|

|

市場調査レポート

商品コード

1336046

ポリヒドロキシアルカノエート(PHA)の世界市場:製品タイプ別(短鎖長、中鎖長)、製造方法別(砂糖発酵、植物油発酵)、用途別(包装・食品サービス、バイオメディカル)、地域別-2028年までの予測Polyhydroxyalkanoate (PHA) Market by Type (Short chain length, Medium Chain Lenth), Production Methods (Sugar Fermentation, Vegetable Oil Fermentation), Application (Packaging & Food Services, Biomedical), and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ポリヒドロキシアルカノエート(PHA)の世界市場:製品タイプ別(短鎖長、中鎖長)、製造方法別(砂糖発酵、植物油発酵)、用途別(包装・食品サービス、バイオメディカル)、地域別-2028年までの予測 |

|

出版日: 2023年08月14日

発行: MarketsandMarkets

ページ情報: 英文 212 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

ポリヒドロキシアルカノエート(PHA)の市場規模は2023年の9,300万米ドルから15.9%のCAGRで拡大し、2028年には1億9,500万米ドルに拡大すると予測されています。

環境に対する厳しい規制や安全性への懸念の高まりと、従来のプラスチックの有害性が、PHA市場の成長を促進しています。欧州や北米などの新興国市場は、厳しい規制を導入しており、市場に生産的な機会を提供しています。PHAの主要メーカーは、製品の品質を向上させる技術を統合しています。

プラスチックは、バイオメディカル材料の生産やドラッグデリバリーシステムへの応用に徐々に採用されつつあります。合成プラスチックかバイオベースプラスチックの選択は、望まれる特性と意図された目的に適しているかどうかによって決まります。この分野で一般的に使用される合成プラスチックにはPE、PS、PVC、PPなどがあり、生分解性の選択肢にはPLAやPHAなどがあります。これらの材料の機械的特性は、組織工学や創傷治療などの様々な医療用途との適合性を確保する上で重要な役割を果たしています。さらに、プラスチック技術の進歩は、患者の転帰を改善し、医療処置を強化することを目指し、生物医学分野の技術革新を推進し続けています。

砂糖発酵は、主に、サトウキビ、ビート、糖蜜、バガスなどの原料をバクテリアによってPHAを生産するための贅沢な入手のしやすさ、消費のしやすさ、変換のしやすさから、広く実施されているPHAの生産方法です。この方法は、予測期間中、金額ベースで著しい複合年間成長率(CAGR)を示すと予測されます。さらに、PHA生産に糖発酵を利用することで、農業製品別や廃棄物の流れを利用できるという利点があり、より持続可能で資源効率の高いアプローチに貢献します。

欧州は、持続可能な包装慣行を重視し、生分解性プラスチックの開発と採用において先駆的な役割を果たしてきました。同地域では環境に対する意識が顕著に高まり、厳しい法律や規制の実施につながっています。こうした規制は、環境にやさしい方法で廃棄物を管理するための効率的な解決策を提供し、先進的な生物学的廃棄物処理施設の設立に拍車をかけています。その結果、環境問題への取り組みと持続可能な慣行の推進に向けた欧州の積極的なアプローチは、他の地域が追随すべきベンチマークとなっています。

当レポートでは、世界のポリヒドロキシアルカノエート(PHA)市場について調査し、製品タイプ別、製造方法別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 業界の動向

- サプライチェーン分析

- 主要な利害関係者と購入基準

- 価格分析

- 顧客のビジネスに影響を与える動向と混乱

- 生態系マッピング

- 技術分析

- ケーススタディ分析

- 貿易データ統計

- 規制状況

- 2023年~2024年の主な会議とイベント

- 特許分析

第7章 PHAの生産源とプロセス

- 一般的な製造プロセス

- 植物由来の糖基質または炭水化物

- トリアシルグリセロール

- 炭化水素

- 株の選択

- バイオプロセスと下流プロセス

第8章 生産能力分析

第9章 ポリヒドロキシアルカン酸(PHA)市場、タイプ別

- イントロダクション

- 短鎖長

- 中鎖長

第10章 ポリヒドロキシアルカン酸(PHA)市場、製造方法別

- イントロダクション

第11章 ポリヒドロキシアルカン酸(PHA)市場、用途別

- イントロダクション

- 包装・食品サービス

- バイオメディカル

- 農業

- その他

第12章 ポリヒドロキシアルカン酸(PHA)市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第13章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略

- 主要な市場参入企業のランキング

- 市場シェア分析

- DANIMER SCIENTIFIC

- SHENZHEN ECOMANN BIOTECHNOLOGY CO., LTD

- KANEKA CORPORATION

- RWDC INDUSTRIES

- NINGBO TIANAN BIOMATERIALS CO., LTD.

- 上位5社の収益分析

- 企業の製品フットプリント分析

- 企業評価マトリックス

- 競合ベンチマーキング

- スタートアップ/中小企業の評価マトリックス

- 競合状況・動向

第14章 企業プロファイル

- 主要参入企業

- KANEKA CORPORATION

- DANIMER SCIENTIFIC

- SHENZHEN ECOMANN BIOTECHNOLOGY CO., LTD

- RWDC INDUSTRIES

- NEWLIGHT TECHNOLOGIES, INC.

- NINGBO TIANAN BIOMATERIALS CO., LTD

- BIOMER

- PHABUILDER

- TERRAVERDAE BIOWORKS INC.

- BLUEPHA

- その他の企業

- NAFIGATE CORPORATION, A.S.

- GENECIS BIOINDUSTRIES INC.

- TEPHA, INC.

- CJ CHEILJEDANG CORPORATION

- FULL CYCLE BIOPLASTICS LLC

- MANGO MATERIALS

- COFCO

- MEDPHA BIOSCIENCE CO. LTD.

第15章 隣接市場および関連市場

第16章 付録

In terms of value, the PHA market size is projected to increase from USD 93 million in 2023 to USD 195 million by 2028, at a CAGR of 15.9%. . The rising strict regulations and safety concerns towards environment and harmful effects of conventional plastics is driving the growth for PHA market. Developed regions such as Europe and North America are introducing strict regulations, which can provide productive opportunities for the market. The key manufacturers of the PHAs are integrating technologies to improve the quality of products.

"By application, biomedical reported as second-largest market share for PHA market, in terms of volume, in 2022."

Plastics are being progressively employed in the production of biomedical materials and for applications in drug delivery systems. The choice of synthetic or bio-based plastics depends on the desired properties and appropriate for the intended purpose. Generally used synthetic plastics in this field include PE, PS, PVC, and PP, while biodegradable options include PLA and PHA. The mechanical properties of these materials play a crucial role in ensuring their compatibility with various medical applications, such as tissue engineering and wound treatment. Moreover, advancements in plastic technology continue to drive innovation in the biomedical field, aiming to improve patient outcomes and enhance medical procedures.

"Sugar fermentation is expected to be the second-fastest growing application for PHA market during the forecast period, in terms of value"

Sugar fermentation is a broadly implemented production method for PHA, mainly due to the lavish accessibility and ease of consumption and conversion of raw materials such as sugarcane, beet, molasses, and bagasse by bacteria to produce PHA. This method is estimated to exhibit a significant compound annual growth rate (CAGR) in terms of value during the forecast period. Additionally, the utilization of sugar fermentation for PHA production offers the advantage of utilizing agricultural by-products and waste streams, contributing to a more sustainable and resource-efficient approach.

"Europe is largest and projected to be the fastest growing region for PHA market, in terms of value, during the forecast period"

Europe has played a pioneering role in the development and adoption of biodegradable plastics, with a strong emphasis on sustainable packaging practices. The region has witnessed a notable rise in environmental awareness, leading to the implementation of stringent laws and regulations. These regulations, in turn, have spurred the establishment of advanced biological waste treatment facilities, providing efficient solutions for managing waste in an environmentally friendly manner. Consequently, Europe's proactive approach towards addressing environmental concerns and promoting sustainable practices has set a benchmark for other regions to follow.

- By Company Type: Tier 1 - 69%, Tier 2 - 23%, and Tier 3 - 8%

- By Designation: C-Level - 23%, Director Level - 37%, and Others - 40%

- By Region: North America - 30%, Europe - 18%, Asia Pacific - 41%, Rest of the World - 11%

The key players profiled in the report include Danimer Scientific (US), Shenzhen Ecomann Biotechnology Co., Ltd. (China), Kaneka Corporation (Japan), RWDC Industries (Singapore), Newlight Technologies LLC (US), TianAn Biologic Materials Co., Ltd. (China), and Biomer (Germany).

Research Coverage

This report segments the market for PHA based on type, production method, application, and region and provides estimations of volume (ton) and value (USD million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for PHA market.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the PHA market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Green procurement policies, Extreme suitability of renewable and lucrative raw materials, Biodegradability driving consumption, Growing concerns about human health and safety), restraints (Extreme price compared to conventional polymers, Performance issues), opportunities (Growing scope in end-use segments, Progress of new raw materials, Cost lessening through economies of scale, Cyanobacteria empowering cost reduction, Development opportunities in Asia Pacific), and challenges (Manufacturing technology in preliminary phase, Underutilization of PHA manufacturing plants, Exclusive and intricate production process) influencing the growth of the PHA market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the PHA market

- Market Penetration: Comprehensive information on coated fabrics offered by top players in the global market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the PHA market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for PHA across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global PHA market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the PHA market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.2.2 DEFINITION AND INCLUSIONS

- TABLE 1 DEFINITION AND INCLUSIONS, BY TYPE

- TABLE 2 DEFINITION AND INCLUSIONS, BY PRODUCTION METHOD

- TABLE 3 DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.3 MARKET SCOPE

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 PHA MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews: Demand and Supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 2 (DEMAD SIDE-PRODUCTS SOLD AND AVERAGE SELLING PRICE)

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 1 (SUPPLY SIDE-COMBINED SHARE OF MAJOR PLAYERS)

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 2 (SUPPLY SIDE-COMBINED SHARE OF MAJOR PLAYERS)

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION APPROACH 3: TOP-DOWN

- 2.3 DATA TRIANGULATION

- FIGURE 6 PHA MARKET: DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS

- 2.4.1 SUPPLY SIDE

- FIGURE 7 CAGR PROJECTIONS FROM SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- FIGURE 8 PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESMENT

- TABLE 4 PHA MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 SHORT CHAIN LENGTH SEGMENT TO LEAD PHA MARKET DURING FORECAST PERIOD

- FIGURE 10 PACKAGING & FOOD SERVICES APPLICATION ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 11 EUROPE ACCOUNTED FOR LARGEST SHARE OF PHA MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PHA MARKET

- FIGURE 12 PACKAGING & FOOD SERVICES AND BIOMEDICAL OFFER SIGNIFICANT OPPORTUNITIES

- 4.2 EUROPE: PHA MARKET, BY APPLICATION AND COUNTRY

- FIGURE 13 GERMANY LED EUROPEAN PHA MARKET

- 4.3 PHA MARKET, BY PRODUCTION METHOD

- FIGURE 14 SUGAR FERMENTATION PRODUCTION METHOD TO DOMINATE MARKET

- 4.4 PHA MARKET, BY REGION

- FIGURE 15 EUROPE TO BE FASTEST-GROWING PHA MARKET

- 4.5 PHA MARKET, REGION VS. APPLICATION

- FIGURE 16 PACKAGING AND FOOD SERVICES APPLICATION LED PHA MARKET IN 2022

- 4.6 ITALY TO BE FASTEST-GROWING PHA MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PHA MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Green procurement policies

- TABLE 5 NORTH AMERICAN AND EUROPEAN UNION REGULATIONS

- 5.2.1.2 High availability of renewable and cost-effective raw materials

- 5.2.1.3 Environmental Concerns or Biodegradability of PHA

- FIGURE 18 SHORTCOMINGS OF NON-BIODEGRADABLE WASTE DISPOSAL METHODS

- 5.2.1.4 Increasing concerns about human health and safety

- TABLE 6 CONVENTIONAL PLASTICS: HEALTH CONCERNS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High price compared to conventional polymers

- 5.2.2.2 Performance issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing scope in end-use segments

- 5.2.3.2 Emergence of new raw materials

- 5.2.3.3 Cost reductions through economies of scale

- 5.2.3.4 Cyanobacteria enabling cost reduction

- 5.2.3.5 Growth opportunities in Asia Pacific

- 5.2.4 CHALLENGES

- 5.2.4.1 Manufacturing technology in initial phase

- 5.2.4.2 Underutilization of manufacturing plants

- TABLE 7 PHA PRODUCTION CAPACITY, BY COMPANY, 2022 (TONS/YEAR)

- 5.2.4.3 Expensive and complex production process

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 PHA MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 8 PHA MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS & FORECASTS

- TABLE 9 GDP TRENDS & FORECASTS, BY MAJOR ECONOMY, 2020-2028 (USD BILLION)

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 20 PHA MARKET: SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL

- 6.1.2 FERMENTATION

- 6.1.3 EXTRACTION

- 6.1.4 END-USE INDUSTRIES

- 6.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS FOR TOP THREE APPLICATIONS

- TABLE 10 STAKEHOLDER INFLUENCE ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 6.2.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE, BY APPLICATION

- FIGURE 23 AVERAGE SELLING PRICE, BY APPLICATION

- TABLE 12 AVERAGE SELLING PRICE OF TOP THREE APPLICATIONS, BY KEY PLAYER (USD/KG)

- 6.3.2 AVERAGE SELLING PRICE, BY REGION

- FIGURE 24 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- TABLE 13 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- 6.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 REVENUE SHIFT FOR PHA MARKET

- 6.5 ECOSYSTEM MAPPING

- TABLE 14 ECOSYSTEM MAPPING

- FIGURE 26 ECOSYSTEM MAPPING

- 6.6 TECHNOLOGY ANALYSIS

- FIGURE 27 DIFFERENT SUBSTRATES UTILIZED FOR PHA PRODUCTION

- 6.6.1 COMMERCIALIZED TECHNOLOGIES

- TABLE 15 COMMERCIALIZED AND TO BE COMMERCIALIZED TECHNOLOGIES, TYPES, AND PRODUCTION METHODS

- 6.6.2 PHA PRODUCTION IN BIOREFINERIES

- 6.6.3 PHA TO BE COMMERCIALIZED

- 6.6.4 OTHER POSSIBILITIES

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 BIODEGRADABLE STRAWS

- 6.7.2 SUSTAINABLE PACKAGING

- 6.7.3 BIODEGRADABLE SPIRIT BOTTLES

- 6.8 TRADE DATA STATISTICS

- 6.8.1 IMPORT SCENARIO OF PHA

- FIGURE 28 IMPORT OF PHA, BY KEY COUNTRY (2015-2022)

- TABLE 16 IMPORT OF PHA, BY REGION, 2015-2022 (USD THOUSAND)

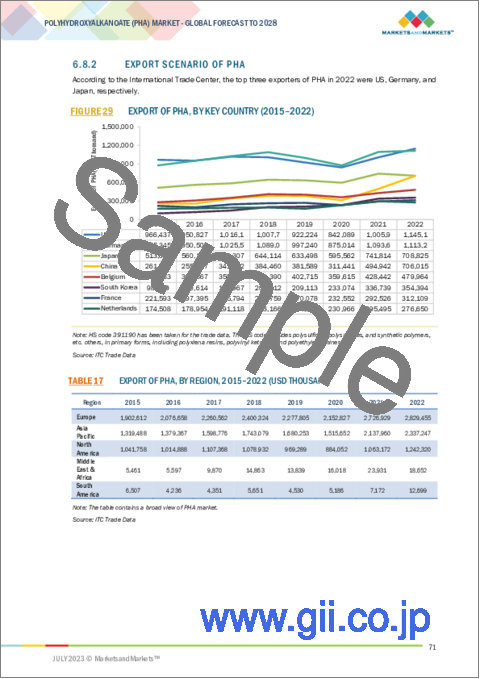

- 6.8.2 EXPORT SCENARIO OF PHA

- FIGURE 29 EXPORT OF PHA, BY KEY COUNTRY (2015-2022)

- TABLE 17 EXPORT OF PHA, BY REGION, 2015-2022 (USD THOUSAND)

- 6.9 REGULATORY LANDSCAPE

- TABLE 18 REGULATORY AUTHORITIES FOR PHA

- TABLE 19 REGULATIONS FOR PHA

- 6.9.1 REACH

- 6.10 KEY CONFERENCES & EVENTS IN 2023--2024

- TABLE 20 PHA MARKET: CONFERENCES & EVENTS

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPE

- TABLE 21 GRANTED PATENTS ACCOUNTED FOR 30% OF ALL PATENTS IN LAST 11 YEARS

- FIGURE 30 PATENTS REGISTERED FOR PHA MARKET, 2012-2022

- FIGURE 31 PATENT PUBLICATION TRENDS FOR PHA MARKET, 2012-2022

- FIGURE 32 LEGAL STATUS OF PATENTS

- 6.11.3 JURISDICTION ANALYSIS

- FIGURE 33 MAXIMUM PATENTS FILED BY COMPANIES IN US

- 6.11.4 TOP APPLICANTS

- FIGURE 34 PROCTER & GAMBLE REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2012 AND 2022

- TABLE 22 PATENTS BY PROCTER & GAMBLE COMPANY

- TABLE 23 PATENTS BY PIONEER HI-BRED INTERNATIONAL, INC.

- TABLE 24 TOP 10 PATENT OWNERS IN US, 2012-2022

7 SOURCES AND PROCESSES OF PHA PRODUCTION

- 7.1 GENERAL PRODUCTION PROCESS

- FIGURE 35 PROCESS FLOW OF PHA PRODUCTION

- 7.2 SUGAR SUBSTRATE OR CARBOHYDRATES FROM PLANTS

- FIGURE 36 SUGAR SUBSTRATES FOR PHA PRODUCTION

- 7.3 TRIACYLGLYCEROLS

- 7.4 HYDROCARBONS

- FIGURE 37 HYDROCARBON SUBSTRATES

- 7.5 STRAIN SELECTION

- TABLE 25 BACTERIUM STRAINS AND OUTPUT

- 7.6 BIOPROCESS AND DOWNSTREAM PROCESS

- 7.6.1 FERMENTATION PROCESS

- 7.6.1.1 Discontinuous process

- 7.6.1.1.1 Batch process

- 7.6.1.1.2 Fed-batch process

- 7.6.1.1.3 Fed-batch process with cell recycling

- 7.6.1.1.4 Repeated fed-batch

- 7.6.1.2 Continuous process

- 7.6.1.2.1 Continuous fed-batch process

- 7.6.1.2.2 One-stage chemostat

- 7.6.1.2.3 Two-stage chemostat

- 7.6.1.2.4 Multi-stage chemostat

- 7.6.1.1 Discontinuous process

- 7.6.2 EXTRACTION PROCESS

- FIGURE 38 EXTRACTION PROCESS FLOW

- 7.6.1 FERMENTATION PROCESS

8 PRODUCTION CAPACITY ANALYSIS

- TABLE 26 CURRENT PRODUCTION CAPACITIES (TON)

- TABLE 27 UPCOMING PLAYERS

- TABLE 28 DISCONTINUED OR STALLED PRODUCTION

9 POLYHYDROXYALKANOATE (PHA) MARKET, BY TYPE

- 9.1 INTRODUCTION

- FIGURE 39 SHORT CHAIN LENGTH SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- TABLE 29 PHA MARKET, BY TYPE, 2017-2021 (TON)

- TABLE 30 PHA MARKET, BY TYPE, 2022-2028 (TON)

- TABLE 31 PHA MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 32 PHA MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.2 SHORT CHAIN LENGTH

- 9.2.1 POLYHYDROXYVALERATE (PHV)

- 9.2.1.1 Increasing use of copolymers to drive market

- 9.2.2 P (4HB-CO-3HB)

- 9.2.2.1 Excellent physical and mechanical properties to drive market

- 9.2.3 P (3HB-CO-3HV)

- 9.2.3.1 Increasing use in packaging films, blow-molded bottles, medical and disposable personal hygiene to drive market

- 9.2.4 OTHERS

- TABLE 33 SHORT CHAIN LENGTH PHA MARKET, BY REGION, 2017-2021 (TON)

- TABLE 34 SHORT CHAIN LENGTH PHA MARKET, BY REGION, 2022-2028 (TON)

- TABLE 35 SHORT CHAIN LENGTH PHA MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 36 SHORT CHAIN LENGTH PHA MARKET, BY REGION, 2022-2028 (USD MILLION)

- 9.2.1 POLYHYDROXYVALERATE (PHV)

- 9.3 MEDIUM CHAIN LENGTH

- 9.3.1 P (HYDROXYBUTYRATE-CO-HYDROXYOCTANOATE)

- 9.3.1.1 High tensile strength, low brittleness, and highly refined physical and mechanical properties to drive market

- 9.3.2 P (3HB-CO-3HV-CO-4HB)

- 9.3.2.1 High mechanical strength to drive market

- 9.3.3 OTHERS

- 9.3.3.1 Increasing demand from medical and biotechnology fields to drive market

- TABLE 37 MEDIUM CHAIN LENGTH PHA MARKET, BY REGION, 2017-2021 (TON)

- TABLE 38 MEDIUM CHAIN LENGTH PHA MARKET, BY REGION, 2022-2028 (TON)

- TABLE 39 MEDIUM CHAIN LENGTH PHA MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 40 MEDIUM CHAIN LENGTH PHA MARKET, BY REGION, 2022-2028 (USD MILLION)

- 9.3.1 P (HYDROXYBUTYRATE-CO-HYDROXYOCTANOATE)

10 POLYHYDROXYALKANOATE (PHA) MARKET, BY PRODUCTION METHOD

- 10.1 INTRODUCTION

- FIGURE 40 SUGAR FERMENTATION PRODUCTION METHOD TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 41 PHA MARKET, BY PRODUCTION METHOD, 2017-2021 (TON)

- TABLE 42 PHA MARKET, BY PRODUCTION METHOD, 2022-2028 (TON)

- TABLE 43 PHA MARKET, BY PRODUCTION METHOD, 2017-2021 (USD MILLION)

- TABLE 44 PHA MARKET, BY PRODUCTION METHOD, 2022-2028 (USD MILLION)

11 POLYHYDROXYALKANOATE (PHA) MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 41 PACKAGING & FOOD SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- TABLE 45 PHA MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 46 PHA MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 47 PHA MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 48 PHA MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 11.2 PACKAGING & FOOD SERVICES

- 11.2.1 PACKAGING

- 11.2.1.1 Rigid packaging

- 11.2.1.1.1 High durability, tamper-resistance, lightweight, and low cost, to drive market

- 11.2.1.2 Flexible packaging

- 11.2.1.2.1 Replacement for petroleum-based plastics to drive market

- 11.2.1.3 Others packaging

- 11.2.1.3.1 Loose-fill

- 11.2.1.3.2 Compost bags

- 11.2.1.1 Rigid packaging

- 11.2.2 FOOD SERVICES

- 11.2.2.1 Cups

- 11.2.2.1.1 Increasing use of biodegradable disposable products to drive market

- 11.2.2.2 Trays

- 11.2.2.2.1 Increasing demand for sustainable trays to drive market

- 11.2.2.3 Other food services

- 11.2.2.3.1 Containers

- 11.2.2.3.2 Jars

- 11.2.2.1 Cups

- TABLE 49 PHA MARKET IN PACKAGING & FOOD SERVICES APPLICATION, BY REGION, 2017-2021 (TON)

- TABLE 50 PHA MARKET IN PACKAGING & FOOD SERVICES APPLICATION, BY REGION, 2022-2028 (TON)

- TABLE 51 PHA MARKET IN PACKAGING & FOOD SERVICES APPLICATION, BY REGION, 2017-2021 (USD MILLION)

- TABLE 52 PHA MARKET IN PACKAGING & FOOD SERVICES APPLICATION, BY REGION, 2022-2028 (USD MILLION)

- 11.2.1 PACKAGING

- 11.3 BIOMEDICAL

- 11.3.1 SUTURES

- 11.3.1.1 High tensile strength to drive market

- 11.3.2 DRUG RELEASE

- 11.3.2.1 Biocompatibility for drug carrier applications to drive market

- 11.3.3 OTHER BIOMEDICAL APPLICATIONS

- TABLE 53 PHA MARKET IN BIOMEDICAL APPLICATION, BY REGION, 2017-2021 (TON)

- TABLE 54 PHA MARKET IN BIOMEDICAL APPLICATION, BY REGION, 2022-2028 (TON)

- TABLE 55 PHA MARKET IN BIOMEDICAL APPLICATION, BY REGION, 2017-2021 (USD MILLION)

- TABLE 56 PHA MARKET IN BIOMEDICAL APPLICATION, BY REGION, 2022-2028 (USD MILLION)

- 11.3.1 SUTURES

- 11.4 AGRICULTURE

- 11.4.1 MULCH FILMS

- 11.4.1.1 Extensive use by farmers to drive market

- 11.4.2 PLANT POTS

- 11.4.2.1 Plant pots help during stages of plant growth

- 11.4.3 OTHER AGRICULTURAL APPLICATIONS

- 11.4.3.1 Bins

- 11.4.3.2 Chutes

- 11.4.3.3 Hoppers

- TABLE 57 PHA MARKET IN AGRICULTURE APPLICATION, BY REGION, 2017-2021 (TON)

- TABLE 58 PHA MARKET IN AGRICULTURE APPLICATION, BY REGION, 2022-2028 (TON)

- TABLE 59 PHA MARKET IN AGRICULTURE APPLICATION, BY REGION, 2017-2021 (USD MILLION)

- TABLE 60 PHA MARKET IN AGRICULTURE APPLICATION, BY REGION, 2022-2028 (USD MILLION)

- 11.4.1 MULCH FILMS

- 11.5 OTHERS

- 11.5.1 WASTEWATER TREATMENT

- 11.5.2 COSMETICS

- 11.5.3 CHEMICAL ADDITIVES

- 11.5.4 3D PRINTING

- TABLE 61 PHA MARKET IN OTHER APPLICATIONS, BY REGION, 2017-2021 (TON)

- TABLE 62 PHA MARKET IN OTHER APPLICATIONS, BY REGION, 2022-2028 (TON)

- TABLE 63 PHA MARKET IN OTHER APPLICATIONS, BY REGION, 2017-2021 (USD MILLION)

- TABLE 64 PHA MARKET IN OTHER APPLICATIONS, BY REGION, 2022-2028 (USD MILLION)

12 POLYHYDROXYALKANOATE (PHA) MARKET, BY REGION

- 12.1 INTRODUCTION

- TABLE 65 PHA MARKET, BY REGION, 2017-2021 (TON)

- TABLE 66 PHA MARKET, BY REGION, 2022-2028 (TON)

- TABLE 67 PHA MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 68 PHA MARKET, BY REGION, 2022-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 IMPACT OF RECESSION

- FIGURE 42 NORTH AMERICA: PHA MARKET SNAPSHOT

- TABLE 69 MAJOR PHA MANUFACTURERS IN NORTH AMERICA

- TABLE 70 UPCOMING PHA MANUFACTURERS IN NORTH AMERICA

- 12.2.2 NORTH AMERICA: PHA MARKET, BY APPLICATION

- TABLE 71 NORTH AMERICA: PHA MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 72 NORTH AMERICA: PHA MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 73 NORTH AMERICA: PHA MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 74 NORTH AMERICA: PHA MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 12.2.3 NORTH AMERICA: PHA MARKET, BY TYPE

- TABLE 75 NORTH AMERICA: PHA MARKET, BY TYPE, 2017-2021 (TON)

- TABLE 76 NORTH AMERICA: PHA MARKET, BY TYPE, 2022-2028 (TON)

- TABLE 77 NORTH AMERICA: PHA MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 78 NORTH AMERICA: PHA MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 12.2.4 NORTH AMERICA: PHA MARKET, BY COUNTRY

- TABLE 79 NORTH AMERICA: PHA MARKET, BY COUNTRY, 2017-2021 (TON)

- TABLE 80 NORTH AMERICA: PHA MARKET, BY COUNTRY, 2022-2028 (TON)

- TABLE 81 NORTH AMERICA: PHA MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 82 NORTH AMERICA: PHA MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 12.2.4.1 US

- 12.2.4.1.1 Stringent guidelines regarding production, use, and disposal of plastics to drive market

- 12.2.4.1 US

- TABLE 83 US: PHA MARKET, 2017-2021

- TABLE 84 US: PHA MARKET, 2022-2028

- 12.2.4.2 Canada

- 12.2.4.2.1 Proposed ban on single-use plastics to drive market

- 12.2.4.2 Canada

- TABLE 85 CANADA: PHA MARKET, 2017-2020

- TABLE 86 CANADA: PHA MARKET, 2021-2027

- 12.2.4.3 Mexico

- 12.2.4.3.1 Government initiatives and international investments to drive market

- 12.2.4.3 Mexico

- TABLE 87 MEXICO: PHA MARKET, 2017-2021

- TABLE 88 MEXICO: PHA MARKET, 2021-2027

- 12.3 EUROPE

- 12.3.1 IMPACT OF RECESSION

- FIGURE 43 EUROPE: PHA MARKET SNAPSHOT

- TABLE 89 MAJOR PHA MANUFACTURERS IN EUROPE

- TABLE 90 UPCOMING PHA MANUFACTURERS IN EUROPE

- 12.3.2 EUROPE PHA MARKET, BY APPLICATION

- TABLE 91 EUROPE: PHA MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 92 EUROPE: PHA MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 93 EUROPE: PHA MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 94 EUROPE: PHA MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 12.3.3 EUROPE PHA MARKET, BY TYPE

- TABLE 95 EUROPE: PHA MARKET, BY TYPE, 2017-2021 (TON)

- TABLE 96 EUROPE: PHA MARKET, BY TYPE, 2022-2028 (TON)

- TABLE 97 EUROPE: PHA MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 98 EUROPE: PHA MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 12.3.4 EUROPE PHA MARKET, BY COUNTRY

- TABLE 99 EUROPE: PHA MARKET, BY COUNTRY, 2017-2021 (TON)

- TABLE 100 EUROPE: PHA MARKET, BY COUNTRY, 2022-2028 (TON)

- TABLE 101 EUROPE: PHA MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 102 EUROPE: PHA MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 12.3.4.1 Germany

- 12.3.4.1.1 Advanced infrastructure for solid waste management to drive market

- 12.3.4.1 Germany

- TABLE 103 GERMANY: PHA MARKET, 2017-2021

- TABLE 104 GERMANY: PHA MARKET, 2022-2028

- 12.3.4.2 UK

- 12.3.4.2.1 Government's aim to achieve zero-waste economy to drive market

- 12.3.4.2 UK

- TABLE 105 UK: PHA MARKET, 2017-2021

- TABLE 106 UK: PHA MARKET SIZE, 2022-2028

- 12.3.4.3 France

- 12.3.4.3.1 Government's initiatives for bio-based economy to drive market

- 12.3.4.3 France

- TABLE 107 FRANCE: PHA MARKET, 2017-2021

- TABLE 108 FRANCE: PHA MARKET, 2022-2028

- 12.3.4.4 Italy

- 12.3.4.4.1 Demand for eco-friendly packaging solutions to drive market

- 12.3.4.4 Italy

- TABLE 109 ITALY: PHA MARKET, 2017-2021

- TABLE 110 ITALY: PHA MARKET, 2022-2028

- 12.3.4.5 Rest of Europe

- TABLE 111 REST OF EUROPE: PHA MARKET, 2017-2020

- TABLE 112 REST OF EUROPE: PHA MARKET, 2021-2027

- 12.4 ASIA PACIFIC

- 12.4.1 IMPACT OF RECESSION

- FIGURE 44 ASIA PACIFIC: PHA MARKET SNAPSHOT

- TABLE 113 MAJOR PHA MANUFACTURERS IN ASIA PACIFIC

- TABLE 114 UPCOMING PHA MANUFACTURERS IN ASIA PACIFIC

- 12.4.2 ASIA PACIFIC PHA MARKET, BY APPLICATION

- TABLE 115 ASIA PACIFIC: PHA MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 116 ASIA PACIFIC: PHA MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 117 ASIA PACIFIC: PHA MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 118 ASIA PACIFIC: PHA MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 12.4.3 ASIA PACIFIC PHA MARKET, BY TYPE

- TABLE 119 ASIA PACIFIC: PHA MARKET, BY TYPE, 2017-2021 (TON)

- TABLE 120 ASIA PACIFIC: PHA MARKET, BY TYPE, 2022-2028 (TON)

- TABLE 121 ASIA PACIFIC: PHA MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 122 ASIA PACIFIC: PHA MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 12.4.4 ASIA PACIFIC PHA MARKET, BY COUNTRY

- TABLE 123 ASIA PACIFIC: PHA MARKET, BY COUNTRY, 2017-2021 (TON)

- TABLE 124 ASIA PACIFIC: PHA MARKET, BY COUNTRY, 2022-2028 (TON)

- TABLE 125 ASIA PACIFIC: PHA MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PHA MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 12.4.4.1 China

- 12.4.4.1.1 Global and local PHA manufacturers to drive market

- 12.4.4.1 China

- TABLE 127 CHINA: PHA MARKET, 2017-2021

- TABLE 128 CHINA: PHA MARKET, 2022-2028

- 12.4.4.2 Japan

- 12.4.4.2.1 Biomass-based and biodegradable plastics to drive market

- 12.4.4.2 Japan

- TABLE 129 JAPAN: PHA MARKET, 2017-2021

- TABLE 130 JAPAN: PHA MARKET, 2022-2028

- 12.4.4.3 India

- 12.4.4.3.1 Ban on non-biodegradable plastics to drive market

- 12.4.4.3 India

- TABLE 131 INDIA: PHA MARKET SIZE, 2017-2021

- TABLE 132 INDIA: PHA MARKET SIZE, 2022-2028

- 12.4.4.4 Malaysia

- 12.4.4.4.1 Fully automated biodegradable plastic from palm oil to drive market

- 12.4.4.4 Malaysia

- TABLE 133 MALAYSIA: PHA MARKET, 2017-2021

- TABLE 134 MALAYSIA: PHA MARKET, 2022-2028

- 12.4.4.5 South Korea

- 12.4.4.5.1 High number of R&D establishments to drive market

- 12.4.4.5 South Korea

- TABLE 135 SOUTH KOREA: PHA MARKET, 2017-2021

- TABLE 136 SOUTH KOREA: PHA MARKET, 2022-2028

- 12.4.4.6 Rest of Asia Pacific

- TABLE 137 REST OF ASIA PACIFIC: PHA MARKET, 2017-2021

- TABLE 138 REST OF ASIA PACIFIC: PHA MARKET, 2022-2028

- 12.5 REST OF THE WORLD (ROW)

- 12.5.1 IMPACT OF RECESSION

- 12.5.2 REST OF THE WORLD PHA MARKET, BY APPLICATION

- TABLE 139 REST OF THE WORLD: PHA MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 140 REST OF THE WORLD: PHA MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 141 REST OF THE WORLD: PHA MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 142 REST OF THE WORLD: PHA MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 12.5.3 REST OF THE WORLD PHA MARKET, BY TYPE

- TABLE 143 REST OF THE WORLD: PHA MARKET, BY TYPE, 2017-2021 (TON)

- TABLE 144 REST OF THE WORLD: PHA MARKET, BY TYPE, 2022-2028 (TON)

- TABLE 145 REST OF THE WORLD: PHA MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 146 REST OF THE WORLD: PHA MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 12.5.4 REST OF THE WORLD PHA MARKET, BY REGION

- TABLE 147 REST OF THE WORLD: PHA MARKET, BY REGION, 2017-2021 (TON)

- TABLE 148 REST OF THE WORLD: PHA MARKET, BY REGION, 2022-2028 (TON)

- TABLE 149 REST OF THE WORLD: PHA MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 150 REST OF THE WORLD: PHA MARKET, BY REGION, 2022-2028 (USD MILLION)

- 12.5.4.1 South America

- 12.5.4.1.1 Awareness of green economy to drive market

- 12.5.4.1 South America

- TABLE 151 SOUTH AMERICA: PHA MARKET, 2017-2021

- TABLE 152 SOUTH AMERICA: PHA MARKET, 2022-2028

- 12.5.4.2 Middle East & Africa

- 12.5.4.2.1 Growing biomedical industry to drive market

- 12.5.4.2 Middle East & Africa

- TABLE 153 MIDDLE EAST & AFRICA: PHA MARKET, 2017-2021

- TABLE 154 MIDDLE EAST & AFRICA: PHA MARKET, 2022-2028

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 155 OVERVIEW OF STRATEGIES ADOPTED BY KEY PHA MANUFACTURERS

- 13.3 RANKING OF KEY MARKET PLAYERS

- FIGURE 45 RANKING OF TOP FIVE PLAYERS IN PHA MARKET, 2022

- 13.4 MARKET SHARE ANALYSIS

- TABLE 156 PHA MARKET: DEGREE OF COMPETITION

- FIGURE 46 DANIMER SCIENTIFIC LED PHA MARKET IN 2022

- 13.4.1 DANIMER SCIENTIFIC

- 13.4.2 SHENZHEN ECOMANN BIOTECHNOLOGY CO., LTD

- 13.4.3 KANEKA CORPORATION

- 13.4.4 RWDC INDUSTRIES

- 13.4.5 NINGBO TIANAN BIOMATERIALS CO., LTD.

- 13.5 REVENUE ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 47 REVENUE ANALYSIS OF KEY COMPANIES FOR LAST FIVE YEARS

- 13.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

- FIGURE 48 PHA MARKET: COMPANY FOOTPRINT

- TABLE 157 PHA MARKET: TYPE FOOTPRINT

- TABLE 158 PHA MARKET: APPLICATION FOOTPRINT

- TABLE 159 PHA MARKET: REGION FOOTPRINT

- 13.7 COMPANY EVALUATION MATRIX

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- FIGURE 49 COMPANY EVALUATION MATRIX FOR PHA MARKET

- 13.8 COMPETITIVE BENCHMARKING

- TABLE 160 PHA MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 161 PHA MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.9 STARTUP/SME EVALUATION MATRIX

- 13.9.1 RESPONSIVE COMPANIES

- 13.9.2 PROGRESSIVE COMPANIES

- 13.9.3 DYNAMIC COMPANIES

- 13.9.4 STARTING BLOCKS

- FIGURE 50 STARTUP/SME EVALUATION MATRIX FOR PHA MARKET

- 13.10 COMPETITIVE SITUATIONS AND TRENDS

- 13.10.1 PRODUCT LAUNCHES

- TABLE 162 PHA MARKET: PRODUCT LAUNCHES (2019-2023)

- 13.10.2 DEALS

- TABLE 163 PHA MARKET: DEALS (2019-2023)

- 13.10.3 OTHERS

- TABLE 164 PHA MARKET: OTHER DEVELOPMENTS (2019-2023)

14 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 14.1 KEY PLAYERS

- 14.1.1 KANEKA CORPORATION

- TABLE 165 KANEKA CORPORATION: COMPANY OVERVIEW

- FIGURE 51 KANEKA CORPORATION: COMPANY SNAPSHOT

- TABLE 166 KANEKA CORPORATION: PRODUCT LAUNCHES

- TABLE 167 KANEKA CORPORATION: DEALS

- TABLE 168 KANEKA CORPORATION: OTHER DEVELOPMENTS

- 14.1.2 DANIMER SCIENTIFIC

- TABLE 169 DANIMER SCIENTIFIC: COMPANY OVERVIEW

- FIGURE 52 DANIMER SCIENTIFIC: COMPANY SNAPSHOT

- TABLE 170 DANIMER SCIENTIFIC: PRODUCT LAUNCHES

- TABLE 171 DANIMER SCIENTIFIC: DEALS

- TABLE 172 DANIMER SCIENTIFIC: OTHER DEVELOPMENTS

- 14.1.3 SHENZHEN ECOMANN BIOTECHNOLOGY CO., LTD

- TABLE 173 SHENZHEN ECOMANN BIOTECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- 14.1.4 RWDC INDUSTRIES

- TABLE 174 RWDC INDUSTRIES: COMPANY OVERVIEW

- TABLE 175 RWDC INDUSTRIES: PRODUCT LAUNCHES

- TABLE 176 RWDC INDUSTRIES: DEALS

- TABLE 177 RWDC INDUSTRIES: OTHER DEVELOPMENTS

- 14.1.5 NEWLIGHT TECHNOLOGIES, INC.

- TABLE 178 NEWLIGHT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 179 NEWLIGHT TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 180 NEWLIGHT TECHNOLOGIES, INC.: DEALS

- TABLE 181 NEWLIGHT TECHNOLOGIES, INC.: OTHER DEVELOPMENTS

- 14.1.6 NINGBO TIANAN BIOMATERIALS CO., LTD

- TABLE 182 NINGBO TIANAN BIOMATERIALS CO., LTD.: COMPANY OVERVIEW

- 14.1.7 BIOMER

- TABLE 183 BIOMER: COMPANY OVERVIEW

- 14.1.8 PHABUILDER

- TABLE 184 PHABUILDER: COMPANY OVERVIEW

- TABLE 185 PHABUILDER: DEALS

- TABLE 186 PHABUILDER: OTHER DEVELOPMENTS

- 14.1.9 TERRAVERDAE BIOWORKS INC.

- TABLE 187 TERRAVERDAE BIOWORKS INC.: COMPANY OVERVIEW

- TABLE 188 TERRAVERDAE BIOWORKS INC.: PRODUCT LAUNCHES

- TABLE 189 TERRAVERDAE BIOWORKS INC.: DEALS

- TABLE 190 TERRAVERDAE BIOWORKS INC.: OTHER DEVELOPMENTS

- 14.1.10 BLUEPHA

- TABLE 191 BLUEPHA: COMPANY OVERVIEW

- TABLE 192 BLUEPHA: DEALS

- TABLE 193 BLUEPHA: OTHER DEVELOPMENTS

- 14.2 OTHER PLAYERS

- 14.2.1 NAFIGATE CORPORATION, A.S.

- TABLE 194 NAFIGATE CORPORATION, A.S.: COMPANY OVERVIEW

- 14.2.2 GENECIS BIOINDUSTRIES INC.

- TABLE 195 GENECIS BIOINDUSTRIES INC.: COMPANY OVERVIEW

- 14.2.3 TEPHA, INC.

- TABLE 196 TEPHA, INC.: COMPANY OVERVIEW

- 14.2.4 CJ CHEILJEDANG CORPORATION

- TABLE 197 CJ CHEILJEDANG CORPORATION: COMPANY OVERVIEW

- 14.2.5 FULL CYCLE BIOPLASTICS LLC

- TABLE 198 FULL CYCLE BIOPLASTICS LLC: COMPANY OVERVIEW

- 14.2.6 MANGO MATERIALS

- TABLE 199 MANGO MATERIALS: COMPANY OVERVIEW

- 14.2.7 COFCO

- TABLE 200 COFCO: COMPANY OVERVIEW

- 14.2.8 MEDPHA BIOSCIENCE CO. LTD.

- TABLE 201 MEDPHA BIOSCIENCE CO. LTD.: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 BIOPLASTICS & BIOPOLYMERS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 BIOPLASTICS & BIOPOLYMERS MARKET, BY REGION

- TABLE 202 BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

- TABLE 203 BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

- 15.4.1 ASIA PACIFIC

- 15.4.1.1 By country

- TABLE 204 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

- TABLE 205 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

- 15.4.1.2 By end-use industry

- TABLE 206 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

- TABLE 207 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

- 15.4.2 EUROPE

- 15.4.2.1 By country

- TABLE 208 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

- TABLE 209 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

- 15.4.2.2 By end-use industry

- TABLE 210 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

- TABLE 211 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

- 15.4.3 NORTH AMERICA

- 15.4.3.1 By country

- TABLE 212 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

- TABLE 213 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

- 15.4.3.2 By end-use industry

- TABLE 214 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

- TABLE 215 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

- 15.4.4 REST OF THE WORLD

- 15.4.4.1 By country

- TABLE 216 REST OF THE WORLD: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

- TABLE 217 REST OF THE WORLD: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

- 15.4.4.2 By end-use industry

- TABLE 218 REST OF THE WORLD: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

- TABLE 219 REST OF THE WORLD: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS