|

|

市場調査レポート

商品コード

1790685

自動車AIの世界市場:オファリング別、技術別、自動運転レベル別、用途別、地域別 - 2030年までの予測Automotive AI Market by Offerings (Compute, Memory, Software), Level of Autonomy (L1, L2, L3, L4, L5), Technology (Deep Learning, ML, Computer Vision, Context-aware Computing, NLP), Application (ADAS, Infotainment, Telematics) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動車AIの世界市場:オファリング別、技術別、自動運転レベル別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月04日

発行: MarketsandMarkets

ページ情報: 英文 265 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

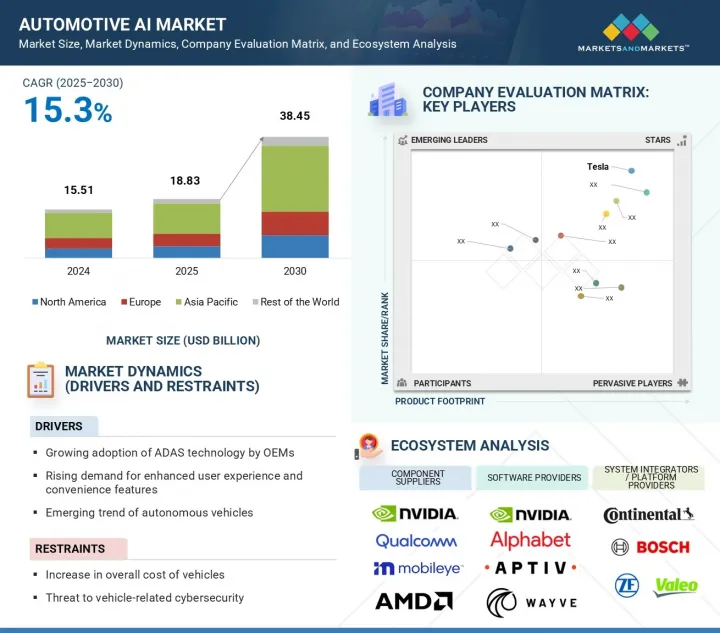

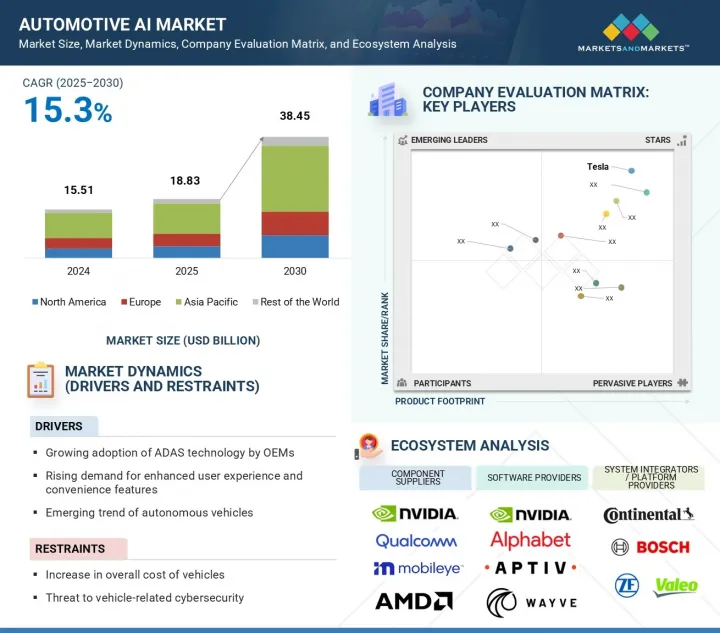

自動車AIの市場規模は、2025年の188億3,000万米ドルから2030年には384億5,000万米ドルに拡大し、CAGRは15.3%を記録すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | オファリング別、技術別、自動運転レベル別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

市場は、知覚、ナビゲーション、リアルタイムの意思決定においてAIに大きく依存する自律走行車の新たな動向に後押しされています。業界がより高度な自律性に向かうにつれ、インテリジェント・システムに対する需要は増加の一途をたどっています。同時に、センサー、カメラ、コネクテッドシステムから生成される車載データの量が増加しているため、安全性、効率性、パーソナライゼーションを強化するためのAI主導の分析ニーズが高まっています。

ハードウェア分野は、自律走行システムやインテリジェントな車両機能を強化するために必要な高度なセンサー、AIアクセラレーター、高性能コンピューティングチップの統合が進んでいることから、自動車AI市場において高い成長が見込まれています。自動車がデータ集約型プラットフォームに進化するにつれ、カメラ、LiDAR、レーダー、超音波センサーからのリアルタイムデータを処理するためのGPU、ASIC、FPGA、エッジAIチップなどの堅牢なハードウェア・インフラに対するニーズが高まっています。さらに、ソフトウェア定義の自動車への移行が、自動車メーカーに強力なドメインコントローラーと集中コンピューティングアーキテクチャの採用を促しています。

コンピュータ・ビジョンは、自律走行とADAS(先進運転支援システム)の両方に不可欠なリアルタイムの環境認識を可能にする上で不可欠な役割を果たすため、自動車AI市場全体で大きなシェアを占めています。この技術は、カメラやセンサーからの視覚データを分析することで、車線検出、歩行者認識、交通標識識別、障害物回避などの重要な機能を強化します。自動車がインテリジェント化し、安全規制が世界的に強化される中、OEMやティア1サプライヤーは、車両の認識と意思決定能力を強化するため、堅牢なコンピュータビジョンシステムへの投資を優先しています。

欧州は、強固な自動車製造基盤、厳格な安全・排ガス規制、先進運転支援・自律走行技術の早期導入により、世界の自動車AI市場で第2位のシェアを占めています。ドイツ、フランス、英国のような国々は、ドライバーの安全性、エネルギー効率、車内体験を向上させるために、車両プラットフォームにAIを積極的に組み込んでいる大手OEMやTier-1サプライヤーの本拠地です。同地域では、プレミアムカー、電気自動車、ソフトウエア定義型自動車に注力しており、AI主導の機能に対する高い需要が生まれています。

当レポートでは、世界の自動車AI市場について調査し、オファリング別、技術別、自動運転レベル別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 特許分析

- 規制状況

- 貿易分析

- 価格分析

- 技術分析

- ケーススタディ分析

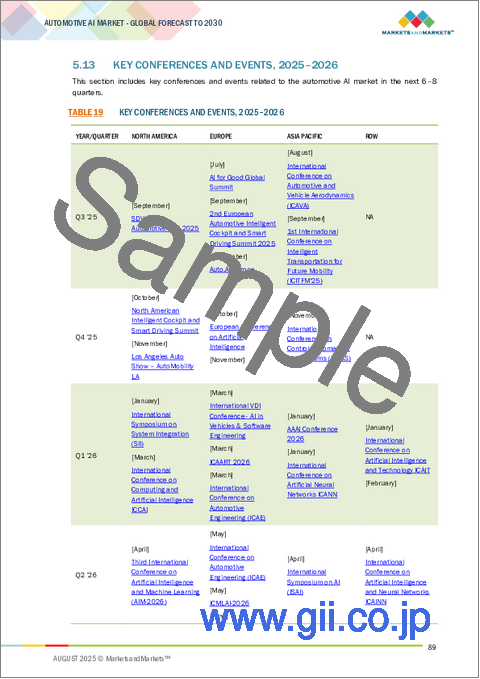

- 2025年~2026年の主な会議とイベント

- 主要な利害関係者と購入基準

- 2025年の米国関税が自動車AI市場に与える影響

第6章 自動車AI市場におけるアーキテクチャ

- イントロダクション

- フォン・ノイマンアーキテクチャ

- ニューロモルフィックアーキテクチャ

第7章 自動車AI市場(オファリング別)

- イントロダクション

- ハードウェア

- ソフトウェア

第8章 自動車AI市場(技術別)

- イントロダクション

- ディープラーニング

- 機械学習

- コンピュータービジョン

- コンテキストアウェアコンピューティング

- 自然言語処理

第9章 自動車AI市場(自動運転レベル別)

- イントロダクション

- L1

- L2

- L3

- L4

- L5

第10章 自動車向けAI市場(用途別)

- イントロダクション

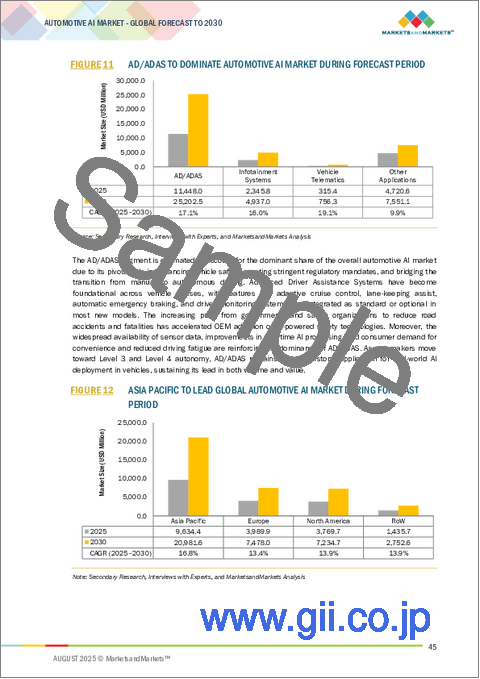

- AD/ADAS

- インフォテインメントシステム

- 車両テレマティクス

- その他

第11章 自動車AI市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 南米

- 中東・アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- TESLA

- NVIDIA CORPORATION

- MOBILEYE

- QUALCOMM TECHNOLOGIES, INC.

- ADVANCED MICRO DEVICES, INC.

- ALPHABET INC.

- APTIV

- MICRON TECHNOLOGY, INC.

- MICROSOFT

- IBM

- その他の企業

- NAUTO

- AURORA OPERATIONS, INC.

- WAYVE

- NURO, INC.

- PONY.AI

- HELM.AI

- TACTILE MOBILITY

- DEEPROUTE.AI

- COGNATA

- NULLMAX

- COMMA_AI

- MOTIONAL, INC.

- OXA AUTONOMY LIMITED

- IMAGRY AUTONOMOUS DRIVING SOFTWARE COMPANY

- APPLIED INTUITION, INC.

第14章 付録

List of Tables

- TABLE 1 AUTOMOTIVE AI MARKET: RISK ANALYSIS

- TABLE 2 AUTOMOTIVE AI MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 3 AUTOMOTIVE AI MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 LIST OF APPLIED/GRANTED PATENTS RELATED TO AUTOMOTIVE AI, MARCH 2024-JUNE 2025

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 STANDARDS

- TABLE 10 IMPORT DATA FOR HS CODE 8471-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 8471-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 INDICATIVE PRICING ANALYSIS OF GPU-DOMINANT SOCS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 13 INDICATIVE PRICING ANALYSIS OF ASIC-DOMINANT SOCS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 14 INDICATIVE PRICING ANALYSIS OF FPGA-DOMINANT SOCS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 15 PRICING RANGE OF AUTOMOTIVE AI COMPUTE, BY KEY PLAYERS, 2024

- TABLE 16 AVERAGE SELLING PRICE TREND OF GPU-DOMINANT SOC, BY REGION, 2021-2024 (USD)

- TABLE 17 AVERAGE SELLING PRICE TREND OF FPGA-DOMINANT SOC, BY REGION, 2021-2024 (USD)

- TABLE 18 AVERAGE SELLING PRICE TREND OF ASIC-DOMINANT SOC, BY REGION, 2021-2024 (USD)

- TABLE 19 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 21 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 22 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 AUTOMOTIVE AI MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 24 AUTOMOTIVE AI MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 25 AUTOMOTIVE AI MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 26 AUTOMOTIVE AI MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 27 HARDWARE: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 HARDWARE: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 AUTOMOTIVE AI MARKET, BY COMPUTE, 2021-2024 (USD MILLION)

- TABLE 30 AUTOMOTIVE AI MARKET, BY COMPUTE, 2025-2030 (USD MILLION)

- TABLE 31 AUTOMOTIVE AI MARKET, BY COMPUTE, 2021-2024 (MILLION UNITS)

- TABLE 32 AUTOMOTIVE AI MARKET, BY COMPUTE, 2025-2030 (MILLION UNITS)

- TABLE 33 COMPUTE: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 COMPUTE: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 GPU-DOMINANT SOC: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 GPU-DOMINANT SOC: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 FPGA-DOMINANT SOC: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 FPGA-DOMINANT SOC: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 ASIC-DOMINANT SOC: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 ASIC-DOMINANT SOC: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 NPU-DOMINANT SOC: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 NPU-DOMINANT SOC: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 MEMORY: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 MEMORY: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 OTHERS: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 OTHERS: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 AUTOMOTIVE AI MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 48 AUTOMOTIVE AI MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 49 SOFTWARE: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 SOFTWARE: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 MIDDLEWARE: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 MIDDLEWARE: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 APPLICATION SOFTWARE: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 APPLICATION SOFTWARE: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 OPERATING SYSTEM: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 OPERATING SYSTEM: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 AUTOMOTIVE AI MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 58 AUTOMOTIVE AI MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 59 DEEP LEARNING: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 DEEP LEARNING: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 MACHINE LEARNING: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 MACHINE LEARNING: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 COMPUTER VISION: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 COMPUTER VISION: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 CONTEXT-AWARE COMPUTING: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 CONTEXT-AWARE COMPUTING: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 NATURAL LANGUAGE PROCESSING: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 NATURAL LANGUAGE PROCESSING: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 AUTOMOTIVE AI MARKET, BY LEVEL OF AUTONOMY, 2021-2024 (USD MILLION)

- TABLE 70 AUTOMOTIVE AI MARKET, BY LEVEL OF AUTONOMY, 2025-2030 (USD MILLION)

- TABLE 71 L1: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 L1: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 L2: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 L2: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 L3: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 L3: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 AUTOMOTIVE AI MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 78 AUTOMOTIVE AI MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 AD/ADAS: AUTOMOTIVE AI MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 80 AD/ADAS: AUTOMOTIVE AI MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 81 INFOTAINMENT SYSTEMS: AUTOMOTIVE AI MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 82 INFOTAINMENT SYSTEMS: AUTOMOTIVE AI MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 83 VEHICLE TELEMATICS: AUTOMOTIVE AI MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 84 VEHICLE TELEMATICS: AUTOMOTIVE AI MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 85 OTHER APPLICATIONS: AUTOMOTIVE AI MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 86 OTHER APPLICATIONS: AUTOMOTIVE AI MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 87 AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 90 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 92 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 94 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY COMPUTE, 2021-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY COMPUTE, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY LEVEL OF AUTONOMY, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY LEVEL OF AUTONOMY, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: AUTOMOTIVE AI MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: AUTOMOTIVE AI MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 EUROPE: AUTOMOTIVE AI MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: AUTOMOTIVE AI MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 106 EUROPE: AUTOMOTIVE AI MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: AUTOMOTIVE AI MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 108 EUROPE: AUTOMOTIVE AI MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: AUTOMOTIVE AI MARKET, BY COMPUTE, 2021-2024 (USD MILLION)

- TABLE 110 EUROPE: AUTOMOTIVE AI MARKET, BY COMPUTE, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: AUTOMOTIVE AI MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: AUTOMOTIVE AI MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: AUTOMOTIVE AI MARKET, BY LEVEL OF AUTONOMY, 2021-2024 (USD MILLION)

- TABLE 114 EUROPE: AUTOMOTIVE AI MARKET, BY LEVEL OF AUTONOMY, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: AUTOMOTIVE AI MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 116 EUROPE: AUTOMOTIVE AI MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 120 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 122 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY COMPUTE, 2021-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY COMPUTE, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY LEVEL OF AUTONOMY, 2021-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY LEVEL OF AUTONOMY, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: AUTOMOTIVE AI MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 131 ROW: AUTOMOTIVE AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 ROW: AUTOMOTIVE AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133 ROW: AUTOMOTIVE AI MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 134 ROW: AUTOMOTIVE AI MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 135 ROW: AUTOMOTIVE AI MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 136 ROW: AUTOMOTIVE AI MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 137 ROW: AUTOMOTIVE AI MARKET, BY COMPUTE, 2021-2024 (USD MILLION)

- TABLE 138 ROW: AUTOMOTIVE AI MARKET, BY COMPUTE, 2025-2030 (USD MILLION)

- TABLE 139 ROW: AUTOMOTIVE AI MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 140 ROW: AUTOMOTIVE AI MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 141 ROW: AUTOMOTIVE AI MARKET, BY LEVEL OF AUTONOMY, 2021-2024 (USD MILLION)

- TABLE 142 ROW: AUTOMOTIVE AI MARKET, BY LEVEL OF AUTONOMY, 2025-2030 (USD MILLION)

- TABLE 143 ROW: AUTOMOTIVE AI MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 144 ROW: AUTOMOTIVE AI MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 145 OVERVIEW OF STRATEGIES ADOPTED BY AUTOMOTIVE AI MANUFACTURERS AND PROVIDERS

- TABLE 146 AUTOMOTIVE AI MARKET SHARE ANALYSIS, 2024

- TABLE 147 AUTOMOTIVE AI MARKET: REGION FOOTPRINT, 2024

- TABLE 148 AUTOMOTIVE AI MARKET: OFFERING FOOTPRINT, 2024

- TABLE 149 AUTOMOTIVE AI MARKET: TECHNOLOGY FOOTPRINT, 2024

- TABLE 150 AUTOMOTIVE AI MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 151 AUTOMOTIVE AI MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 152 AUTOMOTIVE AI MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 153 AUTOMOTIVE AI MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 154 AUTOMOTIVE AI MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 155 TESLA: COMPANY OVERVIEW

- TABLE 156 TESLA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 158 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 NVIDIA CORPORATION: PRODUCT LAUNCHES

- TABLE 160 NVIDIA CORPORATION: DEALS

- TABLE 161 MOBILEYE: COMPANY OVERVIEW

- TABLE 162 MOBILEYE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 MOBILEYE: PRODUCT LAUNCHES

- TABLE 164 MOBILEYE: DEALS

- TABLE 165 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 166 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 QUALCOMM TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 168 QUALCOMM TECHNOLOGIES, INC.: DEALS

- TABLE 169 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- TABLE 170 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 ADVANCED MICRO DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 172 ADVANCED MICRO DEVICES, INC.: DEALS

- TABLE 173 ALPHABET INC.: COMPANY OVERVIEW

- TABLE 174 ALPHABET INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 ALPHABET INC.: DEALS

- TABLE 176 APTIV: COMPANY OVERVIEW

- TABLE 177 APTIV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 APTIV: DEALS

- TABLE 179 MICRON TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 180 MICRON TECHNOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 MICRON TECHNOLOGY, INC.: PRODUCT LAUNCHES

- TABLE 182 MICRON TECHNOLOGY, INC.: DEALS

- TABLE 183 MICROSOFT: COMPANY OVERVIEW

- TABLE 184 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 MICROSOFT: PRODUCT LAUNCHES

- TABLE 186 MICROSOFT: DEALS

- TABLE 187 IBM: COMPANY OVERVIEW

- TABLE 188 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 IBM: PRODUCT LAUNCHES

- TABLE 190 IBM: DEALS

- TABLE 191 NAUTO: COMPANY OVERVIEW

- TABLE 192 AURORA OPERATIONS, INC.: COMPANY OVERVIEW

- TABLE 193 WAYVE: COMPANY OVERVIEW

- TABLE 194 NURO, INC.: COMPANY OVERVIEW

- TABLE 195 PONY.AI: COMPANY OVERVIEW

- TABLE 196 HELM.AI: COMPANY OVERVIEW

- TABLE 197 TACTILE MOBILITY: COMPANY OVERVIEW

- TABLE 198 DEEPROUTE.AI: COMPANY OVERVIEW

- TABLE 199 COGNATA: COMPANY OVERVIEW

- TABLE 200 NULLMAX: COMPANY OVERVIEW

- TABLE 201 COMMA_AI: COMPANY OVERVIEW

- TABLE 202 MOTIONAL, INC.: COMPANY OVERVIEW

- TABLE 203 OXA AUTONOMY LIMITED: COMPANY OVERVIEW

- TABLE 204 IMAGRY AUTONOMOUS DRIVING SOFTWARE COMPANY: COMPANY OVERVIEW

- TABLE 205 APPLIED INTUITION, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AUTOMOTIVE AI MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AUTOMOTIVE AI MARKET: RESEARCH DESIGN

- FIGURE 3 AUTOMOTIVE AI MARKET: RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 AUTOMOTIVE AI MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 5 AUTOMOTIVE AI MARKET: BOTTOM-UP APPROACH

- FIGURE 6 AUTOMOTIVE AI MARKET: TOP-DOWN APPROACH

- FIGURE 7 AUTOMOTIVE AI MARKET: DATA TRIANGULATION

- FIGURE 8 SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 9 LEVEL 2 AUTONOMY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 DEEP LEARNING TECHNOLOGY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 AD/ADAS TO DOMINATE AUTOMOTIVE AI MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO LEAD GLOBAL AUTOMOTIVE AI MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 INCREASING DEPLOYMENT OF ADAS FEATURES AND GROWING DEMAND FOR PERSONALIZED IN-CAR EXPERIENCES DRIVING MARKET GROWTH

- FIGURE 15 L2 SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 16 DEEP LEARNING TECHNOLOGY TO DOMINATE MARKET BY 2030

- FIGURE 17 AD/ADAS APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 CHINA TO WITNESS HIGHEST CAGR IN GLOBAL AUTOMOTIVE AI MARKET DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AUTOMOTIVE AI MARKET

- FIGURE 20 ESTIMATED SHARE OF REGISTERED VEHICLES WITH ADAS FEATURE (2023 AND 2028)

- FIGURE 21 LEVELS OF AUTONOMOUS DRIVING

- FIGURE 22 IMPACT ANALYSIS: DRIVERS

- FIGURE 23 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 24 SENSOR FUSION

- FIGURE 25 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 26 IMPACT ANALYSIS: CHALLENGES

- FIGURE 27 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 28 AUTOMOTIVE AI MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 AUTOMOTIVE AI MARKET: ECOSYSTEM ANALYSIS

- FIGURE 30 AUTOMOTIVE AI MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 AUTOMOTIVE AI MARKET: PATENT ANALYSIS, 2014-2024

- FIGURE 32 IMPORT SCENARIO FOR HS CODE 8471-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2020-2024

- FIGURE 33 EXPORT SCENARIO FOR HS CODE 8471-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2020-2024

- FIGURE 34 AVERAGE SELLING PRICE TREND OF GPU-DOMINANT SOC, BY REGION, 2021-2024 (USD)

- FIGURE 35 AVERAGE SELLING PRICE TREND OF FPGA-DOMINANT SOC, BY REGION, 2021-2024 (USD)

- FIGURE 36 AVERAGE SELLING PRICE TREND OF ASIC-DOMINANT SOC, BY REGION, 2021-2024 (USD)

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 38 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 39 HARDWARE SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 40 DEEP LEARNING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 41 L2 SEGMENT TO ACCOUNT FOR LARGEST SHARE OF AUTOMOTIVE AI MARKET DURING FORECAST PERIOD

- FIGURE 42 AD/ADAS SEGMENT TO DOMINATE AUTOMOTIVE AI MARKET DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: AUTOMOTIVE AI MARKET SNAPSHOT

- FIGURE 45 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICA AUTOMOTIVE AI MARKET DURING FORECAST PERIOD

- FIGURE 46 EUROPE: AUTOMOTIVE AI MARKET SNAPSHOT

- FIGURE 47 GERMANY TO BE FASTEST-GROWING MARKET IN EUROPE DURING FORECAST PERIOD

- FIGURE 48 ASIA PACIFIC: AUTOMOTIVE AI MARKET SNAPSHOT

- FIGURE 49 CHINA TO LEAD AUTOMOTIVE AI MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 50 ROW: AUTOMOTIVE AI MARKET SNAPSHOT

- FIGURE 51 MIDDLE EAST & AFRICA TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 52 REVENUE ANALYSIS OF FIVE KEY PLAYERS IN AUTOMOTIVE AI MARKET, 2021-2024 (USD MILLION)

- FIGURE 53 AUTOMOTIVE AI MARKET: SHARE OF KEY PLAYERS

- FIGURE 54 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 55 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 56 BRAND/PRODUCT COMPARISON

- FIGURE 57 AUTOMOTIVE AI MARKET: COMPETITIVE EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 58 AUTOMOTIVE AI MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 59 AUTOMOTIVE AI MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 60 TESLA: COMPANY SNAPSHOT

- FIGURE 61 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 MOBILEYE: COMPANY SNAPSHOT

- FIGURE 63 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 64 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 65 ALPHABET INC.: COMPANY SNAPSHOT

- FIGURE 66 APTIV: COMPANY SNAPSHOT

- FIGURE 67 MICRON TECHNOLOGY, INC.: COMPANY SNAPSHOT

- FIGURE 68 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 69 IBM: COMPANY SNAPSHOT

The automotive AI market is projected to expand from USD 18.83 billion in 2025 to USD 38.45 billion by 2030, registering a CAGR of 15.3%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Architecture, Level of Autonomy, Technology, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The market is being propelled by the emerging trend of autonomous vehicles, which rely heavily on AI for perception, navigation, and real-time decision-making. As the industry moves toward higher levels of autonomy, the demand for intelligent systems continues to rise. Simultaneously, the growing volume of in-vehicle data generated from sensors, cameras, and connected systems is fueling the need for AI-driven analytics to enhance safety, efficiency, and personalization.

"Hardware segment projected to record highest CAGR during forecast period"

The hardware segment is expected to grow at a high rate in the automotive AI market due to the increasing integration of advanced sensors, AI accelerators, and high-performance computing chips required to power autonomous driving systems and intelligent vehicle features. As vehicles evolve into data-intensive platforms, there is a rising need for robust hardware infrastructure, such as GPUs, ASICs, FPGAs, and edge AI chips, to process real-time data from cameras, LiDAR, radar, and ultrasonic sensors. Moreover, the transition toward software-defined vehicles is pushing automakers to adopt powerful domain controllers and centralized computing architectures.

"Computer vision technology to hold significant market share in 2025"

Computer vision holds a significant share in the overall automotive AI market due to its indispensable role in enabling real-time environmental perception, which is critical for both autonomous driving and advanced driver assistance systems (ADAS). The technology powers essential functionalities such as lane detection, pedestrian recognition, traffic sign identification, and obstacle avoidance by analyzing visual data from cameras and sensors. As vehicles become more intelligent and safety regulations tighten globally, OEMs and Tier 1 suppliers are prioritizing investments in robust computer vision systems to enhance vehicle awareness and decision-making capabilities.

"Europe to be second-largest market for automotive AI in 2025"

Europe accounts for the second-largest share of the global automotive AI market owing to its strong automotive manufacturing base, stringent safety and emissions regulations, and early adoption of advanced driver assistance and autonomous driving technologies. Countries like Germany, France, and the UK are home to leading OEMs and Tier-1 suppliers that are aggressively integrating AI into vehicle platforms to enhance driver safety, energy efficiency, and in-cabin experience. The region's focus on premium, electric, and software-defined vehicles is creating a high demand for AI-driven functionalities.

Extensive primary interviews were conducted with key industry experts in the automotive AI market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-50%, Tier 2-30%, and Tier 3-20%

- By Designation: C-level Executives-40%, Directors-30%, and Others-30%

- By Region: Asia Pacific-40%, Europe-30%, North America-20%, and RoW-10%

The automotive AI market is dominated by a few globally established players, such as Tesla (US), NVIDIA Corporation (US), Mobileye (Israel), Qualcomm Technologies, Inc. (US), Advanced Micro Devices, Inc. (US), Alphabet Inc. (US), Aptiv (Switzerland), Micron Technology, Inc. (US), Microsoft (US), IBM (US), Nauto (US), Aurora Operations, Inc. (US), Wayve (UK), Nuro, Inc. (US), Pony.ai (China), HELM.AI (US), Tactile Mobility (Israel), DeepRoute.ai (China), Cognata (Israel), Nullmax (US), comma ai (US), Motional, Inc. (US), Oxa Autonomy Limited (UK), Imagry Autonomous Driving Software Company (US), and Applied Intuition, Inc. (US).

The study includes an in-depth competitive analysis of these key players in the automotive AI market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the automotive AI market based on offering (hardware, software), architecture (von neumann architecture, neuromorphic architecture), level of autonomy (L1, L2, L3, L4, L5), technology (deep learning, machine learning, computer vision, context-aware computing, natural language processing), and application (autonomous driving (AD)/advanced driver assistance systems (ADAS), infotainment systems, vehicle telematics, others). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes an ecosystem analysis of key players.

Key Benefits of Buying the Report:

- Analysis of key drivers (Growing adoption of ADAS technology by OEMS, Rising demand for enhanced user experience and convenience features, Emerging trend of autonomous vehicles, growing volume of in-vehicle data), restraints (Increase in overall cost of vehicles, Threat to vehicle-related cybersecurity, Inability to identify human signals), opportunities (Increasing demand for premium vehicles, Growing need for sensor fusion, High potential of in-car payments), challenges (Limited real-world testing and validation frameworks, AI model explainability and trust issues)

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the automotive AI market

- Market Development: Comprehensive information about lucrative markets through the analysis of the automotive AI market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the automotive AI market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Tesla (US), NVIDIA Corporation (US), Mobileye (Israel), Qualcomm Technologies, Inc. (US), Advanced Micro Devices, Inc. (US), Alphabet Inc. (US), Aptiv (Switzerland), Micron Technology, Inc. (US), Microsoft (US), IBM (US), Nauto (US), Aurora Operations, Inc. (US), Wayve (UK), Nuro, Inc. (US), and Pony.ai (China), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE AI MARKET

- 4.2 AUTOMOTIVE AI MARKET, BY OFFERING AND LEVEL OF AUTONOMY

- 4.3 AUTOMOTIVE AI MARKET, BY TECHNOLOGY

- 4.4 AUTOMOTIVE AI MARKET, BY APPLICATION

- 4.5 AUTOMOTIVE AI MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of ADAS technology by OEMs

- 5.2.1.2 Rising demand for enhanced user experience and convenience features

- 5.2.1.3 Emerging trend of autonomous vehicles

- 5.2.1.4 Growing volume of in-vehicle data

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increase in overall cost of vehicles

- 5.2.2.2 Threat to vehicle-related cybersecurity

- 5.2.2.3 Inability to identify human signals

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for premium vehicles

- 5.2.3.2 Growing need for sensor fusion

- 5.2.3.3 High potential of in-car payments

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited real-world testing and validation frameworks

- 5.2.4.2 AI model explainability and trust issues

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.6.2 BARGAINING POWER OF SUPPLIERS

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 THREAT OF NEW ENTRANTS

- 5.7 PATENT ANALYSIS

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 STANDARDS

- 5.8.3 REGULATIONS

- 5.8.3.1 North America

- 5.8.3.1.1 US

- 5.8.3.1.2 Canada

- 5.8.3.2 Europe

- 5.8.3.2.1 Germany

- 5.8.3.2.2 UK

- 5.8.3.2.3 France

- 5.8.3.3 Asia Pacific

- 5.8.3.3.1 China

- 5.8.3.3.2 South Korea

- 5.8.3.4 RoW

- 5.8.3.4.1 United Arab Emirates (UAE)

- 5.8.3.4.2 Brazil

- 5.8.3.1 North America

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8471)

- 5.9.2 EXPORT SCENARIO (HS CODE 8471)

- 5.10 PRICING ANALYSIS

- 5.10.1 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY COMPUTE, (2024)

- 5.10.1.1 Indicative pricing analysis of GPU-dominant SOCs, by key players (2024)

- 5.10.1.2 Indicative pricing analysis of ASIC-dominant SOCs, by key players (2024)

- 5.10.1.3 Indicative pricing analysis of FPGA-dominant SOCs, by key players (2024)

- 5.10.2 PRICING RANGE OF COMPUTE, BY KEY PLAYERS, 2024

- 5.10.3 AVERAGE SELING PRICE TREND, BY REGION, 2021-2024 (USD)

- 5.10.1 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY COMPUTE, (2024)

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Edge AI processing

- 5.11.1.2 Sensor fusion algorithms

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Vehicle-to-Everything (V2X) communication

- 5.11.2.2 Cybersecurity for AI models

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Digital twin technology

- 5.11.3.2 Human-Machine Interface (HMI)

- 5.11.1 KEY TECHNOLOGIES

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 HONDA MOTOR CO., LTD. - ACCELERATING KNOWLEDGE TRANSFER WITH GENERATIVE AI, SLASHING DOCUMENTATION TIME BY 67%

- 5.12.2 ECARX - REVOLUTIONIZING IN-VEHICLE EXPERIENCE WITH AMD-POWERED IMMERSIVE DIGITAL COCKPIT PLATFORM

- 5.12.3 SUBARU CORPORATION - ELEVATING EYESIGHT ADAS WITH AMD VERSAL AI EDGE GEN 2 FOR SMARTER, SAFER DRIVING

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF 2025 US TARIFFS ON AUTOMOTIVE AI MARKET

- 5.15.1 KEY TARIFF RATES

- 5.15.2 PRICE IMPACT ANALYSIS

- 5.15.3 KEY IMPACTS ON VARIOUS REGIONS

- 5.15.3.1 US

- 5.15.3.2 Europe

- 5.15.3.3 Asia Pacific

- 5.15.4 IMPACT ON END-USE INDUSTRIES

6 ARCHITECTURE IN AUTOMOTIVE AI MARKET

- 6.1 INTRODUCTION

- 6.2 VON NEUMANN ARCHITECTURE

- 6.3 NEUROMORPHIC ARCHITECTURE

7 AUTOMOTIVE AI MARKET, BY OFFERING

- 7.1 INTRODUCTION

- 7.2 HARDWARE

- 7.2.1 SHIFT TOWARD SOFTWARE-DEFINED VEHICLES ACCELERATING DEMAND FOR HIGH-PERFORMANCE AI HARDWARE

- 7.2.2 COMPUTE

- 7.2.2.1 Rising demand for real-time AI processing to accelerates growth of automotive compute segment

- 7.2.2.2 GPU-dominant SoC

- 7.2.2.2.1 Need for centralized computing to fuel adoption of high-performance GPU-dominant SoCs in automotive

- 7.2.2.3 FPGA-dominant SoC

- 7.2.2.3.1 Flexible hardware architectures position FPGA-dominant SoCs as key enablers in ADAS and safety systems

- 7.2.2.4 ASIC-dominant SoC

- 7.2.2.4.1 Application-specific performance requirements boosting market for custom ASICs

- 7.2.2.5 NPU-dominant SoC

- 7.2.2.5.1 OEMs' focus on energy-efficient AI inference boosting adoption of NPU-based compute solutions

- 7.2.3 MEMORY

- 7.2.3.1 Rising AI data volume and real-time processing needs to drive demand for high-bandwidth automotive memory

- 7.2.4 OTHERS

- 7.3 SOFTWARE

- 7.3.1 SHIFT TOWARD SOFTWARE DEFINED VEHICLES FUELING DEMAND FOR SCALABLE AUTOMOTIVE AI SOFTWARE PLATFORMS

- 7.3.2 MIDDLEWARE

- 7.3.2.1 Shift to centralized and zonal architectures driving demand for intelligent automotive middleware platforms

- 7.3.3 APPLICATION SOFTWARE

- 7.3.3.1 Expanding AI use cases across safety and infotainment driving growth

- 7.3.4 OPERATING SYSTEM

- 7.3.4.1 OEMs' focus on platform standardization to boost market for virtualization-ready automotive OS solutions

8 AUTOMOTIVE AI MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 DEEP LEARNING

- 8.2.1 HIGH-ACCURACY PERCEPTION AND REAL-TIME DECISION MAKING TO DRIVE ADOPTION IN AUTOMOTIVE AI

- 8.3 MACHINE LEARNING

- 8.3.1 PREDICTIVE INTELLIGENCE AND SELF-IMPROVING ALGORITHMS FUELING ADOPTION IN VEHICLES

- 8.4 COMPUTER VISION

- 8.4.1 RISING NEED FOR CAMERA-BASED INTELLIGENCE AND SCENE UNDERSTANDING DRIVING DEMAND

- 8.5 CONTEXT-AWARE COMPUTING

- 8.5.1 NEED FOR ENABLING SMARTER DECISION MAKING THROUGH ENVIRONMENTAL AND BEHAVIORAL INSIGHT TO DRIVE MARKET

- 8.6 NATURAL LANGUAGE PROCESSING

- 8.6.1 ADOPTION OF VOICE-DRIVEN CONTROL AND CONVERSATIONAL INTERFACES TO ACCELERATE DEMAND FOR NLP

9 AUTOMOTIVE AI MARKET, BY LEVEL OF AUTONOMY

- 9.1 INTRODUCTION

- 9.2 L1

- 9.2.1 COST-EFFECTIVE AI INTEGRATION AND SENSOR ADVANCEMENTS TO ACCELERATE ADOPTION OF LEVEL 1 SYSTEMS

- 9.3 L2

- 9.3.1 CONSUMER DEMAND FOR COMFORT AND HIGHWAY ASSISTANCE TO PROPEL SEGMENTAL GROWTH

- 9.4 L3

- 9.4.1 ADVANCEMENTS IN PERCEPTION AI AND DECISION-MAKING ALGORITHMS TO ENABLE TARGETED LEVEL 3 DEPLOYMENTS

- 9.5 L4

- 9.5.1 FLEET APPLICATIONS AND CONTROLLED URBAN ZONES TO DRIVE SCALABLE DEPLOYMENT OF LEVEL 4 AUTONOMY

- 9.6 L5

- 9.6.1 GROWING VISION FOR MOBILITY WITH ZERO HUMAN INTERVENTION TO DRIVE STRATEGIC DEVELOPMENT OF LEVEL 5 PLATFORMS

10 AUTOMOTIVE AI MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 AD/ADAS

- 10.2.1 SIGNIFICANT INVESTMENTS IN SENSOR FUSION ARCHITECTURE, EDGE AI INFERENCE, AND COMPUTE PLATFORMS TO SUPPORT MARKET GROWTH

- 10.3 INFOTAINMENT SYSTEMS

- 10.3.1 SHIFT TO SOFTWARE-DEFINED VEHICLES FUELING DEMAND FOR AI-DRIVEN IN-CABIN INTELLIGENCE

- 10.4 VEHICLE TELEMATICS

- 10.4.1 AI-DRIVEN TELEMATICS TO TRANSFORM VEHICLE FLEETS THROUGH PREDICTIVE MAINTENANCE AND OPERATIONAL INTELLIGENCE

- 10.5 OTHER APPLICATIONS

11 AUTOMOTIVE AI MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Advanced R&D ecosystems and AI compute infrastructure to boost market growth

- 11.2.3 CANADA

- 11.2.3.1 Rising adoption of ADAS and government-led innovation programs to accelerate growth

- 11.2.4 MEXICO

- 11.2.4.1 Rising investment in smart vehicle technologies to support market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Demand for premium vehicles and increasing electrification to drive scalable AI adoption

- 11.3.3 FRANCE

- 11.3.3.1 Strategic collaborations and domestic AI development to propel automotive AI transformation

- 11.3.4 UK

- 11.3.4.1 Government support and urban autonomous vehicles deployment to accelerate market growth

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Integration of OEMs, tech giants, and AI infrastructure accelerating advancement in autonomous driving

- 11.4.3 JAPAN

- 11.4.3.1 Complex urban and aging society needs to boost adoption of autonomous vehicles with AI technologies

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Smart mobility pilots and software-defined platforms strengthening country's role in global automotive AI

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 AI-enabled safety, logistics, and energy optimization emerging as key catalysts in automotive AI market

- 11.5.3 MIDDLE EAST & AFRICA

- 11.5.3.1 Smart city mega-projects and fleet digitization to accelerate automotive AI adoption

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2021-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 Technology footprint

- 12.7.5.5 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 TESLA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 MnM view

- 13.1.1.3.1 Key strengths

- 13.1.1.3.2 Strategic choices

- 13.1.1.3.3 Weaknesses and competitive threats

- 13.1.2 NVIDIA CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 MOBILEYE

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 QUALCOMM TECHNOLOGIES, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 ADVANCED MICRO DEVICES, INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 ALPHABET INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 APTIV

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 MICRON TECHNOLOGY, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.9 MICROSOFT

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 IBM

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.1 TESLA

- 13.2 OTHER PLAYERS

- 13.2.1 NAUTO

- 13.2.2 AURORA OPERATIONS, INC.

- 13.2.3 WAYVE

- 13.2.4 NURO, INC.

- 13.2.5 PONY.AI

- 13.2.6 HELM.AI

- 13.2.7 TACTILE MOBILITY

- 13.2.8 DEEPROUTE.AI

- 13.2.9 COGNATA

- 13.2.10 NULLMAX

- 13.2.11 COMMA_AI

- 13.2.12 MOTIONAL, INC.

- 13.2.13 OXA AUTONOMY LIMITED

- 13.2.14 IMAGRY AUTONOMOUS DRIVING SOFTWARE COMPANY

- 13.2.15 APPLIED INTUITION, INC.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS