|

|

市場調査レポート

商品コード

1802926

3Dプリンティングセラミックスの世界市場:セラミックタイプ別、形態別、最終用途産業別、地域別 - 2030年までの予測3D Printing Ceramics Market by Type (Oxides, Non-oxides), Form (Filament, Powder, Liquid), End-use Industry (Aerospace & Defense, Healthcare, Automotive, Consumer Goods & Electronics, Other End-use Industry), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 3Dプリンティングセラミックスの世界市場:セラミックタイプ別、形態別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月25日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

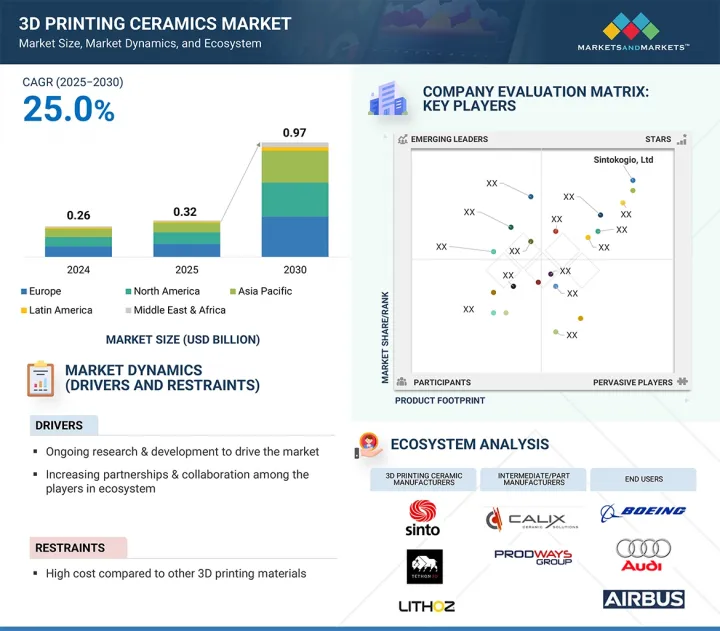

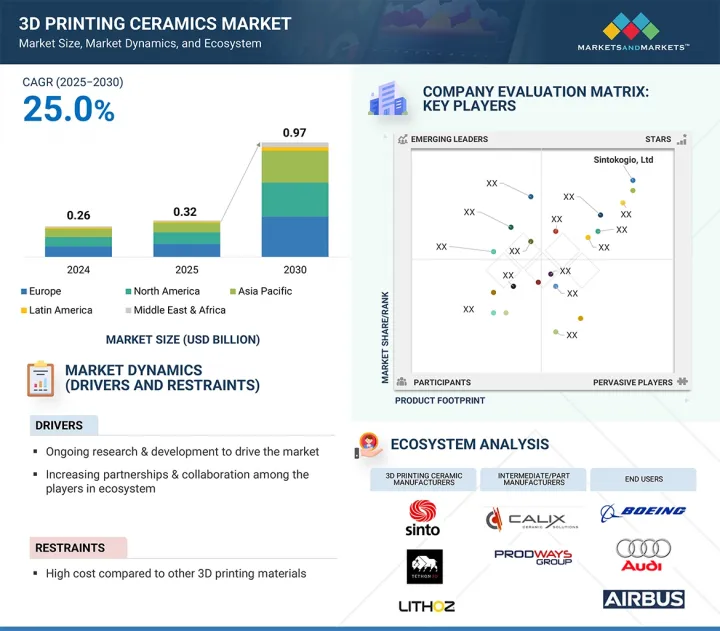

3Dプリンティングセラミックスの市場規模は、2025年に3億2,000万米ドルと推定され、25.0%のCAGRで拡大し、2030年には9億7,000万米ドルに達すると予測されています。

3Dプリンティングセラミックス市場拡大の主な原動力は、軽量、耐熱性、機械的強度の高い部品を必要とする航空宇宙、ヘルスケア、エレクトロニクス産業などの業界全体で、高性能でオーダーメイドのセラミック部品に対するニーズが高まっていることです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)および数量(トン) |

| セグメント | セラミックタイプ別、形態別、最終用途産業別、地域別 |

| 対象地域 | 欧州、北米、アジア太平洋、中東・アフリカ、南米 |

積層造形は、従来のセラミック製造では困難または不可能であった比類のない設計自由度とジオメトリーを提供します。これと並行して、セラミック材料の配合、印刷装置(バインダージェット、ステレオリソグラフィ、押出)、デジタルプロセス制御の進歩により、効率、精度、材料性能が大幅に向上しています。これらの側面は、材料廃棄物の減少やエネルギー使用量の減少からもたらされる持続可能性の利点と相まって、産業および商業プロセスへの広範な応用を後押ししています。

3Dプリンティングセラミックス業界のフィラメントセグメントは、主にその扱いやすさ、一般的に利用されているFDM/FFFプリンターとの互換性、デスクトップレベルでの低コストのセラミックプリンティングソリューションへの関心の高まりに基づいて、最も高いCAGRを示しています。フィラメントベースのセラミック印刷は製造プロセスを合理化するため、歯科、電子機器、研究などさまざまな産業でプロトタイピングや小規模生産の目的で利用できるようになります。とはいえ、世界には高品質のセラミックフィラメントを製造するメーカーが皆無に等しいため、供給ギャップがあり、新規参入や技術革新のための高い市場ポテンシャルが残されているため、満たされていない需要も成長を後押ししています。

ヘルスケア分野は、歯科修復物、骨インプラント、手術器具に生体適合性セラミック材料の使用が増加しているため、3Dプリンティングセラミック市場で2番目に高いCAGRを示すと推定されます。ジルコニアやアルミナなどのセラミック材料は生体適合性が高く、耐摩耗性、強度に優れているため、オーダーメイドの歯冠や整形外科用インプラントに適しています。3Dプリンティングは、正確で患者に合わせた設計を可能にし、手術時間を短縮し、治療結果を向上させます。さらに、医療が個別化治療や低侵襲治療へと進化するにつれて、オーダーメイドの高性能セラミック部品の必要性が高まっています。セラミック印刷技術に使用されるプロセスと材料の進歩により、歯科および整形外科用途での採用が加速しています。

欧州は、積層造形に対する政府の強力なバックアップ、確立された産業基盤、先端材料における研究開発費の増加により、3Dプリンティングセラミックス市場で2番目に高いCAGRを示すものと予測されています。ドイツ、フランス、ロシアは、セラミック3Dプリンティングの技術革新を主導しており、特に航空宇宙、ヘルスケア、自動車産業に重点を置いています。また、この地域は、明日のセラミックプリンティング技術を生み出すために業界リーダーと協力している大学や研究機関の強力な基盤に支えられています。さらに、デジタル製造と持続可能性に重点を置くEUは、低廃棄物、効率的、軽量生産のための3Dプリンティングセラミックスの応用を推進しています。

当レポートでは、世界の3Dプリンティングセラミックスン市場について調査し、セラミックタイプ別、形態別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- エコシステム分析

- 価格分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- AI/生成AIが3Dプリントセラミックス市場に与える影響

- マクロ経済見通し

- 特許分析

- 規制状況

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 2025年の米国関税が3Dプリントセラミックス市場に与える影響

第6章 3Dプリントセラミックス市場(セラミックスタイプ別)

- イントロダクション

- 酸化物

- 非酸化物

第7章 3Dプリントセラミックス市場(形態別)

- イントロダクション

- フィラメント

- 液体

- 粉

第8章 3Dプリントセラミックス市場(最終用途産業別)

- イントロダクション

- 航空宇宙および防衛

- ヘルスケア

- 自動車

- 消費財・電子機器

- その他

第9章 3Dプリントセラミックス市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 3Dプリントセラミックスベンダーの企業評価と財務指標

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- SINTOKOGIO, LTD.

- SGL CARBON

- CERAMTEC GMBH

- NANOE

- SAINT-GOBAIN

- CONCR3DE

- JIANGSU SANZER NEW MATERIALS TECHNOLOGY CO., LTD.

- LITHOZ GMBH

- TETHON 3D

- KYOCERA CORPORATION

- その他の企業

- STEINBACH AG

- XJET

- ZRAPID TECH

- TRUNNANO

- INTERNATIONAL SYALONS

- FORMLABS

- SCHUNK TECHNICAL CERAMICS

- STANDARD NUCLEAR

- SHENZHEN ADVENTURE TECHNOLOGY CO., LTD

- SINTX TECHNOLOGIES, INC.

- SPECTRUM FILAMENTS

- CERAMARET

- ZHENGZHOU HAIXU ABRASIVES CO., LTD

- NISHIMURA ADVANCED CERAMICS

- WUNDER-MOLD, INC.

第12章 付録

List of Tables

- TABLE 1 3D PRINTING CERAMICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- TABLE 3 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 4 3D PRINTING CERAMICS MARKET: ROLE IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE TREND OF 3D PRINTING CERAMICS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- TABLE 6 AVERAGE SELLING PRICE TREND OF 3D PRINTING CERAMICS, BY REGION, 2022-2030 (USD/KG)

- TABLE 7 TOP 10 EXPORTING COUNTRIES OF 3D PRINTING CERAMICS, 2022-2024 (USD THOUSAND)

- TABLE 8 TOP 10 IMPORTING COUNTRIES OF 3D PRINTING CERAMICS, 2022-2024 (USD THOUSAND)

- TABLE 9 TOP USE CASES AND MARKET POTENTIAL

- TABLE 10 CASE STUDIES OF AI IMPLEMENTATION IN 3D PRINTING CERAMICS MARKET

- TABLE 11 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 12 3D PRINTING CERAMICS MARKET: TOTAL NUMBER OF PATENTS

- TABLE 13 LIST OF PATENTS BY PRINCETON UNIVERSITY

- TABLE 14 LIST OF PATENTS BY HEWLETT PACKARD DEVELOPMENT CO.

- TABLE 15 US: TOP 10 PATENT OWNERS IN LAST 10 YEARS

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 3D PRINTING CERAMICS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 21 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR 3D PRINTING CERAMICS

- TABLE 22 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS

- TABLE 23 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2021-2024 (USD THOUSAND)

- TABLE 24 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2021-2024 (TON)

- TABLE 25 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2025-2030 (USD THOUSAND)

- TABLE 26 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2025-2030 (TON)

- TABLE 27 3D PRINTING OXIDE CERAMICS MARKET, BY TYPE, 2021-2024 (USD THOUSAND)

- TABLE 28 3D PRINTING OXIDE CERAMICS MARKET, BY TYPE, 2021-2024 (TON)

- TABLE 29 3D PRINTING OXIDE CERAMICS MARKET, BY TYPE, 2025-2030 (USD THOUSAND)

- TABLE 30 3D PRINTING OXIDE CERAMICS MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 31 3D PRINTING OXIDE CERAMICS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 32 3D PRINTING OXIDE CERAMICS MARKET, BY REGION, 2021-2024 (TON)

- TABLE 33 3D PRINTING OXIDE CERAMICS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 34 3D PRINTING OXIDE CERAMICS MARKET, BY REGION, 2025-2030 (TON)

- TABLE 35 3D PRINTING NON-OXIDE CERAMICS MARKET, BY TYPE, 2021-2024 (USD THOUSAND)

- TABLE 36 3D PRINTING NON-OXIDE CERAMICS MARKET, BY TYPE, 2021-2024 (TON)

- TABLE 37 3D PRINTING NON-OXIDE CERAMICS MARKET, BY TYPE, 2025-2030 (USD THOUSAND)

- TABLE 38 3D PRINTING NON-OXIDE CERAMICS MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 39 3D PRINTING NON-OXIDE CERAMICS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 40 3D PRINTING NON-OXIDE CERAMICS MARKET, BY REGION, 2021-2024 (TON)

- TABLE 41 3D PRINTING NON-OXIDE CERAMICS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 42 3D PRINTING NON-OXIDE CERAMICS MARKET, BY REGION, 2025-2030 (TON)

- TABLE 43 3D PRINTING CERAMICS MARKET, BY FORM, 2021-2024 (USD THOUSAND)

- TABLE 44 3D PRINTING CERAMICS MARKET, BY FORM, 2021-2024 (TON)

- TABLE 45 3D PRINTING CERAMICS MARKET, BY FORM, 2025-2030 (USD THOUSAND)

- TABLE 46 3D PRINTING CERAMICS MARKET, BY FORM, 2025-2030 (TON)

- TABLE 47 3D PRINTING FILAMENT-BASED CERAMICS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 48 3D PRINTING FILAMENT-BASED CERAMICS MARKET, BY REGION, 2021-2024 (TON)

- TABLE 49 3D PRINTING FILAMENT-BASED CERAMICS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 50 3D PRINTING FILAMENT-BASED CERAMICS MARKET, BY REGION, 2025-2030 (TON)

- TABLE 51 3D PRINTING LIQUID-BASED CERAMICS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 52 3D PRINTING LIQUID-BASED CERAMICS MARKET, BY REGION, 2021-2024 (TON)

- TABLE 53 3D PRINTING LIQUID-BASED CERAMICS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 54 3D PRINTING LIQUID-BASED CERAMICS MARKET, BY REGION, 2025-2030 (TON)

- TABLE 55 3D PRINTING POWDER-BASED CERAMICS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 56 3D PRINTING POWDER-BASED CERAMICS MARKET, BY REGION, 2021-2024 (TON)

- TABLE 57 3D PRINTING POWDER-BASED CERAMICS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 58 3D PRINTING POWDER-BASED CERAMICS MARKET, BY REGION, 2025-2030 (TON)

- TABLE 59 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 60 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 61 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 62 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 63 3D PRINTING CERAMICS MARKET IN AEROSPACE & DEFENSE, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 64 3D PRINTING CERAMICS MARKET IN AEROSPACE & DEFENSE, BY REGION, 2021-2024 (TON)

- TABLE 65 3D PRINTING CERAMICS MARKET IN AEROSPACE & DEFENSE, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 66 3D PRINTING CERAMICS MARKET IN AEROSPACE & DEFENSE, BY REGION, 2025-2030 (TON)

- TABLE 67 3D PRINTING CERAMICS MARKET IN HEALTHCARE, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 68 3D PRINTING CERAMICS MARKET IN HEALTHCARE, BY REGION, 2021-2024 (TON)

- TABLE 69 3D PRINTING CERAMICS MARKET IN HEALTHCARE, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 70 3D PRINTING CERAMICS MARKET IN HEALTHCARE, BY REGION, 2025-2030 (TON)

- TABLE 71 3D PRINTING CERAMICS MARKET IN AUTOMOTIVE INDUSTRY, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 72 3D PRINTING CERAMICS MARKET IN AUTOMOTIVE INDUSTRY, BY REGION, 2021-2024 (TON)

- TABLE 73 3D PRINTING CERAMICS MARKET IN AUTOMOTIVE INDUSTRY, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 74 3D PRINTING CERAMICS MARKET IN AUTOMOTIVE INDUSTRY, BY REGION, 2025-2030 (TON)

- TABLE 75 3D PRINTING CERAMICS MARKET IN CONSUMER GOODS & ELECTRONICS, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 76 3D PRINTING CERAMICS MARKET IN CONSUMER GOODS & ELECTRONICS, BY REGION, 2021-2024 (TON)

- TABLE 77 3D PRINTING CERAMICS MARKET IN CONSUMER GOODS & ELECTRONICS, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 78 3D PRINTING CERAMICS MARKET IN CONSUMER GOODS & ELECTRONICS, BY REGION, 2025-2030 (TON)

- TABLE 79 3D PRINTING CERAMICS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 80 3D PRINTING CERAMICS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (TON)

- TABLE 81 3D PRINTING CERAMICS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 82 3D PRINTING CERAMICS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (TON)

- TABLE 83 3D PRINTING CERAMICS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 84 3D PRINTING CERAMICS MARKET, BY REGION, 2021-2024 (TON)

- TABLE 85 3D PRINTING CERAMICS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 86 3D PRINTING CERAMICS MARKET, BY REGION, 2025-2030 (TON)

- TABLE 87 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2021-2024 (USD THOUSAND)

- TABLE 88 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2021-2024 (TON)

- TABLE 89 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2025-2030 (USD THOUSAND)

- TABLE 90 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2025-2030 (TON)

- TABLE 91 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY FORM, 2021-2024 (USD THOUSAND)

- TABLE 92 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY FORM, 2021-2024 (TON)

- TABLE 93 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY FORM, 2025-2030 (USD THOUSAND)

- TABLE 94 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY FORM, 2025-2030 (TON)

- TABLE 95 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 96 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 97 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 98 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 99 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 100 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2021-2024 (TON)

- TABLE 101 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 102 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 103 US: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 104 US: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 105 US: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 106 US: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 107 CANADA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 108 CANADA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 109 CANADA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 110 CANADA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 111 EUROPE: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2021-2024 (USD THOUSAND)

- TABLE 112 EUROPE: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2021-2024 (TON)

- TABLE 113 EUROPE: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2025-2030 (USD THOUSAND)

- TABLE 114 EUROPE: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2025-2030 (TON)

- TABLE 115 EUROPE: 3D PRINTING CERAMICS MARKET, BY FORM, 2021-2024 (USD THOUSAND)

- TABLE 116 EUROPE: 3D PRINTING CERAMICS MARKET, BY FORM, 2021-2024 (TON)

- TABLE 117 EUROPE: 3D PRINTING CERAMICS MARKET, BY FORM, 2025-2030 (USD THOUSAND)

- TABLE 118 EUROPE: 3D PRINTING CERAMICS MARKET, BY FORM, 2025-2030 (TON)

- TABLE 119 EUROPE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 120 EUROPE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 121 EUROPE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 122 EUROPE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 123 EUROPE: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 124 EUROPE: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2021-2024 (TON)

- TABLE 125 EUROPE: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 126 EUROPE: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 127 GERMANY: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 128 GERMANY: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 129 GERMANY: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 130 GERMANY: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 131 FRANCE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 132 FRANCE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 133 FRANCE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 134 FRANCE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 135 UK: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 136 UK: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 137 UK: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 138 UK: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 139 ITALY: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 140 ITALY: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 141 ITALY: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 142 ITALY: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 143 REST OF EUROPE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 144 REST OF EUROPE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 145 REST OF EUROPE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 146 REST OF EUROPE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 147 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2021-2024 (USD THOUSAND)

- TABLE 148 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2021-2024 (TON)

- TABLE 149 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2025-2030 (USD THOUSAND)

- TABLE 150 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2025-2030 (TON)

- TABLE 151 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY FORM, 2021-2024 (USD THOUSAND)

- TABLE 152 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY FORM, 2021-2024 (TON)

- TABLE 153 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY FORM, 2025-2030 (USD THOUSAND)

- TABLE 154 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY FORM, 2025-2030 (TON)

- TABLE 155 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 156 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 157 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 158 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 159 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 160 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2021-2024 (TON)

- TABLE 161 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 162 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 163 CHINA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 164 CHINA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 165 CHINA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 166 CHINA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 167 JAPAN: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 168 JAPAN: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 169 JAPAN: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 170 JAPAN: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 171 SOUTH KOREA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 172 SOUTH KOREA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 173 SOUTH KOREA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 174 SOUTH KOREA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 175 INDIA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 176 INDIA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 177 INDIA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 178 INDIA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 179 REST OF ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 180 REST OF ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 181 REST OF ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 182 REST OF ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 183 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2021-2024 (USD THOUSAND)

- TABLE 184 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2021-2024 (TON)

- TABLE 185 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2025-2030 (USD THOUSAND)

- TABLE 186 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2025-2030 (TON)

- TABLE 187 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY FORM, 2021-2024 (USD THOUSAND)

- TABLE 188 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY FORM, 2021-2024 (TON)

- TABLE 189 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY FORM, 2025-2030 (USD THOUSAND)

- TABLE 190 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY FORM, 2025-2030 (TON)

- TABLE 191 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 192 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 193 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 194 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 195 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 196 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2021-2024 (TON)

- TABLE 197 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 198 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 199 UAE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 200 UAE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 201 UAE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 202 UAE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 203 SAUDI ARABIA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 204 SAUDI ARABIA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 205 SAUDI ARABIA 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 206 SAUDI ARABIA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 207 REST OF GCC COUNTRIES: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 208 REST OF GCC COUNTRIES: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 209 REST OF GCC COUNTRIES: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 210 REST OF GCC COUNTRIES: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 211 SOUTH AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 212 SOUTH AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 213 SOUTH AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 214 SOUTH AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 216 REST OF MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 217 REST OF MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 218 REST OF MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 219 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2021-2024 (USD THOUSAND)

- TABLE 220 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2021-2024 (TON)

- TABLE 221 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2025-2030 (USD THOUSAND)

- TABLE 222 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE, 2025-2030 (TON)

- TABLE 223 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY FORM, 2021-2024 (USD THOUSAND)

- TABLE 224 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY FORM, 2021-2024 (TON)

- TABLE 225 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY FORM, 2025-2030 (USD THOUSAND)

- TABLE 226 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY FORM, 2025-2030 (TON)

- TABLE 227 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 228 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 229 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 230 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 231 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 232 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2021-2024 (TON)

- TABLE 233 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 234 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 235 BRAZIL: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 236 BRAZIL: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 237 BRAZIL: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 238 BRAZIL: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 239 MEXICO: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 240 MEXICO: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 241 MEXICO: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 242 MEXICO: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 243 REST OF LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 244 REST OF LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2021-2024 (TON)

- TABLE 245 REST OF LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 246 REST OF LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY, 2025-2030 (TON)

- TABLE 247 STRATEGIES ADOPTED BY 3D PRINTING CERAMICS MANUFACTURERS

- TABLE 248 DEGREE OF COMPETITION: 3D PRINTING CERAMICS MARKET

- TABLE 249 3D PRINTING CERAMICS MARKET: REGION FOOTPRINT, 2024

- TABLE 250 3D PRINTING CERAMICS MARKET: CERAMIC TYPE FOOTPRINT, 2024

- TABLE 251 3D PRINTING CERAMICS MARKET: FORM FOOTPRINT, 2024

- TABLE 252 3D PRINTING CERAMICS MARKET: END-USE INDUSTRY FOOTPRINT, 2024

- TABLE 253 3D PRINTING CERAMICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 254 3D PRINTING CERAMICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 255 3D PRINTING CERAMICS MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 256 3D PRINTING CERAMICS MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 257 3D PRINTING CERAMICS MARKET: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 258 SINTOKOGIO, LTD.: COMPANY OVERVIEW

- TABLE 259 SINTOKOGIO, LTD.: PRODUCTS OFFERED

- TABLE 260 SINTOKOGIO, LTD.: DEALS

- TABLE 261 SINTOKOGIO, LTD.: EXPANSIONS

- TABLE 262 SINTOKOGIO, LTD.: OTHER DEVELOPMENTS, JANUARY 2019-JUNE 2025

- TABLE 263 SGL CARBON: COMPANY OVERVIEW

- TABLE 264 SGL CARBON: PRODUCTS OFFERED

- TABLE 265 SGL CARBON: DEALS

- TABLE 266 CERAMTEC GMBH: COMPANY OVERVIEW

- TABLE 267 CERAMTEC GMBH: PRODUCTS OFFERED

- TABLE 268 CERAMTEC GMBH: DEALS

- TABLE 269 CERAMTEC GMBH: EXPANSIONS

- TABLE 270 NANOE: COMPANY OVERVIEW

- TABLE 271 NANOE: PRODUCTS OFFERED

- TABLE 272 NANOE: PRODUCT LAUNCHES

- TABLE 273 NANOE: DEALS

- TABLE 274 NANOE: EXPANSIONS

- TABLE 275 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 276 SAINT-GOBAIN: PRODUCTS OFFERED

- TABLE 277 SAINT-GOBAIN: DEALS

- TABLE 278 CONCR3DE: COMPANY OVERVIEW

- TABLE 279 CONCR3DE: PRODUCTS OFFERED

- TABLE 280 JIANGSU SANZER NEW MATERIALS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 281 JIANGSU SANZER NEW MATERIALS TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 282 JIANGSU SANZER NEW MATERIALS TECHNOLOGY CO., LTD.: EXPANSIONS

- TABLE 283 LITHOZ GMBH: COMPANY OVERVIEW

- TABLE 284 LITHOZ GMBH: PRODUCTS OFFERED

- TABLE 285 LITHOZ GMBH: PRODUCT LAUNCHES

- TABLE 286 LITHOZ GMBH: OTHER DEVELOPMENTS

- TABLE 287 TETHON 3D: COMPANY OVERVIEW

- TABLE 288 TETHON 3D: PRODUCTS OFFERED

- TABLE 289 TETHON 3D: PRODUCT LAUNCHES

- TABLE 290 TETHON 3D: DEALS

- TABLE 291 TETHON 3D: OTHER DEVELOPMENTS

- TABLE 292 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 293 KYOCERA CORPORATION: PRODUCTS OFFERED

- TABLE 294 KYOCERA CORPORATION: EXPANSIONS

- TABLE 295 STEINBACH AG: COMPANY OVERVIEW

- TABLE 296 XJET: COMPANY OVERVIEW

- TABLE 297 ZRAPID TECH: COMPANY OVERVIEW

- TABLE 298 TRUNNANO: COMPANY OVERVIEW

- TABLE 299 INTERNATIONAL SYALONS: COMPANY OVERVIEW

- TABLE 300 FORMLABS: COMPANY OVERVIEW

- TABLE 301 SCHUNK TECHNICAL CERAMICS: COMPANY OVERVIEW

- TABLE 302 STANDARD NUCLEAR: COMPANY OVERVIEW

- TABLE 303 SHENZHEN ADVENTURE TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 304 SINTX TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 305 SPECTRUM FILAMENTS: COMPANY OVERVIEW

- TABLE 306 CERAMARET: COMPANY OVERVIEW

- TABLE 307 ZHENGZHOU HAIXU ABRASIVES CO., LTD: COMPANY OVERVIEW

- TABLE 308 NISHIMURA ADVANCED CERAMICS: COMPANY OVERVIEW

- TABLE 309 WUNDER-MOLD, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 3D PRINTING CERAMICS MARKET SEGMENTATION

- FIGURE 2 3D PRINTING CERAMICS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS WITH EXPERTS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 APPROACH 1: SUPPLY-SIDE APPROACH

- FIGURE 5 APPROACH 2: DEMAND-SIDE APPROACH

- FIGURE 6 3D PRINTING CERAMICS MARKET: BOTTOM-UP APPROACH

- FIGURE 7 3D PRINTING CERAMICS MARKET: TOP-DOWN APPROACH

- FIGURE 8 3D PRINTING CERAMICS MARKET: DATA TRIANGULATION

- FIGURE 9 FACTOR ANALYSIS

- FIGURE 10 OXIDE-BASED CERAMICS TO DOMINATE MARKET IN 2030

- FIGURE 11 POWDER FORM TO DOMINATE 3D PRINTING CERAMICS MARKET BY 2030

- FIGURE 12 AEROSPACE & DEFENSE TO LEAD 3D PRINTING CERAMICS MARKET AMONG END-USE INDUSTRIES IN 2025

- FIGURE 13 EUROPE TO LEAD GLOBAL 3D PRINTING CERAMICS MARKET IN 2024 AND 2030

- FIGURE 14 HIGH DEMAND FROM AEROSPACE & DEFENSE INDUSTRY TO DRIVE 3D PRINTING CERAMICS MARKET DURING FORECAST PERIOD

- FIGURE 15 AEROSPACE & DEFENSE AND EUROPE REGION LED RESPECTIVE SEGMENTS IN 2024

- FIGURE 16 OXIDES TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 17 FILAMENT TO REGISTER HIGHEST CAGR IN FORECAST PERIOD

- FIGURE 18 AEROSPACE & DEFENSE IS PROJECTED TO REGISTER HIGHEST CAGR IN FORECAST PERIOD

- FIGURE 19 MARKET IN CHINA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 3D PRINTING CERAMICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 3D PRINTING CERAMICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 23 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 24 3D PRINTING CERAMICS MARKET: KEY STAKEHOLDERS IN ECOSYSTEM

- FIGURE 25 AVERAGE SELLING PRICE TREND OF 3D PRINTING CERAMICS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- FIGURE 26 AVERAGE SELLING PRICE TREND ACROSS SEGMENTS, 2022-2024 (USD/KG)

- FIGURE 27 3D PRINTING CERAMICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 EXPORT DATA OF HS CODE 69-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 29 IMPORT DATA OF HS CODE 69-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 30 PATENT ANALYSIS, BY PATENT TYPE

- FIGURE 31 PATENT PUBLICATION TRENDS, JANUARY 2015-JULY 2025

- FIGURE 32 3D PRINTING CERAMICS MARKET: LEGAL STATUS OF PATENTS, 2015-2025

- FIGURE 33 US JURISDICTION REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 34 UNIVERSITY OF PRINCETON REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 35 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 36 3D PRINTING CERAMICS MARKET: NUMBER OF DEALS AND FUNDING GREW SIGNIFICANTLY IN 2025

- FIGURE 37 OXIDES TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 FILAMENT-BASED CERAMICS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 AEROSPACE & DEFENSE END-USE INDUSTRY TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: 3D PRINTING CERAMICS MARKET SNAPSHOT

- FIGURE 42 EUROPE: 3D PRINTING CERAMICS MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET SNAPSHOT

- FIGURE 44 3D PRINTING CERAMICS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 45 3D PRINTING CERAMICS MARKET SHARE ANALYSIS, 2024

- FIGURE 46 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY 3D PRINTING CERAMICS PRODUCT

- FIGURE 47 3D PRINTING CERAMICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 3D PRINTING CERAMICS MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 49 3D PRINTING CERAMICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 3D PRINTING CERAMICS MARKET: EV/EBITDA OF KEY VENDORS

- FIGURE 51 PROMINENT 3D PRINTING CERAMICS MANUFACTURING FIRMS IN 2024 (USD BILLION)

- FIGURE 52 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 53 SINTOKOGIO, LTD.: COMPANY SNAPSHOT

- FIGURE 54 SGL CARBON: COMPANY SNAPSHOT

- FIGURE 55 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 56 KYOCERA CORPORATION: COMPANY SNAPSHOT

The 3D printing ceramics market is estimated at USD 0.32 billion in 2025 and is projected to reach USD 0.97 billion by 2030, at a CAGR of 25.0%. The main impetus for the expansion of the 3D-printing ceramics market is the increasing need for high-performance, tailor-made ceramic parts across industries like aerospace, health-care, and electronics industries that necessitate light, heat-resistant, and mechanically strong components.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Ton) |

| Segments | Ceramic Type, Form, End-use Industry, and Region |

| Regions covered | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

Additive manufacturing provides unparalleled design freedom and geome-tries that are hard or impossible to achieve with conventional ceramic manufacture. Parallel to this, advances in ceramic materials formulation, printing equipment (binder jetting, stereolithography, and extrusion), and digital process control have greatly enhanced efficiency, precision, and material performance. These aspects, combined with sustainability advantages resulting from decreased material waste and lower energy usage, are driving widespread application in industrial and commercial processes.

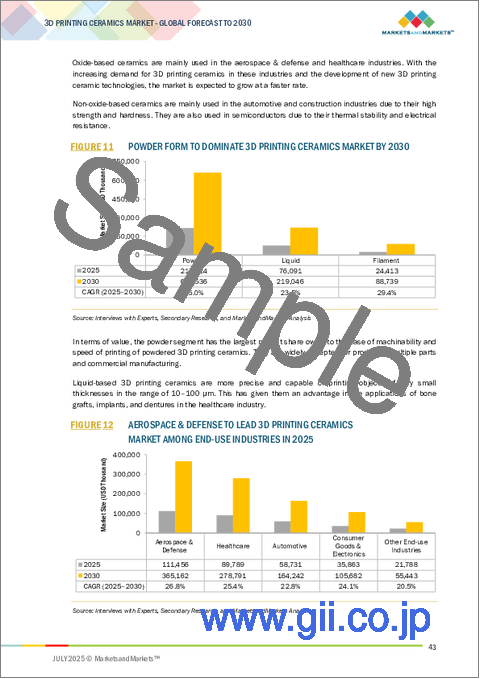

"Filament is projected to be the fastest-growing form during the forecast period."

The filament segment of the 3D printing ceramics industry is exhibiting the highest CAGR, based mainly on its handling ease, compatibility with commonly utilized FDM/FFF printers, and growing interest in low-cost ceramic printing solutions at the desktop level. Filament-based ceramic printing streamlines the manufacturing process, allowing it to be made accessible for prototyping and small-scale production purposes in various industries such as dental, electronics, and research. Nonetheless, the unmet demand also fuels growth since there are virtually no manufacturers of high-quality ceramic filaments worldwide, leaving a supply gap and high market potential for new entrants and innovations.

"The healthcare segment is projected to register the second-highest growth rate during the forecast period."

The healthcare sector is estimated to exhibit the second-best CAGR in the 3D printing ceramics market because of the increasing use of biocompatible ceramic material for dental restorations, bone implants, and surgical instruments. Ceramic materials such as zirconia and alumina are highly biocompatible, resistant to wear, and strong, and hence can be well-suited for tailor-made dental crowns and orthopedic implants. 3D printing allows accurate, patient-specific designs that save surgery time and enhance outcomes. Further, as medicine evolves toward personalized care and minimally invasive treatments, the need for tailored, high-performance ceramic parts is growing. Advances in the processes and materials used in ceramic printing technologies are accelerating adoption in dental and orthopedic applications.

"Europe is projected to register the second-highest growth rate in the 3D printing ceramics market during the forecast period."

Europe is pegged to witness the second-highest CAGR in the 3D printing ceramics market because of robust government backing of additive manufacturing, an established industrial foundation, and rising R&D spending in advanced materials. Germany, France, and Russia are leading the charge in ceramic 3D printing innovation, with specific emphasis in the aerospace, healthcare, and automotive industries, with high demand for precision and material performance. The area is also underpinned by a strong base of universities and research institutes cooperating with industry leaders to create tomorrow's ceramic printing technologies. In addition, the EU's focus on digital manufacturing and sustainability drives the application of 3D printed ceramics for low-waste, efficient, and lightweight production.

This study has been validated through primary interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%; Tier 2 - 33%; and Tier 3 - 27%

- By Designation: C-level - 50%; Director-level - 30%; and Managers - 20%

- By Region: North America - 15%; Europe - 50%; Asia Pacific - 20%; the Middle East & Africa - 10%; and Latin America - 5%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market include Sintokogio, Ltd. (Japan), Lithoz GmbH (Austria), SGL Carbon (France), CeramTec GmbH (Germany), Tethon 3D (US), Saint-Gobain (France), Nanoe (France), Jiangsu Sanzer New Materials Technology Co., Ltd. (China), and KYOCERA Corporation (Japan).

Research Coverage

This research report categorizes the 3D printing ceramics market by ceramic type (oxides, non-oxides), form (liquid, filament, powder), end-use industry (aerospace & defense, healthcare, automotive, consumer goods & electronics, other end-use industries), and region (North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the 3D printing ceramics market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions and services, key strategies, and recent developments in the 3D printing ceramics market. This report includes a competitive analysis of upcoming startups in the 3D printing ceramics market ecosystem.

Reasons to buy this report

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall 3D printing ceramics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing research & development activities in 3D printing ceramics), restraints (availability of substitutes and high cost of 3D printing ceramics), opportunities (growing investments and fundings in the market), and challenges (low adoption and acceptance of 3D printing ceramics and high cost compared to substitute materials) are influencing the growth of the 3D printing ceramics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the 3D printing ceramics market.

- Market Development: Comprehensive information about lucrative markets-the report analyses the 3D printing ceramics market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the 3D printing ceramics market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Sintokogio, Ltd. (Japan), Lithoz GmbH (Austria), SGL Carbon (France), CeramTec GmbH (Germany), Tethon 3D (US), Saint-Gobain (France), Nanoe (France), Jiangsu Sanzer New Materials Technology Co., Ltd. (China), and KYOCERA Corporation (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET S COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Interviews with top 3D printing ceramics manufacturers

- 2.1.2.3 Breakdown of primary interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN 3D PRINTING CERAMICS MARKET

- 4.2 3D PRINTING CERAMICS MARKET BY END-USE INDUSTRY AND REGION

- 4.3 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE

- 4.4 3D PRINTING CERAMICS MARKET, BY FORM

- 4.5 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY

- 4.6 3D PRINTING CERAMICS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Ongoing research & development

- 5.2.1.2 Increase in partnerships & collaboration among players in ecosystem

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost compared to other 3D printing materials

- 5.2.2.2 Economy of scale not achieved

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increase in investments in 3D printing ceramics manufacturing

- 5.2.3.2 Development of advanced printers compatible with ceramics

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability of substitutes

- 5.2.4.2 Capital-intensive production and complex manufacturing process

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

- 5.6.2 AVERAGE SELLING PRICE TREND, BY CERAMIC TYPE

- 5.6.3 AVERAGE SELLING PRICE TREND, BY FORM

- 5.6.4 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO (HS CODE 69)

- 5.8.2 IMPORT SCENARIO (HS CODE 69)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Stereolithography

- 5.9.1.2 Binder jetting

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Fused filament fabrication (FFF)

- 5.9.1 KEY TECHNOLOGIES

- 5.10 IMPACT OF AI/GEN AI ON 3D PRINTING CERAMICS MARKET

- 5.10.1 TOP USE CASES AND MARKET POTENTIAL

- 5.10.2 CASE STUDIES OF AI IMPLEMENTATION IN 3D PRINTING CERAMICS MARKET

- 5.11 MACROECONOMIC OUTLOOK

- 5.11.1 INTRODUCTION

- 5.11.2 GDP TRENDS AND FORECAST

- 5.11.3 TRENDS IN GLOBAL AEROSPACE & DEFENSE INDUSTRY

- 5.11.4 TRENDS IN GLOBAL HEALTHCARE INDUSTRY

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 METHODOLOGY

- 5.12.3 PATENT TYPES

- 5.12.4 INSIGHTS

- 5.12.5 LEGAL STATUS

- 5.12.6 JURISDICTION ANALYSIS

- 5.12.7 TOP APPLICANTS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 DENBY POTTERY AND UWE BRISTOL: TRANSFORMING TABLEWARE PROTOTYPING WITH 3D PRINTED CERAMICS

- 5.15.2 LITHOZ LITHABONE TCP 300 FOR PATIENT-SPECIFIC BONE IMPLANTS IN HEALTHCARE

- 5.15.3 3DCERAM'S CERIA AI-TRANSFORMING MEDICAL 3D PRINTED CERAMICS

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF ON 3D PRINTING CERAMICS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACTS ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE

- 6.1 INTRODUCTION

- 6.1.1 OXIDES

- 6.1.1.1 Growing demand from various end-use industries to drive market

- 6.1.1.2 Alumina

- 6.1.1.3 Zirconia

- 6.1.1.4 Other oxide types

- 6.1.2 NON-OXIDES

- 6.1.2.1 Advanced performance requirements to drive non-oxide ceramic demand in 3D printing

- 6.1.2.2 Silicon carbide

- 6.1.2.3 Silicon nitride

- 6.1.2.4 Other non-oxide types

- 6.1.1 OXIDES

7 3D PRINTING CERAMICS MARKET, BY FORM

- 7.1 INTRODUCTION

- 7.1.1 FILAMENT

- 7.1.1.1 Technological development in manufacturing of ceramic filament to drive market

- 7.1.2 LIQUID

- 7.1.2.1 Increased adoption of liquid-based ceramics for high-resolution applications

- 7.1.3 POWDER

- 7.1.3.1 Extensive industry backing and process simplicity to propel powder-based ceramic printing

- 7.1.1 FILAMENT

8 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 AEROSPACE & DEFENSE

- 8.2.1 INCREASE IN USE IN MANUFACTURING COMPLEX COMPONENTS AND EQUIPMENT TO DRIVE MARKET

- 8.3 HEALTHCARE

- 8.3.1 ADVANCEMENTS IN BIOCOMPATIBLE CERAMICS TO FUEL GROWTH IN HEALTHCARE 3D PRINTING

- 8.4 AUTOMOTIVE

- 8.4.1 DEMAND FOR HIGH-PERFORMANCE COMPONENTS TO FUEL ADOPTION OF 3D PRINTING CERAMICS

- 8.5 CONSUMER GOODS & ELECTRONICS

- 8.5.1 HIGH DEMAND FOR MANUFACTURING COMPLEX DESIGNS IN CONSUMER GOODS & ELECTRONICS TO DRIVE MARKET

- 8.6 OTHER END-USE INDUSTRIES

9 3D PRINTING CERAMICS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE

- 9.2.2 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY FORM

- 9.2.3 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY

- 9.2.4 NORTH AMERICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY

- 9.2.4.1 US

- 9.2.4.1.1 Growing strategic partnerships to drive market

- 9.2.4.2 Canada

- 9.2.4.2.1 Adoption of 3D printing technology for consumer goods to support market growth

- 9.2.4.1 US

- 9.3 EUROPE

- 9.3.1 EUROPE: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE

- 9.3.2 EUROPE: 3D PRINTING CERAMICS MARKET, BY FORM

- 9.3.3 EUROPE: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY

- 9.3.4 EUROPE: 3D PRINTING CERAMICS MARKET, BY COUNTRY

- 9.3.4.1 Germany

- 9.3.4.1.1 Presence of 3D-printed ceramic manufacturers to drive market

- 9.3.4.2 France

- 9.3.4.2.1 Increase in demand from aerospace & defense industries to fuel market

- 9.3.4.3 UK

- 9.3.4.3.1 Growth in research & development centers to propel market

- 9.3.4.4 Italy

- 9.3.4.4.1 Adoption of 3D printing ceramics in various sectors to drive market

- 9.3.4.5 Rest of Europe

- 9.3.4.1 Germany

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE

- 9.4.2 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY FORM

- 9.4.3 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY

- 9.4.4 ASIA PACIFIC: 3D PRINTING CERAMICS MARKET, BY COUNTRY

- 9.4.4.1 China

- 9.4.4.1.1 Rapid industrialization and investments to propel market

- 9.4.4.2 Japan

- 9.4.4.2.1 Ongoing research collaborations to result in surge in demand

- 9.4.4.3 South Korea

- 9.4.4.3.1 Strategic collaborations among universities & manufacturers to drive market

- 9.4.4.4 India

- 9.4.4.4.1 Growing government initiatives and partnerships to support market growth

- 9.4.4.5 Rest of Asia Pacific

- 9.4.4.1 China

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE

- 9.5.2 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY FORM

- 9.5.3 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY

- 9.5.4 MIDDLE EAST & AFRICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY

- 9.5.4.1 GCC Countries

- 9.5.4.1.1 UAE

- 9.5.4.1.1.1 High demand from end-use industries to propel growth

- 9.5.4.1.2 Saudi Arabia

- 9.5.4.1.2.1 Growing government initiatives toward technological innovation and industrial diversification to drive market

- 9.5.4.1.3 Rest of GCC

- 9.5.4.1.1 UAE

- 9.5.4.2 South Africa

- 9.5.4.2.1 Growing adoption of 3D printing ceramics across various sectors to fuel market

- 9.5.4.3 Rest of Middle East & Africa

- 9.5.4.1 GCC Countries

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY CERAMIC TYPE

- 9.6.2 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY FORM

- 9.6.3 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY END-USE INDUSTRY

- 9.6.4 LATIN AMERICA: 3D PRINTING CERAMICS MARKET, BY COUNTRY

- 9.6.4.1 Brazil

- 9.6.4.1.1 Economic improvements to propel market for 3D printing ceramics

- 9.6.4.2 Mexico

- 9.6.4.2.1 Increase in innovations to augment market growth

- 9.6.4.3 Rest of Latin America

- 9.6.4.1 Brazil

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.5.1 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- 10.7.5.1 Detailed list of key startups/SMEs

- 10.7.5.2 Competitive benchmarking of key startups/SMEs

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS OF 3D PRINTING CERAMICS VENDORS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SINTOKOGIO, LTD.

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Expansions

- 11.1.1.3.3 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 SGL CARBON

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 CERAMTEC GMBH

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 NANOE

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 SAINT-GOBAIN

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 CONCR3DE

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 MnM view

- 11.1.6.3.1 Right to win

- 11.1.6.3.2 Strategic choices

- 11.1.6.3.3 Weaknesses and competitive threats

- 11.1.7 JIANGSU SANZER NEW MATERIALS TECHNOLOGY CO., LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Expansions

- 11.1.7.4 MnM view

- 11.1.7.4.1 Right to win

- 11.1.7.4.2 Strategic choices

- 11.1.7.4.3 Weaknesses and competitive threats

- 11.1.8 LITHOZ GMBH

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.8.3.2 Other developments

- 11.1.8.4 MnM view

- 11.1.8.4.1 Right to win

- 11.1.8.4.2 Strategic choices

- 11.1.8.4.3 Weaknesses and competitive threats

- 11.1.9 TETHON 3D

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.3.2 Deals

- 11.1.9.3.3 Other developments

- 11.1.9.4 MnM view

- 11.1.9.4.1 Right to win

- 11.1.9.4.2 Strategic choices

- 11.1.9.4.3 Weaknesses and competitive threats

- 11.1.10 KYOCERA CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Expansions

- 11.1.10.4 MnM view

- 11.1.10.4.1 Right to win

- 11.1.10.4.2 Strategic choices

- 11.1.10.4.3 Weaknesses and competitive threats

- 11.1.1 SINTOKOGIO, LTD.

- 11.2 OTHER PLAYERS

- 11.2.1 STEINBACH AG

- 11.2.2 XJET

- 11.2.3 ZRAPID TECH

- 11.2.4 TRUNNANO

- 11.2.5 INTERNATIONAL SYALONS

- 11.2.6 FORMLABS

- 11.2.7 SCHUNK TECHNICAL CERAMICS

- 11.2.8 STANDARD NUCLEAR

- 11.2.9 SHENZHEN ADVENTURE TECHNOLOGY CO., LTD

- 11.2.10 SINTX TECHNOLOGIES, INC.

- 11.2.11 SPECTRUM FILAMENTS

- 11.2.12 CERAMARET

- 11.2.13 ZHENGZHOU HAIXU ABRASIVES CO., LTD

- 11.2.14 NISHIMURA ADVANCED CERAMICS

- 11.2.15 WUNDER-MOLD, INC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS