CONVENTION BY REGION/COUNTRY

- TABLE 16 OVERVIEW OF BFRS LISTED IN STOCKHOLM CONVENTION

- TABLE 17 US STATES THAT REGULATE BFRS IN COMMERCIAL GOODS

- TABLE 18 EUROPEAN UNION REGULATIONS AND DIRECTIVES GOVERNING POP-BFRS

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11 PATENT ANALYSIS

- FIGURE 27 LIST OF MAJOR PATENTS FOR INSULATED PRODUCTS

- 6.11.1 LIST OF MAJOR PATENTS

- TABLE 19 LIST OF MAJOR PATENTS

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 20 IMPACT OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 6.12.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 21 KEY BUYING CRITERIA FOR RESPONDENTS, BY APPLICATION

- 6.13 INVESTMENT AND FUNDING SCENARIO

- FIGURE 30 INVESTOR DEALS AND FUNDING IN BROMINE MARKET 2021-2023

- FIGURE 31 MOST VALUED BROMINE MANUFACTURERS IN 2024 (USD BILLION)

7 BROMINE MARKET, BY DERIVATIVE

- 7.1 INTRODUCTION

- FIGURE 32 ORGANOBROMINE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 22 BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 23 BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 24 BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 25 BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- 7.2 ORGANOBROMINES

- 7.2.1 INCREASING USE IN FLAME RETARDANTS AND BIOCIDES TO DRIVE MARKET

- TABLE 26 ORGANOBROMINES: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 27 ORGANOBROMINES: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 ORGANOBROMINES: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 29 ORGANOBROMINES: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 7.3 CLEAR BRINE FLUIDS

- 7.3.1 EXTENSIVE USE FOR OIL EXPLORATION TO DRIVE MARKET

- TABLE 30 CLEAR BRINE FLUIDS: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 31 CLEAR BRINE FLUIDS: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 CLEAR BRINE FLUIDS: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 33 CLEAR BRINE FLUIDS: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 7.4 HYDROGEN BROMIDE

- 7.4.1 WIDE USE IN CHEMICAL, PLASTICS, AND PHARMACEUTICAL INDUSTRIES TO DRIVE MARKET

- TABLE 34 HYDROGEN BROMIDE: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 35 HYDROGEN BROMIDE: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 36 HYDROGEN BROMIDE: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 37 HYDROGEN BROMIDE: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

8 BROMINE MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 OIL & GAS

- 8.2.1 DEMAND FOR CLEAR BRINE FLUIDS TO DRIVE MARKET

- 8.3 AUTOMOTIVE

- 8.3.1 INCREASING USE OF HYDROGEN BROMIDE IN ELECTRIC VEHICLES TO FUEL MARKET

- 8.4 ELECTRICAL & ELECTRONICS

- 8.4.1 BROMINE TO INCREASE FIRE RESISTANCE IN ELECTRICAL AND ELECTRONIC COMPONENTS

- 8.5 AGRICULTURE

- 8.5.1 USE OF BROMINE COMPOUNDS IN PESTICIDES TO DRIVE MARKET

- 8.6 PHARMACEUTICAL

- 8.6.1 BROMINE TO BE USED AS CATALYST IN PHARMACEUTICAL PRODUCTS

- 8.7 COSMETICS

- 8.7.1 BROMINE DERIVATIVES TO INCREASE SHELF LIFE OF COSMETICS

- 8.8 TEXTILE

- 8.8.1 REDUCED FLAMMABILITY IN TEXTILE FIBERS TO DRIVE MARKET

- 8.9 OTHERS

9 BROMINE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 33 FLAME RETARDANTS TO DOMINATE DURING FORECAST PERIOD

- TABLE 38 BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 39 BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 40 BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 41 BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 9.2 FLAME RETARDANTS

- 9.2.1 FLAME RETARDANTS TO REDUCE FIRE DAMAGE

- TABLE 42 FLAME RETARDANTS: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 43 FLAME RETARDANTS: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 44 FLAME RETARDANTS: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 45 FLAME RETARDANTS: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.3 WATER TREATMENT & BIOCIDES

- 9.3.1 ORGANOBROMINES USED AS BIOCIDES IN WATER TREATMENT TO DRIVE MARKET

- TABLE 46 WATER TREATMENT & BIOCIDES: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 47 WATER TREATMENT & BIOCIDES: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 WATER TREATMENT & BIOCIDES: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 49 WATER TREATMENT & BIOCIDES: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.4 MERCURY EMISSION CONTROL

- 9.4.1 BROMINATED COMPOUNDS TO CONTROL MERCURY EMISSION AT COAL-FIRED POWER PLANTS

- TABLE 50 MERCURY EMISSION CONTROL: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 51 MERCURY EMISSION CONTROL: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 MERCURY EMISSION CONTROL: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 53 MERCURY EMISSION CONTROL: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.5 OIL & GAS DRILLING

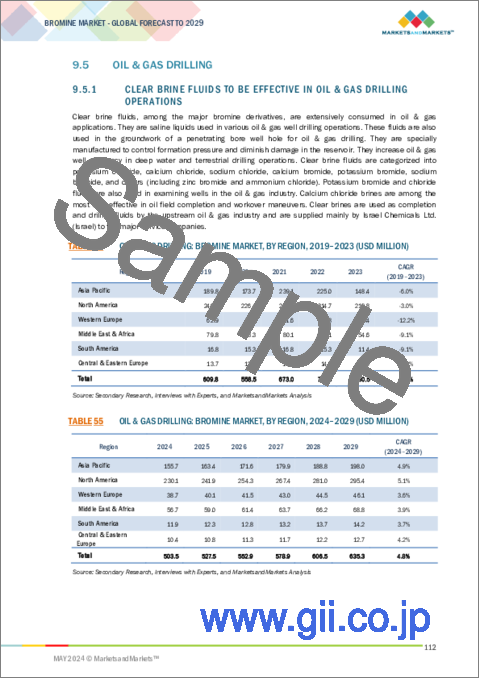

- 9.5.1 CLEAR BRINE FLUIDS TO BE EFFECTIVE IN OIL & GAS DRILLING OPERATIONS

- TABLE 54 OIL & GAS DRILLING: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 55 OIL & GAS DRILLING: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 OIL & GAS DRILLING: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 57 OIL & GAS DRILLING: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.6 HYDROGEN BROMIDE FLOW BATTERIES

- 9.6.1 HYDROGEN BROMIDE TO BE USED IN LOW-COST ENERGY STORAGE DEVICES

- TABLE 58 HYDROGEN BROMIDE FLOW BATTERIES: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 59 HYDROGEN BROMIDE FLOW BATTERIES: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 60 HYDROGEN BROMIDE FLOW BATTERIES: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 61 HYDROGEN BROMIDE FLOW BATTERIES: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.7 PTA SYNTHESIS

- 9.7.1 HYDROGEN BROMIDE TO CATALYZE PTA SYNTHESIS

- TABLE 62 PTA SYNTHESIS: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 63 PTA SYNTHESIS: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 64 PTA SYNTHESIS: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 65 PTA SYNTHESIS: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.8 PESTICIDES

- 9.8.1 INCREASING USE OF METHYL BROMIDE IN PEST CONTROL TO DRIVE MARKET

- TABLE 66 PESTICIDES: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 67 PESTICIDES: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 68 PESTICIDES: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 69 PESTICIDES: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.9 PLASMA ETCHING

- 9.9.1 USE OF HYDROGEN BROMIDE FOR PLASMA ETCHING

- TABLE 70 PLASMA ETCHING: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 71 PLASMA ETCHING: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 72 PLASMA ETCHING: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 73 PLASMA ETCHING: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.10 PHARMACEUTICALS

- 9.10.1 WIDE USE IN PHARMACEUTICAL AND MEDICINAL PREPARATIONS TO DRIVE MARKET

- TABLE 74 PHARMACEUTICALS: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 75 PHARMACEUTICALS: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 76 PHARMACEUTICALS: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 77 PHARMACEUTICALS: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.11 BUTYL RUBBER

- 9.11.1 CHEMICAL RESISTANCE TO INCREASE DEMAND IN BUTYL RUBBER PRODUCTION

- TABLE 78 BUTYL RUBBER: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 79 BUTYL RUBBER: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 80 BUTYL RUBBER: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 81 BUTYL RUBBER: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.12 OTHER APPLICATIONS

- TABLE 82 OTHER APPLICATIONS: BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 83 OTHER APPLICATIONS: BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 84 OTHER APPLICATIONS: BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 85 OTHER APPLICATIONS: BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

10 BROMINE MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 34 REGIONAL SNAPSHOT

- TABLE 86 BROMINE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 87 BROMINE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 88 BROMINE MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 89 BROMINE MARKET, BY REGION, 2024-2029 (KILOTON)

- 10.2 ASIA PACIFIC

- FIGURE 35 ASIA PACIFIC: BROMINE MARKET SNAPSHOT

- 10.2.1 RECESSION IMPACT ON ASIA PACIFIC

- TABLE 90 ASIA PACIFIC: BROMINE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 91 ASIA PACIFIC: BROMINE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 92 ASIA PACIFIC: BROMINE MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 93 ASIA PACIFIC: BROMINE MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 94 ASIA PACIFIC: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 95 ASIA PACIFIC: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 96 ASIA PACIFIC: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 97 ASIA PACIFIC: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 98 ASIA PACIFIC: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 99 ASIA PACIFIC: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 100 ASIA PACIFIC: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 101 ASIA PACIFIC: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.2.2 CHINA

- 10.2.2.1 Growth of electrical and electronics industry to fuel demand

- TABLE 102 CHINA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 103 CHINA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 104 CHINA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 105 CHINA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 106 CHINA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 107 CHINA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 108 CHINA: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 109 CHINA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.2.3 JAPAN

- 10.2.3.1 Automotive and electronics industries to fuel demand

- TABLE 110 JAPAN: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 111 JAPAN: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 112 JAPAN: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 113 JAPAN: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 114 JAPAN: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 115 JAPAN: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 116 JAPAN: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 117 JAPAN: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.2.4 INDIA

- 10.2.4.1 Rising demand from flame retardants, pesticides, and water treatment applications to fuel market

- TABLE 118 INDIA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 119 INDIA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 120 INDIA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 121 INDIA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 122 INDIA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 123 INDIA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 124 INDIA: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 125 INDIA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.2.5 SOUTH KOREA

- 10.2.5.1 Rapidly growing electronics industry to drive market

- TABLE 126 SOUTH KOREA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 127 SOUTH KOREA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 128 SOUTH KOREA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 129 SOUTH KOREA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 130 SOUTH KOREA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 131 SOUTH KOREA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 132 SOUTH KOREA: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 133 SOUTH KOREA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.2.6 TAIWAN

- 10.2.6.1 Growing demand for flame retardants to drive market

- TABLE 134 TAIWAN: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 135 TAIWAN: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 136 TAIWAN: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 137 TAIWAN: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 138 TAIWAN: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 139 TAIWAN: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 140 TAIWAN: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 141 TAIWAN: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.2.7 REST OF ASIA PACIFIC

- TABLE 142 REST OF ASIA PACIFIC: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 145 REST OF ASIA PACIFIC: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 146 REST OF ASIA PACIFIC: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 149 REST OF ASIA PACIFIC: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.3 NORTH AMERICA

- FIGURE 36 NORTH AMERICA: BROMINE MARKET SNAPSHOT

- 10.3.1 RECESSION IMPACT ON NORTH AMERICA

- TABLE 150 NORTH AMERICA: BROMINE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 151 NORTH AMERICA: BROMINE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 152 NORTH AMERICA: BROMINE MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 153 NORTH AMERICA: BROMINE MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 154 NORTH AMERICA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 155 NORTH AMERICA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 156 NORTH AMERICA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 157 NORTH AMERICA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 158 NORTH AMERICA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 159 NORTH AMERICA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 160 NORTH AMERICA: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 161 NORTH AMERICA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.3.2 US

- 10.3.2.1 Stringent environmental policies to reduce mercury emissions

- TABLE 162 US: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 163 US: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 164 US: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 165 US: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 166 US: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 167 US: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 168 US: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 169 US: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.3.3 CANADA

- 10.3.3.1 Shale gas recovery to drive market

- TABLE 170 CANADA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 171 CANADA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 172 CANADA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 173 CANADA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 174 CANADA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 175 CANADA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 176 CANADA: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 177 CANADA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.3.4 MEXICO

- 10.3.4.1 Growing demand from flame retardants segment to fuel market

- TABLE 178 MEXICO: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 179 MEXICO: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 180 MEXICO: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 181 MEXICO: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 182 MEXICO: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 183 MEXICO: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 184 MEXICO: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 185 MEXICO: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4 WESTERN EUROPE

- FIGURE 37 WESTERN EUROPE: BROMINE MARKET SNAPSHOT

- 10.4.1 RECESSION IMPACT ON WESTERN EUROPE

- TABLE 186 WESTERN EUROPE: BROMINE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 187 WESTERN EUROPE: BROMINE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 188 WESTERN EUROPE: BROMINE MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 189 WESTERN EUROPE: BROMINE MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 190 WESTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 191 WESTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 192 WESTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 193 WESTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 194 WESTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 195 WESTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 196 WESTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 197 WESTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4.2 GERMANY

- 10.4.2.1 Rising demand from automotive sector to fuel market

- TABLE 198 GERMANY: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 199 GERMANY: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 200 GERMANY: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 201 GERMANY: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 202 GERMANY: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 203 GERMANY: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 204 GERMANY: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 205 GERMANY: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4.3 FRANCE

- 10.4.3.1 Growth in agriculture industry to increase demand for bromine

- TABLE 206 FRANCE: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 207 FRANCE: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 208 FRANCE: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 209 FRANCE: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 210 FRANCE: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 211 FRANCE: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 212 FRANCE: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 213 FRANCE: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4.4 UK

- 10.4.4.1 Rise in pharmaceutical industry to propel market

- TABLE 214 UK: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 215 UK: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 216 UK: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 217 UK: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 218 UK: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 219 UK: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 220 UK: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 221 UK: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4.5 REST OF WESTERN EUROPE

- TABLE 222 REST OF WESTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 223 REST OF WESTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 224 REST OF WESTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 225 REST OF WESTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 226 REST OF WESTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 227 REST OF WESTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 228 REST OF WESTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 229 REST OF WESTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.5 CENTRAL & EASTERN EUROPE

- 10.5.1 RECESSION IMPACT ON CENTRAL & EASTERN EUROPE

- TABLE 230 CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 231 CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 232 CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 233 CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 234 CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 235 CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 236 CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 237 CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 238 CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 239 CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 240 CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 241 CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.5.2 RUSSIA

- 10.5.2.1 Oil & gas drilling to be major application of bromine

- TABLE 242 RUSSIA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 243 RUSSIA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 244 RUSSIA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 245 RUSSIA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 246 RUSSIA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 247 RUSSIA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 248 RUSSIA: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 249 RUSSIA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.5.3 TURKEY

- 10.5.3.1 Increasing demand for flame retardants to fuel market

- TABLE 250 TURKEY: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 251 TURKEY: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 252 TURKEY: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 253 TURKEY: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 254 TURKEY: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 255 TURKEY: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 256 TURKEY: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 257 TURKEY: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.5.4 REST OF CENTRAL & EASTERN EUROPE

- TABLE 258 REST OF CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 259 REST OF CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 260 REST OF CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 261 REST OF CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 262 REST OF CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 263 REST OF CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 264 REST OF CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 265 REST OF CENTRAL & EASTERN EUROPE: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RECESSION IMPACT ON MIDDLE EAST & AFRICA

- TABLE 266 MIDDLE EAST & AFRICA: BROMINE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: BROMINE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 268 MIDDLE EAST & AFRICA: BROMINE MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 269 MIDDLE EAST & AFRICA: BROMINE MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 270 MIDDLE EAST & AFRICA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 271 MIDDLE EAST & AFRICA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 272 MIDDLE EAST & AFRICA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 273 MIDDLE EAST & AFRICA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 274 MIDDLE EAST & AFRICA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 276 MIDDLE EAST & AFRICA: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 277 MIDDLE EAST & AFRICA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTONS)

- 10.6.2 GCC COUNTRIES

- 10.6.3 SAUDI ARABIA

- 10.6.3.1 Large oil reserves to drive oil & gas drilling segment

- TABLE 278 SAUDI ARABIA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 279 SAUDI ARABIA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 280 SAUDI ARABIA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 281 SAUDI ARABIA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 282 SAUDI ARABIA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 283 SAUDI ARABIA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 284 SAUDI ARABIA: BROMINE MARKET, BY APPLICATION, 2019-2023 KILOTON)

- TABLE 285 SAUDI ARABIA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.6.4 UAE

- 10.6.4.1 Growth of petroleum industry to propel market

- TABLE 286 UAE: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 287 UAE: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 288 UAE: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 289 UAE: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 290 UAE: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 291 UAE: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 292 UAE: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 293 UAE: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.6.5 REST OF GCC COUNTRIES

- 10.6.5.1 Ongoing construction projects generating demand for insulation products to drive market

- TABLE 294 REST OF GCC COUNTRIES: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 295 REST OF GCC COUNTRIES: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 296 REST OF GCC COUNTRIES: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 297 REST OF GCC COUNTRIES: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 298 REST OF GCC COUNTRIES: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 299 REST OF GCC COUNTRIES: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 300 REST OF GCC COUNTRIES: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 301 REST OF GCC COUNTRIES: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.6.6 SOUTH AFRICA

- 10.6.6.1 Rising urban development to fuel market

- TABLE 302 SOUTH AFRICA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 303 SOUTH AFRICA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 304 SOUTH AFRICA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 305 SOUTH AFRICA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 306 SOUTH AFRICA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 307 SOUTH AFRICA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 308 SOUTH AFRICA: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 309 SOUTH AFRICA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.6.7 REST OF MIDDLE EAST & AFRICA

- TABLE 310 REST OF MIDDLE EAST & AFRICA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 311 REST OF MIDDLE EAST & AFRICA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 312 REST OF MIDDLE EAST & AFRICA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 313 REST OF MIDDLE EAST & AFRICA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 314 REST OF MIDDLE EAST & AFRICA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 315 REST OF MIDDLE EAST & AFRICA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 316 REST OF MIDDLE EAST & AFRICA: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 317 REST OF MIDDLE EAST & AFRICA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.7 SOUTH AMERICA

- 10.7.1 RECESSION IMPACT ON SOUTH AMERICA

- TABLE 318 SOUTH AMERICA: BROMINE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 319 SOUTH AMERICA: BROMINE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 320 SOUTH AMERICA: BROMINE MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 321 SOUTH AMERICA: BROMINE MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 322 SOUTH AMERICA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 323 SOUTH AMERICA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 324 SOUTH AMERICA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 325 SOUTH AMERICA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 326 SOUTH AMERICA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 327 SOUTH AMERICA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 328 SOUTH AMERICA: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 329 SOUTH AMERICA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.7.2 BRAZIL

- 10.7.2.1 Extensive use of bromine in manufacturing consumer products to drive market

- TABLE 330 BRAZIL: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 331 BRAZIL: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 332 BRAZIL: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 333 BRAZIL: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 334 BRAZIL: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 335 BRAZIL: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 336 BRAZIL: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 337 BRAZIL: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.7.3 ARGENTINA

- 10.7.3.1 Rising environmental concerns to affect market

- TABLE 338 ARGENTINA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 339 ARGENTINA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 340 ARGENTINA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 341 ARGENTINA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 342 ARGENTINA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 343 ARGENTINA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 344 ARGENTINA: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 345 ARGENTINA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.7.4 REST OF SOUTH AMERICA

- TABLE 346 REST OF SOUTH AMERICA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (USD MILLION)

- TABLE 347 REST OF SOUTH AMERICA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (USD MILLION)

- TABLE 348 REST OF SOUTH AMERICA: BROMINE MARKET, BY DERIVATIVE, 2019-2023 (KILOTON)

- TABLE 349 REST OF SOUTH AMERICA: BROMINE MARKET, BY DERIVATIVE, 2024-2029 (KILOTON)

- TABLE 350 REST OF SOUTH AMERICA: BROMINE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 351 REST OF SOUTH AMERICA: BROMINE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 352 REST OF SOUTH AMERICA: BROMINE MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 353 REST OF SOUTH AMERICA: BROMINE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY BROMINE MANUFACTURERS

- 11.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- 11.3.1 REVENUE ANALYSIS OF TOP PLAYERS IN BROMINE MARKET

- FIGURE 38 TOP FIVE PLAYERS-REVENUE ANALYSIS (2019-2023)

- 11.4 MARKET SHARE ANALYSIS: BROMINE MARKET (2023)

- FIGURE 39 ICL GROUP ACCOUNTED FOR LARGEST SHARE OF BROMINE MARKET IN 2023

- TABLE 354 BROMINE MARKET: DEGREE OF COMPETITION

- 11.4.1 RANKING OF KEY PLAYERS, 2023

- FIGURE 40 RANKING OF TOP FIVE PLAYERS IN BROMINE MARKET, 2023

- 11.5 BRAND/PRODUCT COMPARISON ANALYSIS

- FIGURE 41 BROMINE MARKET: BRAND/PRODUCT COMPARISON

- 11.5.1 ICL GROUP LTD

- 11.5.2 ALBEMARLE CORPORATION

- 11.5.3 TOSOH CORPORATION

- 11.5.4 LANXESS AG

- 11.5.5 TETRA TECHNOLOGIES INC.

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 42 BROMINE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 11.7 COMPANY FOOTPRINT ANALYSIS

- FIGURE 43 BROMINE MARKET: OVERALL, COMPANY FOOTPRINT

- TABLE 355 COMPANY BROMINE DERIVATIVE FOOTPRINT, 2023

- TABLE 356 COMPANY APPLICATION FOOTPRINT, 2023

- TABLE 357 COMPANY END USER FOOTPRINT, 2023

- TABLE 358 COMPANY REGIONAL FOOTPRINT, 2023

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 DYNAMIC COMPANIES

- 11.8.3 RESPONSIVE COMPANIES

- 11.8.4 STARTING BLOCKS

- FIGURE 44 BROMINE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 11.9 COMPETITIVE BENCHMARKING

- TABLE 359 BROMINE MARKET: KEY STARTUPS/SMES

- TABLE 360 BROMINE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.10 VALUATION AND FINANCIAL METRICS OF BROMINE MANUFACTURERS

- FIGURE 45 EV/EBITDA OF KEY BROMINE MANUFACTURERS

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY MANUFACTURERS

- 11.11 COMPETITIVE SCENARIO AND TRENDS

- 11.11.1 PRODUCT LAUNCHES

- TABLE 361 BROMINE MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2017-APRIL 2024

- 11.11.2 DEALS

- TABLE 362 BROMINE MARKET: DEALS, JANUARY 2017-APRIL 2024

- 11.11.3 EXPANSIONS

- TABLE 363 BROMINE MARKET: EXPANSIONS, JANUARY 2017-APRIL 2024

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 ICL GROUP LIMITED

- TABLE 364 ICL GROUP LIMITED: BUSINESS OVERVIEW

- FIGURE 47 ICL GROUP LIMITED: COMPANY SNAPSHOT

- TABLE 365 ICL GROUP LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 366 ICL GROUP LIMITED: PRODUCT LAUNCHES, JANUARY 2017-APRIL 2024

- TABLE 367 ICL GROUP LIMITED: EXPANSIONS, JANUARY 2017-APRIL 2024

- 2.2.2 ALBEMARLE CORPORATION

- TABLE 368 ALBEMARLE CORPORATION: COMPANY OVERVIEW

- FIGURE 48 ALBEMARLE CORPORATION: COMPANY SNAPSHOT

- TABLE 369 ALBEMARLE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 370 ALBEMARLE CORPORATION: EXPANSIONS, JANUARY 2017-APRIL 2024

- 12.2.3 LANXESS AG

- TABLE 371 LANXESS AG: COMPANY OVERVIEW

- FIGURE 49 LANXESS AG: COMPANY SNAPSHOT

- TABLE 372 LANXESS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 373 LANXESS AG: PRODUCT LAUNCHES, JANUARY 2017-APRIL 2024

- 12.2.4 TOSOH CORPORATION

- TABLE 374 TOSOH CORPORATION: COMPANY OVERVIEW

- FIGURE 50 TOSOH CORPORATION: COMPANY SNAPSHOT

- TABLE 375 TOSOH CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 376 TOSOH CORPORATION: EXPANSIONS, JANUARY 2017-APRIL 2024

- 12.2.5 GULF RESOURCES INC.

- TABLE 377 GULF RESOURCES INC.: COMPANY OVERVIEW

- FIGURE 51 GULF RESOURCES INC.: COMPANY SNAPSHOT

- TABLE 378 GULF RESOURCES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 379 GULF RESOURCES INC.: EXPANSIONS, JANUARY 2017-APRIL 2024

- 12.2.6 TETRA TECHNOLOGIES, INC.

- TABLE 380 TETRA TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 52 TETRA TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 381 TETRA TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 382 TETRA TECHNOLOGIES, INC.: DEALS, JANUARY 2017-APRIL 2024

- 12.2.7 TATA CHEMICALS LIMITED

- TABLE 383 TATA CHEMICALS LIMITED: COMPANY OVERVIEW

- FIGURE 53 TATA CHEMICALS LIMITED: COMPANY SNAPSHOT

- TABLE 384 TATA CHEMICALS LIMITED.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.8 HINDUSTAN SALTS LIMITED

- TABLE 385 HINDUSTAN SALTS LIMITED: COMPANY OVERVIEW

- FIGURE 54 HINDUSTAN SALTS LIMITED: COMPANY SNAPSHOT

- TABLE 386 HINDUSTAN SALTS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.9 HONEYWELL INTERNATIONAL INC.

- TABLE 387 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 55 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 388 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 HONEYWELL INTERNATIONAL INC.: DEALS, JANUARY 2017- APRIL 2024

- 12.2.10 ARCHEAN CHEMICAL INDUSTRIES LTD

- TABLE 390 ARCHEAN CHEMICAL INDUSTRIES LTD: COMPANY OVERVIEW

- FIGURE 56 ARCHEAN CHEMICAL INDUSTRIES LTD: COMPANY SNAPSHOT

- TABLE 391 ARCHEAN CHEMICAL INDUSTRIES LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 392 ARCHEAN CHEMICAL INDUSTRIES LTD: EXPANSIONS, JANUARY 2017- APRIL 2024

- 12.2.11 AGROCEL INDUSTRIES PVT LTD.

- TABLE 393 AGROCEL INDUSTRIES PVT LTD.: COMPANY OVERVIEW

- TABLE 394 AGROCEL INDUSTRIES PVT LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 395 AGROCEL INDUSTRIES PVT LTD.: DEALS, JANUARY 2017- APRIL 2024

- 12.2.12 PEREKOP BROMINE FACTORY

- TABLE 396 PEREKOP BROMINE: COMPANY OVERVIEW

- TABLE 397 PEREKOP BROMINE: COMPANY PRODUCTS/SOLUTIONS/SERVICES

- 12.2.13 SATYESH BRINECHEM PVT. LTD.

- TABLE 398 SATYESH BRINECHEM PVT. LTD.: COMPANY OVERVIEW

- TABLE 399 SATYESH BRINECHEM PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.3 OTHER PLAYERS

- 12.3.1 MORRE-TEC INDUSTRIES INC.

- TABLE 400 MORRE-TEC INDUSTRIES INC.: COMPANY OVERVIEW

- 12.3.2 SHANDONG YUYUAN GROUP CO., LTD.

- TABLE 401 SHANDONG YUYUAN GROUP CO., LTD.: COMPANY OVERVIEW

- 12.3.3 SHANDONG HAIWANG CHEMICAL CO., LTD.

- TABLE 402 SHANDONG HAIWANG CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- 12.3.4 SHANDONG HAIHUA GROUP CO., LTD.

- TABLE 403 SHANDONG HAIHUA GROUP CO., LTD.: COMPANY SNAPSHOT

- 12.3.5 SHANDONG OCEAN CHEMICAL CO., LTD.

- TABLE 404 SHANDONG OCEAN CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- 12.3.6 SHANDONG WEIFANG LONGWEI INDUSTRIAL CO., LTD.

- TABLE 405 SHANDONG WEIFANG LONGWEI INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT

- 12.3.7 SHANDONG RUNKE CHEMICAL ENGINEERING CO., LTD.

- TABLE 406 SHANDONG RUNKE CHEMICAL ENGINEERING CO., LTD.: COMPANY SNAPSHOT

- 12.3.8 DHRUV CHEM INDUSTRIES

- TABLE 407 DHRUV CHEM INDUSTRIES: COMPANY SNAPSHOT

- 12.3.9 SHANDONG LUBEI CHEMICAL CO., LTD.

- TABLE 408 SHANDONG LUBEI CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- 12.3.10 SHANDONG HAOYUAN GROUP

- TABLE 409 SHANDONG HAOYUAN GROUP: COMPANY SNAPSHOT

- 12.3.11 CHEMCON SPECIALITY CHEMICALS LTD.

- TABLE 410 CHEMCON SPECIALITY CHEMICALS LTD.: COMPANY OVERVIEW

- 12.3.12 SANGFROID CHEMICALS PVT. LTD.

- TABLE 411 SANGFROID CHEMICALS PVT. LTD.: COMPANY OVERVIEW

- 12.3.13 CHEMADA INDUSTRIES LTD.

- TABLE 412 CHEMADA INDUSTRIES LTD.: COMPANY OVERVIEW

- 12.3.14 VINYL KFT.

- TABLE 413 VINYL KFT.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 BROMINE MARKET INTERCONNECTED MARKETS

- 13.3.1 FLAME RETARDANTS MARKET

- 13.3.1.1 Market definition

- 13.3.1.2 Market overview

- 13.3.1 FLAME RETARDANTS MARKET

- 13.4 FLAME RETARDANTS MARKET, BY TYPE

- TABLE 414 FLAME RETARDANTS MARKET, BY TYPE, 2017-2021 (KILOTON)

- TABLE 415 FLAME RETARDANTS MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 416 FLAME RETARDANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 417 FLAME RETARDANTS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 13.4.1 ALUMINUM TRIHYDRATE (ATH)

- 13.4.1.1 Rapid development of infrastructure to drive market

- TABLE 418 ALUMINUM TRIHYDRATE: FLAME RETARDANTS MARKET, BY REGION, 2017-2021 (KILOTON)

- TABLE 419 ALUMINUM TRIHYDRATE: FLAME RETARDANTS MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 420 ALUMINUM TRIHYDRATE: FLAME RETARDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 421 ALUMINUM TRIHYDRATE: FLAME RETARDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 13.4.2 ANTIMONY OXIDE

- 13.4.2.1 Need to achieve fire safety standards to drive market

- 13.4.3 BROMINATED FLAME RETARDANTS

- 13.4.3.1 Higher cost-efficiency to drive demand

- 13.4.4 CHLORINATED FLAME RETARDANTS

- 13.4.4.1 Asia Pacific to be fastest-growing market

- 13.4.5 PHOSPHORUS FLAME RETARDANTS

- 13.4.5.1 Low volatility of phosphorus flame retardants to fuel demand

- 13.4.6 NITROGEN FLAME RETARDANTS

- 13.4.6.1 Shift toward non-halogenated flame retardants to drive market

- 13.4.7 OTHERS

- 13.4.7.1 Zinc borate

- 13.4.7.2 Magnesium hydroxide

- 13.4.7.3 Boron flame retardants

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS