|

|

市場調査レポート

商品コード

1829986

シリコーンの世界市場:タイプ別、最終用途産業別、地域別 - 2030年までの予測Silicone Market by Type (Elastomer, Fluid, Resin, Gel, & Other), End-use Industry (Industrial Process, Building & Construction, Transportation, Personal Care & Consumer, Electronic, Medical & Healthcare, Energy), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| シリコーンの世界市場:タイプ別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月25日

発行: MarketsandMarkets

ページ情報: 英文 333 Pages

納期: 即納可能

|

概要

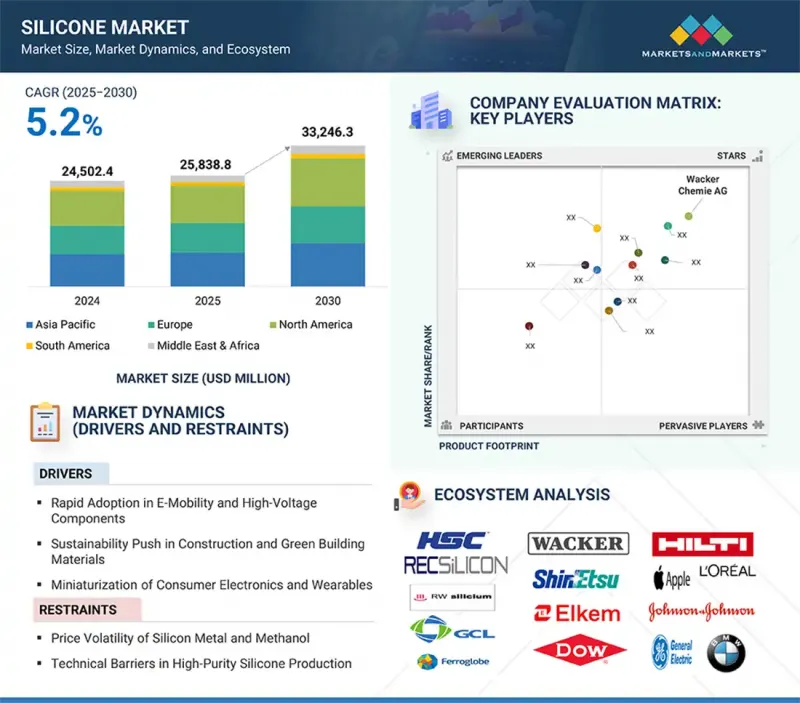

シリコーンの市場規模は2024年に245億240万米ドルとなりました。

同市場は、2030年には332億4,630万米ドルに達すると予測され、予測期間中のCAGRは5.2%と見込まれています。シリコーンの需要は、その柔軟性、強度、様々な産業での用途により増加しています。シリコーンは、増加する都市化やインフラに耐えるため、シーリング材や接着剤、コーティング剤など、建築分野での使用が増加しています。自動車産業では、電気自動車製造用の軽量部品、ガスケット、絶縁体にシリコーンが使用されています。化粧品やパーソナルケアでは、シリコーンは製品にソフトでべたつかないテクスチャーと滑らかな感触を与えることができ、これが消費者の人気の一因となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)、数量(1,000トン) |

| セグメント | タイプ別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、南米 |

シリコーンは、エレクトロニクスやヘルスケア産業における熱管理、断熱、医療用途に使用されています。シリコーンは耐久性に優れ、劣化しにくく、メンテナンスの必要がないため、持続可能性の動向も関係しています。一般的に、急速な工業化、急速な技術開発、高性能で信頼性の高い材料を求めるエンドユーザーの要求が、潜在的な成長促進要因となっています。

シリコーン市場の流体分野は、さまざまな産業で採用されていることから、第2位のシェアを占めると予想されます。シリコーンオイル、例えばポリジメチルシロキサン(PDMS)オイルは、表面張力が低く、潤滑性に優れ、熱安定性が高いことから珍重されています。シリコーンオイルは、スキンクリーム、デオドラント、ヘアケアなどのパーソナルケアや化粧品産業において、のび、感触、滑らかさを向上させるために一般的に使用されています。シリコーンオイルは、工業分野では離型剤や油圧作動油の潤滑剤として、また、使用する機械の効率や製品の品質を確保するための消泡剤として使用されています。シリコーンオイルは、エレクトロニクス産業においても、特に高性能部品の冷却や絶縁エアギャップとして使用されています。また、チューブ、コーティング剤、ドラッグデリバリーシステムにおける液剤ベースの処方など、医療グレードのシリコーンの需要も増加しており、これも市場を牽引しています。シリコーンオイルは極端な暑さでも性能を発揮し、ほとんどの化学物質の影響を受けないため、安定性と寿命の長さも魅力となっています。全体として、流体セグメントは、その汎用性、機能効率、および業界全体のアプリケーションにより、予測期間中に世界のシリコーン市場の主要な貢献者の一つです。

最終用途産業別では、工業プロセス分野が予測期間中、シリコーン市場で2番目に大きなシェアを占めると予想されます。これは、この材料の幅広い用途と、工業プロセスでの使用による運用上の利点によるものです。シリコーンは優れた熱安定性、耐薬品性、製造工程における優れた潤滑特性を持っています。自動車産業や航空宇宙産業では、シーラント、コーティング、流体として使用され、機械の性能を最適化し、部品の寿命を延ばします。電子・電気分野では、シリコーンは絶縁体や熱界面化合物として使用され、高熱やストレス環境での信頼性を保証する保護コーティングを提供します。また、建設・建築業界では、インフラの耐久性に関連する建設工程で、シリコーンを使ってシーリング材、接着剤、消泡剤を製造しています。さらに、産業界では現在、環境の持続可能性と業務効率に重点を置いているため、業務の最適化、メンテナンス業務、製品の生産性の面でシリコーンの統合が進んでいます。工業プロセス分野は、様々なプロセス環境に対応できる汎用性と、プロセスにとって性能が重要な主要用途における規制認可により、予測期間中シリコーンの成長を支えると予想されます。

アジア太平洋は、工業化、都市化、様々な産業における消費者の需要が急速に増加しており、予測期間中、シリコーン業界で最大のシェアを占めると予想されます。中国、日本、韓国、インドなどの国々が主な貢献国であり、自動車、エレクトロニクス、パーソナルケア、建設事業などの成長も拡大しています。自動車産業では、電気自動車や軽量部品の採用動向から、シリコーンシーラント、ガスケット、流体の使用が増加しています。シリコーンはまた、エレクトロニクス産業において、熱に敏感なハードウェアの熱管理、繊細なエレクトロニクスの絶縁と保護に広く使用されています。パーソナルケアと化粧品では、可処分所得の増加と顧客動向の変化により、ヘアケア製品やスキンケア製品など、シリコーンベースの処方の使用が促進されています。また、シリコーンシーラント、接着剤、コーティング剤は、同地域の建設に伴う政府のインフラプロジェクトやイニシアチブの支援を受けています。シリコーンはまた、原料の入手可能性、コストの優位性、この地域の主要なカスタムシリコーン製造会社に基づいて、この地域での優位性を立証しています。したがって、堅調な産業成長、技術利用、幅広い最終用途により、アジア太平洋は予測期間中、最大かつ最も急成長しているシリコーン市場になると予想されます。

当レポートでは、世界のシリコーン市場について調査し、タイプ別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界動向

- 顧客のビジネスに影響を与える動向/ディスラプション

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 生成AIがシリコーン市場に与える影響

- 特許分析

- 貿易分析

- 主要な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- マクロ経済分析

- 投資と資金調達のシナリオ

- 2025年の米国関税がシリコーン市場に与える影響

- 価格影響分析

第7章 シリコーン市場(タイプ別)

- イントロダクション

- エラストマー

- 流体

- 樹脂

- ジェルおよびその他の製品

第8章 シリコーン市場(最終用途産業別)

- イントロダクション

- 工業プロセス

- 建築・建設

- 輸送

- パーソナルケアおよび消費財

- エレクトロニクス

- 医療・ヘルスケア

- エネルギー

- その他

第9章 シリコーン市場(地域別)

- イントロダクション

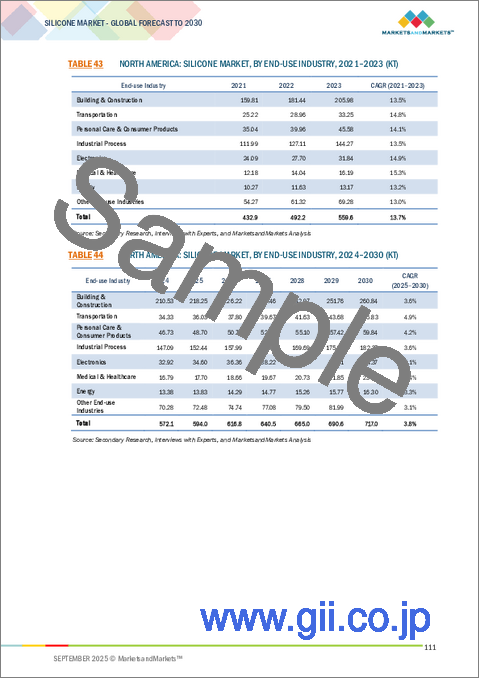

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- トルコ

- ロシア

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- WACKER CHEMIE AG

- SHIN-ETSU CHEMICAL CO., LTD.

- ELKEM ASA

- DOW

- MOMENTIVE PERFORMANCE MATERIALS, INC.

- EVONIK INDUSTRIES AG

- GELEST INC.

- INNOSPEC INC.

- SPECIALTY SILICONE PRODUCTS, INC.

- HOSHINE SILICON INDUSTRY CO., LTD.

- その他の企業

- ZHEJIANG XIN'AN CHEMICAL INDUSTRY GROUP CO., LTD.

- REISS MANUFACTURING, INC.

- SILTECH CORPORATION

- KANEKA CORPORATION

- CHT GROUP

- GENESEE POLYMERS CORPORATION

- SILICONE SOLUTIONS, INC.

- SILICONE ENGINEERING LTD

- ZHEJIANG SUCON SILICONE CO., LTD.

- SILTEQ LTD

- KONARK SILICONE TECHNOLOGIES

- SUPREME SILICONES INDIA PVT. LTD.

- SHENZHEN SQUARE SILICONE CO., LTD.

- GUANGZHOU OTT NEW MATERIALS CO., LTD.

- CSL SILICONES INC.