|

|

市場調査レポート

商品コード

1800738

ポリアミドの世界市場:タイプ別、用途別、地域別 - 予測(~2030年)Polyamide Market by Type (Polyamide 6, Polyamide 66, Bio-Based & Specialty Polyamide), Application (Engineering Plastics (Automotive, Electrical & Electronics, Wire & Cable) and Fiber (Textile, Industrial, Carpet)), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ポリアミドの世界市場:タイプ別、用途別、地域別 - 予測(~2030年) |

|

出版日: 2025年08月20日

発行: MarketsandMarkets

ページ情報: 英文 255 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のポリアミドの市場規模は、2025年の429億7,000万米ドルから2030年までに536億2,000万米ドルに達すると予測され、予測期間にCAGRで4.5%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル、キロトン |

| セグメント | タイプ、用途、プロセス、地域 |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

急速な都市化と人口増加によって成長する世界の自動車産業が、ポリアミド需要を大きく促進しています。自動車メーカーは燃費を向上させるために、軽量で耐久性があり、耐熱性のある材料を求めています。この乗用車と商用車の両方における採用の増加が、世界中でポリアミド消費をさらに加速させると予測されます。

「タイプ別では、ポリアミド66セグメントが予測期間に第2位の市場シェアを占める見込みです。」

ポリアミド66セグメントは、主に他のポリアミドに比べて優れた機械的強度、耐熱性、摩耗特性により、予測期間に金額ベースで2番目に大きな市場シェアを占める見込みです。高い結晶化度と剛性により、特に耐久性と耐熱性が重要な自動車産業や電気・電子産業などの用途に最適です。エンジン部品、コネクター、ボンネット内部品など、軽量で高性能な材料への需要の高まりが、ポリアミド66の採用を後押しし続けています。

「用途別では、繊維セグメントが予測期間に第2位のシェアを占めます。」

テキスタイル、カーペット、その他の部門での広範な使用により、繊維セグメントが予測期間にポリアミド市場で金額・数量ともに第2位のシェアを占める見込みです。ポリアミド繊維、特にナイロンは、その卓越した強度、伸縮性、耐摩耗性、軽量性で評価されており、アパレル、スポーツウェア、家具に最適です。さらに、タイヤコード、ロープ、漁網などの工業用途も需要に大きく寄与しています。耐久性と性能重視のファブリックに対する消費者の選好の高まりは、世界のポリアミド市場における繊維の優位性を引き続き強化しています。

「欧州が予測期間に第2位のシェアを占めます。」

欧州は、堅調な産業基盤と自動車、電気・電子、テキスタイルなどの部門からの旺盛な需要に支えられ、予測期間に金額ベースでポリアミド市場の第2位のシェアを占める見込みです。ドイツ、フランス、英国、イタリアなどの国々では、特に軽量化や熱管理用途で、特殊ポリアミドやバイオベースポリアミドへの関心が高まっています。射出成形、押出成形、繊維押出などの加工技術の進歩により、ポリアミドの使用範囲はさらに拡大しています。欧州の産業界が引き続き効率性、耐久性、環境コンプライアンスを優先付けていることから、ポリアミド市場はさまざまな最終用途部門でその勢いを維持すると予測されます。

当レポートでは、世界のポリアミド市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- ポリアミド市場の企業にとって魅力的な機会

- ポリアミド市場:地域別

- ポリアミド市場:タイプ別

- ポリアミド市場:用途別

- ポリアミド市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- 世界のマクロ経済の見通し

- サプライチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 価格設定の分析

- 平均販売価格の動向:地域別(2022年~2024年)

- 主要企業の平均販売価格の動向:タイプ別(2024年)

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 主な会議とイベント(2025年~2026年)

- 特許分析

- 技術分析

- 主要技術

- 隣接技術

- ケーススタディ分析

- CELANESE CORPORATION、高性能フットウェア向け次世代フィットシステムでBOAを支援

- TE CONNECTIVITY、過酷な環境に耐える堅牢な自動車用コネクターとしてCELANESE ZYTEL PA PLUSを採用

- 3Dプリンティングとバイオサーキュラーポリアミド11による、整形外科インソールの革新

- 貿易分析

- 輸入シナリオ(HSコード3908)

- 輸出シナリオ(HSコード3908)

- カスタマービジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ポリアミド市場における生成AIの影響

- AIを活用した染色の最適化

- 予測精度と効率性の向上

- 環境にやさしいバイオベース処理の支援

- 結論:ポリアミド用途におけるAIの戦略的役割

- ポリアミド市場に対するトランプ関税の影響

- 市場に影響を与える主な関税率

- 価格の影響の分析

- さまざまな地域への重要な影響

- ポリアミドの最終用途産業に対する影響

第7章 ポリアミド市場:タイプ別

- イントロダクション

- ポリアミド6

- ポリアミド66

- バイオベース・特殊ポリアミド

第8章 ポリアミド市場:プロセス別

- イントロダクション

- 押出成形

- 射出成形

- 繊維押出

第9章 ポリアミド市場:用途別

- イントロダクション

- エンジニアリングプラスチック

- 繊維

第10章 ポリアミド市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 韓国

- 日本

- インド

- 台湾

- インドネシア

- その他のアジア太平洋

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- ロシア

- その他の欧州

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- GCC諸国

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- ランキング分析

- 市場シェア分析

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

- 企業の評価と財務指標

第12章 企業プロファイル

- 主要企業

- INVISTA

- BASF

- ASCEND PERFORMANCE MATERIALS

- ENVALIOR

- LEALEA ENTERPRISE CO., LTD.

- EVONIK INDUSTRIES AG

- ARKEMA

- CELANESE CORPORATION

- DOMO CHEMICALS

- EMS-CHEMIE HOLDING AG

- ASAHI KASEI CORPORATION

- SABIC

- KURARAY CO., LTD.

- TORAY INDUSTRIES, INC.

- UBE CORPORATION

- FCFC

- ADVANSIX

- HUNTSMAN INTERNATIONAL LLC

- MITSUBISHI CHEMICAL GROUP

- RADICI PARTECIPAZIONI SPA

- その他の企業

- TOYOBO MC CORPORATION

- GRODNO AZOT

- RTP COMPANY

- XIAMEN KEYUAN PLASTIC CO., LTD.

第13章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 相互接続された市場

- エンジニアリングプラスチック市場

- 市場の定義

- 市場の概要

- エンジニアリングプラスチック市場:最終用途産業別

- 自動車・輸送

- 内装

- 外装

- パワートレイン

- ボンネット内用途

- 家電

- エアコン

- モバイル・コンピューター

- テレビ・音楽プレーヤー

- 電気・電子

- 半導体

- ソケット・スイッチ

- 工業・機械

- 動力工具

- 包装

- 食品

- 医療

- その他

- 医療

- 建設

第14章 付録

List of Tables

- TABLE 1 POLYAMIDE MARKET SNAPSHOT: 2025 VS. 2030

- TABLE 2 POLYAMIDE MARKET: KEY APPLICATIONS OF POLYAMIDES IN EVS

- TABLE 3 POLYAMIDE MARKET: POPULAR POLYAMIDE GRADES USED IN EVS

- TABLE 4 POLYAMIDE MARKET: KEY APPLICATIONS OF POLYAMIDE IN ELECTRICAL & ELECTRONIC APPLIANCES

- TABLE 5 POLYAMIDE MARKET: PREFERRED POLYAMIDE GRADES IN ELECTRICAL & ELECTRONIC APPLIANCES

- TABLE 6 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2022-2024 (%)

- TABLE 7 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 8 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 9 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 AND 2023 (USD BILLION)

- TABLE 10 ROLES OF COMPANIES IN POLYAMIDE ECOSYSTEM

- TABLE 11 POLYAMIDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATIONS (%)

- TABLE 13 KEY BUYING CRITERIA, BY APPLICATIONS

- TABLE 14 AVERAGE SELLING PRICE TREND OF POLYAMIDE, BY REGION, 2022-2024 (USD/KG)

- TABLE 15 INDICATIVE PRICING ANALYSIS OF POLYAMIDES OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD/KG)

- TABLE 16 TARIFF ANALYSIS RELATED TO HS CODE 3908-COMPLIANT PRODUCTS, 2024

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 POLYAMIDE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 21 POLYAMIDE MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 22 IMPORT DATA FOR HS CODE 3908-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 23 EXPORT DATA FOR HS CODE 3908-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 24 POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 25 POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 26 POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 27 POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 28 POLYAMIDE 6: POLYAMIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 POLYAMIDE 6: POLYAMIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 POLYAMIDE 6: POLYAMIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 31 POLYAMIDE 6: POLYAMIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 32 POLYAMIDE 66: POLYAMIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 POLYAMIDE 66: POLYAMIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 POLYAMIDE 66: POLYAMIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 35 POLYAMIDE 66: POLYAMIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 36 BIO-BASED & SPECIALTY POLYAMIDE: POLYAMIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 BIO-BASED & SPECIALTY POLYAMIDE: POLYAMIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 BIO-BASED & SPECIALTY POLYAMIDE: POLYAMIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 39 BIO-BASED & SPECIALTY POLYAMIDE: POLYAMIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 40 POLYAMIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 41 POLYAMIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 42 POLYAMIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 43 POLYAMIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 44 ENGINEERING PLASTICS: POLYAMIDE MARKET, BY SUB-APPLICATION, 2021-2024 (KILOTON)

- TABLE 45 ENGINEERING PLASTICS: POLYAMIDE MARKET, BY SUB-APPLICATION, 2025-2030 (KILOTON)

- TABLE 46 FIBER: POLYAMIDE MARKET, BY SUB-APPLICATION, 2021-2024 (KILOTON)

- TABLE 47 FIBER: POLYAMIDE MARKET, BY SUB-APPLICATION, 2025-2030 (KILOTON)

- TABLE 48 ENGINEERING PLASTICS: POLYAMIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 ENGINEERING PLASTICS: POLYAMIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 ENGINEERING PLASTICS: POLYAMIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 51 ENGINEERING PLASTICS: POLYAMIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 52 FIBER: POLYAMIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 FIBER: POLYAMIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 FIBER: POLYAMIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 55 FIBER: POLYAMIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 56 POLYAMIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 POLYAMIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 POLYAMIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 59 POLYAMIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 60 ASIA PACIFIC: POLYAMIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 61 ASIA PACIFIC: POLYAMIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 62 ASIA PACIFIC: POLYAMIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 63 ASIA PACIFIC: POLYAMIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 64 ASIA PACIFIC: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 65 ASIA PACIFIC: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 66 ASIA PACIFIC: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 67 ASIA PACIFIC: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 68 ASIA PACIFIC: POLYAMIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 69 ASIA PACIFIC: POLYAMIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: POLYAMIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 71 ASIA PACIFIC: POLYAMIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 72 CHINA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 73 CHINA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 74 CHINA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 75 CHINA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 76 SOUTH KOREA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 77 SOUTH KOREA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 78 SOUTH KOREA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 79 SOUTH KOREA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 80 JAPAN: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 81 JAPAN: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 82 JAPAN: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 83 JAPAN: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 84 INDIA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 85 INDIA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 86 INDIA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 87 INDIA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 88 TAIWAN: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 89 TAIWAN: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 90 TAIWAN: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 91 TAIWAN: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 92 INDONESIA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 93 INDONESIA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 94 INDONESIA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 95 INDONESIA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 96 REST OF ASIA PACIFIC: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 99 REST OF ASIA PACIFIC: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 100 EUROPE: POLYAMIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 101 EUROPE: POLYAMIDE MARKET, BY COUNTRY, 2025-2030 (USD MLLION)

- TABLE 102 EUROPE: POLYAMIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 103 EUROPE: POLYAMIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 104 EUROPE: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 105 EUROPE: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 106 EUROPE: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 107 EUROPE: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 108 EUROPE: POLYAMIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 109 EUROPE: POLYAMIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: POLYAMIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 111 EUROPE: POLYAMIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 112 GERMANY: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 113 GERMANY: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 114 GERMANY: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 115 GERMANY: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 116 FRANCE: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 117 FRANCE: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 118 FRANCE: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 119 FRANCE: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 120 UK: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 121 UK: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 122 UK: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 123 UK: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 124 ITALY: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 125 ITALY: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 126 ITALY: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 127 ITALY: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 128 RUSSIA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 129 RUSSIA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 130 RUSSIA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 131 RUSSIA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 132 REST OF EUROPE: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 133 REST OF EUROPE: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 134 REST OF EUROPE: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 135 REST OF EUROPE: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 136 NORTH AMERICA: POLYAMIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: POLYAMIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 138 NORTH AMERICA: POLYAMIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 139 NORTH AMERICA: POLYAMIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 140 NORTH AMERICA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 141 NORTH AMERICA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 142 NORTH AMERICA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 143 NORTH AMERICA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 144 NORTH AMERICA: POLYAMIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 145 NORTH AMERICA: POLYAMIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 NORTH AMERICA: POLYAMIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 147 NORTH AMERICA: POLYAMIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 148 US: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 149 US: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 150 US: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 151 US: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 152 CANADA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 153 CANADA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 154 CANADA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 155 CANADA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 156 MEXICO: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 157 MEXICO: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 158 MEXICO: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 159 MEXICO: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: POLYAMIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: POLYAMIDE MARKET, BY COUNTRY, 2025-2030 (USD MLLION)

- TABLE 162 MIDDLE EAST & AFRICA: POLYAMIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 163 MIDDLE EAST & AFRICA: POLYAMIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 164 MIDDLE EAST & AFRICA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 167 MIDDLE EAST & AFRICA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 168 MIDDLE EAST & AFRICA: POLYAMIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: POLYAMIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: POLYAMIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 171 MIDDLE EAST & AFRICA: POLYAMIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 172 SAUDI ARABIA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 173 SAUDI ARABIA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 174 SAUDI ARABIA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 175 SAUDI ARABIA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 176 UAE: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 177 UAE: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 178 UAE: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 179 UAE: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 180 SOUTH AMERICA: POLYAMIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 181 SOUTH AMERICA: POLYAMIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 182 SOUTH AMERICA: POLYAMIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 183 SOUTH AMERICA: POLYAMIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 184 SOUTH AMERICA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 185 SOUTH AMERICA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 186 SOUTH AMERICA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 187 SOUTH AMERICA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 188 SOUTH AMERICA: POLYAMIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 189 SOUTH AMERICA: POLYAMIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 190 SOUTH AMERICA: POLYAMIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 191 SOUTH AMERICA: POLYAMIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 192 BRAZIL: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 193 BRAZIL: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 194 BRAZIL: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 195 BRAZIL: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 196 ARGENTINA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 197 ARGENTINA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 198 ARGENTINA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 199 ARGENTINA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 200 REST OF SOUTH AMERICA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 201 REST OF SOUTH AMERICA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 202 REST OF SOUTH AMERICA: POLYAMIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 203 REST OF SOUTH AMERICA: POLYAMIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 204 POLYAMIDE MARKET: OVERVIEW OF KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, 2020-2025

- TABLE 205 POLYAMIDE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 206 POLYAMIDE MARKET: REGION FOOTPRINT (20 COMPANIES)

- TABLE 207 POLYAMIDE MARKET: APPLICATION FOOTPRINT (20 COMPANIES)

- TABLE 208 POLYAMIDE MARKET: TYPE FOOTPRINT (20 COMPANIES)

- TABLE 209 POLYAMIDE MARKET: PROCESS FOOTPRINT (20 COMPANIES)

- TABLE 210 POLYAMIDE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 211 POLYAMIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 212 POLYAMIDE MARKET: PRODUCT LAUNCHES, JULY 2021-JULY 2025

- TABLE 213 POLYAMIDE MARKET: DEALS, JULY 2021-JULY 2025

- TABLE 214 POLYAMIDE MARKET: EXPANSIONS, JULY 2021-JULY 2025

- TABLE 215 INVISTA: COMPANY OVERVIEW

- TABLE 216 INVISTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 INVISTA: DEALS

- TABLE 218 INVISTA: EXPANSIONS

- TABLE 219 BASF: COMPANY OVERVIEW

- TABLE 220 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 BASF: PRODUCT LAUNCHES

- TABLE 222 BASF: DEALS

- TABLE 223 BASF: EXPANSIONS

- TABLE 224 ASCEND PERFORMANCE MATERIALS: COMPANY OVERVIEW

- TABLE 225 ASCEND PERFORMANCE MATERIALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 ASCEND PERFORMANCE MATERIALS: PRODUCT LAUNCHES

- TABLE 227 ASCEND PERFORMANCE MATERIALS: DEALS

- TABLE 228 ENVALIOR: COMPANY OVERVIEW

- TABLE 229 ENVALIOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 ENVALIOR: PRODUCT LAUNCHES

- TABLE 231 ENVALIOR: DEALS

- TABLE 232 LEALEA ENTERPRISE CO., LTD.: COMPANY OVERVIEW

- TABLE 233 LEALEA ENTERPRISE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 235 EVONIK INDUSTRIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 EVONIK INDUSTRIES AG: PRODUCT LAUNCHES

- TABLE 237 EVONIK INDUSTRIES AG: EXPANSIONS

- TABLE 238 ARKEMA: COMPANY OVERVIEW

- TABLE 239 ARKEMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 ARKEMA: PRODUCT LAUNCHES

- TABLE 241 ARKEMA: DEALS

- TABLE 242 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 243 CELANESE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 CELANESE CORPORATION: DEALS

- TABLE 245 DOMO CHEMICALS: COMPANY OVERVIEW

- TABLE 246 DOMO CHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 DOMO CHEMICALS: PRODUCT LAUNCHES

- TABLE 248 DOMO CHEMICALS: DEALS

- TABLE 249 DOMO CHEMICALS: EXPANSIONS

- TABLE 250 EMS-CHEMIE HOLDING AG: COMPANY OVERVIEW

- TABLE 251 EMS-CHEMIE HOLDING AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 253 ASAHI KASEI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 ASAHI KASEI CORPORATION: DEALS

- TABLE 255 SABIC: COMPANY OVERVIEW

- TABLE 256 SABIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 KURARAY CO., LTD.: COMPANY OVERVIEW

- TABLE 258 KURARAY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 KURARAY CO., LTD.: PRODUCT LAUNCHES

- TABLE 260 KURARAY CO., LTD.: EXPANSIONS

- TABLE 261 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 262 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 264 TORAY INDUSTRIES, INC.: DEALS

- TABLE 265 UBE CORPORATION: COMPANY OVERVIEW

- TABLE 266 UBE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 UBE CORPORATION: EXPANSIONS

- TABLE 268 FCFC: COMPANY OVERVIEW

- TABLE 269 FCFC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 ADVANSIX: COMPANY OVERVIEW

- TABLE 271 ADVANSIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

- TABLE 273 HUNTSMAN INTERNATIONAL LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 MITSUBISHI CHEMICAL GROUP: COMPANY OVERVIEW

- TABLE 275 MITSUBISHI CHEMICAL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 RADICI PARTECIPAZIONI SPA: COMPANY OVERVIEW

- TABLE 277 RADICI PARTECIPAZIONI SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 RADICI PARTECIPAZIONI SPA: DEALS

- TABLE 279 RADICI PARTECIPAZIONI SPA: EXPANSIONS

- TABLE 280 TOYOBO MC CORPORATION: COMPANY OVERVIEW

- TABLE 281 GRODNO AZOT: COMPANY OVERVIEW

- TABLE 282 RTP COMPANY: COMPANY OVERVIEW

- TABLE 283 XIAMEN KEYUAN PLASTIC CO., LTD.: COMPANY OVERVIEW

- TABLE 284 ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 285 ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 286 ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 287 ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- TABLE 288 AUTOMOTIVE & TRANSPORTATION: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 289 AUTOMOTIVE & TRANSPORTATION: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 290 AUTOMOTIVE & TRANSPORTATION: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 291 AUTOMOTIVE & TRANSPORTATION: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- TABLE 292 CONSUMER APPLIANCES: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 293 CONSUMER APPLIANCES: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 294 CONSUMER APPLIANCES: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 295 CONSUMER APPLIANCES: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- TABLE 296 ELECTRICAL & ELECTRONICS: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 297 ELECTRICAL & ELECTRONICS: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 298 ELECTRICAL & ELECTRONICS: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 299 ELECTRICAL & ELECTRONICS: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- TABLE 300 INDUSTRIAL & MACHINERY: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 301 INDUSTRIAL & MACHINERY: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 302 INDUSTRIAL & MACHINERY: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 303 INDUSTRIAL & MACHINERY: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- TABLE 304 PACKAGING: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 305 PACKAGING: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 306 PACKAGING: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 307 PACKAGING: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- TABLE 308 OTHERS: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 309 OTHERS: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 310 OTHERS: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 311 OTHERS: ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

List of Figures

- FIGURE 1 POLYAMIDE MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 POLYAMIDE MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMANDFOR POLYAMIDES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY USED FOR SUPPLY-SIDE SIZING OF POLYAMIDES

- FIGURE 7 POLYAMIDE MARKET: DATA TRIANGULATION

- FIGURE 8 POLYAMIDE 6 SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 9 FIBER SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 GROWING USE OF POLYAMIDES IN THE AUTOMOTIVE SECTOR TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 12 MIDDLE EAST & AFRICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 BIO-BASED & SPECIALTY POLYAMIDE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 ENGINEERING PLASTICS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 15 JAPAN TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 POLYAMIDE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 GLOBAL EV SALES, 2014-2024 (MILLION UNITS)

- FIGURE 18 CRUDE OIL FIRST PURCHASE PRICES, 2011-2024 (USD/BARREL)

- FIGURE 19 POLYAMIDE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 POLYAMIDE MARKET: ECOSYSTEM MAPPING

- FIGURE 21 POLYAMIDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 23 KEY BUYING CRITERIA, BY APPLICATIONS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF POLYAMIDE, BY REGION, 2022-2024 (USD/KG)

- FIGURE 25 LIST OF MAJOR PATENTS RELATED TO POLYAMIDES, 2014-2024

- FIGURE 26 IMPORT DATA RELATED TO HS CODE 3908-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 27 EXPORT DATA RELATED TO HS CODE 3908-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 29 POLYAMIDE MARKET: INVESTMENT AND FUNDING SCENARIO, 2019-2025 (USD MILLION)

- FIGURE 30 POLYAMIDE 6 SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 31 FIBER SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 32 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF POLYAMIDE MARKET IN 2025

- FIGURE 33 ASIA PACIFIC: POLYAMIDE MARKET SNAPSHOT

- FIGURE 34 EUROPE: POLYAMIDE MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICA: POLYAMIDE MARKET SNAPSHOT

- FIGURE 36 POLYAMIDE MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD BILLION)

- FIGURE 37 POLYAMIDE MARKET: RANKING OF KEY PLAYERS, 2024

- FIGURE 38 POLYAMIDE MARKET SHARE ANALYSIS, 2024

- FIGURE 39 POLYAMIDE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 40 POLYAMIDE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 POLYAMIDE MARKET: COMPANY FOOTPRINT (20 COMPANIES)

- FIGURE 42 POLYAMIDE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 43 POLYAMIDE MARKET: COMPANY VALUATION OF KEY COMPANIES

- FIGURE 44 POLYAMIDE MARKET: FINANCIAL METRICS OF KEY COMPANIES (USD BILLION)

- FIGURE 45 POLYAMIDE MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 46 BASF: COMPANY SNAPSHOT

- FIGURE 47 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 48 ARKEMA: COMPANY SNAPSHOT

- FIGURE 49 CELANESE CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 EMS-CHEMIE HOLDING AG: COMPANY SNAPSHOT

- FIGURE 51 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 SABIC: COMPANY SNAPSHOT

- FIGURE 53 KURARAY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 54 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 55 UBE CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 FCFC: COMPANY SNAPSHOT

- FIGURE 57 ADVANSIX: COMPANY SNAPSHOT

- FIGURE 58 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

- FIGURE 59 MITSUBISHI CHEMICAL GROUP: COMPANY SNAPSHOT

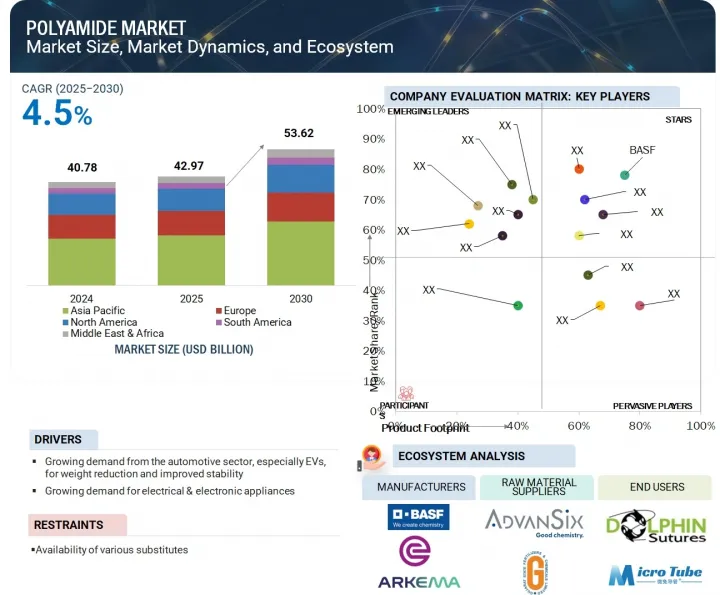

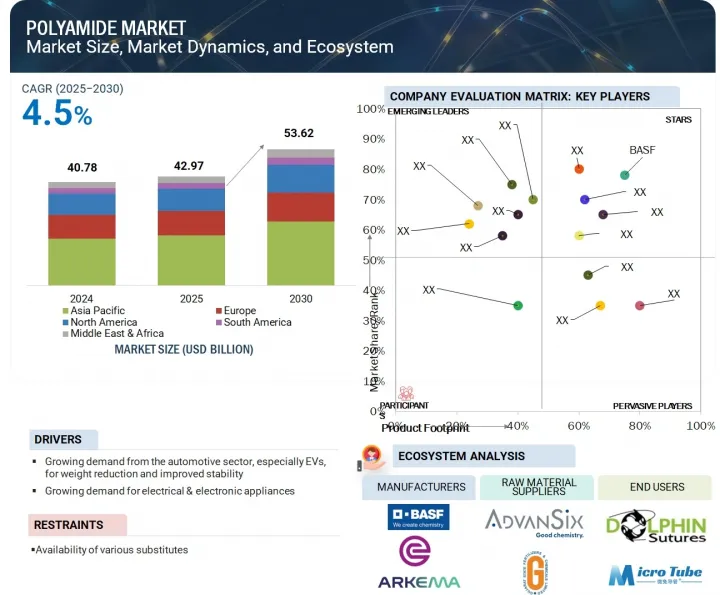

The global polyamide market is projected to grow from USD 42.97 billion in 2025 to USD 53.62 billion by 2030, at a CAGR of 4.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | By Type, Application, Process, and Region |

| Regions covered | North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

The growing global automotive industry, fueled by rapid urbanization and increasing population, is significantly driving the demand for polyamides. As automotive manufacturers seek lightweight, durable, and heat-resistant materials to improve fuel efficiency. This rising adoption across both passenger and commercial vehicles is expected to further accelerate polyamide consumption worldwide.

"By type, the polyamide 66 segment is expected to account for the second-largest market share during the forecast period."

The polyamide 66 segment is expected to account for the second-largest share of the market in terms of value during the forecast period, primarily due to its superior mechanical strength, thermal resistance, and wear properties compared to other polyamides. Its high crystallinity and rigidity make it ideal for applications, especially in the automotive and electrical & electronics industries, where durability and heat resistance are critical. The growing demand for lightweight, high-performance materials in engine components, connectors, and under-the-hood parts continues to drive the adoption of polyamide 66.

"By application, the fiber segment will account for the second-largest share during the forecast period."

The fiber segment is expected to account for the second-largest share of the polyamide market in terms of value and volume during the forecast period, driven by its extensive use in the textile, carpet, and other sectors. Polyamide fibers, especially nylon, are valued for their exceptional strength, elasticity, abrasion resistance, and lightweight nature, making them ideal for apparel, sportswear, and home furnishings. Additionally, industrial applications such as tire cords, ropes, and fishing nets also contribute significantly to demand. The increasing consumer preference for durable and performance-oriented fabrics continues to bolster the dominance of fiber in the global polyamide market.

"Europe will account for the second-largest share during the forecast period."

Europe is expected to account for the second-largest share of the polyamide market in terms of value during the forecast period, supported by its robust industrial base and strong demand from sectors such as automotive, electrical & electronics, and textiles. Countries such as Germany, France, the UK, Italy, and others are seeing rising interest in specialty and bio-based polyamides, particularly in lightweighting and thermal management applications. Advancements in processing techniques such as injection molding, extrusion molding, and fiber extrusion are further expanding the scope of polyamide use. As industries in Europe continue to prioritize efficiency, durability, and environmental compliance, the polyamide market is expected to maintain its momentum across various end-use sectors.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors Level- 25%, Managers Level- 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, Middle East & Africa - 7%, and South America - 3%

BASF (Germany), Envalior (Germany), Ascend Performance Materials (US), INVISTA (US), and LEALEA ENTERPRISE CO., LTD. (Taiwan) are some of the major players operating in the polyamide market. These players have adopted expansions, acquisitions, agreements, partnerships, and product launches to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the polyamide market based on type, application, and region. It provides detailed information about the key factors influencing market growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles polyamide manufacturers, thoroughly analyzing their market shares and core competencies, and monitors and assesses competitive developments, such as product launches, acquisitions, agreements, and others.

Reasons to Buy the Report:

The report aims to assist market leaders and new entrants by providing close estimates of revenue figures in the polyamide market and its segments. It also helps stakeholders gain a deeper understanding of the market's competitive landscape, obtain insights to enhance their business positions, and develop effective go-to-market strategies. Additionally, it enables stakeholders to understand the market's pulse and offers information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of drivers (growing demand from the automotive sector, especially EVs, for weight reduction and improved stability, growing demand for electrical & electronic appliances), opportunities (investment and R&D in bio-based polyamides), restraints (availability of various substitutes), and challenges (fluctuating raw material prices, environmental risks associated with the use of plastics) influencing the growth of the polyamide market.

- Product development/innovation: Detailed insights on upcoming technologies and research & development activities in the polyamide market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the polyamide market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the polyamide market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as BASF (Germany), Envalior (Germany), Ascend Performance Materials (US), INVISTA (US), and LEALEA ENTERPRISE CO., LTD. (Taiwan) in the polyamide market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants (demand and supply sides)

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 SUPPLY-SIDE ANALYSIS

- 2.4.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RESEARCH LIMITATIONS

- 2.10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POLYAMIDE MARKET

- 4.2 POLYAMIDE MARKET, BY REGION

- 4.3 POLYAMIDE MARKET, BY TYPE

- 4.4 POLYAMIDE MARKET, BY APPLICATION

- 4.5 POLYAMIDE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand in automotive sector for weight reduction and improved stability

- 5.2.1.2 Growing demand for electrical & electronic appliances

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of various substitutes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Investments and R&D in bio-based polyamides

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuating raw material prices

- 5.2.4.2 Environmental risks associated with use of plastics

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.1.1 GDP

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PORTER'S FIVE FORCES ANALYSIS

- 6.4.1 BARGAINING POWER OF SUPPLIERS

- 6.4.2 BARGAINING POWER OF BUYERS

- 6.4.3 THREAT OF NEW ENTRANTS

- 6.4.4 THREAT OF SUBSTITUTES

- 6.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 6.6.2 AVERAGE SELLING PRICE TREND FOR KEY PLAYERS, BY TYPE, 2024

- 6.7 TARIFF AND REGULATORY LANDSCAPE

- 6.7.1 TARIFF ANALYSIS

- 6.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.1.1 Bio-based polyamide

- 6.10.2 ADJACENT TECHNOLOGIES

- 6.10.2.1 Engineering plastics

- 6.10.1 KEY TECHNOLOGIES

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 CELANESE CORPORATION HELPS BOA IN NEXT-GENERATION FIT SYSTEMS FOR HIGH-PERFORMANCE FOOTWEAR

- 6.11.2 TE CONNECTIVITY CHOOSES CELANESE ZYTEL PA PLUS FOR ROBUST AUTOMOTIVE CONNECTORS IN HARSH ENVIRONMENTS

- 6.11.3 REVOLUTIONIZING ORTHOPEDIC INSOLES WITH 3D PRINTING AND BIO-CIRCULAR POLYAMIDE 11

- 6.12 TRADE ANALYSIS

- 6.12.1 IMPORT SCENARIO (HS CODE 3908)

- 6.12.2 EXPORT SCENARIO (HS CODE 3908)

- 6.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 6.15 IMPACT OF GENERATIVE AI ON POLYAMIDE MARKET

- 6.15.1 INTRODUCTION

- 6.16 AI-ENABLED DYEING OPTIMIZATION

- 6.17 IMPROVED PREDICTIVE ACCURACY AND EFFICIENCY

- 6.18 SUPPORTING ECO-FRIENDLY AND BIO-BASED PROCESSING

- 6.19 CONCLUSION: AI'S STRATEGIC ROLE IN POLYAMIDE APPLICATIONS

- 6.20 TRUMP TARIFF IMPACT ON POLYAMIDE MARKET

- 6.20.1 KEY TARIFF RATES IMPACTING MARKET

- 6.20.2 PRICE IMPACT ANALYSIS

- 6.20.3 KEY IMPACT ON VARIOUS REGIONS

- 6.20.3.1 US

- 6.20.3.2 Europe

- 6.20.3.3 Asia Pacific

- 6.20.4 IMPACT ON END-USE INDUSTRIES OF POLYAMIDES

- 6.20.4.1 Automotive

- 6.20.4.2 Industrial/machinery

- 6.20.4.3 Electrical & electronics

- 6.20.4.4 Consumer goods/Appliances

- 6.20.4.5 Packaging/Film

- 6.20.4.6 Wire & cable

- 6.20.4.7 Textile

- 6.20.4.8 Carpet

- 6.20.4.9 Staple fiber

7 POLYAMIDE MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 POLYAMIDE 6

- 7.2.1 HIGH TENSILE STRENGTH AND ABRASION RESISTANCE TO BOOST MARKET GROWTH

- 7.3 POLYAMIDE 66

- 7.3.1 HIGH STRENGTH, THERMAL RESISTANCE, AND DIMENSIONAL STABILITY TO DRIVE DEMAND

- 7.4 BIO-BASED & SPECIALTY POLYAMIDE

- 7.4.1 LOW ENVIRONMENTAL FOOTPRINT ASSOCIATED WITH PRODUCTION OF POLYAMIDES TO SUPPORT MARKET

- 7.4.2 POLYAMIDE 11

- 7.4.3 POLYAMIDE 12

- 7.4.4 POLYAMIDE 46

- 7.4.5 POLYAMIDE 6/10

- 7.4.6 POLYAMIDE 6/12

- 7.4.7 POLYPHTHALAMIDE (PPA)

- 7.4.8 OTHER SPECIALTY POLYAMIDES

8 POLYAMIDE MARKET, BY PROCESS

- 8.1 INTRODUCTION

- 8.2 EXTRUSION MOLDING

- 8.2.1 RISING DEMAND FOR LIGHTWEIGHT, HIGH-STRENGTH FILMS IN PACKAGING AND CONSTRUCTION INDUSTRIES TO DRIVE MARKET

- 8.3 INJECTION MOLDING

- 8.3.1 GROWING PRODUCTION OF AUTOMOTIVE AND CONSUMER ELECTRONICS TO DRIVE DEMAND

- 8.4 FIBER EXTRUSION

- 8.4.1 SURGING USE OF DURABLE AND ELASTIC FIBERS IN TEXTILES AND INDUSTRIAL SECTORS TO PROPEL MARKET

9 POLYAMIDE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 ENGINEERING PLASTICS

- 9.2.1 HIGH MECHANICAL STRENGTH, THERMAL STABILITY, AND CHEMICAL RESISTANCE TO DRIVE DEMAND

- 9.2.2 AUTOMOTIVE

- 9.2.3 INDUSTRIAL/MACHINERY

- 9.2.4 ELECTRICAL/ELECTRONICS

- 9.2.5 CONSUMER GOODS & APPLIANCES

- 9.2.6 PACKAGING/FILM

- 9.2.7 WIRE & CABLE

- 9.2.8 OTHERS

- 9.3 FIBER

- 9.3.1 GROWING DEMAND FOR DURABLE AND SUSTAINABLE SOLUTIONS TO PROPEL MARKET

- 9.3.2 TEXTILE

- 9.3.3 INDUSTRIAL

- 9.3.4 CARPET

- 9.3.5 STAPLE

10 POLYAMIDE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Rising EV production to boost market

- 10.2.2 SOUTH KOREA

- 10.2.2.1 Rising demand from automotive and textile industries to fuel market growth

- 10.2.3 JAPAN

- 10.2.3.1 Booming automotive and electronics industries to propel market

- 10.2.4 INDIA

- 10.2.4.1 Expanding automotive, electronics, and textile industries to boost market growth

- 10.2.5 TAIWAN

- 10.2.5.1 Advanced industrial infrastructure and growing electronics and semiconductor industries to drive market

- 10.2.6 INDONESIA

- 10.2.6.1 Government-led industrialization policies and rising electronics manufacturing to drive market

- 10.2.7 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 High demand from automotive and industrial machinery sectors to fuel market growth

- 10.3.2 FRANCE

- 10.3.2.1 Increased applications in automotive, electrical & electronics, and packaging/film industries to drive market

- 10.3.3 UK

- 10.3.3.1 Growing demand for polyamides in electrical & electronics to boost market

- 10.3.4 ITALY

- 10.3.4.1 Increasing focus on sustainability to drive market

- 10.3.5 RUSSIA

- 10.3.5.1 Expanding manufacturing and heavy engineering sectors to drive market

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Booming automotive and consumer appliances industries to drive demand

- 10.4.2 CANADA

- 10.4.2.1 Expanding automotive sector and consumer spending power to drive market

- 10.4.3 MEXICO

- 10.4.3.1 Booming industrialization and large-scale development projects to propel market

- 10.4.1 US

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Industrial diversification efforts under Vision 2030 to drive market

- 10.5.1.2 UAE

- 10.5.1.2.1 Increasing demand from various end-use industries to propel market

- 10.5.1.3 Rest of GCC Countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Growing demand for lightweight materials to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Booming textile and automotive industries to drive market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS

- 11.4 RANKING ANALYSIS

- 11.5 MARKET SHARE ANALYSIS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Application footprint

- 11.7.5.4 Type footprint

- 11.7.5.5 Process footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.10 COMPANY VALUATION AND FINANCIAL METRICS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 INVISTA

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 Expansions

- 12.1.1.5 MnM View

- 12.1.1.5.1 Key strengths/Right to win

- 12.1.1.5.2 Strategic choices

- 12.1.1.5.3 Weaknesses/Competitive threats

- 12.1.2 BASF

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM View

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 ASCEND PERFORMANCE MATERIALS

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM View

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 ENVALIOR

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM View

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 LEALEA ENTERPRISE CO., LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM View

- 12.1.5.3.1 Key strengths/Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses/Competitive threats

- 12.1.6 EVONIK INDUSTRIES AG

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Expansions

- 12.1.7 ARKEMA

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.8 CELANESE CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 DOMO CHEMICALS

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Deals

- 12.1.9.3.3 Expansions

- 12.1.10 EMS-CHEMIE HOLDING AG

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.11 ASAHI KASEI CORPORATION

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 SABIC

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.13 KURARAY CO., LTD.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches

- 12.1.13.3.2 Expansions

- 12.1.14 TORAY INDUSTRIES, INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches

- 12.1.14.3.2 Deals

- 12.1.15 UBE CORPORATION

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Expansions

- 12.1.16 FCFC

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions/Services offered

- 12.1.17 ADVANSIX

- 12.1.17.1 Business overview

- 12.1.17.2 Products/Solutions/Services offered

- 12.1.18 HUNTSMAN INTERNATIONAL LLC

- 12.1.18.1 Business overview

- 12.1.18.2 Products/Solutions/Services offered

- 12.1.19 MITSUBISHI CHEMICAL GROUP

- 12.1.19.1 Business overview

- 12.1.19.2 Products/Solutions/Services offered

- 12.1.20 RADICI PARTECIPAZIONI SPA

- 12.1.20.1 Business overview

- 12.1.20.2 Products/Solutions/Services offered

- 12.1.20.3 Recent developments

- 12.1.20.3.1 Deals

- 12.1.20.3.2 Expansions

- 12.1.1 INVISTA

- 12.2 OTHER PLAYERS

- 12.2.1 TOYOBO MC CORPORATION

- 12.2.2 GRODNO AZOT

- 12.2.3 RTP COMPANY

- 12.2.4 XIAMEN KEYUAN PLASTIC CO., LTD.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 INTERCONNECTED MARKETS

- 13.4 ENGINEERING PLASTICS MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- 13.4.3 ENGINEERING PLASTICS MARKET, BY END-USE INDUSTRY

- 13.5 AUTOMOTIVE & TRANSPORTATION

- 13.5.1 INTERIOR

- 13.5.2 EXTERIOR

- 13.5.3 POWER TRAIN

- 13.5.4 UNDER-THE-HOOD APPLICATIONS

- 13.6 CONSUMER APPLIANCES

- 13.6.1 AIR CONDITIONERS

- 13.6.2 MOBILES AND COMPUTERS

- 13.6.3 TELEVISION AND MUSIC PLAYERS

- 13.7 ELECTRICAL & ELECTRONICS

- 13.7.1 SEMICONDUCTORS

- 13.7.2 SOCKETS & SWITCHES

- 13.8 INDUSTRIAL & MACHINERY

- 13.8.1 POWER TOOLS

- 13.9 PACKAGING

- 13.9.1 FOOD

- 13.9.2 MEDICAL

- 13.10 OTHERS

- 13.10.1 MEDICAL

- 13.10.2 CONSTRUCTION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS