|

|

市場調査レポート

商品コード

1756520

給餌システムの世界市場:タイプ別、技術別、オファリング別、機能別、家畜別、動力源別、農場規模別、地域別 - 2030年までの予測Feeding Systems Market by Type (Rail-guided, Conveyor, Self-propelled), Offering (Hardware, Software, Services), Technology (Manual, Automatic), Function, Power Source, Farm Size, Livestock, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 給餌システムの世界市場:タイプ別、技術別、オファリング別、機能別、家畜別、動力源別、農場規模別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月23日

発行: MarketsandMarkets

ページ情報: 英文 291 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の給餌システムの市場規模は、2025年には34億6,000万米ドルと予測され、予測期間中のCAGRは8.1%と見込まれており、2030年には51億米ドルに達すると予測されています。

給餌システム産業は、牛、家禽、豚、養殖などの動物に効率的で正確な自動給餌ソリューションを提供し、近代的な家畜生産に不可欠です。給餌システムは、飼料供給を合理化し、ロスを減らし、適切な栄養素を適切なタイミングで適切な量だけ家畜に供給するように設計されており、家畜の健康とより効率的なオペレーションを可能にしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象ユニット | 金額(米ドル)および数量(台) |

| セグメント別 | タイプ別、技術別、オファリング別、機能別、家畜別、動力源別、農場規模別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

農業がより厳格になり技術に依存するようになるにつれて、給餌システムは単純な機械化された設備から、非常に複雑なセンサーベースの完全自動化された飼料管理ソリューションへと進化しています。このような洗練されたシステムの導入が進むにつれ、農場内の飼料管理が変化し、生産性の向上と持続可能性の強化につながっています。この変化は、技術的変化、活気ある消費者ニーズ、畜産現場の改革によって、世界の給餌システム市場の力強い拡大を促しています。

給餌システムの自動化セグメントは、耕作活動の効率化と人件費節約能力により、大きな牽引力を得ています。ロボット工学、テレメトリー、RFID、ガイダンス、リモートセンシングなどの技術は、飼料分配の正確な精度とタイムリーな制御を提供します。これにより、無駄を省きながら最大限の栄養が確保され、最終的には生産性が向上し、家畜の健康状態が改善されます。自動給餌システムにおけるロボット遠隔計測は、ロボット工学と遠隔計測を組み合わせて、飼料供給を自動化し、家畜をリアルタイムでモニターします。ロボティクスは飼料の混合、運搬、分配といった物理的な作業を行い、遠隔測定システムは飼料の消費量、動物の行動、環境状況に関するデータを収集・送信します。このテクノロジーは、労働要件を削減し、飼料の精度を向上させ、動物の福祉を強化することで、畜産を変えつつあります。酪農、養鶏、養豚で広く使用されているロボット遠隔測定システムは、IoTやAIと統合してデータ主導の洞察を提供し、酪農家が給餌プロセスを最適化して農場の生産性を向上させることを可能にします。

反芻動物はミルクと肉の不可欠な供給源であり、これらのアウトプットの質は飼料供給の質と精度に直接影響されます。先進的な動物給餌技術は、微生物に関連する疾病を最小限に抑え、飼料効率を改善し、動物の成長をサポートする上で極めて重要です。農業園芸開発委員会(Agriculture and Horticulture Development Board)の2023年7月の報告書によると、世界の牛肉生産量は5,960万トンに達し、大規模牛肉畜産への傾向が強まっていることが浮き彫りになっています。このような大規模牛群の管理は、高度な自動給餌システムにますます依存するようになっており、高度なセンサーを備えた完全自動化ソリューションへと進化しています。より大規模で効率的な畜産経営への変化は、給餌システムメーカーに大きな成長の見通しをもたらしています。さらに、食糧安全保障と持続可能な農業に対する懸念が強まるにつれ、畜産業者は飼料の効率化と廃棄物の最小化を優先するようになっています。

アジア太平洋諸国では、急速な都市化と可処分所得の増加により、消費者の嗜好がタンパク質優位の食生活へと急速に変化しており、高品質の家畜飼料と効果的な給餌システムへの需要を促進しています。飼料インフラに補助金を支給するインドの国家畜産ミッション・スキームのような政府の取り組みも、同地域での高度な給餌技術の使用を後押ししています。この業界における技術の進歩、特にAI駆動システムやIoTによる技術の進歩は、リアルタイムのモニタリングや予測分析を可能にすることで市場に変革をもたらしつつあります。例えば、2024年1月、Precision Livestock Technologiesは、牛の飼料摂取量を予測できるAI駆動システムを発表し、これにより給餌効率と農場の収益性を向上させました。アジア太平洋地域における畜産の産業的近代化は、給餌システム業界に多大な機会をもたらしています。現地の酪農家の間で商業的な飼料ソリューションに対する需要が高まっていることが、先進的な給餌技術の採用を促進しており、こうした動向がアジア太平洋地域における給餌システム市場の成長の重要な要因となっています。反芻動物はミルクと肉の生産に不可欠であるため、飼料供給の精度と品質はこれらの畜産物の品質に直接的な影響を与えます。従って、先進的な動物給餌技術は、微生物に関連する疾病を最小限に抑え、飼料効率を改善し、動物の成長を促進するために極めて重要です。

当レポートでは、世界の給餌システム市場について調査し、タイプ別、技術別、オファリング別、機能別、家畜別、動力源別、農場規模別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済見通し

- 市場力学

- 生成AIが動物の栄養に与える影響

第6章 業界動向

- イントロダクション

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- 2025年~2026年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

第7章 給餌システム市場(タイプ別)

- イントロダクション

- レールガイド式給餌システム

- コンベア給餌システム

- 自走式給餌システム

第8章 給餌システム市場(技術別)

- イントロダクション

- 手動

- 自動

第9章 給餌システム市場(オファリング別)

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第10章 給餌システム市場(機能別)

- イントロダクション

- 制御

- 混合

- 充填とスクリーニング

- その他

第11章 給餌システム市場(家畜別)

- イントロダクション

- 反芻動物

- 家禽

- 豚

- その他

第12章 給餌システム市場(動力源別)

- イントロダクション

- 電気給餌システム

- 油圧/空気圧システム

- バッテリー駆動システム

第13章 給餌システム市場(農場規模別)

- イントロダクション

- 小規模農場

- 商業農場

- 工業農場

第14章 給餌システム市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- 中東

- アフリカ

第15章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第16章 企業プロファイル

- 主要参入企業

- TETRA LAVAL

- GEA GROUP AKTIENGESELLSCHAFT

- LELY

- TRIOLIET

- VDL AGROTECH BV

- SCALEAQ

- AGCO CORPORATION

- BOUMATIC A/S A/S

- PELLON GROUP OY

- ROVIBEC AGRISOLUTIONS

- CTB, INC.(BERKSHIRE HATHAWAY)

- AKVA GROUP

- DAIRYMASTER

- MASKINFABRIKKEN CORMALL A/S

- SCHAUER AGROTRONIC GMBH

- その他の企業

- HETWIN AUTOMATION SYSTEMS GMBH

- JH AGRO A/S

- WASSERBAUER GMBH FEEDING SYSTEMS

- VALMETAL

- VIJAY RAJ POULTRY EQUIPMENTS PVT. LTD

- EMILY ETS

- SARL GALONNIER

- BISON INDUSTRIES, INC.

- SIEPLO

- FEEDTECH FEEDING SYSTEMS PTY LTD(TREVASKIS ENGINEERING)

- ONE2FEED A/S

- CLOVERDALE EQUIPMENT, LLC

第17章 隣接市場と関連市場

第18章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 FEEDING SYSTEMS MARKET SNAPSHOT, 2025 VS. 2030 (USD MILLION)

- TABLE 3 CHICKEN MEAT PRODUCTION FOR KEY COUNTRIES, 2019-2023 (MILLION METRIC TONS)

- TABLE 4 IMPORT SCENARIO FOR HS CODE: 843610, BY COUNTRY, 2019-2024 (USD)

- TABLE 5 EXPORT SCENARIO FOR HS CODE: 843610, BY COUNTRY, 2019-2023 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF FEEDING SYSTEMS AMONG KEY PLAYERS, BY LIVESTOCK, 2023 (USD MILLION/UNIT)

- TABLE 7 INDICATIVE PRICING ANALYSIS, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 8 FEEDING SYSTEMS MARKET: ECOSYSTEM

- TABLE 9 LIST OF MAJOR PATENTS PERTAINING TO FEEDING SYSTEMS MARKET, 2014-2024

- TABLE 10 FEEDING SYSTEMS MARKET: LIST OF KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 PORTER'S FIVE FORCES: IMPACT ON FEEDING SYSTEMS MARKET

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR LIVESTOCK

- TABLE 17 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 18 FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 19 FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 20 RAIL-GUIDED FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 21 RAIL-GUIDED FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 CONVEYOR FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 23 CONVEYOR FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 CONVEYOR FEEDING SYSTEMS MARKET, BY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 25 CONVEYOR FEEDING SYSTEMS MARKET, BY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 26 BELT FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 BELT FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 PAN FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 PAN FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

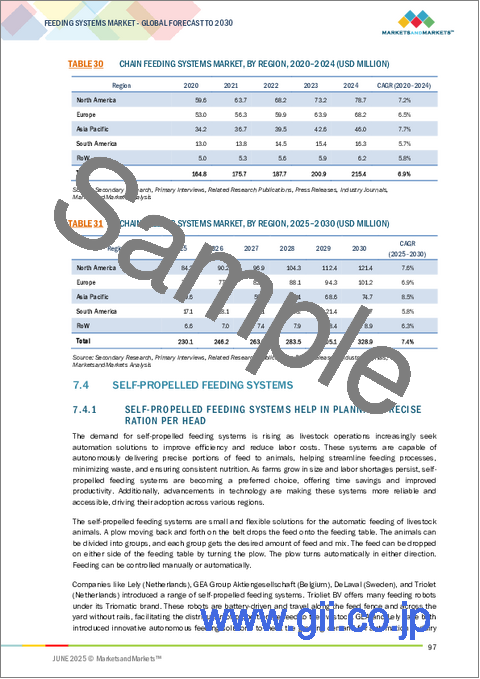

- TABLE 30 CHAIN FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 CHAIN FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 SELF-PROPELLED FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 SELF-PROPELLED FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 35 FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 36 MANUAL: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 MANUAL: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 AUTOMATED: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 AUTOMATED: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 AUTOMATED: FEEDING SYSTEMS MARKET, BY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 41 AUTOMATED: FEEDING SYSTEMS MARKET, BY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 42 ROBOTIC & TELEMETRY: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 ROBOTIC & TELEMETRY: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 RFID TECHNOLOGY: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 RFID TECHNOLOGY: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 GUIDANCE & REMOTE SENSING TECHNOLOGY: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 GUIDANCE & REMOTE SENSING TECHNOLOGY: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 OTHER SUB-TYPES: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 OTHER SUB-TYPES: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 FEEDING SYSTEMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 51 FEEDING SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 52 HARDWARE: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 HARDWARE: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 SOFTWARE: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 SOFTWARE: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 SERVICES: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 SERVICES: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 FEEDING SYSTEMS MARKET, BY FUNCTION, 2020-2024 (USD MILLION)

- TABLE 59 FEEDING SYSTEMS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 60 CONTROLLING: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 CONTROLLING: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 MIXING: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 MIXING: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 FILLING & SCREENING: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 FILLING & SCREENING: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 OTHER FUNCTIONS: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 OTHER FUNCTIONS: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2020-2024 (USD MILLION)

- TABLE 69 FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 70 RUMINANT: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 RUMINANT: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 RUMINANT: FEEDING SYSTEMS MARKET, BY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 73 RUMINANTS: FEEDING SYSTEMS MARKET, BY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 74 POULTRY: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 POULTRY: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 POULTRY: FEEDING SYSTEMS MARKET, BY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 77 POULTRY: FEEDING SYSTEMS MARKET, BY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 78 SWINE: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 SWINE: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 SWINE: FEEDING SYSTEMS MARKET, BY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 81 SWINE: FEEDING SYSTEMS MARKET, BY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 82 OTHER LIVESTOCK: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 OTHER LIVESTOCK: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (UNITS)

- TABLE 87 FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 88 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY CONVEYOR SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY CONVEYOR SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2020-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY FUNCTION, 2020-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 104 US: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 105 US: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 106 US: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 107 US: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 108 CANADA: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 109 CANADA: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 110 CANADA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 111 CANADA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 112 MEXICO: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 113 MEXICO: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 114 MEXICO: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 115 MEXICO: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: FEEDING SYSTEMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 117 EUROPE: FEEDING SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 119 EUROPE: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: FEEDING SYSTEMS MARKET, BY CONVEYOR SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 121 EUROPE: FEEDING SYSTEMS MARKET, BY CONVEYOR SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2020-2024 (USD MILLION)

- TABLE 123 EUROPE: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 124 EUROPE: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 125 EUROPE: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 126 EUROPE: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 127 EUROPE: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: FEEDING SYSTEMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 129 EUROPE: FEEDING SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: FEEDING SYSTEMS MARKET, BY FUNCTION, 2020-2024 (USD MILLION)

- TABLE 131 EUROPE: FEEDING SYSTEMS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 132 GERMANY: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 133 GERMANY: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 134 GERMANY: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 135 GERMANY: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 136 UK: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 137 UK: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 138 UK: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 139 UK: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 140 FRANCE: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 141 FRANCE: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 142 FRANCE: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 143 FRANCE: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 144 ITALY: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 145 ITALY: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 146 ITALY: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 147 ITALY: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 148 SPAIN: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 149 SPAIN: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 150 SPAIN: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 151 SPAIN: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 152 REST OF EUROPE: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 153 REST OF EUROPE: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 154 REST OF EUROPE: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 155 REST OF EUROPE: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 157 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 159 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY CONVEYOR SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 161 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY CONVEYOR SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2020-2024 (USD MILLION)

- TABLE 163 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 164 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 165 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 167 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 169 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 170 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY FUNCTION, 2020-2024 (USD MILLION)

- TABLE 171 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 172 CHINA: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 173 CHINA: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 174 CHINA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 175 CHINA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 176 INDIA: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 177 INDIA: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 178 INDIA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 179 INDIA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 180 JAPAN: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 181 JAPAN: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 182 JAPAN: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 183 JAPAN: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 184 AUSTRALIA & NEW ZEALAND: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 185 AUSTRALIA & NEW ZEALAND: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 186 AUSTRALIA & NEW ZEALAND: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 187 AUSTRALIA & NEW ZEALAND: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 188 REST OF ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 189 REST OF ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 190 REST OF ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 192 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 193 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 194 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 195 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 196 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY CONVEYOR SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 197 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY CONVEYOR SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 198 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2020-2024 (USD MILLION)

- TABLE 199 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 200 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 201 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 202 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 203 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 204 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 205 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 206 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY FUNCTION, 2020-2024 (USD MILLION)

- TABLE 207 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 208 BRAZIL: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 209 BRAZIL: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 210 BRAZIL: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 211 BRAZIL: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 212 ARGENTINA: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 213 ARGENTINA: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 214 ARGENTINA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 215 ARGENTINA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 216 REST OF SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 217 REST OF SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 218 REST OF SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 219 REST OF SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 220 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 221 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 222 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 223 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 224 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY CONVEYOR SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 225 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY CONVEYOR SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 226 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2020-2024 (USD MILLION)

- TABLE 227 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 228 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 229 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 230 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 231 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 232 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 233 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 234 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY FUNCTION, 2020-2024 (USD MILLION)

- TABLE 235 REST OF THE WORLD: FEEDING SYSTEMS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 236 MIDDLE EAST: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 237 MIDDLE EAST: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 238 MIDDLE EAST: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 239 MIDDLE EAST: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 240 AFRICA: FEEDING SYSTEMS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 241 AFRICA: FEEDING SYSTEMS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 242 AFRICA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 243 AFRICA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 244 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS

- TABLE 245 FEEDING SYSTEMS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 246 FEEDING SYSTEMS MARKET: TYPE FOOTPRINT

- TABLE 247 FEEDING SYSTEMS MARKET: LIVESTOCK FOOTPRINT

- TABLE 248 FEEDING SYSTEMS MARKET: OFFERING FOOTPRINT

- TABLE 249 FEEDING SYSTEMS MARKET: REGION FOOTPRINT

- TABLE 250 FEEDING SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 251 FEEDING SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 252 FEEDING SYSTEMS MARKET: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 253 FEEDING SYSTEMS MARKET: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 254 FEEDING SYSTEMS MARKET: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 255 TETRA LAVAL: COMPANY OVERVIEW

- TABLE 256 TETRA LAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 TETRA LAVAL: PRODUCT LAUNCHES

- TABLE 258 TETRA LAVAL: DEALS

- TABLE 259 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 260 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

- TABLE 262 GEA GROUP AKTIENGESELLSCHAFT: DEALS

- TABLE 263 LELY: COMPANY OVERVIEW

- TABLE 264 LELY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 LELY: PRODUCT LAUNCHES

- TABLE 266 TRIOLIET: COMPANY OVERVIEW

- TABLE 267 TRIOLIET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 TRIOLIET: PRODUCT LAUNCHES

- TABLE 269 TRIOLIET: DEALS

- TABLE 270 TRIOLIET: EXPANSIONS

- TABLE 271 VDL AGROTECH BV: COMPANY OVERVIEW

- TABLE 272 VDL AGROTECH BV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 VDL AGROTECH BV: DEALS

- TABLE 274 SCALEAQ: COMPANY OVERVIEW

- TABLE 275 SCALEAQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 SCALEAQ: DEALS

- TABLE 277 AGCO CORPORATION: COMPANY OVERVIEW

- TABLE 278 AGCO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 BOUMATIC A/S A/S: COMPANY OVERVIEW

- TABLE 280 BOUMATIC A/S A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 BOUMATIC A/S A/S: DEALS

- TABLE 282 PELLON GROUP OY: COMPANY OVERVIEW

- TABLE 283 PELLON GROUP OY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 PELLON GROUP OY: PRODUCT LAUNCHES

- TABLE 285 ROVIBEC AGRISOLUTIONS: COMPANY OVERVIEW

- TABLE 286 ROVIBEC AGRISOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 CTB, INC.: COMPANY OVERVIEW

- TABLE 288 CTB, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 AKVA GROUP: COMPANY OVERVIEW

- TABLE 290 AKVA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 AKVA GROUP: DEALS

- TABLE 292 DAIRYMASTER: COMPANY OVERVIEW

- TABLE 293 DAIRYMASTER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 MASKINFABRIKKEN CORMALL A/S: COMPANY OVERVIEW

- TABLE 295 MASKINFABRIKKEN CORMALL A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 SCHAUER AGROTRONIC GMBH: COMPANY OVERVIEW

- TABLE 297 SCHAUER AGROTRONIC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 SCHAUER AGROTRONIC GMBH: DEALS

- TABLE 299 HETWIN AUTOMATION SYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 300 HETWIN AUTOMATION SYSTEMS GMBH: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 301 JH AGRO A/S: COMPANY OVERVIEW

- TABLE 302 JH AGRO A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 WASSERBAUER GMBH FEEDING SYSTEMS: COMPANY OVERVIEW

- TABLE 304 WASSERBAUER GMBH FEEDING SYSTEMS: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 305 WASSERBAUER GMBH FEEDING SYSTEMS: EXPANSIONS

- TABLE 306 VALMETAL: COMPANY OVERVIEW

- TABLE 307 VALMETAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 VIJAY RAJ POULTRY EQUIPMENTS PVT. LTD: COMPANY OVERVIEW

- TABLE 309 VIJAY RAJ POULTRY EQUIPMENTS PVT. LTD: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 310 EMILY ETS: COMPANY OVERVIEW

- TABLE 311 EMILY ETS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 SARL GALONNIER: COMPANY OVERVIEW

- TABLE 313 SARL GALONNIER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 BISON INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 315 BISON INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 ADJACENT MARKETS

- TABLE 317 PRECISION SWINE FARMING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 318 PRECISION SWINE FARMING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 319 FEED ROBOTICS MARKET, BY FARMING ENVIRONMENT, 2019-2023 (USD MILLION)

- TABLE 320 FEED ROBOTICS MARKET, BY FARMING ENVIRONMENT, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 FEEDING SYSTEMS MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 FEEDING SYSTEMS MARKET SIZE CALCULATION: SUPPLY SIDE

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 8 FEEDING SYSTEMS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 9 FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2025 VS. 2030 (USD MILLION)

- FIGURE 10 FEEDING SYSTEMS MARKET, BY FUNCTION, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 FEEDING SYSTEMS MARKET, BY OFFERING, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 FEEDING SYSTEMS MARKET SHARE AND GROWTH RATE, BY REGION, 2025

- FIGURE 13 RISING MECHANIZATION & AUTOMATION OF FARMS TO PROPEL MARKET

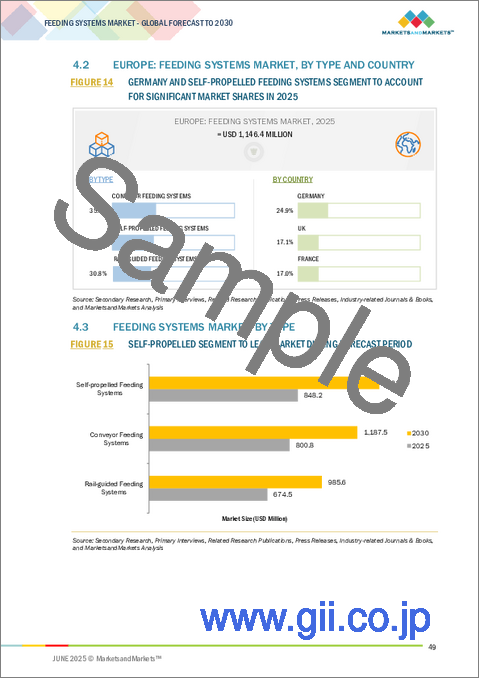

- FIGURE 14 GERMANY AND SELF-PROPELLED FEEDING SYSTEMS SEGMENT TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2025

- FIGURE 15 SELF-PROPELLED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 RUMINANTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 FILLING & SCREENING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 HARDWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 AUTOMATED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 US TO DOMINATE FEEDING SYSTEMS MARKET IN 2025

- FIGURE 21 CHICKEN MEAT PRODUCTION FOR KEY COUNTRIES, 2019-2023 (MILLION METRIC TONS)

- FIGURE 22 FEED PRODUCTION IN KEY REGIONS, 2023 (MILLION METRIC TONS)

- FIGURE 23 FEED PRODUCTION, BY LIVESTOCK FEED, 2022 VS. 2023 (MILLION METRIC TONS)

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FEEDING SYSTEMS MARKET

- FIGURE 25 GLOBAL CATTLE & SWINE STOCK, 2020-2022 (1,000 HEADS)

- FIGURE 26 ADOPTION OF GEN AI IN ANIMAL NUTRITION INDUSTRY

- FIGURE 27 FEEDING SYSTEMS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 FEEDING SYSTEMS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 IMPORT OF MACHINERY FOR PREPARING ANIMAL FEEDING STUFFS IN AGRICULTURAL HOLDINGS AND SIMILAR UNDERTAKINGS (EXCL. MACHINERY FOR FEEDING STUFF INDUSTRY, FORAGE HARVESTERS AND AUTOCLAVES FOR COOKING FODDER), BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 30 EXPORT OF MACHINERY FOR PREPARING ANIMAL FEEDING STUFFS IN AGRICULTURAL HOLDINGS AND SIMILAR UNDERTAKINGS (EXCL. MACHINERY FOR FEEDING STUFF INDUSTRY, FORAGE HARVESTERS AND AUTOCLAVES FOR COOKING FODDER) BY KEY COUNTRY, 2019-2023 (USD)

- FIGURE 31 AVERAGE SELLING PRICE TREND OF FEEDING SYSTEMS AMONG KEY PLAYERS, BY LIVESTOCK (USD/UNIT)

- FIGURE 32 FEEDING SYSTEMS MARKET: INDICATIVE PRICING ANALYSIS, BY REGION, 2021-2024 (USD /UNIT)

- FIGURE 33 MARKET MAP: FEEDING SYSTEMS MARKET

- FIGURE 34 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 35 NUMBER OF PATENTS GRANTED FOR FEEDING SYSTEMS MARKET, 2014-2024

- FIGURE 36 REGIONAL ANALYSIS OF PATENTS GRANTED FOR FEEDING SYSTEMS MARKET, 2023

- FIGURE 37 FEEDING SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY LIVESTOCK

- FIGURE 39 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 40 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD BILLION)

- FIGURE 41 FEEDING SYSTEMS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 42 FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 43 FEEDING SYSTEMS MARKET, BY OFFERING, 2025 VS. 2030 (USD MILLION)

- FIGURE 44 FEEDING SYSTEMS MARKET, BY FUNCTION, 2025 VS. 2030 (USD MILLION)

- FIGURE 45 FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2025 VS. 2030 (USD MILLION)

- FIGURE 46 GERMANY TO BE FASTEST-GROWING COUNTRY-LEVEL MARKET, 2025-2030

- FIGURE 47 MEXICO PRODUCTION DATA OF LIVESTOCK, 2020-2023

- FIGURE 48 EUROPE: FEEDING SYSTEMS MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: FEEDING SYSTEMS MARKET SNAPSHOT

- FIGURE 50 REVENUE ANALYSIS FOR KEY COMPANIES IN LAST 3 YEARS, 2022-2024 (USD BILLION)

- FIGURE 51 SHARE OF LEADING PLAYERS IN FEEDING SYSTEMS MARKET, 2024

- FIGURE 52 RANKING OF TOP FIVE PLAYERS IN FEEDING SYSTEMS MARKET

- FIGURE 53 FEEDING SYSTEMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 FEEDING SYSTEMS MARKET: COMPANY FOOTPRINT

- FIGURE 55 FEEDING SYSTEMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 56 COMPANY VALUATION FOR TWO MAJOR PLAYERS IN FEEDING SYSTEMS MARKET

- FIGURE 57 EV/EBITDA OF MAJOR PLAYERS

- FIGURE 58 FEEDING SYSTEMS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 59 TETRA LAVAL: COMPANY SNAPSHOT

- FIGURE 60 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 61 LELY: COMPANY SNAPSHOT

- FIGURE 62 SCALEAQ: COMPANY SNAPSHOT

- FIGURE 63 AGCO CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 AKVA GROUP: COMPANY SNAPSHOT

The global market for feeding systems is estimated to be USD 3.46 billion in 2025 and is projected to reach USD 5.10 billion by 2030, at a CAGR of 8.1% during the forecast period. The feeding systems industry is essential for modern livestock production, providing efficient, accurate, and automated feeding solutions for animals such as cattle, poultry, swine, and those in aquaculture. The systems are designed to streamline feed delivery, reduce loss, and deliver the right nutrients to animals at the right time and in the right quantity, enabling healthier livestock and more efficient operations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (Units) |

| Segments | By Livestock, Type, Offering, Technology, Function, Power Source, Farm Size, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

As farming becomes more rigorous and technology-dependent, feeding systems are evolving from simple mechanized installations to highly complex, sensor-based, and fully automated feed management solutions. Increased incorporation of such sophisticated systems is transforming feed management within farms, resulting in increased productivity and enhanced sustainability. This change is driving a strong expansion in the global feeding systems market, driven by technological change, vibrant consumer needs, and the reforming landscape of animal agriculture.

"The automated segment is projected to register a significant CAGR during the forecast period."

The automated segment of feeding systems is gaining significant traction due to its efficiency in farming activities and its ability to save labor costs. Technologies such as robotics, telemetry, RFID, guidance, and remote sensing provide accurate precision and timely control of feed distribution. This ensures maximum nutrition while reducing waste, ultimately enhancing productivity and improving the health of the animal population. Robotic telemetry in automatic feeding systems combines robotics and telemetry to automate feed delivery and monitor livestock in real-time. Robotics handles the physical tasks of mixing, transporting, and dispensing feed, while telemetry systems collect and transmit data on feed consumption, animal behavior, and environmental conditions. This technology is changing livestock farming by reducing labor requirements, improving feed precision, and enhancing animal welfare. Widely used in dairy, poultry, and swine operations, robotic telemetry systems integrate with IoT and AI to provide data-driven insights, enabling farmers to optimize feeding processes and improve farm productivity.

"The ruminant segment is estimated to hold a significant market share during the forecast period."

Ruminants provide essential sources of milk and meat, and the quality of these outputs is directly influenced by the quality and accuracy of feed delivery. Advanced animal feeding technologies are critical in minimizing microbial-related diseases, improving feed efficiency, and supporting animal growth. A July 2023 report from the Agriculture and Horticulture Development Board noted that global beef production had reached 59.6 million tonnes, highlighting a growing trend toward large-scale beef farming. Managing these larger herds increasingly depends on advanced automated feeding systems, which have evolved into sophisticated, sensor-equipped, and fully automated solutions. The change toward larger, more efficient farming operations is creating significant growth prospects for manufacturers of feeding systems. Additionally, as concerns about food security and sustainable agriculture intensify, livestock producers are prioritizing feed efficiency and waste minimization.

"Asia Pacific is estimated to account for a significant share of the feeding systems market."

There is a fast-changing trend of consumer tastes in Asia Pacific nations toward protein-dominant diets due to rapid urbanization and rising disposable incomes, driving demand for quality animal feed and effective feeding systems. Government initiatives, such as India's National Livestock Mission Scheme, which offers subsidies on feed infrastructure, are also encouraging the use of advanced feeding technologies within the region. Technological advancements in the industry, particularly those with AI-driven systems and IoT, are transforming the market by enabling real-time monitoring and predictive analysis. For instance, in January 2024, Precision Livestock Technologies unveiled an AI-driven system that can predict cattle feed intake, thereby enhancing feeding efficiency and farm profitability. The industrial modernization of livestock farming in the Asia Pacific region is creating tremendous opportunities for the feeding systems industry. The increasing demand for commercial feed solutions among local farmers is driving the adoption of advanced feeding technologies, making these trends key factors in the growth of the feeding systems market in the Asia Pacific region. Since ruminants are essential for producing milk and meat, the accuracy and quality of feed delivery have a direct impact on the quality of these animal products. Consequently, advanced animal feeding technologies are crucial for minimizing microbial-related diseases, improving feed efficiency, and promoting animal growth.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the feeding systems market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Others - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World -10%

Prominent companies in the market include DeLaval (Sweden), GEA Group Aktiengesellschaft (Germany), Lely (Netherlands), Trioliet B.V. (Netherlands), VDL Agrotech (Netherlands), ScaleAQ (Norway), AGCO Corporation (US), BouMatic (US), Pellon Group Oy (Finland), Rovibec Agrisolutions (Canada), CTB, Inc. (US), AKVA Group (Norway), Dairymaster (US), Maskinfabrikken Cormall A/S (Denmark), and Schauer Agrotronic GmbH (Austria).

Other players include HETWIN Automation Systems GmbH (Austria), and JH AGRO A/S (Denmark), WASSERBAUER GmbH Feeding Systems (Austria), Valmetal (Canada), Vijay Raj Poultry Equipments Pvt Ltd (India), EMILY Ets (France), SARL GALONNIER (France), Bison Industries, Inc. (US), SIEPLO (Netherlands), Feedtech Feeding Systems (Australia), One2Feed (Denmark), and Cloverdale Equipment (US).

Research Coverage:

This research report categorizes the feeding systems market by type (rail-guided, conveyor belt, self-propelled), livestock (ruminant, poultry, swine), offering (hardware, software, services), technology, function, farm size, power source, and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the market growth. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the feeding systems market. This report covers a competitive analysis of upcoming startups in the feeding systems market ecosystem. Furthermore, technology analysis, ecosystem and market mapping, patent analysis, and regulatory landscape, among others, are also covered in the study.

Reasons to Buy this Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall feeding systems and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growing number of dairy farms), restraints (high setup charges of automatic feeding systems), opportunities (remarkable growth opportunities for feeding systems in developing countries), and challenges (lack of standardization of feeding systems technology) influencing the growth of the feeding systems market.

- New Product Launch/Innovation: Detailed insights on research & development activities and new product launches in the feeding systems market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the feeding systems across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the feeding systems market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product food prints of leading players, such as GEA Group Aktiengesellschaft (Germany), Lely (Netherlands), DeLaval (Sweden), ScaleAQ (Norway), and Trioliet (Netherlands), and other players in the feeding systems market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FEEDING SYSTEMS MARKET

- 4.2 EUROPE: FEEDING SYSTEMS MARKET, BY TYPE AND COUNTRY

- 4.3 FEEDING SYSTEMS MARKET, BY TYPE

- 4.4 FEEDING SYSTEMS MARKET, BY LIVESTOCK

- 4.5 FEEDING SYSTEMS MARKET, BY FUNCTION

- 4.6 FEEDING SYSTEMS MARKET, BY OFFERING

- 4.7 FEEDING SYSTEMS MARKET, BY TECHNOLOGY AND REGION

- 4.8 FEEDING SYSTEMS MARKET: REGIONAL SNAPSHOT

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INCREASING DEMAND AND PRODUCTION OF POULTRY MEAT

- 5.2.2 RISING FEED PRODUCTION IN KEY REGIONS

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Growth in livestock production

- 5.3.1.2 Surging labor costs and rising demand for automation in livestock industry

- 5.3.1.3 Increasing efficiency associated with advanced feeding systems

- 5.3.2 RESTRAINTS

- 5.3.2.1 High cost of feeding systems and regular maintenance requirement

- 5.3.2.2 Lack of awareness and availability of new technologies to small-scale farmers

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Collaboration with tech companies for innovative solutions

- 5.3.3.2 Rising automation in livestock farming

- 5.3.4 CHALLENGES

- 5.3.4.1 Integration with existing infrastructure

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON ANIMAL NUTRITION

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN ANIMAL NUTRITION

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Cainthus introduced AI-powered smart cameras to track livestock behavior

- 5.4.3.2 Cargill Incorporated launched two AI tools for optimizing poultry production

- 5.4.4 IMPACT OF AI ON FEEDING SYSTEMS MARKET

- 5.4.5 IMPACT OF GEN AI ON ADJACENT ECOSYSTEM

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.3.2 HARDWARE COMPONENT PROVIDERS AND SOFTWARE PROVIDERS

- 6.3.3 SERVICE PROVIDERS

- 6.3.4 SUPPLIERS & DISTRIBUTORS

- 6.3.5 END USERS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO OF MACHINERY FOR PREPARING ANIMAL FEEDING STUFFS IN AGRICULTURAL HOLDINGS AND SIMILAR UNDERTAKINGS (EXCL. MACHINERY FOR FEEDING STUFF INDUSTRY, FORAGE HARVESTERS AND AUTOCLAVES FOR COOKING FODDER)

- 6.4.2 EXPORT SCENARIO OF MACHINERY FOR PREPARING ANIMAL FEEDING STUFFS IN AGRICULTURAL HOLDINGS AND SIMILAR UNDERTAKINGS (EXCL. MACHINERY FOR FEEDING STUFF INDUSTRY, FORAGE HARVESTERS AND AUTOCLAVES FOR COOKING FODDER), BY KEY COUNTRY

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Artificial intelligence

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Smart camera systems

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 GPS-based systems

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND OF FEEDING SYSTEMS AMONG KEY PLAYERS, BY LIVESTOCK

- 6.6.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS DURING 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.11.2.1 Introduction

- 6.11.2.2 North America

- 6.11.2.3 Europe

- 6.11.3 INTERNATIONAL FEED INDUSTRY FEDERATION (IFIF)

- 6.11.4 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)

- 6.11.5 INTERNATIONAL ELECTRONICS SYMPOSIUM (IES)

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 ONE2FEED: MIXING & FEEDING EFFICIENCY PROVIDED BY AUTOMATED FEEDING ROBOTICS

- 6.14.2 GIORDANO POULTRY PLAST (GPP): EFFECTIVE SOLUTION FOR ENTIRE POULTRY PRODUCTION CHAIN

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 FEEDING SYSTEMS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 RAIL-GUIDED FEEDING SYSTEMS

- 7.2.1 RAIL-GUIDED FEEDING SYSTEMS BOOST EFFICIENCY OF FEEDING OPERATIONS

- 7.3 CONVEYOR FEEDING SYSTEMS

- 7.3.1 CONVEYOR FEEDING SYSTEMS FACILITATE EVEN DISTRIBUTION OF FODDER AND FEED TO FARM ANIMALS

- 7.3.2 BELT FEEDING SYSTEMS

- 7.3.3 PAN FEEDING SYSTEMS

- 7.3.4 CHAIN FEEDING SYSTEMS

- 7.4 SELF-PROPELLED FEEDING SYSTEMS

- 7.4.1 SELF-PROPELLED FEEDING SYSTEMS HELP IN PLANNING PRECISE RATION PER HEAD

8 FEEDING SYSTEMS MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 MANUAL

- 8.2.1 EASY HANDLING OF EQUIPMENT TO DRIVE DEMAND

- 8.3 AUTOMATIC

- 8.3.1 RISING ADOPTION OF CLOUD-BASED TECHNOLOGIES TO INFLUENCE FEEDING SYSTEMS MARKET

- 8.3.2 ROBOTIC & TELEMETRY

- 8.3.3 RFID TECHNOLOGY

- 8.3.4 GUIDANCE & REMOTE-SENSING TECHNOLOGY

- 8.3.5 OTHER SUB-TYPES

9 FEEDING SYSTEMS MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 HARDWARE

- 9.2.1 HARDWARE OFFERS HIGH RELIABILITY AND REDUCES DAILY WORKLOAD

- 9.3 SOFTWARE

- 9.3.1 SOFTWARE SYSTEMS REDUCE OPERATIONAL ERRORS, RESULTING IN HIGHER PRODUCTION RATE

- 9.4 SERVICES

- 9.4.1 FACILITATES OPTIMUM USAGE OF RESOURCES BY PROVIDING CLIMATE INFORMATION, FINANCIAL MANAGEMENT, AND INVENTORY CONTROL

10 FEEDING SYSTEMS MARKET, BY FUNCTION

- 10.1 INTRODUCTION

- 10.2 CONTROLLING

- 10.2.1 RISING MEAT & POULTRY INDUSTRY TO DRIVE MARKET

- 10.3 MIXING

- 10.3.1 FEED MIXING EQUIPMENT HELPS MEET NUTRITIONAL REQUIREMENTS OF LIVESTOCK

- 10.4 FILLING & SCREENING

- 10.4.1 FILLING & SCREENING EXECUTE WIDE RANGE OF FEEDING ACTIVITIES, RESULTING IN CONSISTENT HIGH DEMAND

- 10.5 OTHER FUNCTIONS

11 FEEDING SYSTEMS MARKET, BY LIVESTOCK

- 11.1 INTRODUCTION

- 11.2 RUMINANTS

- 11.2.1 CONTROL OVER FEED TIME AND QUANTITY TO INCREASE DEMAND FOR RUMINANT FEEDING SYSTEMS

- 11.2.2 BEEF CATTLE

- 11.2.3 DAIRY CATTLE

- 11.2.4 OTHER RUMINANTS

- 11.3 POULTRY

- 11.3.1 RISING POULTRY MEAT DEMAND TO DRIVE GROWTH OF EFFECTIVE FEEDING SYSTEMS

- 11.3.2 BROILERS

- 11.3.3 LAYERS

- 11.3.4 BREEDERS

- 11.4 SWINE

- 11.4.1 EXPANDING PORK MARKET TO DRIVE INVESTMENTS IN ADVANCED FEEDING TECHNOLOGIES

- 11.4.2 STARTER

- 11.4.3 GROWERS

- 11.4.4 SOWS

- 11.5 OTHER LIVESTOCK

12 FEEDING SYSTEMS MARKET, BY POWER SOURCE

- 12.1 INTRODUCTION

- 12.2 ELECTRIC FEEDING SYSTEMS

- 12.2.1 SIMPLE CONTROL SYSTEMS MAKE ELECTRIC FEEDING SYSTEMS EASY TO OPERATE

- 12.3 HYDRAULIC/PNEUMATIC SYSTEMS

- 12.3.1 EASY HANDLING OF HYDRAULIC SYSTEMS TO DRIVE MARKET

- 12.4 BATTERY-OPERATED SYSTEMS

- 12.4.1 REDUCED FUEL COSTS BY ELIMINATING TRACTOR-FEEDING OPERATIONS

13 FEEDING SYSTEMS MARKET, BY FARM SIZE

- 13.1 INTRODUCTION

- 13.2 SMALL-SCALE FARMS

- 13.2.1 INCREASING AUTOMATION TO DRIVE DEMAND

- 13.3 COMMERCIAL FARMS

- 13.3.1 RISING LABOR COSTS TO DRIVE NEED FOR AUTOMATION

- 13.4 INDUSTRIAL FARMS

- 13.4.1 NEED TO MINIMIZE FEED WASTAGE TO DRIVE MARKET

14 FEEDING SYSTEMS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 US

- 14.2.1.1 Rising poultry industry to drive market

- 14.2.2 CANADA

- 14.2.2.1 Labor shortage to drive demand for automated feeding systems

- 14.2.3 MEXICO

- 14.2.3.1 Rising livestock production to drive demand for feeding systems

- 14.2.1 US

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Rising milk production and labor costs lead to automation

- 14.3.2 UK

- 14.3.2.1 Improvements in overall economy to fuel market growth

- 14.3.3 FRANCE

- 14.3.3.1 Largest beef producer to drive market

- 14.3.4 ITALY

- 14.3.4.1 Export of beef to other countries to influence demand

- 14.3.5 SPAIN

- 14.3.5.1 Growth in meat industry to increase market demand

- 14.3.6 REST OF EUROPE

- 14.3.1 GERMANY

- 14.4 ASIA PACIFIC

- 14.4.1 CHINA

- 14.4.1.1 Increase in meat demand to drive market

- 14.4.2 INDIA

- 14.4.2.1 Increased production of milk & meat to boost market

- 14.4.3 JAPAN

- 14.4.3.1 Growth of livestock sector to drive demand

- 14.4.4 AUSTRALIA & NEW ZEALAND

- 14.4.4.1 Rising production & export of meat to drive demand

- 14.4.5 REST OF ASIA PACIFIC

- 14.4.1 CHINA

- 14.5 SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.5.1.1 Increased exports of meat products to support feeding systems use

- 14.5.2 ARGENTINA

- 14.5.2.1 Increased demand for beef/cattle to drive market

- 14.5.3 REST OF SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.6 REST OF THE WORLD (ROW)

- 14.6.1 MIDDLE EAST

- 14.6.1.1 Rising meat production to boost demand

- 14.6.2 AFRICA

- 14.6.2.1 Increasing livestock production to drive demand

- 14.6.1 MIDDLE EAST

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.3 REVENUE ANALYSIS

- 15.4 MARKET SHARE ANALYSIS

- 15.4.1 MARKET RANKING ANALYSIS

- 15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- 15.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.5.5.1 Company footprint

- 15.5.5.2 Type footprint

- 15.5.5.3 Livestock footprint

- 15.5.5.4 Offering footprint

- 15.5.5.5 Region footprint

- 15.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- 15.6.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2024

- 15.6.5.1 Detailed list of key startups/SMEs

- 15.6.5.2 Competitive benchmarking of startups/SMEs

- 15.7 COMPANY VALUATION AND FINANCIAL METRICS

- 15.8 BRAND/PRODUCT COMPARISON

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 TETRA LAVAL

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 GEA GROUP AKTIENGESELLSCHAFT

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 LELY

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 TRIOLIET

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 VDL AGROTECH BV

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 SCALEAQ

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Deals

- 16.1.6.4 MnM view

- 16.1.7 AGCO CORPORATION

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 MnM view

- 16.1.8 BOUMATIC A/S A/S

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.8.4 MnM view

- 16.1.9 PELLON GROUP OY

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches

- 16.1.9.4 MnM view

- 16.1.10 ROVIBEC AGRISOLUTIONS

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 MnM view

- 16.1.11 CTB, INC. (BERKSHIRE HATHAWAY)

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.11.3 MnM view

- 16.1.12 AKVA GROUP

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Deals

- 16.1.12.4 MnM view

- 16.1.13 DAIRYMASTER

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.13.3 MnM view

- 16.1.14 MASKINFABRIKKEN CORMALL A/S

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Solutions/Services offered

- 16.1.14.3 MnM view

- 16.1.15 SCHAUER AGROTRONIC GMBH

- 16.1.15.1 Business overview

- 16.1.15.2 Products/Solutions/Services offered

- 16.1.15.3 Recent developments

- 16.1.15.3.1 Deals

- 16.1.15.4 MnM view

- 16.1.1 TETRA LAVAL

- 16.2 OTHER PLAYERS

- 16.2.1 HETWIN AUTOMATION SYSTEMS GMBH

- 16.2.1.1 Business overview

- 16.2.1.2 Products/Solutions/Services offered

- 16.2.1.3 MnM view

- 16.2.2 JH AGRO A/S

- 16.2.2.1 Business overview

- 16.2.2.2 Products/Solutions/Services offered

- 16.2.2.3 MnM view

- 16.2.3 WASSERBAUER GMBH FEEDING SYSTEMS

- 16.2.3.1 Business overview

- 16.2.3.2 Products/Solutions/Services offered

- 16.2.3.3 Recent developments

- 16.2.3.3.1 Expansions

- 16.2.3.4 MnM view

- 16.2.4 VALMETAL

- 16.2.4.1 Business overview

- 16.2.4.2 Products/Solutions/Services offered

- 16.2.4.3 MnM view

- 16.2.5 VIJAY RAJ POULTRY EQUIPMENTS PVT. LTD

- 16.2.5.1 Business overview

- 16.2.5.2 Products/Solutions/Services offered

- 16.2.5.3 MnM view

- 16.2.6 EMILY ETS

- 16.2.6.1 Business overview

- 16.2.6.2 Products/Solutions/Services offered

- 16.2.6.3 MnM view

- 16.2.7 SARL GALONNIER

- 16.2.7.1 Business overview

- 16.2.7.2 Products/Solutions/Services offered

- 16.2.7.3 MnM view

- 16.2.8 BISON INDUSTRIES, INC.

- 16.2.8.1 Business overview

- 16.2.8.2 Products/Solutions/Services offered

- 16.2.8.3 MnM view

- 16.2.9 SIEPLO

- 16.2.10 FEEDTECH FEEDING SYSTEMS PTY LTD (TREVASKIS ENGINEERING)

- 16.2.11 ONE2FEED A/S

- 16.2.12 CLOVERDALE EQUIPMENT, LLC

- 16.2.1 HETWIN AUTOMATION SYSTEMS GMBH

17 ADJACENT & RELATED MARKETS

- 17.1 INTRODUCTION

- 17.2 STUDY LIMITATIONS

- 17.3 PRECISION SWINE FARMING MARKET

- 17.3.1 MARKET DEFINITION

- 17.3.2 MARKET OVERVIEW

- 17.4 FEED ROBOTICS MARKET

- 17.4.1 MARKET DEFINITION

- 17.4.2 MARKET OVERVIEW

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS