|

|

市場調査レポート

商品コード

1763331

工作機械の世界市場:製品タイプ別、自動化別、販売チャネル別、エンドユーザー業界別、地域別 - 2032年までの予測Machine Tools Market by Product Type (Milling Machines, Turning Machines, Grinding Machines, Electrical Discharge Machine, Machining Centers), Automation Type (CNC, Conventional), End-User Industry, Sales Channel, and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 工作機械の世界市場:製品タイプ別、自動化別、販売チャネル別、エンドユーザー業界別、地域別 - 2032年までの予測 |

|

出版日: 2025年07月03日

発行: MarketsandMarkets

ページ情報: 英文 261 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

工作機械の市場規模は、2025年の810億9,000万米ドルから2032年には1,051億1,000万米ドルに成長し、CAGRは3.8%を記録すると予測されています。

世界市場は、自動車、航空宇宙、エレクトロニクス、エネルギー、重機の各分野からの需要増に後押しされ、着実な成長を遂げています。生産工程が複雑化し、精密さが要求されるようになるにつれて、メーカーは精度、生産性、柔軟性を高める高度な工作機械に投資するようになっています。新興経済諸国も市場拡大に重要な役割を果たしており、インド、ベトナム、インドネシアなどの国々では、インフラ整備が進み、国内製造業が増加しています。さらに、北米と欧州における再ショアリングの取り組みが現地生産能力を後押しし、金属切断機と金属成形機の需要を押し上げています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 対象ユニット | 金額(100万米ドル)、数量(台) |

| セグメント | 製品タイプ別、自動化別、販売チャネル別、エンドユーザー業界別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、その他の地域 |

自動車製造は、エンジン、トランスミッション、シャーシ、ボディ部品のような車両と部品の大量生産に依存しています。そのため、継続的かつ一貫して大規模に稼働するために、多数のCNC機械、旋盤、フライス盤、ボール盤、研削盤などが必要となります。自動車・運輸部門は、自動車生産、自動化、スマート製造技術の急速な進歩に牽引され、引き続き工作機械市場を独占しています。自動車メーカーは、バッテリーハウジング、電動ドライブトレイン、軽量シャーシなどの複雑な部品の高精度加工を実現するため、CNC機械やロボットシステムの採用を増やしています。例えば、Mazakは2024年3月にINTEGREX i-500S AMを発表しました。これは、自動車のパワートレインとトランスミッション部品向けに開発されたハイブリッド複合加工機で、部品の複雑性を高め、サイクルタイムを短縮するためにアディティブプロセスとサブトラクティブプロセスを統合しています。このような発展は、予測期間中の市場成長を牽引すると思われます。

ターニングマシンは、自動車、航空宇宙、医療機器部門全体で高精度の円筒形部品を製造する上で重要な役割を果たすため、工作機械市場で突出したシェアを占めています。旋盤の優位性は、1回のセットアップでフライス加工や穴あけ加工などの複合加工が可能なCNC旋盤の需要が急増し、サイクルタイムが大幅に短縮され、生産性が向上したことでさらに強化されています。2025年2月、DMG MORIはワールドプレミアオープンハウスで第6世代CTX 750|1250旋盤を発表しました。最大旋削径700mm、最大旋削長1,290mmを実現し、様々な複雑ワークの高能率重切削加工を可能にしました。両機にはオークマの新型CNC制御装置OSP-P500が搭載され、デュアルコアプロセッサによる高い処理能力と、操作とデータを保護するサイバーセキュリティ機能が組み込まれています。さらに、最新のターニングマシンに自動バーフィーダーとロボットローディングシステムを採用することは、ライトアウトマニュファクチャリングの動向とよく一致しています。これらの開発は、多品種少量生産におけるカスタマイズニーズの増加と相まって、旋盤加工機をデジタル化された製造エコシステムの中心に位置づけています。

中国は工作機械市場においてアジア太平洋で最も高いシェアを占めています。この優位性は、同国の広範な製造インフラ、強固な産業基盤、製造能力の強化を目的とした様々な取り組みによる政府の多大な支援によってもたらされています。中国政府はまた、適格な工作機械企業に対して研究開発税の控除を提供する政策を導入しており、これは国内の技術革新を後押しし、外国依存を減らすことを意図しています。中国の工作機械市場はさらに、大連機工集団、瀋陽機工、捷爾機工集団、重慶機工(集団)、南通機工などの主要メーカー数社によって支配されています。これらの企業は、自動車、航空宇宙、鉄道、エネルギー、一般製造業向けの設備供給で重要な役割を果たしています。例えば、 Brother Industries, Ltd.は2025年4月、子会社のBROTHER MACHINERY SHANGHAI LTD.を通じて天津にテクノロジーセンターを新設すると発表しました。同センターでは、デモンストレーション、セミナー、テスト加工、サービスサポートなどを行い、工作機械の販売をサポートします。

当レポートでは、世界の工作機械市場について調査し、製品タイプ別、自動化別、販売チャネル別、エンドユーザー業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向と混乱

- 価格分析

- エコシステム分析

- バリューチェーン分析

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIの影響

- 技術分析

- 規制状況

- トレンド分析

- 2025年~2026年の主な会議とイベント

- 主要な利害関係者と購入基準

第6章 工作機械市場(製品タイプ別)

- イントロダクション

- フライス盤

- 掘削機

- 旋盤

- 研削盤

- 放電加工機

- マシニングセンター

- その他

- 主要な洞察

第7章 工作機械市場(自動化別)

- イントロダクション

- CNC工作機械

- 従来型工作機械

- 主要な洞察

第8章 工作機械市場(販売チャネル別)

- イントロダクション

- 直接販売

- イベントと展示会

- ディーラーと販売代理店

- 主要な洞察

第9章 工作機械市場(エンドユーザー業界別)

- イントロダクション

- 航空宇宙

- 医療

- 半導体

- 自動車・輸送

- 資本財

- エネルギー・電力

- 板金

- 市場を牽引する機能

- その他

- 主要な洞察

第10章 工作機械市場(地域別)

- イントロダクション

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- タイ

- 台湾

- ベトナム

- マレーシア

- その他

- 欧州

- マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- スイス

- トルコ

- 北米

- マクロ経済見通し

- 米国

- カナダ

- メキシコ

- その他の地域

- マクロ経済見通し

- ロシア

- ブラジル

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- MAKINO INC.

- JTEKT CORPORATION

- OKUMA CORPORATION

- DMG MORI

- DN SOLUTIONS

- AMADA CO., LTD.

- YAMAZAKI MAZAK CORPORATION

- CHIRON GROUP SE

- KOMATSU NTC

- HAAS AUTOMATION, INC.

- GENERAL TECHNOLOGY GROUP DALIAN MACHINE TOOL CO., LTD.

- UNITED GRINDING GROUP

- INDEX-WERKE GMBH & CO. KG HAHN & TESSKY

- CITIZEN MACHINERY CO., LTD.

- EMAG GMBH & CO. KG

- SHENYANG MACHINE TOOL CO., LTD.

- その他の企業

- FFG EUROPEAN & AMERICAN HOLDINGS GMBH

- HMT MACHINE TOOLS LIMITED

- SPINNER WERKZEUGMASCHINENFABRIK GMBH

- GLEASON CORPORATION

- GROB-WERKE GMBH & CO. KG

- BLASER SWISSLUBE

- CASTROL LIMITED

- QUAKER HOUGHTON

- SCHULER AG

- ELECTRONICA HI-TECH ENGINEERING PVT. LTD.

- ACEMICROMATIC GROUP

- TUNGALOY CORPORATION

- MACHINE TOOLS INDIA LIMITED

- ISEMBARD MACHINE TOOLS

- MANUKAI AG

- IPERCEPT TECHNOLOGY

- AUGURY LTD.

第13章 市場における提言

第14章 付録

List of Tables

- TABLE 1 MACHINE TOOLS MARKET DEFINITION, BY PRODUCT TYPE

- TABLE 2 MACHINE TOOLS MARKET DEFINITION, BY AUTOMATION

- TABLE 3 MACHINE TOOLS MARKET DEFINITION, BY SALES CHANNEL

- TABLE 4 MACHINE TOOLS MARKET DEFINITION, BY END-USER INDUSTRY

- TABLE 5 CURRENCY EXCHANGE RATES (PER USD)

- TABLE 6 IMPACT OF MARKET DYNAMICS

- TABLE 7 AVERAGE SELLING PRICE OF MACHINE TOOLS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF MACHINE TOOLS, BY PRODUCT TYPE, 2022-2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF MACHINE TOOLS, BY REGION, 2022-2024 (USD)

- TABLE 10 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 11 LIST OF FUNDINGS, 2021-2024

- TABLE 12 PATENT ANALYSIS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 IMPORT DATA FOR HS CODE 8458-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 18 EXPORT DATA FOR HS CODE 8458-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 19 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT TYPE

- TABLE 21 KEY BUYING CRITERIA, BY PRODUCT TYPE

- TABLE 22 MACHINE TOOLS MARKET, BY PRODUCT TYPE, 2021-2024 (USD BILLION)

- TABLE 23 MACHINE TOOLS MARKET, BY PRODUCT TYPE, 2025-2032 (USD BILLION)

- TABLE 24 MILLING MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 25 MILLING MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 26 LIST OF 4 AND 5-AXIS MILLING MACHINES

- TABLE 27 MILLING MACHINE TOOLS MARKET, BY AXIS TYPE, 2021-2024 (USD BILLION)

- TABLE 28 MILLING MACHINE TOOLS MARKET, BY AXIS TYPE, 2025-2032 (USD BILLION)

- TABLE 29 DRILLING MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 30 DRILLING MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 31 TURNING MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 32 TURNING MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 33 TURNING MACHINE TOOLS MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 34 TURNING MACHINE TOOLS MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 35 GRINDING MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 36 GRINDING MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 37 ELECTRICAL DISCHARGE MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 38 ELECTRICAL DISCHARGE MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 39 MACHINING CENTER TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 40 MACHINING CENTER TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 41 OTHER MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 42 OTHER MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 43 MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 44 MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 45 CNC MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 46 CNC MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 47 CONVENTIONAL MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 48 CONVENTIONAL MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 49 MACHINE TOOLS MARKET, BY SALES CHANNEL, 2021-2024 (USD BILLION)

- TABLE 50 MACHINE TOOLS MARKET, BY SALES CHANNEL, 2025-2032 (USD BILLION)

- TABLE 51 DIRECT SALES: MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 52 DIRECT SALES: MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 53 EVENTS & EXHIBITIONS: MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 54 EVENTS & EXHIBITIONS: MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 55 DEALERS & DISTRIBUTORS: MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 56 DEALERS & DISTRIBUTORS: MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 57 MACHINE TOOLS MARKET, BY END-USER INDUSTRY, 2021-2024 (USD BILLION)

- TABLE 58 MACHINE TOOLS MARKET, BY END-USER INDUSTRY, 2025-2032 (USD BILLION)

- TABLE 59 AEROSPACE: MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 60 AEROSPACE: MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 61 MEDICAL: MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 62 MEDICAL: MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 63 SEMICONDUCTOR: MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 64 SEMICONDUCTOR: MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 65 AUTOMOTIVE & TRANSPORTATION: MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 66 AUTOMOTIVE & TRANSPORTATION: MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 67 CAPITAL GOODS: MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 68 CAPITAL GOODS: MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 69 ENERGY & POWER: MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 70 ENERGY & POWER: MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 71 SHEET METAL: MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 72 SHEET METAL: MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 73 OTHERS: MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 74 OTHERS: MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 75 MACHINE TOOLS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 76 MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 77 ASIA PACIFIC: MACHINE TOOLS MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 78 ASIA PACIFIC: MACHINE TOOLS MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 79 CHINA: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 80 CHINA: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 81 JAPAN: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 82 JAPAN: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 83 SOUTH KOREA: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 84 SOUTH KOREA: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 85 INDIA: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 86 INDIA: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 87 THAILAND: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 88 THAILAND: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 89 TAIWAN: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 90 TAIWAN: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 91 VIETNAM: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 92 VIETNAM: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 93 MALAYSIA: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 94 MALAYSIA: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 95 REST OF ASIA PACIFIC: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 96 REST OF ASIA PACIFIC: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 97 EUROPE: MACHINE TOOLS MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 98 EUROPE: MACHINE TOOLS MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 99 UK: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 100 UK: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 101 GERMANY: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 102 GERMANY: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 103 FRANCE: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 104 FRANCE: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 105 ITALY: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 106 ITALY: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 107 SPAIN: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 108 SPAIN: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 109 SWITZERLAND: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 110 SWITZERLAND: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 111 TURKEY: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 112 TURKEY: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 113 NORTH AMERICA: MACHINE TOOLS MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 114 NORTH AMERICA: MACHINE TOOLS MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 115 US: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 116 US: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 117 CANADA: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 118 CANADA: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 119 MEXICO: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 120 MEXICO: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 121 REST OF THE WORLD: MACHINE TOOLS MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 122 REST OF THE WORLD: MACHINE TOOLS MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 123 RUSSIA: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 124 RUSSIA: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 125 BRAZIL: MACHINE TOOLS MARKET, BY AUTOMATION, 2021-2024 (USD BILLION)

- TABLE 126 BRAZIL: MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- TABLE 127 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 128 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- TABLE 129 REGION FOOTPRINT

- TABLE 130 PRODUCT TYPE FOOTPRINT

- TABLE 131 SALES CHANNEL FOOTPRINT

- TABLE 132 LIST OF START-UPS/SMES

- TABLE 133 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 134 MACHINE TOOLS MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021-2025

- TABLE 135 MACHINE TOOLS MARKET: DEALS, 2021-2025

- TABLE 136 MACHINE TOOLS MARKET: EXPANSIONS, 2021-2025

- TABLE 137 MAKINO INC.: COMPANY OVERVIEW

- TABLE 138 MAKINO INC.: PRODUCTS OFFERED

- TABLE 139 MAKINO INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 140 MAKINO INC.: DEALS

- TABLE 141 MAKINO INC.: EXPANSIONS

- TABLE 142 JTEKT CORPORATION: COMPANY OVERVIEW

- TABLE 143 JTEKT CORPORATION: PRODUCTS OFFERED

- TABLE 144 JTEKT CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 145 JTEKT CORPORATION: DEALS

- TABLE 146 JTEKT CORPORATION: EXPANSIONS

- TABLE 147 JTEKT CORPORATION: OTHER DEVELOPMENTS

- TABLE 148 OKUMA CORPORATION: COMPANY OVERVIEW

- TABLE 149 OKUMA CORPORATION: PRODUCTS OFFERED

- TABLE 150 OKUMA CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 151 OKUMA CORPORATION: DEALS

- TABLE 152 OKUMA CORPORATION: OTHER DEVELOPMENTS

- TABLE 153 DMG MORI: COMPANY OVERVIEW

- TABLE 154 DMG MORI: PRODUCTS OFFERED

- TABLE 155 DMG MORI: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 156 DMG MORI: DEALS

- TABLE 157 DMG MORI: EXPANSIONS

- TABLE 158 DMG MORI: OTHER DEVELOPMENTS

- TABLE 159 DN SOLUTIONS: COMPANY OVERVIEW

- TABLE 160 DN SOLUTIONS: PRODUCTS OFFERED

- TABLE 161 DN SOLUTIONS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 162 DN SOLUTIONS: DEALS

- TABLE 163 DN SOLUTIONS: EXPANSIONS

- TABLE 164 DN SOLUTIONS: OTHER DEVELOPMENTS

- TABLE 165 AMADA CO., LTD.: COMPANY OVERVIEW

- TABLE 166 AMADA CO., LTD.: PRODUCTS OFFERED

- TABLE 167 AMADA CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 168 AMADA CO., LTD.: DEALS

- TABLE 169 AMADA CO., LTD.: OTHER DEVELOPMENTS

- TABLE 170 YAMAZAKI MAZAK CORPORATION: COMPANY OVERVIEW

- TABLE 171 YAMAZAKI MAZAK CORPORATION: PRODUCTS OFFERED

- TABLE 172 YAMAZAKI MAZAK CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 173 YAMAZAKI MAZAK CORPORATION: EXPANSIONS

- TABLE 174 CHIRON GROUP SE: COMPANY OVERVIEW

- TABLE 175 CHIRON GROUP SE: PRODUCTS OFFERED

- TABLE 176 CHIRON GROUP SE: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 177 CHIRON GROUP SE: DEALS

- TABLE 178 KOMATSU NTC: COMPANY OVERVIEW

- TABLE 179 KOMATSU NTC: PRODUCTS OFFERED

- TABLE 180 KOMATSU NTC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 181 HAAS AUTOMATION, INC.: COMPANY OVERVIEW

- TABLE 182 HAAS AUTOMATION, INC.: PRODUCTS OFFERED

- TABLE 183 GENERAL TECHNOLOGY DALIAN MACHINE TOOL CO., LTD.: COMPANY OVERVIEW

- TABLE 184 GENERAL TECHNOLOGY DALIAN MACHINE TOOL CO., LTD.: PRODUCTS OFFERED

- TABLE 185 GENERAL TECHNOLOGY DALIAN MACHINE TOOL CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 186 GENERAL TECHNOLOGY DALIAN MACHINE TOOL CO., LTD.: EXPANSIONS

- TABLE 187 UNITED GRINDING GROUP: COMPANY OVERVIEW

- TABLE 188 UNITED GRINDING GROUP: PRODUCTS OFFERED

- TABLE 189 UNITED GRINDING GROUP: DEALS

- TABLE 190 UNITED GRINDING GROUP: EXPANSIONS

- TABLE 191 INDEX-WERKE GMBH & CO. KG HAHN & TESSKY: COMPANY OVERVIEW

- TABLE 192 INDEX-WERKE GMBH & CO. KG HAHN & TESSKY: PRODUCTS OFFERED

- TABLE 193 INDEX-WERKE GMBH & CO. KG HAHN & TESSKY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 194 CITIZEN MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 195 CITIZEN MACHINERY CO., LTD.: PRODUCTS OFFERED

- TABLE 196 CITIZEN MACHINERY CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 197 EMAG GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 198 EMAG GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 199 EMAG GMBH & CO. KG.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 200 EMAG GMBH & CO. KG: DEALS

- TABLE 201 SHENYANG MACHINE TOOL CO., LTD.: COMPANY OVERVIEW

- TABLE 202 SHENYANG MACHINE TOOL CO., LTD.: PRODUCTS OFFERED

- TABLE 203 SHENYANG MACHINE TOOL CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 204 SHENYANG MACHINE TOOL CO., LTD.: DEALS

- TABLE 205 FFG EUROPEAN & AMERICAN HOLDINGS GMBH: COMPANY OVERVIEW

- TABLE 206 HMT MACHINE TOOLS LIMITED: COMPANY OVERVIEW

- TABLE 207 SPINNER WERKZEUGMASCHINENFABRIK GMBH: COMPANY OVERVIEW

- TABLE 208 GLEASON CORPORATION: COMPANY OVERVIEW

- TABLE 209 GROB-WERKE GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 210 BLASER SWISSLUBE: COMPANY OVERVIEW

- TABLE 211 CASTROL LIMITED: COMPANY OVERVIEW

- TABLE 212 QUAKER HOUGHTON: COMPANY OVERVIEW

- TABLE 213 SCHULER AG: COMPANY OVERVIEW

- TABLE 214 ELECTRONICA HI-TECH ENGINEERING PVT. LTD.: COMPANY OVERVIEW

- TABLE 215 ACEMICROMATIC GROUP: COMPANY OVERVIEW

- TABLE 216 TUNGALOY CORPORATION: COMPANY OVERVIEW

- TABLE 217 MACHINE TOOLS INDIA LIMITED: COMPANY OVERVIEW

- TABLE 218 ISEMBARD MACHINE TOOLS: COMPANY OVERVIEW

- TABLE 219 MANUKAI AG: COMPANY OVERVIEW

- TABLE 220 IPERCEPT TECHNOLOGY: COMPANY OVERVIEW

- TABLE 221 AUGURY LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MACHINE TOOLS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION NOTES

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS

- FIGURE 10 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- FIGURE 11 MACHINE TOOLS MARKET OVERVIEW

- FIGURE 12 ASIA PACIFIC TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 13 CNC MACHINE TOOLS TO BE LARGER THAN CONVENTIONAL MACHINE TOOLS DURING FORECAST PERIOD

- FIGURE 14 MACHINING CENTERS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 15 RISING DEMAND FOR MACHINE TOOLS IN ASIA PACIFIC TO DRIVE MARKET

- FIGURE 16 MACHINING CENTERS TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 CNC MACHINE TOOLS TO HOLD HIGHER SHARE DURING FORECAST PERIOD

- FIGURE 18 DEALERS & DISTRIBUTORS TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 19 AUTOMOTIVE & TRANSPORTATION TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR MACHINE TOOLS DURING FORECAST PERIOD

- FIGURE 21 MACHINE TOOLS MARKET DYNAMICS

- FIGURE 22 VALUE ADDED IN MANUFACTURING MARKET, 2018-2024

- FIGURE 23 APPROACHES FOR INCREASING ENERGY EFFICIENCY OF MACHINE TOOLS

- FIGURE 24 EVOLUTIONARY HISTORY OF INDUSTRIALIZATION AND MACHINE TOOLS

- FIGURE 25 ADAPTIVE CONTROL SYSTEMS FOR MACHINE TOOLS

- FIGURE 26 WORKFORCE SKILL GAP BETWEEN 2018 AND 2028

- FIGURE 27 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF MACHINE TOOLS, BY PRODUCT TYPE, 2022-2024 (USD)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF MACHINE TOOLS, BY REGION, 2022-2024 (USD)

- FIGURE 30 ECOSYSTEM ANALYSIS

- FIGURE 31 VALUE CHAIN ANALYSIS

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 33 PATENT ANALYSIS

- FIGURE 34 SYSTEM ARCHITECTURE OF INTELLIGENT NUMERICAL CONTROLLERS

- FIGURE 35 IOT FOR MACHINE TOOL MONITORING SOLUTIONS

- FIGURE 36 IMPORT DATA FOR HS CODE 8458-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 37 EXPORT DATA FOR HS CODE 8458-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT TYPE

- FIGURE 39 KEY BUYING CRITERIA, BY PRODUCT TYPE

- FIGURE 40 MACHINE TOOLS MARKET, BY PRODUCT TYPE, 2025-2032 (USD BILLION)

- FIGURE 41 MACHINE TOOLS MARKET, BY AUTOMATION, 2025-2032 (USD BILLION)

- FIGURE 42 MACHINE TOOLS MARKET, BY SALES CHANNEL, 2025-2032 (USD BILLION)

- FIGURE 43 MACHINE TOOLS MARKET, BY END-USER INDUSTRY, 2025-2032 (USD BILLION)

- FIGURE 44 MACHINE TOOLS MARKET, BY REGION, 2025-2032 (USD BILLION)

- FIGURE 45 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 46 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 47 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 48 ASIA PACIFIC: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 49 ASIA PACIFIC: MACHINE TOOLS MARKET SNAPSHOT

- FIGURE 50 MARKET SHARE OF LEADING MACHINE TOOL COMPANIES IN SOUTH KOREA, 2024

- FIGURE 51 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 52 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 53 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 54 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 55 EUROPE: MACHINE TOOLS MARKET SNAPSHOT

- FIGURE 56 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 57 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 58 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 59 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 60 NORTH AMERICA: MACHINE TOOLS MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- FIGURE 61 REST OF THE WORLD: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 62 REST OF THE WORLD: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 63 REST OF THE WORLD: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 64 REST OF THE WORLD: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 65 REST OF THE WORLD: MACHINE TOOLS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- FIGURE 66 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 67 REVENUE ANALYSIS OF TOP FIVE PLAYERS 2020-2024 (USD BILLION)

- FIGURE 68 COMPANY VALUATION OF PROMINENT PLAYERS

- FIGURE 69 FINANCIAL METRICS OF PROMINENT PLAYERS

- FIGURE 70 BRAND/PRODUCT COMPARISON

- FIGURE 71 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 72 COMPANY FOOTPRINT

- FIGURE 73 COMPANY EVALUATION MARKET (START-UPS/SMES), 2024

- FIGURE 74 MAKINO INC.: COMPANY SNAPSHOT

- FIGURE 75 JTEKT CORPORATION: COMPANY SNAPSHOT

- FIGURE 76 OKUMA CORPORATION: COMPANY SNAPSHOT

- FIGURE 77 DMG MORI: COMPANY SNAPSHOT

- FIGURE 78 DN SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 79 DN SOLUTIONS: COMPANY REGIONAL PRESENCE

- FIGURE 80 AMADA CO., LTD.: COMPANY SNAPSHOT

- FIGURE 81 YAMAZAKI MAZAK CORPORATION: COMPANY SNAPSHOT

- FIGURE 82 KOMATSU NTC: GEOGRAPHICAL PRESENCE

- FIGURE 83 CITIZEN MACHINERY CO., LTD.: COMPANY SNAPSHOT

The machine tools market is expected to grow from USD 81.09 billion in 2025 to USD 105.11 billion by 2032, registering a CAGR of 3.8%. The global market is experiencing steady growth, fueled by increasing demand from automotive, aerospace, electronics, energy, and heavy machinery sectors. As production processes become more complex and precision-driven, manufacturers are investing in advanced machine tools that enhance accuracy, productivity, and flexibility. Developing economies are also playing a significant role in market expansion, with countries like India, Vietnam, and Indonesia witnessing significant infrastructure development and rising domestic manufacturing. Moreover, reshoring efforts in North America and Europe encourage local production capabilities, boosting demand for metal-cutting and metal-forming machines.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million), Volume (Units) |

| Segments | Product Type, Automation, Sales Channel, End-User Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, and Rest of the World |

"Automotive & transportation is expected to be the largest segment during the forecast period."

Automotive manufacturing relies on the mass production of vehicles and components like engines, transmissions, chassis, and body parts. This demands a large number of CNC machines, lathes, milling machines, drilling machines, grinding machines, etc., to operate continuously and consistently at scale. The automotive & transportation sector continues to dominate the machine tools market, driven by rapid advancements in vehicle production, automation, and smart manufacturing technologies. Automakers are increasingly adopting CNC machines and robotic systems to achieve high-precision machining of complex components such as battery housings, electric drivetrains, and lightweight chassis. For instance, in March 2024, Mazak launched the INTEGREX i-500S AM, a hybrid multi-tasking machine tailored for automotive powertrain and transmission components, integrating additive and subtractive processes to enhance part complexity and reduce cycle time. Such developments will drive the market growth in the forecast period.

"Turning machines are expected to hold a significant share during the forecast period."

Turning machines hold a prominent share in the machine tools market due to their critical role in producing cylindrical components with high precision across the automotive, aerospace, and medical device sectors. Their dominance is further bolstered by the surge in demand for CNC lathes capable of multi-tasking operations, including milling and drilling in a single setup, significantly reducing cycle time and enhancing productivity. In February 2025, DMG MORI unveiled the 6th Generation CTX 750|1250 turning machine at the World Premiere Open House. It features a maximum turning diameter of 700 mm and a turning length of up to 1,290 mm, enabling efficient heavy-duty machining for various complex workpieces. Both machines are equipped with Okuma's new OSP-P500 CNC control, offering greater processing power with dual-core processors and embedded cybersecurity features to protect operations and data. Moreover, the adoption of automated bar feeders and robotic loading systems in modern turning machines aligns well with the trend toward lights-out manufacturing. These developments, combined with increased customization needs in high-mix, low-volume production, position turning machines as central to digitalized manufacturing ecosystems.

"China is expected to hold the highest share in Asia Pacific during the forecast period."

China accounts for Asia Pacific's highest share of the machine tools market. This dominance is driven by the country's extensive manufacturing infrastructure, robust industrial base, and significant government support through various initiatives that aim to enhance manufacturing capabilities. The Chinese government has also introduced policies offering R&D tax deductions to qualified machine tool enterprises, intending to boost domestic innovation and reduce foreign dependence. China's machine tool market is further dominated by several key manufacturers, including Dalian Machine Tool Group, Shenyang Machine Tool Co., Ltd., JIER Machine-Tool Group, Chongqing Machine Tool (Group) Co., Ltd, and Nantong Machine Tool Co., Ltd. These companies play a significant role in supplying equipment for automotive, aerospace, railways, energy, and general manufacturing sectors. For instance, in April 2025, Brother Industries, Ltd. announced the establishment of a new Technology Center in Tianjin through its subsidiary BROTHER MACHINERY SHANGHAI LTD., marking its sixth such facility in China with a machine tool showroom. The center will support machine tool sales by offering demonstrations, seminars, test processing, and service support.

Breakdown of Primaries:

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Machine Tools Manufacturers - 35%, Tier 1/Tier 2 - 41%, and End Users - 24%

- By Designation: C Level - 60%, D Level - 10%, and Others - 30%

- By Region: Asia Pacific-40%, Europe-30%, North America-20%, Rest of the World-10%

The machine tools market is dominated by major players, including Makino Inc. (Japan), JTEKT Corporation (Japan), Okuma Corporation (Japan), DMG MORI Co., Ltd. (Japan), and DN Solutions (South Korea).

The study includes an in-depth competitive analysis of these key players in the machine tools market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

This research report categorizes the machine tools market By Product Type (Milling Machines, Turning Machines, Grinding Machines, Electrical Discharge Machine, Machining Centers, and Others), Automation Type (CNC and Conventional), Sales Channel (Events & Exhibitions, Dealers & Distributors, and Direct Sales), End-user Industry (Aerospace, Medical, Semiconductor, Automotive and Transportation, Capital Goods, Energy, and Power, Sheet Metals, and Others), and Region (North America, Europe, Asia Pacific, and Rest of the World). The scope of the report covers detailed information regarding drivers, restraints, challenges, and opportunities influencing the market growth. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions & services, key strategies, contracts, partnerships, agreements, product & service launches, mergers & acquisitions, and recent developments associated with the machine tools market. This report also covers a competitive analysis of upcoming start-ups in the machine tools market ecosystem.

Reasons to Buy this Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall machine tools market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising adoption of manufactured goods, increased demand for precision and efficiency, growing automobile production, heightened focus on automation), restraints (high initial investment), opportunities (Industry 4.0 and digitization, rapid adoption of CNC technology, rising implementation of adaptive machining), and challenges (absence of standardization in industrial communication protocols and interfaces, lack of skilled workforce to operate automated machine tools) influencing the growth of the machine tools market

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the machine tools market

- Market Development: Comprehensive information about lucrative markets - the report analyses the machine tools market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the machine tools market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Makino Inc. (Japan), JTEKT Corporation (Japan), Okuma Corporation (Japan), DMG MORI Co., Ltd. (Japan), and DN Solutions (South Korea), and among others, in the machine tools market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews: demand and supply sides

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Primary participants

- 2.1.2.4 Objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

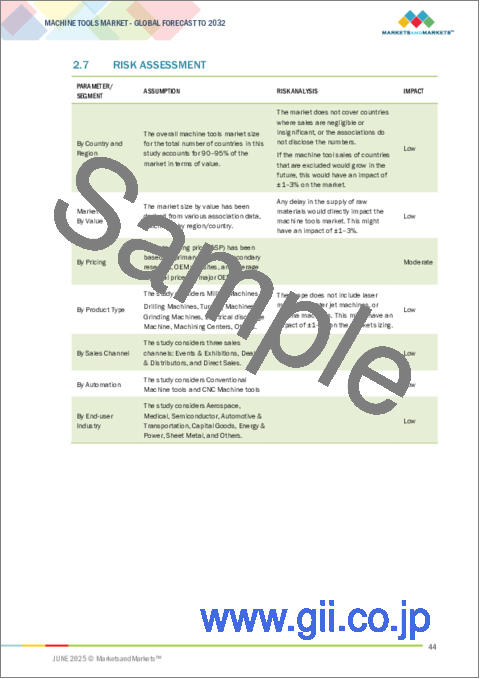

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MACHINE TOOLS MARKET

- 4.2 MACHINE TOOLS MARKET, BY PRODUCT TYPE

- 4.3 MACHINE TOOLS MARKET, BY AUTOMATION

- 4.4 MACHINE TOOLS MARKET, BY SALES CHANNEL

- 4.5 MACHINE TOOLS MARKET, BY END-USER INDUSTRY

- 4.6 MACHINE TOOLS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of manufactured goods

- 5.2.1.2 Increased demand for precision and efficiency

- 5.2.1.3 Growing automobile production

- 5.2.1.4 Heightened focus on automation

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Industry 4.0 and digitization

- 5.2.3.2 Rapid adoption of CNC technology

- 5.2.3.3 Increased implementation of adaptive machining

- 5.2.4 CHALLENGES

- 5.2.4.1 Absence of standardization in industrial communication protocols

- 5.2.4.2 Lack of skilled workforce to operate automated machine tools

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF MACHINE TOOLS OFFERED BY KEY PLAYERS

- 5.4.2 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 MACHINE TOOL COMPONENT MANUFACTURERS

- 5.5.3 CUTTING TOOL MANUFACTURERS

- 5.5.4 SOFTWARE AND DIGITIZATION PROVIDERS

- 5.5.5 MACHINE TOOL MANUFACTURERS

- 5.5.6 DISTRIBUTORS AND DEALERS

- 5.5.7 MAINTENANCE AND REPAIR SERVICE PROVIDERS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 CIRCLE GMBH INSTALLED ROEDERS 5-AXIS MACHINING CENTER OF HURCO EUROPE TO PRODUCE MACHINE PROTOTYPES

- 5.7.2 JONES NUTTAL INSTALLED PRECISION CNC MACHINES TO IMPROVE OPERATIONAL EFFICIENCY AND RELIABILITY

- 5.7.3 P-Q CONTROLS, INC. USED DETRON NEO CNC MACHINE TO REDUCE OPERATING COSTS

- 5.7.4 HYPERION MATERIALS & TECHNOLOGIES EMPLOYED HIGH-PRECISION SOLUTION FOR MANUFACTURING

- 5.7.5 GRUPOS DIFERENCIALES CUSTOMIZED GRINDING MACHINES FOR MACHINING GEARS

- 5.7.6 MAN DIESEL & TURBO INCORPORATED HIGH-PRECISION GRINDING MACHINE FOR TURBO-COMPRESSORS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 PATENT ANALYSIS

- 5.10 IMPACT OF AI/GEN AI

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Smart features and networks

- 5.11.1.2 Automated and IoT-ready machines

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Advanced materials and cutting tool technology

- 5.11.2.2 Additive manufacturing integration

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Software and digital twin technology

- 5.11.1 KEY TECHNOLOGIES

- 5.12 REGULATORY LANDSCAPE

- 5.13 TREND ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 8458)

- 5.13.2 EXPORT SCENARIO (HS CODE 8458)

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

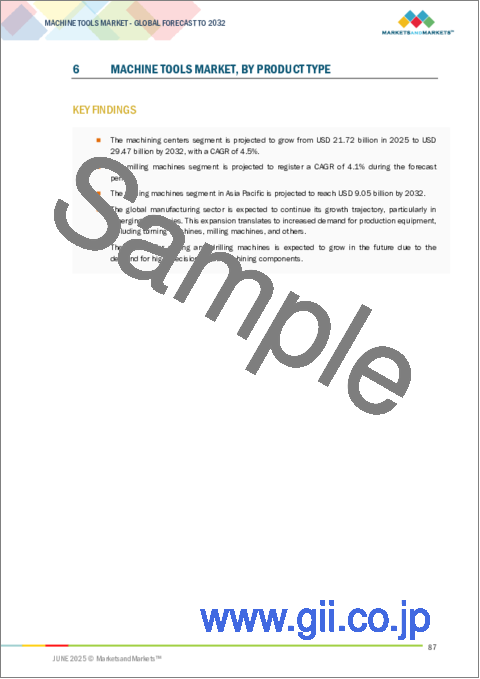

6 MACHINE TOOLS MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 MILLING MACHINES

- 6.2.1 FOCUS ON PROCESS AUTOMATION TO DRIVE MARKET

- 6.2.2 MILLING MACHINES MARKET, BY AXIS TYPE

- 6.2.2.1 4-axis

- 6.2.2.2 5-axis

- 6.2.3 UNIVERSAL MILLING MACHINES

- 6.3 DRILLING MACHINES

- 6.3.1 RAPID INDUSTRIALIZATION AND INFRASTRUCTURE DEVELOPMENT TO DRIVE MARKET

- 6.4 TURNING MACHINES

- 6.4.1 DEMAND FOR ACCURACY AND VERSATILITY FROM AEROSPACE AND AUTOMOTIVE INDUSTRIES TO DRIVE MARKET

- 6.4.2 TURNING MACHINES MARKET, BY TYPE

- 6.4.2.1 Swiss-type

- 6.4.2.2 Multi-spindle

- 6.4.3 UNIVERSAL TURNING MACHINES

- 6.5 GRINDING MACHINES

- 6.5.1 NEED FOR COST-EFFECTIVE MACHINING SOLUTIONS TO DRIVE MARKET

- 6.6 ELECTRICAL DISCHARGE MACHINES

- 6.6.1 CONTINUOUS ADVANCEMENTS IN TECHNOLOGY TO DRIVE MARKET

- 6.7 MACHINING CENTERS

- 6.7.1 INCREASED ADOPTION OF AUTOMATION IN MANUFACTURING PROCESSES TO DRIVE MARKET

- 6.8 OTHERS

- 6.9 PRIMARY INSIGHTS

7 MACHINE TOOLS MARKET, BY AUTOMATION

- 7.1 INTRODUCTION

- 7.2 CNC MACHINE TOOLS

- 7.2.1 CUSTOMIZATION DEMANDS FROM DIVERSE INDUSTRIES TO DRIVE MARKET

- 7.3 CONVENTIONAL MACHINE TOOLS

- 7.3.1 LOWER CAPITAL INVESTMENT AND EASE OF OPERATION TO DRIVE MARKET

- 7.4 PRIMARY INSIGHTS

8 MACHINE TOOLS MARKET, BY SALES CHANNEL

- 8.1 INTRODUCTION

- 8.2 DIRECT SALES

- 8.2.1 DEMAND FOR TAILORED SOLUTIONS AND QUICKER FEEDBACK LOOPS TO DRIVE MARKET

- 8.3 EVENTS & EXHIBITIONS

- 8.3.1 UNTAPPED NETWORKING AND EXPANSION POTENTIAL TO DRIVE MARKET

- 8.4 DEALERS & DISTRIBUTORS

- 8.4.1 STRONG LOCAL MARKET ACCESS TO DRIVE MARKET

- 8.5 PRIMARY INSIGHTS

9 MACHINE TOOLS MARKET, BY END-USER INDUSTRY

- 9.1 INTRODUCTION

- 9.2 AEROSPACE

- 9.2.1 GROWING RELIANCE ON HIGH-PRECISION COMPONENTS TO DRIVE MARKET

- 9.3 MEDICAL

- 9.3.1 INCREASED PREFERENCE FOR PRECISION MEDICAL DEVICES AND BIOCOMPATIBLE MATERIALS TO DRIVE MARKET

- 9.4 SEMICONDUCTOR

- 9.4.1 HIGH DEMAND FOR MACHINE TOOLS IN DIE AND WIRE BONDING PROCESSES TO DRIVE MARKET

- 9.5 AUTOMOTIVE & TRANSPORTATION

- 9.5.1 EMPHASIS ON INCREASING MANUFACTURING EFFICIENCY DURING MASS PRODUCTION TO DRIVE MARKET

- 9.6 CAPITAL GOODS

- 9.6.1 HEIGHTENED DEMAND FOR FABRICATED METAL PARTS TO DRIVE MARKET

- 9.7 ENERGY & POWER

- 9.7.1 EXTENSIVE USE IN MANUFACTURING LARGE, HIGH-PRECISION COMPONENTS TO DRIVE MARKET

- 9.8 SHEET METAL

- 9.8.1 IMPROVED THROUGHPUT AND DECREASED DOWNTIME WITH INDUSTRY

- 4.0 FEATURES TO DRIVE MARKET

- 9.9 OTHERS

- 9.10 PRIMARY INSIGHTS

10 MACHINE TOOLS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 MACROECONOMIC OUTLOOK

- 10.2.2 CHINA

- 10.2.2.1 Government-led initiatives for automation to drive market

- 10.2.3 JAPAN

- 10.2.3.1 Increased production of precision components for automotive industry to drive market

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Elevated demand for advanced machine tools to drive market

- 10.2.5 INDIA

- 10.2.5.1 Anticipated growth in high-end machine tool manufacturing to drive market

- 10.2.6 THAILAND

- 10.2.6.1 Large-scale automobile production to drive market

- 10.2.7 TAIWAN

- 10.2.7.1 Shift toward smart manufacturing to drive market

- 10.2.8 VIETNAM

- 10.2.8.1 Increased foreign investments to drive market

- 10.2.9 MALAYSIA

- 10.2.9.1 Surge in demand from key end-user industries to drive market

- 10.2.10 REST OF ASIA PACIFIC

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK

- 10.3.2 UK

- 10.3.2.1 Technological developments in automotive industry to drive market

- 10.3.3 GERMANY

- 10.3.3.1 Growing investments in advanced manufacturing processes to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Foreign investments and government incentives in electric and hybrid vehicles to drive market

- 10.3.5 ITALY

- 10.3.5.1 Government support for machine tool manufacturing to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Emphasis on cutting-edge technology to drive market

- 10.3.7 SWITZERLAND

- 10.3.7.1 Robust industrial environment to drive market

- 10.3.8 TURKEY

- 10.3.8.1 Strategic shift toward export-driven manufacturing to drive market

- 10.4 NORTH AMERICA

- 10.4.1 MACROECONOMIC OUTLOOK

- 10.4.2 US

- 10.4.2.1 Increased funding for smart machining solutions by local and global players to drive market

- 10.4.3 CANADA

- 10.4.3.1 New product launches and advanced manufacturing facilities to drive market

- 10.4.4 MEXICO

- 10.4.4.1 Booming automotive industry to drive market

- 10.5 REST OF THE WORLD

- 10.5.1 MACROECONOMIC OUTLOOK

- 10.5.2 RUSSIA

- 10.5.2.1 Push toward modernization and self-reliance to drive market

- 10.5.3 BRAZIL

- 10.5.3.1 Ongoing modernization of domestic manufacturing sector to drive market

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Product type footprint

- 11.7.5.4 Sales channel footprint

- 11.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING

- 11.8.5.1 List of start-ups/SMEs

- 11.8.5.2 Competitive benchmarking of start-ups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 MAKINO INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches/developments

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 JTEKT CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches/developments

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.3.4 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 OKUMA CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches/developments

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Others developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 DMG MORI

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches/developments

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.3.4 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 DN SOLUTIONS

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches/developments

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.5.3.4 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 AMADA CO., LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches/developments

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Other developments

- 12.1.7 YAMAZAKI MAZAK CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches/developments

- 12.1.7.3.2 Expansions

- 12.1.8 CHIRON GROUP SE

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches/developments

- 12.1.8.3.2 Deals

- 12.1.9 KOMATSU NTC

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches/developments

- 12.1.10 HAAS AUTOMATION, INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 GENERAL TECHNOLOGY GROUP DALIAN MACHINE TOOL CO., LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches/developments

- 12.1.11.3.2 Expansions

- 12.1.12 UNITED GRINDING GROUP

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.12.3.2 Expansions

- 12.1.13 INDEX-WERKE GMBH & CO. KG HAHN & TESSKY

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches/developments

- 12.1.14 CITIZEN MACHINERY CO., LTD.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches/developments

- 12.1.15 EMAG GMBH & CO. KG

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Product launches/developments

- 12.1.15.3.2 Deals

- 12.1.16 SHENYANG MACHINE TOOL CO., LTD.

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Product launches/developments

- 12.1.16.3.2 Deals

- 12.1.1 MAKINO INC.

- 12.2 OTHER PLAYERS

- 12.2.1 FFG EUROPEAN & AMERICAN HOLDINGS GMBH

- 12.2.2 HMT MACHINE TOOLS LIMITED

- 12.2.3 SPINNER WERKZEUGMASCHINENFABRIK GMBH

- 12.2.4 GLEASON CORPORATION

- 12.2.5 GROB-WERKE GMBH & CO. KG

- 12.2.6 BLASER SWISSLUBE

- 12.2.7 CASTROL LIMITED

- 12.2.8 QUAKER HOUGHTON

- 12.2.9 SCHULER AG

- 12.2.10 ELECTRONICA HI-TECH ENGINEERING PVT. LTD.

- 12.2.11 ACEMICROMATIC GROUP

- 12.2.12 TUNGALOY CORPORATION

- 12.2.13 MACHINE TOOLS INDIA LIMITED

- 12.2.14 ISEMBARD MACHINE TOOLS

- 12.2.15 MANUKAI AG

- 12.2.16 IPERCEPT TECHNOLOGY

- 12.2.17 AUGURY LTD.

13 RECOMMENDATIONS BY MARKETSANDMARKETS

- 13.1 GROWING DEVELOPMENT OF CNC MACHINES IN MANUFACTURING PLANTS TO REDUCE OPERATING COSTS AND INCREASE PRODUCTION EFFICIENCY

- 13.2 ASIA PACIFIC TO GROW RAPIDLY DURING FORECAST PERIOD

- 13.3 RISING DEMAND FOR MACHINING CENTERS

- 13.4 CONCLUSION

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.4.1 COMPANY PROFILE

- 14.4.2 MACHINE TOOLS MARKET, BY PRODUCT TYPE, AT COUNTRY LEVEL

- 14.4.3 MACHINE TOOLS MARKET, BY END-USER INDUSTRY, AT COUNTRY LEVEL

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS