|

|

市場調査レポート

商品コード

1409025

組織診断の世界市場 (~2028年):製品 (消耗品 (抗体・試薬・組織・プローブ)・機器 (処理システム・スキャナー))・技術 (ISH・IHC・スライド染色)・疾患タイプ (乳癌・リンパ腫・前立腺癌) 別Tissue Diagnostics Market by Product (Consumables (Antibodies, Reagents, Tissue, Probes ), Instrument (Processing System, Scanner)), Technology (ISH, IHC, Slide Staining), Disease Type (Breast Cancer, Lymphoma, Prostate Cancer) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 組織診断の世界市場 (~2028年):製品 (消耗品 (抗体・試薬・組織・プローブ)・機器 (処理システム・スキャナー))・技術 (ISH・IHC・スライド染色)・疾患タイプ (乳癌・リンパ腫・前立腺癌) 別 |

|

出版日: 2024年01月08日

発行: MarketsandMarkets

ページ情報: 英文 254 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | 製品・技術・疾患タイプ・エンドユーザー・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・その他 |

世界の組織診断の市場規模は、2023年の56億米ドルから、予測期間中は8.4%のCAGRで推移し、2028年には84億米ドルに達すると予測されています。

製品別では、消耗品の部門が2022年に最大のシェアを記録しています。ライフサイエンスや癌研究に対する政府および民間によるの資金投入の増加、大手製薬会社によるR&D費の増加などの要因が同部門の成長に寄与しています。さらに、有効な結果や正確な診断を提供する優れた消耗品が入手可能になったことも、需要の拡大につながり、同部門の成長をもたらしています。

技術別では、免疫組織化学 (IHC) の部門が2022年に最大のシェアを示すと推計されています。老年人口の増加、癌疾患の有病率の増加、糖尿病、IHC検査に対する償還のアベイラビリティ、デジタルパソロジーの導入などの要因がIHC製品の需要を牽引しています。

疾患別では、乳癌の部門が2022年に最大のシェアを示しています。これは年齢、家族歴、生殖歴、乳腺組織の密度が高いこと、運動不足、飲酒、喫煙、放射線被曝などの要因に加え、非浸潤性乳管癌 (DCIS)、浸潤性乳管癌 (IDC)、炎症性乳癌 (IBC) などの乳癌の発生率が増加しているためです。

地域別では、アジア太平洋地域が予測期間中にもっとも高い成長率を示す見通しです。同地域の高成長は、対象人口の多さ、同地域の経済成長、アジア諸国における癌有病率の上昇に起因しています。

当レポートでは、世界の組織診断の市場を調査し、市場概要、市場影響因子の分析、技術・特許の動向、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界の動向

- バリューチェーン分析

- サプライチェーン分析

- 技術分析

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- 規制状況

- 特許分析

- 主要な会議とイベント

- 価格分析

- 貿易分析

- エコシステム市場/マップ

- 顧客の事業に影響を与える動向/ディスラプション

第6章 組織診断市場:製品別

- 消耗品

- 抗体

- キット

- 試薬

- プローブ

- 機器

- スライド染色システム

- スキャナー

- 組織処理システム

- その他

第7章 組織診断市場:技術別

- 免疫組織化学

- in situハイブリダイゼーション

- デジタルパソロジー&ワークフロー管理

- 特殊染色

第8章 組織診断市場:疾患タイプ別

- 乳癌

- 胃癌

- リンパ腫

- 前立腺癌

- 非小細胞肺癌

- その他

第9章 組織診断市場:エンドユーザー別

- 病院

- 研究機関

- 製薬会社

- CRO

- その他

第10章 組織診断市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 概要

- 主要企業の戦略

- 主要企業の収益分析

- 市場シェア分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 新興企業/中小企業の競合ベンチマーキング

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- F. HOFFMANN-LA ROCHE LTD.

- DANAHER CORPORATION

- PHC HOLDINGS CORPORATION

- THERMO FISHER SCIENTIFIC INC.

- ABBOTT

- AGILENT TECHNOLOGIES, INC.

- MERCK KGAA

- SAKURA FINETEK JAPAN CO., LTD.

- ABCAM PLC

- BECTON, DICKINSON AND COMPANY (BD)

- BIO SB

- BIOGENEX

- CELL SIGNALING TECHNOLOGY, INC.

- HISTO-LINE LABORATORIES

- SLEE MEDICAL GMBH

- CELLPATH LTD.

- その他の企業

- AMOS SCIENTIFIC PTY LTD.

- JINHUA YIDI MEDICAL APPLIANCE CO., LTD.

- MEDITE MEDICAL GMBH

- DIAPATH S.P.A.

- KFBIO KONFOONG BIOINFORMATION TECH CO., LTD

- DIAGNOSTIC BIOSYSTEMS INC.

- 3DHISTECH LTD.

- RWD LIFE SCIENCE CO., LTD.

- DAKEWE

- SYSMEX CORPORATION

- ENZO LIFE SCIENCES, INC.

- BIOCARE MEDICAL, LLC.

- MILESTONE MEDICAL

- BIO-OPTICA MILANO SPA

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Billion |

| Segments | Product, Technology, Disease Type, End User, and Region |

| Regions covered | North America, Europe, APAC, and Rest of the World |

The global tissue diagnostics market is projected to reach USD 8.4 billion by 2028 from USD 5.6 billion in 2023, at a CAGR of 8.4% during the forecast period. Market growth is driven by factors such as the rising prevalence of cancer, increasing availability of reimbursements and increasing technological advancements in tissue diagnostics are the major factors driving the growth of the market.

"The Consumables to register the largest share of the tissue diagnostics market, by product."

The global tissue diagnostics market product segment is divided into Consumables and Instruments . In product segment the consumables is expected to account for the largest share of the tissue diagnostics market in 2022. Market growth is largely driven by the rise in government and private funding in life sciences and cancer research, growing R&D expenditure by leading pharma companies. Moreover, the availability of better consumables that offer efficient results and precision in diagnosis attributes to their growing demand, resulting in growth of the segment.

"Immunohistochemistry tissue diagnostics segment to grow at a considerable rate among technology during the forecast period."

The tissue diagnostics market is four technology segments, namely, Immunohistochemistry (IHC), In Situ Hybridization (ISH), Digital Pathology & Workflow, and Special Staining. The Immunohistochemistry technology segment is expected to account for the largest share of the tissue diagnostics market in 2022. The large share of this segment can primarily be attributed to the Rising geriatric population and growing prevalence of cancer diseases diabetes, availability of reimbursements for IHC tests, and adoption of digital pathology are driving the demand for immunohistochemistry products.

"Breast Cancer segment accounted for the largest share in the tissue diagnostics market, by disease."

The global tissue diagnostics market is segmented into Breast Cancer, Gastric Cancer, Lymphoma, Prostate Cancer, Non-small Cell Lung Cancer, and Other Diseases. The breast cancer segment accounted for a largest share in 2022, primarily due number of factors such as age, family history, reproductive history, the presence of dense breast tissues, a lack of physical activity, alcohol consumption, smoking, radiation exposure coupled with the increasing incidence of breast cancer such as ductal carcinoma in situ (DCIS), invasive ductal carcinoma (IDC), and inflammatory breast cancer (IBC), among others.

"Asia Pacific: The fastest-growing region in the tissue diagnostics market."

The global tissue diagnostics market is segmented into four major regions - North America, Europe, the Asia Pacific, and Rest of the World (RoW). The Asia Pacific region is expected to grow at the highest rate in the tissue diagnostics market during the forecast period. The high growth in the region is due to the presence of a large target population, the economic growth in the countries of this region and rising prevalence of cancer in Asian countries.

The break-up of the profile of primary participants in the tissue diagnostics market:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, and Rest of the World- 10%

The key players in this market are F. Hoffmann-La Roche Ltd (Switzerland), Danaher Corporation (US), PHC Holdings Corporation Corporation (Japan), Agilent Technologies Inc. (US), Thermo Fisher Scientific, Inc (US), Abbott (US), Merck KGAA (Germany), SAKURA FINETEK JAPAN CO., LTD (Japan), Abcam Plc. (UK), Becton, Dickinson and Company (BD) (US), Bio SB (US), Biogenix (US), Cell Signaling Technology, Inc (US), Histo-Line Laboratories (Italy), SLEE Medical GMBH (Germany), Cellpath Ltd (UK), Amos scientific Pty Ltd. (Australia), Jinhua YIDI Medical Appliance CO.,LTD (China), MEDITE Medical GmbH (Germany), Diapath S.p.A. (Italy), KONFOONG BIOINFORMATION TECH CO.,LTD (China), Diagnostic BioSystems Inc. (US), 3DHISTECH (Hungary), RWD Life Science Co.,LTD (China), Dakewei Biotechnology co., Ltd (China), Sysmax Corporation (Japan), Enzo Life Sciences, Inc. (US), Biocare Medical, LLC. (US), MILESTONE MEDICAL (US), and Bio-Optica Milano Spa (Italy).

Research Coverage:

This research report categorizes the tissue diagnostics market by product (consumables and instruments), technology (immunohistochemistry (IHC), in situ hybridization (ISH), digital pathology & workflow management, special staining), disease type (breast cancer, gastric cancer, lymphoma, prostate cancer, non-small cell lung cancer, other disease types), end user (hospitals, research laboratories, pharmaceutical companies, Contract Research Organizations (CROs), and Other End Users), and region (North America, Europe, Asia Pacific, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the tissue diangostics market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, key strategies, acquisitions, and partnerships. New product launches and approvals, and recent developments associated with the tissue diagnostics market. This report covers the competitive analysis of upcoming startups in the tissue diangostics market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall tissue diagnostics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (the rising prevalence of cancer, growing healthcare expenditure, growing demand for digital pathology, increasing healthcare expenditure, developing infrastructure for cancer diagnosis, increasing availability of reimbursements, and increasing technological advancements in tissue diagnostics are the major factors driving the growth of the market), restraints (high degree of consolidation, high cost of diagnostic imaging system), opportunities (significant opportunities in BRICS countries, growing demand for personalized medicines, increasing number of clinical trails perraining to cancer drugs, emerging economics to offer significant opportunities to companies), challenges (lack of skilled professionals, availability of refurbished products, stringent regulatory requirements, lack of infrastructure and low awareness in middle and low income countries and lack of standardization ) and trends (Increasing number of reagent rental agreements, increasing usage of Al in histopathology ) influencing the growth of the tissue diagnostics market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the tissue diagnostics market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the tissue diagnostics market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the tissue diagnostics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like F. Hoffmann-La Roche Ltd (Switzerland), Danaher Corporation (US), PHC Holdings Corporation (Japan), Agilent Technologies (US), Thermo Fisher Scientific Inc. (US), and among others in the tissue diagnostics market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 MARKET SEGMENTATION

- 1.4.2 REGIONS COVERED

- 1.4.3 YEARS CONSIDERED

- 1.4.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 5 REVENUE SHARE ANALYSIS

- FIGURE 6 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- FIGURE 7 TISSUE DIAGNOSTICS MARKET: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.5.1 MARKET ASSUMPTIONS

- 2.5.2 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT ANALYSIS

- 2.8 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 9 TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2023 VS. 2028 (USD BILLION)

- FIGURE 10 TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD BILLION)

- FIGURE 11 TISSUE DIAGNOSTICS MARKET, BY DISEASE TYPE, 2023 VS. 2028 (USD BILLION)

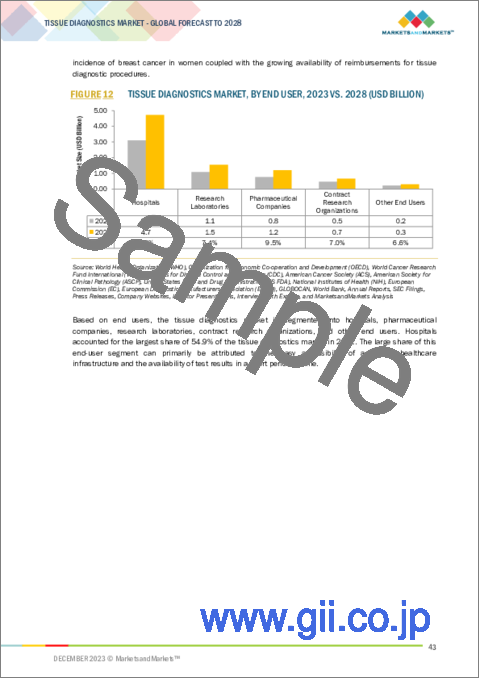

- FIGURE 12 TISSUE DIAGNOSTICS MARKET, BY END USER, 2023 VS. 2028 (USD BILLION)

- FIGURE 13 GEOGRAPHICAL SNAPSHOT OF TISSUE DIAGNOSTICS MARKET

4 PREMIUM INSIGHTS

- 4.1 TISSUE DIAGNOSTICS MARKET OVERVIEW

- FIGURE 14 RISING INCIDENCE OF CANCER AND INFECTIOUS DISEASES TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- 4.2 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT & COUNTRY (2022)

- FIGURE 15 CONSUMABLES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.3 TISSUE DIAGNOSTICS MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 16 CHINA & INDIA TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.4 TISSUE DIAGNOSTICS MARKET: REGIONAL MIX

- FIGURE 17 ASIA PACIFIC REGION IS PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.5 TISSUE DIAGNOSTICS MARKET: DEVELOPED COUNTRIES VS. EMERGING ECONOMIES

- FIGURE 18 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 TISSUE DIAGNOSTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising incidence of cancer and infectious diseases

- TABLE 2 INCREASING INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (MILLION)

- TABLE 3 PROJECTED INCREASE IN GLOBAL NUMBER OF CANCER PATIENTS, 2018 VS. 2020 VS. 2040

- 5.2.1.2 Growing demand for digital pathology

- 5.2.1.3 Increasing healthcare expenditure

- FIGURE 20 CURRENT HEALTH EXPENDITURE PER CAPITA

- FIGURE 21 CURRENT HEALTH EXPENDITURE (% OF GDP)

- 5.2.1.4 Growing availability of reimbursements

- 5.2.1.5 Rising establishment of private diagnostics centers

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of tissue diagnostic systems

- 5.2.2.2 Stringent regulatory requirements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth potential of emerging economies

- FIGURE 22 GROWTH IN CURRENT HEALTHCARE EXPENDITURE IN BRICS COUNTRIES, 2012-2020

- 5.2.3.2 Growing preference for personalized medicines

- FIGURE 23 PERSONALIZED MEDICINES APPROVED BY FDA (%), 2015-2022

- 5.2.3.3 Increasing number of clinical trials for cancer therapeutics

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled professionals

- 5.2.4.2 Availability of refurbished products

- 5.2.4.3 Inadequate standardization for TDx

- 5.2.5 INDUSTRY TRENDS

- 5.2.5.1 Increasing number of reagent rental agreements

- 5.2.5.2 Growing usage of AI in histopathology

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASE

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 25 DIRECT DISTRIBUTION-PREFERRED STRATEGY FOR PROMINENT COMPANIES

- 5.5 TECHNOLOGY ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 BARGAINING POWER OF BUYERS

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USERS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- 5.7.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 5 KEY BUYING CRITERIA FOR END USERS

- 5.8 REGULATORY LANDSCAPE

- TABLE 6 INDICATIVE LIST OF REGULATORY AUTHORITIES IN TISSUE DIAGNOSTICS MARKET

- 5.9 PATENT ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS

- TABLE 7 LIST OF CONFERENCES & EVENTS (2023-2024)

- 5.11 PRICING ANALYSIS

- TABLE 8 PRICE RANGE FOR TISSUE DIAGNOSTICS

- 5.12 TRADE ANALYSIS

- TABLE 9 IMPORT DATA FOR MICROTOMES, PARTS, AND ACCESSORIES OF INSTRUMENTS AND APPARATUS FOR PHYSICAL/CHEMICAL ANALYSIS, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 10 EXPORT DATA FOR MICROTOMES, PARTS, AND ACCESSORIES OF INSTRUMENTS AND APPARATUS FOR PHYSICAL/CHEMICAL ANALYSIS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.13 ECOSYSTEM MARKET/MAP

- TABLE 11 TISSUE DIAGNOSTICS MARKET: ROLE IN ECOSYSTEM

- FIGURE 28 KEY PLAYERS OPERATING IN TISSUE DIAGNOSTICS MARKET

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

6 TISSUE DIAGNOSTICS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 12 TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2 CONSUMABLES

- TABLE 13 TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 14 TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY REGION, 2021-2028 (USD MILLION)

- 6.2.1 ANTIBODIES

- 6.2.1.1 Rising prevalence of infectious diseases to drive market

- TABLE 15 TISSUE DIAGNOSTICS MARKET FOR ANTIBODIES, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2 KITS

- 6.2.2.1 Optimized sensitivity and versatility to boost demand

- TABLE 16 TISSUE DIAGNOSTICS MARKET FOR KITS, BY REGION, 2021-2028 (USD MILLION)

- 6.2.3 REAGENTS

- 6.2.3.1 Rising uptake in IHC and FISH procedures to support market growth

- TABLE 17 TISSUE DIAGNOSTICS MARKET FOR REAGENTS, BY REGION, 2021-2028 (USD MILLION)

- 6.2.4 PROBES

- 6.2.4.1 Utilization in fluorescence microscopy applications to boost demand

- TABLE 18 TISSUE DIAGNOSTICS MARKET FOR PROBES, BY REGION, 2021-2028 (USD MILLION)

- 6.3 INSTRUMENTS

- TABLE 19 TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 20 TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1 SLIDE-STAINING SYSTEMS

- 6.3.1.1 Development of high-throughput staining systems to drive market

- TABLE 21 KEY MANUFACTURERS OF AUTOMATED SLIDE STAINERS

- TABLE 22 TISSUE DIAGNOSTICS MARKET FOR SLIDE-STAINING SYSTEMS, BY REGION, 2021-2028 (USD MILLION)

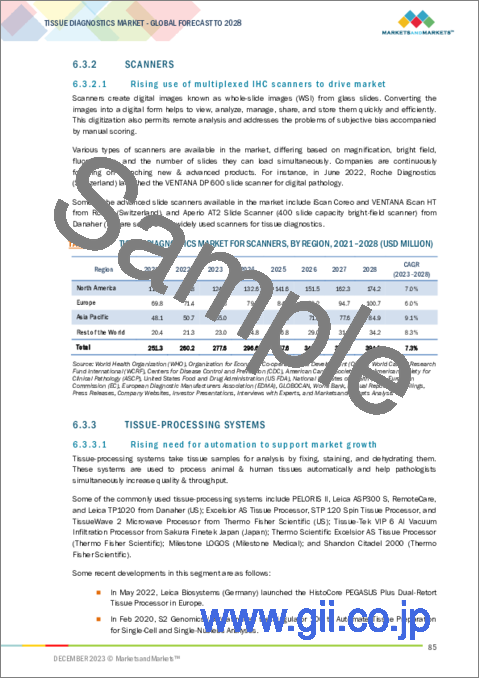

- 6.3.2 SCANNERS

- 6.3.2.1 Rising use of multiplexed IHC scanners to drive market

- TABLE 23 TISSUE DIAGNOSTICS MARKET FOR SCANNERS, BY REGION, 2021-2028 (USD MILLION)

- 6.3.3 TISSUE-PROCESSING SYSTEMS

- 6.3.3.1 Rising need for automation to support market growth

- TABLE 24 TISSUE DIAGNOSTICS MARKET FOR TISSUE-PROCESSING SYSTEMS, BY REGION, 2021-2028 (USD MILLION)

- 6.3.4 OTHER INSTRUMENTS

- TABLE 25 TISSUE DIAGNOSTICS MARKET FOR OTHER INSTRUMENTS, BY REGION, 2021-2028 (USD MILLION)

7 TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- TABLE 26 TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 7.2 IMMUNOHISTOCHEMISTRY

- 7.2.1 RISING UPTAKE OF IHC KITS FOR DIAGNOSTIC APPLICATIONS TO FUEL MARKET

- TABLE 27 TISSUE DIAGNOSTICS MARKET FOR IMMUNOHISTOCHEMISTRY, BY REGION, 2021-2028 (USD MILLION)

- 7.3 IN SITU HYBRIDIZATION

- 7.3.1 ABILITY TO DETECT SPECIFIC RNA AND DNA SEQUENCES TO BOOST DEMAND

- TABLE 28 TISSUE DIAGNOSTICS MARKET FOR IN SITU HYBRIDIZATION, BY REGION, 2021-2028 (USD MILLION)

- 7.4 DIGITAL PATHOLOGY & WORKFLOW MANAGEMENT

- 7.4.1 RISING NEED FOR ANALYSIS AND SEAMLESS MANAGEMENT TO SUPPORT MARKET GROWTH

- TABLE 29 TISSUE DIAGNOSTICS MARKET FOR DIGITAL PATHOLOGY & WORKFLOW MANAGEMENT, BY REGION, 2021-2028 (USD MILLION)

- 7.5 SPECIAL STAINING

- 7.5.1 UTILIZATION IN CANCER DIAGNOSTICS TO BOOST DEMAND

- TABLE 30 TISSUE DIAGNOSTICS MARKET FOR SPECIAL STAINING, BY REGION, 2021-2028 (USD MILLION)

8 TISSUE DIAGNOSTICS MARKET, BY DISEASE TYPE

- 8.1 INTRODUCTION

- TABLE 31 GLOBAL CANCER INCIDENCE, 2020 VS. 2040

- TABLE 32 TISSUE DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021-2028 (USD MILLION)

- 8.2 BREAST CANCER

- 8.2.1 RISING UPTAKE OF HER2 TESTS FOR CANCER DIAGNOSIS TO DRIVE MARKET

- TABLE 33 BREAST CANCER INCIDENCE, BY REGION, 2020 VS. 2040

- FIGURE 29 ARTICLES PUBLISHED ON BREAST CANCER TISSUE DIAGNOSTICS, 2011-2021

- TABLE 34 TISSUE DIAGNOSTICS MARKET FOR BREAST CANCER, BY REGION, 2021-2028 (USD MILLION)

- 8.3 GASTRIC CANCER

- 8.3.1 RISING INCIDENCE OF GASTROINTESTINAL CANCER TO BOOST DEMAND

- TABLE 35 COLON CANCER INCIDENCE, BY REGION, 2020 VS. 2040

- TABLE 36 TISSUE DIAGNOSTICS MARKET FOR GASTRIC CANCER, BY REGION, 2021-2028 (USD MILLION)

- 8.4 LYMPHOMA

- 8.4.1 RISING INCIDENCE OF NON-HODGKIN'S LYMPHOMA IN ADULTS TO SUPPORT MARKET GROWTH

- TABLE 37 HODGKIN LYMPHOMA INCIDENCE, BY REGION, 2020 VS. 2040

- TABLE 38 NON-HODGKIN LYMPHOMA INCIDENCE, BY REGION, 2020 VS. 2040

- TABLE 39 TISSUE DIAGNOSTICS MARKET FOR LYMPHOMA, BY REGION, 2021-2028 (USD MILLION)

- 8.5 PROSTATE CANCER

- 8.5.1 RISING UPTAKE OF ISH TESTS FOR DIAGNOSIS TO FUEL MARKET

- TABLE 40 PROSTATE CANCER INCIDENCE, BY REGION, 2020 VS. 2040

- TABLE 41 TISSUE DIAGNOSTICS MARKET FOR PROSTATE CANCER, BY REGION, 2021-2028 (USD MILLION)

- 8.6 NON-SMALL CELL LUNG CANCER

- 8.6.1 GROWING FOCUS ON DEVELOPING COMPANION DIAGNOSTIC TESTS TO DRIVE MARKET

- TABLE 42 TISSUE DIAGNOSTICS MARKET FOR NON-SMALL CELL LUNG CANCER, BY REGION, 2021-2028 (USD MILLION)

- 8.7 OTHER DISEASE TYPES

- TABLE 43 TISSUE DIAGNOSTICS MARKET FOR OTHER DISEASE TYPES, BY REGION, 2021-2028 (USD MILLION)

9 TISSUE DIAGNOSTICS MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 44 TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2 HOSPITALS

- 9.2.1 ABILITY TO OFFER ADVANCED EQUIPMENT & INFRASTRUCTURE TO DRIVE MARKET

- TABLE 45 TISSUE DIAGNOSTICS MARKET FOR HOSPITALS, BY REGION, 2021-2028 (USD MILLION)

- 9.3 RESEARCH LABORATORIES

- 9.3.1 RISING DEMAND OF SPECIALTY TESTS TO DRIVE MARKET

- TABLE 46 TISSUE DIAGNOSTICS MARKET FOR RESEARCH LABORATORIES, BY REGION, 2021-2028 (USD MILLION)

- 9.4 PHARMACEUTICAL COMPANIES

- 9.4.1 INCREASING R&D ACTIVITIES FOR DISEASE DIAGNOSTICS TO DRIVE MARKET

- TABLE 47 TISSUE DIAGNOSTICS MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- 9.5 CONTRACT RESEARCH ORGANIZATIONS

- 9.5.1 OUTSOURCING OF R&D ACTIVITIES TO SUPPORT MARKET GROWTH

- TABLE 48 CONTRACT RESEARCH ORGANIZATIONS FOR ONCOLOGY DIAGNOSTICS

- TABLE 49 TISSUE DIAGNOSTICS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2021-2028 (USD MILLION)

- 9.6 OTHER END USERS

- TABLE 50 TISSUE DIAGNOSTICS MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

10 TISSUE DIAGNOSTICS MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 51 TISSUE DIAGNOSTICS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 30 TISSUE DIAGNOSTICS MARKET: NORTH AMERICA SNAPSHOT

- TABLE 52 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021-2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 High healthcare expenditure to drive market

- TABLE 59 US CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

- TABLE 60 US: KEY MACROINDICATORS

- TABLE 61 LIST OF US FDA-APPROVED PRODUCTS FOR TISSUE DIAGNOSTICS

- TABLE 62 US: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 63 US: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 64 US: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 65 US: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 66 US: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 High prevalence of cancer to support market growth

- TABLE 67 CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

- TABLE 68 CANADA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 69 CANADA: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 70 CANADA: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 71 CANADA: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 72 CANADA: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.3 NORTH AMERICA: RECESSION IMPACT

- 10.3 EUROPE

- TABLE 73 EUROPE: TISSUE DIAGNOSTICS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 74 EUROPE: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 75 EUROPE: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 76 EUROPE: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 77 EUROPE: TISSUE DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021-2028 (USD MILLION)

- TABLE 78 EUROPE: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 79 EUROPE: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Availability of reimbursements for colorectal cancer screening procedures to support market growth

- TABLE 80 GERMANY: CANCER INCIDENCE, BY TYPE, 2020 VS. 2040

- TABLE 81 GERMANY: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 82 GERMANY: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 83 GERMANY: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 84 GERMANY: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 85 GERMANY: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION

- 10.3.2 UK

- 10.3.2.1 Rising investments in cancer research to propel market

- TABLE 86 UK: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 87 UK: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 88 UK: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 89 UK: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 90 UK: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Growing focus on early disease diagnosis to boost demand

- TABLE 91 FRANCE: CANCER INCIDENCE, BY TYPE, 2020 VS. 2040

- TABLE 92 FRANCE: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 93 FRANCE: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 94 FRANCE: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 FRANCE: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 96 FRANCE: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 High incidence of cancer and geriatric population to support market growth

- TABLE 97 ITALY: CANCER INCIDENCE, BY TYPE, 2020 VS. 2040

- TABLE 98 ITALY: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 99 ITALY: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 100 ITALY: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 ITALY: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 102 ITALY: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.5 SPAIN

- 10.3.5.1 High incidence of chronic diseases to drive market

- TABLE 103 SPAIN: CANCER INCIDENCE, BY TYPE, 2020 VS. 2025

- TABLE 104 SPAIN: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 105 SPAIN: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 SPAIN: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 107 SPAIN: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 108 SPAIN: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 109 REST OF EUROPE: CANCER INCIDENCE, 2020 VS. 2025

- TABLE 110 REST OF EUROPE: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 REST OF EUROPE: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 REST OF EUROPE: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.7 EUROPE: RECESSION IMPACT

- 10.4 ASIA PACIFIC

- FIGURE 31 TISSUE DIAGNOSTICS MARKET: ASIA PACIFIC SNAPSHOT

- TABLE 115 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY DISEASE, 2021-2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Rising incidence of chronic & infectious diseases to propel market

- TABLE 122 CANCER INCIDENCE, BY CANCER TYPE (CHINA), 2020 VS. 2025

- TABLE 123 CHINA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 124 CHINA: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 CHINA: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 126 CHINA: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 127 CHINA: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Development of advanced diagnostic products to fuel market

- TABLE 128 CANCER INCIDENCE, BY CANCER TYPE (JAPAN), 2020 VS. 2040

- TABLE 129 JAPAN: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 130 JAPAN: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 131 JAPAN: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 JAPAN: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 133 JAPAN: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Rising establishment of diagnostic centers to drive market

- TABLE 134 INDIA: CANCER INCIDENCE, BY TYPE, 2020 VS. 2025

- TABLE 135 INDIA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 136 INDIA: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 137 INDIA: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 138 INDIA: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 139 INDIA: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.4 REST OF ASIA PACIFIC

- TABLE 140 REST OF ASIA PACIFIC: CANCER INCIDENCE, 2020 VS. 2040

- TABLE 141 REST OF ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.5 ASIA PACIFIC: RECESSION IMPACT

- 10.5 REST OF THE WORLD

- TABLE 146 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 147 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 148 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 149 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 150 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021-2028 (USD MILLION)

- TABLE 151 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 152 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.1 LATIN AMERICA

- 10.5.1.1 Rising number of cancer screening programs to drive market

- TABLE 153 LATIN AMERICA: CANCER INCIDENCE, 2020 VS. 2025

- TABLE 154 LATIN AMERICA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 155 LATIN AMERICA: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 156 LATIN AMERICA: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 LATIN AMERICA: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 158 LATIN AMERICA: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 Improvements in healthcare infrastructure to support market growth

- TABLE 159 CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2025

- TABLE 160 MIDDLE EAST & AFRICA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.3 REST OF THE WORLD: RECESSION IMPACT

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY MARKET PLAYERS

- TABLE 165 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN TISSUE DIAGNOSTICS MARKET

- 11.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 32 REVENUE ANALYSIS OF KEY PLAYERS IN TISSUE DIAGNOSTICS MARKET

- 11.4 MARKET SHARE ANALYSIS

- TABLE 166 TISSUE DIAGNOSTICS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- FIGURE 33 TISSUE DIAGNOSTICS MARKET SHARE, BY KEY PLAYER (2022)

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 34 TISSUE DIAGNOSTICS MARKET: COMPANY EVALUATION MATRIX

- 11.5.5 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 167 COMPANY FOOTPRINT

- 11.5.6 PRODUCT FOOTPRINT

- 11.5.7 REGIONAL FOOTPRINT

- 11.6 START-UP/SME EVALUATION MATRIX

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 35 TISSUE DIAGNOSTICS MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES

- 11.7 COMPETITIVE BENCHMARKING OF STARTUP/SME PLAYERS

- TABLE 168 TISSUE DIAGNOSTICS MARKET: KEY STARTUPS/SMES

- 11.8 COMPETITIVE SCENARIOS AND TRENDS

- 11.8.1 PRODUCT LAUNCHES & APPROVALS

- TABLE 169 TISSUE DIAGNOSTICS MARKET: PRODUCT LAUNCHES & APPROVALS (JANUARY 2020-OCTOBER 2023)

- 11.8.2 DEALS

- TABLE 170 TISSUE DIAGNOSTICS MARKET: DEALS (JANUARY 2020-OCTOBER 2023)

- 11.8.3 OTHER DEVELOPMENTS

- TABLE 171 TISSUE DIAGNOSTIC MARKET: OTHER DEVELOPMENTS (JANUARY 2020-OCTOBER 2023)

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 KEY PLAYERS

- 12.1.1 F. HOFFMANN-LA ROCHE LTD.

- TABLE 172 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- FIGURE 36 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- 12.1.2 DANAHER CORPORATION

- TABLE 173 DANAHER CORPORATION: BUSINESS OVERVIEW

- FIGURE 37 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- 12.1.3 PHC HOLDINGS CORPORATION

- TABLE 174 PHC HOLDINGS CORPORATION: BUSINESS OVERVIEW

- FIGURE 38 PHC HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

- 12.1.4 THERMO FISHER SCIENTIFIC INC.

- TABLE 175 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- FIGURE 39 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- 12.1.5 ABBOTT

- TABLE 176 ABBOTT: BUSINESS OVERVIEW

- FIGURE 40 ABBOTT: COMPANY SNAPSHOT (2022)

- 12.1.6 AGILENT TECHNOLOGIES, INC.

- TABLE 177 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 41 AGILENT TECHNOLOGIES INC.: COMPANY SNAPSHOT (2022)

- 12.1.7 MERCK KGAA

- TABLE 178 MERCK KGAA: BUSINESS OVERVIEW

- FIGURE 42 MERCK KGAA: COMPANY SNAPSHOT (2022)

- 12.1.8 SAKURA FINETEK JAPAN CO., LTD.

- TABLE 179 SAKURA FINETEK JAPAN CO., LTD.: BUSINESS OVERVIEW

- 12.1.9 ABCAM PLC

- TABLE 180 ABCAM PLC.: BUSINESS OVERVIEW

- FIGURE 43 ABCAM PLC. COMPANY SNAPSHOT (2022)

- 12.1.10 BECTON, DICKINSON AND COMPANY (BD)

- TABLE 181 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- FIGURE 44 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- 12.1.11 BIO SB

- TABLE 182 BIO SB: BUSINESS OVERVIEW

- 12.1.12 BIOGENEX

- TABLE 183 BIOGENEX: BUSINESS OVERVIEW

- 12.1.13 CELL SIGNALING TECHNOLOGY, INC.

- TABLE 184 CELL SIGNALING TECHNOLOGY, INC.: BUSINESS OVERVIEW

- 12.1.14 HISTO-LINE LABORATORIES

- TABLE 185 HISTO-LINE LABORATORIES: BUSINESS OVERVIEW

- 12.1.15 SLEE MEDICAL GMBH

- TABLE 186 SLEE MEDICAL GMBH: BUSINESS OVERVIEW

- 12.1.16 CELLPATH LTD.

- TABLE 187 CELLPATH LTD.: BUSINESS OVERVIEW

- 12.2 OTHER PLAYERS

- 12.2.1 AMOS SCIENTIFIC PTY LTD.

- 12.2.2 JINHUA YIDI MEDICAL APPLIANCE CO., LTD.

- 12.2.3 MEDITE MEDICAL GMBH

- 12.2.4 DIAPATH S.P.A.

- 12.2.5 KFBIO KONFOONG BIOINFORMATION TECH CO., LTD

- 12.2.6 DIAGNOSTIC BIOSYSTEMS INC.

- 12.2.7 3DHISTECH LTD.

- 12.2.8 RWD LIFE SCIENCE CO., LTD.

- 12.2.9 DAKEWE

- 12.2.10 SYSMEX CORPORATION

- 12.2.11 ENZO LIFE SCIENCES, INC.

- 12.2.12 BIOCARE MEDICAL, LLC.

- 12.2.13 MILESTONE MEDICAL

- 12.2.14 BIO-OPTICA MILANO SPA

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS