|

|

市場調査レポート

商品コード

1772635

燃料電池発電機の世界市場:燃料電池タイプ別、規模別、燃料タイプ別、エンドユーザー別、地域別 - 2030年までの予測Fuel Cell Generator Market by End User (Marine, Aquaculture, Construction, Agriculture, Data Centers, Emergency Response Generators), Size [Small (=200 kW), Large (>200 kW)], Fuel Type (Hydrogen, Ammonia, Methanol), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 燃料電池発電機の世界市場:燃料電池タイプ別、規模別、燃料タイプ別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月15日

発行: MarketsandMarkets

ページ情報: 英文 231 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

燃料電池発電機の市場規模は、2025年の推定値6億3,000万米ドルから2030年には18億米ドルに達すると予測され、予測期間中のCAGRは23.3%になるとみられています。

燃料電池発電機市場は、クリーンなオフグリッド電力に対する需要の増加、エネルギー安全保障に対する懸念の高まり、重要セクターにおける信頼性の高いバックアップシステムの必要性によって牽引されています。水素インフラへの投資の増加、政府の支援策、燃料電池の効率と寿命の進歩が採用を後押ししています。脱炭素化目標や、弾力的で低排出ガスなエネルギーソリューションへの移行は、産業、商業、遠隔地の各用途で市場をさらに促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象ユニット | 金額(100万米ドル/10億米ドル)、数量(MW) |

| セグメント | 燃料電池タイプ別、規模別、燃料タイプ別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋地域、ラテンアメリカ、その他の地域 |

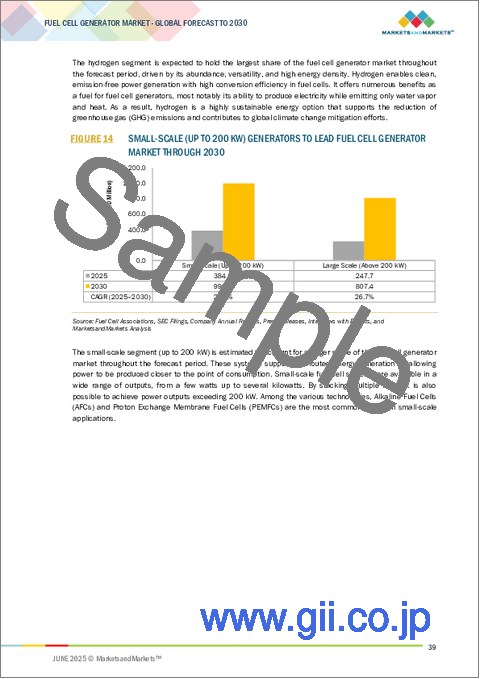

小規模燃料電池発電機は、主にその多用途性、配備の容易さ、分散型電源への適合性により、市場規模別で最大のセグメントを占めています。これらのコンパクトなシステムは、最小限のスペースとインフラ要件で、信頼性が高くクリーンなバックアップ電力を必要とする住宅、通信タワー、移動ユニット、小規模商業施設に理想的です。遠隔地や非電化地域での無停電電源に対するニーズの高まりや、グリッドアクセスが不安定な発展途上地域での採用が増加していることが、小規模ユニットの需要を促進しています。さらに、低騒音、ゼロエミッション運転、拡張性により、持続可能なエネルギー・ソリューションとしても魅力的です。技術の進歩により効率が向上し、コストが削減され、可搬性が改善されたため、さらに普及が進んでいます。政府の支援政策や、太陽光や風力などの再生可能エネルギー源の統合も、このセグメントの市場地位の高さと持続的成長に寄与しています。

データセンター分野は、信頼性が高く、継続的でクリーンな電力を必要とする重要な分野であるため、燃料電池発電機市場におけるエンドユーザー別最大セグメントであり続けると予想されます。クラウド・コンピューティング、AI、IoT、デジタル・サービスの台頭で世界のデータ消費が急増する中、データセンターは中断のない運用を確保しなければならないです。燃料電池発電機は、バックアップと一次電源の両方のニーズに対して、ディーゼル発電機に代わる高効率で低排出ガスの発電機を提供します。そのモジュール性、拡張性、グリッドから独立して動作する能力は、ハイパースケールデータセンターやエッジデータセンターに適しています。さらに、大手テクノロジー企業はカーボンニュートラルに取り組み、持続可能なエネルギーインフラに投資しており、燃料電池システムの需要をさらに押し上げています。メンテナンスの軽減、静音運転、迅速な起動も、稼働時間と持続可能性が最重要視されるデータセンター環境での魅力を高めています。

燃料電池発電機市場は、アジア太平洋地域の急速な工業化とエネルギー需要の増加に支えられ、クリーンエネルギー技術の導入を促進する政府の取り組みと相まって、2021年から2030年の間に、アジア太平洋地域で第2位の規模になると予測されています。日本と中国は水素と燃料電池のリーダーであり、水素経済の政府支援、インフラ投資の支援、燃料電池システムのその後の商業化によって、水素と燃料電池のリーダーとなっています。日本政府の「水素社会」構想は、据置型および輸送用途の燃料発電機を通じて、経済における水素の役割を増大させることに基づいています。中国では、政策、国有エネルギー企業の関与、巨大な製造能力を通じた大きな支援が燃料電池の能力を形成し、燃料電池技術へのコストとアクセスの両方を引き下げています。

燃料電池発電機市場は、幅広い地域で存在感を示す少数の大手企業によって支配されています。燃料電池発電機市場の大手企業は、Bloom Energy(米国)、PowerCell Sweden AB(スウェーデン)、Nedstack Fuel Cell Technology(オランダ)、Ballard Power Systems(米国)、Plug Power Inc.(米国)、Doosan Fuel Cell(韓国)、ABB(スイス)、Siemens Energy(ドイツ)、Cummins Inc.(米国)、AFC Energy(英国)、Toshiba Energy Systems & Solutions Corporation(日本)などです。

この調査レポートは、燃料電池発電機市場を規模別、用途別、燃料タイプ別に定義、記述、予測しています。また、市場の詳細な質的・量的分析も行っています。主な市場促進要因・抑制要因・機会・課題を包括的にレビューしています。また、市場の様々な重要な側面もカバーしています。これらには、競合情勢、市場力学、金額ベースの市場推定、燃料電池発電機市場の将来動向などの分析が含まれます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- エコシステム分析

- テクノロジー分析

- ケーススタディ分析

- 特許分析

- 貿易分析

- 主要な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- AI/生成AIが燃料電池発電機市場に与える影響

- 米国関税の影響- 概要

第6章 燃料電池発電機市場(燃料電池タイプ別)

- イントロダクション

- プロトン交換膜燃料電池(PEMFC)

- 固体酸化物燃料電池(SOFC)

- アルカリ燃料電池(AFC)

- リン酸燃料電池(PAFC)

第7章 燃料電池発電機市場(規模別)

- イントロダクション

- 小規模(最大200kW)

- 大規模(200kW以上)

第8章 燃料電池発電機市場(燃料タイプ別)

- イントロダクション

- 水素

- メタノール

- アンモニア

- その他

第9章 燃料電池発電機市場(エンドユーザー別)

- イントロダクション

- 海洋工学プラットフォーム

- 建設現場

- 農業施設

- 養殖施設

- データセンター

- 緊急対応発電機

第10章 燃料電池発電機市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- その他

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- その他

- その他の地域

- マクロ経済要因

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- BLOOM ENERGY

- DOOSAN FUEL CELL CO., LTD.

- POWERCELL SWEDEN AB

- BALLARD POWER SYSTEMS

- NEDSTACK FUEL CELL TECHNOLOGY

- PLUG POWER INC.

- ABB

- ZEPP.SOLUTIONS B.V.

- SIEMENS ENERGY

- CUMMINS INC.

- AFC ENERGY

- TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- PROTON MOTOR FUEL CELL GMBH

- PANASONIC CORPORATION

- EODEV

- GENCELL LTD.

- その他の企業

- FUJI ELECTRIC CO., LTD.

- POWERUP ENERGY TECHNOLOGIES

- HORIZON FUEL CELL TECHNOLOGIES

- UPSTART POWER

- FREUDENBERG SEALING TECHNOLOGIES GMBH & CO. KG

- BOC LIMITED

- H2SYS

- GREENAMP TECHNOS(OPC)PRIVATE LIMITED

- YANMAR HOLDINGS CO., LTD

第13章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 FUEL CELL GENERATOR MARKET SNAPSHOT

- TABLE 3 POLICIES BY MAJOR ECONOMIES TO STIMULATE HYDROGEN DEMAND

- TABLE 4 PEM STACK COMPONENT COST SUMMARY FOR 5 KW BACKUP SYSTEM, 2022-2024 (USD)

- TABLE 5 PEM BALANCE OF PLANT (BOP) COST SUMMARY FOR 5 KW BACKUP SYSTEM, 2022-2024 (USD)

- TABLE 6 5 KW BACKUP SYSTEM BOP COST DISTRIBUTION

- TABLE 7 PEM STACK COMPONENT COST SUMMARY FOR 10 KW BACKUP SYSTEM, 2022-2024 (USD)

- TABLE 8 PEM BALANCE OF PLANT (BOP) COST SUMMARY FOR 10 KW BACKUP SYSTEM, 2022-2024 (USD)

- TABLE 9 10 KW BACKUP SYSTEM BOP COST DISTRIBUTION

- TABLE 10 PEM STACK COMPONENT COST SUMMARY FOR 100 KW AND 250 KW SYSTEMS, 2022-2024 (USD)

- TABLE 11 PEM STACK MANUFACTURING COST SUMMARY: 100 KW AND 250 KW SYSTEM, 2022-2024 (USD)

- TABLE 12 ROLE OF COMPANIES IN FUEL CELL GENERATOR ECOSYSTEM

- TABLE 13 LIST OF KEY PATENTS, 2024-2025

- TABLE 14 IMPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 15 EXPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 16 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

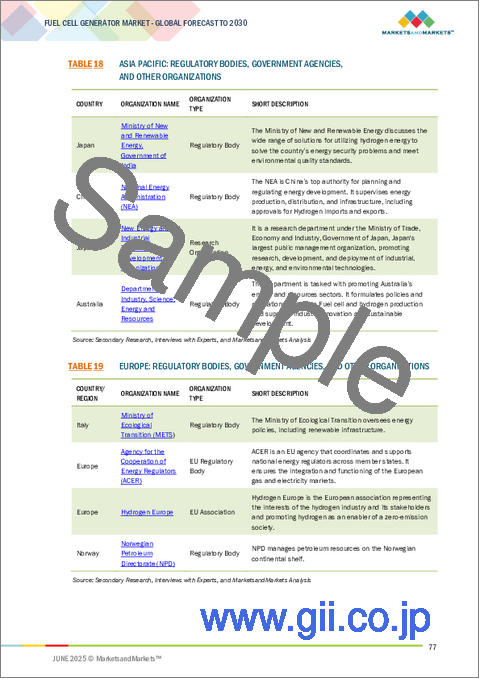

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 NORTH AMERICA: FUEL CELL GENERATOR MARKET, REGULATORY FRAMEWORK

- TABLE 22 EUROPE: FUEL CELL GENERATOR MARKET, REGULATORY FRAMEWORK

- TABLE 23 ASIA PACIFIC: FUEL CELL GENERATOR MARKET, REGULATORY FRAMEWORK

- TABLE 24 PORTER'S FIVE FORCES ANALYSIS

- TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VARIOUS GENERATOR SIZES

- TABLE 26 KEY BUYING CRITERIA FOR VARIOUS GENERATOR SIZES

- TABLE 27 US: ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 28 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END USE MARKET DUE TO TARIFF IMPACT

- TABLE 29 FUEL CELL GENERATOR MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 30 FUEL CELL GENERATOR MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 31 PRODUCT AVAILABILITY STATUS OF MARKET PLAYERS, BY SIZE

- TABLE 32 FUEL CELL GENERATOR MARKET, BY FUEL TYPE, 2020-2024 (USD MILLION)

- TABLE 33 FUEL CELL GENERATOR MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 34 PRODUCT AVAILABILITY STATUS OF MARKET PLAYERS, BY FUEL TYPE

- TABLE 35 FUEL CELL GENERATOR MARKET, BY END USER, 2020-2024 (MW)

- TABLE 36 FUEL CELL GENERATOR MARKET, BY END USER, 2025-2030 (MW)

- TABLE 37 FUEL CELL GENERATOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 38 FUEL CELL GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 39 PRODUCT AVAILABILITY STATUS OF MARKET PLAYERS, BY END USER

- TABLE 40 FUEL CELL GENERATOR MARKET, BY REGION, 2020-2024 (MW)

- TABLE 41 FUEL CELL GENERATOR MARKET, BY REGION, 2025-2030 (MW)

- TABLE 42 FUEL CELL GENERATOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 FUEL CELL GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 FUEL CELL TECHNOLOGY KEY PROJECTS IN ASIA PACIFIC

- TABLE 45 CHINA: CO2 EMISSIONS, 2015-2023 (TONNES PER CAPITA)

- TABLE 46 CHINA: NUMBER OF SHIPS, 2016-2021

- TABLE 47 INDIA: CO2 EMISSIONS, 2010-2021 (TONNES PER CAPITA)

- TABLE 48 JAPAN: CO2 EMISSIONS, 2015-2023 (TONNES PER CAPITA)

- TABLE 49 JAPAN: NUMBER OF SHIPS, 2016-2021

- TABLE 50 FUEL CELL TECHNOLOGY KEY PROJECTS IN NORTH AMERICA

- TABLE 51 US: CO2 EMISSIONS, 2010-2022 (TONNES PER CAPITA)

- TABLE 52 US: NUMBER OF SHIPS, 2016-2021

- TABLE 53 CANADA: CO2 EMISSIONS, 2010-2021 (TONNES PER CAPITA)

- TABLE 54 FUEL CELL TECHNOLOGY KEY PROJECTS IN EUROPE

- TABLE 55 GERMANY: CO2 EMISSIONS, 2010-2021 (TONNES PER CAPITA)

- TABLE 56 GERMANY: NUMBER OF SHIPS, 2016-2021

- TABLE 57 UK: CO2 EMISSIONS, 2010-2021 (TONNES PER CAPITA)

- TABLE 58 UK: NUMBER OF SHIPS, 2016-2021

- TABLE 59 FRANCE: CO2 EMISSIONS, 2010-2021 (TONNES PER CAPITA)

- TABLE 60 FRANCE: NUMBER OF SHIPS, 2016-2021

- TABLE 61 ROW: CO2 EMISSIONS (TONNES PER CAPITA), 2010-2019

- TABLE 62 FUEL CELL GENERATOR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 63 FUEL CELL GENERATOR MARKET: DEGREE OF COMPETITION, 2024

- TABLE 64 FUEL CELL GENERATOR MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 65 FUEL CELL GENERATOR MARKET: END USER FOOTPRINT, 2024

- TABLE 66 FUEL CELL GENERATOR MARKET: FUEL TYPE FOOTPRINT, 2024

- TABLE 67 FUEL CELL GENERATOR MARKET: SIZE FOOTPRINT, 2024

- TABLE 68 FUEL CELL GENERATOR MARKET: KEY STARTUPS/SMES, 2024

- TABLE 69 FUEL CELL GENERATOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 70 FUEL CELL GENERATOR MARKET: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 71 FUEL CELL GENERATOR MARKET: DEALS, JANUARY 2020-JUNE 2025

- TABLE 72 FUEL CELL GENERATOR MARKET: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 73 FUEL CELL GENERATOR MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JUNE 2025

- TABLE 74 BLOOM ENERGY: COMPANY OVERVIEW

- TABLE 75 BLOOM ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 76 BLOOM ENERGY: DEALS

- TABLE 77 BLOOM ENERGY: EXPANSIONS

- TABLE 78 BLOOM ENERGY: OTHER DEVELOPMENTS

- TABLE 79 DOOSAN FUEL CELL CO., LTD.: COMPANY OVERVIEW

- TABLE 80 DOOSAN FUEL CELL CO., LTD.: PRODUCTS OFFERED

- TABLE 81 DOOSAN FUEL CELL CO., LTD.: DEALS

- TABLE 82 DOOSAN FUEL CELL CO., LTD.: EXPANSIONS

- TABLE 83 POWERCELL SWEDEN AB: COMPANY OVERVIEW

- TABLE 84 POWERCELL SWEDEN AB: PRODUCTS OFFERED

- TABLE 85 POWERCELL SWEDEN AB: PRODUCT LAUNCHES

- TABLE 86 POWERCELL SWEDEN AB: DEALS

- TABLE 87 POWERCELL SWEDEN AB: EXPANSIONS

- TABLE 88 POWERCELL SWEDEN AB: OTHER DEVELOPMENTS

- TABLE 89 BALLARD POWER SYSTEMS: COMPANY OVERVIEW

- TABLE 90 BALLARD POWER SYSTEMS: PRODUCTS OFFERED

- TABLE 91 BALLARD POWER SYSTEMS: PRODUCT LAUNCHES

- TABLE 92 BALLARD POWER SYSTEMS: DEALS

- TABLE 93 BALLARD POWER SYSTEMS: OTHER DEVELOPMENTS

- TABLE 94 NEDSTACK FUEL CELL TECHNOLOGY: COMPANY OVERVIEW

- TABLE 95 NEDSTACK FUEL CELL TECHNOLOGY: PRODUCTS OFFERED

- TABLE 96 NEDSTACK FUEL CELL TECHNOLOGY: DEALS

- TABLE 97 NEDSTACK FUEL CELL TECHNOLOGY: OTHER DEVELOPMENTS

- TABLE 98 PLUG POWER INC.: COMPANY OVERVIEW

- TABLE 99 PLUG POWER INC.: PRODUCTS OFFERED

- TABLE 100 ABB: COMPANY OVERVIEW

- TABLE 101 ABB: PRODUCTS OFFERED

- TABLE 102 ABB: DEALS

- TABLE 103 ABB: OTHER DEVELOPMENTS

- TABLE 104 ZEPP.SOLUTIONS B.V.: COMPANY OVERVIEW

- TABLE 105 ZEPP.SOLUTIONS B.V.: PRODUCTS OFFERED

- TABLE 106 ZEPP.SOLUTIONS B.V.: PRODUCT LAUNCH

- TABLE 107 ZEPP.SOLUTIONS B.V.: EXPANSIONS

- TABLE 108 ZEPP.SOLUTIONS B.V.: OTHER DEVELOPMENTS

- TABLE 109 SIEMENS ENERGY: COMPANY OVERVIEW

- TABLE 110 SIEMENS ENERGY: PRODUCTS OFFERED

- TABLE 111 SIEMENS ENERGY: DEALS

- TABLE 112 SIEMENS ENERGY: OTHER DEVELOPMENTS

- TABLE 113 CUMMINS INC.: BUSINESS OVERVIEW

- TABLE 114 CUMMINS INC.: PRODUCTS OFFERED

- TABLE 115 CUMMINS INC.: PRODUCT LAUNCHES

- TABLE 116 CUMMINS INC.: OTHER DEVELOPMENTS

- TABLE 117 AFC ENERGY: BUSINESS OVERVIEW

- TABLE 118 AFC ENERGY: PRODUCTS OFFERED

- TABLE 119 AFC ENERGY: PRODUCT LAUNCHES

- TABLE 120 AFC ENERGY: DEALS

- TABLE 121 AFC ENERGY: EXPANSIONS

- TABLE 122 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: COMPANY OVERVIEW

- TABLE 123 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: PRODUCTS OFFERED

- TABLE 124 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: DEALS

- TABLE 125 PROTON MOTOR FUEL CELL GMBH: COMPANY OVERVIEW

- TABLE 126 PROTON MOTOR FUEL CELL GMBH: PRODUCTS OFFERED

- TABLE 127 PROTON MOTOR FUEL CELL GMBH: PRODUCT LAUNCHES

- TABLE 128 PROTON MOTOR FUEL CELL GMBH: DEALS

- TABLE 129 PROTON MOTOR FUEL CELL GMBH: OTHER DEVELOPMENTS

- TABLE 130 PANASONIC CORPORATION: COMPANY OVERVIEW

- TABLE 131 PANASONIC CORPORATION: PRODUCTS OFFERED

- TABLE 132 PANASONIC CORPORATION: PRODUCT LAUNCHES

- TABLE 133 PANASONIC CORPORATION: DEALS

- TABLE 134 PANASONIC CORPORATION: EXPANSIONS

- TABLE 135 EODEV: BUSINESS OVERVIEW

- TABLE 136 EODEV: PRODUCTS OFFERED

- TABLE 137 EODEV: DEALS

- TABLE 138 EODEV: EXPANSIONS

- TABLE 139 EODEV: OTHER DEVELOPMENTS

- TABLE 140 GENCELL LTD.: COMPANY OVERVIEW

- TABLE 141 GENCELL LTD.: PRODUCTS OFFERED

- TABLE 142 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 143 POWERUP ENERGY TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 144 HORIZON FUEL CELL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 145 UPSTART POWER: COMPANY OVERVIEW

- TABLE 146 FREUDENBERG SEALING TECHNOLOGIES GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 147 BOC LIMITED: COMPANY OVERVIEW

- TABLE 148 H2SYS: COMPANY OVERVIEW

- TABLE 149 GREENAMP TECHNOS (OPC) PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 150 YANMAR HOLDINGS CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 FUEL CELL GENERATOR MARKET SEGMENTATION

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 FUEL CELL GENERATOR MARKET: RESEARCH DESIGN

- FIGURE 4 DATA TRIANGULATION METHODOLOGY

- FIGURE 5 KEY DATA FROM SECONDARY SOURCES

- FIGURE 6 KEY INSIGHTS FROM PRIMARY SOURCES

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY, DESIGNATION, AND REGION

- FIGURE 8 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF FUEL CELL GENERATORS

- FIGURE 9 FUEL CELL GENERATOR MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 10 FUEL CELL GENERATOR MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 11 NORTH AMERICA HELD LARGEST SHARE OF FUEL CELL GENERATOR MARKET IN 2024

- FIGURE 12 DATA CENTERS TO DOMINATE FUEL CELL GENERATOR MARKET DURING FORECAST PERIOD

- FIGURE 13 HYDROGEN FUEL CELL TO ACCOUNT FOR DOMINANT SHARE OF FUEL CELL GENERATOR MARKET IN 2030

- FIGURE 14 SMALL-SCALE (UP TO 200 KW) GENERATORS TO LEAD FUEL CELL GENERATOR MARKET THROUGH 2030

- FIGURE 15 RISE IN DEMAND FOR CLEAN POWER GENERATION TO BOOST ADOPTION OF FUEL CELL GENERATORS BY ENVIRONMENTALLY CONSCIOUS INDUSTRIES

- FIGURE 16 EUROPEAN FUEL CELL GENERATOR MARKET TO EXPERIENCE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 DATA CENTERS TO ACCOUNT FOR LARGEST MARKET SHARE AMONG END USERS OF FUEL CELL GENERATORS IN 2030

- FIGURE 18 HYDROGEN FUEL CELL GENERATORS TO ACCOUNT FOR MAJORITY OF MARKET SHARE IN 2030

- FIGURE 19 SMALL SCALE (UP TO 200 KW) TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 20 FUEL CELL GENERATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 CO2 EMISSIONS FROM ENERGY COMBUSTION AND INDUSTRIAL PROCESSES, GT CO2 (2000-2022)

- FIGURE 22 GLOBAL INVESTMENT IN CLEAN ENERGY, 2018-2025 (USD BILLION)

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 100 KW PEM STACK COMPONENT COST SUMMARY BREAKUP, 2024 (100 STACKS/YEAR)

- FIGURE 25 100 KW PEM STACK COMPONENT COST SUMMARY BREAKUP, 2024 (1,000 STACKS/YEAR)

- FIGURE 26 100 KW PEM STACK COMPONENT COST SUMMARY BREAKUP, 2024 (10,000 STACKS/YEAR)

- FIGURE 27 100 KW PEM STACK COMPONENT COST SUMMARY BREAKUP, 2024 (50,000 STACKS/YEAR)

- FIGURE 28 250 KW PEM STACK COMPONENT COST SUMMARY BREAKUP, 2024 (100 STACKS/YEAR)

- FIGURE 29 250 KW PEM STACK COMPONENT COST SUMMARY BREAKUP, 2024 (1,000 STACKS/YEAR)

- FIGURE 30 250 KW PEM STACK COMPONENT COST SUMMARY BREAKUP, 2024 (10,000 STACKS/YEAR)

- FIGURE 31 250 KW PEM STACK COMPONENT COST SUMMARY BREAKUP, 2024 (50,000 STACKS/YEAR)

- FIGURE 32 100 KW PEM STACK MANUFACTURING COST SUMMARY BREAKUP, 2024 (100 STACKS/YEAR)

- FIGURE 33 100 KW PEM STACK MANUFACTURING COST SUMMARY BREAKUP, 2024 (1,000 STACKS/YEAR)

- FIGURE 34 100 KW PEM STACK MANUFACTURING COST SUMMARY BREAKUP, 2024 (10,000 STACKS/YEAR)

- FIGURE 35 100 KW PEM STACK MANUFACTURING COST SUMMARY BREAKUP, 2024 (50,000 STACKS/YEAR)

- FIGURE 36 250 KW PEM STACK MANUFACTURING COST SUMMARY BREAKUP, 2024 (100 STACKS/YEAR)

- FIGURE 37 250 KW PEM STACK MANUFACTURING COST SUMMARY BREAKUP, 2024 (1,000 STACKS/YEAR)

- FIGURE 38 250 KW PEM STACK MANUFACTURING COST SUMMARY BREAKUP, 2024 (10,000 STACKS/YEAR)

- FIGURE 39 250 KW PEM STACK MANUFACTURING COST SUMMARY BREAKUP, 2024 (50,000 STACKS/YEAR)

- FIGURE 40 100 KW PEM BOP COST SUMMARY BREAKUP, 2024 (100 STACKS/YEAR)

- FIGURE 41 100 KW PEM BOP COST SUMMARY BREAKUP, 2024 (1,000 STACKS/YEAR)

- FIGURE 42 100 KW PEM BOP COST SUMMARY BREAKUP, 2024 (10,000 STACKS/YEAR)

- FIGURE 43 100 KW PEM BOP COST SUMMARY BREAKUP, 2024 (50,000 STACKS/YEAR)

- FIGURE 44 250 KW PEM BOP COST SUMMARY BREAKUP, 2024 (100 STACKS/YEAR)

- FIGURE 45 250 KW PEM BOP COST SUMMARY BREAKUP, 2024 (1,000 STACKS/YEAR)

- FIGURE 46 250 KW PEM BOP COST SUMMARY BREAKUP, 2024 (10,000 STACKS/YEAR)

- FIGURE 47 250 KW PEM BOP COST SUMMARY BREAKUP, 2024 (50,000 STACKS/YEAR)

- FIGURE 48 SUPPLY CHAIN ANALYSIS

- FIGURE 49 FUEL CELL GENERATOR MARKET ECOSYSTEM

- FIGURE 50 PATENT APPLIED AND GRANTED, 2014-2024

- FIGURE 51 IMPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2022-2024 (USD THOUSAND)

- FIGURE 52 EXPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2022-2024

- FIGURE 53 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 54 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR VARIOUS GENERATOR SIZES

- FIGURE 55 KEY BUYING CRITERIA FOR VARIOUS GENERATOR SIZES

- FIGURE 56 IMPACT OF AI/GEN AI ON FUEL CELL GENERATOR SUPPLY CHAIN, BY REGION

- FIGURE 57 FUEL CELL GENERATOR MARKET, BY SIZE, 2025

- FIGURE 58 FUEL CELL GENERATOR MARKET, BY FUEL TYPE, 2024

- FIGURE 59 FUEL CELL GENERATOR MARKET, BY END USER, 2024

- FIGURE 60 EUROPE TO BE FASTEST-GROWING MARKET FOR FUEL CELL GENERATORS DURING FORECAST PERIOD

- FIGURE 61 ASIA PACIFIC: FUEL CELL GENERATOR MARKET SNAPSHOT

- FIGURE 62 NORTH AMERICA: FUEL CELL GENERATOR MARKET SNAPSHOT

- FIGURE 63 FUEL CELL GENERATOR MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 64 FUEL CELL GENERATOR MARKET SHARE ANALYSIS, 2024

- FIGURE 65 COMPANY VALUATION, 2024 (USD MILLION)

- FIGURE 66 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS, 2024

- FIGURE 67 BRAND/PRODUCT COMPARISON

- FIGURE 68 FUEL CELL GENERATOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 69 FUEL CELL GENERATOR MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 70 FUEL CELL GENERATOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 71 BLOOM ENERGY: COMPANY SNAPSHOT

- FIGURE 72 DOOSAN FUEL CELL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 73 POWERCELL SWEDEN AB: COMPANY SNAPSHOT

- FIGURE 74 BALLARD POWER SYSTEMS: COMPANY SNAPSHOT

- FIGURE 75 PLUG POWER INC.: COMPANY SNAPSHOT

- FIGURE 76 ABB: COMPANY SNAPSHOT

- FIGURE 77 SIEMENS ENERGY: COMPANY SNAPSHOT

- FIGURE 78 CUMMINS INC.: COMPANY SNAPSHOT

- FIGURE 79 AFC ENERGY: COMPANY SNAPSHOT

- FIGURE 80 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: COMPANY SNAPSHOT

- FIGURE 81 PANASONIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 82 GENCELL LTD.: COMPANY SNAPSHOT

The fuel cell generator market is estimated to reach USD 1.80 billion by 2030 from an estimated value of USD 0.63 billion in 2025, at a CAGR of 23.3% during the forecast period. The fuel cell generator market is driven by increasing demand for clean, off-grid power, rising concerns over energy security, and the need for reliable backup systems in critical sectors. Growing investments in hydrogen infrastructure, supportive government incentives, and advancements in fuel cell efficiency and lifespan are boosting adoption. Decarbonization goals and the transition toward resilient, low-emission energy solutions further propel the market across industrial, commercial, and remote applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion); Volume (MW) |

| Segments | Fuel Type, Fuel Cell Type, End User, Size, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Rest of the World |

"Small Scale: The larger segment of fuel cell generators in terms of size."

Small-scale fuel cell generators represent the largest segment of the market by size, primarily due to their versatility, ease of deployment, and suitability for decentralized power applications. These compact systems are ideal for residential buildings, telecom towers, mobile units, and small commercial facilities that require reliable, clean backup power with minimal space and infrastructure requirements. The increasing need for uninterrupted power in remote and off-grid areas, along with rising adoption in developing regions with unreliable grid access, is driving demand for small-scale units. Additionally, their low noise, zero-emission operation, and scalability make them attractive for sustainable energy solutions. Technological advancements have enhanced efficiency, reduced costs, and improved portability, further encouraging adoption. Supportive government policies and the integration of renewable energy sources like solar and wind also contribute to the segment's strong market position and sustained growth.

"The data centers segment is estimated to remain the largest segment among end users."

The data center segment is expected to remain the largest segment by end user in the fuel cell generator market due to the sector's critical need for reliable, continuous, and clean power. As global data consumption surges with the rise of cloud computing, AI, IoT, and digital services, data centers must ensure uninterrupted operation. Fuel cell generators offer a highly efficient, low-emission alternative to diesel generators for both backup and primary power needs. Their modularity, scalability, and ability to operate independently from the grid make them well-suited for hyperscale and edge data centers. Moreover, major technology firms are committing to carbon neutrality and investing in sustainable energy infrastructure, further boosting demand for fuel cell systems. Reduced maintenance, silent operation, and rapid startup times also enhance their appeal in data center environments where uptime and sustainability are paramount.

"Asia Pacific is projected to be the second-largest region in the fuel cell generator market."

The fuel cell generator market is projected to be the second largest in the Asia Pacific region, during the 2021-2030 period, underpinned by rapid industrialization and growing energy demands in the region, combined with government initiatives to foster the uptake of clean energy technology. Japan and China are the leaders in hydrogen and fuel cells, with government backing of the hydrogen economy, supportive infrastructure investment, and later commercialization of fuel cell systems. The Japanese government's concept of a "Hydrogen Society" is based on increased hydrogen's role in the economy through fuel generators working in stationary and transportation applications. In China, significant support through policy, engagement of the state-owned energy enterprises, and massive manufacturing capacity are shaping its fuel cell capabilities, lowering both the cost and access to fuel cell technologies.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1: 65%, Tier 2: 24%, and Tier 3: 11%

By Designation: C-Level Executives: 30%, Managers: 25%, and Others: 45%

By Region: North America: 27%, Europe: 20%, Asia Pacific: 53%,

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined based on their total revenues as of 2023; Tier 1: Greater than USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: Less than USD 500 million.

The fuel cell generator market is dominated by a few major players that have a wide regional presence. The leading players in fuel cell generator market are Bloom Energy (US), PowerCell Sweden AB (Sweden), Nedstack Fuel Cell Technology (Netherlands), Ballard Power Systems (US), Plug Power Inc. (US), Doosan Fuel Cell Co., Ltd. (South Korea), ABB (Switzerland), Siemens Energy (Germany), Cummins Inc. (US), AFC Energy (UK), Toshiba Energy Systems & Solutions Corporation (Japan) among others.

Research Coverage

The report defines, describes, and forecasts the fuel cell generator market by size, application, and fuel type. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the fuel cell generator market.

Key Benefits of Buying the Report

- The fuel cell generator market is driven by the global transition toward cleaner, more resilient, and sustainable energy systems. With rising concerns over carbon emissions, air quality, and energy security, fuel cell generators offer a reliable, low-emission alternative to traditional diesel and gas-powered generators. Their ability to deliver continuous, off-grid, and backup power with high efficiency and minimal environmental impact makes them increasingly attractive across sectors such as data centers, healthcare, telecom, defense, and remote infrastructure. The growing urgency for decarbonization, coupled with climate-induced power disruptions, is accelerating demand for dependable backup solutions. Supportive government policies, financial incentives, and hydrogen development roadmaps further fuel market growth. Advancements in fuel cell technologies-including improved lifespan, scalability, and integration with renewables-enhance system performance and cost-competitiveness. Additionally, strategic investments in hydrogen infrastructure and green hydrogen production are expanding the viability of fuel cell generators. As industries prioritize clean energy resilience and grid independence, fuel cell generators are emerging as a vital solution in the global push toward net-zero emissions and sustainable energy diversification.

- Product Development/Innovation: The fuel cell generator market is advancing through innovations that enhance efficiency, durability, and system integration. Companies are developing compact, modular fuel cell systems that enable flexible deployment across residential, commercial, and industrial settings. Technological improvements in catalysts, membranes, and thermal management boost power density and extend operational life. Integration with IoT platforms enables real-time monitoring, predictive maintenance, and performance optimization. Hybrid systems combining fuel cells with renewables and batteries offer greater energy resilience. Additionally, advancements in hydrogen storage and ammonia-to-hydrogen conversion technologies are expanding fuel flexibility, supporting broader adoption and scalability of fuel cell generators in diverse applications.

- Market Development: In June 2024, PowerCell Sweden AB launched the Marine System 225, a next-generation maritime fuel cell system built on the success of the Marine System 200. With enhanced power output, improved efficiency, and a compact design, it is ideal for marine vessels. Designed for durability and ease of installation, the system highlights PowerCell's leadership in marine innovation and supports the growing demand for sustainable maritime power solutions.

- Market Diversification: In February 2025, Zepp.solutions B.V. has been chosen as the fuel cell system supplier for the NERA-H2 project, funded by the Dutch Maritime Master Plan. This initiative focuses on retrofitting river cruise vessels with hydrogen fuel cell propulsion systems, addressing stringent emissions regulations in cities like Amsterdam, Basel, and Vienna. By providing modular fuel cell systems with over 1MW output, Zepp.solutions is driving the adoption of hydrogen-powered solutions in the maritime sector. This project is pivotal in scaling up the use of hydrogen technology within the river cruise industry, ultimately pushing the fuel cell generator market towards sustainable applications in maritime transport.

- Competitive Assessment: Assessment of rankings of some of the key players, including of Bloom Energy (US), PowerCell Sweden AB (Sweden), Nedstack Fuel Cell Technology (Netherlands), Ballard Power Systems (US), Plug Power Inc. (US), Doosan Fuel Cell Co., Ltd. (South Korea), ABB (Switzerland), Siemens Energy (Germany), Cummins Inc. (US), AFC Energy (UK), and Toshiba Energy Systems & Solutions Corporation (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key insights from primary sources

- 2.2.2.2 Breakdown of primaries

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.1.1 Supply-side calculations

- 2.3.1.2 Supply-side assumptions

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.3.2.1 Demand-side assumptions

- 2.3.2.2 Demand-side limitations

- 2.3.2.3 Demand-side calculation

- 2.3.3 FORECAST

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.4 RESEARCH LIMITATIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FUEL CELL GENERATOR MARKET

- 4.2 FUEL CELL GENERATOR MARKET, BY REGION

- 4.3 FUEL CELL GENERATOR MARKET, BY END USER

- 4.4 FUEL CELL GENERATOR MARKET, BY FUEL TYPE

- 4.5 FUEL CELL GENERATOR MARKET, BY SIZE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Global focus on reducing carbon emissions and environmental impact

- 5.2.1.2 Hydrogen fuel cell generators are replacing diesel backups in data centers seeking cleaner energy

- 5.2.2 RESTRAINTS

- 5.2.2.1 High upfront cost compared to conventional diesel or gas generators limits mass adoption.

- 5.2.2.2 High capital expenditure associated with hydrogen energy storage

- 5.2.2.3 Lack of robust hydrogen infrastructure limits fuel availability and distribution

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of renewable energy sources into power grids

- 5.2.3.2 Supportive government policies, incentives, and rebates on installation of fuel cell generators

- 5.2.4 CHALLENGES

- 5.2.4.1 Water management in proton-exchange membrane fuel cells

- 5.2.4.2 High operational temperature of solid oxide fuel cells

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PEM BACKUP FUEL CELL GENERATOR INDICATIVE PRICING MODEL ANALYSIS

- 5.4.1.1 5 kW FCG stack and balance of plant (BoP) indicative cost

- 5.4.1.2 10 kW FCG stack and balance of plant (BoP) indicative cost

- 5.4.2 PEM STACK AND SYSTEM BOP PRICING MODEL ANALYSIS

- 5.4.2.1 PEM stack component cost summary

- 5.4.2.1.1 100 KW PEM stack component cost summary

- 5.4.2.1.2 250 KW PEM stack component cost summary

- 5.4.2.2 PEM stack manufacturing cost summary

- 5.4.2.2.1 100 KW PEM stack manufacturing cost summary

- 5.4.2.2.2 250 KW PEM stack manufacturing cost summary

- 5.4.2.3 PEM BoP cost summary

- 5.4.2.3.1 100 KW PEM BoP cost summary

- 5.4.2.3.2 250 kW PEM BoP cost summary

- 5.4.2.1 PEM stack component cost summary

- 5.4.1 PEM BACKUP FUEL CELL GENERATOR INDICATIVE PRICING MODEL ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIER

- 5.5.2 COMPONENT MANUFACTURING

- 5.5.3 FUEL CELL STACK & SYSTEM INTEGRATION

- 5.5.4 FUEL CELL GENERATOR PROVIDER

- 5.5.5 END USER

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Atomically dispersed Pt and Fe sites and Pt-Fe nanoparticles for durable proton-exchange membrane fuel cells

- 5.7.1.2 Nanoparticle-based fuel cells

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 Non-precious metal catalyst-based fuel cells

- 5.7.2.2 Hexagonal perovskites for ceramic fuel cells

- 5.7.1 KEY TECHNOLOGIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 POWERING SUSTAINABILITY AND SAVINGS-WALMART TURNS TO BLOOM ENERGY FOR RESILIENT, LOW-CARBON ENERGY AT SCALE.

- 5.8.2 FUEL CELLS POWER VERIZON'S RESILIENCE-CUTTING COSTS, SLASHING EMISSIONS, AND SECURING CRITICAL INFRASTRUCTURE WITH HIGH-EFFICIENCY, ON-SITE ENERGY

- 5.8.3 KEEPING FLOOD WARNINGS FLOWING-EFOY FUEL CELLS POWER THE ENVIRONMENT AGENCY'S OFF-GRID MONITORING WITH SILENT, WEATHERPROOF RELIABILITY

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 280410)

- 5.10.2 EXPORT SCENARIO (HS CODE 280410)

- 5.11 KEY CONFERENCES AND EVENTS

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY FRAMEWORK

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF AI/GEN AI ON FUEL CELL GENERATOR MARKET

- 5.15.1 SYSTEM OPTIMIZATION & PREDICTIVE MAINTENANCE

- 5.15.2 DESIGN & R&D ACCELERATION

- 5.15.3 MARKET INTELLIGENCE AND CUSTOMER PROFILING

- 5.16 IMPACT OF US TARIFF - OVERVIEW

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON END-USER INDUSTRIES

6 FUEL CELL GENERATOR MARKET, BY FUEL CELL TYPE

- 6.1 INTRODUCTION

- 6.2 PROTON-EXCHANGE MEMBRANE FUEL CELL (PEMFC)

- 6.2.1 INCREASING USE OF PEM FUEL CELLS IN MARINE APPLICATIONS

- 6.3 SOLID OXIDE FUEL CELL (SOFC)

- 6.3.1 RISE IN ADOPTION OF SOFCS IN ENERGY SECTOR TO ACHIEVE HIGH ELECTRICAL EFFICIENCY AND LOW CO2 EMISSIONS

- 6.4 ALKALINE FUEL CELL (AFC)

- 6.4.1 HIGH ADOPTION OF AFC IN CONSTRUCTION AND MARINE APPLICATIONS

- 6.5 PHOSPHORIC ACID FUEL CELL (PAFC)

- 6.5.1 ADOPTION OF PAFCS IN STATIONARY APPLICATIONS

7 FUEL CELL GENERATOR MARKET, BY SIZE

- 7.1 INTRODUCTION

- 7.2 SMALL SCALE (UP TO 200 KW)

- 7.2.1 DIVERSE POWER OUTPUT OF SMALL FUEL CELL SYSTEMS TO INCREASE THEIR USE BY ALL END USERS

- 7.3 LARGE SCALE (ABOVE 200 KW)

- 7.3.1 ROBUST ENERGY AND CLIMATE POLICIES TO DRIVE MARKET

8 FUEL CELL GENERATOR MARKET, BY FUEL TYPE

- 8.1 INTRODUCTION

- 8.2 HYDROGEN

- 8.2.1 HIGH ENERGY DENSITY OF HYDROGEN TO SUPPORT SEGMENTAL GROWTH

- 8.3 METHANOL

- 8.3.1 EASE OF STORAGE AND USE TO BOOST DEMAND FOR METHANOL

- 8.4 AMMONIA

- 8.4.1 STRINGENT REGULATIONS TO REDUCE CARBON FOOTPRINT TO INCREASE DEMAND FOR AMMONIA

- 8.5 OTHERS

9 FUEL CELL GENERATOR MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 MARINE ENGINEERING PLATFORMS

- 9.2.1 DECARBONIZATION TARGETS SET BY INTERNATIONAL MARITIME ORGANIZATIONS TO STIMULATE DEMAND

- 9.3 CONSTRUCTION SITES

- 9.3.1 REPLACEMENT OF DIESEL GENERATORS WITH FUEL CELL GENERATORS TO ACHIEVE DECARBONIZATION GOALS TO DRIVE MARKET

- 9.4 AGRICULTURAL FACILITIES

- 9.4.1 IMPLEMENTATION OF HYDROGEN GENERATORS IN AGRICULTURAL APPLICATIONS TO SUPPORT MARKET GROWTH

- 9.5 AQUACULTURE FACILITIES

- 9.5.1 RISING NEED FOR ENERGY-EFFICIENT AND LOW-NOISE SOLUTIONS IN AQUACULTURE FACILITIES TO BOOST DEMAND FOR FUEL CELL GENERATORS

- 9.6 DATA CENTERS

- 9.6.1 GROWING USE OF BACKUP POWER SYSTEMS DURING OUTAGES TO PUSH DEMAND FOR FUEL CELL GENERATORS

- 9.7 EMERGENCY RESPONSE GENERATORS

- 9.7.1 POWER BACKUP REQUIREMENT FROM TELECOM TOWERS TO CONTRIBUTE TO MARKET GROWTH

10 FUEL CELL GENERATOR MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Increase in focus on improving energy efficiency to drive market

- 10.2.1.2 Macroeconomic factors

- 10.2.2 INDIA

- 10.2.2.1 Need for decarbonization of energy sector to support market growth

- 10.2.2.2 Macroeconomic factors

- 10.2.3 JAPAN

- 10.2.3.1 Rise in use of hydrogen for clean energy to boost demand for fuel cell generators

- 10.2.3.2 Macroeconomic factors

- 10.2.4 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Growing focus on clean energy generation to boost demand for fuel cell technology

- 10.3.1.2 Macroeconomic factors

- 10.3.2 CANADA

- 10.3.2.1 Government grants to run fuel cell technology-based programs to support market growth

- 10.3.2.2 Macroeconomic factors

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Focus on emission-free transportation to foster requirement for fuel cell technology

- 10.4.1.2 Macroeconomic factors

- 10.4.2 UK

- 10.4.2.1 Efforts to reduce GHG emissions to stimulate demand for fuel cell technology

- 10.4.2.2 Macroeconomic factors

- 10.4.3 FRANCE

- 10.4.3.1 Energy transition outlook of French government to facilitate market growth

- 10.4.3.2 Macroeconomic factors

- 10.4.4 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 REST OF THE WORLD (ROW)

- 10.5.1 MACROECONOMIC FACTORS

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5.1 COMPANY VALUATION

- 11.5.2 FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT, KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Regional footprint

- 11.7.5.3 End user footprint

- 11.7.5.4 Fuel type footprint

- 11.7.5.5 Size footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed List of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 BLOOM ENERGY

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 DOOSAN FUEL CELL CO., LTD.

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 POWERCELL SWEDEN AB

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.3.4 Others developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 BALLARD POWER SYSTEMS

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Other Developments

- 12.1.4.4 MnM View

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 NEDSTACK FUEL CELL TECHNOLOGY

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Other Developments

- 12.1.5.4 MnM View

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 PLUG POWER INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 MnM View

- 12.1.6.3.1 Right to win

- 12.1.6.3.2 Strategic choices

- 12.1.6.3.3 Weaknesses/Competitive threats

- 12.1.7 ABB

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.3.2 Other developments

- 12.1.8 ZEPP.SOLUTIONS B.V.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product Launch

- 12.1.8.3.2 Expansions

- 12.1.8.3.3 Other developments

- 12.1.9 SIEMENS ENERGY

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Other developments

- 12.1.10 CUMMINS INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Other developments

- 12.1.11 AFC ENERGY

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.11.3.2 Deals

- 12.1.11.3.3 Expansions

- 12.1.12 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.13 PROTON MOTOR FUEL CELL GMBH

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches

- 12.1.13.3.2 Deals

- 12.1.13.3.3 Other Developments

- 12.1.14 PANASONIC CORPORATION

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches

- 12.1.14.3.2 Deals

- 12.1.14.3.3 Expansions

- 12.1.15 EODEV

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.15.3.2 Expansions

- 12.1.15.3.3 Other developments

- 12.1.16 GENCELL LTD.

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.1 BLOOM ENERGY

- 12.2 OTHER PLAYERS

- 12.2.1 FUJI ELECTRIC CO., LTD.

- 12.2.2 POWERUP ENERGY TECHNOLOGIES

- 12.2.3 HORIZON FUEL CELL TECHNOLOGIES

- 12.2.4 UPSTART POWER

- 12.2.5 FREUDENBERG SEALING TECHNOLOGIES GMBH & CO. KG

- 12.2.6 BOC LIMITED

- 12.2.7 H2SYS

- 12.2.8 GREENAMP TECHNOS (OPC) PRIVATE LIMITED

- 12.2.9 YANMAR HOLDINGS CO., LTD

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS