|

|

市場調査レポート

商品コード

1759938

スポーツショットガンの世界市場:用途別、アクションタイプ別、ゲージ別、地域別 - 2030年までの予測Sports Shotgun Market by Application (Competition (Clay, Trap, Skeet Shooting) and Hunting), Action Type (Over and Under, Side by Side, Semi-automatic, Pump Action), Gauge (12, 20, 28, .410 Bore) and Region Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| スポーツショットガンの世界市場:用途別、アクションタイプ別、ゲージ別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月23日

発行: MarketsandMarkets

ページ情報: 英文 215 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

スポーツショットガンの市場規模は、2025年に2億6,050万米ドルと推定され、5.6%のCAGRで拡大し、2030年までに3億4,260万米ドルに達すると予測されています。

この成長は、トラップ、スキート、フィールド射撃、3銃競技などの射撃スポーツの人気の高まりによって駆動されます。アマチュアとプロの両レベルにおける世界の参加者の急増は、トレーニング施設の充実、国内射撃連盟の拡大、主要イベントのメディア報道の増加によって支えられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | 用途別、アクションタイプ別、ゲージ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

用途別では、スポーツショットガン市場は競技と狩猟にセグメント化されています。ショットガンは競技用射撃と狩猟で広く使用されており、市場の主要製品となっています。スキート、トラップ、スポーツクレーなどのスポーツでは、参加者は信頼性の高い高性能ショットガンに依存して、精度と結果を向上させます。同様に、ハンターは、陸上や水鳥の狩猟で動きの速い狩猟鳥をターゲットにしたその汎用性と有効性のために散弾銃を支持します。競合と狩猟における二重の魅力は、機能性、伝統、性能を兼ね備えた製品としての重要性を浮き彫りにしています。

アクションタイプ別では、スポーツショットガン市場は、サイドバイサイド、オーバーアンドアンダー、セミオートマチック、プッシュアクションにセグメント化されています。銃身の配列はこれらの区分の基礎であり、オーバーアンドアンダー散弾銃は銃身が垂直に積み重ねられ、一方サイドバイサイド散弾銃は銃身が水平に並んでいます。そのアンティークな外観とコレクターへのアピールにより、サイドバイサイドショットガンは伝統と強く結びついています。競合射撃や狩猟産業は、その精度、バランス、および汎用性のためにオーバー-アンド-アンダー散弾銃によって支配されています。世界中のハンター、コレクター、競合射手の間で進化する嗜好で、両方のアクションタイプはまだ発展しています。

北米地域のスポーツショットガン市場は米国とカナダについて調査されています。米国がスポーツショットガン市場を独占し、2024年には大きな市場シェアを占めています。文化的な狩猟習慣、特に鹿や水鳥の射撃が、その強固な市場プレゼンスとハイエンドショットガンの需要増加の主な要因です。多くの射撃場とクラブがある米国は、競技用射撃スポーツの中心地でもあります。

当レポートでは、世界のスポーツショットガン市場について調査し、用途別、アクションタイプ別、ゲージ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向と混乱

- エコシステム分析

- 指標価格分析

- 主要な利害関係者と購入基準

- 流通チャネル

- 技術分析

- 規制状況

- 2025年~2026年の主な会議とイベント

- 投資と資金調達のシナリオ

- 貿易データ分析

- 運用データ

- マクロ経済見通し

- サプライチェーン分析

- AI/生成AIの影響

- イントロダクション

- 技術動向

- メガトレンドの影響

- ケーススタディ分析

- 特許分析

第6章 スポーツショットガン市場(用途別)

- イントロダクション

- 競技

- 狩猟

第7章 スポーツショットガン市場(アクションタイプ別)

- イントロダクション

- サイドバイサイド

- オーバーアンドアンダー

- セミオートマチック

- ポンプアクション

第8章 スポーツショットガン市場(ゲージ別)

- イントロダクション

- 12ゲージ

- 20ゲージ

- 28ゲージ

- .410ボアゲージ

第9章 スポーツショットガン市場(地域別)

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- 欧州

- PESTLE分析

- 英国

- フランス

- ドイツ

- イタリア

- スペイン

- フィンランド

- その他の地域

- PESTLE分析

- ブラジル

- 南アフリカ

- アルゼンチン

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2021年~2024年

- 主要企業の市場シェア分析(2024年)

- 企業評価と財務指標

- ブランド/製品比較

- 主要参入企業の企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- BROWNING INTERNATIONAL S.A.

- BERETTA HOLDING S.A.

- ARMI PERAZZI S.P.A.

- H. KRIEGHOFF GMBH

- CAESAR GUERINI S.R.L.

- RIZZINI USA

- KOLAR ARMS

- SYREN USA

- ATKIN GRANT & LANG

- A.A. BROWN & SONS

- WESTLEY RICHARDS & COMPANY LIMITED

- JAMES PURDEY & SONS

- WILLIAM POWELL GUNROOM

- BLASER

- FABARM S.P.A.

- その他の企業

- GALLYON GUN & RIFLE MAKERS LTD.

- LONGTHORNE GUNMAKERS LTD

- COGSWELL & HARRISON

- MCKAY BROWN GUNMAKERS LTD.

- HOLLOWAY & NAUGHTON

- HOLLAND & HOLLAND

- O.F. MOSSBERG & SONS, INC.

- WEBLEY & SCOTT

- ARMAS KEMEN, S.L.

- ZOLI ANTONIO S.R.L.

第12章 付録

List of Tables

- TABLE 1 SPORTS SHOTGUN MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2020-2024

- TABLE 3 SHOTGUN DISCIPLINE, QUOTA ALLOCATION IN OLYMPICS, 2008-2024

- TABLE 4 ESTIMATED SHOOTERS TRAINED ANNUALLY, BY COUNTRY, 2023 (UNITS)

- TABLE 5 REGULATION LEVEL FOR SHOTGUN PROCUREMENT, BY COUNTRY, 2023

- TABLE 6 HUNTING LICENSES ISSUED IN US, 2010-2023 (MILLION)

- TABLE 7 ROLE OF COMPANIES IN SPORTS SHOTGUN MARKET ECOSYSTEM

- TABLE 8 INDICATIVE PRICING ANALYSIS, BY APPLICATION, 2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE OF COMPETITION SHOTGUNS, BY KEY PLAYERS, 2024 (USD)

- TABLE 10 AVERAGE SELLING PRICE OF HUNTING SHOTGUNS, BY KEY PLAYERS, 2024 (USD)

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 12 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 13 DISTRIBUTION CHANNEL ADOPTION LEVEL, BY KEY MANUFACTURERS

- TABLE 14 DISTRIBUTION CHANNEL

- TABLE 15 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS, BY COUNTRY

- TABLE 16 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 IMPORT DATA FOR HS CODE 9303, BY COUNTRY, 2022-2024 (USD)

- TABLE 18 EXPORT DATA FOR HS CODE 9303, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 19 NUMBER OF SHOOTERS TRAINED ANNUALLY, BY COUNTRY, 2024

- TABLE 20 NORTH AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 21 EUROPE: KEY MACROECONOMIC INDICATORS

- TABLE 22 ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

- TABLE 23 BROWNING ENHANCED ENTRY-LEVEL MARKET PENETRATION THROUGH AFFORDABLE SPORTING SHOTGUN LINEUP

- TABLE 24 FABARM COLLABORATED WITH SHOOTING CLUBS TO BOOST DEMAND FOR SEMI-AUTOMATIC SHOTGUNS IN YOUTH TRAINING PROGRAMS

- TABLE 25 KRIEGHOFF LEVERAGED CUSTOM FITTING TECHNOLOGY TO INCREASE SALES AMONG PROFESSIONAL SHOOTERS

- TABLE 26 KEY PATENTS, 2015-2024

- TABLE 27 SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 28 SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 29 INTERNATIONAL SHOOTING SPORT FEDERATION'S SHOTGUN COMPETITIONS, 2023

- TABLE 30 UPCOMING TRAP SHOOTING COMPETITIONS

- TABLE 31 UPCOMING SPORTING CLAY SHOOTING COMPETITIONS

- TABLE 32 UPCOMING SKEET SHOOTING COMPETITIONS:

- TABLE 33 SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 34 SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 35 SIDE-BY-SIDE SHOTGUN OFFERINGS, BY MANUFACTURER

- TABLE 36 OVER-AND-UNDER SHOTGUN OFFERINGS, BY MANUFACTURER

- TABLE 37 SPORTS SHOTGUN MARKET, BY GAUGE, 2021-2024 (USD MILLION)

- TABLE 38 SPORTS SHOTGUN MARKET, BY GAUGE, 2025-2030 (USD MILLION)

- TABLE 39 12-GAUGE SHOTGUN OFFERINGS, BY MANUFACTURER

- TABLE 40 20-GAUGE SHOTGUN OFFERINGS, BY MANUFACTURER

- TABLE 41 28-GAUGE SHOTGUN OFFERINGS, BY MANUFACTURER

- TABLE 42 .410 BORE SHOTGUN OFFERINGS, BY MANUFACTURER

- TABLE 43 SPORTS SHOTGUN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 SPORTS SHOTGUN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 46 NORTH AMERICA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 48 NORTH AMERICA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: SPORTS SHOTGUN MARKET, BY GAUGE, 2021-2024 (USD MILLION)

- TABLE 50 NORTH AMERICA: SPORTS SHOTGUN MARKET, BY GAUGE, 2025-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: SPORTS SHOTGUN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 52 NORTH AMERICA: SPORTS SHOTGUN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 53 US: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 54 US: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 55 US: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 56 US: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 57 CANADA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 58 CANADA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 59 CANADA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 60 CANADA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 61 ASIA PACIFIC: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 62 ASIA PACIFIC: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 ASIA PACIFIC: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 64 ASIA PACIFIC: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: SPORTS SHOTGUN MARKET, BY GAUGE, 2021-2024 (USD MILLION)

- TABLE 66 ASIA PACIFIC: SPORTS SHOTGUN MARKET, BY GAUGE, 2025-2030 (USD MILLION)

- TABLE 67 ASIA PACIFIC: SPORTS SHOTGUN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 ASIA PACIFIC: SPORTS SHOTGUN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 CHINA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 70 CHINA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 71 CHINA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 72 CHINA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 73 INDIA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 74 INDIA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 75 INDIA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 76 INDIA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 77 JAPAN: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 78 JAPAN: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 JAPAN: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 80 JAPAN: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 81 AUSTRALIA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 82 AUSTRALIA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83 AUSTRALIA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 84 AUSTRALIA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 85 SOUTH KOREA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 86 SOUTH KOREA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 87 SOUTH KOREA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 88 SOUTH KOREA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 90 EUROPE: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 EUROPE: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 92 EUROPE: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: SPORTS SHOTGUN MARKET, BY GAUGE, 2021-2024 (USD MILLION)

- TABLE 94 EUROPE: SPORTS SHOTGUN MARKET, BY GAUGE, 2025-2030 (USD MILLION)

- TABLE 95 EUROPE: SPORTS SHOTGUN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 EUROPE: SPORTS SHOTGUN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 UK: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 98 UK: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 UK: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 100 UK: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 101 FRANCE: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 102 FRANCE: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 103 FRANCE: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 104 FRANCE: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 105 GERMANY: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 106 GERMANY: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 GERMANY: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 108 GERMANY: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 109 ITALY: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 110 ITALY: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 ITALY: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 112 ITALY: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 113 SPAIN: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 114 SPAIN: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 SPAIN: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 116 SPAIN: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 117 FINLAND: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 118 FINLAND: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 FINLAND: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 120 FINLAND: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 121 REST OF THE WORLD: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 122 REST OF THE WORLD: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 123 REST OF THE WORLD: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 124 REST OF THE WORLD: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 125 REST OF THE WORLD: SPORTS SHOTGUN MARKET, BY GAUGE, 2021-2024 (USD MILLION)

- TABLE 126 REST OF THE WORLD: SPORTS SHOTGUN MARKET, BY GAUGE, 2025-2030 (USD MILLION)

- TABLE 127 REST OF THE WORLD: SPORTS SHOTGUN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 128 REST OF THE WORLD: SPORTS SHOTGUN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129 BRAZIL: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 130 BRAZIL: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 BRAZIL: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 132 BRAZIL: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 133 SOUTH AFRICA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 134 SOUTH AFRICA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 SOUTH AFRICA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 136 SOUTH AFRICA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 137 ARGENTINA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 138 ARGENTINA: SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 ARGENTINA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2021-2024 (USD MILLION)

- TABLE 140 ARGENTINA: SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- TABLE 141 SPORTS SHOTGUN MARKET: DEGREE OF COMPETITION

- TABLE 142 SPORTS SHOTGUN MARKET: REGION FOOTPRINT

- TABLE 143 SPORTS SHOTGUN MARKET: APPLICATION FOOTPRINT

- TABLE 144 SPORTS SHOTGUN MARKET: ACTION TYPE FOOTPRINT

- TABLE 145 SPORTS SHOTGUN MARKET: LIST OF STARTUPS/SMES

- TABLE 146 SPORTS SHOTGUN MARKET: COMPETITIVE BENCHMARKING

- TABLE 148 SPORTS SHOTGUN MARKET: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 149 BROWNING INTERNATIONAL S.A.: COMPANY OVERVIEW

- TABLE 150 BROWNING INTERNATIONAL S.A.: PRODUCTS OFFERED

- TABLE 151 BERETTA HOLDING S.A.: COMPANY OVERVIEW

- TABLE 152 BERETTA HOLDING S.A.: PRODUCTS OFFERED

- TABLE 153 BERETTA HOLDING S.A.: DEALS

- TABLE 154 ARMI PERAZZI S.P.A.: COMPANY OVERVIEW

- TABLE 155 ARMI PERAZZI S.P.A.: PRODUCTS OFFERED

- TABLE 156 ARMI PERAZZI S.P.A.: PRODUCT LAUNCHES

- TABLE 157 ARMI PERAZZI S.P.A.: DEALS

- TABLE 158 H. KRIEGHOFF GMBH: COMPANY OVERVIEW

- TABLE 159 H. KRIEGHOFF GMBH: PRODUCTS OFFERED

- TABLE 160 H. KRIEGHOFF GMBH: PRODUCT LAUNCHES

- TABLE 161 CAESAR GUERINI S.R.L.: COMPANY OVERVIEW

- TABLE 162 CAESAR GUERINI S.R.L.: PRODUCTS OFFERED

- TABLE 163 RIZZINI USA: COMPANY OVERVIEW

- TABLE 164 RIZZINI USA: PRODUCTS OFFERED

- TABLE 165 KOLAR ARMS: COMPANY OVERVIEW

- TABLE 166 KOLAR ARMS: PRODUCTS OFFERED

- TABLE 167 SYREN USA: COMPANY OVERVIEW

- TABLE 168 SYREN USA: PRODUCTS OFFERED

- TABLE 169 ATKIN GRANT & LANG: COMPANY OVERVIEW

- TABLE 170 ATKIN GRANT & LANG: PRODUCTS OFFERED

- TABLE 171 A.A. BROWN & SONS: COMPANY OVERVIEW

- TABLE 172 A.A. BROWN & SONS: PRODUCTS OFFERED

- TABLE 173 WESTLEY RICHARDS & COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 174 WESTLEY RICHARDS & COMPANY LIMITED: PRODUCTS OFFERED

- TABLE 175 JAMES PURDEY & SONS: COMPANY OVERVIEW

- TABLE 176 JAMES PURDEY & SONS: PRODUCTS OFFERED

- TABLE 177 WILLIAM POWELL GUNROOM: COMPANY OVERVIEW

- TABLE 178 WILLIAM POWELL GUNROOM: PRODUCTS OFFERED

- TABLE 179 BLASER: COMPANY OVERVIEW

- TABLE 180 BLASER: PRODUCTS OFFERED

- TABLE 181 FABARM S.P.A.: COMPANY OVERVIEW

- TABLE 182 FABARM S.P.A.: PRODUCTS OFFERED

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 DEMAND-SIDE APPROACH

- FIGURE 5 DEMAND-SIDE APPROACH: COMPETITION SHOTGUN MARKET

- FIGURE 6 DEMAND-SIDE APPROACH: HUNTING SHOTGUN MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 COMPETITION SEGMENT TO EXHIBIT HIGHER CAGR THAN HUNTING SEGMENT DURING FORECAST PERIOD

- FIGURE 10 OVER-AND-UNDER SHOTGUN SEGMENT TO LEAD MARKET IN 2030

- FIGURE 11 12-GAUGE SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 13 INCREASING YOUTH AND FEMALE PARTICIPATION IN SHOOTING COMPETITIONS TO DRIVE MARKET

- FIGURE 14 COMPETITION SEGMENT TO LEAD MARKET FROM 2025 TO 2030

- FIGURE 15 OVER-AND-UNDER SHOTGUN SEGMENT TO LEAD MARKET IN 2030

- FIGURE 16 12-GAUGE SHOTGUN SEGMENT TO LEAD MARKET IN 2030

- FIGURE 17 SPORTS SHOTGUN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN SPORTS SHOTGUN MARKET

- FIGURE 19 ECOSYSTEM ANALYSIS OF SPORTS SHOTGUN MARKET

- FIGURE 20 INDICATIVE PRICING ANALYSIS, BY APPLICATION

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 22 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 23 BRICK-AND-MORTAR RETAILERS: FLOW OF DISTRIBUTION

- FIGURE 24 E-COMMERCE: FLOW OF DISTRIBUTION

- FIGURE 25 RESELLERS: FLOW OF DISTRIBUTION

- FIGURE 26 ACTUATION HOUSES: FLOW OF DISTRIBUTION

- FIGURE 27 MANUFACTURER-DIRECT SALES: FLOW OF DISTRIBUTION

- FIGURE 28 SPECIALIZED TRADE SHOWS AND EVENTS: FLOW OF DISTRIBUTION

- FIGURE 29 SPORTING CLUBS AND PRIVATE SALES: FLOW OF DISTRIBUTION

- FIGURE 30 TECHNOLOGY ANALYSIS

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO, 2019-2024 (USD BILLION)

- FIGURE 32 IMPORT DATA FOR HS CODE 9303, BY COUNTRY, 2022-2024 (USD)

- FIGURE 33 EXPORT DATA FOR HS CODE 9303, BY COUNTRY, 2022-2024 (USD)

- FIGURE 34 SUPPLY CHAIN ANALYSIS

- FIGURE 35 TECHNOLOGY TRENDS IN SPORTS SHOTGUN MARKET

- FIGURE 36 PATENT ANALYSIS OF SPORTS SHOTGUN MARKET

- FIGURE 37 SPORTS SHOTGUN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- FIGURE 38 SPORTS SHOTGUN MARKET, BY ACTION TYPE, 2025-2030 (USD MILLION)

- FIGURE 39 SPORTS SHOTGUN MARKET, BY GAUGE, 2025-2030 (USD MILLION)

- FIGURE 40 SPORTS SHOTGUN MARKET, BY REGION, 2025-2030

- FIGURE 41 NORTH AMERICA: SPORTS SHOTGUN MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: SPORTS SHOTGUN MARKET SNAPSHOT

- FIGURE 43 EUROPE: SPORTS SHOTGUN MARKET SNAPSHOT

- FIGURE 44 REST OF THE WORLD: SPORTS SHOTGUN MARKET SNAPSHOT

- FIGURE 45 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2021-2024

- FIGURE 46 FINANCIAL METRICS OF PROMINENT PLAYERS, MAY 2025

- FIGURE 47 VALUATION OF PROMINENT MARKET PLAYERS, MAY 2025

- FIGURE 48 BRAND/PRODUCT COMPARISON

- FIGURE 49 SPORTS SHOTGUN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 SPORTS SHOTGUN MARKET: COMPANY FOOTPRINT

- FIGURE 51 SPORTS SHOTGUN MARKET: START-UP/SME EVALUATION MATRIX, 2024

The sports shotgun is estimated to be at USD 260.5 million in 2025 and is projected to reach USD 342.6 million by 2030 at a CAGR of 5.6%. This growth is driven by the rising popularity of shooting sports such as trap, skeet, field shooting, and 3-gun competitions. The surge in global participation across both amateur and professional levels is supported by enhanced training facilities, expansion of national shooting federations, and increased media coverage of major events.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Application, action type, gauge, and region |

| Regions covered | North America, Europe, APAC, RoW |

"The competition application segment is projected to witness strong growth during the forecast period."

Based on application, the sports shotgun market has been segmented into competition and hunting. Shotguns are widely used in competitive shooting and hunting, making them a key product in the market. In sports such as skeet, trap, and sporting clays, participants depend on reliable, high-performance shotguns to improve their accuracy and results. Similarly, hunters favor shotguns for their versatility and effectiveness in targeting fast-moving game birds during upland and waterfowl hunts. Their dual appeal in competition and hunting highlights their importance as a product that combines functionality, tradition, and performance.

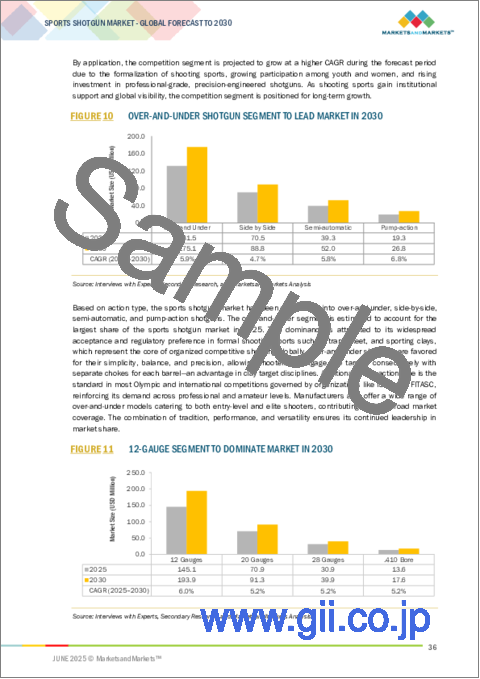

"The over and under action type segment accounts for a market significant share."

Based on action type, the sports shotgun market has been segmented into side-by-side, over and under, semi-automatic, and push-action. Barrel alignment is the basis for these divisions; over-and-under shotguns have barrels stacked vertically, while side-by-side shotguns have barrels lined horizontally. Due to their antique appearance and appeal to collectors, side-by-side shotguns are strongly associated with tradition. Competitive shooting and hunting industries are dominated by over-and-under shotguns due to their accuracy, balance, and versatility. With evolving preferences among hunters, collectors, and competitive shooters worldwide, both action types are still developing.

"North America is projected to be the largest sports shotgun market."

The sports shotgun market in the North American region has been studied for the US and Canada. The US dominates the sports shotgun market, with a significant market share in 2024. Cultural hunting customs, especially those involving deer and waterfowl shooting, are the primary factor behind its robust market presence and increased demand for high-end shotguns. With a large number of shooting ranges and clubs, the US is also a center for competitive shooting sports.

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1: 48%; Tier 2: 36%; and Tier 3: 16%

- By Designation: C Level: 52%; Directors: 30%; and Others: 18%

- By Region: North America: 42%; Europe: 30%; Asia Pacific: 21%; Rest of the World: 7%

Fabbrica d'Armi Pietro Beretta S.p.A. (Italy), Blaser GmbH (Germany), Armi Perazzi S.p.A. (Italy), H. Krieghoff GmbH (Germany), and Caesar Guerini S.r.l. (Italy) are some of the leading players operating in the sports shotgun market.

Research Coverage

This research report categorizes the sports shotgun market based on application (competition and hunting), action type (over and under, side by side, semi-automatic, and push-action), and gauge (12, 20, 28, and .410). These segments have been mapped across major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World.

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the sports shotgun market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches associated with the sports shotgun market. This report also covers competitive analysis of upcoming startups in the sports shotgun market ecosystem.

Key Benefits of Buying this Report: This report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall sports shotgun market and its subsegments. The report covers the entire ecosystem of the market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of the key drivers (growing interest in sports shooting, rising number of shooting clubs and associations, and increasing cultural value of luxury shotguns), restraint (stringent regulatory framework for shotgun procurement, decline in hunting licenses, and environmental and ethical concerns on wildlife conservation) opportunities (rising participation in shooting sports and ongoing collaborations with event organizers and federations), and challenges (high cost of competition shotguns for professional shooting and fluctuating raw material prices)

- Market Penetration: Comprehensive information on sports shotguns offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the sports shotgun market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the sports shotgun market across varied regions)

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the sports shotgun market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the sports shotgun market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation & methodology

- 2.3.1.2 Demand-side approach: Competition shotgun market

- 2.3.1.3 Demand-side approach: Hunting shotgun market

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN SPORTS SHOTGUN MARKET

- 4.2 SPORTS SHOTGUN MARKET, BY APPLICATION

- 4.3 SPORTS SHOTGUN MARKET, BY ACTION TYPE

- 4.4 SPORTS SHOTGUN MARKET, BY GAUGE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing interest and participation in shooting sports

- 5.2.1.2 Rising number of shooting clubs and associations

- 5.2.1.3 Increasing cultural value of luxury shotguns

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulatory framework for shotgun procurement

- 5.2.2.2 Decline in hunting licenses

- 5.2.2.3 Environmental and ethical concerns on wildlife conservation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Collaborations among shotgun makers, event organizers, and federations

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of competition shotguns for professional shooting

- 5.2.4.2 Fluctuating raw material prices

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 STARTUPS

- 5.4.4 END USERS

- 5.5 INDICATIVE PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS, BY APPLICATION, 2024

- 5.5.2 AVERAGE SELLING PRICE OF COMPETITION SHOTGUNS, BY KEY PLAYERS, 2024 (USD)

- 5.5.3 AVERAGE SELLING PRICE OF HUNTING SHOTGUNS, BY KEY PLAYERS, 2024 (USD)

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 DISTRIBUTION CHANNEL

- 5.7.1 DISTRIBUTION CHANNEL ADOPTION LEVEL, BY KEY MANUFACTURERS

- 5.7.2 DISTRIBUTION CHANNEL TYPES

- 5.7.3 BRICK-AND-MORTAR RETAILERS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Advanced material engineering

- 5.8.1.2 Modular designs

- 5.8.1.3 Enhanced barrel technologies

- 5.8.1.4 Advanced testing and ballistic simulation

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Precision manufacturing and computer numerical control machining

- 5.8.2.2 Augmented and virtual reality for training

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Safety and compliance enhancements

- 5.8.3.2 Precision ammunition & reloading technology

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 INVESTMENT AND FUNDING SCENARIO

- 5.12 TRADE DATA ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 9303)

- 5.12.2 EXPORT DATA (HS CODE 9303)

- 5.13 OPERATIONAL DATA

- 5.14 MACROECONOMIC OUTLOOK

- 5.14.1 INTRODUCTION

- 5.14.2 MACROECONOMIC OUTLOOK, BY REGION

- 5.14.2.1 North America

- 5.14.2.2 Europe

- 5.14.2.3 Asia Pacific

- 5.15 SUPPLY CHAIN ANALYSIS

- 5.16 IMPACT OF AI/GEN AI

- 5.16.1 INTRODUCTION

- 5.16.2 KEY USE CASES

- 5.16.3 IMPACT OF AI ON SPORTS SHOTGUN ECOSYSTEM

- 5.17 INTRODUCTION

- 5.18 TECHNOLOGY TRENDS

- 5.18.1 ADVANCED RECOIL MANAGEMENT SYSTEMS

- 5.18.2 PRECISION BARREL MANUFACTURING

- 5.18.3 MODULAR & ADJUSTABLE STOCK DESIGNS

- 5.18.4 LIGHTWEIGHT MATERIALS AND ERGONOMIC CHASSIS

- 5.18.5 INTEGRATION OF SMART SIGHTING SYSTEMS

- 5.19 IMPACT OF MEGATRENDS

- 5.19.1 INSTITUTIONALIZATION OF COMPETITIVE SHOOTING SPORTS

- 5.19.2 PREMIUMIZATION AND CUSTOMIZATION DEMAND

- 5.19.3 REGULATORY STABILIZATION AND GLOBAL MARKET EXPANSION

- 5.20 CASE STUDY ANALYSIS

- 5.21 PATENT ANALYSIS

6 SPORTS SHOTGUN MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 COMPETITION

- 6.2.1 INCREASING PARTICIPATION IN COMPETITIVE SHOOTING TO DRIVE GROWTH

- 6.2.2 TRAP SHOOTING

- 6.2.3 SPORTING CLAY SHOOTING

- 6.2.4 SKEET SHOOTING

- 6.3 HUNTING

- 6.3.1 SURGE IN UPLAND HUNTING AND PAID HUNTING TO DRIVE MARKET

7 SPORTS SHOTGUN MARKET, BY ACTION TYPE

- 7.1 INTRODUCTION

- 7.2 SIDE BY SIDE

- 7.2.1 SUITABLE FOR UPLAND BIRD HUNTING

- 7.3 OVER AND UNDER

- 7.3.1 WIDELY USED FOR PRECISION SPORTS

- 7.4 SEMI-AUTOMATIC

- 7.4.1 SUITABLE FOR DYNAMIC SHOOTING SPORTS

- 7.5 PUMP-ACTION

- 7.5.1 ALLOW FOR IMMEDIATE TROUBLESHOOTING OF MISFIRES

8 SPORTS SHOTGUN MARKET, BY GAUGE

- 8.1 INTRODUCTION

- 8.2 12 GAUGE

- 8.2.1 GROWING POPULARITY OF CLAY TARGET SPORTS TO DRIVE GROWTH

- 8.3 20 GAUGE

- 8.3.1 INCREASING FOCUS ON ERGONOMICS AND USER-SPECIFIC GUN FIT TO DRIVE GROWTH

- 8.4 28 GAUGE

- 8.4.1 SURGE IN PREMIUM SPORTING EVENTS AND PRIVATE SHOOTING CLUBS TO DRIVE GROWTH

- 8.5 .410 BORE GAUGE

- 8.5.1 ENTRY-LEVEL SUITABILITY AND AMMUNITION INNOVATION TO DRIVE GROWTH

9 SPORTS SHOTGUN MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 PESTLE ANALYSIS

- 9.2.2 US

- 9.2.2.1 Cultural capitalization to drive market

- 9.2.3 CANADA

- 9.2.3.1 Focus on both competitive shooting and hunting traditions to fuel market

- 9.3 ASIA PACIFIC

- 9.3.1 PESTLE ANALYSIS

- 9.3.2 CHINA

- 9.3.2.1 Government's efforts to encourage shooting sports to drive growth

- 9.3.3 INDIA

- 9.3.3.1 Olympic success and inclusive sports infrastructure to drive growth

- 9.3.4 JAPAN

- 9.3.4.1 Significant presence in international competitions to drive growth

- 9.3.5 AUSTRALIA

- 9.3.5.1 Balanced sporting culture and regulatory support to drive growth

- 9.3.6 SOUTH KOREA

- 9.3.6.1 Significant domestic participation to drive growth

- 9.4 EUROPE

- 9.4.1 PESTLE ANALYSIS

- 9.4.2 UK

- 9.4.2.1 Heritage shooting culture and national sporting initiatives to drive growth

- 9.4.3 FRANCE

- 9.4.3.1 Involvement in international clay shooting competitions to drive growth

- 9.4.4 GERMANY

- 9.4.4.1 High demand for precision-engineered competition shotguns to drive growth

- 9.4.5 ITALY

- 9.4.5.1 Legacy manufacturing and sporting excellence to drive growth

- 9.4.6 SPAIN

- 9.4.6.1 Rural game heritage to drive growth

- 9.4.7 FINLAND

- 9.4.7.1 Sustainable hunting and elite sports programs to drive growth

- 9.5 REST OF THE WORLD

- 9.5.1 PESTLE ANALYSIS

- 9.5.2 BRAZIL

- 9.5.2.1 Increasing demand for competition shotguns to drive growth

- 9.5.3 SOUTH AFRICA

- 9.5.3.1 Conservation-driven hunting to drive growth

- 9.5.4 ARGENTINA

- 9.5.4.1 Partnerships between government and regional shooting clubs to drive growth

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 10.3 REVENUE ANALYSIS, 2021-2024

- 10.4 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Application footprint

- 10.7.5.4 Action type footprint

- 10.8 STARTUP/SME EVALUATION MATRIX

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING

- 10.8.5.1 List of key start-ups/SMEs

- 10.8.5.2 Competitive benchmarking of key start-ups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 BROWNING INTERNATIONAL S.A.

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Key strengths

- 11.1.1.3.2 Strategic choices

- 11.1.1.3.3 Weaknesses and competitive threats

- 11.1.2 BERETTA HOLDING S.A.

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 ARMI PERAZZI S.P.A.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 H. KRIEGHOFF GMBH

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 CAESAR GUERINI S.R.L.

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 RIZZINI USA

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 MnM view

- 11.1.6.3.1 Key strengths

- 11.1.6.3.2 Strategic choices

- 11.1.6.3.3 Weaknesses and competitive threats

- 11.1.7 KOLAR ARMS

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 SYREN USA

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 ATKIN GRANT & LANG

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.10 A.A. BROWN & SONS

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.11 WESTLEY RICHARDS & COMPANY LIMITED

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.12 JAMES PURDEY & SONS

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.13 WILLIAM POWELL GUNROOM

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 BLASER

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 FABARM S.P.A.

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.1 BROWNING INTERNATIONAL S.A.

- 11.2 OTHER PLAYERS

- 11.2.1 GALLYON GUN & RIFLE MAKERS LTD.

- 11.2.2 LONGTHORNE GUNMAKERS LTD

- 11.2.3 COGSWELL & HARRISON

- 11.2.4 MCKAY BROWN GUNMAKERS LTD.

- 11.2.5 HOLLOWAY & NAUGHTON

- 11.2.6 HOLLAND & HOLLAND

- 11.2.7 O.F. MOSSBERG & SONS, INC.

- 11.2.8 WEBLEY & SCOTT

- 11.2.9 ARMAS KEMEN, S.L.

- 11.2.10 ZOLI ANTONIO S.R.L.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 LAUNDRY LIST OF MARKET PLAYERS

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS