|

|

市場調査レポート

商品コード

1174452

バイオインフォマティクスの世界市場:製品・サービス別(ナレッジマネジメントツール、バイオインフォマティクスプラットフォーム、バイオインフォマティクスサービス)、用途別(ゲノミクス、プロテオミクス、トランスクリプトミクス)、セクター別 - 2027年までの予測Bioinformatics Market by Product & Service (Knowledge Management Tools, Bioinformatics Platforms, Data Analysis, Structural Analysis, Services), Applications (Genomics, Proteomics, Transcriptomics), & Sectors (Medical, Animal) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| バイオインフォマティクスの世界市場:製品・サービス別(ナレッジマネジメントツール、バイオインフォマティクスプラットフォーム、バイオインフォマティクスサービス)、用途別(ゲノミクス、プロテオミクス、トランスクリプトミクス)、セクター別 - 2027年までの予測 |

|

出版日: 2022年12月15日

発行: MarketsandMarkets

ページ情報: 英文 226 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のバイオインフォマティクスの市場規模は、2022年に101億米ドルとなり、2027年までに187億米ドルに達し、予測期間中にCAGRで13.0%の成長が予測されています。

バイオインフォマティクス市場の成長は、バイオインフォマティクスに対する官民の資金提供の増加、個別化医療に対する需要の高まり、製薬・バイオテクノロジー研究開発費の増加、ゲノム解読のコスト低下などが要因となっています。しかし、機器の高コストがこの市場の成長を妨げています。

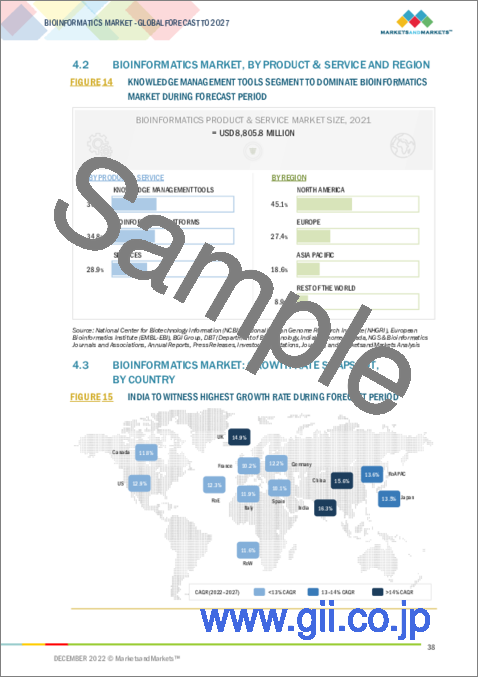

"バイオインフォマティクスサービスセグメントが、予測期間中に最も急成長すると推定される"

バイオインフォマティクス市場は、製品・サービス別では、ナレッジマネジメントツール、バイオインフォマティクスプラットフォーム、バイオインフォマティクスサービスに区分されます。2021年のバイオインフォマティクス市場では、ナレッジマネジメントツールセグメントが36.3%と最大のシェアを占めています。このセグメントの大きなシェアは、ライフサイエンス研究や創薬で発生する大量のデータを管理するための知識管理ツールへの需要が高まっていることに起因しています。しかし、バイオインフォマティクスサービスセグメントは、予測期間中に最も急成長するセグメントになると推定されます。シーケンスのコスト削減と増大するデータ量の管理の必要性、およびゲノム研究に対する政府の資金提供の増加が、この市場セグメントの成長の要因となっています。

"医療用バイオテクノロジーセグメントが、市場で最大シェアを占める見込み"

市場は、セクター別では、医療用バイオテクノロジー、動物用バイオテクノロジー、植物用バイオテクノロジー、環境用バイオテクノロジー、法医学用バイオテクノロジー、その他のセクターに分類されます。2021年のバイオインフォマティクス市場では、医療用バイオテクノロジーセグメントが50.3%と最大のシェアを占めています。創薬のための新しいデータベース、臨床診断へのバイオインフォマティクスの応用、臨床診断のためのバイオインフォマティクスソリューションを立ち上げるための資金調達機会の増加が、市場における医療用バイオテクノロジーセグメントの成長を促進する主な要因となっています。

"ゲノミクスセグメントが、市場で最大シェアを占める見込み"

バイオインフォマティクス市場は、用途別では、ゲノミクス、ケモインフォマティクス・薬剤設計、プロテオミクス、トランスクリプトミクス、メタボロミクス、その他の用途に区分されます。2021年、ゲノミクスセグメントが36.9%と最大の市場シェアを占めています。精密医療開発のためのファーマコゲノム研究の利用拡大、ゲノム研究に対する有利な資金調達シナリオの拡大、高度なバイオインフォマティクスツールとソフトウェアの開発のためのさまざまなライフサイエンスとインフォマティクス企業間のパートナーシップと協力の増加が、ゲノミクス向けバイオインフォマティクス市場の成長をもたらす主要因となっています。

"米国が、北米のバイオインフォマティクス市場を独占する"

バイオインフォマティクス市場は、2021年に北米が45.1%のシェアを占め、次いで欧州とアジア太平洋地域、その他の地域となっています。北米は、医療産業におけるバイオインフォマティクスサービスの開発において、フロントランナーの一角を占めています。米国のバイオインフォマティクス市場は、病院におけるEHRの導入が進んでいることから、今後数年間で成長機会を提供するものと期待されています。また、多くの大手企業が米国に拠点を置いており、米国はバイオインフォマティクス市場のイノベーションの中心地となっています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- バリューチェーン分析

- 規制状況

- ケーススタディ

- エコシステム/市場マップ

- 技術分析

- 業界動向

- 価格分析

- 主な会議とイベント

- 主な利害関係者と購入基準

第6章 バイオインフォマティクス市場:製品・サービス別

- イントロダクション

- ナレッジマネジメントツール

- バイオインフォマティクスプラットフォーム

- バイオインフォマティクスサービス

第7章 バイオインフォマティクス市場:用途別

- イントロダクション

- ゲノミクス

- ケモインフォマティクス・薬剤設計

- プロテオミクス

- トランスクリプトミクス

- メタボロミクス

- その他

第8章 バイオインフォマティクス市場:セクター別

- イントロダクション

- 医療用バイオテクノロジー

- 動物用バイオテクノロジー

- 植物用バイオテクノロジー

- 環境用バイオテクノロジー

- 法医学用バイオテクノロジー

- その他

第9章 バイオインフォマティクス市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋地域

- 中国

- 日本

- インド

- その他

- その他の地域

第10章 競合情勢

- イントロダクション

- 主要企業の戦略/有力企業

- 上位市場企業の収益シェア分析

- 市場ランキング分析

- 競合リーダーシップマッピング

- 競合リーダーシップマッピング:スタートアップ/中小企業

- 競合ベンチマーキング

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC, INC.

- EUROFINS SCIENTIFIC

- ILLUMINA, INC.

- PERKINELMER, INC.

- NEOGENOMICS LABORATORIES

- QIAGEN N.V.

- SOURCE BIOSCIENCE

- AGILENT TECHNOLOGIES, INC.

- DNASTAR

- PSOMAGEN, INC.(FORMERLY MACROGEN CORP.)

- その他の企業

- WATERS CORPORATION

- MICROSYNTH

- GENEWIZ(A BROOKS LIFE SCIENCES COMPANY)

- MEDGENOME LABS LTD.

- PARTEK

- BEIJING GENOMICS INSTITUTE(BGI)

- BIOMAX INFORMATICS AG

- SOPHIA GENETICS

- FIOS GENOMICS

- GENUITY SCIENCE(FORMERLY WUXI NEXTCODE)

- PETDX

- JADBIO

- BIOSYSTEMS IMMUNOLAB PLC.

- ASTALAKE BIOSYSTEMS

- NUCLEOME INFORMATICS PVT. LTD.

第12章 付録

The global bioinformatics market was valued at USD 10.1 Billion in 2022 and is projected to reach USD 18.7 Billion by 2027, at a CAGR of 13.0% during the forecast period. The growth of the bioinformatics market is driven by the increasing public and private-sector funding for bioinformatics, growing demand for personalized medicine, increasing pharmaceutical and biotechnology R&D expenditure, and decreasing cost of genome sequencing. However, the high cost of equipment is hindering the growth of this market.

"Bioinformatics services segment is estimated to be the fastest-growing segment during the forecast period"

Based on product & service, the bioinformatics market is segmented into knowledge management tools, bioinformatics platforms, and bioinformatics services. In 2021, the knowledge management tools segment accounted for the largest share of 36.3% of the bioinformatics market. The large share of this segment is attributed to the growing demand for knowledge management tools to manage large volumes of data generated in life science research and drug discovery. However, the bioinformatics services segment is estimated to be the fastest-growing segment during the forecast period. The need to reduce sequencing costs and manage growing data volumes, as well as the growing government funding for genomics research, are responsible for the growth of this market segment.

Medical biotechnology to hold the largest segment of the market

Based on the sector, the market is segmented into medical biotechnology, animal biotechnology, plant biotechnology, environmental biotechnology, forensic biotechnology, an dother sectors . The medical biotechnology segment accounted for the largest share of 50.3% of the bioinformatics market in 2021. The new databases for drug discovery, the application of bioinformatics for clinical diagnostics, and the increased funding opportunities to launch bioinformatics solutions for clinical diagnostics are major factors driving the growth of the medical biotechnology segment in the market.

Genomics segment to hold the largest share of the component market

Based on application, the bioinformatics market is segmented into genomics, chemoinformatics & drug design, proteomics, transcripomics, metabolomics, and other applications. The genomics segment accounted for the largest market share of 36.9% in 2021. The increasing use of pharmacogenomic research for the development of precision medicine, the growing favorable funding scenario for genomic research, and the increasing partnerships and collaborations between various life sciences and informatics companies for the development of advanced bioinformatics tools and software are the major factors contributing to the growth of the bioinformatics market for genomics.

The US to dominate the bioinformatics market in North America

North America dominated the bioinformatics market, with a share of 45.1% in 2021, followed by Europe and the Asia Pacific, and Rest of World. North America has been among the frontrunners in developing bioinformatics services in the healthcare industry. The bioinformatics market in the US is expected to offer growth opportunities in the coming years owing to the increasing incorporation of EHR in the hospitals. Many major global players are also based in the US, owing to which the country has become a center of innovation in the bioinformatics market.

Breakdown of supply-side primary interviews: * By Company Type: Tier 1 - 45%, Tier 2 - 40%, and Tier 3 - 15% * By Designation: Director-level - 30%, C-level - 41%, and Others - 29% * By Region: North America - 36%, Europe - 30%, APAC -21%, Rest of the World -13%

Some of the prominent players operating in the bioinformatics market are Thermo Fisher Scientific, Inc. (US), Eurofins Scientific (Luxembourg), QIAGEN N.V. (Netherlands), Agilent Technologies, Inc. (US), and Illumina, Inc. (US), Waters Corporation (US), DNASTAR (US), NeoGenomics Laboratories (US), Perkin Elmer, Inc. (US), GENEWIZ (US) and BGI Group (China) Waters Corporation (US), DNASTAR (US), NeoGenomics Laboratories (US), Partek Incorporated (US), SOPHiA Genetics (Switzerland), Source BioScience (UK), and Biomax Informatics AG (Germany) among others.

Research Coverage

This report studies the bioinformatics market based on products & services, sector, and application, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth. It analyzes the opportunities and challenges in the market and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to two main geographies - source and destination.

Key Benefits of Buying the Report

This report focuses on various levels of analysis-industry trends, market share of top players, and company profiles, which together form basic views and analyze the competitive landscape, and high-growth regions and their drivers, restraints, challenges, and opportunities. The report will help both established firms as well as new entrants/smaller firms to gauge the pulse of the market and garner greater market shares.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY SOURCES

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY SOURCES

- FIGURE 2 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- FIGURE 3 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 BIOINFORMATICS MARKET: REVENUE MAPPING-BASED MARKET ESTIMATION (BOTTOM-UP APPROACH)

- FIGURE 5 BIOINFORMATICS MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022-2027)

- FIGURE 6 CAGR PROJECTIONS: BIOINFORMATICS MARKET

- FIGURE 7 BIOINFORMATICS MARKET: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- 2.4 ASSUMPTIONS

- 2.5 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 9 BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2021 VS. 2027 (USD MILLION)

- FIGURE 10 BIOINFORMATICS MARKET, BY SECTOR, 2021 VS. 2027 (USD MILLION)

- FIGURE 11 BIOINFORMATICS MARKET, BY APPLICATION, 2021 VS. 2027 (USD MILLION)

- FIGURE 12 GEOGRAPHICAL SNAPSHOT OF BIOINFORMATICS MARKET

4 PREMIUM INSIGHTS

- 4.1 BIOINFORMATICS MARKET OVERVIEW

- FIGURE 13 INCREASING PUBLIC AND PRIVATE-SECTOR FUNDING FOR BIOINFORMATICS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- 4.2 BIOINFORMATICS MARKET, BY PRODUCT & SERVICE AND REGION

- FIGURE 14 KNOWLEDGE MANAGEMENT TOOLS SEGMENT TO DOMINATE BIOINFORMATICS MARKET DURING FORECAST PERIOD

- 4.3 BIOINFORMATICS MARKET: GROWTH RATE SNAPSHOT, BY COUNTRY

- FIGURE 15 INDIA TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.4 BIOINFORMATICS MARKET: REGIONAL MIX

- FIGURE 16 NORTH AMERICA DOMINATED MARKET IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 17 BIOINFORMATICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.1.1 DRIVERS

- 5.1.1.1 Increasing public and private-sector funding for bioinformatics

- TABLE 1 PUBLIC AND PRIVATE-SECTOR FUNDING FOR BIOINFORMATICS AND RELATED FIELDS

- 5.1.1.2 Growing demand for personalized medicine

- 5.1.1.3 Increasing pharmaceutical and biotechnology R&D expenditure

- TABLE 2 R&D INVESTMENTS BY PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN ASIA PACIFIC REGION

- 5.1.1.4 Decreasing cost of genome sequencing

- 5.1.2 RESTRAINTS

- 5.1.2.1 High cost of equipment

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Lucrative opportunities in emerging markets

- 5.1.3.2 Adoption of blockchain technology and cloud computing

- 5.1.3.3 Integration of machine learning and AI in healthcare

- 5.1.3.4 Investments by leading IT companies in development of bioinformatics solutions

- 5.1.4 CHALLENGES

- 5.1.4.1 Management of large data volumes

- 5.1.4.2 Lack of interoperability and multiplatform capabilities

- 5.1.4.3 Growing competition from in-house development and publicly available tools

- 5.1.4.4 Shortage of skilled bioinformatics professionals

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 BARGAINING POWER OF SUPPLIERS

- 5.2.3 BARGAINING POWER OF BUYERS

- 5.2.4 THREAT OF SUBSTITUTES

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 18 VALUE CHAIN ANALYSIS: BIOINFORMATICS MARKET

- 5.3.1 RESEARCH AND DEVELOPMENT (R&D)

- 5.3.2 RAW MATERIALS

- 5.3.3 DISTRIBUTION AND AFTER-SALES SERVICES

- 5.4 REGULATORY LANDSCAPE

- 5.4.1 NORTH AMERICA

- 5.4.2 EUROPE

- 5.4.3 ASIA PACIFIC

- 5.4.4 MIDDLE EAST & AFRICA

- 5.4.5 LATIN AMERICA

- 5.5 CASE STUDIES

- 5.6 ECOSYSTEM/MARKET MAP

- FIGURE 19 BIOINFORMATICS ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- TABLE 3 TECHNOLOGICAL DEVELOPMENTS BY LEADING VENDORS

- 5.8 INDUSTRY TRENDS

- 5.8.1 DISCOVERY OF BIOMARKERS

- 5.8.2 PROTEIN INTERACTIONS AND PATHWAYS

- 5.8.3 GENETIC INTERACTION DUE TO HUMAN DISEASES

- 5.9 PRICING ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE OF BIOINFORMATICS SOLUTIONS, BY PRODUCT

- TABLE 5 AVERAGE SELLING PRICE OF BIOINFORMATICS SOLUTIONS, BY SERVICE

- 5.10 KEY CONFERENCES AND EVENTS

- TABLE 6 BIOINFORMATICS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS AMONG END USERS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS AMONG END USERS

- 5.11.2 BUYING CRITERIA

- FIGURE 21 KEY BUYING CRITERIA FOR END USERS

- TABLE 8 KEY BUYING CRITERIA FOR END USERS

6 BIOINFORMATICS MARKET, BY PRODUCT & SERVICE

- 6.1 INTRODUCTION

- TABLE 9 BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- 6.2 KNOWLEDGE MANAGEMENT TOOLS

- TABLE 10 KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 11 KNOWLEDGE MANAGEMENT TOOLS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 12 NORTH AMERICA: KNOWLEDGE MANAGEMENT TOOLS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 13 EUROPE: KNOWLEDGE MANAGEMENT TOOLS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 14 APAC: KNOWLEDGE MANAGEMENT TOOLS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.2.1 GENERALIZED KNOWLEDGE MANAGEMENT TOOLS

- 6.2.1.1 Development of novel generalized knowledge management tools to drive growth

- TABLE 15 GENERALIZED KNOWLEDGE MANAGEMENT TOOLS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.2 SPECIALIZED KNOWLEDGE MANAGEMENT TOOLS

- 6.2.2.1 Data security and highly reliable information storage systems to support growth

- TABLE 16 SPECIALIZED KNOWLEDGE MANAGEMENT TOOLS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 BIOINFORMATICS PLATFORMS

- TABLE 17 BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 18 BIOINFORMATICS PLATFORMS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 19 NORTH AMERICA: BIOINFORMATICS PLATFORMS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 20 EUROPE: BIOINFORMATICS PLATFORMS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 21 APAC: BIOINFORMATICS PLATFORMS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3.1 DATA ANALYSIS PLATFORMS

- 6.3.1.1 Increasing need for data analysis during sequencing programs to drive growth

- TABLE 22 DATA ANALYSIS PLATFORMS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.2 STRUCTURAL & FUNCTIONAL ANALYSIS PLATFORMS

- 6.3.2.1 Growing proteomics research worldwide to drive growth

- TABLE 23 STRUCTURAL & FUNCTIONAL ANALYSIS PLATFORMS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.3 OTHER BIOINFORMATICS PLATFORMS

- TABLE 24 OTHER BIOINFORMATICS PLATFORMS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.4 BIOINFORMATICS SERVICES

- TABLE 25 BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 26 BIOINFORMATICS SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 27 NORTH AMERICA: BIOINFORMATICS SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 28 EUROPE: BIOINFORMATICS SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 29 APAC: BIOINFORMATICS SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.4.1 SEQUENCING SERVICES

- 6.4.1.1 Financial support from government and private bodies to drive growth

- TABLE 30 SEQUENCING SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 31 NORTH AMERICA: SEQUENCING SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 32 EUROPE: SEQUENCING SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 33 APAC: SEQUENCING SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.4.2 DATA ANALYSIS SERVICES

- 6.4.2.1 Growing adoption of big data analytics in life science research to drive growth

- TABLE 34 DATA ANALYSIS SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 35 NORTH AMERICA: DATA ANALYSIS SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 36 EUROPE: DATA ANALYSIS SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 37 APAC: DATA ANALYSIS SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.4.3 DRUG DISCOVERY SERVICES

- 6.4.3.1 Growing technological advancements in pharmacogenomics to drive growth

- TABLE 38 DRUG DISCOVERY SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 40 EUROPE: DRUG DISCOVERY SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 41 APAC: DRUG DISCOVERY SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

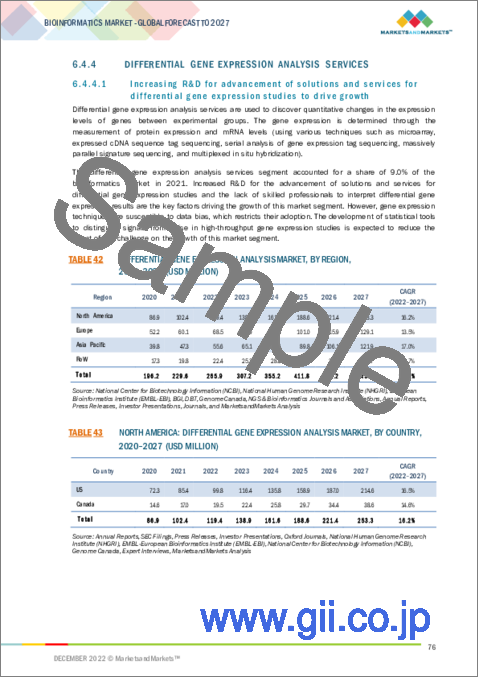

- 6.4.4 DIFFERENTIAL GENE EXPRESSION ANALYSIS SERVICES

- 6.4.4.1 Increasing R&D for advancement of solutions and services for differential gene expression studies to drive growth

- TABLE 42 DIFFERENTIAL GENE EXPRESSION ANALYSIS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: DIFFERENTIAL GENE EXPRESSION ANALYSIS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 44 EUROPE: DIFFERENTIAL GENE EXPRESSION ANALYSIS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 45 APAC: DIFFERENTIAL GENE EXPRESSION ANALYSIS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.4.5 DATABASE AND MANAGEMENT SERVICES

- 6.4.5.1 Growing volume of data generated to increase need for database and management services

- TABLE 46 DATABASE AND MANAGEMENT SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 47 NORTH AMERICA: DATABASE AND MANAGEMENT SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 48 EUROPE: DATABASE AND MANAGEMENT SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 49 APAC: DATABASE AND MANAGEMENT SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.4.6 OTHER BIOINFORMATICS SERVICES

- TABLE 50 OTHER BIOINFORMATICS SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: OTHER BIOINFORMATICS SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 52 EUROPE: OTHER BIOINFORMATICS SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 53 APAC: OTHER BIOINFORMATICS SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

7 BIOINFORMATICS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 54 BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 7.2 GENOMICS

- 7.2.1 DECREASING COST OF NEXT-GENERATION SEQUENCING TO BOOST GROWTH

- TABLE 55 GENOMICS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3 CHEMOINFORMATICS & DRUG DESIGN

- 7.3.1 GROWING USE IN DRUG DESIGNING PROCESS BY PHARMACEUTICAL COMPANIES TO DRIVE GROWTH

- TABLE 56 CHEMOINFORMATICS & DRUG DESIGN MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.4 PROTEOMICS

- 7.4.1 INCREASING APPLICATIONS IN DRUG DISCOVERY TO DRIVE GROWTH

- TABLE 57 PROTEOMICS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.5 TRANSCRIPTOMICS

- 7.5.1 TRANSCRIPTOMICS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 58 TRANSCRIPTOMICS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.6 METABOLOMICS

- 7.6.1 INCREASING RESEARCH FUNDING TO DRIVE GROWTH

- TABLE 59 METABOLOMICS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.7 OTHER APPLICATIONS

- TABLE 60 OTHER APPLICATIONS MARKET, BY REGION, 2020-2027 (USD MILLION)

8 BIOINFORMATICS MARKET, BY SECTOR

- 8.1 INTRODUCTION

- TABLE 61 BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- 8.2 MEDICAL BIOTECHNOLOGY

- TABLE 62 BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 63 BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY REGION, 2020-2027 (USD MILLION)

- TABLE 64 NORTH AMERICA: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 65 EUROPE: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 66 APAC: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.2.1 DRUG DISCOVERY & DEVELOPMENT

- 8.2.1.1 Increasing adoption of bioinformatics services and products for drug designing to drive growth

- TABLE 67 BIOINFORMATICS MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY REGION, 2020-2027 (USD MILLION)

- 8.2.2 CLINICAL DIAGNOSTICS & PERSONALIZED MEDICINE

- 8.2.2.1 Focus on development of bioinformatics tools for personalized medicine to propel growth

- TABLE 68 BIOINFORMATICS MARKET FOR CLINICAL DIAGNOSTICS & PERSONALIZED MEDICINE, BY REGION, 2020-2027 (USD MILLION)

- 8.2.3 REPRODUCTIVE HEALTH

- 8.2.3.1 Increasing R&D on reproductive health to bolster market growth

- TABLE 69 BIOINFORMATICS MARKET FOR REPRODUCTIVE HEALTH, BY REGION, 2020-2027 (USD MILLION)

- 8.3 ANIMAL BIOTECHNOLOGY

- 8.3.1 RAPID ADVANCES IN UNDERSTANDING OF FARM ANIMAL GENOMES TO AID MARKET GROWTH

- TABLE 70 BIOINFORMATICS MARKET FOR ANIMAL BIOTECHNOLOGY, BY REGION, 2020-2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: BIOINFORMATICS MARKET FOR ANIMAL BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 72 EUROPE: BIOINFORMATICS MARKET FOR ANIMAL BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 73 APAC: BIOINFORMATICS MARKET FOR ANIMAL BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.4 PLANT BIOTECHNOLOGY

- 8.4.1 INCREASED USE OF BIOINFORMATICS FOR TIME AND COST-EFFICIENT R&D IN AGRICULTURE TO DRIVE MARKET GROWTH

- TABLE 74 BIOINFORMATICS MARKET FOR PLANT BIOTECHNOLOGY, BY REGION, 2020-2027 (USD MILLION)

- TABLE 75 NORTH AMERICA: BIOINFORMATICS MARKET FOR PLANT BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 76 EUROPE: BIOINFORMATICS MARKET FOR PLANT BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 77 APAC: BIOINFORMATICS MARKET FOR PLANT BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.5 ENVIRONMENTAL BIOTECHNOLOGY

- 8.5.1 INCREASING USE OF NGS FOR ENVIRONMENTAL BIOTECHNOLOGY APPLICATIONS TO DRIVE MARKET GROWTH

- TABLE 78 BIOINFORMATICS MARKET FOR ENVIRONMENTAL BIOTECHNOLOGY, BY REGION, 2020-2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: BIOINFORMATICS MARKET FOR ENVIRONMENTAL BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 80 EUROPE: BIOINFORMATICS MARKET FOR ENVIRONMENTAL BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 81 APAC: BIOINFORMATICS MARKET FOR ENVIRONMENTAL BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.6 FORENSIC BIOTECHNOLOGY

- 8.6.1 INCREASING AVAILABILITY OF ADVANCED SOFTWARE FOR INVESTIGATIONAL PURPOSES TO DRIVE GROWTH

- TABLE 82 BIOINFORMATICS MARKET FOR FORENSIC BIOTECHNOLOGY, BY REGION, 2020-2027 (USD MILLION)

- TABLE 83 NORTH AMERICA: BIOINFORMATICS MARKET FOR FORENSIC BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 84 EUROPE: BIOINFORMATICS MARKET FOR FORENSIC BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 85 APAC: BIOINFORMATICS MARKET FOR FORENSIC BIOTECHNOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.7 OTHER SECTORS

- TABLE 86 BIOINFORMATICS MARKET FOR OTHER SECTORS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 87 NORTH AMERICA: BIOINFORMATICS MARKET FOR OTHER SECTORS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 88 EUROPE: BIOINFORMATICS MARKET FOR OTHER SECTORS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 89 APAC: BIOINFORMATICS MARKET FOR OTHER SECTORS, BY COUNTRY, 2020-2027 (USD MILLION)

9 BIOINFORMATICS MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 90 BIOINFORMATICS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 22 NORTH AMERICA: BIOINFORMATICS MARKET SNAPSHOT (2021)

- TABLE 91 NORTH AMERICA: BIOINFORMATICS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 92 NORTH AMERICA: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 94 NORTH AMERICA: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 95 NORTH AMERICA: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 96 NORTH AMERICA: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 97 NORTH AMERICA: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 98 NORTH AMERICA: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 US dominated North American market in 2021

- TABLE 99 US: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 100 US: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 101 US: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 102 US: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 103 US: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 104 US: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 105 US: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Growth in genomics field to drive market

- TABLE 106 CANADA: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 107 CANADA: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 108 CANADA: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 109 CANADA: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 110 CANADA: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 111 CANADA: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 112 CANADA: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3 EUROPE

- FIGURE 23 EUROPE: BIOINFORMATICS MARKET SNAPSHOT (2021)

- TABLE 113 EUROPE: BIOINFORMATICS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 114 EUROPE: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 115 EUROPE: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 116 EUROPE: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 117 EUROPE: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 118 EUROPE: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 119 EUROPE: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 120 EUROPE: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Germany expected to be largest market for bioinformatics products and services in Europe

- TABLE 121 GERMANY: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 122 GERMANY: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 123 GERMANY: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 124 GERMANY: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 125 GERMANY: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 126 GERMANY: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 127 GERMANY: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Increasing genomics research to drive market growth

- TABLE 128 UK: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 129 UK: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 130 UK: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 131 UK: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 132 UK: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 133 UK: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 134 UK: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Government initiatives for genomics research to drive market growth

- TABLE 135 FRANCE: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 136 FRANCE: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 137 FRANCE: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 138 FRANCE: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 139 FRANCE: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 140 FRANCE: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 141 FRANCE: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Increasing research in genomics to drive market growth

- TABLE 142 ITALY: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 143 ITALY: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 144 ITALY: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 145 ITALY: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 146 ITALY: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 147 ITALY: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 148 ITALY: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Presence of several local players in Spanish bioinformatics market to drive growth

- TABLE 149 SPAIN: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 150 SPAIN: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 151 SPAIN: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 152 SPAIN: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 153 SPAIN: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 154 SPAIN: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 155 SPAIN: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 156 ROE: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 157 ROE: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 158 ROE: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 159 ROE: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 160 ROE: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 161 ROE: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 162 ROE: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 24 ASIA PACIFIC: BIOINFORMATICS MARKET SNAPSHOT (2021)

- TABLE 163 ASIA PACIFIC: BIOINFORMATICS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 164 ASIA PACIFIC: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 165 ASIA PACIFIC: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 166 ASIA PACIFIC: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 167 ASIA PACIFIC: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 168 ASIA PACIFIC: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 169 ASIA PACIFIC: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 170 ASIA PACIFIC: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Partnerships and collaborations between various industry stakeholders driving development of bioinformatics

- TABLE 171 CHINA: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 172 CHINA: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 173 CHINA: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 174 CHINA: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 175 CHINA: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 176 CHINA: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 177 CHINA: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Growing focus of Japanese bioinformatics firms on product launches and collaborations to drive growth

- TABLE 178 JAPAN: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 179 JAPAN: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 180 JAPAN: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 181 JAPAN: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 182 JAPAN: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 183 JAPAN: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 184 JAPAN: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Increasing outsourcing of pharmaceutical drug discovery to drive growth

- TABLE 185 INDIA: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 186 INDIA: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 187 INDIA: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 188 INDIA: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 189 INDIA: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 190 INDIA: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 191 INDIA: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.4 REST OF ASIA PACIFIC

- TABLE 192 ROAPAC: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 193 ROAPAC: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 194 ROAPAC: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 195 ROAPAC: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 196 ROAPAC: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 197 ROAPAC: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 198 ROAPAC: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.5 REST OF THE WORLD

- TABLE 199 ROW: BIOINFORMATICS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 200 ROW: BIOINFORMATICS KNOWLEDGE MANAGEMENT TOOLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 201 ROW: BIOINFORMATICS PLATFORMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 202 ROW: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 203 ROW: BIOINFORMATICS MARKET, BY SECTOR, 2020-2027 (USD MILLION)

- TABLE 204 ROW: BIOINFORMATICS MARKET FOR MEDICAL BIOTECHNOLOGY, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 205 ROW: BIOINFORMATICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES OF KEY PLAYERS/RIGHT TO WIN

- TABLE 206 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 25 REVENUE ANALYSIS OF KEY PLAYERS IN BIOINFORMATICS MARKET

- 10.4 MARKET RANKING ANALYSIS, 2021

- FIGURE 26 RANK OF COMPANIES IN GLOBAL BIOINFORMATICS MARKET, 2021

- 10.5 COMPETITIVE LEADERSHIP MAPPING

- 10.5.1 STARS

- 10.5.2 PERVASIVE PLAYERS

- 10.5.3 EMERGING LEADERS

- 10.5.4 PARTICIPANTS

- FIGURE 27 BIOINFORMATICS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.6 COMPETITIVE LEADERSHIP MAPPING: START-UPS/SMES (2021)

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 STARTING BLOCKS

- 10.6.3 RESPONSIVE COMPANIES

- 10.6.4 DYNAMIC COMPANIES

- FIGURE 28 BIOINFORMATICS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2021

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 207 FOOTPRINT OF COMPANIES

- TABLE 208 PRODUCT & SERVICE FOOTPRINT OF COMPANIES

- TABLE 209 REGIONAL FOOTPRINT OF COMPANIES

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT & SERVICE LAUNCHES

- TABLE 210 BIOINFORMATICS MARKET: PRODUCT & SERVICE LAUNCHES, JANUARY 2019-NOVEMBER 2022

- 10.8.2 DEALS

- TABLE 211 BIOINFORMATICS MARKET: DEALS, JANUARY 2019-NOVEMBER 2022

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business overview, Products & services offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats)**

- 11.1.1 THERMO FISHER SCIENTIFIC, INC.

- TABLE 212 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- FIGURE 29 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2021)

- 11.1.2 EUROFINS SCIENTIFIC

- TABLE 213 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

- FIGURE 30 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2021)

- 11.1.3 ILLUMINA, INC.

- TABLE 214 ILLUMINA, INC.: BUSINESS OVERVIEW

- FIGURE 31 ILLUMINA, INC.: COMPANY SNAPSHOT (2021)

- 11.1.4 PERKINELMER, INC.

- TABLE 215 PERKINELMER, INC.: BUSINESS OVERVIEW

- FIGURE 32 PERKINELMER, INC.: COMPANY SNAPSHOT (2021)

- 11.1.5 NEOGENOMICS LABORATORIES

- TABLE 216 NEOGENOMICS LABORATORIES: BUSINESS OVERVIEW

- FIGURE 33 NEOGENOMICS LABORATORIES: COMPANY SNAPSHOT (2021)

- 11.1.6 QIAGEN N.V.

- TABLE 217 QIAGEN N.V.: BUSINESS OVERVIEW

- FIGURE 34 QIAGEN N.V.: COMPANY SNAPSHOT (2021)

- 11.1.7 SOURCE BIOSCIENCE

- TABLE 218 SOURCE BIOSCIENCE: BUSINESS OVERVIEW

- FIGURE 35 SOURCE BIOSCIENCE: COMPANY SNAPSHOT (2021)

- 11.1.8 AGILENT TECHNOLOGIES, INC.

- TABLE 219 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 36 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2021)

- 11.1.9 DNASTAR

- TABLE 220 DNASTAR: BUSINESS OVERVIEW

- 11.1.10 PSOMAGEN, INC. (FORMERLY MACROGEN CORP.)

- TABLE 221 PSOMAGEN, INC.: BUSINESS OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 WATERS CORPORATION

- 11.2.2 MICROSYNTH

- 11.2.3 GENEWIZ (A BROOKS LIFE SCIENCES COMPANY)

- 11.2.4 MEDGENOME LABS LTD.

- 11.2.5 PARTEK

- 11.2.6 BEIJING GENOMICS INSTITUTE (BGI)

- 11.2.7 BIOMAX INFORMATICS AG

- 11.2.8 SOPHIA GENETICS

- 11.2.9 FIOS GENOMICS

- 11.2.10 GENUITY SCIENCE (FORMERLY WUXI NEXTCODE)

- 11.2.11 PETDX

- 11.2.12 JADBIO

- 11.2.13 BIOSYSTEMS IMMUNOLAB PLC.

- 11.2.14 ASTALAKE BIOSYSTEMS

- 11.2.15 NUCLEOME INFORMATICS PVT. LTD.

- *Details on Business overview, Products & services offered, Recent developments, MnM view, Right to win, Strategic choices made, and weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS