|

|

市場調査レポート

商品コード

1761745

AIデータセンターの世界市場:オファリング別、データセンタータイプ別、展開別、用途別、エンドユーザー別、地域別 - 2030年までの予測AI Data Center Market by Offering (Compute Server (GPU-Based, FPGA-Based, ASIC-based), Storage, Cooling, Power, DCIM), Data Center Type (Hyperscale, Colocation), Application (GenAI, Machine Learning, NLP, Computer Vision) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| AIデータセンターの世界市場:オファリング別、データセンタータイプ別、展開別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月30日

発行: MarketsandMarkets

ページ情報: 英文 323 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のAIデータセンターの市場規模は、2025年の2,364億4,000万米ドルから2030年には9,337億6,000万米ドルに成長し、予測期間中のCAGRは31.6%を記録すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | オファリング別、データセンタータイプ別、展開別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

AIデータセンター市場は、ヘルスケア、金融、製造の各分野でAIワークロードの需要が高まっていることから、力強い成長を遂げています。これらのワークロードは、複雑なアルゴリズムや大規模なデータセットをリアルタイムで処理するための高性能コンピューティング・インフラを必要とします。企業はこの需要を満たすため、GPU、TPU、高度なストレージシステムを統合したAIに最適化されたデータセンターに投資しています。しかし、主な制約の1つは、特殊なハードウェア、高度な冷却システム、熟練した人材への投資を含む、AI中心のデータセンターの設置に関連する高い導入コストです。これは、特に中小企業にとっては障壁となり得る。新たな機会は、組織が持続可能性とエネルギー効率に注力する中で、グリーンAIデータセンターの採用が増加していることにあります。

コンピュートサーバセグメントは、AIワークロードの実行に重要な役割を果たすため、予測期間中にAIデータセンター市場で最も高い市場シェアを占めると予測されています。ディープラーニング、自然言語処理、コンピュータビジョンなどのAIアプリケーションは膨大な計算能力を必要とするが、これは主にGPU、TPU、カスタムAIアクセラレータを搭載した高性能コンピュートサーバによって実現されます。これらのサーバーは、並列処理とリアルタイムのデータ分析を可能にし、トレーニングや推論タスクに不可欠です。

自動化、分析、イノベーションのためにAIを導入する企業が各業界で増加するにつれ、AI向けにカスタマイズされたコンピュート・サーバーの需要が急増し続けています。

また、大量のデータを継続的に処理するハイパースケールデータセンターでのAIの利用が増加していることも一因となっています。このような性能ニーズに対応するため、コンピュート・サーバーは最新のAIデータセンターの基幹となりつつあります。このような広範な適用可能性と重要な機能性により、コンピュートサーバーはこの市場で支配的なセグメントとなっています。

AIデータセンター市場では、業界全体の急速なデジタルトランスフォーメーションと、インテリジェントでデータ駆動型の意思決定に対するニーズの高まりにより、企業セグメントが予測期間中に最高のCAGRを記録すると予測されています。企業は、予知保全、顧客分析、不正検知、ビジネスプロセスの自動化など、さまざまな用途にAIワークロードを導入しています。これらの機能をサポートするために、高い計算能力、スケーラブルなストレージ、より高速なデータ処理を提供するAIに最適化されたデータセンターに投資しています。

すでに確立されたインフラを持つハイパースケーラーとは異なり、企業は現在、競争力を維持するためにAIに特化したインフラを積極的に構築したり、提携したりしています。例えば、金融機関はリアルタイムのリスク評価にAIデータセンターを利用し、ヘルスケア企業はより迅速な診断や創薬にAIデータセンターを活用しています。さらに、AI-as-a-Service(AIaaS)の利用が可能になりつつあることで、中堅・中小企業も多額の先行投資をせずにAI機能を導入できるようになっています。

製造業や運輸業などの分野におけるデジタル革新やAI導入に対する政府の優遇措置も、企業のAIインフラ投資を後押ししています。企業がAIの利用規模を拡大し、ハイブリッドクラウドやエッジ展開に移行するにつれて、堅牢でセキュアでエネルギー効率に優れたAIデータセンター・インフラに対する需要が急速に高まっており、このセグメントのCAGRが高くなっています。

北米は、先進的なデジタルインフラ、AIイノベーションの強力なエコシステム、テクノロジー企業の高集積を背景に、予測期間中、AIデータセンター市場で2番目に高い市場シェアを占めると予測されます。同地域には、Amazon Web Services(AWS)(米国)、Microsoft(米国)、Google(米国)、IBM(米国)などの大手クラウドおよびAIサービスプロバイダーがあり、いずれも次世代アプリケーションをサポートするためにAIに最適化されたデータセンター機能を継続的に拡大しています。

さらに、米国CHIPS・科学法や様々なAI資金提供プログラムのようなイニシアチブは、国内のAIインフラ開発を促進し、地域の成長を促進します。エヌビディアやインテルなど主要なAIチップメーカーの存在は、AIデータセンター開発におけるこの地域の戦略的強みをさらに高めています。

急速なデジタル化と人口増加によりアジア太平洋地域がリードすると予測される一方、北米は確立されたAIエコシステムとハイパースケールデータセンターへの継続的な投資により、市場シェア2位の強力な競合国として位置付けられています。

当レポートでは、世界のAIデータセンター市場について調査し、オファリング別、データセンタータイプ別、展開別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 2025年の米国関税がAIデータセンター市場に与える影響

第6章 AIデータセンター市場(オファリング別)

- イントロダクション

- コンピューティングサーバー

- ストレージソリューション

- ネットワークスイッチ

- 冷却ソリューション

- 電源ソリューション

- DCIM

第7章 AIデータセンター市場(データセンタータイプ別)

- イントロダクション

- ハイパースケールデータセンター

- コロケーションデータセンター

- その他

第8章 AIデータセンター市場(展開別)

- イントロダクション

- オンプレミス

- クラウドベース

- ハイブリッド

第9章 AIデータセンター市場(用途別)

- イントロダクション

- 生成AI

- 機械学習

- 自然言語処理

- コンピュータービジョン

第10章 AIデータセンター市場(エンドユーザー別)

- イントロダクション

- クラウドサービスプロバイダー

- 企業

- 政府機関

第11章 AIデータセンター市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2025年

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- DELL INC.

- HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- LENOVO

- HUAWEI TECHNOLOGIES CO., LTD.

- IBM

- SUPER MICRO COMPUTER, INC.

- IEIT SYSTEMS CO.,LTD.

- H3C TECHNOLOGIES CO., LTD.

- CISCO SYSTEMS, INC.

- FUJITSU

- その他の企業

- QUANTA COMPUTER INC.

- WISTRON CORPORATION.

- WIWYNN CORPORATION

- GIGA-BYTE TECHNOLOGY CO., LTD.

- MITAC COMPUTING TECHNOLOGY CORPORATION

- GRAPHCORE

- CEREBRAS

- LIQUIDSTACK HOLDING B.V.

- COOLIT SYSTEMS

- SUBMER

- ASPERITAS

- ICEOTOPE

- JETCOOL TECHNOLOGIES INC.

- ZUTACORE

- ACCELSIUS LLC

第14章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 LIST OF SECONDARY SOURCES

- TABLE 3 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 4 KEY DATA FROM PRIMARY SOURCES

- TABLE 5 AI DATA CENTER MARKET: RESEARCH ASSUMPTIONS

- TABLE 6 AI DATA CENTER MARKET: RISK ANALYSIS

- TABLE 7 PRICING RANGE OF COMPUTE SERVERS, BY KEY PLAYER, 2024 (USD)

- TABLE 8 PRICING RANGE OF GPU-BASED COMPUTE SERVERS, BY REGION, 2021-2024 (USD)

- TABLE 9 PRICING RANGE OF FPGA-BASED COMPUTE SERVERS, BY REGION, 2021-2024 (USD)

- TABLE 10 ROLE OF COMPANIES IN AI DATA CENTER ECOSYSTEM

- TABLE 11 LIST OF PATENTS, 2023-2025

- TABLE 12 IMPORT DATA FOR HS CODE 847150-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 EXPORT DATA FOR HS CODE 847150-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 STANDARDS

- TABLE 20 AI DATA CENTER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 23 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 24 EXEMPTED PRODUCTS UNDER USMCA (US-MEXICO-CANADA) AGREEMENT, BY HS CODE

- TABLE 25 AI DATA CENTER MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 26 AI DATA CENTER MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 27 COMPUTE SERVER: AI DATA CENTER MARKET, BY PROCESSOR TYPE, 2021-2024 (USD MILLION)

- TABLE 28 COMPUTE SERVER: AI DATA CENTER MARKET, BY PROCESSOR TYPE, 2025-2030 (USD MILLION)

- TABLE 29 COMPUTE SERVER: AI DATA CENTER MARKET, BY PROCESSOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 30 COMPUTE SERVER: AI DATA CENTER MARKET, BY PROCESSOR TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 31 COMPUTE SERVER: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 COMPUTE SERVER: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 GPU-BASED SERVER: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 GPU-BASED SERVER: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 FPGA-BASED SERVER: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 FPGA-BASED SERVER: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

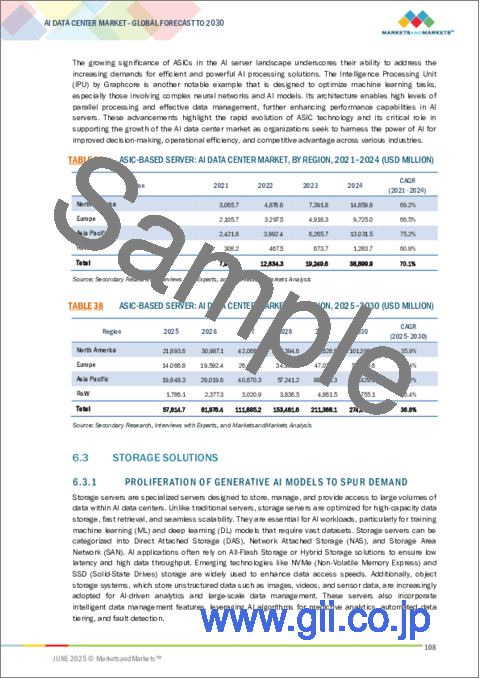

- TABLE 37 ASIC-BASED SERVER: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 ASIC-BASED SERVER: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 STORAGE SOLUTIONS: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 STORAGE SOLUTIONS: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 NETWORK SWITCHES: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 NETWORK SWITCHES: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 COOLING SOLUTIONS: AI DATA CENTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 44 COOLING SOLUTIONS: AI DATA CENTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 COOLING SOLUTIONS: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 COOLING SOLUTIONS: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 ROOM-BASED COOLING: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 ROOM-BASED COOLING: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 ROW/RACK-BASED COOLING: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 ROW/RACK-BASED COOLING: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 POWER SOLUTIONS: AI DATA CENTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 52 POWER SOLUTIONS: AI DATA CENTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 53 POWER SOLUTIONS: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 POWER SOLUTIONS: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 UNINTERRUPTIBLE POWER SUPPLY (UPS): AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 UNINTERRUPTIBLE POWER SUPPLY (UPS): AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 POWER DISTRIBUTION UNIT (PDU): AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 POWER DISTRIBUTION UNIT (PDU): AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 DCIM: AI DATA CENTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 60 DCIM: AI DATA CENTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 61 DCIM SERVICES: AI DATA CENTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 62 DCIM SERVICES: AI DATA CENTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 63 DCIM: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 DCIM: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 DCIM SOFTWARE: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 DCIM SOFTWARE: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 DCIM SERVICES: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 DCIM SERVICES: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 AI DATA CENTER MARKET, BY DATA CENTER TYPE, 2021-2024 (USD MILLION)

- TABLE 70 AI DATA CENTER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 71 HYPERSCALE DATA CENTER: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 HYPERSCALE DATA CENTER: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 COLOCATION DATA CENTER: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 COLOCATION DATA CENTER: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 OTHER DATA CENTER TYPES: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 OTHER DATA CENTER TYPES: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 AI DATA CENTER MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 78 AI DATA CENTER MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 79 ON-PREMISES: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 ON-PREMISES: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 CLOUD-BASED: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 CLOUD-BASED: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 HYBRID: DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 HYBRID: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 AI DATA CENTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 86 AI DATA CENTER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 87 AI DATA CENTER MARKET, FOR GENERATIVE AI, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 88 AI DATA CENTER MARKET, FOR GENERATIVE AI, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 89 GENERATIVE AI: AI DATA CENTER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 90 GENERATIVE AI: AI DATA CENTER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 91 MACHINE LEARNING: AI DATA CENTER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 92 MACHINE LEARNING: AI DATA CENTER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 93 NLP: AI DATA CENTER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 94 NLP: AI DATA CENTER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 95 COMPUTER VISION: AI DATA CENTER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 96 COMPUTER VISION: AI DATA CENTER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 97 AI DATA CENTER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 98 AI DATA CENTER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 99 AI DATA CENTER MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD MILLION)

- TABLE 100 AI DATA CENTER MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD MILLION)

- TABLE 101 CLOUD SERVICE PROVIDERS: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 CLOUD SERVICE PROVIDERS: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 CLOUD SERVICE PROVIDERS: AI DATA CENTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 104 CLOUD SERVICE PROVIDERS: AI DATA CENTER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 CLOUD SERVICE PROVIDERS: AI DATA CENTER MARKET FOR GENERATIVE AI, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 106 CLOUD SERVICE PROVIDERS: AI DATA CENTER MARKET FOR GENERATIVE AI, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 ENTERPRISES: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 ENTERPRISES: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 ENTERPRISES: AI DATA CENTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 110 ENTERPRISES: AI DATA CENTER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 ENTERPRISES: AI DATA CENTER MARKET FOR GENERATIVE AI, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 112 ENTERPRISES: AI DATA CENTER MARKET FOR GENERATIVE AI, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 113 HEALTHCARE: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 HEALTHCARE: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 BFSI: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 BFSI: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 AUTOMOTIVE: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 AUTOMOTIVE: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 RETAIL & E-COMMERCE: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 RETAIL & E-COMMERCE: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 MEDIA & ENTERTAINMENT: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 122 MEDIA & ENTERTAINMENT: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 OTHER ENTERPRISES: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 OTHER ENTERPRISES: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125 GOVERNMENT ORGANIZATIONS: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 GOVERNMENT ORGANIZATIONS: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 GOVERNMENT ORGANIZATIONS: AI DATA CENTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 128 GOVERNMENT ORGANIZATIONS: AI DATA CENTER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 GOVERNMENT ORGANIZATIONS: AI DATA CENTER MARKET FOR GENERATIVE AI, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 130 GOVERNMENT ORGANIZATION: AI DATA CENTER MARKET FOR GENERATIVE AI, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 131 AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133 NORTH AMERICA: AI DATA CENTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 NORTH AMERICA: AI DATA CENTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: AI DATA CENTER MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 136 NORTH AMERICA: AI DATA CENTER MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: COMPUTE SERVER, AI DATA CENTER MARKET, BY PROCESSOR TYPE, 2021-2024 (USD MILLION)

- TABLE 138 NORTH AMERICA: COMPUTE SERVER, AI DATA CENTER MARKET, BY PROCESSOR TYPE, 2025-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: COOLING SOLUTIONS, AI DATA CENTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 140 NORTH AMERICA: COOLING SOLUTIONS, AI DATA CENTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: POWER SOLUTIONS, AI DATA CENTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 142 NORTH AMERICA: POWER SOLUTIONS, AI DATA CENTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: DCIM, AI DATA CENTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 144 NORTH AMERICA: DCIM, AI DATA CENTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 145 NORTH AMERICA: AI DATA CENTER MARKET, BY DATA CENTER TYPE, 2021-2024 (USD MILLION)

- TABLE 146 NORTH AMERICA: AI DATA CENTER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: AI DATA CENTER MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 148 NORTH AMERICA: AI DATA CENTER MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: AI DATA CENTER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: AI DATA CENTER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 151 NORTH AMERICA: AI DATA CENTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 152 NORTH AMERICA: AI DATA CENTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 153 EUROPE: AI DATA CENTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 154 EUROPE: AI DATA CENTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 155 EUROPE: AI DATA CENTER MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 156 EUROPE: AI DATA CENTER MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 157 EUROPE: AI DATA CENTER MARKET IN COMPUTE SERVER, BY PROCESSOR TYPE, 2021-2024 (USD MILLION)

- TABLE 158 EUROPE: COMPUTE SERVER, AI DATA CENTER MARKET, BY PROCESSOR TYPE, 2025-2030 (USD MILLION)

- TABLE 159 EUROPE: COOLING SOLUTIONS, AI DATA CENTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 160 EUROPE: COOLING SOLUTIONS, AI DATA CENTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 161 EUROPE: POWER SOLUTIONS, AI DATA CENTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 162 EUROPE: POWER SOLUTIONS, AI DATA CENTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 163 EUROPE: DCIM, AI DATA CENTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 164 EUROPE: DCIM, AI DATA CENTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 165 EUROPE: AI DATA CENTER MARKET, BY DATA CENTER TYPE, 2021-2024 (USD MILLION)

- TABLE 166 EUROPE: AI DATA CENTER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 167 EUROPE: AI DATA CENTER MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 168 EUROPE: AI DATA CENTER MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 169 EUROPE: AI DATA CENTER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 170 EUROPE: AI DATA CENTER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 171 EUROPE: AI DATA CENTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 172 EUROPE: AI DATA CENTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: AI DATA CENTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 174 ASIA PACIFIC: AI DATA CENTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: AI DATA CENTER MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 176 ASIA PACIFIC: AI DATA CENTER MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: AI DATA CENTER MARKET FOR COMPUTE SERVER, BY PROCESSOR TYPE, 2021-2024 (USD MILLION)

- TABLE 178 ASIA PACIFIC: AI DATA CENTER MARKET FOR COMPUTE SERVER, BY PROCESSOR TYPE, 2025-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: AI DATA CENTER MARKET IN COOLING SOLUTIONS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 180 ASIA PACIFIC: AI DATA CENTER MARKET FOR COOLING SOLUTIONS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: AI DATA CENTER MARKET FOR POWER SOLUTIONS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 182 ASIA PACIFIC: AI DATA CENTER MARKET FOR POWER SOLUTIONS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 183 ASIA PACIFIC: AI DATA CENTER MARKET FOR DCIM, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 184 ASIA PACIFIC: AI DATA CENTER MARKET FOR DCIM, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 ASIA PACIFIC: AI DATA CENTER MARKET, BY DATA CENTER TYPE, 2021-2024 (USD MILLION)

- TABLE 186 ASIA PACIFIC: AI DATA CENTER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 187 ASIA PACIFIC: AI DATA CENTER MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 188 ASIA PACIFIC: AI DATA CENTER MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: AI DATA CENTER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 190 ASIA PACIFIC: AI DATA CENTER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 191 ASIA PACIFIC: AI DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 192 ASIA PACIFIC: AI DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 193 ROW: AI DATA CENTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 194 ROW: AI DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 195 ROW: AI DATA CENTER MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 196 ROW: AI DATA CENTER MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 197 ROW: AI DATA CENTER MARKET FOR COMPUTE SERVERS, BY PROCESSOR TYPE, 2021-2024 (USD MILLION)

- TABLE 198 ROW: AI DATA CENTER MARKET FOR COMPUTE SERVERS, BY PROCESSOR TYPE, 2025-2030 (USD MILLION)

- TABLE 199 ROW: AI DATA CENTER MARKET FOR COOLING SOLUTIONS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 200 ROW: AI DATA CENTER MARKET FOR COOLING SOLUTIONS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 201 ROW: AI DATA CENTER MARKET FOR POWER SOLUTIONS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 202 ROW: AI DATA CENTER MARKET FOR POWER SOLUTIONS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 203 ROW: AI DATA CENTER MARKET FOR DCIM, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 204 ROW: AI DATA CENTER MARKET FOR DCIM, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 205 ROW: AI DATA CENTER MARKET, BY DATA CENTER TYPE, 2021-2024 (USD MILLION)

- TABLE 206 ROW: AI DATA CENTER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 207 ROW: AI DATA CENTER MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 208 ROW: AI DATA CENTER MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 209 ROW: AI DATA CENTER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 210 ROW: AI DATA CENTER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 211 ROW: AI DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 212 ROW: AI DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST: AI DATA CENTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 214 MIDDLE EAST: AI DATA CENTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 215 AFRICA: AI DATA CENTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 216 AFRICA: AI DATA CENTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 217 AI DATA CENTER MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 218 AI DATA CENTER MARKET: DEGREE OF COMPETITION, 2024

- TABLE 219 AI DATA CENTER MARKET: REGION FOOTPRINT

- TABLE 220 AI DATA CENTER MARKET: OFFERING FOOTPRINT

- TABLE 221 AI DATA CENTER MARKET: APPLICATION FOOTPRINT

- TABLE 222 AI DATA CENTER MARKET: END USER FOOTPRINT

- TABLE 223 AI DATA CENTER MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 224 AI DATA CENTER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 225 AI DATA CENTER MARKET: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2025

- TABLE 226 AI DATA CENTER MARKET: DEALS, JANUARY 2020-FEBRUARY 2025

- TABLE 227 DELL INC.: COMPANY OVERVIEW

- TABLE 228 DELL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 DELL INC.: DEALS

- TABLE 230 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY OVERVIEW

- TABLE 231 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: PRODUCTS/ SOLUTIONS/ SERVICES OFFERINGS

- TABLE 232 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: PRODUCT LAUNCHES

- TABLE 233 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: DEALS

- TABLE 234 LENOVO: COMPANY OVERVIEW

- TABLE 235 LENOVO: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 236 LENOVO: PRODUCT LAUNCHES

- TABLE 237 LENOVO: DEALS

- TABLE 238 LENOVO: EXPANSIONS

- TABLE 239 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 240 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

- TABLE 242 IBM: COMPANY OVERVIEW

- TABLE 243 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 IBM: PRODUCT LAUNCHES

- TABLE 245 IBM: DEALS

- TABLE 246 SUPER MICRO COMPUTER, INC.: COMPANY OVERVIEW

- TABLE 247 SUPER MICRO COMPUTER, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 SUPER MICRO COMPUTER, INC.: PRODUCT LAUNCHES

- TABLE 249 SUPER MICRO COMPUTER, INC.: DEALS

- TABLE 250 IEIT SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 251 IEIT SYSTEMS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 IEIT SYSTEMS CO., LTD.: PRODUCT LAUNCHES

- TABLE 253 H3C TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 254 H3C TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 H3C TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 256 H3C TECHNOLOGIES CO., LTD.: DEALS

- TABLE 257 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 258 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 CISCO SYSTEMS, INC.: PRODUCT LAUNCHES

- TABLE 260 CISCO SYSTEMS, INC.: DEALS

- TABLE 261 FUJITSU: COMPANY OVERVIEW

- TABLE 262 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 FUJITSU: PRODUCT LAUNCHES

- TABLE 264 FUJITSU: DEALS

List of Figures

- FIGURE 1 AI DATA CENTER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AI DATA CENTER MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARIES

- FIGURE 5 KEY INDUSTRY INSIGHTS

- FIGURE 6 AI DATA CENTER MARKET: RESEARCH FLOW

- FIGURE 7 REVENUE GENERATED FROM SALES OF AI DATA CENTER OFFERINGS IN 2024

- FIGURE 8 AI DATA CENTER MARKET: BOTTOM-UP APPROACH

- FIGURE 9 AI DATA CENTER MARKET: TOP-DOWN APPROACH

- FIGURE 10 AI DATA CENTER MARKET: DATA TRIANGULATION

- FIGURE 11 COMPUTE SERVER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 12 HYPERSCALE DATA CENTER SEGMENT TO SECURE LARGEST MARKET SHARE IN 2030

- FIGURE 13 CLOUD-BASED SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 14 GENERATIVE AI SEGMENT TO LEAD MARKET IN 2025

- FIGURE 15 HEALTHCARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 16 CLOUD SERVICE PROVIDERS SEGMENT TO CLAIM LARGEST MARKET SHARE IN 2030

- FIGURE 17 NORTH AMERICA TO DOMINATE MARKET IN 2030

- FIGURE 18 RISING DEMAND FOR AI WORKLOADS TO DRIVE MARKET

- FIGURE 19 COMPUTE SERVER SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 HYPERSCALE DATA CENTER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 CLOUD-BASED SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 GENERATIVE AI END USERS SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 23 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 24 CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 AI DATA CENTER MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 27 AI DATA CENTER MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 28 AI DATA CENTER MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 29 DATA CENTER ELECTRICITY CONSUMPTION, 2022-2026

- FIGURE 30 AI DATA CENTER MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 PRICING RANGE OF GPU-BASED COMPUTE SERVERS, BY REGION, 2021-2024 (USD)

- FIGURE 33 PRICING RANGE OF FPGA-BASED COMPUTE SERVERS, BY REGION, 2021-2024 (USD)

- FIGURE 34 AI DATA CENTER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 35 AI DATA CENTER MARKET ECOSYSTEM

- FIGURE 36 INVESTMENT AND FUNDING SCENARIO, 2023-2024

- FIGURE 37 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 38 IMPORT DATA FOR HS CODE 847150-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 39 EXPORT DATA FOR HS CODE 847150-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 40 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 41 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 42 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 43 COMPUTE SERVER SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 COLOCATION DATA CENTERS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 CLOUD-BASED SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 46 GENERATIVE AI TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 ENTERPRISES SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: AI DATA CENTER MARKET SNAPSHOT

- FIGURE 50 US TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 51 EUROPE: AI DATA CENTER MARKET SNAPSHOT

- FIGURE 52 GERMANY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 53 ASIA PACIFIC: AI DATA CENTER MARKET SNAPSHOT

- FIGURE 54 CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 55 ROW: AI DATACENTER MARKET SNAPSHOT

- FIGURE 56 MIDDLE EAST TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 57 AI DATA CENTER MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024

- FIGURE 58 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 59 COMPANY VALUATION

- FIGURE 60 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 61 BRAND/PRODUCT COMPARISON

- FIGURE 62 AI DATA CENTER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 63 AI DATA CENTER MARKET: COMPANY FOOTPRINT

- FIGURE 64 AI DATA CENTER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 65 DELL INC.: COMPANY SNAPSHOT

- FIGURE 66 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY SNAPSHOT

- FIGURE 67 LENOVO: COMPANY SNAPSHOT

- FIGURE 68 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 69 IBM: COMPANY SNAPSHOT

- FIGURE 70 SUPER MICRO COMPUTER, INC.: COMPANY SNAPSHOT

- FIGURE 71 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 72 FUJITSU: COMPANY SNAPSHOT

The global AI data center market is anticipated to grow from USD 236.44 billion in 2025 to USD 933.76 billion by 2030, registering a CAGR of 31.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, By Data Center Type, By Deployment, Application, End User, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The AI data center market is witnessing strong growth due to the rising demand for AI workloads across healthcare, finance, and manufacturing sectors. These workloads require high-performance computing infrastructure to process complex algorithms and large-scale data sets in real-time. Companies are investing in AI-optimized data centers that integrate GPUs, TPUs, and advanced storage systems to meet this demand. However, one main constraint is the high implementation cost associated with setting up AI-centric data centers, including investment in specialized hardware, advanced cooling systems, and skilled personnel. This can be a barrier, particularly for small and mid-sized enterprises. An emerging opportunity lies in the increasing adoption of green AI data centers as organizations focus on sustainability and energy efficiency.

By offering, the compute server segment is projected to hold the highest market share during the forecast period.

The compute server segment is expected to hold the highest market share in the AI data center market during the forecast period due to its critical role in executing AI workloads. AI applications such as deep learning, natural language processing, and computer vision require massive computational power, which is primarily delivered by high-performance compute servers equipped with GPUs, TPUs, or custom AI accelerators. These servers enable parallel processing and real-time data analysis, which are essential for training and inference tasks.

As enterprises across industries increasingly deploy AI for automation, analytics, and innovation, the demand for compute servers tailored for AI continues to surge.

Another contributing factor is the increasing use of AI in hyperscale data centers, where large volumes of data are processed continuously. To meet such performance needs, compute servers are becoming the backbone of modern AI data centers. This widespread applicability and critical functionality make compute servers the dominant segment in this market.

"Enterprises segment by end user is anticipated to record the highest CAGR during the forecast period."

The enterprise segment is expected to register the highest CAGR in the AI data center market during the forecast period due to the rapid digital transformation across industries and the increasing need for intelligent, data-driven decision-making. Enterprises are deploying AI workloads for various applications such as predictive maintenance, customer analytics, fraud detection, and automation of business processes. They are investing in AI-optimized data centers that offer high computational power, scalable storage, and faster data processing to support these capabilities.

Unlike hyperscalers that already have established infrastructure, enterprises are now actively building or partnering to develop AI-focused infrastructure to stay competitive. For instance, financial institutions use AI data centers for real-time risk assessment, while healthcare firms apply them for faster diagnostics and drug discovery. Moreover, the growing availability of AI-as-a-Service (AIaaS) is allowing mid-sized and even smaller enterprises to adopt AI capabilities without large upfront investments.

Government incentives for digital innovation and AI adoption in sectors like manufacturing and transportation are also pushing enterprise AI infrastructure investments. As enterprises scale their AI usage and move toward hybrid cloud and edge deployments, the demand for robust, secure, and energy-efficient AI data center infrastructure is growing rapidly-driving high CAGR in this segment.

"

By region, North America is projected to account for the second-highest market share during the forecast period.

North America is expected to hold the second-highest market share in the AI data center market during the forecast period, driven by its advanced digital infrastructure, strong ecosystem of AI innovation, and high concentration of technology companies. The region is home to leading cloud and AI service providers such as Amazon Web Services (AWS) (US), Microsoft (US), Google (US), and IBM (US), all of which are continuously expanding their AI-optimized data center capabilities to support next-generation applications.

.

Furthermore, initiatives like the US CHIPS and Science Act and various AI funding programs promote domestic AI infrastructure development and foster regional growth. The presence of key AI chip manufacturers, including NVIDIA and Intel, adds to the region's strategic strength in AI data center development.

While the Asia Pacific region is projected to lead due to its rapid digitalization and growing population, North America's established AI ecosystem and ongoing investments in hyperscale data centers position it as a strong contender with the second-highest market share.

Extensive primary interviews were conducted with key industry experts in the AI data center market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 20%, and Tier 3 - 25%

- By Designation - C-level Executives - 30%, Directors - 30%, and Others - 40%

- By Region - Asia Pacific - 30%, Europe - 20%, North America - 40%, and RoW - 10%

Note: Other designations include technology heads, media analysts, sales managers, marketing managers, and product managers.

The three tiers of companies are based on their total revenues as of 2024 -Tier : >USD 1 billion, Tier 2: USD 500 million to 1 billion, and Tier 3: <USD 500 million.

The AI data center is dominated by a few globally established players: Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (US), Huawei Technologies Co., Ltd (China), IBM (US), Super Micro Computer, Inc. (US), IEIT SYSTEMS CO., LTD. (China), H3C Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Fujitsu (Japan), ABB (Switzerland), Schneider Electric (France), Vertiv Group Corp. (US), DUG Technology (Australia), MiTAC Holdings Corp. (Taiwan).

The study includes an in-depth competitive analysis of these key players in the AI data center market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the AI data center market. It forecasts its size by offering (compute server, storage, network switches, cooling, power, data center infrastructure management (DCIM)), data center type (hyperscale, colocation, others (edge, enterprise, hybrid)), deployment (on-premises, cloud, hybrid), application (generative AI, machine learning, natural language processing, computer vision), and end user (cloud service providers, enterprises (healthcare, BSFI, automotive, retail & e-commerce, media & entertainment, and others.

It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes an ecosystem analysis of key players.

Key Benefits of Buying the Report:

- Analysis of key drivers (Rising demand for AI workloads, data explosion, and big data analytics, Increasing government investments and regulations, growing demand for AI-as-a-Service (AlaaS) restraints (High implementation costs, Data privacy and cyber security concerns), opportunities (Rising adoption of green AI data centers, Increasing demand for hyperscale data center, challenges (Supply chain disruptions, Energy consumption and environmental concerns)

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the AI data center market

- Market Development: Comprehensive information about lucrative markets through the analysis of the AI data center market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the AI data center market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (US), Huawei Technologies Co., Ltd (China), IBM (US), Super Micro Computer, Inc. (US), IEIT SYSTEMS CO., LTD. (China), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI DATA CENTER MARKET

- 4.2 AI DATA CENTER MARKET, BY OFFERING

- 4.3 AI DATA CENTER MARKET, BY DATA CENTER TYPE

- 4.4 AI DATA CENTER MARKET, BY DEPLOYMENT

- 4.5 AI DATA CENTER MARKET, BY REGION

- 4.6 AI DATA CENTER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for AI workloads

- 5.2.1.2 Explosion of data and growing reliance on big data analytics

- 5.2.1.3 Government-led investments in AI data centers

- 5.2.1.4 Growing demand for AI-as-a-Service

- 5.2.2 RESTRAINTS

- 5.2.2.1 High implementation costs

- 5.2.2.2 Concerns regarding data breaches and unauthorized access

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising adoption of green AI data centers

- 5.2.3.2 Increasing demand for hyperscale data centers

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain disruptions

- 5.2.4.2 High energy consumption and environmental concerns

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING RANGE OF COMPUTE SERVERS, BY KEY PLAYER, 2024

- 5.4.2 PRICING RANGE OF GPU-BASED COMPUTE SERVERS, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Generative AI

- 5.8.1.2 AI-optimized cloud platforms

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Edge computing

- 5.8.2.2 Cybersecurity

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Big data

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 847150)

- 5.10.2 EXPORT SCENARIO (HS CODE 847150)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 HYPERACCEL DEPLOYS AMD EPYC PROCESSORS THAT OFFER HIGH CORE COUNTS, SUPERIOR MEMORY BANDWIDTH, AND ENERGY EFFICIENCY

- 5.12.2 KT CLOUD BUILDS SCALABLE AI PLATFORM USING AMD MI250 GPUS

- 5.12.3 BMW LEVERAGES GEN AI AND NVIDIA TOOLS TO OPTIMIZE PRODUCTION

- 5.12.4 SIEMENS PARTNERS WITH MICROSOFT TO DELIVER AI-ENHANCED SOLUTIONS FOR RESILIENT PRODUCT LIFECYCLE MANAGEMENT WITH AZURE

- 5.12.5 PERPLEXITY DEPLOYS HIGH-EFFICIENCY LLM INFERENCE WITH NVIDIA H100 GPUS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF 2025 US TARIFF ON AI DATA CENTER MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 IMPACT ON COUNTRY/REGION

- 5.16.3.1 US

- 5.16.3.2 Europe

- 5.16.3.3 Asia Pacific

- 5.16.4 EXEMPTIONS FOR GPUS UNDER USMCA AGREEMENT

- 5.16.5 IMPACT ON END USERS

6 AI DATA CENTER MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 COMPUTE SERVER

- 6.2.1 GPU-BASED SERVER

- 6.2.1.1 Ability to process massive datasets and run intricate algorithms efficiently to drive market

- 6.2.2 FPGA-BASED SERVERS

- 6.2.2.1 Integration into cloud and data center infrastructures to enhance AI processing capabilities to fuel market growth

- 6.2.3 ASIC-BASED SERVER

- 6.2.3.1 Efficient execution of predefined tasks to boost demand

- 6.2.1 GPU-BASED SERVER

- 6.3 STORAGE SOLUTIONS

- 6.3.1 PROLIFERATION OF GENERATIVE AI MODELS TO SPUR DEMAND

- 6.4 NETWORK SWITCHES

- 6.4.1 GROWING COMPLEXITY IN AI WORKLOADS AND DATA-INTENSIVE APPLICATIONS TO SUPPORT MARKET GROWTH

- 6.5 COOLING SOLUTIONS

- 6.5.1 ROOM-BASED COOLING

- 6.5.1.1 Ability to provide scalable and cost-effective cooling solutions to fuel market growth

- 6.5.2 RACK-BASED COOLING

- 6.5.2.1 Increasing focus on reducing carbon footprints and adherence to green data center initiatives to foster market growth

- 6.5.1 ROOM-BASED COOLING

- 6.6 POWER SOLUTIONS

- 6.6.1 UNINTERRUPTIBLE POWER SUPPLY (UPS)

- 6.6.1.1 Expansion of hyperscale and colocation data centers to offer lucrative growth opportunities

- 6.6.2 POWER DISTRIBUTION UNIT (PDU)

- 6.6.2.1 Increasing adoption of intelligent PDUs with AI-powered monitoring capabilities to boost demand

- 6.6.1 UNINTERRUPTIBLE POWER SUPPLY (UPS)

- 6.7 DCIM

- 6.7.1 DCIM SOFTWARE

- 6.7.1.1 Ability to support remote management to boost demand

- 6.7.2 DCIM SERVICES

- 6.7.2.1 Design and consulting

- 6.7.2.1.1 Growing need to manage computational workloads, ensure resilience, and maintain high operational standards to drive market

- 6.7.2.2 Integration and deployment

- 6.7.2.2.1 Integration of AI-powered monitoring tools and automation systems to support market growth

- 6.7.2.3 Support and maintenance

- 6.7.2.3.1 Minimized disruptions and operational continuity to fuel market growth

- 6.7.2.1 Design and consulting

- 6.7.1 DCIM SOFTWARE

7 AI DATA CENTER MARKET, BY DATA CENTER TYPE

- 7.1 INTRODUCTION

- 7.2 HYPERSCALE DATA CENTER

- 7.2.1 RAPID DEPLOYMENT OF 5G NETWORKS AND SURGE IN DATA TRAFFIC AND CONNECTIVITY TO FUEL MARKET GROWTH

- 7.3 COLOCATION DATA CENTER

- 7.3.1 SURGING ADOPTION OF AI AND CLOUD-BASED DIGITAL TRANSFORMATION STRATEGIES TO FUEL MARKET GROWTH

- 7.4 OTHER DATA CENTER TYPES

8 AI DATA CENTER MARKET, BY DEPLOYMENT

- 8.1 INTRODUCTION

- 8.2 ON-PREMISES

- 8.2.1 INCREASING EMPHASIS ON REGULATORY COMPLIANCES AND DATA SOVEREIGNTY TO SUPPORT MARKET GROWTH

- 8.3 CLOUD-BASED

- 8.3.1 GROWING INTEGRATION OF ADVANCED AI CAPABILITIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 8.4 HYBRID

- 8.4.1 INCREASING APPLICATION IN FINANCE AND HEALTHCARE SECTORS TO BOOST DEMAND

9 AI DATA CENTER MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 GENERATIVE AI

- 9.2.1 RULE-BASED MODELS

- 9.2.1.1 Increasing application in banking, insurance, and government sectors to fuel market growth

- 9.2.2 STATISTICAL MODELS

- 9.2.2.1 Growing reliance on real-time analytics and data-driven decision-making to spur demand

- 9.2.3 DEEP LEARNING

- 9.2.3.1 Rising popularity of AI chatbots and virtual assistants to drive market

- 9.2.4 GENERATIVE ADVERSARIAL NETWORKS (GANS)

- 9.2.4.1 Ability to generate realistic synthetic data to foster market growth

- 9.2.5 AUTOENCODERS

- 9.2.5.1 Increasing application in healthcare, cybersecurity, and manufacturing industries to foster market growth

- 9.2.6 CONVOLUTIONAL NEURAL NETWORKS (CNNS)

- 9.2.6.1 Growing emphasis on developing deepDream and visualization tools to offer lucrative growth opportunities

- 9.2.7 TRANSFORMER MODELS

- 9.2.7.1 Increasing popularity of GPT models and BERT to boost demand

- 9.2.1 RULE-BASED MODELS

- 9.3 MACHINE LEARNING

- 9.3.1 INCREASING DEMAND FOR AI-POWERED SOLUTIONS AND RAPID ADVANCEMENTS IN AI HARDWARE TO FOSTER MARKET GROWTH

- 9.4 NATURAL LANGUAGE PROCESSING

- 9.4.1 GROWING DEMAND FOR PERSONALIZED AND INTELLIGENT LANGUAGE-BASED SOLUTIONS TO ACCELERATE MARKET GROWTH

- 9.5 COMPUTER VISION

- 9.5.1 PROLIFERATION OF AI-POWERED DEVICES TO DRIVE MARKET

10 AI DATA CENTER MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 CLOUD SERVICE PROVIDERS

- 10.2.1 INCREASING ADOPTION OF AI-AS-A-SERVICE SOLUTIONS TO DRIVE MARKET

- 10.3 ENTERPRISES

- 10.3.1 HEALTHCARE

- 10.3.1.1 Growing adoption of AI for personalized medicine, genomics research, and predictive analytics to drive market

- 10.3.2 BFSI

- 10.3.2.1 Rising need for real-time insights, fraud detection, and automated financial services to support market growth

- 10.3.3 AUTOMOTIVE

- 10.3.3.1 Proliferation of connected car ecosystems to boost demand

- 10.3.4 RETAIL & E-COMMERCE

- 10.3.4.1 Growing need for data-driven insights to enhance customer engagement to foster market growth

- 10.3.5 MEDIA & ENTERTAINMENT

- 10.3.5.1 Surge in content creation, personalized experiences, and data-driven decision-making to support market growth

- 10.3.6 OTHER ENTERPRISES

- 10.3.1 HEALTHCARE

- 10.4 GOVERNMENT ORGANIZATIONS

- 10.4.1 GROWING NEED TO ENHANCE PUBLIC SAFETY AND SECURITY TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

11 AI DATA CENTER MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Substantial investments in data center infrastructure to fuel market growth

- 11.2.3 CANADA

- 11.2.3.1 Abundance of natural resources and favorable climate to offer lucrative growth opportunities

- 11.2.4 MEXICO

- 11.2.4.1 Advancements in local infrastructure to support market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Rising public-private investments to boost AI infrastructure to foster market growth

- 11.3.3 UK

- 11.3.3.1 Increasing adoption of cloud computing and large-scale investments in data center infrastructure to fuel market growth

- 11.3.4 FRANCE

- 11.3.4.1 Presence of energy-efficient infrastructure to drive market

- 11.3.5 SPAIN

- 11.3.5.1 Rising number of AI startups to offer lucrative growth opportunities

- 11.3.6 ITALY

- 11.3.6.1 Strategic investments in AI infrastructure to spur demand

- 11.3.7 POLAND

- 11.3.7.1 Rapid adoption of emerging technologies like quantum computing and cybersecurity frameworks to fuel market growth

- 11.3.8 NORDICS

- 11.3.8.1 Presence of advanced digital infrastructure and skilled workforce to drive market

- 11.3.9 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Surging cloud computing, IoT, and AI-driven applications to fuel market growth

- 11.4.3 JAPAN

- 11.4.3.1 Substantial investments from global tech giants to boost demand

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Expanding AI-driven industries to offer lucrative growth opportunities

- 11.4.5 INDIA

- 11.4.5.1 Adoption of liquid cooling technologies and renewable energy sources to meet AI workloads to drive market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Increasing demand for advanced data processing capabilities to fuel market growth

- 11.4.7 INDONESIA

- 11.4.7.1 Strategic collaborations with global tech giants to support market growth

- 11.4.8 MALAYSIA

- 11.4.8.1 Rising emphasis on developing digital economy to foster market growth

- 11.4.9 THAILAND

- 11.4.9.1 Rising demand for cloud computing and generative AI applications to fuel market growth

- 11.4.10 VIETNAM

- 11.4.10.1 Rising emphasis on building AI data centers and R&D facilities to support market growth

- 11.4.11 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Bahrain

- 11.5.2.1.1 Rising foreign investments and strategic collaborations to drive market

- 11.5.2.2 Kuwait

- 11.5.2.2.1 Increasing demand for AI-powered applications across various industries to offer lucrative growth opportunities

- 11.5.2.3 Oman

- 11.5.2.3.1 Commitment to digital innovation to support market growth

- 11.5.2.4 Qatar

- 11.5.2.4.1 Growing emphasis on sustainability and digitalization to foster market growth

- 11.5.2.5 Saudi Arabia

- 11.5.2.5.1 Rising need for localized cloud storage due to data sovereignty regulations to fuel market growth

- 11.5.2.6 UAE

- 11.5.2.6.1 Surging adoption of renewable and energy-efficient solutions to drive market

- 11.5.2.7 Rest of Middle East

- 11.5.2.1 Bahrain

- 11.5.3 AFRICA

- 11.5.3.1 South Africa

- 11.5.3.1.1 Rapid digital transformation and increasing demand for cloud and AI-driven solutions to boost demand

- 11.5.3.2 Rest of Africa

- 11.5.3.1 South Africa

- 11.5.4 SOUTH AMERICA

- 11.5.4.1 Expanding data center operations to support local cloud services to offer lucrative growth opportunities

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 12.3 REVENUE ANALYSIS, 2021-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 Application footprint

- 12.7.5.5 End user footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DELL INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 LENOVO

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 HUAWEI TECHNOLOGIES CO., LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 IBM

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 SUPER MICRO COMPUTER, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 IEIT SYSTEMS CO.,LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 H3C TECHNOLOGIES CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.9 CISCO SYSTEMS, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 FUJITSU

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.1 DELL INC.

- 13.2 OTHER PLAYERS

- 13.2.1 QUANTA COMPUTER INC.

- 13.2.2 WISTRON CORPORATION.

- 13.2.3 WIWYNN CORPORATION

- 13.2.4 GIGA-BYTE TECHNOLOGY CO., LTD.

- 13.2.5 MITAC COMPUTING TECHNOLOGY CORPORATION

- 13.2.6 GRAPHCORE

- 13.2.7 CEREBRAS

- 13.2.8 LIQUIDSTACK HOLDING B.V.

- 13.2.9 COOLIT SYSTEMS

- 13.2.10 SUBMER

- 13.2.11 ASPERITAS

- 13.2.12 ICEOTOPE

- 13.2.13 JETCOOL TECHNOLOGIES INC.

- 13.2.14 ZUTACORE

- 13.2.15 ACCELSIUS LLC

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS