|

|

市場調査レポート

商品コード

1927586

防火システム市場:オファリング別、製品別、サービス別、業界別、地域別 - 2030年までの予測Fire Protection System Market by Product, Service - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 防火システム市場:オファリング別、製品別、サービス別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年11月03日

発行: MarketsandMarkets

ページ情報: 英文 331 Pages

納期: 即納可能

|

概要

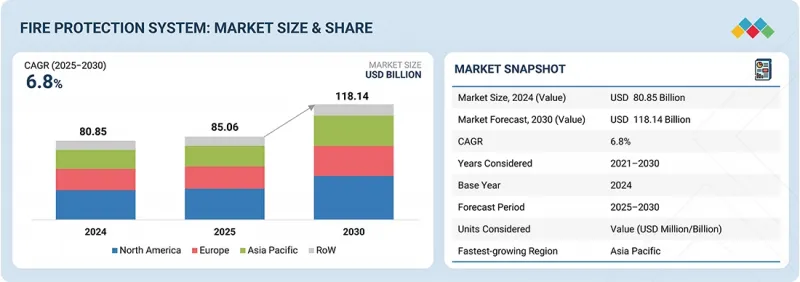

世界の防火システムの市場規模は、2025年の850億6,000万米ドルから2030年までに1,181億4,000万米ドルへ成長し、CAGR6.8%で拡大すると予測されています。

世界の防火システム市場は、世界の工業化の進展、都市インフラ整備の拡大、およびより厳格な防火安全規制の施行を背景に、著しい成長を遂げています。各業界では、運用リスクの最小化、資産損失の防止、規制順守の確保を実現する統合型安全ソリューションの導入を優先しています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象単位 | 金額(10億米ドル) |

| セグメント | オファリング別、製品別、サービス別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

IoT対応の火災監視、AI支援の火災分析、予知保全システムなどの技術的進歩により、状況認識と対応時間が向上しています。産業安全の近代化に向けた政府の取り組み、保険要件、啓発キャンペーンが導入をさらに推進しています。新興経済国における製造プラント、エネルギー施設、物流拠点の建設増加に加え、持続可能性と環境に優しい消火システムへの注目が高まっていることから、防火エコシステムにおける世界のベンダーやサービスプロバイダーにとって大きな機会が生まれています。

2024年には、石油・ガス、製造、エネルギー、化学セクターにおける安全ソリューションの需要増加により、産業分野が防火システム市場で最大のシェアを占めると予想されます。各産業は厳格な防火規制のもとで操業しており、人員、設備、重要資産を火災リスクから保護するため、高度なシステムに依存しています。製油所、発電所、生産施設などの高リスク環境では、自動消火システム、炎・熱感知器、遠隔監視プラットフォームの導入が大幅に増加しています。防火システムをプラント自動化やSCADAフレームワークと統合する動向の高まりは、信頼性と運用安全性をさらに向上させています。加えて、頻繁な改修プロジェクトや旧式防火システムの近代化が、持続的な市場需要を牽引しています。ダウンタイムの削減、保険責任の軽減、物的損失の抑制が重視される中、産業分野は世界の防火システム収益における主要な貢献分野として位置づけられています。

火災分析セグメントは、予測期間中に最も高いCAGRを記録すると予測されています。これは、予測型火災リスクモデリングとデータ駆動型安全計画の重要性が高まっていることが主な要因です。これらのシステムは火災挙動のリアルタイムシミュレーションと評価を可能にし、組織が事故対応準備を強化し、規制順守を確保するのに役立ちます。AI、デジタルツイン、IoTベースのデータ収集を統合することで、従来の防火安全管理は予防的かつ予測的な枠組みへと変革されます。火災分析ソフトウェアは、産業・商業インフラにおける性能ベース設計を支援し、リスク軽減と避難計画のための精密な知見を提供します。現代施設の複雑化と資産価値の高騰に伴い、検知・消火システムを補完する分析ソリューションへの投資が拡大しています。さらに、保険会社や規制当局がコンプライアンスと安全監査に不可欠なツールとして火災分析を認識する動きが加速し、世界中の重要産業やインフラプロジェクトにおける導入を後押ししています。

アジア太平洋は2030年時点で世界の防火システム市場において最大のシェアを占め、予測期間終了時までその優位性を維持すると見込まれています。中国、インド、日本、韓国における急速な工業化、都市拡大、商業・製造インフラへの投資増加が、先進的な防火技術への強い需要を牽引しています。各国政府はより厳格な安全基準を施行しており、自動検知・消火・分析システムの導入拡大につながっています。同地域における労働者の安全、コンプライアンス、資産保護への関心の高まりが、市場の拡大をさらに後押ししています。地域および世界の企業は、費用対効果に優れ、拡張性があり、IoT対応のソリューションを通じて存在感を強化しています。意識の高まり、規制の施行、建設活動の増加に伴い、アジア太平洋地域は防火システムにおいて最大かつ最もダイナミックな地域市場であり続けています。

防火システム市場における主要業界専門家への広範な一次調査を実施し、2次調査で収集した各種セグメントおよびサブセグメントの市場規模を確定・検証いたしました。当レポートの一次調査対象者の内訳は下記の通りです。

防火システム市場は、Johnson Controls(アイルランド)、Honeywell International Inc.(米国)、Siemens(ドイツ)、Robert Bosch GmbH(ドイツ)、Eaton(アイルランド)など、世界的に確立された数社の主要参入企業によって主導されています。

本調査では、防火システム市場におけるこれらの主要企業について、企業プロファイル、最近の動向、主要な市場戦略を含む詳細な競合分析を実施しています。

調査範囲

当レポートでは、防火システム市場をセグメント化しています。製品別、サービス別、および業界別、産業別に市場規模を予測しています。また、市場の促進要因、抑制要因、機会、課題についても論じています。北米、欧州、アジア太平洋の4つの主要地域における詳細な市場分析を提供し、市場動向を包括的に把握できます。当レポートには、防火システムエコシステムで事業を展開する主要企業のサプライチェーンと競合情勢のレビューも含まれています。

当レポート購入の主なメリット

- 主な促進要因の分析(世界のインフラ開発の拡大と先進安全システムへの需要増加、リスク・損失最小化のための企業別防火投資の増加、煙感知器・防火安全システムに関する世界の規制・コンプライアンス基準の強化、住宅・商業ビルにおけるケーブル不要型防火安全システムへの需要増加)、制約要因(先進防火システムの設置・維持費の高さ、発展途上地域における消費者認知度の低さと防火安全対策の不十分さ、誤作動や検知信頼性の問題による防火安全導入への影響)、機会(先進的な泡消火システムや水噴霧消火システムの導入拡大、安全性と監視強化のためのIoT統合型スマート火災検知デバイスの普及拡大、防火安全とコンプライアンス向上のための政府建築基準の強化)、課題(複雑な火災検知システムの統合・設定における課題、進化し多様化する規制コンプライアンス課題への対応)

- サービス開発/イノベーション:防火システム市場における新技術動向、研究開発活動、製品投入に関する詳細な分析

- 市場開発:多様な地域における防火システム市場の分析を通じた、収益性の高い市場に関する包括的な情報

- 市場の多様化:防火システム市場における新製品・サービス、未開拓地域、最近の動向、投資動向に関する包括的な情報

- 競合評価:Johnson Controls(アイルランド)、Honeywell International Inc.(米国)、Siemens(ドイツ)、Robert Bosch GmbH(ドイツ)、Eaton(アイルランド)などの主要企業の市場シェア、成長戦略、サービス提供内容に関する詳細な評価

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要考察

第4章 市場概要

- 市場力学

- アンメットニーズと空白

- 相互接続された市場と分野横断的な機会

- ティア1/2/3参入企業の戦略的動き

第5章 業界動向

- ポーターのファイブフォース分析

- マクロ経済見通し

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 貿易分析

- 2026年の主な会議とイベント

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税の影響- 概要

第6章 技術の進歩、AI別影響、特許、イノベーション

- 主要な新興技術

- 補完的技術

- 特許分析

- AI/生成AIが防火システム市場に与える影響

第7章 規制状況

- 地域の規制とコンプライアンス

- 規制機関、政府機関、その他の組織

- 業界標準

第8章 顧客情勢と購買行動

- 意思決定プロセス

- 購買プロセスに関与する主要な利害関係者とその評価基準

- 採用障壁と内部課題

- さまざまな業界のアンメットニーズ

第9章 防火システム市場(オファリング別)

- 製品

- サービス

第10章 防火システム市場(製品別)

- 消火

- 消火スプリンクラー

- 火災検知

- 火災分析

- 火災対応

第11章 防火システム市場(サービス別)

- エンジニアリングサービス

- 設置および設計サービス

- メンテナンスサービス

- マネージドサービス

- その他

第12章 防火システム市場(業界別)

- 住宅

- 商業

- 工業

第13章 防火システム市場(地域別)

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第14章 競合情勢

- 主要参入企業の競争戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- 製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第15章 企業プロファイル

- 主要参入企業

- HONEYWELL INTERNATIONAL INC.

- JOHNSON CONTROLS

- ROBERT BOSCH GMBH

- SIEMENS

- EATON

- GENTEX CORPORATION

- HALMA PLC

- HOCHIKI CORPORATION

- TELEDYNE TECHNOLOGIES INCORPORATED

- MSA(MSA SAFETY INCORPORATED)

- SECOM CO., LTD.

- RESIDEO TECHNOLOGIES INC.

- NOHMI BOSAI LTD.

- ABB

- NAFFCO

- その他の主要企業

- API GROUP CORPORATION

- DNV AS

- MINIMAX VIKING GMBH

- その他の企業

- ARGUS FIRE PROTECTION COMPANY LTD.

- BAKERRISK

- CIQURIX

- ENCORE FIRE PROTECTION

- FIKE

- FIRE & GAS DETECTION TECHNOLOGIES, INC.

- GEXCON

- INSIGHT NUMERICS, LLC

- NAPCO SECURITY TECHNOLOGIES, INC.

- ORR PROTECTION

- POTTER ELECTRIC SIGNAL COMPANY, LLC

- SCHRACK SECONET AG

- SECURITON AG

- S&S SPRINKLER CO. LLC.

- MARIOFF CORPORATION

- MIRCOM GROUP OF COMPANIES

- CONSILIUM SAFETY GROUP AB

- NETATMO