|

|

市場調査レポート

商品コード

1766391

消費財(CPG)の世界市場:製品タイプ別、包装タイプ別、包装材料別、流通チャネル別、地域別 - 予測(~2030年)Consumer Packaged Goods Market by Product Type, Packaging Type, Packaging Material, Distribution Channel, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 消費財(CPG)の世界市場:製品タイプ別、包装タイプ別、包装材料別、流通チャネル別、地域別 - 予測(~2030年) |

|

出版日: 2025年07月07日

発行: MarketsandMarkets

ページ情報: 英文 341 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の消費財(CPG)の市場規模は、2025年に推定3兆4,501億2,000万米ドルであり、2030年までに4兆2,350億1,000万米ドルに達すると予測され、予測期間にCAGRで4.2%の成長が見込まれます。

消費財(CPG)産業は、日常的に消費する食品・飲料、パーソナルケア製品、ホームケア製品など、日常生活において重要な役割を担っています。消費者の選好が、利便性、健康的な食品オプション、環境にやさしい包装に対する需要の増加とともに変化する中、業界の企業は、競争を勝ち抜くために絶えず革新を続けています。業界はさらに、デジタル化の進行、オンラインショッピングの拡大、世界の人口動態の変化などの影響を受けています。激しい競争と消費者性向の変化により、CPG領域は進化を続けており、特に新興市場や俊敏性と顧客中心主義を重視するブランドには大きな成長機会がもたらされています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 米ドル |

| セグメント | 製品タイプ、包装タイプ、流通チャネル、包装形式、包装材料、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

「包装材料別では、板紙セグメントが消費財(CPG)市場の大きく成長するセグメントとなる見込みです。」

板紙は、環境にやさしい包装における最新の技術革新により、消費財(CPG)カテゴリにおいてもっとも急成長するセグメントの1つとなるとみられます。データの直近の節目は2025年2月で、Tetra Pakは2025年4月から適用されるPlastic Waste Management(Amendment)Rules 2022に基づき、インド初の認定再生ポリマー由来のカートンを発売しました。この技術革新は、板紙カートンに再生材料を直接組み込むことで、強力な循環型包装ソリューションの勢いを示しています。India Packaging Excellence AwardsのInnovation Awardは終了しました。また、2024年11月、Tetra Pakはアラブ首長国連邦のUnion Paper Mills(UPM)と共同で、年間1万トンを処理する国内初のカートン包装リサイクルラインを設立します。板紙に基づくリサイクル業務は、アラブ首長国連邦のGreen Agenda 2030に沿ったもので、紙由来の包装のインフラが拡大していることを裏付けるものです。こうした発展は、板紙が環境にやさしい選択肢として人気を集めているだけでなく、大規模な投資や政府の支援も得ているという、CPG市場の転換を意味しています。

「包装タイプ別では、硬包装セグメントが大きなシェアを占めています。」

硬包装は、その耐久性、リサイクル可能性、保管・輸送過程を通じて製品を保護する能力から、消費財(CPG)産業でますます需要が高まっています。The Coca-Cola Companyのような大企業も、ガラスボトル、アルミ缶、PETボトルなど、環境にやさしい硬包装に投資しています。Coca-Colaは、2035年までに一次包装のリサイクル率を35%から40%にすることを約束し、市場に投入するボトルや缶の70%から75%を回収するという目標を掲げていますが、これは硬包装をベースとした循環型経済モデルへ向かう業界の動向を反映しています。2023年、The Coca-Cola Companyのボトルと缶の回収率は62%であり、これはこの需要を促進するインフラと政策支援の成長を示しています。Coca-Colaの包装の90%はすでにリサイクル可能であり、デザインの革新への取り組み、材料のリサイクル、共同回収モデルは、硬包装がいかに持続可能な包装プロセスの礎となりつつあるかを示す好例です。

当レポートでは、世界の消費財(CPG)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 消費財(CPG)市場における魅力的な機会

- アジア太平洋の消費財(CPG)市場:製品タイプ別、国別

- 消費財(CPG)市場:製品タイプ別

- 消費財(CPG)市場:包装タイプ別

- 消費財(CPG)市場:主要地域サブ市場

第5章 市場の概要

- イントロダクション

- マクロ経済指標

- 世界経済の見通し:消費財(CPG)市場の成長に対する影響

- 世界の貿易の見通しとCPG市場に対する影響

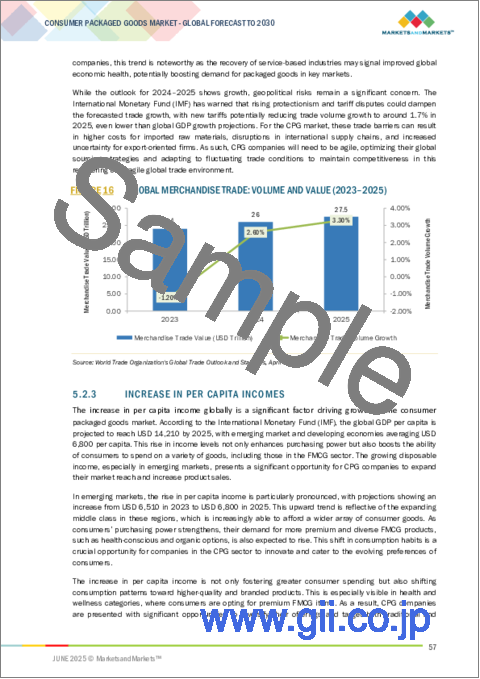

- 1人当たり所得の増加

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 消費財(CPG)に対する生成AIの影響

- イントロダクション

- 消費財(CPG)における生成AIの活用

- ケーススタディ分析

- 消費財(CPG)市場に対する影響

- 生成AIに取り組む隣接エコシステム

第6章 産業動向

- イントロダクション

- サプライチェーン分析

- バリューチェーン分析

- 製品コンセプト・イノベーション(0~10%)

- 原材料調達(10~25%)

- 製造・加工(25~45%)

- 包装・ラベリング(45~60%)

- 品質保証・規制遵守(60~75%)

- 流通・ロジスティクス(75~90%)

- マーケティング・セールス支援(90~100%)

- 貿易分析

- HSコード2106.90の貿易分析:消費財(CPG)における各種の調製食料品

- HSコード22の貿易分析:消費財(CPG)における飲料、蒸留酒、酢

- HSコード22の貿易分析:消費財(CPG)における精油とレジノイド、香料、化粧品、またはトイレタリー製品

- HSコード4818の貿易分析:消費財(CPG)における衛生、家庭用紙製品

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 価格分析

- 平均販売価格の動向:包装材別

- 平均販売価格の動向:地域別

- 市場マップ

- デマンドサイド

- サプライサイド

- 顧客のビジネスに影響を与える動向/混乱

- 特許分析

- 主な会議とイベント

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制枠組み

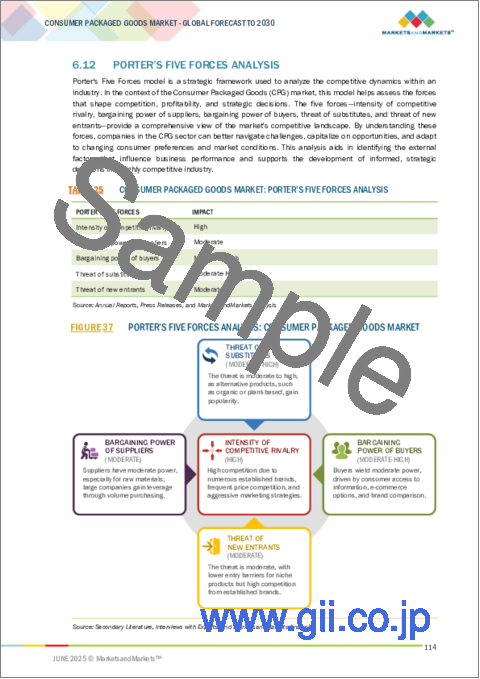

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 業務効率化に向けた戦略的リストラ

- 飲料産業における革新的な製品デザイン

- 投資と資金調達のシナリオ

- 2025年の米国関税の影響 - 消費財(CPG)市場

- イントロダクション

- 主な関税率

- 消費財(CPG)産業の混乱

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

第7章 消費財(CPG)市場:製品タイプ別

- イントロダクション

- 食品・飲料

- 化粧品・パーソナルケア製品

- 家事用品

- 医療製品

- その他の製品タイプ

第8章 消費財(CPG)市場:流通チャネル別

- イントロダクション

- スーパーマーケット/ハイパーマーケット

- コンビニエンスストア

- eコマース

- その他の流通チャネル

第9章 消費財(CPG)市場:包装形式別

- イントロダクション

- 硬包装

- 軟包装

- その他

第10章 消費財(CPG)市場:包装材料別

- イントロダクション

- プラスチック

- 金属

- 紙・板紙

- ガラス

- その他の包装材

第11章 消費財(CPG)市場:包装タイプ別

- イントロダクション

- ボトル

- 缶

- ボックス

- パウチ

- その他

第12章 消費財(CPG)市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- 南米

- アルゼンチン

- ブラジル

- その他の南米

- その他の地域

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析(2022年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標(2024年)

- ブランド/製品の比較

- PROCTER & GAMBLE (P&G)

- UNILEVER

- NESTLE

- JOHNSON & JOHNSON

- COLGATE-PALMOLIVE

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオと動向

第14章 企業プロファイル

- 主要企業

- PROCTER & GAMBLE

- UNILEVER

- NESTLE

- DANONE

- THE COCA-COLA COMPANY

- MONDELEZ INTERNATIONAL

- AB INBEV

- COLGATE-PALMOLIVE COMPANY

- RECKITT

- L'OREAL

- THE KRAFT HEINZ COMPANY

- GENERAL MILLS INC.

- PHILIP MORRIS PRODUCTS S.A.

- KENVUE

- HENKEL AG & CO. KGAA

- THE CLOROX COMPANY

- THE J.M. SMUCKER COMPANY

- KIMBERLY-CLARK

- PEPSICO

- BEIERSDORF

- MARS, INCORPORATED AND ITS AFFILIATES-CONSUMER PACKAGED GOODS MARKET

- NOMOLOTUS, LLC-CONSUMER PACKAGED GOODS MARKET

- BLUELAND-CONSUMER PACKAGED GOODS MARKET

- RITUAL-CONSUMER PACKAGED GOODS MARKET

- HUM NUTRITION INC.-CONSUMER PACKAGED GOODS MARKET

第15章 隣接市場と関連市場

- イントロダクション

- 制限事項

- スマート食品包装市場

- 市場の定義

- 市場の概要

- 食品・飲料金属缶市場

- 市場の定義

- 市場の概要

第16章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 TOP 10 EXPORTERS OF HS CODE 2106.90, 2020-2024 (USD THOUSAND)

- TABLE 3 TOP 10 EXPORTERS OF HS CODE 2106.90, 2020-2024 (TONS)

- TABLE 4 TOP 10 IMPORTERS OF HS CODE 2106.90, 2020-2024 (USD THOUSAND)

- TABLE 5 TOP 10 IMPORTERS OF HS CODE 2106.90, 2020-2024 (TONS)

- TABLE 6 TOP 10 EXPORTERS OF HS CODE 22, 2020-2024 (USD THOUSAND)

- TABLE 7 TOP 10 IMPORTERS OF HS CODE 22, 2020-2024 (USD THOUSAND)

- TABLE 8 TOP 10 EXPORTERS OF HS CODE 33, 2020-2024 (USD THOUSAND)

- TABLE 9 TOP 10 IMPORTERS OF HS CODE 33, 2020-2024 (USD THOUSAND)

- TABLE 10 TOP 10 EXPORTERS OF HS CODE 4818, 2020-2024 (USD THOUSAND)

- TABLE 11 TOP 10 EXPORTERS OF HS CODE 4818, 2020-2024 (TONS)

- TABLE 12 TOP 10 IMPORTERS OF HS CODE 4818, 2020-2024 (USD THOUSAND)

- TABLE 13 TOP 10 IMPORTERS OF HS CODE 4818, 2020-2024 (TONS)

- TABLE 14 AVERAGE SELLING PRICE OF KEY PLAYERS IN CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE (USD/UNIT)

- TABLE 15 AVERAGE SELLING PRICE (ASP), BY PACKAGING MATERIAL, 2020-2024 (USD/MILLION METRIC TONS)

- TABLE 16 AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2024 (USD/MILLION METRIC TONS)

- TABLE 17 CONSUMER PACKAGED GOODS MARKET: ECOSYSTEM

- TABLE 18 LIST OF MAJOR PATENTS PERTAINING TO CONSUMER PACKAGED GOODS MARKET, 2020-2023

- TABLE 19 CONSUMER PACKAGED GOODS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 CONSUMER PACKAGED GOODS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PACKAGING MATERIALS

- TABLE 27 KEY BUYING CRITERIA FOR CONSUMER-PACKAGED PRODUCT TYPES

- TABLE 28 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 29 EXPECTED IMPACT LEVEL ON TARGET PRODUCTS WITH RELEVANT HS CODES DUE TO TRUMP TARIFF IMPACT

- TABLE 30 EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES: CONSUMER PACKAGED GOODS

- TABLE 31 CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 32 CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 33 FOOD & BEVERAGES: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 34 FOOD & BEVERAGES: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 35 COSMETICS & PERSONAL CARE PRODUCTS: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 36 COSMETICS & PERSONAL CARE PRODUCTS: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 37 HOUSEHOLD CARE PRODUCTS: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 38 HOUSEHOLD CARE PRODUCTS: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 39 HEALTHCARE PRODUCTS: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 40 HEALTHCARE PRODUCTS: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 41 OTHER PRODUCT TYPES: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 42 OTHER PRODUCT TYPES: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 43 CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL, 2020-2024 (USD BILLION)

- TABLE 44 CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD BILLION)

- TABLE 45 SUPERMARKETS: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 46 SUPERMARKETS: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 47 CONVENIENCE STORES: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 48 CONVENIENCE STORES: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 49 E-COMMERCE: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 50 E-COMMERCE: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 51 OTHER DISTRIBUTION CHANNELS: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 52 OTHER DISTRIBUTION CHANNELS: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 53 CONSUMER GOODS PACKAGING MARKET, BY PACKAGING FORMAT, 2020-2024 (USD BILLION)

- TABLE 54 CONSUMER GOODS PACKAGING MARKET, BY PACKAGING FORMAT, 2025-2030 (USD BILLION)

- TABLE 55 GLOBAL CONSUMER GOODS PACKAGING MARKET, BY PACKAGING MATERIAL, 2020-2024 (USD BILLION)

- TABLE 56 GLOBAL CONSUMER GOODS PACKAGING MARKET, BY PACKAGING MATERIAL, 2025-2030 (USD BILLION)

- TABLE 57 GLOBAL CONSUMER GOODS PACKAGING MARKET, BY PACKAGING TYPE, 2020-2024 (MILLION METRIC TONS)

- TABLE 58 GLOBAL CONSUMER GOODS PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (MILLION METRIC TONS)

- TABLE 59 GLOBAL CONSUMER GOODS PACKAGING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 60 GLOBAL CONSUMER GOODS PACKAGING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 61 GLOBAL CONSUMER GOODS PACKAGING MARKET, BY REGION, 2020-2024 (MILLION METRIC TONS)

- TABLE 62 GLOBAL CONSUMER GOODS PACKAGING MARKET, BY REGION, 2025-2030 (MILLION METRIC TONS)

- TABLE 63 GLOBAL CONSUMER GOODS PACKAGING MARKET, BY PACKAGING TYPE, 2020-2024 (USD BILLION)

- TABLE 64 GLOBAL CONSUMER GOODS PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD BILLION)

- TABLE 65 CONSUMER PACKAGED GOODS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 CONSUMER PACKAGED GOODS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 70 NORTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 71 NORTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL, 2020-2024 (USD BILLION)

- TABLE 72 NORTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD BILLION)

- TABLE 73 US: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 74 US: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 75 CANADA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 76 CANADA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 77 MEXICO: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 78 MEXICO: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 79 EUROPE: CONSUMER PACKAGED GOODS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 80 EUROPE: CONSUMER PACKAGED GOODS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 EUROPE: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 82 EUROPE: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 83 EUROPE: CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL, 2020-2024 (USD BILLION)

- TABLE 84 EUROPE: CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD BILLION)

- TABLE 85 GERMANY: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 86 GERMANY: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 87 UK: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 88 UK: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 89 ITALY: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 90 ITALY: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 91 FRANCE: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 92 FRANCE: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 93 SPAIN: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 94 SPAIN: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 95 REST OF EUROPE: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 96 REST OF EUROPE: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 97 ASIA PACIFIC: CONSUMER PACKAGED GOODS MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 98 ASIA PACIFIC: CONSUMER PACKAGED GOODS MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 99 ASIA PACIFIC: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 100 ASIA PACIFIC: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 101 ASIA PACIFIC: CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL, 2020-2024 (USD BILLION)

- TABLE 102 ASIA PACIFIC: CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD BILLION)

- TABLE 103 CHINA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 104 CHINA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 105 JAPAN: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 106 JAPAN: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 107 INDIA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 108 INDIA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 109 AUSTRALIA & NEW ZEALAND: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 110 AUSTRALIA & NEW ZEALAND: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 111 REST OF ASIA PACIFIC: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 112 REST OF ASIA PACIFIC: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 113 SOUTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 114 SOUTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 115 SOUTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 116 SOUTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 117 SOUTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL, 2020-2024 (USD BILLION)

- TABLE 118 SOUTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD BILLION)

- TABLE 119 ARGENTINA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 120 ARGENTINA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 121 BRAZIL: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 122 BRAZIL: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 123 REST OF SOUTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 124 REST OF SOUTH AMERICA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 125 ROW: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 126 ROW: CONSUMER PACKAGED GOODS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 127 ROW: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 128 ROW: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 129 ROW: CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL, 2020-2024 (USD BILLION)

- TABLE 130 ROW: CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD BILLION)

- TABLE 131 MIDDLE EAST: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 132 MIDDLE EAST: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 133 AFRICA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2020-2024 (USD BILLION)

- TABLE 134 AFRICA: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025-2030 (USD BILLION)

- TABLE 135 OVERVIEW OF STRATEGIES ADOPTED BY KEY CONSUMER PACKAGED GOODS VENDORS

- TABLE 136 CONSUMER PACKAGED GOODS MARKET: DEGREE OF COMPETITION

- TABLE 137 CONSUMER PACKAGED GOODS MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 138 CONSUMER PACKAGED GOODS MARKET: PACKAGING MATERIAL FOOTPRINT, 2024

- TABLE 139 CONSUMER PACKAGED GOODS MARKET: PACKAGING TYPE FOOTPRINT, 2024

- TABLE 140 CONSUMER PACKAGED GOODS MARKET: PRODUCT TYPE FOOTPRINT, 2024

- TABLE 141 CONSUMER PACKAGED GOODS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 142 CONSUMER PACKAGED GOODS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024, (1/2)

- TABLE 143 CONSUMER PACKAGED GOODS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024, (2/2)

- TABLE 144 CONSUMER PACKAGED GOODS MARKET: PRODUCT LAUNCHES

- TABLE 145 CONSUMER PACKAGED GOODS MARKET: DEALS

- TABLE 146 CONSUMER PACKAGED GOODS MARKET: EXPANSIONS

- TABLE 147 PROCTER & GAMBLE: COMPANY OVERVIEW

- TABLE 148 PROCTER & GAMBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 PROCTER & GAMBLE: PRODUCT LAUNCHES

- TABLE 150 UNILEVER: COMPANY OVERVIEW

- TABLE 151 UNILEVER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 UNILEVER: PRODUCT LAUNCHES

- TABLE 153 UNILEVER: EXPANSIONS

- TABLE 154 NESTLE: COMPANY OVERVIEW

- TABLE 155 NESTLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 NESTLE: PRODUCT LAUNCHES

- TABLE 157 NESTLE: DEALS

- TABLE 158 NESTLE: EXPANSIONS

- TABLE 159 DANONE: COMPANY OVERVIEW

- TABLE 160 DANONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 DANONE: DEALS

- TABLE 162 DANONE: EXPANSIONS

- TABLE 163 THE COCA-COLA COMPANY: COMPANY OVERVIEW

- TABLE 164 THE COCA-COLA COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 THE COCA-COLA COMPANY: DEALS

- TABLE 166 THE COCA-COLA COMPANY: PRODUCT LAUNCHES

- TABLE 167 MONDELEZ INTERNATIONAL: COMPANY OVERVIEW

- TABLE 168 MONDELEZ INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 MONDELEZ INTERNATIONAL: DEALS

- TABLE 170 MONDELEZ INTERNATIONAL: EXPANSIONS

- TABLE 171 AB INBEV: COMPANY OVERVIEW

- TABLE 172 AB INBEV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 AB INBEV: EXPANSIONS

- TABLE 174 COLGATE-PALMOLIVE COMPANY: COMPANY OVERVIEW

- TABLE 175 COLGATE-PALMOLIVE COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 COLGATE-PALMOLIVE COMPANY: DEALS

- TABLE 177 COLGATE-PALMOLIVE COMPANY: PRODUCT LAUNCHES

- TABLE 178 RECKITT: COMPANY OVERVIEW

- TABLE 179 RECKITT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 RECKITT: DEALS

- TABLE 181 RECKITT: PRODUCT LAUNCHES

- TABLE 182 RECKITT: EXPANSIONS

- TABLE 183 L'OREAL: COMPANY OVERVIEW

- TABLE 184 L'OREAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 L'OREAL: DEALS

- TABLE 186 L'OREAL: EXPANSIONS

- TABLE 187 THE KRAFT HEINZ COMPANY: COMPANY OVERVIEW

- TABLE 188 THE KRAFT HEINZ COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 KRAFT HEINZ COMPANY: DEALS

- TABLE 190 THE KRAFT HEINZ COMPANY: PRODUCT LAUNCHES

- TABLE 191 GENERAL MILLS INC.: COMPANY OVERVIEW

- TABLE 192 GENERAL MILLS, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 GENERAL MILLS: DEALS

- TABLE 194 GENERAL MILLS: PRODUCT LAUNCHES

- TABLE 195 PHILIP MORRIS PRODUCTS S.A.: COMPANY OVERVIEW

- TABLE 196 PHILIP MORRIS PRODUCTS S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 PHILIP MORRIS PRODUCTS S.A.: DEALS

- TABLE 198 PHILIP MORRIS PRODUCTS S.A.: PRODUCT LAUNCHES

- TABLE 199 PHILIP MORRIS PRODUCTS S.A.: EXPANSIONS

- TABLE 200 KENVUE: COMPANY OVERVIEW

- TABLE 201 KENVUE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 KENVUE: DEALS

- TABLE 203 KENVUE: PRODUCT LAUNCHES

- TABLE 204 KENVUE: EXPANSIONS

- TABLE 205 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 206 HENKEL AG & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 HENKEL AG & CO. KGAA: DEALS

- TABLE 208 HENKEL AG & CO. KGAA: EXPANSIONS

- TABLE 209 THE CLOROX COMPANY: COMPANY OVERVIEW

- TABLE 210 THE CLOROX COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 THE CLOROX COMPANY: DEALS

- TABLE 212 THE J.M. SMUCKER COMPANY: COMPANY OVERVIEW

- TABLE 213 THE J.M. SMUCKER COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 THE J.M. SMUCKER COMPANY: DEALS

- TABLE 215 KIMBERLY-CLARK: COMPANY OVERVIEW

- TABLE 216 KIMBERLY-CLARK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 KIMBERLY-CLARK: PRODUCT LAUNCHES

- TABLE 218 KIMBERLY-CLARK: EXPANSIONS

- TABLE 219 PEPSICO: COMPANY OVERVIEW

- TABLE 220 PEPSICO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 PEPSICO: PRODUCT LAUNCHES

- TABLE 222 PEPSICO: DEALS

- TABLE 223 PEPSICO: EXPANSIONS

- TABLE 224 BEIERSDORF: COMPANY OVERVIEW

- TABLE 225 BEIERSDORF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 BEIERSDORF: PRODUCT LAUNCHES

- TABLE 227 BEIERSDORF: DEALS

- TABLE 228 BEIERSDORF: EXPANSIONS

- TABLE 229 MARS, INCORPORATED AND ITS AFFILIATES: COMPANY OVERVIEW

- TABLE 230 NOMOLOTUS, LLC: COMPANY OVERVIEW

- TABLE 231 BLUELAND: COMPANY OVERVIEW

- TABLE 232 RITUAL: COMPANY OVERVIEW

- TABLE 233 HUM NUTRITION INC.: COMPANY OVERVIEW

- TABLE 234 ADJACENT MARKETS TO CONSUMER PACKAGED GOODS MARKET

- TABLE 235 SMART FOOD PACKAGING MARKET, BY MATERIAL, 2019-2023 (USD MILLION)

- TABLE 236 SMART FOOD PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 237 FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2020-2023 (USD BILLION)

- TABLE 238 FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2024-2029 (USD BILLION)

List of Figures

- FIGURE 1 CONSUMER PACKAGED GOODS MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 CONSUMER PACKAGED GOODS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 SUPPLY-SIDE ANALYSIS: SOURCES OF INFORMATION AT EVERY STEP

- FIGURE 5 CONSUMER PACKAGED GOODS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 CONSUMER PACKAGED GOODS MARKET: DATA TRIANGULATION

- FIGURE 7 CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD BILLION)

- FIGURE 8 CONSUMER PACKAGED GOODS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025 VS. 2030 (USD BILLION)

- FIGURE 9 CONSUMER PACKAGED GOODS MARKET SHARE AND GROWTH RATE, BY REGION, 2024

- FIGURE 10 ADVANCEMENTS IN FOOD PROCESSING INDUSTRY TO SUPPORT GROWTH OF CONSUMER PACKAGED GOODS MARKET

- FIGURE 11 CHINA ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2024

- FIGURE 12 FOOD & BEVERAGES PROJECTED TO DOMINATE DURING FORECAST PERIOD

- FIGURE 13 BOTTLES PROJECTED TO DOMINATE CONSUMER PACKAGED GOODS MARKET DURING FORECAST PERIOD

- FIGURE 14 US WAS LARGEST MARKET GLOBALLY FOR CONSUMER PACKAGED GOODS IN 2024

- FIGURE 15 GLOBAL ECONOMIC PROJECTIONS (2025-2026)

- FIGURE 16 GLOBAL MERCHANDISE TRADE: VOLUME AND VALUE (2023-2025)

- FIGURE 17 GDP PER CAPITA, CURRENT PRICES (USD PER CAPITA), 2020-2030

- FIGURE 18 CONSUMER PACKAGED GOODS MARKET DYNAMICS

- FIGURE 19 ADOPTION OF GEN AI IN CONSUMER PACKAGED GOODS

- FIGURE 20 RISING DEMAND FOR SUSTAINABLE, CONVENIENT, AND DIGITALLY INTEGRATED SOLUTIONS ACROSS CONSUMER PACKAGED GOODS MARKET

- FIGURE 21 CONSUMER PACKAGED GOODS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 EXPORT VALUE OF CONSUMER PACKAGED GOODS UNDER HS CODE 2106.90 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 23 IMPORT VALUE OF CONSUMER PACKAGED GOODS UNDER HS CODE 2106.90 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 24 EXPORT VALUE OF CONSUMER PACKAGED GOODS UNDER HS CODE 22 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 25 IMPORT VALUE OF CONSUMER PACKAGED GOODS UNDER HS CODE 22 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 26 EXPORT VALUE OF CONSUMER PACKAGED GOODS UNDER HS CODE 33 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 27 IMPORT VALUE OF CONSUMER PACKAGED GOODS UNDER HS CODE 33 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 28 EXPORT VALUE OF CONSUMER PACKAGED GOODS UNDER HS CODE 4818 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 29 IMPORT VALUE OF CONSUMER PACKAGED GOODS UNDER HS CODE 4818 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 30 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT TYPE, 2020 (USD/PIECE)

- FIGURE 31 AVERAGE SELLING PRICE TREND, BY PACKAGING MATERIAL (USD/MILLION METRIC TONS)

- FIGURE 32 AVERAGE SELLING PRICE TREND, BY REGION (USD/MILLION METRIC TONS)

- FIGURE 33 CONSUMER PACKAGED GOODS MARKET MAP

- FIGURE 34 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 35 NUMBER OF PATENTS GRANTED FOR CONSUMER PACKAGED GOODS MARKET, 2014-2024

- FIGURE 36 REGIONAL ANALYSIS OF PATENTS GRANTED FOR CONSUMER PACKAGED GOODS MARKET, 2014-2024

- FIGURE 37 PORTER'S FIVE FORCES ANALYSIS: CONSUMER PACKAGED GOODS MARKET

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PACKAGING MATERIALS

- FIGURE 39 KEY BUYING CRITERIA FOR CONSUMER PACKAGED PRODUCT TYPES

- FIGURE 40 INVESTMENT AND FUNDING SCENARIO, 2020-2025 (USD MILLION)

- FIGURE 41 FOOD & BEVERAGES TO DOMINATE MARKET THROUGH 2030

- FIGURE 42 SUPERMARKETS TO DOMINATE MARKET THROUGH 2030

- FIGURE 43 RIGID PACKAGING TO DOMINATE MARKET THROUGH 2030

- FIGURE 44 PLASTIC SEGMENT TO DOMINATE MARKET THROUGH 2030

- FIGURE 45 BOTTLES SEGMENT TO DOMINATE MARKET THROUGH 2030

- FIGURE 46 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN ASIA PACIFIC, 2025-2030

- FIGURE 47 NORTH AMERICA: CONSUMER PACKAGED GOODS MARKET SNAPSHOT

- FIGURE 48 ONLINE GROCERY SALES PENETRATION IN US (2020-2024)

- FIGURE 49 ASIA PACIFIC: CONSUMER PACKAGED GOODS MARKET SNAPSHOT

- FIGURE 50 REVENUE ANALYSIS FOR KEY COMPANIES IN LAST THREE YEARS, 2022-2024 (USD BILLION)

- FIGURE 51 MARKET SHARE OF LEADING COMPANIES IN CONSUMER PACKAGED GOODS MARKET, 2024

- FIGURE 52 COMPANY VALUATION (USD BILLION), 2024

- FIGURE 53 EV/EBITDA OF MAJOR PLAYERS, 2024

- FIGURE 54 CONSUMER PACKAGED GOODS MARKET: BRAND/PRODUCT COMPARISON ANALYSIS, BY PRODUCT BRAND

- FIGURE 55 CONSUMER PACKAGED GOODS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 CONSUMER PACKAGED GOODS MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 57 CONSUMER PACKAGED GOODS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 PROCTER & GAMBLE: COMPANY SNAPSHOT

- FIGURE 59 UNILEVER: COMPANY SNAPSHOT

- FIGURE 60 NESTLE: COMPANY SNAPSHOT

- FIGURE 61 DANONE: COMPANY SNAPSHOT

- FIGURE 62 THE COCA-COLA COMPANY: COMPANY SNAPSHOT

- FIGURE 63 MONDELEZ INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 64 AB INBEV: COMPANY SNAPSHOT

- FIGURE 65 COLGATE-PALMOLIVE COMPANY: COMPANY SNAPSHOT

- FIGURE 66 RECKITT: COMPANY SNAPSHOT

- FIGURE 67 L'OREAL: COMPANY SNAPSHOT

- FIGURE 68 THE KRAFT HEINZ COMPANY: COMPANY SNAPSHOT

- FIGURE 69 GENERAL MILLS INC.: COMPANY SNAPSHOT

- FIGURE 70 PHILIP MORRIS PRODUCTS S.A.: COMPANY SNAPSHOT

- FIGURE 71 KENVUE: COMPANY SNAPSHOT

- FIGURE 72 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 73 THE CLOROX COMPANY: COMPANY SNAPSHOT

- FIGURE 74 THE J.M. SMUCKER COMPANY: COMPANY SNAPSHOT

- FIGURE 75 KIMBERLY-CLARK: COMPANY SNAPSHOT

- FIGURE 76 PEPSICO: COMPANY SNAPSHOT

- FIGURE 77 BEIERSDORF: COMPANY SNAPSHOT

The global market for consumer packaged goods is estimated to be valued at USD 3,450.12 billion in 2025 and is projected to reach USD 4,235.01 billion by 2030, at a CAGR of 4.2% during the forecast period. The consumer-packaged goods (CPG) industry is important in our everyday lives, covering items we consume daily food and drinks, personal care products, and home care items. As the tastes of consumers change with increasing demand for convenience, healthy food options, and eco-friendly packaging, businesses in the industry are continuously innovating to remain in the game. The industry is further influenced by increased digitalization, online shopping expansion, and demographic changes worldwide. With intense competition and changing consumer patterns, the CPG space remains evolving, presenting significant opportunities for growth, especially in the emerging markets and brands that focus on agility and customer-centricity.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) |

| Segments | By Product Type, Packaging Type, Distribution Channel, Packaging Format, Packaging Material, And Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

"Paperboard segment is expected to be the significantly growing segment by packaging material of the consumer packaged goods market."

Paperboard will be one of the fastest-growing segments of the consumer packaged goods (CPG) category, driven by the latest innovations in eco-friendly packaging. The data's most recent milestone came in February 2025, when Tetra Pak launched India's first cartons from certified recycled polymers under the Plastic Waste Management (Amendment) Rules 2022, effective from April 2025. The innovation reflects strong circular package solution momentum by integrating recycled content into paperboard cartons in a direct manner. The Innovation Award at the India Packaging Excellence Awards has now concluded. Besides, in November 2024, Tetra Pak joined forces with Union Paper Mills (UPM) in the UAE to install the country's first carton package recycling line that will treat 10,000 tonnes annually. The paperboard-based recycling operation is in line with the UAE's Green Agenda 2030 and confirms the growing infrastructure for paper-based packaging. These developments combined signify a shift for the CPG market, where paperboard is not just gaining popularity as an environmentally friendly choice but also getting large-scale investment and government support.

"The rigid segment holds a significant market share in the packaging type segment of the consumer packaged goods market."

Rigid packaging is increasingly in demand in the consumer goods industry due to its durability, recyclability, and ability to protect products throughout storage and transport processes. Large corporations such as The Coca-Cola Company are also investing in environmentally friendly rigid packaging types such as glass bottles, aluminum cans, and PET plastic bottles. Coca-Cola's commitment to 35% to 40% recycled content in its primary packaging by 2035 and its goal to collect 70% to 75% of bottles and cans it places into the market reflect the trend of the industry toward rigid-packaging-based circular economy models. In 2023, the Coca-Cola company had a collection rate for bottles and cans was 62%, which shows the growth of infrastructure and policy support driving this demand. Having already 90% of its packaging being recyclable, Coca-Cola's design innovation efforts, material recycling, and collaborative collection models are a good example of how rigid packaging is becoming a cornerstone of sustainable packaging processes.

Europe holds a significant market share in the global consumer packaged goods market.

Europe holds a significant share of the consumer packaged goods (CPG) market, supported by a well-established retail system, evolving regulatory frameworks, and growing consumer attention to sustainability. The region's focus on reducing its environmental impact has had a significant impact on packaging innovation in the CPG sector. One of the most significant developments that support this trend is the January 2025 collaboration between AeroFlexx, a global leader in eco-friendly liquid packaging, and Chemipack, a Polish blending and filling firm. This partnership represents a strategic move towards developing green packaging solutions in Europe. Through the installation of AeroFlexx's patented filling machinery at Chemipack's manufacturing facility, the collaboration increases local manufacturing effectiveness and enables instant deployment of green packaging formats. Chemipack's robust manufacturing capacity-over 100 million liters a year-and BRC certification further strengthen this project. Collectively, the firms will address increasing European demand for environmentally friendly liquid packaging, boosting the region's leadership in sustainable CPG practices and underpinning ongoing market growth.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the consumer packaged goods market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors- 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15% and Rest of the World -10%

Prominent companies in the market include Procter & Gamble (US), Unilever (UK), Nestle (Switzerland), The Coca-Cola Company (US), Danone (France), PepsiCo (US), Colgate-Palmolive Company (US), AB InBev (Belgium), Mondelez International (US), Reckitt (US), L'Oreal (France), The Kraft Heinz Company (US), General Mills, Inc. (US), Philip Morris Products S.A. (US), Kenvue (US), Henkel AG & Co. KGaA (Germany).

Other players include The Clorox Company (US), The J.M. Smucker Company (US), Kimberly-Clark (US), PepsiCo (US), Mars, Incorporated and its Affiliates (US), Beiersdorf (Germany), Nomolotus, LLC (US), Blueland (US), Ritual (US), HUM Nutrition Inc (US).

Research Coverage:

This research report categorizes the consumer packaged goods market by products type (food & beverages, cosmetics & personal care products, household care products, health care products, others), packaging type (rigid, flexible, others), distribution channel (supermarkets/hypermarkets, convenience store, e-commerce, others) and region (north america, europe, asia pacific, south america, and rest of the world). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the consumer packaged goods market. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the consumer packaged goods market. Competitive analysis of upcoming startups in the consumer packaged goods market ecosystem is covered in this report. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall consumer packaged goods and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (E-commerce expansion is fueling cpg growth by broadening consumer reach through online and omnichannel platforms), restraints (High cost of sustainable materials), opportunities (Technology integration in the cpg industry) and challenges (Challenges in meeting growing sustainability demands in the CPG industry) influencing the growth of the consumer packaged goods market.

- New service launch/Innovation: Detailed insights on research & development activities and new service launches in the consumer packaged goods market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the consumer packaged goods market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the consumer packaged goods market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as Procter & Gamble (US), Unilever (UK), Nestle (Switzerland), The Coca-Cola Company (US), Danone (France), and other players in the consumer packaged goods market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN CONSUMER PACKAGED GOODS MARKET

- 4.2 ASIA PACIFIC: CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE & COUNTRY

- 4.3 CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE

- 4.4 CONSUMER PACKAGED GOODS MARKET, BY PACKAGING TYPE

- 4.5 CONSUMER PACKAGED GOODS MARKET: MAJOR REGIONAL SUBMARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GLOBAL ECONOMIC OUTLOOK: IMPLICATIONS FOR GROWTH OF CONSUMER PACKAGED GOODS MARKET

- 5.2.2 GLOBAL TRADE OUTLOOK AND ITS IMPACT ON CPG MARKET

- 5.2.3 INCREASE IN PER CAPITA INCOMES

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 E-commerce expansion is fueling CPG growth by broadening consumer reach through online and omnichannel platforms

- 5.3.1.2 Health & wellness trends

- 5.3.1.3 Sustainability initiatives

- 5.3.2 RESTRAINTS

- 5.3.2.1 High cost of sustainable materials

- 5.3.2.2 Impact of sustainability on product shelf life and quality

- 5.3.2.3 Rising regulatory compliance costs in CPG sector

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Technology integration in CPG industry

- 5.3.3.2 Growth in emerging markets

- 5.3.4 CHALLENGES

- 5.3.4.1 Challenges in meeting growing sustainability demands in CPG industry

- 5.3.4.2 Shifts in consumer behavior

- 5.3.4.3 Rising competition from private labels in CPG industry

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON CONSUMER PACKAGED GOODS

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN CONSUMER PACKAGED GOODS

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Mondelez International - Accelerating Snack Innovation with AI

- 5.4.3.2 Colgate-Palmolive - Utilizing Digital Twins for Product Development

- 5.4.4 IMPACT ON CONSUMER PACKAGED GOODS MARKET

- 5.4.5 ADJACENT ECOSYSTEM WORKING ON GEN AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 PRODUCT CONCEPT & INNOVATION (0-10%)

- 6.3.2 RAW MATERIAL SOURCING & PROCUREMENT (10-25%)

- 6.3.3 MANUFACTURING & PROCESSING (25-45%)

- 6.3.4 PACKAGING & LABELLING (45-60%)

- 6.3.5 QUALITY ASSURANCE & REGULATORY COMPLIANCE (60-75%)

- 6.3.6 DISTRIBUTION & LOGISTICS (75-90%)

- 6.3.7 MARKETING & SALES ENABLEMENT (90-100%)

- 6.4 TRADE ANALYSIS

- 6.4.1 TRADE ANALYSIS OF HS CODE 2106.90: MISCELLANEOUS FOOD PREPARATIONS IN CONSUMER PACKAGED GOODS

- 6.4.1.1 Export Trends of Consumer Packaged Goods under HS Code 2106.90 (2020-2024)

- 6.4.1.2 Import Trends of Consumer Packaged Goods under HS Code 2106.90 (2020-2024)

- 6.4.2 TRADE ANALYSIS OF HS CODE 22: BEVERAGES, SPIRITS, AND VINEGAR IN CONSUMER PACKAGED GOODS

- 6.4.2.1 Export Trends of Consumer Packaged Goods under HS Code 22 (2020-2024)

- 6.4.2.2 Import Trends of Consumer Packaged Goods under HS Code 22 (2020-2024)

- 6.4.3 TRADE ANALYSIS OF HS CODE 22: ESSENTIAL OILS AND RESINOIDS; PERFUMERY, COSMETIC, OR TOILET PREPARATIONS IN CONSUMER PACKAGED GOODS

- 6.4.3.1 Export Trends of Consumer Packaged Goods under HS Code 33 (2020-2024)

- 6.4.3.2 Import Trends of Consumer Packaged Goods under HS Code 33 (2020-2024)

- 6.4.4 TRADE ANALYSIS OF HS CODE 4818: SANITARY AND HOUSEHOLD PAPER GOODS IN CONSUMER PACKAGED GOODS

- 6.4.4.1 Export Trends of Consumer Packaged Goods under HS Code 4818 (2020-2024)

- 6.4.4.2 Import Trends of Consumer Packaged Goods under HS Code 4818 (2020-2024)

- 6.4.1 TRADE ANALYSIS OF HS CODE 2106.90: MISCELLANEOUS FOOD PREPARATIONS IN CONSUMER PACKAGED GOODS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Artificial Intelligence (AI) in Inventory and Supply Chain Optimization

- 6.5.1.2 Digital Twin Technology in Product Development

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Artificial Intelligence (AI) + Advanced Analytics

- 6.5.2.2 Internet of Things (IoT) + Blockchain

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Cloud Computing

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY PACKAGING MATERIAL

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.7 MARKET MAP

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 6.9 PATENT ANALYSIS

- 6.9.1 LIST OF MAJOR PATENTS

- 6.10 KEY CONFERENCES & EVENTS

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 STRATEGIC RESTRUCTURING FOR OPERATIONAL EFFICIENCY

- 6.14.2 INNOVATING PRODUCT DESIGN IN BEVERAGE SECTOR

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 IMPACT OF 2025 US TARIFF - CONSUMER PACKAGED GOODS MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 DISRUPTION IN CONSUMER PACKAGED GOODS

- 6.16.4 PRICE IMPACT ANALYSIS

- 6.16.5 IMPACT ON COUNTRY/REGION

- 6.16.5.1 China

- 6.16.5.2 Mexico

- 6.16.5.3 Southeast Asia (Vietnam, Malaysia, Thailand)

- 6.16.6 IMPACT ON END-USE INDUSTRY

7 CONSUMER PACKAGED GOODS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 FOOD & BEVERAGES

- 7.2.1 GROWING CONSUMER DEMAND FOR CONVENIENT, HEALTHY, AND SUSTAINABLY PACKAGED FOOD & BEVERAGE PRODUCTS WORLDWIDE

- 7.3 COSMETICS & PERSONAL CARE PRODUCTS

- 7.3.1 GROWING DEMAND FOR SUSTAINABLE, CLEAN-LABEL, AND FUNCTIONAL PRODUCTS TO RESHAPE COSMETICS AND PERSONAL CARE INNOVATION

- 7.4 HOUSEHOLD CARE PRODUCTS

- 7.4.1 STRINGENT ENVIRONMENTAL REGULATIONS AND CONSUMER PREFERENCE FOR LOW-WASTE, REFILLABLE CLEANING PRODUCTS DRIVE HOUSEHOLD CARE INNOVATION

- 7.5 HEALTHCARE PRODUCTS

- 7.5.1 RISING SELF-CARE TRENDS AND EVOLVING REGULATORY FRAMEWORKS TO DRIVE INNOVATION IN NON-PRESCRIPTION HEALTHCARE PRODUCTS

- 7.6 OTHER PRODUCT TYPES

8 CONSUMER PACKAGED GOODS MARKET, BY DISTRIBUTION CHANNEL

- 8.1 INTRODUCTION

- 8.2 SUPERMARKETS/HYPERMARKETS

- 8.2.1 PRIVATE-LABEL GROWTH, OMNICHANNEL INTEGRATION, AND SUSTAINABILITY TO DRIVE DEMAND IN SUPERMARKETS/HYPERMARKETS

- 8.3 CONVENIENCE STORES

- 8.3.1 PROXIMITY, EXTENDED HOURS, QUICK COMMERCE, AND INNOVATIVE FOODSERVICE TO DRIVE DEMAND IN CONVENIENCE STORES

- 8.4 E-COMMERCE

- 8.4.1 CONVENIENCE, PERSONALIZATION, AND SUSTAINABILITY TO DRIVE DEMAND FOR E-COMMERCE

- 8.5 OTHER DISTRIBUTION CHANNELS

9 CONSUMER GOODS PACKAGING MARKET, BY PACKAGING FORMAT

- 9.1 INTRODUCTION

- 9.2 RIGID PACKAGING

- 9.2.1 PREMIUM APPEAL, PRODUCT PROTECTION, AND SUSTAINABILITY MANDATES TO ACCELERATE INNOVATIONS IN RIGID CONSUMER GOODS PACKAGING

- 9.3 FLEXIBLE PACKAGING

- 9.3.1 LIGHTWEIGHT DESIGN, COST-EFFICIENCY, AND CONSUMER DEMAND FOR CONVENIENCE TO BOOST FLEXIBLE PACKAGING ADOPTION ACROSS APPLICATIONS

- 9.4 OTHERS

- 9.4.1 INNOVATION IN HYBRID AND EMERGING PACKAGING FORMATS DRIVEN BY SUSTAINABILITY, CONVENIENCE, AND EVOLVING CONSUMER EXPECTATIONS

10 CONSUMER GOODS PACKAGING MARKET, BY PACKAGING MATERIAL

- 10.1 INTRODUCTION

- 10.2 PLASTIC

- 10.2.1 VERSATILITY, COST-EFFECTIVENESS, LIGHTWEIGHT DESIGN, AND SUSTAINABILITY INNOVATIONS DRIVE PLASTIC PACKAGING DEMAND

- 10.3 METAL

- 10.3.1 SUSTAINABILITY, HIGH RECYCLABILITY, LIGHTWEIGHTING, AND PREMIUM CONSUMER APPEAL TO DRIVE METAL PACKAGING DEMAND

- 10.4 PAPER & PAPERBOARD

- 10.4.1 E-COMMERCE GROWTH, SUSTAINABILITY, HIGH RECYCLABILITY, AND ECO-FRIENDLY CONSUMER PERCEPTION TO DRIVE PAPERBOARD PACKAGING DEMAND

- 10.5 GLASS

- 10.5.1 GLASS MAINTAINS STRONG PRESENCE IN WINE AND SPIRITS FOR ITS PREMIUM APPEAL AND IS POPULAR IN CRAFT BEVERAGES

- 10.6 OTHER PACKAGING MATERIALS

11 CONSUMER GOODS PACKAGING MARKET, BY PACKAGING TYPE

- 11.1 INTRODUCTION

- 11.2 BOTTLES

- 11.2.1 GROWING PREFERENCE FOR LIGHTWEIGHT, RECYCLABLE BOTTLES DRIVING DEMAND ACROSS BEVERAGE AND PERSONAL CARE PACKAGING SEGMENTS

- 11.3 CANS

- 11.3.1 GROWING DEMAND FOR SUSTAINABLE AND RECYCLABLE CAN PACKAGING ACROSS BEVERAGE AND PROCESSED FOOD SEGMENTS GLOBALLY

- 11.4 BOXES

- 11.4.1 GROWING DEMAND FOR SUSTAINABLE, BRANDED, AND FUNCTIONAL BOX PACKAGING ACROSS E-COMMERCE AND RETAIL CPG APPLICATIONS GLOBALLY

- 11.5 POUCHES

- 11.5.1 RISING DEMAND FOR LIGHTWEIGHT, COST-EFFECTIVE, AND SUSTAINABLE PACKAGING FORMATS ACCELERATING ADOPTION OF FLEXIBLE POUCHES

- 11.6 OTHERS

12 CONSUMER PACKAGED GOODS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Rising Health Consciousness and Clean Label Preferences Reshape US Consumer Packaged Goods Market

- 12.2.2 CANADA

- 12.2.2.1 Growing Sustainability Mandates and Packaging Regulations Drive Material Innovation Across Canada's CPG Industry Segments

- 12.2.3 MEXICO

- 12.2.3.1 Government Regulation and Localized Consumer Preferences Drive Mexico's Evolving Packaged Goods Market

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Germany's Sustainable Consumer Shift Drives Local, Organic, and Circular Innovation in Packaged Goods

- 12.3.2 UK

- 12.3.2.1 Growing Regulatory Pressure and Consumer Demand to Shape UK's Sustainable and Health-conscious CPG Market

- 12.3.3 ITALY

- 12.3.3.1 Rising Demand for Traditional, Organic, and Regionally Certified Consumer Packaged Goods in Italy

- 12.3.4 FRANCE

- 12.3.4.1 Consumer Preference for Premium, Organic, and Sustainable Products Drives French CPG Market Evolution

- 12.3.5 SPAIN

- 12.3.5.1 Rising Domestic Innovation and Sustainability Efforts to Reshape Spain's Consumer Packaged Goods Sector

- 12.3.6 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 China's food processing industry is dependent on sourcing domestic food ingredients for domestic consumption

- 12.4.2 JAPAN

- 12.4.2.1 Rising Demand for Functional, Convenient, and Sustainable Products in Japan's Aging Consumer Market

- 12.4.3 INDIA

- 12.4.3.1 Digital Transformation, Rising Incomes, and Rural Expansion Accelerating India's Consumer Packaged Goods Market Growth

- 12.4.4 AUSTRALIA & NEW ZEALAND

- 12.4.4.1 Rising Demand for Sustainable, Health-focused, and Locally-sourced Products Across Australasia's CPG Market

- 12.4.5 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 SOUTH AMERICA

- 12.5.1 ARGENTINA

- 12.5.1.1 Increasing demand for beverages and expanding beauty and personal care preferences drive growth in Argentina's consumer packaged goods market

- 12.5.2 BRAZIL

- 12.5.2.1 Sustainable Packaging and Premium Beverages Reshape Brazil's Consumer Goods Sector

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 ARGENTINA

- 12.6 REST OF THE WORLD

- 12.6.1 MIDDLE EAST

- 12.6.1.1 Innovative product launches and advancements in packaging are key drivers of market expansion

- 12.6.2 AFRICA

- 12.6.2.1 Wellness Trends Transform Africa's Beverage Preferences

- 12.6.1 MIDDLE EAST

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2022-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 13.5.1 FINANCIAL METRICS, 2024

- 13.6 BRAND/PRODUCT COMPARISON

- 13.6.1 PROCTER & GAMBLE (P&G)

- 13.6.2 UNILEVER

- 13.6.3 NESTLE

- 13.6.4 JOHNSON & JOHNSON

- 13.6.5 COLGATE-PALMOLIVE

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Regional footprint

- 13.7.5.3 Packaging material footprint

- 13.7.5.4 Packaging Type footprint

- 13.7.5.5 Product Type footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs (1/2)

- 13.8.5.3 Competitive benchmarking of key startups/SMEs (2/2)

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 PROCTER & GAMBLE

- 14.1.1.1 Business overview

- 14.1.1.1.1 Plastic Sustainability Goals

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.1.1 Business overview

- 14.1.2 UNILEVER

- 14.1.2.1 Business overview

- 14.1.2.1.1 Plastic Sustainability Goals

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.2.1 Business overview

- 14.1.3 NESTLE

- 14.1.3.1 Business overview

- 14.1.3.1.1 Plastic Sustainability Goals

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.3.1 Business overview

- 14.1.4 DANONE

- 14.1.4.1 Business overview

- 14.1.4.1.1 Plastic Sustainability Goals

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.3.2 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.4.1 Business overview

- 14.1.5 THE COCA-COLA COMPANY

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.3.2 Product launches

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 MONDELEZ INTERNATIONAL

- 14.1.6.1 Business overview

- 14.1.6.1.1 Plastic Sustainability Goals

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.3.2 Expansions

- 14.1.6.4 MnM view

- 14.1.6.1 Business overview

- 14.1.7 AB INBEV

- 14.1.7.1 Business overview

- 14.1.7.1.1 Plastic Sustainability Goals

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Expansions

- 14.1.7.4 MnM view

- 14.1.7.1 Business overview

- 14.1.8 COLGATE-PALMOLIVE COMPANY

- 14.1.8.1 Business overview

- 14.1.8.1.1 Plastic Sustainability Goals

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Product launches

- 14.1.8.4 MnM view

- 14.1.8.1 Business overview

- 14.1.9 RECKITT

- 14.1.9.1 Business overview

- 14.1.9.1.1 Plastic Sustainability Goals

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.3.2 Product launches

- 14.1.9.3.3 Expansions

- 14.1.9.4 MnM view

- 14.1.9.1 Business overview

- 14.1.10 L'OREAL

- 14.1.10.1 Business overview

- 14.1.10.1.1 Plastic Sustainability Goals

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.10.3.2 Expansions

- 14.1.10.4 MnM view

- 14.1.10.1 Business overview

- 14.1.11 THE KRAFT HEINZ COMPANY

- 14.1.11.1 Business overview

- 14.1.11.1.1 Plastic Sustainability Goals

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Product launches

- 14.1.11.4 MnM view

- 14.1.11.1 Business overview

- 14.1.12 GENERAL MILLS INC.

- 14.1.12.1 Business overview

- 14.1.12.1.1 Plastic Sustainability Goals

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.12.3.2 Product launches

- 14.1.12.4 MnM view

- 14.1.12.1 Business overview

- 14.1.13 PHILIP MORRIS PRODUCTS S.A.

- 14.1.13.1 Business overview

- 14.1.13.1.1 Plastic Sustainability Goals

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Product launches

- 14.1.13.3.2 Expansions

- 14.1.13.4 MnM view

- 14.1.13.1 Business overview

- 14.1.14 KENVUE

- 14.1.14.1 Business overview

- 14.1.14.1.1 Plastic Sustainability Goals

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Deals

- 14.1.14.3.2 Product launches

- 14.1.14.3.3 Expansions

- 14.1.14.4 MnM view

- 14.1.14.1 Business overview

- 14.1.15 HENKEL AG & CO. KGAA

- 14.1.15.1 Business overview

- 14.1.15.1.1 Plastic Sustainability Goals

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Deals

- 14.1.15.3.2 Expansions

- 14.1.15.4 MnM view

- 14.1.15.1 Business overview

- 14.1.16 THE CLOROX COMPANY

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Deals

- 14.1.16.4 MnM view

- 14.1.17 THE J.M. SMUCKER COMPANY

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Solutions/Services offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Deals

- 14.1.17.4 MnM view

- 14.1.18 KIMBERLY-CLARK

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Solutions/Services offered

- 14.1.18.3 Recent developments

- 14.1.18.3.1 Product launches

- 14.1.18.3.2 Expansions

- 14.1.18.4 MnM view

- 14.1.19 PEPSICO

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Solutions/Services offered

- 14.1.19.3 Recent developments

- 14.1.19.3.1 Product launches

- 14.1.19.3.2 Deals

- 14.1.19.3.3 Expansions

- 14.1.19.4 MnM view

- 14.1.20 BEIERSDORF

- 14.1.20.1 Business overview

- 14.1.20.2 Products/Solutions/Services offered

- 14.1.20.3 Recent developments

- 14.1.20.3.1 Product launches

- 14.1.20.3.2 Deals

- 14.1.20.3.3 Expansions

- 14.1.20.4 MnM view

- 14.1.21 MARS, INCORPORATED AND ITS AFFILIATES - CONSUMER PACKAGED GOODS MARKET

- 14.1.22 NOMOLOTUS, LLC - CONSUMER PACKAGED GOODS MARKET

- 14.1.23 BLUELAND - CONSUMER PACKAGED GOODS MARKET

- 14.1.24 RITUAL - CONSUMER PACKAGED GOODS MARKET

- 14.1.25 HUM NUTRITION INC. - CONSUMER PACKAGED GOODS MARKET

- 14.1.1 PROCTER & GAMBLE

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 SMART FOOD PACKAGING MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 FOOD & BEVERAGE METAL CANS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS