|

|

市場調査レポート

商品コード

1318146

コンテンツデリバリーネットワーク(CDN)の世界市場:予測(~2028年)Content Delivery Network Market Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| コンテンツデリバリーネットワーク(CDN)の世界市場:予測(~2028年) |

|

出版日: 2023年07月20日

発行: MarketsandMarkets

ページ情報: 英文 282 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

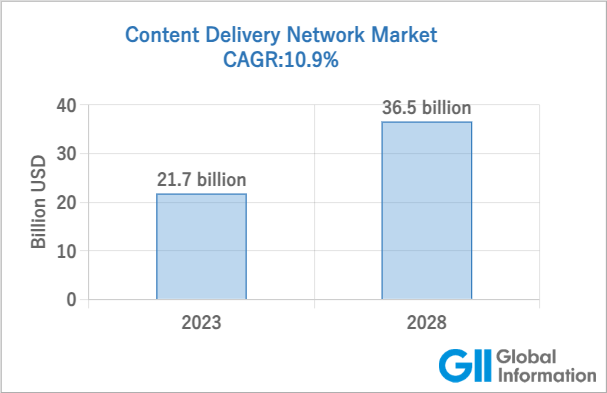

世界のコンテンツデリバリーネットワーク(CDN)の市場規模は、2023年の217億米ドルから2028年までに365億米ドルに達し、2023年~2028年にCAGRで10.9%の成長が予測されています。

エコシステムにはさまざまな主要企業が存在するため、市場は競争的で多様性に富んでいます。スマートフォンが普及し、インターネットアクセスにおけるモバイル機器への依存が高まる中、モバイルプラットフォーム向けにコンテンツデリバリーを最適化し、シームレスなユーザー体験を保証するCDN提供のニーズが高まっています。

プロバイダータイプ別では、従来型CDNセグメントが予測期間中に最大の市場規模を占めています。

世界のデータ消費の増加とユーザーたちのデジタル化が従来型CDNプロバイダーの成長を促進しており、特にスマートフォンによるインターネット消費の多さとオンラインショッピングの需要から、アジア太平洋に注目が集まっています。

ソリューション別では、ウェブパフォーマンス最適化セグメントが予測期間中にもっとも高い成長率を記録する見込みです。

"予測期間中、アジア太平洋がもっとも高い成長率を記録します。"

新興経済国とダイナミックな技術変化を特徴とするアジア太平洋は、市場においてもっとも高いCAGRを記録すると予想されます。中国、日本、韓国などの国々がこの地域の急成長を牽引しています。コンテンツ消費の増加や、インターネット加入者の増加、スマートフォンやポータブルデバイスの普及が、市場の繁栄に寄与しています。ライブビデオストリーミング、OTT提供の需要、メディア、エンターテインメント、ゲーム、教育部門に対するCOVID-19の影響は、市場の成長をさらに加速させています。eコマース業界の力強い成長と、インド、中国、韓国、シンガポールなどの国々におけるインターネットTVの導入は、CDNソリューションの需要をさらに高める要因となっています。主要CDNベンダーは、増大する需要に対応し、セキュリティコンプライアンスを確保しながら、より充実した顧客体験を提供するため、アジア太平洋にデータセンターを設立しています。

当レポートでは、世界のコンテンツデリバリーネットワーク(CDN)市場について調査分析し、市場力学、地域とセグメントの分析、企業プロファイルなどを提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主要考察

- コンテンツデリバリーネットワーク(CDN)市場の主要企業にとっての魅力的な機会

- 北米のコンテンツデリバリーネットワーク(CDN)市場:提供別、国別(2023年)

- アジア太平洋のコンテンツデリバリーネットワーク(CDN)市場:提供別、国別(2023年)

第5章 市場の概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界の動向

- バリューチェーン分析

- コンテンツデリバリーネットワーク(CDN)ソリューションの略歴

- エコシステム/市場マップ

- コンテンツデリバリーネットワーク(CDN)のツール、フレームワーク、技術

- ビジネスモデル

- ポーターのファイブフォース分析モデル

- コンテンツデリバリーネットワーク(CDN)市場:隣接するニッチテクノロジー

- 主なステークホルダーと購入基準

- 技術分析

- コンテンツデリバリーネットワーク(CDN)市場情勢の未来の見通し

- 顧客のビジネスに影響を与える動向/混乱

- コンテンツデリバリーネットワーク(CDN)市場のベストプラクティス

- 特許分析

- 価格モデルの分析

- ケーススタディ分析

- 主な会議とイベント(2023年)

- 規制遵守

第6章 コンテンツデリバリーネットワーク(CDN)市場:提供別

- イントロダクション

- ソリューション

- CDNソリューションの採用を促進するデジタル化の進行

- ウェブパフォーマンス最適化

- メディアデリバリー

- クラウドセキュリティ

- サービス

- 安全で効果的なストレージオプションに対するニーズの増加が市場を牽引

- 設計・コンサルティングサービス

- ストレージサービス

- アナリティクス・パフォーマンスモニタリングサービス

- ウェブサイト・API管理サービス

- ネットワーク最適化サービス

- サポート・メンテナンス

- デジタル著作権管理

- 透過型キャッシュ

- その他のサービス

第7章 コンテンツデリバリーネットワーク(CDN)市場:機能別

- イントロダクション

- ビデオストリーミング

- ウェブサイト高速化

- ソフトウェアデリバリー

- クラウドストレージ

- モバイルコンテンツデリバリー

第8章 コンテンツデリバリーネットワーク(CDN)市場:コンテンツタイプ別

- イントロダクション

- 静的コンテンツ

- 動的コンテンツ

第9章 コンテンツデリバリーネットワーク(CDN)市場:プロバイダータイプ別

- イントロダクション

- 従来型CDN

- 通信事業者CDN

- クラウドCDN

- ピアツーピアCDN

- その他のプロバイダータイプ

第10章 コンテンツデリバリーネットワーク(CDN)市場:応用分野別

- イントロダクション

- メディア・エンターテインメント

- オンラインゲーム

- 小売・eコマース

- eラーニング

- 医療

- その他の応用分野

第11章 コンテンツデリバリーネットワーク(CDN)市場:地域別

- イントロダクション

- 北米

- 北米のコンテンツデリバリーネットワーク(CDN)市場の促進要因

- 北米の不況の影響

- 米国

- カナダ

- 欧州

- 欧州のコンテンツデリバリーネットワーク(CDN)市場の促進要因

- 欧州の不況の影響

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- 北欧

- その他の欧州

- アジア太平洋

- アジア太平洋のコンテンツデリバリーネットワーク(CDN)市場の促進要因

- アジア太平洋の不況の影響

- 中国

- 日本

- インド

- ニュージーランド

- 韓国

- インドネシア

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのコンテンツデリバリーネットワーク(CDN)市場の促進要因

- 中東・アフリカの不況の影響

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカのコンテンツデリバリーネットワーク(CDN)市場の促進要因

- ラテンアメリカの不況の影響

- ブラジル

- アルゼンチン

- その他のラテンアメリカ

第12章 競合情勢

- 概要

- 主要企業が採用した戦略

- 主要企業の市場シェアの分析

- 主要企業の過去の収益の分析

- 主要企業のランキング(2023年)

- 主要企業の評価マトリックス(2023年)

- スタートアップ/中小企業の評価マトリックス(2023年)

- 競合ベンチマーキング

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- AKAMAI TECHNOLOGIES

- MICROSOFT

- IBM

- EDGIO

- AMAZON WEB SERVICES

- AT&T

- CLOUDFLARE

- LUMEN TECHNOLOGIES

- DEUTSCHE TELEKOM

- FASTLY

- CITRIX SYSTEMS

- NTT COMMUNICATIONS

- COMCAST

- RACKSPACE TECHNOLOGY

- CDNETWORKS

- TATA COMMUNICATIONS

- IMPERVA

- TENCENT CLOUD

- KINGSOFT CLOUD

- スタートアップ/中小企業

- BROADPEAK

- EVG CORP

- QUANTIL

- STACKPATH

- G-CORE LABS

- ONAPP LIMITED (VIRTUOZZO) 2021

- BUNNY.NET

- BAISHAN CLOUD TECHNOLOGY

第14章 隣接市場と関連市場

- イントロダクション

- LTE・5Gブロードキャスト市場 - 世界の予測(~2026年)

- ネットワークスライシング市場 - 世界の予測(2025年)

- 商業用P2P CDN市場 - 世界の予測(2023年)

第15章 付録

The Content delivery network market is estimated at USD 21.7 billion in 2023 and is projected to reach USD 36.5 billion by 2028, at a CAGR of 10.9% from 2023 to 2028. Various key players in the ecosystem have led to a competitive and diverse market. With the proliferation of smartphones and the increasing reliance on mobile devices for internet access, there is a growing need for CDN services to optimize content delivery for mobile platforms, ensuring seamless user experiences.

By provider type, the traditional CDN segment holds the largest market size during the forecast period.

Traditional CDN providers, also known as pure players, offer a range of CDN solutions such as network optimization, content acceleration, and media delivery. They utilize a globally distributed network of strategically deployed servers to balance network load and deliver static and dynamic content with minimal latency. These servers provide load balancing, caching, secure access, and analytics services. Key traditional CDN vendors include Akamai, ChinaCache, Arvaka Networks, and StackPath. The increasing data consumption and digitization among users globally have fueled the growth of traditional CDN providers, with a particular focus on the APAC region due to high smartphone internet consumption and the demand for online shopping.

Based on solutions, the Web performance optimization segment are expected to register the fastest growth rate during the forecast period.

Web performance optimization, also known as Front-End Optimization (FEO), is a critical process of improving website performance by making it browser-friendly and faster to load. It ensures secure and reliable content delivery to users and helps eliminate issues like slow loading and unoptimized content on mobile devices. In the competitive eCommerce and mCommerce landscape, web performance optimization is crucial for enhancing user experience, increasing brand value, and gaining a competitive edge. By using intelligent routing methods, it speeds up the delivery of web content, reduces latency, and improves overall quality of experience (QoE) for end-users.

"Asia Pacific to register the highest growth rate during the forecast period."

The Asia Pacific region, characterized by emerging economies and dynamic technological changes, is expected to witness the highest compound annual growth rate (CAGR) in the CDN market. Countries like China, Japan, and South Korea are driving the rapid growth in this region. The increasing content consumption, growing internet subscriber base, and widespread use of smartphones and portable devices contribute to the region's thriving CDN market. The demand for live video streaming, OTT services, and the impact of COVID-19 on media, entertainment, gaming, and education sectors have further accelerated market growth. The robust growth of the eCommerce industry and the adoption of internet TV in countries like India, China, Korea, and Singapore are additional factors driving the demand for CDN solutions. Major CDN vendors have established data centers in the Asia Pacific region to cater to the increasing demand and provide enhanced customer experiences while ensuring security compliance.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 62%, Tier 2 - 23%, and Tier 3 - 15%

- By Designation: C-level -38%, D-level - 30%, and Others - 32%

- By Region: North America - 40%, Europe - 15%, Asia Pacific - 35%, Middle East & Africa- 5%, and Latin America- 5%.

The major players in the Content delivery network market are Akamai Technologies (US), Microsoft (US), IBM (US), Edgio (US), Google (US), AWS (US), AT&T (US), Cloudflare (US), Lumen Technologies (US), Deutsche Telekom (Germany), Fastly (US), Citrix systems (US), NTT Communications (Japan), Comcast Technologies (US), Rackspace Technology (US), CDNetworks (South Korea), Tata Communications (India), Imperva (US), Broadpeak (France), Quantil (US), StackPath (US), G Core Labs SA (Luxembourg), Tencent Cloud (China), OnApp Limited (UK),EVG Corp (Vietnam), Kingsoft Cloud (China), Bunny.net (Slovenia) and Baishan Cloud (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, and product enhancements, and acquisitions to expand their footprint in the Content delivery network market.

Research Coverage

The market study covers the Content delivery network market size across different segments. It aims at estimating the market size and the growth potential across different segments, including offerings (solutions, and services), functionality, content type, provider type, application area, and region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the global Content delivery network market and its subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Rising need for effective solutions to enable live and uninterrupted content delivery over high-speed data network, increasing demand for enhanced QoE and QoS, proliferation of video and rich media over websites, increasing demand for enhanced video content and latency-free online gaming experience, and exponential increase in the consumption of online video content is expected to drive the growth of the market), restraints (Complex architecture and concern about QoS, Network connectivity and technical difficulties in live video streaming), opportunities (Rising demand for cloud-enabled services, Increasing demand for integrated and next-generation security solutions and services, and Growing interest of consumers in OTT platforms and VOD for entertainment), and challenges (Data security and privacy concerns, Variations in website monetization and applications) influencing the growth of the Content delivery network market. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Content delivery network market. Market Development: Comprehensive information about lucrative markets - the report analyses the Content delivery network market across various regions. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Content delivery network market. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Akamai Technologies (US), Microsoft (US), IBM (US), Edgio (US), Google (US), AWS (US), AT&T (US), Cloudflare (US), Lumen Technologies (US), Deutsche Telekom (Germany), Fastly (US), Citrix systems (US), NTT Communications (Japan), Comcast Technologies (US), Rackspace Technology (US), CDNetworks (South Korea), Tata Communications (India), Imperva (US), Broadpeak (France), Quantil (US), StackPath (US), G Core Labs SA (Luxembourg), Tencent Cloud (China), OnApp Limited (UK),EVG Corp (Vietnam), Kingsoft Cloud (China), Bunny.net (Slovenia) and Baishan Cloud (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2019-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 CONTENT DELIVERY NETWORK MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Breakup of primary profiles

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key insights from industry experts

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES OF CONTENT DELIVERY NETWORK MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (BOTTOM-UP) (SUPPLY SIDE): COLLECTIVE REVENUE OF SOLUTIONS AND SERVICES OF CONTENT DELIVERY NETWORK MARKET

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): CONTENT DELIVERY NETWORK MARKET

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- TABLE 3 ASSUMPTIONS

- 2.6 LIMITATIONS

- FIGURE 7 LIMITATIONS

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 CONTENT DELIVERY NETWORK MARKET, 2021-2028 (USD MILLION)

- FIGURE 9 CONTENT DELIVERY NETWORK MARKET, REGIONAL SHARE, 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY COMPANIES IN CONTENT DELIVERY NETWORK MARKET

- FIGURE 10 INTERNET PENETRATION, PROLIFERATION OF VIDEO AND RICH MEDIA OVER WEBSITES, AND NEED FOR ENHANCED QOE AND QOS TO DRIVE MARKET

- 4.2 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY OFFERING AND COUNTRY, 2023

- FIGURE 11 SOLUTIONS SEGMENT AND US TO ACCOUNT FOR LARGEST SHARES

- 4.3 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY OFFERING AND COUNTRY, 2023

- FIGURE 12 SOLUTIONS SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CONTENT DELIVERY NETWORK MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rising need for live and uninterrupted content delivery over high-speed data network

- 5.2.1.2 Increasing demand for enhanced QoE and QoS

- 5.2.1.3 Proliferation of video and rich media over websites

- 5.2.1.4 Increasing demand for enhanced video content and latency-free online gaming experience

- FIGURE 14 GLOBAL ONLINE GAMING ACCORDING TO AGE GROUP, 2018-2020

- FIGURE 15 GLOBAL ONLINE GAMING ACCORDING TO DIFFERENT DEVICES, 2018-2020

- 5.2.1.5 Increasing consumption of online video content

- FIGURE 16 GLOBAL INTERNET VIDEO CONSUMER TRAFFIC, 2016-2021

- FIGURE 17 ONLINE GAMING INTERNET TRAFFIC

- 5.2.1.6 Increasing internet penetration and adoption of mobile devices

- FIGURE 18 GLOBAL CONTENT DELIVERY NETWORK INTERNET TRAFFIC, 2017-2021

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complex architecture and concern about QoS

- 5.2.2.2 Network connectivity and technical difficulties in live video streaming

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for cloud-enabled services

- 5.2.3.2 Increasing demand for integrated and next-generation security solutions and services

- 5.2.3.3 Growing interest of consumers in OTT platforms and VOD for entertainment

- 5.2.4 CHALLENGES

- 5.2.4.1 Data security and privacy concerns

- 5.2.4.2 Variations in website monetization and applications

- 5.3 INDUSTRY TRENDS

- 5.3.1 VALUE CHAIN ANALYSIS

- FIGURE 19 CONTENT DELIVERY NETWORK MARKET: VALUE CHAIN ANALYSIS

- 5.3.2 BRIEF HISTORY OF CONTENT DELIVERY NETWORK SOLUTIONS

- FIGURE 20 BRIEF HISTORY OF CONTENT DELIVERY NETWORK SOLUTIONS

- 5.3.2.1 1900s

- 5.3.2.2 2000s

- 5.3.2.3 2010s

- 5.3.2.4 2020s-Present

- 5.3.3 ECOSYSTEM/MARKET MAP

- FIGURE 21 CONTENT DELIVERY NETWORK MARKET: MARKET MAP

- TABLE 4 CONTENT DELIVERY NETWORK MARKET: ECOSYSTEM

- 5.3.4 CONTENT DELIVERY NETWORK TOOLS, FRAMEWORKS, AND TECHNIQUES

- FIGURE 22 CONTENT DELIVERY NETWORK TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.3.5 BUSINESS MODEL

- 5.3.6 PORTER'S FIVE FORCES MODEL

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES ON CONTENT DELIVERY NETWORK MARKET

- 5.3.6.1 THREAT OF NEW ENTRANTS

- 5.3.6.2 THREAT OF SUBSTITUTES

- 5.3.6.3 BARGAINING POWER OF SUPPLIERS

- 5.3.6.4 BARGAINING POWER OF BUYERS

- 5.3.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3.7 CONTENT DELIVERY NETWORK MARKET: ADJACENT NICHE TECHNOLOGIES

- 5.3.7.1 Edge Computing

- 5.3.7.2 Internet of Things (IoT)

- 5.3.7.3 Cloud Computing

- 5.3.7.4 AI and ML

- 5.3.7.5 Web Application Firewalls (WAF)

- 5.3.7.6 Video encoding and transcoding

- 5.3.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.8.1 Key Stakeholders in Buying Process

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.3.8.2 Buying Criteria

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.3.9 TECHNOLOGY ANALYSIS

- 5.3.9.1 Adjacent technologies

- 5.3.9.1.1 ML and AI

- 5.3.9.1.2 IoT

- 5.3.9.1.3 Analytics

- 5.3.9.1.4 Cloud

- 5.3.9.1.5 Edge computing

- 5.3.9.1.6 Blockchain

- 5.3.9.2 Related Technologies

- 5.3.9.2.1 Caching

- 5.3.9.2.2 Content optimization

- 5.3.9.2.3 Load balancing

- 5.3.9.1 Adjacent technologies

- 5.3.10 FUTURE OF CONTENT DELIVERY NETWORK MARKET LANDSCAPE

- 5.3.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.3.12 BEST PRACTICES OF CONTENT DELIVERY NETWORK MARKET

- 5.3.13 PATENT ANALYSIS

- 5.3.13.1 Methodology

- 5.3.13.2 Document type

- TABLE 8 PATENTS FILED, 2020-2023

- 5.3.13.3 Innovation and patent application

- FIGURE 26 TOTAL NUMBER OF PATENTS GRANTED, 2020-2023

- 5.3.13.4 Top applicants

- FIGURE 27 TOP 10 PATENT APPLICANTS, 2020-2023

- 5.3.14 PRICING MODEL ANALYSIS

- 5.3.14.1 Average selling price trends

- TABLE 9 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED CONTENT DELIVERY NETWORK

- 5.3.15 CASE STUDY ANALYSIS

- 5.3.15.1 Imperva secured NetRefer's website and boosted performance

- 5.3.15.2 Fastly's edge cloud platform enabled Ticketmaster to support varied delivery and security needs of business units

- 5.3.15.3 Divio streamlined manual access configuration process application availability and improved efficiency and security with Cloudflare

- 5.3.15.4 Sky Italia optimized content management workflow and improved storage upload rate with Aspera

- 5.3.15.5 Amazon CloudFront helped King deliver their game content to global user base

- 5.3.15.6 Gaijin Entertainment enhanced scalability and reliability of its network with Lumen Technologies

- 5.3.16 KEY CONFERENCES & EVENTS IN 2023

- 5.3.16.1 Content delivery network market: detailed list of conferences & events

- 5.3.17 REGULATORY COMPLIANCES

- 5.3.17.1 Regulatory Bodies, Government Agencies, and Other Organizations

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.17.2 International Organization For Standardization Standard 27001

- 5.3.17.3 General Data Protection Regulation (GDPR)

- 5.3.17.4 California Consumer Privacy Act (CCPA)

- 5.3.17.5 Health Insurance Portability and Accountability Act (HIPPA)

- 5.3.17.6 Health Level Seven (HL7)

- 5.3.17.7 Sarbanes-Oxley Act (SOX)

- 5.3.17.8 Communications Decency Act (CDA)

- 5.3.17.9 Digital Millennium Copyright Act (DMCA)

- 5.3.17.10 Anti-Cybersquatting Consumer Protection Act (ACPA)

6 CONTENT DELIVERY NETWORK MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 CONTENT DELIVERY NETWORK MARKET, BY OFFERING: DRIVERS

- FIGURE 28 SOLUTIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 13 CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 14 CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 INCREASING DIGITALIZATION TO DRIVE ADOPTION OF CDN SOLUTIONS

- TABLE 15 SOLUTIONS: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 16 SOLUTIONS: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 29 WEB-PERFORMANCE OPTIMIZATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 17 OFFERING: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 18 OFFERING: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- 6.2.2 WEB-PERFORMANCE OPTIMIZATION

- TABLE 19 WEB-PERFORMANCE OPTIMIZATION: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 20 WEB-PERFORMANCE OPTIMIZATION: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3 MEDIA DELIVERY

- TABLE 21 MEDIA DELIVERY: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 22 MEDIA DELIVERY: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.4 CLOUD SECURITY

- TABLE 23 CLOUD SECURITY: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 24 CLOUD SECURITY: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 INCREASING NEED FOR SECURE AND EFFECTIVE STORAGE OPTIONS TO DRIVE MARKET

- TABLE 25 SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 26 SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 30 STORAGE SERVICES SEGMENT TO GROW WITH FASTEST CAGR DURING FORECAST PERIOD

- TABLE 27 OFFERING: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 28 OFFERING: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 6.3.2 DESIGNING AND CONSULTING SERVICES

- TABLE 29 DESIGNING AND CONSULTING SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 30 DESIGNING AND CONSULTING SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 STORAGE SERVICES

- TABLE 31 STORAGE SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

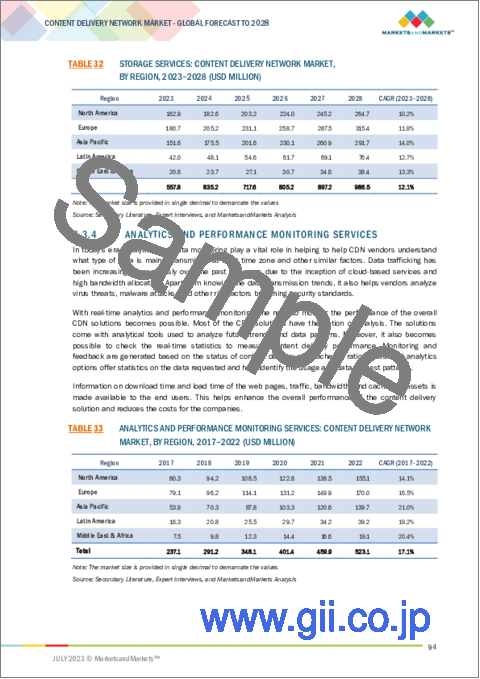

- TABLE 32 STORAGE SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.4 ANALYTICS AND PERFORMANCE MONITORING SERVICES

- TABLE 33 ANALYTICS AND PERFORMANCE MONITORING SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 34 ANALYTICS AND PERFORMANCE MONITORING SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.5 WEBSITE AND API MANAGEMENT SERVICES

- TABLE 35 WEBSITE AND API MANAGEMENT SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 36 WEBSITE AND API MANAGEMENT SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.6 NETWORK OPTIMIZATION SERVICES

- TABLE 37 NETWORK OPTIMIZATION SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 38 NETWORK OPTIMIZATION SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.7 SUPPORT AND MAINTENANCE

- TABLE 39 SUPPORT AND MAINTENANCE: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 40 SUPPORT AND MAINTENANCE: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.8 DIGITAL RIGHTS MANAGEMENT

- TABLE 41 DIGITAL RIGHTS MANAGEMENT: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 42 DIGITAL RIGHTS MANAGEMENT: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.9 TRANSPARENT CACHING

- TABLE 43 TRANSPARENT CACHING: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 44 TRANSPARENT CACHING: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.10 OTHER SERVICES

- TABLE 45 OTHER SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 46 OTHER SERVICES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

7 CONTENT DELIVERY NETWORK MARKET, BY FUNCTIONALITY

- 7.1 INTRODUCTION

- 7.1.1 CONTENT DELIVERY NETWORK MARKET, BY FUNCTIONALITY: DRIVERS

- 7.2 VIDEO STREAMING

- 7.2.1 OPTIMIZING VIDEO STREAMING TO LEVERAGE CDNS FOR SEAMLESS CONTENT DELIVERY AND ENHANCED USER EXPERIENCES

- 7.3 WEBSITE ACCELERATION

- 7.3.1 CDN TO OFFER QUALITATIVE ADVANTAGE THAT IMPROVES WEBSITE PERFORMANCE AND USER SATISFACTION

- 7.4 SOFTWARE DELIVERY

- 7.4.1 CDN TO OPTIMIZE SOFTWARE DELIVERY FOR ENHANCED SPEED, SCALABILITY, RELIABILITY, AND SECURITY

- 7.5 CLOUD STORAGE

- 7.5.1 CDN TO OPTIMIZE PERFORMANCE AND ACCESSIBILITY OF CLOUD STORAGE, OFFERING QUALITATIVE BENEFITS FOR EFFICIENT AND SECURE DATA MANAGEMENT

- 7.6 MOBILE CONTENT DELIVERY

- 7.6.1 CDNS TO ENHANCE MOBILE CONTENT DELIVERY BY REDUCING LATENCY AND IMPROVING LOADING TIMES THROUGH THEIR DISTRIBUTED SERVER NETWORK

8 CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE

- 8.1 INTRODUCTION

- 8.1.1 CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE: DRIVERS

- FIGURE 31 DYNAMIC CONTENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 47 CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 48 CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- 8.2 STATIC CONTENT

- 8.2.1 STATIC CONTENT TO DELIVER CONTENT TO END USER WITHOUT BEING GENERATED, MODIFIED, OR PROCESSED

- TABLE 49 STATIC CONTENT: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 50 STATIC CONTENT: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 DYNAMIC CONTENT

- 8.3.1 INCREASING DEMAND FOR UNINTERRUPTED VIDEO AND WEBSITE CONTENT TO DRIVE MARKET

- TABLE 51 DYNAMIC CONTENT: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 52 DYNAMIC CONTENT: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

9 CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE

- 9.1 INTRODUCTION

- 9.1.1 CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE: DRIVERS

- FIGURE 32 TRADITIONAL CDN PROVIDER TYPE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 53 CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 54 CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- 9.2 TRADITIONAL CDN

- 9.2.1 INCREASING DATA CONSUMPTION TO SUPPORT TRADITIONAL CDN PROVIDERS

- TABLE 55 TRADITIONAL CDN: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 56 TRADITIONAL CDN: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 TELCO CDN

- 9.3.1 INCREASING CONSUMPTION OF SMARTPHONES AND OTHER PORTABLE DEVICES TO DRIVE MARKET

- TABLE 57 TELCO CDN: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 58 TELCO CDN: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 CLOUD CDN

- 9.4.1 CDN PROVIDERS TO ENABLE CSPS TO DETECT AND AVOID BOTTLENECKS IN THEIR NETWORKS

- TABLE 59 CLOUD CDN: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 60 CLOUD CDN: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 PEER-TO-PEER CDN

- 9.5.1 NEED TO OPTIMIZE WEB-PERFORMANCE TO DRIVE GROWTH OF P2P CDN SEGMENT

- TABLE 61 P2P CDN: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 62 P2P CDN: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 OTHER PROVIDER TYPES

- TABLE 63 OTHER PROVIDER TYPES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 64 OTHER PROVIDER TYPES: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

10 CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA

- 10.1 INTRODUCTION

- 10.1.1 CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA: DRIVERS

- FIGURE 33 MEDIA AND ENTERTAINMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 65 CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 66 CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- 10.2 MEDIA AND ENTERTAINMENT

- 10.2.1 INCREASING DEMAND FOR ONLINE VIDEO STREAMING TO DRIVE MARKET

- 10.2.2 MEDIA AND ENTERTAINMENT: CONTENT DELIVERY NETWORK USE CASES

- 10.2.2.1 Live Events and Broadcasting:

- 10.2.2.2 Digital Media Distribution:

- 10.2.2.3 Advertising and Content Monetization:

- 10.2.2.4 Over-The-Top (OTT) Services:

- TABLE 67 MEDIA AND ENTERTAINMENT: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 68 MEDIA AND ENTERTAINMENT: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 ONLINE GAMING

- 10.3.1 CDN SOLUTIONS TO PROTECT GAMES FROM MALICIOUS ATTACKS

- 10.3.2 ONLINE GAMING: CONTENT DELIVERY NETWORK USE CASES

- 10.3.2.1 Game Downloads and Updates:

- 10.3.2.2 Invent Patch and Content Distribution:

- 10.3.2.3 Multiplayer Gaming:

- 10.3.2.4 eSports and Competitive Gaming:

- TABLE 69 ONLINE GAMING: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 70 ONLINE GAMING: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 RETAIL AND ECOMMERCE

- 10.4.1 CDN TO HELP RETAIL AND ECOMMERCE BUSINESSES DELIVER CONTENT QUICKLY AND WITHOUT ANY HASSLES

- 10.4.2 RETAIL AND ECOMMERCE: CONTENT DELIVERY NETWORK USE CASES

- 10.4.2.1 Global Ecommerce:

- 10.4.2.2 Personalized Content Optimization:

- 10.4.2.3 Real-Time Updates:

- 10.4.2.4 Flash Sales and Promotions:

- TABLE 71 RETAIL AND ECOMMERCE: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 72 RETAIL AND ECOMMERCE: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 ELEARNING

- 10.5.1 RISING ADOPTION OF COST-EFFECTIVE CLOUD COMPUTING TECHNIQUES AND ADOPTION OF PORTABLE SMART DEVICES TO DRIVE MARKET

- 10.5.2 ELEARNING: CONTENT DELIVERY NETWORK USE CASES

- 10.5.2.1 Interactive Learning:

- 10.5.2.2 Mobile Learning:

- 10.5.2.3 Offline Content Access:

- 10.5.2.4 Global Accessibility:

- TABLE 73 ELEARNING: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 74 ELEARNING: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6 HEALTHCARE

- 10.6.1 CDN TO OFFER SECURITY PROTECTION TO SAFEGUARD COMPANIES FROM DATA BREACHES

- 10.6.2 HEALTHCARE: CONTENT DELIVERY NETWORK USE CASES

- 10.6.2.1 Telemedicine and Telehealth:

- 10.6.2.2 Health Education and Training:

- 10.6.2.3 Electronic Health Records (EHR):

- 10.6.2.4 Emergency Medical Services:

- TABLE 75 HEALTHCARE: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 76 HEALTHCARE: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7 OTHER APPLICATION AREAS

- 10.7.1 OTHER APPLICATION AREAS: CONTENT DELIVERY NETWORK USE CASES

- 10.7.1.1 Online Banking and Financial Services:

- 10.7.1.2 Emergency Notifications and Alerts:

- 10.7.1.3 Supply Chain and Logistics:

- TABLE 77 OTHER APPLICATION AREAS: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 78 OTHER APPLICATION AREAS: CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7.1 OTHER APPLICATION AREAS: CONTENT DELIVERY NETWORK USE CASES

11 CONTENT DELIVERY NETWORK MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 34 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 79 CONTENT DELIVERY NETWORK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 80 CONTENT DELIVERY NETWORK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 35 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET SNAPSHOT

- TABLE 81 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: CONTENT DELIVERY NETWORK MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.3 US

- 11.2.3.1 Presence of major CDN solution providers and significant government support to drive market growth

- TABLE 95 US: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 96 US: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- TABLE 97 US: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 98 US: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 99 US: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 100 US: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 101 US: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 102 US: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 103 US: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 104 US: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- TABLE 105 US: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 106 US: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- 11.2.4 CANADA

- 11.2.4.1 Adoption of new technologies like AI and ML in content delivery to drive market growth

- TABLE 107 CANADA: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 108 CANADA: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- TABLE 109 CANADA: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 110 CANADA: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 111 CANADA: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 112 CANADA: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 113 CANADA: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 114 CANADA: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 115 CANADA: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 116 CANADA: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- TABLE 117 CANADA: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 118 CANADA: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: CONTENT DELIVERY NETWORK MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- TABLE 119 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 120 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- TABLE 121 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 122 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 123 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 124 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 125 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 126 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 127 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 128 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- TABLE 129 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 130 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- TABLE 131 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 132 EUROPE: CONTENT DELIVERY NETWORK MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Rising consumption of video content over different platforms to drive market growth

- TABLE 133 UK: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 134 UK: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- TABLE 135 UK: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 136 UK: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 137 UK: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 138 UK: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 139 UK: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 140 UK: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 141 UK: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 142 UK: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- TABLE 143 UK: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 144 UK: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- 11.3.4 GERMANY

- 11.3.4.1 Need for faster content delivery to fuel demand for multi-CDN devices

- TABLE 145 GERMANY: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 146 GERMANY: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- TABLE 147 GERMANY: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 148 GERMANY: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 149 GERMANY: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 150 GERMANY: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 151 GERMANY: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 152 GERMANY: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 153 GERMANY: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 154 GERMANY: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- TABLE 155 GERMANY: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 156 GERMANY: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- 11.3.5 FRANCE

- 11.3.5.1 Exponential rise in usage of internet and mobile devices for content consumption to drive market growth

- TABLE 157 FRANCE: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 158 FRANCE: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- TABLE 159 FRANCE: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 160 FRANCE: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 161 FRANCE: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 162 FRANCE: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 163 FRANCE: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 164 FRANCE: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 165 FRANCE: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 166 FRANCE: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- TABLE 167 FRANCE: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 168 FRANCE: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- 11.3.6 SPAIN

- 11.3.6.1 Increasing adoption of mobile devices to fuel market growth

- 11.3.7 ITALY

- 11.3.7.1 Several CDN providers with points of presence (PoPs) to drive market growth

- TABLE 169 ITALY: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 170 ITALY: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- TABLE 171 ITALY: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 172 ITALY: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 173 ITALY: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 174 ITALY: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 175 ITALY: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 176 ITALY: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 177 ITALY: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 178 ITALY: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- TABLE 179 ITALY: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 180 ITALY: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- 11.3.8 NORDICS

- 11.3.8.1 Rising popularity of streaming services to fuel market growth

- 11.3.9 REST OF EUROPE

- TABLE 181 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 182 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- TABLE 183 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 184 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 185 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 186 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 187 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 188 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 189 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 190 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- TABLE 191 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 192 REST OF EUROPE: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 193 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 194 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- TABLE 195 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 196 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 197 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 198 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 199 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 200 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 201 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 202 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- TABLE 203 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 204 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- TABLE 205 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 206 ASIA PACIFIC: CONTENT DELIVERY NETWORK MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 Growing usage of social media and OTT platforms to drive market growth

- 11.4.4 JAPAN

- 11.4.4.1 Increase in mobile usage and internet users to drive market growth

- 11.4.5 INDIA

- 11.4.5.1 Increasing demand for online video streaming and rapid broadband expansion to drive market

- 11.4.6 ANZ

- 11.4.6.1 Increasing adoption of CDN technologies in various industries to drive market

- 11.4.7 SOUTH KOREA

- 11.4.7.1 Increasing demand for video content across OTT platforms, especially live video streaming, to drive market

- 11.4.8 INDONESIA

- 11.4.8.1 Government initiatives and network infrastructure development to drive market

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 207 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: CONTENT DELIVERY NETWORK MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.3 KSA

- 11.5.3.1 Government's ongoing initiatives, such as National Transformation Program, to drive market

- 11.5.4 UAE

- 11.5.4.1 Introduction of new data centers and collaborative partnerships to drive market growth

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Bridging digital divide and promoting economic growth with CDNs to drive market

- 11.5.6 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 221 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2017-2022 (USD MILLION)

- TABLE 222 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2023-2028 (USD MILLION)

- TABLE 223 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 224 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 225 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 226 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 227 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 228 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 229 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2017-2022 (USD MILLION)

- TABLE 230 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY PROVIDER TYPE, 2023-2028 (USD MILLION)

- TABLE 231 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2017-2022 (USD MILLION)

- TABLE 232 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- TABLE 233 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 234 LATIN AMERICA: CONTENT DELIVERY NETWORK MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.6.3 BRAZIL

- 11.6.3.1 Increased adoption of new technologies and government initiatives to drive growth

- 11.6.4 ARGENTINA

- 11.6.4.1 Government initiatives and growing internet penetration to drive growth

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 235 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- TABLE 236 INTENSITY OF COMPETITIVE RIVALRY

- 12.4 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- FIGURE 37 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS, 2018-2022 (USD MILLION)

- 12.5 RANKING OF KEY PLAYERS, 2023

- FIGURE 38 RANKING OF KEY PLAYERS, 2023

- 12.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 39 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 40 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- 12.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 41 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 42 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- 12.8 COMPETITIVE BENCHMARKING

- TABLE 237 LIST OF KEY STARTUPS/SMES

- TABLE 238 COMPETITIVE BENCHMARKING FOR KEY PLAYERS

- TABLE 239 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- TABLE 240 PRODUCT LAUNCHES, 2021-2023

- 12.9.2 DEALS

- TABLE 241 DEALS, 2021-2023

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats)**

- 13.1.1 AKAMAI TECHNOLOGIES

- TABLE 242 AKAMAI TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 43 AKAMAI TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 243 AKAMAI TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 AKAMAI TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 245 AKAMAI TECHNOLOGIES: DEALS

- 13.1.2 MICROSOFT

- TABLE 246 MICROSOFT: COMPANY OVERVIEW

- FIGURE 44 MICROSOFT: COMPANY SNAPSHOT

- TABLE 247 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 MICROSOFT: PRODUCT LAUNCHES

- TABLE 249 MICROSOFT: DEALS

- TABLE 250 MICROSOFT: OTHERS

- 13.1.3 IBM

- TABLE 251 IBM: COMPANY OVERVIEW

- FIGURE 45 IBM: COMPANY SNAPSHOT

- TABLE 252 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 IBM: DEALS

- 13.1.4 EDGIO

- TABLE 254 EDGIO: COMPANY OVERVIEW

- FIGURE 46 EDGIO: COMPANY SNAPSHOT

- TABLE 255 EDGIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 EDGIO: PRODUCT LAUNCHES

- TABLE 257 EDGIO: DEALS

- TABLE 258 EDGIO: OTHERS

- 13.1.5 GOOGLE

- TABLE 259 GOOGLE: COMPANY OVERVIEW

- FIGURE 47 GOOGLE: COMPANY SNAPSHOT

- TABLE 260 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 GOOGLE: PRODUCT LAUNCHES

- TABLE 262 GOOGLE: DEALS

- 13.1.6 AMAZON WEB SERVICES

- TABLE 263 AMAZON WEB SERVICES: BUSINESS OVERVIEW

- FIGURE 48 AMAZON WEB SERVICES: COMPANY SNAPSHOT

- TABLE 264 AMAZON WEB SERVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 AMAZON WEB SERVICES: PRODUCT LAUNCHES

- TABLE 266 AMAZON WEB SERVICES: DEALS

- TABLE 267 AMAZON WEB SERVICES: OTHERS

- 13.1.7 AT&T

- TABLE 268 AT&T: BUSINESS OVERVIEW

- FIGURE 49 AT&T: COMPANY SNAPSHOT

- TABLE 269 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 AT&T: DEALS

- 13.1.8 CLOUDFLARE

- TABLE 271 CLOUDFLARE: BUSINESS OVERVIEW

- FIGURE 50 CLOUDFLARE: COMPANY SNAPSHOT

- TABLE 272 CLOUDFLARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 CLOUDFLARE: PRODUCT LAUNCHES

- TABLE 274 CLOUDFLARE: DEALS

- 13.1.9 LUMEN TECHNOLOGIES

- TABLE 275 LUMEN TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 51 LUMEN TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 276 LUMEN TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 LUMEN TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 278 LUMEN TECHNOLOGIES: DEALS

- 13.1.10 DEUTSCHE TELEKOM

- 13.1.11 FASTLY

- 13.1.12 CITRIX SYSTEMS

- 13.1.13 NTT COMMUNICATIONS

- 13.1.14 COMCAST

- 13.1.15 RACKSPACE TECHNOLOGY

- 13.1.16 CDNETWORKS

- 13.1.17 TATA COMMUNICATIONS

- 13.1.18 IMPERVA

- 13.1.19 TENCENT CLOUD

- 13.1.20 KINGSOFT CLOUD

- 13.2 STARTUPS/SMES

- 13.2.1 BROADPEAK

- 13.2.2 EVG CORP

- 13.2.3 QUANTIL

- 13.2.4 STACKPATH

- 13.2.5 G-CORE LABS

- 13.2.6 ONAPP LIMITED (VIRTUOZZO)2021

- 13.2.7 BUNNY.NET

- 13.2.8 BAISHAN CLOUD TECHNOLOGY

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.1.1 LIMITATIONS

- 14.2 LTE AND 5G BROADCAST MARKET - GLOBAL FORECAST TO 2026

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.2.1 LTE and 5G broadcast market, by technology

- TABLE 279 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2017-2020 (USD MILLION)

- TABLE 280 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2021-2026 (USD MILLION)

- 14.2.2.2 LTE and 5G broadcast market, by end use

- TABLE 281 LTE AND 5G BROADCAST MARKET, BY END USE, 2017-2020 (USD MILLION)

- TABLE 282 LTE AND 5G BROADCAST MARKET, BY END USE, 2021-2026 (USD MILLION)

- 14.2.2.3 LTE and 5G broadcast market, by region

- TABLE 283 LTE AND 5G BROADCAST MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 284 LTE AND 5G BROADCAST MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 14.3 NETWORK SLICING MARKET - GLOBAL FORECAST 2025

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.2.1 Network slicing market, by component

- TABLE 285 NETWORK SLICING MARKET, BY COMPONENT, 2017-2019 (USD MILLION)

- TABLE 286 NETWORK SLICING MARKET, BY COMPONENT, 2020-2025 (USD MILLION)

- 14.3.2.2 Network slicing market, by service

- TABLE 287 NETWORK SLICING MARKET, BY SERVICE, 2017-2019 (USD MILLION)

- TABLE 288 NETWORK SLICING MARKET, BY SERVICE, 2020-2025 (USD MILLION)

- TABLE 289 NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2017-2019 (USD MILLION)

- TABLE 290 NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2020-2025 (USD MILLION)

- 14.3.2.3 Network slicing market, by end user

- TABLE 291 NETWORK SLICING MARKET, BY END USER, 2017-2019 (USD MILLION)

- TABLE 292 NETWORK SLICING MARKET, BY END USER, 2020-2025 (USD MILLION)

- 14.3.2.3.1 Telecom operators

- TABLE 293 TELECOM OPERATORS: NETWORK SLICING MARKET, BY REGION, 2017-2019 (USD MILLION)

- TABLE 294 TELECOM OPERATORS: NETWORK SLICING MARKET, BY REGION, 2020-2025 (USD MILLION)

- 14.3.2.4 Network slicing market, by region

- TABLE 295 NETWORK SLICING MARKET, BY REGION, 2017-2019 (USD MILLION)

- TABLE 296 NETWORK SLICING MARKET, BY REGION, 2020-2025 (USD MILLION)

- 14.4 COMMERCIAL P2P CDN MARKET - GLOBAL FORECAST 2023

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.4.2.1 Commercial P2P CDN market, by content type

- TABLE 297 COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY CONTENT TYPE, 2016-2023 (USD MILLION)

- 14.4.2.2 Commercial P2P CDN market, by solution

- TABLE 298 COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY SOLUTION, 2016-2023 (USD MILLION)

- 14.4.2.3 Commercial P2P CDN market, by service

- TABLE 299 COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY SERVICE, 2016-2023 (USD MILLION)

- 14.4.2.3.1 Professional services

- TABLE 300 PROFESSIONAL SERVICES: COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY REGION, 2016-2023 (USD MILLION)

- 14.4.2.3.2 Maintenance and support

- TABLE 301 MAINTENANCE AND SUPPORT: COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY REGION, 2016-2023 (USD MILLION)

- 14.4.2.4 Commercial P2P CDN market, by end user

- TABLE 302 COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY END USER, 2016-2023 (USD MILLION)

- 14.4.2.4.1 Consumer

- TABLE 303 CONSUMER: COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY REGION, 2016-2023 (USD MILLION)

- 14.4.2.4.2 Business

- TABLE 304 BUSINESS: COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY REGION, 2016-2023 (USD MILLION)

- 14.4.2.5 Commercial P2P CDN market, by vertical

- TABLE 305 COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY VERTICAL, 2016-2023 (USD MILLION)

- 14.4.2.6 Commercial P2P CDN market, by region

- TABLE 306 COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY REGION, 2016-2023 (USD MILLION)

- TABLE 307 NORTH AMERICA: COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY COMPONENT, 2016-2023 (USD MILLION)

- TABLE 308 EUROPE: COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY COMPONENT, 2016-2023 (USD MILLION)

- TABLE 309 ASIA PACIFIC: COMMERCIAL P2P CONTENT DELIVERY NETWORK MARKET, BY COMPONENT, 2016-2023 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS