|

|

市場調査レポート

商品コード

1797402

アスファルト添加剤の世界市場:タイプ別、技術別、用途別、地域別 - 予測(~2030年)Asphalt Additive Market by Type, Technology, Application, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| アスファルト添加剤の世界市場:タイプ別、技術別、用途別、地域別 - 予測(~2030年) |

|

出版日: 2025年08月06日

発行: MarketsandMarkets

ページ情報: 英文 338 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

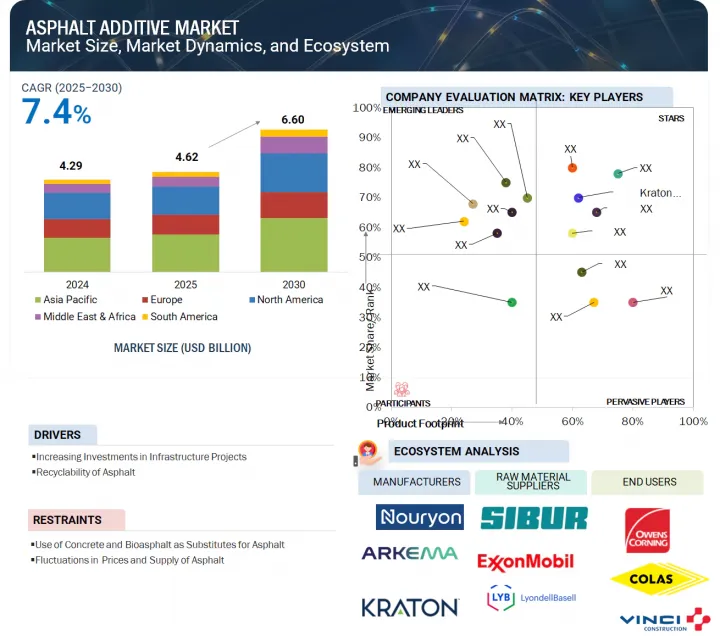

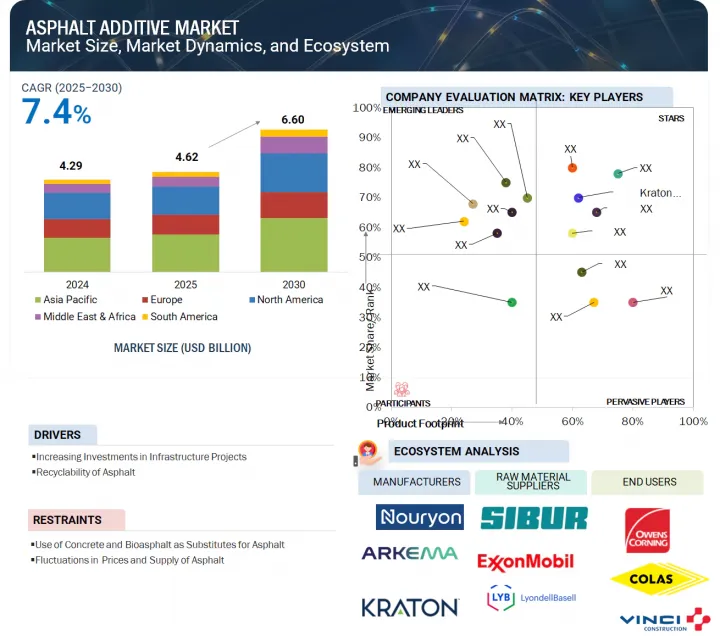

世界のアスファルト添加剤の市場規模は、2025年の46億2,000万米ドルから2030年までに66億米ドルに達すると予測され、予測期間にCAGRで7.4%の成長が見込まれます。

新興経済圏におけるインフラ部門の急速な拡大により、道路の新設や復旧プロジェクトの需要が大幅に増加しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル、キロトン |

| セグメント | 用途、タイプ、技術、地域 |

| 対象地域 | 北米、アジア太平洋、欧州、中東・アフリカ、南米 |

都市化が加速し、交通網が拡大するにつれて、重い交通荷重やさまざまな気候条件に耐えられる高性能舗装へのニーズが高まっています。このような建設活動の急増は、アスファルト混合物の耐久性、強度、寿命を向上させるアスファルト添加剤の需要を直接的に後押ししています。これらの添加剤は、道路の品質を高め、メンテナンスの必要性を低減し、発展途上地域全体の持続可能なインフラ開発を支援するのに不可欠です。

「用途別では、屋根材セグメントが予測期間に2番目に大きな市場シェアを占める見込みです。」

耐久性、耐候性に優れた屋根ソリューションの需要の増加により、予測期間に屋根用途セグメントが金額と数量ともに市場シェア第2位を占める見込みです。アスファルト添加剤は、紫外線、熱、湿気、老朽化に対する耐性を高めることで、屋根材の性能を向上させるのに不可欠です。アスファルト添加剤の使用は、屋根システムの寿命を延ばし、建物のエネルギー効率を促進します。特に住宅と商業部門における建設活動の活発化が、屋根用途におけるアスファルト添加剤の採用をさらに後押ししています。

「技術別では、ウォームミックスセグメントが予測期間に第2位の市場シェアを占める見込みです。」

ウォームミックス技術セグメントは、その環境上と運用上の利点から、予測期間に金額ベースで第2位の市場シェアを占める見込みです。この技術により、アスファルトを低温で生産・塗布できるようになり、エネルギー使用と温室効果ガス排出が削減されます。また、作業性と締固めを向上させ、舗装時季を拡大し、現場の安全性を高めます。建設において持続可能性が重視されるようになるにつれて、先進市場でも新興市場でもウォームミックス技術の採用が増加しています。

「タイプ別では、剥離防止剤・接着促進剤が予測期間中第2位のシェアを占めます。」

アスファルト添加剤市場では、予測期間に剥離防止剤・接着促進剤セグメントが金額ベースで第2位のシェアを占める見込みです。これらの添加剤は、アスファルトバインダーと骨材との結合の強化に重要であり、剥離や表面の劣化を防ぐのに役立ちます。水による損傷を減らし、穴あきやわだち掘れのリスクを下げることで、舗装の寿命を延ばし、耐久性を向上させます。水分の多い地域や、凍結融解のサイクルが頻繁な地域では、特に有効です。

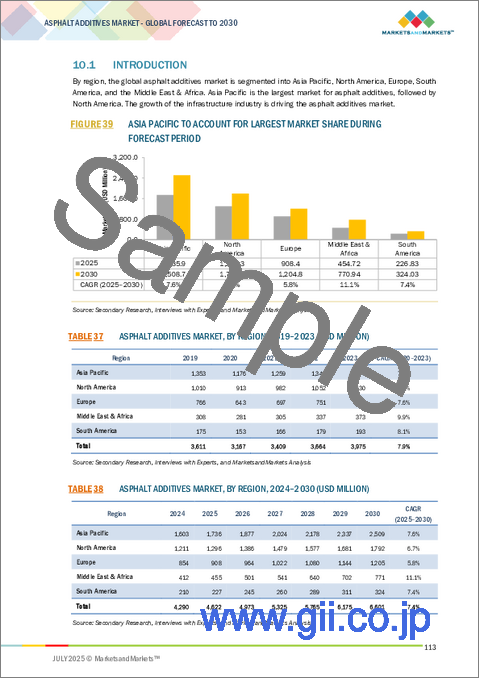

「北米が予測期間に第2位のシェアを占めます。」

北米地域は、予測期間にアスファルト添加剤市場において、金額と数量ともに第2位のシェアを占めると予測されます。この成長は、確立されたインフラ網と、道路整備とアップグレードへの継続的な投資によるものです。同地域では、特に異常気象や激しい交通の多さに対応するため、舗装の耐久性と性能の強化が重視されています。さらに、持続可能な建設方法への注目の高まりと、ウォームミックスアスファルトのような先進技術の採用が、アスファルト添加剤の需要を押し上げています。政府の規制や交通インフラへの資金援助も、この地域の市場成長を大きく支えています。

当レポートでは、世界のアスファルト添加剤市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- アスファルト添加剤市場の企業にとって魅力的な機会

- アスファルト添加剤市場:タイプ別

- アスファルト添加剤市場:技術別

- アスファルト添加剤市場:用途別

- アジア太平洋のアスファルト添加剤市場:用途別、国別

- アスファルト添加剤市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済指標

第6章 産業動向

- サプライチェーン分析

- 原材料サプライヤー

- メーカー

- 流通ネットワーク

- エンドユーザー

- 価格設定の分析

- 主要企業が提供するアスファルト添加剤の平均販売価格(2024年)

- アスファルト添加剤の平均販売価格の動向:地域別(2022年~2024年)

- カスタマービジネスに影響を与える動向/混乱

- エコシステム分析

- ケーススタディ分析

- BASFのポリマー改質剤による舗装の柔軟性の向上

- KRATONのポリマー強化による先進のバインダー性能

- 技術分析

- 主要技術

- 補完技術

- 貿易分析

- 輸入シナリオ(HSコード381129)

- 輸出シナリオ(HSコード381129)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制枠組み

- 主な会議とイベント

- 投資と資金調達のシナリオ

- 特許分析

- アプローチ

- 文書の種類

- 主な出願者

- 管轄分析

- 2025年の米国関税の影響 - 概要

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 用途に対する影響

- アスファルト添加剤市場に対するAI/生成AIの影響

第7章 アスファルト添加剤市場:用途別

- イントロダクション

- 道路建設・舗装

- 屋根

- 空港建設

- その他

第8章 アスファルト添加剤市場:タイプ別

- イントロダクション

- ポリマー改質剤

- 剥離防止剤・接着促進剤

- 乳化剤

- 化学改質剤

- 再生剤

- 繊維

- フラックスオイル

- 着色アスファルト

- その他

第9章 アスファルト添加剤市場:技術別

- イントロダクション

- ホットミックス

- コールドミックス

- ウォームミックス

第10章 アスファルト添加剤市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- エジプト

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他の南米

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- インドネシア

- マレーシア

- オーストラリア

- その他のアジア太平洋

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- ロシア

- スペイン

- その他の欧州

第11章 競合情勢

- イントロダクション

- 市場の評価フレームワーク

- 市場シェア分析

- 収益分析

- ブランド/製品の比較

- SYLVAROAD RP 1000(KRATON CORPORATION)

- EVOTHERM(INGEVITY)

- SOLPRENE SBS(DYNASOL)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ企業/その他の企業と中小企業(2024年)

- 企業の評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- KRATON CORPORATION

- INGEVITY CORPORATION

- DYNASOL GROUP

- NOURYON

- ARKEMA SPECIALTY SURFACTANTS

- THE DOW CHEMICAL COMPANY

- BASF SE

- HONEYWELL INTERNATIONAL INC

- HUNTSMAN CORPORATION

- EVONIK INDUSTRIES AG

- SASOL CHEMICALS

- KAO CORPORATION

- SINOPEC

- TOTALENERGIES

- ITERCHIMICA SPA

- その他の企業

- LCY

- ERGON ASPHALT & EMULSIONS, INC.

- MCASPHALT INDUSTRIES LIMITED

- BULLDOG PLANT & EQUIPMENT LTD

- WACKER CHEMIE AG

- ENGINEERED ADDITIVES LLC

- PETROCHEM SPECIALITIES

- AMAZ CHEMICALS LLP

- NINGBO CHANGHONG POLYMER SCIENTIFIC AND TECHNICAL INC.

第13章 隣接市場

- イントロダクション

- 制限事項

- 接着促進剤市場

- 市場の定義

- 接着促進剤市場:タイプ別

- 接着促進剤市場:用途別

- 接着促進剤市場:地域別

第14章 付録

List of Tables

- TABLE 1 ASPHALT ADDITIVES MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- TABLE 2 ASPHALT ADDITIVES MARKET: DEFINITION AND INCLUSIONS, BY TECHNOLOGY

- TABLE 3 ASPHALT ADDITIVES MARKET: DEFINITION AND INCLUSIONS, BY APPLICATION

- TABLE 4 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 IMPACT OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE TYPES (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE TYPES

- TABLE 7 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 8 AVERAGE SELLING PRICE OF ASPHALT ADDITIVES OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD/KG)

- TABLE 9 AVERAGE SELLING PRICE TREND OF ASPHALT ADDITIVES, BY REGION, 2022-2024 (USD/KG)

- TABLE 10 ROLES OF COMPANIES IN ASPHALT ADDITIVES ECOSYSTEM

- TABLE 11 IMPORT DATA RELATED TO ASPHALT ADDITIVES, BY REGION, 2019-2024 (USD MILLION)

- TABLE 12 EXPORT DATA RELATED TO ASPHALT ADDITIVES, BY REGION, 2019-2024 (USD MILLION)

- TABLE 13 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASPHALT ADDITIVES MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 20 ASPHALT ADDITIVES MARKET: FUNDING/INVESTMENT SCENARIO, 2020-2025

- TABLE 21 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS, 2014-2024

- TABLE 22 LIST OF MAJOR PATENTS RELATED TO ASPHALT ADDITIVES, 2014-2024

- TABLE 23 PATENTS BY LG CHEM, LTD.

- TABLE 24 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 26 ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 27 ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 28 ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 29 ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 30 ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 31 ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 32 ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 33 ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 34 ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 35 ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 36 ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 37 ASPHALT ADDITIVES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 ASPHALT ADDITIVES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 39 ASPHALT ADDITIVES MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 40 ASPHALT ADDITIVES MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 41 ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 42 ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030(USD MILLION)

- TABLE 43 ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 44 ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 45 ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 46 ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 47 ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 48 ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 49 ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 50 ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 51 ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 52 ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 53 NORTH AMERICA ASPHALT ADDITIVES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 54 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA ASPHALT ADDITIVES MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 56 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 57 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 58 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 60 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 61 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 62 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 64 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 65 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 66 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 68 NORTH AMERICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 69 US: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 70 US: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 71 US: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 72 US: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 73 US: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 74 US: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030(USD MILLION)

- TABLE 75 US: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 76 US: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 77 US: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 78 US: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 79 US: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 80 US: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 81 CANADA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 82 CANADA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 83 CANADA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 84 CANADA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 85 CANADA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 86 CANADA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030(USD MILLION)

- TABLE 87 CANADA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 88 CANADA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 89 CANADA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 90 CANADA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 91 CANADA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 92 CANADA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 93 MEXICO: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 94 MEXICO: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 95 MEXICO: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 96 MEXICO: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 97 MEXICO: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 98 MEXICO: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030(USD MILLION)

- TABLE 99 MEXICO: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 100 MEXICO: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 101 MEXICO: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 102 MEXICO: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 103 MEXICO: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 104 MEXICO: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 105 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 108 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 109 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 112 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 113 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 116 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 117 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 120 MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 121 SAUDI ARABIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 122 SAUDI ARABIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 123 SAUDI ARABIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 124 SAUDI ARABIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 125 SAUDI ARABIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 126 SAUDI ARABIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030(USD MILLION)

- TABLE 127 SAUDI ARABIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 128 SAUDI ARABIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 129 SAUDI ARABIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 130 SAUDI ARABIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 131 SAUDI ARABIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 132 SAUDI ARABIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 133 UAE: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 134 UAE: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 135 UAE: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 136 UAE: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 137 UAE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 138 UAE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 139 UAE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 140 UAE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 141 UAE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 142 UAE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 143 UAE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 144 UAE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 145 EGYPT: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 146 EGYPT: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 147 EGYPT: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 148 EGYPT: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 149 EGYPT: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 150 EGYPT: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 151 EGYPT: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 152 EGYPT: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 153 EGYPT: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 154 EGYPT: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 155 EGYPT: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 156 EGYPT: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 157 REST OF MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 158 REST OF MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 159 REST OF MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 160 REST OF MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 161 REST OF MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 162 REST OF MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030(USD MILLION)

- TABLE 163 REST OF MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 165 REST OF MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 166 REST OF MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 167 REST OF MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 168 REST OF MIDDLE EAST & AFRICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 169 SOUTH AMERICA ASPHALT ADDITIVES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 170 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 171 SOUTH AMERICA ASPHALT ADDITIVES MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 172 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 173 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 174 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 175 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 176 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 177 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 178 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 179 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 180 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 181 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 182 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 183 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 184 SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 185 BRAZIL: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 186 BRAZIL: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 187 BRAZIL: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 188 BRAZIL: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 189 BRAZIL: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 190 BRAZIL: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 191 BRAZIL: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 192 BRAZIL: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 193 BRAZIL: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 194 BRAZIL: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 195 BRAZIL: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 196 BRAZIL: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 197 ARGENTINA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 198 ARGENTINA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 199 ARGENTINA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 200 ARGENTINA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 201 ARGENTINA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 202 ARGENTINA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 203 ARGENTINA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 204 ARGENTINA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 205 ARGENTINA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 206 ARGENTINA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 207 ARGENTINA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 208 ARGENTINA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 209 COLOMBIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 210 COLOMBIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 211 COLOMBIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 212 COLOMBIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 213 COLOMBIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 214 COLOMBIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 215 COLOMBIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 216 COLOMBIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 217 COLOMBIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 218 COLOMBIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 219 COLOMBIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 220 COLOMBIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 221 REST OF SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 222 REST OF SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 223 REST OF SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 224 REST OF SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 225 REST OF SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 226 REST OF SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 227 REST OF SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 228 REST OF SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 229 REST OF SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 230 REST OF SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 231 REST OF SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 232 REST OF SOUTH AMERICA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 233 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 234 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 235 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 236 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 237 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 238 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 239 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 240 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 241 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 242 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 243 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 244 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 245 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 246 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 247 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 248 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 249 CHINA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 250 CHINA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 251 CHINA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 252 CHINA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 253 CHINA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 254 CHINA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 255 CHINA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 256 CHINA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 257 CHINA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 258 CHINA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 259 CHINA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 260 CHINA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 261 INDIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 262 INDIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 263 INDIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 264 INDIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 265 INDIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 266 INDIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 267 INDIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 268 INDIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 269 INDIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 270 INDIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 271 INDIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 272 INDIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 273 JAPAN: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 274 JAPAN: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 275 JAPAN: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 276 JAPAN: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 277 JAPAN: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 278 JAPAN: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 279 JAPAN: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 280 JAPAN: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 281 JAPAN: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 282 JAPAN: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 283 JAPAN: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 284 JAPAN: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 285 SOUTH KOREA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 286 SOUTH KOREA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 287 SOUTH KOREA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 288 SOUTH KOREA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 289 SOUTH KOREA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 290 SOUTH KOREA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 291 SOUTH KOREA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 292 SOUTH KOREA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 293 SOUTH KOREA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 294 SOUTH KOREA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 295 SOUTH KOREA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 296 SOUTH KOREA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 297 INDONESIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 298 INDONESIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 299 INDONESIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 300 INDONESIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 301 INDONESIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 302 INDONESIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 303 INDONESIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 304 INDONESIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 305 INDONESIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 306 INDONESIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 307 INDONESIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 308 INDONESIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 309 MALAYSIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 310 MALAYSIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 311 MALAYSIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 312 MALAYSIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 313 MALAYSIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 314 MALAYSIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 315 MALAYSIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 316 MALAYSIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 317 MALAYSIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 318 MALAYSIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 319 MALAYSIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 320 MALAYSIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 321 AUSTRALIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 322 AUSTRALIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 323 AUSTRALIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 324 AUSTRALIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 325 AUSTRALIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 326 AUSTRALIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 327 AUSTRALIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 328 AUSTRALIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 329 AUSTRALIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 330 AUSTRALIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 331 AUSTRALIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 332 AUSTRALIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 333 REST OF ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 334 REST OF ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 335 REST OF ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 336 REST OF ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 337 REST OF ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 338 REST OF ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 339 REST OF ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 340 REST OF ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 341 REST OF ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 342 REST OF ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 343 REST OF ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 344 REST OF ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 345 EUROPE: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 346 EUROPE: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 347 EUROPE: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 348 EUROPE: ASPHALT ADDITIVES MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 349 EUROPE: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 350 EUROPE: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 351 EUROPE: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 352 EUROPE: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 353 EUROPE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 354 EUROPE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 355 EUROPE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 356 EUROPE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 357 EUROPE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 358 EUROPE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 359 EUROPE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 360 EUROPE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 361 GERMANY: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 362 GERMANY: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 363 GERMANY: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 364 GERMANY: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 365 GERMANY: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 366 GERMANY: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 367 GERMANY: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 368 GERMANY: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 369 GERMANY: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 370 GERMANY: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 371 GERMANY: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 372 GERMANY: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 373 FRANCE: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 374 FRANCE: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 375 FRANCE: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 376 FRANCE: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 377 FRANCE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 378 FRANCE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 379 FRANCE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 380 FRANCE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 381 FRANCE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 382 FRANCE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 383 FRANCE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 384 FRANCE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 385 UK: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 386 UK: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 387 UK: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 388 UK: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 389 UK: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 390 UK: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 391 UK: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 392 UK: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 393 UK: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 394 UK: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 395 UK: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 396 UK: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 397 ITALY: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 398 ITALY: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 399 ITALY: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 400 ITALY: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 401 ITALY: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 402 ITALY: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 403 ITALY: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 404 ITALY: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 405 ITALY: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 406 ITALY: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 407 ITALY: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 408 ITALY: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 409 RUSSIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 410 RUSSIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 411 RUSSIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 412 RUSSIA: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 413 RUSSIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 414 RUSSIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 415 RUSSIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 416 RUSSIA: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 417 RUSSIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 418 RUSSIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 419 RUSSIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 420 RUSSIA: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 421 SPAIN: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 422 SPAIN: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 423 SPAIN: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 424 SPAIN: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 425 SPAIN: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 426 SPAIN: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 427 SPAIN: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 428 SPAIN: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 429 SPAIN: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 430 SPAIN: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 431 SPAIN: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 432 SPAIN: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 433 REST OF EUROPE: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 434 REST OF EUROPE: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 435 REST OF EUROPE: ASPHALT ADDITIVES MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 436 REST OF EUROPE: ASPHALT ADDITIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 437 REST OF EUROPE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 438 REST OF EUROPE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 439 REST OF EUROPE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 440 REST OF EUROPE: ASPHALT ADDITIVES MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 441 REST OF EUROPE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 442 REST OF EUROPE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 443 REST OF EUROPE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2019-2023 (KILOTON)

- TABLE 444 REST OF EUROPE: ASPHALT ADDITIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 445 ASPHALT ADDITIVES MARKET EVALUATION FRAMEWORK FOR ALL PLAYERS, 2019-2025

- TABLE 446 ASPHALT ADDITIVES MARKET: REGION FOOTPRINT

- TABLE 447 ASPHALT ADDITIVES MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 448 ASPHALT ADDITIVES MARKET: TECHNOLOGY FOOTPRINT

- TABLE 449 ASPHALT ADDITIVES MARKET: APPLICATION FOOTPRINT

- TABLE 450 ASPHALT ADDITIVES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 451 ASPHALT ADDITIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 452 ASPHALT ADDITIVES MARKET: PRODUCT LAUNCHES, JANUARY 2019-JUNE 2025

- TABLE 453 ASPHALT ADDITIVES MARKET: DEALS, JANUARY 2019- APRIL 2023

- TABLE 454 ASPHALT ADDITIVES MARKET: EXPANSIONS, JANUARY 2019- APRIL 2023

- TABLE 455 ASPHALT ADDITIVES MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS, JANUARY 2019- APRIL 2023

- TABLE 456 KRATON CORPORATION: COMPANY OVERVIEW

- TABLE 457 KRATON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 458 KRATON CORPORATION: DEALS

- TABLE 459 KRATON CORPORATION: EXPANSIONS

- TABLE 460 INGEVITY CORPORATION: COMPANY OVERVIEW

- TABLE 461 INGEVITY CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 462 INGEVITY CORPORATION: DEALS

- TABLE 463 INGEVITY CORPORATION: EXPANSIONS

- TABLE 464 DYNASOL GROUP: COMPANY OVERVIEW

- TABLE 465 DYNASOL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 466 DYNASOL GROUP: OTHER DEVELOPMENTS

- TABLE 467 NOURYON: COMPANY OVERVIEW

- TABLE 468 NOURYON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 469 NOURYON: PRODUCT LAUNCHES

- TABLE 470 NOURYON: EXPANSIONS

- TABLE 471 ARKEMA SPECIALTY SURFACTANTS: COMPANY OVERVIEW

- TABLE 472 ARKEMA SPECIALTY SURFACTANTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 473 ARKEMA SPECIALTY SURFACTANTS: PRODUCT LAUNCHES

- TABLE 474 ARKEMA SPECIALTY SURFACTANTS: DEALS

- TABLE 475 ARKEMA SPECIALTY SURFACTANTS: OTHER DEVELOPMENTS

- TABLE 476 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 477 THE DOW CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 478 BASF SE: COMPANY OVERVIEW

- TABLE 479 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 480 BASF SE: PRODUCT LAUNCHES

- TABLE 481 BASF SE: DEALS

- TABLE 482 HONEYWELL INTERNATIONAL INC: COMPANY OVERVIEW

- TABLE 483 HONEYWELL INTERNATIONAL INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 484 HUNTSMAN CORPORATION: COMPANY OVERVIEW

- TABLE 485 HUNTSMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 486 HUNTSMAN CORPORATION: DEALS

- TABLE 487 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 488 EVONIK INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 489 EVONIK INDUSTRIES: PRODUCT LAUNCHES

- TABLE 490 EVONIK INDUSTRIES: EXPANSIONS

- TABLE 491 SASOL CHEMICALS: COMPANY OVERVIEW

- TABLE 492 SASOL CHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 493 SASOL LIMITED: DEALS

- TABLE 494 KAO CORPORATION: COMPANY OVERVIEW

- TABLE 495 KAO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 496 KAO CORPORATION: EXPANSIONS

- TABLE 497 SINOPEC: COMPANY OVERVIEW

- TABLE 498 SINOPEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 499 TOTAL ENERGIES: COMPANY OVERVIEW

- TABLE 500 TOTALENERGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 501 ITERCHIMICA SPA: COMPANY OVERVIEW

- TABLE 502 INTERCHIMICA SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 503 ITERCHIMICA SPA: DEALS

- TABLE 504 ITERCHIMICA SPA: EXPANSIONS

- TABLE 505 LCY: COMPANY OVERVIEW

- TABLE 506 ERGON ASPHALT & EMULSIONS, INC.: COMPANY OVERVIEW

- TABLE 507 MCASPHALT INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 508 BULLDOG PLANT & EQUIPMENT LTD: COMPANY OVERVIEW

- TABLE 509 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 510 ENGINEERED ADDITIVES LLC: COMPANY OVERVIEW

- TABLE 511 PETROCHEM SPECIALITIES: COMPANY OVERVIEW

- TABLE 512 AMAZ CHEMICALS LLP: COMPANY OVERVIEW

- TABLE 513 NINGBO CHANGHONG POLYMER SCIENTIFIC AND TECHNICAL INC.: COMPANY OVERVIEW

- TABLE 514 ADHESION PROMOTERS MARKET, BY TYPE, 2014-2021 (USD MILLION)

- TABLE 515 ADHESION PROMOTERS MARKET, BY TYPE, 2014-2021 (KILOTON)

- TABLE 516 ADHESION PROMOTERS MARKET, BY APPLICATION, 2014-2021 (USD MILLION)

- TABLE 517 ADHESION PROMOTERS MARKET, BY APPLICATION, 2014-2021 (KILOTON)

- TABLE 518 ADHESION PROMOTERS MARKET, BY REGION, 2014-2021 (USD MILLION)

- TABLE 519 ADHESION PROMOTERS MARKET, BY REGION, 2014-2021 (KILOTON)

List of Figures

- FIGURE 1 ASPHALT ADDITIVES MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 ASPHALT ADDITIVES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE), COLLECTIVE MARKET SHARE OF KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY SIDE), COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (DEMAND SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4-TOP-DOWN

- FIGURE 7 ASPHALT ADDITIVES MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 10 POLYMERIC MODIFIERS TO BE LARGEST TYPE SEGMENT OF ASPHALT ADDITIVES MARKET DURING FORECAST PERIOD

- FIGURE 11 HOT MIX TO BE LARGEST TECHNOLOGY SEGMENT OF ASPHALT ADDITIVES DURING FORECAST PERIOD

- FIGURE 12 ROAD CONSTRUCTION AND PAVING TO BE LARGEST APPLICATION OF ASPHALT ADDITIVES DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC DOMINATED ASPHALT ADDITIVES MARKET IN 2024

- FIGURE 14 ASIA PACIFIC TO BE FASTEST-GROWING REGION IN ASPHALT ADDITIVES MARKET DURING FORECAST PERIOD

- FIGURE 15 POLYMERIC MODIFIERS TO LEAD ASPHALT ADDITIVES MARKET DURING FORECAST PERIOD

- FIGURE 16 HOT MIX TO LEAD ASPHALT ADDITIVES MARKET DURING FORECAST PERIOD

- FIGURE 17 ROAD CONSTRUCTION AND PAVING TO LEAD ASPHALT ADDITIVES MARKET DURING FORECAST PERIOD

- FIGURE 18 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC IN 2024

- FIGURE 19 SAUDI ARABIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ASPHALT ADDITIVES MARKET

- FIGURE 21 ASPHALT ADDITIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE TYPES

- FIGURE 24 ASPHALT ADDITIVES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE OF ASPHALT ADDITIVES OFFERED BY KEY PLAYERS FOR TOP THREE TYPES, 2024

- FIGURE 26 AVERAGE SELLING PRICE TREND OF ASPHALT ADDITIVES, BY REGION, 2022-2024 (USD/KG)

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 ASPHALT ADDITIVES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 IMPORT DATA FOR ASPHALT ADDITIVES, BY KEY COUNTRY, 2019-2024 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR ASPHALT ADDITIVES, BY KEY COUNTRY, 2019-2024 (USD MILLION)

- FIGURE 31 PATENTS REGISTERED FOR ASPHALT ADDITIVES, 2014-2024

- FIGURE 32 MAJOR PATENTS RELATED TO ASPHALT ADDITIVES, 2014-2024

- FIGURE 33 LEGAL STATUS OF PATENTS FILED RELATED TO ASPHALT ADDITIVES, 2014-2024

- FIGURE 34 MAXIMUM PATENTS FILED IN JURISDICTION OF CHINA, 2014-2024

- FIGURE 35 IMPACT OF AI/GEN AI ON ASPHALT ADDITIVES MARKET

- FIGURE 36 ASPHALT ADDITIVES MARKET, BY APPLICATION, 2025 VS. 2030

- FIGURE 37 REJUVENATORS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 38 HOT MIX SEGMENT TO LEAD ASPHALT ADDITIVES MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: ASPHALT ADDITIVES MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: ASPHALT ADDITIVES MARKET SNAPSHOT

- FIGURE 42 EUROPE: ASPHALT ADDITIVES MARKET SNAPSHOT

- FIGURE 43 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS IN ASPHALT ADDITIVES MARKET

- FIGURE 44 ASPHALT ADDITIVES MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 45 ASPHALT ADDITIVES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 46 COMPANY EVALUATION MATRIX FOR ASPHALT ADDITIVES MARKET: KEY PLAYERS, 2024

- FIGURE 47 ASPHALT ADDITIVES MARKET: COMPANY FOOTPRINT

- FIGURE 48 COMPANY EVALUATION MATRIX: STARTUPS/OTHER ADDITIONAL PLAYERS AND SMES, 2024

- FIGURE 49 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 50 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 51 INGEVITY CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 NOURYON: COMPANY SNAPSHOT

- FIGURE 53 ARKEMA SPECIALTY SURFACTANTS: COMPANY SNAPSHOT

- FIGURE 54 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 55 BASF SE: COMPANY SNAPSHOT

- FIGURE 56 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 57 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 EVONIK INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 59 SASOL CHEMICALS: COMPANY SNAPSHOT

- FIGURE 60 KAO CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 SINOPEC: COMPANY SNAPSHOT

- FIGURE 62 TOTALENERGIES: COMPANY SNAPSHOT

The global asphalt additive market is expected to grow from USD 4.62 billion in 2025 to USD 6.60 billion by 2030, with a CAGR of 7.4% during the forecast period. The rapid expansion of the infrastructure sector in emerging economies is significantly increasing the demand for new road construction and rehabilitation projects.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kilotons) |

| Segments | By Application, Type, Technology, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

As urbanization accelerates and transportation networks broaden, there is a growing need for high-performance pavements capable of withstanding heavy traffic loads and various climate conditions. This surge in construction activity is directly boosting the demand for asphalt additives, which improve the durability, strength, and longevity of asphalt mixtures. These additives are essential for enhancing road quality, lowering maintenance requirements, and supporting the development of sustainable infrastructure across developing regions.

"By application, the roofing segment is expected to account for the second-largest market share during the forecast period."

The roofing application segment is expected to account for the second-largest share of the market by value and volume during the forecast period, driven by the increasing demand for durable, weather-resistant roofing solutions. Asphalt additives are essential in improving the performance of roofing materials by increasing resistance to UV radiation, heat, moisture, and aging. Their use extends the lifespan of roofing systems and promotes energy efficiency in buildings. Rising construction activity, especially in residential and commercial sectors, is further boosting the adoption of asphalt additives in roofing applications.

"By technology, the warm mix segment is expected to account for the second-largest market share during the forecast period."

The warm mix technology segment is expected to hold the second-largest market share by value during the forecast period, due to its environmental and operational benefits. This technology enables asphalt to be produced and applied at lower temperatures, reducing energy use and greenhouse gas emissions. It also improves workability and compaction, extends the paving season, and enhances site safety. As sustainability becomes a key focus in construction, the adoption of warm mix technology is increasing across both developed and emerging markets regions.

"By type, the anti-strip and adhesion promoters segment will account for the second-largest share during the forecast period."

The anti-strip and adhesion promoters segment is projected to hold the second-largest share of the asphalt additive market by value during the forecast period. These additives are crucial for enhancing the bond between asphalt binder and aggregates, which helps prevent stripping and surface deterioration. By reducing water-induced damage and lowering the risk of potholes and rutting, they extend pavement life and increase durability. Their use is especially beneficial in regions with high moisture levels or frequent freeze-thaw cycles.

"North America will account for the second-largest share during the forecast period."

The North America region is expected to account for the second-largest share of the asphalt additive market in both value and volume during the forecast period. This growth is driven by its well-established infrastructure network and ongoing investments in road maintenance and upgrades. The region emphasizes enhancing the durability and performance of pavements, especially in response to extreme weather and heavy traffic. Furthermore, the increasing focus on sustainable construction practices and the adoption of advanced technologies like warm mix asphalt are boosting demand for asphalt additives. Government regulations and funding for transportation infrastructure also significantly support market growth in the region.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: C Level- 25%, Director Level- 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, Middle East & Africa - 7%, and South America - 3%

Kraton Corporation (US), Arkema SA (France), Ingevity Corporation (US), Nouryon (Netherlands), and BASF SE (Germany) are some of the major players operating in the asphalt additive market. These players have adopted expansions to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the asphalt additive market based on type, application, technology, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles asphalt additive manufacturers, comprehensively analyzing their market shares and core competencies, and tracks and analyzes competitive developments, such as product launches, acquisitions, agreements, and others.

Reasons to Buy the Report:

The report is expected to assist market leaders and new entrants by providing them with the closest estimates of revenue figures for the asphalt additive market and its segments. It is also anticipated to help stakeholders gain a better understanding of the market's competitive landscape, acquire insights to enhance their business positioning, and develop effective go-to-market strategies. Additionally, it enables stakeholders to gauge the market's pulse and offers information on key drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

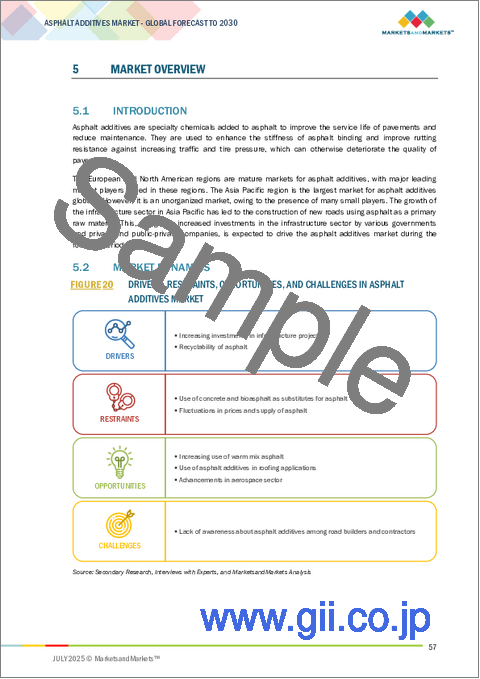

- Analysis of drivers (Increasing investments in infrastructure projects, recyclability of asphalt), opportunities (Increasing use of warm mix asphalt, use of asphalt additives in roofing applications, advancement in aerospace sector), restraint (Use of concrete and bioasphalt as substitutes for asphalt, fluctuation in prices and supply of asphalt), and challenges (Lack of awareness about asphalt additives among road builders and contractors) influencing the growth of the asphalt additive market.

- Product development/innovation: Detailed insights on upcoming technologies and research & development activities in the asphalt additive market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the asphalt additive market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the asphalt additive market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Kraton Corporation (US), Arkema SA (France), Ingevity Corporation (US), Nouryon (Netherlands), and BASF SE (Germany) in the asphalt additive market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ASPHALT ADDITIVES MARKET

- 4.2 ASPHALT ADDITIVES MARKET, BY TYPE

- 4.3 ASPHALT ADDITIVES MARKET, BY TECHNOLOGY

- 4.4 ASPHALT ADDITIVES MARKET, BY APPLICATION

- 4.5 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY APPLICATION & COUNTRY

- 4.6 ASPHALT ADDITIVES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing investments in infrastructure projects

- 5.2.1.2 Recyclability of asphalt

- 5.2.2 RESTRAINTS

- 5.2.2.1 Use of concrete and bioasphalt as substitutes for asphalt

- 5.2.2.2 Fluctuations in prices and supply of asphalt

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing use of warm mix asphalt

- 5.2.3.2 Use of asphalt additives in roofing applications

- 5.2.3.3 Advancements in aerospace sector

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness about asphalt additives among road builders and contractors

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTION NETWORKS

- 6.1.4 END-USERS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF ASPHALT ADDITIVES OFFERED BY KEY PLAYERS, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND OF ASPHALT ADDITIVES, BY REGION, 2022-2024

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 BOOSTING PAVEMENT FLEXIBILITY WITH BASF'S POLYMERIC MODIFIERS

- 6.5.2 ADVANCED BINDER PERFORMANCE WITH KRATON POLYMER ENHANCEMENTS

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Warm mix asphalt (WMA) technology

- 6.6.1.2 Rejuvenation and recycling technologies

- 6.6.2 COMPLIMENTARY TECHNOLOGIES

- 6.6.2.1 Asphalt mixing and blending systems

- 6.6.1 KEY TECHNOLOGIES

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 381129)

- 6.7.2 EXPORT SCENARIO (HS CODE 381129)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 ASTM D977 - Standard specification for emulsified asphalts

- 6.8.2.2 BS EN 12591:2009 - Bitumen and bituminous binders - specifications for paving grade bitumen

- 6.9 KEY CONFERENCES AND EVENTS

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON APPLICATIONS:

- 6.13 IMPACT OF AI/GEN AI ON ASPHALT ADDITIVES MARKET

7 ASPHALT ADDITIVES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 ROAD CONSTRUCTION & PAVING

- 7.2.1 HIGH GOVERNMENT INVESTMENTS FOR INFRASTRUCTURE DEVELOPMENT IN EMERGING ECONOMIES TO DRIVE SEGMENT

- 7.3 ROOFING

- 7.3.1 GROWING CONSTRUCTION SECTOR IN NORTH AMERICA TO DRIVE SEGMENT

- 7.4 AIRPORT CONSTRUCTION

- 7.4.1 GROWTH OF AEROSPACE SECTOR TO INCREASE DEMAND

- 7.5 OTHERS

8 ASPHALT ADDITIVES MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 POLYMERIC MODIFIERS

- 8.2.1 GROWING USE OF HIGH-PERFORMANCE BINDERS TO DRIVE DEMAND

- 8.3 ANTI-STRIP AND ADHESION PROMOTERS

- 8.3.1 CLIMATE RESILIENCE TO DRIVE MARKET GROWTH

- 8.4 EMULSIFIERS

- 8.4.1 SHIFT TOWARD LOW-EMISSION PAVEMENT TECHNOLOGIES TO DRIVE DEMAND

- 8.5 CHEMICAL MODIFIERS

- 8.5.1 IMPROVED BINDER DURABILITY AND COST-EFFICIENCY TO DRIVE DEMAND

- 8.6 REJUVENATORS

- 8.6.1 GROWING USE OF RAP AND RAS TO DRIVE MARKET

- 8.7 FIBERS

- 8.7.1 IMPROVING TENSILE STRENGTH AND CRACK RESISTANCE TO DRIVE DEMAND

- 8.8 FLUX OIL

- 8.8.1 ENHANCED ASPHALT FLEXIBILITY AND SUSTAINABILITY TO DRIVE DEMAND

- 8.9 COLORED ASPHALT

- 8.9.1 ENHANCED ROAD DURABILITY AND HEAT MANAGEMENT TO DRIVE DEMAND

- 8.10 OTHERS

9 ASPHALT ADDITIVES MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 HOT MIX

- 9.2.1 ENABLES HIGH-HEAT PROCESSING WITH SUPERIOR COMPACTION AND DURABILITY

- 9.3 COLD MIX

- 9.3.1 ENABLES COST-EFFICIENT, EMISSION-FREE ROAD BUILDING WITH ADVANCED EMULSION FORMULATIONS

- 9.4 WARM MIX

- 9.4.1 ENABLES LOW-TEMPERATURE PAVING THROUGH FOAMING SYSTEMS AND WAX-BASED ADDITIVES

10 ASPHALT ADDITIVES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Construction and infrastructure developments to boost market

- 10.2.2 CANADA

- 10.2.2.1 Increased investments in building & construction to drive market

- 10.2.3 MEXICO

- 10.2.3.1 Growing population and automobile sector to drive demand

- 10.2.1 US

- 10.3 MIDDLE EAST & AFRICA

- 10.3.1 SAUDI ARABIA

- 10.3.1.1 Infrastructural developments to drive market

- 10.3.2 UAE

- 10.3.2.1 Growth in housing units to increase demand

- 10.3.3 EGYPT

- 10.3.3.1 Increasing investments in road networks

- 10.3.4 REST OF MIDDLE EAST & AFRICA

- 10.3.1 SAUDI ARABIA

- 10.4 SOUTH AMERICA

- 10.4.1 BRAZIL

- 10.4.1.1 Infrastructural developments to boost market

- 10.4.2 ARGENTINA

- 10.4.2.1 Growing investments in road building to boost demand

- 10.4.3 COLOMBIA

- 10.4.3.1 Growth in urbanization to create demand for road construction

- 10.4.4 REST OF SOUTH AMERICA

- 10.4.1 BRAZIL

- 10.5 ASIA PACIFIC

- 10.5.1 CHINA

- 10.5.1.1 Growth in construction of green buildings to propel demand

- 10.5.2 INDIA

- 10.5.2.1 Investments to upgrade infrastructure and buildings to fuel market

- 10.5.3 JAPAN

- 10.5.3.1 Government investments in construction industry to boost market

- 10.5.4 SOUTH KOREA

- 10.5.4.1 Investments in construction industry to increase demand

- 10.5.5 INDONESIA

- 10.5.5.1 Rising construction industry to increase market demand

- 10.5.6 MALAYSIA

- 10.5.6.1 Expansion of construction industry to lead to market growth

- 10.5.7 AUSTRALIA

- 10.5.7.1 Government's five-year infrastructure investment plan to boost market demand

- 10.5.8 REST OF ASIA PACIFIC

- 10.5.1 CHINA

- 10.6 EUROPE

- 10.6.1 GERMANY

- 10.6.1.1 Infrastructure investments to drive market

- 10.6.2 FRANCE

- 10.6.2.1 Increase in use of new technologies to boost market demand

- 10.6.3 UK

- 10.6.3.1 Major infrastructure projects to boost market

- 10.6.4 ITALY

- 10.6.4.1 Growing demand for eco-friendly materials to drive market

- 10.6.5 RUSSIA

- 10.6.5.1 New road developments to propel demand for asphalt additives

- 10.6.6 SPAIN

- 10.6.6.1 Expansion of construction industry to drive market

- 10.6.7 REST OF EUROPE

- 10.6.1 GERMANY

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 MARKET EVALUATION FRAMEWORK

- 11.3 MARKET SHARE ANALYSIS

- 11.3.1 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- 11.4 REVENUE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.5.1 SYLVAROAD RP 1000 (KRATON CORPORATION)

- 11.5.2 EVOTHERM (INGEVITY)

- 11.5.3 SOLPRENE SBS (DYNASOL)

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 COMPANY EVALUATION AND MAPPING

- 11.6.2 STARS

- 11.6.3 EMERGING LEADERS

- 11.6.4 PERVASIVE PLAYERS

- 11.6.5 PARTICIPANTS

- 11.6.6 COMPANY FOOTPRINT

- 11.6.6.1 Asphalt Additives: Region footprint analysis

- 11.6.6.2 Asphalt Additives: Product type footprint analysis

- 11.6.6.3 Asphalt Additives: Technology footprint analysis

- 11.6.6.4 Asphalt Additives: Application footprint analysis

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/OTHER ADDITIONAL PLAYERS AND SMES, 2024

- 11.7.1 MAPPING OF STARTUPS/OTHER ADDITIONAL PLAYERS AND SMES, 2024

- 11.7.2 PROGRESSIVE COMPANIES

- 11.7.3 RESPONSIVE COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 DYNAMIC COMPANIES

- 11.7.6 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.6.1 Detailed list of key startups/SMEs

- 11.7.6.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 KRATON CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 INGEVITY CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 DYNASOL GROUP

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 NOURYON

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 ARKEMA SPECIALTY SURFACTANTS

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 THE DOW CHEMICAL COMPANY

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.6.3.1 Right to win

- 12.1.6.3.2 Strategic choices

- 12.1.6.3.3 Weaknesses and competitive threats

- 12.1.7 BASF SE

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.4 MnM view

- 12.1.7.4.1 Right to win

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 HONEYWELL INTERNATIONAL INC

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.8.3.1 Right to win

- 12.1.8.3.2 Strategic choices

- 12.1.8.3.3 Weaknesses and competitive threats

- 12.1.9 HUNTSMAN CORPORATION

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 EVONIK INDUSTRIES AG

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Expansions

- 12.1.11 SASOL CHEMICALS

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 KAO CORPORATION

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Expansions

- 12.1.13 SINOPEC

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.14 TOTALENERGIES

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.15 ITERCHIMICA SPA

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.15.3.2 Expansions

- 12.1.1 KRATON CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 LCY

- 12.2.2 ERGON ASPHALT & EMULSIONS, INC.

- 12.2.3 MCASPHALT INDUSTRIES LIMITED

- 12.2.4 BULLDOG PLANT & EQUIPMENT LTD

- 12.2.5 WACKER CHEMIE AG

- 12.2.6 ENGINEERED ADDITIVES LLC

- 12.2.7 PETROCHEM SPECIALITIES

- 12.2.8 AMAZ CHEMICALS LLP

- 12.2.9 NINGBO CHANGHONG POLYMER SCIENTIFIC AND TECHNICAL INC.

13 ADJACENT MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 ADHESION PROMOTERS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 ADHESION PROMOTERS MARKET, BY TYPE

- 13.3.3 ADHESION PROMOTERS MARKET, BY APPLICATION

- 13.3.4 ADHESION PROMOTERS MARKET, BY REGION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS