|

|

市場調査レポート

商品コード

1795412

デジタル著作権管理の世界市場 (~2030年):コンポーネント (ソリューション・サービス)・用途 (オーディオコンテンツ・画像・ビデオコンテンツ・機密文書・ソフトウェア&ゲーム)・産業 (BFSI・教育&トレーニング・メディア&エンターテイメント) 別Digital Rights Management Market by Component (Solutions and Services), Application (Audio Content, Images, Video Content, Confidential Documents, Software & Games), Vertical (BFSI, Education & Training, Media & Entertainment) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| デジタル著作権管理の世界市場 (~2030年):コンポーネント (ソリューション・サービス)・用途 (オーディオコンテンツ・画像・ビデオコンテンツ・機密文書・ソフトウェア&ゲーム)・産業 (BFSI・教育&トレーニング・メディア&エンターテイメント) 別 |

|

出版日: 2025年07月29日

発行: MarketsandMarkets

ページ情報: 英文 265 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

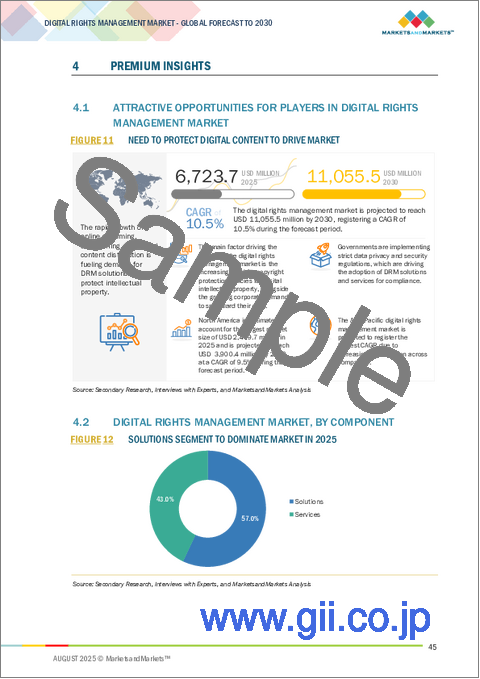

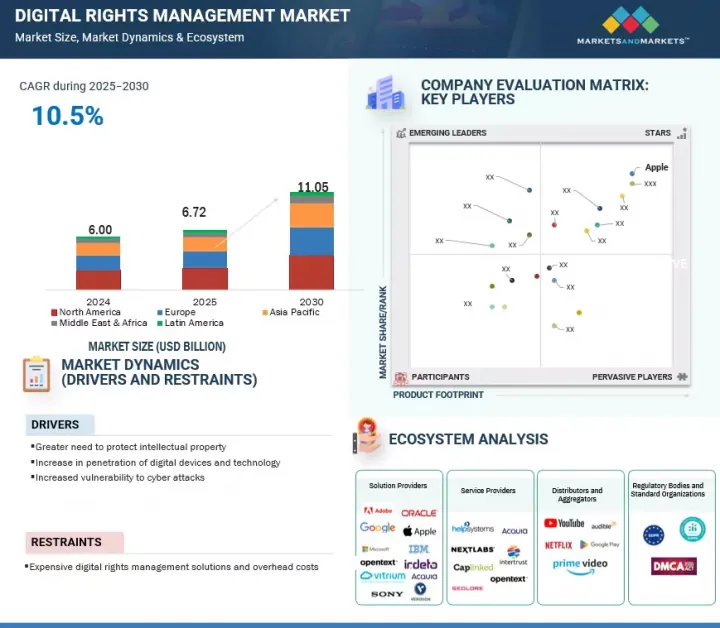

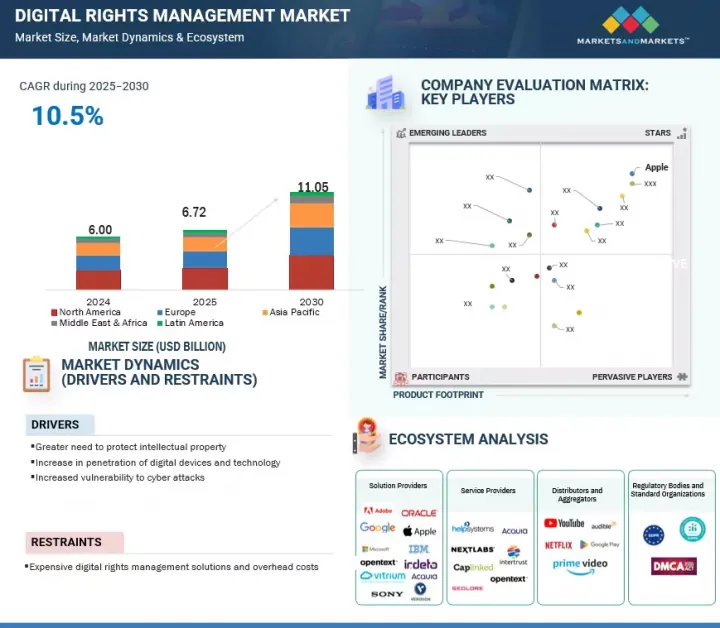

デジタル著作権管理の市場規模は、2025年の67億2,000万米ドルから、予測期間中はCAGR 10.5%で推移し、2030年には110億5,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | コンポーネント・用途・産業・地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

AIやクラウドネイティブな展開へのシフトは、企業がデジタルコンテンツを保護し、プラットフォーム横断で利用権を行使する方法を大きく変革しています。こうした最新のDRM (デジタル著作権管理) 技術により、組織はストリーミングプラットフォーム、電子書籍、企業文書、ソフトウェアなどのデジタル資産へのアクセスをリアルタイムで制御しながら、クラウド環境やコンテンツ配信ネットワーク (CDN) とシームレスに統合することが可能となります。クラウドベースのDRMは、メディア、出版、企業のエコシステムにおける分散型消費モデルのサポートに不可欠な、スケーラビリティ、リモートポリシー実施、集中型ライセンス管理を提供します。また、AIと機械学習は、異常検知、予測的な違法コピー監視、不正な共有や漏えいを防止するインテリジェントなアクセス制御を実現し、DRMにおける役割が高まっています。

"予測期間中、教育・トレーニングの部門が予測期間中に最大の成長を遂げる見通し"

eラーニングプラットフォームやデジタル学習リソースの急速な拡大が同部門の成長を牽引しています。大規模公開オンラインコース (MOOC) やデジタル出版物の普及により、知的財産を保護し、教材の不正コピーを防止するためにDRMが必要とされています。Digifyなどのソリューションは、機密文書を保護し、ライセンス契約の遵守を確実にします。リモート学習の拡大も、安全なデジタルコンテンツ配信への需要をさらに高めています。

”予測期間中、アジア太平洋地域が最も高い成長率を記録する見込み"

アジア太平洋地域はDRM技術開発への投資と参加から、この産業におけるホットスポットとなっています。同地域は急速なデジタル化とインターネット普及の進展に牽引されています。中国、インド、日本といった国々が、拡大するエンターテインメントおよびゲーム産業によって地域をリードしています。インドの情報技術省による透かし技術プロジェクトなどといった政府の取り組みも、DRMの採用を後押ししています。

当レポートでは、世界のデジタル著作権管理の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- デジタル著作権管理市場:簡単な歴史

- サプライチェーン分析

- エコシステム分析

- 価格分析

- 技術分析

- ケーススタディ分析

- 顧客の事業に影響を与える動向/混乱

- 特許分析

- ポーターのファイブフォース分析

- 規制状況

- 主要なステークホルダーと購入基準

- 2025-2026年の主な会議とイベント

- デジタル著作権管理市場におけるベストプラクティス

- デジタル著作権管理市場の技術ロードマップ

- 投資と資金調達のシナリオ

- デジタル著作権管理のビジネスモデル

- AI/生成AIがデジタル著作権管理市場に与える影響

- 2025年の米国関税の影響

第6章 デジタル著作権管理市場:コンポーネント別

- ソリューション

- サービス

- コンサルティング

- 統合

- 運用とメンテナンス

第7章 デジタル著作権管理市場:用途別

- オーディオコンテンツ

- 画像

- ビデオコンテンツ

- 機密文書、スプレッドシート、プレゼンテーション

- ソフトウェアとゲーム

- 電子書籍

- その他

第8章 デジタル著作権管理市場:産業別

- 銀行・金融サービス・保険

- 教育・訓練

- 研究・出版

- メディア&エンターテイメント

- IT・ITES

- ヘルスケア

- 法律

- その他

第9章 デジタル著作権管理市場:地域別

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- インド

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- 中東

- アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

- ブランド/製品比較

- 企業評価と財務指標

第11章 企業プロファイル

- 主要企業

- ADOBE SYSTEMS

- GOOGLE LLC

- MICROSOFT CORPORATION

- APPLE

- ORACLE

- IBM

- IRDETO

- OPENTEXT

- KUDELSKI GROUP

- SONY CORPORATION

- VERISIGN INC

- ACQUIA

- OVHCLOUD

- FORTRA

- SME/スタートアップ

- VITRIUM SYSTEMS

- NEXTLABS

- VERIMATRIX

- SECLORE

- VAULTIZE

- BITMOVIN

- EDITIONGUARD

- EZDRM

- INTERTRUST TECHNOLOGIES

- ARTISTSCOPE

- CAPLINKED

- BYNDER

- DIGIFY

第12章 隣接市場/関連市場

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2022-2024

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 DIGITAL RIGHTS MANAGEMENT MARKET: RISK ASSESSMENT

- TABLE 4 DIGITAL RIGHTS MANAGEMENT MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SOLUTION (2024)

- TABLE 6 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY PRICING MODEL (2024)

- TABLE 7 LIST OF PATENTS IN DIGITAL RIGHTS MANAGEMENT MARKET, 2022-2025

- TABLE 8 IMPACT OF PORTER'S FIVE FORCES ON DIGITAL RIGHTS MANAGEMENT MARKET

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 16 DIGITAL RIGHTS MANAGEMENT MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 19 DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 20 DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 21 SOLUTIONS: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 22 SOLUTIONS: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 SERVICES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 24 SERVICES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 SERVICES: DIGITAL RIGHTS MANAGEMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 26 SERVICES: DIGITAL RIGHTS MANAGEMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 CONSULTING SERVICES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 28 CONSULTING SERVICES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 INTEGRATION SERVICES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 30 INTEGRATION SERVICES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 OPERATION AND MAINTENANCE SERVICES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 32 OPERATION AND MAINTENANCE SERVICES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 34 DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 35 AUDIO CONTENT: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 36 AUDIO CONTENT: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 IMAGES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 38 IMAGES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 VIDEO CONTENT: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 40 VIDEO CONTENT: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 CONFIDENTIAL DOCUMENTS, SPREADSHEETS, AND PRESENTATIONS: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 42 CONFIDENTIAL DOCUMENTS, SPREADSHEETS, AND PRESENTATIONS: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 SOFTWARE AND GAMES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 44 SOFTWARE AND GAMES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 EBOOKS: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 46 EBOOKS: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 OTHER APPLICATIONS: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 48 OTHER APPLICATIONS: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 50 DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 51 BANKING, FINANCIAL SERVICES, AND INSURANCE: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 52 BANKING, FINANCIAL SERVICES, AND INSURANCE: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 EDUCATION AND TRAINING: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 54 EDUCATION AND TRAINING: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 RESEARCH AND PUBLICATIONS: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 56 RESEARCH AND PUBLICATIONS: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 MEDIA AND ENTERTAINMENT: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 58 MEDIA AND ENTERTAINMENT: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 IT AND ITES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 60 IT AND ITES: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 HEALTHCARE: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 62 HEALTHCARE: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 LEGAL: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 64 LEGAL: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 OTHER VERTICALS: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 66 OTHER VERTICALS: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 68 DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 70 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 US: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 80 US: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 81 US: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 82 US: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 83 US: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 84 US: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 US: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 86 US: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 87 CANADA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 88 CANADA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 89 CANADA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 90 CANADA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 91 CANADA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 92 CANADA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 CANADA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 94 CANADA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 95 EUROPE: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 96 EUROPE: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 98 EUROPE: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 99 EUROPE: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 100 EUROPE: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 EUROPE: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 102 EUROPE: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: DIGITAL RIGHTS MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 104 EUROPE: DIGITAL RIGHTS MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 UK: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 106 UK: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 107 UK: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 108 UK: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 109 UK: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 110 UK: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 UK: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 112 UK: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 113 GERMANY: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 114 GERMANY: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 115 GERMANY: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 116 GERMANY: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 117 GERMANY: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 118 GERMANY: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 GERMANY: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 120 GERMANY: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 122 ASIA PACIFIC: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DIGITAL RIGHTS MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DIGITAL RIGHTS MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 131 CHINA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 132 CHINA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 133 CHINA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 134 CHINA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 135 CHINA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 136 CHINA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 CHINA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 138 CHINA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 139 INDIA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 140 INDIA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 141 INDIA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 142 INDIA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 143 INDIA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 144 INDIA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 INDIA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 146 INDIA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST AND AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 156 MIDDLE EAST AND AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 160 MIDDLE EAST: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 165 AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 166 AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 167 AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 168 AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 169 AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 170 AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 171 AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 172 AFRICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 173 LATIN AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 174 LATIN AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 175 LATIN AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 176 LATIN AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 178 LATIN AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 179 LATIN AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 180 LATIN AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 181 LATIN AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 182 LATIN AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 BRAZIL: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 184 BRAZIL: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 185 BRAZIL: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 186 BRAZIL: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 187 BRAZIL: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 188 BRAZIL: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 189 BRAZIL: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 190 BRAZIL: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 191 MEXICO: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2019-2024 (USD MILLION)

- TABLE 192 MEXICO: DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 193 MEXICO: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 194 MEXICO: DIGITAL RIGHTS MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 195 MEXICO: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 196 MEXICO: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 197 MEXICO: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 198 MEXICO: DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 199 DIGITAL RIGHTS MANAGEMENT MARKET: OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS, 2022-2025

- TABLE 200 DIGITAL RIGHTS MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 201 DIGITAL RIGHTS MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 202 DIGITAL RIGHTS MANAGEMENT MARKET: VERTICAL FOOTPRINT

- TABLE 203 DIGITAL RIGHTS MANAGEMENT MARKET: KEY STARTUPS/SMES

- TABLE 204 DIGITAL RIGHTS MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 205 DIGITAL RIGHTS MANAGEMENT MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2021-2024

- TABLE 206 DIGITAL RIGHTS MANAGEMENT MARKET: DEALS, 2021-2024

- TABLE 207 ADOBE SYSTEMS: COMPANY OVERVIEW

- TABLE 208 ADOBE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 ADOBE SYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 210 ADOBE SYSTEMS: DEALS

- TABLE 211 GOOGLE LLC: COMPANY OVERVIEW

- TABLE 212 GOOGLE LLC: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 213 GOOGLE LLC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 214 GOOGLE LLC: DEALS

- TABLE 215 MICROSOFT CORPORATION: COMPANY OVERVIEW

- TABLE 216 MICROSOFT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 MICROSOFT CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 218 MICROSOFT CORPORATION: DEALS

- TABLE 219 APPLE: COMPANY OVERVIEW

- TABLE 220 APPLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 APPLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 222 APPLE: DEALS

- TABLE 223 ORACLE: COMPANY OVERVIEW

- TABLE 224 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 226 ORACLE: DEALS

- TABLE 227 IBM: COMPANY OVERVIEW

- TABLE 228 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 230 IBM: DEALS

- TABLE 231 IRDETO: COMPANY OVERVIEW

- TABLE 232 IRDETO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 IRDETO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 234 IRDETO: DEALS

- TABLE 235 OPENTEXT: COMPANY OVERVIEW

- TABLE 236 OPENTEXT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 OPENTEXT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 238 OPENTEXT: DEALS

- TABLE 239 VITRIUM SYSTEMS: COMPANY OVERVIEW

- TABLE 240 VITRIUM SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 VITRIUM SYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 242 NEXTLABS: COMPANY OVERVIEW

- TABLE 243 NEXTLABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 NEXTLABS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 245 VERIMATRIX: COMPANY OVERVIEW

- TABLE 246 VERIMATRIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 VERIMATRIX: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 248 VERIMATRIX: DEALS

- TABLE 249 SECLORE: COMPANY OVERVIEW

- TABLE 250 SECLORE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 SECLORE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 252 SECLORE: DEALS

- TABLE 253 VAULTIZE: COMPANY OVERVIEW

- TABLE 254 VAULTIZE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 256 DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 257 DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION)

- TABLE 258 DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- TABLE 259 DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 260 DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 261 DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 262 DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 263 DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 264 DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 265 ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 266 ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 267 ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY BUSINESS FUNCTION, 2018-2022 (USD MILLION)

- TABLE 268 ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY BUSINESS FUNCTION, 2023-2028 (USD MILLION)

- TABLE 269 ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 270 ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 271 ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 272 ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 273 ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 274 ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 DIGITAL RIGHTS MANAGEMENT MARKET SEGMENTATION

- FIGURE 2 DIGITAL RIGHTS MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE DRM MARKET

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 DIGITAL RIGHTS MANAGEMENT MARKET, 2023-2030 (USD MILLION)

- FIGURE 10 DIGITAL RIGHTS MANAGEMENT MARKET: REGIONAL SNAPSHOT

- FIGURE 11 NEED TO PROTECT DIGITAL CONTENT TO DRIVE MARKET

- FIGURE 12 SOLUTIONS SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 13 VIDEO CONTENT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 14 MEDIA & ENTERTAINMENT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 15 VIDEO CONTENT AND MEDIA & ENTERTAINMENT SEGMENTS TO DOMINATE NORTH AMERICAN MARKET IN 2025

- FIGURE 16 DIGITAL RIGHTS MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 BRIEF HISTORY OF DIGITAL RIGHTS MANAGEMENT MARKET

- FIGURE 18 DIGITAL RIGHTS MANAGEMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 19 DIGITAL RIGHTS MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 20 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SOLUTION

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 MAJOR PATENTS FOR DIGITAL RIGHTS MANAGEMENT MARKET, 2015-2024

- FIGURE 23 DIGITAL RIGHTS MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2021- 2024

- FIGURE 27 USE CASES OF GENERATIVE AI IN DIGITAL RIGHTS MANAGEMENT MARKET

- FIGURE 28 SERVICES SEGMENT TO REGISTER HIGHER CAGR THAN SOLUTIONS SEGMENT DURING FORECAST PERIOD

- FIGURE 29 SOFTWARE AND GAME SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 EDUCATION AND TRAINING VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

- FIGURE 31 DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION, 2025 VS. 2030 (USD MILLION)

- FIGURE 32 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: DIGITAL RIGHTS MANAGEMENT MARKET SNAPSHOT

- FIGURE 34 SHARES OF LEADING COMPANIES IN DIGITAL RIGHTS MANAGEMENT MARKET, 2024

- FIGURE 35 DIGITAL RIGHTS MANAGEMENT MARKET: RANKING ANALYSIS OF TOP FIVE PLAYERS, 2024

- FIGURE 36 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2020-2024

- FIGURE 37 DIGITAL RIGHTS MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 38 DIGITAL RIGHTS MANAGEMENT MARKET: COMPANY FOOTPRINT

- FIGURE 39 DIGITAL RIGHTS MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 40 DIGITAL RIGHTS MANAGEMENT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 41 COMPANY VALUATION, 2025

- FIGURE 42 FINANCIAL METRICS OF KEY DIGITAL RIGHTS MANAGEMENT VENDORS

- FIGURE 43 ADOBE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 44 GOOGLE LLC: COMPANY SNAPSHOT

- FIGURE 45 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 APPLE: COMPANY SNAPSHOT

- FIGURE 47 ORACLE: COMPANY SNAPSHOT

- FIGURE 48 IBM: COMPANY SNAPSHOT

- FIGURE 49 OPENTEXT: COMPANY SNAPSHOT

The digital rights management market is estimated at USD 6.72 billion in 2025 and is expected to reach USD 11.05 billion by 2030 at a CAGR of 10.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By Component, Application, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The shift toward AI, cloud-native deployment, is revolutionizing how enterprises secure digital content and enforce usage rights across platforms. These modern DRM technologies enable organizations to control access to digital assets in real time across streaming platforms, eBooks, enterprise documents, and software, while integrating seamlessly with cloud environments and content delivery networks (CDNs). Cloud-based DRM offers scalability, remote policy enforcement, and centralized license management, which is essential for supporting distributed consumption models in media, publishing, and corporate ecosystems. AI and machine learning play a growing role in DRM, powering anomaly detection, predictive piracy monitoring, and intelligent access control to prevent unauthorized sharing or leaks.

As data privacy regulations intensify and digital assets grow more valuable, businesses are prioritizing flexible DRM platforms that support compliance, geo-blocking, offline access, and watermarking. These innovations are shifting DRM from static access tools to dynamic security frameworks, enabling content owners to deliver protected experiences with speed, adaptability, and data-informed control, driving the next wave of secure digital content consumption.

"The education and training vertical segment will witness the fastest growth during the forecast period."

The rapid expansion of e-learning platforms and digital learning resources drives the education and training vertical. The proliferation of massive open online courses (MOOCs) and digital publications necessitates DRM to protect intellectual property and prevent unauthorized duplication of course materials. Solutions such as Digify protect sensitive documents and ensure compliance with licensing agreements. The rise of remote learning has increased demand for secure digital content distribution.

"Integration service segment is expected to have the largest market size during the forecast period."

Integration services are a critical component of the DRM market, driven by the need to seamlessly incorporate DRM solutions into existing IT ecosystems. Its demand is further propelled by the complexity of integrating DRM with platforms like OTT, IPTV, and enterprise systems, ensuring secure content delivery without disrupting workflows. The rise of cloud-based DRM, such as Microsoft's PlayReady integration with Azure Media Services, requires expert integration to support multi-device streaming and compliance with licensing agreements. Industries like media and entertainment, with growing digital content repositories, rely on integration services to manage large-scale deployments.

"Asia Pacific is expected to record the highest growth rate during the forecast period."

The investment and participation of Asia Pacific in the development of DRM technology have made the region a hotspot for this industry. The region is driven by rapid digitalization and increasing internet penetration. Countries like China, India, and Japan lead due to their expanding entertainment and gaming industries. Government initiatives, such as India's watermarking projects by the Department of Information Technology, enhance DRM adoption. The rise of OTT platforms like Mola.tv, secured by Verimatrix, reflects the region's focus on secure content delivery. High population density and growing cyber threats, as reported by the Data Security Council of India, further necessitate robust DRM solutions to safeguard digital assets and ensure compliance with copyright regulations.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 30%, Tier 2 - 45%, and Tier 3 - 25%

- By Designation: C-level - 35%, D-level - 30%, and Others - 35%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 30%, Middle East & Africa - 5%, Latin America - 5%

The major players in the digital rights management market include Adobe Systems (US), Google LLC (US), Microsoft Corporation (US), Apple (US), Oracle (US), IBM (US), Irdeto (Netherlands), OpenText (Canada), Kudelski Group (Switzerland), Sony Corporation (Japan), Verisign Inc (US), Acquia (US), OVH Cloud (France), Fortra (US), Vitrium Systems (Canada), NextLabs (US), Verimatrix (France), Seclore (US), Digify (US), Bitmovin (US), EditionGuard (US), EZDRM (US), Intertrust Technologies (Us), ArtistScope (Australia), CapLinked (US), Vaultize (India), and Bynder (Netherlands). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, product launches, enhancements, and acquisitions, to expand their digital rights management market footprint.

Research Coverage

- The market study covers the digital rights management market size and the growth potential across different segments, including components, applications, verticals, and regions. The offerings are sub-segmented into solutions and services. The services studied under the digital rights management market include consulting, integration, operation & maintenance. The application segment includes audio content, images, video content, confidential documents, spreadsheets & presentations, software & games, eBooks, and other applications. The vertical segment includes BFSI, education & training, research & publications, media & entertainment, IT & ITeS, healthcare, legal, and other verticals. The regional analysis of the digital rights management market covers North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global digital rights management market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape, gain insights, and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides the following insights.

1. Analysis of key drivers (Greater need to protect intellectual property, increase in penetration of digital devices and technology, Increased vulnerability to cyber-attacks), restraints (Expensive digital rights management solutions and overhead costs), opportunities (Expansion of OTT platforms, Rise in corporate need to protect data), and challenges (Unclear legal precedents) influencing the growth of the digital rights management market.

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital rights management market

3. Market Development: The report provides comprehensive information about lucrative markets, analyzing the digital rights management market across various regions.

4. Market Diversification: Comprehensive information about new products and services, untapped geographies, recent developments, and investments in the digital rights management market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Adobe Systems (US), Google LLC (US), Microsoft Corporation (US), Apple (US), Oracle (US), IBM (US), Irdeto (Netherlands), OpenText (Canada), Kudelski Group (Switzerland), Sony Corporation (Japan), Verisign Inc (US), Acquia (US), OVH Cloud (France), Fortra (US), Vitrium Systems (Canada), NextLabs (US), Verimatrix (France), Seclore (US), Digify (US), Bitmovin (US), EditionGuard (US), EZDRM (US), Intertrust Technologies (Us), ArtistScope (Australia), CapLinked (US), Vaultize (India), and Bynder (Netherlands).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 DIGITAL RIGHTS MANAGEMENT MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.2.4 DIGITAL RIGHTS MANAGEMENT MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DIGITAL RIGHTS MANAGEMENT MARKET

- 4.2 DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT

- 4.3 DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION

- 4.4 DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL

- 4.5 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION AND VERTICAL

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Greater need to protect intellectual property

- 5.2.1.2 Increase in penetration of digital devices and technology

- 5.2.1.3 Increased vulnerability to cyberattacks

- 5.2.2 RESTRAINTS

- 5.2.2.1 Expensive digital rights management solutions and overhead costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of OTT platforms

- 5.2.3.2 Rise in corporate need to protect data

- 5.2.4 CHALLENGES

- 5.2.4.1 Unclear legal precedents

- 5.2.1 DRIVERS

- 5.3 DIGITAL RIGHTS MANAGEMENT MARKET: BRIEF HISTORY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION

- 5.6.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY PRICING MODEL

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Encryption

- 5.7.1.2 Digital watermarking

- 5.7.1.3 Content fingerprinting

- 5.7.1.4 Conditional access system (CAS)

- 5.7.1.5 Artificial intelligence (AI) and machine learning (ML)

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 High-bandwidth digital content protection (HDCP)

- 5.7.2.2 Content delivery network (CDN)

- 5.7.2.3 Augmented/virtual reality

- 5.7.3 COMPLEMENTARY TECHNOLOGIES

- 5.7.3.1 Blockchain

- 5.7.3.2 Multi-factor authentication (MFA)

- 5.7.3.3 Cloud computing

- 5.7.1 KEY TECHNOLOGIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CASE STUDY 1: TATA SKY CHOSE IRTEDO AS A STRATEGIC PARTNER TO SECURE OTT CONTENT

- 5.8.2 CASE STUDY 2: WOHLERS ASSOCIATES DEPLOYED DRM SOLUTIONS PROVIDED BY VITRIUM

- 5.8.3 CASE STUDY 3: CITY ONLINE MEDIA USED PALLYCON'S MULTI-DRM SOLUTION

- 5.8.4 CASE STUDY 4: FLUTTERWAVE USES DIGIFY TO SECURELY SHARE FUNDRAISING DOCUMENTS

- 5.8.5 CASE STUDY 5: DIGIFY PROTECTS RTD LEARNING'S COURSE MATERIALS FROM UNAUTHORIZED ACCESS

- 5.8.6 CASE STUDY 6: PALLYCON DELIVERED A MULTI-DRM SOLUTION TO VIDIO.COM

- 5.8.7 CASE STUDY 7: FTI CONSULTING DEPLOYS ROBUST WATERMARKING TECHNIQUE OF CAPLINKED

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 KEY REGULATIONS

- 5.12.2.1 North America

- 5.12.2.1.1 US

- 5.12.2.1.2 Canada

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.2.3.1 China

- 5.12.2.3.2 India

- 5.12.2.3.3 Australia

- 5.12.2.3.4 Japan

- 5.12.2.4 Middle East & Africa

- 5.12.2.4.1 Middle East

- 5.12.2.4.2 South Africa

- 5.12.2.5 Latin America

- 5.12.2.5.1 Brazil

- 5.12.2.5.2 Mexico

- 5.12.2.1 North America

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 BEST PRACTICES IN DIGITAL RIGHTS MANAGEMENT MARKET

- 5.16 TECHNOLOGY ROADMAP FOR DIGITAL RIGHTS MANAGEMENT MARKET

- 5.16.1 SHORT-TERM ROADMAP (2025-2026)

- 5.16.2 MID-TERM ROADMAP (2026-2028)

- 5.16.3 LONG-TERM ROADMAP (2028-2030)

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 BUSINESS MODELS OF DIGITAL RIGHTS MANAGEMENT

- 5.18.1 CURRENT BUSINESS MODELS

- 5.18.2 EMERGING BUSINESS MODELS

- 5.19 IMPACT OF AI/GENERATIVE AI ON DIGITAL RIGHTS MANAGEMENT MARKET

- 5.19.1 USE CASES OF GENERATIVE AI IN DIGITAL RIGHTS MANAGEMENT

- 5.20 IMPACT OF 2025 US TARIFF - DIGITAL RIGHTS MANAGEMENT MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.5 IMPACT ON END-USE INDUSTRIES

6 DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: DIGITAL RIGHTS MANAGEMENT MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 GROWING NEED TO PROTECT CRITICAL BUSINESS-RELATED INFORMATION

- 6.3 SERVICES

- 6.3.1 CONTINUAL SERVICE RESPONSE DEMAND FROM CONSULTANTS

- 6.3.2 CONSULTING

- 6.3.3 INTEGRATION

- 6.3.4 OPERATION AND MAINTENANCE

7 DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: DIGITAL RIGHTS MANAGEMENT MARKET DRIVERS

- 7.2 AUDIO CONTENT

- 7.2.1 USE OF MP4 FORMAT TO INTEGRATE MULTI-DRM IN AUDIO CONTENT

- 7.3 IMAGES

- 7.3.1 NEED TO PREVENT DOWNLOADING, SHARING, AND MODIFICATION OF IMAGES

- 7.4 VIDEO CONTENT

- 7.4.1 GROWTH OF SECURE STREAMING OF DIGITAL VIDEO CONTENT

- 7.5 CONFIDENTIAL DOCUMENTS, SPREADSHEETS, AND PRESENTATION

- 7.5.1 GREATER NEED TO PROTECT SENSITIVE DOCUMENTS FROM UNAUTHORIZED ACCESS

- 7.6 SOFTWARE AND GAMES

- 7.6.1 GROWTH OF CONTENT SECURITY THREATS IN GAMING INDUSTRY

- 7.7 EBOOKS

- 7.7.1 DEMAND TO KEEP UNAUTHORIZED DISTRIBUTION OF EBOOKS IN CHECK

- 7.8 OTHER APPLICATIONS

8 DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: DIGITAL RIGHTS MANAGEMENT MARKET DRIVERS

- 8.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 8.2.1 HIGHER THREAT OF CYBER ATTACKS IN BANKING, FINANCIAL SERVICES, AND INSURANCE

- 8.3 EDUCATION AND TRAINING

- 8.3.1 INCREASE IN DIGITAL TRANSFORMATION AND E-LEARNING PLATFORMS

- 8.4 RESEARCH AND PUBLICATIONS

- 8.4.1 NEED TO MAINTAIN AUTHENTICITY AND CREDIBILITY OF PUBLICATIONS

- 8.5 MEDIA AND ENTERTAINMENT

- 8.5.1 RISE IN NEED TO PROTECT DATA FROM ALARMING PIRACY STATISTICS

- 8.6 IT AND ITES

- 8.6.1 NEED TO ENHANCE SECURITY OF CONFIDENTIAL DOCUMENTS

- 8.7 HEALTHCARE

- 8.7.1 PROTECTION OF SENSITIVE HEALTHCARE INFORMATION

- 8.8 LEGAL

- 8.8.1 NEED BY FIRMS TO STAY LEGALLY COMPLIANT AND KEEP DOCUMENTS SECURE

- 8.9 OTHER VERTICALS

9 DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Need for efficient data protection solutions to drive market

- 9.2.3 CANADA

- 9.2.3.1 Increase in cyber solutions to protect businesses from data loss

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Rising need to reduce data breaches

- 9.3.3 GERMANY

- 9.3.3.1 High demand for data protection solutions

- 9.3.4 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Increase in data breaches to drive demand

- 9.4.3 INDIA

- 9.4.3.1 Higher demand for strong content protection systems

- 9.4.4 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Increasing adoption of DRM solutions due to rising cybercrimes

- 9.5.3 AFRICA

- 9.5.3.1 Greater cloud adoption to increase demand

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Increasing investment in digital infrastructure

- 9.6.3 MEXICO

- 9.6.3.1 Growth in innovations to drive market

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.3.1 MARKET RANKING ANALYSIS

- 10.4 REVENUE ANALYSIS, 2021-2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Vertical footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/ SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPETITIVE SCENARIO

- 10.7.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 10.7.2 DEALS

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPANY VALUATION AND FINANCIAL METRICS

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- 11.1.1 ADOBE SYSTEMS

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MNM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 GOOGLE LLC

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches and enhancements

- 11.1.2.3.2 Deals

- 11.1.2.4 MNM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 MICROSOFT CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 APPLE

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and enhancements

- 11.1.4.3.2 Deals

- 11.1.4.4 MNM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 ORACLE

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and enhancements

- 11.1.5.3.2 Deals

- 11.1.5.4 MNM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 IBM

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches and enhancements

- 11.1.6.3.2 Deals

- 11.1.7 IRDETO

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches and enhancements

- 11.1.7.3.2 Deals

- 11.1.8 OPENTEXT

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches and enhancements

- 11.1.8.3.2 Deals

- 11.1.9 KUDELSKI GROUP

- 11.1.10 SONY CORPORATION

- 11.1.11 VERISIGN INC

- 11.1.12 ACQUIA

- 11.1.13 OVHCLOUD

- 11.1.14 FORTRA

- 11.1.1 ADOBE SYSTEMS

- 11.2 SMES/STARTUPS

- 11.2.1 VITRIUM SYSTEMS

- 11.2.1.1 Business overview

- 11.2.1.2 Products/Solutions/Services offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches and enhancements

- 11.2.2 NEXTLABS

- 11.2.2.1 Business overview

- 11.2.2.2 Products/Solutions/Services offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Product launches and enhancements

- 11.2.3 VERIMATRIX

- 11.2.3.1 Business overview

- 11.2.3.2 Products/Solutions/Services offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product launches and enhancements

- 11.2.3.3.2 Deals

- 11.2.4 SECLORE

- 11.2.4.1 Business overview

- 11.2.4.2 Products/Solutions/Services offered

- 11.2.4.3 Recent developments

- 11.2.4.3.1 Product launches and enhancements

- 11.2.4.3.2 Deals

- 11.2.5 VAULTIZE

- 11.2.5.1 Business overview

- 11.2.5.2 Products/Solutions/Services offered

- 11.2.6 BITMOVIN

- 11.2.7 EDITIONGUARD

- 11.2.8 EZDRM

- 11.2.9 INTERTRUST TECHNOLOGIES

- 11.2.10 ARTISTSCOPE

- 11.2.11 CAPLINKED

- 11.2.12 BYNDER

- 11.2.13 DIGIFY

- 11.2.1 VITRIUM SYSTEMS

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 DIGITAL ASSET MANAGEMENT MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING

- 12.2.3 DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION

- 12.2.4 DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 12.2.5 DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL

- 12.2.6 DIGITAL ASSET MANAGEMENT MARKET, BY REGION

- 12.3 ENTERPRISE FILE SYNCHRONIZATION AND SHARING (EFSS) MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 ENTERPRISE FILE SYNCHRONIZATION AND SHARING (EFSS) MARKET, BY OFFERING

- 12.3.3 ENTERPRISE FILE SYNCHRONIZATION AND SHARING (EFSS) MARKET, BY BUSINESS FUNCTION

- 12.3.4 ENTERPRISE FILE SYNCHRONIZATION AND SHARING (EFSS) MARKET, BY APPLICATION

- 12.3.5 ENTERPRISE FILE SYNCHRONIZATION AND SHARING (EFSS) MARKET, BY VERTICAL

- 12.3.6 ENTERPRISE FILE SYNCHRONIZATION AND SHARING (EFSS) MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS