|

|

市場調査レポート

商品コード

1758242

インスリンデリバリーデバイスの世界市場:タイプ別、疾患タイプ別 - 予測(~2030年)Insulin Delivery Device Market by Type (Insulin Pens (Reusable, Disposable), Insulin Pumps (Tethered, Tubeless), Insulin Pen Needle (Standard, Safety), Insulin Syringes, Others), Disease Type (Type 1 Diabetes, Type 2 Diabetes) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| インスリンデリバリーデバイスの世界市場:タイプ別、疾患タイプ別 - 予測(~2030年) |

|

出版日: 2025年06月25日

発行: MarketsandMarkets

ページ情報: 英文 379 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のインスリンデリバリーデバイスの市場規模は、2025年の353億米ドルから2030年までに527億米ドルに達すると予測され、予測期間にCAGRで8.3%の成長が見込まれます。

市場は、複数の要因によって一貫した成長を示しています。世界的な高齢化に伴い、糖尿病のような疾患の有病率が上昇し、先進のインスリンデリバリーデバイスの需要の増加につながっています。さらに、政府の支援と有利な償還制度が市場の成長をさらに促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | タイプ、疾患タイプ、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

AIや機械学習(ML)の統合など、インスリンデリバリーデバイスの技術的進歩もこの需要に寄与しています。さらに、研究開発活動の活発化と戦略的提携が、市場成長のさらなる機会を生み出しています。

全体として、糖尿病治療に焦点を当てた医療費の増加が、糖尿病の有病率の増加もあり、市場拡大への新たな機会を育んでいます。

インスリンペンタイプ別では、再使用可能インスリンペンセグメントが2024年に市場で最大のシェアを占めています。

再使用可能インスリンペンは、プレフィルドインスリンカートリッジを保持するように設計されたデリバリーチャンバーを備えています。これらのデバイスは、使い捨てインスリンペンよりも費用対効果が高く、インスリンデリバリーへの人気の高まりにつながっています。手頃な価格、持続可能性、使いやすさの点で大きな利点があります。さらに、再使用可能なペンは環境上の恩恵もあります。

エクセター大学が2024年に行った近年の調査によると、英国では年間約400万本の使い捨てインスリンペンが処方されており、その結果、約79トンのプラスチック廃棄物が発生し、1,000トンの二酸化炭素を排出しています。これに対して、再使用可能インスリンペンは、この廃棄物を大幅に減らすことができ、より持続可能な選択肢となります。その結果、再使用可能インスリンペンを選ぶエンドユーザーが増え、このセグメントの成長を促進しています。

2024年、在宅ケア環境セグメントが市場でもっとも大きなシェアを占めました。

この動向は主に、患者の間でインスリンの自己投与に対する選好が高まっていることに起因しています。自己投与の主な利点の1つは、患者がインスリン投与のために医療提供者を定期的に訪れる必要がなくなるため、時間とコストが節約できることです。さらに、自己注射は服薬アドヒアランスを高め、治療成績を向上させます。

先進の使いやすいデリバリーデバイスの上市や、メーカーの患者訓練の提供への注力、主要市場でインスリン自己投与に対する償還が受けられることなど、複数の要因がこの動向を支えています。長年にわたり、この市場では患者の自己投与による糖尿病管理を支援するために設計された、先進技術を利用したポンプやペンニードルも導入されてきました。これらの新製品は、侵襲性の低い技術を用いて正確な量のインスリンを投与できるように設計されています。これらの要因が組み合わさり、この市場セグメントの成長が促進されています。

2024年、北米が市場で最大のシェアを占めました。

これは主に、同地域での1型糖尿病の有病率の向上によるものです。1型糖尿病はインスリンに依存するため、糖尿病患者の増加がインスリンデリバリーデバイスの需要を押し上げています。

当レポートでは、世界のインスリンデリバリーデバイス市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- インスリンデリバリーデバイス:市場の概要

- 北米のインスリンデリバリーデバイス市場:タイプ別、国別

- インスリンデリバリーデバイス市場:地理的構成

- インスリンデリバリーデバイス市場:地域の構成

- インスリンデリバリーデバイス市場:先進国市場 vs. 発展途上国市場

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 規制分析

- 規制機関、政府機関、その他の組織

- 規制枠組み

- 産業動向

- ハイブリッド閉ループシステム/人工膵臓デバイスシステムの需要の増加

- スマートインスリンペンと持続血糖モニタリングシステムの同期により糖尿病データの共有が促進される

- ステークホルダー間の提携の増加

- 償還シナリオ

- 技術分析

- 主な会議とイベント

- 価格分析

- インスリンデリバリーデバイスの参考価格の動向:主要企業別

- インスリンデリバリーデバイスの参考価格の動向:地域別

- 貿易分析

- 特許分析

- インスリンデリバリーデバイスの特許公報の動向

- 管轄分析:インスリンデリバリーデバイス市場における上位の特許出願者

- サプライチェーン分析

- バリューチェーン分析

- エコシステム市場マップ

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 隣接市場の分析

- 投資と資金調達のシナリオ

- インスリンデリバリーデバイス市場におけるアンメットニーズ/エンドユーザーの期待

- 顧客のビジネスに影響を与える動向/混乱

- インスリンデリバリーデバイス市場に対するAI/生成AIの影響

第6章 インスリンデリバリーデバイス市場:タイプ別

- イントロダクション

- インスリンペン

- インスリンポンプ

- インスリンペンニードル

- インスリンシリンジ

- その他のインスリンデリバリーデバイス

第7章 インスリンデリバリーデバイス市場:疾患別

- イントロダクション

- 1型糖尿病

- 2型糖尿病

第8章 インスリンデリバリーデバイス市場:エンドユーザー別

- イントロダクション

- 在宅ケア環境

- 病院・診療所

- その他のエンドユーザー

第9章 インスリンデリバリーデバイス市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- 中東の中東・アフリカ

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2022年~2024年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- ブランド/製品の比較

- 企業の評価と財務指標

- 主要企業のR&Dの評価

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- EMBECTA CORP. (FORMERLY BECTON, DICKINSON AND COMPANY DIABETES CARE BUSINESS)

- NOVO NORDISK A/S

- MEDTRONIC

- SANOFI

- ELI LILLY AND COMPANY

- TANDEM DIABETES CARE, INC.

- INSULET CORPORATION

- BIOCON

- ROCHE DIABETES CARE

- HTL-STREFA (SUBSIDIARY OF THE MTD GROUP)

- YPSOMED

- MEDTRUM TECHNOLOGIES INC.

- TERUMO CORPORATION

- WOCKHARDT LIMITED

- NIPRO

- その他の企業

- CEQUR CORPORATION

- EOFLOW CO., LTD.

- HINDUSTAN SYRINGES & MEDICAL DEVICES LTD

- SOOIL DEVELOPMENTS CO., LTD

- SUNGSHIM MEDICAL CO., LTD.

- B.BRAUN SE

- DEBIOTECH SA

- JIANGSU DELFU MEDICAL DEVICE CO., LTD

- HASELMEIER (A SUBSIDIARY OF MEDMIX)

- MANNKIND CORPORATION

第12章 付録

List of Tables

- TABLE 1 INCLUSION AND EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES (USD)

- TABLE 3 RISK ASSESSMENT: INSULIN DELIVERY DEVICES MARKET

- TABLE 4 TOP 10 COUNTRIES/TERRITORIES WITH HIGHEST NUMBER OF ADULTS (20-79 YEARS) WITH DIABETES, 2024 AND 2050 (MILLION)

- TABLE 5 TOTAL DIABETES-RELATED HEALTH EXPENDITURE ACROSS REGIONS, 2024 AND 2050 (USD MILLION)

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 US: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 12 EUROPE: MEDICAL DEVICES, BY CLASS

- TABLE 13 EUROPE: CONFORMITY ASSESSMENT

- TABLE 14 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODY

- TABLE 15 CHINA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 16 INDIA: MEDICAL DEVICE CLASSIFICATION

- TABLE 17 HYBRID CLOSED-LOOP SYSTEMS: CURRENT MARKET SCENARIO

- TABLE 18 MAJOR SMART INSULIN PENS AVAILABLE GLOBALLY

- TABLE 19 RECENT COLLABORATIONS IN INSULIN DELIVERY DEVICE MARKET

- TABLE 20 US: INSULIN DELIVERY DEVICE COVERAGE AND REIMBURSEMENT

- TABLE 21 CANADA: INSULIN DELIVERY DEVICE COVERAGE AND REIMBURSEMENT

- TABLE 22 UK: INSULIN DELIVERY DEVICE COVERAGE AND REIMBURSEMENT

- TABLE 23 AUSTRALIA: INSULIN DELIVERY DEVICES COVERAGE AND REIMBURSEMENT

- TABLE 24 OTHER COUNTRIES: INSULIN DELIVERY DEVICE COVERAGE AND REIMBURSEMENT

- TABLE 25 INSULIN DELIVERY DEVICES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 26 INDICATIVE PRICING TREND OF INSULIN DELIVERY DEVICE, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 27 INDICATIVE PRICING TREND OF INSULIN DELIVERY DEVICE, BY REGION, 2022-2024 (USD)

- TABLE 28 IMPORT DATA FOR INSULIN DELIVERY SYSTEMS (HS CODE: 901839), BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 29 EXPORT DATA FOR INSULIN DELIVERY SYSTEMS (HS CODE: 901839), BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 30 LIST OF PATENTS IN INSULIN DELIVERY DEVICES MARKET, 2022-2024

- TABLE 31 INSULIN DELIVERY DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF END USERS

- TABLE 33 KEY BUYING CRITERIA FOR END USERS

- TABLE 34 UNMET NEEDS: INSULIN DELIVERY DEVICES MARKET

- TABLE 35 END-USER EXPECTATIONS: INSULIN DELIVERY DEVICES MARKET

- TABLE 36 INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 37 INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 38 INSULIN PENS MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 39 INSULIN PENS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 REUSABLE INSULIN PENS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 41 REUSABLE INSULIN PENS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 42 DISPOSABLE INSULIN PENS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 43 DISPOSABLE INSULIN PENS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 44 INSULIN PUMPS MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 45 INSULIN PUMPS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 46 TETHERED INSULIN PUMPS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 47 TETHERED INSULIN PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 48 TUBELESS INSULIN PUMPS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 49 TUBELESS INSULIN PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 50 INSULIN PEN NEEDLES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 51 INSULIN PEN NEEDLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 52 STANDARD INSULIN PEN NEEDLES OFFERED BY KEY PLAYERS

- TABLE 53 STANDARD INSULIN PEN NEEDLES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 54 STANDARD INSULIN PEN NEEDLES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 55 SAFETY INSULIN PEN NEEDLES OFFERED BY KEY PLAYERS

- TABLE 56 SAFETY INSULIN PEN NEEDLES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 57 SAFETY INSULIN PEN NEEDLES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 58 INSULIN SYRINGES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

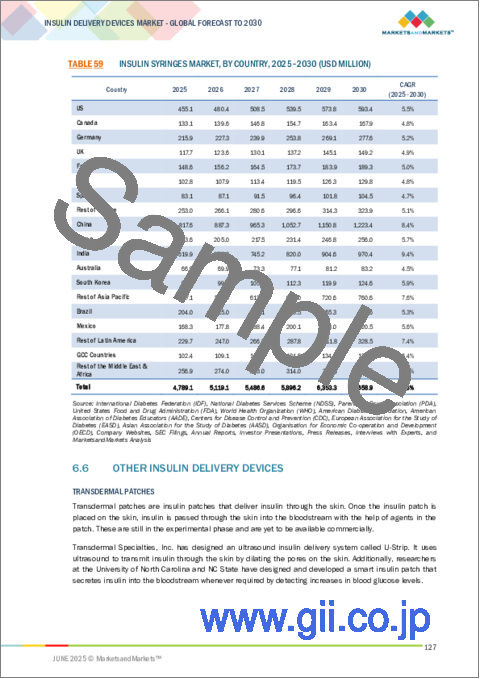

- TABLE 59 INSULIN SYRINGES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 60 OTHER INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 61 OTHER INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 62 INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 63 INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 64 INSULIN DELIVERY DEVICES MARKET FOR TYPE 1 DIABETES, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 65 INSULIN DELIVERY DEVICES MARKET FOR TYPE 1 DIABETES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 INSULIN DELIVERY DEVICES MARKET FOR TYPE 2 DIABETES, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 67 INSULIN DELIVERY DEVICES MARKET FOR TYPE 2 DIABETES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 68 INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 69 INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 70 INSULIN DELIVERY DEVICES MARKET FOR HOME CARE SETTINGS, BY REGION, 2022-2024 (USD MILLION)

- TABLE 71 INSULIN DELIVERY DEVICES MARKET FOR HOME CARE SETTINGS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 INSULIN DELIVERY DEVICES MARKET FOR HOSPITALS & CLINICS, BY REGION, 2022-2024 (USD MILLION)

- TABLE 73 INSULIN DELIVERY DEVICES MARKET FOR HOSPITALS & CLINICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 INSULIN DELIVERY DEVICES MARKET FOR OTHER END USERS, BY REGION, 2022-2024 (USD MILLION)

- TABLE 75 INSULIN DELIVERY DEVICES MARKET FOR OTHER END USERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 INSULIN DELIVERY DEVICES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 77 INSULIN DELIVERY DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 92 US: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 93 US: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 94 US: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 95 US: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 96 US: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 97 US: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 98 US: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 99 US: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 100 US: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 101 US: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 102 US: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 103 US: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 104 ELIGIBILITY FOR INSULIN PUMPS AND SUPPLIES IN CANADA FOR TYPE I DIABETES, 2023

- TABLE 105 CANADA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 106 CANADA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 CANADA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 108 CANADA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 109 CANADA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 110 CANADA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 111 CANADA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 112 CANADA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 113 CANADA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 114 CANADA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 115 CANADA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 116 CANADA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 118 EUROPE: INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 120 EUROPE: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 122 EUROPE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 124 EUROPE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 126 EUROPE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 128 EUROPE: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 130 EUROPE: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 131 GERMANY: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 132 GERMANY: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 133 GERMANY: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 134 GERMANY: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 135 GERMANY: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 136 GERMANY: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 137 GERMANY: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 138 GERMANY: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 139 GERMANY: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 140 GERMANY: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 141 GERMANY: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 142 GERMANY: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 143 UK: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 144 UK: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 145 UK: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 146 UK: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 147 UK: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 148 UK: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 149 UK: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 150 UK: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 151 UK: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 152 UK: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 153 UK: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 154 UK: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 155 FRANCE: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 156 FRANCE: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 157 FRANCE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 158 FRANCE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 159 FRANCE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 160 FRANCE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 161 FRANCE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 162 FRANCE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 163 FRANCE: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 164 FRANCE: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 165 FRANCE: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 166 FRANCE: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 167 ITALY: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 168 ITALY: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 169 ITALY: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 170 ITALY: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 171 ITALY: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 172 ITALY: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 173 ITALY: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 174 ITALY: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 175 ITALY: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 176 ITALY: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 177 ITALY: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 178 ITALY: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 179 SPAIN: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 180 SPAIN: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 181 SPAIN: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 182 SPAIN: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 183 SPAIN: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 184 SPAIN: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 SPAIN: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 186 SPAIN: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 187 SPAIN: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 188 SPAIN: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 189 SPAIN: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 190 SPAIN: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 191 REST OF EUROPE: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 192 REST OF EUROPE: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 193 REST OF EUROPE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 194 REST OF EUROPE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 195 REST OF EUROPE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 196 REST OF EUROPE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 197 REST OF EUROPE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 198 REST OF EUROPE: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 199 REST OF EUROPE: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 200 REST OF EUROPE: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 201 REST OF EUROPE: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 202 REST OF EUROPE: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 203 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 204 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 206 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 208 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 210 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 211 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 212 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 213 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 214 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 215 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 216 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 217 CHINA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 218 CHINA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 219 CHINA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 220 CHINA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 221 CHINA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 222 CHINA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 223 CHINA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 224 CHINA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 225 CHINA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 226 CHINA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 227 CHINA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 228 CHINA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 229 JAPAN: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 230 JAPAN: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 231 JAPAN: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 232 JAPAN: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 233 JAPAN: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 234 JAPAN: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 235 JAPAN: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 236 JAPAN: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 237 JAPAN: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 238 JAPAN: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 239 JAPAN: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 240 JAPAN: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 241 INDIA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 242 INDIA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 243 INDIA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 244 INDIA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 245 INDIA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 246 INDIA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 247 INDIA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 248 INDIA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 249 INDIA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 250 INDIA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 251 INDIA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 252 INDIA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 253 AUSTRALIA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 254 AUSTRALIA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 255 AUSTRALIA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 256 AUSTRALIA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 257 AUSTRALIA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 258 AUSTRALIA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 259 AUSTRALIA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 260 AUSTRALIA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 261 AUSTRALIA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 262 AUSTRALIA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 263 AUSTRALIA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 264 AUSTRALIA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 265 SOUTH KOREA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 266 SOUTH KOREA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 267 SOUTH KOREA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 268 SOUTH KOREA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 269 SOUTH KOREA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 270 SOUTH KOREA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 271 SOUTH KOREA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 272 SOUTH KOREA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 273 SOUTH KOREA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 274 SOUTH KOREA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 275 SOUTH KOREA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 276 SOUTH KOREA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 277 REST OF ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 278 REST OF ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 279 REST OF ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 280 REST OF ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 281 REST OF ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 282 REST OF ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 283 REST OF ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 284 REST OF ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 285 REST OF ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 286 REST OF ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 287 REST OF ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 288 REST OF ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 289 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 290 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 291 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 292 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 293 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 294 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 295 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 296 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 297 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 298 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 299 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 300 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 301 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 302 LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 303 BRAZIL: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 304 BRAZIL: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 305 BRAZIL: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 306 BRAZIL: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 307 BRAZIL: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 308 BRAZIL: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 309 BRAZIL: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 310 BRAZIL: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 311 BRAZIL: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 312 BRAZIL: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 313 BRAZIL: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 314 BRAZIL: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 315 MEXICO: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 316 MEXICO: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 317 MEXICO: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 318 MEXICO: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 319 MEXICO: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 320 MEXICO: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 321 MEXICO: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 322 MEXICO: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 323 MEXICO: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 324 MEXICO: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 325 MEXICO: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 326 MEXICO: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 327 REST OF LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 328 REST OF LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 329 REST OF LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 330 REST OF LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 331 REST OF LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 332 REST OF LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 333 REST OF LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 334 REST OF LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 335 REST OF LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 336 REST OF LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 337 REST OF LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 338 REST OF LATIN AMERICA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 339 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 340 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 341 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 342 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 343 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 344 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 345 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 346 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 347 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 348 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 349 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 350 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 351 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 352 MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 353 GCC COUNTRIES: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 354 GCC COUNTRIES: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 355 GCC COUNTRIES: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 356 GCC COUNTRIES: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 357 GCC COUNTRIES: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 358 GCC COUNTRIES: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 359 GCC COUNTRIES: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 360 GCC COUNTRIES: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 361 GCC COUNTRIES: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 362 GCC COUNTRIES: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 363 GCC COUNTRIES: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 364 GCC COUNTRIES: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 365 REST OF MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 366 REST OF MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 367 REST OF MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 368 REST OF MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PENS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 369 REST OF MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 370 REST OF MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PUMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 371 REST OF MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 372 REST OF MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET FOR INSULIN PEN NEEDLES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 373 REST OF MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2022-2024 (USD MILLION)

- TABLE 374 REST OF MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025-2030 (USD MILLION)

- TABLE 375 REST OF MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 376 REST OF MIDDLE EAST & AFRICA: INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 377 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN INSULIN DELIVERY DEVICES MARKET

- TABLE 378 INSULIN DELIVERY DEVICE MARKET: DEGREE OF COMPETITION

- TABLE 379 INSULIN DELIVERY DEVICES MARKET: TYPE FOOTPRINT, 2024

- TABLE 380 INSULIN DELIVERY DEVICES MARKET: REGION FOOTPRINT, 2024

- TABLE 381 INSULIN DELIVERY DEVICES MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 382 INSULIN DELIVERY DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 383 INSULIN DELIVERY DEVICES MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 384 INSULIN DELIVERY DEVICES MARKET: DEALS, JANUARY 2022-APRIL 2025

- TABLE 385 INSULIN DELIVERY DEVICES MARKET: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 386 INSULIN DELIVERY DEVICES MARKET: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 387 EMBECTA CORP.: BUSINESS OVERVIEW

- TABLE 388 EMBECTA CORP.: PRODUCTS OFFERED

- TABLE 389 EMBECTA CORP: PRODUCTS LAUNCHES & APPROVALS

- TABLE 390 EMBECTA CORP: DEALS

- TABLE 391 EMBECTA CORP: EXPANSIONS

- TABLE 392 EMBECTA CORP.: OTHER DEVELOPMENTS

- TABLE 393 NOVO NORDISK A/S: BUSINESS OVERVIEW

- TABLE 394 NOVO NORDISK A/S: PRODUCTS OFFERED

- TABLE 395 NOVO NORDISK A/S: PRODUCTS LAUNCHES & APPROVALS

- TABLE 396 NOVO NORDISK A/S: DEALS

- TABLE 397 NOVO NORDISK A/S: OTHER DEVELOPMENTS

- TABLE 398 MEDTRONIC: BUSINESS OVERVIEW

- TABLE 399 MEDTRONIC: PRODUCTS OFFERED

- TABLE 400 MEDTRONIC: PRODUCT LAUNCHES & APPROVALS

- TABLE 401 MEDTRONIC: DEALS

- TABLE 402 MEDTRONIC: EXPANSIONS

- TABLE 403 MEDTRONIC: OTHER DEVELOPMENTS

- TABLE 404 SANOFI: BUSINESS OVERVIEW

- TABLE 405 SANOFI: PRODUCTS OFFERED

- TABLE 406 SANOFI: PRODUCT LAUNCHES & APPROVALS

- TABLE 407 SANOFI: EXPANSIONS

- TABLE 408 SANOFI: OTHER DEVELOPMENTS

- TABLE 409 ELI LILLY AND COMPANY: BUSINESS OVERVIEW

- TABLE 410 ELI LILLY AND COMPANY: PRODUCTS OFFERED

- TABLE 411 ELI LILLY AND COMPANY: PRODUCTS LAUNCHES

- TABLE 412 ELI LILLY AND COMPANY: DEALS

- TABLE 413 ELI LILLY AND COMPANY: EXPANSIONS

- TABLE 414 ELI LILLY AND COMPANY: OTHER DEVELOPMENTS

- TABLE 415 TANDEM DIABETES CARE, INC.: BUSINESS OVERVIEW

- TABLE 416 TANDEM DIABETES CARE, INC.: PRODUCTS OFFERED

- TABLE 417 TANDEM DIABETES CARE, INC.: PRODUCTS LAUNCHES & APPROVALS

- TABLE 418 TANDEM DIABETES CARE, INC.: DEALS

- TABLE 419 INSULET CORPORATION: BUSINESS OVERVIEW

- TABLE 420 INSULET CORPORATION: PRODUCTS LAUNCHES & APPROVALS

- TABLE 421 INSULET CORPORATION: DEALS

- TABLE 422 INSULET CORPORATION: EXPANSIONS

- TABLE 423 INSULET CORPORATION: OTHER DEVELOPMENTS

- TABLE 424 BIOCON: BUSINESS OVERVIEW

- TABLE 425 BIOCON: PRODUCTS OFFERED

- TABLE 426 BIOCON: DEALS

- TABLE 427 BIOCON: OTHER DEVELOPMENTS

- TABLE 428 F. HOFFMANN-LA ROCHE: BUSINESS OVERVIEW

- TABLE 429 F. HOFFMANN-LA ROCHE: PRODUCTS OFFERED

- TABLE 430 HOFFMANN-LA ROCHE LTD.: PRODUCTS LAUNCHES

- TABLE 431 HTL-STREFA (SUBSIDIARY OF THE MTD GROUP): BUSINESS OVERVIEW

- TABLE 432 HTL-STREFA (SUBSIDIARY OF THE MTD GROUP): PRODUCTS OFFERED

- TABLE 433 HTL-STREFA (SUBSIDIARY OF THE MTD GROUP): DEALS

- TABLE 434 YPSOMED: BUSINESS OVERVIEW

- TABLE 435 YPSOMED: PRODUCTS OFFERED

- TABLE 436 YPSOMED: PRODUCT LAUNCHES & APPROVALS

- TABLE 437 YPSOMED: DEALS

- TABLE 438 YPSOMED: EXPANSIONS

- TABLE 439 YPSOMED: OTHER DEVELOPMENTS

- TABLE 440 MEDTRUM TECHNOLOGIES INC.: BUSINESS OVERVIEW

- TABLE 441 MEDTRUM TECHNOLOGIES INC.: PRODUCT PORTFOLIO

- TABLE 442 TERUMO CORPORATION: BUSINESS OVERVIEW

- TABLE 443 TERUMO CORPORATION: PRODUCTS OFFERED

- TABLE 444 TERUMO CORPORATION: PRODUCT LAUNCHES

- TABLE 445 TERUMO CORPORATION: DEALS

- TABLE 446 TERUMO CORPORATION: EXPANSIONS

- TABLE 447 TERUMO CORPORATION: OTHER DEVELOPMENTS

- TABLE 448 WOCKHARDT LIMITED: BUSINESS OVERVIEW

- TABLE 449 WOCKHARDT LIMITED: PRODUCTS OFFERED

- TABLE 450 WOCKHARDT LIMITED: PRODUCTS LAUNCHES

- TABLE 451 WOCKHARDT LIMITED: OTHER DEVELOPMENTS

- TABLE 452 NIPRO: BUSINESS OVERVIEW

- TABLE 453 NIPRO: PRODUCTS OFFERED

- TABLE 454 NIPRO: EXPANSIONS

List of Figures

- FIGURE 1 INSULIN DELIVERY DEVICES MARKET SEGMENTATION

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 PRIMARY SOURCES

- FIGURE 6 KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 KEY INDUSTRY INSIGHTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 9 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 10 MARKET SIZE APPROACH: REVENUE SHARE ANALYSIS

- FIGURE 11 TOP-DOWN APPROACH

- FIGURE 12 INSULIN DELIVERY DEVICES MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 13 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- FIGURE 15 INSULIN DELIVERY DEVICES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT OF INSULIN DELIVERY DEVICES MARKET

- FIGURE 19 INCREASING TECHNOLOGICAL ADVANCEMENTS IN INSULIN DELIVERY DEVICES TO DRIVE MARKET

- FIGURE 20 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF INSULIN DELIVERY DEVICES MARKET IN 2024

- FIGURE 21 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD (2025-2030)

- FIGURE 23 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 24 INSULIN DELIVERY DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 ESTIMATES OF GLOBAL PREVALENCE OF DIABETES IN 20-79-YEAR AGE GROUP, 2011-2024 (MILLION)

- FIGURE 26 DIABETES AGE-STANDARDIZED PREVALENCE IN PEOPLE (65-99 YEARS), BY REGION, 2024 AND 2050 (MILLION)

- FIGURE 27 ADVANCEMENTS IN INSULIN DELIVERY DEVICES

- FIGURE 28 FDA 510(K) APPROVAL PROCESS

- FIGURE 29 EUROPE: CE MARK APPROVAL PROCESS FOR INSULIN DELIVERY DEVICES

- FIGURE 30 SUMMARY OF APPROVAL, ACCESS, AND DISTRIBUTION PATHWAYS FOR NEW TECHNOLOGY USED FOR INSULIN DRUG DELIVERY DEVICES

- FIGURE 31 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR INSULIN DELIVERY DEVICES MARKET, JANUARY 2014-DECEMBER 2024

- FIGURE 32 TOP PATENT APPLICANT COUNTRIES FOR INSULIN DELIVERY DEVICES, JANUARY 2014-DECEMBER 2024

- FIGURE 33 INSULIN DELIVERY DEVICE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 34 INSULIN DELIVERY DEVICE: VALUE CHAIN ANALYSIS

- FIGURE 35 INSULIN DELIVERY DEVICE MARKET: ECOSYSTEM MAPPING

- FIGURE 36 INSULIN DELIVERY DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF END USERS

- FIGURE 38 KEY BUYING CRITERIA FOR END USERS

- FIGURE 39 INSULIN DELIVERY DEVICES MARKET: ADJACENT MARKET ANALYSIS

- FIGURE 40 INVESTMENT/VENTURE CAPITAL SCENARIO IN INSULIN DELIVERY DEVICES, 2021-2023 (USD MILLION)

- FIGURE 41 INSULIN DELIVERY DEVICES MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 42 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: INSULIN DELIVERY DEVICES MARKET SNAPSHOT

- FIGURE 44 REVENUE SHARE ANALYSIS OF KEY PLAYERS, 2022-2024 (USD MILLION)

- FIGURE 45 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 46 INSULIN DELIVERY DEVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 INSULIN DELIVERY DEVICES MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 48 INSULIN DELIVERY DEVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 INSULIN DELIVERY DEVICES MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 50 EV/EBITDA OF KEY VENDORS, 2024

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2024

- FIGURE 52 R&D ASSESSMENT OF KEY PLAYERS

- FIGURE 53 EMBECTA CORP.: COMPANY SNAPSHOT, 2024

- FIGURE 54 NOVO NORDISK A/S: COMPANY SNAPSHOT, 2024

- FIGURE 55 MEDTRONIC: COMPANY SNAPSHOT, 2024

- FIGURE 56 SANOFI: COMPANY SNAPSHOT, 2024

- FIGURE 57 ELI LILLY AND COMPANY: COMPANY SNAPSHOT, 2024

- FIGURE 58 TANDEM DIABETES CARE, INC.: COMPANY SNAPSHOT, 2024

- FIGURE 59 INSULET CORPORATION: COMPANY SNAPSHOT, 2024

- FIGURE 60 BIOCON: COMPANY SNAPSHOT, 2024

- FIGURE 61 F. HOFFMANN-LA ROCHE: COMPANY SNAPSHOT, 2024

- FIGURE 62 YPSOMED: COMPANY SNAPSHOT, 2024

- FIGURE 63 TERUMO CORPORATION: COMPANY SNAPSHOT, 2024

- FIGURE 64 WOCKHARDT LIMITED: COMPANY SNAPSHOT, 2024

- FIGURE 65 NIPRO: COMPANY SNAPSHOT, 2024

The global insulin delivery devices market is projected to reach USD 52.7 billion by 2030 from USD 35.3 billion in 2025, at a CAGR of 8.3% during the forecast period. The insulin delivery devices market is experiencing consistent growth due to several factors. As the global population ages, the prevalence of conditions like diabetes is rising, leading to an increased demand for advanced insulin delivery devices. Additionally, government support and favorable reimbursement schemes are further promoting market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, Disease Type, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Technological advancements in insulin delivery devices, such as the integration of artificial intelligence (AI) and machine learning (ML), have also contributed to this demand. Furthermore, an increase in research and development activities, along with strategic partnerships, is creating additional opportunities for growth in the market.

Overall, the rise in healthcare expenditure focused on diabetes care, combined with the increasing prevalence of diabetes, is fostering new opportunities for market expansion.

The reusable insulin pens segment accounted for the largest share of the insulin delivery devices market, by type of insulin pen, in 2024.

The insulin delivery devices market can be categorized into several types: insulin pens, insulin pumps, insulin syringes, insulin pen needles, and other insulin delivery devices. Within the category of insulin pens, there are two main types: reusable insulin pens and disposable insulin pens. As of 2024, reusable insulin pens held the largest market share.

Reusable insulin pens feature a delivery chamber designed to hold prefilled insulin cartridges. These devices are more cost-effective than disposable insulin pens, leading to their increasing popularity for insulin delivery. They provide significant advantages in terms of affordability, sustainability, and user-friendliness. Additionally, reusable pens offer environmental benefits.

A recent study from the University of Exeter in 2024 reported that approximately four million single-use insulin pens are prescribed annually in England, resulting in about 79 tons of plastic waste and emitting 1,000 tons of carbon dioxide, which is equivalent to the emissions from 250 additional cars on the road. In contrast, reusable insulin pens can significantly reduce this waste, making them a more sustainable option. Consequently, a growing number of end users are opting for reusable insulin pens, driving the segment's growth.

In 2024, the home care settings segment held the largest share of the insulin delivery devices market.

The insulin delivery devices market is categorized by end users into home care settings, hospitals & clinics, and other end users. In 2024, the home care settings segment held the largest market share. This trend is primarily attributed to the increasing preference for self-administration of insulin among patients. One of the main advantages of self-administration is the time and cost savings it offers, as patients can avoid the need for regular visits to healthcare providers for insulin administration. Additionally, self-administration can enhance medication adherence and improve treatment outcomes.

Several factors support this trend, including the launch of advanced, user-friendly delivery devices, manufacturers' focus on providing patient training, and the availability of reimbursements for insulin self-administration in key markets. Over the years, the market has also seen the introduction of technologically advanced pumps and pen needles designed to help patients manage diabetes through self-administration. These new products are designed to deliver precise amounts of insulin using minimally invasive techniques. Collectively, these factors are driving growth in this segment of the market.

In 2024, North America accounted for the largest share of the insulin delivery devices market.

The global market for insulin delivery devices is divided into five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of this market, primarily due to the rising prevalence of type 1 diabetes in the region. Since type 1 diabetes is dependent on insulin, the increasing number of diabetes patients is driving up demand for insulin delivery devices.

According to the International Diabetes Federation (IDF) Atlas 2025, approximately 1.4 million individuals in the US and 240,000 in Canada were reported to be living with type 1 diabetes in 2024. This growing patient population is fueling a continuous demand for various insulin delivery devices, including pens, pumps, syringes, and pen needles.

Additionally, the North American region is witnessing significant investments in research and development aimed at enhancing insulin delivery technologies. Companies in the area are actively working to improve patient convenience, accuracy, and connectivity of these devices to meet the evolving needs of healthcare professionals and patients. The combination of high disease prevalence, technological advancements, and a robust healthcare infrastructure ensures that North America remains a leading region in the global insulin delivery devices market.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (50%), Director-level Executives (30%), and Others (20%)

- By Region: North America (30%), Europe (25%), Asia Pacific (20%), Latin America (15%), and the Middle East & Africa (10%)

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10 billion, Tier 2 = USD 1 billion to USD 10 billion, and Tier 3 = <USD 1 billion.

Note 2: C-level executives include CEOs, CFOs, COOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The players operating in the insulin delivery devices market include Embecta Corp.(US), Novo Nordisk A/S (Denmark), Ypsomed (Switzerland), Medtronic (Ireland), Tandem Diabetes Care, Inc. (US), Sanofi (France), and Eli Lilly and Company (US), Tandem Diabetes Care, Inc. (US), Insulet Corporation (US), Biocon (India), Roche Diabetes Care (Switzerland), HTL-STREFA, a subsidiary of the MTD Group (Poland), Ypsomed (Switzerland), Medtrum Technologies Inc. (China), Terumo Corporation (Japan), Wockhardt Limited (India), Nipro (Japan), Cequr Corporation (Switzerland), Eoflow Co., Ltd. (South Korea), Hindustan Syringes & Medical Devices Ltd. (India), SOOIL Developments Co., Ltd. (South Korea), SUNGSHIM MEDICAL CO., LTD (South Korea), B. Braun SE (Germany), Debiotech SA (Switzerland), Jiangsu Delfu Medical Device Co., Ltd. (China), Haselmeier, a Medmix company (Germany), and Mankind Corporation (US).

Research Coverage

This report studies the insulin delivery devices market based on type, disease type, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will allow both established companies and smaller or new firms to assess market trends, helping them increase their market share. Companies that purchase the report can employ one or more of the strategies outlined below to enhance their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (growing prevalence of diabetes, technological advancements in insulin delivery devices, government support, and favorable reimbursement schemes), restraints (high cost and lack of reimbursement in developing countries, needle anxiety in patients, and alternative drug delivery methods), opportunities (increasing research and development activities and strategic partnerships, increasing healthcare expenditure on diabetes care, advances in syringe and needle technology, and mandates pertaining to safety-engineered medical needles), challenges (needlestick injuries and misuse of injection pens and lack of interoperability among insulin delivery devices)

- Market Penetration: Complete knowledge of the spectrum of products presented by the major companies in the insulin delivery devices market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches within the insulin delivery devices market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new goods, expanding geographies, and current changes in the insulin delivery devices industry helps to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Embecta Corp. (US), Novo Nordisk A/S (Denmark), Ypsomed (Switzerland), Medtronic (Ireland), Tandem Diabetes Care, Inc. (US), Sanofi (France), and Eli Lilly and Company (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 STUDY INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED

- 1.3.3 YEARS CONSIDERED FOR STUDY

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 ASSUMPTIONS FOR STUDY

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 INSULIN DELIVERY DEVICES: MARKET OVERVIEW

- 4.2 NORTH AMERICA: INSULIN DELIVERY DEVICES MARKET, BY TYPE AND COUNTRY

- 4.3 INSULIN DELIVERY DEVICES MARKET: GEOGRAPHICAL MIX

- 4.4 INSULIN DELIVERY DEVICES MARKET: REGIONAL MIX

- 4.5 INSULIN DELIVERY DEVICES MARKET: DEVELOPED VS. DEVELOPING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in prevalence of diabetic population

- 5.2.1.2 Technological advancements in insulin delivery devices

- 5.2.1.3 Government support and favorable reimbursement schemes to favor the market growth

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and lack of reimbursement in emerging economies

- 5.2.2.2 Needle anxiety in patients to affect growth of pen needles and syringes market

- 5.2.2.3 Oral insulin as alternative drug delivery method

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increase in research & development activities and strategic partnerships

- 5.2.3.2 Increase in healthcare expenditure on diabetes care

- 5.2.3.3 Advances in insulin syringe and needle technology

- 5.2.3.4 Mandates pertaining to safety-engineered medical needles

- 5.2.4 CHALLENGES

- 5.2.4.1 Needlestick injuries and misuse of injection pens

- 5.2.4.2 Lack of interoperability among insulin delivery devices

- 5.2.1 DRIVERS

- 5.3 REGULATORY ANALYSIS

- 5.3.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.2 REGULATORY FRAMEWORK

- 5.3.2.1 North America

- 5.3.2.1.1 US

- 5.3.2.1.2 Canada

- 5.3.2.2 Europe

- 5.3.2.3 Asia Pacific

- 5.3.2.3.1 Japan

- 5.3.2.3.2 China

- 5.3.2.3.3 India

- 5.3.2.3.4 Australia

- 5.3.2.4 Latin America

- 5.3.2.4.1 Brazil

- 5.3.2.4.2 Mexico

- 5.3.2.5 Middle East

- 5.3.2.6 Africa

- 5.3.2.1 North America

- 5.4 INDUSTRY TRENDS

- 5.4.1 GROWING DEMAND FOR HYBRID CLOSED-LOOP SYSTEMS/ARTIFICIAL PANCREAS DEVICE SYSTEMS

- 5.4.2 SYNCHRONIZATION OF SMART INSULIN PENS WITH CONTINUOUS GLUCOSE MONITORING SYSTEMS PROMOTES DIABETES DATA SHARING

- 5.4.3 INCREASE IN NUMBER OF COLLABORATIONS AMONG STAKEHOLDERS

- 5.5 REIMBURSEMENT SCENARIO

- 5.5.1 GLOBAL COVERAGE AND REIMBURSEMENT

- 5.6 TECHNOLOGY ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Automated insulin delivery

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Bluetooth

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Continuous glucose monitoring

- 5.7.1 KEY TECHNOLOGIES

- 5.8 KEY CONFERENCES & EVENTS

- 5.9 PRICING ANALYSIS

- 5.9.1 INDICATIVE PRICING TREND OF INSULIN DELIVERY DEVICE, BY KEY PLAYER

- 5.9.2 INDICATIVE PRICING TREND OF INSULIN DELIVERY DEVICE, BY REGION

- 5.10 TRADE ANALYSIS

- 5.11 PATENT ANALYSIS

- 5.11.1 PATENT PUBLICATION TRENDS FOR INSULIN DELIVERY DEVICES

- 5.11.2 JURISDICTION ANALYSIS: TOP APPLICANTS FOR PATENTS IN INSULIN DELIVERY DEVICES MARKET

- 5.12 SUPPLY CHAIN ANALYSIS

- 5.13 VALUE CHAIN ANALYSIS

- 5.14 ECOSYSTEM MARKET MAP

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 OMNIPOD 5 FACILITATED EFFECTIVE INSULIN MANAGEMENT FOR YOUNG ATHLETES, SUPPORTING CONTINUITY IN TRAINING AND COMPETITION

- 5.15.2 MEDTRONIC MINIMED INSULIN PUMP ENHANCED GLUCOSE CONTROL, IMPROVING DAILY MANAGEMENT FOR PEOPLE WITH DIABETES

- 5.15.3 SMART INSULIN DELIVERY WITH MEDTRONIC INPEN FOR IMPROVED DIABETES MANAGEMENT

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.16.2 BARGAINING POWER OF SUPPLIERS

- 5.16.3 BARGAINING POWER OF BUYERS

- 5.16.4 THREAT OF SUBSTITUTES

- 5.16.5 THREAT OF NEW ENTRANTS

- 5.17 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 ADJACENT MARKET ANALYSIS

- 5.19 INVESTMENT & FUNDING SCENARIO

- 5.20 UNMET NEEDS/END-USER EXPECTATIONS IN INSULIN DELIVERY DEVICES MARKET

- 5.21 TRENDS/DISRUPTION IMPACTING CUSTOMER'S BUSINESS

- 5.22 IMPACT OF AI/GENERATIVE AI ON INSULIN DELIVERY DEVICES MARKET

6 INSULIN DELIVERY DEVICES MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 INSULIN PENS

- 6.2.1 ADVANCED AND CONVENIENT SOLUTIONS FOR INSULIN ADMINISTRATION TO DRIVE MARKET

- 6.2.2 REUSABLE INSULIN PENS

- 6.2.2.1 Technology innovations offering cost-effectiveness to boost growth

- 6.2.3 DISPOSABLE INSULIN PENS

- 6.2.3.1 Ease of use to drive market, though shift toward eco-friendly environment can challenge growth

- 6.3 INSULIN PUMPS

- 6.3.1 PRECISION OFFERED BY NEWER AND MORE REFINED TECHNOLOGY TO DRIVE INSULIN PUMPS MARKET

- 6.3.2 TETHERED INSULIN PUMPS

- 6.3.2.1 Increase in collaborations and partnerships between companies to develop integrated CGM systems to drive market

- 6.3.3 TUBELESS INSULIN PUMPS

- 6.3.3.1 Use of artificial intelligence and technological advancements to boost market

- 6.4 INSULIN PEN NEEDLES

- 6.4.1 STANDARD INSULIN PEN NEEDLES

- 6.4.1.1 Affordability of standard insulin pen needles over safety pen needles to propel growth

- 6.4.2 SAFETY INSULIN PEN NEEDLES

- 6.4.2.1 Reduced chances of infection and accidental pricking to drive market

- 6.4.1 STANDARD INSULIN PEN NEEDLES

- 6.5 INSULIN SYRINGES

- 6.5.1 COMMONLY USED DELIVERY MEANS CHALLENGED BY SAFETY CONCERNS AND AWARENESS OF AFFORDABLE ALTERNATIVES

- 6.6 OTHER INSULIN DELIVERY DEVICES

7 INSULIN DELIVERY DEVICES MARKET, BY DISEASE TYPE

- 7.1 INTRODUCTION

- 7.2 TYPE 1 DIABETES

- 7.2.1 CHRONIC NATURE OF TYPE 1 DIABETES, COMBINED WITH SIGNIFICANT INCIDENCE IN CHILDREN AND YOUNG ADULTS, TO DRIVE GROWTH

- 7.3 TYPE 2 DIABETES

- 7.3.1 RISING PREVALENCE OF TYPE 2 DIABETES, DRIVEN BY LIFESTYLE-RELATED RISK FACTORS AND EARLIER DISEASE ONSET TO FUEL MARKET

8 INSULIN DELIVERY DEVICES MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOME CARE SETTINGS

- 8.2.1 INCREASE IN AFFORDABILITY OF SELF-MONITORING SYSTEMS AND INSULIN DELIVERY DEVICES TO FUEL SELF/HOME HEALTHCARE

- 8.3 HOSPITALS & CLINICS

- 8.3.1 RISE IN DEMAND FOR POINT-OF-CARE TESTING IN HOSPITALS TO BOOST MARKET GROWTH

- 8.4 OTHER END USERS

9 INSULIN DELIVERY DEVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Largest share of North American insulin delivery device market

- 9.2.3 CANADA

- 9.2.3.1 Rise in government support to boost market in Canada

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Germany to dominate European insulin delivery devices market

- 9.3.3 UK

- 9.3.3.1 Government support and research funding to drive market growth in UK

- 9.3.4 FRANCE

- 9.3.4.1 High insurance coverage and increasing affordability to fuel market

- 9.3.5 ITALY

- 9.3.5.1 Increase in government spending to drive insulin delivery device growth in Italy

- 9.3.6 SPAIN

- 9.3.6.1 Minimal co-payments and full reimbursement to drive market growth in Spain

- 9.3.7 REST OF EUROPE (ROE)

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 China to dominate Asia Pacific's insulin delivery devices market

- 9.4.3 JAPAN

- 9.4.3.1 Rise in aging population and high diabetes cases to drive growth in Japan

- 9.4.4 INDIA

- 9.4.4.1 Rise in diabetes cases and affordable local manufacturing to fuel insulin device demand in India

- 9.4.5 AUSTRALIA

- 9.4.5.1 Government subsidies to support market growth

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Rise in diabetes cases and strong government healthcare support to boost market

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Brazil to account for largest share in Latin American insulin delivery devices market

- 9.5.3 MEXICO

- 9.5.3.1 Growth in regulatory support to propel market

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR THE MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Rise in diabetes prevalence and high per capita healthcare expenditure to drive market in GCC countries

- 9.6.3 REST OF THE MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN INSULIN DELIVERY DEVICES MARKET

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Type footprint

- 10.5.5.3 Region footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING

- 10.6.5.1 DETAILED LIST OF KEY STARTUPS/SMES, 2024

- 10.6.5.2 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.7 BRAND/PRODUCT COMPARISON

- 10.8 COMPANY VALUATION & FINANCIAL METRICS

- 10.8.1 FINANCIAL METRICS

- 10.8.2 COMPANY VALUATION

- 10.9 R&D ASSESSMENT OF KEY PLAYERS

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES & APPROVALS

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

- 10.10.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 EMBECTA CORP. (FORMERLY BECTON, DICKINSON AND COMPANY DIABETES CARE BUSINESS)

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.3.4 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 NOVO NORDISK A/S

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches and approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 MEDTRONIC

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and approvals

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.3.4 Other developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 SANOFI

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and approvals

- 11.1.4.3.2 Expansions

- 11.1.4.3.3 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 ELI LILLY AND COMPANY

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and approvals

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.5.3.4 Other developments

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 TANDEM DIABETES CARE, INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches and approvals

- 11.1.6.3.2 Deals

- 11.1.7 INSULET CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches and approvals

- 11.1.7.3.2 Deals

- 11.1.7.3.3 Expansions

- 11.1.7.3.4 Other developments

- 11.1.8 BIOCON

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.3.2 Other developments

- 11.1.9 ROCHE DIABETES CARE

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches and approvals

- 11.1.10 HTL-STREFA (SUBSIDIARY OF THE MTD GROUP)

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 YPSOMED

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches and approvals

- 11.1.11.3.2 Deals

- 11.1.11.3.3 Expansions

- 11.1.11.3.4 Other developments

- 11.1.12 MEDTRUM TECHNOLOGIES INC.

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.13 TERUMO CORPORATION

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product launches and approvals

- 11.1.13.3.2 Deals

- 11.1.13.3.3 Expansions

- 11.1.13.3.4 Other developments

- 11.1.14 WOCKHARDT LIMITED

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches and approvals

- 11.1.14.3.2 Other developments

- 11.1.15 NIPRO

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Expansions

- 11.1.1 EMBECTA CORP. (FORMERLY BECTON, DICKINSON AND COMPANY DIABETES CARE BUSINESS)

- 11.2 OTHER PLAYERS

- 11.2.1 CEQUR CORPORATION

- 11.2.2 EOFLOW CO., LTD.

- 11.2.3 HINDUSTAN SYRINGES & MEDICAL DEVICES LTD

- 11.2.4 SOOIL DEVELOPMENTS CO., LTD

- 11.2.5 SUNGSHIM MEDICAL CO., LTD.

- 11.2.6 B.BRAUN SE

- 11.2.7 DEBIOTECH SA

- 11.2.8 JIANGSU DELFU MEDICAL DEVICE CO., LTD

- 11.2.9 HASELMEIER (A SUBSIDIARY OF MEDMIX)

- 11.2.10 MANNKIND CORPORATION

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS