|

|

市場調査レポート

商品コード

1780345

Wi-Fi as a Service (WaaS) の世界市場 (~2030年):サービスタイプ (フルマネージド・パーシャルマネージド・サブスクリプションベース)・ロケーションタイプ (屋内・屋外)・企業規模 (大企業・中小企業)・エンドユーザー (消費者・企業) 別Wi-Fi as a Service Market by Service Type (Fully Managed, Partially Managed, Subscription-based), Location Type (Indoor, Outdoor), Enterprise Size (Large Enterprises, SMEs), End User (Consumer, Enterprise) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| Wi-Fi as a Service (WaaS) の世界市場 (~2030年):サービスタイプ (フルマネージド・パーシャルマネージド・サブスクリプションベース)・ロケーションタイプ (屋内・屋外)・企業規模 (大企業・中小企業)・エンドユーザー (消費者・企業) 別 |

|

出版日: 2025年07月24日

発行: MarketsandMarkets

ページ情報: 英文 240 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

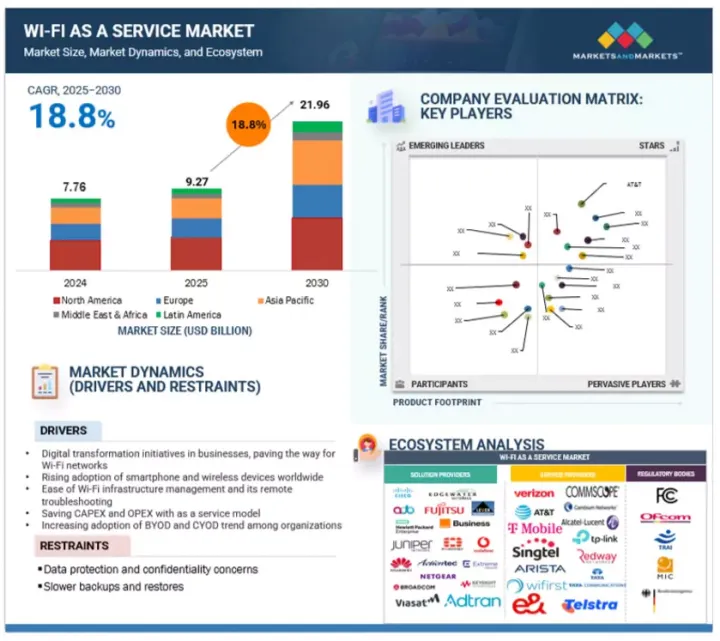

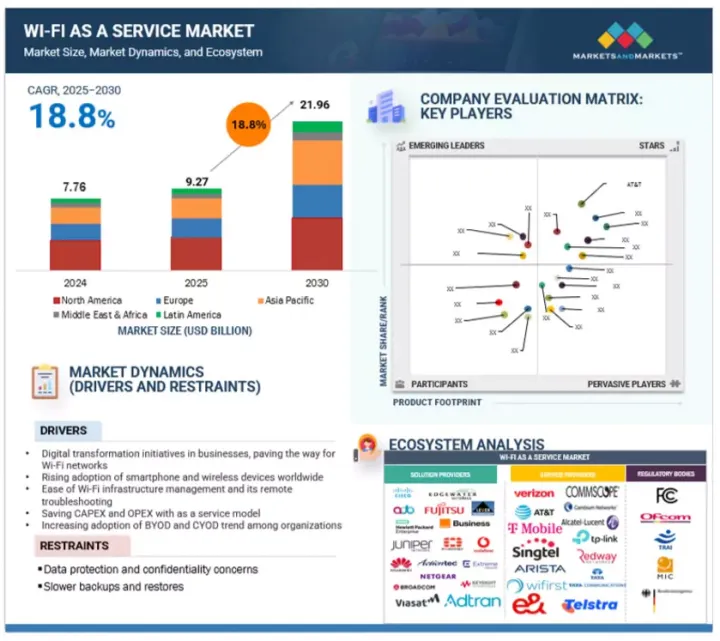

世界のWi-Fi as a Service (WaaS) の市場規模は、2025年の92億7,000万米ドルから、予測期間中はCAGR 18.8%で推移し、2030年には219億6,000万米ドルに成長すると予測されています。

WaaS市場は、いくつかの主要な要因によって力強い成長を遂げています。企業は、CAPEX中心のインフラモデルから、より柔軟なOPEXベースのサブスクリプションモデルへと移行を進めており、これによりコストの予測が可能になり、ネットワーク管理も容易になっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-203年0 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 検討単位 | 金額(米ドル) |

| セグメント別 | サービスタイプ・ロケーションタイプ・エンタープライズタイプ・エンドユーザー・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

ハイブリッドな職場環境における安全で拡張性の高い接続に対する需要の高まりと、IoTデバイスの急速な普及が採用をさらに後押ししています。小売、教育、医療などの業界では、デジタルトランスフォーメーション、集中管理、ユーザーエクスペリエンスの向上を実現するためにWaaSを活用しています。しかしながら、市場にはいくつかの課題も存在します。特に、サードパーティによって管理されるネットワークにおけるデータのセキュリティやプライバシーへの懸念がWaaSの広範な普及を妨げる要因となっています。加えて、高速インターネットへの依存、レガシーシステムとの統合の難しさ、大企業向けのカスタマイズ性の限界、ベンダーロックインの可能性なども市場成長の障壁となっています。それにもかかわらず、WaaSモデルは、柔軟性、拡張性、管理されたネットワーク効率を求める企業にとって、依然として魅力的な選択肢となっています。

"アジア太平洋地域が予測期間中に最も高いCAGRで成長する見込み”

アジア太平洋地域のWaaS市場は急速に成長しており、世界で最も急速に拡大している地域市場となっています。この成長は、中国、インド、日本、韓国といった国々におけるデジタルトランスフォーメーションの進展に加え、新興国での急速な都市化、インターネットアクセスの拡大、デジタル技術の進化によって支えられています。中国、インド、日本では、スマートデバイスの利用拡大、モバイル接続の改善、企業のデジタル化推進により、WaaSの導入が加速しています。特にこの地域には中小企業が多く存在し、大規模な初期投資を必要としない、スケーラブルでコスト効率の高いネットワークソリューションとしてWaaSの需要が高まっています。さらに、政府主導のスマートシティプロジェクト、5Gの展開、公共Wi-Fiインフラの拡充といった取り組みも市場の成長を後押ししています。アジア太平洋地域の企業がクラウドファースト戦略や柔軟なネットワークモデルを採用する中、同地域は今後、WaaS市場の主要な成長拠点となることが見込まれています。

当レポートでは、世界のWi-Fi as a Service (WaaS) の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界動向

第6章 Wi-Fi as a Service (WaaS) 市場:サービスタイプ別

- サブスクリプションベース

- 屋内

- 屋外

第8章 Wi-Fi as a Service (WaaS) 市場:企業規模別

- 大企業

- 中小企業

第9章 Wi-Fi as a Service (WaaS) 市場:エンドユーザー別

- 消費者

- 企業

- 教育

- 小売

- 旅行・ホスピタリティ

- ヘルスケア&ライフサイエンス

- 製造

- BFSI

- IT・ITES

- 運輸・物流

- 政府・公共部門

- その他

第10章 Wi-Fi as a Service (WaaS) 市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- その他

- 中東・アフリカ

- マクロ経済見通し

- 中東

- アフリカ

- ラテンアメリカ

- マクロ経済見通し

- ブラジル

- メキシコ

- その他

第11章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 主要企業の市場シェア分析

- 企業評価マトリックス:主要企業

- スタートアップ/中小企業評価マトリックス

- 競合ベンチマーキング

- ブランド/製品比較

- 企業評価

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- AT&T

- VERIZON

- T-MOBILE

- E&

- SINGTEL

- TATA COMMUNICATIONS

- COMMSCOPE

- ARISTA NETWORKS

- TP-LINK

- WIFIRST

- その他の企業

- ALCATEL LUCENT ENTERPRISE

- JIO

- SPECTRA

- TELSTRA

- VIASAT

- ADTRAN

- ALLIED TELESIS

- 4IPNET

- スタートアップ/SME

- LANCOM SYSTEMS

- RUIJIE NETWORKS

- DATTO

- SUPERLOOP

- CAMBIUM NETWORKS

- REDWAY NETWORKS

- CUCUMBER TONY

- TANAZA

- EDGECORE NETWORKS

第13章 隣接市場・付録

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2022-2025

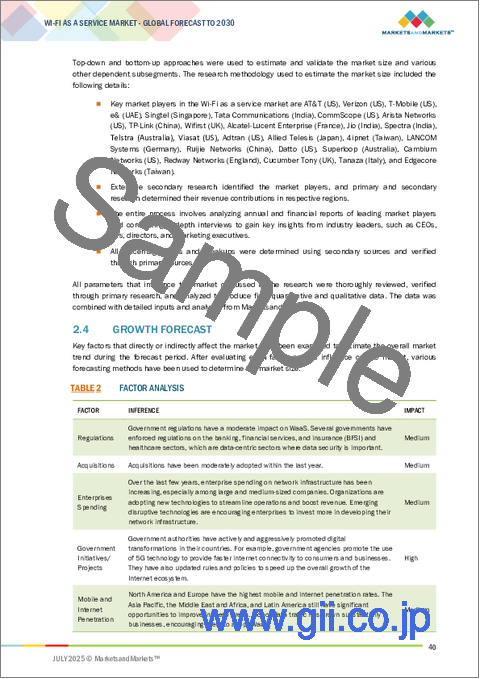

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SERVICE TYPE, 2025

- TABLE 4 INDICATIVE PRICING LEVELS OF KEY PLAYERS, BY LOCATION TYPE, 2024

- TABLE 5 WI-FI AS A SERVICE MARKET: ECOSYSTEM

- TABLE 6 WI-FI AS A SERVICE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISES (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISES

- TABLE 9 WAAS MARKET: KEY PATENTS, 2022-2024

- TABLE 10 WAAS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS

- TABLE 18 WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 19 WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 20 FULLY MANAGED: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 21 FULLY MANAGED: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 PARTIALLY MANAGED: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 23 PARTIALLY MANAGED: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 SUBSCRIPTION-BASED: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 SUBSCRIPTION-BASED: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2020-2024 (USD MILLION)

- TABLE 27 WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 28 INDOOR: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 INDOOR: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 OUTDOOR: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 OUTDOOR: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2020-2024 (USD MILLION)

- TABLE 33 WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2025-2030 (USD MILLION)

- TABLE 34 LARGE ENTERPRISES: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 LARGE ENTERPRISES: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 SMALL AND MEDIUM-SIZED ENTERPRISES: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 SMALL AND MEDIUM-SIZED ENTERPRISES: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 WI-FI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 39 WI-FI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 40 CONSUMER: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 CONSUMER: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 ENTERPRISE: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 ENTERPRISE: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 45 WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 46 EDUCATION: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 EDUCATION: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 RETAIL: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 RETAIL: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 TRAVEL & HOSPITALITY: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 TRAVEL & HOSPITALITY: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 HEALTHCARE & LIFE SCIENCES: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 HEALTHCARE & LIFE SCIENCES: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 MANUFACTURING: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 MANUFACTURING: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 BFSI: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 BFSI: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 IT & ITES: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 IT & ITES: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 TRANSPORTATION & LOGISTICS: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 TRANSPORTATION & LOGISTICS: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 GOVERNMENT & PUBLIC SECTOR: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 GOVERNMENT & PUBLIC SECTOR: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 OTHER ENTERPRISES: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 OTHER ENTERPRISES: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 69 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2020-2024 (USD MILLION)

- TABLE 71 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2020-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 US: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 81 US: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 82 US: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2020-2024 (USD MILLION)

- TABLE 83 US: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 84 US: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2020-2024 (USD MILLION)

- TABLE 85 US: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2025-2030 (USD MILLION)

- TABLE 86 US: WI-FI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 87 US: WI-FI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 88 US: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 89 US: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 91 EUROPE: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2020-2024 (USD MILLION)

- TABLE 93 EUROPE: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2020-2024 (USD MILLION)

- TABLE 95 EUROPE: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: WI-FI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 97 EUROPE: WI-FI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 98 EUROPE: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 99 EUROPE: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 100 EUROPE: WI-FI AS A SERVICE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 101 EUROPE: WI-FI AS A SERVICE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 102 UK: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 103 UK: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 104 UK: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2020-2024 (USD MILLION)

- TABLE 105 UK: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 106 UK: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2020-2024 (USD MILLION)

- TABLE 107 UK: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2025-2030 (USD MILLION)

- TABLE 108 UK: WI-FI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 109 UK: WI-FI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 110 UK: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 111 UK: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 112 ITALY: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 113 ITALY: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 114 ITALY: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2020-2024 (USD MILLION)

- TABLE 115 ITALY: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 116 ITALY: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2020-2024 (USD MILLION)

- TABLE 117 ITALY: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2025-2030 (USD MILLION)

- TABLE 118 ITALY: WI-FI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 119 ITALY: WI-FI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 120 ITALY: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 121 ITALY: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 123 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2020-2024 (USD MILLION)

- TABLE 125 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2020-2024 (USD MILLION)

- TABLE 127 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2025-2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 129 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 131 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 133 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 CHINA: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 135 CHINA: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 136 CHINA: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2020-2024 (USD MILLION)

- TABLE 137 CHINA: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 138 CHINA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2020-2024 (USD MILLION)

- TABLE 139 CHINA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2025-2030 (USD MILLION)

- TABLE 140 CHINA: WI-FI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 141 CHINA: WI-FI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 142 CHINA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 143 CHINA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2020-2024 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2020-2024 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2025-2030 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: WI-FI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: WI-FI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: WI-FI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: WI-FI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 156 MIDDLE EAST: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 157 MIDDLE EAST: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2020-2024 (USD MILLION)

- TABLE 159 MIDDLE EAST: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 160 MIDDLE EAST: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2020-2024 (USD MILLION)

- TABLE 161 MIDDLE EAST: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2025-2030 (USD MILLION)

- TABLE 162 MIDDLE EAST: WI-FI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 163 MIDDLE EAST: WI-FI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 166 LATIN AMERICA: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 167 LATIN AMERICA: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 168 LATIN AMERICA: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2020-2024 (USD MILLION)

- TABLE 169 LATIN AMERICA: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 170 LATIN AMERICA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2020-2024 (USD MILLION)

- TABLE 171 LATIN AMERICA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2025-2030 (USD MILLION)

- TABLE 172 LATIN AMERICA: WI-FI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 173 LATIN AMERICA: WI-FI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 174 LATIN AMERICA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 175 LATIN AMERICA: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 176 LATIN AMERICA: WI-FI AS A SERVICE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 177 LATIN AMERICA: WI-FI AS A SERVICE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 178 BRAZIL: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 179 BRAZIL: WI-FI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 180 BRAZIL: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2020-2024 (USD MILLION)

- TABLE 181 BRAZIL: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 182 BRAZIL: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2020-2024 (USD MILLION)

- TABLE 183 BRAZIL: WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE, 2025-2030 (USD MILLION)

- TABLE 184 BRAZIL: WI-FI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 185 BRAZIL: WI-FI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 186 BRAZIL: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 187 BRAZIL: WI-FI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 188 OVERVIEW OF STRATEGIES ADOPTED BY KEY WI-FI AS A SERVICE PLAYERS

- TABLE 189 WAAS MARKET: DEGREE OF COMPETITION

- TABLE 190 WAAS MARKET: REGION FOOTPRINT

- TABLE 191 WAAS MARKET: SERVICE TYPE FOOTPRINT

- TABLE 192 WAAS MARKET: LOCATION TYPE FOOTPRINT

- TABLE 193 WAAS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 194 WAAS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 195 WAAS MARKET: PRODUCT LAUNCHES, 2021-2025

- TABLE 196 WAAS MARKET: DEALS, 2021-2025

- TABLE 197 AT&T: COMPANY OVERVIEW

- TABLE 198 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 AT&T: DEALS

- TABLE 200 VERIZON: COMPANY OVERVIEW

- TABLE 201 VERIZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 VERIZON: DEALS

- TABLE 203 T-MOBILE: COMPANY OVERVIEW

- TABLE 204 T-MOBILE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 T-MOBILE: PRODUCT LAUNCHES

- TABLE 206 T-MOBILE: DEALS

- TABLE 207 E&: COMPANY OVERVIEW

- TABLE 208 E&: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 E&: PRODUCT LAUNCHES

- TABLE 210 SINGTEL: COMPANY OVERVIEW

- TABLE 211 SINGTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 SINGTEL: DEALS

- TABLE 213 TATA COMMUNICATIONS: COMPANY OVERVIEW

- TABLE 214 TATA COMMUNICATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 TATA COMMUNICATIONS: PRODUCT LAUNCHES

- TABLE 216 TATA COMMUNICATIONS: DEALS

- TABLE 217 COMMSCOPE: COMPANY OVERVIEW

- TABLE 218 COMMSCOPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 COMMSCOPE: PRODUCT LAUNCHES

- TABLE 220 COMMSCOPE: DEALS

- TABLE 221 ARISTA NETWORKS: COMPANY OVERVIEW

- TABLE 222 ARISTA NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 TP-LINK: COMPANY OVERVIEW

- TABLE 224 TP-LINK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 TP-LINK: PRODUCT LAUNCHES

- TABLE 226 WIFIRST: COMPANY OVERVIEW

- TABLE 227 WIFIRST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 WIFIRST: DEALS

- TABLE 229 WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 230 WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 231 WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 232 WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 233 WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 234 WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 235 WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 236 WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 237 WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 238 WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 239 WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 240 NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 241 NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 242 NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 243 NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 244 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 245 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 246 NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 247 NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 248 NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 249 NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

List of Figures

- FIGURE 1 WI-FI AS A SERVICE MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 WI-FI AS A SERVICE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES IN WI-FI AS A SERVICE MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (BOTTOM-UP) (SUPPLY-SIDE): COLLECTIVE REVENUE OF SERVICES IN WI-FI AS A SERVICE MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE ANALYSIS): COLLECTIVE REVENUE FROM ALL SERVICES IN WI-FI AS A SERVICE MARKET

- FIGURE 7 WI-FI AS A SERVICE MARKET, 2023-2030

- FIGURE 8 WI-FI AS A SERVICE MARKET: REGIONAL SNAPSHOT

- FIGURE 9 INCREASING BYOD AND CYOD TREND IN ORGANIZATIONS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 10 INDOOR SEGMENT AND US TO ACCOUNT FOR MAJOR MARKET SHARE IN NORTH AMERICA IN 2025

- FIGURE 11 INDOOR SEGMENT AND CHINA TO DOMINATE ASIA PACIFIC MARKET IN 2025

- FIGURE 12 SUBSCRIPTION-BASED SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 13 ENTERPRISE SEGMENT TO HOLD MAJOR MARKET SHARE IN 2025

- FIGURE 14 WI-FI AS A SERVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 SMART CITY: WI-FI APPLICATION AREAS

- FIGURE 16 HISTORY OF WI-FI AS A SERVICE MARKET

- FIGURE 17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 18 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SERVICE TYPE, 2024

- FIGURE 19 WI-FI AS A SERVICE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 WI-FI AS A SERVICE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 WI-FI AS A SERVICE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISES

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISES

- FIGURE 24 PATENTS APPLIED AND GRANTED, 2014-2024

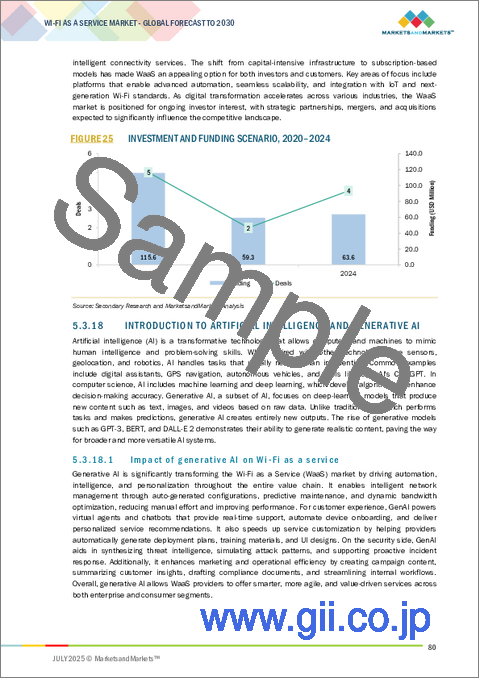

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 26 USE CASES OF GENERATIVE AI IN WI-FI AS A SERVICE

- FIGURE 27 SUBSCRIPTION-BASED SEGMENT TO LEAD MARKET IN 2030

- FIGURE 28 OUTDOOR SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 LARGE ENTERPRISES TO LEAD WI-FI AS A SERVICE MARKET IN 2025 AND 2030

- FIGURE 30 ENTERPRISE SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 31 IT& ITES SEGMENT TO LEAD MARKET AMONG END USERS

- FIGURE 32 NORTH AMERICA TO HOLD LARGEST MARKET SIZE IN 2025 AND 2030

- FIGURE 33 ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 37 SHARE OF LEADING COMPANIES IN WAAS MARKET, 2024

- FIGURE 38 WAAS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 39 WAAS MARKET: COMPANY FOOTPRINT

- FIGURE 40 WAAS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 41 BRAND/PRODUCT COMPARISON

- FIGURE 42 COMPANY VALUATION

- FIGURE 43 VALUATION AND FINANCIAL METRICS OF KEY WI-FI AS A SERVICE PLAYERS

- FIGURE 44 AT&T: COMPANY SNAPSHOT

- FIGURE 45 VERIZON: COMPANY SNAPSHOT

- FIGURE 46 T-MOBILE: COMPANY SNAPSHOT

- FIGURE 47 E&: COMPANY SNAPSHOT

- FIGURE 48 SINGTEL: COMPANY SNAPSHOT

- FIGURE 49 TATA COMMUNICATIONS: COMPANY SNAPSHOT

- FIGURE 50 COMMSCOPE: COMPANY SNAPSHOT

- FIGURE 51 ARISTA NETWORKS: COMPANY SNAPSHOT

The global Wi-Fi as a Service market is projected to grow from USD 9.27 billion in 2025 to USD 21.96 billion by 2030, with a compounded annual growth rate (CAGR) of 18.8% during the forecast period. The Wi-Fi as a Service (WaaS) market is experiencing strong growth, driven by several key factors. Organizations are increasingly shifting from CapEx-heavy infrastructure models to more flexible OpEx-based subscription models, allowing for predictable costs and easier network management.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By Service Type, Location Type, Enterprise Type, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The rising demand for secure, scalable connectivity in hybrid work settings and the rapid spread of IoT devices are further boosting adoption. Industries such as retail, education, and healthcare are utilizing WaaS to enable digital transformation, centralized control, and improved user experiences. However, the market faces certain challenges. Concerns about data security and privacy, especially with networks managed by third parties, continue to hinder widespread adoption. Additionally, reliance on high-speed internet, integration issues with legacy systems, limited customization options for large enterprises, and potential vendor lock-in act as barriers to market growth. Despite these hurdles, the WaaS model remains appealing for businesses seeking agility, scalability, and managed network efficiency.

Based on enterprise size, the large enterprises segment is expected to hold the largest market share during the forecast period.

Large enterprises are key adopters of Wi-Fi as a Service (WaaS) because of their extensive operations, high user density, and complex IT setups. They use WaaS to simplify wireless network management across many locations, ensuring consistent and secure connectivity. This model supports bring-your-own-device (BYOD) policies, promotes workforce mobility, and seamlessly integrates with cloud-based enterprise applications. Large enterprises also depend on WaaS to meet strict security and compliance standards, manage IoT devices, and track network performance with advanced analytics. Additionally, WaaS provides scalability during mergers, acquisitions, or geographic growth, enabling enterprises to quickly deploy wireless infrastructure without heavy capital costs.

Based on service type, the subscription-based segment is expected to grow at the highest CAGR during the forecast period.

Subscription-based Wi-Fi services provide a cost-effective and flexible solution for organizations to access Wi-Fi infrastructure by paying a recurring fee-monthly, quarterly, or annually-eliminating the need for large upfront investments. This typically includes a complete package from the provider, covering hardware, software licenses, network setup, security features, remote monitoring, and technical support. It is especially suitable for SMEs, co-working spaces, SOHOs, and temporary setups like events or pop-up shops, where limited IT resources and rapid deployment are crucial. The increasing demand for consumption-based IT services and the ongoing digital transformation of SMBs are fueling adoption, as these services offer enterprise-grade connectivity without complexity or high costs.

Asia Pacific is expected to grow at the highest CAGR during the forecast period.

The Asia Pacific Wi-Fi as a Service market is rapidly growing, making it the fastest-expanding regional market worldwide. This expansion is driven by increased digital transformation in countries like China, India, Japan, and South Korea, supported by quick urbanization, wider internet access, and advancing digital technologies in emerging economies. China, India, and Japan are experiencing strong WaaS adoption, fueled by the rising use of smart devices, improved mobile connectivity, and extensive enterprise digitalization efforts. The region's large number of small and medium-sized enterprises (SMEs) is increasingly turning to WaaS for scalable, cost-effective network solutions that eliminate the need for large upfront investments. Additionally, initiatives such as government-backed smart city projects, 5G rollouts, and the expansion of public Wi-Fi infrastructure are further boosting market growth. As businesses in APAC adopt cloud-first strategies and more adaptable networking models, the region is set to become a major growth center for the WaaS market in the future.

Breakdown of primaries

Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant Wi-Fi as a Service market were interviewed.

- By Company: Tier I: 35%, Tier II: 40%, and Tier III: 25%

- By Designation: C-Level Executives: 40%, Director Level: 25%, and Others: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, Rest of World: 10%

Some of the significant Wi-Fi as a Service vendors are AT&T (US), Verizon (US), T-Mobile (US), e& (UAE), Singtel (Singapore), Tata Communications (India), CommScope (US), Arista Networks (US), TP-Link (China), Wifirst (UK).

Research coverage:

The report covers the Wi-Fi as a Service market across various segments. We estimate the market size and growth potential for many segments based on service type, location type, enterprise size, end user, and region. It includes a comprehensive analysis of the major market players, details about their businesses, key observations on their product offerings, current trends, and vital market strategies.

Reasons to buy this report:

With data on the most accurate revenue estimates for the entire Wi-Fi as a Service industry and its subsegments, the research will benefit market leaders and new entrants. Stakeholders will gain a better understanding of the competitive landscape through this report, helping them position their companies more effectively and develop go-to-market strategies. The research provides insights into the main market drivers, constraints, opportunities, and challenges, as well as helps players grasp the industry's current trends.

The report provides insights on the following:

Analysis of key drivers includes digital transformation initiatives in businesses that pave the way for Wi-Fi networks, rising adoption of smartphones and wireless devices worldwide, the ease of Wi-Fi infrastructure management and remote troubleshooting, and cost savings on CAPEX and OPEX through a service model. It also considers increasing adoption of BYOD and CYOD trends among organizations. Restraints involve data protection and confidentiality concerns, as well as slower backups and restores. Opportunities arise from the emergence of Wi-Fi 6, which is expected to boost the growth of the as-a-service model across various industries, increasing demand for Wi-Fi as a service in small, medium, and distributed companies, along with the expansion of smart cities. Challenges include poor user experience in high-density environments and a lack of skilled workforce.

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the Wi-Fi as a Service market

- Market Development: In-depth details regarding profitable markets - the paper examines the global Wi-Fi as a Service market

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, new goods and services, and the Wi-Fi as a Service market

- Competitive Assessment: In-depth analysis of the market share, expansion strategies, and service offerings of leading competitors in the Wi-Fi as a Service industry, including AT&T (US), Verizon (US), T-Mobile (US), e& (UAE), Singtel (Singapore), Tata Communications (India), CommScope (US), Arista Networks (US), TP-Link (China), Wifirst (UK), Alcatel-Lucent Enterprise (France), Jio (India), Spectra (India), Telstra (Australia), Viasat (US), Adtran (US), Allied Telesis (Japan), 4ipnet (Taiwan), LANCOM Systems (Germany), Ruijie Networks (China), Datto (US), Superloop (Australia), Cambium Networks (US), Redway Networks (England), Cucumber Tony (UK), Tanaza (Italy), and Edgecore Networks (Taiwan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 GROWTH FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF WI-FI AS A SERVICE MARKET

- 4.2 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE AND COUNTRY

- 4.3 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE AND COUNTRY

- 4.4 WI-FI AS A SERVICE MARKET, BY SERVICE TYPE

- 4.5 WI-FI AS A SERVICE MARKET, BY END USER

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Digital transformation initiatives in businesses

- 5.2.1.2 Rising adoption of smartphones and wireless devices

- 5.2.1.3 Ease of Wi-Fi infrastructure management and remote troubleshooting

- 5.2.1.4 Savings in CapEx and OpEx with 'as a service' model

- 5.2.1.5 Increasing adoption of BYOD and CYOD trend among organizations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data protection and confidentiality concerns

- 5.2.2.2 Slower backups and restores

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Shift from CapEx to OpEx models

- 5.2.3.2 Increasing demand for WaaS in small, medium, and distributed companies

- 5.2.3.3 Expansion of smart cities

- 5.2.4 CHALLENGES

- 5.2.4.1 Poor user experience in high-density environments

- 5.2.4.2 Lack of skilled workforce

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 HISTORY OF WI-FI AS A SERVICE MARKET

- 5.3.1.1 2000-2010

- 5.3.1.2 2010-2020

- 5.3.1.3 2021-present

- 5.3.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.3 PRICING ANALYSIS

- 5.3.3.1 Average selling price of key players, by service type

- 5.3.3.2 Indicative pricing analysis of Wi-Fi as a service

- 5.3.4 SUPPLY CHAIN ANALYSIS

- 5.3.5 ECOSYSTEM ANALYSIS

- 5.3.6 TECHNOLOGY ANALYSIS

- 5.3.6.1 Key technologies

- 5.3.6.1.1 Network analytics and monitoring tools

- 5.3.6.1.2 Cloud networking platforms

- 5.3.6.2 Complementary technologies

- 5.3.6.2.1 Edge computing

- 5.3.6.2.2 5G network

- 5.3.6.3 Adjacent technologies

- 5.3.6.3.1 Artificial intelligence and machine learning

- 5.3.6.3.2 Cloud-based IT service management

- 5.3.6.1 Key technologies

- 5.3.7 PORTER'S FIVE FORCES ANALYSIS

- 5.3.7.1 Threat of new entrants

- 5.3.7.2 Threat of substitutes

- 5.3.7.3 Bargaining power of suppliers

- 5.3.7.4 Bargaining power of buyers

- 5.3.7.5 Intensity of competitive rivalry

- 5.3.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.8.1 Key stakeholders in buying process

- 5.3.8.2 Buying criteria

- 5.3.9 PATENT ANALYSIS

- 5.3.9.1 Methodology

- 5.3.10 USE CASES

- 5.3.10.1 Case study 1: Deployment of Extreme Networks Wi-Fi service to support digital learning

- 5.3.10.2 Case study 2: Ghelamco stadium deploys Wi-Fi to improve fan experience

- 5.3.10.3 Case study 3: Deployment of Wi-Fi service provided by ADTRAN to support BYOD policy

- 5.3.10.4 Case study 4: Deployment of Extreme Networks Wi-Fi service to support digital learning

- 5.3.10.5 Case study 5: Anord Mardix uses Redway Networks Wi-Fi to create city-wide network access

- 5.3.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.3.12 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.13 BEST PRACTICES OF WI-FI AS A SERVICE MARKET

- 5.3.14 TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.3.15 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.15.1 North America

- 5.3.15.1.1 US

- 5.3.15.1.2 Canada

- 5.3.15.2 Europe

- 5.3.15.2.1 Germany

- 5.3.15.2.2 Spain

- 5.3.15.2.3 Italy

- 5.3.15.2.4 UK

- 5.3.15.3 Asia Pacific

- 5.3.15.3.1 South Korea

- 5.3.15.3.2 China

- 5.3.15.3.3 India

- 5.3.15.4 Middle East & Africa

- 5.3.15.4.1 UAE

- 5.3.15.4.2 KSA

- 5.3.15.4.3 South Africa

- 5.3.15.5 Latin America

- 5.3.15.5.1 Brazil

- 5.3.15.5.2 Mexico

- 5.3.15.1 North America

- 5.3.16 FUTURE LANDSCAPE OF WI-FI AS A SERVICE MARKET

- 5.3.16.1 Wi-Fi as a service: Technology roadmap till 2030

- 5.3.16.2 Short-term roadmap (2025-2026)

- 5.3.16.3 Mid-term roadmap (2027-2028)

- 5.3.16.4 Long-term roadmap (2029-2030)

- 5.3.17 INVESTMENT AND FUNDING SCENARIO

- 5.3.18 INTRODUCTION TO ARTIFICIAL INTELLIGENCE AND GENERATIVE AI

- 5.3.18.1 Impact of generative AI on Wi-Fi as a service

- 5.3.18.2 Use cases of generative AI in Wi-Fi as a service

- 5.3.18.3 Future of generative AI in Wi-Fi as a service

- 5.3.19 IMPACT OF 2025 US TARIFF - WI-FI AS A SERVICE MARKET

- 5.3.19.1 Introduction

- 5.3.19.2 Key tariff rates

- 5.3.19.3 Price impact analysis

- 5.3.19.4 Impact on country/region

- 5.3.19.4.1 US

- 5.3.19.4.2 Europe

- 5.3.19.4.3 Asia Pacific

- 5.3.19.5 Impact on verticals

- 5.3.1 HISTORY OF WI-FI AS A SERVICE MARKET

6 WI-FI AS A SERVICE MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- 6.1.1 SERVICE TYPE: WI-FI AS A SERVICE MARKET DRIVERS

- 6.2 FULLY MANAGED

- 6.2.1 ENHANCED NEED FOR SEAMLESS, SECURE, AND HIGH-PERFORMANCE CONNECTIVITY TO DRIVE MARKET

- 6.3 PARTIALLY MANAGED

- 6.3.1 NEED FOR CUSTOMIZABLE NETWORK CONTROL FOR INFRASTRUCTURE AND SUPPORT TO BOOST MARKET

- 6.4 SUBSCRIPTION-BASED

- 6.4.1 FLEXIBILITY OF PAY-AS-YOU-GO MODELS FOR AFFORDABLE AND SCALABLE WI-FI ACCESS - KEY DRIVER

7 WI-FI AS A SERVICE MARKET, BY LOCATION TYPE

- 7.1 INTRODUCTION

- 7.1.1 LOCATION TYPE: WI-FI AS A SERVICE MARKET DRIVERS

- 7.2 INDOOR

- 7.2.1 NEED FOR HIGH-SPEED, RELIABLE WI-FI IN DENSE ENVIRONMENTS TO DRIVE MARKET GROWTH

- 7.3 OUTDOOR

- 7.3.1 SMART CITY PROJECTS AND WI-FI DEPLOYMENT IN OPEN SPACES AND TRANSPORT HUBS TO FUEL GROWTH

8 WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE

- 8.1 INTRODUCTION

- 8.1.1 ENTERPRISE SIZE: WI-FI AS A SERVICE MARKET DRIVERS

- 8.2 LARGE ENTERPRISES

- 8.2.1 DEMAND FOR SCALABLE, SECURE WIRELESS NETWORKS ACROSS MULTIPLE SITES TO DRIVE MARKET

- 8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 8.3.1 RISING NEED FOR AFFORDABLE, EASY-TO-MANAGE WI-FI WITHOUT HEAVY IT INVESTMENT TO DRIVE MARKET

9 WI-FI AS A SERVICE MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.1.1 END USER: WI-FI AS A SERVICE MARKET DRIVERS

- 9.2 CONSUMER

- 9.2.1 INCREASING SURGE IN SMART HOME AND IOT DEVICE USAGE TO DRIVE MARKET

- 9.3 ENTERPRISE

- 9.3.1 RISING DEMAND FOR SCALABLE, CENTRALLY MANAGED WI-FI NETWORKS TO DRIVE MARKET GROWTH

- 9.3.2 EDUCATION

- 9.3.3 RETAIL

- 9.3.4 TRAVEL & HOSPITALITY

- 9.3.5 HEALTHCARE & LIFE SCIENCES

- 9.3.6 MANUFACTURING

- 9.3.7 BFSI

- 9.3.8 IT & ITES

- 9.3.9 TRANSPORTATION & LOGISTICS

- 9.3.10 GOVERNMENT & PUBLIC SECTOR

- 9.3.11 OTHER ENTERPRISES

10 WI-FI AS A SERVICE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.3 CANADA

- 10.3 EUROPE

- 10.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.2 UK

- 10.3.3 GERMANY

- 10.3.4 FRANCE

- 10.3.5 ITALY

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.3 JAPAN

- 10.4.4 SOUTH KOREA

- 10.4.5 INDIA

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.2 MIDDLE EAST

- 10.5.3 AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.2 BRAZIL

- 10.6.3 MEXICO

- 10.6.4 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES /RIGHT TO WIN, 2021-2024

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Service type footprint

- 11.5.5.4 Location type footprint

- 11.6 STARTUP/SME EVALUATION MATRIX, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

- 11.7.1 WAAS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 11.7.2 WAAS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPANY VALUATION

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- 11.10.2 DEALS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 AT&T

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 VERIZON

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 T-MOBILE

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 E&

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 SINGTEL

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 TATA COMMUNICATIONS

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.7 COMMSCOPE

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.8 ARISTA NETWORKS

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.9 TP-LINK

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.10 WIFIRST

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.1 AT&T

- 12.2 OTHER PLAYERS

- 12.2.1 ALCATEL LUCENT ENTERPRISE

- 12.2.2 JIO

- 12.2.3 SPECTRA

- 12.2.4 TELSTRA

- 12.2.5 VIASAT

- 12.2.6 ADTRAN

- 12.2.7 ALLIED TELESIS

- 12.2.8 4IPNET

- 12.3 STARTUPS/SMES

- 12.3.1 LANCOM SYSTEMS

- 12.3.2 RUIJIE NETWORKS

- 12.3.3 DATTO

- 12.3.4 SUPERLOOP

- 12.3.5 CAMBIUM NETWORKS

- 12.3.6 REDWAY NETWORKS

- 12.3.7 CUCUMBER TONY

- 12.3.8 TANAZA

- 12.3.9 EDGECORE NETWORKS

13 ADJACENT MARKETS AND APPENDIX

- 13.1 INTRODUCTION

- 13.2 WI-FI MARKET - GLOBAL FORECAST TO 2029

- 13.2.1 MARKET DEFINITION

- 13.3 NETWORK AS A SERVICE MARKET - GLOBAL FORECAST TO 2027

- 13.3.1 MARKET DEFINITION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS