|

|

市場調査レポート

商品コード

1759024

太陽光発電の世界市場:材料別、コンポーネント別、設置タイプ別、セルタイプ別、地域別 -予測(~ 2030年)Photovoltaics Market by Material (Silicon, CIGS, CdTe, Perovskite, Organic Photovoltaic, Quantum Dot), Component (Modules, Inverters, BOS), Installation Type (Ground-mounted, Building-integrated, Floating), Cell Type and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 太陽光発電の世界市場:材料別、コンポーネント別、設置タイプ別、セルタイプ別、地域別 -予測(~ 2030年) |

|

出版日: 2025年06月26日

発行: MarketsandMarkets

ページ情報: 英文 290 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

太陽光発電(PV)とエネルギー貯蔵システムのコスト低下が、太陽光発電市場の成長を大きく加速させています。

技術が進歩し規模の経済性が高まるにつれて、太陽光発電システムの設置費と維持費は低下しています。同様に、電池技術の革新によりストレージの価格が下がり、太陽エネルギーはより安定し、手頃な価格になっています。こうしたコスト削減により投資の収益率が向上し、住宅、商業施設、電力企業の顧客にとっての太陽光発電システムの魅力が高まっています。その結果、価格の手頃さが普及を加速し、世界的な再生可能エネルギーへの移行を可能にしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | コンポーネント、タイプ、材料タイプ、セルタイプ、設置タイプ、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「リジッドセグメントが2030年に太陽光発電市場で最大のシェアを占める見込みです。」

リジッドタイプセグメントは、住宅、商業施設、ユーティリティスケールの設備で広く使用されているため、太陽光発電市場で大きな市場シェアを占めると予測されます。これらのパネルタイプは、フレキシブルの代替品よりも高い効率を達成でき、メンテナンスが少なく済み、より長く使用できます。リジッドパネルは製造部門で確立されており、価格は代替品と同等です。リジッドパネルは、構造上の制限がほぼ存在しない固定式の設備に適しています。大規模な太陽光発電プロジェクトの需要が高まっていることから、太陽光発電プロジェクトにおけるリジッドパネルの有用性が低下することはないとみられます。

「インバーターセグメントが予測期間にもっとも高いCAGRを記録する可能性が高いです。」

インバーターは、ソーラーパネルで発電された直流電力を使用可能な交流電力に変換する重要な役割を担っているため、予測期間に太陽光発電市場でもっとも高いCAGRを記録する見込みです。グリッドサポート機能、遠隔モニタリング機能、エネルギーストレージ統合機能を備えたスマートインバーターの採用が増加しているため、住宅、商業施設、ユーティリティスケールプロジェクトで需要が高まっています。さらに、インバーターの効率性、モジュール設計、進化するグリッド規制への対応などの進歩が、インバーターの普及をさらに加速させています。分散型エネルギー資源の増加に伴い、インバーターはソーラーシステムの性能を最適化し、グリッドの安定性を実現するのに不可欠なものとなっています。

「中国が2030年にアジア太平洋の太陽光発電市場で最大のシェアを占めると予測されます。」

中国は、その圧倒的な製造能力と強力な政策支援により、2030年までにアジア太平洋の太陽光発電市場で最大のシェアを占めると予測されます。同国はソーラーモジュール、ウエハー、ポリシリコンの生産で世界をリードしており、規模の経済とコスト削減の恩恵を受けています。例えば、National Renewable Energy Laboratory(Spring 2024 Solar Industry Update)によると、2024年1月現在、26の省がPVプロジェクトにストレージの設置を義務付けており、平均ストレージ容量要件はPV発電量の12%に相当します。

当レポートでは、世界の太陽光発電市場について調査分析し、主な促進要因と抑制要因、製品の開発とイノベーション、競合情勢などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 太陽光発電市場の企業にとって魅力的な機会

- 太陽光発電市場:セルタイプ別

- 太陽光発電市場:設置タイプ別

- 太陽光発電市場:用途別

- アジア太平洋の太陽光発電市場:国別、用途別

- 太陽光発電市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 貿易分析

- 輸入シナリオ(HSコード854140)

- 輸出シナリオ(HSコード854140)

- 特許分析

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 規制

- 標準

- 主な会議とイベント(2025年~2026年)

- 価格分析

- 主要企業が提供する太陽光発電モジュールの価格帯:用途別(2024年)

- 太陽光発電セルの平均販売価格の動向:地域別(2021年~2024年)

- 太陽光発電市場に対するAI/生成AIの影響

- 太陽光発電市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 用途に対する影響

第6章 太陽光発電の集光度

- イントロダクション

- 高集光

- 中集光

- 低集光

第7章 太陽光発電システムの発電量の範囲

- イントロダクション

- 100WP以下

- 100.1~300WP

- 300WP超

第8章 太陽光発電市場:コンポーネント別

- イントロダクション

- モジュール

- インバーター

- 周辺機器(BOS)

- 接続・ケーブル

- ジャンクションボックス

- 安全装置

- トラッカー

- 電池

- モニタリングシステム

- その他のBOSタイプ

第9章 太陽光発電市場:タイプ別

- イントロダクション

- リジッド

- フレキシブル

第10章 太陽光発電市場:材料タイプ別

- イントロダクション

- シリコン

- 結晶

- アモルファス

- セレン化銅インジウムガリウム(CIGS)

- テルル化カドミウム(CdTe)

- ペロブスカイト

- 有機太陽電池

- 量子ドット

第11章 太陽光発電市場:セルタイプ別

- イントロダクション

- 燃料電池PVモジュール

- ハーフセルPVモジュール

第12章 太陽光発電市場:設置タイプ別

- イントロダクション

- 地上設置型

- 建材一体型

- 浮体式

第13章 太陽光発電市場:用途別

- イントロダクション

- 住宅

- 商工業

- 電力企業

第14章 太陽光発電市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東

- アフリカ

- 南米

第15章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2023年~2025年)

- 収益分析(2022年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標

- ブランドの比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第16章 企業プロファイル

- 主要企業

- JINKO SOLAR

- JA SOLAR TECHNOLOGY CO., LTD.

- TRINASOLAR

- LONGI

- TONGWEI CO., LTD.

- CANADIAN SOLAR

- FIRST SOLAR

- HANWHA QCELLS

- MITSUBISHI ELECTRIC CORPORATION

- SHARP CORPORATION

- WUXI SUNTECH POWER CO., LTD.

- HUAWEI TECHNOLOGIES CO., LTD.

- SUNGROW

- SMA SOLAR TECHNOLOGY AG

- SOLAREDGE

- ABB

- その他の企業

- ARRAY TECHNOLOGIES, INC.

- ZHEJIANG CHINT NEW ENERGY DEVELOPMENT CO. LTD.

- GCL-SI

- NEXTRACKER INC.

- RISEN ENERGY CO., LTD.

- YINGLI SOLAR

- ACCIONA

- TATA POWER SOLAR SYSTEMS LTD.

- WAAREE ENERGIES LTD.

- SHUNFENG INTERNATIONAL CLEAN ENERGY CO., LTD.

- EMMVEE SOLAR

- ALLEARTH RENEWABLES

- EATON

- POWER ELECTRONICS S.L.

- FIMER

第17章 付録

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 3 MAJOR SOLAR PROJECTS ACROSS VARIOUS REGIONS

- TABLE 4 PHOTOVOLTAICS MARKET: RISK ANALYSIS

- TABLE 5 ROLE OF COMPANIES IN PHOTOVOLTAICS ECOSYSTEM

- TABLE 6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 8 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 9 IMPORT DATA FOR HS CODE 854140-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 854140-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 11 LIST OF KEY PATENTS, 2024

- TABLE 12 MFN TARIFF FOR HS CODE 854140-COMPLIANT PRODUCTS EXPORTED BY TAIPEI, CHINA, 2023

- TABLE 13 MFN TARIFF FOR HS CODE 854140-COMPLIANT PRODUCTS EXPORTED BY PHILIPPINES, 2023

- TABLE 14 MFN TARIFF FOR HS CODE 854140-COMPLIANT PRODUCTS EXPORTED BY KENYA, 2023

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 20 PRICING RANGE OF PV MODULES OFFERED BY KEY PLAYERS, BY APPLICATION, 2024 (USD/WATT)

- TABLE 21 AVERAGE SELLING PRICE TREND OF PHOTOVOLTAIC CELLS, BY REGION, 2021-2024 (USD/KW)

- TABLE 22 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 DIFFERENT CLASSES OF CPV SYSTEMS AND THEIR REQUIREMENTS

- TABLE 24 COMPANIES OFFERING PV MODULES OF UP TO 100 WP

- TABLE 25 COMPANIES OFFERING PV MODULES OF 100.1-300 WP

- TABLE 26 COMPANIES OFFERING PV MODULES OF ABOVE 300 WP

- TABLE 27 PHOTOVOLTAICS MARKET, BY COMPONENT, 2021-2024 (USD BILLION)

- TABLE 28 PHOTOVOLTAICS MARKET, BY COMPONENT, 2025-2030 (USD BILLION)

- TABLE 29 PHOTOVOLTAICS MARKET, BY VALUE AND VOLUME, 2021-2024 (USD BILLION/GW)

- TABLE 30 PHOTOVOLTAICS MARKET, BY VALUE AND VOLUME, 2025-2030 (USD BILLION/GW)

- TABLE 31 COMPANIES OFFERING 60-CELL PV MODULES

- TABLE 32 COMPANIES OFFERING 72-CELL PV MODULES

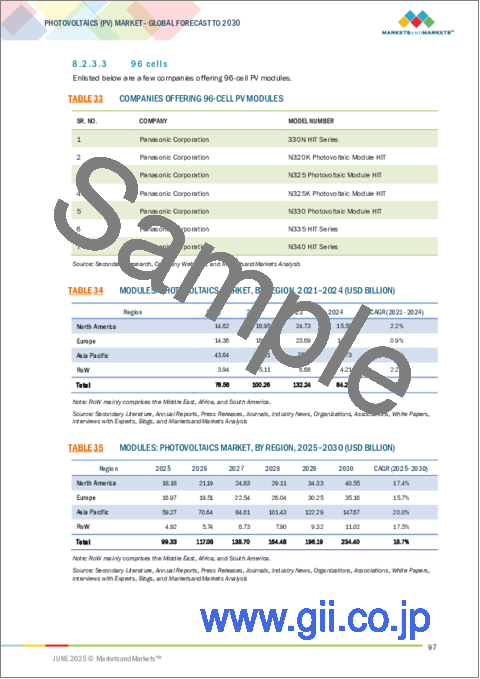

- TABLE 33 COMPANIES OFFERING 96-CELL PV MODULES

- TABLE 34 MODULES: PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 35 MODULES: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 36 MODULES: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 37 MODULES: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 38 INVERTERS: PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 39 INVERTERS: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 40 INVERTERS: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 41 INVERTERS: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 42 BALANCE OF SYSTEM (BOS): PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 43 BALANCE OF SYSTEM (BOS): PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 44 BALANCE OF SYSTEM (BOS): PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 45 BALANCE OF SYSTEM (BOS): PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 46 BALANCE OF SYSTEM (BOS): PHOTOVOLTAICS MARKET, BY BOS TYPE, 2021-2024 (USD BILLION)

- TABLE 47 BALANCE OF SYSTEM (BOS): PHOTOVOLTAICS MARKET, BY BOS TYPE, 2025-2030 (USD BILLION)

- TABLE 48 PHOTOVOLTAICS MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 49 PHOTOVOLTAICS MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 50 RIGID: PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 51 RIGID: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 52 FLEXIBLE: PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 53 FLEXIBLE: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 54 PHOTOVOLTAICS MARKET, BY MATERIAL TYPE, 2021-2024 (USD BILLION)

- TABLE 55 PHOTOVOLTAICS MARKET, BY MATERIAL TYPE, 2025-2030 (USD BILLION)

- TABLE 56 SILICON: PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 57 SILICON: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 58 SILICON: PHOTOVOLTAIC MARKET, BY SILICON TYPE, 2021-2024 (USD BILLION)

- TABLE 59 SILICON: PHOTOVOLTAIC MARKET, BY SILICON TYPE, 2025-2030 (USD BILLION)

- TABLE 60 COPPER INDIUM GALLIUM SELENIDE (CIGS): PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 61 COPPER INDIUM GALLIUM SELENIDE (CIGS): PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 62 CADMIUM TELLURIDE (CDTE): PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 63 CADMIUM TELLURIDE (CDTE): PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 64 PEROVSKITE: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 65 ORGANIC PHOTOVOLTAIC: PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 66 ORGANIC PHOTOVOLTAIC: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 67 QUANTUM DOT: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 68 PHOTOVOLTAICS MARKET, BY CELL TYPE, 2021-2024 (USD BILLION)

- TABLE 69 PHOTOVOLTAICS MARKET, BY CELL TYPE, 2025-2030 (USD BILLION)

- TABLE 70 PHOTOVOLTAICS MARKET, BY INSTALLATION TYPE, 2021-2024 (USD BILLION)

- TABLE 71 PHOTOVOLTAICS MARKET, BY INSTALLATION TYPE, 2025-2030 (USD BILLION)

- TABLE 72 PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 73 PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 74 RESIDENTIAL: PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 75 RESIDENTIAL: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 76 RESIDENTIAL: PHOTOVOLTAICS MARKET, BY COMPONENT, 2021-2024 (USD BILLION)

- TABLE 77 RESIDENTIAL: PHOTOVOLTAICS MARKET, BY COMPONENT, 2025-2030 (USD BILLION)

- TABLE 78 COMMERCIAL & INDUSTRIAL: PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 79 COMMERCIAL & INDUSTRIAL: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 80 COMMERCIAL & INDUSTRIAL: PHOTOVOLTAICS MARKET, BY COMPONENT, 2021-2024 (USD BILLION)

- TABLE 81 COMMERCIAL & INDUSTRIAL: PHOTOVOLTAICS MARKET, BY COMPONENT, 2025-2030 (USD BILLION)

- TABLE 82 UTILITIES: PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 83 UTILITIES: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 84 UTILITIES: PHOTOVOLTAICS MARKET, BY COMPONENT, 2021-2024 (USD BILLION)

- TABLE 85 UTILITIES: PHOTOVOLTAICS MARKET, BY COMPONENT, 2025-2030 (USD BILLION)

- TABLE 86 PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 87 PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 88 NORTH AMERICA: PHOTOVOLTAICS MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 89 NORTH AMERICA: PHOTOVOLTAICS MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 90 NORTH AMERICA: PHOTOVOLTAICS MARKET, BY COMPONENT, 2021-2024 (USD BILLION)

- TABLE 91 NORTH AMERICA: PHOTOVOLTAICS MARKET, BY COMPONENT, 2025-2030 (USD BILLION)

- TABLE 92 NORTH AMERICA: PHOTOVOLTAICS MARKET, BY MATERIAL TYPE, 2021-2024 (USD BILLION)

- TABLE 93 NORTH AMERICA: PHOTOVOLTAICS MARKET, BY MATERIAL TYPE, 2025-2030 (USD BILLION)

- TABLE 94 NORTH AMERICA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 95 NORTH AMERICA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 96 NORTH AMERICA: PHOTOVOLTAICS MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 97 NORTH AMERICA: PHOTOVOLTAICS MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 98 US: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 99 US: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 100 CANADA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 101 CANADA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 102 MEXICO: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 103 MEXICO: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 104 EUROPE: PHOTOVOLTAICS MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 105 EUROPE: PHOTOVOLTAICS MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 106 EUROPE: PHOTOVOLTAICS MARKET, BY COMPONENT, 2021-2024 (USD BILLION)

- TABLE 107 EUROPE: PHOTOVOLTAICS MARKET, BY COMPONENT, 2025-2030 (USD BILLION)

- TABLE 108 EUROPE: PHOTOVOLTAICS MARKET, BY MATERIAL TYPE, 2021-2024 (USD BILLION)

- TABLE 109 EUROPE: PHOTOVOLTAICS MARKET, BY MATERIAL TYPE, 2025-2030 (USD BILLION)

- TABLE 110 EUROPE: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 111 EUROPE: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 112 EUROPE: PHOTOVOLTAICS MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 113 EUROPE: PHOTOVOLTAICS MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 114 UK: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 115 UK: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 116 GERMANY: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 117 GERMANY: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 118 FRANCE: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 119 FRANCE: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 120 ITALY: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 121 ITALY: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 122 SPAIN: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 123 SPAIN: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 124 POLAND: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 125 POLAND: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 126 NORDICS: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 127 NORDICS: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 128 REST OF EUROPE: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 129 REST OF EUROPE: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 130 ASIA PACIFIC: PHOTOVOLTAICS MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 131 ASIA PACIFIC: PHOTOVOLTAICS MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 132 ASIA PACIFIC: PHOTOVOLTAICS MARKET, BY COMPONENT, 2021-2024 (USD BILLION)

- TABLE 133 ASIA PACIFIC: PHOTOVOLTAICS MARKET, BY COMPONENT, 2025-2030 (USD BILLION)

- TABLE 134 ASIA PACIFIC: PHOTOVOLTAICS MARKET, BY MATERIAL TYPE, 2021-2024 (USD BILLION)

- TABLE 135 ASIA PACIFIC: PHOTOVOLTAICS MARKET, BY MATERIAL TYPE, 2025-2030 (USD BILLION)

- TABLE 136 ASIA PACIFIC: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 137 ASIA PACIFIC: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 138 ASIA PACIFIC: PHOTOVOLTAICS MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 139 ASIA PACIFIC: PHOTOVOLTAICS MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 140 CHINA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 141 CHINA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 142 JAPAN: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 143 JAPAN: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 144 INDIA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 145 INDIA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 146 SOUTH KOREA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 147 SOUTH KOREA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 148 AUSTRALIA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 149 AUSTRALIA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 150 INDONESIA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 151 INDONESIA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 152 MALAYSIA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 153 MALAYSIA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 154 THAILAND: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 155 THAILAND: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 156 VIETNAM: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 157 VIETNAM: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 158 REST OF ASIA PACIFIC: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 159 REST OF ASIA PACIFIC: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 160 ROW: PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 161 ROW: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 162 ROW: PHOTOVOLTAICS MARKET, BY COMPONENT, 2021-2024 (USD BILLION)

- TABLE 163 ROW: PHOTOVOLTAICS MARKET, BY COMPONENT, 2025-2030 (USD BILLION)

- TABLE 164 ROW: PHOTOVOLTAICS MARKET, BY MATERIAL TYPE, 2021-2024 (USD BILLION)

- TABLE 165 ROW: PHOTOVOLTAICS MARKET, BY MATERIAL TYPE, 2025-2030 (USD BILLION)

- TABLE 166 ROW: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 167 ROW: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 168 ROW: PHOTOVOLTAICS MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 169 ROW: PHOTOVOLTAICS MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 170 MIDDLE EAST: PHOTOVOLTAICS MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 171 MIDDLE EAST: PHOTOVOLTAICS MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 172 MIDDLE EAST: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 173 MIDDLE EAST: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 174 AFRICA: PHOTOVOLTAICS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 175 AFRICA: PHOTOVOLTAICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 176 AFRICA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 177 AFRICA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 178 SOUTH AMERICA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 179 SOUTH AMERICA: PHOTOVOLTAICS MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 180 PHOTOVOLTAICS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2023-JANUARY 2025

- TABLE 181 PHOTOVOLTAICS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 182 PHOTOVOLTAICS MARKET: REGION FOOTPRINT

- TABLE 183 PHOTOVOLTAICS MARKET: COMPONENT FOOTPRINT

- TABLE 184 PHOTOVOLTAICS MARKET: MATERIAL TYPE FOOTPRINT

- TABLE 185 PHOTOVOLTAICS MARKET: TYPE FOOTPRINT

- TABLE 186 PHOTOVOLTAICS MARKET: APPLICATION FOOTPRINT

- TABLE 187 PHOTOVOLTAICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 188 PHOTOVOLTAICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 189 PHOTOVOLTAICS MARKET: PRODUCT LAUNCHES, JANUARY 2023-JANUARY 2025

- TABLE 190 PHOTOVOLTAICS MARKET: DEALS, JANUARY 2023-JANUARY 2025

- TABLE 191 PHOTOVOLTAICS MARKET: OTHER DEVELOPMENTS, JANUARY 2023-JANUARY 2025

- TABLE 192 JINKO SOLAR: COMPANY OVERVIEW

- TABLE 193 JINKO SOLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 JINKO SOLAR: PRODUCT LAUNCHES

- TABLE 195 JINKO SOLAR: DEALS

- TABLE 196 JA SOLAR TECHNOLOGY CO.,LTD.: COMPANY OVERVIEW

- TABLE 197 JA SOLAR TECHNOLOGY CO.,LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 JA SOLAR TECHNOLOGY CO.,LTD.: DEALS

- TABLE 199 TRINASOLAR: COMPANY OVERVIEW

- TABLE 200 TRINASOLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 TRINASOLAR: PRODUCT LAUNCHES

- TABLE 202 TRINASOLAR: DEALS

- TABLE 203 TRINASOLAR: OTHER DEVELOPMENTS

- TABLE 204 LONGI: COMPANY OVERVIEW

- TABLE 205 LONGI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 LONGI: PRODUCT LAUNCHES

- TABLE 207 LONGI: DEALS

- TABLE 208 TONGWEI CO., LTD.: COMPANY OVERVIEW

- TABLE 209 TONGWEI CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 TONGWEI CO., LTD.: DEVELOPMENTS

- TABLE 211 CANADIAN SOLAR: COMPANY OVERVIEW

- TABLE 212 CANADIAN SOLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 CANADIAN SOLAR: PRODUCT LAUNCHES

- TABLE 214 CANADIAN SOLAR: DEALS

- TABLE 215 CANADIAN SOLAR: EXPANSIONS

- TABLE 216 FIRST SOLAR: COMPANY OVERVIEW

- TABLE 217 FIRST SOLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 FIRST SOLAR: EXPANSIONS

- TABLE 219 HANWHA QCELLS: COMPANY OVERVIEW

- TABLE 220 HANWHA QCELLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 HANWHA QCELLS: DEALS

- TABLE 222 HANWHA QCELLS: OTHER DEVELOPMENTS

- TABLE 223 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 224 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 226 SHARP CORPORATION: COMPANY OVERVIEW

- TABLE 227 SHARP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 WUXI SUNTECH POWER CO., LTD.: COMPANY OVERVIEW

- TABLE 229 WUXI SUNTECH POWER CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 WUXI SUNTECH POWER CO., LTD.: DEVELOPMENTS

- TABLE 231 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 232 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 234 SUNGROW: COMPANY OVERVIEW

- TABLE 235 SUNGROW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 SUNGROW: PRODUCT LAUNCHES

- TABLE 237 SUNGROW: DEALS

- TABLE 238 SMA SOLAR TECHNOLOGY AG: COMPANY OVERVIEW

- TABLE 239 SMA SOLAR TECHNOLOGY AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 SOLAREDGE: COMPANY OVERVIEW

- TABLE 241 SOLAREDGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 SOLAREDGE: PRODUCT LAUNCHES

- TABLE 243 SOLAREDGE: DEALS

- TABLE 244 ABB: COMPANY OVERVIEW

- TABLE 245 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 PHOTOVOLTAICS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 PHOTOVOLTAICS MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARIES

- FIGURE 5 KEY DATA FROM PRIMARY SOURCES

- FIGURE 6 KEY INDUSTRY INSIGHTS

- FIGURE 7 PHOTOVOLTAICS MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 8 PHOTOVOLTAICS MARKET: BOTTOM-UP APPROACH

- FIGURE 9 PHOTOVOLTAICS MARKET: TOP-DOWN APPROACH

- FIGURE 10 PHOTOVOLTAICS MARKET: DATA TRIANGULATION

- FIGURE 11 PHOTOVOLTAICS MARKET: RESEARCH ASSUMPTIONS

- FIGURE 12 PHOTOVOLTAICS MARKET: RESEARCH LIMITATIONS

- FIGURE 13 BALANCE OF SYSTEM (BOS) SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 14 SILICON SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 15 UTILITIES SEGMENT TO HOLD LARGEST SHARE OF PHOTOVOLTAICS MARKET IN 2030

- FIGURE 16 ASIA PACIFIC TO HOLD LARGEST SHARE OF PHOTOVOLTAICS MARKET IN 2030

- FIGURE 17 DECREASING COSTS OF PV SYSTEMS TO CONTRIBUTE TO MARKET GROWTH

- FIGURE 18 HALF-CELL PV MODULES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 FLOATING SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 UTILITIES SEGMENT TO DOMINATE PHOTOVOLTAICS MARKET FROM 2025 TO 2030

- FIGURE 21 CHINA AND UTILITIES SEGMENT TO CAPTURE LARGEST SHARE OF PHOTOVOLTAICS MARKET IN ASIA PACIFIC IN 2025

- FIGURE 22 INDIA TO RECORD HIGHEST CAGR IN GLOBAL PHOTOVOLTAIC MARKET DURING FORECAST PERIOD

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 IMPACT ANALYSIS: DRIVERS

- FIGURE 25 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 26 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 27 IMPACT ANALYSIS: CHALLENGES

- FIGURE 28 SUPPLY CHAIN ANALYSIS

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 ECOSYSTEM ANALYSIS

- FIGURE 31 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 33 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 34 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 35 IMPORT DATA FOR HS CODE 854140-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 36 EXPORT DATA FOR HS CODE 854140-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 37 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 38 AVERAGE SELLING PRICE TREND OF PHOTOVOLTAIC CELLS, BY REGION, 2021-2024

- FIGURE 39 IMPACT OF AI/GEN AI ON PHOTOVOLTAICS MARKET

- FIGURE 40 INVERTERS SEGMENT TO WITNESS HIGHEST CAGR IN PHOTOVOLTAICS MARKET FROM 2025 TO 2030

- FIGURE 41 FLEXIBLE SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 42 SILICON SEGMENT TO DOMINATE PHOTOVOLTAICS MARKET DURING FORECAST PERIOD

- FIGURE 43 HALF-CELL PV MODULES SEGMENT TO HOLD LARGER MARKET SHARE IN 2025

- FIGURE 44 FLOATING SEGMENT TO WITNESS HIGHEST CAGR IN PHOTOVOLTAICS MARKET FROM 2025 TO 2030

- FIGURE 45 UTILITIES SEGMENT TO DOMINATE PHOTOVOLTAICS MARKET BETWEEN 2025 AND 2030

- FIGURE 46 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: PHOTOVOLTAICS MARKET SNAPSHOT

- FIGURE 48 EUROPE: PHOTOVOLTAICS MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: PHOTOVOLTAICS MARKET SNAPSHOT

- FIGURE 50 PHOTOVOLTAICS MARKET: REVENUE ANALYSIS OF KEY FIVE PLAYERS, 2022-2024

- FIGURE 51 MARKET SHARE ANALYSIS OF COMPANIES OFFERING PV MODULES, 2024

- FIGURE 52 COMPANY VALUATION

- FIGURE 53 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 54 BRAND COMPARISON

- FIGURE 55 PHOTOVOLTAICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 PHOTOVOLTAICS MARKET: COMPANY FOOTPRINT

- FIGURE 57 PHOTOVOLTAICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 JINKO SOLAR: COMPANY SNAPSHOT

- FIGURE 59 LONGI: COMPANY SNAPSHOT

- FIGURE 60 TONGWEI CO., LTD.: COMPANY SNAPSHOT

- FIGURE 61 CANADIAN SOLAR: COMPANY SNAPSHOT

- FIGURE 62 FIRST SOLAR: COMPANY SNAPSHOT

- FIGURE 63 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 SHARP CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 66 SUNGROW: COMPANY SNAPSHOT

- FIGURE 67 SMA SOLAR TECHNOLOGY AG: COMPANY SNAPSHOT

- FIGURE 68 SOLAREDGE: COMPANY SNAPSHOT

- FIGURE 69 ABB: COMPANY SNAPSHOT

The declining cost of photovoltaic (PV) and energy storage systems is significantly accelerating the growth of the photovoltaics market. As technology advances and economies of scale increase, the installation and upkeep expenditures of solar PV systems have fallen. In the same way, innovations in battery technology decreased storage prices, making solar energy more stable and affordable. These cost savings increase the return on investment, increasing the attractiveness of PV systems for residential, commercial, and utility customers. Consequently, affordability accelerates broader adoption and enables the global shift to renewable energy.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Type, Material Type, Cell Type, Installation Type, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Rigid segment is expected to account for largest share of photovoltaics market in 2030"

The rigid type of segment is expected to hold a larger market share in the photovoltaics market due to its widespread use in residential, commercial, and utility-scale installations. These panel types can achieve higher efficiency rates, require less maintenance, and can operate longer than flexible alternatives. Rigid panels are established in the manufacturing sectors and tend to have comparable prices with their alternatives. Rigid panels are compatible with fixed installations where minimal structural limitations exist. As demand increases for large-scale solar projects, their utility in a solar project will not diminish.

"Inverters segment is likely to witness highest CAGR during the forecast period"

Inverters are expected to register the highest CAGR in the photovoltaics market during the forecast period due to their critical role in converting DC electricity generated by solar panels into usable AC power. The rising adoption of smart inverters with grid-support functionalities, remote monitoring, and energy storage integration drives their demand across residential, commercial, and utility-scale projects. Additionally, advancements in inverter efficiency, modular designs, and compliance with evolving grid regulations further accelerate their deployment. As distributed energy resources grow, inverters are becoming essential for optimizing solar system performance and enabling grid stability.

"China is projected to hold largest share of Asia Pacific photovoltaics market in 2030"

China is expected to hold the largest share of the Asia Pacific photovoltaics market by 2030, driven by its dominant manufacturing capacity and strong policy support. The country is the global leader in the production of solar modules, wafers, and polysilicon, reaping the benefits of economies of scale and cost savings. For instance, according to the National Renewable Energy Laboratory (Spring 2024 Solar Industry Update). As of January 2024, 26 provinces mandated storage with PV projects, with an average storage capacity requirement equivalent to 12% of the PV capacity.

Extensive primary interviews were conducted with key industry experts in the photovoltaics market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakup of primary participants for the report is shown below: The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 40%, and Tier 3 - 20%

- By Designation: C-level Executives - 40%, Directors - 40%, and Others - 20%

- By Region: North America - 40%, Europe - 30%, Asia Pacific - 20%, and RoW - 10%

Note: Three tiers of companies are defined based on their total revenue as of 2024: tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million.

Jinko Solar (China), JA SOLAR Technology Co., Ltd. (China), Trinasolar (China), LONGi (China), Tongwei Co.Ltd (China), Canadian Solar (Canada), First Solar (US), Hanwha Qcells (South Korea), Mitsubishi Electric Corporation (Japan), SHARP CORPORATION (Japan), Wuxi Suntech Power Co., Ltd. (China), Huawei Technologies Co., Ltd. (China), SUNGROW (China), SMA Solar Technology AG (Germany), SolarEdge (Israel) are some key players in the photovoltaics market.

The study includes an in-depth competitive analysis of these key players in the photovoltaics market, with their company profiles, recent developments, and key market strategies.

Study Coverage: This research report categorizes the photovoltaics market based on component (modules, inverters, balance of system), type (rigid, flexible), material type [silicon, copper indium gallium selenide (CIGS), cadmium telluride (CDTE), perovskite, organic photovoltaic, quantum dot], cell type (full-cell PV modules, half-cell PV modules), installation type (ground-mounted, building-integrated, floating), application (residential, commercial & industrial, utilities), and region (North America, Europe, Asia Pacific, and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the photovoltaics market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all the companies in the photovoltaic ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall photovoltaics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising solar installations due to government-led incentives and schemes, growing adoption of PV systems in residential applications, decreasing cost of energy storage devices), restraints (lack of skilled workforce for PV installation and maintenance,), opportunities (increasing investment in renewable energy, ongoing technological developments such as Perovskite solar cell manufacturing), and challenges (issues related to land acquisition for deployment of solar projects) influencing the growth of the photovoltaics market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the photovoltaics market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the photovoltaics market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the photovoltaics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Jinko Solar (China), JA SOLAR Technology Co., Ltd. (China), Trinasolar (China), LONGi (China), Tongwei Co.Ltd (China) in the photovoltaics market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PHOTOVOLTAICS MARKET

- 4.2 PHOTOVOLTAICS MARKET, BY CELL TYPE

- 4.3 PHOTOVOLTAICS MARKET, BY INSTALLATION TYPE

- 4.4 PHOTOVOLTAICS MARKET, BY APPLICATION

- 4.5 PHOTOVOLTAICS MARKET IN ASIA PACIFIC, BY COUNTRY AND APPLICATION

- 4.6 PHOTOVOLTAICS MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising government incentives and schemes to encourage solar energy adoption

- 5.2.1.2 Growing installation of PV systems in residential sector

- 5.2.1.3 Low maintenance and operational costs of solar PV systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Shortage of skilled workforce for PV installation

- 5.2.2.2 Safety risks associated with high DC voltages

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing investment in renewable energy to address climate change

- 5.2.3.2 Rapid advances in Perovskite PV technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Legal issues related to land allotment for solar deployment

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 TATA POWER SOLAR COMMISSIONS 3 MW SOLAR PV POWER PLANT IN IRON ORE MINE IN INDIA

- 5.8.2 COPENHAGEN ZOO INSTALLS HANWHA QCELLS' Q.PEAK DUO SOLAR MODULES TO MEET SUSTAINABILITY GOALS

- 5.8.3 BIG C SUPERMARKET USES SHARP CORPORATION'S ROOFTOP SOLAR PANELS TO CURB EMISSIONS IN THAILAND

- 5.8.4 HEWLETT PACKARD INSTALLS ROOFTOP SOLAR PANELS TO REDUCE CARBON DIOXIDE EMISSIONS

- 5.8.5 LONGI INSTALLS PV POWER PLANT AT GUIZHOU COMPLEX IN CHINA TO HARNESS SOLAR ENERGY

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Perovskite

- 5.10.1.2 Quantum dots

- 5.10.1.3 Dye-sensitized solar cells (DSSCs)

- 5.10.1.4 Organic solar cells

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Inverters

- 5.10.2.2 Power electronics

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Wind energy systems

- 5.10.1 KEY TECHNOLOGIES

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 854140)

- 5.11.2 EXPORT SCENARIO (HS CODE 854140)

- 5.12 PATENT ANALYSIS

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 REGULATIONS

- 5.13.4 STANDARDS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 PRICING ANALYSIS

- 5.15.1 PRICING RANGE OF PV MODULES OFFERED BY KEY PLAYERS, BY APPLICATION, 2024

- 5.15.2 AVERAGE SELLING PRICE TREND OF PHOTOVOLTAIC CELLS, BY REGION, 2021-2024

- 5.16 IMPACT OF AI/GEN AI ON PHOTOVOLTAICS MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON PHOTOVOLTAICS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.18 IMPACT ON APPLICATIONS

6 PHOTOVOLTAIC CONCENTRATION LEVELS

- 6.1 INTRODUCTION

- 6.2 HIGH CONCENTRATION

- 6.3 MEDIUM CONCENTRATION

- 6.4 LOW CONCENTRATION

7 POWER CAPACITY RANGES OF PHOTOVOLTAIC SYSTEMS

- 7.1 INTRODUCTION

- 7.2 UP TO 100 WP

- 7.3 100.1-300 WP

- 7.4 ABOVE 300 WP

8 PHOTOVOLTAICS MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 MODULES

- 8.2.1 USE TO BOOST POWER OUTPUTS OF PV CELLS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 8.2.2 PV MODULE TYPES

- 8.2.2.1 Organic PV modules

- 8.2.2.2 Inorganic PV modules

- 8.2.2.3 Hybrid PV modules

- 8.2.3 PV CELL TYPES

- 8.2.3.1 60 cells

- 8.2.3.2 72 cells

- 8.2.3.3 96 cells

- 8.3 INVERTERS

- 8.3.1 ABILITY TO MONITOR POWER GRID WITH ADHERENCE TO SAFETY STANDARDS TO FOSTER SEGMENTAL GROWTH

- 8.4 BALANCE OF SYSTEM (BOS)

- 8.4.1 CONNECTIONS & CABLES

- 8.4.1.1 Strong focus on ensuring safe and optimal functioning of PV systems to spur demand

- 8.4.2 JUNCTION BOXES

- 8.4.2.1 Use to protect solar panels using diodes to accelerate segmental growth

- 8.4.3 SAFETY EQUIPMENT

- 8.4.3.1 High emphasis on preventing high voltage damage to PV systems to bolster segmental growth

- 8.4.4 TRACKERS

- 8.4.4.1 Ability to increase solar energy output to contribute to segmental growth

- 8.4.5 BATTERIES

- 8.4.5.1 Development of efficient energy storage devices for residential and commercial use to fuel segmental growth

- 8.4.6 MONITORING SYSTEMS

- 8.4.6.1 Reliable functioning and maximum yield of solar electric systems to boost segmental growth

- 8.4.7 OTHER BOS TYPES

- 8.4.1 CONNECTIONS & CABLES

9 PHOTOVOLTAICS MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 RIGID

- 9.2.1 HIGH CONVERSION EFFICIENCY, DURABILITY, AND LONG OPERATIONAL LIFE TO BOLSTER SEGMENTAL GROWTH

- 9.3 FLEXIBLE

- 9.3.1 LOW TRANSPORTATION AND INSTALLATION COSTS AND LIGHTWEIGHT FEATURES TO SPUR DEMAND

10 PHOTOVOLTAICS MARKET, BY MATERIAL TYPE

- 10.1 INTRODUCTION

- 10.2 SILICON

- 10.2.1 CRYSTALLINE

- 10.2.1.1 Ideal for industrial solar power generation due to enhanced lifespan to expedite segmental growth

- 10.2.2 AMORPHOUS

- 10.2.2.1 High performance in low-light conditions to foster segmental growth

- 10.2.1 CRYSTALLINE

- 10.3 COPPER INDIUM GALLIUM SELENIDE (CIGS)

- 10.3.1 USE TO SUPPORT PV CELL EFFICIENCY AND HIGH ELECTRICITY PRODUCTION TO AUGMENT SEGMENTAL GROWTH

- 10.4 CADMIUM TELLURIDE (CDTE)

- 10.4.1 ABILITY TO CAPTURE ENERGY AT SHORTER WAVELENGTHS TO BOLSTER SEGMENTAL GROWTH

- 10.5 PEROVSKITE

- 10.5.1 LOW PRICE, THIN DESIGN, LOW-TEMPERATURE PROCESSING, AND EXCELLENT LIGHT ABSORPTION PROPERTIES TO DRIVE MARKET

- 10.6 ORGANIC PHOTOVOLTAIC

- 10.6.1 LIGHTWEIGHT, SEMI-TRANSPARENT, AND FLEXIBLE ATTRIBUTES TO FOSTER SEGMENTAL GROWTH

- 10.7 QUANTUM DOT

- 10.7.1 UNIQUE QUANTUM MECHANICAL PROPERTIES AND TUNABLE BANDGAPS TO FACILITATE SEGMENTAL GROWTH

11 PHOTOVOLTAICS MARKET, BY CELL TYPE

- 11.1 INTRODUCTION

- 11.2 FUEL-CELL PV MODULES

- 11.2.1 ABILITY TO ENSURE EFFICIENCY AT LOWER COSTS TO SPUR DEMAND

- 11.3 HALF-CELL PV MODULES

- 11.3.1 HIGH OUTPUT RATINGS AND RELIABILITY TO CONTRIBUTE TO SEGMENTAL GROWTH

12 PHOTOVOLTAICS MARKET, BY INSTALLATION TYPE

- 12.1 INTRODUCTION

- 12.2 GROUND-MOUNTED

- 12.2.1 HIGH STABILITY AND RESISTANCE TO WIND TO ACCELERATE SEGMENTAL GROWTH

- 12.3 BUILDING-INTEGRATED

- 12.3.1 INSTALLATION IN RESIDENTIAL AND COMMERCIAL BUILDINGS TO FUEL SEGMENTAL GROWTH

- 12.3.2 ROOFTOPS

- 12.3.3 WINDOWS

- 12.4 FLOATING

- 12.4.1 LOW INSTALLATION COSTS AND HIGH POWER PRODUCTION TO BOOST SEGMENTAL GROWTH

13 PHOTOVOLTAICS MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- 13.2 RESIDENTIAL

- 13.2.1 RISING INCENTIVES TO BOOST ROOFTOP SOLAR INSTALLATIONS TO EXPEDITE SEGMENTAL GROWTH

- 13.3 COMMERCIAL & INDUSTRIAL

- 13.3.1 INCREASING USE OF PV SYSTEMS TO PROVIDE ELECTRICAL AND THERMAL ENERGY AND ACHIEVE HIGH ENERGY CONVERSION RATE TO DRIVE MARKET

- 13.4 UTILITIES

- 13.4.1 GROWING EMPHASIS ON REDUCING FOSSIL FUEL GENERATION TO BOOST SEGMENTAL GROWTH

14 PHOTOVOLTAICS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 Heightened focus on achieving net-zero emission targets to bolster market growth

- 14.2.3 CANADA

- 14.2.3.1 Rising emphasis on generating power from renewable energy sources to augment market growth

- 14.2.4 MEXICO

- 14.2.4.1 Increasing need for efficient energy storage systems to fuel market growth

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 14.3.2 UK

- 14.3.2.1 Growing focus on producing clean energy to contribute to market growth

- 14.3.3 GERMANY

- 14.3.3.1 Increasing registration for solar energy systems to augment market growth

- 14.3.4 FRANCE

- 14.3.4.1 Rising emphasis on reducing share of nuclear energy to boost market growth

- 14.3.5 ITALY

- 14.3.5.1 Increasing reliance on renewables for power generation to drive market

- 14.3.6 SPAIN

- 14.3.6.1 Strong focus on achieving energy independence to expedite market growth

- 14.3.7 POLAND

- 14.3.7.1 Rising electricity prices and focus on energy security to bolster market growth

- 14.3.8 NORDICS

- 14.3.8.1 Increasing adoption of decentralized energy strategies to fuel market growth

- 14.3.9 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 14.4.2 CHINA

- 14.4.2.1 Rising cumulative capacity of solar installations to accelerate market growth

- 14.4.3 JAPAN

- 14.4.3.1 Growing emphasis on reducing greenhouse gas emissions to drive market

- 14.4.4 INDIA

- 14.4.4.1 Burgeoning electricity demand to contribute to market growth

- 14.4.5 SOUTH KOREA

- 14.4.5.1 Increasing efforts to make solar energy accessible option to foster market growth

- 14.4.6 AUSTRALIA

- 14.4.6.1 Abundant solar resources and supportive government policies to bolster market growth

- 14.4.7 INDONESIA

- 14.4.7.1 Rising need to diversify energy mix to facilitate market growth

- 14.4.8 MALAYSIA

- 14.4.8.1 Ambitious renewable energy goals to accelerate market growth

- 14.4.9 THAILAND

- 14.4.9.1 Growing focus on industrial decarbonization strategies to boost market growth

- 14.4.10 VIETNAM

- 14.4.10.1 Mounting electricity demand and shift toward clean energy to fuel market growth

- 14.4.11 REST OF ASIA PACIFIC

- 14.5 ROW

- 14.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 14.5.2 MIDDLE EAST

- 14.5.2.1 Bahrain

- 14.5.2.1.1 Rising emphasis on diversifying energy mix to drive market

- 14.5.2.2 Kuwait

- 14.5.2.2.1 Reduced reliance on fossil fuels to contribute to market growth

- 14.5.2.3 Oman

- 14.5.2.3.1 Strategic energy diversification goals to fuel market growth

- 14.5.2.4 Qatar

- 14.5.2.4.1 Sustainability goals and high solar potential to create market growth opportunities

- 14.5.2.5 Saudi Arabia

- 14.5.2.5.1 Abundant solar resources and large-scale solar project development to drive market

- 14.5.2.6 Rest of Middle East

- 14.5.2.1 Bahrain

- 14.5.3 AFRICA

- 14.5.3.1 South Africa

- 14.5.3.1.1 Increased rate of blackouts due to energy shortages to augment market growth

- 14.5.3.2 Other African countries

- 14.5.3.1 South Africa

- 14.5.4 SOUTH AMERICA

- 14.5.4.1 Increased investment in power distribution sector to boost market growth

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 15.3 REVENUE ANALYSIS, 2022-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.6 BRAND COMPARISON

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Component footprint

- 15.7.5.4 Material type footprint

- 15.7.5.5 Type footprint

- 15.7.5.6 Application footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 JINKO SOLAR

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths/Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses/Competitive threats

- 16.1.2 JA SOLAR TECHNOLOGY CO.,LTD.

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths/Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses/Competitive threats

- 16.1.3 TRINASOLAR

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches

- 16.1.3.3.2 Deals

- 16.1.3.3.3 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths/Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses/Competitive threats

- 16.1.4 LONGI

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Deals

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths/Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses/Competitive threats

- 16.1.5 TONGWEI CO., LTD.

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths/Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses/Competitive threats

- 16.1.6 CANADIAN SOLAR

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches

- 16.1.6.3.2 Deals

- 16.1.6.3.3 Expansions

- 16.1.7 FIRST SOLAR

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Expansions

- 16.1.8 HANWHA QCELLS

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.8.3.2 Other developments

- 16.1.9 MITSUBISHI ELECTRIC CORPORATION

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Deals

- 16.1.10 SHARP CORPORATION

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.11 WUXI SUNTECH POWER CO., LTD.

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Developments

- 16.1.12 HUAWEI TECHNOLOGIES CO., LTD.

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Product launches

- 16.1.13 SUNGROW

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Product launches

- 16.1.13.3.2 Deals

- 16.1.14 SMA SOLAR TECHNOLOGY AG

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Solutions/Services offered

- 16.1.15 SOLAREDGE

- 16.1.15.1 Business overview

- 16.1.15.2 Products/Solutions/Services offered

- 16.1.15.3 Recent developments

- 16.1.15.3.1 Product launches

- 16.1.15.3.2 Deals

- 16.1.16 ABB

- 16.1.16.1 Business overview

- 16.1.16.2 Products/Solutions/Services offered

- 16.1.1 JINKO SOLAR

- 16.2 OTHER PLAYERS

- 16.2.1 ARRAY TECHNOLOGIES, INC.

- 16.2.2 ZHEJIANG CHINT NEW ENERGY DEVELOPMENT CO. LTD.

- 16.2.3 GCL-SI

- 16.2.4 NEXTRACKER INC.

- 16.2.5 RISEN ENERGY CO., LTD.

- 16.2.6 YINGLI SOLAR

- 16.2.7 ACCIONA

- 16.2.8 TATA POWER SOLAR SYSTEMS LTD.

- 16.2.9 WAAREE ENERGIES LTD.

- 16.2.10 SHUNFENG INTERNATIONAL CLEAN ENERGY CO., LTD.

- 16.2.11 EMMVEE SOLAR

- 16.2.12 ALLEARTH RENEWABLES

- 16.2.13 EATON

- 16.2.14 POWER ELECTRONICS S.L.

- 16.2.15 FIMER

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS