|

|

市場調査レポート

商品コード

1500650

農業用フィルムの世界市場:タイプ別、用途別 - 予測(~2029年)Agricultural Films Market by Type (LDPE, LLDPE, EVA, Reclaim, HDPE), Application (Greenhouse Film (Classic Greenhouse, Low Tunnel)), Mulch Film (Black Mulches, Transparent Mulches), Silage Film (Silage Stretch Wrap, Silage Bag) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 農業用フィルムの世界市場:タイプ別、用途別 - 予測(~2029年) |

|

出版日: 2024年06月21日

発行: MarketsandMarkets

ページ情報: 英文 301 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の農業用フィルムの市場規模は、2024年の138億米ドルから2029年までに195億米ドルに達すると推定され、CAGRで7.1%の成長が見込まれます。

中東・アフリカとアジア太平洋における人口の増加、顧客の食品に関する選好の変化、加工食品に対する需要の高まりが農業用フィルム市場を牽引しています。また、農業用フィルムの廃棄に関連する潜在的な健康被害への意識が高まるにつれて、バイオベースで分解可能な農業用フィルムの代替品への要望が高まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 数量(キロトン)、金額(100万米ドル) |

| セグメント | タイプ、用途、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

「EVAが予測期間に市場で金額ベースでもっとも急成長するタイプになると予測されます。」

EVA(エチレンビニルアセテート)は、農業用フィルム市場でもっともCAGRが高く、もっとも急成長するセグメントタイプになると予測されています。この急成長は、透明性、柔軟性、耐紫外線性といった優れた性能があり、温室に最適であるという利点によるものです。また、特に予算が限られている地域では、農家にとって費用対効果の高い選択肢となります。最後に、生分解性EVAの開発は、農業における環境の持続可能性への関心の高まりに対応し、環境意識の高い農家を惹きつけています。機能性、手頃な価格、環境への責任を兼ね備えたEVAは、農業用フィルム市場で爆発的に成長する見込みです。

「中東・アフリカが予測期間に市場で金額ベースで3番目に急成長する地域になると予測されます。」

中東・アフリカは、複数の要因から農業用フィルム市場で大きな成長が見込まれています。この地域の乾燥した気候と水不足は、土壌の水を節約するマルチングフィルムのようなソリューションを必要とします。さらに、人口の増加により食料安全保障の強化が求められており、フィルムによって支援された温室がこれに対応できます。政策や取り組みを通じた政府の支援は、フィルムの採用を促進することで市場の成長をさらに後押しします。最後に、農業の近代化に対する関心の高まりにより、中東・アフリカの農家はフィルムのような先進技術を受け入れやすくなっており、収穫高と資源効率の向上を可能にしています。このような複合的な要因により、中東・アフリカは農業用フィルム市場においてかなりの成長を示す見通しです。

当レポートでは、世界の農業用フィルム市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 農業用フィルム市場の企業にとって魅力的な機会

- アジア太平洋の農業用フィルム市場:用途別、国別

- 農業用フィルム市場:地域別

- 農業用フィルムの市場規模:タイプ別、地域別(2023年)

- 農業用フィルム市場の魅力

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 産業の動向

- 主なステークホルダーと購入基準

- サプライチェーン分析

- 原材料サプライヤー

- メーカー

- 流通ネットワーク

- 最終用途産業

- エコシステム分析/市場マップ

- ケーススタディ

- BERRY GLOBAL GROUP, INC.はSILOTITE 1800で農業経営の効率を向上させた

- BASFは循環型経済に向けたECOVIOの活用を計画する

- 新技術による農業の変革

- 規制情勢

- 技術分析

- 主要技術

- 補完技術

- 顧客のビジネスに影響を与える動向/混乱

- 貿易データ統計

- 農業用フィルムの輸入シナリオ

- 農業用フィルムの輸出シナリオ

- 主な会議とイベント(2024年~2025年)

- 価格分析

- 主要企業の平均販売価格の動向:用途別

- 平均販売価格の動向:地域別

- 投資と資金調達のシナリオ

- 特許分析

第7章 農業用フィルム市場:タイプ別

- イントロダクション

- LLDPE

- LDPE

- 再生

- EVA

- HDPE

- その他

第8章 農業用フィルム市場:用途別

- イントロダクション

- グリーンハウスフィルムズ

- クラシックグリーンハウスフィルム

- マクロトンネル/ウォーキングトンネル

- ロートンネル

- マルチフィルム

- 透明/クリアマルチ

- ブラックマルチ

- その他のマルチ

- サイレージフィルム

- サイレージストレッチラップ

- サイレージシート

- サイレージバッグ

第9章 農業用フィルム市場:地域別

- イントロダクション

- アジア太平洋

- 景気後退の影響

- アジア太平洋の農業用フィルム市場:タイプ別

- アジア太平洋の農業用フィルム市場:用途別

- アジア太平洋の農業用フィルム市場:国別

- 欧州

- 景気後退の影響

- 欧州の農業用フィルム市場:タイプ別

- 欧州の農業用フィルム市場:用途別

- 欧州の農業用フィルム市場:国別

- 北米

- 景気後退の影響

- 北米の農業用フィルム市場:タイプ別

- 北米の農業用フィルム市場:用途別

- 北米の農業用フィルム市場:国別

- 中東・アフリカ

- 景気後退の影響

- 中東・アフリカの農業用フィルム市場:タイプ別

- 中東・アフリカの農業用フィルム市場:用途別

- 中東・アフリカの農業用フィルム市場:国別

- 南米

- 景気後退の影響

- 南米の農業用フィルム市場:タイプ別

- 南米の農業用フィルム市場:用途別

- 南米の農業用フィルム市場:国別

第10章 競合情勢

- イントロダクション

- 主要企業の戦略/有力企業

- 市場シェア分析

- 主要企業の収益分析

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- BERRY GLOBAL GROUP, INC.

- KURARAY CO., LTD.

- COVERIS

- RKW GROUP

- BASF SE

- RANI GROUP

- DOW INC.

- ARMANDO ALVAREZ GROUP

- TRIOWORLD

- INDUSTRIAL DEVELOPMENT COMPANY SAL

- スタートアップ/中小企業

- EXXON MOBIL CORPORATION

- TILAK POLYPACK PRIVATE LIMITED

- MEGAPLAST INDIA PVT LTD

- PLASTIKA KRITIS S.A.

- GROUPE BARBIER

- ACHILLES CORPORATION

- POLIFILM GROUP

- ANHUI GUOFENG PLASTIC INDUSTRY CO., LTD.

- AGRIPLAST TECH INDIA PRIVATE LIMITED

- PLASTIK V SDN. BHD.

- IM SANIN SRL

- AGRIPLAST

- GINEGAR PLASTIC PRODUCTS LTD.

- ECOPOLYSTW

- FUTAMURA CHEMICAL CO., LTD.

第12章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 生分解性フィルム市場

- 市場の定義

- 市場の概要

- 生分解性フィルム市場:地域別

- 欧州

- 北米

- アジア太平洋

- 中東・アフリカ

- 南米

第13章 付録

In terms of value, the agricultural films market is estimated to grow from USD 13.8 billion in 2024 to USD 19.5 billion by 2029, at a CAGR of 7.1%. The rising population in the Middle East & Africa and Asia Pacific, changing customer preferences regarding food, mounting demand from for processed foods are driving the agricultural films market. Also, as individuals become more conscious of the potential health hazards linked to disposal of agricultural films, there is an escalating desire for bio-based and degradable agricultural film alternatives.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Volume (Kiloton) and Value (USD Million) |

| Segments | Type, Application, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"EVA is projected to be the fastest growing type of agricultural films market, in terms of value, during forecast period."

EVA (Ethylene Vinyl Acetate) is on projected to be the fastest growing segment type of the agricultural films market, displaying the highest CAGR. This surge is driven by a combination of advantages: superior performance with its clarity, flexibility, and UV resistance, making it ideal for greenhouses. It also offers a cost effective option for farmers, especially in budget-conscious regions. Lastly, the development of biodegradable EVA caters to the growing focus on environmental sustainability in agriculture, attracting eco conscious farmers. This unique combination of functionality, affordability, and environmental responsibility positions EVA for explosive growth in the agricultural films market.

"The Middle East & AFrica is projected to be the third fastest-growing region, in terms of value, during the forecast period in the agricultural films market."

The Middle East & Africa region is expected to see significant growth in the agricultural films market due to several factors. Dry climates and water scarcity in the region necessitate solutions like mulching films that conserve water in the soil. Additionally, the rising population creates a demand for increased food security, which greenhouses facilitated by films can address. Government support through policies and initiatives further fuels market growth by encouraging film adoption. Finally, a growing focus on agricultural modernization makes farmers in the Middle East & Africa more receptive to advanced technologies like films, enabling them to improve yields and resource efficiency. These combined forces position the Middle East & Africa region for remarkable growth in the agricultural films market.

- By Company Type: Tier 1 - 69%, Tier 2 - 23%, and Tier 3 - 8%

- By Designation: C-Level - 23%, Director Level - 37%, and Others - 40%

- By Region: North America - 24%, Europe - 40%, Asia Pacific - 17%, South America - 7%, Middle East & Africa - 12%,

The key players profiled in the report include Berry Global Group, Inc. (US), Dow Inc. (US), RKW Group (Germany), BASF SE (Germany), Coveris (Austria), Kuraray Co., Ltd. (Japan), Rani Group (Finland), Armando Alvarez Group (Spain), and others.

Research Coverage

This report segments the market for agricultural films based on type, application, and region and provides estimations of volume (Kiloton) and value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies, associated with the market for agricultural films.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the agricultural films market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on agricultural films offered by top players in the global market

- Analysis of key drivers: (Growing agricultural output across the world, mounting demand for dairy products, and inventions regarding agricultural films), restraints (Extreme installation prices and harsh effects of plastics on surrounding), opportunities (Rising use of nano greenhouses and increased use of biodegradable films), and challenges (Escalating raw material prices and discarding of agricultural films) influencing the growth of agricultural films market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the agricultural films market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for agricultural films across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global agricultural films market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the agricultural films market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 AGRICULTURAL FILMS MARKET: INCLUSIONS AND EXCLUSIONS

- 1.2.2 AGRICULTURAL FILMS MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.2.3 AGRICULTURAL FILMS MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.3 MARKET SCOPE

- FIGURE 1 AGRICULTURAL FILMS: MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AGRICULTURAL FILMS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE REVENUE OF COMPANIES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM UP (DEMAND SIDE): PRODUCTS SOLD

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - TOP DOWN

- 2.3 DATA TRIANGULATION

- FIGURE 7 AGRICULTURAL FILMS MARKET: DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

- 2.4.1 SUPPLY SIDE

- FIGURE 8 MARKET GROWTH PROJECTION FROM SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- FIGURE 9 MARKET GROWTH PROJECTION FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- 2.5 IMPACT OF RECESSION

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 RISK ASSESSMENT

- TABLE 1 AGRICULTURAL FILMS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 10 LLDPE TO BE LARGEST TYPE OF AGRICULTURAL FILMS BY 2029

- FIGURE 11 MULCH FILMS TO BE LARGEST APPLICATION OF AGRICULTURAL FILMS DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AGRICULTURAL FILMS MARKET

- FIGURE 13 AGRICULTURAL FILMS MARKET TO WITNESS STEADY GROWTH DURING FORECAST PERIOD

- 4.2 ASIA PACIFIC AGRICULTURAL FILMS MARKET, BY APPLICATION AND COUNTRY

- FIGURE 14 CHINA LED ASIA PACIFIC AGRICULTURAL FILMS MARKET IN 2023

- 4.3 AGRICULTURAL FILMS MARKET, BY REGION

- FIGURE 15 ASIA PACIFIC TO BE LARGEST MARKET FOR AGRICULTURAL FILMS DURING FORECAST PERIOD

- 4.4 AGRICULTURAL FILMS MARKET SIZE, BY TYPE AND REGION, 2023

- FIGURE 16 LLDPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- 4.5 AGRICULTURAL FILMS MARKET ATTRACTIVENESS

- FIGURE 17 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

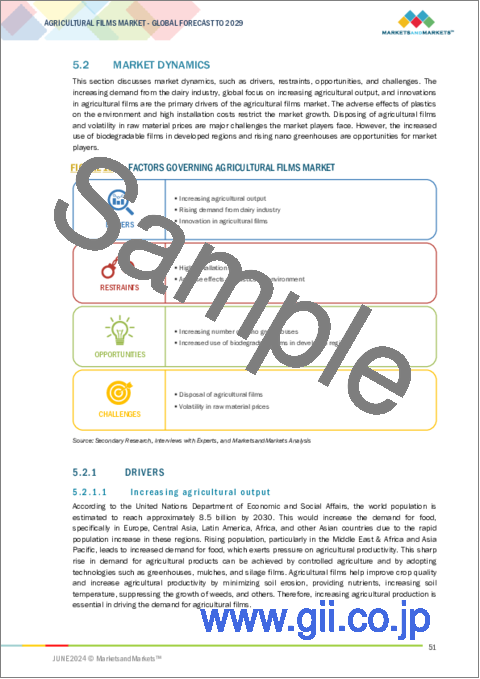

- FIGURE 18 FACTORS GOVERNING AGRICULTURAL FILMS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing agricultural output

- 5.2.1.2 Rising demand from dairy industry

- 5.2.1.3 Innovation in agricultural films

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation cost

- 5.2.2.2 Adverse effects of plastics on environment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing number of nano greenhouses

- 5.2.3.2 Rising use of biodegradable films in developed regions

- 5.2.4 CHALLENGES

- 5.2.4.1 Disposal of agricultural films

- 5.2.4.2 Volatility in raw material prices

- TABLE 2 CRUDE OIL PRICE TREND (2019-2023)

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 AGRICULTURAL FILMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 RIVALRY AMONG EXISTING COMPETITORS

- TABLE 3 AGRICULTURAL FILMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- TABLE 4 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2029 (USD BILLION)

6 INDUSTRY TRENDS

- 6.1 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.1.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 5 IMPACT OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 6.1.2 BUYING CRITERIA

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 22 AGRICULTURAL FILMS MARKET: SUPPLY CHAIN ANALYSIS

- 6.2.1 RAW MATERIAL SUPPLIERS

- 6.2.2 MANUFACTURER

- 6.2.3 DISTRIBUTION NETWORK

- 6.2.4 END-USE INDUSTRIES

- 6.3 ECOSYSTEM ANALYSIS/MARKET MAP

- FIGURE 23 AGRICULTURAL FILMS MARKET: ECOSYSTEM ANALYSIS/MARKET MAP

- TABLE 7 AGRICULTURAL FILMS MARKET: ECOSYSTEM

- 6.4 CASE STUDIES

- 6.4.1 BERRY GLOBAL GROUP, INC. IMPROVED EFFICIENCY OF FARMING OPERATIONS WITH ITS SILOTITE 1800

- 6.4.2 BASF PLANS TO USE ECOVIO FOR CIRCULAR ECONOMY

- 6.4.3 TRANSFORMING AGRICULTURE WITH MODERN TECHNOLOGIES

- 6.5 REGULATORY LANDSCAPE

- TABLE 8 NORTH AMERICA: REGULATIONS FOR AGRICULTURAL FILMS

- TABLE 9 EUROPE: REGULATIONS FOR AGRICULTURAL FILMS

- TABLE 10 ASIA PACIFIC: REGULATIONS FOR AGRICULTURAL FILMS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATIONS FOR AGRICULTURAL FILMS

- TABLE 12 SOUTH AMERICA: REGULATIONS FOR AGRICULTURAL FILMS

- 6.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Smart films

- 6.6.1.2 ProTechnology in agricultural films

- 6.6.1.3 Multi-layer plastic films

- 6.6.2 COMPLEMENTARY TECHNOLOGY

- 6.6.2.1 ADDITIVE AND PIGMENT TECHNOLOGY

- 6.6.2.1.1 Smart Aluminum

- 6.6.2.1.2 Thermal Additives

- 6.6.2.1.3 Anti-fog/Anti-drip Technology

- 6.6.2.1 ADDITIVE AND PIGMENT TECHNOLOGY

- 6.6.1 KEY TECHNOLOGIES

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.7.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR AGRICULTURAL FILMS MARKET

- FIGURE 24 AGRICULTURAL FILMS MARKET: FUTURE REVENUE MIX

- 6.8 TRADE DATA STATISTICS

- 6.8.1 IMPORT SCENARIO OF AGRICULTURAL FILMS

- FIGURE 25 AGRICULTURAL FILMS IMPORT, BY KEY COUNTRY (2018-2022)

- TABLE 13 IMPORTS OF AGRICULTURAL FILMS, BY REGION, 2018-2022 (USD MILLION)

- 6.8.2 EXPORT SCENARIO OF AGRICULTURAL FILMS

- FIGURE 26 AGRICULTURAL FILMS EXPORT, BY KEY COUNTRY (2018-2022)

- TABLE 14 EXPORTS OF AGRICULTURAL FILMS, BY REGION, 2018-2022 (USD MILLION)

- 6.9 KEY CONFERENCES & EVENTS, 2024-2025

- TABLE 15 AGRICULTURAL FILMS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- 6.10 PRICING ANALYSIS

- 6.10.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- FIGURE 27 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR TOP THREE APPLICATIONS

- TABLE 16 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/KG)

- 6.10.2 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 28 AVERAGE SELLING PRICE TREND OF AGRICULTURAL FILMS, BY REGION (2022-2029)

- TABLE 17 AVERAGE SELLING PRICE TREND OF AGRICULTURAL FILMS, BY REGION, 2022-2029 (USD/KG)

- 6.11 INVESTMENT AND FUNDING SCENARIO

- 6.12 PATENT ANALYSIS

- 6.12.1 APPROACH

- 6.12.2 PATENT TYPE

- TABLE 18 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS

- FIGURE 29 PATENTS REGISTERED, 2013-2023

- FIGURE 30 LIST OF MAJOR PATENTS FOR AGRICULTURAL FILMS

- TABLE 19 MAJOR PATENTS FOR AGRICULTURAL FILMS

- 6.12.3 TOP APPLICANTS

- TABLE 20 PATENTS BY MONSANTO TECHNOLOGY, L.L.C.

- TABLE 21 PATENTS BY PIONEER HI-BRED INTERNATIONAL, INC.

- TABLE 22 TOP 10 PATENT OWNERS IN US, 2013-2023

- FIGURE 31 LEGAL STATUS OF PATENTS FILED IN AGRICULTURAL FILMS MARKET

- 6.12.4 JURISDICTION ANALYSIS

- FIGURE 32 MAXIMUM PATENTS FILED IN JURISDICTION OF US

7 AGRICULTURAL FILMS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 33 LLDPE TO DOMINATE AGRICULTURAL FILMS MARKET DURING FORECAST PERIOD

- TABLE 23 AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 24 AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 25 AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (KILOTON)

- TABLE 26 AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2029 (KILOTON)

- 7.2 LINEAR LOW-DENSITY POLYETHYLENE (LLDPE)

- 7.2.1 WIDELY USED AMONG PE FILMS

- TABLE 27 LLDPE: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 28 LLDPE: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 29 LLDPE: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 30 LLDPE: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 7.3 LOW-DENSITY POLYETHYLENE (LDPE)

- 7.3.1 WIDELY USED IN PACKAGING APPLICATIONS

- TABLE 31 LDPE: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 32 LDPE: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 33 LDPE: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 34 LDPE: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 7.4 RECLAIM

- 7.4.1 USE OF INNOVATIVE TECHNOLOGIES

- TABLE 35 RECLAIM: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 36 RECLAIM: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 37 RECLAIM: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 38 RECLAIM: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 7.5 ETHYLENE-VINYL ACETATE (EVA)

- 7.5.1 INCREASING DEMAND FROM DAIRY INDUSTRY

- TABLE 39 EVA: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 40 EVA: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 41 EVA: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 42 EVA: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 7.6 HIGH-DENSITY POLYETHYLENE (HDPE)

- 7.6.1 HIGH BARRIER PROPERTIES AND LESSER TRANSPARENCY

- TABLE 43 HDPE: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 44 HDPE: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 45 HDPE: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 46 HDPE: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 7.7 OTHERS

- TABLE 47 OTHERS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 48 OTHERS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 49 OTHERS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 50 OTHERS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

8 AGRICULTURAL FILMS MARKET, BY APPLICATION

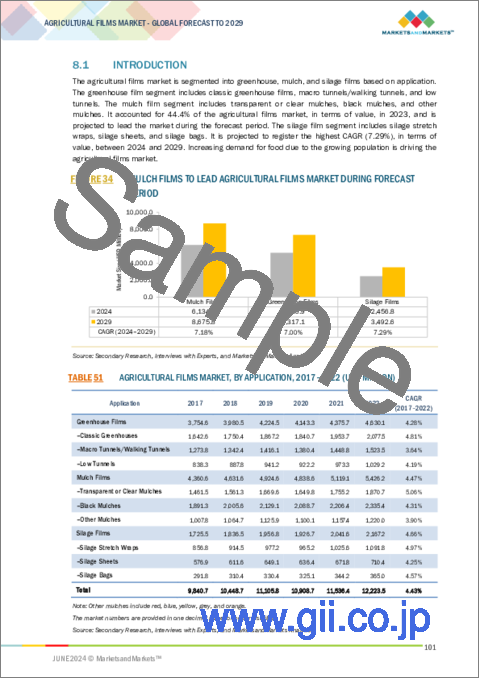

- 8.1 INTRODUCTION

- FIGURE 34 MULCH FILMS TO LEAD AGRICULTURAL FILMS MARKET DURING FORECAST PERIOD

- TABLE 51 AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 52 AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 53 AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 54 AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 8.2 GREENHOUSE FILMS

- TABLE 55 GREENHOUSE FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 56 GREENHOUSE FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 57 GREENHOUSE FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 58 GREENHOUSE FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 8.2.1 CLASSIC GREENHOUSE FILMS

- 8.2.1.1 Unique structure and controlled atmosphere

- TABLE 59 CLASSIC GREENHOUSE FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 60 CLASSIC GREENHOUSE FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 61 CLASSIC GREENHOUSE FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 62 CLASSIC GREENHOUSE FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 8.2.2 MACRO TUNNELS/WALKING TUNNELS

- 8.2.2.1 Low price of macro tunnel films

- TABLE 63 MACRO TUNNELS/WALKING TUNNELS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 64 MACRO TUNNELS/WALKING TUNNELS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 65 MACRO TUNNELS/WALKING TUNNELS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 66 MACRO TUNNELS/WALKING TUNNELS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 8.2.3 LOW TUNNELS

- 8.2.3.1 Protect crops from birds and harsh environmental conditions

- TABLE 67 LOW TUNNELS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 68 LOW TUNNELS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 69 LOW TUNNELS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 70 LOW TUNNELS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 8.3 MULCH FILMS

- TABLE 71 MULCH FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 72 MULCH FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 73 MULCH FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 74 MULCH FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 8.3.1 TRANSPARENT OR CLEAR MULCHES

- 8.3.1.1 Growing use of clear plastic mulches in cooler regions

- TABLE 75 TRANSPARENT OR CLEAR MULCHES: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 76 TRANSPARENT OR CLEAR MULCHES: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 77 TRANSPARENT OR CLEAR MULCHES: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 78 TRANSPARENT OR CLEAR MULCHES: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 8.3.2 BLACK MULCHES

- 8.3.2.1 Increased production of leafy vegetables

- TABLE 79 BLACK MULCHES: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 80 BLACK MULCHES: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 81 BLACK MULCHES: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 82 BLACK MULCHES: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 8.3.3 OTHER MULCHES

- TABLE 83 OTHER MULCHES: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 84 OTHER MULCHES: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 85 OTHER MULCHES: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 86 OTHER MULCHES: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 8.4 SILAGE FILMS

- TABLE 87 SILAGE FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 88 SILAGE FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 89 SILAGE FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 90 SILAGE FILMS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 8.4.1 SILAGE STRETCH WRAPS

- 8.4.1.1 Wrap large quantities of silage with less opacity and thickness

- TABLE 91 SILAGE STRETCH WRAPS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 92 SILAGE STRETCH WRAPS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 93 SILAGE STRETCH WRAPS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 94 SILAGE STRETCH WRAPS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 8.4.2 SILAGE SHEETS

- 8.4.2.1 High-quality barrier films of various sizes

- TABLE 95 SILAGE SHEETS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 96 SILAGE SHEETS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 97 SILAGE SHEETS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 98 SILAGE SHEETS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 8.4.3 SILAGE BAGS

- 8.4.3.1 Protect silage from sunlight and facilitate lactic acid fermentation

- TABLE 99 SILAGE BAGS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 100 SILAGE BAGS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 101 SILAGE BAGS: AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 102 SILAGE BAGS: AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

9 AGRICULTURAL FILMS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 35 ASIA PACIFIC TO LEAD AGRICULTURAL FILMS MARKET DURING FORECAST PERIOD

- TABLE 103 AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 104 AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 105 AGRICULTURAL FILMS MARKET, BY REGION, 2017-2022 (KILOTON)

- TABLE 106 AGRICULTURAL FILMS MARKET, BY REGION, 2023-2029 (KILOTON)

- 9.2 ASIA PACIFIC

- 9.2.1 RECESSION IMPACT

- FIGURE 36 ASIA PACIFIC AGRICULTURAL FILMS MARKET SNAPSHOT

- 9.2.2 ASIA PACIFIC AGRICULTURAL FILMS MARKET, BY TYPE

- TABLE 107 ASIA PACIFIC: AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 109 ASIA PACIFIC: AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (KILOTON)

- TABLE 110 ASIA PACIFIC: AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2029 (KILOTON)

- 9.2.3 ASIA PACIFIC AGRICULTURAL FILMS MARKET, BY APPLICATION

- TABLE 111 ASIA PACIFIC: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 114 ASIA PACIFIC: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.2.4 ASIA PACIFIC AGRICULTURAL FILMS MARKET, BY COUNTRY

- TABLE 115 ASIA PACIFIC: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 117 ASIA PACIFIC: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2017-2022 (KILOTON)

- TABLE 118 ASIA PACIFIC: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2023-2029 (KILOTON)

- 9.2.4.1 China

- 9.2.4.1.1 Growing focus on increasing agricultural output to drive market

- 9.2.4.1 China

- TABLE 119 CHINA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 120 CHINA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 121 CHINA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 122 CHINA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.2.4.2 Japan

- 9.2.4.2.1 Advanced crop technologies to propel market

- 9.2.4.2 Japan

- TABLE 123 JAPAN: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 124 JAPAN: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 125 JAPAN: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 126 JAPAN: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.2.4.3 India

- 9.2.4.3.1 Increasing demand for food to fuel market growth

- 9.2.4.3 India

- TABLE 127 INDIA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 128 INDIA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 129 INDIA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 130 INDIA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.2.4.4 Australia & New Zealand

- 9.2.4.4.1 Technological advancements to fuel demand

- 9.2.4.4 Australia & New Zealand

- TABLE 131 AUSTRALIA & NEW ZEALAND: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 132 AUSTRALIA & NEW ZEALAND: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 133 AUSTRALIA & NEW ZEALAND: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 134 AUSTRALIA & NEW ZEALAND: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.2.4.5 Indonesia

- 9.2.4.5.1 Vast and abundant fertile soil to drive market

- 9.2.4.5 Indonesia

- TABLE 135 INDONESIA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 136 INDONESIA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 137 INDONESIA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 138 INDONESIA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.3 EUROPE

- 9.3.1 RECESSION IMPACT

- FIGURE 37 EUROPE AGRICULTURAL FILMS MARKET SNAPSHOT

- 9.3.2 EUROPE AGRICULTURAL FILMS MARKET, BY TYPE

- TABLE 139 EUROPE: AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 140 EUROPE: AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 141 EUROPE: AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (KILOTON)

- TABLE 142 EUROPE: AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2029 (KILOTON)

- 9.3.3 EUROPE AGRICULTURAL FILMS MARKET, BY APPLICATION

- TABLE 143 EUROPE: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 144 EUROPE: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 145 EUROPE: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 146 EUROPE: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.3.4 EUROPE AGRICULTURAL FILMS MARKET, BY COUNTRY

- TABLE 147 EUROPE: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 148 EUROPE: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 149 EUROPE: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2017-2022 (KILOTON)

- TABLE 150 EUROPE: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2023-2029 (KILOTON)

- 9.3.4.1 Italy

- 9.3.4.1.1 Use of eco-friendly films to fuel market

- 9.3.4.1 Italy

- TABLE 151 ITALY: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 152 ITALY: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 153 ITALY: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 154 ITALY: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.3.4.2 Spain

- 9.3.4.2.1 Extensive use of plastic films to protect greenhouses from sunlight

- 9.3.4.2 Spain

- TABLE 155 SPAIN: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 156 SPAIN: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 157 SPAIN: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 158 SPAIN: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.3.4.3 Germany

- 9.3.4.3.1 Rising demand for greenhouse films to drive market

- 9.3.4.3 Germany

- TABLE 159 GERMANY: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 160 GERMANY: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 161 GERMANY: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 162 GERMANY: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.3.4.4 France

- 9.3.4.4.1 Growing agricultural activities in France to drive market

- 9.3.4.4 France

- TABLE 163 FRANCE: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 164 FRANCE: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 165 FRANCE: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 166 FRANCE: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.3.4.5 UK

- 9.3.4.5.1 Manufacturing agricultural films complying with environmental standards to propel market

- 9.3.4.5 UK

- TABLE 167 UK: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 168 UK: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 169 UK: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 170 UK: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.3.4.6 Turkey

- 9.3.4.6.1 Fertile and arable lands with favorable climate to drive market

- 9.3.4.6 Turkey

- TABLE 171 TURKEY: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 172 TURKEY: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 173 TURKEY: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 174 TURKEY: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.4 NORTH AMERICA

- 9.4.1 RECESSION IMPACT

- FIGURE 38 NORTH AMERICA MARKET SNAPSHOT

- 9.4.2 NORTH AMERICA AGRICULTURAL FILMS MARKET, BY TYPE

- TABLE 175 NORTH AMERICA: AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 176 NORTH AMERICA: AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 177 NORTH AMERICA: AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (KILOTON)

- TABLE 178 NORTH AMERICA: AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2029 (KILOTON)

- 9.4.3 NORTH AMERICA AGRICULTURAL FILMS MARKET, BY APPLICATION

- TABLE 179 NORTH AMERICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 180 NORTH AMERICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 181 NORTH AMERICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 182 NORTH AMERICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.4.4 NORTH AMERICA AGRICULTURAL FILMS MARKET, BY COUNTRY

- TABLE 183 NORTH AMERICA: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 184 NORTH AMERICA: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 185 NORTH AMERICA: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2017-2022 (KILOTON)

- TABLE 186 NORTH AMERICA: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2023-2029 (KILOTON)

- 9.4.4.1 US

- 9.4.4.1.1 Traditional plastic films to drive market

- 9.4.4.1 US

- TABLE 187 US: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 188 US: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 189 US: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 190 US: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.4.4.2 Mexico

- 9.4.4.2.1 Low labor costs and free trade agreements to drive market

- 9.4.4.2 Mexico

- TABLE 191 MEXICO: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 192 MEXICO: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 193 MEXICO: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 194 MEXICO: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.4.4.3 Canada

- 9.4.4.3.1 Gradual rise in demand for end-use industries to drive market

- 9.4.4.3 Canada

- TABLE 195 CANADA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 196 CANADA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 197 CANADA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 198 CANADA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 RECESSION IMPACT

- 9.5.2 MIDDLE EAST & AFRICA AGRICULTURAL FILMS MARKET, BY TYPE

- TABLE 199 MIDDLE EAST & AFRICA: AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (KILOTON)

- TABLE 202 MIDDLE EAST & AFRICA: AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2029 (KILOTON)

- 9.5.3 MIDDLE EAST & AFRICA AGRICULTURAL FILMS MARKET, BY APPLICATION

- TABLE 203 MIDDLE EAST & AFRICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 206 MIDDLE EAST & AFRICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.5.4 MIDDLE EAST & AFRICA AGRICULTURAL FILMS MARKET, BY COUNTRY

- TABLE 207 MIDDLE EAST & AFRICA: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2017-2022 (KILOTON)

- TABLE 210 MIDDLE EAST & AFRICA: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2023-2029 (KILOTON)

- 9.5.4.1 GCC countries

- 9.5.4.1.1 Saudi Arabia

- 9.5.4.1 GCC countries

- TABLE 211 SAUDI ARABIA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 212 SAUDI ARABIA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 213 SAUDI ARABIA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 214 SAUDI ARABIA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.5.4.2 Iran

- 9.5.4.2.1 Government policies and efficient crop management to fuel market

- 9.5.4.2 Iran

- TABLE 215 IRAN: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 216 IRAN: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 217 IRAN: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 218 IRAN: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.5.4.3 Egypt

- 9.5.4.3.1 Growth of food & dairy industry to drive market

- 9.5.4.3 Egypt

- TABLE 219 EGYPT: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 220 EGYPT: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 221 EGYPT: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 222 EGYPT: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.5.4.4 South Africa

- 9.5.4.4.1 Dual agricultural economy to drive market

- 9.5.4.4 South Africa

- TABLE 223 SOUTH AFRICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 224 SOUTH AFRICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 225 SOUTH AFRICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 226 SOUTH AFRICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.6 SOUTH AMERICA

- 9.6.1 RECESSION IMPACT

- 9.6.2 SOUTH AMERICA AGRICULTURAL FILMS MARKET, BY TYPE

- TABLE 227 SOUTH AMERICA: AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 228 SOUTH AMERICA: AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 229 SOUTH AMERICA: AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (KILOTON)

- TABLE 230 SOUTH AMERICA: AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2029 (KILOTON)

- 9.6.3 SOUTH AMERICA AGRICULTURAL FILMS MARKET, BY APPLICATION

- TABLE 231 SOUTH AMERICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 232 SOUTH AMERICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 233 SOUTH AMERICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 234 SOUTH AMERICA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.6.4 SOUTH AMERICA AGRICULTURAL FILMS MARKET, BY COUNTRY

- TABLE 235 SOUTH AMERICA: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 236 SOUTH AMERICA: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 237 SOUTH AMERICA: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2017-2022 (KILOTON)

- TABLE 238 SOUTH AMERICA: AGRICULTURAL FILMS MARKET, BY COUNTRY, 2023-2029 (KILOTON)

- 9.6.4.1 Brazil

- 9.6.4.1.1 Rising agricultural activities to fuel market growth

- 9.6.4.1 Brazil

- TABLE 239 BRAZIL: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 240 BRAZIL: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 241 BRAZIL: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 242 BRAZIL: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- 9.6.4.2 Argentina

- 9.6.4.2.1 Emerging agricultural activities to drive market

- 9.6.4.2 Argentina

- TABLE 243 ARGENTINA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 244 ARGENTINA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 245 ARGENTINA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017-2022 (KILOTON)

- TABLE 246 ARGENTINA: AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- TABLE 247 OVERVIEW OF STRATEGIES ADOPTED BY KEY AGRICULTURAL FILM MANUFACTURERS

- 10.3 MARKET SHARE ANALYSIS

- TABLE 248 AGRICULTURAL FILMS MARKET: DEGREE OF COMPETITION

- FIGURE 39 BERRY GLOBAL GROUP, INC. LED AGRICULTURAL FILMS MARKET IN 2023

- 10.3.1 RANKING OF KEY MARKET PLAYERS

- FIGURE 40 RANKING OF KEY PLAYERS IN AGRICULTURAL FILMS MARKET, 2023

- 10.4 REVENUE ANALYSIS OF MAJOR PLAYERS

- FIGURE 41 REVENUE ANALYSIS OF KEY COMPANIES (2019-2023)

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 42 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.5.5 COMPANY FOOTPRINT, 2023

- 10.5.5.1 Company footprint

- FIGURE 43 AGRICULTURAL FILMS MARKET: COMPANY OVERALL FOOTPRINT

- 10.5.5.2 Region footprint

- TABLE 249 AGRICULTURAL FILMS MARKET: REGION FOOTPRINT

- 10.5.5.3 Type footprint

- TABLE 250 AGRICULTURAL FILMS MARKET: TYPE FOOTPRINT

- 10.5.5.4 Application footprint

- TABLE 251 AGRICULTURAL FILMS MARKET: APPLICATION FOOTPRINT

- 10.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 44 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 10.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 10.6.5.1 Agricultural films market: Detailed list of key start-ups/SMEs

- 10.6.5.2 Agricultural films market: Competitive benchmarking of key start-ups/SMEs

- 10.7 COMPANY EVALUATION AND FINANCIAL METRICS

- FIGURE 45 COMPANY VALUATION AND FINANCIAL METRICS OF KEY PLAYERS

- FIGURE 46 EV/EBITDA OF KEY PLAYERS

- 10.8 BRAND/PRODUCT COMPARISON

- FIGURE 47 BRAND/ PRODUCT COMPARISON OF TOP 10 KEY PLAYERS

- 10.9 COMPETITIVE SCENARIO AND TRENDS

- 10.9.1 PRODUCT LAUNCHES

- TABLE 252 AGRICULTURAL FILMS MARKET: PRODUCT LAUNCHES, JANUARY 2019-MAY 2024

- 10.9.2 DEALS

- TABLE 253 AGRICULTURAL FILMS MARKET: DEALS, JANUARY 2019-MAY 2024

- 10.9.3 EXPANSIONS

- TABLE 254 AGRICULTURAL FILMS MARKET: EXPANSIONS, JANUARY 2019-MAY 2024

- 10.9.4 OTHER DEVELOPMENTS

- TABLE 255 AGRICULTURAL FILMS MARKET: OTHER DEVELOPMENTS, JANUARY 2019-MAY 2024

11 COMPANY PROFILE

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 11.1 KEY PLAYERS

- 11.1.1 BERRY GLOBAL GROUP, INC.

- TABLE 256 BERRY GLOBAL GROUP, INC.: COMPANY OVERVIEW

- FIGURE 48 BERRY GLOBAL GROUP, INC.: COMPANY SNAPSHOT

- TABLE 257 BERRY GLOBAL GROUP, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 258 BERRY GLOBAL GROUP, INC.: PRODUCT LAUNCHES, JANUARY 2019-MAY 2024

- TABLE 259 BERRY GLOBAL GROUP, INC.: DEALS, JANUARY 2019-MAY 2024

- TABLE 260 BERRY GLOBAL GROUP, INC.: EXPANSIONS, JANUARY 2019-MAY 2024

- TABLE 261 BERRY GLOBAL GROUP, INC.: OTHER DEVELOPMENTS, JANUARY 2019-MAY 2024

- 11.1.2 KURARAY CO., LTD.

- TABLE 262 KURARAY CO., LTD.: COMPANY OVERVIEW

- FIGURE 49 KURARAY CO., LTD.: COMPANY SNAPSHOT

- TABLE 263 KURARAY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 264 KURARAY CO., LTD.: DEALS, JANUARY 2019-MAY 2024

- TABLE 265 KURARAY CO., LTD.: EXPANSIONS, JANUARY 2019-MAY 2024

- 11.1.3 COVERIS

- TABLE 266 COVERIS: COMPANY OVERVIEW

- TABLE 267 COVERIS: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 268 COVERIS: PRODUCT LAUNCHES, JANUARY 2019-MAY 2024

- TABLE 269 COVERIS: DEALS, JANUARY 2019-MAY 2024

- TABLE 270 COVERIS: EXPANSIONS, JANUARY 2019-MAY 2024

- 11.1.4 RKW GROUP

- TABLE 271 RKW GROUP: COMPANY OVERVIEW

- TABLE 272 RKW GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 273 RKW GROUP: PRODUCT LAUNCHES, JANUARY 2019-MAY 2024

- TABLE 274 RKW GROUP: EXPANSIONS, JANUARY 2019-MAY 2024

- 11.1.5 BASF SE

- TABLE 275 BASF SE: COMPANY OVERVIEW

- FIGURE 50 BASF SE: COMPANY SNAPSHOT

- TABLE 276 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 277 BASF SE: DEALS, JANUARY 2019-MAY 2024

- TABLE 278 BASF SE: EXPANSIONS, JANUARY 2019-MAY 2024

- 11.1.6 RANI GROUP

- TABLE 279 RANI GROUP: COMPANY OVERVIEW

- TABLE 280 RANI GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 281 RANI GROUP: PRODUCT LAUNCHES, JANUARY 2019-MAY 2024

- TABLE 282 RANI GROUP: EXPANSIONS, JANUARY 2019-MAY 2024

- 11.1.7 DOW INC.

- TABLE 283 DOW INC.: COMPANY OVERVIEW

- FIGURE 51 DOW INC.: COMPANY SNAPSHOT

- TABLE 284 DOW INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 285 DOW INC.: PRODUCT LAUNCHES, JANUARY 2019-MAY 2024

- TABLE 286 DOW INC.: DEALS, JANUARY 2019-MAY 2024

- 11.1.8 ARMANDO ALVAREZ GROUP

- TABLE 287 ARMANDO ALVAREZ GROUP: COMPANY OVERVIEW

- TABLE 288 ARMANDO ALVAREZ GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 289 ARMANDO ALVAREZ GROUP: DEALS, JANUARY 2019-MAY 2024

- 11.1.9 TRIOWORLD

- TABLE 290 TRIOWORLD: COMPANY OVERVIEW

- TABLE 291 TRIOWORLD: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 292 TRIOWORLD: PRODUCT LAUNCHES, JANUARY 2019-MAY 2024

- TABLE 293 TRIOWORLD: DEALS, JANUARY 2019-MAY 2024

- TABLE 294 TRIOWORLD: EXPANSIONS, JANUARY 2019-MAY 2024

- 11.1.10 INDUSTRIAL DEVELOPMENT COMPANY SAL

- TABLE 295 INDUSTRIAL DEVELOPMENT COMPANY SAL: COMPANY OVERVIEW

- TABLE 296 INDUSTRIAL DEVELOPMENT COMPANY SAL: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 11.2 START-UP/SMES

- 11.2.1 EXXON MOBIL CORPORATION

- TABLE 297 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- 11.2.2 TILAK POLYPACK PRIVATE LIMITED

- TABLE 298 TILAK POLYPACK PRIVATE LIMITED: COMPANY OVERVIEW

- 11.2.3 MEGAPLAST INDIA PVT LTD

- TABLE 299 MEGAPLAST INDIA PVT LTD: COMPANY OVERVIEW

- 11.2.4 PLASTIKA KRITIS S.A.

- TABLE 300 PLASTIKA KRITIS S.A.: COMPANY OVERVIEW

- 11.2.5 GROUPE BARBIER

- TABLE 301 GROUPE BARBIER: COMPANY OVERVIEW

- 11.2.6 ACHILLES CORPORATION

- TABLE 302 ACHILLES CORPORATION: COMPANY OVERVIEW

- 11.2.7 POLIFILM GROUP

- TABLE 303 POLIFILM GROUP: COMPANY OVERVIEW

- 11.2.8 ANHUI GUOFENG PLASTIC INDUSTRY CO., LTD.

- TABLE 304 ANHUI GUOFENG PLASTIC INDUSTRY CO., LTD.: COMPANY OVERVIEW

- 11.2.9 AGRIPLAST TECH INDIA PRIVATE LIMITED

- TABLE 305 AGRIPLAST TECH INDIA PRIVATE LIMITED: COMPANY OVERVIEW

- 11.2.10 PLASTIK V SDN. BHD.

- TABLE 306 PLASTIK V SDN. BHD.: COMPANY OVERVIEW

- 11.2.11 IM SANIN SRL

- TABLE 307 IM SANIN SRL: COMPANY OVERVIEW

- 11.2.12 AGRIPLAST

- TABLE 308 AGRIPLAST: COMPANY OVERVIEW

- 11.2.13 GINEGAR PLASTIC PRODUCTS LTD.

- TABLE 309 GINEGAR PLASTIC PRODUCTS LTD.: COMPANY OVERVIEW

- 11.2.14 ECOPOLYSTW

- TABLE 310 ECOPOLYSTW: COMPANY OVERVIEW

- 11.2.15 FUTAMURA CHEMICAL CO., LTD.

- TABLE 311 FUTAMURA CHEMICAL CO., LTD.: COMPANY OVERVIEW

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 BIODEGRADABLE FILMS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.4 BIODEGRADABLE FILMS MARKET, BY REGION

- TABLE 312 BIODEGRADABLE FILMS MARKET, BY REGION, 2018-2026 (USD MILLION)

- TABLE 313 BIODEGRADABLE FILMS MARKET, BY REGION, 2018-2026 (KILOTON)

- 12.4.1 EUROPE

- TABLE 314 EUROPE: BIODEGRADABLE FILMS MARKET, BY COUNTRY, 2018-2026 (USD MILLION)

- TABLE 315 EUROPE: BIODEGRADABLE FILMS MARKET, BY COUNTRY, 2018-2026 (KILOTON)

- 12.4.2 NORTH AMERICA

- TABLE 316 NORTH AMERICA: BIODEGRADABLE FILMS MARKET, BY COUNTRY, 2018-2026 (USD MILLION)

- TABLE 317 NORTH AMERICA: BIODEGRADABLE FILMS MARKET, BY COUNTRY, 2018-2026 (KILOTON)

- 12.4.3 ASIA PACIFIC

- TABLE 318 ASIA PACIFIC: BIODEGRADABLE FILMS MARKET, BY COUNTRY, 2018-2026 (USD MILLION)

- TABLE 319 ASIA PACIFIC: BIODEGRADABLE FILMS MARKET, BY COUNTRY, 2018-2026 (KILOTON)

- 12.4.4 MIDDLE EAST & AFRICA

- TABLE 320 MIDDLE EAST & AFRICA: BIODEGRADABLE FILMS MARKET, BY COUNTRY, 2018-2026 (USD MILLION)

- TABLE 321 MIDDLE EAST & AFRICA: BIODEGRADABLE FILMS MARKET, BY COUNTRY, 2018-2026 (KILOTON)

- 12.4.5 SOUTH AMERICA

- TABLE 322 SOUTH AMERICA: BIODEGRADABLE FILMS MARKET, BY COUNTRY, 2018-2026 (USD MILLION)

- TABLE 323 SOUTH AMERICA: BIODEGRADABLE FILMS MARKET, BY COUNTRY, 2018-2026 (KILOTON)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS