|

|

市場調査レポート

商品コード

1686698

エネルギーハーベスティングシステムの世界市場 (~2030年):光エネルギーハーベスティング・振動エネルギーハーベスティング・RFエネルギーハーベスティング・熱エネルギーハーベスティング・変換器・電力管理集積回路・ビル&ホームオートメーションEnergy Harvesting System Market by Light Energy Harvesting, Vibration Energy Harvesting, RF Energy Harvesting, Thermal Energy Harvesting, Transducers, Power Management Integrated Circuits, Building & Home Automation - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| エネルギーハーベスティングシステムの世界市場 (~2030年):光エネルギーハーベスティング・振動エネルギーハーベスティング・RFエネルギーハーベスティング・熱エネルギーハーベスティング・変換器・電力管理集積回路・ビル&ホームオートメーション |

|

出版日: 2025年03月05日

発行: MarketsandMarkets

ページ情報: 英文 287 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

エネルギーハーベスティングシステムの市場規模は、予測期間中にCAGR 9.1%で推移し、2025年の6億1,000万米ドルから、2030年には9億4,000万米ドルに成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | 技術・コンポーネント・用途・最終用途システム・エネルギー源・電力容量・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

市場成長の主な促進要因は、ウェアラブルエレクトロニクスへのセンサーの採用、ビル&ホームオートメーション、CE製品、工業、輸送、セキュリティ、農業&スマート農業など多様な用途におけるスマートシティやインフラプロジェクトの拡大です。

予測期間中、PMIC (電力管理集積回路) の部門がもっとも高いCAGRで成長する見込み:

PMIC部門は、自己給電デバイスにおける効率的なエネルギー変換、貯蔵、配電に対する需要の高まりにより、予測期間中に最大のCAGRで成長すると予想されています。PMICは、電圧を効率的に調整し、エネルギー損失を低減することでエネルギーハーベスティング電源からの電力伝送を最大化し、回収されたエネルギーの最大利用を保証する上で極めて重要です。PMICはまた、充電サイクルを効率的に管理し、過充電やエネルギーの浪費を防ぐことで、キャパシタや充電式電池などのエネルギー貯蔵デバイスの性能を向上させ、エネルギー貯蔵管理を改善します。さらにPMICは、自己給電デバイスのさまざまなコンポーネントにスムーズで安定した電力を供給することで、高い信頼性を備えた配電を実現し、システム全体の効率を高め、デバイスの寿命を延ばします。さらに、超低消費電力設計や適応型電力管理方式など、PMIC技術が進んでいることも、市場のさらなる成長を促進しています。

予測期間中、光エネルギーハーベスティングの部門が最大の規模を維持する見込み:

光エネルギーハーベスティング部門は、その幅広い適用性、高いエネルギー変換効率、光起電力技術の一貫した進歩により、予測期間を通じて最大の市場規模を獲得すると予想されています。光エネルギーハーベスティングは、CE製品、産業オートメーション、スマートビルディング、輸送を含む様々な産業で広く利用されており、もっとも汎用的で拡張性のあるエネルギーハーベスティング技術となっています。さらに、特に太陽電池や光起電力技術による高いエネルギー変換率は、IoT機器から遠隔監視システムまで、幅広い用途に安定した電力供給を提供します。また、軟質透明太陽電池などの光電池材料の進歩は、光エネルギーハーベスティングの効率、寿命、統合価値を向上させ、さらなる普及につながっています。さらに、太陽光発電センサー、ウェアラブル、IoTデバイスの使用の増加も、光エネルギーハーベスティングソリューションの需要を促進しており、デバイスの寿命延長を可能にし、従来のバッテリーへの依存を減らしています。政府のインセンティブ、再生可能エネルギー導入を促進する政策、太陽エネルギーインフラへの投資の増加も、さらに市場成長に貢献しています。

北米は予測期間中に2番目に高いCAGRを記録する見込み:

北米は、技術革新に力を入れており、スマートで持続可能なエネルギーソリューションの採用が増加しており、研究開発への投資が活発であるため、予測期間中に2番目に高いCAGRを示すと予測されています。同地域は、大手技術企業と洗練された半導体製造の拠点であり、エネルギーハーベスティング技術の継続的な進歩を後押しし、さらなるコスト削減と効率化を実現しています。加えて、IoTデバイス、スマートホーム、産業オートメーション、ヘルスケアにおけるエネルギーハーベスティングシステムの導入拡大が市場の成長を促進しています。エネルギー効率の高い自立型ソリューションは、持続可能性プログラムや政府の政策によっても後押しされています。さらに、民間および公的機関からの多額の投資が技術革新を促進し、システム性能の向上、応用範囲の拡大、業界を超えた商品化が進んでいます。これらの複合的要因により、北米はエネルギーハーベスティングシステムのもっとも急成長している市場の一つとして最前線に立ち、自立型エネルギーソリューションの開発を推進し、エネルギー効率と持続可能性に向けた世界のシフトの中でその地位を固めています。

当レポートでは、世界のエネルギーハーベスティングシステムの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客の事業に影響を与える動向/ディスラプション

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 規制状況

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- AI/生成AIがエネルギーハーベスティングシステム市場に与える影響

第6章 エネルギーハーベスティングシステム市場:用途別

- ビルディング&ホームオートメーション

- CE製品

- 工業

- 輸送

- その他

第7章 エネルギーハーベスティングシステム市場:コンポーネント別

- 変換器

- 太陽光発電

- 電磁力学、圧電、電磁力学

- 熱電

- 無線周波数変換器

- PMIC

- ストレージデバイス

- バッテリー

- コンデンサー

- その他

第8章 エネルギーハーベスティングシステム市場:最終用途システム別

- ワイヤレススイッチングシステム

- ワイヤレスHVACシステム

- ワイヤレスセンシング&テレマティクスシステム

- タイヤ空気圧監視システム

- 資産追跡システム

- 遠隔健康モニタリングシステム

- 再生エネルギー収集システム

第9章 エネルギーハーベスティングシステム市場:エネルギー源別

- 振動&キネティックエネルギー

- 熱エネルギー

- 産業廃熱

- 自動車排気ガス

- 地熱資源

- 住宅/商業廃熱

- 太陽エネルギー

- 屋内照明

- 屋外照明

- 建物一体型太陽光発電

- RFエネルギー

- 周囲RF

- 専用RFトランスミッション

- 移動通信周波数

- その他

第10章 エネルギーハーベスティングシステム市場:技術別

- 光エネルギーハーベスティング

- 振動エネルギーハーベスティング

- RFエネルギーハーベスティング

- 熱エネルギーハーベスティング

- 低温

- 中温

- 高温

第11章 エネルギーハーベスティングシステム市場:電力容量別

- 低電力 (1MW未満)

- 中出力 (1~100MW)

- 高出力 (100MW超)

第12章 エネルギーハーベスティングシステム市場:地域別

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域:マクロ経済見通し

- 中東

- アフリカ

- 南米

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業価値と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合状況・動向

第14章 企業プロファイル

- 主要企業

- STMICROELECTRONICS

- MICROCHIP TECHNOLOGY INC.

- INFINEON TECHNOLOGIES AG

- ANALOG DEVICES, INC.

- TEXAS INSTRUMENTS INCORPORATED

- ABB

- RENESAS ELECTRONICS CORPORATION

- ENOCEAN GMBH

- HONEYWELL INTERNATIONAL INC.

- QORVO, INC.

- その他の企業

- E-PEAS

- KISTLER GROUP

- MIDE TECHNOLOGY CORP.

- PHYSIK INSTRUMENTE (PI) SE & CO. KG

- TRAMETO LIMITED

- CTS CORPORATION

- NEXPERIA

- CERAMTEC GMBH

- BIONIC POWER INC.

- KINERGIZER

- POWERCAST

- MICROPELT

- ADVANCED LINEAR DEVICES, INC.

- APC INTERNATIONAL, LTD.

- VOLTREE POWER, INC.

第15章 付録

List of Tables

- TABLE 1 ENERGY HARVESTING SYSTEMS MARKET: RISK ASSESSMENT

- TABLE 2 AVERAGE SELLING PRICE OF PMICS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE OF TRANSDUCERS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND OF PMICS, BY REGION, 2021-2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF TRANSDUCERS, BY REGION, 2021-2024 (USD)

- TABLE 6 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 ENERGY HARVESTING SYSTEMS MARKET: MAJOR PATENTS, 2023-2024

- TABLE 8 IMPORT DATA FOR HS CODE 854140-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 854140-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 IMPACT OF PORTER'S FIVE FORCES: ENERGY HARVESTING SYSTEMS MARKET

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 18 ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 19 ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 20 BUILDING & HOME AUTOMATION: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 21 BUILDING & HOME AUTOMATION: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 22 BUILDING & HOME AUTOMATION: ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 23 BUILDING & HOME AUTOMATION: ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 CONSUMER ELECTRONICS: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 25 CONSUMER ELECTRONICS: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 26 CONSUMER ELECTRONICS: ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

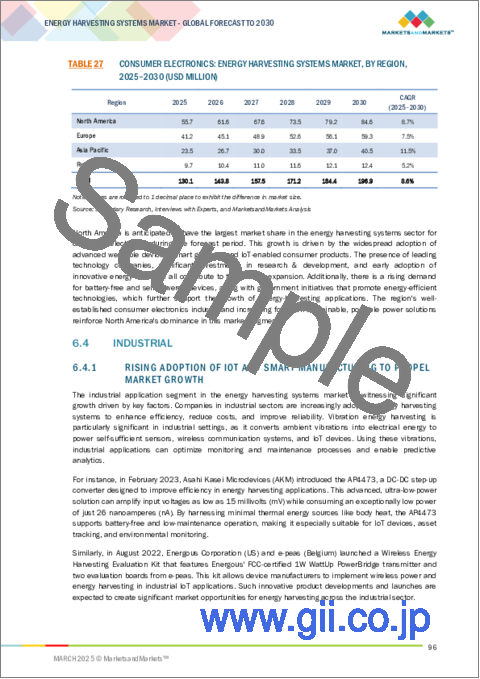

- TABLE 27 CONSUMER ELECTRONICS: ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 INDUSTRIAL: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 29 INDUSTRIAL: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 30 INDUSTRIAL: ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 INDUSTRIAL: ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 TRANSPORTATION: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 33 TRANSPORTATION: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 34 TRANSPORTATION: ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 TRANSPORTATION: ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 OTHER APPLICATIONS: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 37 OTHER APPLICATIONS: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 38 OTHER APPLICATIONS: ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 OTHER APPLICATIONS: ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 41 ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 42 ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT, 2021-2024 (MILLION UNITS)

- TABLE 43 ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (MILLION UNITS)

- TABLE 44 TRANSDUCERS: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 45 TRANSDUCERS: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 46 PMIC: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 47 PMIC: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 48 STORAGE DEVICES: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 49 STORAGE DEVICES: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 50 STORAGE DEVICES: ENERGY HARVESTING SYSTEMS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 51 STORAGE DEVICES: ENERGY HARVESTING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 52 ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 53 ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 54 LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 55 LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 56 BUILDING & HOME AUTOMATION: LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 BUILDING & HOME AUTOMATION: LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 CONSUMER ELECTRONICS: LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 CONSUMER ELECTRONICS: LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 INDUSTRIAL: LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 INDUSTRIAL: LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 TRANSPORTATION: LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 TRANSPORTATION: LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 OTHER APPLICATIONS: LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 OTHER APPLICATIONS: LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 67 LIGHT ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 68 VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 69 VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 70 BUILDING & HOME AUTOMATION: VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 BUILDING & HOME AUTOMATION: VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 CONSUMER ELECTRONICS: VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 CONSUMER ELECTRONICS: VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 INDUSTRIAL: VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 INDUSTRIAL: VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 TRANSPORTATION: VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 TRANSPORTATION: VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 OTHER APPLICATIONS: VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 OTHER APPLICATIONS: VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 81 VIBRATION ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 82 RF ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 83 RF ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 84 BUILDING & HOME AUTOMATION: RF ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 85 BUILDING & HOME AUTOMATION: RF ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 86 CONSUMER ELECTRONICS: RF ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 87 CONSUMER ELECTRONICS: RF ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 88 INDUSTRIAL: RF ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 89 INDUSTRIAL: RF ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 90 TRANSPORTATION: RF ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 91 TRANSPORTATION: RF ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 92 OTHER APPLICATIONS: RF ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 93 OTHER APPLICATIONS: RF ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 94 RF ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 95 RF ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 96 THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 97 THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY TEMPERATURE RANGE, 2021-2024 (USD MILLION)

- TABLE 99 THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY TEMPERATURE RANGE, 2025-2030 (USD MILLION)

- TABLE 100 BUILDING & HOME AUTOMATION: THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 101 BUILDING & HOME AUTOMATION: THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 102 CONSUMER ELECTRONICS: THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 103 CONSUMER ELECTRONICS: THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 104 INDUSTRIAL: THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 105 INDUSTRIAL: THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 106 TRANSPORTATION: THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 107 TRANSPORTATION: THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 108 OTHER APPLICATIONS: THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 109 OTHER APPLICATIONS: THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 110 THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 111 THERMAL ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 112 ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: ENERGY HARVESTING SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: ENERGY HARVESTING SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 117 NORTH AMERICA: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 119 NORTH AMERICA: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 120 US: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 121 US: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 CANADA: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 123 CANADA: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 124 MEXICO: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 MEXICO: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 EUROPE: ENERGY HARVESTING SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 EUROPE: ENERGY HARVESTING SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 129 EUROPE: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 131 EUROPE: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 132 UK: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 UK: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 GERMANY: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 GERMANY: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 FRANCE: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 FRANCE: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 ITALY: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 ITALY: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 REST OF EUROPE: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 141 REST OF EUROPE: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: ENERGY HARVESTING SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 143 ASIA PACIFIC: ENERGY HARVESTING SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 145 ASIA PACIFIC: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 148 CHINA: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 149 CHINA: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 150 JAPAN: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 151 JAPAN: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 152 SOUTH KOREA: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 153 SOUTH KOREA: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 154 INDIA: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 155 INDIA: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 158 ROW: ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 159 ROW: ENERGY HARVESTING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: ENERGY HARVESTING SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: ENERGY HARVESTING SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 162 ROW: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 163 ROW: ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 164 ROW: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 165 ROW: ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 166 ENERGY HARVESTING SYSTEMS MARKET: KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 167 ENERGY HARVESTING SYSTEMS MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- TABLE 168 ENERGY HARVESTING SYSTEMS MARKET: REGION FOOTPRINT

- TABLE 169 ENERGY HARVESTING SYSTEMS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 170 ENERGY HARVESTING SYSTEMS MARKET: COMPONENT FOOTPRINT

- TABLE 171 ENERGY HARVESTING SYSTEMS MARKET: END-USE SYSTEM FOOTPRINT

- TABLE 172 ENERGY HARVESTING SYSTEMS MARKET: APPLICATION FOOTPRINT

- TABLE 173 ENERGY HARVESTING SYSTEMS MARKET: KEY STARTUPS/SMES

- TABLE 174 ENERGY HARVESTING SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 175 ENERGY HARVESTING SYSTEMS MARKET: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2024

- TABLE 176 ENERGY HARVESTING SYSTEMS MARKET: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 177 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 178 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 180 STMICROELECTRONICS: DEALS

- TABLE 181 STMICROELECTRONICS: EXPANSIONS

- TABLE 182 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 183 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES

- TABLE 185 MICROCHIP TECHNOLOGY INC.: EXPANSIONS

- TABLE 186 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 187 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 189 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 190 INFINEON TECHNOLOGIES AG: EXPANSIONS

- TABLE 191 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 192 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 ANALOG DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 194 ANALOG DEVICES, INC.: DEALS

- TABLE 195 ANALOG DEVICES, INC.: OTHER DEVELOPMENTS

- TABLE 196 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 197 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 TEXAS INSTRUMENT INCORPORATED: PRODUCT LAUNCHES

- TABLE 199 TEXAS INSTRUMENT INCORPORATED: DEALS

- TABLE 200 ABB: COMPANY OVERVIEW

- TABLE 201 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 ABB: PRODUCT LAUNCHES

- TABLE 203 ABB: DEALS

- TABLE 204 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 205 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES

- TABLE 207 RENESAS ELECTRONICS CORPORATION: DEALS

- TABLE 208 ENOCEAN GMBH: COMPANY OVERVIEW

- TABLE 209 ENOCEAN GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 ENOCEAN GMBH: PRODUCT LAUNCHES

- TABLE 211 ENOCEAN GMBH: DEALS

- TABLE 212 ENOCEAN GMBH: OTHER DEVELOPMENTS

- TABLE 213 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 214 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 216 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 217 QORVO, INC: COMPANY OVERVIEW

- TABLE 218 QORVO, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 QORVO, INC.: PRODUCT LAUNCHES

- TABLE 220 QORVO, INC.: DEALS

- TABLE 221 E-PEAS: COMPANY OVERVIEW

- TABLE 222 KISTLER GROUP: COMPANY OVERVIEW

- TABLE 223 MIDE TECHNOLOGY CORP.: COMPANY OVERVIEW

- TABLE 224 PHYSIK INSTRUMENTE (PI) SE & CO. KG: COMPANY OVERVIEW

- TABLE 225 TRAMETO LIMITED: COMPANY OVERVIEW

- TABLE 226 CTS CORPORATION: COMPANY OVERVIEW

- TABLE 227 NEXPERIA: COMPANY OVERVIEW

- TABLE 228 CERAMTEC GMBH: COMPANY OVERVIEW

- TABLE 229 BIONIC POWER INC.: COMPANY OVERVIEW

- TABLE 230 KINERGIZER: COMPANY OVERVIEW

- TABLE 231 POWERCAST: COMPANY OVERVIEW

- TABLE 232 MICROPELT: COMPANY OVERVIEW

- TABLE 233 ADVANCED LINEAR DEVICES, INC.: COMPANY OVERVIEW

- TABLE 234 APC INTERNATIONAL, LTD.: COMPANY OVERVIEW

- TABLE 235 VOLTREE POWER, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ENERGY HARVESTING SYSTEMS MARKET SEGMENTATION

- FIGURE 2 ENERGY HARVESTING SYSTEMS MARKET: RESEARCH DESIGN

- FIGURE 3 ENERGY HARVESTING SYSTEMS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 ENERGY HARVESTING SYSTEMS MARKET: TOP-DOWN APPROACH

- FIGURE 5 ENERGY HARVESTING SYSTEMS MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- FIGURE 6 ENERGY HARVESTING SYSTEMS MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 7 ENERGY HARVESTING SYSTEMS MARKET: DATA TRIANGULATION

- FIGURE 8 ENERGY HARVESTING SYSTEMS MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 ENERGY HARVESTING SYSTEMS MARKET SNAPSHOT

- FIGURE 10 LIGHT ENERGY HARVESTING TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 11 TRANSDUCERS TO SECURE MAJOR MARKET SHARE IN 2025

- FIGURE 12 BUILDING & HOME AUTOMATION SEGMENT TO LEAD ENERGY HARVESTING SYSTEMS MARKET IN 2025

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 14 RISING DEMAND FOR ENERGY-EFFICIENT AND SUSTAINABLE SOLUTIONS TO DRIVE MARKET

- FIGURE 15 LIGHT ENERGY HARVESTING TO HOLD MAJORITY OF MARKET IN 2030

- FIGURE 16 TRANSDUCERS TO SECURE LARGEST MARKET SIZE IN 2030

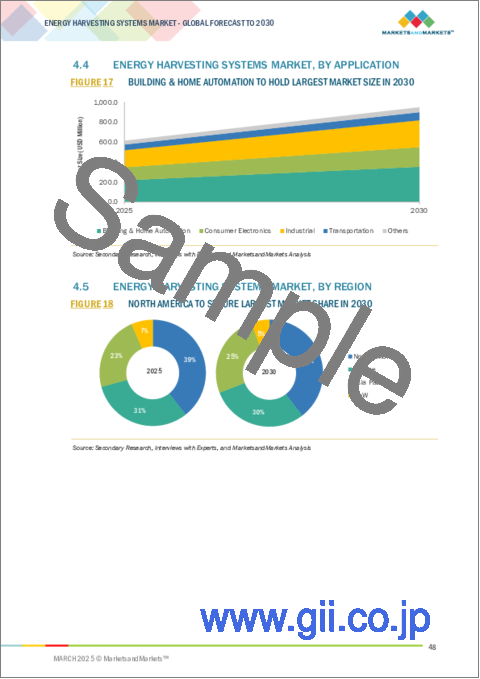

- FIGURE 17 BUILDING & HOME AUTOMATION TO HOLD LARGEST MARKET SIZE IN 2030

- FIGURE 18 NORTH AMERICA TO SECURE LARGEST MARKET SHARE IN 2030

- FIGURE 19 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 20 ENERGY HARVESTING SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 IMPACT ANALYSIS OF DRIVERS ON ENERGY HARVESTING SYSTEMS MARKET

- FIGURE 22 IMPACT ANALYSIS OF RESTRAINTS ON ENERGY HARVESTING SYSTEMS MARKET

- FIGURE 23 IMPACT ANALYSIS OF OPPORTUNITIES IN ENERGY HARVESTING SYSTEMS MARKET

- FIGURE 24 IMPACT ANALYSIS OF CHALLENGES ON ENERGY HARVESTING SYSTEMS MARKET

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 AVERAGE SELLING PRICE OF PMICS OFFERED BY KEY PLAYERS, 2024

- FIGURE 27 AVERAGE SELLING PRICE OF TRANSDUCERS OFFERED BY KEY PLAYERS, 2024

- FIGURE 28 AVERAGE SELLING PRICE TREND OF PMICS, BY REGION, 2021-2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF TRANSDUCERS, BY REGION, 2021-2024

- FIGURE 30 VALUE CHAIN ANALYSIS

- FIGURE 31 ECOSYSTEM ANALYSIS

- FIGURE 32 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 33 IMPORT SCENARIO FOR HS CODE 854140-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 34 EXPORT SCENARIO FOR HS CODE 854140-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 36 ENERGY HARVESTING SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 IMPACT OF PORTER'S FIVE FORCES

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE APPLICATIONS

- FIGURE 39 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 40 IMPACT OF AI/GEN AI ON ENERGY HARVESTING SYSTEMS MARKET

- FIGURE 41 BUILDING & HOME AUTOMATION SEGMENT TO LEAD MARKET IN 2025

- FIGURE 42 TRANSDUCERS TO BE LARGEST COMPONENT SEGMENT IN 2025

- FIGURE 43 LIGHT ENERGY HARVESTING SEGMENT TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 44 NORTH AMERICA TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 45 NORTH AMERICA: ENERGY HARVESTING SYSTEMS MARKET SNAPSHOT

- FIGURE 46 EUROPE: ENERGY HARVESTING SYSTEMS MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: ENERGY HARVESTING SYSTEMS MARKET SNAPSHOT

- FIGURE 48 ENERGY HARVESTING SYSTEMS MARKET SHARE ANALYSIS, 2024

- FIGURE 49 ENERGY HARVESTING SYSTEMS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2021-2024

- FIGURE 50 ENERGY HARVESTING SYSTEMS MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 51 ENERGY HARVESTING SYSTEMS MARKET: FINANCIAL METRICS, 2024 (USD BILLION)

- FIGURE 52 ENERGY HARVESTING SYSTEMS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 53 ENERGY HARVESTING SYSTEMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 ENERGY HARVESTING SYSTEMS MARKET: COMPANY FOOTPRINT

- FIGURE 55 ENERGY HARVESTING SYSTEMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 56 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 57 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 58 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 59 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 60 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 61 ABB: COMPANY SNAPSHOT

- FIGURE 62 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 64 QORVO, INC.: COMPANY SNAPSHOT

The energy harvesting system market is expected to grow from USD 0.61 billion in 2025 to USD 0.94 billion in 2030, at a CAGR of 9.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Component, Application, End-use System, Energy Source, Power Capacity and Region |

| Regions covered | North America, Europe, APAC, RoW |

The major drivers contributing to the market growth are the adoption of sensors in wearable electronics and the expansion of smart cities and infrastructure projects across diverse applications such as building & home automation, consumer electronics, industrial, transportation, security, and agriculture & smart farming.

PMICs segment is expected to grow at the highest CAGR during the forecast period

The power management integrated circuits (PMICs) segment is expected to grow at the highest compound annual growth rate (CAGR) in the energy harvesting system market during the forecast period due to the growing demand for effective energy conversion, storage, and distribution in self-powered devices. PMICs are crucial in maximizing power transfer from energy harvesting sources by regulating voltage efficiently and reducing energy loss to ensure the maximum use of harvested energy. PMICs also improve energy storage management through enhanced performance of energy storage devices, including capacitors and rechargeable batteries, by managing charging cycles effectively and preventing overcharging or wastage of energy. In addition, PMICs provide power distribution with high reliability by providing smooth and stable power to different components in self-powered devices, thus enhancing overall system efficiency and prolonging device lifespan. Furthermore, ongoing technological advancements in PMICs, such as ultra-low-power designs and adaptive power management schemes, are also promoting further market growth.

The light energy harvesting is expected to hold the largest market size during the forecast period

The light energy harvesting segment is anticipated to capture the highest market size within the energy harvesting system market throughout the forecast period because of its broad applicability, high energy conversion efficiency, and consistent advancements in photovoltaic technology. Light energy harvesting is widely utilized across various industries, including consumer electronics, industrial automation, smart buildings, and transportation, making it the most versatile and scalable energy harvesting technology. Moreover, its higher energy conversion rates, especially via solar and photovoltaic technologies, provide a stable power supply for a vast array of uses, ranging from IoT devices to remote monitoring systems. In addition, ongoing advancements in photovoltaic materials, like flexible and transparent solar cells, improve the efficiency, longevity, and integration value of light energy harvesting, leading to further penetration. Additionally, the growing use of solar-powered sensors, wearables, and IoT devices is driving demand for light energy harvesting solutions, enabling extended device lifespans and reducing reliance on traditional batteries. Government incentives, policies promoting renewable energy adoption, and increasing investments in solar energy infrastructure further contribute to market growth.

North America is expected to witness the second-highest CAGR during the forecast period

North America is expected to witness the second-highest compound annual growth rate (CAGR) in the energy harvesting system market during the forecast period due to the region's strong focus on technological innovation, increasing adoption of smart and sustainable energy solutions, and substantial investments in research and development. North America region is a hub for major technology companies and sophisticated semiconductor manufacturing, which boosts ongoing advancements in energy harvesting technology, making them more cost-saving and efficient. In addition, expanding the implementation of energy harvesting systems in IoT devices, smart homes, industrial automation, and healthcare is pushing market growth forward. Energy-efficient and self-sustaining solutions are also fueled by sustainability programs and government policies. In addition, substantial investments from private and public sources promote innovation, resulting in improved system performance, broader application, and more commercialization across industries. These combined factors put North America at the forefront as one of the fastest-growing markets for energy harvesting systems, pushing the development of self-sustaining energy solutions and solidifying its position in the global shift toward energy efficiency and sustainability.

Breakdown of Primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the profile of primary participants in the energy harvesting system market:

- By Company Type: Tier 1 - 25%, Tier 2 - 35%, Tier 3 - 40%

- By Designation Type: C Level - 40%, Director Level - 30%, Others - 30%

- By Region Type: North America - 40%, Europe - 25%, Asia Pacific - 20%, Rest of the World - 15%

The major players in the energy harvesting system market with a significant global presence include STMicroelectronics (Switzerland), Microchip Technology Inc. (US), Texas Instruments Incorporated (US), Analog Devices, Inc. (US), and Infineon Technologies AG (Germany).

Research Coverage

The report segments the energy harvesting system market and forecasts its size by Technology, Component, Application, and region. It also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth and covers qualitative and quantitative aspects of the market.

Reasons to buy the report:

The report will help market leaders and new entrants with information on the closest approximate revenues for the overall energy harvesting system market and related segments. It will also help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand for energy-efficient and sustainable solutions, integration of IoT devices in automation and energy harvesting systems for building and home automation, growing preference for wireless sensor networks equipped with energy harvesting systems, government regulations and incentives for green energy), restraints (high initial cost of energy harvesting system, limited power output and storage challenges, limitations of remotely installed networking modules, geographic and environmental constraints), opportunities (expansion of smart cities and infrastructure projects, adoption of sensors in wearable electronics, integration of energy harvesting in automotive and EVs), and challenges (lack of standardization and compatibility issues, slow adoption in large-scale industrial applications, limitations associated with integrating energy harvesting systems into existing infrastructure).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new solution and service launches in the energy harvesting system market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the energy harvesting system market across varied regions.

- Market Diversification: Exhaustive information about new solutions and services, untapped geographies, recent developments, and investments in the energy harvesting system market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and solution and service offerings of leading players, including STMicroelectronics (Switzerland), Microchip Technology Inc. (US), Texas Instruments Incorporated (US), Analog Devices, Inc. (US), and Infineon Technologies AG (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ENERGY HARVESTING SYSTEMS MARKET

- 4.2 ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY

- 4.3 ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT

- 4.4 ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION

- 4.5 ENERGY HARVESTING SYSTEMS MARKET, BY REGION

- 4.6 ENERGY HARVESTING SYSTEMS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for energy-efficient and sustainable solutions

- 5.2.1.2 Integration of IoT devices in building & home automation

- 5.2.1.3 Government regulations and incentives for green energy

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial cost of energy harvesting systems

- 5.2.2.2 Limited power output and storage challenges

- 5.2.2.3 Limitations in remotely installed networking modules

- 5.2.2.4 Geographic and environmental constraints

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of smart cities and infrastructure projects

- 5.2.3.2 Adoption of sensors in wearable electronics

- 5.2.3.3 Integration of energy harvesting in automotive

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardization and compatibility issues

- 5.2.4.2 Slow adoption in large-scale industrial applications

- 5.2.4.3 Integration of energy harvesting systems into existing infrastructure

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY COMPONENT

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Body motion energy harvesting

- 5.7.1.2 Photo-electrochemistry-based energy harvesting

- 5.7.1.3 Multi-source harvesting

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Nanomaterials and metamaterials

- 5.7.2.2 3D printing

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Battery management systems

- 5.7.3.2 Renewable energy sources

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 854140)

- 5.9.2 EXPORT SCENARIO (HS CODE 854140)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 THERMOKON ACHIEVES ENERGY EFFICIENCY IN HISTORIC TOWN HALL WITH WIRELESS SOLUTION

- 5.11.2 PAVEGEN POWERS PHONE CHARGING THROUGH FOOTSTEPS

- 5.11.3 NXP AND ENOCEAN STREAMLINE WIRELESS ENERGY HARVESTING IN SMART HOME DEVICES WITH NFC

- 5.11.4 PAVEGEN DEVELOPS KINETIC TENNIS EXPERIENCE TO SUPPORT SUSTAINABILITY

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREATS OF NEW ENTRANTS

- 5.14.2 THREATS OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON ENERGY HARVESTING SYSTEMS MARKET

6 ENERGY HARVESTING SYSTEMS MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 BUILDING & HOME AUTOMATION

- 6.2.1 INCREASING EMPHASIS ON ENERGY-EFFICIENT BUILDINGS AND SMART HOMES TO DRIVE GROWTH

- 6.3 CONSUMER ELECTRONICS

- 6.3.1 GROWING PREFERENCE FOR EXTENDED BATTERY LIFE AND SUSTAINABLE POWER SOLUTIONS TO DRIVE GROWTH

- 6.4 INDUSTRIAL

- 6.4.1 RISING ADOPTION OF IOT AND SMART MANUFACTURING TO PROPEL MARKET GROWTH

- 6.5 TRANSPORTATION

- 6.5.1 GROWING DEMAND FOR EMISSION REDUCTION TO PROPEL MARKET GROWTH

- 6.6 OTHER APPLICATIONS

7 ENERGY HARVESTING SYSTEMS MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 TRANSDUCERS

- 7.2.1 PHOTOVOLTAIC

- 7.2.1.1 Building automation, consumer electronics, and transportation applications to drive growth

- 7.2.2 ELECTRODYNAMIC, PIEZOELECTRIC, AND ELECTROMAGNETIC

- 7.2.2.1 Electrodynamic

- 7.2.2.1.1 Rising demand for self-powered sensors and smart infrastructure to drive growth

- 7.2.2.2 Piezoelectric

- 7.2.2.2.1 Increasing demand for self-powered devices to boost market growth

- 7.2.2.3 Electromagnetic

- 7.2.2.3.1 Increasing adoption in industrial automation and smart infrastructure to drive market growth

- 7.2.2.1 Electrodynamic

- 7.2.3 THERMOELECTRIC

- 7.2.3.1 Increasing demand for sustainable power sources across industrial sector to drive growth

- 7.2.4 RADIO FREQUENCY TRANSDUCERS

- 7.2.4.1 Widespread adoption in switches, fitness trackers, smart cards, and RFID tags to boost market growth

- 7.2.1 PHOTOVOLTAIC

- 7.3 POWER MANAGEMENT INTEGRATED CIRCUITS

- 7.3.1 RISING DEMAND FOR ENERGY-EFFICIENT AND IOT-ENABLED DEVICES TO BOOST MARKET GROWTH

- 7.4 STORAGE DEVICES

- 7.4.1 NEED FOR RELIABLE ENERGY STORAGE SOLUTIONS TO DRIVE GROWTH

- 7.4.2 BATTERIES

- 7.4.3 CAPACITORS

- 7.5 OTHER COMPONENTS

8 ENERGY HARVESTING SYSTEMS MARKET, BY END-USE SYSTEM

- 8.1 INTRODUCTION

- 8.2 WIRELESS SWITCHING SYSTEMS

- 8.3 WIRELESS HVAC SYSTEMS

- 8.4 WIRELESS SENSING & TELEMATICS SYSTEMS

- 8.5 TIRE PRESSURE MONITORING SYSTEMS

- 8.6 ASSET TRACKING SYSTEMS

- 8.7 REMOTE HEALTH MONITORING SYSTEMS

- 8.8 REGENERATIVE ENERGY HARVESTING SYSTEMS

- 8.8.1 FOOTWEAR

- 8.8.2 TEXTILE

9 ENERGY HARVESTING SYSTEMS MARKET, BY ENERGY SOURCE

- 9.1 INTRODUCTION

- 9.2 VIBRATION & KINETIC ENERGY

- 9.3 THERMAL

- 9.3.1 INDUSTRIAL WASTE HEAT

- 9.3.2 AUTOMOTIVE EXHAUST

- 9.3.3 GEOTHERMAL SOURCES

- 9.3.4 RESIDENTIAL/COMMERCIAL WASTE HEAT

- 9.4 SOLAR

- 9.4.1 INDOOR LIGHTING

- 9.4.2 OUTDOOR LIGHTING

- 9.4.3 BUILDING-INTEGRATED PHOTOVOLTAICS

- 9.5 RADIO FREQUENCY

- 9.5.1 AMBIENT RF

- 9.5.2 DEDICATED RF TRANSMISSION

- 9.5.3 MOBILE COMMUNICATION FREQUENCIES

- 9.6 OTHER ENERGY SOURCES

10 ENERGY HARVESTING SYSTEMS MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 LIGHT ENERGY HARVESTING

- 10.2.1 RISING PREFERENCE FOR SELF-POWERED AND SUSTAINABLE DEVICES TO DRIVE GROWTH

- 10.3 VIBRATION ENERGY HARVESTING

- 10.3.1 HOME AUTOMATION AND INDUSTRIAL SENSOR NETWORK APPLICATIONS TO DRIVE GROWTH

- 10.4 RF ENERGY HARVESTING

- 10.4.1 EXTENSIVE ADOPTION OF WIRELESS COMMUNICATION TECHNOLOGIES TO DRIVE GROWTH

- 10.5 THERMAL ENERGY HARVESTING

- 10.5.1 IMMENSE THERMAL ENERGY RESERVES IN INDUSTRIAL APPLICATIONS TO FUEL MARKET GROWTH

- 10.5.2 LOW-TEMPERATURE RANGE

- 10.5.3 MEDIUM-TEMPERATURE RANGE

- 10.5.4 HIGH-TEMPERATURE RANGE

11 ENERGY HARVESTING SYSTEMS MARKET, BY POWER CAPACITY

- 11.1 INTRODUCTION

- 11.2 LOW POWER (<1 MW)

- 11.3 MEDIUM POWER (1-100 MW)

- 11.4 HIGH POWER (>100 MW)

12 ENERGY HARVESTING SYSTEMS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.2 US

- 12.2.2.1 Government policies and technological advancements to drive growth

- 12.2.3 CANADA

- 12.2.3.1 Sustainability initiatives and remote energy needs to drive growth

- 12.2.4 MEXICO

- 12.2.4.1 Clean energy transition and industrial demand to boost market

- 12.3 EUROPE

- 12.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.2 UK

- 12.3.2.1 Increasing government support for sustainability and smart infrastructure to drive growth

- 12.3.3 GERMANY

- 12.3.3.1 Industrial automation and Industry 4.0 to drive growth

- 12.3.4 FRANCE

- 12.3.4.1 Transition to renewable energy and smart grid integration to drive growth

- 12.3.5 ITALY

- 12.3.5.1 Renewable energy and energy-efficient infrastructure - key drivers

- 12.3.6 SPAIN

- 12.3.6.1 Government policies and renewable energy push to drive growth

- 12.3.7 POLAND

- 12.3.7.1 Transition to renewable energy and industrial applications to drive growth

- 12.3.8 NORDICS

- 12.3.8.1 Sustainable energy practices and smart solutions to propel market growth

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.2 CHINA

- 12.4.2.1 Government focus on lowering carbon emissions to fuel growth

- 12.4.3 JAPAN

- 12.4.3.1 Advancements in wearable technology to drive growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Advancing sustainability and smart infrastructure to boost market growth

- 12.4.5 INDIA

- 12.4.5.1 Push for renewable energy and smart technology adoption to drive market growth

- 12.4.6 AUSTRALIA

- 12.4.6.1 Advancements in solar energy optimization to drive market growth

- 12.4.7 INDONESIA

- 12.4.7.1 Market driven by expansion of renewable infrastructure and rural electrification

- 12.4.8 MALAYSIA

- 12.4.8.1 Commitment to renewable energy development and sustainability initiatives to drive growth

- 12.4.9 THAILAND

- 12.4.9.1 Rural electrification and off-grid power solutions to drive growth

- 12.4.10 VIETNAM

- 12.4.10.1 Rapid industrialization and strong government initiatives to drive market growth

- 12.4.11 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 ROW: MACROECONOMIC OUTLOOK

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Bahrain

- 12.5.2.2 Kuwait

- 12.5.2.3 Oman

- 12.5.2.4 Qatar

- 12.5.2.5 Saudi Arabia

- 12.5.2.6 United Arab Emirates

- 12.5.2.7 Rest of Middle East

- 12.5.3 AFRICA

- 12.5.4 SOUTH AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2021-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024 (USD BILLION)

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Technology footprint

- 13.7.5.4 Component footprint

- 13.7.5.5 End-use system footprint

- 13.7.5.6 Application footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 List of startups/SMEs

- 13.8.5.2 Competitive benchmarking of startups/SMEs

- 13.9 COMPETITIVE SITUATION AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 STMICROELECTRONICS

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches

- 14.2.1.3.2 Deals

- 14.2.1.3.3 Expansions

- 14.2.1.4 MnM view

- 14.2.1.4.1 Right to win

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses and competitive threats

- 14.2.2 MICROCHIP TECHNOLOGY INC.

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product launches

- 14.2.2.3.2 Expansions

- 14.2.2.4 MnM view

- 14.2.2.4.1 Right to win

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses and competitive threats

- 14.2.3 INFINEON TECHNOLOGIES AG

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.3.3.3 Expansions

- 14.2.3.4 MnM view

- 14.2.3.4.1 Right to win

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses and competitive threats

- 14.2.4 ANALOG DEVICES, INC.

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Product launches

- 14.2.4.3.2 Deals

- 14.2.4.3.3 Other developments

- 14.2.4.4 MnM view

- 14.2.4.4.1 Right to win

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses and competitive threats

- 14.2.5 TEXAS INSTRUMENTS INCORPORATED

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Product launches

- 14.2.5.3.2 Deals

- 14.2.5.4 MnM view

- 14.2.5.4.1 Right to win

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weaknesses and competitive threats

- 14.2.6 ABB

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Solutions/Services offered

- 14.2.6.3 Recent developments

- 14.2.6.3.1 Product launches

- 14.2.6.3.2 Deals

- 14.2.6.4 MnM view

- 14.2.6.4.1 Right to win

- 14.2.6.4.2 Strategic choices

- 14.2.6.4.3 Weaknesses and competitive threats

- 14.2.7 RENESAS ELECTRONICS CORPORATION

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Solutions/Services offered

- 14.2.7.3 Recent developments

- 14.2.7.3.1 Product launches

- 14.2.7.3.2 Deals

- 14.2.8 ENOCEAN GMBH

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Solutions/Services offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Product launches

- 14.2.8.3.2 Deals

- 14.2.8.3.3 Other developments

- 14.2.9 HONEYWELL INTERNATIONAL INC.

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Solutions/Services offered

- 14.2.9.3 Recent developments

- 14.2.9.3.1 Product launches

- 14.2.9.3.2 Deals

- 14.2.10 QORVO, INC.

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Solutions/Services offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Product launches

- 14.2.10.3.2 Deals

- 14.2.1 STMICROELECTRONICS

- 14.3 OTHER PLAYERS

- 14.3.1 E-PEAS

- 14.3.2 KISTLER GROUP

- 14.3.3 MIDE TECHNOLOGY CORP.

- 14.3.4 PHYSIK INSTRUMENTE (PI) SE & CO. KG

- 14.3.5 TRAMETO LIMITED

- 14.3.6 CTS CORPORATION

- 14.3.7 NEXPERIA

- 14.3.8 CERAMTEC GMBH

- 14.3.9 BIONIC POWER INC.

- 14.3.10 KINERGIZER

- 14.3.11 POWERCAST

- 14.3.12 MICROPELT

- 14.3.13 ADVANCED LINEAR DEVICES, INC.

- 14.3.14 APC INTERNATIONAL, LTD.

- 14.3.15 VOLTREE POWER, INC.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS