|

|

市場調査レポート

商品コード

1458401

エンタープライズビデオの世界市場:オファリング別、用途別、展開モデル別、組織規模別、業界別、地域別 - 2029年までの予測Enterprise Video Market by Offering (Solutions and Services), Application (Corporate Communications, Training & Development, and Marketing & Client Engagement), Deployment Model, Organization Size, Vertical and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| エンタープライズビデオの世界市場:オファリング別、用途別、展開モデル別、組織規模別、業界別、地域別 - 2029年までの予測 |

|

出版日: 2024年03月26日

発行: MarketsandMarkets

ページ情報: 英文 329 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

エンタープライズビデオの市場規模は、2024年の238億米ドルから2029年には358億米ドルに成長し、予測期間中の年間平均成長率(CAGR)は8.6%になると予測されています。

この市場には、AIとアナリティクスの統合によって新興企業が統合を組み込んで提供するサービスを収益化できるようになること、仮想イベントの拡大や採用が増えること、エンタープライズビデオ市場の開拓や利用の機会が増えること、垂直方向や地域全体でエンタープライズビデオの採用を促進するための政府の政策や制度の需要が増えることなど、優れた成長機会があります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | オファリング別、用途別、展開モデル別、組織規模別、業界別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

プロフェッショナルサービスは、世界のエンタープライズビデオ市場で重要な役割を果たしており、ビデオソリューションの展開、統合、最適化において、専門的な専門知識とサポートを組織に提供しています。導入・統合サービスでは、既存のITインフラにビデオ技術をシームレスに導入し、互換性、セキュリティ、パフォーマンスを確保します。コンサルティングとアドバイザリーサービスは、ビデオ戦略の策定、ソリューションの選択、ビジネス目標に基づくカスタマイズに関する戦略的ガイダンスを提供します。トレーニング・教育サービスでは、動画プラットフォームを効果的に活用するためのスキルと知識をユーザーに習得してもらうための包括的な学習プログラムを提供します。例えば、ある多国籍企業は、包括的なビデオ会議ソリューションの導入、統合、トレーニングの提供を専門サービス会社に依頼し、世界チーム間でのシームレスなコラボレーションとコミュニケーションを実現すると同時に、エンタープライズビデオテクノロジーへの投資価値を最大化することができます。

世界の企業向け動画市場におけるマーケティングおよび顧客エンゲージメントのアプリケーションには、顧客との対話を強化し、ブランドエンゲージメントを促進するためのさまざまな戦略やツールが含まれます。これには、マーケティングキャンペーン、製品デモ、顧客サポートに動画コンテンツを活用することが含まれます。例えば、多国籍小売企業は、企業向け動画ソリューションを使用して、インタラクティブな製品チュートリアルを作成したり、ライブストリーミングで発売イベントを実施したり、パーソナライズされた動画コンサルティングを提供したりして、顧客エンゲージメントを強化し、販売を促進することができます。これらのアプリケーションは、顧客とのより深いつながりを促進し、ブランドの認知度を向上させ、最終的には顧客とのより強固な関係構築に貢献します。

当レポートでは、世界のエンタープライズビデオ市場について調査し、オファリング別、用途別、展開モデル別、組織規模別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- エコシステム分析

- バリューチェーン分析

- 技術分析

- 価格分析

- ビジネスモデル分析

- 投資情勢

- 特許分析

- ポーターのファイブフォース分析

- 規制の影響と業界標準

- 主な会議とイベント

- 顧客のビジネスに影響を与える動向と混乱

- 主な利害関係者と購入基準

第6章 エンタープライズビデオ市場、オファリング別

- イントロダクション

- ソリューション

- サービス

第7章 エンタープライズビデオ市場、展開モデル別

- イントロダクション

- オンプレミス

- クラウド

第8章 エンタープライズビデオ市場、組織規模別

- イントロダクション

- 大企業

- 中小企業

第9章 エンタープライズビデオ市場、用途別

- イントロダクション

- コーポレートコミュニケーション

- トレーニング&開発

- マーケティングと顧客エンゲージメント

第10章 エンタープライズビデオ市場、業界別

- イントロダクション

- 銀行、金融サービス、保険(BFSI)

- 電気通信

- ヘルスケア・ライフサイエンス

- 教育

- メディア・エンターテインメント

- 小売・消費財

- IT・ITES

- その他

第11章 エンタープライズビデオ市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- エンタープライズビデオ市場:ベンダー/ブランド比較

- 過去の収益分析

- 企業評価マトリックス:主要参入企業

- 企業評価マトリックス:スタートアップ/中小企業

- 主要ベンダーの企業評価と財務指標

- 競合シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- IBM

- ZOOM

- MICROSOFT

- AVAYA

- AWS

- CISCO

- POLY

- ADOBE

- GOTO

- その他の企業

- RINGCENTRAL

- MEDIAPLATFORM

- NOTIFIED

- KOLLECTIVE TECHNOLOGY

- HAIVISION

- KALTURA

- ON24

- ENGHOUSE SYSTEMS

- BRIGHTCOVE

- VIDIZMO

- PANOPTO

- VBRICK

- SONIC FOUNDRY

- QUMU

- DALET DIGITAL MEDIA SYSTEMS

第14章 隣接市場と関連市場

第15章 付録

The Enterprise video market size is expected to grow from USD 23.8 billion in 2024 to USD 35.8 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 8.6% during the forecast period. The market has excellent growth opportunities, such as integration between AI and Analytics that enables startups to monetize their offerings by embedding integration, expansion, and higher adoption of virtual events, creating/generating more opportunities for enterprise video market exploration and usage therefore, and demand increase in government policies and schemes to leverage Enterprise video adoption across verticals and regions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Application, Deployment Model, Organization Size, and Vertical. |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

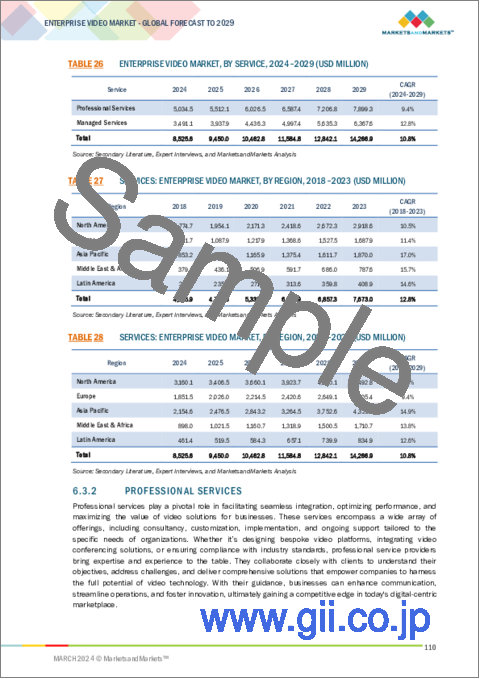

"By Services, Professional Services segment to hold a larger market share during the forecast period."

Professional services play a vital role in the global enterprise video market, offering specialized expertise and support to organizations in deploying, integrating, and optimizing video solutions. Deployment and integration services involve the seamless implementation of video technologies into existing IT infrastructures, ensuring compatibility, security, and performance. Consulting and advisory services provide strategic guidance on video strategy development, solution selection, and customization based on business objectives. Training and education services offer comprehensive learning programs to empower users with the skills and knowledge to utilize video platforms effectively. For instance, a multinational corporation may engage a professional services firm to deploy, integrate, and provide training for a comprehensive video conferencing solution, enabling seamless collaboration and communication across global teams while maximizing the value of their investment in enterprise video technology.

"By Application, Marketing & Client engagement segment will record the highest CAGR during the forecast period."

Marketing and client engagement applications in the global enterprise video market encompass various strategies and tools to enhance customer interactions and promote brand engagement. This includes leveraging video content for marketing campaigns, product demonstrations, and customer support. For instance, a multinational retail corporation may use enterprise video solutions to create interactive product tutorials, conduct live-streamed launch events, and offer personalized video consultations to enhance customer engagement and drive sales. These applications facilitate more profound connections with clients, improve brand visibility, and ultimately contribute to building stronger relationships with customers.

"By organization size, the large enterprises segment is projected to hold a higher market share during the forecast period."

Large enterprises (companies with an employee count of more than 1,000) play a pivotal role in driving the global enterprise video market forward by adopting advanced video communication technologies to streamline internal operations and enhance external engagement. For instance, a multinational corporation (MNC) might deploy enterprise video solutions for conducting virtual meetings, training sessions, and town hall events across geographically dispersed teams. Large enterprises can improve collaboration, boost employee productivity, and deliver seamless customer experiences by leveraging such technologies. Additionally, their substantial investment in innovative video solutions often sets industry standards and influences market trends, further shaping the landscape of enterprise video technologies.

The breakup of the profiles of the primary participants is below:

- By Company Type: Tier I: 34%, Tier II: 43%, and Tier III: 23%

- By Designation: C-Level Executives: 50%, Director Level: 33%, and *Others: 20%

- By Region: North America: 30%, Europe: 25%, Asia Pacific: 30%, **RoW: 10%

- Others include sales managers, marketing managers, and product managers

*RoW include Middle East & Africa and Latin America

Note: Tier 1 companies have revenues of more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Key Players

Some of the key players operating in the Open Banking solutions market are IBM (US), Google (US), Microsoft (US), AWS (US), Avaya (US), Zoom (US), Adobe (US), Cisco (US), GoTo (US), among others.

Research coverage:

The market analysis in all its areas covers the enterprise video market. Its goal is to project market size and development potential in several segments, including offering, application, organization size, deployment model, verticals, and regions. It comprises a thorough competition analysis of the major market players, company biographies, important insights regarding their offers in terms of goods and services, current advancements, and crucial market strategies.

Reasons to buy this report:

The study will include information on the closest approximations of revenue figures for the Enterprise video market and its subsegments, which will assist market leaders and new entrants. Stakeholders will receive additional insights and a better understanding of the competitive landscape, enabling them to position their companies better and develop go-to-market (GTM) strategies. Additionally, the research offers information on major market drivers, constraints, opportunities, and challenges to help stakeholders understand the state of the industry.

The report provides insights on the following pointers:

- Analysis of key drivers (such as video being an effective tool that allows businesses to engage and attract customers more effectively), restraints (such as lack of compatibility issues across a wide range of devices), opportunities (such as development of industry-specific video solutions creates the exact impact required for large enterprises as well as SMEs, on the buyers/users), and challenges (such as lack of relevant, upgraded skillset and expertise needed in enterprise video market) influencing the proliferation of the Enterprise video market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development (R&D) activities, and new product & service launches in the Enterprise video market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Enterprise video market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Enterprise video market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Google, Microsoft, IBM, and Zoom in the Enterprise video market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2023

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 ENTERPRISE VIDEO MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary interviews

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 2 ENTERPRISE VIDEO MARKET: MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 ENTERPRISE VIDEO MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 ENTERPRISE VIDEO MARKET: RESEARCH FLOW

- 2.3.3 MARKET SIZE ESTIMATION APPROACHES

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY (BOTTOM-UP APPROACH): SUPPLY SIDE - COLLECTIVE REVENUE OF VENDORS

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 2): SUPPLY-SIDE ANALYSIS

- FIGURE 10 ENTERPRISE VIDEO MARKET: DEMAND-SIDE APPROACH

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 IMPACT OF RECESSION ON ENTERPRISE VIDEO MARKET

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 OVERVIEW OF RECESSION IMPACT

- FIGURE 11 IMPACT OF RECESSION ON ENTERPRISE VIDEO MARKET

- FIGURE 12 ENTERPRISE VIDEO MARKET: SEGMENTS WITH HIGH GROWTH RATE

- FIGURE 13 ENTERPRISE VIDEO MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ENTERPRISE VIDEO MARKET

- FIGURE 14 NEED FOR UNIFIED COMMUNICATION CAPABILITIES AND REMOTE WORKFORCE COLLABORATION EFFORTS TO SUPPORT GROWTH OF ENTERPRISE VIDEO MARKET

- 4.2 ENTERPRISE VIDEO MARKET, BY OFFERING

- FIGURE 15 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.3 ENTERPRISE VIDEO MARKET, BY SOLUTION

- FIGURE 16 VIDEO CONFERENCING SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 4.4 ENTERPRISE VIDEO MARKET, BY SERVICE

- FIGURE 17 PROFESSIONAL SERVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 ENTERPRISE VIDEO MARKET, BY APPLICATION

- FIGURE 18 CORPORATE COMMUNICATIONS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 4.6 ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE

- FIGURE 19 CONSULTING & ADVISORY SEGMENT TO LEAD MARKET BY 2029

- 4.7 ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE

- FIGURE 20 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER SHARE BY 2029

- 4.8 ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE

- FIGURE 21 CLOUD SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.9 ENTERPRISE VIDEO MARKET, BY VERTICAL

- FIGURE 22 TELECOMMUNICATIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- 4.10 ENTERPRISE VIDEO MARKET: REGIONAL SCENARIO

- FIGURE 23 ASIA PACIFIC TO EMERGE AS LUCRATIVE MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 ENTERPRISE VIDEO MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid technological advances across industries

- 5.2.1.2 Need for engaging and visually appealing content

- FIGURE 25 VIDEO MARKETING STRATEGIES ADOPTED BY GLOBAL VENDORS

- 5.2.1.3 Rapid expansion of digital workplace ecosystem

- 5.2.1.4 Demand for cost-efficient video solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of compatibility across devices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of virtual events to open avenues for enterprise video market exploration

- 5.2.3.2 Integration of AI with advanced analytics

- 5.2.3.3 Development of industry-specific video solutions

- 5.2.3.4 Demand for mobile and remote workforce

- 5.2.3.5 Expansion of modern, fast-paced business environments

- FIGURE 26 PERCENTAGE OF COMPANIES THAT HAVE ADOPTED ENTERPRISE VIDEO SOLUTIONS AND SERVICES, 2016-2024

- 5.2.3.6 Demand for video communication and collaboration tools and platforms to facilitate zero barrier/buffer interactions

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of sufficient bandwidth for high-quality video streaming solutions

- 5.2.4.2 Lack of relevant technical skillset and expertise

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 AVAYA'S VIDEO CONFERENCING SOLUTION ENABLED REAL-TIME TRANSMISSION OF HIGH-DEFINITION VIDEOS FOR KOCH MEDIA

- 5.3.2 AWS OFFERED SEAMLESS VIDEO UPLOAD AND PLAYBACK CAPABILITIES FOR VIDYARD'S GLOBAL CUSTOMER BASE

- 5.3.3 KALTURA OFFERED VIDEO MANAGEMENT SOLUTIONS TO ENSURE CONTENT ACCESSIBILITY FOR CALIFORNIA STATE UNIVERSITY'S DIVERSE STUDENT POPULATION

- 5.3.4 FORBES LEVERAGED ZOOM'S ROBUST FEATURES TO CREATE SEAMLESS VIRTUAL EXPERIENCES

- 5.3.5 STARLING BANK DEPLOYED LIFESIZE'S INTEGRATED SOLUTION TO OPTIMIZE ITS COMMUNICATION INFRASTRUCTURE

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 27 ECOSYSTEM MAPPING

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 ENTERPRISE VIDEO PLATFORM/SOLUTION VENDORS

- 5.5.2 ENTERPRISE VIDEO SERVICE PROVIDERS

- 5.5.3 VIDEO EQUIPMENT MANUFACTURERS

- 5.5.4 SYSTEM INTEGRATORS

- 5.5.5 NETWORK SERVICE PROVIDERS

- 5.5.6 VERTICALS

- FIGURE 28 VALUE CHAIN ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Video analytics

- 5.6.1.2 AI & ML

- 5.6.1.3 Augmented & virtual reality (AR/VR)

- 5.6.1.4 Digital rights management (DRM)

- 5.6.2 COMPLIMENTARY TECHNOLOGIES

- 5.6.2.1 5G networks

- 5.6.2.2 Edge computing

- 5.6.2.3 Blockchain

- 5.6.2.4 Natural language processing (NLP)

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Internet of things (IoT)

- 5.6.3.2 Content delivery networks (CDNs)

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE PRICING ANALYSIS

- TABLE 3 INDICATIVE PRICING ANALYSIS FOR KEY PLAYERS

- 5.7.1.1 Average selling price (ASP) trend

- 5.8 BUSINESS MODEL ANALYSIS

- 5.8.1 ADVERTISING MODEL

- 5.8.2 FREEMIUM MODEL

- 5.8.3 SERVICE-BASED MODEL

- 5.8.4 PAY-AS-YOU-GO MODEL

- 5.8.5 SUBSCRIPTION-BASED MODEL

- 5.8.6 LICENSING MODEL

- 5.8.7 PARTNERSHIPS, RESELLER MODEL, AND COLLABORATIONS

- 5.9 INVESTMENT LANDSCAPE

- FIGURE 29 LEADING ENTERPRISE VIDEO MARKET VENDORS, BY NUMBER OF INVESTORS AND FUNDING ROUNDS, 2023

- 5.10 PATENT ANALYSIS

- FIGURE 30 NUMBER OF PATENTS PUBLISHED, 2012-2023

- FIGURE 31 TOP FIVE PATENT OWNERS (GLOBAL), 2023

- TABLE 4 TOP TEN PATENT OWNERS, 2023

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES ON ENTERPRISE VIDEO MARKET

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.12.1 GENERAL DATA PROTECTION REGULATION (GDPR)

- 5.12.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)

- 5.12.3 CALIFORNIA CONSUMER PRIVACY ACT (CCPA)

- 5.12.4 FAMILY EDUCATIONAL RIGHTS AND PRIVACY ACT (FERPA)

- 5.12.5 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI DSS)

- 5.12.6 SYSTEM AND ORGANIZATION CONTROLS 2 (SOC 2)

- 5.12.7 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)

- 5.12.8 REGULATORY LANDSCAPE

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES & EVENTS

- TABLE 10 KEY CONFERENCES & EVENTS, 2024-2025

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 33 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN ENTERPRISE VIDEO MARKET

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.15.2 BUYING CRITERIA

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

6 ENTERPRISE VIDEO MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: ENTERPRISE VIDEO MARKET DRIVERS

- FIGURE 36 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 13 ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 14 ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 ENTERPRISE VIDEO SOLUTIONS HELP INCREASE REMOTE WORKFORCES' OVERALL PRODUCTIVITY AND REDUCE COSTS

- FIGURE 37 WEBCASTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 15 ENTERPRISE VIDEO MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 16 ENTERPRISE VIDEO MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 17 SOLUTIONS: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 18 SOLUTIONS: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.2 VIDEO CONFERENCING

- TABLE 19 VIDEO CONFERENCING: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 20 VIDEO CONFERENCING: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.2.1 Unified communications platform

- 6.2.2.2 Huddle room systems

- 6.2.2.3 Telepresence systems

- 6.2.2.4 Desktop & mobile applications

- 6.2.2.5 Web-based conferencing solutions

- 6.2.3 VIDEO CONTENT MANAGEMENT

- TABLE 21 VIDEO CONTENT MANAGEMENT: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 22 VIDEO CONTENT MANAGEMENT: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.3.1 Video hosting & streaming platforms

- 6.2.3.2 Content creation & editing software

- 6.2.3.3 Digital asset management (DAM) systems

- 6.2.3.4 Learning management systems (LMSs)

- 6.2.3.5 Video analytics & optimization software

- 6.2.4 WEBCASTING

- TABLE 23 WEBCASTING: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 24 WEBCASTING: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.4.1 Virtual event platforms

- 6.2.4.2 Live streaming software

- 6.2.4.3 On-demand video platforms

- 6.2.4.4 Hybrid event solutions

- 6.3 SERVICES

- 6.3.1 ENTERPRISE VIDEO SERVICES IMPROVE BUSINESS PROCESSES AND OPTIMIZE BUSINESS OPERATIONS

- FIGURE 38 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 25 ENTERPRISE VIDEO MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 26 ENTERPRISE VIDEO MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 27 SERVICES: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 28 SERVICES: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.2 PROFESSIONAL SERVICES

- FIGURE 39 TRAINING & EDUCATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 29 ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 30 ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 31 PROFESSIONAL SERVICES: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 32 PROFESSIONAL SERVICES: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.2.1 Consulting & advisory

- TABLE 33 CONSULTING & ADVISORY: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 34 CONSULTING & ADVISORY: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.2.2 Deployment & integration

- TABLE 35 DEPLOYMENT & INTEGRATION: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 36 DEPLOYMENT & INTEGRATION: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.2.3 Training & education

- TABLE 37 TRAINING & EDUCATION: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 38 TRAINING & EDUCATION: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.3 MANAGED SERVICES

- TABLE 39 MANAGED SERVICES: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 40 MANAGED SERVICES: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.3.1 Support & maintenance

- 6.3.3.2 Performance monitoring & optimization

- 6.3.3.3 Security & compliance

7 ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODES: ENTERPRISE VIDEO MARKET DRIVERS

- FIGURE 40 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 41 ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 42 ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 7.2 ON-PREMISES

- 7.2.1 ON-PREMISE DEPLOYMENT OF ENTERPRISE VIDEO SOLUTIONS REDUCES SERVICE MAINTENANCE COSTS

- TABLE 43 ON-PREMISES: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 44 ON-PREMISES: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3 CLOUD

- 7.3.1 CLOUD-BASED ENTERPRISE VIDEO SOLUTIONS ALLOW ORGANIZATIONS TO ADJUST TO DYNAMIC BUSINESS ENVIRONMENT

- TABLE 45 CLOUD: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 46 CLOUD: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

8 ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZES: ENTERPRISE VIDEO MARKET DRIVERS

- FIGURE 41 LARGE ENTERPRISES SEGMENT TO LEAD MARKET BY 2029

- TABLE 47 ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 48 ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 8.2 LARGE ENTERPRISES

- 8.2.1 USE OF HIGH VOLUME OF APPLICATIONS IN LARGE ENTERPRISES TO DRIVE ADOPTION OF ENTERPRISE VIDEO SOLUTIONS

- TABLE 49 LARGE ENTERPRISES: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 50 LARGE ENTERPRISES: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- 8.3.1 GROWING DEMAND IN SMES FOR SOLUTIONS THAT CAN RESOLVE COMPLEXITIES AND OPTIMIZE COST OF BUSINESS PROCESSES TO DRIVE MARKET

- TABLE 51 SMES: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 52 SMES: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

9 ENTERPRISE VIDEO MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.1.1 APPLICATIONS: ENTERPRISE VIDEO MARKET DRIVERS

- FIGURE 42 MARKETING & CLIENT ENGAGEMENT SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- TABLE 53 ENTERPRISE VIDEO MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 54 ENTERPRISE VIDEO MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 9.2 CORPORATE COMMUNICATIONS

- 9.2.1 VIDEO CONFERENCING SOLUTIONS HELP PROVIDE EFFECTIVE PERSONALIZED COMMUNICATION WITHIN ORGANIZATIONS

- TABLE 55 CORPORATE COMMUNICATIONS: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 56 CORPORATE COMMUNICATIONS: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.2.2 INTERNAL ANNOUNCEMENTS & UPDATES

- 9.2.3 LIVE EVENTS & CONFERENCES

- 9.2.4 EMPLOYEE TRAINING & ONBOARDING

- 9.2.5 TOWN HALL MEETINGS

- 9.3 TRAINING & DEVELOPMENT

- 9.3.1 NEED FOR EFFECTIVE ELEARNING AND INTERACTIVE DISTANCE LEARNING TOOLS TO BOOST MARKET GROWTH

- TABLE 57 TRAINING & DEVELOPMENT: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 58 TRAINING & DEVELOPMENT: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3.2 EMPLOYEE SKILLS DEVELOPMENT

- 9.3.3 COMPLIANCE TRAINING

- 9.3.4 SOFT SKILLS TRAINING

- 9.3.5 CERTIFICATION PROGRAMS

- 9.4 MARKETING & CLIENT ENGAGEMENT

- 9.4.1 ENTERPRISE VIDEO SOLUTIONS ENHANCE CUSTOMER ENGAGEMENT AND PROVIDE EFFECTIVE COMMUNICATION

- TABLE 59 MARKETING & CLIENT ENGAGEMENT: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 60 MARKETING & CLIENT ENGAGEMENT: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4.2 PRODUCT DEMONSTRATIONS & TUTORIALS

- 9.4.3 CUSTOMER TESTIMONIALS & CASE STUDIES

- 9.4.4 WEBINARS

- 9.4.5 VIRTUAL EVENTS & TRADE SHOWS

10 ENTERPRISE VIDEO MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICALS: ENTERPRISE VIDEO MARKET DRIVERS

- FIGURE 43 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 61 ENTERPRISE VIDEO MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 62 ENTERPRISE VIDEO MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 10.2.1 USE OF VIDEO SOLUTIONS IMPROVES ACCOUNTABILITY IN BFSI ORGANIZATIONS

- TABLE 63 BFSI: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 64 BFSI: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2.2 BFSI: APPLICATION AREAS

- 10.2.2.1 Virtual banking

- 10.2.2.2 Training & compliance

- 10.2.2.3 Remote financial advisory

- 10.2.2.4 Other application areas

- 10.3 TELECOMMUNICATIONS

- 10.3.1 ENTERPRISE VIDEO SOLUTIONS HELP IT ORGANIZATIONS MANAGE DIGITAL CONTENT FROM CENTRALIZED PLATFORMS

- TABLE 65 TELECOMMUNICATIONS: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 66 TELECOMMUNICATIONS: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3.2 TELECOMMUNICATIONS: APPLICATION AREAS

- 10.3.2.1 Customer support

- 10.3.2.2 Product demonstrations

- 10.3.2.3 Internal training & knowledge sharing

- 10.3.2.4 Other application areas

- 10.4 HEALTHCARE & LIFE SCIENCES

- 10.4.1 ENTERPRISE VIDEO COLLABORATIONS OFFER HEALTHCARE PROVIDERS EFFECTIVE COMMUNICATION OPTIONS TO HELP THEM PROVIDE ENHANCED PATIENT CARE

- TABLE 67 HEALTHCARE & LIFE SCIENCES: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 68 HEALTHCARE & LIFE SCIENCES: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.4.2 HEALTHCARE & LIFE SCIENCES: APPLICATION AREAS

- 10.4.2.1 Telemedicine consultations

- 10.4.2.2 Medical training & education

- 10.4.2.3 Patient education & wellness programs

- 10.4.2.4 Other application areas

- 10.5 EDUCATION

- 10.5.1 ENTERPRISE VIDEO SOLUTIONS HELP COLLEGES AND UNIVERSITIES ENHANCE CLASSROOM EXPERIENCE

- TABLE 69 EDUCATION: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 70 EDUCATION: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.5.2 EDUCATION: APPLICATION AREAS

- 10.5.2.1 Distance learning & online classes

- 10.5.2.2 Virtual laboratories

- 10.5.2.3 Teachers' professional development

- 10.5.2.4 Other application areas

- 10.6 MEDIA & ENTERTAINMENT

- 10.6.1 VIDEO STREAMING AND WEBCASTING SOLUTIONS ENHANCE PERSONALIZED VIEWING EXPERIENCE

- TABLE 71 MEDIA & ENTERTAINMENT: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 72 MEDIA & ENTERTAINMENT: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.6.2 MEDIA & ENTERTAINMENT: APPLICATION AREAS

- 10.6.2.1 Content creation & production

- 10.6.2.2 Live event streaming

- 10.6.2.3 Audience engagement & interactivity

- 10.6.2.4 Other application areas

- 10.7 RETAIL & CONSUMER GOODS

- 10.7.1 ONLINE VIDEO ADVERTISING AND CAMPAIGNS ALLOW RETAILERS TO STRENGTHEN BRAND IMAGE COMMUNICATION TO HELP INCREASE CUSTOMER BRAND LOYALTY

- TABLE 73 RETAIL & CONSUMER GOODS: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 74 RETAIL & CONSUMER GOODS: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.7.2 RETAIL & CONSUMER GOODS: APPLICATION AREAS

- 10.7.2.1 Virtual product demonstrations

- 10.7.2.2 Personalized shopping experiences

- 10.7.2.3 Training & onboarding

- 10.7.2.4 Other application areas

- 10.8 IT & ITES

- 10.8.1 ENTERPRISE VIDEO SOLUTIONS ENCOURAGE IT COMPANIES TO TRANSFER KNOWLEDGE AND INFORMATION THROUGH VIDEOS

- TABLE 75 IT & ITES: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 76 IT & ITES: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.8.2 IT & ITES: APPLICATION AREAS

- 10.8.2.1 Remote technical support

- 10.8.2.2 Internal communication & collaboration

- 10.8.2.3 Software training & demo

- 10.8.2.4 Other application areas

- 10.9 OTHER VERTICALS

- TABLE 77 OTHER VERTICALS: ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 78 OTHER VERTICALS: ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

11 ENTERPRISE VIDEO MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 44 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 79 ENTERPRISE VIDEO MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 80 ENTERPRISE VIDEO MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: ENTERPRISE VIDEO MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 81 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 83 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 87 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 88 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 89 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 90 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 91 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 92 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 94 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 96 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 97 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 98 NORTH AMERICA: ENTERPRISE VIDEO MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.2.3 US

- 11.2.3.1 High adoption of enterprise video solutions and associated services to drive market growth

- TABLE 99 US: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 100 US: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 101 US: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 102 US: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.2.4 CANADA

- 11.2.4.1 Remote work culture and enhanced collaboration to benefit Canadian market, driving high adoption of enterprise video solutions

- TABLE 103 CANADA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 104 CANADA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 105 CANADA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 106 CANADA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: ENTERPRISE VIDEO MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- TABLE 107 EUROPE: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 108 EUROPE: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 109 EUROPE: ENTERPRISE VIDEO MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 110 EUROPE: ENTERPRISE VIDEO MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 111 EUROPE: ENTERPRISE VIDEO MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 112 EUROPE: ENTERPRISE VIDEO MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 113 EUROPE: ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 114 EUROPE: ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 115 EUROPE: ENTERPRISE VIDEO MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 116 EUROPE: ENTERPRISE VIDEO MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 117 EUROPE: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 118 EUROPE: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 119 EUROPE: ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 120 EUROPE: ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 121 EUROPE: ENTERPRISE VIDEO MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 122 EUROPE: ENTERPRISE VIDEO MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 123 EUROPE: ENTERPRISE VIDEO MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 124 EUROPE: ENTERPRISE VIDEO MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Increasing adoption of enterprise video solutions across verticals and companies to drive market

- TABLE 125 UK: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 126 UK: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 127 UK: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 128 UK: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.3.4 GERMANY

- 11.3.4.1 Need for implementing enterprise video usage into employee training, customer support, and marketing campaigns to propel market

- TABLE 129 GERMANY: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 130 GERMANY: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 131 GERMANY: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 132 GERMANY: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.3.5 FRANCE

- 11.3.5.1 Effective usage of enterprise video solutions toward digital transformation efforts to drive market

- TABLE 133 FRANCE: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 134 FRANCE: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 135 FRANCE: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 136 FRANCE: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.3.6 ITALY

- 11.3.6.1 Rise in demand for innovative, customizable, effective, and efficient solutions from vendors to leverage market proliferation

- TABLE 137 ITALY: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 138 ITALY: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 139 ITALY: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 140 ITALY: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.3.7 REST OF EUROPE

- TABLE 141 REST OF EUROPE: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 142 REST OF EUROPE: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 143 REST OF EUROPE: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 144 REST OF EUROPE: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: ENTERPRISE VIDEO MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 145 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 146 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 147 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 148 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 149 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 150 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 151 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 152 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 153 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 154 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 155 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 156 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 157 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 158 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 159 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 160 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 161 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 162 ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 Rapid proliferation and surge in adoption of enterprise video solutions to drive market

- TABLE 163 CHINA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 164 CHINA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 165 CHINA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 166 CHINA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Significant boost by government and initiatives taken toward high adoption of enterprise video solutions to propel market

- TABLE 167 JAPAN: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 168 JAPAN: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 169 JAPAN: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 170 JAPAN: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.4.5 AUSTRALIA & NEW ZEALAND (ANZ)

- 11.4.5.1 Large-scale adoption of enterprise video solutions in healthcare industry to leverage market proliferation

- TABLE 171 AUSTRALIA & NEW ZEALAND: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 172 AUSTRALIA & NEW ZEALAND: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 173 AUSTRALIA & NEW ZEALAND: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 174 AUSTRALIA & NEW ZEALAND: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 175 REST OF ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 179 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.5.3 GCC (GULF COOPERATION COUNCIL) COUNTRIES

- TABLE 197 GCC COUNTRIES: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 198 GCC COUNTRIES: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 199 GCC COUNTRIES: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 200 GCC COUNTRIES: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 201 GCC COUNTRIES: ENTERPRISE VIDEO MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 202 GCC COUNTRIES: ENTERPRISE VIDEO MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.5.3.1 KSA (Kingdom of Saudi Arabia)

- 11.5.3.1.1 Advancement of telecom infrastructure and state-of-the-art government initiatives to drive market adoption

- 11.5.3.2 United Arab Emirates (UAE)

- 11.5.3.2.1 Demand for innovative solutions to meet diverse business needs to drive enterprise video market

- 11.5.3.3 Other GCC countries

- 11.5.3.1 KSA (Kingdom of Saudi Arabia)

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Emergence of cloud-based video conferencing solutions to leverage market growth

- TABLE 203 SOUTH AFRICA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 204 SOUTH AFRICA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 205 SOUTH AFRICA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 206 SOUTH AFRICA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 207 REST OF MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: ENTERPRISE VIDEO MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 211 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 212 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 213 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 214 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 215 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 216 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 217 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 218 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 219 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 220 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 221 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 222 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 223 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 224 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 225 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 226 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 227 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 228 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.6.3 BRAZIL

- 11.6.3.1 Rapid adoption of digital technologies and growing internet penetration rate to boost growth

- TABLE 229 BRAZIL: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 230 BRAZIL: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 231 BRAZIL: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 232 BRAZIL: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.6.4 MEXICO

- 11.6.4.1 Recent structural reforms to create opportunities for entrepreneurs and investors

- TABLE 233 MEXICO: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 234 MEXICO: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 235 MEXICO: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 236 MEXICO: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 11.6.5 REST OF LATIN AMERICA

- TABLE 237 REST OF LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 238 REST OF LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 239 REST OF LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 240 REST OF LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- TABLE 241 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- 12.3 MARKET SHARE ANALYSIS

- TABLE 242 MARKET SHARE OF KEY VENDORS, 2023

- FIGURE 47 ENTERPRISE VIDEO MARKET: MARKET SHARE ANALYSIS, 2023

- 12.4 ENTERPRISE VIDEO MARKET: VENDOR/BRAND COMPARISON

- FIGURE 48 VENDOR/BRAND COMPARISON

- 12.5 HISTORICAL REVENUE ANALYSIS

- FIGURE 49 HISTORICAL REVENUE ANALYSIS, 2019-2023 (USD MILLION)

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS

- FIGURE 50 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 51 ENTERPRISE VIDEO MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 12.6.5 COMPANY FOOTPRINT

- FIGURE 52 ENTERPRISE VIDEO MARKET: OVERALL COMPANY FOOTPRINT

- TABLE 243 ENTERPRISE VIDEO MARKET: COMPANY REGIONAL FOOTPRINT

- TABLE 244 ENTERPRISE VIDEO MARKET: COMPANY OFFERING FOOTPRINT

- TABLE 245 ENTERPRISE VIDEO MARKET: COMPANY APPLICATION FOOTPRINT

- TABLE 246 ENTERPRISE VIDEO MARKET: COMPANY VERTICAL FOOTPRINT

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- FIGURE 53 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- 12.7.1 RESPONSIVE COMPANIES

- 12.7.2 PROGRESSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 54 ENTERPRISE VIDEO MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 12.7.5 COMPETITIVE BENCHMARKING

- 12.7.5.1 Detailed list of key startups/SMEs

- TABLE 247 ENTERPRISE VIDEO MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 248 ENTERPRISE VIDEO MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 55 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 56 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- 12.9 COMPETITIVE SCENARIO & TRENDS

- 12.9.1 PRODUCT/SERVICE LAUNCHES & ENHANCEMENTS

- TABLE 249 ENTERPRISE VIDEO MARKET: PRODUCT/SERVICE LAUNCHES & ENHANCEMENTS, JULY 2020-JANUARY 2024

- 12.9.2 DEALS

- TABLE 250 ENTERPRISE VIDEO MARKET: DEALS, JUNE 2021-FEBRUARY 2024

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 13.2.1 IBM

- TABLE 251 IBM: BUSINESS OVERVIEW

- FIGURE 57 IBM: COMPANY SNAPSHOT

- TABLE 252 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 IBM: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 254 IBM: DEALS

- 13.2.2 ZOOM

- TABLE 255 ZOOM: BUSINESS OVERVIEW

- FIGURE 58 ZOOM: COMPANY SNAPSHOT

- TABLE 256 ZOOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 ZOOM: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 258 ZOOM: DEALS

- 13.2.3 MICROSOFT

- TABLE 259 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 59 MICROSOFT: COMPANY SNAPSHOT

- TABLE 260 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 262 MICROSOFT: DEALS

- 13.2.4 GOOGLE

- TABLE 263 GOOGLE: BUSINESS OVERVIEW

- FIGURE 60 GOOGLE: COMPANY SNAPSHOT

- TABLE 264 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 266 GOOGLE: DEALS

- 13.2.5 AVAYA

- TABLE 267 AVAYA: BUSINESS OVERVIEW

- TABLE 268 AVAYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 AVAYA: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 270 AVAYA: DEALS

- 13.2.6 AWS

- TABLE 271 AWS: BUSINESS OVERVIEW

- FIGURE 61 AWS: COMPANY SNAPSHOT

- TABLE 272 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 AWS: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 274 AWS: DEALS

- 13.2.7 CISCO

- TABLE 275 CISCO: BUSINESS OVERVIEW

- FIGURE 62 CISCO: COMPANY SNAPSHOT

- TABLE 276 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 CISCO: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 278 CISCO: DEALS

- 13.2.8 POLY

- TABLE 279 POLY: BUSINESS OVERVIEW

- TABLE 280 POLY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 POLY: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 282 POLY: DEALS

- 13.2.9 ADOBE

- TABLE 283 ADOBE: BUSINESS OVERVIEW

- FIGURE 63 ADOBE: COMPANY SNAPSHOT

- TABLE 284 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 ADOBE: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 286 ADOBE: DEALS

- 13.2.10 GOTO

- TABLE 287 GOTO: BUSINESS OVERVIEW

- TABLE 288 GOTO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 GOTO: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 290 GOTO: DEALS

- 13.3 OTHER PLAYERS

- 13.3.1 RINGCENTRAL

- 13.3.2 MEDIAPLATFORM

- 13.3.3 NOTIFIED

- 13.3.4 KOLLECTIVE TECHNOLOGY

- 13.3.5 HAIVISION

- 13.3.6 KALTURA

- 13.3.7 ON24

- 13.3.8 ENGHOUSE SYSTEMS

- 13.3.9 BRIGHTCOVE

- 13.3.10 VIDIZMO

- 13.3.11 PANOPTO

- 13.3.12 VBRICK

- 13.3.13 SONIC FOUNDRY

- 13.3.14 QUMU

- 13.3.15 DALET DIGITAL MEDIA SYSTEMS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.1.1 MARKETS ADJACENT TO ENTERPRISE VIDEO MARKET

- 14.2 VIDEO ANALYTICS MARKET

- TABLE 291 VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 292 VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 293 VIDEO ANALYTICS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 294 VIDEO ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 295 VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 296 VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 297 VIDEO ANALYTICS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 298 VIDEO ANALYTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 299 VIDEO ANALYTICS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 300 VIDEO ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 301 VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 302 VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.3 VIDEO STREAMING SOFTWARE MARKET

- TABLE 303 VIDEO STREAMING SOFTWARE MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 304 VIDEO STREAMING SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 305 VIDEO STREAMING SOFTWARE MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 306 VIDEO STREAMING SOFTWARE MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 307 VIDEO STREAMING SOFTWARE MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 308 VIDEO STREAMING SOFTWARE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 309 VIDEO STREAMING SOFTWARE MARKET, BY STREAMING TYPE, 2019-2022 (USD MILLION)

- TABLE 310 VIDEO STREAMING SOFTWARE MARKET, BY STREAMING TYPE, 2023-2028 (USD MILLION)

- TABLE 311 VIDEO STREAMING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019-2022 (USD MILLION)

- TABLE 312 VIDEO STREAMING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 313 VIDEO STREAMING SOFTWARE MARKET, BY DELIVERY CHANNEL, 2019-2022 (USD MILLION)

- TABLE 314 VIDEO STREAMING SOFTWARE MARKET, BY DELIVERY CHANNEL, 2023-2028 (USD MILLION)

- TABLE 315 VIDEO STREAMING SOFTWARE MARKET, BY MONETIZATION MODE, 2019-2022 (USD MILLION)

- TABLE 316 VIDEO STREAMING SOFTWARE MARKET, BY MONETIZATION MODE, 2023-2028 (USD MILLION)

- TABLE 317 VIDEO STREAMING SOFTWARE MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 318 VIDEO STREAMING SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 319 VIDEO STREAMING SOFTWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 320 VIDEO STREAMING SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS