|

|

市場調査レポート

商品コード

1794023

コントロールバルブの世界市場:コンポーネント別、材質別、タイプ別、サイズ別、業界別、地域別 - 2030年までの予測Control Valve Market by Material (Stainless Steel, Cast Iron, Cryogenic, Alloy Based), Actuators (Pneumatic, Electrical, Hydraulic), Size, Rotary Valves (Ball, Butterfly, Plug), Linear Valves (Globe, Diaphragm), Industry - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| コントロールバルブの世界市場:コンポーネント別、材質別、タイプ別、サイズ別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月14日

発行: MarketsandMarkets

ページ情報: 英文 279 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

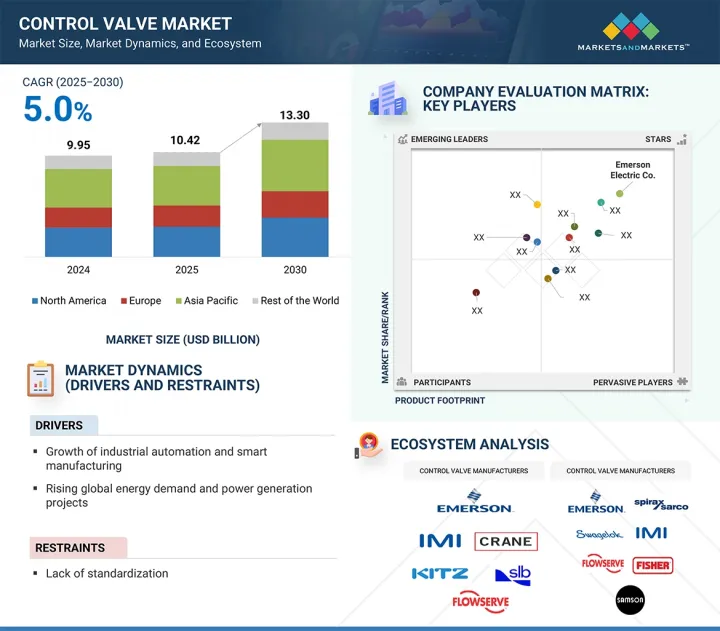

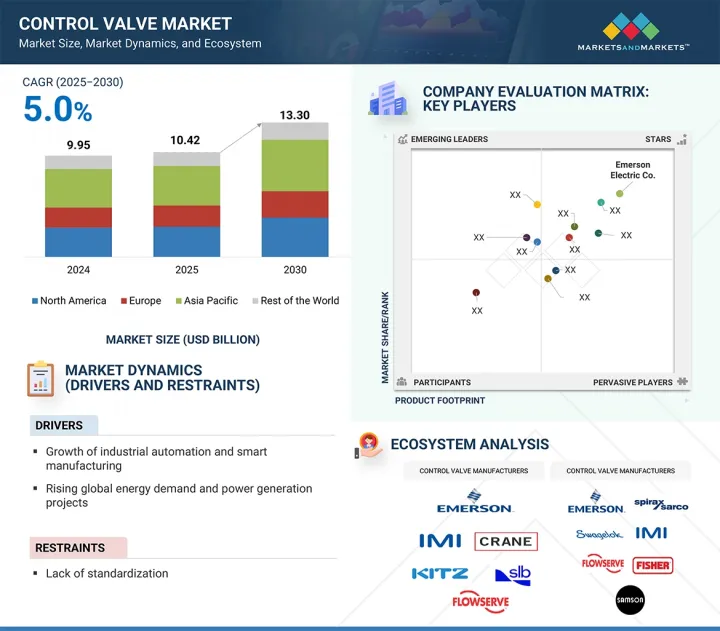

世界のコントロールバルブの市場規模は、2025年の104億2,000万米ドルから2030年には133億米ドルに成長し、CAGRは5.0%を記録すると予測されています。

同市場は、スマートオートメーション技術の採用が増加し、産業プロセス全体でエネルギー効率が重視されるようになったことが原動力となり、大きな成長を遂げています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | コンポーネント別、材質別、タイプ別、サイズ別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

産業用モノのインターネット(IIoT)と予知保全機能の統合により、最新のコントロールバルブはリアルタイムの監視、ダウンタイムの削減、性能の最適化を可能にしています。石油・ガス、発電、水処理などの業界では、より厳しい環境規制を満たし、業務効率を向上させるために、これらの先進的なソリューションを急速に取り入れています。このようなインテリジェントな流量制御システムへのシフトは、競合情勢を再構築し、市場の技術革新を加速しています。

バルブ本体セグメントは市場で力強い成長を遂げています。バルブアセンブリの主要コンポーネントであるバルブボディは、すべての内部コンポーネントを統合する機能を持っています。一般的に、真鍮、青銅、鋳鉄、合金鋼、ステンレス鋼、プラスチックなどの金属で作られ、バルブの最初の圧力バリアとして機能し、接続されたパイプラインからの流体圧力に耐えます。ネジ式、ボルト式、または溶接継手を介して、入口と出口の配管に対応します。一般的に、鋳造または鍛造法により多様な形状で製造されます。

コントロールバルブ市場は、ステンレス鋼材料の利用における大幅な成長を示しています。この急成長は、ステンレス鋼の耐食性、耐久性、多様な産業用途における汎用性に起因しています。その堅牢な特性は、信頼性が高く長持ちするバルブシステムに対する需要の高まりに対応し、市場で好まれる選択肢としての地位を固めています。

ロータリーバルブ部門は市場で力強い成長を遂げています。コントロールバルブ市場は、ロータリーバルブの人気の高まりとともに大きな成長を遂げています。正確な制御と信頼できる性能で知られるロータリーバルブは、石油・ガス、化学、発電など様々な産業で支持されています。その効果的な流量調整機能は、設計と材料の進歩とともに、市場での隆盛と採用を後押ししています。

6~25インチサイズの調節弁の世界市場は、特にエネルギー・石油・ガス・水処理セクターにおける産業インフラの拡大により、著しい成長を遂げています。自動化要求の高まりとバルブ設計の進歩がこの拡大に寄与し、世界中の様々な産業需要を満たしています。

石油・ガス産業では、技術の進歩と効率性、安全性、環境コンプライアンスに対する要求の高まりにより、コントロールバルブが大幅な成長を遂げています。これらのバルブは、パイプラインや処理システム内の流体の流れを調整し、流量、圧力、温度などのパラメータを正確に制御する上で重要な役割を果たしています。その進化は、探鉱、生産、精製、流通を含む様々な部門における操業の信頼性と性能を大幅に向上させ、業界の進化するニーズに効果的に応えています。

アジア太平洋のコントロールバルブ市場は、工業化、インフラ拡張、石油・ガス、発電、上下水道治療などの分野におけるプロセス自動化需要の高まりなどの要因により、大幅な成長を遂げています。技術の進歩とスマートバルブソリューションの普及が、この拡大にさらに拍車をかけています。産業界が効率性、信頼性、安全性の向上を優先しているため、この動向は今後も続くと予想されます。

当レポートでは、世界のコントロールバルブ市場について調査し、コンポーネント別、材質別、タイプ別、サイズ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 技術分析

- 貿易分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- 関税と規制状況

- AI/生成AIがコントロールバルブ市場に与える影響

- 2025年の米国関税がコントロールバルブ市場に与える影響

- 産業オートメーションにおけるフロー制御の未来

第6章 コントロールバルブ市場(コンポーネント別)

- イントロダクション

- アクチュエータ

- バルブボディ

- その他

第7章 コントロールバルブ市場(材質別)

- イントロダクション

- ステンレス鋼

- 鋳鉄

- 合金ベース

- 極低温

- その他

第8章 コントロールバルブ市場(タイプ別)

- イントロダクション

- ロータリーバルブ

- リニアバルブ

第9章 コントロールバルブ市場(サイズ別)

- イントロダクション

- 1インチ未満

- 1~6インチ

- 6~25インチ

- 25~50インチ

- 50インチ超

第10章 コントロールバルブ市場(業界別)

- イントロダクション

- 石油・ガス

- 水・廃水処理

- エネルギー・電力

- 医薬品

- 食品・飲料

- 化学薬品

- 建築・建設

- パルプ・紙

- 金属・鉱業

- その他

第11章 コントロールバルブ市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- その他

- その他の地域

- GCC

- アフリカとその他

- 南米

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2023年~2025年

- 2020~2024年におけるトップ5社の収益分析

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- CRANE COMPANY

- EMERSON ELECTRIC CO.

- FLOWSERVE CORPORATION

- IMI

- SLB

- CHRISTIAN BURKERT GMBH & CO. KG

- CURTISS-WRIGHT CORPORATION

- VALMET

- SPIRAX GROUP PLC

- KITZ CORPORATION

- BAKER HUGHES COMPANY

- KSB SE & CO. KGAA

- ROTORK PLC

- BADGER METER, INC.

- その他の企業

- SAMSONCONTROLS.NET

- TRILLIUM FLOW TECHNOLOGIES

- NEWAY VALVE

- ALFA LAVAL

- AVK HOLDING A/S

- AVCON CONTROLS PVT. LTD.

- HAM-LET GROUP

- DWYER INSTRUMENTS, LLC

- RICHARDS INDUSTRIAL

- SWAGELOK COMPANY

- R.K. CONTROL INSTRUMENTS PVT. LTD

- ARCA REGLER GMBH

- LAPAR CONTROL VALVE

- TAYLOR VALVE TECHNOLOGY

- HABONIM

第14章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 LIST OF KEY SECONDARY SOURCES

- TABLE 3 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 4 CONTROL VALVE MARKET: RISK ANALYSIS

- TABLE 5 ROLE OF COMPANIES IN CONTROL VALVE ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE TREND OF CONTROL VALVES, 2020-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE OF CONTROL VALVES OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD)

- TABLE 8 PRICING TREND OF CONTROL VALVES, BY REGION, 2020-2024 (USD)

- TABLE 9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 12 IMPORT DATA FOR HS CODE 848110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 EXPORT DATA FOR HS CODE 8536-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 LIST OF KEY PATENTS, 2023-2024

- TABLE 15 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 MFN TARIFF FOR HS CODE 848110-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 STANDARDS FOLLOWED BY INDUSTRIAL VALVES MANUFACTURERS

- TABLE 22 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR CONTROL VALVE MARKET

- TABLE 24 CONTROL VALVE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 25 CONTROL VALVE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 26 ACTUATOR: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 27 ACTUATOR: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 28 CONTROL VALVE MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 29 CONTROL VALVE MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 30 CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 31 CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 32 CONTROL VALVE MARKET, 2021-2024 (MILLION UNITS)

- TABLE 33 CONTROL VALVE MARKET, 2025-2030 (MILLION UNITS)

- TABLE 34 ROTARY VALVES: CONTROL VALVE MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 35 ROTARY VALVES: CONTROL VALVE MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 36 ROTARY VALVES: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 37 ROTARY VALVES: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 38 ROTARY VALVES: CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 ROTARY VALVES: CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 ROTARY VALVES: CONTROL VALVE MARKET, BY VALVE TYPE, 2021-2024 (USD MILLION)

- TABLE 41 ROTARY VALVES: CONTROL VALVE MARKET, BY VALVE TYPE, 2025-2030 (USD MILLION)

- TABLE 42 LINEAR VALVES: CONTROL VALVE MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 43 LINEAR VALVES: CONTROL VALVE MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 44 LINEAR VALVES: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 45 LINEAR VALVES: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 46 LINEAR VALVES: CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 LINEAR VALVES: CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 LINEAR VALVES: CONTROL VALVE MARKET, BY VALVE TYPE, 2021-2024 (USD MILLION)

- TABLE 49 LINEAR VALVES: CONTROL VALVE MARKET, BY VALVE TYPE, 2025-2030 (USD MILLION)

- TABLE 50 CONTROL VALVE MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 51 CONTROL VALVE MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 52 UP TO 1": CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 53 UP TO 1": CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 54 >1-6": CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 55 >1-6": CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 56 >6-25": CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 57 >6-25": CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 58 >25-50": CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 59 >25-50": CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 60 >50": CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 61 >50": CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 62 CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 63 CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 64 OIL & GAS: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 65 OIL & GAS: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 66 OIL & GAS: CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 OIL & GAS: CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 OIL & GAS: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 69 OIL & GAS: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 70 OIL & GAS: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 71 OIL & GAS: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 OIL & GAS: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 OIL & GAS: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 OIL & GAS: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 75 OIL & GAS: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 76 WATER & WASTEWATER TREATMENT: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 77 WATER & WASTEWATER TREATMENT: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 78 WATER & WASTEWATER TREATMENT: CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 WATER & WASTEWATER TREATMENT: CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 WATER & WASTEWATER TREATMENT: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 WATER & WASTEWATER TREATMENT: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 WATER & WASTEWATER TREATMENT: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 WATER & WASTEWATER TREATMENT: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 WATER & WASTEWATER TREATMENT: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 WATER & WASTEWATER TREATMENT: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 86 WATER & WASTEWATER TREATMENT: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 87 WATER & WASTEWATER TREATMENT: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 88 ENERGY & POWER: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 89 ENERGY & POWER: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 90 ENERGY & POWER: CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 ENERGY & POWER: CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 ENERGY & POWER: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 93 ENERGY & POWER: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 ENERGY & POWER: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 95 ENERGY & POWER: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 ENERGY & POWER: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 97 ENERGY & POWER: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 ENERGY & POWER: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 99 ENERGY & POWER: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 100 PHARMACEUTICALS: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 101 PHARMACEUTICALS: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 102 PHARMACEUTICALS: CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 PHARMACEUTICALS: CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 PHARMACEUTICALS: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 105 PHARMACEUTICALS: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 106 PHARMACEUTICALS: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 107 PHARMACEUTICALS: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 PHARMACEUTICALS: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 109 PHARMACEUTICALS: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 PHARMACEUTICALS: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 111 PHARMACEUTICALS: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 112 FOOD & BEVERAGES: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 113 FOOD & BEVERAGES: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 114 FOOD & BEVERAGES: CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 FOOD & BEVERAGES: CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 FOOD & BEVERAGES: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 FOOD & BEVERAGES: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 FOOD & BEVERAGES: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 119 FOOD & BEVERAGES: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 120 FOOD & BEVERAGES: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 121 FOOD & BEVERAGES: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 122 FOOD & BEVERAGES: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 123 FOOD & BEVERAGES: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 124 CHEMICALS: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 125 CHEMICALS: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 126 CHEMICALS: CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 CHEMICALS: CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 128 CHEMICALS: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 129 CHEMICALS: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 CHEMICALS: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 131 CHEMICALS: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 CHEMICALS: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 CHEMICALS: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 CHEMICALS: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 135 CHEMICALS: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 136 BUILDING & CONSTRUCTION: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 137 BUILDING & CONSTRUCTION: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 138 BUILDING & CONSTRUCTION: CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 139 BUILDING & CONSTRUCTION: CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 140 BUILDING & CONSTRUCTION: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 141 BUILDING & CONSTRUCTION: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 142 BUILDING & CONSTRUCTION: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 143 BUILDING & CONSTRUCTION: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 144 BUILDING & CONSTRUCTION: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 145 BUILDING & CONSTRUCTION: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 146 BUILDING & CONSTRUCTION: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 147 BUILDING & CONSTRUCTION: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 148 PULP & PAPER: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 149 PULP & PAPER: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 150 PULP & PAPER: CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 151 PULP & PAPER: CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 152 PULP & PAPER: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 153 PULP & PAPER: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 154 PULP & PAPER: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 155 PULP & PAPER: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 PULP & PAPER: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 157 PULP & PAPER: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 158 PULP & PAPER: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 159 PULP & PAPER: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 160 METALS & MINING: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 161 METALS & MINING: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 162 METALS & MINING: CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 163 METALS & MINING: CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 164 METALS & MINING: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 METALS & MINING: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 METALS & MINING: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 167 METALS & MINING: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 168 METALS & MINING: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 169 METALS & MINING: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 170 METALS & MINING: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 171 METALS & MINING: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 172 OTHER INDUSTRIES: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 173 OTHER INDUSTRIES: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 174 OTHER INDUSTRIES: CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 175 OTHER INDUSTRIES: CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 176 OTHER INDUSTRIES: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 177 OTHER INDUSTRIES: CONTROL VALVE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 178 OTHER INDUSTRIES: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 179 OTHER INDUSTRIES: CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 180 OTHER INDUSTRIES: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 181 OTHER INDUSTRIES: CONTROL VALVE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 182 OTHER INDUSTRIES: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 183 OTHER INDUSTRIES: CONTROL VALVE MARKET IN ROW, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 184 CONTROL VALVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 185 CONTROL VALVE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 186 NORTH AMERICA: CONTROL VALVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 187 NORTH AMERICA: CONTROL VALVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 188 NORTH AMERICA: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 189 NORTH AMERICA: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 190 NORTH AMERICA: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 191 NORTH AMERICA: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 192 US: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 193 US: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 194 CANADA: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 195 CANADA: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 196 MEXICO: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 197 MEXICO: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 198 EUROPE: CONTROL VALVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 199 EUROPE: CONTROL VALVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 200 EUROPE: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 201 EUROPE: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 202 EUROPE: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 203 EUROPE: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 204 UK: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 205 UK: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 206 GERMANY: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 207 GERMANY: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 208 FRANCE: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 209 FRANCE: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 210 ITALY: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 211 ITALY: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 212 REST OF EUROPE: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 213 REST OF EUROPE: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 214 ASIA PACIFIC: CONTROL VALVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 215 ASIA PACIFIC: CONTROL VALVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 216 ASIA PACIFIC: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 217 ASIA PACIFIC: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 218 ASIA PACIFIC: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 219 ASIA PACIFIC: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 220 CHINA: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 221 CHINA: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 222 JAPAN: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 223 JAPAN: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 224 SOUTH KOREA: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 225 SOUTH KOREA: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 226 INDIA: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 227 INDIA: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 229 REST OF ASIA PACIFIC: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 230 ROW: CONTROL VALVE MARKET, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 231 ROW: CONTROL VALVE MARKET, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 232 ROW: CONTROL VALVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 233 ROW: CONTROL VALVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 234 ROW: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 235 ROW: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 236 GCC: CONTROL VALVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 237 GCC: CONTROL VALVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 238 GCC: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 239 GCC: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 240 AFRICA & REST OF MIDDLE EAST: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 241 AFRICA & REST OF MIDDLE EAST: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 242 SOUTH AMERICA: CONTROL VALVE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 243 SOUTH AMERICA: CONTROL VALVE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 244 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2023-JULY 2025

- TABLE 245 CONTROL VALVE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 246 CONTROL VALVE MARKET: REGION FOOTPRINT

- TABLE 247 CONTROL VALVE MARKET: TYPE FOOTPRINT

- TABLE 248 CONTROL VALVE MARKET: INDUSTRY FOOTPRINT

- TABLE 249 CONTROL VALVE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 250 CONTROL VALVE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 251 CONTROL VALVE MARKET: PRODUCT LAUNCHES, JANUARY 2023-JULY 2025

- TABLE 252 CONTROL VALVE MARKET: DEALS, JANUARY 2023-JULY 2025

- TABLE 253 CONTROL VALVE MARKET: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 254 CRANE COMPANY: COMPANY OVERVIEW

- TABLE 255 CRANE COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 CRANE COMPANY: DEALS

- TABLE 257 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 258 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 260 FLOWSERVE CORPORATION: COMPANY OVERVIEW

- TABLE 261 FLOWSERVE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 FLOWSERVE CORPORATION: PRODUCT LAUNCHES

- TABLE 263 FLOWSERVE CORPORATION: DEALS

- TABLE 264 IMI: COMPANY OVERVIEW

- TABLE 265 IMI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 IMI: PRODUCT LAUNCHES

- TABLE 267 SLB: COMPANY OVERVIEW

- TABLE 268 SLB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 CHRISTIAN BURKERT GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 270 CHRISTIAN BURKERT GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

- TABLE 272 CURTISS-WRIGHT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 VALMET: COMPANY OVERVIEW

- TABLE 274 VALMET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 SPIRAX GROUP PLC: COMPANY OVERVIEW

- TABLE 276 SPIRAX GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 KITZ CORPORATION: COMPANY OVERVIEW

- TABLE 278 KITZ CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 KITZ CORPORATION: PRODUCT LAUNCHES

- TABLE 280 KITZ CORPORATION: EXPANSIONS

- TABLE 281 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 282 BAKER HUGHES COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 BAKER HUGHES COMPANY: PRODUCT LAUNCHES

- TABLE 284 KSB SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 285 KSB SE & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 KSB SE & CO. KGAA: PRODUCT LAUNCHES

- TABLE 287 ROTORK PLC: COMPANY OVERVIEW

- TABLE 288 ROTORK PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 BADGER METER, INC.: COMPANY OVERVIEW

- TABLE 290 BADGER METER, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 CONTROL VALVE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 CONTROL VALVE MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARIES

- FIGURE 6 KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 KEY INDUSTRY INSIGHTS

- FIGURE 8 CONTROL VALVE MARKET: RESEARCH APPROACH

- FIGURE 9 CONTROL VALVE MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 10 CONTROL VALVE MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 11 CONTROL VALVE MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 12 CONTROL VALVE MARKET: DATA TRIANGULATION

- FIGURE 13 CONTROL VALVE MARKET: RESEARCH ASSUMPTIONS

- FIGURE 14 ACTUATOR SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025

- FIGURE 15 STAINLESS STEEL SEGMENT TO CLAIM LARGEST MARKET SHARE IN 2030

- FIGURE 16 ROTARY VALVES SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 17 6-25" SEGMENT TO DOMINATE CONTROL VALVE MARKET BETWEEN 2025 AND 2030

- FIGURE 18 OIL & GAS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC HELD LARGEST SHARE OF CONTROL VALVE MARKET IN 2024

- FIGURE 20 EXPANDING INDUSTRIAL SECTOR AND RISING INFRASTRUCTURE DEVELOPMENT TO BOOST MARKET GROWTH

- FIGURE 21 ACTUATOR SEGMENT TO HOLD LARGEST SHARE OF CONTROL VALVE MARKET IN 2025

- FIGURE 22 ALLOY-BASED SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 23 ROTARY VALVES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 24 UP TO 1" SEGMENT TO EXHIBIT HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 25 OIL & GAS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 26 ASIA PACIFIC TO HOLD LARGEST SHARE OF CONTROL VALVE MARKET IN 2030

- FIGURE 27 INDIA TO RECORD HIGHEST CAGR IN GLOBAL CONTROL VALVE MARKET DURING FORECAST PERIOD

- FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 IMPACT ANALYSIS: DRIVERS

- FIGURE 30 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 31 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 32 IMPACT ANALYSIS: CHALLENGES

- FIGURE 33 CONTROL VALVE SUPPLY CHAIN

- FIGURE 34 CONTROL VALVE ECOSYSTEM

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO

- FIGURE 36 AVERAGE SELLING PRICE TREND OF CONTROL VALVES, 2020-2024

- FIGURE 37 AVERAGE SELLING PRICE OF CONTROL VALVES OFFERED BY KEY PLAYERS, BY VALVE TYPE, 2024

- FIGURE 38 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 39 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 41 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 42 IMPORT DATA FOR HS CODE 848110-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 43 EXPORT DATA FOR HS CODE 8536-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 44 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 45 AI/GEN AI USE CASES

- FIGURE 46 CONTROL VALVE MARKET, BY COMPONENT

- FIGURE 47 ACTUATOR SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 48 CONTROL VALVE MARKET, BY MATERIAL

- FIGURE 49 STAINLESS STEEL SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 50 CONTROL VALVE MARKET, BY TYPE

- FIGURE 51 ROTARY VALVES SEGMENT TO RECORD HIGHER CAGR BETWEEN 2025 AND 2030

- FIGURE 52 CONTROL VALVE MARKET, BY SIZE

- FIGURE 53 >6-25" SEGMENT TO HOLD LARGEST SHARE OF CONTROL VALVE MARKET IN 2030

- FIGURE 54 CONTROL VALVE MARKET, BY INDUSTRY

- FIGURE 55 OIL & GAS SEGMENT TO DOMINATE CONTROL VALVE MARKET FROM 2025 TO 2030

- FIGURE 56 APPLICATIONS OF CONTROL VALVES IN OIL & GAS INDUSTRY

- FIGURE 57 CONTROL VALVE MARKET, BY REGION

- FIGURE 58 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN CONTROL VALVE MARKET DURING FORECAST PERIOD

- FIGURE 59 NORTH AMERICA: CONTROL VALVE MARKET SNAPSHOT

- FIGURE 60 EUROPE: CONTROL VALVE MARKET SNAPSHOT

- FIGURE 61 ASIA PACIFIC: CONTROL VALVE MARKET SNAPSHOT

- FIGURE 62 CONTROL VALVE MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 63 MARKET SHARE ANALYSIS OF COMPANIES OFFERING CONTROL VALVES, 2024

- FIGURE 64 COMPANY VALUATION

- FIGURE 65 FINANCIAL METRICS

- FIGURE 66 BRAND/PRODUCT COMPARISON

- FIGURE 67 CONTROL VALVE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 68 CONTROL VALVE MARKET: COMPANY FOOTPRINT

- FIGURE 69 CONTROL VALVE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 70 CRANE COMPANY: COMPANY SNAPSHOT

- FIGURE 71 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 72 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

- FIGURE 73 IMI: COMPANY SNAPSHOT

- FIGURE 74 SLB: COMPANY SNAPSHOT

- FIGURE 75 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- FIGURE 76 VALMET: COMPANY SNAPSHOT

- FIGURE 77 SPIRAX GROUP PLC: COMPANY SNAPSHOT

- FIGURE 78 KITZ CORPORATION: COMPANY SNAPSHOT

- FIGURE 79 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- FIGURE 80 KSB SE & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 81 ROTORK PLC: COMPANY SNAPSHOT

- FIGURE 82 BADGER METER, INC.: COMPANY SNAPSHOT

The global control valve market is expected to grow from USD 10.42 billion in 2025 to USD 13.30 billion by 2030, registering a CAGR of 5.0%. The market is witnessing significant growth, driven by the rising adoption of smart automation technologies and the increasing emphasis on energy efficiency across industrial processes.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Material, Type, Size, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

With the integration of Industrial Internet of Things (IIoT) and predictive maintenance capabilities, modern control valves are enabling real-time monitoring, reduced downtime, and optimized performance. Industries such as oil & gas, power generation, and water treatment are rapidly embracing these advanced solutions to meet stricter environmental regulations and improve operational efficiency. This shift toward intelligent flow control systems is reshaping the competitive landscape and accelerating innovation in the market.

"Valve body segment to register highest CAGR during forecast period"

The valve body segment is experiencing robust growth in the market. The primary component of a valve assembly, the valve body, functions to consolidate all internal components. Typically crafted from metals like brass, bronze, cast iron, alloy steels, stainless steels, or plastics, it serves as the initial pressure barrier in a valve, withstanding fluid pressure from connected pipelines. Through threaded, bolted, or welded joints, it accommodates inlet and outlet piping. It is commonly manufactured through casting or forging methods in diverse configurations.

"Stainless steel material segment accounted for largest share of control valve market in 2024"

The control valve market has witnessed substantial growth in the utilization of stainless steel material. This surge is attributed to stainless steel's corrosion resistance, durability, and versatility across diverse industrial applications. Its robust properties meet the escalating demand for reliable and long-lasting valve systems, cementing its position as a preferred choice in the market.

"Rotary valves segment to grow at highest CAGR in control valve market during forecast period"

The rotary valves segment is experiencing robust growth in the market. The control valve market has experienced significant growth with the increasing popularity of rotary valves. Known for their precise control and dependable performance, rotary valves are favored in various industries, such as oil & gas, chemicals, and power generation. Their effective flow regulation capabilities, alongside advancements in design and materials, have propelled their prominence and adoption in the market.

>6"-25" segment accounted for largest share of control valve market in 2024"

The global market for control valves sized >6"-25" has experienced significant growth, spurred by expanding industrial infrastructure, particularly in energy, oil & gas, and water treatment sectors. Rising automation requirements and advancements in valve design have contributed to this expansion, meeting varied industrial demands across the globe.

"Oil & gas accounted for largest market share in 2024"

In the oil & gas industry, control valves have experienced substantial growth due to technological advancements and heightened demands for efficiency, safety, and environmental compliance. These valves play a crucial role in regulating fluid flow within pipelines and processing systems, ensuring precise control over parameters such as flow rates, pressures, and temperatures. Their evolution has significantly enhanced operational reliability and performance across various sectors, including exploration, production, refining, and distribution, meeting the industry's evolving needs effectively.

"Asia Pacific to be fastest-growing market during forecast period"

The control valve market in Asia Pacific has experienced substantial growth owing to factors like industrialization, infrastructure expansion, and rising demand for process automation in sectors such as oil & gas, power generation, and water & wastewater treatment. Technological advancements and the uptake of smart valve solutions have further fueled this expansion. The trend is anticipated to persist as industries prioritize improved efficiency, reliability, and safety measures in their operations.

Break-up of profiles of primary participants:

- By Company Type - Tier 1-35%, Tier 2-30%, and Tier 3-35%

- By Designation - C-level Executives-45%, Directors-35%, and Others-20%

- By Region - North America - 35%, Europe - 25%, Asia Pacific - 30%, RoW - 10%

The major players in the market are Emerson Electric Co. (US), Flowserve Corporation (US), IMI (UK), and SLB (US).

Research Coverage:

The control valve market has been segmented based on component, material, type, size, industry, and region. The market is studied for North America, Europe, Asia Pacific, and the Rest of the World (RoW). The report describes the major drivers, restraints, challenges, and opportunities of the control valve market and forecasts the same till 2030. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the control valve ecosystem.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the control valve market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- Analysis of Key Drivers (Rising demand for energy & power in Asia Pacific, Rising surge in control valve demand in the oil & gas industry, Adoption of automation to improve efficiency and new nuclear power plants and upscaling of existing ones), Restraints (Lack of standardized certifications and government policies, Complexity of installation and maintenance), Opportunities (Implementation of valves in water & wastewater treatment plants to handle sanitation-related issues, Need for replacement of outdated valves and adoption of smart valves, Focus of industry players on offering improved customer services), Challenges (Rise in collaboration activities among industry players, Unplanned downtime due to malfunctioning or failure of valves)

- Product Development/Innovation: Detailed insights on research and development activities and new product launches in the control valve market

- Market Development: Comprehensive information about lucrative markets-the report analyses the control valve market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the control valve market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Christian Burkert GmbH & Co. KG (Germany), Emerson Electric Co. (US), Flowserve Corporation (US), IMI (UK), Curtiss-Wright Corporation (US), Valmet (Finland), SLB (US), Spirax Sarco Limited (US), Crane Company (US), and KITZ Corporation (Japan), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CONTROL VALVE MARKET

- 4.2 CONTROL VALVE MARKET, BY COMPONENT

- 4.3 CONTROL VALVE MARKET, BY MATERIAL

- 4.4 CONTROL VALVE MARKET, BY TYPE

- 4.5 CONTROL VALVE MARKET, BY SIZE

- 4.6 CONTROL VALVE MARKET, BY INDUSTRY

- 4.7 CONTROL VALVE MARKET, BY REGION

- 4.8 CONTROL VALVE MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid industrial automation and energy infrastructure expansion

- 5.2.1.2 Increasing investment in oil and gas infrastructure in Middle East

- 5.2.1.3 Mounting electricity demand amid rapid urbanization in Southeast Asia

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of standardized certifications and government policies

- 5.2.2.2 Complications associated with installation and maintenance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising integration of advanced technologies into smart valves

- 5.2.3.2 Increasing green hydrogen production for industrial use

- 5.2.4 CHALLENGES

- 5.2.4.1 Risks associated with safety and operational efficiency due to leakage

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF CONTROL VALVES, 2020-2024

- 5.6.2 AVERAGE SELLING PRICE OF CONTROL VALVES OFFERED BY KEY PLAYERS, BY VALVE TYPE, 2024

- 5.6.3 PRICING RANGE OF CONTROL VALVES, BY REGION, 2020-2024

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 HORIZON TRUCK & BODY ADOPTS SUR-FLO CONTROL VALVE FOR OIL LOADING AND UNLOADING AT ONE SPOT

- 5.10.2 SF10V MAINTAINS CONSISTENT PRESSURE WHILE ALLOWING PASSAGE OF PROCESS FLUIDS FROM SEPARATORS

- 5.10.3 HABONIM PROVIDES EXPERTISE TO LNG PROJECTS WITH CRYOGENIC FIRE-SAFE FLOATING BALL VALVES

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 IoT

- 5.11.1.2 3D printing

- 5.11.2 ADJACENT TECHNOLOGIES

- 5.11.2.1 Smart valve positioners

- 5.11.2.2 Predictive maintenance and condition monitoring

- 5.11.1 KEY TECHNOLOGIES

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 848110)

- 5.12.2 EXPORT SCENARIO (HS CODE 848110)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF ANALYSIS

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.3 STANDARDS

- 5.16 IMPACT OF AI/GEN AI ON CONTROL VALVE MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON CONTROL VALVE MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON INDUSTRIES

- 5.18 FUTURE OF FLOW CONTROL IN INDUSTRIAL AUTOMATION

- 5.18.1 STRATEGIC SHIFTS DRIVING VALVE ADOPTION

6 CONTROL VALVE MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 ACTUATOR

- 6.2.1 PUSH TOWARD AUTOMATION AND SUSTAINABILITY TO FUEL SEGMENTAL GROWTH

- 6.3 VALVE BODY

- 6.3.1 MATERIAL INNOVATION AND AUTOMATION TREND TO CONTRIBUTE TO SEGMENTAL GROWTH

- 6.4 OTHER COMPONENTS

7 CONTROL VALVE MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- 7.2 STAINLESS STEEL

- 7.2.1 NEED FOR CORROSION-RESISTANT MATERIALS TO TACKLE CHALLENGING SERVICE CONDITIONS IN INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 7.3 CAST IRON

- 7.3.1 ABILITY TO WITHSTAND SEVERE VIBRATIONS TO FOSTER SEGMENTAL GROWTH

- 7.4 ALLOY-BASED

- 7.4.1 STRONG FOCUS ON TACKLING PRESSURES AND TEMPERATURES IN STEAM POWER PLANTS TO SPUR DEMAND

- 7.5 CRYOGENIC

- 7.5.1 NEED FOR SAFE PRODUCTION AND STORAGE OF LIQUEFIED GASES TO ACCELERATE SEGMENTAL GROWTH

- 7.6 OTHER MATERIALS

8 CONTROL VALVE MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 ROTARY VALVES

- 8.2.1 BALL VALVES

- 8.2.1.1 Rising demand from metals & mining and water and wastewater treatment industries to fuel segmental growth

- 8.2.2 BUTTERFLY VALVES

- 8.2.2.1 Growing installation for high-pressure recovery applications to foster segmental growth

- 8.2.3 PLUG VALVES

- 8.2.3.1 Increasing application in water injection and metering stations to augment segmental growth

- 8.2.1 BALL VALVES

- 8.3 LINEAR VALVES

- 8.3.1 GLOBE VALVES

- 8.3.1.1 Ease of automation and availability with limit switches to drive market

- 8.3.2 DIAPHRAGM VALVES

- 8.3.2.1 Growing demand in food & beverages and pharmaceuticals industries to foster segmental growth

- 8.3.3 OTHER LINEAR VALVES

- 8.3.1 GLOBE VALVES

9 CONTROL VALVE MARKET, BY SIZE

- 9.1 INTRODUCTION

- 9.2 UP TO 1"

- 9.2.1 RISING NEED FOR LOW PRESSURE AND TEMPERATURE IN PROCESS INDUSTRIES TO BOLSTER SEGMENTAL GROWTH

- 9.3 >1-6"

- 9.3.1 GROWING DEMAND FROM OIL & GAS AND CHEMICALS INDUSTRIES TO DRIVE MARKET

- 9.4 >6-25"

- 9.4.1 RISING USE FOR HIGH-PRESSURE APPLICATIONS TO BOOST SEGMENTAL GROWTH

- 9.5 >25-50"

- 9.5.1 INCREASING APPLICATIONS IN OIL & GAS, CHEMICAL, ENERGY & POWER, AND PHARMACEUTICAL PLANTS TO FUEL SEGMENTAL GROWTH

- 9.6 >50"

- 9.6.1 GROWING DEMAND FROM THERMAL POWER AND PETROCHEMICAL REFINERIES TO EXPEDITE SEGMENTAL GROWTH

10 CONTROL VALVE MARKET, BY INDUSTRY

- 10.1 INTRODUCTION

- 10.2 OIL & GAS

- 10.2.1 GROWING EMPHASIS ON REDUCING PRODUCTION COSTS TO BOOST SEGMENTAL GROWTH

- 10.3 WATER & WASTEWATER TREATMENT

- 10.3.1 RISING DEMAND FOR CLEAN WATER AND MODIFICATION IN OLD WATER INFRASTRUCTURE TO DRIVE MARKET

- 10.4 ENERGY & POWER

- 10.4.1 INCREASING NEED TO UTILIZE NON-RENEWABLE RESOURCES EFFICIENTLY TO BOOST SEGMENTAL GROWTH

- 10.5 PHARMACEUTICALS

- 10.5.1 ONGOING ADVANCEMENTS IN LIFE SCIENCES INDUSTRY TO FUEL SEGMENTAL GROWTH

- 10.6 FOOD & BEVERAGES

- 10.6.1 GROWING NEED FOR LEAK-PROOF AND CLEAN CONTAINERS TO BOLSTER SEGMENTAL GROWTH

- 10.7 CHEMICALS

- 10.7.1 RISING EMPHASIS ON ENHANCED STAFF SAFETY AND ASSURED PROCESS OF INTEGRITY TO ACCELERATE SEGMENTAL GROWTH

- 10.8 BUILDING & CONSTRUCTION

- 10.8.1 INCREASING IMPLEMENTATION IN HVAC AND FIRE PROTECTION SYSTEMS TO DRIVE MARKET

- 10.9 PULP & PAPER

- 10.9.1 RISING APPLICATIONS IN STOCK PREPARATION AND RE-PULPING TO ACCELERATE SEGMENTAL GROWTH

- 10.10 METALS & MINING

- 10.10.1 GROWING EMPHASIS ON REDUCING SCRAP AND DOWNTIME TO FOSTER SEGMENTAL GROWTH

- 10.11 OTHER INDUSTRIES

11 CONTROL VALVE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Modernization of wastewater treatment infrastructure and rising shale gas production to bolster market growth

- 11.2.2 CANADA

- 11.2.2.1 Implementation of large-scale geothermal heating projects to accelerate market growth

- 11.2.3 MEXICO

- 11.2.3.1 Growing demand for energy and water sanitation solutions to fuel market growth

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 UK

- 11.3.1.1 Formulation of stringent regulatory frameworks to ensure environmental protection to drive market

- 11.3.2 GERMANY

- 11.3.2.1 Advances in industrial automation and process control to expedite market growth

- 11.3.3 FRANCE

- 11.3.3.1 Nuclear investments and renewable energy ambitions to create lucrative growth opportunities

- 11.3.4 ITALY

- 11.3.4.1 Growing emphasis on reducing water wastage to contribute to market growth

- 11.3.5 REST OF EUROPE

- 11.3.1 UK

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Rapid industrialization and infrastructure development projects to boost market growth

- 11.4.2 JAPAN

- 11.4.2.1 High dependence on nuclear programs to generate electricity to augment market growth

- 11.4.3 SOUTH KOREA

- 11.4.3.1 High growth of semiconductor industry to drive market

- 11.4.4 INDIA

- 11.4.4.1 Expansion of oil & gas pipeline infrastructure to bolster market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 ROW

- 11.5.1 GCC

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Thriving oil & gas industry to contribute to market growth

- 11.5.1.2 UAE

- 11.5.1.2.1 Expansion of transportation network and increasing number of desalination plants to drive market

- 11.5.1.3 Rest of GCC

- 11.5.1.1 Saudi Arabia

- 11.5.2 AFRICA & REST OF MIDDLE EAST

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Growing demand for automation and process optimization to accelerate market growth

- 11.5.1 GCC

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 12.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Type footprint

- 12.7.5.4 Industry footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 CRANE COMPANY

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 EMERSON ELECTRIC CO.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 FLOWSERVE CORPORATION

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 IMI

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 SLB

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses/Competitive threats

- 13.1.6 CHRISTIAN BURKERT GMBH & CO. KG

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.7 CURTISS-WRIGHT CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 VALMET

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 SPIRAX GROUP PLC

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 KITZ CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Expansions

- 13.1.11 BAKER HUGHES COMPANY

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.12 KSB SE & CO. KGAA

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches

- 13.1.13 ROTORK PLC

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 BADGER METER, INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.1 CRANE COMPANY

- 13.2 OTHER PLAYERS

- 13.2.1 SAMSONCONTROLS.NET

- 13.2.2 TRILLIUM FLOW TECHNOLOGIES

- 13.2.3 NEWAY VALVE

- 13.2.4 ALFA LAVAL

- 13.2.5 AVK HOLDING A/S

- 13.2.6 AVCON CONTROLS PVT. LTD.

- 13.2.7 HAM-LET GROUP

- 13.2.8 DWYER INSTRUMENTS, LLC

- 13.2.9 RICHARDS INDUSTRIAL

- 13.2.10 SWAGELOK COMPANY

- 13.2.11 R.K. CONTROL INSTRUMENTS PVT. LTD

- 13.2.12 ARCA REGLER GMBH

- 13.2.13 LAPAR CONTROL VALVE

- 13.2.14 TAYLOR VALVE TECHNOLOGY

- 13.2.15 HABONIM

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS