|

|

市場調査レポート

商品コード

1244933

食品着色料の世界市場:製品種類別 (天然、合成、NI)・用途別 (食品、飲料)・原料別 (植物・動物、微生物、ミネラル・化学物質)・形状別・溶解度別・地域別の将来予測 (2028年まで)Food Colors Market by Type (Natural, Synthetic, and Nature-identical), Application (Food Products and Beverages), Source (Plants & Animals, Microorganisms, and Minerals & Chemicals), Form, Solubility and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 食品着色料の世界市場:製品種類別 (天然、合成、NI)・用途別 (食品、飲料)・原料別 (植物・動物、微生物、ミネラル・化学物質)・形状別・溶解度別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月16日

発行: MarketsandMarkets

ページ情報: 英文 306 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の食品着色料の市場規模は、2023年から2028年にかけて5.4%のCAGRで成長し、2028年には60億米ドルに達すると予測されています。

食品着色料は、食品に色をつけるだけでなく、栄養価を高め、食品・飲料の食べやすさを向上させるために、食品・飲料産業で使用される必須添加物です。合成着色料は、天然着色料と比較して、温度や水分の変化など様々な加工条件に対して安定性が高く、また費用対効果も高いことから、多くの食品メーカーで使用されています。鮮やかな色や意外性のある色の使用は、菓子類、デザート、焼き菓子、スナック菓子、飲料などでよく見られます。欧州では、飲料が天然色素の最大の用途を占めており、ノンアルコール飲料はこの地域の食生活に不可欠な要素となっています。乳製品は、特に風味のあるヨーグルトや乳製品の需要の増加に伴い、着色料の主要な応用分野を形成しています。また、キャンディー・トフィー・チューインガム・エアレーションガム・チョコレート・健康バー・フィリング・デコレーション・クラッカー・スタッフィング・フィリング・ソース・ドレッシング・ペストリー・クッキーなど、さまざまな食品に着色料が使用されています。

"食品加工業界では食品着色料の需要は大きい"

加工食品業界は近い将来、加工食品市場は、所得の増加に伴う食生活の改善や健康増進などの要因により、継続的に成長すると予測されます。また、各地域で加工食品の消費量が増加していることも、着色料の需要を促進する主な要因であると予測されます。特にインド・中国・ブラジル・アルゼンチン・南アフリカなどの新興国において、菓子類や乳製品の需要が伸びています。このため、食品着色料の消費量が増加しており、今後5年間はこの傾向が続くと予測されています。

"アジア太平洋の食品着色料市場は、予測期間中に大幅な成長を示す"

アジア太平洋の食品着色料市場は、食品産業における堅調な成長を目の当たりにしています。また、東アジア・太平洋地域では栄養不良が大きな問題となっており、機能性食品や栄養・医療製品の潜在的な成長地域となっています。これらの製品の需要が高いため、栄養面での利点を付加した食品着色料のニーズが高まると予測され、同地域の食品着色料メーカーにビジネスチャンスがもたらされています。世界の食品着色料メーカーは、アジア太平洋市場が最も急成長していると考えられているため、新製品の発売や事業拡大を通じて、この市場での拡大に注力しています。2022年10月にはIFFが、滋養強壮、医療・バイオサイエンス、香料、ファーマソリューションといった4つの事業部門すべての技術、能力、専門知識を統合するために、3,000万米ドルを投資してシンガポールに新しいイノベーションセンターを開設しました。この投資により、事業の強化と、より広いアジアのお客様との接点を強化することを目的としています。2021年6月、インドのDivi's Nutraceuticals社は、濃縮ベータカロチンとニンジンジュースから自然に抽出したCaroNat(濃い黄色からオレンジ色)の食品着色料を発売しました。この製品は、乳製品を含む様々な飲食品に使用することができます。

当レポートでは、世界の食品着色料の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・原料別・形状別・溶解度別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- 技術分析

- 価格分析

- エコシステムマッピング:食品着色料市場

- 顧客のビジネスに影響を与える動向

- 特許分析

- 貿易データ

- 主な会議とイベント

- ポーターのファイブフォース分析

- ケーススタディ

- 主な利害関係者と購入基準

- 貿易・規制状況

第7章 食品着色料市場:種類別

- イントロダクション

- 天然着色料

- カルミン

- アントシアニン

- カラメル

- アナトー

- カロテノイド

- クロロフィル

- スピルリナ

- その他の天然着色料

- 合成着色料

- ブルー

- レッド

- イエロー

- グリーン

- アマランス

- カルモシン

- その他の合成着色料

- NI (Nature-identical)

第8章 食品着色料市場:原料別

- イントロダクション

- 植物・動物

- ミネラル・化学物質

- 微生物

第9章 食品着色料市場:形状別

- イントロダクション

- 液体

- 粉末

- ゲル

第10章 食品着色料市場:溶解度別

- イントロダクション

- 染料

- レーキ

第11章 食品着色料市場:用途別

- イントロダクション

- 食品

- 加工食品

- ベーカリー製品・菓子

- 食肉・鶏肉・魚介類

- 油脂

- 乳製品

- その他の食品

- 飲料

- ジュース・ジュース濃縮物

- 機能性飲料

- 炭酸飲料

- アルコール飲料

第12章 食品着色料市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- 韓国

- 他のアジア太平洋諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 他の国々 (RoW)

- 南アフリカ

- 中東

- 他のアフリカ諸国

第13章 競合情勢

- 概要

- 主要企業の収益分析

- 市場シェア分析

- 上位4社の戦略

- 企業評価クアドラント (主要企業)

- 企業評価クアドラント (スタートアップ/中小企業)

- 新製品の発売と資本取引

第14章 企業プロファイル

- 主要企業

- ARCHER DANIELS MIDLAND COMPANY

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- SENSIENT TECHNOLOGIES CORPORATION

- DSM

- NATUREX

- DDW

- DOHLER GROUP

- FIORIO COLORI

- LYCORED

- KALSEC INC.

- ALLIANCE ORGANICS LLP

- HORIZON SPECIALITIES LTD.

- SUN FOOD TECH PVT. LTD.

- SAN-EI GEN F.F.I., INC.

- その他の企業

- PHARMOGANA GMBH

- CHROMATECH INCORPORATED

- SUNRISE GREENFOOD

- PROQUIMAC

- EXBERRY

- AJANTA CHEMICAL INDUSTRIES

第15章 隣接・関連市場

- イントロダクション

- 制限事項

- 食品フレーバー市場

- 天然着色料・フレーバー市場

第16章 付録

The food colors market is projected to reach USD 6.0 billion by 2028 growing at a CAGR of 5.4% from 2023 to 2028. Food colors are essential additives used in the food & beverage industry, not only to provide color to the food products but also to add nutritional value and increase the palatability of food or beverage products. The application of colors in food and beverages help in enhancing the color and aesthetics of the product. Synthetic colors are used by many food manufacturers, as they are more stable across various processing conditions, such as temperature and moisture variations, as compared to natural food colors, and are also cost-effective. The use of bright or unexpected colors is common in confectionery, desserts, baked goods, snacks, and beverages. In Europe, beverages make up the largest application of natural colors, with non-alcoholic beverages forming an integral part of the diet in the region. Dairy products form a major area of application for colors, particularly with the increase in demand for flavored yogurt and milk products. Food colors are also used in various food items, such as candies, toffees, chewing gums, aerated gums, chocolates, health bars, fillings, decorations, crackers, stuffing, fillings, sauces, dressings, pastries, and cookies.

" Food colors have high demand in food processing industry."

The processed food products industry is gradually growing as a result of the high demand for convenience foods with improved lifestyles. In the near future, the processed food products market is estimated to grow continuously due to factors such as diet upgrades resulting from a rise in incomes, as well as growing health. The increase in consumption of processed food products across regions is a major factor projected to drive the demand for food colors. The demand for confectionery and dairy products is growing, particularly in emerging economies such as India, China, Brazil, Argentina, and South Africa. This has led to an increase in the consumption of food colors, which is projected to continue over the next five years.

"Asia Pacific is projected to witness substantial growth during the forecast period in the food colors market."

The Asia Pacific food colors market has witnessed robust growth in the food industry. The Asian region is an emerging processed and functional food market, which is growing rapidly. Malnutrition is a major issue in East Asia and the Pacific region, which makes it a potential growth area for functional foods and nutritional & healthcare products. Due to the high demand for these products, the need for food colors with added nutritional benefits is projected to increase, thereby creating an opportunity for food color manufacturers in the region. Global food color manufacturers are focusing on expanding in the Asia Pacific market through new product launches and expansions, as it is considered to be the fastest-growing food color market. In October 2022, IFF opened a new innovation center in Singapore with an investment of USD 30 million to integrate the technologies, capabilities, and expertise of all four business divisions, such as nourish, health & biosciences, scent, and pharma solutions. This investment aimed to strengthen its business and enhance accessibility to customers in greater Asia. In June 2021, Divi's Nutraceuticals an Indian company has launched CaroNat (dark yellow to orange color) food color which is sourced naturally from concentrated beta carotene and carrot juice. It can be used in various food and beverages including the dairy sector.

Break-up of Primaries:

By Company Type: Tier 1 -43%, Tier 2- 41% , Tier 3 - 16%

By Designation: C level - 54%, D level - 46%

By Region: North America - 24%, Europe - 19%, Asia Pacific - 32%, South America - 15%, RoW -10%

Leading players profiled in this report:

- Archer Daniels Midland Company (US)

- International Flavors & Fragrances Inc. (US)

- Sensient Technologies Corporation (US)

- DSM (Netherlands)

- Naturex (France)

- DDW (US)

- Dohler Group (Germany)

- Fiorio Colori (Italy)

- LycoRed (Israel)

- Kalsec Inc (US)

- Alliance Organics LLP (India)

- Horizon Specialities Ltd. (Germany)

- Sun Food Tech Pvt. Ltd. (India)

- San-Ei Gen F.F.I., Inc. (Japan)

- Pharmogana GmbH (Germany)

- Chromatech Incorporated (US)

- Sunrise Green Food (India)

- Proquimac (Spain)

- Exberry (Netherlands)

- Ajanta Chemical Industries(India)

Research Coverage:

The report segments the food colors market on the basis of type, form, solubility, source, application and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global food colors markets, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the food colors market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the food colors market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 FOOD COLORS MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 GEOGRAPHIC SCOPE

- FIGURE 2 REGIONAL SEGMENTATION

- 1.4 YEARS CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.5.1 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2019-2022

- 1.5.2 VOLUME UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 FOOD COLORS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- TABLE 3 KEY DATA FROM PRIMARY SOURCES

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key industry insights

- FIGURE 5 KEY INDUSTRY INSIGHTS

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 6 FOOD COLORS MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.3.1 SUPPLY-SIDE ANALYSIS

- FIGURE 8 SUPPLY-SIDE ANALYSIS

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

- 2.6 RECESSION IMPACT ANALYSIS

- 2.6.1 MACRO INDICATORS OF RECESSION

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 GLOBAL INFLATION RATE, 2011-2021

- FIGURE 11 GLOBAL GROSS DOMESTIC PRODUCT: 2011-2021 (USD TRILLION)

- FIGURE 12 GLOBAL FOOD INGREDIENTS MARKET: PREVIOUS FORECAST VS. RECESSION IMPACT FORECAST

- FIGURE 13 RECESSION INDICATORS AND THEIR IMPACT ON FOOD COLORS MARKET

- FIGURE 14 GLOBAL FOOD COLORS MARKET: PREVIOUS FORECAST VS. RECESSION IMPACT FORECAST

3 EXECUTIVE SUMMARY

- TABLE 4 FOOD COLORS MARKET SNAPSHOT, BY TYPE, 2023 VS. 2028

- FIGURE 15 FOOD COLORS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 FOOD COLORS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

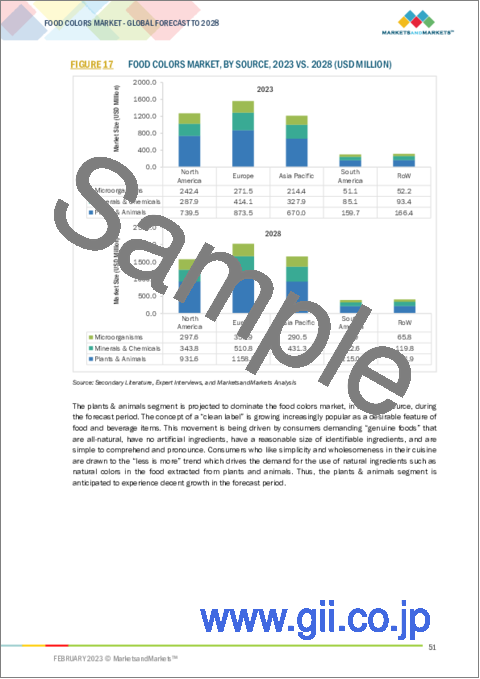

- FIGURE 17 FOOD COLORS MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 FOOD COLORS MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 FOOD COLORS MARKET SHARE (VALUE), BY REGION, 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR FOOD COLORS MARKET PLAYERS

- FIGURE 20 RISE IN DEMAND FOR NATURAL FOOD COLORS DUE TO INCREASED CONSUMER AWARENESS

- 4.2 ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE & COUNTRY

- FIGURE 21 CHINA TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2023

- 4.3 FOOD COLORS MARKET, BY TYPE

- FIGURE 22 NATURAL FOOD COLORS TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 FOOD COLORS MARKET, BY APPLICATION

- FIGURE 23 APPLICATION IN FOOD PRODUCTS TO DOMINATE OVER BEVERAGES DURING FORECAST PERIOD

- 4.5 FOOD COLORS MARKET, BY FORM

- FIGURE 24 LIQUID COLORS TO REMAIN LARGEST MARKET DURING FORECAST PERIOD

- 4.6 FOOD COLORS MARKET, BY SOLUBILITY

- FIGURE 25 FOOD DYES TO DWARF FOOD LAKES SEGMENT DURING FORECAST PERIOD

- 4.7 FOOD COLORS MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

- FIGURE 26 ASIA PACIFIC COUNTRIES TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 27 MARKET DYNAMICS: FOOD COLORS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in demand for natural and clean-label products

- TABLE 5 NATURAL COLORING AGENTS AND THEIR HEALTH BENEFITS

- FIGURE 28 US: FACTORS DRIVING GROWTH OF CLEAN-LABEL PURCHASES, 2021

- 5.2.1.2 Need to enhance product appeal among manufacturers

- TABLE 6 USE OF FOOD COLORS TO ENHANCE PRODUCT APPEAL

- 5.2.1.3 Growing trade, investment, and expenditure in processed food & beverages market

- FIGURE 29 TRENDS IN FMCG REVENUES, 2016-2020 (USD BILLION)

- 5.2.1.4 Technological advancements and growth in R&D activities

- 5.2.1.4.1 Floral colors gaining market traction

- 5.2.1.5 Increase in consumer preference for organic products

- 5.2.1.4 Technological advancements and growth in R&D activities

- FIGURE 30 ORGANIC FOOD & BEVERAGES MARKET, 2021 (USD BILLION)

- FIGURE 31 TOP FIVE COUNTRIES WITH LARGEST NUMBER OF ORGANIC PRODUCERS, 2020 (MILLION)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Health hazards of synthetic colorants

- TABLE 7 SYNTHETIC FOOD COLORS AND THEIR HEALTH HAZARDS

- 5.2.2.2 Stringent regulations on use of colors in food applications

- 5.2.2.3 Low stability and high cost of natural colors

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Innovative color extractions with use of new raw material sources

- 5.2.3.2 Increase in ventures undertaken by manufacturers in Asia Pacific and South America

- 5.2.3.3 Safety reassessment of synthetic food colors

- 5.2.3.4 Launching of advanced products by manufacturers

- 5.2.3.4.1 Innovative color shades

- 5.2.3.4.2 Multi-functional colors

- 5.2.3.4.3 Colors for improving sensory impact

- 5.2.3.5 Consumer willingness to pay more for natural colors

- 5.2.4 CHALLENGES

- 5.2.4.1 Consumer preference for natural food colors due to labeling mandates for E numbers

- TABLE 8 COLORING FOOD, NUTRIENTS, AND HEALTH BENEFITS

- TABLE 9 E NUMBERS OF FOOD COLORS

- 5.2.4.2 Misperception about titanium dioxide among consumers

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.2.2 SOURCING & PRODUCTION

- 6.2.3 MARKETING & SALES AND LOGISTICS

- FIGURE 32 VALUE CHAIN ANALYSIS: SOURCING AND PRODUCTION OF FOOD COLORS TO BE KEY CONTRIBUTORS

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 MICROENCAPSULATION TECHNOLOGY

- 6.3.2 NON-THERMAL TREATMENTS: HPP & PEF ENHANCE COLOR RETENTION

- 6.3.3 OTHER TECHNOLOGIES

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND ANALYSIS

- TABLE 10 FOOD COLORS MARKET: AVERAGE SELLING PRICES, BY TYPE, 2022 (USD/KG)

- TABLE 11 FOOD COLORS MARKET: AVERAGE SELLING PRICES, BY REGION, 2022 (USD/KG)

- 6.5 ECOSYSTEM MAPPING: FOOD COLORS MARKET

- 6.5.1 DEMAND-SIDE ECOSYSTEM

- 6.5.2 SUPPLY-SIDE ECOSYSTEM

- FIGURE 33 FOOD COLORS MARKET ECOSYSTEM

- TABLE 12 FOOD COLORS MARKET: ECOSYSTEM MAPPING

- 6.6 TRENDS IMPACTING CUSTOMERS' BUSINESS

- FIGURE 34 FOOD COLORS MARKET: TRENDS IMPACTING BUYERS

- 6.7 PATENT ANALYSIS

- FIGURE 35 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2022

- TABLE 13 PATENTS PERTAINING TO FOOD COLORS, 2020-2022

- 6.8 TRADE DATA

- TABLE 14 IMPORT AND EXPORT VALUE OF FOOD COLORS, BY COUNTRY, 2021 (USD MILLION)

- TABLE 15 IMPORT AND EXPORT VOLUME OF FOOD COLORS, BY COUNTRY, 2021 (KG)

- 6.9 KEY CONFERENCES & EVENTS

- TABLE 16 KEY CONFERENCES & EVENTS, 2023-2024

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 FOOD COLORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 DEGREE OF COMPETITION

- 6.10.2 BARGAINING POWER OF SUPPLIERS

- 6.10.3 BARGAINING POWER OF BUYERS

- 6.10.4 THREAT FROM SUBSTITUTES

- 6.10.5 THREAT FROM NEW ENTRANTS

- 6.11 CASE STUDIES

- 6.11.1 ALLERGEN SENSORS FOR CONSUMERS

- 6.11.2 SENSORY EXPERIENCE TO REMAIN KEY PRIORITY FOR CONSUMERS

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD COLOR TYPES

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD COLOR TYPES

- 6.12.2 KEY BUYING CRITERIA

- FIGURE 37 KEY BUYING CRITERIA FOR TYPES OF FOOD COLORS

- 6.13 TRADE AND REGULATORY LANDSCAPE

- TABLE 19 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.13.1 MEXICO

- 6.13.1.1 Mexican Food Regulations

- 6.13.2 BRAZIL

- 6.13.2.1 Brazilian Health Regulatory Agency (ANVISA)

- 6.13.2.1.1 Section II Food Additive Regulations

- 6.13.2.2 Brazilian Food Regulations and Standards

- 6.13.2.1 Brazilian Health Regulatory Agency (ANVISA)

- 6.13.3 ARGENTINA

- 6.13.3.1 The Argentina Food Safety Act

- 6.13.4 REST OF SOUTH AMERICA

- 6.13.5 EUROPE

- 6.13.5.1 Food and Agricultural Import Regulations and Standards (Berlin, Germany)

- 6.13.5.2 Food and Agriculture Imports Regulations and Standards (France)

- 6.13.5.3 Italy

- 6.13.6 CHINA

- 6.13.7 INDIA

- 6.13.8 JAPAN

- 6.13.8.1 Japanese Ministry of Health, Labour and Welfare

- 6.13.8.2 Japan Food Chemical Research Foundation (JFCRF)

- 6.13.9 SOUTH KOREA

- 6.13.9.1 Ministry of Food and Drug Safety (MFDS)

- 6.13.10 AUSTRALIA & NEW ZEALAND

- 6.13.10.1 Australia New Zealand Food Standards Code - Standard 1.3.1 - Food Additives

- 6.13.11 MIDDLE EAST

- 6.13.11.1 Food, Agricultural, and Water Import Regulations, and Standards - Dubai, United Arab Emirates

7 FOOD COLORS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 38 FOOD COLORS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 20 FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 21 FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 22 FOOD COLORS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 23 FOOD COLORS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 24 NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 25 NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 26 SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 27 SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.2 NATURAL COLORS

- 7.2.1 INCREASE IN FOOD QUALITY AND SAFETY AWARENESS AMONG CONSUMERS

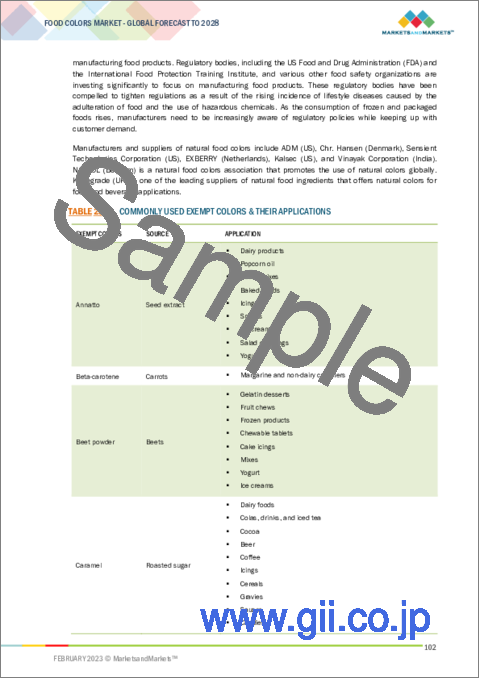

- TABLE 28 COMMONLY USED EXEMPT COLORS & THEIR APPLICATIONS

- FIGURE 39 CARMINE TO LEAD AMONG NATURAL COLORS MARKET THROUGH 2028 (USD MILLION)

- TABLE 29 NATURAL FOOD COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 NATURAL FOOD COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 31 NATURAL FOOD COLORS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 32 NATURAL FOOD COLORS MARKET, BY REGION, 2023-2028 (KT)

- 7.2.2 CARMINE

- TABLE 33 CARMINE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 CARMINE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.3 ANTHOCYANINS

- TABLE 35 ANTHOCYANINS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 ANTHOCYANINS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.4 CARAMEL

- TABLE 37 CARAMEL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 CARAMEL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.5 ANNATTO

- TABLE 39 ANNATTO MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 ANNATTO MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.6 CAROTENOIDS

- TABLE 41 CAROTENOIDS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 42 CAROTENOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.7 CHLOROPHYLL

- TABLE 43 CHLOROPHYLL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 CHLOROPHYLL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.8 SPIRULINA

- TABLE 45 SPIRULINA MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 46 SPIRULINA MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.9 OTHER NATURAL COLORS

- TABLE 47 OTHER NATURAL FOOD COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 OTHER NATURAL FOOD COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 SYNTHETIC

- 7.3.1 HIGH ADOPTION AND EXTENSIVE COLOR PALETTE OFFERED BY SYNTHETIC COLORS

- TABLE 49 E NUMBER OF COLORS

- TABLE 50 SYNTHETIC COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 SYNTHETIC COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 52 SYNTHETIC COLORS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 53 SYNTHETIC COLORS MARKET, BY REGION, 2023-2028 (KT)

- 7.3.2 BLUE

- TABLE 54 BLUE FOOD COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 BLUE FOOD COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.3 RED

- TABLE 56 RED FOOD COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 57 RED FOOD COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.4 YELLOW

- TABLE 58 YELLOW FOOD COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 YELLOW FOOD COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.5 GREEN

- TABLE 60 GREEN FOOD COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 GREEN FOOD COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.6 AMARANTH

- TABLE 62 AMARANTH MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 AMARANTH MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.7 CARMOISINE

- TABLE 64 CARMOISINE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 CARMOISINE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.8 OTHER SYNTHETIC COLORS

- TABLE 66 OTHER SYNTHETIC FOOD COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 67 OTHER SYNTHETIC FOOD COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 NATURE-IDENTICAL

- 7.4.1 LOW HEALTH IMPACT OF NATURE-IDENTICAL COLORS AND COST-EFFECTIVENESS OVER NATURAL COLORS

- TABLE 68 NATURE-IDENTICAL FOOD COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 NATURE-IDENTICAL FOOD COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 70 NATURE-IDENTICAL FOOD COLORS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 71 NATURE-IDENTICAL FOOD COLORS MARKET, BY REGION, 2023-2028 (KT)

8 FOOD COLORS MARKET, BY SOURCE

- 8.1 INTRODUCTION

- FIGURE 40 FOOD COLORS MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- TABLE 72 FOOD COLORS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 73 FOOD COLORS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 74 FOOD COLORS MARKET, BY SOURCE, 2019-2022 (KT)

- TABLE 75 FOOD COLORS MARKET, BY SOURCE, 2023-2028 (KT)

- 8.2 PLANTS & ANIMALS

- 8.2.1 INCREASE IN CONSUMER DEMAND FOR NATURAL INGREDIENTS AND SUSTAINABLE, ETHICAL PRODUCTION METHODS

- TABLE 76 PLANT & ANIMAL SOURCES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 PLANT & ANIMAL SOURCES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 MINERALS & CHEMICALS

- 8.3.1 PETROLEUM, PETROCHEMICALS, AND MINERAL COMPOUNDS USED IN FOOD AND PHARMACEUTICAL INDUSTRIES

- TABLE 78 MINERAL & CHEMICAL SOURCES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 79 MINERAL & CHEMICAL SOURCES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 MICROORGANISMS

- 8.4.1 PROMISING ALTERNATIVE TO SYNTHETIC FOOD COLORANTS

- TABLE 80 MICROORGANISM SOURCES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 81 MICROORGANISM SOURCES MARKET, BY REGION, 2023-2028 (USD MILLION)

9 FOOD COLORS MARKET, BY FORM

- 9.1 INTRODUCTION

- FIGURE 41 LIQUID FORM TO BE LARGEST AMONG FORMS DURING FORECAST PERIOD

- TABLE 82 FOOD COLORS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 83 FOOD COLORS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 9.2 LIQUID

- 9.2.1 EASE OF USE AND INCREASE IN APPLICATION FOR FURTHER BLENDING AND FORMULATION OF NEW FOOD COLORS

- TABLE 84 LIQUID FOOD COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 85 LIQUID FOOD COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 POWDER

- 9.3.1 DIVERSE COLOR PROFILE FACILITATED BY POWDERED COLORS

- TABLE 86 POWDER-BASED FOOD COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 87 POWDER-BASED FOOD COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 GEL

- 9.4.1 LONGER SHELF LIFE AND WIDE COLOR PALETTE OFFERED IN GEL FORM

- TABLE 88 GEL-BASED FOOD COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 89 GEL-BASED FOOD COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 FOOD COLORS MARKET, BY SOLUBILITY

- 10.1 INTRODUCTION

- FIGURE 42 FOOD COLORS MARKET, BY SOLUBILITY, 2023 VS. 2028 (USD MILLION)

- TABLE 90 FOOD COLORS MARKET, BY SOLUBILITY, 2019-2022 (USD MILLION)

- TABLE 91 FOOD COLORS MARKET, BY SOLUBILITY, 2023-2028 (USD MILLION)

- 10.2 DYES

- 10.2.1 HIGH GROWTH OF FOOD & BEVERAGE INDUSTRY AND GLOBAL DEMAND FOR NATURAL FOOD INGREDIENTS

- 10.3 LAKES

- 10.3.1 INCREASED APPLICABILITY OF LAKES IN DYNAMIC BAKERY AND CONFECTIONERY INDUSTRY

- TABLE 92 EU: APPROVED LAKES COLORS

11 FOOD COLORS MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 43 FOOD COLORS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- TABLE 93 FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 94 FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 95 FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 96 FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 97 BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 98 BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- 11.2 FOOD PRODUCTS

- 11.2.1 RAPID GROWTH OF FOOD SECTORS GLOBALLY

- FIGURE 44 COLORS IN PROCESSED FOOD TO DOMINATE AMONG FOOD PRODUCTS THROUGH 2028

- TABLE 99 FOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 100 FOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2.2 PROCESSED FOOD PRODUCTS

- TABLE 101 PROCESSED FOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 102 PROCESSED FOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2.3 BAKERY & CONFECTIONERY PRODUCTS

- TABLE 103 BAKERY & CONFECTIONERY APPLICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 104 BAKERY & CONFECTIONERY APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2.4 MEAT, POULTRY, AND SEAFOOD

- TABLE 105 MEAT, POULTRY, AND SEAFOOD APPLICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 106 MEAT, POULTRY, AND SEAFOOD APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2.5 OILS & FATS

- TABLE 107 OIL & FAT APPLICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 108 OIL & FAT APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2.6 DAIRY PRODUCTS

- TABLE 109 DAIRY PRODUCT APPLICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 110 DAIRY PRODUCT APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2.7 OTHER FOOD PRODUCTS

- TABLE 111 OTHER FOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 112 OTHER FOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 BEVERAGES

- 11.3.1 AVAILABILITY OF NEW, REFRESHING, AND HEALTHIER JUICES AND BEVERAGES

- TABLE 113 BEVERAGE APPLICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 114 BEVERAGE APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3.2 JUICE & JUICE CONCENTRATES

- TABLE 115 JUICE & JUICE CONCENTRATE APPLICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 116 JUICE & JUICE CONCENTRATE APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3.3 FUNCTIONAL DRINKS

- TABLE 117 FUNCTIONAL DRINK APPLICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 118 FUNCTIONAL DRINK APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3.4 CARBONATED SOFT DRINKS

- TABLE 119 FOOD COLOR TYPES USED IN SOFT DRINKS

- TABLE 120 CARBONATED SOFT DRINK APPLICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 121 CARBONATED SOFT DRINK APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3.5 ALCOHOLIC BEVERAGES

- TABLE 122 ALCOHOLIC BEVERAGE APPLICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 123 ALCOHOLIC BEVERAGE APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

12 FOOD COLORS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 45 US TO ACCOUNT FOR LARGEST SHARE IN FOOD COLORS MARKET, 2023

- TABLE 124 FOOD COLORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 125 FOOD COLORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 126 FOOD COLORS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 127 FOOD COLORS MARKET, BY REGION, 2023-2028 (KT)

- 12.2 NORTH AMERICA

- FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 128 NORTH AMERICA: FOOD COLORS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: FOOD COLORS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 133 NORTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 134 NORTH AMERICA: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: FOOD COLORS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: FOOD COLORS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: FOOD COLORS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: FOOD COLORS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- 12.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- 12.2.2 US

- 12.2.2.1 Presence of key players and well-established food & beverage industries

- TABLE 148 US: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 149 US: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 150 US: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 151 US: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Increase in consumer preference for clean-label food products to encourage natural food colors

- TABLE 152 CANADA: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 153 CANADA: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 154 CANADA: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 155 CANADA: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.2.4 MEXICO

- 12.2.4.1 High demand for natural food colors

- TABLE 156 MEXICO: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 157 MEXICO: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 158 MEXICO: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 159 MEXICO: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3 EUROPE

- TABLE 160 EUROPE: FOOD COLORS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 161 EUROPE: FOOD COLORS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 162 EUROPE: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 163 EUROPE: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 164 EUROPE: FOOD COLORS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 165 EUROPE: FOOD COLORS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 166 EUROPE: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 167 EUROPE: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 168 EUROPE: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 169 EUROPE: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 170 EUROPE: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 171 EUROPE: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 172 EUROPE: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 173 EUROPE: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 174 EUROPE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 175 EUROPE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 176 EUROPE: FOOD COLORS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 177 EUROPE: FOOD COLORS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 178 EUROPE: FOOD COLORS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 179 EUROPE: FOOD COLORS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- 12.3.2 GERMANY

- 12.3.2.1 High growth of chemicals and processed foods manufacturing sectors

- TABLE 180 GERMANY: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 181 GERMANY: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 182 GERMANY: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 183 GERMANY: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Steady rise in food & beverage processing sector along with high demand for natural ingredients

- TABLE 184 UK: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 185 UK: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 186 UK: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 187 UK: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.4 FRANCE

- 12.3.4.1 Rise in preference for ready-to-eat meals with premium ingredients during pandemic

- TABLE 188 FRANCE: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 189 FRANCE: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 190 FRANCE: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 191 FRANCE: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.5 ITALY

- 12.3.5.1 Slowly rising expenditure on food in Italy due to changing lifestyles

- TABLE 192 ITALY: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 193 ITALY: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 194 ITALY: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 195 ITALY: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.6 SPAIN

- 12.3.6.1 Well-established processed food sector demanding high-quality food colors

- TABLE 196 SPAIN: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 197 SPAIN: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 198 SPAIN: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 199 SPAIN: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.7 REST OF EUROPE

- TABLE 200 REST OF EUROPE: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 201 REST OF EUROPE: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 202 REST OF EUROPE: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 203 REST OF EUROPE: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4 ASIA PACIFIC

- TABLE 204 ASIA PACIFIC: FOOD COLORS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 205 ASIA PACIFIC: FOOD COLORS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 206 ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 207 ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 208 ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 209 ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 210 ASIA PACIFIC: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 211 ASIA PACIFIC: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 213 ASIA PACIFIC: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 215 ASIA PACIFIC: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 217 ASIA PACIFIC: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 218 ASIA PACIFIC: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 219 ASIA PACIFIC: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 220 ASIA PACIFIC: FOOD COLORS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 221 ASIA PACIFIC: FOOD COLORS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 222 ASIA PACIFIC: FOOD COLORS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 223 ASIA PACIFIC: FOOD COLORS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- 12.4.2 CHINA

- 12.4.2.1 Increase in chemical production and exports

- TABLE 224 CHINA: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 225 CHINA: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 226 CHINA: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 227 CHINA: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.3 INDIA

- 12.4.3.1 Rise in local food color manufacturers and domestic consumption of processed foods

- TABLE 228 INDIA: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 229 INDIA: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 230 INDIA: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 231 INDIA: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Increase in demand for natural food colors

- TABLE 232 JAPAN: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 233 JAPAN: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 234 JAPAN: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 235 JAPAN: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 Rise in demand for organic and natural food products

- TABLE 236 AUSTRALIA & NEW ZEALAND: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 237 AUSTRALIA & NEW ZEALAND: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 238 AUSTRALIA & NEW ZEALAND: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 239 AUSTRALIA & NEW ZEALAND: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Robust food processing industries in South Korea

- TABLE 240 SOUTH KOREA: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 241 SOUTH KOREA: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 242 SOUTH KOREA: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 243 SOUTH KOREA: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.7 REST OF ASIA PACIFIC

- TABLE 244 REST OF ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 245 REST OF ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 246 REST OF ASIA PACIFIC: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 247 REST OF ASIA PACIFIC: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.5 SOUTH AMERICA

- TABLE 248 SOUTH AMERICA: FOOD COLORS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 249 SOUTH AMERICA: FOOD COLORS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 250 SOUTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 251 SOUTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 252 SOUTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 253 SOUTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 254 SOUTH AMERICA: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 255 SOUTH AMERICA: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 256 SOUTH AMERICA: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 257 SOUTH AMERICA: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 258 SOUTH AMERICA: FOOD COLORS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 259 SOUTH AMERICA: FOOD COLORS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 260 SOUTH AMERICA: FOOD COLORS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 261 SOUTH AMERICA: FOOD COLORS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 262 SOUTH AMERICA: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 263 SOUTH AMERICA: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 264 SOUTH AMERICA: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 265 SOUTH AMERICA: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 266 SOUTH AMERICA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 267 SOUTH AMERICA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- 12.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- 12.5.2 BRAZIL

- 12.5.2.1 Increase in presence of key food retailers and growth of food processing industries

- TABLE 268 BRAZIL: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 269 BRAZIL: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 270 BRAZIL: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 271 BRAZIL: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.5.3 ARGENTINA

- 12.5.3.1 Growth of food processing sector

- TABLE 272 ARGENTINA: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 273 ARGENTINA: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 274 ARGENTINA: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 275 ARGENTINA: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.5.4 REST OF SOUTH AMERICA

- TABLE 276 REST OF SOUTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 277 REST OF SOUTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 278 REST OF SOUTH AMERICA: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 279 REST OF SOUTH AMERICA: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 ROW: RECESSION IMPACT ANALYSIS

- TABLE 280 ROW: FOOD COLORS MARKET, BY COUNTRY/REGION, 2019-2022 (USD MILLION)

- TABLE 281 ROW: FOOD COLORS MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- TABLE 282 ROW: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 283 ROW: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 284 ROW: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 285 ROW: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 286 ROW: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 287 ROW: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 288 ROW: FOOD COLORS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 289 ROW: FOOD COLORS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 290 ROW: FOOD COLORS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 291 ROW: FOOD COLORS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 292 ROW: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 293 ROW: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 294 ROW: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 295 ROW: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 296 ROW: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 297 ROW: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- 12.6.2 SOUTH AFRICA

- 12.6.2.1 Growth of food & beverage industry to offer attractive investment opportunities

- TABLE 298 SOUTH AFRICA: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 299 SOUTH AFRICA: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 300 SOUTH AFRICA: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 301 SOUTH AFRICA: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.6.3 MIDDLE EAST

- 12.6.3.1 Gradual growth in food & beverage sector in this region

- TABLE 302 MIDDLE EAST: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 303 MIDDLE EAST: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 304 MIDDLE EAST: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 305 MIDDLE EAST: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.6.4 REST OF AFRICA

- TABLE 306 REST OF AFRICA: FOOD COLORS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 307 REST OF AFRICA: FOOD COLORS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 308 REST OF AFRICA: FOOD COLORS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 309 REST OF AFRICA: FOOD COLORS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 47 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2019-2021 (USD BILLION)

- 13.3 MARKET SHARE ANALYSIS

- TABLE 310 FOOD COLORS MARKET: DEGREE OF COMPETITION

- 13.4 STRATEGIES OF TOP FOUR PLAYERS

- TABLE 311 FOOD COLORS MARKET: KEY PLAYER STRATEGIES

- 13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 13.5.1 STARS

- 13.5.2 PERVASIVE PLAYERS

- 13.5.3 EMERGING LEADERS

- 13.5.4 PARTICIPANTS

- FIGURE 48 FOOD COLORS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 13.5.5 PRODUCT FOOTPRINT

- TABLE 312 KEY COMPANY FOOTPRINT, BY TYPE

- TABLE 313 KEY COMPANY FOOTPRINT, BY SOURCE

- TABLE 314 KEY COMPANY FOOTPRINT, BY FORM

- TABLE 315 KEY COMPANY FOOTPRINT, BY APPLICATION

- TABLE 316 KEY COMPANY FOOTPRINT, BY REGION

- TABLE 317 OVERALL KEY COMPANY FOOTPRINT

- 13.6 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 STARTING BLOCKS

- 13.6.3 RESPONSIVE COMPANIES

- 13.6.4 DYNAMIC COMPANIES

- FIGURE 49 FOOD COLORS MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- 13.6.5 COMPETITIVE BENCHMARKING

- TABLE 318 FOOD COLORS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 319 STARTUP/SME COMPANY FOOTPRINT, BY TYPE

- TABLE 320 STARTUP/SME COMPANY FOOTPRINT, BY SOURCE

- TABLE 321 STARTUP/SME COMPANY FOOTPRINT, BY FORM

- TABLE 322 STARTUP/SME COMPANY FOOTPRINT, BY SOLUBILITY

- TABLE 323 STARTUP/SME COMPANY FOOTPRINT, BY APPLICATION

- TABLE 324 STARTUP/SME COMPANY FOOTPRINT, BY REGION

- TABLE 325 OVERALL STARTUP/SME COMPANY FOOTPRINT

- 13.7 NEW PRODUCT LAUNCHES AND DEALS

- 13.7.1 NEW PRODUCT LAUNCHES

- TABLE 326 FOOD COLORS MARKET: NEW PRODUCT LAUNCHES, JANUARY 2019-JANUARY 2023

- TABLE 327 FOOD COLORS MARKET: DEALS, OCTOBER 2019-OCTOBER 2022

14 COMPANY PROFILES

(Business overview, Products offered, Recent developments & MnM View)*

- 14.1 KEY PLAYERS

- 14.1.1 ARCHER DANIELS MIDLAND COMPANY

- TABLE 328 ADM: BUSINESS OVERVIEW

- FIGURE 50 ADM: COMPANY SNAPSHOT

- TABLE 329 ADM: PRODUCTS OFFERED

- TABLE 330 ADM: PRODUCT LAUNCHES

- 14.1.2 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- TABLE 331 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- FIGURE 51 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- TABLE 332 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS OFFERED

- TABLE 333 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHER DEVELOPMENTS

- 14.1.3 SENSIENT TECHNOLOGIES CORPORATION

- TABLE 334 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- FIGURE 52 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 335 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

- TABLE 336 SENSIENT TECHNOLOGIES CORPORATION: DEALS

- 14.1.4 DSM

- TABLE 337 DSM: BUSINESS OVERVIEW

- FIGURE 53 DSM: COMPANY SNAPSHOT

- TABLE 338 DSM: PRODUCTS OFFERED

- 14.1.5 NATUREX

- TABLE 339 NATUREX: BUSINESS OVERVIEW

- TABLE 340 NATUREX: PRODUCTS OFFERED

- TABLE 341 NATUREX: NEW PRODUCT LAUNCHES

- 14.1.6 DDW

- TABLE 342 DDW: BUSINESS OVERVIEW

- TABLE 343 DDW: PRODUCTS OFFERED

- TABLE 344 DDW: DEALS

- 14.1.7 DOHLER GROUP

- TABLE 345 DOHLER GROUP: BUSINESS OVERVIEW

- TABLE 346 DOHLER GROUP: PRODUCTS OFFERED

- 14.1.8 FIORIO COLORI

- TABLE 347 FIORIO COLORI: BUSINESS OVERVIEW

- TABLE 348 FIORIO COLORI: PRODUCTS OFFERED

- 14.1.9 LYCORED

- TABLE 349 LYCORED: BUSINESS OVERVIEW

- TABLE 350 LYCORED: PRODUCTS OFFERED

- TABLE 351 LYCORED: OTHER DEVELOPMENTS

- 14.1.10 KALSEC INC.

- TABLE 352 KALSEC INC.: BUSINESS OVERVIEW

- TABLE 353 KALSEC INC.: PRODUCTS OFFERED

- 14.1.11 ALLIANCE ORGANICS LLP

- TABLE 354 ALLIANCE ORGANICS LLP: BUSINESS OVERVIEW

- TABLE 355 ALLIANCE ORGANICS LLP: PRODUCTS OFFERED

- 14.1.12 HORIZON SPECIALITIES LTD.

- TABLE 356 HORIZON SPECIALITIES LTD.: BUSINESS OVERVIEW

- TABLE 357 HORIZON SPECIALITIES LTD.: PRODUCTS OFFERED

- 14.1.13 SUN FOOD TECH PVT. LTD.

- TABLE 358 SUN FOOD TECH PVT. LTD.: BUSINESS OVERVIEW

- TABLE 359 SUN FOOD TECH PVT. LTD.: PRODUCTS OFFERED

- 14.1.14 SAN-EI GEN F.F.I., INC.

- TABLE 360 SAN-EI GEN F.F.I., INC.: BUSINESS OVERVIEW

- TABLE 361 SAN-EI GEN F.F.I., INC.: PRODUCTS OFFERED

- TABLE 362 SAN-EI GEN F.F.I., INC.: PRODUCT LAUNCHES

- Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 14.2 OTHER PLAYERS

- 14.2.1 PHARMOGANA GMBH

- 14.2.2 CHROMATECH INCORPORATED

- 14.2.3 SUNRISE GREENFOOD

- 14.2.4 PROQUIMAC

- 14.2.5 EXBERRY

- 14.2.6 AJANTA CHEMICAL INDUSTRIES

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 363 ADJACENT MARKETS TO FOOD COLORS

- 15.2 LIMITATIONS

- 15.3 FOOD FLAVORS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- TABLE 364 FLAVORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 365 FLAVORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.4 NATURAL COLORS & FLAVORS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- TABLE 366 NATURAL FOOD COLORS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS