|

|

市場調査レポート

商品コード

1794017

ロボットビジョンの世界市場:コンポーネント別、タイプ別、業界別、地域別 - 2030年までの予測Robotic Vision Market by Type, Component, Deployment - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ロボットビジョンの世界市場:コンポーネント別、タイプ別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月07日

発行: MarketsandMarkets

ページ情報: 英文 320 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

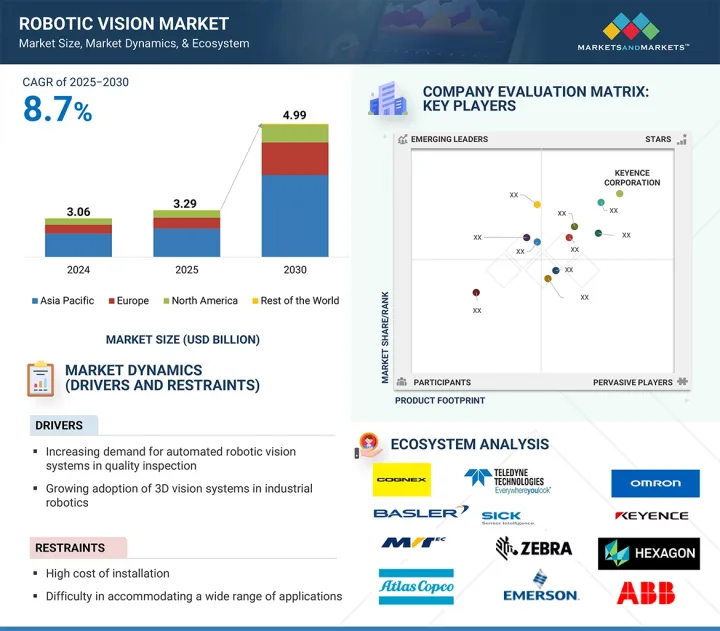

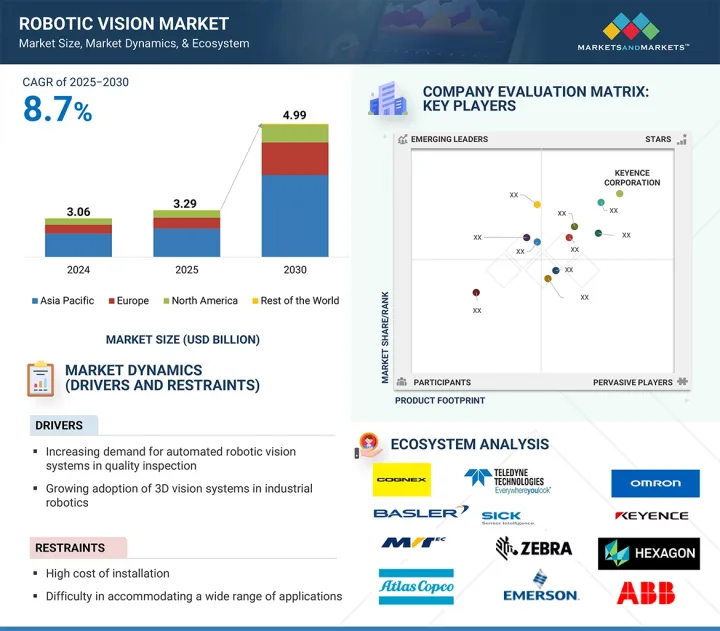

世界のロボットビジョンの市場規模は、8.7%のCAGRで拡大し、2025年の32億9,000万米ドルから2030年には49億9,000万米ドルに成長すると予測されています。

3Dロボットシステムは、ビンピッキング、検査、測定など様々な機能に柔軟性を提供する3Dビジョン技術から大きな恩恵を受けています。この高度な技術は、形状に基づいて対象物を識別し、位置を特定することができるため、コントラストの低い対象物や複雑な形状の対象物を確実に検出することができます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | コンポーネント別、タイプ別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

カメラの解像度が向上し、価格が下がるにつれて、大きなデータセットをリアルタイムで処理できる新しいマイクロプロセッサと相まって、3Dビジョンはロボットビジョン市場を拡大し、ロボットアプリケーションにとってより魅力的になっています。

2次元(2D)ビジョンシステムは、デジタルカメラで画像をキャプチャし、x-y平面に処理します。2Dビジョンシステムは、反射強度やコントラストの平坦な2次元マップを作成するため、これらのカメラでは照明が重要な要素となります。通常、頭上に設置され、産業用ロボットを見下ろし、ロボットのプログラム経路を作成するのに役立ちます。2Dビジョンシステムは、処理された2D画像を様々な解像度で捉えます。3Dシステムに対する2Dシステムの主な利点は、より経済的で便利なことです。このようなシステムは、飲食品産業やヘルスケアでますます使用されるようになっています。

ロボットビジョンシステムは、エレクトロニクス・半導体産業におけるスループット、品質、生産性を向上させ、生産を変革する可能性を秘めています。マテリアルハンドリングと自動検査は、ビジョンシステムの最も一般的なアプリケーションです。これらのシステムは、半導体を含む電子部品の検査に革命をもたらしました。溶接、パッケージング、パレタイジングなどのアプリケーションも、ロボットビジョンシステムが提供する高精度に依存しています。さらに、電子チップや電子部品はさまざまなサイズで製造されるため、溶接やパレタイジングにはマイクロレベルの精度が要求されます。

欧州のロボットビジョン市場は、この地域が多くの活発な産業と企業を包含していることから成長しています。特にフランス、ドイツ、イタリア、スペイン、スイス、オランダ、北欧、英国などです。特にフランス、ドイツ、イタリア、スペイン、スイス、オランダ、北欧、英国です。これらの強みを、新興のロボットビジョン市場に向けることができます。また、中小企業(SME)にも成長が見られ、ロボットビジョン市場が拡大する大きな機会となっています。欧州マシンビジョン協会(EMVA)は、欧州におけるマシンビジョン産業の成功を支援し、この市場の明るい見通しを予測しています。EMVAは、より多くの会員特典を提供し、欧州のマシンビジョンコミュニティの代弁者としての役割を果たすことで、ロボットビジョン技術をサポートし続けています。

当レポートでは、世界のロボットビジョン市場について調査し、コンポーネント別、タイプ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- AI/生成AIがロボットビジョン市場に与える影響

- 2025年の米国関税がロボットビジョン市場に与える影響

第6章 ロボットビジョンシステムの導入分野

- イントロダクション

- ロボット誘導システム

- ロボット細胞

第7章 ロボット視覚システムのための検出アルゴリズム

- イントロダクション

- 輪郭ベース

- 相関関係ベース

- 特徴抽出

- 点群

第8章 ロボットビジョン市場(コンポーネント別)

- イントロダクション

- カメラ

- LED照明システム

- 光学

- プロセッサとコントローラ

- フレームグラバー

- その他のハードウェアコンポーネント

- ソフトウェア

第9章 ロボットビジョン市場(タイプ別)

- イントロダクション

- 2Dビジョンシステム

- 3Dビジョンシステム

第10章 ロボットビジョンの応用

- イントロダクション

- 溶接とはんだ付け

- マテリアルハンドリング

- 梱包とパレタイジング

- 絵画

- 組み立てと分解

- 切断、プレス、研磨、バリ取り

- 測定、検査、試験

第11章 ロボットビジョン市場(業界別)

- イントロダクション

- 自動車

- エレクトロニクス・半導体

- ゴム・プラスチック

- 金属・機械

- 食品・飲料

- ヘルスケア

- ロジスティクス

- その他

第12章 ロボットビジョン市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- スイス

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- シンガポール

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- 南米

- アフリカ

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 製品比較

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- COGNEX CORPORATION

- KEYENCE CORPORATION

- TELEDYNE TECHNOLOGIES INC.

- OMRON CORPORATION

- FANUC CORPORATION

- BASLER AG

- SICK AG

- ATLAS COPCO AB

- EMERSON ELECTRIC CO.

- ZEBRA TECHNOLOGIES CORP.

- HEXAGON AB

- ADVANTECH CO., LTD.

- ABB

- QUALCOMM TECHNOLOGIES, INC.

- その他の企業

- QUALITAS TECHNOLOGIES

- BAUMER

- TORDIVEL AS

- OPTOTUNE

- MVTEC SOFTWARE GMBH

- INDUSTRIAL VISION SYSTEMS

- IDS IMAGING DEVELOPMENT SYSTEMS GMBH

- WENGLOR SENSORIC GMBH

- ZIVID

- ADLINK TECHNOLOGY INC.

- LMI TECHNOLOGIES INC.

第15章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 LIST OF KEY SECONDARY SOURCES

- TABLE 3 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 4 ROBOTIC VISION MARKET: RESEARCH ASSUMPTIONS

- TABLE 5 ROBOTIC VISION MARKET: RISK ANALYSIS

- TABLE 6 GOVERNMENT-LED INVESTMENTS IN INDUSTRIAL AUTOMATION

- TABLE 7 PRICING RANGE OF ROBOTIC VISION SYSTEMS OFFERED BY KEY PLAYERS, BY COMPONENT, 2024 (USD)

- TABLE 8 PRICING RANGE OF ROBOTIC CAMERAS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF ROBOTIC VISION SYSTEMS, BY HARDWARE COMPONENT, 2021-2024 (USD)

- TABLE 10 AVERAGE SELLING PRICE TREND OF ROBOTIC VISION HARDWARE COMPONENTS, BY REGION, 2021-2024 (USD)

- TABLE 11 ROLE OF COMPANIES IN ROBOTIC VISION ECOSYSTEM

- TABLE 12 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 13 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 14 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 15 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 STANDARDS

- TABLE 21 IMPACT OF PORTER'S FIVE FORCES

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR ROBOTIC VISION SYSTEMS

- TABLE 26 ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 27 ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 28 HARDWARE: ROBOTIC VISION MARKET, BY COMPONENT TYPE, 2021-2024 (MILLION UNITS)

- TABLE 29 HARDWARE: ROBOTIC VISION MARKET, BY COMPONENT TYPE, 2025-2030 (MILLION UNITS)

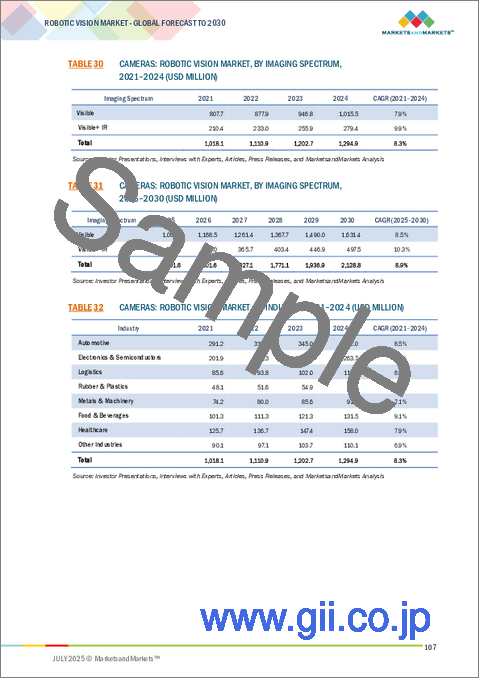

- TABLE 30 CAMERAS: ROBOTIC VISION MARKET, BY IMAGING SPECTRUM, 2021-2024 (USD MILLION)

- TABLE 31 CAMERAS: ROBOTIC VISION MARKET, BY IMAGING SPECTRUM, 2025-2030 (USD MILLION)

- TABLE 32 CAMERAS: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 33 CAMERAS: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 34 CAMERAS: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 CAMERAS: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 LED LIGHTING SYSTEMS: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 37 LED LIGHTING SYSTEMS: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 38 LED LIGHTING SYSTEMS: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 LED LIGHTING SYSTEMS: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 OPTICS: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 41 OPTICS: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 42 OPTICS: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 OPTICS: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 PROCESSORS & CONTROLLERS: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 45 PROCESSORS & CONTROLLERS: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 46 PROCESSORS & CONTROLLERS: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 PROCESSORS & CONTROLLERS: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 FRAME GRABBERS: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 49 FRAME GRABBERS: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 50 FRAME GRABBERS: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 FRAME GRABBERS: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 OTHER HARDWARE COMPONENTS: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 53 OTHER HARDWARE COMPONENTS: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 54 OTHER HARDWARE COMPONENTS: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 OTHER HARDWARE COMPONENTS: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 SOFTWARE: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 57 SOFTWARE: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 58 SOFTWARE: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 SOFTWARE: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 61 ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 62 2D VISION SYSTEMS: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 63 2D VISION SYSTEMS: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 64 2D VISION SYSTEMS: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 2D VISION SYSTEMS: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 3D VISION SYSTEMS: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 67 3D VISION SYSTEMS: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 68 3D VISION SYSTEMS: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 3D VISION SYSTEMS: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 71 ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 72 AUTOMOTIVE: ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 73 AUTOMOTIVE: ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 74 AUTOMOTIVE: ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 75 AUTOMOTIVE: ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 76 AUTOMOTIVE: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 AUTOMOTIVE: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 ELECTRONICS & SEMICONDUCTORS: ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 79 ELECTRONICS & SEMICONDUCTORS: ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 80 ELECTRONICS & SEMICONDUCTORS: ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 81 ELECTRONICS & SEMICONDUCTORS: ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 82 ELECTRONICS & SEMICONDUCTORS: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 ELECTRONICS & SEMICONDUCTORS: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 RUBBER & PLASTICS: ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 85 RUBBER & PLASTICS: ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 86 RUBBER & PLASTICS: ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 87 RUBBER & PLASTICS: ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 88 RUBBER & PLASTICS: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 RUBBER & PLASTICS: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 METALS & MACHINERY: ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 91 METALS & MACHINERY: ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 92 METALS & MACHINERY: ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 93 METALS & MACHINERY: ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 94 METALS & MACHINERY: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 METALS & MACHINERY: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 FOOD & BEVERAGES: ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 97 FOOD & BEVERAGES: ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 98 FOOD & BEVERAGES: ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 99 FOOD & BEVERAGES: ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 100 FOOD & BEVERAGES: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 FOOD & BEVERAGES: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 HEALTHCARE: ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 103 HEALTHCARE: ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 104 HEALTHCARE: ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 105 HEALTHCARE: ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 106 HEALTHCARE: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 HEALTHCARE: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 LOGISTICS: ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 109 LOGISTICS: ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 110 LOGISTICS: ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 111 LOGISTICS: ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 112 LOGISTICS: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 LOGISTICS: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 OTHER INDUSTRIES: ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 115 OTHER INDUSTRIES: ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 116 OTHER INDUSTRIES: ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 117 OTHER INDUSTRIES: ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 118 OTHER INDUSTRIES: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 OTHER INDUSTRIES: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: ROBOTIC VISION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 123 NORTH AMERICA: ROBOTIC VISION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 127 NORTH AMERICA: ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 130 US: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 131 US: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 132 CANADA: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 133 CANADA: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 134 MEXICO: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 135 MEXICO: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: ROBOTIC VISION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 137 EUROPE: ROBOTIC VISION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 139 EUROPE: ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 141 EUROPE: ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 143 EUROPE: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 144 GERMANY: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 145 GERMANY: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 146 UK: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 147 UK: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 148 FRANCE: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 149 FRANCE: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 150 ITALY: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 151 ITALY: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 152 SPAIN: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 153 SPAIN: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 154 NETHERLANDS: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 155 NETHERLANDS: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 156 SWITZERLAND: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 157 SWITZERLAND: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 158 NORDICS: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 159 NORDICS: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 160 REST OF EUROPE: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 161 REST OF EUROPE: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: ROBOTIC VISION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 163 ASIA PACIFIC: ROBOTIC VISION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 164 ASIA PACIFIC: ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 165 ASIA PACIFIC: ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 167 ASIA PACIFIC: ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 169 ASIA PACIFIC: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 170 CHINA: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 171 CHINA: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 172 JAPAN: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 173 JAPAN: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 174 SOUTH KOREA: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 175 SOUTH KOREA: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 176 INDIA: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 177 INDIA: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 178 AUSTRALIA: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 179 AUSTRALIA: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 180 INDONESIA: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 181 INDONESIA: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 182 SINGAPORE: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 183 SINGAPORE: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 186 ROW: ROBOTIC VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 187 ROW: ROBOTIC VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 188 ROW: ROBOTIC VISION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 189 ROW: ROBOTIC VISION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 190 ROW: ROBOTIC VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 191 ROW: ROBOTIC VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 192 ROW: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 193 ROW: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST: ROBOTIC VISION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 195 MIDDLE EAST: ROBOTIC VISION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 197 MIDDLE EAST: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 198 SOUTH AMERICA: ROBOTIC VISION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 199 SOUTH AMERICA: ROBOTIC VISION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 200 SOUTH AMERICA: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 201 SOUTH AMERICA: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 202 AFRICA: ROBOTIC VISION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 203 AFRICA: ROBOTIC VISION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 204 AFRICA: ROBOTIC VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 205 AFRICA: ROBOTIC VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 206 ROBOTIC VISION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-MARCH 2025

- TABLE 207 ROBOTIC VISION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 208 ROBOTIC VISION MARKET: REGION FOOTPRINT

- TABLE 209 ROBOTIC VISION MARKET: TYPE FOOTPRINT

- TABLE 210 ROBOTIC VISION MARKET: COMPONENT FOOTPRINT

- TABLE 211 ROBOTIC VISION MARKET: INDUSTRY FOOTPRINT

- TABLE 212 ROBOTIC VISION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 213 ROBOTIC VISION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 214 ROBOTIC VISION MARKET: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 215 ROBOTIC VISION MARKET: DEALS, JANUARY 2021-MARCH 2025

- TABLE 216 COGNEX CORPORATION: COMPANY OVERVIEW

- TABLE 217 COGNEX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 COGNEX CORPORATION: PRODUCT LAUNCHES

- TABLE 219 KEYENCE CORPORATION: COMPANY OVERVIEW

- TABLE 220 KEYENCE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 KEYENCE CORPORATION: PRODUCT LAUNCHES

- TABLE 222 TELEDYNE TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 223 TELEDYNE TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 TELEDYNE TECHNOLOGIES INC.: PRODUCT LAUNCHES

- TABLE 225 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 226 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 OMRON CORPORATION: PRODUCT LAUNCHES

- TABLE 228 OMRON CORPORATION: DEALS

- TABLE 229 FANUC CORPORATION: COMPANY OVERVIEW

- TABLE 230 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 FANUC CORPORATION: PRODUCT LAUNCHES

- TABLE 232 BASLER AG: COMPANY OVERVIEW

- TABLE 233 BASLER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 BASLER AG: PRODUCT LAUNCHES

- TABLE 235 BASLER AG: DEALS

- TABLE 236 SICK AG: COMPANY OVERVIEW

- TABLE 237 SICK AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 SICK AG: PRODUCT LAUNCHES

- TABLE 239 SICK AG: DEALS

- TABLE 240 ATLAS COPCO AB: COMPANY OVERVIEW

- TABLE 241 ATLAS COPCO AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 243 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 EMERSON ELECTRIC CO.: DEALS

- TABLE 245 ZEBRA TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 246 ZEBRA TECHNOLOGIES CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 ZEBRA TECHNOLOGIES CORP.: PRODUCT LAUNCHES

- TABLE 248 ZEBRA TECHNOLOGIES CORP.: DEALS

- TABLE 249 HEXAGON AB: BUSINESS OVERVIEW

- TABLE 250 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 HEXAGON AB: DEALS

- TABLE 252 ADVANTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 253 ADVANTECH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 ABB: COMPANY OVERVIEW

- TABLE 255 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 ABB: DEALS

- TABLE 257 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 258 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 QUALCOMM TECHNOLOGIES, INC.: DEALS

List of Figures

- FIGURE 1 ROBOTIC VISION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 ROBOTIC VISION MARKET: RESEARCH DESIGN

- FIGURE 4 ROBOTIC VISION MARKET: RESEARCH APPROACH

- FIGURE 5 KEY DATA FROM SECONDARY SOURCES

- FIGURE 6 KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 KEY INDUSTRY INSIGHTS

- FIGURE 8 BREAKDOWN OF PRIMARIES

- FIGURE 9 ROBOTIC VISION MARKET: BOTTOM-UP APPROACH

- FIGURE 10 ROBOTIC VISION MARKET: TOP-DOWN APPROACH

- FIGURE 11 ROBOTIC VISION MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 12 ROBOTIC VISION MARKET: DATA TRIANGULATION

- FIGURE 13 ROBOTIC VISION MARKET SIZE, IN TERMS OF VALUE, 2021-2030

- FIGURE 14 CAMERAS SEGMENT TO HOLD LARGEST MARKET SHARE OF ROBOTIC VISION MARKET IN 2025

- FIGURE 15 2D VISION SYSTEMS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 FOOD & BEVERAGES SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 17 ASIA PACIFIC CAPTURED LARGEST SHARE OF ROBOTIC VISION MARKET IN 2024

- FIGURE 18 GROWING FOCUS ON AUTOMATION IN MANUFACTURING SECTOR TO CONTRIBUTE TO ROBOTIC VISION MARKET GROWTH

- FIGURE 19 CAMERAS SEGMENT TO HOLD LARGEST SHARE OF ROBOTIC VISION MARKET IN 2030

- FIGURE 20 AUTOMOTIVE SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 21 AUTOMOTIVE SEGMENT AND US HELD LARGEST SHARES OF NORTH AMERICAN ROBOTIC VISION MARKET IN 2024

- FIGURE 22 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL ROBOTIC VISION MARKET FROM 2025 TO 2030

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 IMPACT ANALYSIS: DRIVERS

- FIGURE 25 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 26 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 27 IMPACT ANALYSIS: CHALLENGES

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 AVERAGE SELLING PRICE TREND OF ROBOTIC VISION SYSTEMS, BY HARDWARE COMPONENT, 2021-2024

- FIGURE 30 AVERAGE SELLING PRICE TREND OF ROBOTIC VISION HARDWARE COMPONENTS, BY REGION, 2020-2024

- FIGURE 31 VALUE CHAIN ANALYSIS

- FIGURE 32 ECOSYSTEM ANALYSIS

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 34 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 35 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 36 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 37 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 39 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 40 AI USE CASES IN ROBOTIC VISION

- FIGURE 41 AREAS OF ROBOTIC VISION SYSTEM DEPLOYMENT

- FIGURE 42 DETECTION ALGORITHMS FOR ROBOTIC VISION SYSTEMS

- FIGURE 43 ROBOTIC VISION MARKET, BY COMPONENT

- FIGURE 44 CAMERAS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 45 ROBOTIC VISION MARKET, BY TYPE

- FIGURE 46 3D VISION SYSTEMS SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 47 ROBOTIC VISION APPLICATIONS

- FIGURE 48 MEASUREMENT, INSPECTION, & TESTING SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 49 ROBOTIC VISION MARKET, BY INDUSTRY

- FIGURE 50 AUTOMOTIVE INDUSTRY TO DOMINATE ROBOTIC VISION MARKET FROM 2025 TO 2030

- FIGURE 51 ROBOTIC VISION MARKET, BY REGION

- FIGURE 52 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL ROBOTIC VISION MARKET DURING FORECAST PERIOD

- FIGURE 53 NORTH AMERICA: ROBOTIC VISION MARKET SNAPSHOT

- FIGURE 54 US TO DOMINATE NORTH AMERICAN ROBOTIC VISION MARKET FROM 2025 TO 2030

- FIGURE 55 EUROPE: ROBOTIC VISION MARKET SNAPSHOT

- FIGURE 56 GERMANY TO ACCOUNT FOR LARGEST SHARE OF EUROPEAN ROBOTIC VISION MARKET IN 2030

- FIGURE 57 ASIA PACIFIC: ROBOTIC VISION MARKET SNAPSHOT

- FIGURE 58 CHINA TO BE LARGEST ROBOTIC VISION MARKET IN ASIA PACIFIC BETWEEN 2025 AND 2030

- FIGURE 59 SOUTH AMERICA TO DOMINATE ROBOTIC VISION MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 60 ROBOTIC VISION MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 61 MARKET SHARE ANALYSIS OF COMPANIES OFFERING ROBOTIC VISION TECHNOLOGIES, 2024

- FIGURE 62 PRODUCT COMPARISON

- FIGURE 63 COMPANY VALUATION

- FIGURE 64 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 65 ROBOTIC VISION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 66 ROBOTIC VISION MARKET: COMPANY FOOTPRINT

- FIGURE 67 ROBOTIC VISION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 68 COGNEX CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 KEYENCE CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 TELEDYNE TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 71 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 72 FANUC CORPORATION: COMPANY SNAPSHOT

- FIGURE 73 BASLER AG: COMPANY SNAPSHOT

- FIGURE 74 SICK AG: COMPANY SNAPSHOT

- FIGURE 75 ATLAS COPCO AB: COMPANY SNAPSHOT

- FIGURE 76 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 77 ZEBRA TECHNOLOGIES CORP.: COMPANY SNAPSHOT

- FIGURE 78 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 79 ADVANTECH CO., LTD.: COMPANY SNAPSHOT

- FIGURE 80 ABB: COMPANY SNAPSHOT

- FIGURE 81 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

At a CAGR of 8.7%, the global robotic vision market is expected to grow from USD 3.29 billion in 2025 to USD 4.99 billion in 2030. 3D robotic systems greatly benefit from 3D vision technology, which offers flexibility for various functions like bin picking, inspection, and measurement. This advanced technology can identify and locate objects based on their shape, allowing for reliable detection of objects with low contrast or complex geometries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Component, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

As cameras improve in resolution and prices decrease, combined with new microprocessors capable of handling large data sets in real time, 3D vision is expanding the robotic vision market and becoming more attractive for robotic applications.

"2D vision systems will capture a prominent share of the robotic vision market"

A two-dimensional (2D) vision system uses a digital camera to capture an image and processes it into an x-y plane. 2D vision systems create flat, two-dimensional maps of reflected intensity or contrast, making lighting a crucial factor for these cameras. Usually mounted overhead, these systems look down on industrial robots and help in creating program paths for the robots. A 2D vision system captures the processed 2D image at various resolutions. The main advantage of a 2D system over a 3D system is that it is more economical and convenient. These systems are increasingly used in the food and beverage industry as well as in healthcare.

"Electronics & semiconductors will hold the second-largest market share in the robotic vision market, by industry, throughout the forecast period"

Robotic vision systems have the potential to transform production by increasing throughput, quality, and productivity in the electronics and semiconductors industry. Material handling and automated inspection are the most common applications of vision systems. These systems have revolutionized the inspection of electronic components, including semiconductors. Applications such as welding, packaging, and palletizing also rely on the high precision provided by robotic vision systems. Additionally, electronic chips and components are produced in various sizes, which requires micro-level precision in welding and palletizing.

"Industrial automation and growth concerns will position Europe as the third-largest market for robotic vision solutions"

The robotic vision market in Europe is growing as the region encompasses many active industries and companies. The European industry has strong technical and commercial expertise in the robotic vision sector in several Member States-especially France, Germany, Italy, Spain, Switzerland, the Netherlands, the Nordics, and the UK. It has developed skills for large manufacturing users. These strengths could now be redirected toward emerging robotic vision markets. Growth has also been seen in small and medium-sized enterprises (SMEs), creating a significant opportunity for the robotic vision market to expand. The European Machine Vision Association (EMVA) has supported the success of the machine vision industry in Europe and forecasts a positive outlook for this market. The EMVA continues to support robotic vision technology by offering more member benefits and serving as the voice of the machine vision community in Europe.

Breakdown of Primaries

Various executives from key organizations operating in the robotic vision market, including CEOs, marketing directors, and innovation and technology directors, were interviewed in-depth.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Directors - 33%, C-level - 48%, and Others - 19%

- By Region: North America - 35%, Europe - 18%, Asia Pacific - 40%, and RoW - 7%

Major players profiled in this report are Cognex Corporation (US), KEYENCE CORPORATION (Japan), Teledyne Technologies Inc. (US), Omron Corporation (Japan), FANUC CORPORATION (Japan), Basler AG (Germany), SICK AG (Germany), Atlas Copco AB (Sweden), Emerson Electric Co. (US), Zebra Technologies Corp. (US), Hexagon AB (Sweden), Advantech Co., Ltd.(Taiwan), ABB (Switzerland), Qualcomm Technologies, Inc. (US), Qualitas Technologies (India), Baumer (Switzerland), Tordivel AS (Norway), Optotune (Switzerland), MVTec Software Gmbh (Germany), Industrial Vision Systems (UK), IDS Imaging Development Systems GmbH (Germany), Wenglor ( Germany), Zivid (Norway), ADLINK Technology Inc. (Taiwan), and LMI TECHNOLOGIES INC.(Canada). These leading companies possess a broad portfolio of products and establish a prominent presence in established and emerging markets.

The study provides a detailed competitive analysis of these key players in the robotic vision market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report segments the robotic vision market based on deployment (robotic guidance systems and robotic cells), detection algorithm (counter-based, correlation-based, feature extraction, and cloud of point), application (welding and soldering; material handling; packaging and palletizing; painting; assembling and disassembling; cutting, pressing, grinding, and deburring; measurement, inspection, and testing), type (2D and 3D vision systems) and industry (automotive, electronics & semiconductors, rubber & plastics, metals & machinery, logistics, food & beverages, healthcare, and other industries). The market has been segmented into four regions-North America, Asia Pacific, Europe, and the Rest of the World (RoW).

Reasons to Buy the Report

The report will assist leaders and new entrants in this market by providing estimates of revenue figures for the overall market and its subsegments. It will also help stakeholders understand the competitive landscape and gain insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report offers insights into the robotic vision market's current dynamics and covers key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (increasing demand for automated robotic vision systems in quality inspection, growing adoption of 3D vision systems in industrial robotics, growing need for safety and high-quality products in industrial sector, rising adoption of smart cameras in robotic vision systems), restraints (high cost of installation, difficulty in accommodating a wide range of applications, limited awareness of robotic vision systems), opportunities (rising implementation of robotic vision systems in the food and beverage industry, government-driven programs to enhance industrial automation, incorporation of AI and deep learning technologies into robotic vision systems, personalization of robotic vision solutions), and challenges (challenges in producing robotic vision systems, configuring advanced inspection operations) influencing the growth of the robotic vision market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the robotic vision market

- Market Development: Comprehensive information about lucrative markets, including the analysis of the robotic vision market across varied regions

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in robotic vision solutions

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, including Cognex Corporation (US), KEYENCE CORPORATION (Japan), Teledyne Technologies Inc. (US), Omron Corporation (Japan), and FANUC CORPORATION (Japan)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ROBOTIC VISION MARKET

- 4.2 ROBOTIC VISION MARKET, BY COMPONENT

- 4.3 ROBOTIC VISION MARKET, BY INDUSTRY

- 4.4 ROBOTIC VISION MARKET IN NORTH AMERICA, BY INDUSTRY AND COUNTRY

- 4.5 ROBOTIC VISION MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising emphasis on machine automation to enhance industrial operations

- 5.2.1.2 Growing adoption of 3D vision systems in industrial robotics

- 5.2.1.3 Increasing need for safe and high-quality products in industrial sectors

- 5.2.1.4 Rising integration of smart cameras into robotic systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial installation costs

- 5.2.2.2 Complexities in creating standard vision systems for different manufacturing applications

- 5.2.2.3 Limited awareness of robotic vision systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising implementation of robotic vision systems in food & beverages industry

- 5.2.3.2 Government-driven programs to enhance industrial automation

- 5.2.3.3 Incorporation of AI and deep learning technologies into robotic vision systems

- 5.2.3.4 Growing demand for personalized robotic vision systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities in integrating robots into vision systems

- 5.2.4.2 Issues related to complex inspections involving deviation and unpredictable defects

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING RANGE OF ROBOTIC VISION SYSTEMS OFFERED BY KEY PLAYERS, BY COMPONENT, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF ROBOTIC VISION SYSTEMS, BY HARDWARE COMPONENT, 2021-2024

- 5.4.3 AVERAGE SELLING PRICE TREND OF ROBOTIC VISION HARDWARE COMPONENTS, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Artificial intelligence

- 5.8.1.2 Deep learning

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Hyperspectral imaging

- 5.8.2.2 Edge computing

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Cloud computing

- 5.8.3.2 5G

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 852580)

- 5.10.2 EXPORT SCENARIO (HS CODE 852580)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY

- 5.12.1 MWES DESIGNS KAWASAKI RS007L ROBOTS FITTED WITH VACUUM GRIPPERS TO HELP CLIENT REDUCE DEPENDENCE ON HUMAN LABOR

- 5.12.2 PRESCRIPTIVE DATA USES TELEDYNE FLIR'S VISION SENSORS TO DELIVER ACCURATE OCCUPANCY DATA FOR SMART BUILDINGS

- 5.12.3 LEADING AUTOMOTIVE SUPPLIER IMPROVES INSPECTION EFFICIENCY WITH FUJIFILM'S 4D HIGH RESOLUTION LENSES

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON ROBOTIC VISION MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI/GEN AI ON KEY INDUSTRIES

- 5.16.2.1 Electronics & semiconductors

- 5.16.2.2 Food & beverages

- 5.16.3 AI USE CASES

- 5.16.4 FUTURE OF AI/GEN AI IN ROBOTIC VISION ECOSYSTEM

- 5.17 IMPACT OF 2025 US TARIFF ON ROBOTIC VISION MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON INDUSTRIES

6 AREAS OF ROBOTIC VISION SYSTEM DEPLOYMENT

- 6.1 INTRODUCTION

- 6.2 ROBOTIC GUIDANCE SYSTEMS

- 6.3 ROBOTIC CELLS

7 DETECTION ALGORITHMS FOR ROBOTIC VISION SYSTEMS

- 7.1 INTRODUCTION

- 7.2 CONTOUR-BASED

- 7.3 CORRELATION-BASED

- 7.4 FEATURE EXTRACTION

- 7.5 CLOUD OF POINTS

8 ROBOTIC VISION MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 CAMERAS

- 8.2.1 BY FORMAT

- 8.2.1.1 Line scan

- 8.2.1.2 Area scan

- 8.2.2 BY SENSOR

- 8.2.2.1 CMOS

- 8.2.2.2 CCD

- 8.2.3 BY IMAGING SPECTRUM

- 8.2.3.1 Visible

- 8.2.3.1.1 Increasing use for discrete part inspection and other robotic vision applications to fuel segmental growth

- 8.2.3.2 Visible + IR

- 8.2.3.2.1 Rising application in large industrial sectors to contribute to segmental growth

- 8.2.3.1 Visible

- 8.2.1 BY FORMAT

- 8.3 LED LIGHTING SYSTEMS

- 8.3.1 BURGEONING DEMAND FOR STRUCTURED LIGHTING TO AUGMENT SEGMENTAL GROWTH

- 8.4 OPTICS

- 8.4.1 INCREASING INTEGRATION WITH CAMERAS FOR IMAGE ACQUISITION TO BOLSTER SEGMENTAL GROWTH

- 8.5 PROCESSORS & CONTROLLERS

- 8.5.1 HIGH COMPLEXITY IN VISION ALGORITHMS TO ACCELERATE SEGMENTAL GROWTH

- 8.5.2 FPGA

- 8.5.3 DSP

- 8.5.4 MICROCONTROLLERS & MICROPROCESSORS

- 8.5.5 VPU

- 8.6 FRAME GRABBERS

- 8.6.1 RISING INTEGRATION WITH DIGITAL CAMERAS TO ACHIEVE HIGH PROCESSING SPEEDS AND RESOLUTIONS TO DRIVE MARKET

- 8.7 OTHER HARDWARE COMPONENTS

- 8.8 SOFTWARE

- 8.8.1 FLEXIBILITY AND TRAIN CUSTOMIZED NEURAL NETWORKS TO EXPEDITE SEGMENTAL GROWTH

9 ROBOTIC VISION MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 2D VISION SYSTEMS

- 9.2.1 COST-EFFECTIVENESS AND CONVENIENT ATTRIBUTES TO BOOST SEGMENTAL GROWTH

- 9.3 3D VISION SYSTEMS

- 9.3.1 ADAPTABILITY AND FLEXIBILITY TO CHANGES TO ACCELERATE SEGMENTAL GROWTH

- 9.3.2 SINGLE- AND MULTI-CAMERA TRIANGULATION

- 9.3.3 STRUCTURED LIGHT

- 9.3.4 TIME-OF-FLIGHT (TOF)

- 9.3.5 STEREO VISION

- 9.3.6 LASER-BASED

10 ROBOTIC VISION APPLICATIONS

- 10.1 INTRODUCTION

- 10.2 WELDING & SOLDERING

- 10.3 MATERIAL HANDLING

- 10.4 PACKAGING & PALLETIZING

- 10.5 PAINTING

- 10.6 ASSEMBLING & DISASSEMBLING

- 10.7 CUTTING, PRESSING, GRINDING & DEBURRING

- 10.8 MEASUREMENT, INSPECTION & TESTING

11 ROBOTIC VISION MARKET, BY INDUSTRY

- 11.1 INTRODUCTION

- 11.2 AUTOMOTIVE

- 11.2.1 SHORTAGE OF SKILLED LABORERS AND LOW MANUFACTURING COSTS TO BOOST SEGMENTAL GROWTH

- 11.3 ELECTRONICS & SEMICONDUCTORS

- 11.3.1 DEMAND FOR ENHANCED QUALITY CONTROL AND OBJECT RECOGNITION TO DRIVE MARKET

- 11.4 RUBBER & PLASTICS

- 11.4.1 APPLICATION IN MATERIAL HANDLING AND INSPECTION TASKS TO BOOST DEMAND FOR ROBOTIC VISION SYSTEMS

- 11.5 METALS & MACHINERY

- 11.5.1 INTEGRATION OF ROBOTIC VISION SYSTEMS INTO MANUFACTURING SYSTEMS TO ENHANCE PRODUCTION QUALITY TO FUEL SEGMENTAL GROWTH

- 11.6 FOOD & BEVERAGES

- 11.6.1 FOCUS ON ENHANCING SANITATION AND MATERIAL HANDLING OPERATIONS TO ACCELERATE SEGMENTAL GROWTH

- 11.7 HEALTHCARE

- 11.7.1 REQUIREMENT FOR HIGH LEVEL OF SCRUTINY TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.8 LOGISTICS

- 11.8.1 NEED FOR FASTER, SMARTER, AND MORE RELIABLE OPERATIONS TO FUEL SEGMENTAL GROWTH

- 11.9 OTHER INDUSTRIES

12 ROBOTIC VISION MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Increasing need for improved product inspection and quality control in manufacturing sector to drive market

- 12.2.3 CANADA

- 12.2.3.1 Rising adoption of automated inspection and monitoring solutions to augment market growth

- 12.2.4 MEXICO

- 12.2.4.1 Growing emphasis on manufacturing automation to contribute to market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Rising vehicle production and factory operations to bolster market growth

- 12.3.3 UK

- 12.3.3.1 Increasing focus on improving product quality and minimizing waste in automotive sector to fuel market growth

- 12.3.4 FRANCE

- 12.3.4.1 Rising deployment of electric and hybrid vehicles to drive market

- 12.3.5 ITALY

- 12.3.5.1 Growing emphasis on factory automation to contribute to market growth

- 12.3.6 SPAIN

- 12.3.6.1 Increasing government incentives for purchasing EVs and HEVs to foster market growth

- 12.3.7 NETHERLANDS

- 12.3.7.1 Rising adoption in logistics and electronics sectors to expedite market growth

- 12.3.8 SWITZERLAND

- 12.3.8.1 High expertise in precision engineering and high-tech manufacturing to boost market growth

- 12.3.9 NORDICS

- 12.3.9.1 Strong focus on predictive maintenance, quality assurance, and AI-based inspection to accelerate market growth

- 12.3.10 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Rising manufacturing of electronics & semiconductor components and commercial vehicles to drive market

- 12.4.3 JAPAN

- 12.4.3.1 Increasing export of robots to contribute to market growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Thriving electronics industry and demand for automation to augment market growth

- 12.4.5 INDIA

- 12.4.5.1 Growing focus on automation and digitalization to stimulate market growth

- 12.4.6 AUSTRALIA

- 12.4.6.1 Expanding applications in electronics and food & beverages industries to bolster market growth

- 12.4.7 INDONESIA

- 12.4.7.1 Rising need for efficiency, consistency, and quality in production processes to spur robotic vision system adoption

- 12.4.8 SINGAPORE

- 12.4.8.1 Rapid technological advances and well-developed infrastructure to foster market growth

- 12.4.9 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Saudi Arabia

- 12.5.2.1.1 Growing emphasis on smart manufacturing, automation, and digital transformation to accelerate market growth

- 12.5.2.2 UAE

- 12.5.2.2.1 Rising initiatives to promote automation technology adoption to expedite market growth

- 12.5.2.3 Bahrain

- 12.5.2.3.1 National strategies to support industrial automation to accelerate market growth

- 12.5.2.4 Kuwait

- 12.5.2.4.1 Growing focus on modernizing manufacturing sector to contribute to market growth

- 12.5.2.5 Oman

- 12.5.2.5.1 High preference for smart manufacturing practices to bolster market growth

- 12.5.2.6 Qatar

- 12.5.2.6.1 Escalating adoption of smart automation technologies to fuel market growth

- 12.5.2.7 Rest of Middle East

- 12.5.2.1 Saudi Arabia

- 12.5.3 SOUTH AMERICA

- 12.5.3.1 Brazil

- 12.5.3.1.1 Increasing investment in industrial automation and smart manufacturing technologies to drive market

- 12.5.3.2 Argentina

- 12.5.3.2.1 Rising emphasis on modernizing manufacturing facilities to boost market growth

- 12.5.3.3 Other South American countries

- 12.5.3.1 Brazil

- 12.5.4 AFRICA

- 12.5.4.1 South Africa

- 12.5.4.1.1 Increasing focus on enhancing manufacturing competitiveness to fuel market growth

- 12.5.4.2 Other African countries

- 12.5.4.1 South Africa

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 PRODUCT COMPARISON

- 13.6 COMPANY VALUATION AND FINANCIAL METRICS

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Type footprint

- 13.7.5.4 Component footprint

- 13.7.5.5 Industry footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 COGNEX CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 KEYENCE CORPORATION

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 TELEDYNE TECHNOLOGIES INC.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 OMRON CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 FANUC CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 BASLER AG

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.4 MnM view

- 14.1.6.4.1 Key strengths/Right to win

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses/Competitive threats

- 14.1.7 SICK AG

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.8 ATLAS COPCO AB

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 EMERSON ELECTRIC CO.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.10 ZEBRA TECHNOLOGIES CORP.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.11 HEXAGON AB

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.12 ADVANTECH CO., LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 ABB

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.14 QUALCOMM TECHNOLOGIES, INC.

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Deals

- 14.1.1 COGNEX CORPORATION

- 14.2 OTHER PLAYERS

- 14.2.1 QUALITAS TECHNOLOGIES

- 14.2.2 BAUMER

- 14.2.3 TORDIVEL AS

- 14.2.4 OPTOTUNE

- 14.2.5 MVTEC SOFTWARE GMBH

- 14.2.6 INDUSTRIAL VISION SYSTEMS

- 14.2.7 IDS IMAGING DEVELOPMENT SYSTEMS GMBH

- 14.2.8 WENGLOR SENSORIC GMBH

- 14.2.9 ZIVID

- 14.2.10 ADLINK TECHNOLOGY INC.

- 14.2.11 LMI TECHNOLOGIES INC.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS