|

|

市場調査レポート

商品コード

1775083

地理空間画像解析の世界市場:用途別、データモダリティ別、データソース別、オファリング別、業界別、地域別 - 2030年までの予測Geospatial Imagery Analytics Market by Offering (Image Processing, Object Tracking, Change Detection), Data Source (Satellite Imagery, SAR, UAV/Drones), Application (Disaster Management, Precision Farming, Urban Planning) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 地理空間画像解析の世界市場:用途別、データモダリティ別、データソース別、オファリング別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月03日

発行: MarketsandMarkets

ページ情報: 英文 384 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

地理空間画像解析の市場規模は、予測期間中に8.9%のCAGRで拡大し、2025年の121億2,000万米ドルから2030年には185億5,000万米ドルに成長すると予測されています。

同市場は、農業、防衛、都市計画、災害管理などの分野で衛星やドローンベースの画像処理に対する需要が高まっていることを背景に、堅調な成長を遂げています。AIと機械学習の革新により画像解釈が強化され、より迅速で正確な意思決定が可能になっています。政府や民間企業は、インフラ監視、気候分析、セキュリティ監視のために地理空間データへの依存度を高めています。クラウド統合とリアルタイム分析は、使いやすさと拡張性をさらに拡大します。しかし、市場は、初期投資コストの高さ、新興国地域での高解像度データへのアクセスの制限、常時監視と地理空間追跡に関連するプライバシー懸念の高まりなどの抑制要因に直面しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 米ドル(100万米ドル) |

| セグメント | 用途別、データモダリティ別、データソース別、オファリング別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

持続可能性、災害対策、気候回復力に対する世界の注目が高まっていることから、地理空間画像解析市場では、環境モニタリング・気候変動分野が用途別で最大の市場シェアを占めると予測されています。政府、NGO、国際機関は、森林伐採、氷冠の融解、海面上昇などの環境変化を正確に追跡できる技術に多額の投資を行っています。地理空間画像は継続的に広域をカバーするため、急速に進化する生態系の状況をリアルタイムで把握することができます。さらに、環境規制の強化や気候変動に関する合意により、データに基づく施行や報告の必要性が高まっています。こうした独自のニーズが、この特定用途分野の成長を加速させています。

リアルタイムのリスク評価、不正検知、効率的な保険金請求管理に対する需要の高まりから、保険業種は予測期間中に地理空間画像解析市場で最も速い成長を遂げる見通しです。衛星画像やドローン画像を含む地理空間データにより、保険会社は財産の状況、災害の影響、環境リスクをより正確に評価できるようになります。気候関連の事象が頻発する中、保険会社は損失を軽減し、業務を合理化するために高度な分析に目を向けています。さらに、AIや機械学習などのテクノロジーは画像の解釈をさらに強化し、地理空間ソリューションを引受やポートフォリオのモニタリングに非常に魅力的なものにしています。保険業界におけるデジタルトランスフォーメーションに対する規制当局の支援もこの成長を後押ししており、保険業界は地理空間分析ツールの主要な採用企業として位置付けられています。

アジア太平洋は、新興技術の採用の高まり、インフラへの投資の増加、スマートシティとデジタルトランスフォーメーションを推進する政府の取り組みにより、地理空間画像解析市場で最も速い成長を示すと予測されています。中国、インド、日本、韓国などの国々では、都市計画、農業、災害管理、防衛などに地理空間技術を活用しています。この地域では、スマートフォン、衛星サービス、ドローンの普及がデータ収集能力を高め、人工知能(AI)とクラウドコンピューティングの進歩がリアルタイムの分析と実用的な洞察を促進しています。技術系新興企業の成長と官民連携も業界全体の技術革新に拍車をかけており、同地域の市場拡大をさらに加速させています。

一方、北米は地理空間技術の早期導入と大手企業の強い存在感により、市場規模では引き続きリードしています。米国とカナダは、防衛、環境モニタリング、輸送、保険などを支えるインフラが確立された成熟市場です。特にNASAやUSGSのような組織を通じた政府の支援と民間部門の投資が、この地域のリーダーシップを支えています。さらに、高度な技術統合と部門を超えた高度な分析への需要が、市場の持続的優位性を確実なものにしています。アジア太平洋市場が急成長する一方で、北米は技術の成熟度、確立されたユーザーベース、一貫した技術革新により、市場の主導権を維持しています。

当レポートでは、世界の地理空間画像解析市場について調査し、用途別、データモダリティ別、データソース別、オファリング別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 2025年の米国関税の影響- 地理空間画像解析市場

- 地理空間画像解析市場の進化

- サプライチェーン分析

- エコシステム分析

- 投資情勢と資金調達シナリオ

- 生成AIが地理空間画像解析市場に与える影響

- ケーススタディ分析

- 技術分析

- 規制状況

- 特許分析

- 価格分析

- 主要な会議とイベント(2025年~2026年)

- ポーターのファイブフォース分析

- 顧客のビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

第6章 地理空間画像解析市場(用途別)

- イントロダクション

- 監視・モニタリング

- 環境モニタリング・気候変動

- 土地利用・土地被覆(LULC)分類

- 資産・インフラ管理

- 保険リスク評価・請求検証

- 災害管理・緊急対応

- 精密農業・作物監視

- 都市計画・スマートシティデザイン

- ターゲット検出・戦略情報

- サプライチェーン・物流の監視

- 疾病発生の追跡・資源配分

- 小売店舗の立地選定と消費者の足跡マッピング

- その他

第7章 地理空間画像解析市場(データモダリティ別)

- イントロダクション

- 画像ベース

- ビデオベース

- マルチモーダル

第8章 地理空間画像解析市場(データソース別)

- イントロダクション

- 衛星画像

- 合成開口レーダー(SAR)

- 航空写真

- 無人航空機/ドローン

- GISおよびマッピングプラットフォーム

- その他

第9章 地理空間画像解析市場(オファリング別)

- イントロダクション

- ソフトウェア

- サービス

第10章 地理空間画像解析市場(業界別)

- イントロダクション

- 保険

- 農業

- 建設・不動産

- 鉱業

- ヘルスケア・ライフサイエンス

- エネルギー・公益事業

- 政府・防衛

- 電気通信

- 運輸・物流

- メディア・エンターテインメント

- その他

第11章 地理空間画像解析市場(地域別)

- イントロダクション

- 北米

- 北米:地理空間画像解析市場促進要因

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:地理空間画像解析市場促進要因

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋:地理空間画像解析市場促進要因

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリアとニュージーランド

- ASEAN

- その他

- 中東・アフリカ

- 中東・アフリカ:地理空間画像解析市場促進要因

- 中東・アフリカ:マクロ経済見通し

- サウジアラビア王国(KSA)

- アラブ首長国連邦

- カタール

- イスラエル

- 南アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:地理空間画像解析市場促進要因

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 製品比較分析

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- IBM

- HEXAGON AB

- TOMTOM

- MAXAR TECHNOLOGIES

- TRIMBLE

- CALIPER CORPORATION

- PLANET LABS

- ESRI

- L3HARRIS TECHNOLOGIES

- ORACLE

- NV5 GEOSPATIAL

- RMSI

- MAPLARGE

- FUGRO

- BLACKSKY

- NEARMAP

- SUPERMAP

- スタートアップ/中小企業

- EARTHDAILY ANALYTICS

- SPARKGEO

- ORBICA

- CARTO

- MAPBOX

- BLUE SKY ANALYTICS

- LATITUDO40

- ECOPIA.AI

- EOS DATA ANALYTICS

- CATALYST

- SPACEKNOW

- FLYPIX AI

- PICTERRA

- GEOSPATIAL INSIGHT

- UP42

- SIMULARITY

- CAPELLA SPACE

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2020-2024

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 GLOBAL GEOSPATIAL IMAGERY ANALYTICS MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 5 GLOBAL GEOSPATIAL IMAGERY ANALYTICS MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 6 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 7 GEOSPATIAL IMAGERY ANALYTICS MARKET: ECOSYSTEM

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PATENTS FILED, 2016-2025

- TABLE 14 LIST OF FEW PATENTS IN GEOSPATIAL IMAGERY ANALYTICS MARKET, 2024-2025

- TABLE 15 PRICING DATA OF GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING

- TABLE 16 PRICING DATA OF GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION

- TABLE 17 GEOSPATIAL IMAGERY ANALYTICS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 18 PORTER'S FIVE FORCES' IMPACT ON GEOSPATIAL IMAGERY ANALYTICS MARKET

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY VERTICALS

- TABLE 20 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 21 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 22 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 23 SURVEILLANCE & MONITORING: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 24 SURVEILLANCE & MONITORING: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 ENVIRONMENTAL MONITORING & CLIMATE CHANGE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 ENVIRONMENTAL MONITORING & CLIMATE CHANGE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 LAND USE & LAND COVER (LULC) CLASSIFICATION: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 LAND USE & LAND COVER (LULC) CLASSIFICATION: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 ASSET & INFRASTRUCTURE MANAGEMENT: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 ASSET & INFRASTRUCTURE MANAGEMENT: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 INSURANCE RISK ASSESSMENT & CLAIMS VALIDATION: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 INSURANCE RISK ASSESSMENT & CLAIMS VALIDATION: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

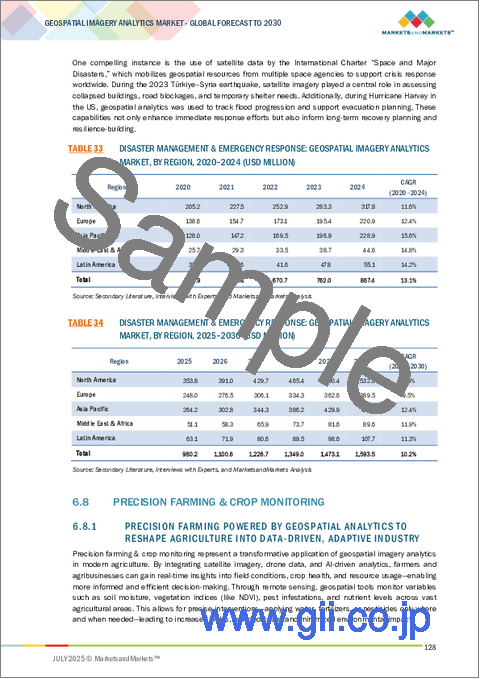

- TABLE 33 DISASTER MANAGEMENT & EMERGENCY RESPONSE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 DISASTER MANAGEMENT & EMERGENCY RESPONSE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 PRECISION FARMING & CROP MONITORING: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 PRECISION FARMING & CROP MONITORING: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 URBAN PLANNING & SMART CITY DESIGN: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 URBAN PLANNING & SMART CITY DESIGN: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 TARGET DETECTION & STRATEGIC INTELLIGENCE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 TARGET DETECTION & STRATEGIC INTELLIGENCE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 SUPPLY CHAIN & LOGISTICS MONITORING: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 SUPPLY CHAIN & LOGISTICS MONITORING: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 DISEASE OUTBREAK TRACKING & RESOURCE ALLOCATION: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 DISEASE OUTBREAK TRACKING & RESOURCE ALLOCATION: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 RETAIL SITE SELECTION & CONSUMER FOOTFALL MAPPING: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 RETAIL SITE SELECTION & CONSUMER FOOTFALL MAPPING: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 OTHER APPLICATIONS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 OTHER APPLICATIONS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 50 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY, 2025-2030 (USD MILLION)

- TABLE 51 IMAGE-BASED ANALYTICS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 IMAGE-BASED ANALYTICS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 VIDEO-BASED ANALYTICS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 VIDEO-BASED ANALYTICS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 MULTIMODAL ANALYTICS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 MULTIMODAL ANALYTICS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE, 2020-2024 (USD MILLION)

- TABLE 58 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE, 2025-2030 (USD MILLION)

- TABLE 59 SATELLITE IMAGERY: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 SATELLITE IMAGERY: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 SYNTHETIC APERTURE RADAR (SAR): GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 SYNTHETIC APERTURE RADAR (SAR): GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 AERIAL IMAGERY: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 AERIAL IMAGERY: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 UAV/DRONES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 UAV/DRONES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 GIS & MAPPING PLATFORMS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 GIS & MAPPING PLATFORMS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 OTHER DATA SOURCES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 OTHER DATA SOURCES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 72 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 73 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 74 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 75 IMAGE PROCESSING & ENHANCEMENT: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 IMAGE PROCESSING & ENHANCEMENT: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 OBJECT TRACKING AND FEATURE DETECTION: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 OBJECT TRACKING AND FEATURE DETECTION: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 CHANGE DETECTION & TIME-SERIES ANALYSIS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 CHANGE DETECTION & TIME-SERIES ANALYSIS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 PREDICTIVE MODELING & PATTERN RECOGNITION: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 82 PREDICTIVE MODELING & PATTERN RECOGNITION: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 AI-BASED GEOSPATIAL IMAGERY ANALYTICS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 84 AI-BASED GEOSPATIAL IMAGERY ANALYTICS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 OTHERS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 86 OTHERS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 88 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 89 CLOUD: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 CLOUD: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 ON-PREMISES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 ON-PREMISES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 94 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 95 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 96 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 97 CONSULTING & ADVISORY: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 98 CONSULTING & ADVISORY: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 DEPLOYMENT & INTEGRATION: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 100 DEPLOYMENT & INTEGRATION: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 SUPPORT & MAINTENANCE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 102 SUPPORT & MAINTENANCE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 MANAGED SERVICES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 104 MANAGED SERVICES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 106 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 107 INSURANCE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 108 INSURANCE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 AGRICULTURE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 110 AGRICULTURE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 CONSTRUCTION & REAL ESTATE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 112 CONSTRUCTION & REAL ESTATE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 MINING: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 114 MINING: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 HEALTHCARE & LIFE SCIENCES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 116 HEALTHCARE & LIFE SCIENCES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 ENERGY & UTILITIES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 118 ENERGY & UTILITIES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 GOVERNMENT & DEFENSE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 120 GOVERNMENT & DEFENSE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 TELECOMMUNICATIONS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 122 TELECOMMUNICATIONS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 TRANSPORTATION & LOGISTICS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 124 TRANSPORTATION & LOGISTICS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125 MEDIA & ENTERTAINMENT: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 126 MEDIA & ENTERTAINMENT: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 OTHER VERTICALS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 128 OTHER VERTICALS: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 130 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 132 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 133 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 134 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 136 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 138 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 140 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 142 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY, 2025-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE, 2020-2024 (USD MILLION)

- TABLE 144 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE, 2025-2030 (USD MILLION)

- TABLE 145 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 146 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 148 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 151 US: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 152 US: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 153 CANADA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 154 CANADA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 155 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 156 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 157 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 158 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 159 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 160 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 161 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 162 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 163 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 164 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 165 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 166 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY, 2025-2030 (USD MILLION)

- TABLE 167 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE, 2020-2024 (USD MILLION)

- TABLE 168 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE, 2025-2030 (USD MILLION)

- TABLE 169 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 170 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 171 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 172 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 173 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 174 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 175 UK: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 176 UK: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 177 GERMANY: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 178 GERMANY: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 179 FRANCE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 180 FRANCE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 181 ITALY: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 182 ITALY: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 183 SPAIN: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 184 SPAIN: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 185 REST OF EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 186 REST OF EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 187 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 188 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 190 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 191 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 192 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 193 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 194 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 195 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 196 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 197 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 198 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY, 2025-2030 (USD MILLION)

- TABLE 199 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE, 2020-2024 (USD MILLION)

- TABLE 200 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE, 2025-2030 (USD MILLION)

- TABLE 201 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 202 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 203 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 204 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 206 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 207 CHINA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 208 CHINA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 209 JAPAN: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 210 JAPAN: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 211 INDIA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 212 INDIA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 213 SOUTH KOREA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 214 SOUTH KOREA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 215 AUSTRALIA & NEW ZEALAND: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 216 AUSTRALIA & NEW ZEALAND: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 217 ASEAN: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 218 ASEAN: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 219 REST OF ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 220 REST OF ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY, 2025-2030 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE, 2020-2024 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE, 2025-2030 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 239 MIDDLE EAST: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 240 MIDDLE EAST: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 241 KSA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 242 KSA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 243 UAE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 244 UAE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 245 QATAR: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 246 QATAR: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 247 ISRAEL: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 248 ISRAEL: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 249 SOUTH AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 250 SOUTH AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 251 REST OF MIDDLE EAST: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 252 REST OF MIDDLE EAST: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 253 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 254 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 255 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 256 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 257 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 258 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 259 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 260 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 261 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 262 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 263 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 264 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY, 2025-2030 (USD MILLION)

- TABLE 265 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE, 2020-2024 (USD MILLION)

- TABLE 266 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE, 2025-2030 (USD MILLION)

- TABLE 267 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 268 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 269 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 270 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 271 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 272 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 273 BRAZIL: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 274 BRAZIL: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 275 MEXICO: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 276 MEXICO: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 277 ARGENTINA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 278 ARGENTINA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 279 REST OF LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 280 REST OF LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 281 OVERVIEW OF STRATEGIES ADOPTED BY KEY GEOSPATIAL IMAGERY ANALYTICS VENDORS, 2022-2025

- TABLE 282 GEOSPATIAL IMAGERY ANALYTICS MARKET: DEGREE OF COMPETITION

- TABLE 283 REGIONAL FOOTPRINT (18 COMPANIES), 2024

- TABLE 284 OFFERING FOOTPRINT (18 COMPANIES), 2024

- TABLE 285 APPLICATION FOOTPRINT (18 COMPANIES), 2024

- TABLE 286 VERTICAL FOOTPRINT (18 COMPANIES), 2024

- TABLE 287 GEOSPATIAL IMAGERY ANALYTICS MARKET: KEY STARTUPS/SMES, 2024

- TABLE 288 GEOSPATIAL IMAGERY ANALYTICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 289 GEOSPATIAL IMAGERY ANALYTICS MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2022-2025

- TABLE 290 GEOSPATIAL IMAGERY ANALYTICS MARKET: DEALS, 2022-2025

- TABLE 291 GOOGLE: COMPANY OVERVIEW

- TABLE 292 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 GOOGLE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 294 GOOGLE: DEALS

- TABLE 295 IBM: COMPANY OVERVIEW

- TABLE 296 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 IBM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 298 IBM: DEALS

- TABLE 299 HEXAGON AB: COMPANY OVERVIEW

- TABLE 300 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 HEXAGON AB: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 302 HEXAGON AB: DEALS

- TABLE 303 TOMTOM: COMPANY OVERVIEW

- TABLE 304 TOMTOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 TOMTOM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 306 TOMTOM: DEALS

- TABLE 307 MAXAR TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 308 MAXAR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 MAXAR TECHNOLOGIES: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 310 MAXAR TECHNOLOGIES: DEALS

- TABLE 311 TRIMBLE: COMPANY OVERVIEW

- TABLE 312 TRIMBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 TRIMBLE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 314 TRIMBLE: DEALS

- TABLE 315 CALIPER CORPORATION: COMPANY OVERVIEW

- TABLE 316 CALIPER CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 CALIPER CORPORATION: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 318 PLANET LABS: COMPANY OVERVIEW

- TABLE 319 PLANET LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 PLANET LABS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 321 PLANET LABS: DEALS

- TABLE 322 ESRI: COMPANY OVERVIEW

- TABLE 323 ESRI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 ESRI: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 325 ESRI: DEALS

- TABLE 326 L3HARRIS TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 327 L3HARRIS TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 GEOSPATIAL ANALYTICS MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 329 GEOSPATIAL ANALYTICS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 330 GEOSPATIAL ANALYTICS MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 331 GEOSPATIAL ANALYTICS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 332 GEOSPATIAL ANALYTICS MARKET, BY DATA TYPE, 2019-2023 (USD MILLION)

- TABLE 333 GEOSPATIAL ANALYTICS MARKET, BY DATA TYPE, 2024-2029 (USD MILLION)

- TABLE 334 GEOSPATIAL ANALYTICS MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 335 GEOSPATIAL ANALYTICS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 336 GEOSPATIAL ANALYTICS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 337 GEOSPATIAL ANALYTICS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 338 LOCATION ANALYTICS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 339 LOCATION ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 340 LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 341 LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 342 LOCATION ANALYTICS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 343 LOCATION ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 344 LOCATION ANALYTICS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 345 LOCATION ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 346 LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 347 LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 GEOSPATIAL IMAGERY ANALYTICS MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 GEOSPATIAL IMAGERY ANALYTICS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF GEOSPATIAL IMAGERY ANALYTICS MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF GEOSPATIAL IMAGERY ANALYTICS MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/SERVICES OF GEOSPATIAL IMAGERY ANALYTICS MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF GEOSPATIAL IMAGERY ANALYTICS THROUGH OVERALL GEOSPATIAL IMAGERY ANALYTICS SPENDING

- FIGURE 8 SOFTWARE SEGMENT ESTIMATED TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 9 IMAGE-BASED ANALYTICS SEGMENT SET TO REGISTER LARGEST MARKET SHARE IN 2025

- FIGURE 10 SATELLITE IMAGERY SEGMENT TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 11 ENVIRONMENTAL MONITORING & CLIMATE CHANGE SEGMENT SET TO REGISTER LARGEST MARKET SHARE IN 2025

- FIGURE 12 INSURANCE TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER FASTEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 14 RISING DEMAND FOR REAL-TIME LOCATION INTELLIGENCE AND ENHANCED DECISION-MAKING ACROSS SECTORS TO DRIVE GEOSPATIAL IMAGERY ANALYTICS MARKET

- FIGURE 15 INSURANCE RISK ASSESSMENT & CLAIMS VALIDATION TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 16 IMAGE PROCESSING & ENHANCEMENT AND GOVERNMENT & DEFENSE TO BE LARGEST SHAREHOLDERS IN NORTH AMERICA IN 2025

- FIGURE 17 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 18 GEOSPATIAL IMAGERY ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 EVOLUTION OF GEOSPATIAL IMAGERY ANALYTICS MARKET

- FIGURE 20 GEOSPATIAL IMAGERY ANALYTICS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 KEY PLAYERS IN GEOSPATIAL IMAGERY ANALYTICS MARKET ECOSYSTEM

- FIGURE 22 GEOSPATIAL IMAGERY ANALYTICS MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- FIGURE 23 MARKET POTENTIAL OF GENERATIVE AI IN VARIOUS GEOSPATIAL IMAGERY ANALYTICS USE CASES

- FIGURE 24 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2016-2025

- FIGURE 25 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016-2025

- FIGURE 26 GEOSPATIAL IMAGERY ANALYTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY VERTICALS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 30 INSURANCE RISK ASSESSMENT & CLAIMS VALIDATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 MULTIMODAL ANALYTICS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 UAV/DRONES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 AI-BASED GEOSPATIAL IMAGERY ANALYTICS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 CLOUD TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 SUPPORT & MAINTENANCE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 INSURANCE VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA TO BE LARGEST REGIONAL MARKET DURING FORECAST PERIOD

- FIGURE 40 INDIA TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET SNAPSHOT

- FIGURE 43 TOP FIVE PUBLIC PLAYERS IN GEOSPATIAL IMAGERY ANALYTICS MARKET, 2020-2024 (USD MILLION)

- FIGURE 44 SHARE OF LEADING COMPANIES IN GEOSPATIAL IMAGERY ANALYTICS MARKET, 2024

- FIGURE 45 PRODUCT COMPARATIVE ANALYSIS

- FIGURE 46 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 47 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 48 GEOSPATIAL IMAGERY ANALYTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 COMPANY FOOTPRINT (15 COMPANIES), 2024

- FIGURE 50 GEOSPATIAL IMAGERY ANALYTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 51 GOOGLE: COMPANY SNAPSHOT

- FIGURE 52 IBM: COMPANY SNAPSHOT

- FIGURE 53 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 54 TOMTOM: COMPANY SNAPSHOT

- FIGURE 55 TRIMBLE: COMPANY SNAPSHOT

- FIGURE 56 PLANET LABS: COMPANY SNAPSHOT

- FIGURE 57 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

The geospatial imagery analytics market is projected to grow from USD 12.12 billion in 2025 to USD 18.55 billion by 2030 at a CAGR of 8.9% during the forecast period. The market is experiencing robust growth, driven by rising demand for satellite and drone-based imaging across sectors such as agriculture, defense, urban planning, and disaster management. Innovations in AI and machine learning have enhanced image interpretation, enabling faster, more precise decision-making. Governments and private enterprises increasingly rely on geospatial data for infrastructure monitoring, climate analysis, and security surveillance. Cloud integration and real-time analytics further expand usability and scalability. However, the market faces restraints, including high initial investment costs, limited access to high-resolution data in developing regions, and growing privacy concerns related to constant surveillance and geospatial tracking.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Million) |

| Segments | Offering, Data Modality, Data Source, Application, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"Environmental monitoring & climate change application segment expected to account for the largest market share during the forecast period"

The environmental monitoring and climate change segment is projected to have the largest market share by application in the geospatial imagery analytics market due to the increasing global focus on sustainability, disaster preparedness, and climate resilience. Governments, NGOs, and international bodies are investing heavily in technologies that can track environmental changes with precision, such as deforestation, melting ice caps, and rising sea levels. Geospatial imagery provides continuous, wide-area coverage, enabling real-time insights into rapidly evolving ecological conditions. Moreover, stricter environmental regulations and climate agreements have amplified the need for data-driven enforcement and reporting. These unique needs are accelerating growth in this specific application segment.

"Insurance vertical segment expected to register the fastest growth rate during the forecast period"

The insurance vertical is poised to experience the fastest growth in the geospatial imagery analytics market during the forecast period due to increasing demand for real-time risk assessment, fraud detection, and efficient claims management. Geospatial data, including satellite and drone imagery, enables insurers to assess property conditions, disaster impact, and environmental risks with greater precision. As climate-related events become more frequent, insurers are turning to advanced analytics to mitigate losses and streamline operations. Additionally, technologies like AI and machine learning further enhance image interpretation, making geospatial solutions highly attractive for underwriting and portfolio monitoring. Regulatory support for digital transformation in insurance also drives this growth, positioning the sector as a key adopter of geospatial analytics tools.

"Asia Pacific market projected to witness rapid growth fueled by innovation and emerging technologies, while North America leads in market size"

Asia Pacific is expected to witness the fastest growth in the geospatial imagery analytics market due to the rising adoption of emerging technologies, increasing investments in infrastructure, and government initiatives promoting smart cities and digital transformation. Countries such as China, India, Japan, and South Korea are leveraging geospatial technologies for urban planning, agriculture, disaster management, and defense. The proliferation of smartphones, satellite services, and drones in the region enhances data collection capabilities, while advancements in artificial intelligence (AI) and cloud computing drive real-time analytics and actionable insights. Growing tech startups and public-private collaborations are also fueling innovation across industries, further accelerating market expansion in the region.

Conversely, North America continues to lead in market size due to the early adoption of geospatial technologies and the strong presence of major players. The US and Canada have mature markets with well-established infrastructure supporting defense, environmental monitoring, transportation, and insurance applications. Government support, especially through organizations like NASA and the USGS, alongside private sector investment, underpins the region's leadership. Additionally, a high level of technological integration and demand for advanced analytics across sectors ensures sustained market dominance. While the Asia Pacific market grows rapidly, North America maintains its market leadership due to technological maturity, an established user base, and consistent innovation.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the geospatial imagery analytics market.

- By Company: Tier I - 35%, Tier II - 44%, and Tier III - 21%

- By Designation: C Level - 50%, Director Level - 30%, and others - 20%

- By Region: North America - 30%, Europe - 30%, Asia Pacific - 25%, Middle East & Africa - 10%, and Latin America - 5%

The report includes the study of key players offering geospatial imagery analytics solutions and services. It profiles major vendors in the geospatial imagery analytics market. The major market players include Google (US), IBM (US), Hexagon AB (Sweden), TomTom (Netherlands), Maxar Technologies (US), Trimble (US), Oracle (US), ESRI (US), RMSI (India), Furgo (Netherlands), Planet Labs (US), BlackSky (US), L3Harris Technologies (US), Mapbox (US), Carto (US), SuperMap (China), NV5 Geospatial (US), Nearmap (Australia), Caliper Corporation (US), EOS Data Analytics (US), Sparkgeo (Canada), Orbica (New Zealand), Blue Sky Analytics (Netherlands), Latitude 40 (Italy), Ecopia.AI (Canada), Catalyst (Canada), SpaceKnow (US), Flypix AI (Germany), Picterra (Switzerland), Geospatial Insight (UK), UP42 (Germany), Simularity (US), MapLarge (US), EarthDaily Analytics (Canada), and Capella Space (US).

Research Coverage

This research report covers the geospatial imagery analytics market, which has been segmented based on offering, data modality, data source, and vertical. The offering segment consists of software and services. The software segment contains software by functionality (image processing & enhancement, object tracking & feature detection, change detection & time-series analysis, predictive modeling & pattern recognition, and AI-based geospatial imagery analytics, and others (anomaly detection and stream analytics)) and software by deployment mode (cloud and on-premises). The services segment consists of professional services (consulting & advisory, deployment & integration, and support & maintenance) and managed services. The data modality segment includes image-based analytics, video-based analytics, and multimodal analytics. The data source segment consists of satellite imagery, synthetic aperture radar (SAR), aerial imagery, UAV/drones, GIS & mapping platforms, and others (crowdsourced imagery and balloon-based systems). The application segment includes surveillance & monitoring, environmental monitoring & climate change, land use & land cover (LULC) classification, asset & infrastructure management, insurance risk assessment & claims validation, disaster management & emergency response, precision farming & crop monitoring, urban planning, smart cities & infrastructure, target detection & strategic intelligence, supply chain & logistics monitoring, disease outbreak tracking & resource allocation, retail site selection & consumer footfall mapping, and other applications (site preservation & monitoring and media & audience mapping, and telecommunications network planning). The vertical segment consists of insurance, agriculture, construction & real estate, mining, healthcare and life sciences, energy & utilities, government & defense, telecommunications, transportation & logistics, media and entertainment, and other verticals (banking & financial services, retail & ecommerce, and manufacturing). The regional analysis of the geospatial imagery analytics market covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America. The report also contains a detailed analysis of investment & funding scenarios, case studies, regulatory landscape, ecosystem analysis, supply chain analysis, pricing analysis, and technology analysis.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall geospatial imagery analytics market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

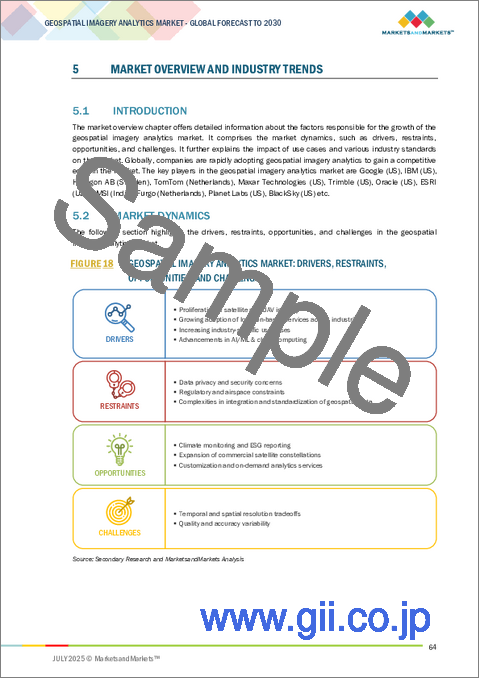

- Analysis of key drivers (Proliferation of Satellite and UAV Imagery, Growing adoption of location-based services across industries, increasing Industry-Specific Use Cases, Advancements in AI/ML & Cloud Computing), restraints (Data Privacy and Security Concerns, Regulatory and Airspace Constraints, Complexities in integration and standardization of geospatial data), opportunities (Climate Monitoring and ESG Reporting, Expansion of Commercial Satellite Constellations, Customization and On-Demand Analytics Services), and challenges (Temporal and Spatial Resolution Tradeoffs, Quality and Accuracy Variability).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the geospatial imagery analytics market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the geospatial imagery analytics market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the geospatial imagery analytics market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Google (US), IBM (US), Hexagon AB (Sweden), TomTom (Netherlands), Maxar Technologies (US), Trimble (US), Oracle (US), ESRI (US), RMSI (India), Furgo (Netherlands), Planet Labs (US), BlackSky (US), L3Harris Technologies (US), Mapbox (US), Carto (US), SuperMap (China), NV5 Geospatial (US), Nearmap (Australia), Caliper Corporation (US), EOS Data Analytics (US), Sparkgeo (Canada), Orbica (New Zealand), Blue Sky Analytics (Netherlands), Latitude 40 (Italy), Ecopia.AI (Canada), Catalyst (Canada), SpaceKnow (US), Flypix AI (Germany), Picterra (Switzerland), Geospatial Insight (UK), UP42 (Germany), Simularity (US), MapLarge (US), EarthDaily Analytics (Canada), Capella Space (US) among others in the geospatial imagery analytics market. The report also helps stakeholders understand the pulse of the geospatial imagery analytics market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GEOSPATIAL IMAGERY ANALYTICS MARKET

- 4.2 GEOSPATIAL IMAGERY ANALYTICS MARKET: TOP THREE APPLICATIONS

- 4.3 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY SOFTWARE FUNCTIONALITY AND VERTICAL

- 4.4 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Proliferation of satellite and UAV imagery

- 5.2.1.2 Growing adoption of location-based services across industries

- 5.2.1.3 Increasing industry-specific use cases

- 5.2.1.4 Advancements in AI/ML & cloud computing

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data privacy and security concerns

- 5.2.2.2 Regulatory barriers restricting scalable access to geospatial data

- 5.2.2.3 Complexities in integration and standardization of geospatial data

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Climate monitoring and ESG reporting

- 5.2.3.2 Expansion of commercial satellite constellations

- 5.2.3.3 Customization and on-demand analytics services

- 5.2.4 CHALLENGES

- 5.2.4.1 Temporal and spatial resolution tradeoffs

- 5.2.4.2 Quality and accuracy variability

- 5.2.1 DRIVERS

- 5.3 IMPACT OF 2025 US TARIFF - GEOSPATIAL IMAGERY ANALYTICS MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 KEY TARIFF RATES

- 5.3.3 PRICE IMPACT ANALYSIS

- 5.3.3.1 Strategic shifts and emerging trends

- 5.3.4 IMPACT ON COUNTRY/REGION

- 5.3.4.1 US

- 5.3.4.1.1 Strategic shifts and key observations

- 5.3.4.2 China

- 5.3.4.2.1 Strategic shifts and key observations

- 5.3.4.3 Southeast Asia

- 5.3.4.3.1 Strategic shifts and key observations

- 5.3.4.4 Europe

- 5.3.4.4.1 Strategic shifts and key observations

- 5.3.4.1 US

- 5.3.5 IMPACT ON END-USE INDUSTRIES

- 5.3.5.1 Agriculture and Precision Farming

- 5.3.5.2 Infrastructure & Urban Planning

- 5.3.5.3 Defense and Intelligence

- 5.3.5.4 Environmental Monitoring & Disaster Management

- 5.3.5.5 Oil, Gas, and Mining

- 5.4 EVOLUTION OF GEOSPATIAL IMAGERY ANALYTICS MARKET

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 IMAGE PROCESSING & ENHANCEMENT

- 5.6.2 OBJECT TRACKING & FEATURE DETECTION

- 5.6.3 CHANGE DETECTION & TIME-SERIES ANALYSIS

- 5.6.4 PREDICTIVE MODELING & PATTERN RECOGNITION

- 5.6.5 AI/ML-BASED GEOSPATIAL ANALYTICS

- 5.6.6 OTHERS (ANOMALY DETECTION AND STREAM ANALYTICS)

- 5.7 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.8 IMPACT OF GENERATIVE AI ON GEOSPATIAL IMAGERY ANALYTICS MARKET

- 5.8.1 SUPER-RESOLUTION IMAGE ENHANCEMENT

- 5.8.2 SYNTHETIC DATA GENERATION FOR MODEL TRAINING

- 5.8.3 AUTOMATIC FEATURE EXTRACTION AND MAPPING

- 5.8.4 CHANGE DETECTION AND TEMPORAL ANALYSIS

- 5.8.5 DISASTER SCENARIO SIMULATION AND RISK ASSESSMENT

- 5.8.6 AUGMENTED REALITY (AR) AND VISUALIZATION FOR GEOSPATIAL DATA

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 GEOCENTO'S SHIP DETECTION AND MONITORING SEAS

- 5.9.2 CARTO ANALYZED ENGLAND'S RESPONSE TO COVID-19 USING DATA AND MAPS

- 5.9.3 ESRI EMPOWERED INSURANCE INDUSTRY IN INDIA

- 5.9.4 GEOSPIN'S ANALYSIS FOR CHARGING INFRASTRUCTURE

- 5.9.5 L3HARRIS HELPED AUSTRALIAN CITY COUNCIL FOR TREE INVENTORY FOR LEVERAGING DEEP LEARNING

- 5.9.6 PHOTOSAT MONITORED OIL SAND MINES OF ALBERTA, CANADA

- 5.9.7 HEXAGON MONITORED FOREST COVER CHANGES IN MADHYA PRADESH, INDIA

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Remote Sensing

- 5.10.1.2 Machine Learning

- 5.10.1.3 Georeferencing

- 5.10.1.4 Photogrammetry

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Edge Computing

- 5.10.2.2 5G

- 5.10.2.3 Cloud Computing

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Digital Twin Technology

- 5.10.3.2 Autonomous Navigation

- 5.10.3.3 Internet of Things (IoT)

- 5.10.3.4 Blockchain

- 5.10.1 KEY TECHNOLOGIES

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY FRAMEWORK

- 5.11.2.1 North America

- 5.11.2.1.1 Geospatial Data Act (GDA) of 2018 (US)

- 5.11.2.1.2 Open Government Directive of 2014 (Canada)

- 5.11.2.2 Europe

- 5.11.2.2.1 INSPIRE Directive 2007/2 (European Commission)

- 5.11.2.2.2 General Data Protection Regulation (European Union)

- 5.11.2.2.3 The Copernicus Regulation 2021/696 (European Union)

- 5.11.2.2.4 Geospatial Information Regulation Act 2016 (India)

- 5.11.2.2.5 Surveying and Mapping Law 2002, Revised 2017 (China)

- 5.11.2.2.6 Basic Act on Advancement of Utilizing Geospatial Information, 2007 (Japan)

- 5.11.2.3 Middle East & Africa

- 5.11.2.3.1 Survey and Mapping Law (Saudi Arabia)

- 5.11.2.3.2 Spatial Data Infrastructure Act 54 of 2003 (South Africa)

- 5.11.2.4 Latin America

- 5.11.2.4.1 National Geospatial Data Infrastructure (INDE) Law (Brazil)

- 5.11.2.4.2 Geospatial Data Law 2020 (Mexico)

- 5.11.2.1 North America

- 5.12 PATENT ANALYSIS

- 5.12.1 METHODOLOGY

- 5.12.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.12.3 INNOVATION AND PATENT APPLICATIONS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

- 5.13.2 AVERAGE SELLING PRICE, BY APPLICATION, 2025

- 5.14 KEY CONFERENCES AND EVENTS (2025-2026)

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF SUPPLIERS

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

6 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.1.1 APPLICATION: GEOSPATIAL IMAGERY ANALYTICS MARKET DRIVERS

- 6.2 SURVEILLANCE & MONITORING

- 6.2.1 GEOSPATIAL IMAGERY-BASED SURVEILLANCE AND MONITORING ENHANCING SITUATIONAL AWARENESS AND STRENGTHENING NATIONAL AND ENVIRONMENTAL SECURITY

- 6.3 ENVIRONMENTAL MONITORING & CLIMATE CHANGE

- 6.3.1 BY OFFERING TIMELY INSIGHTS, GEOSPATIAL IMAGERY ANALYTICS TO COMBAT CLIMATE CHANGE AND SUPPORT SUSTAINABLE ENVIRONMENTAL MANAGEMENT

- 6.4 LAND USE & LAND COVER (LULC) CLASSIFICATION

- 6.4.1 WITH GROWING PRESSURE ON LAND AND RESOURCES, ACCURATE AND TIMELY LULC ANALYSIS TO BECOME NECESSITY FOR SUSTAINABLE DEVELOPMENT

- 6.5 ASSET & INFRASTRUCTURE MANAGEMENT

- 6.5.1 GEOSPATIAL IMAGERY TO TRANSFORM INFRASTRUCTURE MANAGEMENT AND ENABLE SMARTER, DATA-DRIVEN ASSET DECISIONS

- 6.6 INSURANCE RISK ASSESSMENT & CLAIMS VALIDATION

- 6.6.1 GEOSPATIAL IMAGERY ANALYTICS BECOMING STRATEGIC ASSET IN MODERNIZING INSURANCE VALUE CHAIN AND IMPROVING CUSTOMER TRUST

- 6.7 DISASTER MANAGEMENT & EMERGENCY RESPONSE

- 6.7.1 GEOSPATIAL IMAGERY ANALYTICS BECOMING INDISPENSABLE IN MANAGING DISASTERS, MINIMIZING RESPONSE TIME, REDUCING LOSS OF LIFE, AND SUPPORTING MORE EFFICIENT RECOVERY OPERATIONS

- 6.8 PRECISION FARMING & CROP MONITORING

- 6.8.1 PRECISION FARMING POWERED BY GEOSPATIAL ANALYTICS TO RESHAPE AGRICULTURE INTO DATA-DRIVEN, ADAPTIVE INDUSTRY

- 6.9 URBAN PLANNING & SMART CITY DESIGN

- 6.9.1 GEOSPATIAL IMAGERY ANALYTICS TO HELP URBAN AREAS ADAPT TO RAPID GROWTH, CLIMATE PRESSURES, AND EVOLVING CITIZEN NEEDS

- 6.10 TARGET DETECTION & STRATEGIC INTELLIGENCE

- 6.10.1 IMAGERY ANALYTICS STRENGTHENING NATIONAL DEFENSE CAPABILITIES BY PROVIDING UNMATCHED LEVEL OF VISIBILITY, ACCURACY, AND FORESIGHT IN HIGH-STAKES ENVIRONMENTS

- 6.11 SUPPLY CHAIN & LOGISTICS MONITORING

- 6.11.1 GEOSPATIAL IMAGERY ANALYTICS TO ENHANCE LOGISTICS EFFICIENCY, MANAGE RISKS, AND MAKE MORE RESILIENT SUPPLY CHAIN DECISIONS

- 6.12 DISEASE OUTBREAK TRACKING & RESOURCE ALLOCATION

- 6.12.1 BY INTEGRATING SATELLITE IMAGERY WITH GEOSPATIAL AND DEMOGRAPHIC DATA, HEALTH AGENCIES CAN MONITOR ENVIRONMENTAL CONDITIONS THAT INFLUENCE DISEASE SPREAD

- 6.13 RETAIL SITE SELECTION & CONSUMER FOOTFALL MAPPING

- 6.13.1 GEOSPATIAL IMAGERY ANALYTICS TO ENABLE BUSINESSES TO ALIGN THEIR PHYSICAL FOOTPRINT WITH ACTUAL DEMAND AND EVOLVING URBAN DYNAMICS

- 6.14 OTHER APPLICATIONS

7 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA MODALITY

- 7.1 INTRODUCTION

- 7.1.1 DATA MODALITY: GEOSPATIAL IMAGERY ANALYTICS MARKET DRIVERS

- 7.2 IMAGE-BASED ANALYTICS

- 7.2.1 WITH INCREASING NEED FOR ACTIONABLE GEOSPATIAL INTELLIGENCE ACROSS SECTORS, IMAGE-BASED ANALYTICS TO WITNESS SUSTAINED GROWTH

- 7.3 VIDEO-BASED ANALYTICS

- 7.3.1 AS SMART CITIES AND INFRASTRUCTURE PROJECTS GROW, DEMAND FOR INTELLIGENT VIDEO ANALYTICS CONTINUES TO EXPAND

- 7.4 MULTIMODAL ANALYTICS

- 7.4.1 FUSING IMAGE AND VIDEO DATA FOR COMPREHENSIVE SITUATIONAL AWARENESS

8 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DATA SOURCE

- 8.1 INTRODUCTION

- 8.1.1 DATA SOURCE: GEOSPATIAL IMAGERY ANALYTICS MARKET DRIVERS

- 8.2 SATELLITE IMAGERY

- 8.2.1 GROWING ADOPTION OF CLOUD-BASED GEOSPATIAL PLATFORMS AND AI-DRIVEN ANALYTICS TOOLS TO STRENGTHEN UTILITY OF SATELLITE IMAGERY

- 8.3 SYNTHETIC APERTURE RADAR (SAR)

- 8.3.1 VERSATILITY AND RELIABILITY OF SAR IMAGING, ESPECIALLY IN CHALLENGING ENVIRONMENTS, CONTINUE TO POSITION IT AS CRITICAL DATA SOURCE

- 8.4 AERIAL IMAGERY

- 8.4.1 AS TECHNOLOGICAL IMPROVEMENTS LOWER OPERATIONAL COSTS AND IMPROVE RESOLUTION, AERIAL IMAGERY TO MAINTAIN ITS IMPORTANCE

- 8.5 UAV/DRONES

- 8.5.1 AS FLIGHT CONTROL TECHNOLOGIES CONTINUE TO EVOLVE, UAV/DRONES POISED FOR SUSTAINED EXPANSION

- 8.6 GIS & MAPPING PLATFORMS

- 8.6.1 GIS AND MAPPING PLATFORMS TO PLAY CRITICAL ROLE IN CONVERTING RAW IMAGERY DATA INTO ACTIONABLE INSIGHTS

- 8.7 OTHER DATA SOURCES

9 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.1.1 OFFERING: GEOSPATIAL IMAGERY ANALYTICS MARKET DRIVERS

- 9.2 SOFTWARE

- 9.2.1 BY FUNCTIONALITY

- 9.2.1.1 Image Processing & Enhancement

- 9.2.1.1.1 As need for timely and accurate spatial insights grows, image processing and enhancement tools to become indispensable for organizations

- 9.2.1.2 Object Tracking and Feature Detection

- 9.2.1.2.1 Object tracking and feature detection are rapidly growing as volume of imagery data grows

- 9.2.1.3 Change Detection & Time-series Analysis

- 9.2.1.3.1 With global climate events and urbanization accelerating change, ability to track and analyze geospatial trends to become essential

- 9.2.1.4 Predictive Modeling & Pattern Recognition

- 9.2.1.4.1 By analyzing recurring spatial behaviors, geospatial systems to generate models that simulate potential outcomes, providing decision-makers with strategic advantage

- 9.2.1.5 AI-based Geospatial Imagery Analytics

- 9.2.1.5.1 As training data becomes more robust and computing resources more accessible, AI-based geospatial imagery analytics to evolve & redefine scope

- 9.2.1.6 Others

- 9.2.1.1 Image Processing & Enhancement

- 9.2.2 BY DEPLOYMENT MODE

- 9.2.2.1 Cloud

- 9.2.2.1.1 As geospatial applications become more dynamic and data-intensive, cloud deployment to remain key growth driver

- 9.2.2.2 On-premises

- 9.2.2.2.1 With increasing concerns around cybersecurity and data governance, on-premises deployment to remain trusted choice for mission-critical operations

- 9.2.2.1 Cloud

- 9.2.1 BY FUNCTIONALITY

- 9.3 SERVICES

- 9.3.1 PROFESSIONAL SERVICES

- 9.3.1.1 Consulting & Advisory

- 9.3.1.1.1 As geospatial technologies evolve rapidly, consulting and advisory services to help organizations stay ahead of curve

- 9.3.1.2 Deployment & Integration

- 9.3.1.2.1 As organizations increasingly rely on high-resolution imagery, demand for reliable, end-to-end deployment and integration support continues to grow

- 9.3.1.3 Support & Maintenance

- 9.3.1.3.1 With organizations increasingly adopting AI-driven and real-time analytics, complexity of maintaining systems grows, driving strong demand for expert support and maintenance

- 9.3.1.1 Consulting & Advisory

- 9.3.2 MANAGED SERVICES

- 9.3.1 PROFESSIONAL SERVICES

10 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICAL: GEOSPATIAL IMAGERY ANALYTICS MARKET DRIVERS

- 10.2 INSURANCE

- 10.2.1 GEOSPATIAL IMAGERY ANALYTICS TO EMERGE AS STRATEGIC TOOL FOR INSURERS SEEKING TO ENHANCE RESILIENCE, EFFICIENCY, AND COMPETITIVE ADVANTAGE

- 10.3 AGRICULTURE

- 10.3.1 GEOSPATIAL IMAGERY ANALYTICS TO BECOME INDISPENSABLE TOOL FOR ENHANCING PRODUCTIVITY AND PROFITABILITY

- 10.4 CONSTRUCTION & REAL ESTATE

- 10.4.1 GEOSPATIAL IMAGERY SUPPORTS URBAN PLANNING INITIATIVES BY HELPING STAKEHOLDERS VISUALIZE DEVELOPMENT PATTERNS, ZONING IMPACTS, AND ENVIRONMENTAL FACTORS

- 10.5 MINING

- 10.5.1 HIGH-RESOLUTION SATELLITE AND AERIAL IMAGERY TO HELP MINING COMPANIES IDENTIFY MINERAL-RICH ZONES, ANALYZE TERRAIN FEATURES, AND ASSESS SURFACE CHANGES

- 10.6 HEALTHCARE & LIFE SCIENCES

- 10.6.1 AS GLOBAL HEALTH CHALLENGES BECOME INCREASINGLY COMPLEX, GEOSPATIAL IMAGERY ANALYTICS TO OFFER SCALABLE AND DATA-RICH APPROACH TO IMPROVING POPULATION HEALTH MANAGEMENT

- 10.7 ENERGY & UTILITIES

- 10.7.1 ORGANIZATIONS TO USE HIGH-RESOLUTION SATELLITE AND AERIAL IMAGERY TO INSPECT POWER LINES, PIPELINES, AND SUBSTATIONS REMOTELY

- 10.8 GOVERNMENT & DEFENSE

- 10.8.1 FROM NATIONAL DEFENSE TO CIVIC ADMINISTRATION, GEOSPATIAL IMAGERY ANALYTICS TO PROVE INDISPENSABLE FOR ENHANCING DECISION-MAKING, OPERATIONAL EFFICIENCY, AND PUBLIC SAFETY

- 10.9 TELECOMMUNICATIONS

- 10.9.1 AS DEMAND FOR HIGH-SPEED CONNECTIVITY CONTINUES TO GROW, GEOSPATIAL IMAGERY ANALYTICS TO BECOME ESSENTIAL FOR BUILDING SMARTER, MORE RESILIENT TELECOM NETWORKS

- 10.10 TRANSPORTATION & LOGISTICS

- 10.10.1 AS SUPPLY CHAINS BECOME MORE COMPLEX AND CUSTOMER EXPECTATIONS RISE, GEOSPATIAL IMAGERY ANALYTICS TO EMERGE AS KEY ENABLER OF EFFICIENCY, RESILIENCE, AND COMPETITIVENESS

- 10.11 MEDIA & ENTERTAINMENT

- 10.11.1 USING HIGH-RESOLUTION SATELLITE & AERIAL IMAGERY FOR REALISTIC VISUAL WORLDS

- 10.12 OTHER VERTICALS

11 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Driving innovation through advanced geospatial imaging and AI integration

- 11.2.4 CANADA

- 11.2.4.1 Leveraging geospatial analytics for environmental stewardship and industrial efficiency

- 11.3 EUROPE

- 11.3.1 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 UK accelerating urban and environmental decision-making with advanced imagery analytics

- 11.3.4 GERMANY

- 11.3.4.1 Driving climate and infrastructure intelligence through high-tech geospatial solutions

- 11.3.5 FRANCE

- 11.3.5.1 Fusing AI and policy for scalable, sustainable imagery analytics

- 11.3.6 ITALY

- 11.3.6.1 Leveraging national satellite assets for sector-specific geospatial innovation

- 11.3.7 SPAIN

- 11.3.7.1 Boosting agricultural and coastal resilience with smart imagery integration

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 High-resolution satellite constellations fuel China's expanding geospatial analytics ecosystem

- 11.4.4 JAPAN

- 11.4.4.1 Synthetic aperture radar and disaster monitoring drive Japan's imagery analytics innovation

- 11.4.5 INDIA

- 11.4.5.1 Policy reforms and hyperspectral imaging accelerate India's geospatial intelligence growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Urban digital twins and AI-backed imagery position South Korea as regional analytics hub

- 11.4.7 AUSTRALIA & NEW ZEALAND

- 11.4.7.1 Environmental monitoring and disaster resilience boost geospatial analytics in Australasia

- 11.4.8 ASEAN

- 11.4.8.1 Regional satellite programs and smart city initiatives propel ASEAN geospatial adoption

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: GEOSPATIAL IMAGERY ANALYTICS MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 KINGDOM OF SAUDI ARABIA (KSA)

- 11.5.3.1 Driving smart infrastructure with expanding geospatial imagery analytics capabilities

- 11.5.4 UAE

- 11.5.4.1 Accelerating digital governance through geospatial imagery innovation

- 11.5.5 QATAR

- 11.5.5.1 Empowering urban development with advanced geospatial intelligence

- 11.5.6 ISRAEL

- 11.5.6.1 Advancing regional leadership in high-precision geospatial imagery analytics

- 11.5.7 SOUTH AFRICA

- 11.5.7.1 Strengthening national development with spatial analytics integration

- 11.5.8 REST OF MIDDLE EAST

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Substantial government initiatives and strategic investments to help with market growth

- 11.6.4 MEXICO

- 11.6.4.1 Widespread adoption of AI reflecting national trend toward embracing advanced technologies to remain competitive in digital marketplace

- 11.6.5 ARGENTINA

- 11.6.5.1 Market growth driven by need to enhance efficiency and personalization in marketing strategies

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 MARKET RANKING ANALYSIS

- 12.5 PRODUCT COMPARATIVE ANALYSIS

- 12.5.1 MAXAR EARTH INTELLIGENCE (MAXAR TECHNOLOGIES)

- 12.5.2 PLANETSCOPE/SKYSAT (PLANET LABS)

- 12.5.3 SPECTRA AI (BLACKSKY)

- 12.5.4 CAPELLA ANALYTICS (CAPELLA SPACE)

- 12.5.5 GOOGLE EARTH ENGINE (GOOGLE)

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company Footprint

- 12.7.5.2 Regional Footprint

- 12.7.5.3 Offering Footprint

- 12.7.5.4 Application Footprint

- 12.7.5.5 Vertical Footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 GOOGLE

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches & enhancements

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 IBM

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches & enhancements

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Key strengths

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 HEXAGON AB

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product launches & enhancements

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 TOMTOM

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches & enhancements

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 MAXAR TECHNOLOGIES

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches & enhancements

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 TRIMBLE

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product launches & enhancements

- 13.2.6.3.2 Deals

- 13.2.7 CALIPER CORPORATION

- 13.2.7.1 Business overview