|

|

市場調査レポート

商品コード

1772637

屋内ワイヤレスの世界市場:オファリング別、技術別、ビジネスモデル別、建物サイズ別、ネットワークタイプ別、エンドユーザー別、地域別 - 2030年までの予測In-building Wireless Market by Offering (Hardware, Software), Technology (DRS, DAS), Business Model, Building Size, Network Type, and End User (Commercial Campuses, Government, Transportation & Logistics), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 屋内ワイヤレスの世界市場:オファリング別、技術別、ビジネスモデル別、建物サイズ別、ネットワークタイプ別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月15日

発行: MarketsandMarkets

ページ情報: 英文 407 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

屋内ワイヤレスの市場規模は、2025年に225億8,000万米ドル、2030年には394億6,000万米ドルに達すると推定され、2025年から2030年までのCAGRは11.8%になるとみられています。

モバイルトラフィックの80%以上が屋内から発信されるようになった現在、企業はシームレスでセキュア、かつ大容量の屋内ネットワークを提供する必要に迫られています。このシフトは、遅延、セキュリティ、デバイス密度が妥協できないヘルスケア、物流、高密度商業キャンパスで顕著です。CiscoとCharter Communicationsが最近提携した、企業環境内でのマネージドプライベート5GおよびWi-Fi 6の提供は、サービスプロバイダーが受動的な帯域幅サプライヤーから、エンドツーエンドの制御、セキュリティ、オーケストレーションを提供するインフラパートナーへと進化しつつあることを浮き彫りにしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万/10億米ドル) |

| セグメント別 | オファリング別、技術別、ビジネスモデル別、建物サイズ別、ネットワークタイプ別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

しかし、都市部のTier-1ゾーンではインフラの老朽化により、ハードウェアの設置や信号の伝播が制限され、侵襲的な改造やビル全体の再配線が必要になることが多いです。さらに、米国の断片的なCBRSライセンスモデルとアジア太平洋の地域化された周波数帯サンドボックスのような、共有周波数帯に対する世界の一貫性のないアプローチは、地域横断的な無線戦略を計画する企業にとって不確実なものとなっています。オックスフォード大学のような伝統的なキャンパスを最新の建物内無線システムで改修するには、構造上の制約や厳格な保存ガイドラインにより、カスタマイズされたエンジニアリング・ソリューションが必要となります。

公衆ネットワークは、その拡張性、アクセスのしやすさ、幅広い通信事業者のサポートにより、特に商業施設、政府機関、人通りの多い公共施設でのビル内無線配備で優位を保っています。これらのネットワークは多くの場合、分散型アンテナシステム(DAS)やハイブリッドシステムを通じて展開され、通信事業者は認可されたスペクトルカバレッジを屋内に拡大し、音声とデータの品質を向上させることができます。例えば、AT&TとVerizonは、コンベンションセンターやスタジアム、ラスベガス・コンベンション・センターのような交通の要所において、公共DASのカバレッジを積極的に拡大しています。公共ネットワークはシームレスな接続性を提供するため、BYOD(Bring Your Own Device)が普及しているユーザー主導の環境には不可欠であり、混雑を防ぐにはキャリアのオフロードが欠かせません。

さらに、米国や欧州の一部では、大規模な建物内に公衆ネットワークベースの緊急対応無線カバレッジ・システム(ERRCS)を設置することが公共安全上義務付けられており、普及に拍車がかかっています。プライベート・ネットワークに比べ、公共施設では既存の通信バックホールや通信事業者とのパートナーシップを利用できるため、施設管理者の総所有コストを削減できます。そのユビキタス性は、政府による義務付けや、キャリアにとらわれない屋内カバレッジに対するユーザーの高い期待と相まって、公衆ネットワークが市場規模最大のセグメントであることを確固たるものとしています。

ハイテクパーク、企業本社、複合ビジネス施設にまたがる商業キャンパスは、そのユーザー密度、運用の複雑さ、ビジネスを実現するものとして接続性を重視する戦略性から、ビル内無線需要の最大シェアを占めています。これらのキャンパスでは、複数のビルにまたがることが多く、統合されたマルチテナント屋内カバレッジが必要とされるため、DAS、分散型スモールセル、ハイブリッドネットワークアーキテクチャに対する需要が高まっています。例えば、ベンガルールにあるInfosysのエレクトロニック・シティ・キャンパスでは、700本以上のアンテナと建物ごとの専用カバレッジゾーンを備えた、キャンパス全体のプライベート5G対応DASを統合しました。このシステムはモバイル音声とデータをサポートし、IoT対応の環境センサー、訪問者アクセスシステム、エネルギー自動化プラットフォームを接続しています。

同様に、カリフォルニア州にあるGoogleのベイビュー・キャンパスには、シームレスなモビリティ、ゼロタッチ・オンボーディング、AR/VRワークスペース・ツールをサポートする複数ビルのCBRSベースの無線インフラがあります。これらのキャンパスでは、高いSLA環境が優先され、特にサービス・プロバイダーやニュートラル・ホスト・オペレーターによるネットワーク計画、展開、マネージド・サービスなどの専門サービスへの需要が高まっています。商業施設の貸主や企業がデジタル接続を通じて資産の差別化を図る中、屋内無線はテナントの満足度、法規制の遵守、職場の効率化にとって中心的な存在となり、このセグメントの市場シェア首位を確固たるものにしています。

北米は、成熟した通信インフラ、5Gの早期導入、主要州における厳格な公共安全DAS規制が牽引し、ビル内無線市場でリードを維持しています。CommScope、Crown Castle、Boingo Wirelessは、SoFiスタジアム、シカゴのオヘア空港、アマゾンのフルフィルメントセンターなどで大規模なパブリックネットワークとニュートラルホストネットワークを構築し、大規模なマルチオペレーター屋内カバレッジを実現しています。さらに、米国ではNFPAやIFCなどの規制により、ビル内無線は新築時のコンプライアンス要件となっています。

対照的に、アジア太平洋地域では、政府が支援するスマートビルディング・プログラムや、教育、製造、ロジスティクスなどの分野で拡大する民間ネットワークの試験的導入に後押しされ、急速な普及が進んでいます。例えば、SK Telecomは韓国の大学と提携し、キャンパス全体でプライベート5Gネットワークを展開し、アリババは中国の倉庫ネットワークにハイブリッドDASシステムを導入し、スマート・ロジスティクスをサポートしています。さらに、インドのGIFT Cityは、5Gを統合した商業ハブのモデルとして台頭しており、中立的なホストとの提携による周波数共有戦略がテストされています。北米の高価値で規制主導の市場と、アジア太平洋のインフラ集約的で急速な拡大は、世界のビル内無線戦略における極めて重要な転換を意味し、両地域は異なる成長軌道を形成しています。

当レポートでは、世界の屋内ワイヤレス市場について調査し、オファリング別、技術別、ビジネスモデル別、建物サイズ別、ネットワークタイプ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 屋内ワイヤレスソリューションとサービスの簡単な歴史

- エコシステム分析

- ケーススタディ分析

- サプライチェーン分析

- 関税と規制状況

- 価格分析

- 技術分析

- 特許分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 顧客ビジネスに影響を与える動向/混乱

- 2025年~2026年の主な会議とイベント

- 屋内ワイヤレス市場の技術ロードマップ

- 貿易分析

- 現在のビジネスモデルと新興ビジネスモデル

- 屋内ワイヤレス市場におけるベストプラクティス

- ツール、フレームワーク、テクニック

- 屋内ワイヤレス市場における生成AIの影響

- 2025年の米国関税の影響- 屋内ワイヤレス市場

- 投資と資金調達のシナリオ

第6章 屋内ワイヤレス市場(オファリング別)

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第7章 屋内ワイヤレス市場(技術別)

- イントロダクション

- 分散アンテナシステム

- 分散無線システム

- 分散型スモールセル

- その他

第8章 屋内ワイヤレス市場(ビジネスモデル別)

- イントロダクション

- サービスプロバイダー

- 企業

- 中立ホストオペレーター

第9章 屋内ワイヤレス市場(建物サイズ別)

- イントロダクション

- 大型

- 中型

- 小型

第10章 屋内ワイヤレス市場(ネットワークタイプ別)

- イントロダクション

- パブリックネットワーク

- プライベートネットワーク

第11章 屋内ワイヤレス市場(エンドユーザー別)

- イントロダクション

- 商業キャンパス

- 政府

- 運輸・物流

- ホスピタリティ

- 工業および製造業

- エンターテイメント・スポーツ会場

- 教育

- ヘルスケア

- その他

第12章 屋内ワイヤレス市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- イタリア

- フランス

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- オーストラリアとニュージーランド

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- GCC諸国

- 南アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2022年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- ブランド/製品比較

- 企業評価と財務指標

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- COMMSCOPE

- AIRSPAN NETWORKS

- ERICSSON

- HUAWEI

- NOKIA

- COMBA TELECOM

- SAMSUNG

- ZTE

- SOLID

- NEC CORPORATION

- FUJITSU

- SERCOMM CORPORATION

- AMPHENOL CORPORATION

- HUBER+SUHNER

- JMA WIRELESS

- その他の企業

- WILSON CONNECTIVITY

- ADRF

- DALI WIRELESS

- CONTELA

- BAICELLS TECHNOLOGIES

- QUCELL

- BAYLIN TECHNOLOGIES

- PBE AXELL

- MICROLAB

- NEXTIVITY

- WHOOP WIRELESS

- RESOLUTION WIRELESS

- IN-BUILDING WIRELESS SOLUTIONS

- MAVEN WIRELESS

- CELONA

- BTI WIRELESS

第15章 隣接市場と関連市場

第16章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 TARIFF RELATED TO HARMONIZED SYSTEM CODE 852910

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS, BY OFFERING, 2024

- TABLE 9 INDICATIVE PRICING ANALYSIS, BY DAS TECHNOLOGY, 2024

- TABLE 10 INDICATIVE PRICING ANALYSIS, BY SMALL CELL TECHNOLOGY, 2024

- TABLE 11 LIST OF MAJOR PATENTS, 2024-2025

- TABLE 12 PORTER'S FIVE FORCES MODEL ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 15 IN-BUILDING WIRELESS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 EXPORT DATA FOR HS CODE 8529-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 17 IMPORT DATA FOR HS CODE 8529-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 18 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 20 IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 21 IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 22 HARDWARE: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 23 HARDWARE: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 25 IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 26 HEAD END UNITS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 27 HEAD END UNITS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 REMOTE UNITS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 29 REMOTE UNITS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 REPEATERS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 31 REPEATERS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 ANTENNAS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 33 ANTENNAS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 FEMTOCELLS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 35 FEMTOCELLS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 OTHER HARDWARE: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 37 OTHER HARDWARE: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 SOFTWARE: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 39 SOFTWARE: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 41 IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 42 NETWORK PLANNING & DESIGN: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 43 NETWORK PLANNING & DESIGN: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 NETWORK MANAGEMENT: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 45 NETWORK MANAGEMENT: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 OTHER SOFTWARE: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 47 OTHER SOFTWARE: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 SERVICES: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 49 SERVICES: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 51 IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 52 PROFESSIONAL SERVICES: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 53 PROFESSIONAL SERVICES: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 55 IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 56 NETWORK DESIGN: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 57 NETWORK DESIGN: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 INTEGRATION & DEPLOYMENT: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 59 INTEGRATION & DEPLOYMENT: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 TRAINING, SUPPORT, & MAINTENANCE: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 61 TRAINING, SUPPORT, & MAINTENANCE: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 MANAGED SERVICES: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 63 MANAGED SERVICES: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 65 IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 66 DISTRIBUTED ANTENNA SYSTEM: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 67 DISTRIBUTED ANTENNA SYSTEM: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

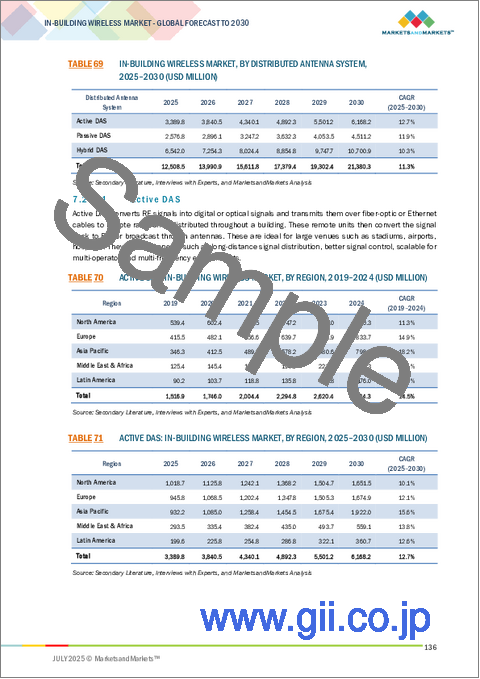

- TABLE 69 IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 70 ACTIVE DAS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 71 ACTIVE DAS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 PASSIVE DAS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 73 PASSIVE DAS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 HYBRID DAS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 75 HYBRID DAS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 DISTRIBUTED RADIO SYSTEM: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 77 DISTRIBUTED RADIO SYSTEM: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 DISTRIBUTED SMALL CELL: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 79 DISTRIBUTED SMALL CELL: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 OTHER TECHNOLOGIES: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 81 OTHER TECHNOLOGIES: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 83 IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 84 SERVICE PROVIDERS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 85 SERVICE PROVIDERS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 ENTERPRISES: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 87 ENTERPRISES: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 NEUTRAL HOST OPERATORS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 89 NEUTRAL HOST OPERATORS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 91 IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 92 LARGE BUILDINGS: LARGE BUILDINGS, BY REGION, 2019-2024 (USD MILLION)

- TABLE 93 LARGE BUILDINGS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 MEDIUM-SIZED BUILDINGS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 95 MEDIUM-SIZED BUILDINGS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 SMALL BUILDINGS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 97 SMALL BUILDINGS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 99 IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 100 PUBLIC NETWORK: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 101 PUBLIC NETWORK: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 PRIVATE NETWORK: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 103 PRIVATE NETWORK: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 105 IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 106 COMMERCIAL CAMPUSES: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 107 COMMERCIAL CAMPUSES: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 GOVERNMENT: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 109 GOVERNMENT: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 TRANSPORTATION & LOGISTICS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 111 TRANSPORTATION & LOGISTICS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 HOSPITALITY: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 113 HOSPITALITY: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 INDUSTRIAL & MANUFACTURING: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 115 INDUSTRIAL & MANUFACTURING: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 ENTERTAINMENT & SPORTS VENUES: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 117 ENTERTAINMENT & SPORTS VENUES: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 EDUCATION: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 119 EDUCATION: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 HEALTHCARE: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 121 HEALTHCARE: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 OTHER END USERS: IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 123 OTHER END USERS: IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 IN-BUILDING WIRELESS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 125 IN-BUILDING WIRELESS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 127 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 135 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 138 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 139 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 141 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 142 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 143 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 144 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 145 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 146 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 147 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 148 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 149 NORTH AMERICA: IN-BUILDING WIRELESS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 US: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 151 US: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 152 US: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 153 US: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 154 US: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 155 US: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 156 US: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 157 US: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 158 US: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 159 US: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 160 US: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 161 US: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 162 US: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 163 US: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 164 US: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 165 US: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 166 US: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 167 US: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 168 US: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 169 US: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 170 US: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 171 US: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 172 CANADA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 173 CANADA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 174 CANADA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 175 CANADA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 176 CANADA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 177 CANADA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 178 CANADA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 179 CANADA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 180 CANADA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 181 CANADA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 182 CANADA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 183 CANADA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 184 CANADA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 185 CANADA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 186 CANADA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 187 CANADA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 188 CANADA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 189 CANADA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 190 CANADA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 191 CANADA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 192 CANADA: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 193 CANADA: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 194 EUROPE: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 195 EUROPE: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 196 EUROPE: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 197 EUROPE: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 198 EUROPE: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 199 EUROPE: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 200 EUROPE: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 201 EUROPE: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 202 EUROPE: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 203 EUROPE: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 204 EUROPE: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 205 EUROPE: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 206 EUROPE: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 207 EUROPE: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 208 EUROPE: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 209 EUROPE: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 210 EUROPE: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 211 EUROPE: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 212 EUROPE: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 213 EUROPE: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 214 EUROPE: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 215 EUROPE: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 216 EUROPE: IN-BUILDING WIRELESS MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 217 EUROPE: IN-BUILDING WIRELESS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 218 UK: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 219 UK: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 220 UK: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 221 UK: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 222 UK: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 223 UK: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 224 UK: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 225 UK: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 226 UK: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 227 UK: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 228 UK: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 229 UK: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 230 UK: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 231 UK: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 232 UK: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 233 UK: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 234 UK: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 235 UK: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 236 UK: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 237 UK: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 238 UK: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 239 UK: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 240 GERMANY: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 241 GERMANY: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 242 GERMANY: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 243 GERMANY: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 244 GERMANY: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 245 GERMANY: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 246 GERMANY: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 247 GERMANY: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 248 GERMANY: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 249 GERMANY: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 250 GERMANY: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 251 GERMANY: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 252 GERMANY: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 253 GERMANY: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 254 GERMANY: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 255 GERMANY: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 256 GERMANY: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 257 GERMANY: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 258 GERMANY: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 259 GERMANY: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 260 GERMANY: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 261 GERMANY: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 262 ITALY: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 263 ITALY: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 264 ITALY: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 265 ITALY: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 266 ITALY: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 267 ITALY: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 268 ITALY: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 269 ITALY: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 270 ITALY: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 271 ITALY: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 272 ITALY: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 273 ITALY: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 274 ITALY: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 275 ITALY: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 276 ITALY: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 277 ITALY: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 278 ITALY: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 279 ITALY: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 280 ITALY: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 281 ITALY: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 282 ITALY: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 283 ITALY: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 284 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 285 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 286 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 287 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 288 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 289 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 290 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 291 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 292 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 293 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 294 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 295 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 296 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 297 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 298 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 299 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 300 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 301 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 302 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 303 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 304 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 305 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 306 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 307 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 308 CHINA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 309 CHINA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 310 CHINA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 311 CHINA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 312 CHINA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 313 CHINA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 314 CHINA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 315 CHINA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 316 CHINA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 317 CHINA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 318 CHINA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 319 CHINA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 320 CHINA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 321 CHINA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 322 CHINA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 323 CHINA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 324 CHINA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 325 CHINA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 326 CHINA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 327 CHINA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 328 CHINA: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 329 CHINA: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 330 JAPAN: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 331 JAPAN: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 332 JAPAN: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 333 JAPAN: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 334 JAPAN: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 335 JAPAN: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 336 JAPAN: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 337 JAPAN: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 338 JAPAN: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 339 JAPAN: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 340 JAPAN: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 341 JAPAN: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 342 JAPAN: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 343 JAPAN: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 344 JAPAN: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 345 JAPAN: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 346 JAPAN: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 347 JAPAN: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 348 JAPAN: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 349 JAPAN: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 350 JAPAN: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 351 JAPAN: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 352 INDIA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 353 INDIA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 354 INDIA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 355 INDIA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 356 INDIA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 357 INDIA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 358 INDIA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 359 INDIA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 360 INDIA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 361 INDIA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 362 INDIA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 363 INDIA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 364 INDIA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 365 INDIA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 366 INDIA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 367 INDIA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 368 INDIA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 369 INDIA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 370 INDIA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 371 INDIA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 372 INDIA: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 373 INDIA: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 374 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 375 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 376 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 377 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 378 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 379 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 380 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 381 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 382 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 383 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 384 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 385 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 386 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 387 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 388 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 389 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 390 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 391 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 392 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 393 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 394 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 395 AUSTRALIA & NEW ZEALAND: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 396 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 397 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 398 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 399 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 400 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 401 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 402 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 403 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 404 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 405 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 406 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 407 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 408 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 409 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 410 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 411 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 412 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 413 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 414 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 415 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 416 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 417 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 418 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 419 MIDDLE EAST & AFRICA: IN-BUILDING WIRELESS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 420 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 421 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 422 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 423 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 424 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 425 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 426 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 427 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 428 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 429 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 430 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 431 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 432 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 433 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 434 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 435 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 436 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 437 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 438 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 439 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 440 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 441 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 442 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 443 GCC COUNTRIES: IN-BUILDING WIRELESS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 444 UAE: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 445 UAE: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 446 UAE: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 447 UAE: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 448 UAE: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 449 UAE: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 450 UAE: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 451 UAE: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 452 UAE: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 453 UAE: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 454 UAE: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 455 UAE: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 456 UAE: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 457 UAE: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 458 UAE: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 459 UAE: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 460 UAE: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 461 UAE: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 462 UAE: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 463 UAE: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 464 UAE: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 465 UAE: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 466 KSA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 467 KSA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 468 KSA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 469 KSA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 470 KSA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 471 KSA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 472 KSA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 473 KSA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 474 KSA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 475 KSA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 476 KSA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 477 KSA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 478 KSA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 479 KSA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 480 KSA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 481 KSA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 482 KSA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 483 KSA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 484 KSA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 485 KSA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 486 KSA: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 487 KSA: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 488 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 489 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 490 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 491 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 492 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 493 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 494 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 495 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 496 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 497 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 498 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 499 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 500 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 501 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 502 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 503 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 504 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 505 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 506 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 507 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 508 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 509 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 510 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 511 LATIN AMERICA: IN-BUILDING WIRELESS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 512 BRAZIL: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 513 BRAZIL: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 514 BRAZIL: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 515 BRAZIL: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 516 BRAZIL: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 517 BRAZIL: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 518 BRAZIL: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 519 BRAZIL: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 520 BRAZIL: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 521 BRAZIL: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 522 BRAZIL: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 523 BRAZIL: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 524 BRAZIL: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 525 BRAZIL: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 526 BRAZIL: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 527 BRAZIL: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 528 BRAZIL: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 529 BRAZIL: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 530 BRAZIL: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 531 BRAZIL: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 532 BRAZIL: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 533 BRAZIL: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 534 MEXICO: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 535 MEXICO: IN-BUILDING WIRELESS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 536 MEXICO: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2019-2024 (USD MILLION)

- TABLE 537 MEXICO: IN-BUILDING WIRELESS MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 538 MEXICO: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2019-2024 (USD MILLION)

- TABLE 539 MEXICO: IN-BUILDING WIRELESS MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 540 MEXICO: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 541 MEXICO: IN-BUILDING WIRELESS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 542 MEXICO: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 543 MEXICO: IN-BUILDING WIRELESS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 544 MEXICO: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2019-2024 (USD MILLION)

- TABLE 545 MEXICO: IN-BUILDING WIRELESS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 546 MEXICO: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2019-2024 (USD MILLION)

- TABLE 547 MEXICO: IN-BUILDING WIRELESS MARKET, BY DISTRIBUTED ANTENNA SYSTEM, 2025-2030 (USD MILLION)

- TABLE 548 MEXICO: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 549 MEXICO: IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 550 MEXICO: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2019-2024 (USD MILLION)

- TABLE 551 MEXICO: IN-BUILDING WIRELESS MARKET, BY BUILDING SIZE, 2025-2030 (USD MILLION)

- TABLE 552 MEXICO: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2019-2024 (USD MILLION)

- TABLE 553 MEXICO: IN-BUILDING WIRELESS MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 554 MEXICO: IN-BUILDING WIRELESS MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 555 MEXICO: IN-BUILDING WIRELESS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 556 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS, 2021-2024

- TABLE 557 IN-BUILDING WIRELESS MARKET: DEGREE OF COMPETITION

- TABLE 558 IN-BUILDING WIRELESS MARKET: REGION FOOTPRINT

- TABLE 559 IN-BUILDING WIRELESS MARKET: OFFERING FOOTPRINT

- TABLE 560 IN-BUILDING WIRELESS MARKET: END USER FOOTPRINT

- TABLE 561 IN-BUILDING WIRELESS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 562 IN-BUILDING WIRELESS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 563 IN-BUILDING WIRELESS: PRODUCT LAUNCHES, JANUARY 2022-FEBRUARY 2025

- TABLE 564 IN-BUILDING WIRELESS MARKET: DEALS, JANUARY 2022-FEBRUARY 2025

- TABLE 565 COMMSCOPE: COMPANY OVERVIEW

- TABLE 566 COMMSCOPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 567 COMMSCOPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 568 COMMSCOPE: DEALS

- TABLE 569 AIRSPAN NETWORKS: COMPANY OVERVIEW

- TABLE 570 AIRSPAN NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 571 AIRSPAN NETWORKS: DEALS

- TABLE 572 ERICSSON: COMPANY OVERVIEW

- TABLE 573 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 574 ERICSSON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 575 ERICSSON: DEALS

- TABLE 576 HUAWEI: COMPANY OVERVIEW

- TABLE 577 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 578 HUAWEI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 579 HUAWEI: DEALS

- TABLE 580 NOKIA: BUSINESS OVERVIEW

- TABLE 581 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 582 NOKIA: DEALS

- TABLE 583 COMBA TELECOM: COMPANY OVERVIEW

- TABLE 584 COMBA TELECOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 585 COMBA TELECOM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 586 COMBA TELECOM: DEALS

- TABLE 587 SAMSUNG: COMPANY OVERVIEW

- TABLE 588 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 589 SAMSUNG: DEALS

- TABLE 590 ZTE: COMPANY OVERVIEW

- TABLE 591 ZTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 592 ZTE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 593 SOLID: COMPANY OVERVIEW

- TABLE 594 SOLID: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 595 SOLID: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 596 SOLID: DEALS

- TABLE 597 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 598 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 599 NEC CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 600 FUJITSU: COMPANY OVERVIEW

- TABLE 601 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 602 FUJITSU: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 603 FUJITSU: DEALS

- TABLE 604 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 605 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 606 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 607 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 608 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 609 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 610 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2019-2022 (USD MILLION)

- TABLE 611 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2023-2028 (USD MILLION)

- TABLE 612 INDOOR COVERAGE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 613 INDOOR COVERAGE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 614 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OWNERSHIP MODEL, 2019-2022 (USD MILLION)

- TABLE 615 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OWNERSHIP MODEL, 2023-2028 (USD MILLION)

- TABLE 616 DISTRIBUTED ANTENNA SYSTEM MARKET, BY USER FACILITY AREA, 2019-2022 (USD MILLION)

- TABLE 617 DISTRIBUTED ANTENNA SYSTEM MARKET, BY USER FACILITY AREA, 2023-2028 (USD MILLION)

- TABLE 618 DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 619 DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 620 INDOOR COVERAGE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL, 2019-2022 (USD MILLION)

- TABLE 621 INDOOR COVERAGE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL, 2023-2028 (USD MILLION)

- TABLE 622 DISTRIBUTED ANTENNA SYSTEM MARKET, BY FREQUENCY PROTOCOL, 2019-2022 (USD MILLION)

- TABLE 623 DISTRIBUTED ANTENNA SYSTEM MARKET, BY FREQUENCY PROTOCOL, 2023-2028 (USD MILLION)

- TABLE 624 DISTRIBUTED ANTENNA SYSTEM MARKET, BY NETWORK TYPE, 2019-2022 (USD MILLION)

- TABLE 625 DISTRIBUTED ANTENNA SYSTEM MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 626 DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 627 DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 628 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2018-2027 (USD MILLION)

- TABLE 629 5G INFRASTRUCTURE MARKET, BY CORE NETWORK TECHNOLOGY, 2018-2027 (USD MILLION)

- TABLE 630 5G INFRASTRUCTURE MARKET, BY NETWORK ARCHITECTURE, 2018-2027 (USD MILLION)

- TABLE 631 5G INFRASTRUCTURE MARKET, BY OPERATIONAL FREQUENCY, 2018-2027 (USD MILLION)

- TABLE 632 5G INFRASTRUCTURE MARKET, BY REGION, 2018-2027 (USD MILLION)

List of Figures

- FIGURE 1 IN-BUILDING WIRELESS MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 IN-BUILDING WIRELESS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN IN-BUILDING WIRELESS MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (DEMAND SIDE): IN-BUILDING WIRELESS MARKET

- FIGURE 6 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 7 IN-BUILDING WIRELESS MARKET: DATA TRIANGULATION

- FIGURE 8 IN-BUILDING WIRELESS MARKET, 2023-2030 (USD MILLION)

- FIGURE 9 IN-BUILDING WIRELESS MARKET, BY REGION (2025)

- FIGURE 10 GROWING DEPLOYMENT OF 5G NETWORKS TO ACT AS OPPORTUNITY IN IN-BUILDING WIRELESS MARKET

- FIGURE 11 HARDWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 ANTENNAS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 INTEGRATION & DEPLOYMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 DISTRIBUTED ANTENNA SYSTEM SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 PUBLIC NETWORK SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 COMMERCIAL CAMPUSES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 HARDWARE AND COMMERCIAL CAMPUSES SEGMENTS TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2025

- FIGURE 19 IN-BUILDING WIRELESS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 BRIEF HISTORY OF IN-BUILDING WIRELESS SOLUTIONS AND SERVICES

- FIGURE 21 IN-BUILDING WIRELESS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 IN-BUILDING WIRELESS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE OF KEY PLAYERS, BY OFFERING, 2024

- FIGURE 24 PATENTS APPLIED AND GRANTED, 2016-2025

- FIGURE 25 IN-BUILDING WIRELESS MARKET: PORTER'S FIVE FORCES MODEL

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 EXPORT SCENARIO FOR HS CODE 8529-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 30 IMPORT SCENARIO FOR HS CODE 8529-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 31 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING IN-BUILDING WIRELESS ACROSS VARIOUS TYPES OF SOLUTIONS

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO

- FIGURE 33 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 REPEATERS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 NETWORK PLANNING & DESIGN SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 TRAINING, SUPPORT, & MAINTENANCE SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 DISTRIBUTED SMALL CELL TECHNOLOGY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 NEUTRAL HOST OPERATORS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 MEDIUM BUILDINGS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 PRIVATE NETWORK SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 42 COMMERCIAL CAMPUSES SEGMENT TO HOLD MAJOR SHARE DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 45 SHARE OF LEADING COMPANIES IN IN-BUILDING WIRELESS MARKET, 2024

- FIGURE 46 REVENUE ANALYSIS OF KEY PLAYERS IN IN-BUILDING WIRELESS MARKET, 2020-2024

- FIGURE 47 IN-BUILDING WIRELESS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 IN-BUILDING WIRELESS MARKET: COMPANY FOOTPRINT

- FIGURE 49 IN-BUILDING WIRELESS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 BRAND/ PRODUCT COMPARISON OF KEY VENDORS

- FIGURE 51 COMPANY VALUATION OF KEY IN-BUILDING WIRELESS SOFTWARE PROVIDERS

- FIGURE 52 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 53 COMMSCOPE: COMPANY SNAPSHOT

- FIGURE 54 ERICSSON: COMPANY SNAPSHOT

- FIGURE 55 HUAWEI: COMPANY SNAPSHOT

- FIGURE 56 NOKIA: COMPANY SNAPSHOT

- FIGURE 57 COMBA TELECOM: COMPANY SNAPSHOT

- FIGURE 58 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 59 ZTE: COMPANY SNAPSHOT

- FIGURE 60 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 FUJITSU: COMPANY SNAPSHOT

The in-building wireless market is estimated to be USD 22.58 billion in 2025 and reach USD 39.46 billion in 2030 at a CAGR of 11.8%, from 2025 to 2030. As over 80% of mobile traffic now originates indoors, businesses are under mounting pressure to deliver seamless, secure, and high-capacity indoor networks. This shift is pronounced in healthcare, logistics, and high-density commercial campuses, where latency, security, and device density cannot be compromised. A recent collaboration between Cisco and Charter Communications to deliver managed private 5G and Wi-Fi 6 within enterprise environments highlights how service providers are evolving from passive bandwidth suppliers to infrastructure partners offering end-to-end control, security, and orchestration.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By Offering, Technology, Business Model, Building Size, Network Type, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

However, aging infrastructure in Tier-1 urban zones restricts hardware installation and signal propagation, often requiring invasive retrofitting or building-wide rewiring. Moreover, the inconsistent global approach to shared spectrum, such as fragmented CBRS licensing models in the US versus localized spectrum sandboxing in Asia Pacific creates uncertainty for enterprises planning cross-regional wireless strategies. Retrofitting heritage campuses such as Oxford University with modern in-building wireless systems requires customized engineering solutions due to structural constraints and strict preservation guidelines.

"Public network segment is expected to hold the largest market size during the forecast period"

Public networks continue to dominate in-building wireless deployments, particularly in commercial, government, and high-footfall public venues, due to their scalability, ease of access, and broad carrier support. These networks are often deployed through distributed antenna systems (DAS) or hybrid systems, allowing telecom operators to extend licensed spectrum coverage indoors for enhanced voice and data quality. For instance, AT&T and Verizon have aggressively expanded public DAS coverage across convention centers, stadiums, and transit hubs such as the Las Vegas Convention Center, where a multi-operator DAS solution supports over 200,000 devices during peak trade events. Public networks offer seamless connectivity, critical for user-driven environments where Bring Your Own Device is prevalent, and carrier offloading is essential to prevent congestion.

Moreover, public safety mandates in the US and parts of Europe now require public network-based emergency responder radio coverage systems (ERRCS) to be present in large buildings, further fueling adoption. Compared to private networks, public deployments benefit from existing telecom backhaul and carrier partnerships, reducing the total cost of ownership for property managers. Their ubiquity, coupled with government mandates and high user expectations for carrier-agnostic indoor coverage, firmly positions public networks as the largest segment by market size.

"Commercial campus segment is projected to register the largest market share during the forecast period"

Commercial campuses spanning tech parks, corporate headquarters, and mixed-use business complexes represent the largest share of in-building wireless demand due to their user density, operational complexity, and strategic focus on connectivity as a business enabler. These campuses often span multiple buildings and require integrated multi-tenant indoor coverage, pushing demand for DAS, distributed small cells, and hybrid network architectures. For instance, Infosys's Electronic City campus in Bengaluru, integrated a campus-wide private 5G-ready DAS with over 700 antennas and dedicated coverage zones per building. This system supports mobile voice and data and connects IoT-enabled environmental sensors, visitor access systems, and energy automation platforms.

Similarly, Google's Bay View campus in California includes a multi-building CBRS-based wireless infrastructure supporting seamless mobility, zero-touch onboarding, and AR/VR workspace tools. These campuses prioritize high SLA environments, driving demand for professional services such as network planning, deployment, and managed services, particularly from service providers and neutral host operators. As commercial landlords and enterprises look to differentiate their assets through digital connectivity, indoor wireless becomes central to tenant satisfaction, regulatory compliance, and workplace efficiency, cementing this segment's leadership in market share.

"North America leads in market share, while Asia Pacific emerges as the fastest-growing region"

North America maintains its lead in the in-building wireless market, driven by mature telecom infrastructure, early 5G adoption, and strict public-safety DAS regulations across key states. CommScope, Crown Castle, and Boingo Wireless have built out extensive public and neutral-host networks in SoFi Stadium, Chicago's O'Hare Airport, and Amazon's fulfillment centers, enabling massive, multi-operator indoor coverage. Additionally, US regulations such as NFPA and IFC mandates have made in-building wireless a compliance necessity in new constructions.

In contrast, Asia Pacific is experiencing rapid adoption momentum, fueled by government-backed smart building programs and expanding private network pilots across education, manufacturing, and logistics. For instance, SK Telecom partnered with Korean universities to roll out campus-wide private 5G networks, whereas Alibaba deployed hybrid DAS systems across its warehouse network to support smart logistics in China. Moreover, India's GIFT City is emerging as a model for 5G-integrated commercial hubs, with spectrum-sharing strategies being tested in partnership with neutral hosts. This dual dynamic North America's high-value, regulation-driven market and Asia Pacific's fast, infrastructure-intensive expansion marks a pivotal shift in global in-building wireless strategy, with both regions shaping different growth trajectories.

Breakdown of primary interviews

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primary interviews is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

- By Designation: C-level - 20%, Directors - 30%, and Others - 50%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of the World - 5%

The major players in the in-building wireless market are CommScope (US), Airspan Networks (US), Ericsson (Sweden), Huawei (China), Nokia (Finland), Samsung (South Korea), Comba Telecom (China), ZTE (China), Solid (South Korea), Fujitsu (Japan), NEC (Japan), Sercomm (Taiwan), Amphenol (US), Huber+Suhner (Switzerland), and JMA Wireless (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, product launches, product enhancements, and acquisitions to expand their footprint in the in-building wireless market.

Research Coverage

The market study covers the in-building wireless market size and the growth potential across different segments, including offering (hardware, software, services), hardware {head end units, remote units, repeaters, antennas, femtocells, other hardware}, software {network planning & designing, network management, other software}, services {professional, deployment and integration, training, support and maintenance, network design services, managed services}), technology (DAS, active, passive, hybrid, DRS, DSC, other technologies), business model (service providers, enterprises, neutral host operators), building size (large buildings, medium buildings, small buildings), network type (public networks, private networks), end user (commercial campuses, government, transportation & logistics, hospitality, industrial & manufacturing, entertainment & sports venues, education, healthcare, other end users), and regions. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global in-building wireless market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points: