|

|

市場調査レポート

商品コード

1794025

永久磁石の世界市場:タイプ別、動作温度別、製造プロセス別、最終用途産業別、地域別 - 2030年までの予測Permanent Magnet Market by Type (NdFeB, SmCo, Ferrite, AlNiCo), Operating Temperature (Standard, High, Ultra-High), Manufacturing Process (Sintered, Bonded), End-use Industry, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 永久磁石の世界市場:タイプ別、動作温度別、製造プロセス別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月14日

発行: MarketsandMarkets

ページ情報: 英文 294 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

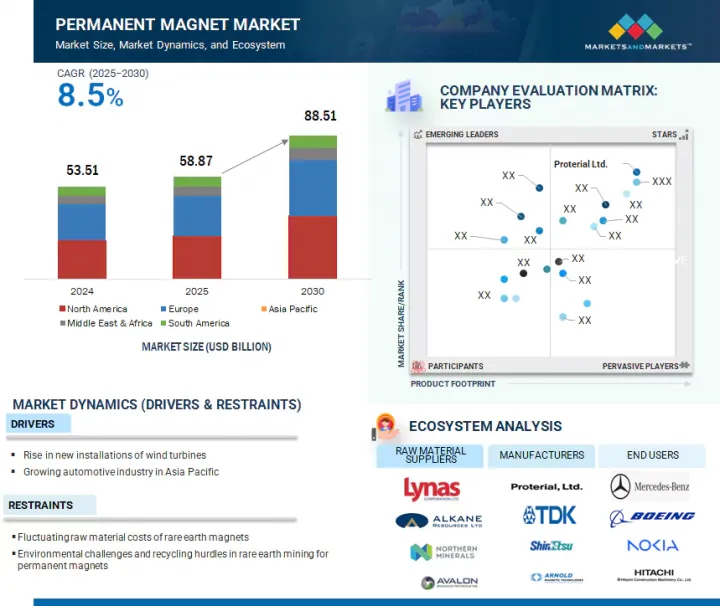

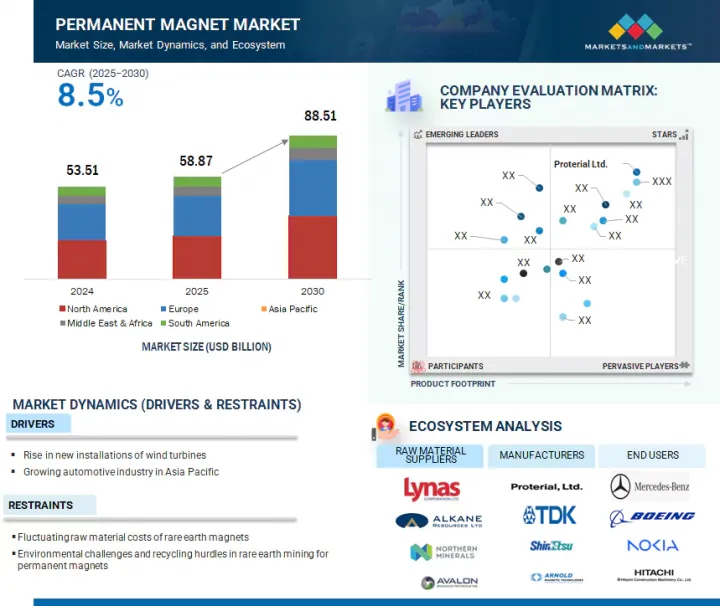

永久磁石の市場規模は、8.5%のCAGRで拡大し、2025年の588億7,000万米ドルから2030年には885億1,000万米ドルに達すると予測されています。

サマリウム・コバルト磁石は、優れた磁気強度、高い減磁抵抗、優れた温度安定性で知られています。これらの磁石は高温でも効率的に動作し、耐腐食性に優れているため、航空宇宙・防衛、医療機器、家電製品などの要求の厳しい用途に最適です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | タイプ別、動作温度別、製造プロセス別、最終用途産業別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

サマリウム・コバルト磁石は、最高350℃またはそれ以上の温度でも磁気特性を維持することができ、80℃前後で効果を失い始めるネオジム鉄ボロン磁石の限界を上回ります。

高温で動作する永久磁石は、卓越した熱安定性と減磁に対する耐性を提供します。家電、自動車、一般産業、医療技術、航空宇宙・防衛、環境・エネルギーなどの業界では、高温下でも性能を維持できる磁石が必要とされることが多いです。アルニコ磁石、SmCo磁石、フェライト磁石は、永久磁石の中で最も高い耐熱性を持ち、性能を損なうことがありません。これらの磁石は、標準的なNdFeB磁石では強度が低下したり、不可逆的な損傷を受けたりするような環境で好まれ、主要部品の信頼性と寿命を保証します。

電気自動車やハイブリッド車の急速な普及により、自動車業界では永久磁石の需要が急速に高まっています。永久磁石、特にネオジム鉄ボロン磁石は、高いトルク密度、優れた効率、コンパクトなサイズを提供し、これらはすべて、自動車の性能向上とバッテリー航続距離の延長に不可欠です。二酸化炭素排出量削減への世界の取り組みが強化されるにつれ、自動車メーカーは電気推進システムの採用を増やしており、これが永久磁石の需要をさらに押し上げています。バッテリーと磁石技術の継続的な進歩は、クリーンエネルギーに対する政府の支援政策とともに、自動車産業における永久磁石の統合を加速させています。

この地域における永久磁石市場の成長は、主に民生用電子機器、自動車、産業用途の増加によって牽引されています。同市場は地理的に広く、定評のある参入企業が存在します。これらの参入企業のほとんどは欧州に拠点を置いています。ドイツでは、永久磁石の需要は主に民生用電子機器産業に支えられています。同国では、家電製品、ウェアラブルデバイス、スマートホーム、拡張現実(AR)や仮想現実(Virtual Reality)の進歩に対する需要が高まっており、これが家電セクター内の永久磁石市場の成長を後押しすると予想されています。2025年までに、ドイツの大手磁石メーカーVacuumschmelze GmbH &Co.KGは、米国のOEMをサポートするために米国事業を拡大し、EVや防衛システムに使用される高性能磁石の主要な非中国サプライヤーとしての地位を確立する計画です。

当レポートでは、世界の永久磁石市場について調査し、タイプ別、動作温度別、製造プロセス別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 価格分析

- マクロ経済見通し

- サプライチェーン分析

- エコシステム分析

- 貿易分析

- 技術分析

- 特許分析

- 規制状況

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向と混乱

- AI/生成AIの影響

- 投資と資金調達のシナリオ

- 2025年の米国関税

- 希土類鉱物処理と永久磁石製造における中国の優位性の影響

第6章 永久磁石市場(タイプ別)

- イントロダクション

- NDFEB

- SMCO

- アルニコ

- フェライト

- その他

第7章 永久磁石市場(動作温度別)

- イントロダクション

- 標準温度

- 高温

- 超高温

第8章 永久磁石市場(製造プロセス別)

- イントロダクション

- 焼結

- 結合

第9章 永久磁石市場(最終用途産業別)

- イントロダクション

- 家電

- 一般産業

- 自動車

- 医療技術

- 環境とエネルギー

- 航空宇宙・防衛

- その他

第10章 永久磁石市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- ロシア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- インドネシア

- その他

- 中東・アフリカ

- GCC

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- PROTERIAL, LTD.

- ARNOLD MAGNETIC TECHNOLOGIES

- TDK CORPORATION

- YANTAI DONGXING MAGNETIC MATERIALS INC.

- SHIN-ETSU CHEMICAL CO., LTD.

- ELECTRON ENERGY CORPORATION

- ADAMS MAGNETIC PRODUCTS, LLC

- BUNTING MAGNETICS CO.

- TENGAM ENGINEERING, INC.

- NINGBO YUNSHENG CO., LTD.

- CHENGDU GALAXY MAGNETS CO., LTD.

- GOUDSMIT MAGNETICS

- ECLIPSE MAGNETICS

- DEXTER MAGNETIC TECHNOLOGIES

- EARTH-PANDA ADVANCED MAGNETIC MATERIAL CO., LTD.

- その他の企業

- HANGZHOU PERMANENT MAGNET GROUP, LTD

- JPMF GUANGDONG CO., LTD

- NINGBO NINGGANG PERMANENT MAGNETIC MATERIALS CO., LTD

- THOMAS AND SKINNER INC.

- YANTAI ZHENGHAI MAGNETIC MATERIAL CO., LTD.

- NINGBO CO-STAR MATERIALS HI-TECH CO., LTD.

- NINGBO RISHENG MAGNETS CO., LTD.

- VACUUMSCHMELZE GMBH & CO. KG

- DAIDO ELECTRONICS CO., LTD.

- PERMANENT MAGNETS LTD.

- MAGNEQUENCH INTERNATIONAL, LLC

第13章 付録

List of Tables

- TABLE 1 ONSHORE WIND OUTLOOK FOR NEW INSTALLATIONS (GW)

- TABLE 2 OFFSHORE WIND OUTLOOK FOR NEW INSTALLATIONS (GW)

- TABLE 3 ANNUAL AUTOMOBILE MANUFACTURING IN INDIA, 2019-2025

- TABLE 4 NEODYMIUM PRICE VOLATILITY, 2021-2024

- TABLE 5 EV SALES, 2024

- TABLE 6 IMPACT OF PORTER'S FIVE FORCES

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 9 AVERAGE SELLING PRICE OF PERMANENT MAGNETS OFFERED BY KEY PLAYERS, 2024 (USD/KG)

- TABLE 10 AVERAGE SELLING PRICE TREND OF PERMANENT MAGNETS, BY REGION, 2021-2024 (USD/KG)

- TABLE 11 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021-2029 (%)

- TABLE 12 ROLES OF COMPANIES IN ECOSYSTEM

- TABLE 13 IMPORT DATA FOR HS CODE 850511-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 850511-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 TOTAL NUMBER OF PATENTS, 2015-2025

- TABLE 16 PATENTS BY MITSUBISHI ELECTRIC CORP

- TABLE 17 PATENTS BY UNIVERSITY OF JIANGSU

- TABLE 18 TOP 10 US PATENT OWNERS, 2015-2025

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 CURRENT STANDARDS FOR PERMANENT MAGNETS

- TABLE 24 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 25 TOP USE CASES AND MARKET POTENTIAL

- TABLE 26 AI IMPLEMENTATION IN PERMANENT MAGNET MARKET

- TABLE 27 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 28 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR PERMANENT MAGNETS

- TABLE 29 ANTICIPATED CHANGES IN PRICES AND POTENTIAL IMPACT ON END-USE MARKET

- TABLE 30 PERMANENT MAGNET MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 31 PERMANENT MAGNET MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 32 PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 33 PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 34 NDFEB: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 NDFEB: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 36 NDFEB: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 NDFEB: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 38 SMCO: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 SMCO: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 40 SMCO: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 SMCO: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 42 ALNICO: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 ALNICO: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 44 ALNICO: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 ALNICO: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 46 FERRITE: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 FERRITE: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 48 FERRITE: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 FERRITE: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 50 OTHER TYPES: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 OTHER TYPES: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 52 OTHER TYPES: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 OTHER TYPES: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 54 PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2020-2024 (USD MILLION)

- TABLE 55 PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2020-2024 (KILOTON)

- TABLE 56 PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 57 PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (KILOTON)

- TABLE 58 STANDARD: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 STANDARD: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 60 STANDARD: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 STANDARD: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 62 HIGH: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 HIGH: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 64 HIGH: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 HIGH: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 66 ULTRA-HIGH: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 ULTRA-HIGH: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 68 ULTRA-HIGH: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 ULTRA-HIGH: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 70 PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2020-2024 (USD MILLION)

- TABLE 71 PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2020-2024 (KILOTON)

- TABLE 72 PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 73 PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KILOTON)

- TABLE 74 SINTERED: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 SINTERED: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 76 SINTERED: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 SINTERED: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 78 BONDED: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 BONDED: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 80 BONDED: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 BONDED: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 82 PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 83 PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 84 PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 85 PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 86 CONSUMER ELECTRONICS: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 CONSUMER ELECTRONICS: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 88 CONSUMER ELECTRONICS: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 CONSUMER ELECTRONICS: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 90 GENERAL INDUSTRIAL: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 91 GENERAL INDUSTRIAL: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 92 GENERAL INDUSTRIAL: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 GENERAL INDUSTRIAL: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 94 AUTOMOTIVE: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 95 AUTOMOTIVE: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 96 AUTOMOTIVE: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 AUTOMOTIVE: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 98 MEDICAL TECHNOLOGY: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 99 MEDICAL TECHNOLOGY: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 100 MEDICAL TECHNOLOGY: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 MEDICAL TECHNOLOGY: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 102 ONSHORE WIND INSTALLATIONS, BY REGION, 2024

- TABLE 103 ENVIRONMENT & ENERGY: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 104 ENVIRONMENT & ENERGY: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 105 ENVIRONMENT & ENERGY: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 ENVIRONMENT & ENERGY: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 107 GLOBAL COMMERCIAL AIRCRAFT FLEET DELIVERIES, BY AIRCRAFT TYPE, 2023-2042 (UNIT)

- TABLE 108 AEROSPACE & DEFENSE: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 109 AEROSPACE & DEFENSE: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 110 AEROSPACE & DEFENSE: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 AEROSPACE & DEFENSE: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 112 OTHER END-USE INDUSTRIES: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 113 OTHER END-USE INDUSTRIES: PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 114 OTHER END-USE INDUSTRIES: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 OTHER END-USE INDUSTRIES: PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 116 PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 117 PERMANENT MAGNET MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 118 PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 PERMANENT MAGNET MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 120 NORTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 121 NORTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 122 NORTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 124 NORTH AMERICA: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2020-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2020-2024 (KILOTON)

- TABLE 126 NORTH AMERICA: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (KILOTON)

- TABLE 128 NORTH AMERICA: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2020-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2020-2024 (KILOTON)

- TABLE 130 NORTH AMERICA: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KILOTON)

- TABLE 132 NORTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 134 NORTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 136 NORTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 138 NORTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 140 US: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 141 US: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 142 US: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 US: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 144 CANADA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 145 CANADA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 146 CANADA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 CANADA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 148 MEXICO: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 149 MEXICO: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 150 MEXICO: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 MEXICO: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 152 EUROPE: PERMANENT MAGNET MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 153 EUROPE: PERMANENT MAGNET MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 154 EUROPE: PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 155 EUROPE: PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 156 EUROPE: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2020-2024 (USD MILLION)

- TABLE 157 EUROPE: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2020-2024 (KILOTON)

- TABLE 158 EUROPE: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 159 EUROPE: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (KILOTON)

- TABLE 160 EUROPE: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2020-2024 (USD MILLION)

- TABLE 161 EUROPE: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2020-2024 (KILOTON)

- TABLE 162 EUROPE: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 163 EUROPE: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KILOTON)

- TABLE 164 EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 165 EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 166 EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 168 EUROPE: PERMANENT MAGNET MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 169 EUROPE: PERMANENT MAGNET MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 170 EUROPE: PERMANENT MAGNET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171 EUROPE: PERMANENT MAGNET MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 172 GERMANY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 173 GERMANY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 174 GERMANY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 175 GERMANY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 176 FRANCE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 177 FRANCE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 178 FRANCE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 179 FRANCE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 180 UK: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 181 UK: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 182 UK: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 183 UK: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 184 ITALY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 185 ITALY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 186 ITALY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 187 ITALY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 188 RUSSIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 189 RUSSIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 190 RUSSIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 191 RUSSIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 192 REST OF EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 193 REST OF EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 194 REST OF EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 195 REST OF EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 196 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 197 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 198 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 199 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 200 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2020-2024 (USD MILLION)

- TABLE 201 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2020-2024 (KILOTON)

- TABLE 202 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 203 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (KILOTON)

- TABLE 204 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2020-2024 (USD MILLION)

- TABLE 205 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2020-2024 (KILOTON)

- TABLE 206 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KILOTON)

- TABLE 208 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 209 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 210 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 211 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 212 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 213 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 214 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 215 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 216 CHINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 217 CHINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 218 CHINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 219 CHINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 220 JAPAN: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 221 JAPAN: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 222 JAPAN: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 223 JAPAN: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 224 INDIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 225 INDIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 226 INDIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 227 INDIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 228 SOUTH KOREA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 229 SOUTH KOREA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 230 SOUTH KOREA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 231 SOUTH KOREA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 232 INDONESIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 233 INDONESIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 234 INDONESIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 235 INDONESIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 236 REST OF ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 237 REST OF ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 238 REST OF ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 240 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 242 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 244 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2020-2024 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2020-2024 (KILOTON)

- TABLE 246 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (KILOTON)

- TABLE 248 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2020-2024 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2020-2024 (KILOTON)

- TABLE 250 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KILOTON)

- TABLE 252 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 254 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 256 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 258 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 260 UAE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 261 UAE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 262 UAE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 263 UAE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 264 SAUDI ARABIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 265 SAUDI ARABIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 266 SAUDI ARABIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 267 SAUDI ARABIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 268 REST OF GCC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 269 REST OF GCC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 270 REST OF GCC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 271 REST OF GCC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 272 SOUTH AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 273 SOUTH AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 274 SOUTH AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 275 SOUTH AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 276 REST OF MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 277 REST OF MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 278 REST OF MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 279 REST OF MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 280 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 281 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 282 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 283 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 284 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2020-2024 (USD MILLION)

- TABLE 285 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2020-2024 (KILOTON)

- TABLE 286 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 287 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (KILOTON)

- TABLE 288 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2020-2024 (USD MILLION)

- TABLE 289 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2020-2024 (KILOTON)

- TABLE 290 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 291 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KILOTON)

- TABLE 292 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 293 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 294 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 295 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 296 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 297 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 298 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 299 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 300 BRAZIL: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 301 BRAZIL: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 302 BRAZIL: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 303 BRAZIL: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 304 ARGENTINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 305 ARGENTINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 306 ARGENTINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 307 ARGENTINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 308 REST OF SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 309 REST OF SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 310 REST OF SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 311 REST OF SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 312 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 313 PERMANENT MAGNET MARKET: DEGREE OF COMPETITION, 2024

- TABLE 314 REGION FOOTPRINT

- TABLE 315 TYPE FOOTPRINT

- TABLE 316 OPERATING TEMPERATURE FOOTPRINT

- TABLE 317 MANUFACTURING PROCESS FOOTPRINT

- TABLE 318 END-USE INDUSTRY FOOTPRINT

- TABLE 319 LIST OF START-UPS/SMES

- TABLE 320 COMPETITIVE BENCHMARKING OF START-UPS/SMES (1/2)

- TABLE 321 COMPETITIVE BENCHMARKING OF START-UPS/SMES (2/2)

- TABLE 322 PERMANENT MAGNET MARKET: DEALS, 2020-2025

- TABLE 323 PERMANENT MAGNET MARKET: EXPANSIONS, 2020-2025

- TABLE 324 PROTERIAL, LTD.: COMPANY OVERVIEW

- TABLE 325 PROTERIAL, LTD.: PRODUCTS OFFERED

- TABLE 326 ARNOLD MAGNETIC TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 327 ARNOLD MAGNETIC TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 328 ARNOLD MAGNETIC TECHNOLOGIES: DEALS

- TABLE 329 ARNOLD MAGNETIC TECHNOLOGIES: EXPANSIONS

- TABLE 330 TDK CORPORATION: COMPANY OVERVIEW

- TABLE 331 TDK CORPORATION: PRODUCTS OFFERED

- TABLE 332 TDK CORPORATION: DEALS

- TABLE 333 YANTAI DONGXING MAGNETIC MATERIALS INC.: COMPANY OVERVIEW

- TABLE 334 YANTAI DONGXING MAGNETIC MATERIALS INC.: PRODUCTS OFFERED

- TABLE 335 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 336 SHIN-ETSU CHEMICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 337 SHIN-ETSU CHEMICAL CO., LTD.: DEALS

- TABLE 338 ELECTRON ENERGY CORPORATION: COMPANY OVERVIEW

- TABLE 339 ELECTRON ENERGY CORPORATION: PRODUCTS OFFERED

- TABLE 340 ELECTRON ENERGY CORPORATION: DEALS

- TABLE 341 ADAMS MAGNETIC PRODUCTS, LLC: COMPANY OVERVIEW

- TABLE 342 ADAMS MAGNETIC PRODUCTS, LLC: PRODUCTS OFFERED

- TABLE 343 BUNTING MAGNETICS CO.: COMPANY OVERVIEW

- TABLE 344 BUNTING MAGNETICS CO.: PRODUCTS OFFERED

- TABLE 345 BUNTING MAGNETICS CO.: DEALS

- TABLE 346 BUNTING MAGNETICS CO.: EXPANSIONS

- TABLE 347 TENGAM ENGINEERING, INC.: COMPANY OVERVIEW

- TABLE 348 TENGAM ENGINEERING, INC.: PRODUCTS OFFERED

- TABLE 349 NINGBO YUNSHENG CO., LTD.: COMPANY OVERVIEW

- TABLE 350 NINGBO YUNSHENG CO., LTD.: PRODUCTS OFFERED

- TABLE 351 CHENGDU GALAXY MAGNETS CO., LTD.: COMPANY OVERVIEW

- TABLE 352 CHENGDU GALAXY MAGNETS CO., LTD.: PRODUCTS OFFERED

- TABLE 353 GOUDSMIT MAGNETICS: COMPANY OVERVIEW

- TABLE 354 GOUDSMIT MAGNETICS: PRODUCTS OFFERED

- TABLE 355 ECLIPSE MAGNETICS: COMPANY OVERVIEW

- TABLE 356 ECLIPSE MAGNETICS: PRODUCTS OFFERED

- TABLE 357 DEXTER MAGNETIC TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 358 DEXTER MAGNETIC TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 359 DEXTER MAGNETIC TECHNOLOGIES: DEALS

- TABLE 360 DEXTER MAGNETIC TECHNOLOGIES: EXPANSIONS

- TABLE 361 EARTH-PANDA ADVANCED MAGNETIC MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 362 EARTH-PANDA ADVANCED MAGNETIC MATERIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 363 HANGZHOU PERMANENT MAGNET GROUP, LTD: COMPANY OVERVIEW

- TABLE 364 JPMF GUANGDONG CO., LTD: COMPANY OVERVIEW

- TABLE 365 NINGBO NINGGANG PERMANENT MAGNETIC MATERIALS CO., LTD: COMPANY OVERVIEW

- TABLE 366 THOMAS AND SKINNER INC.: COMPANY OVERVIEW

- TABLE 367 YANTAI ZHENGHAI MAGNETIC MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 368 NINGBO CO-STAR MATERIALS HI-TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 369 NINGBO RISHENG MAGNETS CO., LTD.: COMPANY OVERVIEW

- TABLE 370 VACUUMSCHMELZE GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 371 DAIDO ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 372 PERMANENT MAGNETS LTD.: COMPANY OVERVIEW

- TABLE 373 MAGNEQUENCH INTERNATIONAL, LLC: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PERMANENT MAGNET MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF PERMANENT MAGNET MARKET

- FIGURE 6 METHODOLOGY FOR DEMAND-SIDE SIZING OF PERMANENT MAGNET MARKET

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 NDFEB SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 9 CONSUMER ELECTRONICS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 10 STANDARD SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 11 SINTERED TO HOLD HIGHER SHARE THAN BONDED DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 13 HIGH DEMAND FROM CONSUMER ELECTRONICS AND AUTOMOTIVE INDUSTRIES TO DRIVE MARKET

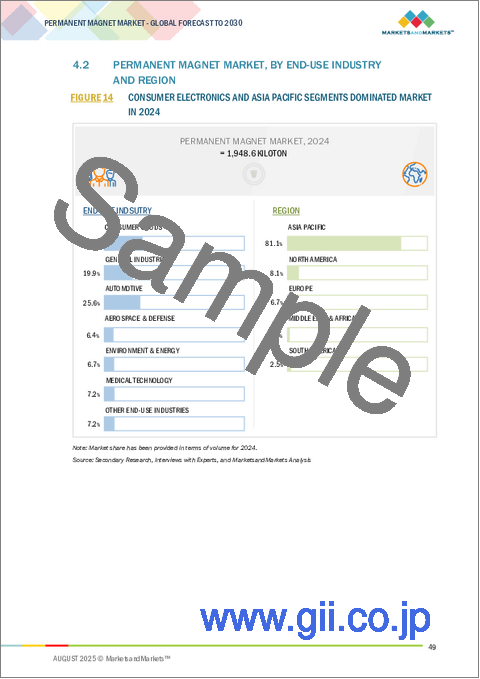

- FIGURE 14 CONSUMER ELECTRONICS AND ASIA PACIFIC SEGMENTS DOMINATED MARKET IN 2024

- FIGURE 15 SMCO SEGMENT TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 STANDARD SEGMENT TO BE PREVALENT DURING FORECAST PERIOD

- FIGURE 17 BONDED SEGMENT TO EXPERIENCE FASTER GROWTH DURING FORECAST PERIOD

- FIGURE 18 CONSUMER ELECTRONICS TO EXCEED OTHER INDUSTRIES DURING FORECAST PERIOD

- FIGURE 19 CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 PERMANENT MAGNET MARKET DYNAMICS

- FIGURE 21 NEW WIND TURBINE INSTALLATIONS, 2020-2024 (GW)

- FIGURE 22 GLOBAL WIND TURBINE INSTALLATION CAPACITY, 2020-2024 (GW)

- FIGURE 23 ELECTRIC CAR REGISTRATIONS AND SALES SHARE, 2018-2023

- FIGURE 24 GLOBAL ELECTRIC CAR SALES, 2018-2024

- FIGURE 25 RARE EARTH RESERVES, 2022

- FIGURE 26 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 29 AVERAGE SELLING PRICE TREND OF PERMANENT MAGNETS, BY REGION, 2021-2024 (USD/KG)

- FIGURE 30 SUPPLY CHAIN ANALYSIS

- FIGURE 31 ECOSYSTEM ANALYSIS

- FIGURE 32 IMPORT DATA FOR HS CODE 850511-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 33 EXPORT DATA FOR HS CODE 850511-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 34 PATENT ANALYSIS, BY DOCUMENT TYPE, 2015-2025

- FIGURE 35 PATENT PUBLICATION TRENDS, 2015-2025

- FIGURE 36 LEGAL STATUS OF PATENTS, 2015-2025

- FIGURE 37 TOP 10 PATENT JURISDICTIONS, 2015-2025

- FIGURE 38 TOP 10 PATENT APPLICANTS, 2015-2025

- FIGURE 39 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 40 INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 41 PERMANENT MAGNET MARKET, BY TYPE, 2025-2030 (USD MILLION)

- FIGURE 42 PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE, 2025-2030 (USD MILLION)

- FIGURE 43 PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- FIGURE 44 PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- FIGURE 45 PERMANENT MAGNET MARKET, BY COUNTRY, 2025-2030

- FIGURE 46 NORTH AMERICA: PERMANENT MAGNET MARKET SNAPSHOT

- FIGURE 47 EUROPE: PERMANENT MAGNET MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: PERMANENT MAGNET MARKET SNAPSHOT

- FIGURE 49 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 50 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 51 TOP TRENDING BRANDS/PRODUCTS

- FIGURE 52 BRAND/PRODUCT COMPARISON

- FIGURE 53 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 COMPANY FOOTPRINT

- FIGURE 55 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 56 COMPANY VALUATION (USD MILLION)

- FIGURE 57 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 58 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA

- FIGURE 59 TDK CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 61 NINGBO YUNSHENG CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 CHENGDU GALAXY MAGNETS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 63 EARTH-PANDA ADVANCED MAGNETIC MATERIAL CO., LTD.: COMPANY SNAPSHOT

The permanent magnet market is projected to reach USD 88.51 billion by 2030, from USD 58.87 billion in 2025, at a CAGR of 8.5%. Samarium Cobalt magnets are known for their excellent magnetic strength, high resistance to demagnetization, and outstanding temperature stability. These magnets can operate efficiently at elevated temperatures and are highly resistant to corrosion, making them ideal for demanding applications in aerospace and defense, medical equipment, and consumer electronics.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Type, Operating Temperature, Manufacturing Process, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

Samarium Cobalt magnets can maintain their magnetic properties at temperatures up to 350°C or even higher, surpassing the limits of neodymium iron boron magnets, which start losing effectiveness around 80°C.

In terms of value, high operating temperature is the second-largest segment in the permanent magnet market."

Permanent magnets operating at high temperatures offer exceptional thermal stability and resistance to demagnetization. Industries such as consumer electronics, automotive, general industrial, medical technology, aerospace & defense, and environment & energy often require magnets that can maintain performance under elevated temperatures. Alnico, SmCo, and ferrite magnets provide the highest temperature resistance among permanent magnets, without any loss of performance. These magnets are preferred in environments where standard NdFeB magnets would lose strength or suffer irreversible damage, ensuring reliability and longevity of key components.

"In terms of value, the automotive industry ranks second in the permanent magnet market."

Due to the rapid growth in electric and hybrid vehicles, the demand for permanent magnets is quickly increasing in the automotive industry. Permanent magnets, particularly Neodymium Iron Boron magnets, offer high torque density, superior efficiency, and a compact size, all of which are essential for improving vehicle performance and extending battery range. As global efforts to reduce carbon emissions intensify, automobile manufacturers are increasingly adopting electric propulsion systems, which further drives demand for permanent magnets. Ongoing advancements in battery and magnet technology, along with supportive government policies for clean energy, have accelerated the integration of permanent magnets in the automotive industry.

"The permanent magnet market in Europe is projected to register the third-highest CAGR."

The growth of the permanent magnet market in this region is primarily driven by increasing consumer electronics, automotive, and industrial applications. The market has a wide geographical presence with well-established players. Most of these players are based in Europe. In Germany, the demand for permanent magnets is mainly fueled by the consumer electronics industry. The country is experiencing a high demand for home appliances, wearable devices, smart homes, and advancements in augmented and virtual reality, which are expected to boost the growth of the permanent magnet market within the consumer electronics sector. By 2025, a leading German magnet manufacturer, Vacuumschmelze GmbH & Co. KG, plans to expand its US operations to support American OEMs and establish itself as a key non-Chinese supplier of high-performance magnets used in EVs and defense systems.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, D-level- 30%, and Executives- 20%

- By Region: North America - 20%, Europe - 15%, Asia Pacific - 50%, South America - 5%, and Middle East & Africa -10%.

The report provides a comprehensive analysis of company profiles:

Prominent companies include Proterial, Ltd. (Japan), Arnold Magnetic Technologies (US), TDK Corporation (Japan), Yantai Dongxing Magnetic Materials Inc. (China), Shin-Etsu Chemical Co., Ltd. (Japan), Electron Energy Corporation (US), Adams Magnetic Products, LLC (US), Bunting Magnetics Co. (US), Tengam Engineering, Inc. (US), Ningbo Yunsheng Co., Ltd. (China), Chengdu Galaxy Magnets Co., Ltd. (China), Goudsmit Magnetics (Netherlands), Eclipse Magnetics (UK), Dexter Magnetic Technologies (US), and Earth Panda Advance Magnetic Material Co., Ltd. (China).

Research Coverage

This research report categorizes the permanent magnet market by type (Neodymium Iron Boron, Samarium Cobalt, Ferrite, Aluminum Nickel Cobalt, and others), operating temperature (Standard, High, Ultra-High), manufacturing process (Sintered, Bonded), end-use industry (Consumer Electronics, General Industrial, Automotive, Medical Technology, Environment & Energy, Aerospace & Defense, and others), and region (Asia Pacific, Europe, North America, Middle East & Africa, and South America). The scope of the report includes detailed information about key drivers, restraints, challenges, and opportunities influencing the growth of the permanent magnet market. A comprehensive analysis of key industry players provides insights into their business overview, solutions, and services, as well as key strategies such as contracts, partnerships, and agreements. The report also covers new product and service launches, mergers and acquisitions, and other developments related to the permanent magnet market. Competitive analysis of upcoming startups within the permanent magnet market ecosystem is included in the report.

Reasons to buy this report:

The report will assist market leaders and new entrants by providing estimated revenue figures for the permanent magnet market and its segments. It will help stakeholders understand the competitive landscape and gain insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report offers key market insights, including main drivers, restraints, challenges, and opportunities, helping stakeholders grasp the market's current pulse.

The report provides insights on the following pointers:

- Analysis of key drivers (Rise in new installations of wind turbines, Growing automotive industry in Asia Pacific), restraints (Fluctuating raw material costs of rare earth magnets), opportunities (Increasing demand for electric and hybrid vehicles), and challenges (High reliance on China for raw materials and magnets) influencing the growth of the permanent magnet market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and new product & service launches in the permanent magnet market

- Market Development: Comprehensive information about lucrative markets; The report analyses the permanent magnet market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the permanent magnet market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Proterial, Ltd. (Japan), Arnold Magnetic Technologies (US), TDK Corporation (Japan), Yantai Dongxing Magnetic Materials Inc. (China), and Shin-Etsu Chemical Co., Ltd. (Japan), among others, in the permanent magnet market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PERMANENT MAGNET MARKET

- 4.2 PERMANENT MAGNET MARKET, BY END-USE INDUSTRY AND REGION

- 4.3 PERMANENT MAGNET MARKET, BY TYPE

- 4.4 PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE

- 4.5 PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS

- 4.6 PERMANENT MAGNET MARKET, BY END-USE INDUSTRY

- 4.7 PERMANENT MAGNET MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in new installations of wind turbines

- 5.2.1.2 Rapidly growing automotive industry in Asia Pacific

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuating raw material prices

- 5.2.2.2 Environmental constraints and recycling hurdles in rare earth mining

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Elevated demand for permanent magnets in electric and hybrid vehicles

- 5.2.3.2 Push for environmentally friendly magnets

- 5.2.3.3 Government initiatives to enhance domestic production of magnets

- 5.2.4 CHALLENGES

- 5.2.4.1 Heavy reliance on China for raw materials

- 5.2.4.2 Need for substantial R&D investments

- 5.2.4.3 Environmental impacts of permanent magnet manufacturing

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF PERMANENT MAGNETS OFFERED BY KEY PLAYERS

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 MACROECONOMIC OUTLOOK

- 5.6.1 INTRODUCTION

- 5.6.2 GDP TRENDS AND FORECAST

- 5.6.3 TRENDS IN PERMANENT MAGNET MARKET

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 850511)

- 5.9.2 EXPORT SCENARIO (HS CODE 850511)

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Powder metallurgy

- 5.10.1.2 Bonding

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Injection molding

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- 5.11.2 METHODOLOGY

- 5.11.3 DOCUMENT TYPES

- 5.11.4 INSIGHTS

- 5.11.5 LEGAL STATUS

- 5.11.6 JURISDICTION ANALYSIS

- 5.11.7 TOP APPLICANT ANALYSIS

- 5.12 REGULATORY LANDSCAPE

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 ADVANCES IN MATERIAL SCIENCE AND MANUFACTURING FOR HIGH-PERFORMANCE PERMANENT MAGNETS

- 5.14.2 HITACHI METALS' COERCIVE NDFEB MAGNETS FOR ELECTRIC VEHICLES

- 5.14.3 ARNOLD'S PROPRIETARY THIN-FILM MAGNETS FOR MEDICAL DEVICES

- 5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 IMPACT OF AI/GEN AI

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.19 IMPACT OF CHINA'S DOMINANCE IN RARE-EARTH MINERAL PROCESSING AND PERMANENT MAGNET MANUFACTURING

- 5.19.1 INTRODUCTION

- 5.19.2 RARE-EARTH MINERAL PROCESSING

- 5.19.3 PERMANENT MAGNET MANUFACTURING

- 5.19.4 IMPACT ON END-USE INDUSTRIES

- 5.19.5 IMPACT ON REGIONS

6 PERMANENT MAGNET MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 NDFEB

- 6.2.1 RISE IN GLOBAL EV SALES TO DRIVE MARKET

- 6.3 SMCO

- 6.3.1 INCREASE IN DEMAND FROM OFFSHORE WIND INDUSTRY TO DRIVE MARKET

- 6.4 ALNICO

- 6.4.1 EXTENSIVE USE IN CONSUMER ELECTRONICS TO DRIVE MARKET

- 6.5 FERRITE

- 6.5.1 COST-EFFECTIVENESS OVER OTHER MAGNETS TO DRIVE MARKET

- 6.6 OTHER TYPES

7 PERMANENT MAGNET MARKET, BY OPERATING TEMPERATURE

- 7.1 INTRODUCTION

- 7.2 STANDARD

- 7.2.1 PREDOMINANCE IN AUTOMOTIVE AND ELECTRONICS INDUSTRIES TO DRIVE MARKET

- 7.3 HIGH

- 7.3.1 SUPERIOR MAGNETIC PROPERTIES IN EXTREME HEAT CONDITIONS TO DRIVE MARKET

- 7.4 ULTRA-HIGH

- 7.4.1 NEED FOR EFFICIENT PERFORMANCE UNDER THERMAL STRESS TO DRIVE MARKET

8 PERMANENT MAGNET MARKET, BY MANUFACTURING PROCESS

- 8.1 INTRODUCTION

- 8.2 SINTERED

- 8.2.1 PRODUCTION OF HIGH-PERFORMANCE MAGNETS WITH STRONG COERCIVITY TO DRIVE MARKET

- 8.3 BONDED

- 8.3.1 SIGNIFICANT INVESTMENTS IN R&D AND CLEAN ENERGY TECHNOLOGIES TO DRIVE MARKET

9 PERMANENT MAGNET MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 CONSUMER ELECTRONICS

- 9.2.1 ROBUST DEMAND FROM EMERGING ECONOMIES TO DRIVE MARKET

- 9.2.2 DC MOTORS

- 9.2.3 LOUDSPEAKERS

- 9.2.4 GENERATORS

- 9.3 GENERAL INDUSTRIAL

- 9.3.1 WIDESPREAD USE OF MAGNETIC ASSEMBLIES IN PROCESSING INDUSTRIES TO DRIVE MARKET

- 9.3.2 MAGNETIC ASSEMBLIES

- 9.3.3 MAGNETIC SEPARATORS

- 9.4 AUTOMOTIVE

- 9.4.1 HEIGHTENED DEMAND FOR PERMANENT MAGNETS FROM EV MANUFACTURERS TO DRIVE MARKET

- 9.4.2 MOTORS

- 9.4.3 SENSORS

- 9.4.4 SWITCHES

- 9.5 MEDICAL TECHNOLOGY

- 9.5.1 ONGOING RESEARCH AND DEVELOPMENT OF NEW MAGNETIC MATERIALS TO DRIVE MARKET

- 9.5.2 SCANNING DEVICES

- 9.5.3 IMPLANTABLE DEVICES

- 9.6 ENVIRONMENT & ENERGY

- 9.6.1 RAPID DEPLOYMENT IN SMALL WIND TURBINES TO DRIVE MARKET

- 9.6.2 WIND TURBINES

- 9.7 AEROSPACE & DEFENSE

- 9.7.1 INCREASED SALES OF NEW PRIVATE BUSINESS JETS TO DRIVE MARKET

- 9.7.2 ELECTRIC ENGINES

- 9.7.3 MAGNETIC BEARINGS

- 9.8 OTHER END-USE INDUSTRIES

10 PERMANENT MAGNET MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Government initiatives for permanent magnets to drive market

- 10.2.2 CANADA

- 10.2.2.1 Growing end-use industries to drive market

- 10.2.3 MEXICO

- 10.2.3.1 Rapid industrialization to drive market

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Shifting preference for EVs to drive market

- 10.3.2 FRANCE

- 10.3.2.1 Rise in rare earth recycling projects to drive market

- 10.3.3 UK

- 10.3.3.1 Increased offshore wind installations to drive market

- 10.3.4 ITALY

- 10.3.4.1 Diverse applications in medical technologies to drive market

- 10.3.5 RUSSIA

- 10.3.5.1 High military spending to drive market

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Extensive rare earth element reserves to drive market

- 10.4.2 JAPAN

- 10.4.2.1 Substantial investments in extraction of rare earth elements to drive market

- 10.4.3 INDIA

- 10.4.3.1 Strong growth of domestic electronics industry to drive market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Surge in demand from defense sector to drive market

- 10.4.5 INDONESIA

- 10.4.5.1 Elevated demand for permanent magnets in EVs to drive market

- 10.4.6 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC

- 10.5.1.1 UAE

- 10.5.1.1.1 Rigorous infrastructure development to drive market

- 10.5.1.2 Saudi Arabia

- 10.5.1.2.1 Vision 2030 to drive market

- 10.5.1.3 Rest of GCC

- 10.5.1.1 UAE

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Government initiatives encouraging localization to drive market

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Investments in REE projects to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Wide scope of applications in automotive industry to drive market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Type footprint

- 11.6.5.4 Operating temperature footprint

- 11.6.5.5 Manufacturing process footprint

- 11.6.5.6 End-use industry footprint

- 11.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING

- 11.7.5.1 List of start-ups/SMEs

- 11.7.5.2 Competitive benchmarking of start-ups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 PROTERIAL, LTD.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Right to win

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses and competitive threats

- 12.1.2 ARNOLD MAGNETIC TECHNOLOGIES

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 TDK CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 YANTAI DONGXING MAGNETIC MATERIALS INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 SHIN-ETSU CHEMICAL CO., LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 ELECTRON ENERGY CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 ADAMS MAGNETIC PRODUCTS, LLC

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 BUNTING MAGNETICS CO.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.9 TENGAM ENGINEERING, INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 NINGBO YUNSHENG CO., LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 CHENGDU GALAXY MAGNETS CO., LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.12 GOUDSMIT MAGNETICS

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 ECLIPSE MAGNETICS

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 DEXTER MAGNETIC TECHNOLOGIES

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.14.3.2 Expansions

- 12.1.15 EARTH-PANDA ADVANCED MAGNETIC MATERIAL CO., LTD.

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.1 PROTERIAL, LTD.

- 12.2 OTHER PLAYERS

- 12.2.1 HANGZHOU PERMANENT MAGNET GROUP, LTD

- 12.2.2 JPMF GUANGDONG CO., LTD

- 12.2.3 NINGBO NINGGANG PERMANENT MAGNETIC MATERIALS CO., LTD

- 12.2.4 THOMAS AND SKINNER INC.

- 12.2.5 YANTAI ZHENGHAI MAGNETIC MATERIAL CO., LTD.

- 12.2.6 NINGBO CO-STAR MATERIALS HI-TECH CO., LTD.

- 12.2.7 NINGBO RISHENG MAGNETS CO., LTD.

- 12.2.8 VACUUMSCHMELZE GMBH & CO. KG

- 12.2.9 DAIDO ELECTRONICS CO., LTD.

- 12.2.10 PERMANENT MAGNETS LTD.

- 12.2.11 MAGNEQUENCH INTERNATIONAL, LLC

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS