|

|

市場調査レポート

商品コード

1509567

顕微鏡の市場規模、シェア、動向:タイプ別、用途別、エンドユーザー別、地域別 - 2029年までの予測Microscopy Market Size, Share & Trends by Product, Type (Optical, Electron, AFM, STM), End User - Region Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 顕微鏡の市場規模、シェア、動向:タイプ別、用途別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年07月04日

発行: MarketsandMarkets

ページ情報: 英文 304 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の顕微鏡の市場規模は、2024年の81億米ドルから2029年には106億米ドルに達し、2024年から2029年の予測期間中のCAGRは5.4%になると予測されています。

研究資金の増加、臨床・診断現場や産業現場での顕微鏡ニーズの高まりなど、多くの要因から市場の拡大が見込まれています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(米ドル) |

| セグメント別 | タイプ別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

光学顕微鏡セグメント(タイプ別)が2023年に市場で最も支配的なシェアを占めました。顕微鏡市場の3つのセグメントで述べたように、光学顕微鏡は材料や一般的な品質管理の目的で産業現場で使用されるだけでなく、学術機関でも最初に選択されるもの1つです。このような光学顕微鏡の多目的な性格が、他のセグメントの同業顕微鏡と比較して、市場への浸透をより深いものにしています。

用途別では、顕微鏡市場は半導体とエレクトロニクス用途分野で予測期間中に最も速い速度で成長すると予測されています。顕微鏡市場は、材料科学、ヘルスケアとライフサイエンス、半導体とエレクトロニクス、その他の用途を含む用途に基づいてセグメントに分けられます。2023年の顕微鏡市場シェアは半導体用途が最大となりました。

顕微鏡市場の産業ユーザーセグメントは最大のシェアを占め、2023年に最も速い速度で拡大していました。ウイルスや細菌の遺伝子構造を観察し、病気を診断するために、電子顕微鏡や原子間力顕微鏡などの高倍率顕微鏡の使用が拡大しています。ナノテクノロジーへの投資の拡大や、技術的に高度な拡大装置に対する様々な産業からの強い需要が市場を牽引しています。

当レポートでは、世界の顕微鏡市場について調査し、タイプ別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 規制状況

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 貿易分析

- 特許分析

- 価格分析

- 技術分析

- ポーターのファイブフォース分析

- 2024年~2025年の主な会議とイベント

- 顧客のビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 主な利害関係者と購入基準

- アンメットニーズ

- 顕微鏡市場における生成AIの活用

第6章 顕微鏡市場(タイプ別)

- イントロダクション

- 機器

- アクセサリー

- ソフトウェアとサービス

第7章 顕微鏡市場(用途別)

- イントロダクション

- 半導体・電子

- ヘルスケア・ライフサイエンス

- 材料科学

- その他

第8章 顕微鏡市場(エンドユーザー別)

- イントロダクション

- 産業ユーザー

- 診断・病理学研究室

- 製薬・バイオ医薬品企業・CROS

- 学術研究機関

- その他

第9章 顕微鏡市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- CARL ZEISS AG

- THERMO FISHER SCIENTIFIC INC.

- DANAHER CORPORATION

- EVIDENT

- NIKON CORPORATION

- TESCAN GROUP

- JEOL LTD.

- HITACHI HIGH-TECH CORPORATION

- KEYENCE CORPORATION

- OXFORD INSTRUMENTS

- SHIMADZU CORPORATION

- BRUKER

- HORIBA LTD.

- ETALUMA, INC.

- ACCU-SCOPE

- EUROMEX MICROSCOPEN BV

- HELMUT HUND GMBH

- その他の企業

- ADELTA OPTEC

- AMETEK, INC.

- CRAIC TECHNOLOGIES

- CYTOVIVA, INC.

- KYKY TECHNOLOGY CO., LTD.

- LABOMED, INC.

- LASERTEC CORPORATION

- OPTIKA SRL

- PARK SYSTEMS

- PICOQUANT

第12章 付録

The global microscopy market is estimated to reach USD 10.6 billion by 2029 from USD 8.1 billion in 2024, at a CAGR of 5.4% during the forecast period of 2024 to 2029. The market is anticipated to rise as a result of a number of factors, including growing funding for research and the growing need for microscopes in clinical and diagnostic settings as well as in industrial settings.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) |

| Segments | By Product, Product Type, Type, Application, End-User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

"The optical microscope segment (by type) to hold the largest share of the market in 2023"

The optical microscope segment (by type) holds the most dominant share of the market in 2023. As mentioned in the three segments for the microscopy market, optical microscopes are not only used in industrial settings for material and general quality control purposes, but they are also among the initial choices of academic institutes. This versatile persona of optical microscopes makes their penetration into the market more deep when compared to other peer microscopes in other segments.

"In context of application, semiconductors and electronics showed the largest share of the market in 2023"

According to application, the microscopy market is anticipated to grow at the fastest rate during the projected period in the semiconductors and electronics applications sector. The microscope market is divided into segments based on applications, including materials science, healthcare and life sciences, semiconductors and electronics, and other applications. Semiconductor applications held the biggest market share for microscopy in 2023.

"For end-users, the industrial user segment showed the most dominant positions as compared to fellow application sub-segments. Also, it showed a robust CAGR for the period considered."

The microscopy market's industrial users segment held the biggest share and was expanding at the fastest rate in 2023. To observe the genetic structures of viruses and bacteria and diagnose diseases, the use of high-level magnification microscopes such as electron microscope and atomic force microscope is growing. The market is being driven by expanding investments in nanotechnology as well as a strong demand from a variety of industries for technologically advanced magnification devices.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 20%, Tier 2- 45%, and Tier 3- 35%

- By Designation: C-level- 30%, Directors-20%, and Others-50%

- By Region: North America-36%, Europe-25%, Asia Pacific-27%, Latin America-9%, and the Middle East & Africa-3%

Key players for microscopy market are Carl Zeiss AG (Germany), Thermo Fisher Scientific (US), Danaher Corporation (US), EVIDENT (Japan), Nikon Corporation (Japan), JEOL Ltd. (Japan), Oxford Instruments plc (UK), Hitachi High-Tech Corporation (Japan), Keyence Corporation (Japan), Shimadzu Corporation (Japan), Euromex Microscopen bv (Netherlands), Bruker Corporation (US) and Helmut Hund GmbH (Germany).

Research Coverage

The research report examines the microscope market by end-users, geography, product type, and application. It also discusses the elements driving market expansion, examines the different prospects and difficulties facing the industry, and gives specifics on the competitive environment facing market leaders. Additionally, the study projects the revenue of market segments with respect to five key regions and analyzes micro markets in terms of their respective growth trends (and the relevant nations in these areas).

Reasons to Buy the Report

The research report will help smaller and newer businesses as well as established ones understand the state of the market, which will help them increase their market share. Businesses that purchase the study may choose to employ one or more of the tactics listed below to increase their market presence.

This report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the microscopy market

- Product Development/Innovation: Detailed data on the product lines provided by the leading companies in the microscopy industry

- Market Development: Detailed data on profitable developing areas

- Market Diversification: comprehensive details regarding recent advancements, expanding regions, and new items in the microscope market

- Competitive Assessment: extensive assessment of the products, growth tactics, revenue projections, and market categories of the top competitors.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- TABLE 1 MICROSCOPY MARKET: INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS COVERED

- FIGURE 1 MICROSCOPY MARKET: SEGMENTS COVERED

- 1.3.2 REGIONS COVERED

- FIGURE 2 MICROSCOPY MARKET: REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- FIGURE 3 MICROSCOPY MARKET: YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.5.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 4 MICROSCOPY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- FIGURE 5 LIST OF KEY PRIMARY SOURCES

- 2.1.2.2 Objectives of primary research

- 2.1.2.3 Breakdown of primaries

- FIGURE 6 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 7 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation approach

- FIGURE 8 MICROSCOPY MARKET: COMPANY REVENUE ESTIMATION

- 2.2.1.2 Customer-based market estimation

- FIGURE 9 MICROSCOPY MARKET SIZE ESTIMATION

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 10 MICROSCOPY MARKET: TOP-DOWN APPROACH

- 2.3 MARKET FORECAST

- FIGURE 11 GROWTH PROJECTIONS BASED ON REVENUE IMPACT OF KEY MACROINDICATORS

- 2.4 DATA TRIANGULATION

- FIGURE 12 MICROSCOPY MARKET: DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- TABLE 2 MICROSCOPY MARET: STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- FIGURE 13 MICROSCOPY MARKET: RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 3 MICROSCOPY MARKET: RISK ASSESSMENT

- 2.8 IMPACT OF ECONOMIC RECESSION ON MICROSCOPY MARKET

3 EXECUTIVE SUMMARY

- FIGURE 14 MICROSCOPY MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 16 MICROSCOPY MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 17 MICROSCOPY MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT OF MICROSCOPY MARKET

4 PREMIUM INSIGHTS

- 4.1 MICROSCOPY MARKET OVERVIEW

- FIGURE 19 FAVORABLE R&D FUNDING AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

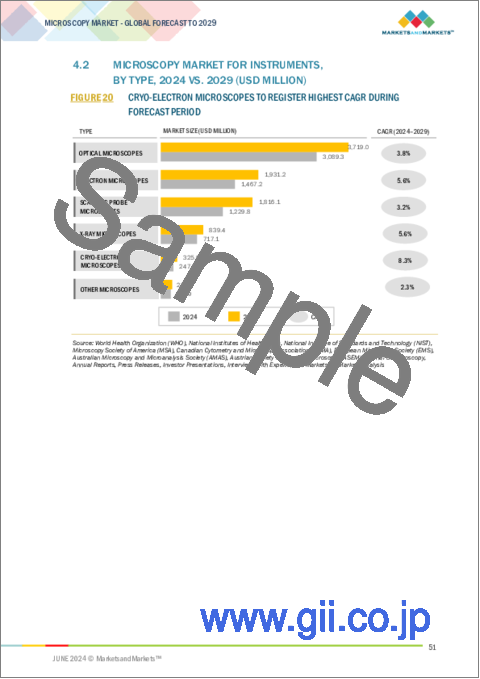

- 4.2 MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 20 CRYO-ELECTRON MICROSCOPES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: MICROSCOPY MARKET, BY END USER AND COUNTRY, 2023

- FIGURE 21 CHINA AND INDUSTRIAL USERS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- 4.4 MICROSCOPY MARKET SHARE, BY APPLICATION, 2024 VS. 2029

- FIGURE 22 SEMICONDUCTOR & ELECTRONIC APPLICATIONS SEGMENT TO COMMAND LARGEST MARKET SHARE FROM 2024 TO 2029

- 4.5 MICROSCOPY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES, 2024-2029

- FIGURE 23 ASIA PACIFIC COUNTRIES TO REGISTER HIGHEST CAGR DURING STUDY PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 MICROSCOPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Favorable R&D funding scenario for development of advanced microscopes

- TABLE 4 RECENT FUNDING FOR R&D IN MICROSCOPY MARKET

- 5.2.1.2 Technological advancements in microscopes

- 5.2.1.3 Increased focus on nanotechnology and regenerative medicine

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of advanced microscopes and related accessories

- 5.2.2.2 Recurring fees for periodic subscriptions to imaging software

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth opportunities in emerging markets

- 5.2.3.2 Increasing applications in pharmacokinetics, drug development, and quality control

- 5.2.3.3 Integration of microscopes with other analytical technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Dearth of skilled and trained professionals

- 5.3 REGULATORY LANDSCAPE

- 5.3.1 REGULATORY TRENDS

- 5.3.1.1 North America

- 5.3.1.1.1 US

- 5.3.1.1 North America

- TABLE 5 MEDICAL DEVICE CLASSIFICATION OF MICROSCOPES BY US FDA

- TABLE 6 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- FIGURE 25 US: PREMARKET NOTIFICATION: 510(K) APPROVALS FOR MEDICAL DEVICES

- 5.3.1.1.2 Canada

- TABLE 7 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- FIGURE 26 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

- 5.3.1.2 Europe

- FIGURE 27 EUROPE: CE APPROVAL PROCESS FOR MEDICAL DEVICES

- 5.3.1.3 Asia Pacific

- 5.3.1.3.1 Japan

- 5.3.1.3 Asia Pacific

- TABLE 8 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PHARMACEUTICAL AND MEDICAL DEVICE AGENCY

- 5.3.1.3.2 China

- TABLE 9 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- 5.3.1.3.3 India

- 5.3.2 LIST OF KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.2.1 North America

- TABLE 10 NORTH AMERICA: LIST OF KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.2.2 Europe

- TABLE 11 EUROPE: LIST OF KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.2.3 Asia Pacific

- TABLE 12 ASIA PACIFIC: LIST OF KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.2.4 Latin America

- TABLE 13 LATIN AMERICA: LIST OF KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.2.5 Middle East & Africa

- TABLE 14 MIDDLE EAST & AFRICA: LIST OF KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.1 REGULATORY TRENDS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 28 MICROSCOPY MARKET: VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH & DEVELOPMENT

- 5.4.2 RAW MATERIAL PROCUREMENT & PRODUCT DEVELOPMENT

- 5.4.3 MARKETING, SALES, AND DISTRIBUTION

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 29 MICROSCOPY MARKET: SUPPLY CHAIN ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.5.3 END USERS

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 30 MICROSCOPY MARKET: ECOSYSTEM MAP

- TABLE 15 MICROSCOPY MARKET: ROLE IN ECOSYSTEM

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA FOR OPTICAL MICROSCOPES (HS CODE 9011)

- TABLE 16 IMPORT DATA FOR OPTICAL MICROSCOPES (HS CODE 9011), BY COUNTRY, 2019-2023 (USD THOUSAND)

- 5.7.2 IMPORT DATA FOR ELECTRON MICROSCOPES (HS CODE 9012)

- TABLE 17 IMPORT DATA FOR ELECTRON MICROSCOPES (HS CODE 9012), BY COUNTRY, 2019-2023 (USD THOUSAND)

- 5.7.3 EXPORT DATA FOR OPTICAL MICROSCOPES (HS CODE 9011)

- TABLE 18 EXPORT DATA FOR OPTICAL MICROSCOPES (HS CODE 9011), BY COUNTRY, 2019-2023 (USD THOUSAND)

- 5.7.4 EXPORT DATA FOR ELECTRON MICROSCOPES (HS CODE 9012)

- TABLE 19 EXPORT DATA FOR ELECTRON MICROSCOPES (HS CODE 9012), BY COUNTRY, 2019-2023 (USD THOUSAND)

- 5.8 PATENT ANALYSIS

- FIGURE 31 PATENT DETAILS FOR MICROSCOPES (JANUARY 2013-DECEMBER 2023)

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE OF MICROSCOPY PRODUCTS, BY TYPE

- FIGURE 32 AVERAGE SELLING PRICE OF MICROSCOPY PRODUCTS, BY TYPE, 2023 (USD THOUSAND)

- TABLE 20 AVERAGE SELLING PRICE OF MICROSCOPY PRODUCTS, BY TYPE, 2021-2023 (USD THOUSAND)

- 5.9.2 AVERAGE SELLING PRICE OF MICROSCOPY PRODUCTS, BY REGION

- FIGURE 33 AVERAGE SELLING PRICE TREND OF MICROSCOPY PRODUCTS, BY REGION, 2023 (USD THOUSAND)

- TABLE 21 AVERAGE SELLING PRICE OF MICROSCOPY PRODUCTS, BY REGION, 2021-2023

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Optical microscopes

- 5.10.1.2 Electron microscopes

- 5.10.1.3 Scanning probe microscopes

- 5.10.1.4 X-ray microscopes

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Particle size analysis software

- 5.10.2.2 Microflow imaging technology

- 5.10.2.3 Cryo-electron tomography

- 5.10.2.4 Image analytics software

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Microinjectors

- 5.10.3.2 Energy dispersive X-ray spectroscopy

- 5.10.3.3 Digital pathology

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PORTER'S FIVE FORCE ANALYSIS

- TABLE 22 MICROSCOPY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 MICROSCOPY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY CONFERENCES & EVENTS IN 2024-2025

- TABLE 23 LIST OF KEY CONFERENCES & EVENTS IN MICROSCOPY MARKET, JANUARY 2024-DECEMBER 2025

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 35 REVENUE SHIFT IN MICROSCOPY MARKET

- 5.14 INVESTMENT & FUNDING SCENARIO

- FIGURE 36 FUNDING IN MICROSCOPY MARKET, 2020-2024

- FIGURE 37 NUMBER OF DEALS IN MICROSCOPY MARKET, BY KEY PLAYER, 2020-2024

- FIGURE 38 VALUE OF DEALS IN MICROSCOPY MARKET, BY KEY PLAYER, 2020-2024 (USD)

- 5.15 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- 5.15.2 KEY BUYING CRITERIA

- FIGURE 40 KEY BUYING CRITERIA FOR MICROSCOPY PRODUCTS

- TABLE 24 KEY BUYING CRITERIA FOR MICROSCOPY PRODUCTS

- 5.16 UNMET NEEDS

- TABLE 25 MICROSCOPY MARKET: LIST OF UNMET NEEDS

- 5.17 USE OF GENERATIVE AI IN MICROSCOPY MARKET

6 MICROSCOPY MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 26 MICROSCOPY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 6.2 INSTRUMENTS

- TABLE 27 MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 28 MICROSCOPY MARKET FOR INSTRUMENTS, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 29 MICROSCOPY MARKET FOR INSTRUMENTS, BY END USER, 2022-2029 (USD MILLION)

- TABLE 30 MICROSCOPY MARKET FOR INSTRUMENTS, BY REGION, 2022-2029 (USD MILLION)

- 6.2.1 OPTICAL MICROSCOPES

- TABLE 31 OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 32 OPTICAL MICROSCOPES MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 33 OPTICAL MICROSCOPES MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 34 OPTICAL MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.1.1 Confocal microscopes

- 6.2.1.1.1 Better optical sectioning capabilities to propel market

- 6.2.1.1 Confocal microscopes

- TABLE 35 CONFOCAL MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.1.2 Stereo microscopes

- 6.2.1.2.1 Increasing use in research laboratories to boost segment growth

- 6.2.1.2 Stereo microscopes

- TABLE 36 STEREO MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.1.3 Digital microscopes

- 6.2.1.3.1 Quick and accurate analysis of 3D surface models to boost adoption in forensics and materials science

- 6.2.1.3 Digital microscopes

- TABLE 37 DIGITAL MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.1.4 Compound & inverted microscopes

- 6.2.1.4.1 Sophisticated imaging algorithms with higher magnification to spur segment growth

- 6.2.1.4 Compound & inverted microscopes

- TABLE 38 COMPOUND & INVERTED MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

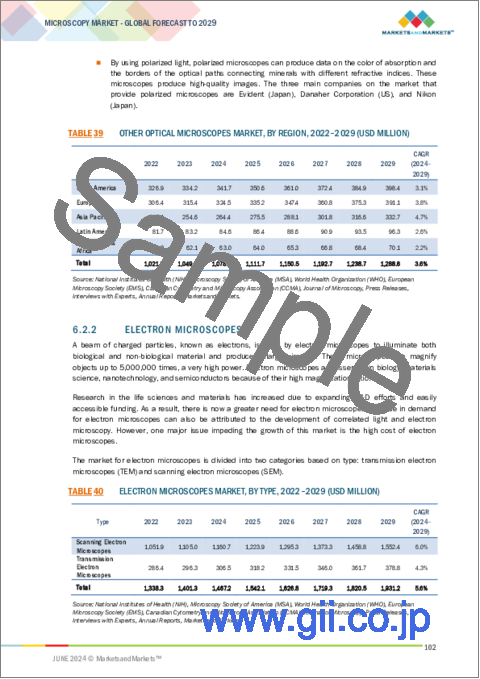

- 6.2.1.5 Other optical microscopes

- TABLE 39 OTHER OPTICAL MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.2 ELECTRON MICROSCOPES

- TABLE 40 ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 41 ELECTRON MICROSCOPES MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 42 ELECTRON MICROSCOPES MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 43 ELECTRON MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.2.1 Scanning electron microscopes

- 6.2.2.1.1 Increasing collaborations between academic institutes and businesses to drive segment

- 6.2.2.1 Scanning electron microscopes

- TABLE 44 SCANNING ELECTRON MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.2.2 Transmission electron microscopes

- 6.2.2.2.1 Growing focus on studying component ultrastructure to favor segment growth

- 6.2.2.2 Transmission electron microscopes

- TABLE 45 TRANSMISSION ELECTRON MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.3 SCANNING PROBE MICROSCOPES

- TABLE 46 SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 47 SCANNING PROBES MICROSCOPES MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 48 SCANNING PROBES MICROSCOPES MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 49 SCANNING PROBES MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.3.1 Atomic force microscopes

- 6.2.3.1.1 Greater focus on nanotechnology research to fuel adoption

- 6.2.3.1 Atomic force microscopes

- TABLE 50 ATOMIC FORCE MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.3.2 Scanning tunneling microscopes

- 6.2.3.2.1 Increasing use in topological studies to drive segment

- 6.2.3.2 Scanning tunneling microscopes

- TABLE 51 SCANNING TUNNELING MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.4 NEAR-FIELD SCANNING OPTICAL MICROSCOPES

- 6.2.4.1 Growing use in precision laser machining and nanometer-scale optical lithography to augment growth

- TABLE 52 NEAR-FIELD SCANNING OPTICAL MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.5 X-RAY MICROSCOPES

- 6.2.5.1 Increasing use in forensics and materials science to propel market growth

- TABLE 53 X-RAY MICROSCOPES MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 54 X-RAY MICROSCOPES MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 55 X-RAY MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.6 CRYO-ELECTRON MICROSCOPES

- 6.2.6.1 Increased focus on imaging biological specimens at cryogenic temperatures to spur market growth

- TABLE 56 CRYO-ELECTRON MICROSCOPES MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 57 CRYO-ELECTRON MICROSCOPES MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 58 CRYO-ELECTRON MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.7 OTHER MICROSCOPES

- TABLE 59 OTHER MICROSCOPES MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 60 OTHER MICROSCOPES MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 61 OTHER MICROSCOPES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.3 ACCESSORIES

- 6.3.1 GREATER FOCUS ON FUNCTIONALITY, PERFORMANCE, AND VERSATILITY OF MICROSCOPES TO DRIVE MARKET

- TABLE 62 MICROSCOPY MARKET FOR ACCESSORIES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 63 MICROSCOPY MARKET FOR ACCESSORIES, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 64 MICROSCOPY MARKET FOR ACCESSORIES, BY END USER, 2022-2029 (USD MILLION)

- 6.4 SOFTWARE & SERVICES

- 6.4.1 NEED FOR BETTER END USER EXPERIENCE TO FUEL MARKET GROWTH

- TABLE 65 MICROSCOPY MARKET FOR SOFTWARE & SERVICES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 66 MICROSCOPY MARKET FOR SOFTWARE & SERVICES, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 67 MICROSCOPY MARKET FOR SOFTWARE & SERVICES, BY END USER, 2022-2029 (USD MILLION)

7 MICROSCOPY MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 68 MICROSCOPY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- 7.2 SEMICONDUCTOR & ELECTRONIC APPLICATIONS

- 7.2.1 STRINGENT STANDARDS FOR QUALITY ASSURANCE AND FAILURE ANALYSIS TO PROPEL MARKET GROWTH

- TABLE 69 MICROSCOPY MARKET FOR SEMICONDUCTOR & ELECTRONIC APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

- 7.3 HEALTHCARE & LIFE SCIENCE APPLICATIONS

- TABLE 70 MICROSCOPY MARKET FOR HEALTHCARE & LIFE SCIENCE APPLICATIONS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 71 MICROSCOPY MARKET FOR HEALTHCARE & LIFE SCIENCE APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

- 7.3.1 PHARMACEUTICAL & BIOPHARMACEUTICAL MANUFACTURING COMPANIES

- 7.3.1.1 Greater adoption of microscopes in nanoscale analysis to drive segment

- TABLE 72 PHARMACEUTICAL & BIOPHARMACEUTICAL MANUFACTURING COMPANIES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.3.2 CLINICAL DIAGNOSTICS

- 7.3.2.1 Time-efficient and accurate diagnosis to aid segment growth

- TABLE 73 CLINICAL DIAGNOSTICS MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.3.3 DRUG DISCOVERY & DEVELOPMENT

- 7.3.3.1 Increasing number of research activities to augment segment growth

- TABLE 74 DRUG DISCOVERY & DEVELOPMENT MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.3.4 OTHER HEALTHCARE & LIFE SCIENCE APPLICATIONS

- TABLE 75 OTHER HEALTHCARE & LIFE SCIENCE APPLICATIONS MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.4 MATERIALS SCIENCE APPLICATIONS

- 7.4.1 GROWING FOCUS ON MICRO-LEVEL EXPLORATION OF NOVEL MATERIALS TO FUEL MARKET GROWTH

- TABLE 76 MICROSCOPY MARKET FOR MATERIALS SCIENCE APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

- 7.5 OTHER APPLICATIONS

- TABLE 77 MICROSCOPY MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

8 MICROSCOPY MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 78 MICROSCOPY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 8.2 INDUSTRIAL USERS

- TABLE 79 INDUSTRIAL APPLICATIONS OF MICROSCOPES

- TABLE 80 MICROSCOPY MARKET FOR INDUSTRIAL USERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 81 MICROSCOPY MARKET FOR INDUSTRIAL USERS, BY REGION, 2022-2029 (USD MILLION)

- 8.2.1 SEMICONDUCTOR & ELECTRONICS INDUSTRIAL USERS

- 8.2.1.1 Growth of semiconductor and electronics market to drive adoption

- TABLE 82 SEMICONDUCTOR & ELECTRONICS INDUSTRIAL USERS MARKET, BY REGION, 2022-2029 (USD MILLION)

- 8.2.2 AUTOMOTIVE INDUSTRIAL USERS

- 8.2.2.1 Increasing need for safety regulations, accuracy, and complexity to support market growth

- TABLE 83 AUTOMOTIVE INDUSTRIAL USERS MARKET, BY REGION, 2022-2029 (USD MILLION)

- 8.2.3 FOOD & BEVERAGE INDUSTRIAL USERS

- 8.2.3.1 Adherence to strict quality and safety measures to propel segment growth

- TABLE 84 FOOD & BEVERAGE INDUSTRIAL USERS MARKET, BY REGION, 2022-2029 (USD MILLION)

- 8.2.4 OTHER INDUSTRIAL USERS

- TABLE 85 OTHER INDUSTRIAL USERS MARKET, BY REGION, 2022-2029 (USD MILLION)

- 8.3 DIAGNOSTIC & PATHOLOGY LABORATORIES

- 8.3.1 RISING DEMAND FOR TECHNOLOGICALLY ADVANCED MICROSCOPY PRODUCTS TO AID MARKET GROWTH

- TABLE 86 MICROSCOPY MARKET FOR DIAGNOSTIC & PATHOLOGY LABORATORIES, BY REGION, 2022-2029 (USD MILLION)

- 8.4 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES AND CROS

- 8.4.1 GROWING DEMAND FOR ADVANCED TECHNIQUES FOR DRUG DEVELOPMENT TO AUGMENT MARKET GROWTH

- TABLE 87 MICROSCOPY MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES AND CROS, BY REGION, 2022-2029 (USD MILLION)

- 8.5 ACADEMIC & RESEARCH INSTITUTES

- 8.5.1 SUPPORTIVE GOVERNMENT AND COMMERCIAL SECTORS TO DRIVE MARKET

- TABLE 88 MICROSCOPY MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2022-2029 (USD MILLION)

- 8.6 OTHER END USERS

- TABLE 89 MICROSCOPY MARKET FOR OTHER END USERS, BY REGION, 2022-2029 (USD MILLION)

9 MICROSCOPY MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 90 MICROSCOPY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 91 MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE (UNITS)

- 9.2 NORTH AMERICA

- FIGURE 41 NORTH AMERICA: MICROSCOPY MARKET SNAPSHOT

- TABLE 92 NORTH AMERICA: MICROSCOPY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: MICROSCOPY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 97 NORTH AMERICA: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: MICROSCOPY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 99 NORTH AMERICA: MICROSCOPY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- 9.2.2 US

- 9.2.2.1 US to dominate North American microscopy market during forecast period

- TABLE 100 US: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 101 US: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 102 US: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 103 US: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Increasing R&D funding for nanotechnology and microscopy research to propel market growth

- TABLE 104 CANADA: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 105 CANADA: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 106 CANADA: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 107 CANADA: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.3 EUROPE

- TABLE 108 EUROPE: MAJOR DEVELOPMENTS IN MICROSCOPY MARKET

- TABLE 109 EUROPE: MICROSCOPY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 110 EUROPE: MICROSCOPY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 111 EUROPE: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 112 EUROPE: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 113 EUROPE: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 114 EUROPE: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 115 EUROPE: MICROSCOPY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 116 EUROPE: MICROSCOPY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.3.1 EUROPE: RECESSION IMPACT

- 9.3.2 GERMANY

- 9.3.2.1 Strong healthcare expenditure and favorable R&D investments to augment market growth

- TABLE 117 GERMANY: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 118 GERMANY: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 119 GERMANY: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 120 GERMANY: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Favorable government initiatives and technological advancements to spur market growth

- TABLE 121 UK: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 122 UK: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 123 UK: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 124 UK: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.3.4 FRANCE

- 9.3.4.1 Increasing investments in nanotechnology and expanding biotechnology sector to drive market

- TABLE 125 FRANCE: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 126 FRANCE: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 127 FRANCE: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 128 FRANCE: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.3.5 ITALY

- 9.3.5.1 Well-established medical device industry and favorable government initiatives to fuel market growth

- TABLE 129 ITALY: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 130 ITALY: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 131 ITALY: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 132 ITALY: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.3.6 SPAIN

- 9.3.6.1 Increased government budget for R&D in life science research to aid market growth

- TABLE 133 SPAIN: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 134 SPAIN: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 135 SPAIN: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 136 SPAIN: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.3.7 REST OF EUROPE

- TABLE 137 REST OF EUROPE: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 138 REST OF EUROPE: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 139 REST OF EUROPE: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 140 REST OF EUROPE: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: MICROSCOPY MARKET SNAPSHOT

- TABLE 141 ASIA PACIFIC: MICROSCOPY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MICROSCOPY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 144 ASIA PACIFIC: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 145 ASIA PACIFIC: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 146 ASIA PACIFIC: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MICROSCOPY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MICROSCOPY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.4.1 ASIA PACIFIC: RECESSION IMPACT

- 9.4.2 JAPAN

- 9.4.2.1 Rising number of collaborations and increasing exports of microscopy products to support market growth

- TABLE 149 JAPAN: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 150 JAPAN: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 151 JAPAN: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 152 JAPAN: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Favorable government initiatives for life science research to propel market growth

- TABLE 153 CHINA: MAJOR DEVELOPMENTS IN MICROSCOPY MARKET

- TABLE 154 CHINA: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 155 CHINA: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 156 CHINA: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 157 CHINA: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Significant growth in biotechnology and pharmaceutical industry to drive demand for microscopes

- TABLE 158 INDIA: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 159 INDIA: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 160 INDIA: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 161 INDIA: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.4.5 AUSTRALIA

- 9.4.5.1 Tax credits and favorable incentives to drive market

- TABLE 162 AUSTRALIA: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 163 AUSTRALIA: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 164 AUSTRALIA: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 165 AUSTRALIA: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.4.6 SOUTH KOREA

- 9.4.6.1 High spending on research activities to support market growth

- TABLE 166 SOUTH KOREA: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 167 SOUTH KOREA: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 168 SOUTH KOREA: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 169 SOUTH KOREA: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.4.7 REST OF ASIA PACIFIC

- TABLE 170 REST OF ASIA PACIFIC: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.5 LATIN AMERICA

- TABLE 174 LATIN AMERICA: MICROSCOPY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 175 LATIN AMERICA: MICROSCOPY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 176 LATIN AMERICA: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 177 LATIN AMERICA: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 178 LATIN AMERICA: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 179 LATIN AMERICA: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 180 LATIN AMERICA: MICROSCOPY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 181 LATIN AMERICA: MICROSCOPY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.5.1 LATIN AMERICA: RECESSION IMPACT

- 9.5.2 BRAZIL

- 9.5.2.1 Favorable research initiatives and presence of several nanoscience-nanotechnology organizations to drive market

- TABLE 182 BRAZIL: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 183 BRAZIL: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 184 BRAZIL: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 185 BRAZIL: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.5.3 MEXICO

- 9.5.3.1 High R&D investments in biotechnology, nanotechnology, and life sciences to aid market growth

- TABLE 186 MEXICO: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 187 MEXICO: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 188 MEXICO: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 189 MEXICO: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.5.4 REST OF LATIN AMERICA

- TABLE 190 REST OF LATIN AMERICA: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 191 REST OF LATIN AMERICA: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 192 REST OF LATIN AMERICA: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 193 REST OF LATIN AMERICA: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- TABLE 194 MIDDLE EAST & AFRICA: MICROSCOPY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: MICROSCOPY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: MICROSCOPY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: MICROSCOPY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.6.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Developments in healthcare infrastructure and high government expenditure to drive market

- TABLE 202 GCC COUNTRIES: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 203 GCC COUNTRIES: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 204 GCC COUNTRIES: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 205 GCC COUNTRIES: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- TABLE 206 REST OF MIDDLE EAST & AFRICA: MICROSCOPY MARKET FOR INSTRUMENTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: OPTICAL MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: ELECTRON MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: SCANNING PROBE MICROSCOPES MARKET, BY TYPE, 2022-2029 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MICROSCOPY MARKET

- TABLE 210 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MICROSCOPY MARKET

- 10.3 REVENUE ANALYSIS

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS IN MICROSCOPY MARKET (2019-2023)

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 44 MARKET SHARE ANALYSIS OF KEY PLAYERS IN MICROSCOPY MARKET (2023)

- TABLE 211 MICROSCOPY MARKET: DEGREE OF COMPETITION

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 45 MICROSCOPY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.5.5.1 Company footprint

- FIGURE 46 MICROSCOPY MARKET: COMPANY FOOTPRINT

- 10.5.5.2 Type footprint

- TABLE 212 MICROSCOPY MARKET: TYPE FOOTPRINT

- 10.5.5.3 Application footprint

- TABLE 213 MICROSCOPY MARKET: APPLICATION FOOTPRINT

- 10.5.5.4 End-user footprint

- TABLE 214 MICROSCOPY MARKET: END-USER FOOTPRINT

- 10.5.5.5 Region footprint

- TABLE 215 MICROSCOPY MARKET: REGION FOOTPRINT

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 47 MICROSCOPY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- TABLE 216 MICROSCOPY MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 217 MICROSCOPY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- FIGURE 48 EV/EBITDA OF KEY VENDORS

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- 10.8 BRAND/PRODUCT COMPARISON

- FIGURE 50 MICROSCOPY MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- TABLE 218 MICROSCOPY MARKET: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- 10.9.2 DEALS

- TABLE 219 MICROSCOPY MARKET: DEALS, JANUARY 2021-MAY 2024

- 10.9.3 EXPANSIONS

- TABLE 220 MICROSCOPY MARKET: EXPANSIONS, JANUARY 2021-MAY 2024

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 11.1.1 CARL ZEISS AG

- TABLE 221 CARL ZEISS AG: COMPANY OVERVIEW

- FIGURE 51 CARL ZIESS AG: COMPANY SNAPSHOT (2023)

- TABLE 222 CARL ZEISS AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 223 CARL ZEISS AG: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2021-MAY 2024

- TABLE 224 CARL ZEISS AG: DEALS, JANUARY 2021-MAY 2024

- 11.1.2 THERMO FISHER SCIENTIFIC INC.

- TABLE 225 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- FIGURE 52 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2023)

- TABLE 226 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 227 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- TABLE 228 THERMO FISHER SCIENTIFIC INC.: DEALS, JANUARY 2021-MAY 2024

- 11.1.3 DANAHER CORPORATION

- TABLE 229 DANAHER CORPORATION: COMPANY OVERVIEW

- FIGURE 53 DANAHER CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 230 DANAHER CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 231 DANAHER CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- TABLE 232 DANAHER CORPORATION: DEALS, JANUARY 2021-MAY 2024

- 11.1.4 EVIDENT

- TABLE 233 EVIDENT: COMPANY OVERVIEW

- FIGURE 54 EVIDENT: COMPANY SNAPSHOT (2023)

- TABLE 234 EVIDENT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 235 EVIDENT: PRODUCT & SOFTWARE LAUNCHES, JANUARY 2021-MAY 2024

- TABLE 236 EVIDENT: DEALS, JANUARY 2021-MAY 2024

- 11.1.5 NIKON CORPORATION

- TABLE 237 NIKON CORPORATION: COMPANY OVERVIEW

- FIGURE 55 NIKON CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 238 NIKON CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 239 NIKON CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- TABLE 240 NIKON CORPORATION: DEALS, JANUARY 2021-MAY 2024

- 11.1.6 TESCAN GROUP

- TABLE 241 TESCAN GROUP: COMPANY OVERVIEW

- TABLE 242 TESCAN GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 243 TESCAN GROUP: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- TABLE 244 TESCAN GROUP: DEALS, JANUARY 2021-MAY 2024

- 11.1.7 JEOL LTD.

- TABLE 245 JEOL LTD.: COMPANY OVERVIEW

- FIGURE 56 JEOL LTD.: COMPANY SNAPSHOT (2023)

- TABLE 246 JEOL LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 247 JEOL LTD.: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- 11.1.8 HITACHI HIGH-TECH CORPORATION

- TABLE 248 HITACHI HIGH-TECH CORPORATION: COMPANY OVERVIEW

- FIGURE 57 HITACHI HIGH-TECH CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 249 HITACHI HIGH-TECH CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 250 HITACHI HIGH-TECH CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- TABLE 251 HITACHI HIGH-TECH CORPORATION: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2024

- 11.1.9 KEYENCE CORPORATION

- TABLE 252 KEYENCE CORPORATION: COMPANY OVERVIEW

- FIGURE 58 KEYENCE CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 253 KEYENCE CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 254 KEYENCE CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- 11.1.10 OXFORD INSTRUMENTS

- TABLE 255 OXFORD INSTRUMENTS: COMPANY OVERVIEW

- FIGURE 59 OXFORD INSTRUMENTS: COMPANY SNAPSHOT (2023)

- TABLE 256 OXFORD INSTRUMENTS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 257 OXFORD INSTRUMENTS: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2021-MAY 2024

- TABLE 258 OXFORD INSTRUMENTS: DEALS, JANUARY 2021-MAY 2024

- TABLE 259 OXFORD INSTRUMENTS: EXPANSIONS, JANUARY 2021-MAY 2024

- 11.1.11 SHIMADZU CORPORATION

- TABLE 260 SHIMADZU CORPORATION: COMPANY OVERVIEW

- FIGURE 60 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 261 SHIMADZU CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 262 SHIMADZU CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- TABLE 263 SHIMADZU CORPORATION: EXPANSIONS, JANUARY 2021-MAY 2024

- 11.1.12 BRUKER

- TABLE 264 BRUKER: COMPANY OVERVIEW

- FIGURE 61 BRUKER: COMPANY SNAPSHOT (2023)

- TABLE 265 BRUKER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 266 BRUKER: DEALS, JANUARY 2021-MAY 2024

- 11.1.13 HORIBA LTD.

- TABLE 267 HORIBA LTD.: COMPANY OVERVIEW

- FIGURE 62 HORIBA LTD.: COMPANY SNAPSHOT (2023)

- TABLE 268 HORIBA LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 269 HORIBA LTD.: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- 11.1.14 ETALUMA, INC.

- TABLE 270 ETALUMA, INC.: COMPANY OVERVIEW

- TABLE 271 ETALUMA, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.15 ACCU-SCOPE

- TABLE 272 ACCU-SCOPE: COMPANY OVERVIEW

- TABLE 273 ACCU-SCOPE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 274 ACCU-SCOPE: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- 11.1.16 EUROMEX MICROSCOPEN BV

- TABLE 275 EUROMEX MICROSCOPEN BV: COMPANY OVERVIEW

- TABLE 276 EUROMEX MICROSCOPEN BV: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 277 EUROMEX MICROSCOPEN BV: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- 11.1.17 HELMUT HUND GMBH

- TABLE 278 HELMUT HUND GMBH: COMPANY OVERVIEW

- TABLE 279 HELMUT HUND GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 280 HELMUT HUND GMBH: PRODUCT LAUNCHES, JANUARY 2021-MAY 2024

- 11.2 OTHER PLAYERS

- 11.2.1 ADELTA OPTEC

- TABLE 281 ADELTA OPTEC: COMPANY OVERVIEW

- 11.2.2 AMETEK, INC.

- TABLE 282 AMETEK, INC.: COMPANY OVERVIEW

- 11.2.3 CRAIC TECHNOLOGIES

- TABLE 283 CRAIC TECHNOLOGIES: COMPANY OVERVIEW

- 11.2.4 CYTOVIVA, INC.

- TABLE 284 CYTOVIVA, INC.: COMPANY OVERVIEW

- 11.2.5 KYKY TECHNOLOGY CO., LTD.

- TABLE 285 KYKY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- 11.2.6 LABOMED, INC.

- TABLE 286 LABOMED, INC.: COMPANY OVERVIEW

- 11.2.7 LASERTEC CORPORATION

- TABLE 287 LASERTEC CORPORATION: COMPANY OVERVIEW

- 11.2.8 OPTIKA SRL

- TABLE 288 OPTIKA SRL: COMPANY OVERVIEW

- 11.2.9 PARK SYSTEMS

- TABLE 289 PARK SYSTEMS: COMPANY OVERVIEW

- 11.2.10 PICOQUANT

- TABLE 290 PICOQUANT: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS