|

|

市場調査レポート

商品コード

1804840

新生児ケア機器の世界市場:製品別、エンドユーザー別、地域別 - 2030年までの予測Neonatal Care Equipment Market by Product (Neonatal Incubators, Convertible Warmers & Incubators, Respiratory Care Devices, Monitoring Devices ), End User - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 新生児ケア機器の世界市場:製品別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月20日

発行: MarketsandMarkets

ページ情報: 英文 327 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

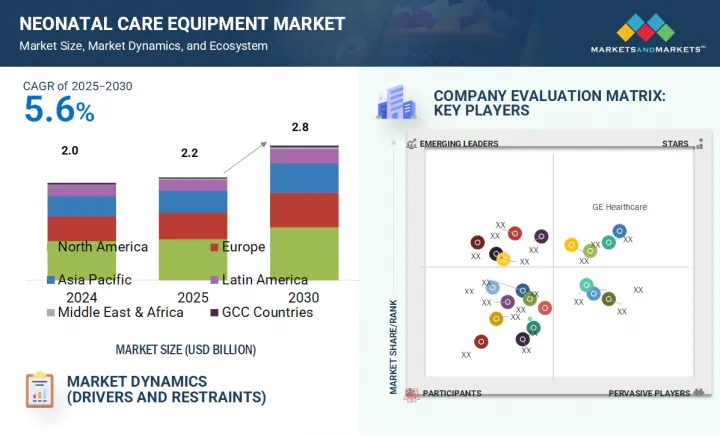

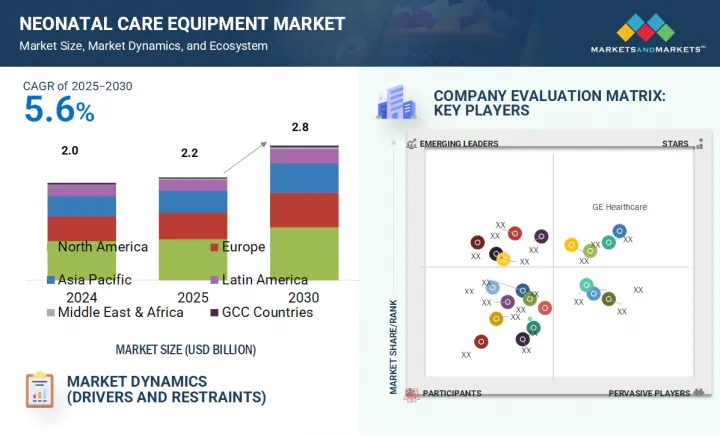

新生児ケア機器の市場規模は、予測期間中に5.6%のCAGRで拡大し、2025年の20億6,000万米ドルから2030年には28億4,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ、GCC諸国 |

新生児ケア機器の技術的進歩は、新生児ヘルスケアの状況を大きく変えつつあります。ハイブリッドウォーマー・インキュベーターシステムなどの技術革新は、オープンウォーマーとクローズドインキュベーターの利点を組み合わせ、柔軟性を提供し、脆弱な新生児を機器間で移動させる必要性を減少させる。自動酸素供給システムは、酸素濃度を正確かつリアルタイムに調節することを可能にし、低酸素症や高酸素症に関連するリスクを最小限に抑えます。保育器や保温器に内蔵された光線療法ユニットにより、新生児の邪魔をすることなく、新生児黄疸の治療を継続的に行うことができます。

さらに、ワイヤレスモニタリングシステムは、シームレスで正確なリアルタイムデータを提供しながら、機動性を高め、ケーブルの乱雑さを減らし、感染リスクを低減します。これらの先進技術は、未熟児や重症の新生児の臨床転帰を改善するだけでなく、病院や新生児集中治療室(NICU)のインフラをアップグレードする原動力にもなっています。その結果、これらの技術革新は、効率性、安全性、ケアの質を高めることにより、世界の新生児ケア機器市場の一貫した成長を促進しています。

製品別では、新生児保育器セグメントが2024年の世界の新生児ケア機器市場で最大のシェアを占めています。早産児や低出生体重児は体温調節能力がないため、低体温症に非常にかかりやすいです。新生児用保育器は、これらの乳児の生存、成長、開発をサポートする安定した制御された温熱環境を提供する上で重要な役割を果たしています。その結果、保育器は新生児集中治療室(NICU)の重要な構成要素となっています。早産児の管理に不可欠な役割を果たすことから、新生児用保育器は新生児医療機器市場で最大のシェアを占めています。

エンドユーザー別では、一般病院が2024年の新生児ケア機器市場で最大の市場シェアを占めています。一般病院は、特に小児科専門センターが限られている新興諸国や中所得諸国において、新生児分娩の主要なアクセスポイントとして機能しています。総合病院では、日常的な出産からリスクの高い出産まで、大量の出産を管理するため、包括的な新生児ケア機器が必要となります。新生児医療提供の中心となっているのは、その幅広いサービス範囲とアクセスの良さです。その結果、新生児医療機器市場では、一貫した需要と広範な患者の流入によって、一般病院部門が最大の市場シェアを占めています。

北米は予測期間中、新生児ケア機器市場で最大のシェアを占めると予想されます。北米、特に米国とカナダは、高いヘルスケア支出と強力な償還の枠組みにより、新生児ケア機器市場をリードしています。GDPのかなりの割合がヘルスケアに充てられており、設備の整った新生児室が確保されています。メディケイド、メディケア、民間保険などのプログラムにより、保育器、人工呼吸器、モニターなどの高度で高価な機器へのアクセスが容易になっています。このような強固な財政的・インフラ的支援により、最先端の新生児医療技術が広く採用され、北米は新生児医療機器の主要な地域市場となっています。

当レポートでは、世界の新生児ケア機器市場について調査し、製品別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- アンメットニーズ/エンドユーザーの期待

- 隣接市場分析

- AI/生成AIが新生児ケア機器市場に与える影響

- 2025年の米国関税が新生児ケア機器市場に与える影響

第6章 新生児ケア機器市場(製品別)

- イントロダクション

- 新生児保育器

- 新生児呼吸ケア機器

- コンバーチブルウォーマー&インキュベーター

- 新生児光線療法機器

- 新生児モニタリング装置

- 新生児診断画像コンポーネント

- 乳児用ウォーマー

- その他

第7章 新生児ケア機器市場(エンドユーザー別)

- イントロダクション

- 総合病院

- 小児病院

- 産科・出産センター

- その他

第8章 新生児ケア機器市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- 韓国

- オーストラリア

- ニュージーランド

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 高い出生率と地域の保健改革が新生児用機器の需要を刺激

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- 戦略的な政府支出、スマートNICU技術の導入、デジタル母子ケアへの注力で市場を牽引

- GCC諸国のマクロ経済見通し

第9章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第10章 企業プロファイル

- 主要参入企業

- GE HEALTHCARE

- DRAGERWERK AG & CO. KGAA

- KONINKLIJKE PHILIPS N.V.

- MASIMO

- FISHER & PAYKEL HEALTHCARE LIMITED

- NIHON KOHDEN CORPORATION

- INSPIRATION HEALTHCARE GROUP PLC

- MEDTRONIC

- CARDINAL HEALTH

- ICU MEDICAL, INC.

- UTAH MEDICAL PRODUCTS, INC.

- AMBU A/S

- BECTON, DICKINSON AND COMPANY(BD)

- ATOM MEDICAL CORP.

- HAMILTON MEDICAL

- その他の企業

- NATUS MEDICAL

- SPACELABS HEALTHCARE

- VENTEC LIFE SYSTEMS

- PHOENIX MEDICAL SYSTEMS

- NONIN

- ANALOGIC CORPORATION

- VYAIRE MEDICAL

- VYGON GROUP

- COOK

- APEX MEDICAL DEVICES

第11章 付録

List of Tables

- TABLE 1 NEONATAL CARE EQUIPMENT MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES

- TABLE 3 NEONATAL CARE EQUIPMENT MARKET: STUDY ASSUMPTIONS

- TABLE 4 NEONATAL CARE EQUIPMENT MARKET: RISK ANALYSIS

- TABLE 5 NEONATAL CARE EQUIPMENT MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 6 AVERAGE SELLING PRICE TREND OF NEONATAL CARE PRODUCTS, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF NEONATAL INCUBATORS, BY REGION, 2022-2024 (USD)

- TABLE 8 NEONATAL CARE EQUIPMENT MARKET: ROLE IN ECOSYSTEM

- TABLE 9 NEONATAL CARE EQUIPMENT MARKET: INNOVATIONS AND PATENT REGISTRATIONS, JANUARY 2023-JULY 2025

- TABLE 10 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 NEONATAL CARE EQUIPMENT MARKET: LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 13 CASE STUDY 1: BOSTON CHILDREN'S HOSPITAL TO MODERNIZE NICU INFRASTRUCTURE FOR IMPROVED CARE AMONG PREMATURE INFANTS

- TABLE 14 CASE STUDY 2: INDIAN MINISTRY OF HEALTH TO DEPLOY LOW-COST LED PHOTOTHERAPY UNITS FOR REDUCING NEONATAL JAUNDICE-RELATED MORTALITY

- TABLE 15 CASE STUDY 3: MOUNT SINAI HOSPITAL TO IMPLEMENT PREDICTIVE NEONATAL MONITORING FOR REDUCING LATE-ONSET SEPSIS AND APNEA IN PRETERM INFANTS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 NEONATAL CARE EQUIPMENT MARKET: PORTER'S FIVE FORCES

- TABLE 22 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PRODUCTS (%)

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE PRODUCTS

- TABLE 24 KEY COMPANIES IMPLEMENTING AI IN NEONATAL CARE EQUIPMENT MARKET

- TABLE 25 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 26 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR NEONATAL CARE EQUIPMENT

- TABLE 27 NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 28 LEADING MANUFACTURERS OF NEONATAL INCUBATORS

- TABLE 29 NEONATAL INCUBATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 NEONATAL INCUBATORS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 31 NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 32 NEONATAL RESPIRATORY CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 LEADING MANUFACTURERS OF NEONATAL VENTILATORS

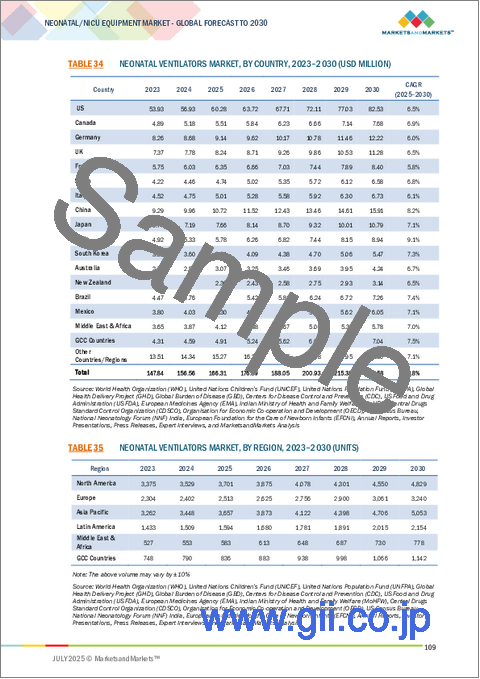

- TABLE 34 NEONATAL VENTILATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 NEONATAL VENTILATORS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 36 LEADING MANUFACTURERS OF CONTINUOUS POSITIVE AIRWAY PRESSURE DEVICES

- TABLE 37 CONTINUOUS POSITIVE AIRWAY PRESSURE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 CONTINUOUS POSITIVE AIRWAY PRESSURE DEVICES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 39 LEADING MANUFACTURERS OF RESUSCITATORS

- TABLE 40 RESUSCITATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 LEADING MANUFACTURERS OF OTHER NEONATAL RESPIRATORY CARE DEVICES

- TABLE 42 OTHER NEONATAL RESPIRATORY CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 LEADING MANUFACTURERS OF CONVERTIBLE WARMERS & INCUBATORS

- TABLE 44 CONVERTIBLE WARMERS & INCUBATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 CONVERTIBLE WARMERS & INCUBATORS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 46 NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 47 NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 49 LEADING MANUFACTURERS OF CONVENTIONAL NEONATAL PHOTOTHERAPY EQUIPMENT

- TABLE 50 CONVENTIONAL NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 LEADING MANUFACTURERS OF FIBRE-OPTIC NEONATAL PHOTOTHERAPY EQUIPMENT

- TABLE 52 FIBRE-OPTIC NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 54 NEONATAL MONITORING DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 LEADING MANUFACTURERS OF BLOOD PRESSURE MONITORS

- TABLE 56 BLOOD PRESSURE MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 LEADING MANUFACTURERS OF CARDIAC MONITORS

- TABLE 58 CARDIAC MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 LEADING MANUFACTURERS OF PULSE OXIMETERS

- TABLE 60 PULSE OXIMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 LEADING MANUFACTURERS OF CAPNOGRAPHS

- TABLE 62 CAPNOGRAPHS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 LEADING MANUFACTURERS OF EXTRACORPOREAL MEMBRANE OXYGENATION SYSTEMS

- TABLE 64 EXTRACORPOREAL MEMBRANE OXYGENATION SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 LEADING MANUFACTURERS OF INTEGRATED MONITORING DEVICES

- TABLE 66 INTEGRATED MONITORING DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 68 NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 69 LEADING MANUFACTURERS OF ULTRASOUND TRANSDUCERS

- TABLE 70 ULTRASOUND TRANSDUCERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 LEADING MANUFACTURERS OF X-RAY DETECTORS

- TABLE 72 X-RAY DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 74 INFANT WARMERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 INFANT WARMERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 76 LEADING MANUFACTURERS OF ELECTRIC WARMERS

- TABLE 77 ELECTRIC WARMERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 LEADING MANUFACTURERS OF N0N-ELECTRIC WARMERS

- TABLE 79 N0N-ELECTRIC WARMERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 OTHER NEONATAL PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 82 NEONATAL CARE EQUIPMENT MARKET FOR GENERAL HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 NEONATAL CARE EQUIPMENT MARKET FOR PEDIATRIC HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 NEONATAL CARE EQUIPMENT MARKET FOR MATERNITY & BIRTHING CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 NEONATAL CARE EQUIPMENT MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 NEONATAL CARE EQUIPMENT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: NEONATAL CARE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 95 US: KEY MACROINDICATORS

- TABLE 96 US: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 97 US: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 US: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 US: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 US: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 US: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 US: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 103 CANADA: KEY MACROINDICATORS

- TABLE 104 CANADA: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 105 CANADA: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 CANADA: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 CANADA: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 CANADA: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 CANADA: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 CANADA: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 111 EUROPE: NEONATAL CARE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 EUROPE: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 EUROPE: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 EUROPE: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 EUROPE: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 EUROPE: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 EUROPE: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 119 GERMANY: KEY MACROINDICATORS

- TABLE 120 GERMANY: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 121 GERMANY: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 GERMANY: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 GERMANY: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 GERMANY: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 GERMANY: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 GERMANY: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 127 FRANCE: KEY MACROINDICATORS

- TABLE 128 FRANCE: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 129 FRANCE: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 FRANCE: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 FRANCE: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 FRANCE: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 FRANCE: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 FRANCE: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 135 UK: KEY MACROINDICATORS

- TABLE 136 UK: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 137 UK: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 UK: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 UK: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 UK: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 UK: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 UK: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 143 ITALY: KEY MACROINDICATORS

- TABLE 144 ITALY: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 145 ITALY: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 ITALY: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 ITALY: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 ITALY: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 ITALY: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 ITALY: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 151 SPAIN: KEY MACROINDICATORS

- TABLE 152 SPAIN: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 153 SPAIN: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 SPAIN: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 SPAIN: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 SPAIN: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 SPAIN: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 SPAIN: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 159 REST OF EUROPE: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 160 REST OF EUROPE: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 REST OF EUROPE: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 REST OF EUROPE: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 REST OF EUROPE: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 REST OF EUROPE: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 REST OF EUROPE: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: NEONATAL CARE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 ASIA PACIFIC: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 ASIA PACIFIC: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 174 JAPAN: KEY MACROINDICATORS

- TABLE 175 JAPAN: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 176 JAPAN: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 JAPAN: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 JAPAN: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 JAPAN: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 JAPAN: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 JAPAN: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 182 CHINA: KEY MACROINDICATORS

- TABLE 183 CHINA: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 184 CHINA: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 CHINA: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 CHINA: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 CHINA: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 CHINA: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 CHINA: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 190 INDIA: KEY MACROINDICATORS

- TABLE 191 INDIA: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 192 INDIA: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 INDIA: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 INDIA: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 INDIA: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 INDIA: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 INDIA: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 198 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 199 SOUTH KOREA: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 200 SOUTH KOREA: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 SOUTH KOREA: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 SOUTH KOREA: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 SOUTH KOREA: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 SOUTH KOREA: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 SOUTH KOREA: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 206 AUSTRALIA: KEY MACROINDICATORS

- TABLE 207 AUSTRALIA: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 208 AUSTRALIA: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 AUSTRALIA: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 AUSTRALIA: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 AUSTRALIA: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 AUSTRALIA: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 AUSTRALIA: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 214 NEW ZEALAND: KEY MACROINDICATORS

- TABLE 215 NEW ZEALAND: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 216 NEW ZEALAND: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 NEW ZEALAND: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 NEW ZEALAND: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 NEW ZEALAND: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 NEW ZEALAND: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 NEW ZEALAND: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 222 REST OF ASIA PACIFIC: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 REST OF ASIA PACIFIC: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 229 LATIN AMERICA: NEONATAL CARE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 230 LATIN AMERICA: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 231 LATIN AMERICA: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 LATIN AMERICA: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 LATIN AMERICA: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 LATIN AMERICA: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 LATIN AMERICA: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 236 LATIN AMERICA: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 237 BRAZIL: KEY MACROINDICATORS

- TABLE 238 BRAZIL: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 239 BRAZIL: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 BRAZIL: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 BRAZIL: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 BRAZIL: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 243 BRAZIL: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 BRAZIL: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 245 MEXICO: KEY MACROINDICATORS

- TABLE 246 MEXICO: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 247 MEXICO: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 MEXICO: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 MEXICO: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 MEXICO: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 MEXICO: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 MEXICO: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 253 REST OF LATIN AMERICA: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 254 REST OF LATIN AMERICA: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 255 REST OF LATIN AMERICA: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 REST OF LATIN AMERICA: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 REST OF LATIN AMERICA: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 258 REST OF LATIN AMERICA: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 259 REST OF LATIN AMERICA: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 267 GCC COUNTRIES: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 268 GCC COUNTRIES: NEONATAL RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 269 GCC COUNTRIES: NEONATAL PHOTOTHERAPY EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 270 GCC COUNTRIES: NEONATAL MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 271 GCC COUNTRIES: NEONATAL DIAGNOSTIC IMAGING COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 272 GCC COUNTRIES: INFANT WARMERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 GCC COUNTRIES: NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 274 KEY DEVELOPMENTS DEPLOYED BY MAJOR PLAYERS IN NEONATAL CARE EQUIPMENT MARKET, JANUARY 2021-JULY 2025

- TABLE 275 NEONATAL CARE EQUIPMENT MARKET: DEGREE OF COMPETITION

- TABLE 276 NEONATAL CARE EQUIPMENT MARKET: REGION FOOTPRINT

- TABLE 277 NEONATAL CARE EQUIPMENT MARKET: PRODUCT FOOTPRINT

- TABLE 278 NEONATAL CARE EQUIPMENT MARKET: END-USER FOOTPRINT

- TABLE 279 NEONATAL CARE EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 280 NEONATAL CARE EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SME PLAYERS, BY END USER AND REGION

- TABLE 281 NEONATAL CARE EQUIPMENT MARKET: PRODUCT LAUNCHES/APPROVALS/ENHANCEMENTS, JANUARY 2021-JULY 2025

- TABLE 282 NEONATAL CARE EQUIPMENT MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 283 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 284 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 285 GE HEALTHCARE: PRODUCT LAUNCHES/APPROVALS/ENHANCEMENTS, JANUARY 2021-JULY 2025

- TABLE 286 DRAGERWERK AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 287 DRAGERWERK AG & CO. KGAA: PRODUCTS OFFERED

- TABLE 288 DRAGERWERK AG & CO. KGAA: PRODUCT LAUNCHES/APPROVALS/ENHANCEMENTS, JANUARY 2021-JULY 2025

- TABLE 289 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 290 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 291 KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2021-JULY 2025

- TABLE 292 MASIMO: COMPANY OVERVIEW

- TABLE 293 MASIMO: PRODUCTS OFFERED

- TABLE 294 MASIMO: DEALS, JANUARY 2021-JULY 2025

- TABLE 295 FISHER & PAYKEL HEALTHCARE LIMITED: COMPANY OVERVIEW

- TABLE 296 FISHER & PAYKEL HEALTHCARE LIMITED: PRODUCTS OFFERED

- TABLE 297 NIHON KOHDEN CORPORATION: COMPANY OVERVIEW

- TABLE 298 NIHON KOHDEN CORPORATION: PRODUCTS OFFERED

- TABLE 299 NIHON KOHDEN CORPORATION: PRODUCT LAUNCHES/APPROVALS/ENHANCEMENTS, JANUARY 2021-JULY 2025

- TABLE 300 INSPIRATION HEALTHCARE GROUP PLC: COMPANY OVERVIEW

- TABLE 301 INSPIRATION HEALTHCARE GROUP PLC: PRODUCTS OFFERED

- TABLE 302 MEDTRONIC: COMPANY OVERVIEW

- TABLE 303 MEDTRONIC: PRODUCTS OFFERED

- TABLE 304 MEDTRONIC: PRODUCT LAUNCHES/APPROVALS/ENHANCEMENTS, JANUARY 2021-JULY 2025

- TABLE 305 CARDINAL HEALTH: COMPANY OVERVIEW

- TABLE 306 CARDINAL HEALTH: PRODUCTS OFFERED

- TABLE 307 ICU MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 308 ICU MEDICAL, INC.: PRODUCTS OFFERED

- TABLE 309 UTAH MEDICAL PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 310 UTAH MEDICAL PRODUCTS, INC.: PRODUCTS OFFERED

- TABLE 311 AMBU A/S: COMPANY OVERVIEW

- TABLE 312 AMBU A/S: PRODUCTS OFFERED

- TABLE 313 BECTON, DICKINSON AND COMPANY (BD): COMPANY OVERVIEW

- TABLE 314 BECTON, DICKINSON AND COMPANY (BD): PRODUCTS OFFERED

- TABLE 315 ATOM MEDICAL CORP.: COMPANY OVERVIEW

- TABLE 316 ATOM MEDICAL CORP.: PRODUCTS OFFERED

- TABLE 317 ATOM MEDICAL CORP.: OTHER DEVELOPMENTS, JANUARY 2021-JULY 2025

- TABLE 318 HAMILTON MEDICAL: COMPANY OVERVIEW

- TABLE 319 HAMILTON MEDICAL: PRODUCTS OFFERED

- TABLE 320 NATUS MEDICAL: COMPANY OVERVIEW

- TABLE 321 SPACELABS HEALTHCARE: COMPANY OVERVIEW

- TABLE 322 VENTEC LIFE SYSTEMS: COMPANY OVERVIEW

- TABLE 323 PHOENIX MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 324 NONIN: COMPANY OVERVIEW

- TABLE 325 ANALOGIC CORPORATION: COMPANY OVERVIEW

- TABLE 326 VYAIRE MEDICAL: COMPANY OVERVIEW

- TABLE 327 VYGON GROUP: COMPANY OVERVIEW

- TABLE 328 COOK: COMPANY OVERVIEW

- TABLE 329 APEX MEDICAL DEVICES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 NEONATAL CARE EQUIPMENT MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 NEONATAL CARE EQUIPMENT MARKET: YEARS CONSIDERED

- FIGURE 3 NEONATAL CARE EQUIPMENT MARKET: RESEARCH DESIGN

- FIGURE 4 NEONATAL CARE EQUIPMENT MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 NEONATAL CARE EQUIPMENT MARKET: PRIMARY SOURCES (SUPPLY AND DEMAND SIDES)

- FIGURE 6 NEONATAL CARE EQUIPMENT MARKET: KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 NEONATAL CARE EQUIPMENT MARKET: KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 9 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 10 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 11 NEONATAL CARE EQUIPMENT MARKET: SUPPLY-SIDE MARKET SIZE ESTIMATION (REVENUE SHARE ANALYSIS)

- FIGURE 12 NEONATAL CARE EQUIPMENT MARKET SIZE ESTIMATION: ILLUSTRATIVE EXAMPLE OF GE HEALTHCARE (2024)

- FIGURE 13 NEONATAL CARE EQUIPMENT MARKET SIZE ESTIMATION (SUPPLY SIDE), 2024

- FIGURE 14 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 15 NEONATAL CARE EQUIPMENT MARKET: CAGR PROJECTIONS (SUPPLY-SIDE ANALYSIS)

- FIGURE 16 NEONATAL CARE EQUIPMENT MARKET: TOP-DOWN APPROACH

- FIGURE 17 NEONATAL CARE EQUIPMENT MARKET: DATA TRIANGULATION METHODOLOGY

- FIGURE 18 NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 NEONATAL CARE EQUIPMENT MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 REGIONAL SNAPSHOT OF NEONATAL CARE EQUIPMENT MARKET

- FIGURE 21 HIGH PRETERM BIRTH RATES AND FAVORABLE GOVERNMENT-FUNDED MATERNAL-CHILD HEALTH PROGRAMS TO DRIVE MARKET

- FIGURE 22 CHINA AND NEONATAL INCUBATORS COMMANDED LARGEST SHARE IN ASIA PACIFIC NEONATAL CARE EQUIPMENT MARKET IN 2024

- FIGURE 23 INDIA TO REGISTER HIGHEST GROWTH RATE DURING STUDY PERIOD

- FIGURE 24 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

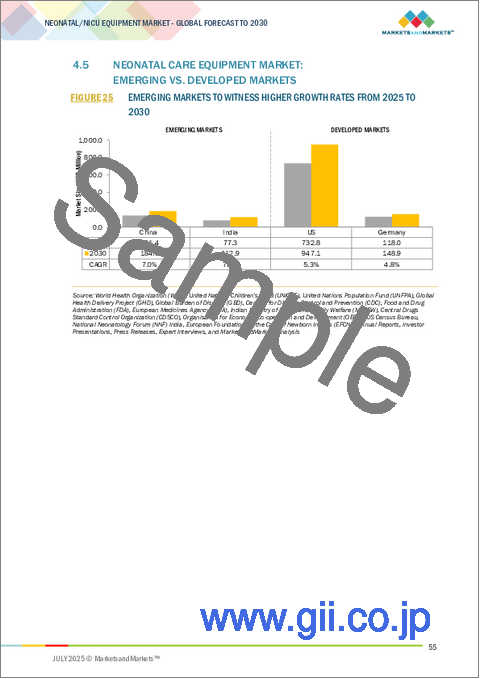

- FIGURE 25 EMERGING MARKETS TO WITNESS HIGHER GROWTH RATES FROM 2025 TO 2030

- FIGURE 26 NEONATAL CARE EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 NEONATAL CARE EQUIPMENT MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 28 AVERAGE SELLING PRICE TREND OF NEONATAL INCUBATORS, BY REGION, 2022-2024 (USD)

- FIGURE 29 NEONATAL CARE EQUIPMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 NEONATAL CARE EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 NEONATAL CARE EQUIPMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 32 NEONATAL CARE EQUIPMENT MARKET: FUNDING AND NUMBER OF DEALS, 2019-2023 (USD MILLION)

- FIGURE 33 NEONATAL CARE EQUIPMENT MARKET: VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 34 NEONATAL CARE EQUIPMENT MARKET: NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 35 NEONATAL CARE EQUIPMENT MARKET: TOP 10 PATENT OWNERS/APPLICANTS AND NUMBER OF PATENTS GRANTED, JANUARY 2015-JULY 2025

- FIGURE 36 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 37 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 38 NEONATAL CARE EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PRODUCTS

- FIGURE 40 KEY BUYING CRITERIA FOR TOP THREE PRODUCTS

- FIGURE 41 ADJACENT MARKETS TO NEONATAL CARE EQUIPMENT MARKET

- FIGURE 42 AI USE CASES IN NEONATAL CARE EQUIPMENT MARKET

- FIGURE 43 NORTH AMERICA: NEONATAL CARE EQUIPMENT MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: NEONATAL CARE EQUIPMENT MARKET SNAPSHOT

- FIGURE 45 REVENUE ANALYSIS OF TOP PLAYERS IN NEONATAL CARE EQUIPMENT MARKET, 2020-2024 (USD MILLION)

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS IN NEONATAL CARE EQUIPMENT MARKET (2024)

- FIGURE 47 NEONATAL CARE EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 NEONATAL CARE EQUIPMENT MARKET: COMPANY FOOTPRINT

- FIGURE 49 NEONATAL CARE EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 EV/EBITDA OF KEY VENDORS

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 52 NEONATAL CARE EQUIPMENT MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 53 GE HEALTHCARE: COMPANY SNAPSHOT

- FIGURE 54 DRAGERWERK AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 55 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

- FIGURE 56 MASIMO: COMPANY SNAPSHOT

- FIGURE 57 FISHER & PAYKEL HEALTHCARE LIMITED: COMPANY SNAPSHOT

- FIGURE 58 NIHON KOHDEN CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 INSPIRATION HEALTHCARE GROUP PLC: COMPANY SNAPSHOT

- FIGURE 60 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 61 CARDINAL HEALTH: COMPANY SNAPSHOT

- FIGURE 62 ICU MEDICAL, INC.: COMPANY SNAPSHOT

- FIGURE 63 UTAH MEDICAL PRODUCTS, INC.: COMPANY SNAPSHOT

- FIGURE 64 AMBU A/S: COMPANY SNAPSHOT

- FIGURE 65 BECTON, DICKINSON AND COMPANY (BD): COMPANY SNAPSHOT

The neonatal care equipment market is projected to reach USD 2.84 billion by 2030 from USD 2.06 billion in 2025, at a CAGR of 5.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

Technological advancements in neonatal care equipment are significantly transforming the landscape of newborn healthcare. Innovations such as hybrid warmer-incubator systems combine the benefits of open warmers and closed incubators, offering flexibility and reducing the need to transfer fragile infants between devices. Automated oxygen delivery systems enable precise and real-time regulation of oxygen levels, minimizing risks associated with hypoxia or hyperoxia. Integrated phototherapy units, embedded within incubators or warmers, allow for continuous treatment of neonatal jaundice without disturbing the infant.

Additionally, wireless monitoring systems enhance mobility, reduce cable clutter, and lower the risk of infection, all while providing seamless and accurate real-time data. These advanced technologies are not only improving clinical outcomes for premature and critically ill neonates but are also driving hospitals and neonatal intensive care units (NICUs) to upgrade their infrastructure. As a result, these innovations are fueling consistent growth in the global neonatal care equipment market by enhancing efficiency, safety, and care quality.

Based on product, the neonatal incubators segment held the largest share of the global neonatal care equipment market in 2024. Preterm and low-birth-weight infants lack the ability to regulate their body temperature, making them highly vulnerable to hypothermia. Neonatal incubators play a critical role in providing a stable and controlled thermal environment that supports survival, growth, and development in these infants. As a result, incubators are a vital component of Neonatal Intensive Care Units (NICUs). Owing to their essential role in managing preterm births, the neonatal incubators segment holds the largest market share in the neonatal care equipment market.

Based on end users, general hospitals held the largest market share in the neonatal care equipment market in 2024. General hospitals act as the primary access point for neonatal deliveries, particularly in developing and middle-income countries where specialized pediatric centers are limited. They manage a high volume of both routine and high-risk childbirths, necessitating the availability of comprehensive neonatal care equipment. Their broad service coverage and accessibility make them central to neonatal care delivery. Consequently, the general hospitals segment accounts for the largest market share in the neonatal care equipment market, driven by consistent demand and widespread patient inflow.

North America is expected to account for the largest share of the neonatal care equipment market during the forecast period. North America, particularly the US and Canada, leads the neonatal care equipment market due to high healthcare spending and strong reimbursement frameworks. A substantial share of GDP is dedicated to healthcare, ensuring well-equipped neonatal units. Programs such as Medicaid, Medicare, and private insurance facilitate access to advanced and often expensive devices such as incubators, ventilators, and monitors. This robust financial and infrastructural support enables widespread adoption of cutting-edge neonatal technologies, positioning North America as the dominant regional market for neonatal care equipment.

A breakdown of the primary participants (supply-side) for the neonatal care equipment market referred to in this report is provided below:

- By Company Type: Tier 1:34%, Tier 2: 38%, and Tier 3: 28%

- By Designation: C Level: 26%, Director Level: 35%, and Others: 39%

- By Region: North America: 17%, Europe: 39%, Asia Pacific: 28%, Latin America: 8%, Middle East & Africa: 3%, GCC Countries: 5%

Prominent players in the neonatal care equipment market are GE Healthcare (US), Dragerwerk AG & Co. KGaA (Germany), Koninklijke Philips N.V. (Netherlands), Masimo (US), Fisher & Paykel Healthcare (New Zealand)

Research Coverage

The report evaluates the neonatal care equipment market and estimates the market size and future growth potential based on various segments, including product, end user, and region. The report also includes a competitive analysis of the major players in this market, along with company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will assist the market leader/new entrants in the market with data on the nearest approximations of the revenue numbers for the overall neonatal care equipment market and the subsegments. The report will assist stakeholders in understanding the competitive landscape and gaining further insights into better placing their businesses and making appropriate go-to-market strategies. The report assists the stakeholders in understanding the market pulse and gives them data on influential drivers, hindrances, obstacles, and opportunities in the market.

This report provides insights into the following points:

- Analysis of key drivers (rising number of preterm and low-weight births, public-private initiatives to strengthen patient care, increasing incidence of HAIs among newborns, changing clinical risks for congenital and obstetric complications, growing number of neonatal care facilities worldwide), restraints (premium pricing of advanced neonatal care equipment, growing preference for refurbished devices across emerging countries), opportunities (development of integrated and multifunctional neonatal care equipment, market opportunities in emerging economies) and challenges (limited access in low-income regions, regulatory and compliance complexities)

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global neonatal care equipment market

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product, end user, and region

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global neonatal care equipment market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global neonatal care equipment market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATON & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key objectives of primary research

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SUPPLY-SIDE ANALYSIS (REVENUE SHARE ANALYSIS)

- 2.2.2 COMPANY PRESENTATIONS & PRIMARY INTERVIEWS

- 2.2.3 DEMAND-SIDE ANALYSIS

- 2.2.4 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 NEONATAL CARE EQUIPMENT MARKET OVERVIEW

- 4.2 ASIA PACIFIC: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT AND COUNTRY

- 4.3 NEONATAL CARE EQUIPMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 NEONATAL CARE EQUIPMENT MARKET, REGIONAL MIX, 2023-2030

- 4.5 NEONATAL CARE EQUIPMENT MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising number of preterm and low-weight births

- 5.2.1.2 Increased public-private initiatives for better patient care

- 5.2.1.3 Growing incidence of healthcare-associated infections (HAIs) among newborns

- 5.2.1.4 Changing clinical risks in congenital and obstetric complications

- 5.2.1.5 Increasing number of neonatal care facilities worldwide

- 5.2.2 RESTRAINTS

- 5.2.2.1 Premium pricing of advanced neonatal care equipment

- 5.2.2.2 Growing preference for refurbished devices in emerging economies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of integrated and multifunctional neonatal care equipment

- 5.2.3.2 High growth opportunities in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited access to neonatal care in low-income regions

- 5.2.4.2 Regulatory and compliance complexities

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 INTEGRATION OF ADVANCED MATERIALS AND SUSTAINABILITY INITIATIVES

- 5.3.2 SHIFT TOWARD PROCEDURE-SPECIFIC STERILE KITS AND MODULAR DESIGNS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF NEONATAL CARE PRODUCTS, BY KEY PLAYER, 2022-2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF NEONATAL INCUBATORS, BY REGION, 2022-2024

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.8.1 ROLE IN ECOSYSTEM

- 5.9 INVESTMENT & FUNDING SCENARIO

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Advanced neonatal ventilation and CPAP systems

- 5.10.1.2 Phototherapy technologies (LED and fiber-optic)

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Heated humidifiers and respiratory gas conditioning units

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Point-of-care diagnostics (POCT)

- 5.10.3.2 Fetal monitoring systems

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.11.1 INNOVATIONS AND PATENT REGISTRATIONS, 2023-2025

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA FOR HS CODE 901890

- 5.12.2 EXPORT DATA FOR HS CODE 901890

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 BOSTON CHILDREN'S HOSPITAL TO MODERNIZE NICU INFRASTRUCTURE FOR IMPROVED CARE AMONG PREMATURE INFANTS

- 5.14.2 INDIAN MINISTRY OF HEALTH TO DEPLOY LOW-COST LED PHOTOTHERAPY UNITS FOR REDUCING NEONATAL JAUNDICE-RELATED MORTALITY

- 5.14.3 MOUNT SINAI HOSPITAL TO IMPLEMENT PREDICTIVE NEONATAL MONITORING FOR REDUCING LATE-ONSET SEPSIS AND APNEA IN PRETERM INFANTS

- 5.15 REGULATORY ANALYSIS

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 REGULATORY LANDSCAPE

- 5.15.2.1 North America

- 5.15.2.1.1 US

- 5.15.2.1.2 Canada

- 5.15.2.2 Europe

- 5.15.2.3 Asia Pacific

- 5.15.2.3.1 China

- 5.15.2.3.2 Japan

- 5.15.2.3.3 India

- 5.15.2.4 Latin America

- 5.15.2.4.1 Brazil

- 5.15.2.4.2 Mexico

- 5.15.2.5 Middle East

- 5.15.2.6 Africa

- 5.15.2.1 North America

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 BARGAINING POWER OF SUPPLIERS

- 5.16.2 BARGAINING POWER OF BUYERS

- 5.16.3 THREAT OF NEW ENTRANTS

- 5.16.4 THREAT OF SUBSTITUTES

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 UNMET NEEDS/END-USER EXPECTATIONS

- 5.19 ADJACENT MARKET ANALYSIS

- 5.20 IMPACT OF AI/GEN AI ON NEONATAL CARE EQUIPMENT MARKET

- 5.20.1 MARKET POTENTIAL OF AI/GEN AI

- 5.20.2 AI USE CASES

- 5.20.3 KEY COMPANIES IMPLEMENTING AI

- 5.20.4 FUTURE OF AI/GEN AI

- 5.21 IMPACT OF 2025 US TARIFF ON NEONATAL CARE EQUIPMENT MARKET

- 5.21.1 KEY TARIFF RATES

- 5.21.2 PRICE IMPACT ANALYSIS

- 5.21.3 IMPACT ON END-USE INDUSTRIES

6 NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 NEONATAL INCUBATORS

- 6.2.1 HIGH PRETERM BIRTH BURDEN AND INCREASED TECH INTEGRATION TO AID MARKET GROWTH

- 6.3 NEONATAL RESPIRATORY CARE DEVICES

- 6.3.1 NEONATAL VENTILATORS

- 6.3.1.1 Increasing burden of neonatal respiratory distress syndrome to augment segment growth

- 6.3.2 CONTINUOUS POSITIVE AIRWAY PRESSURE DEVICES

- 6.3.2.1 Development of affordable and non-invasive CPAP devices to aid global newborn care programs

- 6.3.3 RESUSCITATORS

- 6.3.3.1 Availability of advanced, low-cost kits to drive segment growth

- 6.3.4 OTHER NEONATAL RESPIRATORY CARE DEVICES

- 6.3.1 NEONATAL VENTILATORS

- 6.4 CONVERTIBLE WARMERS & INCUBATORS

- 6.4.1 MULTI-STAGE THERMAL CARE NEEDS AND REQUIRMENT FOR SPACE OPTIMIZATION TO BOOST DEMAND

- 6.5 NEONATAL PHOTOTHERAPY EQUIPMENT

- 6.5.1 CONVENTIONAL NEONATAL PHOTOTHERAPY EQUIPMENT

- 6.5.1.1 Affordability and accessibility to drive continued use of conventional neonatal phototherapy equipment

- 6.5.2 FIBRE-OPTIC NEONATAL PHOTOTHERAPY EQUIPMENT

- 6.5.2.1 Parent-friendly design and home-based care to accelerate market growth

- 6.5.1 CONVENTIONAL NEONATAL PHOTOTHERAPY EQUIPMENT

- 6.6 NEONATAL MONITORING DEVICES

- 6.6.1 BLOOD PRESSURE MONITORS

- 6.6.1.1 Need for critical hemodynamic monitoring to boost adoption of neonatal blood pressure monitors

- 6.6.2 CARDIAC MONITORS

- 6.6.2.1 Non-invasive monitoring and early detection of cardiac issues to propel segment growth

- 6.6.3 PULSE OXIMETERS

- 6.6.3.1 Global push for universal newborn SpO2 screening and growing need for real-time oxygen titration in NICUs to spur market growth

- 6.6.4 CAPNOGRAPHS

- 6.6.4.1 High incidence of neonatal respiratory distress and emphasis on safe airway management in critical care to propel segment growth

- 6.6.5 EXTRACORPOREAL MEMBRANE OXYGENATION SYSTEMS

- 6.6.5.1 Rising incidence of meconium aspiration syndrome and persistent pulmonary hypertension to favor market growth

- 6.6.6 INTEGRATED MONITORING DEVICES

- 6.6.6.1 Real-time vital tracking and AI integration to drive segment growth

- 6.6.1 BLOOD PRESSURE MONITORS

- 6.7 NEONATAL DIAGNOSTIC IMAGING COMPONENTS

- 6.7.1 ULTRASOUND TRANSDUCERS

- 6.7.1.1 Increasing use of point-of-care ultrasound (POCUS) in NICUs to propel market growth

- 6.7.2 X-RAY DETECTORS

- 6.7.2.1 Need for ultra-low dose and portable imaging to drive adoption of neonatal x-ray detectors in NICUs

- 6.7.1 ULTRASOUND TRANSDUCERS

- 6.8 INFANT WARMERS

- 6.8.1 ELECTRIC WARMERS

- 6.8.1.1 Tech-enabled and portable designs to drive demand for electric infant warmers in low-resource settings

- 6.8.2 NON-ELECTRIC WARMERS

- 6.8.2.1 Low-cost and power-free solutions to augment market growth

- 6.8.1 ELECTRIC WARMERS

- 6.9 OTHER NEONATAL PRODUCTS

7 NEONATAL CARE EQUIPMENT MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 GENERAL HOSPITALS

- 7.2.1 LARGE PATIENT BASE AND INTEGRATED NICU FACILITIES TO AUGMENT MARKET GROWTH

- 7.3 PEDIATRIC HOSPITALS

- 7.3.1 AVAILABILITY OF PEDIATRIC SPECIALISTS FOR CRITICAL NEONATAL CASES TO AID MARKET GROWTH

- 7.4 MATERNITY & BIRTHING CENTERS

- 7.4.1 EXPANDING MATERNAL HEALTH COVERAGE AND POPULARITY OF MIDWIFE-LED BIRTHING MODELS TO DRIVE MARKET

- 7.5 OTHER END USERS

8 NEONATAL CARE EQUIPMENT MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 NORTH AMERICA

- 8.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 8.2.2 US

- 8.2.2.1 US to dominate North American neonatal care equipment market during forecast period

- 8.2.3 CANADA

- 8.2.3.1 Strong public healthcare funding and expanding neonatal intensive care infrastructure to propel market growth

- 8.3 EUROPE

- 8.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 8.3.2 GERMANY

- 8.3.2.1 Public-private collaborations and increased focus on product innovations to fuel market growth

- 8.3.3 FRANCE

- 8.3.3.1 High healthcare spending and focus on domestic NICU manufacturing to aid market growth

- 8.3.4 UK

- 8.3.4.1 NHS-led digitization and high preterm care standards to drive neonatal care equipment modernization

- 8.3.5 ITALY

- 8.3.5.1 Regionally decentralized healthcare system to boost market growth

- 8.3.6 SPAIN

- 8.3.6.1 High healthcare spending and investments through the Digital Health Strategy to propel market growth

- 8.3.7 REST OF EUROPE

- 8.4 ASIA PACIFIC

- 8.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 8.4.2 JAPAN

- 8.4.2.1 Low neonatal mortality and advanced health infrastructure to propel adoption of innovative neonatal care equipment

- 8.4.3 CHINA

- 8.4.3.1 High premature birth rates and favorable government initiatives to fuel market growth

- 8.4.4 INDIA

- 8.4.4.1 High birth volume, increased prevalence of preterm deliveries, and favorable public healthcare programs to drive market

- 8.4.5 SOUTH KOREA

- 8.4.5.1 Innovation-driven neonatal care and increased private maternity and pediatric clinics to favor market growth

- 8.4.6 AUSTRALIA

- 8.4.6.1 Advanced public health infrastructure and government prioritization of maternal & child health to drive market

- 8.4.7 NEW ZEALAND

- 8.4.7.1 Government-funded healthcare and maternal & child health equity reforms to drive neonatal care expansion

- 8.4.8 REST OF ASIA PACIFIC

- 8.5 LATIN AMERICA

- 8.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 8.5.2 BRAZIL

- 8.5.2.1 Government-backed healthcare initiatives and active local manufacturing ecosystem to bolster market growth

- 8.5.3 MEXICO

- 8.5.3.1 Universal neonatal health coverage and expansion of NICUs to fuel market growth

- 8.5.4 REST OF LATIN AMERICA

- 8.6 MIDDLE EAST & AFRICA

- 8.6.1 HIGH BIRTH RATES AND REGIONAL HEALTH REFORMS TO CATALYZE NEONATAL EQUIPMENT DEMAND

- 8.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 8.7 GCC COUNTRIES

- 8.7.1 STRATEGIC GOVERNMENT SPENDING, ADOPTION OF SMART NICU TECHNOLOGIES, AND FOCUS ON DIGITAL MATERNAL-CHILD CARE TO DRIVE MARKET

- 8.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 9.2.1 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS IN NEONATAL CARE EQUIPMENT MARKET, 2021-2025

- 9.3 REVENUE ANALYSIS, 2020-2024

- 9.4 MARKET SHARE ANALYSIS, 2024

- 9.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- 9.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 9.5.5.1 Company footprint

- 9.5.5.2 Region footprint

- 9.5.5.3 Product footprint

- 9.5.5.4 End-user footprint

- 9.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 RESPONSIVE COMPANIES

- 9.6.3 DYNAMIC COMPANIES

- 9.6.4 STARTING BLOCKS

- 9.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 9.6.5.1 Detailed list of key startups/SMEs

- 9.6.5.2 Competitive benchmarking of startups/SMEs

- 9.7 COMPANY VALUATION & FINANCIAL METRICS

- 9.7.1 FINANCIAL METRICS

- 9.7.2 COMPANY VALUATION

- 9.8 BRAND/PRODUCT COMPARISON

- 9.9 COMPETITIVE SCENARIO

- 9.9.1 PRODUCT LAUNCHES/APPROVALS/ENHANCEMENTS

- 9.9.2 DEALS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 GE HEALTHCARE

- 10.1.1.1 Business overview

- 10.1.1.2 Products offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Product launches/approvals/enhancements

- 10.1.1.4 MnM view

- 10.1.1.4.1 Right to win

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses & competitive threats

- 10.1.2 DRAGERWERK AG & CO. KGAA

- 10.1.2.1 Business overview

- 10.1.2.2 Products offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Product launches/approvals/enhancements

- 10.1.2.4 MnM view

- 10.1.2.4.1 Right to win

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses & competitive threats

- 10.1.3 KONINKLIJKE PHILIPS N.V.

- 10.1.3.1 Business overview

- 10.1.3.2 Products offered

- 10.1.3.3 Recent developments

- 10.1.3.3.1 Deals

- 10.1.3.4 MnM view

- 10.1.3.4.1 Right to win

- 10.1.3.4.2 Strategic choices

- 10.1.3.4.3 Weaknesses & competitive threats

- 10.1.4 MASIMO

- 10.1.4.1 Business overview

- 10.1.4.2 Products offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Deals

- 10.1.4.4 MnM view

- 10.1.4.4.1 Right to win

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses & competitive threats

- 10.1.5 FISHER & PAYKEL HEALTHCARE LIMITED

- 10.1.5.1 Business overview

- 10.1.5.2 Products offered

- 10.1.5.3 MnM view

- 10.1.5.3.1 Right to win

- 10.1.5.3.2 Strategic choices

- 10.1.5.3.3 Weaknesses & competitive threats

- 10.1.6 NIHON KOHDEN CORPORATION

- 10.1.6.1 Business overview

- 10.1.6.2 Products offered

- 10.1.6.3 Recent developments

- 10.1.6.3.1 Product launches/approvals/enhancements

- 10.1.7 INSPIRATION HEALTHCARE GROUP PLC

- 10.1.7.1 Business overview

- 10.1.7.2 Products offered

- 10.1.8 MEDTRONIC

- 10.1.8.1 Business overview

- 10.1.8.2 Products offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 Product launches/approvals/enhancements

- 10.1.9 CARDINAL HEALTH

- 10.1.9.1 Business overview

- 10.1.9.2 Products offered

- 10.1.10 ICU MEDICAL, INC.

- 10.1.10.1 Business overview

- 10.1.10.2 Products offered

- 10.1.11 UTAH MEDICAL PRODUCTS, INC.

- 10.1.11.1 Business overview

- 10.1.11.2 Products offered

- 10.1.12 AMBU A/S

- 10.1.12.1 Business overview

- 10.1.12.2 Products offered

- 10.1.13 BECTON, DICKINSON AND COMPANY (BD)

- 10.1.13.1 Business overview

- 10.1.13.2 Products offered

- 10.1.14 ATOM MEDICAL CORP.

- 10.1.14.1 Business overview

- 10.1.14.2 Products offered

- 10.1.14.3 Recent developments

- 10.1.14.3.1 Other developments

- 10.1.15 HAMILTON MEDICAL

- 10.1.15.1 Business overview

- 10.1.15.2 Products offered

- 10.1.1 GE HEALTHCARE

- 10.2 OTHER PLAYERS

- 10.2.1 NATUS MEDICAL

- 10.2.2 SPACELABS HEALTHCARE

- 10.2.3 VENTEC LIFE SYSTEMS

- 10.2.4 PHOENIX MEDICAL SYSTEMS

- 10.2.5 NONIN

- 10.2.6 ANALOGIC CORPORATION

- 10.2.7 VYAIRE MEDICAL

- 10.2.8 VYGON GROUP

- 10.2.9 COOK

- 10.2.10 APEX MEDICAL DEVICES

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS