|

|

市場調査レポート

商品コード

1781107

VSATの世界市場:最終用途別、用途別、周波数別、ネットワーク別、地域別 - 予測(~2030年)VSAT Market by End Use (Broadband, Voice Communication, Private Network), Application (Maritime, Aviation, Automotive, Government & Defense), Frequency (L, S, C, X, Ku, Ka, Multi-Band), Network (Standard VSAT, USAT) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| VSATの世界市場:最終用途別、用途別、周波数別、ネットワーク別、地域別 - 予測(~2030年) |

|

出版日: 2025年07月25日

発行: MarketsandMarkets

ページ情報: 英文 337 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

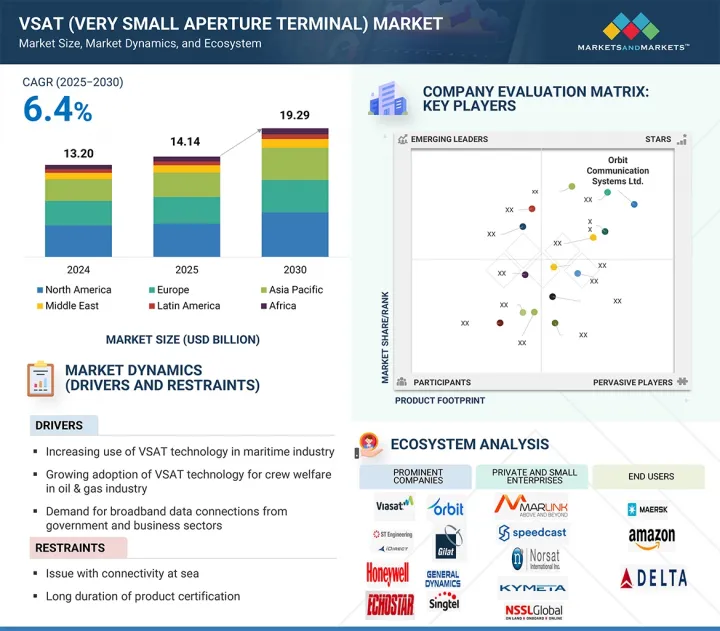

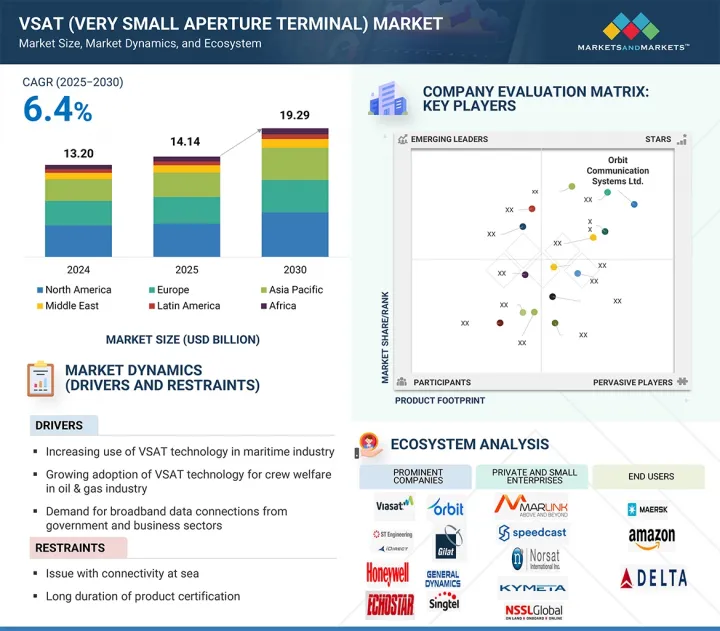

世界のVSAT(Very Small Aperture Terminal)の市場規模は、2025年に推定141億4,000万米ドルであり、2030年までに192億9,000万米ドルに達すると予測され、予測期間にCAGRで6.4%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 最終用途、用途、周波数、ネットワーク、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

技術の進歩と市場環境の変化がVSAT市場の主な促進要因です。

「ラギッドVSAT設計がもっとも高いCAGRを記録すると予測されます。」

設計別では、敵対的でミッションクリティカルな用途での使用の増加により、ラギッドVSATが予測期間に最高のCAGRを記録する見込みです。この端末は高温、振動、埃、湿度、衝撃に耐えるため、防衛、災害復旧、石油・ガス現場、鉱山などに最適です。地政学的緊張の高まりと災害管理ニーズの高まりにより、防衛機関や政府は、堅牢な装置を必要とする現場展開可能な移動体通信ユニットへの支出を増やしています。また、エネルギーやインフラなどの部門におけるオフショアや遠隔地での探査事業では、過酷な条件下でもシームレスな接続を提供できる、持ち運び可能なラギッドVSATユニットが求められています。ダイナミックな非大都市圏でのセキュアな広帯域通信への需要が高まる中、耐久性、機動性、迅速な展開能力を備えたラギッドVSATがますます支持されるようになっています。軽量材料と小型化技術の進歩に刺激されたこの開発は、予測期間の市場成長を促進する見込みです。

「スター型トポロジーネットワークが2025年に最大の市場シェアを占めると推定されます。」

ネットワーク別では、企業や政府ネットワークでの幅広い使用により、スター型トポロジーセグメントがVSAT市場で2025年に最大の市場シェアを占めると推定されます。スター型トポロジーでは、すべての遠隔端末が中央ノードに接続され、集中制御、容易な帯域割り当て、ネットワーク管理が可能になります。このアーキテクチャは、ビデオ会議、インターネットアクセス、VoIP、特に安全で拡張性の高いリンクを必要とする単一オフィスのある企業組織、高等教育機関、小売店、銀行などで有効です。ハブアンドスポークアーキテクチャは、政策の適用だけでなく、よりシンプルなネットワークデバッグもサポートするため、地理的に分散したビジネスを展開する組織に最適です。スター型トポロジーは、メッシュネットワーク全体の遅延を最小化し、スループットの一貫性を高めることができるため、地方や半都市の加入者向けの衛星ブロードバンドサービスに利用されるのが望ましいです。また、HTSとGEOの両方の衛星システムを利用できるため、スケーラビリティも向上します。ネットワークの信頼性とコスト効率が最優先事項であるため、スター型トポロジーがVSATネットワーク構成の主流であり続けています。

「アジア太平洋が予測期間にもっとも急成長する市場となる見込みです。」

アジア太平洋は、急速なデジタル化、膨大な農村人口、衛星通信インフラへの投資の拡大により、予測期間にもっとも高いCAGRを記録する見込みです。インド、インドネシア、ベトナム、フィリピンでは、島嶼部や遠隔地におけるデジタルデバイドを埋めるため、衛星ベースのブロードバンドに対するニーズが高まっています。政府主導の農村部の接続性構想、Universal Service Obligation(USO)、官民パートナーシップが、教育、遠隔医療、電子行政を目的としたVSATの展開を推進しています。海運、民間航空輸送、防衛インフラの開発がこの地域全体で拡大していることも、モバイルVSAT端末の利用を促進しています。地域の衛星通信事業者と地域の衛星コンステレーションの開発は、サービスをより手頃な価格で利用しやすくしています。LEO/HTS衛星プログラムが普及しつつあるアジア太平洋は、固定式、移動式の用途でVSATの普及が拡大している高成長地域となっています。

当レポートでは、世界のVSAT市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- VSAT市場(2025年~2030年)

- VSAT市場:最終用途別

- VSAT市場:ソリューション別

- VSAT市場:ネットワーク別

- VSAT市場:周波数別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- カスタマービジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- 著名企業

- 民間企業と中小企業

- 市場エコシステム

- 規制情勢

- 貿易データ

- 輸入シナリオ

- 輸出シナリオ(HSコード880260)

- 主なステークホルダーと購入基準

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ケーススタディ分析

- ケーススタディ1:L3HARRIS戦術端末 - 防衛軍向けミッションクリティカルVSAT通信の実現

- ケーススタディ2:KYMETAのフラットパネルVSATアンテナの打ち上げとONEWEB LEO経由の海上接続

- ケーススタディ3:エクセター大学、Technical Composite Systems、Cobham Aerospace Connectivityによるメタマテリアルアンテナの開発

- 主な会議とイベント(2025年~2026年)

- VSAT市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 米国

- 欧州

- アジア太平洋

- 最終用途産業に対する影響

- 商業

- 政府・防衛

- 工業・モビリティ

- マクロ経済の見通し

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東

- ラテンアメリカ

- アフリカ

- VSAT市場に対するAI/生成AIの影響

- ネットワーク最適化と予知保全

- AIベースのビーム管理と動的帯域割り当て

- 自動障害検出と遠隔診断

- ネットワークシミュレーションと設計

- パーソナライズされたサービス提供とユーザーエクスペリエンス

- 運用データ

- 価格設定の分析

- ビジネスモデル

- テクノロジーロードマップ

- 投資と資金調達のシナリオ

- 総所有コスト

- 部品表

- イントロダクション

- 技術動向

- 幅広い重要用途をサポートするルーター技術の革新

- VSATシステムのスループット向上に向けた帯域幅効率の改良

- VSATシステムにおける時分割多元接続(TDMA)技術の使用

- 4軸安定化VSATアンテナシステム

- 先進1M KA-/KU-Band海上VSATアンテナ

- 衛星通信におけるKAバンドとKUバンドVSATの利用

- マルチバンド戦術通信増幅器

- 次世代VSATを可能にする先進アンテナ

- 戦術UAV向け超小型・高スループットオンザムーブ(OTM)端末

- ハイブリッド海上VSATネットワークソリューション

- メガトレンドの影響

- サプライチェーンの混乱

- スマートアンテナの開発

- ハイブリッドビームフォーミング方式

- 特許分析

第6章 VSAT市場:タイプ別

- イントロダクション

- 標準VSAT

- USAT

第7章 VSAT市場:設計別

- イントロダクション

- ラギッドVSAT

- 非ラギッドVSAT

第8章 VSAT市場:周波数別

- イントロダクション

- Lバンド

- Sバンド

- Cバンド

- Xバンド

- KUバンド

- KAバンド

- マルチバンド

第9章 VSAT市場:ネットワーク別

- イントロダクション

- スター型トポロジー

- メッシュ型トポロジー

- ハイブリッドトポロジー

- ポイントツーポイントリンク

第10章 VSAT市場:ソリューション別

- イントロダクション

- 装置

- サポートサービス

- 接続性サービス

第11章 VSAT市場:プラットフォーム別

- イントロダクション

- 陸上VSAT

- 海上VSAT

- 航空VSAT

第12章 VSAT市場:最終用途別

- イントロダクション

- ブロードバンド/データネットワークサービス

- 音声通信サービス

- プライベートネットワークサービス

- 放送サービス

- その他

第13章 VSAT市場:用途別

- イントロダクション

- 医療

- エネルギー・電力

- 教育

- BFSI

- メディア・エンターテインメント

- 小売

- 輸送・ロジスティクス

- 通信

- 船舶

- 航空

- 農業・林業

- 鉱業・建設

- 製造

- 自動車

- 政府・防衛

- その他

第14章 地域の分析

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- フランス

- ドイツ

- その他の欧州

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 中東

- PESTLE分析

- GCC

- その他の中東

- ラテンアメリカ

- PESTLE分析

- ブラジル

- メキシコ

- その他のラテンアメリカ

- アフリカ

- PESTLE分析

- 南アフリカ

- ナイジェリア

- その他のアフリカ

第15章 競合情勢

- イントロダクション

- 収益分析

- 市場シェア分析

- 企業の評価マトリクス:主要企業(2024年)

- 企業のフットプリント

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- ブランド/製品の比較

- 企業の評価と財務指標

- 競合シナリオ

第16章 企業プロファイル

- 主要企業

- ORBIT COMMUNICATION SYSTEMS LTD.

- L3HARRIS TECHNOLOGIES INC.

- VIASAT INC.

- GILAT SATELLITE NETWORKS LTD.

- ECHOSTAR CORPORATION (US)

- COMTECH TELECOMMUNICATIONS CORPORATION

- ST ENGINEERING IDIRECT

- KVH INDUSTRIES, INC.

- GENERAL DYNAMICS CORPORATION

- THALES GROUP

- HONEYWELL INTERNATIONAL INC.

- SINGTEL

- MITSUBISHI ELECTRIC CORPORATION

- ULTRA ELECTRONICS

- SATIXFY COMMUNICATIONS LTD

- その他の企業

- THE MARLINK GROUP

- THURAYA TELECOMMUNICATIONS COMPANY

- SPEEDCAST INTERNATIONAL LTD.

- ND SATCOM GMBH

- NORSAT INTERNATIONAL INC.

- NSSL GLOBAL SOLUTIONS PVT. LTD.

- OMNIACCESS S.L.

- KYMETA CORPORATION

- KOGNITIVE NETWORKS

- VIKING SATCOM LLC

第17章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2024

- TABLE 2 VSAT (VERY SMALL APERTURE TERMINAL) MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 3 KEY INFORMATION ON LEO AND MEO CONSTELLATIONS

- TABLE 4 VSAT MARKET: ROLE IN ECOSYSTEM

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 IMPORT DATA FOR HS CODE 880260, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 880260, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 PLATFORMS (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP 3 PLATFORMS

- TABLE 14 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 16 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, DELIVERIES BY MARINE PLATFORM, 2021-2024 (UNITS)

- TABLE 17 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, DELIVERIES BY MARINE PLATFORM, 2025-2030 (UNITS)

- TABLE 18 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, DELIVERIES BY AIRBORNE PLATFORM, 2021-2024 (UNITS)

- TABLE 19 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, DELIVERIES BY AIRBORNE PLATFORM, 2025-2030 (UNITS)

- TABLE 20 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, DELIVERIES BY LAND PLATFORM, 2021-2024 (UNITS)

- TABLE 21 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, DELIVERIES BY LAND PLATFORM, 2025-2030 (UNITS)

- TABLE 22 AVERAGE SELLING PRICE TREND OF VSAT, BY PLATFORM, 2024 (USD THOUSAND)

- TABLE 23 COMPARISON BETWEEN DIFFERENT BUSINESS MODELS

- TABLE 24 LIST OF MAJOR PATENTS FOR VSAT MARKET, APRIL 2023-MARCH 2025

- TABLE 25 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 26 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY DESIGN, 2021-2024 (USD MILLION)

- TABLE 28 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 29 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 30 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 31 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY NETWORK, 2021-2024 (USD MILLION)

- TABLE 32 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY NETWORK, 2025-2030 (USD MILLION)

- TABLE 33 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

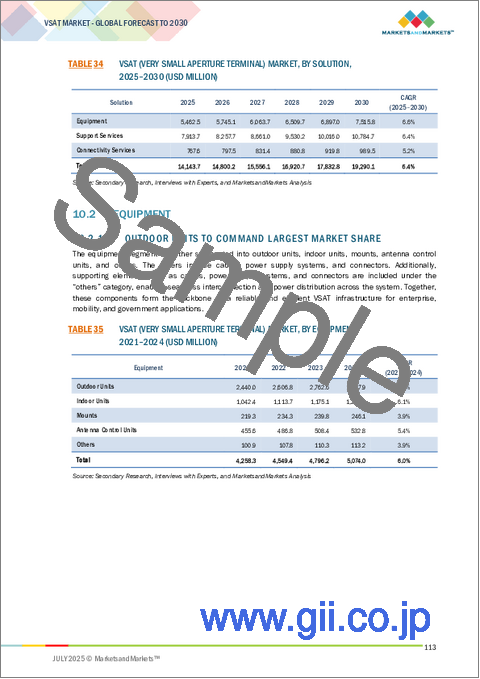

- TABLE 34 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 35 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 36 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 37 VSAT (VERY SMALL APERTURE TERMINAL) EQUIPMENT MARKET, BY OUTDOOR UNITS, 2021-2024 (USD MILLION)

- TABLE 38 VSAT (VERY SMALL APERTURE TERMINAL) EQUIPMENT MARKET, BY OUTDOOR UNITS, 2025-2030 (USD MILLION)

- TABLE 39 VSAT (VERY SMALL APERTURE TERMINAL) OUTDOOR UNITS MARKET, BY ANTENNAS, 2021-2024 (USD MILLION)

- TABLE 40 VSAT (VERY SMALL APERTURE TERMINAL) OUTDOOR UNITS MARKET, BY ANTENNAS, 2025-2030 (USD MILLION)

- TABLE 41 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SUPPORT SERVICES, 2021-2024 (USD MILLION)

- TABLE 42 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 43 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 44 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 45 VSAT (VERY SMALL APERTURE TERMINAL) PLATFORM MARKET, BY LAND VSAT, 2021-2024 (USD MILLION)

- TABLE 46 VSAT (VERY SMALL APERTURE TERMINAL) PLATFORM MARKET, BY LAND VSAT, 2025-2030 (USD MILLION)

- TABLE 47 LAND VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY FIXED SEGMENT, 2021-2024 (USD MILLION)

- TABLE 48 LAND VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY FIXED SEGMENT, 2025-2030 (USD MILLION)

- TABLE 49 LAND VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY MOBILE SEGMENT, 2021-2024 (USD MILLION)

- TABLE 50 LAND VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY MOBILE SEGMENT, 2025-2030 (USD MILLION)

- TABLE 51 VSAT (VERY SMALL APERTURE TERMINAL) PLATFORM MARKET, BY MARITIME VSAT, 2021-2024 (USD MILLION)

- TABLE 52 VSAT (VERY SMALL APERTURE TERMINAL) PLATFORM MARKET, BY MARITIME VSAT, 2025-2030 (USD MILLION)

- TABLE 53 VSAT (VERY SMALL APERTURE TERMINAL) PLATFORM MARKET, BY AIRBORNE VSAT, 2021-2024 (USD MILLION)

- TABLE 54 VSAT (VERY SMALL APERTURE TERMINAL) PLATFORM MARKET, BY AIRBORNE VSAT, 2025-2030 (USD MILLION)

- TABLE 55 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 56 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 57 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 58 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 59 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 64 NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 66 NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 69 US: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 70 US: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 71 US: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 72 US: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 73 US: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 74 US: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 75 CANADA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 76 CANADA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 77 CANADA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 78 CANADA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 79 CANADA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 80 CANADA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 81 EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 84 EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 86 EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 87 EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 88 EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 89 UK: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 90 UK: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 91 UK: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 92 UK: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 93 UK: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 94 UK: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 95 FRANCE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 96 FRANCE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 97 FRANCE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 98 FRANCE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 99 FRANCE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 100 FRANCE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 101 GERMANY: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 102 GERMANY: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 103 GERMANY: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 104 GERMANY: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 105 GERMANY: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 106 GERMANY: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 107 REST OF EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 108 REST OF EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 109 REST OF EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 110 REST OF EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 111 REST OF EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 112 REST OF EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 116 ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 120 ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 121 CHINA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 122 CHINA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 123 CHINA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 124 CHINA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 125 CHINA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 126 CHINA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 127 INDIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 128 INDIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 129 INDIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 130 INDIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 131 INDIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 132 INDIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 133 JAPAN: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 134 JAPAN: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 135 JAPAN: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 136 JAPAN: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 137 JAPAN: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 138 JAPAN: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 139 SOUTH KOREA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 140 SOUTH KOREA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 141 SOUTH KOREA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 142 SOUTH KOREA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 143 SOUTH KOREA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 144 SOUTH KOREA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 152 MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 156 MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 159 UAE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 160 UAE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 161 UAE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 162 UAE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 163 UAE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 164 UAE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 165 SAUDI ARABIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 166 SAUDI ARABIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 167 SAUDI ARABIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 168 SAUDI ARABIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 169 SAUDI ARABIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 170 SAUDI ARABIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 174 REST OF MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 175 REST OF MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 178 LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 179 LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 180 LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 181 LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 182 LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 183 LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 184 LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 185 BRAZIL: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 186 BRAZIL: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 187 BRAZIL: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 188 BRAZIL: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 189 BRAZIL: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 190 BRAZIL: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 191 MEXICO: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 192 MEXICO: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 193 MEXICO: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 194 MEXICO: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 195 MEXICO: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 196 MEXICO: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 197 REST OF LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 198 REST OF LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 199 REST OF LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 200 REST OF LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 201 REST OF LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 202 REST OF LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 203 AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 204 AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 205 AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 206 AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 207 AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 208 AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 209 AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 210 AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 211 SOUTH AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 212 SOUTH AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 213 SOUTH AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 214 SOUTH AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 215 SOUTH AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 216 SOUTH AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 217 NIGERIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 218 NIGERIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 219 NIGERIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 220 NIGERIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 221 NIGERIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 222 NIGERIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 223 REST OF AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 224 REST OF AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 225 REST OF AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 226 REST OF AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 227 REST OF AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 228 REST OF AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 229 KEY DEVELOPMENTS OF LEADING PLAYERS IN VSAT MARKET (DECEMBER 2021-MAY 2025)

- TABLE 230 VSAT MARKET: DEGREE OF COMPETITION

- TABLE 231 VSAT MARKET: SOLUTION FOOTPRINT

- TABLE 232 VSAT MARKET: PLATFORM FOOTPRINT

- TABLE 233 VSAT MARKET: TYPE FOOTPRINT

- TABLE 234 VSAT MARKET: REGION FOOTPRINT

- TABLE 235 VSAT MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 236 VSAT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 237 VSAT MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2020-APRIL 2025

- TABLE 238 VSAT MARKET: DEALS, JANUARY 2020-APRIL 2025

- TABLE 239 VSAT MARKET: OTHERS, DECEMBER 2020-JUNE 2025

- TABLE 240 ORBIT COMMUNICATION SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 241 ORBIT COMMUNICATION SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 242 ORBIT COMMUNICATION SYSTEMS LTD.: DEALS

- TABLE 243 ORBIT COMMUNICATION SYSTEMS LTD.: OTHERS

- TABLE 244 L3HARRIS TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 245 L3HARRIS TECHNOLOGIES INC.: PRODUCTS OFFERED

- TABLE 246 L3HARRIS TECHNOLOGIES INC.: PRODUCT LAUNCHES

- TABLE 247 L3HARRIS TECHNOLOGIES INC.: DEALS

- TABLE 248 L3HARRIS TECHNOLOGIES INC.: OTHERS

- TABLE 249 VIASAT INC.: COMPANY OVERVIEW

- TABLE 250 VIASAT INC.: PRODUCTS OFFERED

- TABLE 251 VIASAT INC.: DEALS

- TABLE 252 VIASAT INC.: OTHERS

- TABLE 253 GILAT SATELLITE NETWORKS LTD.: COMPANY OVERVIEW

- TABLE 254 GILAT SATELLITE NETWORKS LTD.: PRODUCTS OFFERED

- TABLE 255 GILAT SATELLITE NETWORKS LTD.: PRODUCT LAUNCHES

- TABLE 256 GILAT SATELLITE NETWORKS LTD.: DEALS

- TABLE 257 GILAT SATELLITE NETWORKS LTD.: OTHERS

- TABLE 258 ECHOSTAR CORPORATION: COMPANY OVERVIEW

- TABLE 259 ECHOSTAR CORPORATION: PRODUCTS OFFERED

- TABLE 260 ECHOSTAR CORPORATION: PRODUCT LAUNCHES

- TABLE 261 ECHOSTAR CORPORATION: DEALS

- TABLE 262 ECHOSTAR CORPORATION: OTHERS

- TABLE 263 COMTECH TELECOMMUNICATIONS CORPORATION: COMPANY OVERVIEW

- TABLE 264 COMTECH TELECOMMUNICATIONS CORPORATION: PRODUCTS OFFERED

- TABLE 265 COMTECH TELECOMMUNICATIONS CORPORATION: PRODUCT LAUNCHES

- TABLE 266 COMTECH TELECOMMUNICATIONS CORPORATION: DEALS

- TABLE 267 COMTECH TELECOMMUNICATIONS CORPORATION: OTHERS

- TABLE 268 ST ENGINEERING IDIRECT: COMPANY OVERVIEW

- TABLE 269 ST ENGINEERING IDIRECT: PRODUCTS OFFERED

- TABLE 270 ST ENGINEERING IDIRECT: PRODUCT LAUNCHES

- TABLE 271 ST ENGINEERING IDIRECT: DEALS

- TABLE 272 ST ENGINEERING IDIRECT: OTHERS

- TABLE 273 KVH INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 274 KVH INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 275 KVH INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 276 KVH INDUSTRIES, INC.: DEALS

- TABLE 277 KVH INDUSTRIES, INC.: OTHERS

- TABLE 278 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 279 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

- TABLE 280 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 281 GENERAL DYNAMICS CORPORATION: OTHERS

- TABLE 282 THALES GROUP: COMPANY OVERVIEW

- TABLE 283 THALES GROUP: PRODUCTS OFFERED

- TABLE 284 THALES GROUP: DEALS

- TABLE 285 THALES GROUP: OTHERS

- TABLE 286 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 287 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 288 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 289 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 290 HONEYWELL INTERNATIONAL INC.: OTHERS

- TABLE 291 SINGTEL: COMPANY OVERVIEW

- TABLE 292 SINGTEL: PRODUCTS OFFERED

- TABLE 293 SINGTEL: PRODUCT LAUNCHES

- TABLE 294 SINGTEL: DEALS

- TABLE 295 SINGTEL: OTHERS

- TABLE 296 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 297 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 298 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 299 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 300 MITSUBISHI ELECTRIC CORPORATION: OTHERS

- TABLE 301 ULTRA ELECTRONICS: COMPANY OVERVIEW

- TABLE 302 ULTRA ELECTRONICS: PRODUCTS OFFERED

- TABLE 303 ULTRA ELECTRONICS: PRODUCT LAUNCHES

- TABLE 304 ULTRA ELECTRONICS: DEALS

- TABLE 305 ULTRA ELECTRONICS: OTHERS

- TABLE 306 SATIXFY COMMUNICATIONS LTD.: COMPANY OVERVIEW

- TABLE 307 SATIXFY COMMUNICATIONS LTD.: PRODUCTS OFFERED

- TABLE 308 SATIXFY COMMUNICATIONS LTD.: PRODUCT LAUNCHES

- TABLE 309 SATIXFY COMMUNICATIONS LTD.: DEALS

- TABLE 310 SATIXFY COMMUNICATIONS LTD: OTHERS

- TABLE 311 THE MARLINK GROUP: COMPANY OVERVIEW

- TABLE 312 THURAYA TELECOMMUNICATIONS COMPANY: COMPANY OVERVIEW

- TABLE 313 SPEEDCAST INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 314 ND SATCOM GMBH: COMPANY OVERVIEW

- TABLE 315 NORSAT INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 316 NSSL GLOBAL SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

- TABLE 317 OMNIACCESS S.L.: COMPANY OVERVIEW

- TABLE 318 KYMETA CORPORATION: COMPANY OVERVIEW

- TABLE 319 KOGNITIVE NETWORKS: COMPANY OVERVIEW

- TABLE 320 VIKING SATCOM LLC: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 LAND PLATFORM TO LEAD VSAT MARKET IN 2025

- FIGURE 7 SUPPORT SERVICES SOLUTION TO DOMINATE MARKET IN 2025

- FIGURE 8 BROADBAND/DATA NETWORK SERVICES END USE TO LEAD MARKET IN 2025

- FIGURE 9 STAR TOPOLOGY NETWORK TO LEAD MARKET IN 2025

- FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF VSAT (VERY SMALL APERTURE TERMINAL) MARKET IN 2025

- FIGURE 11 INCREASING NEED FOR HIGH-THROUGHPUT SATELLITE CONNECTIVITY TO DRIVE VSAT (VERY SMALL APERTURE TERMINAL) MARKET

- FIGURE 12 BROADBAND/DATA NETWORK SERVICES SEGMENT TO LEAD VSAT (VERY SMALL APERTURE TERMINAL) MARKET IN 2030

- FIGURE 13 SUPPORT SERVICES SEGMENT TO LEAD VSAT (VERY SMALL APERTURE TERMINAL) MARKET IN 2030

- FIGURE 14 STAR TOPOLOGY SEGMENT TO LEAD VSAT (VERY SMALL APERTURE TERMINAL) MARKET IN 2030

- FIGURE 15 KU- BAND SEGMENT TO LEAD VSAT (VERY SMALL APERTURE TERMINAL) MARKET IN 2030

- FIGURE 16 VSAT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 18 VALUE CHAIN ANALYSIS

- FIGURE 19 ECOSYSTEM: VSAT MARKET

- FIGURE 20 IMPORT DATA FOR HS CODE 880260, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 21 EXPORT DATA FOR HS CODE 880260, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 PLATFORMS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP 3 PLATFORMS

- FIGURE 24 VSAT MARKET: IMPACT OF AI/GEN AI

- FIGURE 25 AVERAGE SELLING PRICE OF VSAT FOR TOP 3 PLATFORMS, BY KEY PLAYERS, 2024

- FIGURE 26 BUSINESS MODELS IN VSAT MARKET

- FIGURE 27 EVOLUTION OF TECHNOLOGY

- FIGURE 28 TECHNOLOGY ROADMAP, 2020-2025

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, JANUARY 2020-JULY 2025

- FIGURE 30 TOTAL COST OF OWNERSHIP

- FIGURE 31 BILL OF MATERIALS

- FIGURE 32 LIST OF MAJOR PATENTS RELATED TO VSAT MARKET, JULY 2015-JULY 2025

- FIGURE 33 STANDARD VSAT TO REGISTER HIGHER CAGR THAN USAT DURING FORECAST PERIOD

- FIGURE 34 RUGGED VSAT SEGMENT TO REGISTER HIGHER CAGR THAN NON-RUGGED VSAT SEGMENT DURING FORECAST PERIOD

- FIGURE 35 MULTIBAND SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 HYBRID TOPOLOGY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 EQUIPMENT SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 AIRBORNE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 BROADBAND/DATA NETWORK SERVICES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 TELECOMMUNICATIONS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY REGION, 2025-2030

- FIGURE 42 NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET SNAPSHOT

- FIGURE 43 EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET SNAPSHOT

- FIGURE 45 MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET

- FIGURE 46 LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET SNAPSHOT

- FIGURE 47 AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET SNAPSHOT

- FIGURE 48 REVENUE ANALYSIS FOR KEY COMPANIES IN VSAT MARKET, 2020-2024

- FIGURE 49 MARKET SHARE OF KEY PLAYERS, 2024

- FIGURE 50 COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 51 VSAT MARKET: COMPANY FOOTPRINT

- FIGURE 52 COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- FIGURE 53 BRAND/PRODUCT COMPARISON

- FIGURE 54 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- FIGURE 55 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 56 ORBIT COMMUNICATION SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 57 L3HARRIS TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 58 VIASAT INC.: COMPANY SNAPSHOT

- FIGURE 59 GILAT SATELLITE NETWORKS LTD.: COMPANY SNAPSHOT

- FIGURE 60 ECHOSTAR CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 COMTECH TELECOMMUNICATIONS CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 ST ENGINEERING IDIRECT: COMPANY SNAPSHOT

- FIGURE 63 KVH INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 64 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 66 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 67 SINGTEL: COMPANY SNAPSHOT

- FIGURE 68 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 SATIXFY COMMUNICATIONS LTD.: COMPANY SNAPSHOT

The VSAT (Very Small Aperture Terminal) market is estimated at USD 14.14 billion in 2025 and is projected to reach USD 19.29 billion by 2030 at a CAGR of 6.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By End Use, Application, Frequency, Network and Region |

| Regions covered | North America, Europe, APAC, RoW |

Technological advancements and changing market conditions are the key drivers of the VSAT market.

"The rugged VSAT design is projected to register the highest CAGR."

Based on design, rugged VSAT is projected to register the highest CAGR during the forecast period due to its increasing use in hostile and mission-critical applications. The terminals withstand high temperatures, vibration, dust, humidity, and shock, making them ideal for defense, disaster recovery, oil & gas sites, and mines. With rising geopolitical tensions and disaster management needs, defense agencies and governments are spending more on field-deployable and mobile communication units that demand ruggedized equipment. Off-shore and remote-area exploration ventures in sectors such as energy and infrastructure also demand transportable and heavy-duty VSAT units capable of providing seamless connectivity under harsh conditions. With the increasing demand for secure, high-bandwidth communications in dynamic, non-metropolitan regions, rugged VSATs are increasingly favored for their durability, mobility, and rapid deployment capabilities. This development, stimulated by advancements in lightweight materials and miniaturized engineering, is expected to drive market growth during the forecast period.

"The star topology network is estimated to hold the largest market share in 2025."

Based on network, the star topology segment is estimated to hold the largest market share in 2025 in the VSAT market due to its broad use in enterprise and government networks. In a star topology, all remote terminals are connected to a central node, enabling centralized control, bandwidth allocation ease, and network management. This architecture works for video conferencing, internet access, and VoIP, especially for business organizations, institutions of higher education, retail stores, and banks, where there are single offices that need secure and scalable links. Hub-and-spoke architecture also supports simpler network debugging as well as policy imposition, so it is best suited to organizations that have geographically distributed businesses. Star topology is preferably utilized for satellite broadband services to rural and semi-urban subscribers due to its capability to minimize latency throughout mesh networks as well as providing greater consistency in throughput. Its ability to utilize both HTS and GEO satellite systems also increases its scalability factor. As network reliability and cost-effectiveness remain top priorities, star topology continues to dominate VSAT network configurations.

"Asia Pacific is projected to be the fastest-growing market during the forecast period."

Asia Pacific is projected to register the highest CAGR during the forecast period, driven by rapid digitalization, a huge rural population, and growing investments in satellite communications infrastructure. India, Indonesia, Vietnam, and the Philippines are witnessing a growing need for satellite-based broadband to fill the digital divide in island and remote geographies. Government-initiated rural connectivity initiatives, universal service obligations (USOs), and public-private partnerships are driving VSAT deployment for education, telemedicine, and e-governance. Growing maritime commerce, commercial air transport, and defense infrastructure build-up throughout the region are also driving the use of mobile VSAT terminals. The development of regional satellite operators and regional satellite constellations is making services more affordable and accessible. With LEO and HTS satellite programs becoming more popular, Asia Pacific is positioned as a high-growth region experiencing growing VSAT penetration in fixed and mobility-based applications.

The breakdown of the profile of primary participants in the VSAT market is as follows:

- By Company Type: Tier 1- 35%, Tier 2- 45%, and Tier 3- 20%

- By Designation: Directors- 25%, Managers- 35%, Others- 40%

- By Region: North America- 30%, Europe- 20%, Asia Pacific- 35%, Middle East- 10%, Rest of World- 5%

Research Coverage

The study covers the VSAT market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

This report segments the VSAT (Very Small Aperture Terminal) market across five key regions: North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, as well as their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the VSAT market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, product launches, contracts, expansions, acquisitions, and partnerships associated with the VSAT market.

Reasons to Buy the Report

This report serves as a valuable resource for market leaders and new entrants in the VSAT market, offering data that closely approximates revenue figures for both the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulating effective go-to-market strategies. The report imparts valuable insights into the market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights into the following pointers:

- Analysis of key drivers and factors, such as increasing use of VSAT technology in the maritime industry, growing adoption of VSAT technology for crew welfare in the oil & gas industry, demand for broadband data connections from government and business sectors, low investment and operating costs, and the increasing use of Ku- and Ka-band VSATs

- Market Penetration: Comprehensive information on VSAT solutions offered by the top players in the market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the VSAT market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the VSAT market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the VSAT market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the VSAT market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 VSAT (VERY SMALL APERTURE TERMINAL) MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY AND PRICING

- 1.5 INCLUSIONS AND EXCLUSIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.3 KEY PRIMARY SOURCES

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation & methodology

- 2.3.1.2 Regional split of VSAT market

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, 2025-2030

- 4.2 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE

- 4.3 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION

- 4.4 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY NETWORK

- 4.5 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY FREQUENCY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of VSAT technology for crew welfare in oil & gas industry

- 5.2.1.2 Increasing need for VSAT systems in maritime industry

- 5.2.1.3 Surging demand for broadband data connections from government and business sectors

- 5.2.1.4 Low investment and operating costs

- 5.2.1.5 Increasing use of Ku- and Ka-band VSATs

- 5.2.1.6 High use of USATs for on-the-move applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Issues with connectivity at sea

- 5.2.2.2 Long duration of product certification

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising need for VSAT systems to enable telemedicine in remote locations

- 5.2.3.2 Growing demand for autonomous and connected vehicles

- 5.2.3.3 Increasing use of ultra-compact Ku-band VSATs for tactical UAVs

- 5.2.3.4 Rising number of LEO-HTS constellations

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity concerns

- 5.2.4.2 Radio spectrum availability issues

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 MARKET ECOSYSTEM

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY FRAMEWORK

- 5.6.1.1 North America

- 5.6.1.2 Europe

- 5.6.1 REGULATORY FRAMEWORK

- 5.7 TRADE DATA

- 5.7.1 IMPORT SCENARIO

- 5.7.2 EXPORT SCENARIO (HS CODE 880260)

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Beamforming technology

- 5.9.1.2 Software-defined networking (SDN) in satellite networks

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Power over Ethernet (PoE) Systems

- 5.9.2.2 Remote terminal management software

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 5G Non-terrestrial networks (NTN)

- 5.9.3.2 Network management systems (NMS)

- 5.9.1 KEY TECHNOLOGIES

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 CASE STUDY 1: L3HARRIS TACTICAL TERMINALS - ENABLING MISSION-CRITICAL VSAT COMMUNICATIONS FOR DEFENSE FORCES

- 5.10.2 CASE STUDY 2: KYMETA'S FLAT-PANEL VSAT ANTENNA LAUNCH FOR MARITIME CONNECTIVITY VIA ONEWEB LEO

- 5.10.3 CASE STUDY 3: METAMATERIAL ANTENNA DEVELOPMENT BY UNIVERSITY OF EXETER, TECHNICAL COMPOSITE SYSTEMS, AND COBHAM AEROSPACE CONNECTIVITY

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 IMPACT OF 2025 US TARIFFS ON VSAT MARKET

- 5.13 INTRODUCTION

- 5.14 KEY TARIFF RATES

- 5.15 PRICE IMPACT ANALYSIS

- 5.16 IMPACT ON COUNTRY/REGION

- 5.16.1 US

- 5.16.2 EUROPE

- 5.16.3 ASIA PACIFIC

- 5.17 IMPACT ON END-USE INDUSTRIES

- 5.17.1 COMMERCIAL

- 5.17.2 GOVERNMENT & DEFENSE

- 5.17.3 INDUSTRIAL & MOBILITY

- 5.18 MACROECONOMIC OUTLOOK

- 5.18.1 INTRODUCTION

- 5.18.2 NORTH AMERICA

- 5.18.3 EUROPE

- 5.18.4 ASIA PACIFIC

- 5.18.5 MIDDLE EAST

- 5.18.6 LATIN AMERICA

- 5.18.7 AFRICA

- 5.19 IMPACT OF AI/ GENERATIVE AI ON VSAT MARKET

- 5.19.1 NETWORK OPTIMIZATION AND PREDICTIVE MAINTENANCE

- 5.19.2 AI-BASED BEAM MANAGEMENT AND DYNAMIC BANDWIDTH ALLOCATION

- 5.19.3 AUTOMATED FAULT DETECTION AND REMOTE DIAGNOSTICS

- 5.19.4 NETWORK SIMULATION AND DESIGN

- 5.19.5 PERSONALIZED SERVICE DELIVERY AND USER EXPERIENCE

- 5.20 OPERATIONAL DATA

- 5.21 PRICING ANALYSIS

- 5.21.1 AVERAGE SELLING PRICE OF VSAT FOR TOP 3 PLATFORMS, BY KEY PLAYERS

- 5.22 BUSINESS MODELS

- 5.22.1 BUSINESS MODELS IN VSAT MARKET

- 5.23 TECHNOLOGY ROADMAP

- 5.24 INVESTMENT AND FUNDING SCENARIO

- 5.25 TOTAL COST OF OWNERSHIP

- 5.26 BILL OF MATERIALS

- 5.27 INTRODUCTION

- 5.28 TECHNOLOGY TRENDS

- 5.28.1 INNOVATIONS IN ROUTER TECHNOLOGY TO SUPPORT WIDE RANGE OF CRITICAL APPLICATIONS

- 5.28.2 IMPROVEMENT IN BANDWIDTH EFFICIENCY TO ACHIEVE MORE THROUGHPUT IN VSAT SYSTEMS

- 5.28.3 USE OF TIME DIVISION MULTIPLE ACCESS (TDMA) TECHNOLOGY IN VSAT SYSTEMS

- 5.28.4 4-AXIS STABILIZED VSAT ANTENNA SYSTEMS

- 5.28.5 ADVANCED 1M KA-/KU-BAND MARITIME VSAT ANTENNAS

- 5.28.6 USE OF KA- AND KU-BAND VSATS FOR SATELLITE COMMUNICATIONS

- 5.28.7 MULTIBAND TACTICAL COMMUNICATION AMPLIFIERS

- 5.28.8 ADVANCED ANTENNAS TO ENABLE NEXT GENERATION OF VSATS

- 5.28.9 ULTRA-COMPACT & HIGH THROUGHPUT ON-THE-MOVE (OTM) TERMINALS FOR TACTICAL UAVS

- 5.28.10 HYBRID MARITIME VSAT NETWORK SOLUTIONS

- 5.29 IMPACT OF MEGATRENDS

- 5.29.1 SUPPLY CHAIN DISRUPTIONS

- 5.29.2 DEVELOPMENT OF SMART ANTENNAS

- 5.29.3 HYBRID BEAMFORMING METHODS

- 5.30 PATENT ANALYSIS

6 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 STANDARD VSAT

- 6.2.1 INCREASING DEMAND FOR STANDARD VSAT TECHNOLOGY ACROSS VERTICALS TO DRIVE GROWTH

- 6.3 USAT

- 6.3.1 INCREASING RELIANCE ON SATCOM-ON-THE-MOVE SOLUTIONS TO SUPPORT BATTLEFIELD COMMUNICATIONS TO DRIVE GROWTH

7 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY DESIGN

- 7.1 INTRODUCTION

- 7.2 RUGGED VSAT

- 7.2.1 GROWING DEMAND FOR RESILIENT, HIGH-PERFORMANCE SATELLITE COMMUNICATION IN CHALLENGING ENVIRONMENTS TO DRIVE GROWTH

- 7.3 NON-RUGGED VSAT

- 7.3.1 INCREASING USE IN COMMERCIAL APPLICATIONS ACROSS VARIOUS INDUSTRIES TO DRIVE GROWTH

8 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY FREQUENCY

- 8.1 INTRODUCTION

- 8.2 L-BAND

- 8.2.1 WIDELY USED FOR DATA COMMUNICATIONS AND TRAFFIC INFORMATION

- 8.3 S-BAND

- 8.3.1 USED FOR VARIOUS CROSS-INDUSTRY APPLICATIONS

- 8.4 C-BAND

- 8.4.1 USED IN SATELLITE COMMUNICATION SYSTEMS FOR CRUISE SHIPS

- 8.5 X-BAND

- 8.5.1 RESILIENT TO RAIN FADE AND SIGNAL PROBLEMS

- 8.6 KU-BAND

- 8.6.1 WIDELY USED ON MERCHANT VESSELS TO ALLOW TRANSMISSION OF LARGE VOLUMES OF DATA AT LOW COST

- 8.7 KA-BAND

- 8.7.1 TRANSMITS DATA AT FASTER RATE THAN KU-BANDS

- 8.8 MULTIBAND

- 8.8.1 USED FOR COHERENT DETECTION AND TRACKING OF MOVING TARGETS

9 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY NETWORK

- 9.1 INTRODUCTION

- 9.2 STAR TOPOLOGY

- 9.2.1 USED FOR LARGE ANTENNA GAINS

- 9.3 MESH TOPOLOGY

- 9.3.1 ENABLES MULTIPLE DEVICES TO TRANSMIT DATA SIMULTANEOUSLY

- 9.4 HYBRID TOPOLOGY

- 9.4.1 USES CHARACTERISTICS OF BOTH STAR AND MESH TOPOLOGIES

- 9.5 POINT-TO-POINT LINKS

- 9.5.1 DESIGNED FOR VERY SMALL NETWORKS

10 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION

- 10.1 INTRODUCTION

- 10.2 EQUIPMENT

- 10.2.1 OUTDOOR UNITS TO COMMAND LARGEST MARKET SHARE

- 10.2.2 OUTDOOR UNITS

- 10.2.2.1 Antennas

- 10.2.2.2 Mechanically augmented phased array antennas

- 10.2.2.3 Electronically scanned array antennas

- 10.2.2.4 Block upconverters

- 10.2.2.5 Low noise block downconverters

- 10.2.2.6 Amplifiers

- 10.2.2.7 Diplexers

- 10.2.3 INDOOR UNITS

- 10.2.3.1 Satellite modems

- 10.2.3.2 Satellite routers

- 10.2.4 MOUNTS

- 10.2.5 ANTENNA CONTROL UNITS

- 10.2.6 OTHERS

- 10.3 SUPPORT SERVICES

- 10.3.1 MANAGED SERVICES TO ACQUIRE DOMINANT MARKET SHARE

- 10.3.2 MANAGED SERVICES

- 10.3.2.1 Installation & setup

- 10.3.2.2 Network design & optimization

- 10.3.2.3 Network operations

- 10.3.3 PROFESSIONAL SERVICES

- 10.3.3.1 Engineering and consulting

- 10.3.3.2 Maintenance and support services

- 10.3.3.3 Training

- 10.4 CONNECTIVITY SERVICES

- 10.4.1 NEED TO OPTIMIZE BUSINESS OPERATIONAL COSTS TO DRIVE GROWTH

- 10.4.1.1 Pay-as-you-go

- 10.4.1.2 All-you-can-eat

- 10.4.1.3 Use-what-you-need

- 10.4.1 NEED TO OPTIMIZE BUSINESS OPERATIONAL COSTS TO DRIVE GROWTH

11 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM

- 11.1 INTRODUCTION

- 11.2 LAND VSAT

- 11.2.1 FIXED SEGMENT TO CAPTURE LARGEST MARKET SHARE

- 11.2.2 FIXED

- 11.2.2.1 Command & control centers

- 11.2.2.2 Earth stations

- 11.2.2.3 Commercial buildings

- 11.2.3 PORTABLE/MANPACKS

- 11.2.4 MOBILE

- 11.2.4.1 Commercial vehicles

- 11.2.4.2 Military vehicles

- 11.2.4.3 Emergency vehicles

- 11.2.4.4 Unmanned ground vehicles

- 11.2.4.5 High-speed trains

- 11.3 MARITIME VSAT

- 11.3.1 COMMERCIAL SHIPS SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- 11.3.2 COMMERCIAL SHIPS

- 11.3.3 MILITARY SHIPS

- 11.3.4 UNMANNED MARINE VEHICLES

- 11.4 AIRBORNE VSAT

- 11.4.1 COMMERCIAL AIRCRAFT SEGMENT TO HOLD LARGEST MARKET SHARE

- 11.4.2 COMMERCIAL AIRCRAFT

- 11.4.3 MILITARY AIRCRAFT

- 11.4.4 UNMANNED AERIAL VEHICLES

12 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE

- 12.1 INTRODUCTION

- 12.2 BROADBAND/DATA NETWORK SERVICES

- 12.2.1 INCREASING DEMAND FOR EFFICIENT BROADBAND CONNECTIVITY TO DRIVE GROWTH

- 12.3 VOICE COMMUNICATIONS SERVICES

- 12.3.1 NEED FOR EFFECTIVE VOICE COMMUNICATIONS IN MILITARY AND NAVAL APPLICATIONS TO DRIVE GROWTH

- 12.4 PRIVATE NETWORK SERVICES

- 12.4.1 NEED FOR OPTIMUM SECURITY AND END-TO-END CONNECTIVITY TO DRIVE GROWTH

- 12.5 BROADCAST SERVICES

- 12.5.1 INCREASED DEMAND FOR EFFECTIVE BROADCASTING NETWORKS TO PROPEL MARKET GROWTH

- 12.6 OTHERS

13 VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- 13.2 HEALTHCARE

- 13.2.1 VSAT ENABLES CRUCIAL COMMUNICATION BETWEEN REMOTE CLINICS AND DOCTORS

- 13.3 ENERGY & POWER

- 13.3.1 NEED FOR RELIABLE TELECOMMUNICATIONS NETWORK TO DRIVE GROWTH

- 13.4 EDUCATION

- 13.4.1 RAPID GROWTH OF ONLINE EDUCATION TO DRIVE GROWTH

- 13.5 BFSI

- 13.5.1 SHIFT TO CONNECTIVITY-BASED APPLICATIONS TO DRIVE GROWTH

- 13.6 MEDIA & ENTERTAINMENT

- 13.6.1 TO CAPTURE PROMINENT MARKET SHARE DURING FORECAST PERIOD

- 13.7 RETAIL

- 13.7.1 INCREASING NUMBER OF POINT-OF-SALE TERMINALS TO DRIVE GROWTH

- 13.8 TRANSPORTATION & LOGISTICS

- 13.8.1 DEMAND FOR SMOOTH OPERATIONAL EFFICIENCY TO DRIVE GROWTH

- 13.9 TELECOMMUNICATIONS

- 13.9.1 NEED FOR EXPANSION OF WI-FI CONNECTIVITY TO DRIVE MARKET

- 13.10 MARITIME

- 13.10.1 DEMAND FOR EFFECTIVE SHIP-TO-SHORE COMMUNICATIONS TO DRIVE MARKET

- 13.11 AVIATION

- 13.11.1 DEMAND FOR HIGH-SPEED SATELLITE COMMUNICATION LINK TO DRIVE GROWTH

- 13.12 AGRICULTURE & FORESTRY

- 13.12.1 NEED FOR SMART MONITORING SOLUTIONS TO DRIVE GROWTH

- 13.13 MINING & CONSTRUCTION

- 13.13.1 NEED FOR PROPER COMMUNICATION NETWORK IN REMOTE MINING SITES TO DRIVE GROWTH

- 13.14 MANUFACTURING

- 13.14.1 VSAT PROVIDES ABILITY TO EXTEND COMPANY'S WIDE AREA NETWORK

- 13.15 AUTOMOTIVE

- 13.15.1 NEED FOR IMPROVED NAVIGATION IN AUTOMOBILES TO DRIVE GROWTH

- 13.16 GOVERNMENT & DEFENSE

- 13.16.1 VSAT ENSURES UNINTERRUPTED AND EFFICIENT BATTLEFIELD COMMUNICATION

- 13.16.1.1 Military

- 13.16.1.2 Homeland security and emergency management

- 13.16.1 VSAT ENSURES UNINTERRUPTED AND EFFICIENT BATTLEFIELD COMMUNICATION

- 13.17 OTHERS

14 REGIONAL ANALYSIS

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 PESTLE ANALYSIS

- 14.2.2 US

- 14.2.2.1 Presence of a mature satellite communications ecosystem to drive growth

- 14.2.3 CANADA

- 14.2.3.1 National broadband initiatives and remote connectivity demands to drive growth

- 14.3 EUROPE

- 14.3.1 PESTLE ANALYSIS

- 14.3.2 UK

- 14.3.2.1 National Space Strategy and support for domestic satellite operators to boost market

- 14.3.3 FRANCE

- 14.3.3.1 Government support through France 2030 investment plan to drive growth

- 14.3.4 GERMANY

- 14.3.4.1 Defense modernization to drive growth

- 14.3.5 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 PESTLE ANALYSIS

- 14.4.2 CHINA

- 14.4.2.1 Government investment in national satellite infrastructure to drive growth

- 14.4.3 INDIA

- 14.4.3.1 Policy liberalization and rising enterprise demand to drive growth

- 14.4.4 JAPAN

- 14.4.4.1 Institutional demand for VSAT systems to provide uninterrupted communication during emergencies to drive growth

- 14.4.5 SOUTH KOREA

- 14.4.5.1 Government backed digital innovation and secure communication priorities driving VSAT demand

- 14.4.6 REST OF ASIA PACIFIC

- 14.5 MIDDLE EAST

- 14.5.1 PESTLE ANALYSIS

- 14.5.2 GCC

- 14.5.2.1 UAE

- 14.5.2.2 Saudi Arabia

- 14.5.2.2.1 Vision 2030-driven digital infrastructure and defense modernization to drive growth

- 14.5.3 REST OF MIDDLE EAST

- 14.6 LATIN AMERICA

- 14.6.1 PESTLE ANALYSIS

- 14.6.2 BRAZIL

- 14.6.2.1 Wi-Fi Brasil program to drive growth

- 14.6.3 MEXICO

- 14.6.3.1 Deployment of satellite-based broadband to drive market

- 14.6.4 REST OF LATIN AMERICA

- 14.7 AFRICA

- 14.7.1 PESTLE ANALYSIS

- 14.7.2 SOUTH AFRICA

- 14.7.2.1 Digital transformation goals to drive growth

- 14.7.3 NIGERIA

- 14.7.3.1 National Broadband Plan to drive growth

- 14.7.4 REST OF AFRICA

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 REVENUE ANALYSIS

- 15.3 MARKET SHARE OF ANALYSIS

- 15.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.4.1 STARS

- 15.4.2 EMERGING LEADERS

- 15.4.3 PERVASIVE COMPANIES

- 15.4.4 PARTICIPANTS

- 15.5 COMPANY FOOTPRINT

- 15.5.1 SOLUTION FOOTPRINT

- 15.5.2 PLATFORM FOOTPRINT

- 15.5.3 TYPE FOOTPRINT

- 15.5.4 REGION FOOTPRINT

- 15.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- 15.6.4.1 Competitive benchmarking

- 15.7 BRAND/PRODUCT COMPARISON

- 15.8 COMPANY VALUATION AND FINANCIAL METRICS

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 15.9.2 DEALS

- 15.9.3 OTHERS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 ORBIT COMMUNICATION SYSTEMS LTD.

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Deals

- 16.1.1.3.2 Others

- 16.1.1.4 MnM View

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 L3HARRIS TECHNOLOGIES INC.

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product Launches

- 16.1.2.3.2 Deals

- 16.1.2.3.3 Others

- 16.1.2.4 MnM View

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 VIASAT INC.

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.3.2 Others

- 16.1.3.4 MnM View

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 GILAT SATELLITE NETWORKS LTD.

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product Launches

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Others

- 16.1.4.4 MnM View

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 ECHOSTAR CORPORATION (US)

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product Launches

- 16.1.5.3.2 Deals

- 16.1.5.3.3 Others

- 16.1.5.4 MnM View

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 COMTECH TELECOMMUNICATIONS CORPORATION

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product Launches

- 16.1.6.3.2 Deals

- 16.1.6.3.3 Others

- 16.1.7 ST ENGINEERING IDIRECT

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches

- 16.1.7.3.2 Deals

- 16.1.7.3.3 Others

- 16.1.8 KVH INDUSTRIES, INC.

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches

- 16.1.8.3.2 Deals

- 16.1.8.3.3 Others

- 16.1.9 GENERAL DYNAMICS CORPORATION

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Deals

- 16.1.9.3.2 Others

- 16.1.10 THALES GROUP

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Deals

- 16.1.10.3.2 Others

- 16.1.11 HONEYWELL INTERNATIONAL INC.

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Product launches

- 16.1.11.3.2 Deals

- 16.1.11.3.3 Others

- 16.1.12 SINGTEL

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Product launches

- 16.1.12.3.2 Deals

- 16.1.12.3.3 Others

- 16.1.13 MITSUBISHI ELECTRIC CORPORATION

- 16.1.13.1 Business overview

- 16.1.13.2 Products offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Product launches/developments

- 16.1.13.3.2 Deals

- 16.1.13.3.3 Others

- 16.1.14 ULTRA ELECTRONICS

- 16.1.14.1 Business overview

- 16.1.14.2 Products offered

- 16.1.14.3 Recent developments

- 16.1.14.3.1 Product Launches

- 16.1.14.3.2 Deals

- 16.1.14.3.3 Others

- 16.1.15 SATIXFY COMMUNICATIONS LTD

- 16.1.15.1 Business overview

- 16.1.15.2 Products offered

- 16.1.15.3 Recent developments

- 16.1.15.3.1 Product launches

- 16.1.15.3.2 Deals

- 16.1.15.3.3 Others

- 16.1.1 ORBIT COMMUNICATION SYSTEMS LTD.

- 16.2 OTHER PLAYERS

- 16.2.1 THE MARLINK GROUP

- 16.2.2 THURAYA TELECOMMUNICATIONS COMPANY

- 16.2.3 SPEEDCAST INTERNATIONAL LTD.

- 16.2.4 ND SATCOM GMBH

- 16.2.5 NORSAT INTERNATIONAL INC.

- 16.2.6 NSSL GLOBAL SOLUTIONS PVT. LTD.

- 16.2.7 OMNIACCESS S.L.

- 16.2.8 KYMETA CORPORATION

- 16.2.9 KOGNITIVE NETWORKS

- 16.2.10 VIKING SATCOM LLC

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS