|

|

市場調査レポート

商品コード

1807076

創傷被覆材の世界市場:タイプ別、創傷タイプ別、エンドユーザー別、地域別 - 2030年までの予測Wound Dressings Market by Type (Advanced, Traditional), Wound Type, End User - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 創傷被覆材の世界市場:タイプ別、創傷タイプ別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月28日

発行: MarketsandMarkets

ページ情報: 英文 353 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

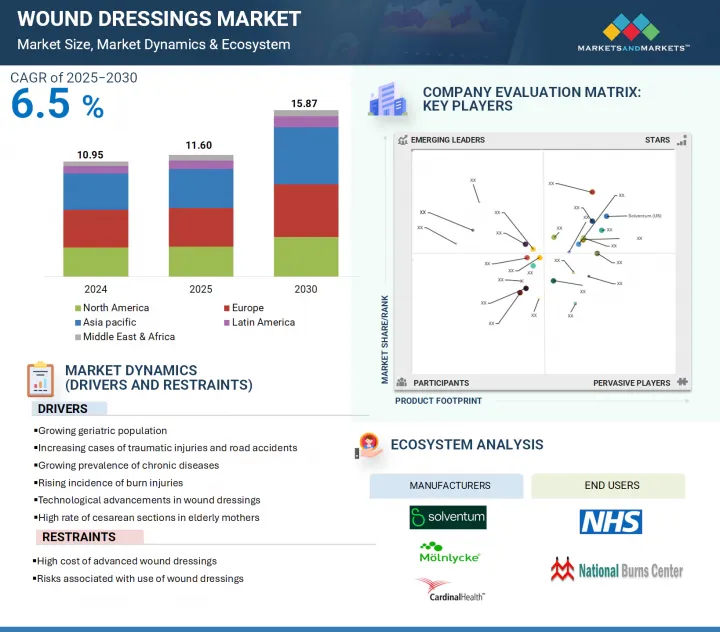

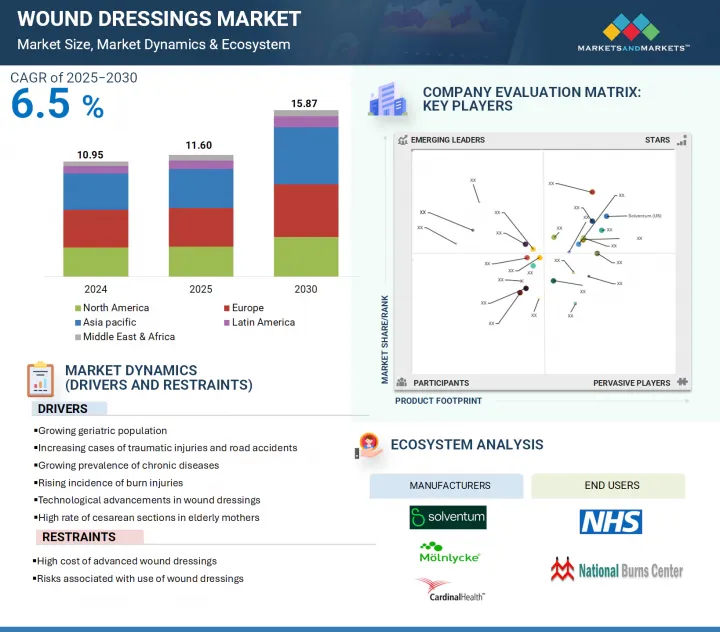

世界の創傷被覆材の市場規模は、2025年の116億米ドルから2030年には158億7,000万米ドルに達すると予測され、予測期間中のCAGRは6.5%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | タイプ別、創傷タイプ別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

市場は主に、熱傷の発生率の上昇、慢性創傷、外科的創傷、外傷性創傷の有病率の上昇、高齢女性の帝王切開率の高さ、交通事故の増加によって牽引されています。しかし、高度創傷被覆材の高価格と限定的な採用が、予測期間中の市場成長の妨げになると予測されています。

タイプ別に見ると、創傷被覆材市場は従来の創傷被覆材と高度創傷被覆材に区分されます。2024年には、進化型創傷被覆材セグメントが創傷被覆材市場のタイプ別シェアで最大を占めました。これは、糖尿病性足潰瘍、静脈性下腿潰瘍、褥瘡などの慢性創傷の発生率が増加しており、専門的でより効果的な治療アプローチが必要とされていることが主な要因です。さらに、糖尿病の有病率の上昇、創傷管理に対する患者の意識の高まり、創傷ケア技術の進歩、院内感染(HAI)の増加といった要因も、高度創傷被覆材の旺盛な需要につながっています。これらの製品は治癒を早め、感染リスクを低減し、患者の転帰を改善するため、さらに採用が進んでいます。

創傷タイプ別では、市場は外科的創傷および外傷性創傷、糖尿病性足潰瘍、褥瘡、静脈性下腿潰瘍、火傷およびその他の創傷に区分されます。創傷のタイプ別に見ると、2024年の創傷被覆材市場では外科的創傷と外傷性創傷の分野が最大のシェアを占めています。この大きなシェアは主に、世界的な外科手術件数の増加、事故や転倒による外傷の発生率の増加によるものです。さらに、慢性疾患や手術を受けやすい高齢者人口の増加や交通事故の世界的な増加が、このセグメントの優位性に寄与しています。また、手術手技の継続的な改善、術後ケア、病院や在宅ケアの現場での創傷被覆材の使用増加により、この分野は予測期間中に最も高いCAGRを記録すると予測されています。

世界の創傷被覆材市場は5つの主要地域(北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ)に分類されます。なかでもアジア太平洋は、高齢化社会と慢性創傷の原因となる生活習慣病有病率の上昇を背景に急成長を遂げています。質の高いヘルスケアサービスに対する需要の高まりに加え、病院のインフラや先進医療技術への多額の投資が、高度創傷治療用ドレッシング材の普及に拍車をかけています。さらに、インド、タイ、シンガポールなどの国々で医療ツーリズム産業が成長しているため、外科手術が増加しており、効果的な術後創傷ケアの必要性が高まっています。患者の治療成績向上と回復期間の短縮にヘルスケアプロバイダーが強い関心を寄せていることから、アジア太平洋市場は予測期間中に最も高いCAGRを記録すると予想されます。

当レポートでは、世界の創傷被覆材市場について調査し、タイプ別、創傷タイプ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- AIが創傷被覆材市場に与える影響

- 2025年の米国関税が創傷被覆材市場に与える影響

第6章 創傷被覆材市場(タイプ別)

- イントロダクション

- 高度な創傷被覆材

- 従来型創傷被覆材

第7章 創傷被覆材市場(創傷タイプ別)

- イントロダクション

- 外科的創傷および外傷

- 糖尿病性足潰瘍

- 褥瘡

- 静脈性下肢潰瘍

- 火傷やその他の傷

第8章 創傷被覆材市場(エンドユーザー別)

- イントロダクション

- 病院、ASCS、クリニック

- 在宅ケア

- その他

第9章 創傷被覆材市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- オーストラリア

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- ヘルスケア施設の需要増加が市場を牽引

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2024年

- 収益分析、2022年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- SOLVENTUM

- MOLNLYCKE AB

- CARDINAL HEALTH

- SMITH+NEPHEW

- CONVATEC GROUP PLC

- PAUL HARTMANN AG

- COLOPLAST GROUP

- OWENS & MINOR

- INTEGRA LIFESCIENCES CORPORATION

- ESSITY AKTIEBOLAG

- B. BRAUN SE

- ADVANCED MEDICAL SOLUTIONS GROUP PLC

- MATIV HOLDINGS, INC.

- その他の企業

- URGO GROUP

- DEROYAL INDUSTRIES, INC.

- LOHMANN & RAUSCHER GMBH & CO. KG

- MEDLINE INDUSTRIES, LP

- WINNER MEDICAL CO., LTD.

- ADVANCIS(UK)

- HOLLISTER INCORPORATED

- DERMARITE INDUSTRIES, LLC

- MIL LABORATORIES PVT. LTD.

- GENTELL

- SHIELDLINE

- FOCUS HEALTH GROUP

第12章 付録

List of Tables

- TABLE 1 WOUND DRESSINGS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 WOUND CARE WOUND DRESSINGS MARKET: RISK ASSESSMENT

- TABLE 3 PEOPLE WITH DIABETES, BY REGION, 2024 VS. 2050 (IN THOUSANDS)

- TABLE 4 ROAD ACCIDENT DEMOGRAPHICS, 2022

- TABLE 5 US: CESAREAN DELIVERY RATE, BY STATE (2022)

- TABLE 6 RISKS ASSOCIATED WITH ADVANCED WOUND DRESSINGS

- TABLE 7 AVERAGE SELLING PRICING TREND OF WOUND DRESSING PRODUCTS, BY TYPE, 2023-2025

- TABLE 8 AVERAGE SELLING PRICE TREND OF WOUND DRESSING PRODUCTS FOR KEY WOUND TYPES, BY KEY PLAYER, 2023-2025

- TABLE 9 AVERAGE SELLING PRICE TREND OF WOUND DRESSING PRODUCTS, BY REGION, 2023-2025

- TABLE 10 WOUND DRESSINGS MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 11 WOUND DRESSINGS MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2023-2025

- TABLE 12 IMPORT DATA FOR HS CODE 300510-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 EXPORT DATA FOR HS CODE 300510-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 WOUND DRESSINGS MARKET: KEY CONFERENCES & EVENTS, APRIL 2025-DECEMBER 2026

- TABLE 15 TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS IN JAPAN

- TABLE 16 NORTH AMERICA: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 LATIN AMERICA: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 IMPACT OF PORTER'S FORCES ON WOUND DRESSINGS MARKET

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF WOUND DRESSINGS, BY END USER (%)

- TABLE 23 KEY BUYING CRITERIA FOR WOUND DRESSINGS, BY END USER

- TABLE 24 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 25 WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 26 ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 27 ADVANCED WOUND DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 NORTH AMERICA: ADVANCED WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 EUROPE: ADVANCED WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 ASIA PACIFIC: ADVANCED WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 LATIN AMERICA: ADVANCED WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 KEY FOAM DRESSINGS AVAILABLE IN MARKET

- TABLE 33 FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 34 FOAM DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: FOAM DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 EUROPE: FOAM DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: FOAM DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 LATIN AMERICA: FOAM DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 SILICONE DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: SILICONE DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 EUROPE: SILICONE DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 ASIA PACIFIC: SILICONE DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 LATIN AMERICA: SILICONE DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 NON-SILICONE DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: NON-SILICONE DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 EUROPE: NON-SILICONE DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: NON-SILICONE DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 LATIN AMERICA: NON-SILICONE DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 KEY HYDROCOLLOID DRESSINGS AVAILABLE IN MARKET

- TABLE 50 HYDROCOLLOID DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: HYDROCOLLOID DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 EUROPE: HYDROCOLLOID DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 ASIA PACIFIC: HYDROCOLLOID DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 LATIN AMERICA: HYDROCOLLOID DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 KEY FILM DRESSINGS AVAILABLE IN MARKET

- TABLE 56 FILM DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: FILM DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 EUROPE: FILM DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 ASIA PACIFIC: FILM DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 LATIN AMERICA: FILM DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 KEY ALGINATE DRESSINGS AVAILABLE IN MARKET

- TABLE 62 ALGINATE DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: ALGINATE DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 EUROPE: ALGINATE DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: ALGINATE DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 LATIN AMERICA: ALGINATE DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 KEY HYDROGEL DRESSINGS AVAILABLE IN MARKET

- TABLE 68 HYDROGEL DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: HYDROGEL DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 EUROPE: HYDROGEL DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 ASIA PACIFIC: HYDROGEL DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 LATIN AMERICA: HYDROGEL DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 KEY COLLAGEN DRESSINGS AVAILABLE IN MARKET

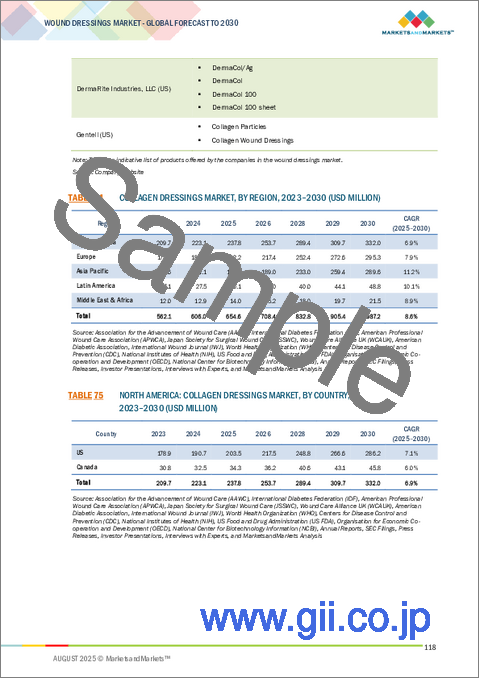

- TABLE 74 COLLAGEN DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: COLLAGEN DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 EUROPE: COLLAGEN DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: COLLAGEN DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 LATIN AMERICA: COLLAGEN DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 KEY HYDROFIBER DRESSINGS AVAILABLE IN MARKET

- TABLE 80 HYDROFIBER DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: HYDROFIBER DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: HYDROFIBER DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 ASIA PACIFIC: HYDROFIBER DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 LATIN AMERICA: HYDROFIBER DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 KEY WOUND CONTACT LAYERS AVAILABLE IN MARKET

- TABLE 86 WOUND CONTACT LAYERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: WOUND CONTACT LAYERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: WOUND CONTACT LAYERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: WOUND CONTACT LAYERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 LATIN AMERICA: WOUND CONTACT LAYERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 KEY SUPERABSORBENT DRESSINGS AVAILABLE IN MARKET

- TABLE 92 SUPERABSORBENT DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: SUPERABSORBENT DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 EUROPE: SUPERABSORBENT DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: SUPERABSORBENT DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 LATIN AMERICA: SUPERABSORBENT DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 OTHER ADVANCED WOUND DRESSINGS AVAILABLE IN MARKET

- TABLE 98 OTHER ADVANCED WOUND DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: OTHER ADVANCED WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 EUROPE: OTHER ADVANCED WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: OTHER ADVANCED WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 LATIN AMERICA: OTHER ADVANCED WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 TRADITIONAL WOUND DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: TRADITIONAL WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 EUROPE: TRADITIONAL WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: TRADITIONAL WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 108 LATIN AMERICA: TRADITIONAL WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 KEY GAUZES AVAILABLE IN MARKET

- TABLE 110 GAUZES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: GAUZES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 EUROPE: GAUZES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: GAUZES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 LATIN AMERICA: GAUZES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 KEY TAPES AVAILABLE IN MARKET

- TABLE 116 TAPES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: TAPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 EUROPE: TAPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: TAPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 LATIN AMERICA: TAPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 121 KEY BANDAGES AVAILABLE IN MARKET

- TABLE 122 BANDAGES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: BANDAGES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 EUROPE: BANDAGES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: BANDAGES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 126 LATIN AMERICA: BANDAGES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 127 KEY ABSORBENT PADS AVAILABLE IN MARKET

- TABLE 128 ABSORBENT PADS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: ABSORBENT PADS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 EUROPE: ABSORBENT PADS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: ABSORBENT PADS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 132 LATIN AMERICA: ABSORBENT PADS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 133 OTHER TRADITIONAL WOUND DRESSINGS AVAILABLE IN MARKET

- TABLE 134 OTHER TRADITIONAL WOUND DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: OTHER TRADITIONAL WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 136 EUROPE: OTHER TRADITIONAL WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: OTHER TRADITIONAL WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 LATIN AMERICA: OTHER TRADITIONAL WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 139 WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 140 WOUND DRESSINGS MARKET FOR SURGICAL & TRAUMATIC WOUNDS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: WOUND DRESSINGS MARKET FOR SURGICAL & TRAUMATIC WOUNDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 142 EUROPE: WOUND DRESSINGS MARKET FOR SURGICAL & TRAUMATIC WOUNDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: WOUND DRESSINGS MARKET FOR SURGICAL & TRAUMATIC WOUNDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 144 LATIN AMERICA: WOUND DRESSINGS MARKET FOR SURGICAL & TRAUMATIC WOUNDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 TOTAL DIABETES-RELATED HEALTHCARE EXPENDITURE IN 2024 (USD MILLION)

- TABLE 146 NUMBER OF ADULT PATIENTS WITH DIABETIC FOOT ULCERS, BY COUNTRY, 2023-2030 (IN THOUSANDS)

- TABLE 147 WOUND DRESSINGS MARKET FOR DIABETIC FOOT ULCERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 148 NORTH AMERICA: WOUND DRESSINGS MARKET FOR DIABETIC FOOT ULCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 EUROPE: WOUND DRESSINGS MARKET FOR DIABETIC FOOT ULCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: WOUND DRESSINGS MARKET FOR DIABETIC FOOT ULCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 151 LATIN AMERICA: WOUND DRESSINGS MARKET FOR DIABETIC FOOT ULCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 152 WOUND DRESSINGS MARKET FOR PRESSURE ULCERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: WOUND DRESSINGS MARKET FOR PRESSURE ULCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 154 EUROPE: WOUND DRESSINGS MARKET FOR PRESSURE ULCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: WOUND DRESSINGS MARKET FOR PRESSURE ULCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 LATIN AMERICA: WOUND DRESSINGS MARKET FOR PRESSURE ULCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 157 WOUND DRESSINGS MARKET FOR VENOUS LEG ULCERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 158 NORTH AMERICA: WOUND DRESSINGS MARKET FOR VENOUS LEG ULCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 159 EUROPE: WOUND DRESSINGS MARKET FOR VENOUS LEG ULCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: WOUND DRESSINGS MARKET FOR VENOUS LEG ULCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 LATIN AMERICA: WOUND DRESSINGS MARKET FOR VENOUS LEG ULCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 162 WOUND DRESSINGS MARKET FOR BURNS & OTHER WOUNDS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 163 NORTH AMERICA: WOUND DRESSINGS MARKET FOR BURNS & OTHER WOUNDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 164 EUROPE: WOUND DRESSINGS MARKET FOR BURNS & OTHER WOUNDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 165 ASIA PACIFIC: WOUND DRESSINGS MARKET FOR BURNS & OTHER WOUNDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 166 LATIN AMERICA: WOUND DRESSINGS MARKET FOR BURNS & OTHER WOUNDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 167 WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 168 WOUND DRESSINGS MARKET FOR HOSPITALS, ASCS, AND CLINICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 169 NORTH AMERICA: WOUND DRESSINGS MARKET FOR HOSPITALS, ASCS, AND CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 170 EUROPE: WOUND DRESSINGS MARKET FOR HOSPITALS, ASCS, AND CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: WOUND DRESSINGS MARKET FOR HOSPITALS, ASCS, AND CLINICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 172 LATIN AMERICA: WOUND DRESSINGS MARKET FOR HOSPITALS, ASCS, AND CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 173 WOUND DRESSINGS MARKET FOR HOME CARE SETTINGS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 174 NORTH AMERICA: WOUND DRESSINGS MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 175 EUROPE: WOUND DRESSINGS AMRKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 176 ASIA PACIFIC: WOUND DRESSINGS MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: WOUND DRESSINGS MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 178 WOUND DRESSINGS MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 179 NORTH AMERICA: WOUND DRESSINGS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 180 EUROPE: WOUND DRESSINGS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: WOUND DRESSINGS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: WOUND DRESSINGS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 183 WOUND DRESSINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 184 NORTH AMERICA: MACROECONOMIC INDICATORS

- TABLE 185 NORTH AMERICA: WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 186 NORTH AMERICA: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 NORTH AMERICA: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 NORTH AMERICA: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 NORTH AMERICA: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 NORTH AMERICA: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 191 NORTH AMERICA: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 192 US: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 US: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 US: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 US: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 US: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 197 US: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 198 CANADA: ESTIMATED PREVALENCE AND COST OF DIABETES, 2024 VS. 2034

- TABLE 199 CANADA: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 CANADA: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 CANADA: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 CANADA: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 CANADA: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 204 CANADA: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 205 EUROPE: MACROECONOMIC INDICATORS

- TABLE 206 EUROPE: WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 207 EUROPE: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 EUROPE: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 EUROPE: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 EUROPE: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 EUROPE: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 212 EUROPE: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 213 GERMANY: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 GERMANY: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 GERMANY: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 GERMANY: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 GERMANY: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 218 GERMANY: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 219 FRANCE: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 FRANCE: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 FRANCE: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 FRANCE: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 FRANCE: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 224 FRANCE: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 225 UK: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 UK: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 UK: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 228 UK: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 UK: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 230 UK: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 231 ITALY: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 ITALY: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 ITALY: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 ITALY: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 ITALY: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 236 ITALY: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 237 SPAIN: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 SPAIN: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 239 SPAIN: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 SPAIN: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 SPAIN: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 242 SPAIN: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 243 RUSSIA: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 RUSSIA: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 245 RUSSIA: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 246 RUSSIA: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 247 RUSSIA: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 248 RUSSIA: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 249 REST OF EUROPE: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 REST OF EUROPE: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 REST OF EUROPE: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 REST OF EUROPE: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 253 REST OF EUROPE: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 254 REST OF EUROPE: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 255 ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

- TABLE 256 ASIA PACIFIC: WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 257 ASIA PACIFIC: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 258 ASIA PACIFIC: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 259 ASIA PACIFIC: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 260 ASIA PACIFIC: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 261 ASIA PACIFIC: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 262 ASIA PACIFIC: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 263 CHINA: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 CHINA: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 CHINA: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 CHINA: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 CHINA: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 268 CHINA: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 269 JAPAN: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 270 JAPAN: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 271 JAPAN: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 272 JAPAN: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 JAPAN: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 274 JAPAN: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 275 INDIA: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 INDIA: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 277 INDIA: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 278 INDIA: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 INDIA: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 280 INDIA: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 281 AUSTRALIA: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 282 AUSTRALIA: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 283 AUSTRALIA: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 284 AUSTRALIA: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 285 AUSTRALIA: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 286 AUSTRALIA: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 287 REST OF ASIA PACIFIC: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 REST OF ASIA PACIFIC: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 289 REST OF ASIA PACIFIC: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 REST OF ASIA PACIFIC: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 291 REST OF ASIA PACIFIC: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 292 REST OF ASIA PACIFIC: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 293 LATIN AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 294 LATIN AMERICA: WOUND DRESSINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 295 LATIN AMERICA: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 296 LATIN AMERICA: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 297 LATIN AMERICA: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 298 LATIN AMERICA: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 299 LATIN AMERICA: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 300 LATIN AMERICA: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 301 BRAZIL: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 BRAZIL: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 303 BRAZIL: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 304 BRAZIL: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 305 BRAZIL: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 306 BRAZIL: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 307 MEXICO: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 308 MEXICO: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 MEXICO: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 310 MEXICO: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 311 MEXICO: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 312 MEXICO: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 313 REST OF LATIN AMERICA: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 314 REST OF LATIN AMERICA: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 315 REST OF LATIN AMERICA: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 316 REST OF LATIN AMERICA: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 REST OF LATIN AMERICA: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 318 REST OF LATIN AMERICA: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 319 MIDDLE EAST & AFRICA: KEY MACROECONOMIC INDICATORS

- TABLE 320 MIDDLE EAST & AFRICA: WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 321 MIDDLE EAST & AFRICA: ADVANCED WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 322 MIDDLE EAST & AFRICA: FOAM DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 323 MIDDLE EAST & AFRICA: TRADITIONAL WOUND DRESSINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 324 MIDDLE EAST & AFRICA: WOUND DRESSINGS MARKET, BY WOUND TYPE, 2023-2030 (USD MILLION)

- TABLE 325 MIDDLE EAST & AFRICA: WOUND DRESSINGS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 326 WOUND DRESSINGS MARKET: OVERVIEW OF STRATEGIES DEPLOYED BY KEY MANUFACTURING COMPANIES, JANUARY 2022-JUNE 2025

- TABLE 327 WOUND DRESSINGS MARKET: DEGREE OF COMPETITION

- TABLE 328 WOUND DRESSINGS MARKET: REGION FOOTPRINT

- TABLE 329 WOUND DRESSINGS MARKET: TYPE FOOTPRINT

- TABLE 330 WOUND DRESSINGS MARKET: WOUND TYPE FOOTPRINT

- TABLE 331 WOUND DRESSINGS MARKET: END-USER FOOTPRINT

- TABLE 332 WOUND DRESSINGS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 333 WOUND DRESSINGS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 334 WOUND DRESSINGS MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 335 WOUND DRESSINGS MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 336 WOUND DRESSINGS MARKET: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 337 WOUND DRESSINGS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 338 SOLVENTUM: COMPANY OVERVIEW

- TABLE 339 SOLVENTUM: PRODUCTS OFFERED

- TABLE 340 SOLVENTUM: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 341 SOLVENTUM: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 342 MOLNLYCKE AB: COMPANY OVERVIEW

- TABLE 343 MOLNLYCKE AB: PRODUCTS OFFERED

- TABLE 344 MOLNLYCKE AB: DEALS, JANUARY 2022-JUNE 2025

- TABLE 345 MOLNLYCKE AB: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 346 CARDINAL HEALTH: COMPANY OVERVIEW

- TABLE 347 CARDINAL HEALTH: PRODUCTS OFFERED

- TABLE 348 CARDINAL HEALTH: DEALS, JANUARY 2022- MAY 2025

- TABLE 349 CARDINAL HEALTH: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 350 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 351 SMITH+NEPHEW: PRODUCTS OFFERED

- TABLE 352 SMITH+NEPHEW: DEALS, JANUARY 2022-JUNE 2025

- TABLE 353 SMITH+NEPHEW: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 354 SMITH+NEPHEW: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 355 CONVATEC GROUP PLC: COMPANY OVERVIEW

- TABLE 356 CONVATEC GROUP PLC: PRODUCTS OFFERED

- TABLE 357 CONVATEC GROUP PLC: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 358 CONVATEC GROUP PLC: DEALS, JANUARY 2022-JUNE 2025

- TABLE 359 PAUL HARTMANN AG: COMPANY OVERVIEW

- TABLE 360 PAUL HARTMANN AG: PRODUCTS OFFERED

- TABLE 361 PAUL HARTMANN AG: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 362 COLOPLAST GROUP: COMPANY OVERVIEW

- TABLE 363 COLOPLAST GROUP: PRODUCTS OFFERED

- TABLE 364 COLOPLAST GROUP: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 365 OWENS & MINOR: COMPANY OVERVIEW

- TABLE 366 OWENS & MINOR: PRODUCTS OFFERED

- TABLE 367 OWENS & MINOR: DEALS, JANUARY 2022-JANUARY 2025

- TABLE 368 OWENS & MINOR: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 369 INTEGRA LIFESCIENCES CORPORATION: COMPANY OVERVIEW

- TABLE 370 INTEGRA LIFESCIENCES CORPORATION: PRODUCTS OFFERED

- TABLE 371 INTEGRA LIFESCIENCES CORPORATION: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 372 ESSITY AKTIEBOLAG: COMPANY OVERVIEW

- TABLE 373 ESSITY AKTIEBOLAG: PRODUCTS OFFERED

- TABLE 374 ESSITY AKTIEBOLAG: OTHER DEVELOPEMENTS, JANUARY 2022-JUNE 2025

- TABLE 375 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 376 B. BRAUN SE: PRODUCTS OFFERED

- TABLE 377 ADVANCED MEDICAL SOLUTIONS GROUP PLC: COMPANY OVERVIEW

- TABLE 378 ADVANCED MEDICAL SOLUTIONS GROUP PLC: PRODUCTS OFFERED

- TABLE 379 ADVANCED MEDICAL SOLUTIONS GROUP PLC: DEALS, JANUARY 2022-JUNE 2025

- TABLE 380 MATIV HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 381 MATIV HOLDINGS, INC.: PRODUCTS OFFERED

- TABLE 382 MATIV HOLDINGS, INC.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 383 URGO GROUP: COMPANY OVERVIEW

- TABLE 384 DEROYAL INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 385 LOHMANN & RAUSCHER GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 386 MEDLINE INDUSTRIES, LP: COMPANY OVERVIEW

- TABLE 387 WINNER MEDICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 388 ADVANCIS (UK): COMPANY OVERVIEW

- TABLE 389 HOLLISTER INCORPORATED: COMPANY OVERVIEW

- TABLE 390 DERMARITE INDUSTRIES, LLC: COMPANY OVERVIEW

- TABLE 391 MIL LABORATORIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 392 GENTELL: COMPANY OVERVIEW

- TABLE 393 SHIELDLINE: COMPANY OVERVIEW

- TABLE 394 FOCUS HEALTH GROUP: COMPANY OVERVIEW

List of Figures

- FIGURE 1 WOUND DRESSINGS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 WOUND DRESSINGS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 6 WOUND DRESSINGS MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 WOUND DRESSINGS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 9 WOUND DRESSINGS MARKET, BY WOUND TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 10 WOUND DRESSINGS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 GEOGRAPHICAL SNAPSHOT OF WOUND DRESSINGS MARKET

- FIGURE 12 INCREASING PREVALENCE OF CHRONIC DISEASES TO DRIVE MARKET GROWTH

- FIGURE 13 HOSPITALS, ASCS, AND CLINICS ACCOUNTED FOR LARGEST SHARE IN 2024

- FIGURE 14 JAPAN TO RECORD HIGHEST GROWTH RATE FROM 2025 TO 2030

- FIGURE 15 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 WOUND DRESSINGS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 18 WOUND DRESSINGS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 WOUND DRESSINGS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 WOUND DRESSINGS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 WOUND DRESSINGS MARKET: INVESTMENT & FUNDING SCENARIO, 2020-2025 (USD MILLION)

- FIGURE 22 WOUND DRESSINGS MARKET: PATENT ANALYSIS, JANUARY 2015-DECEMBER 2024

- FIGURE 23 WOUND DRESSINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF WOUND DRESSINGS, BY END USER

- FIGURE 25 KEY BUYING CRITERIA FOR WOUND DRESSINGS, BY END USER

- FIGURE 26 IMPACT OF AI ON WOUND DRESSINGS MARKET: USE CASES

- FIGURE 27 EUROPE: WOUND DRESSINGS MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: WOUND DRESSINGS MARKET SNAPSHOT

- FIGURE 29 WOUND DRESSINGS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024 (USD MILLION)

- FIGURE 30 MARKET SHARE ANALYSIS OF KEY PLAYERS IN WOUND DRESSINGS MARKET, 2024

- FIGURE 31 RANKING OF KEY PLAYERS IN WOUND DRESSINGS MARKET, 2024

- FIGURE 32 WOUND DRESSINGS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 33 WOUND DRESSINGS MARKET: COMPANY FOOTPRINT

- FIGURE 34 WOUND DRESSINGS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 35 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 36 EV/EBITDA OF KEY VENDORS

- FIGURE 37 WOUND DRESSINGS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 38 SOLVENTUM: COMPANY SNAPSHOT (2024)

- FIGURE 39 MOLNLYCKE AB: COMPANY SNAPSHOT (2024)

- FIGURE 40 CARDINAL HEALTH: COMPANY SNAPSHOT (2024)

- FIGURE 41 SMITH+NEPHEW: COMPANY SNAPSHOT (2024)

- FIGURE 42 CONVATEC GROUP PLC: COMPANY SNAPSHOT (2024)

- FIGURE 43 PAUL HARTMANN AG: COMPANY SNAPSHOT (2024)

- FIGURE 44 COLOPLAST GROUP: COMPANY SNAPSHOT (2024)

- FIGURE 45 OWENS & MINOR: COMPANY SNAPSHOT (2024)

- FIGURE 46 INTEGRA LIFESCIENCES CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 47 ESSITY AKTIEBOLAG: COMPANY SNAPSHOT (2024)

- FIGURE 48 B. BRAUN SE: COMPANY SNAPSHOT (2024)

- FIGURE 49 ADVANCED MEDICAL SOLUTIONS GROUP PLC: COMPANY SNAPSHOT (2024)

- FIGURE 50 MATIV HOLDINGS, INC.: COMPANY SNAPSHOT (2024)

The global wound dressings market is projected to reach USD 15.87 billion by 2030 from USD 11.60 billion in 2025, at a CAGR of 6.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, Wound Type, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

The market is primarily driven by the rising incidence of burn injuries, increasing prevalence of chronic, surgical, and traumatic wounds, a high rate of cesarean sections among elderly women, and a growing number of road accidents. However, the high cost and limited adoption of advanced wound dressings are anticipated to hinder market growth during the forecast period.

The advanced wound dressings segment accounted for the largest share of the wound dressings market, by type.

Based on type, the wound dressings market is segmented into traditional wound dressings and advanced wound dressings. In 2024, the advanced wound dressings segment captured the largest share of the wound dressings market by type. This can be largely attributed to the growing incidence of chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, which require specialized and more effective treatment approaches. Additionally, factors such as the rising prevalence of diabetes, increased awareness among patients regarding wound management, advancements in wound care technologies, and the growing burden of hospital-acquired infections (HAIs) are contributing to the strong demand for advanced wound dressings. These products offer faster healing, reduced infection risk, and improved patient outcomes, further driving their adoption.

The surgical and traumatic wounds accounted for the largest market share in the wound dressings market.

Based on wound type, the market has been segmented into surgical and traumatic wounds, diabetic foot ulcers, pressure ulcers, venous leg ulcers, and burns & other wounds. Based on wound type, the surgical and traumatic wounds segment held the largest share of the wound dressings market in 2024. The significant share is primarily due to the rising number of surgical interventions worldwide and the increasing incidence of traumatic injuries resulting from accidents and falls. Furthermore, the growing elderly population, who are more prone to chronic conditions and surgeries, as well as the global rise in road traffic accidents, contribute to the segment's dominance. This segment is also projected to witness the highest CAGR during the forecast period, owing to continuous improvements in surgical techniques, post-operative care, and the increasing use of wound dressings in hospital and home care settings.

Asia Pacific is the fastest-growing region of the wound dressings market, by region.

The global wound dressings market is categorized into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these, the Asia Pacific region is experiencing rapid growth, driven by an aging population and a rising prevalence of lifestyle-related conditions that contribute to chronic wounds. The increasing demand for high-quality healthcare services, along with substantial investments in hospital infrastructure and advanced medical technologies, is fueling the uptake of advanced wound care dressings. Additionally, the growing medical tourism industry in countries such as India, Thailand, and Singapore has led to a rise in surgical procedures, thereby increasing the need for effective post-operative wound care. With a strong focus among healthcare providers on enhancing patient outcomes and shortening recovery periods, the Asia Pacific market is expected to register the highest compound annual growth rate (CAGR) during the forecast period.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 40%, Tier 2: 30%, and Tier 3: 30%

- By Designation: C Level: 27%, Director Level: 18%, and Others: 55%

- By Region: North America: 51%, Europe: 21%, Asia Pacific: 18%, Latin America: 6%, and Middle East & Africa: 4%

Note 1: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The major players operating in the wound dressings market are Solventum (US), Smith+ Nephew (UK), Convatec Group PLC (UK), Coloplast Group (Denmark), Cardinal Health (US), Molnlycke AB (Sweden), Integra LifeSciences Corporation (US), PAUL HARTMANN AG (Germany), B.Braun SE (Germany), Essity Aktiebolag (Sweden), Advanced Medical Solutions Group plc (UK), Mativ Holdings, Inc. (US), Owens & Minor (US), Lohmann & Rausher GmbH & Co. KG (Germany), Medline Industries, LP (US), DeRoyal Industries, Ine. (US), Winner Medical Co., LTD. (China), Advancis (UK), Hollister Incorporated (US), DermaRite Industries, LLC. (US), Mil Laboratories Pvt. Ltd. (India), Urgo Group (France), Gentell (US), Shield Line (US), and Focus Health Group (US)

Research Coverage

This report studies the wound dressings market based on type, wound type, end user, and country. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends. It forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the strategies mentioned below to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (growing geriatric population, increasing cases of traumatic injuries, growing prevalence of chronic diseases

rising incidence of burn injuries, rising use of regenerative medicine for wound management,

and government initiatives and reimbursement policies), restraints (high cost of advanced wound care products, risks associated with use of advanced wound care products

and antimicrobial resistance challenges), opportunities (Growth opportunities in emerging economies, technological advancement in wound care, and home-care optimized solutions), challenges (lack of trained healthcare professionals, Limited awareness in underdeveloped regions, and data security and privacy concerns)

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the wound dressings market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the wound dressings market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the wound dressings market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Approach 3: Primary interviews

- 2.2.1.4 Growth forecast

- 2.2.1.5 CAGR projections

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 STUDY-RELATED ASSUMPTIONS

- 2.4.2 PARAMETRIC ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 WOUND DRESSINGS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: WOUND DRESSINGS MARKET SHARE, BY END USER AND COUNTRY

- 4.3 WOUND DRESSINGS MARKET: GEOGRAPHIC SNAPSHOT

- 4.4 WOUND DRESSINGS MARKET, REGIONAL MIX, 2025 VS. 2030

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing burden of chronic illnesses and conditions that impair natural wound healing

- 5.2.1.2 Rising cases of burn-related injuries globally

- 5.2.1.3 Increasing number of road accidents and trauma injuries

- 5.2.1.4 Elevated rate of cesarean deliveries in elderly mothers

- 5.2.1.5 Technological advancements in wound dressings

- 5.2.2 RESTRAINTS

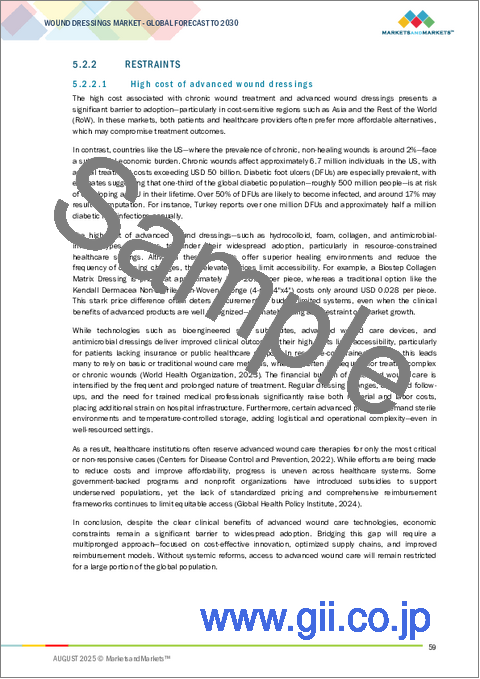

- 5.2.2.1 High cost of advanced wound dressings

- 5.2.2.2 Potential risks and complications linked to wound dressings

- 5.2.2.3 Antimicrobial resistance challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities in emerging economies

- 5.2.3.2 Supportive government initiatives and favorable reimbursement frameworks

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of trained healthcare professionals

- 5.2.4.2 Gaps in awareness and accessibility across emerging markets

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY PRODUCT, 2023-2025

- 5.4.2 AVERAGE SELLING PRICE TREND OF WOUND DRESSING PRODUCTS FOR KEY WOUND TYPES, BY KEY PLAYER, 2023-2025

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2025

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Bioactive wound dressings

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Antimicrobial coating technology

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Negative-pressure wound therapy

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- 5.11.2 EXPORT SCENARIO

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE STUDY 1: HYDROCOLL HYDROCOLLOID DRESSINGS ACCELERATE HEALING IN CHRONIC WOUNDS

- 5.13.2 CASE STUDY 2: BIATAIN SILICONE ENHANCES COMFORT AND HEALING IN CHRONIC WOUNDS

- 5.13.3 CASE STUDY 3: MEPILEX UP REDUCES LEAKAGE AND IMPROVES LIFE QUALITY IN VENOUS LEG ULCERS

- 5.14 REGULATORY ANALYSIS

- 5.14.1 REGULATORY LANDSCAPE

- 5.14.1.1 North America

- 5.14.1.1.1 US

- 5.14.1.1.2 Canada

- 5.14.1.2 Europe

- 5.14.1.2.1 Germany

- 5.14.1.2.2 UK

- 5.14.1.2.3 France

- 5.14.1.3 Asia Pacific

- 5.14.1.3.1 China

- 5.14.1.3.2 Japan

- 5.14.1.3.3 India

- 5.14.1.4 Latin America

- 5.14.1.5 Middle East

- 5.14.1.1 North America

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2.1 North America

- 5.14.2.2 Europe

- 5.14.2.3 Asia Pacific

- 5.14.2.4 Latin America

- 5.14.2.5 Rest of the World

- 5.14.1 REGULATORY LANDSCAPE

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 BARGAINING POWER OF SUPPLIERS

- 5.15.2 BARGAINING POWER OF BUYERS

- 5.15.3 THREAT OF NEW ENTRANTS

- 5.15.4 THREAT OF SUBSTITUTES

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 IMPACT OF AI ON WOUND DRESSINGS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 MARKET POTENTIAL OF AI IN WOUND DRESSINGS MARKET

- 5.17.3 IMPACT OF AI ON WOUND DRESSINGS MARKET: USE CASES

- 5.17.4 KEY COMPANIES IMPLEMENTING AI

- 5.17.5 FUTURE OF AI IN WOUND DRESSINGS MARKET

- 5.18 IMPACT OF US 2025 TARIFFS ON WOUND DRESSINGS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Hospitals, ASCs, and clinics

6 WOUND DRESSINGS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 ADVANCED WOUND DRESSINGS

- 6.2.1 FOAM DRESSINGS

- 6.2.1.1 Silicone dressings

- 6.2.1.1.1 Ability of silicone dressings to expedite wound closure and reduce risk of maceration to drive market

- 6.2.1.2 Non-silicone dressings

- 6.2.1.2.1 Advantages such as scar removal and wound healing to drive demand for non-silicone dressings

- 6.2.1.1 Silicone dressings

- 6.2.2 HYDROCOLLOID DRESSINGS

- 6.2.2.1 Ability to promote granulation and formation of new tissues in open wounds to boost adoption

- 6.2.3 FILM DRESSINGS

- 6.2.3.1 Non-absorbable nature of film dressings to limit adoption

- 6.2.4 ALGINATE DRESSINGS

- 6.2.4.1 Growing incidence of pressure and diabetic foot ulcers to fuel growth

- 6.2.5 HYDROGEL DRESSINGS

- 6.2.5.1 Ability to provide relief and cooling effect on skin to drive use of hydrogel dressings

- 6.2.6 COLLAGEN DRESSINGS

- 6.2.6.1 Favorable reimbursement scenario for collagen dressings to support market

- 6.2.7 HYDROFIBER DRESSINGS

- 6.2.7.1 Combination of properties of hydrocolloids and alginates to boost adoption of hydrofiber dressings

- 6.2.8 WOUND CONTACT LAYERS

- 6.2.8.1 Ability to protect wound beds from bacterial and fungal growth to drive growth

- 6.2.9 SUPERABSORBENT DRESSINGS

- 6.2.9.1 Use of superabsorbent dressings for fragile skin to promote growth

- 6.2.10 OTHER ADVANCED WOUND DRESSINGS

- 6.2.1 FOAM DRESSINGS

- 6.3 TRADITIONAL WOUND DRESSINGS

- 6.3.1 GAUZES

- 6.3.1.1 Wide usage of gauzes in surgeries and wound packing to propel market growth

- 6.3.2 TAPES

- 6.3.2.1 Importance of secure fixation, comfort, and reduced trauma to drive demand

- 6.3.3 BANDAGES

- 6.3.3.1 Wide usage of bandages to support market growth

- 6.3.4 ABSORBENT PADS

- 6.3.4.1 Wide usage of absorbent pads in wound dressing and exudate management to drive market

- 6.3.5 OTHER TRADITIONAL WOUND DRESSINGS

- 6.3.1 GAUZES

7 WOUND DRESSINGS MARKET, BY WOUND TYPE

- 7.1 INTRODUCTION

- 7.2 SURGICAL & TRAUMATIC WOUNDS

- 7.2.1 GROWING VOLUME OF SURGICAL PROCEDURES PERFORMED AND INCREASING INCIDENCE OF BURN INJURIES TO SUPPORT MARKET GROWTH

- 7.3 DIABETIC FOOT ULCERS

- 7.3.1 INCREASING PREVALENCE OF DIABETES TO PROPEL MARKET GROWTH

- 7.4 PRESSURE ULCERS

- 7.4.1 GROWING PREVALENCE OF PRESSURE ULCERS TO SUPPORT MARKET GROWTH

- 7.5 VENOUS LEG ULCERS

- 7.5.1 RISING GERIATRIC POPULATION TO SUPPORT GROWTH OF THIS SEGMENT

- 7.6 BURNS & OTHER WOUNDS

- 7.6.1 HIGH INCIDENCE OF BURN INJURIES IN EMERGING COUNTRIES TO PROPEL GROWTH

8 WOUND DRESSINGS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS, ASCS, AND CLINICS

- 8.2.1 RISING NEED FOR BETTER WOUND MANAGEMENT AND GROWING NUMBER OF HOSPITAL READMISSIONS TO SUPPORT MARKET GROWTH

- 8.3 HOME CARE SETTINGS

- 8.3.1 NEED TO CONTROL RISING HEALTHCARE COSTS TO DRIVE MARKET GROWTH

- 8.4 OTHER END USERS

9 WOUND DRESSINGS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Rising diabetes prevalence and supportive reimbursement policies to drive market growth

- 9.2.3 CANADA

- 9.2.3.1 Government-backed efforts to support market development

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Rising diabetes cases and chronic wound burden to boost market growth

- 9.3.3 FRANCE

- 9.3.3.1 Rising chronic wound cases to drive market expansion in France

- 9.3.4 UK

- 9.3.4.1 Increase in R&D activity to propel market growth

- 9.3.5 ITALY

- 9.3.5.1 Growing number of injury-related cases in Italy to propel growth

- 9.3.6 SPAIN

- 9.3.6.1 Rising life expectancy and aging population to boost wound care adoption in Spain

- 9.3.7 RUSSIA

- 9.3.7.1 Government initiatives to raise diabetes awareness to support market expansion in Russia

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Increasing incidence of diabetic foot ulcers (DFUs) to encourage growth

- 9.4.3 JAPAN

- 9.4.3.1 Evolving healthcare delivery and infrastructure landscape to fuel market

- 9.4.4 INDIA

- 9.4.4.1 Booming medical tourism to speed up market growth

- 9.4.5 AUSTRALIA

- 9.4.5.1 Growing number of medical manufacturing companies to drive market

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Evolving healthcare infrastructure in country to contribute to growth

- 9.5.3 MEXICO

- 9.5.3.1 Expanding hospital infrastructure to aid growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWING DEMAND FOR HEALTHCARE FACILITIES TO DRIVE MARKET

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2024

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN WOUND DRESSINGS MARKET

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Type footprint

- 10.5.5.4 Wound type footprint

- 10.5.5.5 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 COMPANY VALUATION

- 10.7.2 FINANCIAL METRICS

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES & APPROVALS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SOLVENTUM

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 MOLNLYCKE AB

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 CARDINAL HEALTH

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 SMITH+NEPHEW

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.3.2 Expansions

- 11.1.4.3.3 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 CONVATEC GROUP PLC

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 PAUL HARTMANN AG

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Other developments

- 11.1.7 COLOPLAST GROUP

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.8 OWENS & MINOR

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.3.2 Other developments

- 11.1.9 INTEGRA LIFESCIENCES CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Other developments

- 11.1.10 ESSITY AKTIEBOLAG

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Other developments

- 11.1.11 B. BRAUN SE

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.12 ADVANCED MEDICAL SOLUTIONS GROUP PLC

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Deals

- 11.1.13 MATIV HOLDINGS, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Deals

- 11.1.1 SOLVENTUM

- 11.2 OTHER PLAYERS

- 11.2.1 URGO GROUP

- 11.2.2 DEROYAL INDUSTRIES, INC.

- 11.2.3 LOHMANN & RAUSCHER GMBH & CO. KG

- 11.2.4 MEDLINE INDUSTRIES, LP

- 11.2.5 WINNER MEDICAL CO., LTD.

- 11.2.6 ADVANCIS (UK)

- 11.2.7 HOLLISTER INCORPORATED

- 11.2.8 DERMARITE INDUSTRIES, LLC

- 11.2.9 MIL LABORATORIES PVT. LTD.

- 11.2.10 GENTELL

- 11.2.11 SHIELDLINE

- 11.2.12 FOCUS HEALTH GROUP

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS