|

|

市場調査レポート

商品コード

1369132

極低温装置の世界市場:装置別、冷媒別、最終用途産業別、システムタイプ別、用途別、地域別 - 予測(~2028年)Cryogenic Equipment Market by Equipment (Tanks, Valves, Vaporizers, Pumps), Cryogen (Nitrogen, Argon, Oxygen, LNG, Hydrogen), End-user Industry (Energy & Power, Chemical, Metallurgy, Transportation), System Type, Application & Region - Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 極低温装置の世界市場:装置別、冷媒別、最終用途産業別、システムタイプ別、用途別、地域別 - 予測(~2028年) |

|

出版日: 2023年10月19日

発行: MarketsandMarkets

ページ情報: 英文 297 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の極低温装置市場は、2023年の119億米ドルから2028年までに166億米ドルに成長すると予測されており、予測期間にCAGRで6.9%の成長が予測されています。

この成長は、冶金、石油・ガス、エネルギー・電力産業における産業ガスの利用の増加などの要因によるものです。クリーンで効率的なエネルギー源としての液化天然ガスの人気の高まりが、市場の成長を後押ししています。

| レポート範囲 | |

|---|---|

| 対象期間 | 2018-2028 |

| 基準年 | 2022 |

| 予測期間 | 2023-2028 |

| 単位 | 金額 (USD Million/USD Billion) |

| セグメント | 装置別、冷媒別、最終用途産業別、システムタイプ別、用途別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中近東アフリカ、南米 |

「冶金:最終用途産業別での市場の最大のセグメント」

冶金産業セグメントが予測期間に最大のセグメントになる見込みです。EVに使用される非レアアース誘導モーター用の高強度・高導電率合金や、工業用途に使用される剛性の高い金属、電気エネルギー輸送の効率を高める高導電性カーボンナノチューブなどの新しい複合材料、船舶とオフショア用途向けの新しい腐食防止システムの開発に関連する研究と技術革新も、冶金産業における極低温装置の高い需要を生み出すと予測されます。

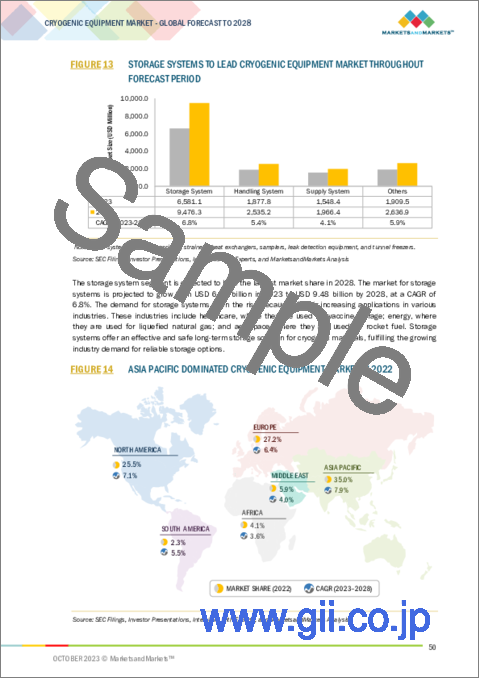

「システムタイプ別では、貯蔵システムセグメントが予測期間に最大のセグメントになる見込みです。」

貯蔵システムセグメントが予測期間に最大の市場シェアを占める見込みです。このセグメントの大きな市場シェアと高い成長率は、拡大する航空宇宙産業と極低温エネルギー貯蔵(CES)システム技術の進歩によってもたらされる有利な成長機会に起因しています。

「用途別では、CASUセグメントが予測期間に最大のセグメントになる見込みです。」

CASU需要の増加は、医療、製造、電子などの産業における高純度の酸素、窒素、アルゴンへの要求の高まりに起因する可能性があります。

「欧州が市場で2番目に大きい地域になると予測されます。」

欧州市場は主に、ドイツの医療産業の近代化とフランスのネットゼロエミッション達成へのコミットメントの影響を受けています。LNG輸出への投資の増加は、輸送産業、特に海運部門における極低温装置への要求を生み出す可能性が高く、この地域の極低温装置プロバイダーに有利な成長機会がもたらされます。

当レポートでは、世界の極低温装置市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 極低温装置市場の企業にとって魅力的な機会

- 極低温装置市場:地域別

- アジア太平洋の極低温装置市場:冷媒別、国別

- 極低温装置市場:装置別

- 極低温装置市場:冷媒別

- 極低温装置市場:最終用途産業別

- 極低温装置市場:用途別

- 極低温装置市場:システムタイプ別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 参考価格分析:装置別

- 平均販売価格の動向:地域別

- サプライチェーン分析

- 極低温装置の原材料サプライヤー

- 極低温装置メーカー

- 産業ガスメーカー

- エンドユーザー

- エコシステム/市場マップ

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント(2023年~2024年)

- 関税と規制情勢

- 規制機関、政府機関、その他の組織

- 極低温装置市場:規制枠組み

- ポーターのファイブフォース分析

- ケーススタディ分析

- 主なステークホルダーと購入基準

第6章 極低温装置市場:装置別

- イントロダクション

- タンク

- バルブ

- 気化器

- パンプス

- その他の装置

第7章 極低温装置市場:冷媒別

- イントロダクション

- 窒素

- アルゴン

- 酸素

- LNG

- 水素

- その他の冷媒

第8章 極低温装置市場:最終用途産業別

- イントロダクション

- 冶金

- エネルギー・電力

- 化学

- 電子

- 輸送

- その他の最終用途産業

第9章 極低温装置市場:システムタイプ別

- イントロダクション

- 貯蔵システム

- ハンドリングシステム

- 供給システム

- その他

第10章 極低温装置市場:用途別

- イントロダクション

- CASU(極低温空気分離装置)

- NON-CASU(非極低温空気分離装置)

第11章 極低温装置市場:地域別

- イントロダクション

- アジア太平洋

- アジア太平洋市場に対する景気後退の影響

- 装置別

- 冷媒別

- 最終用途産業別

- システムタイプ別

- 国別

- 欧州

- 欧州市場に対する景気後退の影響

- 装置別

- 冷媒別

- 最終用途産業別

- システムタイプ別

- 国別

- 北米

- 北米市場に対する景気後退の影響

- 装置別

- 冷媒別

- 最終用途産業別

- システムタイプ別

- 国別

- 中東

- 中東市場に対する景気後退の影響

- 装置別

- 冷媒別

- 最終用途産業別

- システムタイプ別

- 国別

- アフリカ

- アフリカ市場に対する景気後退の影響

- 装置別

- 冷媒別

- 最終用途産業別

- システムタイプ別

- 国別

- 南米

- 南米市場に対する景気後退の影響

- 装置別

- 冷媒別

- 最終用途産業別

- システムタイプ別

- 国別

第12章 競合情勢

- 概要

- 市場シェア分析(2022年)

- 市場の評価枠組み(2018年~2023年)

- 収益分析:部門別(2018年~2022年)

- 競合シナリオと動向

- 企業の評価マトリクス(主要企業)(2022年)

- 企業の評価マトリクス(その他の企業)(2022年)

第13章 企業プロファイル

- 主要企業

- LINDE PLC

- AIR LIQUIDE

- AIR PRODUCTS AND CHEMICALS, INC.

- CHART INDUSTRIES

- PARKER HANNIFIN CORP

- FLOWSERVE CORPORATION

- NIKKISO CO., LTD.

- INOX INDIA LIMITED

- TAYLOR-WHARTON

- EMERSON ELECTRIC CO.

- WESSINGTON CRYOGENICS

- SULZER LTD

- PHPK TECHNOLOGIES

- ACME CRYO.

- SHI CRYOGENICS GROUP

- その他の企業

- FIVES SAS

- CRYOFAB

- HEROSE GMBH

- CRYOSTAR

- SHELL-N-TUBE

第14章 付録

The global cryogenic equipment market is estimated to grow from USD 11.9 Billion in 2023 to USD 16.6 Billion by 2028; it is expected to record a CAGR of 6.9% during the forecast period. The growth is attributed to the factors such as Increasing utilization of industrial gases in metallurgy, oil & gas, and energy & power industries. Growing popularity of liquefied natural gas as source of clean and efficient energy has driven the growth of cryogenic equipment market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | Equipment, Cryogen, End user Industry, System Type, Applcation, Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Metallurgy: The largest segment of the cryogenic equipment market, by emd-user industry "

Based on end-user industyry, the cryogenic equipment market has been split into six types: metallurgy, energy & power, chemical, electronics, transportation, and other end-user industries. The metallurgy segment is expected to be the largest segment during the forecast period. In the metallurgy industry, processes such as metal forming, fabrication, welding, and combustion require industrial gases such as oxygen, nitrogen, argon, and hydrogen. The research and innovations associated with the development of high-strength and high-conductivity alloys for non-rare-earth induction motors used in EVs, metals with high rigidity and stiffness for use in industrial applications, new composites such as highly conducting carbon nanotubes to enhance the efficiency of electrical energy transport, and new corrosion protection systems for marine and offshore applications are also expected to create a high demand for cryogenic equipment in the metallurgy industry.

"Storage system segment is expected to be the largest segment during the forecast period based on system type."

By system type, the cryogenic equipment market has been segmented into storage system, handling system, supply system, and others. The storage system segment is expected to hold the largest market share during the forecast period. The large market share and the high growth rate of this segment can be attributed to the lucrative growth opportunities provided by the expanding aerospace industry and technological advancements in cryogenic energy storage (CES) systems.

"By application, the CASU segment is expected to be the largest segment during the forecast period."

Based on the application, the cryogenic equipment market is segmented into cryogenic air system unit (CASU) and a non-cryogenic air system unit (non-CASU). The CASU segment is expected to be the largest segment of the cryogenic equipment market during the forecast period. Cryogenic ASUs are specialized equipment that use cryogenic refrigeration and distillation techniques to separate air from its individual components. The main products obtained using CASUs are typically oxygen and nitrogen, with small amounts of argon and other trace gases. The rising demand for CASUs can be attributed to higher requirements for high-purity oxygen, nitrogen, and argon in industries such as healthcare, manufacturing, and electronics.

"Europe is expected to be the second-largest region in the cryogenic equipment market."

Europe is expected to be the second-largest region in the cryogenic equipment market during the forecast period. The region has been segmented, by country, into Russia, the UK, Germany, France, and Rest of Europe. The market in Rest of Europe is primarily studied for the Netherlands, Italy, Norway, Sweden, Denmark, and Finland. The European market is mainly influenced by the modernization of Germany's healthcare industry and France's commitment to achieving net-zero emissions. the increasing investments in LNG exports are likely to create requirement for cryogenic equipment in the transportation industry, especially the shipping sector, thereby providing a lucrative growth opportunity for cryogenic equipment providers in the region.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level- 30%, Director Level- 25%, and Others- 45%

By Region: North America- 27%, Europe- 20%, Asia Pacific- 33%, South America- 12%, The Middle East- 4% and Africa- 4%,

Note: Others include sales managers, engineers, and regional managers.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2022. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The cryogenic equipment market is dominated by a few major players that have a wide regional presence. The leading players in the cryogenic equipment market are Linde plc (Ireland); Air Liquide (France); Air Products and Chemicals, Inc. (US); Chart Industries (US); and Parker Hannifin Corp. (US). The major strategy adopted by the players includes contracts & agreements, partnerships, mergers and acquisitions, and investments & expansions.

Research Coverage:

The report defines, describes, and forecasts the global cryogenic equipment market by type, mechanism, application, well type, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the cryogenic equipment market.

Key Benefits of Buying the Report

- Post-COVID-19 recovery and the global energy crisis have significantly boosted clean energy investments, outpacing fossil fuel investments (24% in 2023 vs. 15% in 2021, according to the IEA World Energy Investment 2023 report). The Ukraine conflict's impact on fossil fuel markets has further accelerated investments in cleaner energy sources such as LNG and hydrogen. Consequently, the clean energy transition is reshaping the energy landscape and driving demand for cryogenic equipment.

- Product Development/ Innovation: The cryogenic equipment market is witnessing significant product development and innovation, driven by the growing demand for cryogenic equipment systems in the metallurgy industries. Companies are investing in developing advanced cryogenic equipments.

- Market Development: INOX India Limited built an LNG facility in Tamil Nadu, which comprises 2 x 113 KL LNG tanks, regas system with a capacity of 5,000 SCMH @ 22 Bar pressure and associated equipment was supplied by INOXCVA on a turnkey basis in a record time.

- Market Diversification: Chart Industries collaborated with 8 Rivers Capital, a North Carolina-based clean energy and climate technology company, to grab commercial opportunities for hydrogen technology and solutions. This collaboration includes developing equipment for 8 Rivers technologies backed up by Chart's decades of experience in designing and manufacturing cryogenic, compression, and process technologies, and help 8 Rivers in delivering reliable and cost-effective solutions to its customers. The companies will work together to identify and develop commercial opportunities to integrate Chart offerings into 8 Rivers's projects.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, like include Linde plc (Ireland); Air Liquide (France); Air Products and Chemicals, Inc. (US); Chart Industries (US); and Parker Hannifin Corp. (US), among others in the cryogenic equipment market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 CRYOGENIC EQUIPMENT MARKET SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 CRYOGENIC EQUIPMENT MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- FIGURE 3 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 CRYOGENIC EQUIPMENT MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 CRYOGENIC EQUIPMENT MARKET: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Demand-side metrics

- FIGURE 6 METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR CRYOGENIC EQUIPMENT

- 2.3.3.2 Assumptions for demand-side analysis

- 2.3.4 SUPPLY-SIDE ANALYSIS

- FIGURE 7 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF CRYOGENIC EQUIPMENT

- FIGURE 8 CRYOGENIC EQUIPMENT MARKET: SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Calculations for supply side

- 2.3.4.2 Assumptions for supply-side analysis

- 2.3.5 FORECAST

- 2.3.5.1 Recession impact

3 EXECUTIVE SUMMARY

- TABLE 1 CRYOGENIC EQUIPMENT MARKET SNAPSHOT

- FIGURE 9 TANKS TO DOMINATE CRYOGENIC EQUIPMENT MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 10 NITROGEN TO ACCOUNT FOR LARGEST SHARE OF CRYOGENIC EQUIPMENT MARKET IN 2028

- FIGURE 11 ELECTRONICS INDUSTRY TO HOLD MAJORITY OF MARKET SHARE IN 2028

- FIGURE 12 CASU APPLICATIONS TO HOLD LARGER SHARE OF CRYOGENIC EQUIPMENT MARKET IN 2028

- FIGURE 13 STORAGE SYSTEMS TO LEAD CRYOGENIC EQUIPMENT MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC DOMINATED CRYOGENIC EQUIPMENT MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CRYOGENIC EQUIPMENT MARKET

- FIGURE 15 UTILIZATION OF INDUSTRIAL GASES IN METALLURGY AND ENERGY & POWER INDUSTRIES TO DRIVE MARKET

- 4.2 CRYOGENIC EQUIPMENT MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN CRYOGENIC EQUIPMENT MARKET DURING FORECAST PERIOD

- 4.3 CRYOGENIC EQUIPMENT MARKET IN ASIA PACIFIC, BY CRYOGEN AND COUNTRY

- FIGURE 17 NITROGEN AND CHINA HELD LARGEST SHARE OF ASIA PACIFIC CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN AND COUNTRY, RESPECTIVELY, IN 2022

- 4.4 CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT

- FIGURE 18 TANKS HELD LARGEST SHARE OF GLOBAL CRYOGENIC EQUIPMENT MARKET IN 2022

- 4.5 CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN

- FIGURE 19 NITROGEN SEGMENT CAPTURED MAJORITY OF MARKET SHARE IN 2022

- 4.6 CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY

- FIGURE 20 METALLURGY INDUSTRY ACCOUNTED FOR LARGEST SHARE OF CRYOGENIC EQUIPMENT MARKET IN 2022

- 4.7 CRYOGENIC EQUIPMENT MARKET, BY APPLICATION

- FIGURE 21 CASU APPLICATIONS DOMINATED CRYOGENIC EQUIPMENT MARKET IN 2022

- 4.8 CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE

- FIGURE 22 STORAGE SYSTEMS DOMINATED CRYOGENIC EQUIPMENT MARKET IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 CRYOGENIC EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing utilization of industrial gases in metallurgy, oil & gas, and energy & power industries

- FIGURE 24 GLOBAL OIL DEMAND, 2019-2028

- TABLE 2 GLOBAL OIL DEMAND (OECD VS. NON-OECD), 2021-2028

- 5.2.1.2 Growing popularity of liquefied natural gas as source of clean and efficient energy

- 5.2.1.3 Rapid transition toward clean energy

- FIGURE 25 GLOBAL CLEAN ENERGY INVESTMENTS, 2015-2023

- 5.2.2 RESTRAINTS

- 5.2.2.1 High CAPEX and OPEX costs associated with cryogenic plants

- 5.2.2.2 Volatile raw material and metal prices and significant competition from gray market players

- FIGURE 26 IRON ORE PRICING TREND, 2016-2023

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Launch of new space and satellite missions

- 5.2.3.2 Evolving applications of cryogenic electronics

- 5.2.3.3 Development of hydrogen economy

- 5.2.4 CHALLENGES

- 5.2.4.1 Hazards and greenhouse gas emissions resulting from leakage of cryogenic fluids

- 5.2.4.2 Supply chain disruptions due to Russia-Ukraine war

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING ANALYSIS, BY EQUIPMENT

- TABLE 3 CRYOGENIC EQUIPMENT: INDICATIVE PRICING ANALYSIS, 2022

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 4 CRYOGENIC EQUIPMENT: AVERAGE SELLING PRICE TREND, 2022

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 28 CRYOGENIC EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- 5.5.1 CRYOGENIC EQUIPMENT RAW MATERIAL SUPPLIERS

- 5.5.2 CRYOGENIC EQUIPMENT MANUFACTURERS

- 5.5.3 INDUSTRIAL GAS MANUFACTURERS

- 5.5.4 END USERS

- 5.6 ECOSYSTEM/MARKET MAP

- TABLE 5 ROLE OF PLAYERS IN ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.8 PATENT ANALYSIS

- FIGURE 29 INNOVATIONS AND PATENT REGISTRATIONS PERTAINING TO CRYOGENIC EQUIPMENT, 2018-2022

- 5.8.1 LIST OF MAJOR PATENTS

- 5.9 TRADE ANALYSIS

- 5.9.1 HS CODE 280430

- 5.9.1.1 Nitrogen export scenario

- TABLE 6 EXPORT DATA FOR HS CODE 280430, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 30 NITROGEN EXPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9.1.2 Nitrogen import scenario

- TABLE 7 IMPORT SCENARIO FOR HS CODE 280430, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 31 NITROGEN IMPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9.2 HS CODE 280421

- 5.9.2.1 Argon export scenario

- TABLE 8 EXPORT DATA FOR HS CODE 280421, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 32 ARGON EXPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9.2.2 Argon import scenario

- TABLE 9 IMPORT SCENARIO FOR HS CODE 280421, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 33 ARGON IMPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9.3 HS CODE 280440

- 5.9.3.1 Oxygen export scenario

- TABLE 10 EXPORT DATA FOR HS CODE 280440, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 34 OXYGEN EXPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9.3.2 Oxygen import scenario

- TABLE 11 IMPORT SCENARIO FOR HS CODE 280440, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 35 OXYGEN IMPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9.4 HS CODE 271111

- 5.9.4.1 LNG export scenario

- TABLE 12 EXPORT DATA FOR HS CODE 271111, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 36 LNG EXPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9.4.2 LNG import scenario

- TABLE 13 IMPORT SCENARIO FOR HS CODE 271111, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 37 LNG IMPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9.5 HS CODE 280410

- 5.9.5.1 Hydrogen export scenario

- TABLE 14 EXPORT DATA FOR HS CODE 280410, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 38 HYDROGEN EXPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9.5.2 Hydrogen import scenario

- TABLE 15 IMPORT SCENARIO FOR HS CODE 280410, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 39 HYDROGEN IMPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9.1 HS CODE 280430

- 5.10 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 16 CRYOGENIC EQUIPMENT MARKET: LIST OF CONFERENCES AND EVENTS

- 5.11 TARIFFS AND REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 CRYOGENIC EQUIPMENT MARKET: REGULATORY FRAMEWORK

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 40 CRYOGENIC EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 CRYOGENIC EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT OF SUBSTITUTES

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 PHARMACEUTICAL INGREDIENT MANUFACTURER ADOPTED AFCRYO'S CRYOCUBE PRODUCT TO RECEIVE SECURE SUPPLY OF PHARMACOPOEIA-COMPLIANT LIQUID AND GAS

- 5.14 MAJOR PHARMACEUTICAL COMPANY INTRODUCED COMPREHENSIVE CRYOGENIC SOLUTION TO REVOLUTIONIZE COLD CHAIN MANAGEMENT

- 5.14.1 RESEARCH INSTITUTE DEVELOPED CRYOGENIC SOLUTION FOR SPECIMEN PRESERVATION

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 41 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 42 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- TABLE 22 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

6 CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT

- 6.1 INTRODUCTION

- FIGURE 43 CRYOGENIC EQUIPMENT MARKET SHARE, BY EQUIPMENT, 2022

- TABLE 23 CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018-2022 (USD MILLION)

- TABLE 24 CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- TABLE 25 CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018-2022 (THOUSAND UNITS)

- TABLE 26 CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023-2028 (THOUSAND UNITS)

- 6.2 TANKS

- 6.2.1 INCREASING LNG PRODUCTION TO FUEL DEMAND FOR CRYOGENIC TANKS

- TABLE 27 TANKS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 28 TANKS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 VALVES

- 6.3.1 HIGH DEMAND FOR INDUSTRIAL GASES FROM AEROSPACE AND ELECTRONICS COMPANIES TO DRIVE MARKET

- TABLE 29 VALVES: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 VALVES: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 VAPORIZERS

- 6.4.1 GROWING CONSUMPTION OF INDUSTRIAL GASES ACROSS END-USER INDUSTRIES TO BOOST DEMAND FOR CRYOGENIC VAPORIZERS

- TABLE 31 VAPORIZERS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 VAPORIZERS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

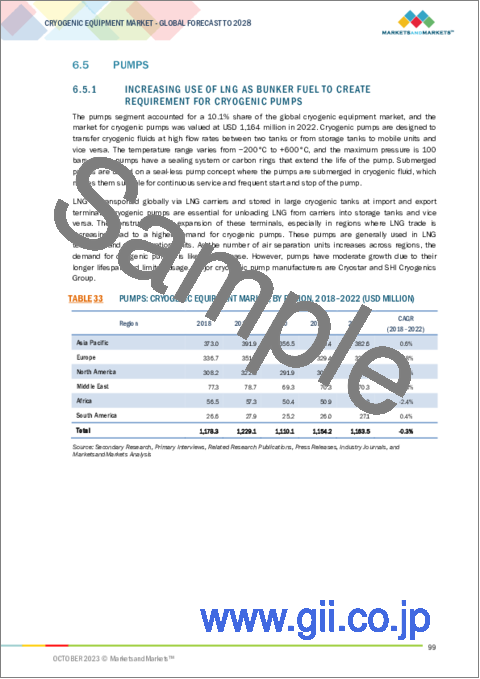

- 6.5 PUMPS

- 6.5.1 INCREASING USE OF LNG AS BUNKER FUEL TO CREATE REQUIREMENT FOR CRYOGENIC PUMPS

- TABLE 33 PUMPS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 PUMPS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.6 OTHER EQUIPMENT

- TABLE 35 OTHER EQUIPMENT: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 OTHER EQUIPMENT: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

7 CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN

- 7.1 INTRODUCTION

- FIGURE 44 CRYOGENIC EQUIPMENT MARKET SHARE, BY CRYOGEN, 2022

- TABLE 37 CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 38 CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 7.2 NITROGEN

- 7.2.1 HIGH ADOPTION OF NITROGEN IN ENERGY & POWER SECTOR TO BOOST DEMAND FOR CRYOGENIC EQUIPMENT

- TABLE 39 NITROGEN: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 NITROGEN: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 ARGON

- 7.3.1 RISING DEMAND FOR ELECTRONICS TO LEAD TO HIGH REQUIREMENT FOR ARGON-HANDLING CRYOGENIC EQUIPMENT

- TABLE 41 ARGON: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 ARGON: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 OXYGEN

- 7.4.1 INCREASING STEEL AND IRON PRODUCTION TO CREATE HIGH DEMAND FOR OXYGEN-RELATED CRYOGENIC EQUIPMENT

- TABLE 43 OXYGEN: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 44 OXYGEN: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 LNG

- 7.5.1 RISING USE OF LNG AS CLEANER ENERGY SOURCE TO ACCELERATE DEMAND FOR CRYOGENIC EQUIPMENT

- TABLE 45 LNG: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 LNG: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 HYDROGEN

- 7.6.1 GROWING IMPLEMENTATION OF HYDROGEN FUEL CELLS IN TRANSPORTATION AND ENERGY APPLICATIONS TO FUEL MARKET GROWTH

- TABLE 47 HYDROGEN: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 HYDROGEN: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.7 OTHER CRYOGENS

- TABLE 49 OTHER CRYOGENS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 OTHER CRYOGENS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

8 CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 45 CRYOGENIC EQUIPMENT MARKET SHARE, BY END-USER INDUSTRY, 2022

- TABLE 51 CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 52 CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 8.2 METALLURGY

- 8.2.1 ADOPTION OF CRYOGENIC EQUIPMENT IN WELDING, FABRICATION, AND COOLING PROCESSES TO BOOST SEGMENTAL GROWTH

- TABLE 53 METALLURGY: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 METALLURGY: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 55 METALLURGY: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 56 METALLURGY: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 8.3 ENERGY & POWER

- 8.3.1 NEED TO IMPROVE EFFICIENCY AND CAPACITY OF POWER TRANSMISSION AND DISTRIBUTION SYSTEMS TO ACCELERATE DEMAND FOR CRYOGENIC EQUIPMENT

- TABLE 57 ENERGY & POWER: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 ENERGY & POWER: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 59 ENERGY & POWER: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 60 ENERGY & POWER: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 8.4 CHEMICAL

- 8.4.1 REQUIREMENT TO STORE VOLATILE AND REACTIVE CHEMICALS FOR EXTENDED PERIOD TO BOOST DEMAND FOR CRYOGENIC EQUIPMENT

- TABLE 61 CHEMICAL: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 62 CHEMICAL: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 63 CHEMICAL: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 64 CHEMICAL: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 8.5 ELECTRONICS

- 8.5.1 DEVELOPMENT OF SUPERCONDUCTING ELECTRONICS TO DRIVE MARKET

- TABLE 65 ELECTRONICS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 ELECTRONICS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 67 ELECTRONICS: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 68 ELECTRONICS: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 8.6 TRANSPORTATION

- 8.6.1 DEVELOPMENT OF FUEL CELL-POWERED ELECTRIC VEHICLES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- TABLE 69 TRANSPORTATION: CRYOGENIC EQUIPMENT MARKET, BY TRANSPORT TYPE, 2018-2022 (USD MILLION)

- TABLE 70 TRANSPORTATION: CRYOGENIC EQUIPMENT MARKET, BY TRANSPORT TYPE, 2023-2028 (USD MILLION)

- TABLE 71 TRANSPORTATION: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 72 TRANSPORTATION: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 73 TRANSPORTATION: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 74 TRANSPORTATION: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 8.7 OTHER END-USER INDUSTRIES

- TABLE 75 OTHER END-USER INDUSTRIES: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 76 OTHER END-USER INDUSTRIES: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 77 OTHER END-USER INDUSTRIES: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 78 OTHER END-USER INDUSTRIES: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

9 CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE

- 9.1 INTRODUCTION

- FIGURE 46 CRYOGENIC EQUIPMENT MARKET SHARE, BY SYSTEM TYPE, 2022

- TABLE 79 CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018-2022 (USD MILLION)

- TABLE 80 CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- 9.2 STORAGE SYSTEM

- 9.2.1 GROWING ADOPTION OF CRYOGENIC ENERGY STORAGE SYSTEMS BY AEROSPACE COMPANIES TO PROVIDE LUCRATIVE OPPORTUNITIES

- TABLE 81 STORAGE SYSTEM: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 82 STORAGE SYSTEM: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 HANDLING SYSTEM

- 9.3.1 INCREASING FOCUS OF MANUFACTURING FIRMS ON EXTENDING LIFESPAN OF TOOLS AND ACHIEVE COST SAVING TO DRIVE SEGMENTAL GROWTH

- TABLE 83 HANDLING SYSTEM: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 84 HANDLING SYSTEM: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 SUPPLY SYSTEM

- 9.4.1 RISING USE OF SUPPLY SYSTEMS IN HEALTHCARE, AEROSPACE, AND INDUSTRIAL APPLICATIONS TO SUPPORT MARKET GROWTH

- TABLE 85 SUPPLY SYSTEM: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 86 SUPPLY SYSTEM: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 OTHERS

- TABLE 87 OTHERS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 88 OTHERS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

10 CRYOGENIC EQUIPMENT MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 47 CRYOGENIC EQUIPMENT MARKET SHARE, BY APPLICATION, 2022

- TABLE 89 CRYOGENIC EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 90 CRYOGENIC EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 91 NON-CASU: CRYOGENIC EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 92 NON-CASU: CRYOGENIC EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2 CASU (CRYOGENIC AIR SEPARATION UNIT)

- 10.2.1 INSTALLATION OF CASU TO SEPARATE AND PRODUCE HIGH-PURITY GASES AT EXTREMELY LOW TEMPERATURES TO DRIVE MARKET

- 10.3 NON-CASU (NON-CRYOGENIC AIR SEPARATION UNIT)

- 10.3.1 UTILIZATION OF NON-CASU IN INDUSTRIAL APPLICATIONS THAT DO NOT REQUIRE HIGH-PURITY GASES TO FUEL MARKET GROWTH

- 10.3.2 RAIL AND ROAD TRANSPORT INDUSTRY

- 10.3.3 LNG BULK CARRIER SHIPS

- 10.3.4 LNG REGASIFICATION AND LIQUEFACTION TERMINALS

- 10.3.5 OTHER MINOR APPLICATIONS

11 CRYOGENIC EQUIPMENT MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 48 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN CRYOGENIC EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 49 CRYOGENIC EQUIPMENT MARKET SHARE, IN TERMS OF VALUE, BY REGION, 2022

- TABLE 93 CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 94 CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 ASIA PACIFIC

- 11.2.1 RECESSION IMPACT ON MARKET IN ASIA PACIFIC

- FIGURE 50 SNAPSHOT: CRYOGENIC EQUIPMENT MARKET IN ASIA PACIFIC

- 11.2.2 BY EQUIPMENT

- TABLE 95 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018-2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- 11.2.3 BY CRYOGEN

- TABLE 97 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 11.2.4 BY END-USER INDUSTRY

- TABLE 99 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.5 BY SYSTEM TYPE

- TABLE 101 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018-2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- 11.2.6 BY COUNTRY

- TABLE 103 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.6.1 China

- 11.2.6.1.1 Growing focus on improving LNG infrastructure to create growth opportunities for providers of cryogenic equipment

- 11.2.6.1.2 By end-user industry

- 11.2.6.1 China

- TABLE 105 CHINA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 106 CHINA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.6.2 India

- 11.2.6.2.1 Increasing investments in space missions to drive market

- 11.2.6.2.2 By equipment

- 11.2.6.2 India

- TABLE 107 INDIA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018-2022 (USD MILLION)

- TABLE 108 INDIA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- 11.2.6.2.3 By cryogen

- TABLE 109 INDIA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 110 INDIA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 11.2.6.2.4 By end-user industry

- TABLE 111 INDIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 112 INDIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.6.2.5 By application

- TABLE 113 INDIA: CRYOGENIC EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 114 INDIA: CRYOGENIC EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 115 INDIA: CRYOGENIC EQUIPMENT MARKET, BY NON-CASU APPLICATION, 2018-2022 (USD MILLION)

- TABLE 116 INDIA: CRYOGENIC EQUIPMENT MARKET, BY NON-CASU APPLICATION, 2023-2028 (USD MILLION)

- 11.2.6.3 Australia

- 11.2.6.3.1 Increasing government investments in energy & power and metallurgy industries to drive market

- 11.2.6.3.2 By end-user industry

- 11.2.6.3 Australia

- TABLE 117 AUSTRALIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 118 AUSTRALIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.6.4 Japan

- 11.2.6.4.1 Increasing investments in LNG projects to fuel market growth

- 11.2.6.4.2 By end-user industry

- 11.2.6.4 Japan

- TABLE 119 JAPAN: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 120 JAPAN: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.6.5 Malaysia

- 11.2.6.5.1 Government focus on energy capacity addition to contribute to market growth

- 11.2.6.5.2 By end-user industry

- 11.2.6.5 Malaysia

- TABLE 121 MALAYSIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 122 MALAYSIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.6.6 Rest of Asia Pacific

- 11.2.6.6.1 By end-user industry

- 11.2.6.6 Rest of Asia Pacific

- TABLE 123 REST OF ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT ON MARKET IN EUROPE

- FIGURE 51 SNAPSHOT: CRYOGENIC EQUIPMENT MARKET IN EUROPE

- 11.3.2 BY EQUIPMENT

- TABLE 125 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018-2022 (USD MILLION)

- TABLE 126 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- 11.3.3 BY CRYOGEN

- TABLE 127 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 128 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 11.3.4 BY END-USER INDUSTRY

- TABLE 129 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 130 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.5 BY SYSTEM TYPE

- TABLE 131 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018-2022 (USD MILLION)

- TABLE 132 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- 11.3.6 BY COUNTRY

- TABLE 133 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 134 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.6.1 Russia

- 11.3.6.1.1 Investments in LNG projects to fuel market growth

- 11.3.6.1.2 By end-user industry

- 11.3.6.1 Russia

- TABLE 135 RUSSIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 136 RUSSIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.6.2 UK

- 11.3.6.2.1 Government's commitment to net zero carbon emissions to foster demand for cryogenic equipment

- 11.3.6.2.2 By end-user industry

- 11.3.6.2 UK

- TABLE 137 UK: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 138 UK: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.6.3 Germany

- 11.3.6.3.1 Booming energy & power and chemical industries to contribute to market growth

- 11.3.6.3.2 By end-user industry

- 11.3.6.3 Germany

- TABLE 139 GERMANY: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 140 GERMANY: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.6.4 France

- 11.3.6.4.1 Industrial decarbonization goals to boost demand for cryogenic equipment

- 11.3.6.4.2 By end-user industry

- 11.3.6.4 France

- TABLE 141 FRANCE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 142 FRANCE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.6.5 Rest of Europe

- 11.3.6.5.1 By end-user industry

- 11.3.6.5 Rest of Europe

- TABLE 143 REST OF EUROPE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 144 REST OF EUROPE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.4 NORTH AMERICA

- 11.4.1 RECESSION IMPACT ON MARKET IN NORTH AMERICA

- 11.4.2 BY EQUIPMENT

- TABLE 145 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018-2022 (USD MILLION)

- TABLE 146 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- 11.4.3 BY CRYOGEN

- TABLE 147 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 148 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 11.4.4 BY END-USER INDUSTRY

- TABLE 149 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 150 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.5 BY SYSTEM TYPE

- TABLE 151 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018-2022 (USD MILLION)

- TABLE 152 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- 11.4.6 BY COUNTRY

- TABLE 153 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 154 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.6.1 US

- 11.4.6.1.1 Strong focus on natural gas generation and exports to support market growth

- 11.4.6.1.2 By end-user industry

- 11.4.6.1 US

- TABLE 155 US: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 156 US: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.6.2 Canada

- 11.4.6.2.1 Construction of LNG export facilities to generate significant demand for cryogenic equipment

- 11.4.6.2.2 By end-user industry

- 11.4.6.2 Canada

- TABLE 157 CANADA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 158 CANADA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.6.3 Mexico

- 11.4.6.3.1 Development of shale reservoirs to create opportunities for market players

- 11.4.6.3.2 By end-user industry

- 11.4.6.3 Mexico

- TABLE 159 MEXICO: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 160 MEXICO: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.5 MIDDLE EAST

- 11.5.1 RECESSION IMPACT ON MARKET IN MIDDLE EAST

- 11.5.2 BY EQUIPMENT

- TABLE 161 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018-2022 (USD MILLION)

- TABLE 162 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- 11.5.3 BY CRYOGEN

- TABLE 163 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 164 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 11.5.4 BY END-USER INDUSTRY

- TABLE 165 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 166 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.5 BY SYSTEM TYPE

- TABLE 167 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018-2022 (USD MILLION)

- TABLE 168 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- 11.5.6 BY COUNTRY

- TABLE 169 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 170 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.6.1 Saudi Arabia

- 11.5.6.1.1 Initiation of LNG projects to accelerate market growth

- 11.5.6.1.2 By end-user industry

- 11.5.6.1 Saudi Arabia

- TABLE 171 SAUDI ARABIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 172 SAUDI ARABIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.6.2 UAE

- 11.5.6.2.1 Booming energy & power sector to contribute to market growth

- 11.5.6.2.2 By end-user industry

- 11.5.6.2 UAE

- TABLE 173 UAE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 174 UAE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.6.3 QATAR

- 11.5.6.3.1 Increasing construction activities to boost demand for cryogenic equipment

- 11.5.6.3.2 By end-user industry

- 11.5.6.3 QATAR

- TABLE 175 QATAR: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 176 QATAR: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.6.4 Rest of Middle East

- 11.5.6.4.1 By end-user industry

- 11.5.6.4 Rest of Middle East

- TABLE 177 REST OF MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.6 AFRICA

- 11.6.1 RECESSION IMPACT ON MARKET IN AFRICA

- 11.6.2 BY EQUIPMENT

- TABLE 179 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018-2022 (USD MILLION)

- TABLE 180 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- 11.6.3 BY CRYOGEN

- TABLE 181 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 182 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 11.6.4 BY END-USER INDUSTRY

- TABLE 183 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 184 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.5 BY SYSTEM TYPE

- TABLE 185 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018-2022 (USD MILLION)

- TABLE 186 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- 11.6.6 BY COUNTRY

- TABLE 187 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 188 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.6.6.1 South Africa

- 11.6.6.1.1 Shipbuilding, electronics, and chemical industries to contribute to market growth

- 11.6.6.1.2 By end-user industry

- 11.6.6.1 South Africa

- TABLE 189 SOUTH AFRICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 190 SOUTH AFRICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.6.2 Nigeria

- 11.6.6.2.1 Increasing demand for LNG and nitrogen from oil & gas and shipping industries to fuel market growth

- 11.6.6.2.2 By end-user industry

- 11.6.6.2 Nigeria

- TABLE 191 NIGERIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 192 NIGERIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.6.3 Algeria

- 11.6.6.3.1 Upcoming offshore projects to drive demand for cryogenic equipment

- 11.6.6.3.2 By end-user industry

- 11.6.6.3 Algeria

- TABLE 193 ALGERIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 194 ALGERIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.6.4 Rest of Africa

- 11.6.6.4.1 By end-user industry

- 11.6.6.4 Rest of Africa

- TABLE 195 REST OF AFRICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 196 REST OF AFRICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.7 SOUTH AMERICA

- 11.7.1 RECESSION IMPACT ON MARKET IN SOUTH AMERICA

- 11.7.2 BY EQUIPMENT

- TABLE 197 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018-2022 (USD MILLION)

- TABLE 198 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- 11.7.3 BY CRYOGEN

- TABLE 199 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018-2022 (USD MILLION)

- TABLE 200 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023-2028 (USD MILLION)

- 11.7.4 BY END-USER INDUSTRY

- TABLE 201 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 202 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.7.5 BY SYSTEM TYPE

- TABLE 203 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018-2022 (USD MILLION)

- TABLE 204 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- 11.7.6 BY COUNTRY

- TABLE 205 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 206 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.7.6.1 Brazil

- 11.7.6.1.1 Energy transition and oil production from offshore sources to drive market

- 11.7.6.1.2 By end-user industry

- 11.7.6.1 Brazil

- TABLE 207 BRAZIL: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 208 BRAZIL: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.7.6.2 Argentina

- 11.7.6.2.1 Reviving oil & gas sector to bring opportunities for cryogenic equipment providers

- 11.7.6.2.2 By end-user industry

- 11.7.6.2 Argentina

- TABLE 209 ARGENTINA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 210 ARGENTINA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.7.6.3 Venezuela

- 11.7.6.3.1 Stabilization in oil prices and development of offshore reserves to drive market

- 11.7.6.3.2 By end-user industry

- 11.7.6.3 Venezuela

- TABLE 211 VENEZUELA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 212 VENEZUELA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.7.6.4 Rest of South America

- 11.7.6.4.1 By end-user industry

- 11.7.6.4 Rest of South America

- TABLE 213 REST OF SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- TABLE 215 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.2 MARKET SHARE ANALYSIS, 2022

- TABLE 216 CRYOGENIC EQUIPMENT MARKET: DEGREE OF COMPETITION

- FIGURE 52 MARKET SHARE ANALYSIS, 2022

- 12.3 MARKET EVALUATION FRAMEWORK, 2018-2023

- TABLE 217 MARKET EVALUATION FRAMEWORK, 2018-2022

- 12.4 SEGMENTAL REVENUE ANALYSIS, 2018-2022

- FIGURE 53 SEGMENTAL REVENUE ANALYSIS, 2018-2022

- 12.5 COMPETITIVE SCENARIOS AND TRENDS

- 12.5.1 DEALS

- TABLE 218 CRYOGENIC EQUIPMENT MARKET: DEALS, 2018-2023

- 12.5.2 OTHERS

- TABLE 219 CRYOGENIC EQUIPMENT MARKET: OTHERS, 2018-2023

- 12.6 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 54 CRYOGENIC EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022

- 12.6.5 COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 220 EQUIPMENT: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 221 CRYOGEN: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 222 END-USER INDUSTRY: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 223 SYSTEM TYPE: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 224 REGION: COMPANY FOOTPRINT (KEY PLAYERS)

- 12.7 COMPANY EVALUATION MATRIX (OTHER PLAYERS), 2022

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- FIGURE 55 CRYOGENIC EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (OTHER PLAYERS), 2022

- 12.7.5 COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 225 EQUIPMENT: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 226 CRYOGEN: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 227 END-USER INDUSTRY: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 228 SYSTEM TYPE: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 229 REGION: COMPANY FOOTPRINT (OTHER PLAYERS)

13 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 13.1 KEY PLAYERS

- 13.1.1 LINDE PLC

- TABLE 230 LINDE PLC: COMPANY OVERVIEW

- FIGURE 56 LINDE PLC: COMPANY SNAPSHOT

- TABLE 231 LINDE PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 232 LINDE PLC: DEALS

- TABLE 233 LINDE PLC: OTHERS

- 13.1.2 AIR LIQUIDE

- TABLE 234 AIR LIQUIDE: COMPANY OVERVIEW

- FIGURE 57 AIR LIQUIDE: COMPANY SNAPSHOT

- TABLE 235 AIR LIQUIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 AIR LIQUIDE: DEALS

- TABLE 237 AIR LIQUIDE: OTHERS

- 13.1.3 AIR PRODUCTS AND CHEMICALS, INC.

- TABLE 238 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- FIGURE 58 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- TABLE 239 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 AIR PRODUCTS AND CHEMICALS, INC.: DEALS

- TABLE 241 AIR PRODUCTS AND CHEMICALS, INC.: OTHERS

- 13.1.4 CHART INDUSTRIES

- TABLE 242 CHART INDUSTRIES: COMPANY OVERVIEW

- FIGURE 59 CHART INDUSTRIES: COMPANY SNAPSHOT

- TABLE 243 CHART INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 CHART INDUSTRIES: DEALS

- TABLE 245 CHART INDUSTRIES: OTHERS

- 13.1.5 PARKER HANNIFIN CORP

- TABLE 246 PARKER HANNIFIN CORP.: COMPANY OVERVIEW

- FIGURE 60 PARKER HANNIFIN CORP.: COMPANY SNAPSHOT

- TABLE 247 PARKER HANNIFIN CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.6 FLOWSERVE CORPORATION

- TABLE 248 FLOWSERVE CORPORATION: COMPANY OVERVIEW

- FIGURE 61 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

- TABLE 249 FLOWSERVE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.7 NIKKISO CO., LTD.

- TABLE 250 NIKKISO CO., LTD.: COMPANY OVERVIEW

- FIGURE 62 NIKKISO CO., LTD.: COMPANY SNAPSHOT

- TABLE 251 NIKKISO CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.8 INOX INDIA LIMITED

- TABLE 252 INOX INDIA LIMITED: COMPANY OVERVIEW

- TABLE 253 INOX INDIA LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 254 INOX INDIA LIMITED: DEALS

- TABLE 255 INOX INDIA LIMITED: OTHERS

- 13.1.9 TAYLOR-WHARTON

- TABLE 256 TAYLOR-WHARTON: COMPANY OVERVIEW

- TABLE 257 TAYLOR-WHARTON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 TAYLOR-WHARTON: DEALS

- 13.1.10 EMERSON ELECTRIC CO.

- TABLE 259 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- FIGURE 63 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 260 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 EMERSON ELECTRIC CO.: DEALS

- 13.1.11 WESSINGTON CRYOGENICS

- TABLE 262 WESSINGTON CRYOGENICS: COMPANY OVERVIEW

- TABLE 263 WESSINGTON CRYOGENICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.12 SULZER LTD

- TABLE 264 SULZER LTD: COMPANY OVERVIEW

- FIGURE 64 SULZER LTD: COMPANY SNAPSHOT

- TABLE 265 SULZER LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.13 PHPK TECHNOLOGIES

- TABLE 266 PHPK TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 267 PHPK TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.14 ACME CRYO.

- TABLE 268 ACME CRYO.: COMPANY OVERVIEW

- TABLE 269 ACME CRYO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 ACME CRYO.: DEALS

- 13.1.15 SHI CRYOGENICS GROUP

- TABLE 271 SHI CRYOGENICS GROUP: COMPANY OVERVIEW

- TABLE 272 SHI CRYOGENICS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 SHI CRYOGENICS GROUP: DEALS

- 13.2 OTHER PLAYERS

- 13.2.1 FIVES SAS

- 13.2.2 CRYOFAB

- 13.2.3 HEROSE GMBH

- 13.2.4 CRYOSTAR

- 13.2.5 SHELL-N-TUBE

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS