|

|

市場調査レポート

商品コード

1802917

精密水産養殖の世界市場:提供別、システムタイプ別、用途別、養殖場タイプ別、地域別 - 予測(~2030年)Precision Aquaculture Market By Offering (Sensors, Camera Systems, Control Systems, Software, Services), By System type, By Application, By Farm type and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 精密水産養殖の世界市場:提供別、システムタイプ別、用途別、養殖場タイプ別、地域別 - 予測(~2030年) |

|

出版日: 2025年08月22日

発行: MarketsandMarkets

ページ情報: 英文 218 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

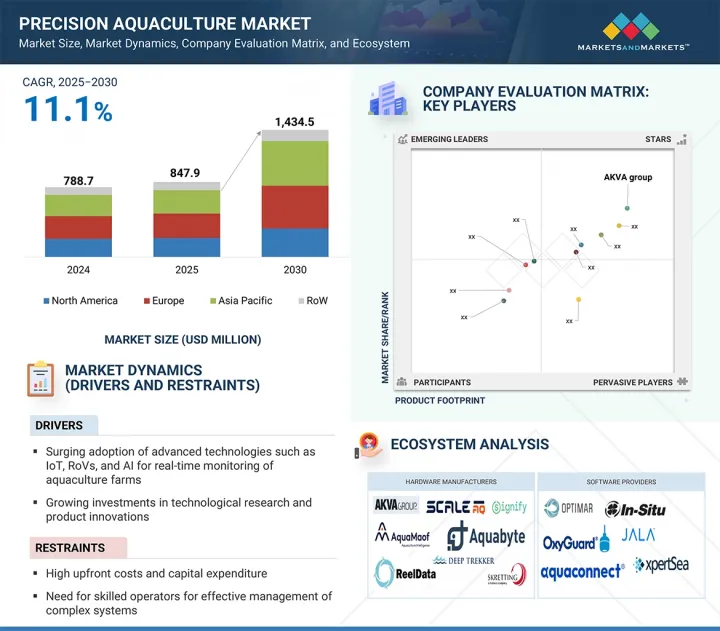

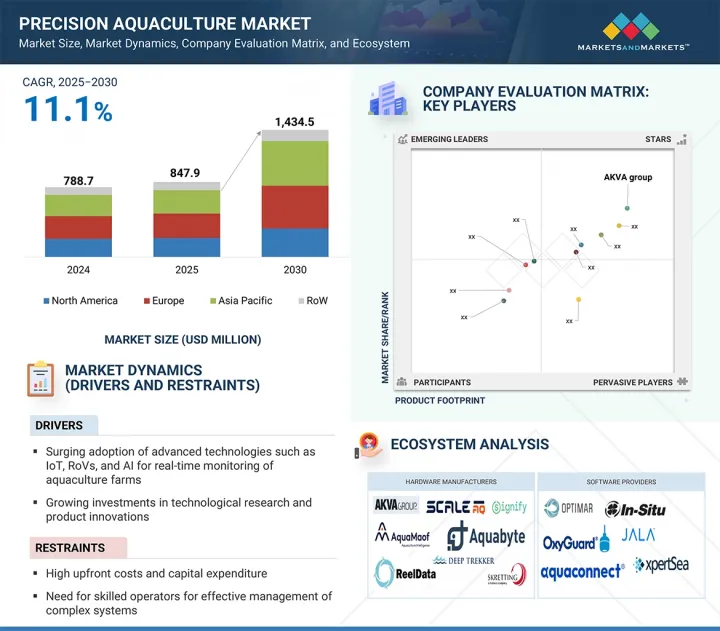

世界の精密水産養殖の市場規模は、2025年の8億4,790万米ドルから2030年までに14億3,450万米ドルに達すると予測され、予測期間にCAGRで11.1%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 提供、システムタイプ、用途、養殖場タイプ、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

現代の水産養殖では、魚の健康を維持することが高い生産性を確保し、経済的損失を最小化するために重要です。水中カメラ、環境センサー、AIによるアナリティクスなどの精密水産養殖ツールにより、水産養殖業者は魚の健康の行動的・生理的指標をリアルタイムでモニターすることができます。これらの技術は、ストレス、疾病症状、ウミジラミのような寄生虫の脅威の早期発見を容易にし、発生が拡大する前のタイムリーな介入を可能にします。この予防的なアプローチにより、抗生物質や化学治療への依存を減らし、抗生物質フリーの生産をサポートし、生存率を向上させ、ますます厳しくなる動物福祉と食品安全規制へのコンプライアンスを確保することができます。持続可能な方法で育てられた水産物を求める消費者の需要が高まるにつれて、精密なヘルスモニタリングは、責任ある収益性の高い水産養殖事業の礎石となりつつあります。

「モニタリング・監視用途が2024年に最大の市場シェアを占めました。」

経営効率、環境コンプライアンス、魚の健康管理の確保における基本的な役割により、モニタリング・監視用途が2024年に最大の市場シェアを占めます。水産養殖事業がますますデータドリブンのアプローチを採用するようになるにつれて、水質、溶存酸素、水温、魚の行動などの主要パラメーターのリアルタイムモニタリングの必要性は、疾患の発生を防ぎ、給餌を最適化し、死亡率を減少させるために不可欠となっています。追跡可能で持続可能な水産物の生産に対する需要の高まりは、主な水産養殖地域における厳しい規制枠組みもあり、統合監視システムの展開をさらに加速させています。これらのソリューションは、意思決定とリソースの最適化を強化するだけでなく、労働力依存を減らし、モニタリングと監視を現代の水産養殖環境全体の中核用途としています。

「ソフトウェアセグメントが予測期間にもっとも高いCAGRを記録する見込みです。」

精密水産養殖市場では、水産養殖事業全体における先進のアナリティクス、オートメーション、リアルタイム意思決定支援ツールに対する需要の高まりにより、ソフトウェアセグメントが予測期間にもっとも高いCAGRを記録する見込みです。養殖場の規模が拡大し、より複雑なシステムが採用されるにつれて、ソフトウェアプラットフォームは、センサー、給餌器、カメラなどのさまざまなハードウェアコンポーネントからのデータのシームレスな統合を可能にし、正確な制御、予知保全、パフォーマンスの最適化を可能にします。クラウドベースの養殖場管理、遠隔モニタリング、飼料効率、魚の健康状態、経営の透明性を向上させるためのAIによる知見に対するニーズの高まりは、ソフトウェアの採用をさらに加速させています。さらに、持続可能性、規制遵守、トレーサビリティへの注目の高まりは、水産養殖業者に堅牢なデジタルプラットフォームへの投資を促し、ソフトウェアセグメントをインテリジェントでスケーラブルな水産養殖ソリューションの重要な成功要因としています。

「米国が予測期間に北米の精密水産養殖市場の成長をリードすると推定されます。」

米国は、技術革新への強い注力、持続可能な水産養殖法への投資の増加、ハイテク水産養殖システムを支える先進のインフラのプレゼンスにより、予測期間に北米の精密水産養殖市場の成長をリードする見込みです。国内の水産物の生産を拡大し、輸入への依存を減らすことを目的とした連邦政府の取り組みが、国全体の水産養殖事業の近代化を推進しています。さらに、米国を拠点とする企業は、自動給餌システム、リアルタイムモニタリングプラットフォーム、AIベースのアナリティクスなどの精密ツール開発の最前線にあり、商業養殖場での採用が進んでいます。追跡可能で高品質な魚介類に対する需要の高まりと、それを支える規制枠組みは、精密水産養殖ソリューションの採用における同国のリーダーシップをさらに強化しています。

当レポートでは、世界の精密水産養殖市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 精密水産養殖市場の企業にとって魅力的な機会

- 精密水産養殖市場:用途別

- 精密水産養殖市場:養殖場タイプ別

- 精密水産養殖市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- カスタマービジネスに影響を与える動向/混乱

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 価格設定の分析

- 主要企業が提供するセンサーの平均販売価格:タイプ別(2024年)

- 精密水産養殖センサーの平均販売価格の動向:地域別(2021年~2024年)

- ケーススタディ分析

- INNOVASEA、OPEN BLUEが世界最大の外洋養殖場となるよう支援

- INNOVASEA、Rugged Evolution PenでEARTH OCEAN FARMSの生産拡大を実現

- AKVA GROUPの専門知識と迅速なサービスが、ERKO SEAFOODのサーモン養殖場の拡大に寄与

- 特許分析

- 貿易分析

- 輸入シナリオ(HSコード9026)

- 輸出シナリオ(HSコード9026)

- ポーターのファイブフォース分析

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 主な会議とイベント(2025年~2026年)

- 精密水産養殖市場に対する生成AI/AIの影響

- 2025年の米国関税の影響 - 概要

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 用途に対する影響

第6章 精密水産養殖市場:提供別

- イントロダクション

- ハードウェア

- センサー

- カメラシステム

- 制御システム

- その他のハードウェアタイプ

- ソフトウェア

- クラウドベース

- オンプレミス

- サービス

- システム統合・展開

- コンサルティング

- データアナリティクス

- サポート・メンテナンス

第7章 精密水産養殖市場:システムタイプ別

- イントロダクション

- スマート給餌システム

- モニタリング・制御システム

- 水中ROVシステム

- その他のシステムタイプ

第8章 精密水産養殖市場:用途別

- イントロダクション

- 給餌最適化

- モニタリング・監視

- 収量分析・測定

- その他の用途

第9章 精密水産養殖市場:養殖場タイプ別

- イントロダクション

- 屋外養殖場

- 池ベース

- ケージベース

- RAS養殖場

第10章 精密水産養殖市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- ノルウェー

- スペイン

- 英国

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 東南アジア

- 日本

- 韓国

- インド

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 南米

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2021年~2025年)

- 収益分析(2022年~2024年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要企業

- AKVA GROUP

- SCALEAQ

- SKRETTING (ERUVAKA TECHNOLOGIES)

- INNOVASEA SYSTEMS INC.

- AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.

- AQUABYTE

- SIGNIFY HOLDING

- REELDATA

- DEEP TREKKER INC.

- AQUACARE ENVIRONMENT, INC.

- その他の企業

- IMENCO AQUA AS

- OPTIMAR AS

- IN-SITU INC.

- OXYGUARD

- PT JALA AKUAKULTUR LESTARI ALAMKU

- AQUACONNECT

- SENSOREX

- PLANET LIGHTING

- MOLEAER INC.

- XPERTSEA

- FISHFARMFEEDER

- CAGEEYE

- AQUAMANAGER

- HUNAN RIKA ELECTRONIC TECH CO., LTD

- CHETU INC.

第13章 付録

List of Tables

- TABLE 1 PRECISION AQUACULTURE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 CHANGES IMPLEMENTED IN UPDATED VERSION

- TABLE 3 PRECISION AQUACULTURE MARKET: RISK ANALYSIS

- TABLE 4 ROLE OF COMPANIES IN PRECISION AQUACULTURE ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE TREND OF PRECISION AQUACULTURE SENSOR TYPES OFFERED BY PLAYERS, 2021-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF PRECISION AQUACULTURE SENSORS, BY REGION, 2021-2024 (USD)

- TABLE 7 LIST OF MAJOR PATENTS, 2025

- TABLE 8 IMPORT DATA FOR HS CODE 9026-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 9026-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 PRECISION AQUACULTURE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 MFN TARIFF FOR HS CODE 9026-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2024

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 19 PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 20 PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 21 PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 22 HARDWARE: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 23 HARDWARE: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 24 HARDWARE: PRECISION AQUACULTURE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 25 HARDWARE: PRECISION AQUACULTURE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 26 HARDWARE: PRECISION AQUACULTURE MARKET, BY SENSOR TYPE, 2021-2024 (USD MILLION)

- TABLE 27 HARDWARE: PRECISION AQUACULTURE MARKET, BY SENSOR TYPE, 2025-2030 (USD MILLION)

- TABLE 28 HARDWARE: PRECISION AQUACULTURE MARKET, BY SENSOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 29 HARDWARE: PRECISION AQUACULTURE MARKET, BY SENSOR TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 30 PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 31 PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 32 SOFTWARE: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 33 SOFTWARE: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 34 SOFTWARE: PRECISION AQUACULTURE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 35 SOFTWARE: PRECISION AQUACULTURE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 36 PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 37 PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 38 SERVICES: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 39 SERVICES: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 40 SERVICES: PRECISION AQUACULTURE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 41 SERVICES: PRECISION AQUACULTURE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 42 PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 43 PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 44 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 45 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 46 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 47 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 48 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 49 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 50 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 51 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 52 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 53 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 54 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 59 SMART FEEDING SYSTEMS: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 60 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 61 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 62 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 63 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 64 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 65 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 66 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 67 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 68 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 69 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 70 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 75 MONITORING & CONTROL SYSTEMS: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 76 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 77 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 78 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 79 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 80 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 81 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 82 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 83 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 84 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 85 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 86 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 89 UNDERWATER ROV SYSTEMS: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 90 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 91 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 92 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 93 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 94 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 95 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 96 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 97 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 98 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 99 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 100 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 105 OTHER SYSTEM TYPES: PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 106 PRECISION AQUACULTURE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 107 PRECISION AQUACULTURE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 FEED OPTIMIZATION: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 109 FEED OPTIMIZATION: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 110 MONITORING & SURVEILLANCE: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 111 MONITORING & SURVEILLANCE: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 112 YIELD ANALYSIS & MEASUREMENT: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 113 YIELD ANALYSIS & MEASUREMENT: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 114 OTHER APPLICATIONS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 115 OTHER APPLICATIONS: PRECISION AQUACULTURE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 116 PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 117 PRECISION AQUACULTURE MARKET, BY FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 118 PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2021-2024 (USD MILLION)

- TABLE 119 PRECISION AQUACULTURE MARKET, BY OPEN AQUACULTURE FARM TYPE, 2025-2030 (USD MILLION)

- TABLE 120 OPEN AQUACULTURE FARMS: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 121 OPEN AQUACULTURE FARMS: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 122 RAS FARMS: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 123 RAS FARMS: PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 124 PRECISION AQUACULTURE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 PRECISION AQUACULTURE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: PRECISION AQUACULTURE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 NORTH AMERICA: PRECISION AQUACULTURE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: PRECISION AQUACULTURE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 EUROPE: PRECISION AQUACULTURE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 135 EUROPE: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 137 EUROPE: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: PRECISION AQUACULTURE MARKET, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: PRECISION AQUACULTURE MARKET, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 143 ASIA PACIFIC: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 144 ROW: PRECISION AQUACULTURE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 ROW: PRECISION AQUACULTURE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 146 ROW: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 147 ROW: PRECISION AQUACULTURE MARKET FOR OPEN AQUACULTURE FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 148 ROW: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 149 ROW: PRECISION AQUACULTURE MARKET FOR RAS FARMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 150 SOUTH AMERICA: PRECISION AQUACULTURE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 SOUTH AMERICA: PRECISION AQUACULTURE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 PRECISION AQUACULTURE MARKET: KEY PLAYER STRATEGIES/ RIGHT TO WIN, APRIL 2021-JULY 2025

- TABLE 153 PRECISION AQUACULTURE MARKET: DEGREE OF COMPETITION

- TABLE 154 PRECISION AQUACULTURE MARKET: REGION FOOTPRINT

- TABLE 155 PRECISION AQUACULTURE MARKET: OFFERING FOOTPRINT

- TABLE 156 PRECISION AQUACULTURE MARKET: SYSTEM TYPE FOOTPRINT

- TABLE 157 PRECISION AQUACULTURE MARKET: APPLICATION FOOTPRINT

- TABLE 158 PRECISION AQUACULTURE MARKET: FARM TYPE FOOTPRINT

- TABLE 159 PRECISION AQUACULTURE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 160 PRECISION AQUACULTURE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 161 PRECISION AQUACULTURE MARKET: PRODUCT LAUNCHES, APRIL 2021-JULY 2025

- TABLE 162 PRECISION AQUACULTURE MARKET: DEALS, APRIL 2021-JULY 2025

- TABLE 163 AKVA GROUP: COMPANY OVERVIEW

- TABLE 164 AKVA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 AKVA GROUP: PRODUCT LAUNCHES

- TABLE 166 AKVA GROUP: DEALS

- TABLE 167 SCALEAQ: COMPANY OVERVIEW

- TABLE 168 SCALEAQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 SCALEAQ: PRODUCT LAUNCHES

- TABLE 170 SCALEAQ: DEALS

- TABLE 171 SKRETTING (ERUVAKA TECHNOLOGIES): COMPANY OVERVIEW

- TABLE 172 SKRETTING (ERUVAKA TECHNOLOGIES): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 SKRETTING (ERUVAKA TECHNOLOGIES): PRODUCT LAUNCHES

- TABLE 174 INNOVASEA SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 175 INNOVASEA SYSTEMS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 INNOVASEA SYSTEMS INC.: PRODUCT LAUNCHES

- TABLE 177 INNOVASEA SYSTEMS INC.: DEALS

- TABLE 178 AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 179 AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 AQUABYTE: COMPANY OVERVIEW

- TABLE 181 AQUABYTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 SIGNIFY HOLDING: COMPANY OVERVIEW

- TABLE 183 SIGNIFY HOLDING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 REELDATA: COMPANY OVERVIEW

- TABLE 185 REELDATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 REELDATA: DEALS

- TABLE 187 DEEP TREKKER INC.: COMPANY OVERVIEW

- TABLE 188 DEEP TREKKER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 AQUACARE ENVIRONMENT, INC.: COMPANY OVERVIEW

- TABLE 190 AQUACARE ENVIRONMENT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 IMENCO AQUA AS: COMPANY OVERVIEW

- TABLE 192 OPTIMAR AS: COMPANY OVERVIEW

- TABLE 193 IN-SITU INC.: COMPANY OVERVIEW

- TABLE 194 OXYGUARD: COMPANY OVERVIEW

- TABLE 195 PT JALA AKUAKULTUR LESTARI ALAMKU: COMPANY OVERVIEW

- TABLE 196 AQUACONNECT: COMPANY OVERVIEW

- TABLE 197 SENSOREX: COMPANY OVERVIEW

- TABLE 198 PLANET LIGHTING: COMPANY OVERVIEW

- TABLE 199 MOLEAER INC.: COMPANY OVERVIEW

- TABLE 200 XPERTSEA: COMPANY OVERVIEW

- TABLE 201 FISHFARMFEEDER: COMPANY OVERVIEW

- TABLE 202 CAGEEYE: COMPANY OVERVIEW

- TABLE 203 AQUAMANAGER: COMPANY OVERVIEW

- TABLE 204 HUNAN RIKA ELECTRONIC TECH CO., LTD: COMPANY OVERVIEW

- TABLE 205 CHETU INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PRECISION AQUACULTURE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DURATION COVERED

- FIGURE 3 PRECISION AQUACULTURE MARKET: RESEARCH DESIGN

- FIGURE 4 PRECISION AQUACULTURE MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 1 (SUPPLY SIDE)

- FIGURE 5 PRECISION AQUACULTURE MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 (SUPPLY SIDE)

- FIGURE 6 PRECISION AQUACULTURE MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 3 (DEMAND SIDE)

- FIGURE 7 PRECISION AQUACULTURE MARKET: BOTTOM-UP APPROACH

- FIGURE 8 PRECISION AQUACULTURE MARKET: TOP-DOWN APPROACH

- FIGURE 9 PRECISION AQUACULTURE MARKET: DATA TRIANGULATION

- FIGURE 10 PRECISION AQUACULTURE MARKET: RESEARCH ASSUMPTIONS

- FIGURE 11 PRECISION AQUACULTURE MARKET: RESEARCH LIMITATIONS

- FIGURE 12 PRECISION AQUACULTURE MARKET SIZE, 2021-2030 (USD MILLION)

- FIGURE 13 MONITORING & CONTROL SYSTEMS TO DOMINATE MARKET BETWEEN 2025 AND 2030

- FIGURE 14 HARDWARE SEGMENT TO CAPTURE LARGEST SHARE OF PRECISION AQUACULTURE MARKET, BY OFFERING, IN 2025

- FIGURE 15 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN PRECISION AQUACULTURE MARKET FROM 2025 TO 2030

- FIGURE 16 EUROPE LED MARKET WITH STRONG REGULATORY SUPPORT FOR SUSTAINABLE AQUACULTURE PRACTICES IN 2024

- FIGURE 17 FEED OPTIMIZATION SEGMENT TO CAPTURE SECOND-LARGEST SHARE OF PRECISION AQUACULTURE MARKET IN 2030

- FIGURE 18 OPEN AQUACULTURE FARMS TO DOMINATE PRECISION AQUACULTURE MARKET IN 2030

- FIGURE 19 EUROPE HELD PROMINENT SHARE OF PRECISION AQUACULTURE MARKET IN 2024

- FIGURE 20 PRECISION AQUACULTURE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 IMPACT ANALYSIS: DRIVERS

- FIGURE 22 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 23 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 24 IMPACT ANALYSIS: CHALLENGES

- FIGURE 25 PRECISION AQUACULTURE VALUE CHAIN ANALYSIS

- FIGURE 26 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 27 PRECISION AQUACULTURE ECOSYSTEM

- FIGURE 28 AVERAGE SELLING PRICE OF PRECISION AQUACULTURE SENSORS PROVIDED BY KEY PLAYERS, BY TYPE, 2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF PRECISION AQUACULTURE SENSORS, BY REGION, 2021-2024

- FIGURE 30 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 31 IMPORT SCENARIO FOR HS CODE 9026-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 32 EXPORT SCENARIO FOR HS CODE 9026-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 33 PRECISION AQUACULTURE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 IMPACT OF GEN AI/AI ON PRECISION AQUACULTURE MARKET

- FIGURE 35 SOFTWARE SEGMENT TO EXHIBIT HIGHEST CAGR IN PRECISION AQUACULTURE MARKET DURING FORECAST PERIOD

- FIGURE 36 MONITORING & CONTROL SYSTEMS TO EXHIBIT HIGHEST CAGR IN PRECISION AQUACULTURE MARKET FROM 2025 TO 2030

- FIGURE 37 MONITORING & SURVEILLANCE SEGMENT TO LEAD PRECISION AQUACULTURE MARKET, BY APPLICATION, IN 2030

- FIGURE 38 RAS FARMS TO EXHIBIT HIGHER CAGR IN PRECISION AQUACULTURE MARKET FROM 2025 TO 2030

- FIGURE 39 ASIA PACIFIC TO RECORD HIGHEST CAGR IN PRECISION AQUACULTURE MARKET BETWEEN 2025 AND 2030

- FIGURE 40 NORTH AMERICA: PRECISION AQUACULTURE MARKET SNAPSHOT

- FIGURE 41 EUROPE: PRECISION AQUACULTURE MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: PRECISION AQUACULTURE MARKET SNAPSHOT

- FIGURE 43 SOUTH AMERICA TO LEAD PRECISION AQUACULTURE MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 44 PRECISION AQUACULTURE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 45 MARKET SHARE ANALYSIS OF TOP COMPANIES OFFERING PRECISION AQUACULTURE SOLUTIONS/SERVICES, 2024

- FIGURE 46 PRECISION AQUACULTURE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 PRECISION AQUACULTURE MARKET: COMPANY FOOTPRINT

- FIGURE 48 PRECISION AQUACULTURE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 AKVA GROUP: COMPANY SNAPSHOT

- FIGURE 50 SCALEAQ: COMPANY SNAPSHOT

- FIGURE 51 SIGNIFY HOLDING: COMPANY SNAPSHOT

The global precision aquaculture market size is expected to grow from USD 847.9 million in 2025 to USD 1,434.5 million by 2030, at a CAGR of 11.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By offering, system type, application, farm type, and region |

| Regions covered | North America, Europe, APAC, RoW |

In modern aquaculture, maintaining fish health is critical to ensure high productivity and minimize economic losses. Precision aquaculture tools such as underwater cameras, environmental sensors, and AI-driven analytics enable farmers to monitor behavioral and physiological indicators of fish health in real time. These technologies facilitate the early detection of stress, disease symptoms, and parasitic threats like sea lice, allowing for timely interventions before outbreaks escalate. This proactive approach reduces dependency on antibiotics and chemical treatments, thereby supporting antibiotic-free production, improving survival rates, and ensuring compliance with increasingly stringent animal welfare and food safety regulations. As consumer demand for sustainably raised seafood grows, precision health monitoring is becoming a cornerstone of responsible and profitable aquaculture operations.

"Monitoring and surveillance application accounted for the largest market share in 2024"

Due to its fundamental role in ensuring operational efficiency, environmental compliance, and fish health management, the monitoring and surveillance application holds the largest market share in 2024. As aquaculture operations increasingly adopt data-driven approaches, the need for real-time monitoring of key parameters such as water quality, dissolved oxygen, temperature, and fish behavior has become essential to prevent disease outbreaks, optimize feeding, and reduce mortality rates. The growing demand for traceable and sustainable seafood production, coupled with stringent regulatory frameworks in key aquaculture regions, has further accelerated the deployment of integrated surveillance systems. These solutions not only enhance decision-making and resource optimization but also reduce labor dependency, positioning monitoring and surveillance as a core application across modern aquafarming environments.

"The software segment is projected to register the highest CAGR during the forecast period"

The software segment is projected to register the highest CAGR during the forecast period in the precision aquaculture market, driven by the increasing demand for advanced analytics, automation, and real-time decision support tools across aquaculture operations. As farms scale and adopt more complex systems, software platforms enable seamless integration of data from various hardware components such as sensors, feeders, and cameras, allowing for precise control, predictive maintenance, and performance optimization. The rising need for cloud-based farm management, remote monitoring, and AI-driven insights to improve feed efficiency, fish health, and operational transparency further accelerates software adoption. Additionally, the growing emphasis on sustainability, regulatory compliance, and traceability is prompting aquafarmers to invest in robust digital platforms, positioning the software segment as a key enabler of intelligent and scalable aquaculture solutions.

"The US is estimated to lead growth in the North American precision aquaculture market during the forecast period"

The US is estimated to lead growth in the North American precision aquaculture market during the forecast period due to its strong focus on technological innovation, increasing investments in sustainable aquaculture practices, and the presence of advanced infrastructure supporting high-tech farming systems. Federal initiatives aimed at expanding domestic seafood production and reducing reliance on imports are driving the modernization of aquaculture operations across the country. Additionally, US-based companies are at the forefront of developing precision tools such as automated feeding systems, real-time monitoring platforms, and AI-based analytics, which are increasingly being adopted by commercial fish farms. The growing demand for traceable, high-quality seafood and supportive regulatory frameworks further reinforces the country's leadership in adopting precision aquaculture solutions.

Breakdown of Primaries

A variety of executives from key organizations operating in the precision aquaculture market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 - 15%, Tier 2 - 40%, and Tier 3 - 45%

- By Designation: C-level Executives - 35%, Directors - 25%, and Others - 40%

- By Region: North America - 35%, Asia Pacific - 30%, Europe - 20%, and RoW - 15%

The precision aquaculture market is dominated by globally established players such as AKVA Group (Norway), ScaleAQ (Norway), Skretting (Norway), Innovasea Systems Inc. (US), AquaMaof Aquaculture Technologies Ltd. (Israel), Aquabyte (US), Signify Holding (Netherlands), ReelData (Canada), Deep Trekker Inc. (Canada), Aquacare Environment, Inc. (US), Imenco Aqua AS (Norway), Optimar AS (Norway), In-Situ, Inc. (US), OxyGuard (Denmark), PT JALA Akuakultur Lestari Alamku (Indonesia), AquaConnect (India), Sensorex (US), Planet Lighting (Australia), Moleaer Inc. (US), XpertSea (Canada), FishFarmFeeder (Spain), CageEye (Europe), AquaManager (Greece), Hunan Rika Electronic Tech Co., Ltd (China), and Chetu Inc. (US). The study includes an in-depth competitive analysis of these key players in the precision aquaculture market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the precision aquaculture market and forecasts its size by system type, offering, farm type, application, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. A value chain analysis has been included in the report, along with the key players and their competitive analysis of the precision aquaculture ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (surging adoption of advanced technologies such as IoT, ROVs, and AI for real-time monitoring of aquaculture farms), restraints (high upfront costs and capital expenditure), opportunities (unlocking inclusive growth through Farm-as-a-Service [FaaS] models), and challenge (lack of a common information management system platform in the aquaculture industry) influencing the growth of the precision aquaculture market

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming technologies, research, and development activities in the precision aquaculture market

- Market Development: Comprehensive information about lucrative markets-the report analyses the precision aquaculture market across varied regions

- Market Diversification: Exhaustive information about new hardware/systems/software/services, untapped geographies, recent developments, and investments in the precision aquaculture market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as AKVA Group (Norway), ScaleAQ (Norway), Skretting (Norway), Innovasea Systems Inc. (US), and Aquabyte (US), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (supply side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (demand side)

- 2.2.1 BOTTOM-UP APPROACH

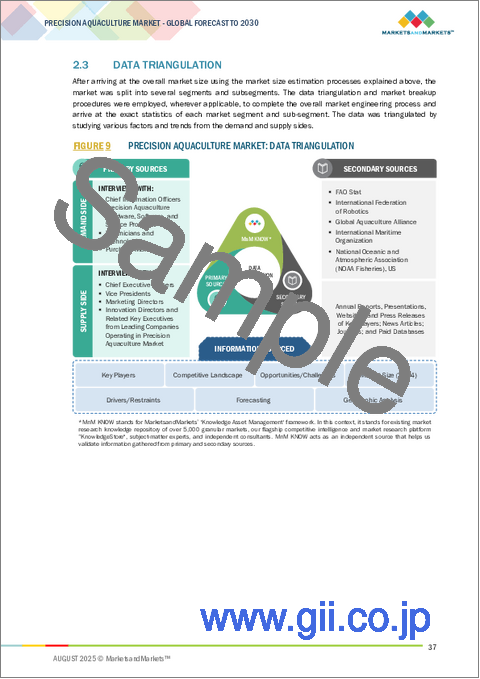

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRECISION AQUACULTURE MARKET

- 4.2 PRECISION AQUACULTURE MARKET, BY APPLICATION

- 4.3 PRECISION AQUACULTURE MARKET, BY FARM TYPE

- 4.4 PRECISION AQUACULTURE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging adoption of advanced technologies to monitor aquaculture farms in real time

- 5.2.1.2 Growing investments in developing technologically advanced products

- 5.2.1.3 Elevating demand for protein-rich aqua food

- 5.2.1.4 Increasing government support for freshwater aquaculture production

- 5.2.1.5 Pressing need for proactive disease detection to reduce economic losses

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement for high initial investment

- 5.2.2.2 Need for skilled operators for effective management of complex systems

- 5.2.2.3 Lack of technological awareness among aquaculture farmers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Escalating use of aquaculture monitoring and feed optimization devices in developing countries

- 5.2.3.2 Growing popularity of land-based recirculating aquaculture systems

- 5.2.3.3 Emergence of Farm-as-a-Service (FaaS) models

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental concerns due to extensive aquaculture farming

- 5.2.4.2 Lack of common information management system platform in aquaculture industry

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Computer vision and imaging

- 5.6.1.2 AI and ML algorithms

- 5.6.1.3 IoT platforms

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Cloud computing and edge computing

- 5.6.2.2 Data dashboards and decision support system (DSS) platforms

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Robotics and drones

- 5.6.3.2 Digital twins

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF SENSORS OFFERED BY KEY PLAYERS, BY TYPE, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND OF PRECISION AQUACULTURE SENSORS, BY REGION, 2021-2024

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 INNOVASEA HELPS OPEN BLUE BECOME LARGEST OPEN OCEAN FISH FARM IN WORLD

- 5.8.2 INNOVASEA ENABLES EARTH OCEAN FARMS TO EXPAND PRODUCTION WITH RUGGED EVOLUTION PENS

- 5.8.3 AKVA GROUP'S EXPERTISE AND QUICK SERVICE HELP ERKO SEAFOOD TO EXPAND ITS SALMON FARM

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 9026)

- 5.10.2 EXPORT SCENARIO (HS CODE 9026)

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF ANALYSIS

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 IMPACT OF GEN AI/AI ON PRECISION AQUACULTURE MARKET

- 5.14.1 INTRODUCTION

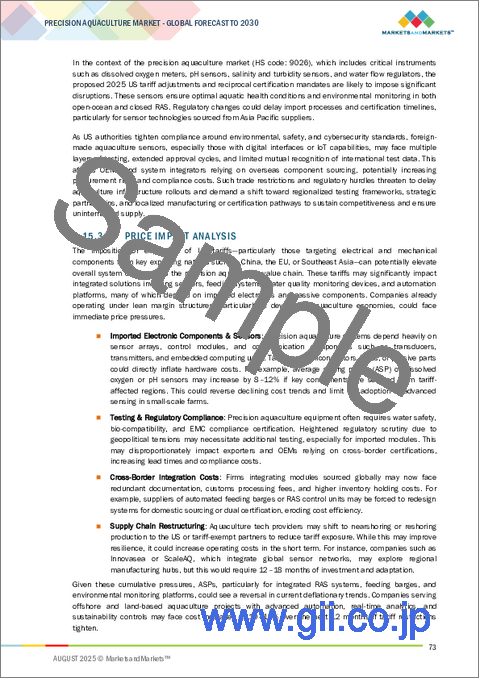

- 5.15 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 IMPACT ON COUNTRIES/REGIONS

- 5.15.4.1 US

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.5 IMPACT ON APPLICATIONS

6 PRECISION AQUACULTURE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 SENSORS

- 6.2.1.1 Temperature & environmental monitoring sensors

- 6.2.1.1.1 Rising focus on improving yields and reducing feed costs to drive segmental growth

- 6.2.1.2 pH & dissolved oxygen sensors

- 6.2.1.2.1 Emphasis on optimizing fish health through oxygen and pH control to boost demand

- 6.2.1.3 EC sensors

- 6.2.1.3.1 Increasing use in recirculating aquaculture systems to foster segmental growth

- 6.2.1.4 Other sensor types

- 6.2.1.1 Temperature & environmental monitoring sensors

- 6.2.2 CAMERA SYSTEMS

- 6.2.2.1 Rising adoption of smart HD and 4K camera systems in aquaculture farms to fuel market growth

- 6.2.3 CONTROL SYSTEMS

- 6.2.3.1 Pressing need to harness real-time data for smarter, sustainable fish farming to facilitate adoption

- 6.2.4 OTHER HARDWARE TYPES

- 6.2.1 SENSORS

- 6.3 SOFTWARE

- 6.3.1 CLOUD-BASED

- 6.3.1.1 Greater flexibility, scalability, and affordability to elevate demand

- 6.3.2 ON-PREMISES

- 6.3.2.1 Reduction in operational costs through server reuse and hardware sharing to support segmental growth

- 6.3.1 CLOUD-BASED

- 6.4 SERVICES

- 6.4.1 SYSTEM INTEGRATION & DEPLOYMENT

- 6.4.1.1 Rising installation of hardware equipment and software platforms in cage-based and RAS aquaculture farms to augment demand

- 6.4.2 CONSULTING

- 6.4.2.1 Execution of high-cost aquaculture projects to contribute to segmental growth

- 6.4.3 DATA ANALYTICS

- 6.4.3.1 Increasing deployment of IoT devices on aquaculture farms to spur demand

- 6.4.4 SUPPORT & MAINTENANCE

- 6.4.4.1 Pressing need to troubleshoot software-related issues and prevent hardware failures to propel market

- 6.4.1 SYSTEM INTEGRATION & DEPLOYMENT

7 PRECISION AQUACULTURE MARKET, BY SYSTEM TYPE

- 7.1 INTRODUCTION

- 7.2 SMART FEEDING SYSTEMS

- 7.2.1 RISING INCLINATION TOWARD DATA-DRIVEN FISH FEEDING TO INCREASE ADOPTION

- 7.3 MONITORING & CONTROL SYSTEMS

- 7.3.1 GREATER EMPHASIS ON EFFECTIVE MANAGEMENT OF AQUACULTURE FARMS TO DRIVE DEPLOYMENT

- 7.4 UNDERWATER ROV SYSTEMS

- 7.4.1 RISING ADOPTION OF NEXT-GENERATION ROVS TO ENHANCE DEEPWATER FARM INTELLIGENCE TO FUEL SEGMENTAL GROWTH

- 7.5 OTHER SYSTEM TYPES

8 PRECISION AQUACULTURE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 FEED OPTIMIZATION

- 8.2.1 TRANSITION TOWARD SUSTAINABLE AND PERFORMANCE-DRIVEN FARMING PRACTICES TO ACCELERATE MARKET GROWTH

- 8.3 MONITORING & SURVEILLANCE

- 8.3.1 ELEVATING ADOPTION OF IOT AND REAL-TIME ANALYTICS FOR FISH HEALTH MANAGEMENT TO FACILITATE SEGMENTAL GROWTH

- 8.4 YIELD ANALYSIS & MEASUREMENT

- 8.4.1 INTEGRATION OF SENSOR-BASED MONITORING TO ENHANCE FARM PRODUCTIVITY TO PROPEL SEGMENTAL GROWTH

- 8.5 OTHER APPLICATIONS

9 PRECISION AQUACULTURE MARKET, BY FARM TYPE

- 9.1 INTRODUCTION

- 9.2 OPEN AQUACULTURE FARMS

- 9.2.1 POND-BASED

- 9.2.1.1 Stringent biosecurity norms to support segmental growth

- 9.2.2 CAGE-BASED

- 9.2.2.1 Scalability and cost-efficiency features to foster segmental growth

- 9.2.1 POND-BASED

- 9.3 RAS FARMS

- 9.3.1 HIGH OPERATIONAL EFFICIENCY AND LOW WATER USAGE TO BOOST SEGMENTAL GROWTH

10 PRECISION AQUACULTURE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rising demand for high-quality, locally sourced seafood to drive market

- 10.2.3 CANADA

- 10.2.3.1 Concentration of majority of aquaculture farms in east and west coasts of country to contribute to market growth

- 10.2.4 MEXICO

- 10.2.4.1 Gradual tech-driven shift toward shrimp and tilapia farming to support market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 NORWAY

- 10.3.2.1 Escalating demand for Norwegian salmon to foster market growth

- 10.3.3 SPAIN

- 10.3.3.1 Early integration of precision technologies in shellfish and mussel farming to support market growth

- 10.3.4 UK

- 10.3.4.1 Increasing focus on sustainable high-yield aquaculture operations to create growth opportunities

- 10.3.5 FRANCE

- 10.3.5.1 High fishing fleet density to boost demand

- 10.3.6 ITALY

- 10.3.6.1 Increasing funding to improve aquaculture infrastructure to stimulate market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Leading aquatic production to accelerate market expansion

- 10.4.3 SOUTHEAST ASIA

- 10.4.3.1 Rising investment in aquatic startups to create lucrative growth opportunities

- 10.4.4 JAPAN

- 10.4.4.1 Greater emphasis on next-generation shrimp farming to push demand

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Government investments in smart and sustainable aquaculture to spike demand

- 10.4.6 INDIA

- 10.4.6.1 Government focus on boosting aquaculture infrastructure to spur demand

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Brazil

- 10.5.2.1.1 Growing trend of data-driven decision-making in aquaculture industry to boost demand

- 10.5.2.2 Chile

- 10.5.2.2.1 Government-backed initiatives promoting sustainability and environmental stewardship to drive market

- 10.5.2.3 Ecuador

- 10.5.2.3.1 Rising demand for traceable, sustainably farmed shrimp from US, Europe, and Asia to fuel market growth

- 10.5.2.4 Rest of South America

- 10.5.2.1 Brazil

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Substantial increase in seafood consumption to drive market

- 10.5.4 AFRICA

- 10.5.4.1 Elevating use of IoT-based farm monitoring and management solutions to support market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Offering footprint

- 11.5.5.4 System type footprint

- 11.5.5.5 Application footprint

- 11.5.5.6 Farm type footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES

- 11.7.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 AKVA GROUP

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches

- 12.2.1.3.2 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths/Right to win

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses/Competitive threats

- 12.2.2 SCALEAQ

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches

- 12.2.2.3.2 Deals

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths/Right to win

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses/Competitive threats

- 12.2.3 SKRETTING (ERUVAKA TECHNOLOGIES)

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product launches

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths/Right to win

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses/Competitive threats

- 12.2.4 INNOVASEA SYSTEMS INC.

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Product launches

- 12.2.4.3.2 Deals

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths/Right to win

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses/Competitive threats

- 12.2.5 AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 MnM view

- 12.2.5.3.1 Key strengths/Right to win

- 12.2.5.3.2 Strategic choices

- 12.2.5.3.3 Weaknesses/Competitive threats

- 12.2.6 AQUABYTE

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.7 SIGNIFY HOLDING

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.8 REELDATA

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Deals

- 12.2.9 DEEP TREKKER INC.

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Solutions/Services offered

- 12.2.10 AQUACARE ENVIRONMENT, INC.

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Solutions/Services offered

- 12.2.1 AKVA GROUP

- 12.3 OTHER PLAYERS

- 12.3.1 IMENCO AQUA AS

- 12.3.2 OPTIMAR AS

- 12.3.3 IN-SITU INC.

- 12.3.4 OXYGUARD

- 12.3.5 PT JALA AKUAKULTUR LESTARI ALAMKU

- 12.3.6 AQUACONNECT

- 12.3.7 SENSOREX

- 12.3.8 PLANET LIGHTING

- 12.3.9 MOLEAER INC.

- 12.3.10 XPERTSEA

- 12.3.11 FISHFARMFEEDER

- 12.3.12 CAGEEYE

- 12.3.13 AQUAMANAGER

- 12.3.14 HUNAN RIKA ELECTRONIC TECH CO., LTD

- 12.3.15 CHETU INC.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS