|

|

市場調査レポート

商品コード

1771285

データ統合の世界市場:オファリング別、データタイプ別、用途別、ビジネス機能別、エンドユーザー別、地域別 - 2030年までの予測Data Integration Market by Software (Data Integration Platforms, iPaaS, Streaming Integration Tools), Data Type (Structured, Unstructured, Semi-structured), Application (Data Warehousing & BI, Data Lakes & Big Data Management) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| データ統合の世界市場:オファリング別、データタイプ別、用途別、ビジネス機能別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月09日

発行: MarketsandMarkets

ページ情報: 英文 385 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

データ統合の市場規模は、2025年の175億8,000万米ドルから2030年には332億4,000万米ドルに成長し、2025年から2030年までのCAGRは13.6%と予測されています。

同市場は、ベンダーがヘルスケア、小売、BFSIなどの分野での展開を簡素化する業界特化型の構築済みテンプレートを提供することで、力強い成長を遂げています。また、社内外の市場を通じてデータを収益化・共有しようとする企業が増える中、拡張性の高い統合プラットフォームが不可欠となっています。しかし市場は、高頻度・低遅延データの処理性能が低いなどの課題に直面しており、IoTや金融などの分野での使用事例が限られています。また、ビジネスニーズとIT実行の間に断絶があり、遅延や俊敏性の低下を引き起こしていることも重要な障壁となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント | オファリング別、データタイプ別、用途別、ビジネス機能別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

データ統合市場内のサービスセグメントは、企業のデータ環境の複雑化と、統合ソリューションの導入、管理、最適化における専門家の指導の必要性により、予測期間中に最も高いCAGRを記録すると予想されます。ハイブリッドやマルチクラウド戦略を採用する企業が増加する中、多様なプラットフォーム間のシームレスな統合を管理するための専門知識が社内に不足していることが多く、コンサルティング、実装、統合設計などの専門サービスが重要な役割を果たしています。これらのサービスは、企業が価値実現までの時間を短縮し、ベストプラクティスを確保し、統合アーキテクチャをビジネス目標に整合させるのに役立ちます。同時に、データパイプラインの維持・監視にかかる日々の運用負担を軽減しようとする企業の動きから、マネージドサービスの需要も高まっています。マネージド・サービス・プロバイダーは、継続的なサポート、パフォーマンス・チューニング、問題解決、セキュリティ・コンプライアンスを提供するため、社内のITチームは中核となるイノベーションに集中できます。さらに、専任の統合チームを持たない中堅・中小企業では、多額の先行投資をせずに統合作業を拡張できるサービス・プロバイダーを利用するケースが増えています。テクノロジー、データ規制、統合ツールの急速な変化に伴い、企業が適応し、競争力を維持する上で、サービス分野の重要性はさらに高まっています。これらの要因が相まって、プロフェッショナルサービスとマネージドサービスは、データ統合市場における今後数年間の重要な成長要因となっています。

非構造化データセグメントは、電子メール、ソーシャルメディア、文書、動画、画像、センサーデータから生成されるデータの急速な増加によるところが大きく、予測期間中、データ統合市場で最大のシェアを占めると予想されます。行や列に整然と収まる構造化データとは異なり、非構造化データはより複雑で多様であるため、処理や分析が難しくなります。しかし、非構造化データには貴重な洞察が含まれており、企業はより良い意思決定、顧客理解、イノベーションのためにこれを活用したいと考えています。デジタルコミュニケーション、リモートワーク、ユーザー生成コンテンツの台頭により、業界全体で非構造化データが爆発的に増加しています。組織がAI、機械学習、高度な分析への投資を増やすにつれ、非構造化データを統合データ環境に統合することが重要になっています。最新のデータ統合プラットフォームは現在、自然言語処理(NLP)、画像認識、メタデータ・タグ付けなどの機能を提供し、非構造化データに構造を持たせ、ビジネス・インテリジェンスに利用できるようにしています。ヘルスケア、BFSI、メディア、eコマースなどの分野では、顧客行動の分析、リスクの評価、不正行為の検出、患者の転帰の改善などのために、非構造化データに大きく依存しています。その結果、非構造化データを大規模に管理・統合する必要性が最重要課題となっており、この分野は市場全体の成長に最も貢献する分野となっています。

データ統合市場は強い地域変動を示しており、北米が最大の市場シェアを占め、アジア太平洋が予測期間中に最も高いCAGRを記録すると予測されています。北米が市場をリードしている背景には、先進技術の早期導入、成熟したITインフラ、IBM、Oracle、Informatica、Microsoft、Talendといった主要データ統合ベンダーの強力なプレゼンスがあります。米国とカナダの各業界の企業は、ハイブリッド・クラウド戦略、AI、アナリティクス、カスタマー・エクスペリエンス・プラットフォームに積極的に投資しており、これらはすべて堅牢なデータ統合を必要とします。さらに、この地域にはBFSI、ヘルスケア、小売などデータ集約的なセクターが集中しており、リアルタイムかつセキュアなデータ統合ソリューションへの需要がさらに高まっています。さらに、HIPAA、SOX、CCPAなどの規制フレームワークが、強力なデータガバナンスと追跡可能なデータパイプラインの実装を企業に促しており、高度なコンプライアンス機能を備えた統合プラットフォームの市場成長を後押ししています。

一方、アジア太平洋は、デジタルトランスフォーメーションへの取り組みの増加、クラウド導入の増加、インド、中国、インドネシア、ベトナムなどの新興経済圏におけるIT支出の拡大により、急成長を遂げています。この地域の多くの企業は、レガシーシステムから最新のデータアーキテクチャへの移行を進めており、新旧システムの橋渡しをする統合サービスへの強い需要を生み出しています。データのローカライゼーション、スマートシティ、デジタル金融を推進する政府主導の取り組みも、統合されたリアルタイムのデータインフラに対するニーズを後押ししています。さらに、地域企業が顧客中心の戦略とアナリティクス主導の意思決定に重点を置くようになるにつれ、データ統合は基盤となる能力となっています。アジア太平洋地域では、SaaS、IoT、モバイルアプリケーションの導入が拡大しており、拡張性の高いクラウドネイティブな統合プラットフォームのニーズが高まっています。その結果、北米が現在の採用でリードしている一方で、アジア太平洋地域は今後数年間で最も急成長する地域市場になると見られています。

当レポートでは、世界のデータ統合市場について調査し、オファリング別、データタイプ別、用途別、ビジネス機能別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 生成AIがデータ統合市場に与える影響

- データ統合の進化

- サプライチェーン分析

- エコシステム分析

- 2025年の米国関税の影響- データ統合市場

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 技術分析

- 規制状況

- 特許分析

- 価格分析

- 主要な会議とイベント

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 顧客ビジネスに影響を与える動向/混乱

第6章 データ統合市場(オファリング別)

- イントロダクション

- ソフトウェア

- サービス

第7章 データ統合市場(データタイプ別)

- イントロダクション

- 構造化データ統合

- 非構造化データ統合

- 半構造化データ統合

第8章 データ統合市場(用途別)

- イントロダクション

- データウェアハウスとビジネスインテリジェンス

- データレイクとビッグデータ管理

- リアルタイムデータ統合

- 顧客360ビューとMDM

- その他

第9章 データ統合市場(ビジネス機能別)

- イントロダクション

- 販売

- マーケティング

- 財務・会計

- IT

- 人事

- その他

第10章 データ統合市場(エンドユーザー別)

- イントロダクション

- BFSI

- 電気通信

- 政府・防衛

- ヘルスケア・ライフサイエンス

- 製造

- 小売・eコマース

- ソフトウェア・テクノロジープロバイダー

- 運輸・物流

- エネルギー・公益事業

- メディア・エンターテインメント

- その他

第11章 データ統合市場(地域別)

- イントロダクション

- 北米

- 北米:データ統合市場促進要因

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:データ統合市場促進要因

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- オランダ

- その他

- アジア太平洋

- アジア太平洋:データ統合市場促進要因

- アジア太平洋:マクロ経済見通し

- 中国

- インド

- 日本

- 韓国

- シンガポール

- オーストラリアとニュージーランド

- その他

- 中東・アフリカ

- 中東・アフリカ:データ統合市場促進要因

- 中東・アフリカ:マクロ経済見通し

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- カタール

- トルコ

- その他

- ラテンアメリカ

- ラテンアメリカ:データ統合市場促進要因

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略、2020~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 製品比較分析

- 主要ベンダーの企業評価と財務指標

- 企業評価マトリックス:主要参入企業

- 企業評価マトリックス:スタートアップ企業/中小企業

- 競合シナリオ

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- IBM

- SAP

- ORACLE

- MICROSOFT

- SAS INSTITUTE

- AWS

- SALESFORCE

- INFORMATICA

- PRECISELY

- TIBCO

- QLIK

- BOOMI

- FIVETRAN

- PALANTIR TECHNOLOGIES

- WORKATO

- ALTERYX

- TALEND

- HUAWEI

- CONFLUENT

- スタートアップ企業/中小企業のプロファイル

- DENODO

- SNAPLOGIC

- JITTERBIT

- ACTIAN

- CELIGO

- DCKAP

- SAFE SOFTWARE

- MATILLION

- K2VIEW

- NEXLA

- EXALATE

- INTEGRATELY

- LONTI

- DEVART

- TRAY.IO

- HEVO DATA

- SEMARCHY

- CDATA SOFTWARE

- DREMIO

- STRIIM

- PROPHECY

- ZIGIWAVE

- ADEPTIA

- FLOWGEAR

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2020-2024

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 GLOBAL DATA INTEGRATION MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 5 GLOBAL DATA INTEGRATION MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 6 DATA INTEGRATION MARKET: ECOSYSTEM

- TABLE 7 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PATENTS FILED, 2016-2025

- TABLE 14 LIST OF FEW PATENTS IN DATA INTEGRATION MARKET, 2024-2025

- TABLE 15 AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

- TABLE 16 AVERAGE SELLING PRICE, BY APPLICATION, 2025

- TABLE 17 DATA INTEGRATION MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 IMPACT OF PORTER'S FIVE FORCES ON DATA INTEGRATION MARKET

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISE END USERS

- TABLE 20 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISE END USERS

- TABLE 21 DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 22 DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

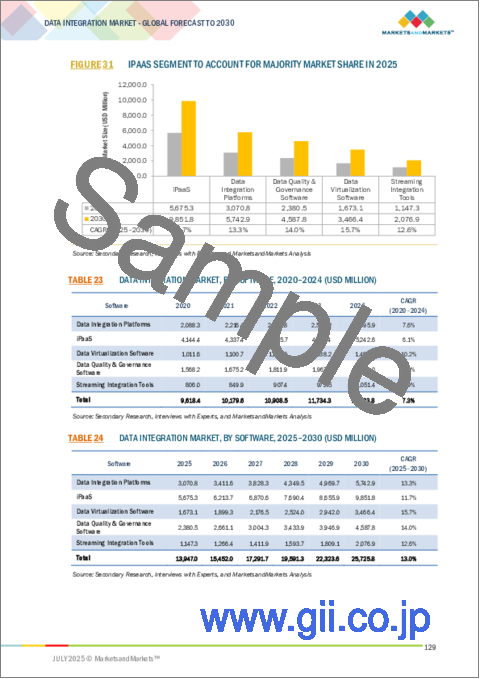

- TABLE 23 DATA INTEGRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 24 DATA INTEGRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 25 DATA INTEGRATION MARKET, BY DATA INTEGRATION PLATFORM, 2020-2024 (USD MILLION)

- TABLE 26 DATA INTEGRATION MARKET, BY DATA INTEGRATION PLATFORM, 2025-2030 (USD MILLION)

- TABLE 27 ETL/ELT ENGINES: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 ETL/ELT ENGINES: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 CDC: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 CDC: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 DATA REPLICATION: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 DATA REPLICATION: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 DATA TRANSFORMATION: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 DATA TRANSFORMATION: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 DATA INTEGRATION MARKET, BY IPAAS, 2020-2024 (USD MILLION)

- TABLE 36 DATA INTEGRATION MARKET, BY IPAAS, 2025-2030 (USD MILLION)

- TABLE 37 CLOUD/SAAS-NATIVE INTEGRATIONS: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 CLOUD/SAAS-NATIVE INTEGRATIONS: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 WORKFLOW AUTOMATION: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 WORKFLOW AUTOMATION: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 DATA VIRTUALIZATION SOFTWARE: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 DATA VIRTUALIZATION SOFTWARE: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 DATA INTEGRATION MARKET, BY DATA QUALITY & GOVERNANCE SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 44 DATA INTEGRATION MARKET, BY DATA QUALITY & GOVERNANCE SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 45 METADATA MANAGEMENT: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 METADATA MANAGEMENT: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 DATA QUALITY & GOVERNANCE SOFTWARE: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 DATA QUALITY & GOVERNANCE SOFTWARE: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 COMPLIANCE ENFORCEMENT: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 COMPLIANCE ENFORCEMENT: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 DATA INTEGRATION MARKET, BY STREAMING INTEGRATION TOOL, 2020-2024 (USD MILLION)

- TABLE 52 DATA INTEGRATION MARKET, BY STREAMING INTEGRATION TOOL, 2025-2030 (USD MILLION)

- TABLE 53 EVENT BROKERS: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 EVENT BROKERS: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 STREAM PROCESSING: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 STREAM PROCESSING: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 IOT & EDGE PIPELINES: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 IOT & EDGE PIPELINES: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 DATA INTEGRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 60 DATA INTEGRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 61 SERVICES: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 SERVICES: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 DATA INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 64 DATA INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 65 CONSULTING SERVICES: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 CONSULTING SERVICES: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 IMPLEMENTATION SERVICES: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 IMPLEMENTATION SERVICES: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 SUPPORT SERVICES: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 SUPPORT SERVICES: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 MANAGED SERVICES: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 MANAGED SERVICES: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 DATA INTEGRATION MARKET, BY DATA TYPE, 2020-2024 (USD MILLION)

- TABLE 74 DATA INTEGRATION MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 75 STRUCTURED DATA INTEGRATION: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 STRUCTURED DATA INTEGRATION: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 UNSTRUCTURED DATA INTEGRATION: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 UNSTRUCTURED DATA INTEGRATION: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 SEMI-STRUCTURED DATA INTEGRATION: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 SEMI-STRUCTURED DATA INTEGRATION: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 DATA INTEGRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 82 DATA INTEGRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83 DATA WAREHOUSING AND BUSINESS INTELLIGENCE: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 84 DATA WAREHOUSING AND BUSINESS INTELLIGENCE: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 DATA LAKES AND BIG DATA MANAGEMENT: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 86 DATA LAKES AND BIG DATA MANAGEMENT: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 REAL-TIME DATA INTEGRATION: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 88 REAL-TIME DATA INTEGRATION: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 CUSTOMER 360 VIEW AND MDM: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 CUSTOMER 360 VIEW AND MDM: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 OTHER APPLICATIONS: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 OTHER APPLICATIONS: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 DATA INTEGRATION MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD MILLION)

- TABLE 94 DATA INTEGRATION MARKET, BY BUSINESS FUNCTION, 2025-2030 (USD MILLION)

- TABLE 95 SALES: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 96 SALES: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 MARKETING: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 98 MARKETING: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 FINANCE & ACCOUNTING: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 100 FINANCE & ACCOUNTING: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 IT: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 102 IT: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 HUMAN RESOURCES: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 104 HUMAN RESOURCES: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 OTHER BUSINESS FUNCTIONS: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 106 OTHER BUSINESS FUNCTIONS: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 DATA INTEGRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 108 DATA INTEGRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 109 BFSI: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 110 BFSI: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 TELECOMMUNICATIONS: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 112 TELECOMMUNICATIONS: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 GOVERNMENT & DEFENSE: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 114 GOVERNMENT & DEFENSE: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 HEALTHCARE & LIFE SCIENCES: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 116 HEALTHCARE & LIFE SCIENCES: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 MANUFACTURING: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 118 MANUFACTURING: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 RETAIL & E-COMMERCE: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 120 RETAIL & E-COMMERCE: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 SOFTWARE & TECHNOLOGY PROVIDERS: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 122 SOFTWARE & TECHNOLOGY PROVIDERS: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 TRANSPORTATION & LOGISTICS: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 124 TRANSPORTATION & LOGISTICS: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125 ENERGY AND UTILITIES: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 126 ENERGY AND UTILITIES: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 MEDIA & ENTERTAINMENT: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 128 MEDIA & ENTERTAINMENT: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129 OTHER END USERS: DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 130 OTHER END USERS: DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 131 DATA INTEGRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 132 DATA INTEGRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133 NORTH AMERICA: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 134 NORTH AMERICA: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: DATA INTEGRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 136 NORTH AMERICA: DATA INTEGRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: DATA INTEGRATION MARKET, BY DATA INTEGRATION PLATFORM, 2020-2024 (USD MILLION)

- TABLE 138 NORTH AMERICA: DATA INTEGRATION MARKET, BY DATA INTEGRATION PLATFORM, 2025-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: DATA INTEGRATION MARKET, BY IPAAS, 2020-2024 (USD MILLION)

- TABLE 140 NORTH AMERICA: DATA INTEGRATION MARKET, BY IPAAS, 2025-2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: DATA INTEGRATION MARKET, BY DATA QUALITY & GOVERNANCE, 2020-2024 (USD MILLION)

- TABLE 142 NORTH AMERICA: DATA INTEGRATION MARKET, BY DATA QUALITY & GOVERNANCE, 2025-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: DATA INTEGRATION MARKET, BY STREAMING INTEGRATION, 2020-2024 (USD MILLION)

- TABLE 144 NORTH AMERICA: DATA INTEGRATION MARKET, BY STREAMING INTEGRATION, 2025-2030 (USD MILLION)

- TABLE 145 NORTH AMERICA: DATA INTEGRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 146 NORTH AMERICA: DATA INTEGRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: DATA INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 148 NORTH AMERICA: DATA INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: DATA INTEGRATION MARKET, BY DATA TYPE, 2020-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: DATA INTEGRATION MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 151 NORTH AMERICA: DATA INTEGRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 152 NORTH AMERICA: DATA INTEGRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: DATA INTEGRATION MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD MILLION)

- TABLE 154 NORTH AMERICA: DATA INTEGRATION MARKET, BY BUSINESS FUNCTION, 2025-2030 (USD MILLION)

- TABLE 155 NORTH AMERICA: DATA INTEGRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 156 NORTH AMERICA: DATA INTEGRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 157 NORTH AMERICA: DATA INTEGRATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 158 NORTH AMERICA: DATA INTEGRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 159 US: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 160 US: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 161 CANADA: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 162 CANADA: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 163 EUROPE: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 164 EUROPE: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 165 EUROPE: DATA INTEGRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 166 EUROPE: DATA INTEGRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 167 EUROPE: DATA INTEGRATION MARKET, BY DATA INTEGRATION PLATFORM, 2020-2024 (USD MILLION)

- TABLE 168 EUROPE: DATA INTEGRATION MARKET, BY DATA INTEGRATION PLATFORM, 2025-2030 (USD MILLION)

- TABLE 169 EUROPE: DATA INTEGRATION MARKET, BY IPAAS, 2020-2024 (USD MILLION)

- TABLE 170 EUROPE: DATA INTEGRATION MARKET, BY IPAAS, 2025-2030 (USD MILLION)

- TABLE 171 EUROPE: DATA INTEGRATION MARKET, BY DATA QUALITY & GOVERNANCE, 2020-2024 (USD MILLION)

- TABLE 172 EUROPE: DATA INTEGRATION MARKET, BY DATA QUALITY & GOVERNANCE, 2025-2030 (USD MILLION)

- TABLE 173 EUROPE: DATA INTEGRATION MARKET, BY STREAMING INTEGRATION, 2020-2024 (USD MILLION)

- TABLE 174 EUROPE: DATA INTEGRATION MARKET, BY STREAMING INTEGRATION, 2025-2030 (USD MILLION)

- TABLE 175 EUROPE: DATA INTEGRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 176 EUROPE: DATA INTEGRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 177 EUROPE: DATA INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 178 EUROPE: DATA INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 179 EUROPE: DATA INTEGRATION MARKET, BY DATA TYPE, 2020-2024 (USD MILLION)

- TABLE 180 EUROPE: DATA INTEGRATION MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 181 EUROPE: DATA INTEGRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 182 EUROPE: DATA INTEGRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 183 EUROPE: DATA INTEGRATION MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD MILLION)

- TABLE 184 EUROPE: DATA INTEGRATION MARKET, BY BUSINESS FUNCTION, 2025-2030 (USD MILLION)

- TABLE 185 EUROPE: DATA INTEGRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 186 EUROPE: DATA INTEGRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 187 EUROPE: DATA INTEGRATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 188 EUROPE: DATA INTEGRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 189 UK: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 190 UK: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 191 GERMANY: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 192 GERMANY: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 193 FRANCE: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 194 FRANCE: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 195 ITALY: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 196 ITALY: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 197 SPAIN: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 198 SPAIN: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 199 NETHERLANDS: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 200 NETHERLANDS: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 201 REST OF EUROPE: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 202 REST OF EUROPE: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 203 ASIA PACIFIC: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 204 ASIA PACIFIC: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: DATA INTEGRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 206 ASIA PACIFIC: DATA INTEGRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: DATA INTEGRATION MARKET, BY DATA INTEGRATION PLATFORM, 2020-2024 (USD MILLION)

- TABLE 208 ASIA PACIFIC: DATA INTEGRATION MARKET, BY DATA INTEGRATION PLATFORM, 2025-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: DATA INTEGRATION MARKET, BY IPAAS, 2020-2024 (USD MILLION)

- TABLE 210 ASIA PACIFIC: DATA INTEGRATION MARKET, BY IPAAS, 2025-2030 (USD MILLION)

- TABLE 211 ASIA PACIFIC: DATA INTEGRATION MARKET, BY DATA QUALITY & GOVERNANCE, 2020-2024 (USD MILLION)

- TABLE 212 ASIA PACIFIC: DATA INTEGRATION MARKET, BY DATA QUALITY & GOVERNANCE, 2025-2030 (USD MILLION)

- TABLE 213 ASIA PACIFIC: DATA INTEGRATION MARKET, BY STREAMING INTEGRATION, 2020-2024 (USD MILLION)

- TABLE 214 ASIA PACIFIC: DATA INTEGRATION MARKET, BY STREAMING INTEGRATION, 2025-2030 (USD MILLION)

- TABLE 215 ASIA PACIFIC: DATA INTEGRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 216 ASIA PACIFIC: DATA INTEGRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 217 ASIA PACIFIC: DATA INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 218 ASIA PACIFIC: DATA INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 219 ASIA PACIFIC: DATA INTEGRATION MARKET, BY DATA TYPE, 2020-2024 (USD MILLION)

- TABLE 220 ASIA PACIFIC: DATA INTEGRATION MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 221 ASIA PACIFIC: DATA INTEGRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 222 ASIA PACIFIC: DATA INTEGRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 223 ASIA PACIFIC: DATA INTEGRATION MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD MILLION)

- TABLE 224 ASIA PACIFIC: DATA INTEGRATION MARKET, BY BUSINESS FUNCTION, 2025-2030 (USD MILLION)

- TABLE 225 ASIA PACIFIC: DATA INTEGRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 226 ASIA PACIFIC: DATA INTEGRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 227 ASIA PACIFIC: DATA INTEGRATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 228 ASIA PACIFIC: DATA INTEGRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 229 CHINA: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 230 CHINA: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 231 INDIA: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 232 INDIA: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 233 JAPAN: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 234 JAPAN: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 235 SOUTH KOREA: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 236 SOUTH KOREA: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 237 SINGAPORE: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 238 SINGAPORE: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 239 AUSTRALIA & NEW ZEALAND: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 240 AUSTRALIA & NEW ZEALAND: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 241 REST OF ASIA PACIFIC: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 242 REST OF ASIA PACIFIC: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY DATA INTEGRATION PLATFORM, 2020-2024 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY DATA INTEGRATION PLATFORM, 2025-2030 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY IPAAS, 2020-2024 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY IPAAS, 2025-2030 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY DATA QUALITY & GOVERNANCE, 2020-2024 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY DATA QUALITY & GOVERNANCE, 2025-2030 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY STREAMING INTEGRATION, 2020-2024 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY STREAMING INTEGRATION, 2025-2030 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 258 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY DATA TYPE, 2020-2024 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY BUSINESS FUNCTION, 2025-2030 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 268 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 269 SAUDI ARABIA: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 270 SAUDI ARABIA: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 271 UAE: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 272 UAE: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 273 SOUTH AFRICA: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 274 SOUTH AFRICA: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 275 QATAR: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 276 QATAR: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 277 TURKEY: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 278 TURKEY: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 279 REST OF MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 280 REST OF MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 281 LATIN AMERICA: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 282 LATIN AMERICA: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 283 LATIN AMERICA: DATA INTEGRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 284 LATIN AMERICA: DATA INTEGRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 285 LATIN AMERICA: DATA INTEGRATION MARKET, BY DATA INTEGRATION PLATFORM, 2020-2024 (USD MILLION)

- TABLE 286 LATIN AMERICA: DATA INTEGRATION MARKET, BY DATA INTEGRATION PLATFORM, 2025-2030 (USD MILLION)

- TABLE 287 LATIN AMERICA: DATA INTEGRATION MARKET, BY IPAAS, 2020-2024 (USD MILLION)

- TABLE 288 LATIN AMERICA: DATA INTEGRATION MARKET, BY IPAAS, 2025-2030 (USD MILLION)

- TABLE 289 LATIN AMERICA: DATA INTEGRATION MARKET, BY DATA QUALITY & GOVERNANCE, 2020-2024 (USD MILLION)

- TABLE 290 LATIN AMERICA: DATA INTEGRATION MARKET, BY DATA QUALITY & GOVERNANCE, 2025-2030 (USD MILLION)

- TABLE 291 LATIN AMERICA: DATA INTEGRATION MARKET, BY STREAMING INTEGRATION, 2020-2024 (USD MILLION)

- TABLE 292 LATIN AMERICA: DATA INTEGRATION MARKET, BY STREAMING INTEGRATION, 2025-2030 (USD MILLION)

- TABLE 293 LATIN AMERICA: DATA INTEGRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 294 LATIN AMERICA: DATA INTEGRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 295 LATIN AMERICA: DATA INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 296 LATIN AMERICA: DATA INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 297 LATIN AMERICA: DATA INTEGRATION MARKET, BY DATA TYPE, 2020-2024 (USD MILLION)

- TABLE 298 LATIN AMERICA: DATA INTEGRATION MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 299 LATIN AMERICA: DATA INTEGRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 300 LATIN AMERICA: DATA INTEGRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 301 LATIN AMERICA: DATA INTEGRATION MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD MILLION)

- TABLE 302 LATIN AMERICA: DATA INTEGRATION MARKET, BY BUSINESS FUNCTION, 2025-2030 (USD MILLION)

- TABLE 303 LATIN AMERICA: DATA INTEGRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 304 LATIN AMERICA: DATA INTEGRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 305 LATIN AMERICA: DATA INTEGRATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 306 LATIN AMERICA: DATA INTEGRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 307 BRAZIL: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 308 BRAZIL: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 309 MEXICO: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 310 MEXICO: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 311 ARGENTINA: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 312 ARGENTINA: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 313 REST OF LATIN AMERICA: DATA INTEGRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 314 REST OF LATIN AMERICA: DATA INTEGRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 315 OVERVIEW OF STRATEGIES ADOPTED BY KEY DATA INTEGRATION VENDORS, 2020-2025

- TABLE 316 DATA INTEGRATION MARKET: DEGREE OF COMPETITION

- TABLE 317 REGIONAL FOOTPRINT (20 COMPANIES), 2024

- TABLE 318 OFFERING FOOTPRINT (20 COMPANIES), 2024

- TABLE 319 APPLICATION FOOTPRINT (20 COMPANIES), 2024

- TABLE 320 END USER FOOTPRINT (20 COMPANIES), 2024

- TABLE 321 DATA INTEGRATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 322 DATA INTEGRATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 323 DATA INTEGRATION MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2021-MARCH 2024

- TABLE 324 DATA INTEGRATION MARKET: DEALS, JANUARY 2021-MARCH 2024

- TABLE 325 IBM: COMPANY OVERVIEW

- TABLE 326 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 328 IBM: DEALS

- TABLE 329 SAP: COMPANY OVERVIEW

- TABLE 330 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 SAP: PRODUCT LAUNCHES

- TABLE 332 SAP: DEALS

- TABLE 333 ORACLE: COMPANY OVERVIEW

- TABLE 334 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 336 ORACLE: DEALS

- TABLE 337 MICROSOFT: COMPANY OVERVIEW

- TABLE 338 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 MICROSOFT: PRODUCT LAUNCHES

- TABLE 340 MICROSOFT: DEALS

- TABLE 341 SAS INSTITUTE: COMPANY OVERVIEW

- TABLE 342 SAS INSTITUTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 SAS INSTITUTE: DEALS

- TABLE 344 AWS: COMPANY OVERVIEW

- TABLE 345 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 346 AWS: PRODUCT LAUNCHES

- TABLE 347 AWS: DEALS

- TABLE 348 SALESFORCE: COMPANY OVERVIEW

- TABLE 349 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 350 SALESFORCE: PRODUCT LAUNCHES

- TABLE 351 SALESFORCE: DEALS

- TABLE 352 INFORMATICA: COMPANY OVERVIEW

- TABLE 353 INFORMATICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 354 PRECISELY: COMPANY OVERVIEW

- TABLE 355 PRECISELY: PRODUCTS OFFERED

- TABLE 356 PRECISELY: DEALS

- TABLE 357 GOOGLE: COMPANY OVERVIEW

- TABLE 358 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 360 GOOGLE: DEALS

- TABLE 361 BIG DATA MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 362 BIG DATA MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 363 BIG DATA MARKET, BY BUSINESS FUNCTION, 2018-2022 (USD MILLION)

- TABLE 364 BIG DATA MARKET, BY BUSINESS FUNCTION, 2023-2028 (USD MILLION)

- TABLE 365 BIG DATA MARKET, BY DATA TYPE, 2018-2022 (USD MILLION)

- TABLE 366 BIG DATA MARKET, BY DATA TYPE, 2023-2028 (USD MILLION)

- TABLE 367 BIG DATA MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 368 BIG DATA MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 369 BIG DATA MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 370 BIG DATA MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 371 DATAOPS PLATFORM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 372 DATAOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 373 DATAOPS PLATFORM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 374 DATAOPS PLATFORM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 375 DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019-2022 (USD MILLION)

- TABLE 376 DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 377 DATAOPS PLATFORM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 378 DATAOPS PLATFORM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 379 DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 380 DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 DATA INTEGRATION MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 DATA INTEGRATION MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM SOFTWARE & SERVICES OF DATA INTEGRATION MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE & SERVICES OF DATA INTEGRATION MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE & SERVICES OF DATA INTEGRATION MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF DATA INTEGRATION THROUGH OVERALL ARTIFICIAL INTELLIGENCE SPENDING

- FIGURE 8 SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2025

- FIGURE 9 BY DATA TYPE, UNSTRUCTURED DATA INTEGRATION TO ACCOUNT FOR MAJORITY MARKET SHARE IN 2025

- FIGURE 10 BY APPLICATION, DATA WAREHOUSING & BI SLATED TO BECOME LEADING SEGMENT IN 2025

- FIGURE 11 BY BUSINESS FUNCTION, IT TO BECOME LEADING SEGMENT IN 2025

- FIGURE 12 BY END USER, HEALTHCARE & LIFE SCIENCES TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER FASTEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 14 DATA INTEGRATION BECOMING CORE ENTERPRISE PRIORITY, DRIVEN BY REAL-TIME ARCHITECTURES AND UNIFIED DATA ACROSS COMPLEX SYSTEMS

- FIGURE 15 REAL-TIME DATA INTEGRATION TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

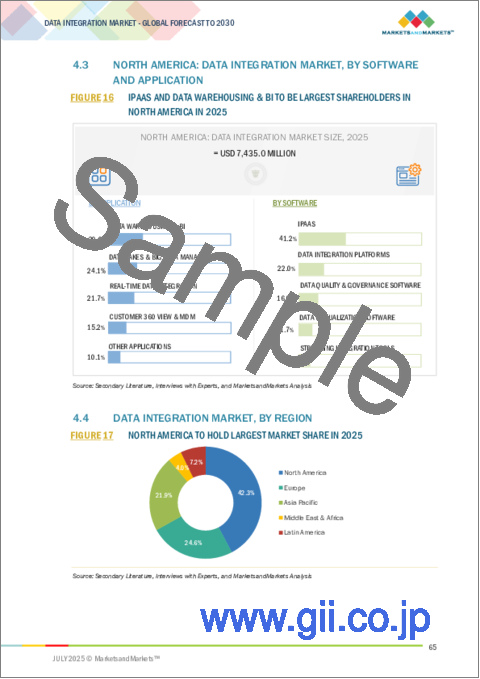

- FIGURE 16 IPAAS AND DATA WAREHOUSING & BI TO BE LARGEST SHAREHOLDERS IN NORTH AMERICA IN 2025

- FIGURE 17 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 18 DATA INTEGRATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 USE CASES OF GENERATIVE AI IN DATA INTEGRATION MARKET

- FIGURE 20 EVOLUTION OF DATA INTEGRATION

- FIGURE 21 DATA INTEGRATION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 KEY PLAYERS IN DATA INTEGRATION MARKET ECOSYSTEM

- FIGURE 23 LEADING DATA INTEGRATION STARTUPS, BY FUNDING VALUE (MILLION) AND FUNDING ROUND, UNTIL 2025

- FIGURE 24 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2016-2025

- FIGURE 25 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016-2025

- FIGURE 26 DATA INTEGRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISE END USERS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISE END USERS

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 IPAAS SEGMENT TO ACCOUNT FOR MAJORITY MARKET SHARE IN 2025

- FIGURE 32 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 UNSTRUCTURED DATA INTEGRATION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 REAL-TIME DATA INTEGRATION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 MARKETING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 HEALTHCARE & LIFE SCIENCES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 INDIA TO REGISTER HIGHEST GROWTH RATE IN DATA INTEGRATION MARKET DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: DATA INTEGRATION MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: DATA INTEGRATION MARKET SNAPSHOT

- FIGURE 41 TOP PLAYERS DOMINATED MARKET OVER LAST FIVE YEARS

- FIGURE 42 SHARE OF LEADING COMPANIES IN DATA INTEGRATION MARKET, 2024

- FIGURE 43 PRODUCT COMPARATIVE ANALYSIS OF VENDORS

- FIGURE 44 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 45 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 46 DATA INTEGRATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 OVERALL COMPANY FOOTPRINT (20 COMPANIES), 2024

- FIGURE 48 DATA INTEGRATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 IBM: COMPANY SNAPSHOT

- FIGURE 50 SAP: COMPANY SNAPSHOT

- FIGURE 51 ORACLE: COMPANY SNAPSHOT

- FIGURE 52 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 53 AWS: COMPANY SNAPSHOT

- FIGURE 54 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 55 INFORMATICA: COMPANY SNAPSHOT

- FIGURE 56 GOOGLE: COMPANY SNAPSHOT

The data integration market is projected to grow from USD 17.58 billion in 2025 to USD 33.24 billion in 2030, at a CAGR of 13.6% from 2025 to 2030. The market is witnessing strong growth as vendors offer pre-built, industry-specific templates that simplify deployment in sectors like healthcare, retail, and BFSI. Additionally, as more enterprises look to monetize and share data through internal and external marketplaces, scalable integration platforms are becoming essential. However, the market faces challenges such as poor performance in handling high-frequency, low-latency data, which limits use cases in areas like IoT and finance. Another key barrier is the disconnect between business needs and IT execution, causing delays and reduced agility.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | Offering, Data Type, Application, Business Function, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"By offering, the services segment is expected to register the fastest growth rate during the forecast period."

The services segment within the data integration market is expected to witness the highest CAGR during the forecast period, driven by the growing complexity of enterprise data environments and the need for expert guidance in deploying, managing, and optimizing integration solutions. As organizations increasingly adopt hybrid and multi-cloud strategies, they often lack in-house expertise to manage seamless integration across diverse platforms, which is where professional services such as consulting, implementation, and integration design play a critical role. These services help enterprises accelerate time-to-value, ensure best practices, and align integration architectures with business goals. At the same time, the demand for managed services is rising as companies seek to offload the day-to-day operational burden of maintaining and monitoring data pipelines. Managed service providers offer continuous support, performance tuning, issue resolution, and security compliance, allowing internal IT teams to focus on core innovation. Additionally, small and mid-sized enterprises, which may not have dedicated integration teams, are increasingly turning to service providers to scale integration efforts without heavy upfront investment. With rapid changes in technologies, data regulations, and integration tools, the services segment becomes even more important in helping organizations adapt and remain competitive. These factors combined make professional and managed services a crucial growth driver in the data integration market over the coming years.

"By data type, the unstructured data segment is expected to account for the largest market share during the forecast period."

The unstructured data segment is expected to hold the largest share of the data integration market during the forecast period, largely due to the rapid growth in data generated from emails, social media, documents, videos, images, and sensor data. Unlike structured data, which fits neatly into rows and columns, unstructured data is more complex and diverse, making it harder to process and analyze. However, it contains valuable insights that businesses are eager to tap into for better decision-making, customer understanding, and innovation. The rise of digital communication, remote work, and user-generated content has led to an explosion of unstructured data across industries. As organizations increasingly invest in AI, machine learning, and advanced analytics, integrating unstructured data into a unified data environment has become critical. Modern data integration platforms are now offering capabilities like natural language processing (NLP), image recognition, and metadata tagging to bring structure to unstructured data and make it usable for business intelligence. Sectors such as healthcare, BFSI, media, and e-commerce rely heavily on unstructured data to analyze customer behavior, assess risk, detect fraud, or improve patient outcomes. As a result, the need to manage and integrate unstructured data at scale is becoming a top priority, positioning this segment as the largest contributor to the market's overall growth.

"By Region, North America is estimated to lead the market in 2025, and Asia Pacific is slated to witness the fastest growth rate during the forecast period."

The data integration market shows strong regional variation, with North America expected to hold the largest market share and Asia Pacific projected to register the highest CAGR during the forecast period. North America's leadership in the market is driven by its early adoption of advanced technologies, mature IT infrastructure, and strong presence of key data integration vendors such as IBM, Oracle, Informatica, Microsoft, and Talend. Enterprises across industries in the US and Canada are actively investing in hybrid cloud strategies, AI, analytics, and customer experience platforms-all of which require robust data integration. Additionally, the region has a high concentration of data-intensive sectors like BFSI, healthcare, and retail, which further increases the demand for real-time and secure data integration solutions. Moreover, regulatory frameworks such as HIPAA, SOX, and CCPA push organizations to implement strong data governance and traceable data pipelines, boosting market growth for integration platforms with advanced compliance features.

In contrast, the Asia Pacific region is witnessing rapid growth due to increasing digital transformation initiatives, rising cloud adoption, and expanding IT spending across emerging economies like India, China, Indonesia, and Vietnam. Many businesses in this region are transitioning from legacy systems to modern data architectures, creating strong demand for integration services that bridge old and new systems. Government-led initiatives promoting data localization, smart cities, and digital finance are also driving the need for integrated, real-time data infrastructure. Furthermore, as regional enterprises focus more on customer-centric strategies and analytics-driven decision-making, data integration becomes a foundational capability. The growing adoption of SaaS, IoT, and mobile applications in Asia Pacific is contributing to the need for scalable, cloud-native integration platforms. As a result, while North America leads in current adoption, Asia Pacific is set to be the fastest-growing regional market in the coming years.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the data integration market.

- By Company Type: Tier I - 46%, Tier II - 33%, and Tier III - 21%

- By Designation: C-Level Executives - 36%, D-Level Executives - 41%, and others - 23%

- By Region: North America - 43%, Europe - 25%, Asia Pacific - 21%, Middle East & Africa - 4%, and Latin America - 7%

The report includes a study of key players offering data integration solutions. It profiles major vendors in the data integration market, which include IBM (US), SAP (Germany), Oracle (US), Microsoft (US), SAS Institute (US), AWS (US), Salesforce (US), Informatica (US), Talend (US), Denodo (US), Tibco (US), Google (US), Informatica (US), Huawei (China), Confluent (US), Snaplogic (US), Jitterbit (US), Qlik (US), Actian (US), Boomi (US), Celigo (US), DCKAP (US), Fivetran (US), Safe Software (Canada), Matillion (UK), K2view (Israel), Nexla (US), Palantir Technologies, Exalate (Belgium), Workato (US), Integrately (India), Lonti (Australia), Devart (US), Tray.io (US), Hevo Data (US), Semarchy (France), CData Software (US), Dremio (US), Striim (US), Prophecy (US), Alteryx (US), Zigiwave (Bulgaria), and Adeptia (US), Zapier (US), Frends (Finland), and AB Intio Software (US).

Research Coverage

This research report categorizes the data integration market by Offering (Tools and Services), Data Type (Structured Data, Unstructured Data, and Semi-structured Data), Business Function (Sales, Marketing, Finance & Accounting, IT, Human Resource, and Other Business Functions), Application (Data Warehousing & Business Intelligence, Data Lakes & Big Data Management, Real-time Data Integration, Customer 360 view & MDM, and Other Applications), End User (BFSI, Retail & E-commerce, Manufacturing, Government & Defense, Healthcare & Life Sciences, Telecommunication, Energy & Utilities, Transportation & Logistics, Software & Technology Providers, Media & Entertainment, and Other End Users), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the Data integration market. A detailed analysis of the key industry players was carried out to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the data integration market. This report covers a competitive analysis of upcoming startups in the data integration market ecosystem.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Data integration market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Surge in AI-centric Data Workloads Needing High-fidelity Input Pipelines, Rise of Data Products and Productization of Integration Pipelines, Enterprise Adoption of Data Fabric and Data Mesh Architectures, and Rise of Contextual and Event-driven Integrations), restraints (Fragmentation Between Business Domains and Centralized IT Pipelines, Performance Bottlenecks in iPaaS for High-frequency Data Loads, and Vendor Lock-in with Managed Services and Lack of Interoperability), opportunities (Industry-specific AI-integrated iPaaS Solutions, AI-generated Pipelines and Metadata-driven Pipeline Authoring, Real-time CX Orchestration in B2C Businesses, and Edge Orchestration via Containerized ETL Agents and Federated Scheduling), and challenges (Non-standardized APIs and Schema Drift in SaaS Integrations, and Lack of Unified Data Contracts Across Source Systems).

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the data integration market.

Market Development: Comprehensive information about lucrative markets - the report analyses the data integration market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the data integration market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like IBM (US), SAP (Germany), Oracle (US), Microsoft (US), SAS Institute (US), AWS (US), Salesforce (US), Informatica (US), Talend (US), Denodo (US), Tibco (US), Google (US), Informatica (US), Huawei (China), Confluent (US), Snaplogic (US), Jitterbit (US), Qlik (US), Actian (US), Boomi (US), Celigo (US), DCKAP (US), Fivetran (US), Safe Software (Canada), Matillion (UK), K2view (Israel), Nexla (US), Palantir Technologies, Exalate (Belgium), Workato (US), Integrately (India), Lonti (Australia), Devart (US), Tray.io (US), Hevo Data (US), Semarchy (France), CData Software (US), Dremio (US), Striim (US), Prophecy (US), Alteryx (US), Zigiwave (Bulgaria), and Adeptia (US), Zapier (US), Frends (Finland), and AB Intio Software (US), among others, in the data integration market. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN DATA INTEGRATION MARKET

- 4.2 DATA INTEGRATION MARKET: TOP THREE APPLICATIONS

- 4.3 NORTH AMERICA: DATA INTEGRATION MARKET, BY SOFTWARE AND APPLICATION

- 4.4 DATA INTEGRATION MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in AI-centric data workloads needing high-fidelity input pipelines

- 5.2.1.2 Rise of data products and productization of integration pipelines

- 5.2.1.3 Enterprise adoption of data fabric and data mesh architectures

- 5.2.1.4 Rise of contextual and event-driven integrations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fragmentation between business domains and centralized IT pipelines

- 5.2.2.2 Performance bottlenecks in iPaaS for high-frequency data loads

- 5.2.2.3 Vendor lock-in with managed services and lack of interoperability

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Industry-specific AI-integrated iPaaS solutions

- 5.2.3.2 AI-generated pipelines and metadata-driven pipeline authoring

- 5.2.3.3 Real-time CX orchestration in B2C businesses

- 5.2.3.4 Edge orchestration via containerized ETL agents and federated scheduling

- 5.2.4 CHALLENGES

- 5.2.4.1 Non-standardized APIs and schema drift in SaaS integrations

- 5.2.4.2 Lack of unified data contracts across source systems

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON DATA INTEGRATION MARKET

- 5.3.1 AUTOMATED SCHEMA MAPPING

- 5.3.2 INTELLIGENT TRANSFORMATION RECOMMENDATION

- 5.3.3 SEMANTIC DATA CATALOGING & DISCOVERY

- 5.3.4 AI DRIVEN DATA QUALITY & CLEANSING

- 5.3.5 AUTO GENERATED INTEGRATION CODE

- 5.3.6 CONVERSATIONAL INTEGRATION ORCHESTRATION

- 5.4 EVOLUTION OF DATA INTEGRATION

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 DATA INTEGRATION TOOLS PROVIDERS

- 5.6.2 DATA INTEGRATION SOLUTION PROVIDERS, BY APPLICATION

- 5.6.3 DATA INTEGRATION SOLUTION PROVIDERS, BY BUSINESS FUNCTION

- 5.7 IMPACT OF 2025 US TARIFF - DATA INTEGRATION MARKET

- 5.7.1 INTRODUCTION

- 5.7.2 KEY TARIFF RATES

- 5.7.3 PRICE IMPACT ANALYSIS

- 5.7.3.1 Strategic Shifts and Emerging Trends

- 5.7.4 IMPACT ON COUNTRY/REGION

- 5.7.4.1 US

- 5.7.4.1.1 Strategic Shifts and Key Observations

- 5.7.4.2 China

- 5.7.4.2.1 Strategic Shifts and Key Observations

- 5.7.4.3 Europe

- 5.7.4.3.1 Strategic Shifts and Key Observations

- 5.7.4.4 Asia Pacific (excluding China)

- 5.7.4.4.1 Strategic Shifts and Key Observations

- 5.7.4.1 US

- 5.7.5 IMPACT ON END-USE INDUSTRIES

- 5.7.5.1 BFSI

- 5.7.5.2 Telecommunications

- 5.7.5.3 Government & Public Sector

- 5.7.5.4 Healthcare & Life Sciences

- 5.7.5.5 Manufacturing

- 5.7.5.6 Media & Entertainment

- 5.7.5.7 Retail & E-commerce

- 5.7.5.8 Software & Technology Providers

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 DOMINO'S TRANSFORMED REAL-TIME GLOBAL OPERATIONS USING QLIK AND TALEND INTEGRATION

- 5.9.2 SCHNEIDER ELECTRIC ACCELERATED CITIZEN DEVELOPMENT WITH SNAPLOGIC'S LOW-CODE INTEGRATION

- 5.9.3 HOMESERVE MODERNIZED OMNICHANNEL SERVICES THROUGH API-LED CONNECTIVITY WITH MULESOFT

- 5.9.4 TE PUKENGA (MIT) STREAMLINED STUDENT OPERATIONS AND BILLING USING TALEND'S UNIFIED DATA PLATFORM

- 5.9.5 AMAZON BOOSTED SUPPLY CHAIN ANALYTICS PERFORMANCE BY ADOPTING DREMIO'S LAKEHOUSE ARCHITECTURE

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Big Data

- 5.10.1.2 Cloud Computing

- 5.10.1.3 Programmable Interfaces (APIs & Webhooks)

- 5.10.1.4 Data Streaming

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Cybersecurity & Data Privacy

- 5.10.2.2 Observability & Monitoring

- 5.10.2.3 Data Encryption & Masking

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Artificial Intelligence (AI)

- 5.10.3.2 DevOps & CI/CD Automation

- 5.10.3.3 Identity & Access Management (IAM)

- 5.10.3.4 Networking & Connectivity

- 5.10.1 KEY TECHNOLOGIES

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATIONS

- 5.11.2.1 North America

- 5.11.2.1.1 California Consumer Privacy Act (CCPA)/California Privacy Rights Act (CPRA) - United States

- 5.11.2.1.2 Virginia Consumer Data Protection Act (VCDPA) - United States

- 5.11.2.1.3 Colorado Privacy Act (CPA) - United States

- 5.11.2.1.4 Quebec Bill 64 (Law 25) - Canada

- 5.11.2.1.5 Federal Information Security Management Act (FISMA) - United States

- 5.11.2.1.6 Personal Information Protection and Electronic Documents Act (PIPEDA) - Canada

- 5.11.2.2 Europe

- 5.11.2.2.1 General Data Protection Regulation (GDPR) - European Union

- 5.11.2.2.2 UK Data Protection Act 2018 - United Kingdom

- 5.11.2.2.3 ePrivacy Directive (Cookie Law) - European Union

- 5.11.2.2.4 France's CNIL Regulation - France

- 5.11.2.2.5 Germany's Bundesdatenschutzgesetz (BDSG) - Germany

- 5.11.2.2.6 Sweden's Lag (2018:218) on Data Protection - Sweden

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 China's Personal Information Protection Law (PIPL) - China

- 5.11.2.3.2 India's Digital Personal Data Protection Act (DPDPA) - India

- 5.11.2.3.3 Singapore's Personal Data Protection Act (PDPA) - Singapore

- 5.11.2.3.4 Australia's Privacy Act 1988 - Australia

- 5.11.2.3.5 South Korea's Personal Information Protection Act (PIPA) - South Korea

- 5.11.2.3.6 Indonesia's Personal Data Protection Law (PDP Law) - Indonesia

- 5.11.2.4 Middle East & Africa

- 5.11.2.4.1 UAE Federal Data Protection Law (PDPL) - United Arab Emirates

- 5.11.2.4.2 Saudi Arabia Personal Data Protection Law (PDPL) - Saudi Arabia

- 5.11.2.4.3 Qatar Data Protection Law - Qatar

- 5.11.2.4.4 South Africa's Protection of Personal Information Act (POPIA) - South Africa

- 5.11.2.4.5 Bahrain Personal Data Protection Law - Bahrain

- 5.11.2.4.6 Kenya Data Protection Act 2019 - Kenya

- 5.11.2.5 Latin America

- 5.11.2.5.1 Brazil's General Data Protection Law (LGPD) - Brazil

- 5.11.2.5.2 Mexico's Federal Law on Protection of Personal Data Held by Private Parties (LFPDPPP) - Mexico

- 5.11.2.5.3 Argentina's Personal Data Protection Law (Law No. 25,326) - Argentina

- 5.11.2.5.4 Chile's Personal Data Protection Law (under reform) - Chile

- 5.11.2.5.5 Colombia's Law 1581 on Data Protection - Colombia

- 5.11.2.5.6 Panama's Law 81 of 2019 - Panama

- 5.11.2.1 North America

- 5.12 PATENT ANALYSIS

- 5.12.1 METHODOLOGY

- 5.12.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.12.3 INNOVATION AND PATENT APPLICATIONS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

- 5.13.2 AVERAGE SELLING PRICE, BY APPLICATION, 2025

- 5.14 KEY CONFERENCES AND EVENTS

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF SUPPLIERS

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6 DATA INTEGRATION MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 DRIVERS: DATA INTEGRATION MARKET, BY OFFERING

- 6.2 SOFTWARE

- 6.2.1 DATA INTEGRATION PLATFORMS

- 6.2.1.1 Building scalable and unified data infrastructure across systems

- 6.2.1.2 ETL/ELT Engines

- 6.2.1.3 Change Data Capture (CDC)

- 6.2.1.4 Data Replication

- 6.2.1.5 Data Transformation

- 6.2.2 INTEGRATION PLATFORM AS A SERVICE (IPAAS)

- 6.2.2.1 Simplifying integration across cloud applications and services

- 6.2.2.2 Cloud/SaaS-native Integrations

- 6.2.2.3 Workflow Automation

- 6.2.3 DATA VIRTUALIZATION SOFTWARE

- 6.2.3.1 Real-time access to distributed data without physical movement

- 6.2.4 DATA QUALITY & GOVERNANCE SOFTWARE

- 6.2.4.1 Aligning data standards with regulatory and business needs

- 6.2.4.2 Metadata Management

- 6.2.4.3 Semantic Mapping

- 6.2.4.4 Compliance Enforcement

- 6.2.5 STREAMING INTEGRATION TOOLS

- 6.2.5.1 Enabling instant data flow for time-critical business decisions

- 6.2.5.2 Event Brokers

- 6.2.5.3 Stream Processing

- 6.2.5.4 IoT & Edge Pipelines

- 6.2.1 DATA INTEGRATION PLATFORMS

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Strategic enablement for tailored integration solutions

- 6.3.1.2 Consulting Services

- 6.3.1.3 Implementation Services

- 6.3.1.4 Support Services

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 End-to-end operational ownership for continuous integration

- 6.3.1 PROFESSIONAL SERVICES

7 DATA INTEGRATION MARKET, BY DATA TYPE

- 7.1 INTRODUCTION

- 7.1.1 DRIVERS: DATA INTEGRATION MARKET, BY DATA TYPE

- 7.2 STRUCTURED DATA INTEGRATION

- 7.2.1 STREAMLINING ENTERPRISE INTELLIGENCE THROUGH STRUCTURED DATA INTEGRATION

- 7.3 UNSTRUCTURED DATA INTEGRATION

- 7.3.1 TRANSFORMING RAW DATA INTO STRATEGIC ASSETS WITH AI-DRIVEN TOOLS

- 7.4 SEMI-STRUCTURED DATA INTEGRATION

- 7.4.1 SUPPORTING REAL-TIME DECISIONS WITH SEMI-STRUCTURED DATA INTEGRATION

8 DATA INTEGRATION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 DRIVERS: DATA INTEGRATION MARKET, BY APPLICATION

- 8.2 DATA WAREHOUSING AND BUSINESS INTELLIGENCE

- 8.2.1 ACCELERATE STRATEGIC DECISION-MAKING BY IMPLEMENTING HYBRID ELT PIPELINES

- 8.3 DATA LAKES AND BIG DATA MANAGEMENT

- 8.3.1 ENABLE ADVANCED ANALYTICS AND MACHINE LEARNING EXPERIMENTS BY INTEGRATING RAW, SCHEMA-ON-READ DATA STREAMS

- 8.4 REAL-TIME DATA INTEGRATION

- 8.4.1 BUILD EVENT-DRIVEN MICROSERVICES ARCHITECTURES THAT SUBSCRIBE TO UNIFIED EVENT STREAMS

- 8.5 CUSTOMER 360 VIEW AND MDM

- 8.5.1 DRIVE PERSONALIZED MARKETING AND SERVICE EXCELLENCE BY SYNCHRONIZING REAL-TIME CUSTOMER INTERACTIONS

- 8.6 OTHER APPLICATIONS

9 DATA INTEGRATION MARKET, BY BUSINESS FUNCTION

- 9.1 INTRODUCTION

- 9.1.1 DRIVERS: DATA INTEGRATION MARKET, BY BUSINESS FUNCTION

- 9.2 SALES

- 9.2.1 TRANSFORMING LEAD MANAGEMENT WITH INTEGRATED CUSTOMER DATA

- 9.3 MARKETING

- 9.3.1 ENABLING REAL-TIME PERSONALIZATION WITH UNIFIED AUDIENCE PROFILES

- 9.4 FINANCE & ACCOUNTING

- 9.4.1 STREAMLINING BUDGETING AND FORECASTING WITH CONNECTED DATA

- 9.5 IT

- 9.5.1 DRIVING OPERATIONAL RESILIENCE WITH AUTOMATED INTEGRATION PIPELINES

- 9.6 HUMAN RESOURCES

- 9.6.1 DRIVING PEOPLE ANALYTICS THROUGH SYSTEM-WIDE DATA INTEGRATION

- 9.7 OTHER BUSINESS FUNCTIONS

10 DATA INTEGRATION MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.1.1 DRIVERS: DATA INTEGRATION MARKET, BY END USER

- 10.2 BFSI

- 10.2.1 DRIVE PERSONALIZED BANKING OFFERS USING UNIFIED 360° CUSTOMER VIEW ACROSS DIGITAL AND BRANCH CHANNELS

- 10.3 TELECOMMUNICATIONS

- 10.3.1 ENHANCE SUPPORT EFFICIENCY BY PROVIDING AGENTS COMPLETE SUBSCRIBER PROFILE FROM DEVICE TO OUTAGE DATA

- 10.4 GOVERNMENT & DEFENSE

- 10.4.1 STREAMLINE CITIZEN SERVICES THROUGH UNIFIED CASE MANAGEMENT OF SOCIAL, LICENSING, AND REGULATORY RECORDS

- 10.5 HEALTHCARE & LIFE SCIENCES

- 10.5.1 TARGET PREVENTIVE PROGRAMS THROUGH COMBINED CLAIMS, SOCIAL-DETERMINANTS, AND COMMUNITY-HEALTH METRICS INTEGRATION

- 10.6 MANUFACTURING

- 10.6.1 ALIGN PRODUCTION PLANNING WITH ACTUAL CAPACITY BY MERGING ERP, SUPPLIER LEAD TIMES, AND SHOP FLOOR DATA

- 10.7 RETAIL & E-COMMERCE

- 10.7.1 INCREASE CAMPAIGN ROI WITH UNIFIED CUSTOMER JOURNEY DATA FROM WEB, MOBILE, AND IN-STORE TOUCHPOINTS

- 10.8 SOFTWARE & TECHNOLOGY PROVIDERS

- 10.8.1 RESOLVE SUPPORT TICKETS FASTER WITH HOLISTIC VIEW OF SYSTEM CONFIGURATIONS, VERSION HISTORY, AND CUSTOMER INTERACTIONS

- 10.9 TRANSPORTATION & LOGISTICS

- 10.9.1 IMPROVE CUSTOMER COMMUNICATION THROUGH UNIFIED ORDER MANAGEMENT, CARRIER TRACKING, AND EXCEPTION NOTIFICATIONS

- 10.10 ENERGY AND UTILITIES

- 10.10.1 MAXIMIZE RENEWABLE ASSET UPTIME THROUGH INTEGRATED PERFORMANCE LOGS, MAINTENANCE HISTORIES, AND METEOROLOGICAL DATA

- 10.11 MEDIA & ENTERTAINMENT

- 10.11.1 BOOST VIEWER RETENTION BY DELIVERING REAL-TIME MULTI-DEVICE RECOMMENDATIONS DERIVED FROM INTEGRATED AUDIENCE PROFILES

- 10.12 OTHER END USERS

11 DATA INTEGRATION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: DATA INTEGRATION MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.4 CANADA

- 11.3 EUROPE

- 11.3.1 EUROPE: DATA INTEGRATION MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.4 GERMANY

- 11.3.5 FRANCE

- 11.3.6 ITALY

- 11.3.7 SPAIN

- 11.3.8 NETHERLANDS

- 11.3.9 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: DATA INTEGRATION MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.4 INDIA

- 11.4.5 JAPAN

- 11.4.6 SOUTH KOREA

- 11.4.7 SINGAPORE

- 11.4.8 AUSTRALIA & NEW ZEALAND

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: DATA INTEGRATION MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 SAUDI ARABIA

- 11.5.4 UAE

- 11.5.5 SOUTH AFRICA

- 11.5.6 QATAR

- 11.5.7 TURKEY

- 11.5.8 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: DATA INTEGRATION MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.4 MEXICO

- 11.6.5 ARGENTINA

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES, 2020-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 MARKET RANKING ANALYSIS, 2024

- 12.5 PRODUCT COMPARATIVE ANALYSIS

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 12.7.5.1 Overall Company Footprint

- 12.7.5.2 Regional Footprint

- 12.7.5.3 Offering Footprint

- 12.7.5.4 Application Footprint

- 12.7.5.5 End User Footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 12.8.5.1 Detailed List of Key Startups/SMEs

- 12.8.5.2 Competitive Benchmarking of Key Startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 IBM

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches and enhancements

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 SAP

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Key strengths

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 ORACLE

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product launches and enhancements

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 MICROSOFT

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 SAS INSTITUTE

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 AWS

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product launches

- 13.2.6.3.2 Deals

- 13.2.7 SALESFORCE

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product launches

- 13.2.7.3.2 Deals

- 13.2.8 INFORMATICA

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.9 PRECISELY

- 13.2.9.1 Business overview

- 13.2.9.2 Products offered

- 13.2.9.3 Recent developments

- 13.2.9.4 Deals

- 13.2.10 GOOGLE

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Product launches and enhancements

- 13.2.10.3.2 Deals

- 13.2.11 TIBCO

- 13.2.12 QLIK

- 13.2.13 BOOMI

- 13.2.14 FIVETRAN

- 13.2.15 PALANTIR TECHNOLOGIES

- 13.2.16 WORKATO

- 13.2.17 ALTERYX

- 13.2.18 TALEND

- 13.2.19 HUAWEI

- 13.2.20 CONFLUENT

- 13.2.1 IBM

- 13.3 STARTUP/SME PROFILES

- 13.3.1 DENODO

- 13.3.2 SNAPLOGIC

- 13.3.3 JITTERBIT

- 13.3.4 ACTIAN

- 13.3.5 CELIGO

- 13.3.6 DCKAP

- 13.3.7 SAFE SOFTWARE

- 13.3.8 MATILLION

- 13.3.9 K2VIEW

- 13.3.10 NEXLA

- 13.3.11 EXALATE

- 13.3.12 INTEGRATELY

- 13.3.13 LONTI

- 13.3.14 DEVART

- 13.3.15 TRAY.IO

- 13.3.16 HEVO DATA

- 13.3.17 SEMARCHY

- 13.3.18 CDATA SOFTWARE

- 13.3.19 DREMIO

- 13.3.20 STRIIM

- 13.3.21 PROPHECY

- 13.3.22 ZIGIWAVE

- 13.3.23 ADEPTIA

- 13.3.24 FLOWGEAR

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 BIG DATA MARKET - GLOBAL FORECAST TO 2028

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.2.1 Big data market, by offering

- 14.2.2.2 Big data market, by business function

- 14.2.2.3 Big data market, by data type

- 14.2.2.4 Big data market, by vertical

- 14.2.2.5 Big data market, by region

- 14.3 DATAOPS PLATFORM MARKET - GLOBAL FORECAST TO 2028

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.2.1 DataOps platform market, by offering

- 14.3.2.2 DataOps platform market, by type

- 14.3.2.3 DataOps platform market, by deployment mode

- 14.3.2.4 DataOps platform market, by vertical

- 14.3.2.5 DataOps platform market, by region

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS