|

|

市場調査レポート

商品コード

1876466

機械安全の世界市場:コンポーネント別 - 予測(~2030年)Machine Safety Market by Component (Safety Light Curtains, Laser Scanners, Safety Controllers/Modules/Relays, Programmable Safety Systems, Safety Interlock Switches, Push Buttons, Pull Rope Buttons, Two-Hand Safety Controls) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 機械安全の世界市場:コンポーネント別 - 予測(~2030年) |

|

出版日: 2025年11月11日

発行: MarketsandMarkets

ページ情報: 英文 282 Pages

納期: 即納可能

|

概要

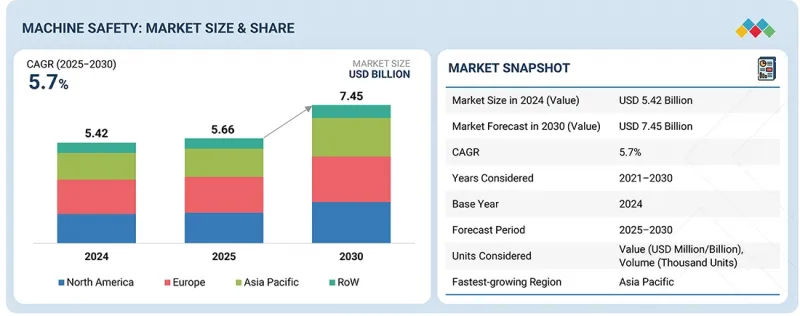

世界の機械安全の市場規模は、2025年の56億6,000万米ドルから2030年までに74億5,000万米ドルに達すると予測され、CAGRで5.7%の成長が見込まれます。

産業火災や爆発事故は、企業や政府に対し、人的被害や物的損害に対する補償として数十億米ドルの費用を負担させています。設備の機械的故障や不具合は、産業施設や製造施設における構造火災の4件に1件の発生原因となっています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | コンポーネント、提供、実装、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

それゆえ、プロセス産業では職場での事故の削減に役立つ複数のセキュリティ技術や機器が採用されています。したがって、事故を防止するための予防的な安全対策の実施がますます重視されるようになり、機械安全市場の成長を促進しています。

「個別セグメントが顕著な市場シェアを獲得します。」

機械安全システムは、産業環境において従業員を保護するため、複数のコンポーネントを組み合わせて構成されます。これには、重要機械、組立ライン、包装ライン、ロボットアプリケーションなどが含まれます。具体的には、存在検知安全センサー、非常停止装置、安全PLC、安全コントローラー/モジュール/リレー、安全インターロックスイッチなどです。個別の安全コンポーネントは、リスクの評価、潜在的な危険の特定、機械防護の必要性の検討、先進の制御機能の追加を経て設置されます。業界では設置や制御が容易なため、個別のコンポーネントが好まれます。ただし、個別の安全コンポーネントの機能は限定的であり、基本的な安全関連要件のみを満たします。

「コンポーネント別では、安全コントローラー/モジュール/リレーセグメントが第2位の市場シェアを占めています。」

機械安全機器は、緊急時に設備を停止させリスクを大幅に低減するために安全コントローラー/モジュール/リレーを必要とします。異常発生時、これらのリレーは安全かつ確実な対応を開始します。各安全リレーは特定の機能をモニターします。製造業界では、安全ガード、ライトカーテン、安全マットなどの追加の安全装置とともにこれらのリレーを活用します。この集合体により包括的な安全システムが形成され、作業員の保護と職場での事故の防止が図られます。機械安全機器メーカー各社は、安全コントローラーの製品ポートフォリオを拡充しています。

「厳格な安全基準の採用の拡大により、北米が成長率で第2位の市場となる見込みです。」

北米の機械安全市場は予測期間に成長する見込みです。北米市場は米国、カナダ、メキシコを対象に調査されています。同地域では厳格な機械安全基準が適用されており、これが市場成長を促進しています。American National Standards Institute(ANSI)、National Fire Protection Association(NFPA)、Robotic Industries Association(RIA)、Occupational Safety & Health Administration(OSHA)などの組織により、さまざまな機械安全基準が地域内で確立されています。OSHAとANSIは、安全な労働環境を確保するために雇用主が遵守すべき最低限の要件も定めています。機械安全規制への不遵守は、企業に対する罰金や懲戒処分につながります。北米における機械安全システムの採用は、米国やカナダなどの主要な石油・ガス生産国のプレゼンスによってさらに促進されています。さらに、多くのサプライヤーや安全システムメーカーがこの地域に拠点を置いています。

当レポートでは、世界の機械安全市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要な知見

- 機械安全市場の企業にとって魅力的な機会

- 機械安全市場:提供別

- 機械安全市場:産業別

- 北米の機械安全市場:産業別、国別

- 機械安全市場:地域別

第4章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

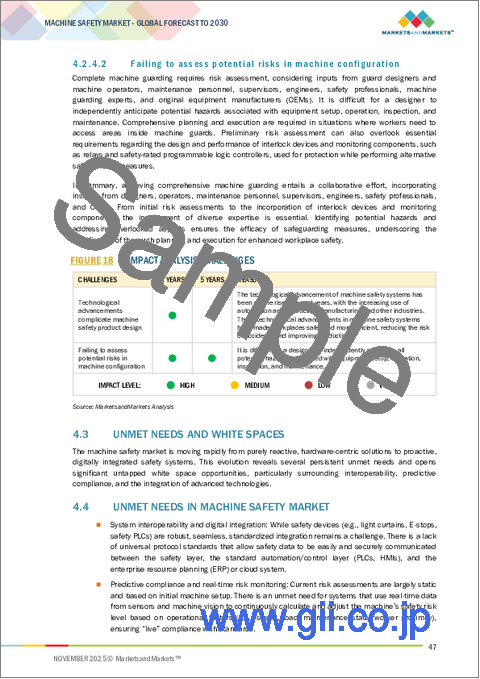

- 課題

- アンメットニーズとホワイトスペース

- 機械安全市場におけるアンメットニーズ

- ホワイトスペースの機会

- 相互接続された市場と部門横断的な機会

- Tier 1/2/3企業の戦略的動き

第5章 業界動向

- ポーターのファイブフォース分析

- マクロ経済指標

- イントロダクション

- GDPの動向と予測

- 世界の自動車業界の動向

- 発電業界の動向

- バリューチェーン分析

- エコシステム分析

- 価格設定の分析

- 主要企業が提供する機械安全コンポーネントの価格帯:展開別

- 機械安全部品の平均販売価格の動向:地域別

- 貿易分析

- 輸入シナリオ(HSコード8536)

- 輸出シナリオ(HSコード8536)

- 主な会議とイベント

- カスタマービジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税の影響 - 概要

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域への影響

- 米国

- 欧州

- アジア太平洋

- 最終用途産業への影響

第6章 戦略的破壊、特許、デジタル、AIの採用

- 主な新技術

- コンピュータービジョン

- IoT

- 補完技術

- バーチャルリアリティ(VR)

- 自動機械学習

- 技術/製品ロードマップ

- 特許分析

- 機械安全市場に対するAI/生成AIの影響

- 主なユースケースと市場の将来性

- 機械安全におけるベストプラクティス

- 機械安全市場におけるAI導入のケーススタディ

- 相互接続された隣接エコシステムと市場企業への影響

- 機械安全市場における生成AIの採用に対する顧客の準備状況

第7章 規制情勢

第8章 顧客情勢と購買行動

- 意思決定プロセス

- バイヤーのステークホルダーと購入評価基準

- 購買プロセスにおける主なステークホルダー

- 購入基準

- 採用障壁と内部課題

- さまざまな最終用途産業からのアンメットニーズ

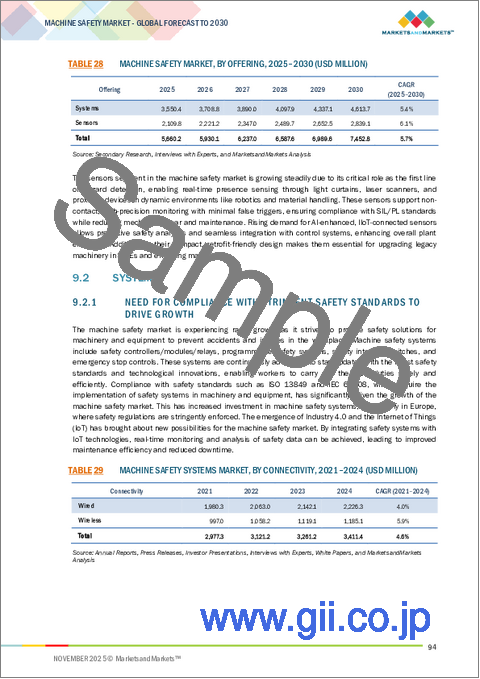

第9章 機械安全市場:提供別

- イントロダクション

- システム

- センサー

第10章 機械安全市場:コンポーネント別

- イントロダクション

- 存在検知センサー

- プログラマブル安全システム

- 安全コントローラー/モジュール/リレー

- 安全インターロックスイッチ

- 緊急停止制御

- 両手安全制御

第11章 機械安全市場:実装別

- イントロダクション

- 個別

- 組み込み

第12章 機械安全市場:接続性別

- イントロダクション

- 有線

- 無線

第13章 機械安全市場:販売チャネル別

- イントロダクション

- 直接

- 間接

第14章 機械安全市場:用途別

- イントロダクション

- 組立

- ロボティクス

- 包装

- マテリアルハンドリング

- 金属加工

- 溶接・シールド

第15章 機械安全市場:産業別

- イントロダクション

- プロセス産業

- 化学

- 食品・飲料

- 金属・鉱業

- 石油・ガス

- 製薬

- 発電

- その他のプロセス産業

- ディスクリート産業

- 航空宇宙

- 自動車

- 半導体・電子

- その他のディスクリート産業

第16章 機械安全市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- 北欧

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- シンガポール

- その他のアジア太平洋

- その他の地域

- 南米

- 中東

- アフリカ

第17章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2021年~2025年)

- 収益分析(2020年~2024年)

- 上位5社の市場シェア分析(2024年)

- 製品の比較

- 企業の評価と財務指標

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第18章 企業プロファイル

- 主要企業

- SCHNEIDER ELECTRIC

- KEYENCE CORPORATION

- ROCKWELL AUTOMATION

- SIEMENS

- EMERSON ELECTRIC CO.

- HONEYWELL INTERNATIONAL INC.

- ABB

- OMRON CORPORATION

- YOKOGAWA ELECTRIC CORPORATION

- MITSUBISHI ELECTRIC CORPORATION

- SICK AG

- HIMA

- IDEC CORPORATION

- その他の企業

- BALLUFF GMBH

- BANNER ENGINEERING CORP.

- BAUMER

- PILZ GMBH & CO. KG

- PEPPERL+FUCHS SE

- EUCHNER GMBH+CO. KG

- DATALOGIC S.P.A.

- LEUZE ELECTRONIC GMBH+CO. KG

- FORTRESS INTERLOCKS

- K.A. SCHMERSAL GMBH & CO. KG

- STEUTE TECHNOLOGIES GMBH & CO. KG

- CARLO GAVAZZI

- MURRELEKTRONIK GMBH

- EAO AG