|

|

市場調査レポート

商品コード

1808970

歯科用消耗品の世界市場:製品別、エンドユーザー別 - 予測(~2030年)Dental Consumables Market by Product (Implants, Prosthetics, Orthodontics, Endodontics, Infection Control, Periodontics, Whitening Products, Finishing Products, Sealants), End User (Dental Hospital & Clinics, Dental Labs) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 歯科用消耗品の世界市場:製品別、エンドユーザー別 - 予測(~2030年) |

|

出版日: 2025年09月04日

発行: MarketsandMarkets

ページ情報: 英文 555 Pages

納期: 即納可能

|

概要

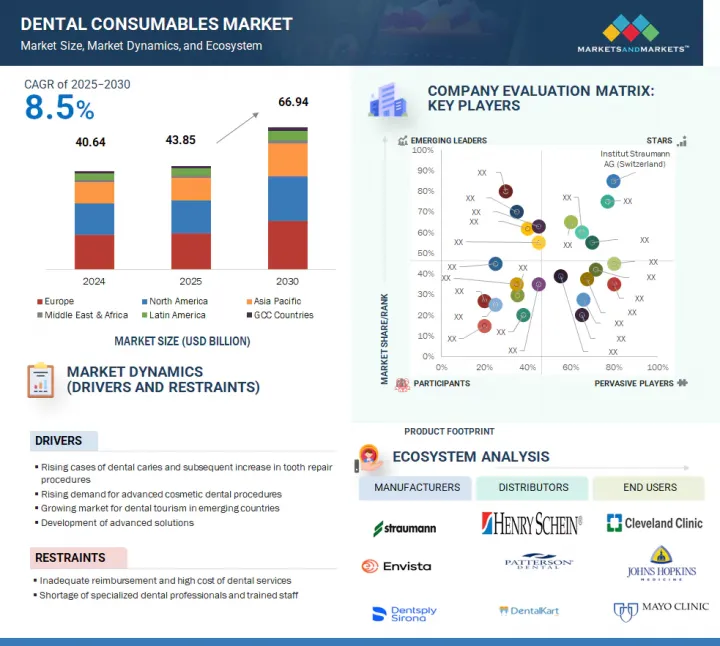

世界の歯科用消耗品の市場規模は、2025年の438億5,000万米ドルから2030年までに669億4,000万米ドルに達すると予測され、予測期間にCAGRで8.5%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 製品タイプ、エンドユーザー、地域 |

| 対象地域 | アジア太平洋、北米、欧州、ラテンアメリカ、中東・アフリカ、GCC諸国 |

歯科用消耗品市場は、人口動態、臨床、技術の複合的な影響による力強い成長が見込まれます。修復・補綴ソリューションを必要とする高齢者の拡大に支えられた歯科疾患の罹患率の増加が、歯科用消耗品の世界的な需要を引き続き促進しています。

デジタルデンティストリー、生体適合性コンポジットレジン、CAD/CAMシステムなどの歯科材料・技術の進歩は、すでに治療結果を大幅に向上させており、製品の採用を推進しています。さらに、オーラルケアへの注目の高まりや、歯科治療へのアクセスのしやすさ、審美歯科への需要の高まりも市場を後押ししています。これらの要因は、今後数年間、先進国市場と新興国市場の両方で勢いを維持する可能性が高いです。

製品タイプ別では、歯科矯正セグメントが歯科用消耗品市場でもっとも高いCAGRとなる見込みです。

歯科矯正セグメントは、不正咬合や歯並びを治療する従来のブレースやクリアアライナーの使用の増加を中心とした、審美歯科治療や矯正歯科治療の需要の増加などの理由から、もっとも高いCAGRで成長すると予測されています。セルフライゲーションブレースやセラミックブレースなどの歯列矯正材料の技術的進歩によって、患者の快適性と治療効果が向上しています。加えて、このセグメントの成長は、新興市場におけるアクセスの向上や、青少年や成人の歯列矯正治療に対する意識の高まりによって促進されています。

エンドユーザー別では、歯科医院・診療所セグメントが歯科用消耗品市場で最大のシェアを占めると予測されます。

歯科医院・診療所は、患者の流入が多いことや、提供される手技が多様であること、最新の歯科技術が利用可能であることから、2024年の歯科用消耗品市場で最大のシェアを占めました。これらの施設では、歯内療法、修復、手術の症例を大量に管理する傾向があり、必然的に消耗品に対する高い需要が生じます。また、経験豊富な歯科医の存在や、公立・私立診療所におけるインフラへの投資の増加が、セグメントの優位性をさらに高めています。診療所における審美歯科治療や予防歯科治療への関心の高まりも、このセグメントの優位性を支えています。

欧州が予測期間に歯科用消耗品市場で最大のシェアを占める見込みです。

欧州が最大の市場になると予測されます。これは同地域の先進の医療インフラ、歯科治療ニーズの増加を伴う高齢者の増加、歯科疾患の高い有病率に起因しています。さらに、主要市場企業のプレゼンスや、歯科製品の継続的な技術革新、政府の支援策が、この市場における欧州の主導的地位をさらに強化しています。口腔衛生に対する意識の高まりと欧州人の可処分所得の増加も、この地域の大幅な市場成長に寄与しています。

当レポートでは、世界の歯科用消耗品市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 歯科用消耗品市場の企業にとって魅力的な機会

- 欧州の歯科用消耗品市場:エンドユーザー別、国別

- 歯科用消耗品市場:地理的成長機会

- 歯科用消耗品市場:地域別

- 歯科用消耗品市場:先進国市場と新興国市場

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 技術分析

- 主要技術

- 隣接技術

- 隣接技術

- 産業動向

- 歯科診療への多額の投資

- 低侵襲歯科治療の増加

- 市場統合

- 製品開発への注力

- 歯科製品のグレー/ブラックマーケット

- 償還シナリオ

- 価格設定の分析

- 平均販売価格の動向:タイプ別

- 平均販売価格の動向:国別

- サプライチェーン分析

- バリューチェーン分析

- エコシステム分析

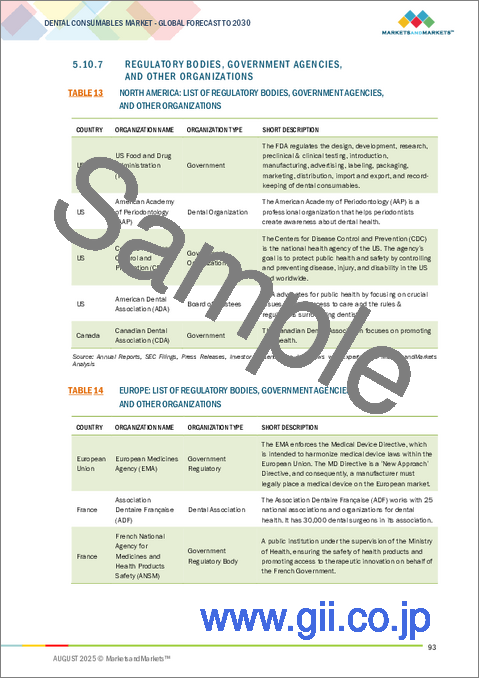

- 規制情勢

- 米国

- 欧州連合

- 中国

- ラテンアメリカ

- 中東

- アフリカ

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 主な会議とイベント(2025年~2026年)

- カスタマービジネスに影響を与える動向/混乱

- 特許分析

- 歯科用消耗品市場における特許公報の動向

- 管轄分析:歯科用消耗品市場における上位の特許出願者

- 貿易分析

- 歯科製品(HSコード:9021)の輸入データ(2020年~2024年)

- 歯科製品(HSコード:9021)の輸出データ(2020年~2024年)

- 関連レポート

- ケーススタディ

- 歯科用消耗品市場におけるアンメットニーズ/エンドユーザーの期待

- 歯科用消耗品市場に対するAIの影響

- 投資と資金調達のシナリオ

- 歯科用消耗品市場に対する米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 地域に対する影響

- 最終用途産業に対する影響

第6章 歯科用消耗品市場:製品別

- イントロダクション

- 歯科インプラント

- チタンインプラント

- ジルコニウムインプラント

- 歯科修復材料

- 直接修復材料

- 間接修復材料

- 歯科用バイオマテリアル

- 矯正用消耗品

- クリアアライナー/取り外し可能なブレース

- 固定式ブレース

- アクセサリ

- 歯周病用消耗品

- 歯科用麻酔

- 歯科用止血材

- 歯科用縫合糸

- 感染管理用消耗品

- 消毒ジェル

- 個人用保護具

- 消毒剤

- 歯内療法用消耗品

- 成形・洗浄用消耗品

- 充填用消耗品

- アクセス準備用消耗品

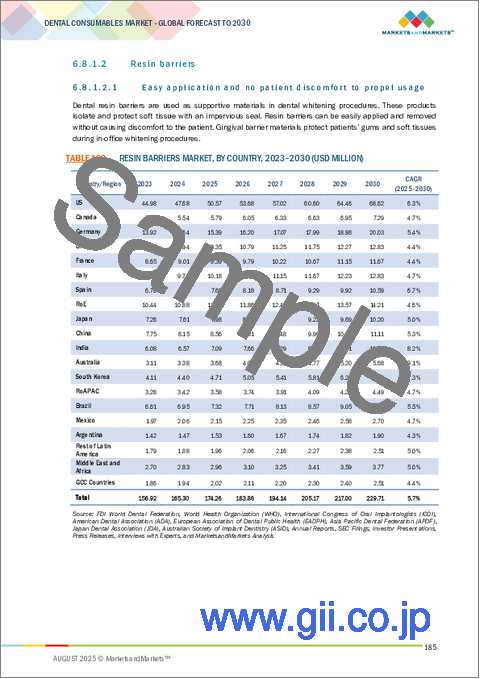

- ホワイトニング用消耗品

- 院内ホワイトニング用消耗品

- 自宅ホワイトニング用消耗品

- 仕上げ・研磨用消耗品

- 予防用品

- フッ化物

- その他の歯科用消耗品

- デンタルスプリント

- 歯科用シーラント

- 歯科用印象材

- 接着剤

- その他の消耗品

第7章 歯科用消耗品市場:エンドユーザー別

- イントロダクション

- 歯科医院・診療所

- 歯科技工所

- 歯科サービス組織

- その他のエンドユーザー

第8章 歯科用消耗品市場:地域別

- イントロダクション

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- イタリア

- スペイン

- フランス

- 英国

- その他の欧州

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 日本

- オーストラリア

- 韓国

- 中国

- インド

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他のラテンアメリカ

- 中東・アフリカ

- GCC諸国

第9章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 主要企業の研究開発費

- 競合シナリオ

第10章 企業プロファイル

- 主要企業

- INSTITUT STRAUMANN AG

- ENVISTA

- DENTSPLY SIRONA

- SOLVENTUM

- ZIMVIE INC.

- HENRY SCHEIN

- KURARAY CO., LTD.

- MITSUI CHEMICALS, INC.

- SHOFU

- IVOCLAR VIVADENT AG

- その他の企業

- GC CORPORATION

- KEYSTONE DENTAL GROUP

- BEGO GMBH & CO. KG

- SEPTODONT HOLDING

- ULTRADENT PRODUCTS

- VOCO GMBH

- COLTENE GROUP

- SDI LIMITED

- YOUNG INNOVATIONS, INC.

- DMG CHEMISCH-PHARMAZEUTISCHE FABRIK GMBH

- BRASSELER USA

- GEISTLICH PHARMA AG

- SHOFU INC.

- GLIDEWELL

- BISCO INC.

- DENTAL TECHNOLOGIES INC.