|

|

市場調査レポート

商品コード

1771774

製品エンジニアリングサービスの世界市場:サービスタイプ別、提供形態別、組織規模別、業界別、地域別 - 2030年までの予測Product Engineering Services Market by Service Type (Product Design & Prototyping, Product Development, Process Engineering, Product Sustenance & Support Services, Product Modernization & Integration, Reverse Engineering ) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 製品エンジニアリングサービスの世界市場:サービスタイプ別、提供形態別、組織規模別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月14日

発行: MarketsandMarkets

ページ情報: 英文 322 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

製品エンジニアリングサービスの市場規模は急速に拡大しており、2025年の1兆2,977億1,000万米ドルから2030年には1兆8,004億5,000万米ドルになると予測され、予測期間中のCAGRは6.8%になるとみられています。

主な市場促進要因としては、自動車分野の急成長が高度な製品開発とエンジニアリング能力の需要を押し上げていることが挙げられます。また、市場投入までの時間を短縮する必要性が高まっていることも大きな促進要因となっています。企業は、より迅速に製品を投入することで、ペースの速い業界で競争力を維持しようとしています。さらに、顧客体験を向上させる製品設計への注目が高まっており、企業は高品質のエンジニアリング・サービスに投資するようになっています。対照的に、ツールチェーンの肥大化とDevOpsの乱立が市場の主な抑制要因となっています。これらの課題は、複雑で重複するワークフローを生み出し、統合とメンテナンスに必要な時間と労力を増大させることで、チームの効率を低下させます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 10億米ドル |

| セグメント | サービスタイプ別、デリバリーモード別、組織規模別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

中小企業は、スピード、イノベーション、コスト効率を重視することに後押しされ、市場の急成長を牽引することになりそうです。2025年3月、American Expressは、人工知能を採用する中小企業は、技術のアップグレードや新製品の発売に投資する可能性が38%高いと報告しました。2024年6月のZohoの調査によると、インドの中小企業の81%が技術予算の最大半分をクラウド・ソリューションに割り当てており、これはクラウドエンジニアリングとIoTベースの開発への世界のシフトを反映しています。

これは、組み込みシステム、ラピッドプロトタイピング、AI統合ファームウェアサービスへの強い需要を生み出しています。中小企業は、エンジニアリング・サービス・プロバイダーと提携することで、専門スキルを利用できるようになり、開発サイクルを短縮し、多額の内部投資をすることなく効率的に規模を拡大することができます。競争が激化する中、複雑なエンジニアリング業務をアウトソーシングすることで、中小企業は俊敏性と革新性を維持できます。これにより、サービス・プロバイダーは、急成長する市場セグメントに対して、モジュール化されたクラウド対応のエンジニアリング・ソリューションを提供し、有利な機会を得ることができます。

産業用製造業では、デジタルトランスフォーメーション、自動化、次世代製品開発への持続的な投資が進んでいます。2025年3月、Johnson & Johnsonは、デジタル化、スマートファクトリー構想、自動化を通じて医薬品・医療機器製造能力を向上させるため、550億米ドルの投資戦略を発表しました。一方、Taiwan Semiconductor Manufacturing Companyは、米国を拠点とする製造・エンジニアリング事業の拡大に1,000億米ドルを投じ、国内のチップ生産能力を高め、先端半導体の市場投入までの時間を短縮し、サプライチェーンの強靭性を強化します。シーメンスはCES 2025で、生産効率を向上させる先進的なデジタルツイン技術と産業用人工知能技術を発表しました。

こうした開発により、組込みシステム、システムインテグレーション、シミュレーション主導のエンジニアリングサービスの需要が高まります。製造業はレガシーシステムを近代化し、オペレーションを拡大する中で、より迅速なイノベーション、技術的専門知識、オペレーションの俊敏性をエンジニアリングパートナーに依存しています。この成長機会は、サービスプロバイダーにとって、市場投入までの時間を短縮し、製品の信頼性を向上させ、長期的な競争力を強化する上で、産業界の顧客をサポートする大きなチャンスとなります。

北米は、優れたエンジニアリング・インフラ、イノベーション・エコシステム、先端製品開発への多額の投資に支えられ、製品エンジニアリング・サービス市場をリードしています。2025年6月、BASFはバイオ医薬品の製品開発を強化するため、ミシガン州に新しいGMPソリューションセンターを開設し、エンジニアリングサービスが製造とラボレベルの設計能力をいかに統合するかを実証しました。一方、アジア太平洋地域は、デジタル・イノベーション、スマート製品需要の高まり、新興経済諸国における地域のエンジニアリング・エコシステム、製造拠点、人材開発に対する政府の支援によって、最も急速に成長している地域です。

当レポートでは、世界の製品エンジニアリングサービス市場について調査し、サービスタイプ別、提供形態別、組織規模別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- エコシステム分析

- サプライチェーン分析

- 価格分析

- 特許分析

- 技術分析

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 顧客ビジネスに影響を与える動向/混乱

- ビジネスモデル分析

- 投資と資金調達のシナリオ

- AI/生成AIが製品エンジニアリングサービス市場に与える影響

- 2025年の米国関税の影響- 製品エンジニアリングサービス市場

- 地域への影響

第6章 製品エンジニアリングサービス市場(サービスタイプ別)

- イントロダクション

- 製品設計とプロトタイピング

- 製品開発

- 試験と品質保証(QA)

- 製品の近代化と統合

- プロセスエンジニアリング

- リバースエンジニアリング

- 製品の維持とサポート

第7章 製品エンジニアリングサービス市場(提供形態別)

- イントロダクション

- オンショア

- オフショア

- ニアショア

- ハイブリッド

第8章 製品エンジニアリングサービス市場(組織規模別)

- イントロダクション

- 大企業

- 中小企業

第9章 製品エンジニアリングサービス市場(業界別)

- イントロダクション

- 工業製造業

- 自動車・輸送

- ヘルスケア・ライフサイエンス

- 航空宇宙・防衛

- 半導体・エレクトロニクス

- IT・通信

- BFSI

- 小売・eコマース

- エネルギー・公益事業

- その他

第10章 製品エンジニアリングサービス市場(地域別)

- イントロダクション

- 北米

- 北米:市場促進要因

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:市場促進要因

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- アジア太平洋:市場促進要因

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- その他

- 中東・アフリカ

- 中東・アフリカ:市場促進要因

- 中東・アフリカ:マクロ経済見通し

- 湾岸協力理事会(GCC)

- 南アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:市場促進要因

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2022年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要参入企業

- ACCENTURE

- CAPGEMINI

- TCS

- COGNIZANT

- HCL TECHNOLOGIES

- IBM

- WIPRO

- ALTEN GROUP

- LTIMINDTREE

- AVL

- その他の企業

- HAPPIEST MINDS

- NEST DIGITAL

- TVS NEXT

- MPHASIS

- NOUS INFOSYSTEMS

- EPAM SYSTEMS

- TECH MAHINDRA

- TRIGENT SOFTWARE

- SEGULA TECHNOLOGIES

- SYSVINE TECHNOLOGIES

- ASPIRE SYSTEMS

- BRILLIO

- CYBAGE

- GLOBALLOGIC

- GLOBANT

- HARMAN

- INNOMINDS

- PERSISTENT SYSTEMS

- SONATA SOFTWARE

- UST

- TO THE NEW

- INFOSYS

- DAFFODIL SOFTWARE

- BLUE COPPER TECHNOLOGIES

- SYNERGYTOP

- THOUGHT&FUNCTION

第13章 隣接市場/関連市場

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 PRODUCT ENGINEERING SERVICES MARKET SIZE AND GROWTH, 2020-2024 (USD BILLION, YOY GROWTH %)

- TABLE 4 PRODUCT ENGINEERING SERVICES MARKET SIZE AND GROWTH, 2025-2030 (USD BILLION, YOY GROWTH %)

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY SERVICE, 2025

- TABLE 7 LIST OF MAJOR PATENTS, 2015-2024

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 PRODUCT ENGINEERING SERVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 15 PRODUCT ENGINEERING SERVICES MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 EXPECTED CHANGE IN PRICES AND THE LIKELY IMPACT ON PRODUCT ENGINEERING SERVICES MARKET DUE TO TARIFF

- TABLE 18 PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD BILLION)

- TABLE 19 PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD BILLION)

- TABLE 20 PRODUCT DESIGN & PROTOTYPING: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 21 PRODUCT DESIGN & PROTOTYPING: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 22 PRODUCT DEVELOPMENT: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 23 PRODUCT DEVELOPMENT: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 24 TESTING & QUALITY ASSURANCE (QA): PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 25 TESTING & QUALITY ASSURANCE (QA): PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 26 PRODUCT MODERNIZATION & INTEGRATION: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 27 PRODUCT MODERNIZATION & INTEGRATION: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 28 PROCESS ENGINEERING: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 29 PROCESS ENGINEERING: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 30 REVERSE ENGINEERING: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 31 REVERSE ENGINEERING: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 32 PRODUCT SUSTENANCE & SUPPORT: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 33 PRODUCT SUSTENANCE & SUPPORT: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 34 PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2020-2024 (USD BILLION)

- TABLE 35 PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2025-2030 (USD BILLION)

- TABLE 36 ONSHORE: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 37 ONSHORE: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 38 OFFSHORE: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 39 OFFSHORE: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 40 NEARSHORE: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 41 NEARSHORE: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 42 HYBRID: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 43 HYBRID: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 44 PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 45 PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 46 LARGE ENTERPRISES: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 47 LARGE ENTERPRISES: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 48 SMES: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 49 SMES: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 50 PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2020-2024 (USD BILLION)

- TABLE 51 PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 52 INDUSTRIAL MANUFACTURING: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 53 INDUSTRIAL MANUFACTURING: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 54 AUTOMOTIVE & TRANSPORTATION: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 55 AUTOMOTIVE & TRANSPORTATION: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 56 HEALTHCARE & LIFE SCIENCES: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 57 HEALTHCARE & LIFE SCIENCES: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 58 AEROSPACE & DEFENSE: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 59 AEROSPACE & DEFENSE: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 60 SEMICONDUCTOR & ELECTRONICS: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 61 SEMICONDUCTOR & ELECTRONICS: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 62 IT & TELECOM: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 63 IT & TELECOM: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 64 BFSI: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 65 BFSI: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 66 RETAIL & E-COMMERCE: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 67 RETAIL & E-COMMERCE: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 68 ENERGY & UTILITIES: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 69 ENERGY & UTILITIES: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 70 OTHER VERTICALS: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 71 OTHER VERTICALS: PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 72 PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 73 PRODUCT ENGINEERING SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 74 NORTH AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD BILLION)

- TABLE 75 NORTH AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD BILLION)

- TABLE 76 NORTH AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2020-2024 (USD BILLION)

- TABLE 77 NORTH AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2025-2030 (USD BILLION)

- TABLE 78 NORTH AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 79 NORTH AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 80 NORTH AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2020-2024 (USD BILLION)

- TABLE 81 NORTH AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 82 NORTH AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 83 NORTH AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 84 US: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 85 US: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 86 CANADA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 87 CANADA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 88 EUROPE: PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD BILLION)

- TABLE 89 EUROPE: PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD BILLION)

- TABLE 90 EUROPE: PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2020-2024 (USD BILLION)

- TABLE 91 EUROPE: PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2025-2030 (USD BILLION)

- TABLE 92 EUROPE: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 93 EUROPE: PRODUCT ENGINEERING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 94 EUROPE: PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2020-2024 (USD BILLION)

- TABLE 95 EUROPE: PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 96 EUROPE: PRODUCT ENGINEERING SERVICES MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 97 EUROPE: PRODUCT ENGINEERING SERVICES MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 98 UK: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 99 UK: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 100 GERMANY: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 101 GERMANY: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 102 FRANCE: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 103 FRANCE: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 104 ITALY: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 105 ITALY: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 106 REST OF EUROPE: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 107 REST OF EUROPE: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 108 ASIA PACIFIC: PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD BILLION)

- TABLE 109 ASIA PACIFIC: PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD BILLION)

- TABLE 110 ASIA PACIFIC: PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2020-2024 (USD BILLION)

- TABLE 111 ASIA PACIFIC: PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2025-2030 (USD BILLION)

- TABLE 112 ASIA PACIFIC: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 113 ASIA PACIFIC: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 114 ASIA PACIFIC: PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2020-2024 (USD BILLION)

- TABLE 115 ASIA PACIFIC: PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 116 ASIA PACIFIC: PRODUCT ENGINEERING SERVICES MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 117 ASIA PACIFIC: PRODUCT ENGINEERING SERVICES MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 118 CHINA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 119 CHINA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 120 JAPAN: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 121 JAPAN: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 122 INDIA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 123 INDIA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 124 REST OF ASIA PACIFIC: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 125 REST OF ASIA PACIFIC: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 126 MIDDLE EAST & AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD BILLION)

- TABLE 127 MIDDLE EAST & AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD BILLION)

- TABLE 128 MIDDLE EAST & AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2020-2024 (USD BILLION)

- TABLE 129 MIDDLE EAST & AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2025-2030 (USD BILLION)

- TABLE 130 MIDDLE EAST & AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 131 MIDDLE EAST & AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 132 MIDDLE EAST & AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2020-2024 (USD BILLION)

- TABLE 133 MIDDLE EAST & AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 134 MIDDLE EAST & AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 135 MIDDLE EAST & AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 136 GCC: PRODUCT ENGINEERING SERVICES MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 137 GCC: PRODUCT ENGINEERING SERVICES MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 138 GCC: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 139 GCC: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 140 UAE: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 141 UAE: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 142 SAUDI ARABIA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 143 SAUDI ARABIA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 144 REST OF GCC: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 145 REST OF GCC: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 146 SOUTH AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 147 SOUTH AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 150 LATIN AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD BILLION)

- TABLE 151 LATIN AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD BILLION)

- TABLE 152 LATIN AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2020-2024 (USD BILLION)

- TABLE 153 LATIN AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2025-2030 (USD BILLION)

- TABLE 154 LATIN AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 155 LATIN AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 156 LATIN AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2020-2024 (USD BILLION)

- TABLE 157 LATIN AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 158 LATIN AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 159 LATIN AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 160 BRAZIL: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 161 BRAZIL: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 162 MEXICO: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 163 MEXICO: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 164 REST OF LATIN AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 165 REST OF LATIN AMERICA: PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 166 PRODUCT ENGINEERING SERVICES MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2025

- TABLE 167 PRODUCT ENGINEERING SERVICES MARKET: DEGREE OF COMPETITION, 2024

- TABLE 168 PRODUCT ENGINEERING SERVICES MARKET: REGION FOOTPRINT

- TABLE 169 PRODUCT ENGINEERING SERVICES MARKET: SERVICE TYPE FOOTPRINT

- TABLE 170 PRODUCT ENGINEERING SERVICES MARKET: VERTICAL FOOTPRINT

- TABLE 171 PRODUCT ENGINEERING SERVICES MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 172 PRODUCT ENGINEERING SERVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 173 PRODUCT ENGINEERING SERVICES MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, MAY 2023-JUNE 2025

- TABLE 174 PRODUCT ENGINEERING SERVICES MARKET: DEALS, MAY 2023-JUNE 2025

- TABLE 175 ACCENTURE: COMPANY OVERVIEW

- TABLE 176 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 ACCENTURE: DEALS

- TABLE 178 ACCENTURE: EXPANSIONS

- TABLE 179 CAPGEMINI: COMPANY OVERVIEW

- TABLE 180 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 CAPGEMINI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 182 CAPGEMINI: DEALS

- TABLE 183 CAPGEMINI: EXPANSIONS

- TABLE 184 TCS: COMPANY OVERVIEW

- TABLE 185 TCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 TCS: PRODUCT LAUNCHES AND ENHANCEMENTS AND ENHANCEMENTS

- TABLE 187 TCS: DEALS

- TABLE 188 COGNIZANT: COMPANY OVERVIEW

- TABLE 189 COGNIZANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 COGNIZANT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 191 COGNIZANT: DEALS

- TABLE 192 HCL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 193 HCL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 HCL TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 195 HCL TECHNOLOGIES: DEALS

- TABLE 196 IBM: COMPANY OVERVIEW

- TABLE 197 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 199 IBM: DEALS

- TABLE 200 WIPRO: COMPANY OVERVIEW

- TABLE 201 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 WIPRO: DEALS

- TABLE 203 WIPRO: EXPANSIONS, MAY 2025 - JUNE 2023

- TABLE 204 ALTEN GROUP: COMPANY OVERVIEW

- TABLE 205 ALTEN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 ALTEN GROUP: DEALS

- TABLE 207 LTIMINDTREE: COMPANY OVERVIEW

- TABLE 208 LTIMINDTREE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 LTIMINDTREE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 210 LTIMINDTREE: DEALS

- TABLE 211 LTIMINDTREE: EXPANSIONS, JUNE 2024 - JUNE 2024

- TABLE 212 AVL: COMPANY OVERVIEW

- TABLE 213 AVL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 AVL: DEALS

- TABLE 215 SIMULATION SOFTWARE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 216 SIMULATION SOFTWARE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 217 SIMULATION SOFTWARE MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 218 SIMULATION SOFTWARE MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 219 IOT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2015-2022 (USD MILLION)

- TABLE 220 IOT ENGINEERING SERVICES MARKET, BY END USER, 2015-2022 (USD MILLION)

List of Figures

- FIGURE 1 PRODUCT ENGINEERING SERVICES MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 PRODUCT ENGINEERING SERVICES MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 PRODUCT ENGINEERING SERVICES MARKET: RESEARCH FLOW

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FROM SUPPLY SIDE - COLLECTIVE REVENUE OF VENDORS

- FIGURE 9 PRODUCT ENGINEERING SERVICES MARKET: DEMAND-SIDE APPROACH

- FIGURE 10 PRODUCT ENGINEERING SERVICES MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 11 FASTEST-GROWING SEGMENTS IN PRODUCT ENGINEERING SERVICES MARKET, 2025-2030

- FIGURE 12 PRODUCT ENGINEERING SERVICES MARKET: REGIONAL SNAPSHOT

- FIGURE 13 INCREASING PRODUCT COMPLEXITY AND DEMAND FOR FASTER INNOVATION TO DRIVE MARKET

- FIGURE 14 PRODUCT DEVELOPMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 OFFSHORE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 INDUSTRIAL MANUFACTURING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

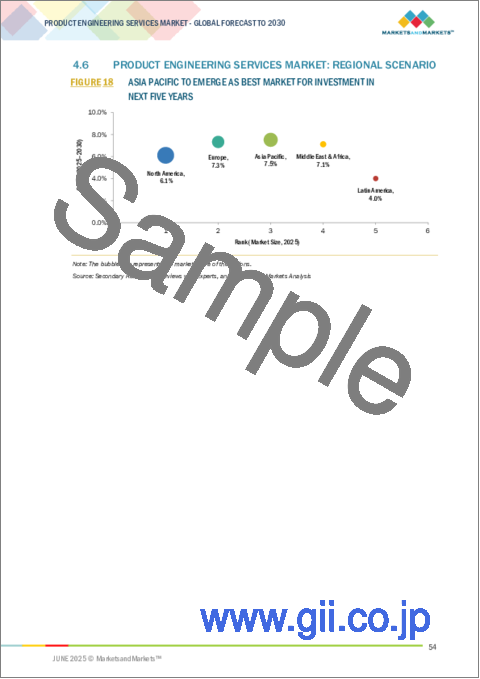

- FIGURE 18 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 19 PRODUCT ENGINEERING SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 PRODUCT ENGINEERING SERVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 PRODUCT ENGINEERING SERVICES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE OF SERVICE PROVIDERS, BY REGION, 2025

- FIGURE 23 PATENTS APPLIED AND PUBLISHED, 2014-2024

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS: PRODUCT ENGINEERING SERVICES MARKET

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 27 PRODUCT ENGINEERING SERVICES MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 28 LEADING GLOBAL PRODUCT ENGINEERING SERVICES MARKET VENDORS, BY NUMBER OF INVESTORS AND FUNDING ROUND, 2025

- FIGURE 29 IMPACT OF GENAI ON PRODUCT ENGINEERING SERVICES MARKET

- FIGURE 30 PRODUCT DEVELOPMENT SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 31 OFFSHORE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 32 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 33 INDUSTRIAL MANUFACTURING SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 37 SHARE ANALYSIS OF PRODUCT ENGINEERING SERVICES MARKET, 2024

- FIGURE 38 PRODUCT ENGINEERING SERVICES MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 39 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 40 PRODUCT ENGINEERING SERVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 PRODUCT ENGINEERING SERVICES MARKET: COMPANY FOOTPRINT

- FIGURE 42 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 43 PRODUCT ENGINEERING SERVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 COMPANY VALUATION OF KEY VENDORS

- FIGURE 45 EV/EBITDA ANALYSIS OF KEY VENDORS

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 47 PRODUCT ENGINEERING SERVICES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 48 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 49 CAPGEMINI: COMPANY SNAPSHOT

- FIGURE 50 TCS: COMPANY SNAPSHOT

- FIGURE 51 COGNIZANT: COMPANY SNAPSHOT

- FIGURE 52 HCL TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 53 IBM: COMPANY SNAPSHOT

- FIGURE 54 WIPRO: COMPANY SNAPSHOT

- FIGURE 55 ALTEN GROUP: COMPANY SNAPSHOT

- FIGURE 56 LTIMINDTREE: COMPANY SNAPSHOT

The product engineering services market is expanding rapidly, with a projected market size rising from USD 1,297.71 billion in 2025 to USD 1,800.45 billion by 2030, at a CAGR of 6.8% during the forecast period. The key market drivers include the rapid growth of the automotive sector, which boosts demand for advanced product development and engineering capabilities. Another major driver is the increasing need to accelerate time-to-market, as companies seek to stay competitive in fast-paced industries by launching products more quickly. Additionally, there is a growing focus on product design to enhance customer experience, pushing organizations to invest in high-quality engineering services. In contrast, toolchain bloat and DevOps sprawl are the market's major restraints. These challenges reduce team efficiency by creating complex, overlapping workflows and increasing the time and effort required for integration and maintenance.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Billion |

| Segments | Service Type, Delivery Mode, Organization Size, Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

"Small & medium enterprises are expected to grow at the highest CAGR during the forecast period"

Small & medium enterprises are set to drive the fastest market growth, propelled by their focus on speed, innovation, and cost-efficiency. In March 2025, American Express reported that SMEs adopting artificial intelligence are 38 percent more likely to invest in technology upgrades and new product launches. A June 2024 Zoho survey found that 81 percent of MSMEs in India allocate up to half their tech budgets to cloud solutions, reflecting a global shift toward cloud engineering and IoT-based development.

This creates a strong demand for embedded systems, rapid prototyping, and AI-integrated firmware services. By partnering with engineering service providers, SMEs gain access to specialized skills, reduce development cycles, and scale efficiently without heavy internal investment. As competition intensifies, outsourcing complex engineering tasks allows SMEs to stay agile and innovative. This opens lucrative opportunities for service providers to deliver modular, cloud-ready engineering solutions to a rapidly growing market segment.

"Industrial manufacturing is expected to hold the largest market share during the forecast period"

The industrial manufacturing sector is gaining sustained investment in digital transformation, automation, and next-generation product development. In March 2025, Johnson & Johnson announced a USD 55 billion investment strategy to advance its pharmaceutical and medical device manufacturing capabilities through digitalization, smart factory initiatives, and automation. Meanwhile, Taiwan Semiconductor Manufacturing Company committed USD 100 billion to expand its US-based fabrication and engineering operations to boost domestic chip production capacity, accelerate time-to-market for advanced semiconductors, and enhance supply chain resilience. At CES 2025, Siemens unveiled advanced digital twin and industrial artificial intelligence technologies to improve production efficiency.

These developments increase demand for embedded systems, system integration, and simulation-led engineering services. As manufacturers modernize legacy systems and scale operations, they rely on engineering partners for faster innovation, technical expertise, and operational agility. This growth presents strong opportunities for service providers to support industrial clients in reducing time-to-market, improving product reliability, and long-term competitiveness.

"North America holds the largest market share, while Asia Pacific records the fastest growth"

North America leads the product engineering services market, supported by its premier engineering infrastructure, innovation ecosystems, and significant investments in advanced product development. In June 2025, BASF opened a new Good Manufacturing Practice Solution Center in Michigan to enhance product development in biopharma, demonstrating how engineering services integrate manufacturing with lab-level design capabilities. Meanwhile, Asia Pacific is the fastest-growing region, driven by digital innovation, rising smart product demand, government-backed support for local engineering ecosystems, manufacturing hubs, and talent development across emerging economies.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the product engineering services market.

- By Company: Tier I - 40%, Tier II - 25%, and Tier III - 35%

- By Designation: C-Level Executives - 25%, D-Level Executives -37%, and Others - 38%

- By Region: North America - 38%, Europe - 24%, Asia Pacific - 22%, and Rest of the World - 16%

The report profiles key players offering product engineering services. These include IBM (US), HCL Tech (India), Cognizant (US), Capgemini (France), Alten Group (France), Accenture (Ireland), Wipro (India), LTIMindtree (India), AVL (Austria), Happiest Minds (India), TVSnext (US), Mphasis (India), Tech Mahindra (India), Cybage Software (India), Innominds (US), Infosys (India), SynergyTop (US), EPAM Systems (US), Brillio (US), GlobalLogic (US), Tata Consultancy Services (India), Nous Infosystems (India), Trigent Software (US), and Aspire Systems (India).

Study Coverage

This research report categorizes the product engineering services market based on Service Type (Product Design & Prototyping [Concept & Ideation, UX/UI & Industrial Design, Others {MBSE, Design for Manufacturability (DFM)/Design for Testability (DFT)}], Product Development [Software Product Development, Hardware & Embedded Systems Development, Prototyping & MVP Development, Integration & Interface Development], Testing & Quality Assurance Services [Functional & Non-functional Testing, Test Automation, Compliance & Certification, Validation & Verification (V&V)], Product Modernization & Integration [Legacy System Migration, Platform Re-platforming, Architectural Overhaul, Technical Debt Reduction], Process Engineering [Manufacturing Engineering Support, Knowledge-based Engineering), Maintenance, Repair & Operations], Reverse Engineering [3D Scanning, Application Modernization & Migration, Others], Product Sustenance & Support Services [Bug Fixing & Maintenance, Performance Optimization & Monitoring, Feature Enhancements & Upgrades, Security Updates & Compliance, DevOps & MLOps Support]), Delivery Mode (Onshore, Offshore, Nearshore, Hybrid), Organization Size (Large Enterprises, SMES), Vertical (Industrial Manufacturing, Automotive & Transportation, Healthcare & Life Sciences, Aerospace & Defense, Semiconductors & Electronics, IT & Telecom, Banking, Financial Services, & Insurances (BFSI), Retail & Ecommerce, Energy & Utilities, Other Verticals), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the product engineering services market. A thorough analysis of the key industry players provided insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions; and recent product engineering services market developments. This report also covered the competitive analysis of upcoming startups in the product engineering services market ecosystem.

Benefits of Buying this Report

The report would provide market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall product engineering services market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Market Dynamics: Key drivers (Automotive sector growth driving demand for product development services, increasing demand for accelerating TTM, Growing focus on product design to enhance customer experience), restraints (Toolchain Bloat and DevOps Sprawl reducing team efficiency), opportunities (Increase in number of innovative city projects, Legacy product modernization at scale, Growth of semiconductor and embedded system), and challenges (Lack of robust feedback loops and continuous management, Fragmented technology ecosystems)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product & service launches in the product engineering services market

- Market Development: Comprehensive information about lucrative markets - analysis of the product engineering services market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the product engineering services market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such IBM (US), HCL Tech (India), Cognizant (US), Capgemini (France), Alten Group (France), Accenture (Ireland), Wipro (India), LTIMindtree (India), AVL (Austria), Happiest Minds (India), TVSnext (US), Mphasis (India), Tech Mahindra (India), Cybage Software (India), Innominds (US), Infosys (India), SynergyTop (US), EPAM Systems (US), Brillio (US), GlobalLogic (US), Tata Consultancy Services (India), Nous Infosystems (India), Trigent Software (US), and Aspire Systems (India)

The report also helps stakeholders understand the pulse of the product engineering services market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 MARKET ESTIMATION APPROACHES

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN PRODUCT ENGINEERING SERVICES MARKET

- 4.2 PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2025 VS 2030

- 4.3 PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE, 2025 VS 2030

- 4.4 PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE, 2025 VS 2030

- 4.5 PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL, 2025 VS 2030

- 4.6 PRODUCT ENGINEERING SERVICES MARKET: REGIONAL SCENARIO

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Demand for accelerated TTM

- 5.2.1.2 Need for continuous innovation and iteration

- 5.2.1.3 Automotive sector growth

- 5.2.1.4 Requirements for legacy application modernization

- 5.2.2 RESTRAINTS

- 5.2.2.1 Toolchain bloat and DevOps sprawl reducing team efficiency

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing number of smart city projects

- 5.2.3.2 Increase in semiconductor and embedded systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of robust feedback loops and continuous management

- 5.2.4.2 Fragmented technology ecosystems

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 E-COMMERCE PLATFORM MODERNIZATION FOR LEADING ATHLEISURE BRAND

- 5.3.2 HOW SNACK EMPIRE STAYS VIBRANT

- 5.3.3 HIGH-PERFORMANCE DATA ARCHITECTURE FOR GLOBAL OPERATIONS

- 5.3.4 SOC PHYSICAL DESIGN IMPLEMENTATION IN TSMC 5NM FOR AMERICAN FABLESS SEMICONDUCTOR FIRM

- 5.3.5 SILICON & PLATFORM ENGINEERING FOR V2X SOC OF KEY AUTOMOTIVE SEMICONDUCTOR SOLUTIONS SUPPLIER

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF SERVICE PROVIDERS, BY REGION

- 5.6.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY SERVICE

- 5.7 PATENT ANALYSIS

- 5.7.1 LIST OF MAJOR PATENTS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Embedded systems

- 5.8.1.2 IoT engineering

- 5.8.1.3 Cloud-native product engineering

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 AI/ML integration

- 5.8.2.2 5G & edge integration

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Digital twins

- 5.8.3.2 Robotics engineering

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATIONS, BY REGION

- 5.9.2.1 North America

- 5.9.2.2 Europe

- 5.9.2.3 Asia Pacific

- 5.9.2.4 Middle East & Africa

- 5.9.2.5 Latin America

- 5.9.3 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.9.3.1 General Data Protection Regulation

- 5.9.3.2 SEC Rule 17a-4

- 5.9.3.3 ISO/IEC 27001

- 5.9.3.4 System and Organization Controls 2 Type II

- 5.9.3.5 Financial Industry Regulatory Authority

- 5.9.3.6 Freedom of Information Act

- 5.9.3.7 Health Insurance Portability and Accountability Act

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 BUSINESS MODEL ANALYSIS

- 5.14.1 TIME AND MATERIAL (T&M) MODEL

- 5.14.2 FIXED PRICE MODEL

- 5.14.3 DEDICATED TEAM/OFFSHORE DEVELOPMENT CENTER (ODC)

- 5.14.4 OUTCOME-BASED MODEL

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 IMPACT OF AI/GENERATIVE AI ON PRODUCT ENGINEERING SERVICES MARKET

- 5.16.1 CASE STUDY

- 5.16.1.1 GenAI-powered operations ensure seamless service for millions of subscribers

- 5.16.2 VENDOR INITIATIVE

- 5.16.2.1 Capgemini

- 5.16.2.2 EPAM Systems

- 5.16.1 CASE STUDY

- 5.17 IMPACT OF 2025 US TARIFF - PRODUCT ENGINEERING SERVICES MARKET

- 5.17.1 INTRODUCTION

- 5.17.1.1 Key tariff rates

- 5.17.1.2 Price impact analysis

- 5.17.1 INTRODUCTION

- 5.18 IMPACT ON REGION

- 5.18.1 NORTH AMERICA

- 5.18.1.1 US

- 5.18.1.2 Canada

- 5.18.1.3 Mexico

- 5.18.2 EUROPE

- 5.18.2.1 Germany

- 5.18.2.2 France

- 5.18.3 ASIA PACIFIC

- 5.18.3.1 China

- 5.18.3.2 India

- 5.18.3.3 Australia

- 5.18.1 NORTH AMERICA

6 PRODUCT ENGINEERING SERVICES MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- 6.1.1 SERVICE TYPE: PRODUCT ENGINEERING SERVICES MARKET DRIVERS

- 6.2 PRODUCT DESIGN & PROTOTYPING

- 6.2.1 STRUCTURING EARLY-STAGE DEVELOPMENT THROUGH PRODUCT DESIGN AND PROTOTYPING

- 6.2.2 CONCEPT & IDEATION

- 6.2.3 UX/UI & INDUSTRIAL DESIGN

- 6.2.4 OTHERS (MBSE, DESIGN FOR MANUFACTURABILITY (DFM)/DESIGN FOR TESTABILITY (DFT))

- 6.3 PRODUCT DEVELOPMENT

- 6.3.1 ACCELERATING TIME-TO-MARKET THROUGH INTEGRATED ENGINEERING SOLUTIONS

- 6.3.2 SOFTWARE PRODUCT DEVELOPMENT

- 6.3.3 HARDWARE & EMBEDDED SYSTEMS DEVELOPMENT

- 6.3.4 PROTOTYPING & MVP DEVELOPMENT

- 6.3.5 INTEGRATION & INTERFACE DEVELOPMENT

- 6.4 TESTING & QUALITY ASSURANCE (QA)

- 6.4.1 ENSURING PRODUCT RELIABILITY THROUGH COMPREHENSIVE QUALITY VALIDATION

- 6.4.2 FUNCTIONAL & NON-FUNCTIONAL TESTING

- 6.4.3 TEST AUTOMATION

- 6.4.4 COMPLIANCE & CERTIFICATION

- 6.4.5 VALIDATION & VERIFICATION (V&V)

- 6.5 PRODUCT MODERNIZATION & INTEGRATION

- 6.5.1 TRANSFORMING LEGACY PRODUCTS INTO FUTURE-READY SOLUTIONS

- 6.5.2 LEGACY SYSTEM MIGRATION

- 6.5.3 PLATFORM RE-PLATFORMING

- 6.5.4 ARCHITECTURAL OVERHAUL

- 6.5.5 TECHNICAL DEBT REDUCTION

- 6.6 PROCESS ENGINEERING

- 6.6.1 OPTIMIZING MANUFACTURING EFFICIENCY THROUGH SYSTEMATIC PROCESS INNOVATION

- 6.6.2 MANUFACTURING ENGINEERING SUPPORT

- 6.6.3 KBE (KNOWLEDGE-BASED ENGINEERING)

- 6.6.4 MAINTENANCE, REPAIR & OPERATIONS (MRO)

- 6.7 REVERSE ENGINEERING

- 6.7.1 COMPREHENSIVE COMPONENT ANALYSIS AND RECREATION

- 6.7.2 3D SCANNING

- 6.7.3 APPLICATION MODERNIZATION & MIGRATION

- 6.7.4 OTHERS

- 6.8 PRODUCT SUSTENANCE & SUPPORT

- 6.8.1 ENSURING LONG-TERM PRODUCT VALUE THROUGH SUSTENANCE AND SUPPORT

- 6.8.2 BUG FIXING & MAINTENANCE

- 6.8.3 PERFORMANCE OPTIMIZATION & MONITORING

- 6.8.4 FEATURE ENHANCEMENTS & UPGRADES

- 6.8.5 SECURITY UPDATES & COMPLIANCE

- 6.8.6 DEVOPS & MLOPS SUPPORT

7 PRODUCT ENGINEERING SERVICES MARKET, BY DELIVERY MODE

- 7.1 INTRODUCTION

- 7.1.1 DELIVERY MODE: PRODUCT ENGINEERING SERVICES MARKET DRIVERS

- 7.2 ONSHORE

- 7.2.1 MAXIMIZING PES VALUE THROUGH STRATEGIC ONSHORE DELIVERY EXCELLENCE

- 7.3 OFFSHORE

- 7.3.1 SCALING GLOBAL EXECUTION WITH OFFSHORE ENGINEERING HUBS

- 7.4 NEARSHORE

- 7.4.1 BALANCING COST AND COLLABORATION WITH NEARSHORE ENGINEERING DELIVERY

- 7.5 HYBRID

- 7.5.1 MAXIMIZING DELIVERY FLEXIBILITY THROUGH HYBRID ENGINEERING MODELS

8 PRODUCT ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZE: PRODUCT ENGINEERING SERVICES MARKET DRIVERS

- 8.2 LARGE ENTERPRISES

- 8.2.1 EMPOWERING COMPLEX ENGINEERING PROGRAMS FOR LARGE ENTERPRISES

- 8.3 SMES

- 8.3.1 ACCELERATING AGILE INNOVATION FOR SMES IN PRODUCT ENGINEERING

9 PRODUCT ENGINEERING SERVICES MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICAL: PRODUCT ENGINEERING SERVICES MARKET DRIVERS

- 9.2 INDUSTRIAL MANUFACTURING

- 9.2.1 DRIVING OPERATIONAL EFFICIENCY AND SMART INNOVATION IN INDUSTRIAL MANUFACTURING

- 9.2.2 INDUSTRIAL MANUFACTURING: USE CASES

- 9.2.2.1 Industry 4.0

- 9.2.2.2 IoT for smart factories

- 9.2.2.3 Digital twins

- 9.2.2.4 Others (PLC & HMI development, predictive maintenance solutions)

- 9.3 AUTOMOTIVE & TRANSPORTATION

- 9.3.1 ELECTRIFICATION AND SMART MOBILITY SOLUTIONS FOR SUSTAINABLE TRANSPORTATION

- 9.3.2 AUTOMOTIVE & TRANSPORTATION: USE CASES

- 9.3.2.1 Connected cars

- 9.3.2.2 ADAS

- 9.3.2.3 Infotainment

- 9.3.2.4 Others (Battery management systems (BMS), Over-the-Air (OTA) updates, vehicle diagnostics & telematics)

- 9.4 HEALTHCARE & LIFE SCIENCES

- 9.4.1 ENABLING INTELLIGENT, COMPLIANT HEALTHCARE SYSTEMS

- 9.4.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 9.4.2.1 Medical devices

- 9.4.2.2 E-health platforms

- 9.4.2.3 Telemedicine

- 9.4.2.4 Others (remote monitoring, workflow automation)

- 9.5 AEROSPACE & DEFENSE

- 9.5.1 PRECISION ENGINEERING FOR HIGH-STAKES AEROSPACE & DEFENSE SYSTEMS

- 9.5.2 AEROSPACE & DEFENSE: USE CASES

- 9.5.2.1 Avionics

- 9.5.2.2 Defense systems

- 9.5.2.3 Simulation and training

- 9.5.2.4 Others (UAS development, satellite communication systems)

- 9.6 SEMICONDUCTOR & ELECTRONICS

- 9.6.1 ENABLING SMARTER, FASTER, HIGH-DENSITY ELECTRONICS

- 9.6.2 SEMICONDUCTOR & ELECTRONICS: USE CASES

- 9.6.2.1 Chip design & development

- 9.6.2.2 Embedded systems & firmware engineering

- 9.6.2.3 Testing & validation (DFT, DFM, DFT)

- 9.6.2.4 Others (hardware board design, EDA toolchain automation, smart device engineering)

- 9.7 IT & TELECOM

- 9.7.1 ENGINEERING INTELLIGENT CONNECTIVITY FOR DIGITAL ERA

- 9.7.2 IT & TELECOM: USE CASES

- 9.7.2.1 Network function virtualization (NFV) & SDN product development

- 9.7.2.2 5G infrastructure enablement

- 9.7.2.3 Others (OSS/BSS platform modernization, cloud-native SaaS platform development, telecom hardware & embedded systems design)

- 9.8 BFSI

- 9.8.1 BUILDING SECURE AND SCALABLE PLATFORMS FOR FINANCIAL OPERATIONS

- 9.8.2 BFSI: USE CASES

- 9.8.2.1 Fintech solutions

- 9.8.2.2 Digital banking

- 9.8.2.3 Trading platforms

- 9.8.2.4 Others (Insurtech, Regtech tools)

- 9.9 RETAIL & E-COMMERCE

- 9.9.1 PRODUCT ENGINEERING FOR SEAMLESS RETAIL JOURNEYS

- 9.9.2 RETAIL & E-COMMERCE: USE CASES

- 9.9.2.1 Digital commerce platforms

- 9.9.2.2 Personalized shopping experiences

- 9.9.2.3 Others (Retail analytics, in-store automation)

- 9.10 ENERGY & UTILITIES

- 9.10.1 ENGINEERING RESILIENT AND INTELLIGENT ENERGY & UTILITY SYSTEMS FOR MODERN GRIDS

- 9.10.2 ENERGY & UTILITIES: USE CASES

- 9.10.2.1 Smart grid solutions

- 9.10.2.2 Scada systems engineering

- 9.10.2.3 Others (renewable energy management platforms, field service & mobility solutions)

- 9.11 OTHER VERTICALS

10 PRODUCT ENGINEERING SERVICES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.3.1 Enhancing engineering precision and speed with generative AI

- 10.2.4 CANADA

- 10.2.4.1 Government-funded network to drive market

- 10.3 EUROPE

- 10.3.1 EUROPE: MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.3.1 Use of 5G to increase factory output to advance Industry 4.0

- 10.3.4 GERMANY

- 10.3.4.1 Mittelstand-Digital Initiative creating networks between stakeholders

- 10.3.5 FRANCE

- 10.3.5.1 Major producer of professional electronics

- 10.3.6 ITALY

- 10.3.6.1 Leveraging public R&D investments to drive engineering innovation

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.3.1 NEV revolutionizing product engineering

- 10.4.4 JAPAN

- 10.4.4.1 Prominent manufacturing sector and auto parts suppliers

- 10.4.5 INDIA

- 10.4.5.1 Accelerating product engineering growth with innovation and government support

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 GULF COOPERATION COUNCIL (GCC)

- 10.5.3.1 UAE

- 10.5.3.1.1 Rising popularity of SCADA in construction industry

- 10.5.3.2 Saudi Arabia

- 10.5.3.2.1 Strong economy to drive technology manufacturing growth

- 10.5.3.3 Rest of GCC

- 10.5.3.3.1 Unlocking regional potential with agile product development

- 10.5.3.1 UAE

- 10.5.4 SOUTH AFRICA

- 10.5.4.1 Resurgence of tech workforce and push for industrial innovation

- 10.5.5 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: MARKET DRIVERS

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.3.1 Elevating product engineering through innovation in aerospace and maritime

- 10.6.4 MEXICO

- 10.6.4.1 Rising investment in R&D and technology-driven manufacturing

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Service type footprint

- 11.5.5.4 Vertical footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of startups/SMEs

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7.1 COMPANY VALUATION

- 11.7.2 FINANCIAL METRICS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.8.1 IBM (PRODUCT DESIGN & ENGINEERING SERVICES)

- 11.8.2 HCL TECHNOLOGIES (PRODUCT ENGINEERING SERVICES)

- 11.8.3 COGNIZANT (SOFTWARE ENGINEERING SERVICES)

- 11.8.4 CAPGEMINI (SOFTWARE PRODUCT ENGINEERING)

- 11.8.5 ALTEN GROUP (SOFTWARE ENGINEERING SERVICES)

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES AND ENHANCEMENT

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 MAJOR PLAYERS

- 12.2.1 ACCENTURE

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Right to win

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 CAPGEMINI

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches and enhancements

- 12.2.2.3.2 Deals

- 12.2.2.3.3 Expansions

- 12.2.2.4 MnM view

- 12.2.2.4.1 Right to win

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses and competitive threats

- 12.2.3 TCS

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product launches and enhancements

- 12.2.3.3.2 Deals

- 12.2.3.4 MnM view

- 12.2.3.4.1 Right to win

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 COGNIZANT

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Product launches and enhancements

- 12.2.4.3.2 Deals

- 12.2.4.4 MnM view

- 12.2.4.4.1 Right to win

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 HCL TECHNOLOGIES

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Product launches and enhancements

- 12.2.5.3.2 Deals

- 12.2.5.4 MnM view

- 12.2.5.4.1 Right to win

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 IBM

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Product launches and enhancements

- 12.2.6.3.2 Deals

- 12.2.7 WIPRO

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.7.3 Recent developments

- 12.2.7.3.1 Deals

- 12.2.7.3.2 Expansions

- 12.2.8 ALTEN GROUP

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Deals

- 12.2.9 LTIMINDTREE

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Solutions/Services offered

- 12.2.9.3 Recent developments

- 12.2.9.3.1 Product launches and enhancements

- 12.2.9.3.2 Deals

- 12.2.9.3.3 Expansions

- 12.2.10 AVL

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Solutions/Services offered

- 12.2.10.3 Recent developments

- 12.2.10.3.1 Deals

- 12.2.1 ACCENTURE

- 12.3 OTHER PLAYERS

- 12.3.1 HAPPIEST MINDS

- 12.3.2 NEST DIGITAL

- 12.3.3 TVS NEXT

- 12.3.4 MPHASIS

- 12.3.5 NOUS INFOSYSTEMS

- 12.3.6 EPAM SYSTEMS

- 12.3.7 TECH MAHINDRA

- 12.3.8 TRIGENT SOFTWARE

- 12.3.9 SEGULA TECHNOLOGIES

- 12.3.10 SYSVINE TECHNOLOGIES

- 12.3.11 ASPIRE SYSTEMS

- 12.3.12 BRILLIO

- 12.3.13 CYBAGE

- 12.3.14 GLOBALLOGIC

- 12.3.15 GLOBANT

- 12.3.16 HARMAN

- 12.3.17 INNOMINDS

- 12.3.18 PERSISTENT SYSTEMS

- 12.3.19 SONATA SOFTWARE

- 12.3.20 UST

- 12.3.21 TO THE NEW

- 12.3.22 INFOSYS

- 12.3.23 DAFFODIL SOFTWARE

- 12.3.24 BLUE COPPER TECHNOLOGIES

- 12.3.25 SYNERGYTOP

- 12.3.26 THOUGHT&FUNCTION

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.1.1 RELATED MARKETS

- 13.1.2 LIMITATIONS

- 13.2 SIMULATION SOFTWARE MARKET

- 13.3 IOT ENGINEERING SERVICES MARKET

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS