|

|

市場調査レポート

商品コード

1754856

ヘルスケアデータの収益化の世界市場:タイプ別、データタイプ別、展開別、エンドユーザー別、地域別 - 2030年までの予測Healthcare Data Monetization Market by Type (Direct, Indirect), Deployment (On-premise, Cloud), End User (Pharmaceutical & Biotechnology Companies, Healthcare Payers, Healthcare Providers, Medical Technology Companies) & Region- Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ヘルスケアデータの収益化の世界市場:タイプ別、データタイプ別、展開別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月18日

発行: MarketsandMarkets

ページ情報: 英文 334 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

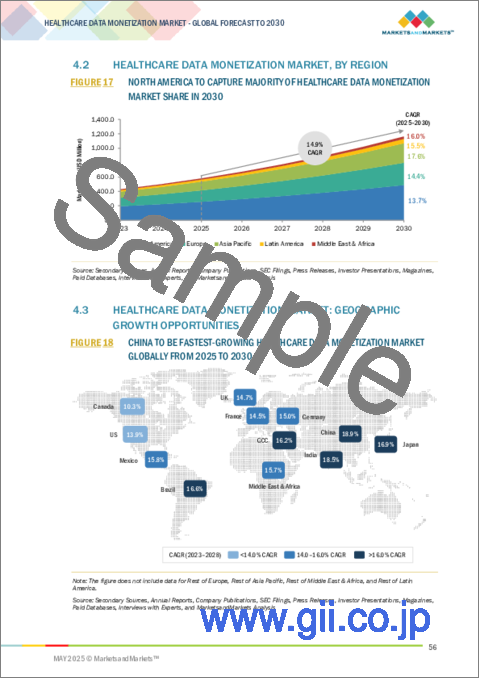

世界のヘルスケアデータの収益化の市場規模は、予測期間中に14.9%のCAGRで拡大し、2025年の5億8,000万米ドルから2030年には11億6,000万米ドルに達すると予測されています。

同市場の成長は、主に医用画像データ量の増加、企業全体の相互運用性へのシフト、画像処理ワークフローを合理化する一元化されたベンダーニュートラルなプラットフォームに対する需要の高まりによってもたらされます。さらに、ヘルスケアのデジタル化構想や医療情報交換に対する規制当局の支援が、市場の拡大をさらに促進しています。しかし、高い導入コストとデータ移行に関する課題が、特に中小規模のヘルスケアプロバイダーにおいて、先進的なベンダーニュートラルアーカイブ(VNA)および画像保管通信システム(PACS)ソリューションの採用を妨げる要因となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | タイプ別、データタイプ別、展開別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

タイプ別では、ヘルスケアデータの収益化市場は直接データ収益化と間接データ収益化に区分されます。直接データ収益化セグメントはソフトウェアとサービスに分けられます。同様に、間接データ収益化市場もソフトウェアとサービスに分類されます。このうち、間接データ収益化のサービス・サブセグメントが予測期間中に最も急成長すると予想されます。この成長の原動力は、複雑な健康データから実用的な知見を抽出するための専門知識に対する需要の高まりです。高度な分析、相互運用性、実世界のエビデンスへの注目が高まり続ける中、サービスプロバイダーはデータを直接販売することなく収益化の可能性を引き出すためにヘルスケア組織を支援しています。Innovaccer、Komodo Health、IQVIAなどの企業は、データ統合、予測モデリング、戦略的コラボレーションを可能にするプラットフォームやコンサルティングサービスを提供しています。これらの取り組みは、バリューベースのケア、調査、製品イノベーションを通じて収益を促進するのに役立ちます。

展開モデル別では、オンプレミス展開モデルが2024年のヘルスケアデータの収益化市場で最大のシェアを占めましたが、これは主にデータセキュリティ、管理、コンプライアンスにおける優位性によるものです。ヘルスケア機関は非常に機密性の高い患者情報を取り扱っており、HIPAA、GDPR、国内データ保護法などの厳しい規制要件を遵守しなければならないです。オンプレミス・システムでは、こうした機関がデータ・インフラを直接管理できるため、侵害や不正アクセスに対する保護が強化されます。また、多くの大規模病院やヘルスケアプロバイダーは、オンプレミス・ソリューションとより効果的に連携するレガシーシステムやIT投資を行っており、より優れた統合、カスタマイズ、パフォーマンスの最適化を可能にしています。この展開モデルは、データ居住に関する法律が厳しい地域や、クラウドインフラが限られている地域で特に好まれ、大きな市場シェアにつながっています。

アジア太平洋地域は、予測期間中、世界のヘルスケアデータの収益化市場で最も高いCAGRを達成すると予想されています。この成長の原動力は、強力なデジタルヘルスへの取り組みとクラウドインフラの拡大です。インドのAyushman Bharat Digital Missionや中国のHealth Information Platformのようなイニシアティブは、収益化に適した大量の医療データを生成します。さらに、マイクロソフトのマレーシアへの22億米ドルの投資や、富士通の日本におけるクラウドベースのプラットフォームなどに見られるように、世界・テクノロジー企業は地域能力を強化しています。このような開発により、効率的でコンプライアンスが高く、価値主導のヘルスケアデータの収益化のための強固な基盤が構築されています。

当レポートでは、世界のヘルスケアデータの収益化市場について調査し、タイプ別、データタイプ別、展開別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- ヘルスケアデータの収益化ソリューションの種類

- 技術分析

- 規制状況

- サプライチェーン分析

- エコシステム分析

- 特許分析

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 2025年の主な会議とイベント

- 平均販売価格:データ収益化市場

- 顧客ビジネスに影響を与える動向/混乱

第6章 2025年の米国関税が医療データ収益化市場に与える影響

- イントロダクション

- 主要関税率

- 価格影響分析

- 国/地域への影響

- エンドユーザーへの影響

第7章 ヘルスケアデータの収益化市場(タイプ別)

- イントロダクション

- 直接的なデータ収益化

- 間接的なデータ収益化

第8章 ヘルスケアデータの収益化市場(データタイプ別)

- イントロダクション

- 臨床データ

- 臨床試験データ

- 請求および請求データ

- 消費者とデジタルヘルスデータ

- ゲノムおよび分子データ

- その他のデータ型

第9章 ヘルスケアデータの収益化市場(展開別)

- イントロダクション

- オンプレミス

- クラウドベース

第10章 ヘルスケアデータの収益化市場(エンドユーザー別)

- イントロダクション

- 製薬・バイオテクノロジー企業

- ヘルスケア支払者

- ヘルスケアプロバイダー

- 医療技術企業

- その他

第11章 ヘルスケアデータの収益化市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/ソフトウェア比較

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- ORACLE

- MICROSOFT

- SALESFORCE, INC.

- SAS INSTITUTE INC.

- SAP SE

- TIBCO SOFTWARE INC.

- SNOWFLAKE INC.

- QLIKTECH INTERNATIONAL AB

- INFOSYS LIMITED

- SISENSE INC.

- ACCENTURE

- AVAILITY, LLC

- DOMO, INC.

- KOMODO HEALTH, INC.

- VIRTUSA

- DATAVANT

- INFOR, INC.

- HEALTHVERITY, INC.

- THOUGHTSPOT INC.

- その他の企業

- VERATO

- PARTICLE HEALTH, INC.

- INNOVACCER, INC.

- H1

- MEDABLE INC.

第14章 付録

List of Tables

- TABLE 1 EXCHANGE RATES CONSIDERED FOR CONVERSION TO USD

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ASSUMPTIONS FOR RESEARCH STUDY

- TABLE 4 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 5 MAJOR HEALTHCARE DATA BREACHES (2021-2025)

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: REGULATIONS

- TABLE 8 EUROPE: REGULATIONS

- TABLE 9 ASIA PACIFIC: REGULATIONS

- TABLE 10 MIDDLE EAST & SOUTH AFRICA: REGULATIONS

- TABLE 11 LATIN AMERICA: REGULATIONS

- TABLE 12 HEALTHCARE DATA MONETIZATION MARKET: LIST OF PATENTS/PATENT APPLICATIONS, 2022-2025

- TABLE 13 HEALTHCARE DATA MONETIZATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 15 KEY BUYING CRITERIA, BY END USER (%)

- TABLE 16 HEALTHCARE DATA MONETIZATION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 17 COMMONLY ADOPTED PRICING STRATEGIES IN HEALTHCARE DATA MONETIZATION MARKET

- TABLE 18 MICROSOFT CORPORATION: PRICING OF AZURE HEALTH DATA SERVICES

- TABLE 19 MICROSOFT CORPORATION: PRICING OF AZURE API FOR FHIR

- TABLE 20 MICROSOFT CORPORATION: PRICING OF AZURE DATA SHARE

- TABLE 21 MICROSOFT CORPORATION: PRICING OF MEDIA SERVICES

- TABLE 22 SALESFORCE, INC.: PRICING OF HEALTH CLOUD

- TABLE 23 SALESFORCE, INC.: PRICING OF DATA CLOUD FOR HEALTH

- TABLE 24 SALESFORCE, INC.: PRICING OF ADDITIONAL SOLUTIONS

- TABLE 25 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 26 HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 27 HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 28 DIRECT DATA MONETIZATION: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 DIRECT DATA MONETIZATION: HEALTHCARE DATA MONETIZATION MARKET FOR SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 DIRECT DATA MONETIZATION: HEALTHCARE DATA MONETIZATION MARKET FOR SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 32 INDIRECT DATA MONETIZATION: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 INDIRECT DATA MONETIZATION: HEALTHCARE DATA MONETIZATION MARKET FOR SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 INDIRECT DATA MONETIZATION: HEALTHCARE DATA MONETIZATION MARKET FOR SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 36 CLINICAL DATA: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 CLINICAL TRIAL DATA: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 CLAIMS AND BILLING DATA: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 CONSUMER AND DIGITAL HEALTH DATA: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 GENOMIC AND MOLECULAR DATA: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 OTHER DATA TYPES: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 43 ON-PREMISES: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 CLOUD-BASED: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 46 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 HEALTHCARE PAYERS: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 HEALTHCARE PROVIDERS: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 MEDICAL TECHNOLOGY COMPANIES: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 OTHER END USERS: HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING 2023-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 59 US: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 60 US: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 61 US: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 62 US: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 63 US: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 64 US: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 65 CANADA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 66 CANADA: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 67 CANADA: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING 2023-2030 (USD MILLION)

- TABLE 68 CANADA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 69 CANADA: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 70 CANADA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 71 EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 73 EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 74 EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 75 EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 76 EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 77 EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 78 UK: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 UK: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 80 UK: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 81 UK: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 82 UK: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 83 UK: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 84 GERMANY: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 GERMANY: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 86 GERMANY: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 87 GERMANY: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 88 GERMANY: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 89 GERMANY: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 90 FRANCE: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 FRANCE: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION TYPE, 2023-2030 (USD MILLION)

- TABLE 92 FRANCE: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION TYPE, 2023-2030 (USD MILLION)

- TABLE 93 FRANCE: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 94 FRANCE: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 95 FRANCE: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 96 ITALY: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 ITALY: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 98 ITALY: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 99 ITALY: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 100 ITALY: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 101 ITALY: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 102 SPAIN: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 SPAIN: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 104 SPAIN: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 105 SPAIN: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 106 SPAIN: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 107 SPAIN: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 108 REST OF EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 REST OF EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 110 REST OF EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 111 REST OF EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 112 REST OF EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING , 2023-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING , 2023-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 121 JAPAN: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 JAPAN: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING , 2023-2030 (USD MILLION)

- TABLE 123 JAPAN: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 124 JAPAN: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 125 JAPAN: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 126 JAPAN: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 127 CHINA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 CHINA: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 129 CHINA: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 130 CHINA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 131 CHINA: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 132 CHINA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 133 INDIA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 INDIA: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 135 INDIA: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 136 INDIA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 137 INDIA: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 138 INDIA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 145 LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 146 LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 148 LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 149 LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 150 LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 151 LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 152 BRAZIL: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 BRAZIL: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 154 BRAZIL: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 155 BRAZIL: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 156 BRAZIL: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 157 BRAZIL: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 158 MEXICO: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 MEXICO: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 160 MEXICO: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 161 MEXICO: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 162 MEXICO: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 163 MEXICO: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 164 REST OF LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 REST OF LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 166 REST OF LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION TYPE, 2023-2030 (USD MILLION)

- TABLE 167 REST OF LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 168 REST OF LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 169 REST OF LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION TYPE, 2023-2030 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 177 GCC: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 GCC: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 179 GCC: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 180 GCC: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 181 GCC: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 182 GCC: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY DIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY INDIRECT DATA MONETIZATION OFFERING, 2023-2030 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE, 2023-2030 (USD MILLION)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 189 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN HEALTHCARE DATA MONETIZATION MARKET, JANUARY 2022-MAY 2025

- TABLE 190 HEALTHCARE DATA MONETIZATION MARKET: DEGREE OF COMPETITION

- TABLE 191 HEALTHCARE DATA MONETIZATION MARKET: REGION FOOTPRINT

- TABLE 192 HEALTHCARE DATA MONETIZATION MARKET: TYPE FOOTPRINT

- TABLE 193 HEALTHCARE DATA MONETIZATION MARKET: END USER FOOTPRINT

- TABLE 194 HEALTHCARE DATA MONETIZATION MARKET: DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 195 HEALTHCARE DATA MONETIZATION MARKET: COMPETITIVE BENCHMARKING OF KEY SMES SMES/STARTUPS

- TABLE 196 HEALTHCARE DATA MONETIZATION MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 197 HEALTHCARE DATA MONETIZATION MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 198 ORACLE: COMPANY OVERVIEW

- TABLE 199 ORACLE: PRODUCTS OFFERED

- TABLE 200 ORACLE: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 201 ORACLE: DEALS, JANUARY 2022-MAY 2025

- TABLE 202 MICROSOFT: COMPANY OVERVIEW

- TABLE 203 MICROSOFT: PRODUCTS OFFERED

- TABLE 204 MICROSOFT: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 205 MICROSOFT: DEALS, JANUARY 2022-MAY 2025

- TABLE 206 GOOGLE: COMPANY OVERVIEW

- TABLE 207 GOOGLE: PRODUCTS OFFERED

- TABLE 208 GOOGLE: PRODUCT LAUNCHES & ENHANCEMENTS, ENHANCEMENTS JANUARY 2021-MAY 2025

- TABLE 209 GOOGLE: DEALS, JANUARY 2021-MAY 2025

- TABLE 210 SALESFORCE, INC.: COMPANY OVERVIEW

- TABLE 211 SALESFORCE INC.: PRODUCTS OFFERED

- TABLE 212 SALESFORCE INC.: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 213 SALESFORCE INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 214 SAS INSTITUTE INC.: COMPANY OVERVIEW

- TABLE 215 SAS INSTITUTE INC.: PRODUCTS OFFERED

- TABLE 216 SAS INSTITUTE INC.: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 217 SAS INSTITUTE INC.: DEALS, JANUARY 2021-MAY 2025

- TABLE 218 SAP SE: COMPANY OVERVIEW

- TABLE 219 SAP SE: PRODUCTS OFFERED

- TABLE 220 SAP SE: PRODUCT LAUNCHES & ENHANCEMENTS, ENHANCEMENT JANUARY 2022-MAY 2025

- TABLE 221 SAP SE: DEALS, JANUARY 2021-MAY 2025

- TABLE 222 TIBCO SOFTWARE INC.: COMPANY OVERVIEW

- TABLE 223 TIBCO SOFTWARE INC.: PRODUCTS OFFERED

- TABLE 224 TIBCO SOFTWARE INC.: PRODUCT LAUNCHES, APPROVALS, & ENHANCEMENT JANUARY 2022-MAY 2025

- TABLE 225 TIBCO SOFTWARE INC: DEALS, JANUARY 2022-MAY 2025

- TABLE 226 SNOWFLAKE INC.: COMPANY OVERVIEW

- TABLE 227 SNOWFLAKE INC.: PRODUCTS OFFERED

- TABLE 228 SNOWFLAKE INC.: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 229 SNOWFLAKE INC.: DEALS, JANUARY 2021-MAY 2025

- TABLE 230 QLIKTECH INTERNATIONAL AB: COMPANY OVERVIEW

- TABLE 231 QLIKTECH INTERNATIONAL AB: PRODUCTS OFFERED

- TABLE 232 QLIKTECH INTERNATIONAL AB: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 233 QLIKTECH INTERNATIONAL AB: DEALS, JANUARY 2021-MAY 2025

- TABLE 234 INFOSYS LIMITED: COMPANY OVERVIEW

- TABLE 235 INFOSYS LIMITED: PRODUCTS OFFERED

- TABLE 236 INFOSYS LIMITED: DEALS, JANUARY 2021-MAY 2025

- TABLE 237 SISENSE INC.: COMPANY OVERVIEW

- TABLE 238 SISENSE INC.: PRODUCTS OFFERED

- TABLE 239 SISENSE INC.: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 240 SISENSE INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 241 ACCENTURE: COMPANY OVERVIEW

- TABLE 242 ACCENTURE: PRODUCTS OFFERED

- TABLE 243 ACCENTURE: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2021-FEBRUARY 2025

- TABLE 244 ACCENTURE: DEALS, JANUARY 2022-MAY 2025

- TABLE 245 AVAILITY, LLC: COMPANY OVERVIEW

- TABLE 246 AVAILITY, LLC: PRODUCTS OFFERED

- TABLE 247 ATHENAHEALTH, INC.: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 248 ATHENAHEALTH, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 249 DOMO, INC.: COMPANY OVERVIEW

- TABLE 250 DOMO, INC.: PRODUCTS OFFERED

- TABLE 251 DOMO, INC.: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 252 DOMO, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 253 KOMODO HEALTH, INC.: COMPANY OVERVIEW

- TABLE 254 KOMODO HEALTH, INC.: PRODUCTS OFFERED

- TABLE 255 KOMODO HEALTH, INC.: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 256 KOMODO HEALTH, INC.: DEALS, JANUARY 2021-MAY 2025

- TABLE 257 VIRTUSA: COMPANY OVERVIEW

- TABLE 258 VIRTUSA: PRODUCTS OFFERED

- TABLE 259 VIRTUSA: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 260 VIRTUSA: DEALS, JANUARY 2021-MAY 2025

- TABLE 261 DATAVANT: COMPANY OVERVIEW

- TABLE 262 DATAVANT: PRODUCTS OFFERED

- TABLE 263 DATAVANT: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 264 DATAVANT.: DEALS, JANUARY 2022-MAY 2025

- TABLE 265 INFOR, INC.: COMPANY OVERVIEW

- TABLE 266 INFOR, INC.: PRODUCTS OFFERED

- TABLE 267 INFOR, INC.: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 268 HEALTHVERITY, INC.: COMPANY OVERVIEW

- TABLE 269 HEALTHVERITY, INC.: PRODUCTS OFFERED

- TABLE 270 HEALTHVERITY, INC.: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 271 HEALTHVERITY, INC.: DEALS, JANUARY 2021-MAY 2025

- TABLE 272 THOUGHTSPOT INC.: COMPANY OVERVIEW

- TABLE 273 THOUGHTSPOT INC.: PRODUCTS OFFERED

- TABLE 274 THOUGHTSPOT INC.: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 275 THOUGHTSPOT INC.: DEALS, JANUARY 2021-MAY 2025

List of Figures

- FIGURE 1 HEALTHCARE DATA MONETIZATION MARKET: MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 APPROACH FOR ASSESSING SUPPLY OF HEALTHCARE DATA MONETIZATION SOLUTIONS

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HEALTHCARE DATA MONETIZATION MARKET

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 DIRECT DATA MONETIZATION SEGMENT TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 12 CLOUD-BASED HEALTHCARE DATA MONETIZATION MODELS TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 13 CLINICAL DATA SEGMENT TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 14 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES TO DOMINATE HEALTHCARE DATA MONETIZATION MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 15 NORTH AMERICA HELD LARGEST MARKET SHARE IN 2024

- FIGURE 16 EXPONENTIALLY INCREASING DATA VOLUMES AND GENERATION OF LARGE AND COMPLEX HEALTHCARE DATASETS TO DRIVE MARKET

- FIGURE 17 NORTH AMERICA TO CAPTURE MAJORITY OF HEALTHCARE DATA MONETIZATION MARKET SHARE IN 2030

- FIGURE 18 CHINA TO BE FASTEST-GROWING HEALTHCARE DATA MONETIZATION MARKET GLOBALLY FROM 2025 TO 2030

- FIGURE 19 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND US DOMINATED MARKET IN NORTH AMERICA IN 2024

- FIGURE 20 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: HEALTHCARE DATA MONETIZATION MARKET

- FIGURE 22 US: ADOPTION OF ELECTRONIC HEALTH RECORDS, BY HOSPITAL SERVICE TYPE (2021)

- FIGURE 23 COST OF GENOME ANALYSIS VS. VOLUME OF RAW DATA GENERATED, 2003-2023

- FIGURE 24 US HEALTHCARE SPENDING, 2012-2030 (USD BILLION)

- FIGURE 25 US: NUMBER OF DATA BREACHES (JANUARY 2009-MAY 2023)

- FIGURE 26 DIRECT VS. INDIRECT DATA MONETIZATION

- FIGURE 27 HEALTHCARE DATA MONETIZATION MARKET: SUPPLY CHAIN

- FIGURE 28 HEALTHCARE DATA MONETIZATION ECOSYSTEM

- FIGURE 29 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR HEALTHCARE DATA MONETIZATION SOLUTIONS, JANUARY 2015-MAY 2025

- FIGURE 30 TOP APPLICANT COUNTRIES/JURISDICTIONS FOR PATENTS RELATED TO HEALTHCARE DATA MONETIZATION, JANUARY 2015-MAY 2025

- FIGURE 31 HEALTHCARE DATA MONETIZATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 33 KEY BUYING CRITERIA, BY END USER

- FIGURE 34 PRICING ANALYSIS: DATA MONETIZATION MARKET

- FIGURE 35 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 36 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET SNAPSHOT

- FIGURE 38 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2020-2024

- FIGURE 39 HEALTHCARE DATA MONETIZATION MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 40 HEALTHCARE DATA MONETIZATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 HEALTHCARE DATA MONETIZATION MARKET: COMPANY FOOTPRINT

- FIGURE 42 HEALTHCARE DATA MONETIZATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 43 EV/EBITDA OF KEY VENDORS

- FIGURE 44 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 45 HOSPITAL INFORMATION SYSTEMS MARKET: BRAND/SOFTWARE COMPARATIVE ANALYSIS

- FIGURE 46 ORACLE: COMPANY SNAPSHOT

- FIGURE 47 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 48 GOOGLE: COMPANY SNAPSHOT

- FIGURE 49 SALESFORCE, INC.: COMPANY SNAPSHOT

- FIGURE 50 SAP SE: COMPANY SNAPSHOT

- FIGURE 51 SNOWFLAKE INC.: COMPANY SNAPSHOT

- FIGURE 52 INFOSYS LIMITED: COMPANY SNAPSHOT

- FIGURE 53 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 54 DOMO, INC.: COMPANY SNAPSHOT

The global healthcare data monetization market is projected to reach USD 1.16 billion by 2030 from USD 0.58 billion in 2025, at a CAGR of 14.9% during the forecast period. The growth of the market is mainly driven by the increasing volume of medical imaging data, the shift towards enterprise-wide interoperability, and the rising demand for centralized, vendor-neutral platforms that streamline imaging workflows. Additionally, healthcare digitization initiatives and regulatory support for health information exchange are further promoting market expansion. However, high implementation costs and challenges related to data migration continue to hinder the adoption of advanced Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) solutions, particularly among small and mid-sized healthcare providers.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, Deployment, and End User |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa |

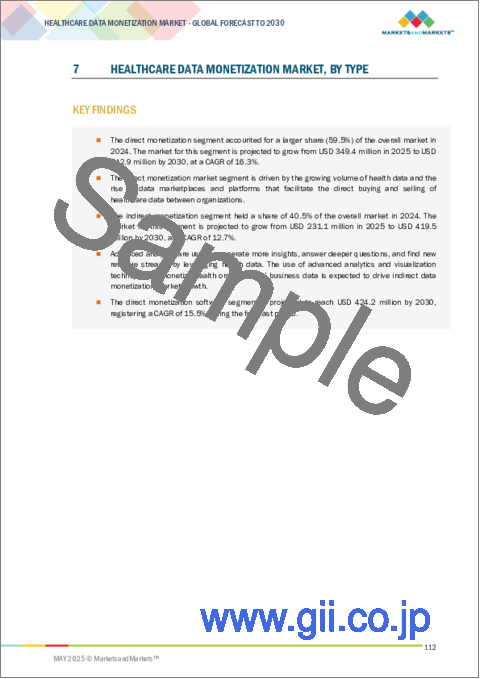

"Services, an indirect data monetization segment, will witness the highest growth during the forecast period."

Based on type, the healthcare data monetization market is segmented into direct and indirect data monetization. The direct data monetization segment is divided into software and services. Similarly, the indirect data monetization market is also categorized into software and services. Among these, the services subsegment of indirect data monetization is expected to experience the fastest growth during the forecast period. This growth is driven by the increasing demand for specialized expertise in extracting actionable insights from complex health data. As the focus on advanced analytics, interoperability, and real-world evidence continues to rise, service providers are assisting healthcare organizations in unlocking monetization potential without directly selling data. Companies such as Innovaccer, Komodo Health, and IQVIA offer platforms and consulting services that enable data integration, predictive modeling, and strategic collaborations. These efforts help drive revenue through value-based care, research, and product innovation.

"The on-premise segment held the largest segment in the healthcare data monetization market, by deployment model, in 2024."

By deployment model, the on-premise deployment model held the largest share of the healthcare data monetization market in 2024, primarily due to its advantages in data security, control, and compliance. Healthcare organizations handle highly sensitive patient information and must comply with strict regulatory requirements such as HIPAA, GDPR, and national data protection laws. On-premises systems allow these institutions to maintain direct control over their data infrastructure, which enhances protection against breaches and unauthorized access. Many large hospitals and healthcare providers also have legacy systems and IT investments that work more effectively with on-premises solutions, enabling better integration, customization, and performance optimization. This deployment model is especially preferred in regions with strict data residency laws or limited cloud infrastructure, contributing to its significant market share.

"The Asia Pacific market is expected to register the highest growth throughout the forecast period."

The Asia Pacific (APAC) region is expected to achieve the highest CAGR in the global healthcare data monetization market during the forecast period. This growth is driven by strong digital health initiatives and the expansion of cloud infrastructure. Initiatives like India's Ayushman Bharat Digital Mission and China's Health Information Platform generate large volumes of health data that are well-suited for monetization. Additionally, global technology companies are enhancing regional capabilities, as seen in Microsoft's USD 2.2 billion investment in Malaysia and Fujitsu's cloud-based platform in Japan. These developments create a robust foundation for efficient, compliant, and value-driven healthcare data monetization.

The breakdown of primary participants is as mentioned below:

- By Company Type: Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation: C-level: 42%, Director-level: 31%, and Others: 27%

- By Region: North America: 35%, Europe: 30%, Asia Pacific: 25%, Middle East & Africa: 5%, Latin America: 5%

Key Players in the Healthcare Data Monetization Market

The key players functioning in the healthcare data monetization market include Oracle Corporation (US), Microsoft Corporation (US), Google (US), Salesforce, Inc. (US), SAS Institute Inc. (US), SAP SE (Germany), TIBCO Software Inc. (US), Sisense Inc. (US), Snowflake Inc. (US), QlikTech International AB (US), HealthVerity, Inc. (US), Accenture (Ireland), Availity, LLC (US), Domo, Inc. (US), Komodo Health, Inc. (US), ThoughtSpot Inc. (US), Datavant (US), Verato (US), Infor, Inc. (US), Virtusa (US), Infosys (India), Particle Health, Inc. (US), Innovaccer, Inc. (US), H1 (US), and Medable Inc. (US).

Research Coverage:

The report analyzes the healthcare data monetization market. It aims to estimate the market size and future growth potential of various market segments based on type, deployment type, end-user, and region. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will help established firms and new entrants/smaller firms gauge the market's pulse, which would help them garner a greater market share. Firms purchasing the report could use one or a combination of the strategies mentioned below to strengthen their positions in the market.

This report provides insights on:

- Analysis of key drivers (rising volume of healthcare data, shift toward value-based care, advancements in AI and analytics), restraints (data privacy and regulatory concerns, lack of standardization and interoperability), opportunities (emergence of cloud-based data platforms, growing demand for real-world evidence (RWE)), and challenges (ethical concerns around data ownership and consent, limited digital maturity among healthcare providers) influencing the growth of the market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the healthcare data monetization market.

- Market Development: Comprehensive information on the lucrative emerging markets, type, deployment, end user, and region.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the healthcare data monetization market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the healthcare data monetization market like Oracle Corporation (US), Microsoft Corporation (US), Google (US), Salesforce (US), SAS Institute (US), and SAP (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKET SEGMENTATION

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH APPROACH

- 2.2.1 SECONDARY RESEARCH

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY RESEARCH

- 2.2.2.1 Key primary sources

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primary interviews

- 2.2.1 SECONDARY RESEARCH

- 2.3 RESEARCH METHODOLOGY DESIGN

- 2.4 MARKET SIZE ESTIMATION

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.8 RESEARCH LIMITATIONS

- 2.8.1 METHODOLOGY-RELATED LIMITATIONS

- 2.8.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES IN HEALTHCARE DATA MONETIZATION MARKET

- 4.2 HEALTHCARE DATA MONETIZATION MARKET, BY REGION

- 4.3 HEALTHCARE DATA MONETIZATION MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 HEALTHCARE DATA MONETIZATION MARKET IN NORTH AMERICA, BY END USER AND COUNTRY

- 4.5 HEALTHCARE DATA MONETIZATION MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing use of external data sources

- 5.2.1.2 Increasing adoption of electronic health records (EHRs)

- 5.2.1.3 Growing volume of large and complex healthcare datasets

- 5.2.1.4 Rising need to curtail escalating healthcare costs

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of data standardization and interoperability

- 5.2.2.2 Regulatory constraints

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for real-world evidence

- 5.2.3.2 Emergence of personalized medicine and genomics

- 5.2.4 CHALLENGES

- 5.2.4.1 Security concerns

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 HIGH DEMAND FOR OUTCOME-LINKED DATA MONETIZATION DUE TO SURGE IN VALUE-BASED CARE

- 5.3.2 SIGNIFICANT DEMAND FOR REAL-WORLD DATA (RWD) BY PHARMA COMPANIES FOR DRUG DEVELOPMENT

- 5.3.3 EMERGENCE OF HEALTH DATA MARKETPLACES FOR DATA EXCHANGE

- 5.3.4 GROWTH IN CONSUMER-GENERATED HEALTH DATA

- 5.4 TYPES OF HEALTHCARE DATA MONETIZATION SOLUTIONS

- 5.4.1 DIRECT DATA MONETIZATION

- 5.4.2 INDIRECT DATA MONETIZATION

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 DATA AS A SERVICE

- 5.5.2 INSIGHT AS A SERVICE

- 5.5.3 ANALYTICS-ENABLED PLATFORM AS A SERVICE

- 5.5.4 EMBEDDED ANALYTICS

- 5.5.5 ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

- 5.6.2 REGULATIONS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 PATENT ANALYSIS

- 5.9.1 PATENT PUBLICATION TRENDS IN HEALTHCARE DATA MONETIZATION MARKET

- 5.9.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 CASE STUDY 1: ACCOLADE REDUCES PATIENT ONBOARDING TIME BY DEPLOYING AWS-INTEGRATED DATA FABRIC SOLUTION

- 5.10.2 CASE STUDY 2: LEADING HEALTHCARE REVENUE MANAGEMENT COMPANY ADOPTS TIBCO SOFTWARE TO CUT DEVELOPER COSTS BY 50%

- 5.10.3 CASE STUDY 3: SAKURA FINETEK EUROPE FUTURE-PROOFS ITS BUSINESS BY DEPLOYING ORACLE CLOUD APPLICATIONS

- 5.10.4 CASE STUDY 4: AMERISOURCEBERGEN GAINS FINANCE EFFICIENCIES USING ORACLE CLOUD EPM

- 5.10.5 CASE STUDY 5: SKYGEN IMPROVES FINANCIAL VISIBILITY USING ORACLE CLOUD ERP AND EPM

- 5.10.6 CASE STUDY 6: HEALTH FIRST USES AZURE SYNAPSE ANALYTICS TO CREATE A DATA MANAGEMENT SOLUTION AND IMPROVE REFRESH SPEEDS BY 75%

- 5.10.7 CASE STUDY 7: COMMERCIAL UNDERWRITER ADOPTS HEALTHVERITY'S HVID SOLUTION TO CALIBRATE RISKS IN INSURANCE POLICIES

- 5.10.8 CASE STUDY 8: PHARMA COMPANIES USE HEALTHVERITY'S HVID SOLUTION IN PRAGMATIC CLINICAL TRIALS TO TRACK TREATMENT AND CLINICALLY RELEVANT OUTCOMES

- 5.10.9 CASE STUDY 9: PHARMA COMPANIES ADOPT HEALTHVERITY'S HVID SOLUTION TO IDENTIFY HEART FAILURE PATIENTS

- 5.10.10 CASE STUDY 10: PHARMA COMPANIES DEPLOY HEALTHVERITY MARKETPLACE AND CENSUS SOLUTIONS FOR CLINICAL TRIAL ANALYSIS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2025

- 5.14 AVERAGE SELLING PRICE: DATA MONETIZATION MARKET

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6 IMPACT OF 2025 US TARIFF ON HEATHCARE DATA MONETIZATION MARKET

- 6.1 INTRODUCTION

- 6.2 KEY TARIFF RATES

- 6.3 PRICE IMPACT ANALYSIS

- 6.4 IMPACT ON COUNTRY/REGION

- 6.4.1 US

- 6.4.2 EUROPE

- 6.4.3 ASIA PACIFIC

- 6.5 IMPACT ON END USERS

- 6.5.1 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 6.5.1.1 Clinical trial data analytics

- 6.5.1.2 Real-world evidence platforms

- 6.5.1.3 Genomics and precision medicines

- 6.5.1.4 Supply chain data analytics

- 6.5.1.5 Regulatory compliance

- 6.5.2 HEALTHCARE PAYERS

- 6.5.2.1 Claims analytics platforms

- 6.5.2.2 Population health management

- 6.5.2.3 Risk assessment and underwriting

- 6.5.2.4 Regulatory reporting

- 6.5.2.5 Market consolidation

- 6.5.3 HEALTHCARE SERVICE PROVIDERS

- 6.5.3.1 Clinical decision support

- 6.5.3.2 Operational analytics

- 6.5.3.3 Research and clinical trials

- 6.5.3.4 Benchmarking and comparative analytics

- 6.5.3.5 Technology integration

- 6.5.4 MEDTECH COMPANIES

- 6.5.4.1 Product development analytics

- 6.5.4.2 Post-market surveillance

- 6.5.4.3 Device data monetization

- 6.5.4.4 Regulatory compliance

- 6.5.4.5 Supply chain integration

- 6.5.5 DIGITAL HEALTH COMPANIES

- 6.5.6 HEALTHCARE CONSULTING FIRMS

- 6.5.7 ACADEMIC RESEARCH INSTITUTIONS

- 6.5.8 GOVERNMENT AGENCIES

- 6.5.1 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

7 HEALTHCARE DATA MONETIZATION MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 DIRECT DATA MONETIZATION

- 7.2.1 SOFTWARE

- 7.2.1.1 Rising adoption of AI, ML, and blockchain technologies to enhance value proposition of data assets to drive market

- 7.2.2 SERVICES

- 7.2.2.1 Cloud-based infrastructure, scalability, and cost-effectiveness to improve adoption of direct data monetization services

- 7.2.1 SOFTWARE

- 7.3 INDIRECT DATA MONETIZATION

- 7.3.1 SOFTWARE

- 7.3.1.1 Growing focus on data analytics and insights to support market growth

- 7.3.2 SERVICES

- 7.3.2.1 Rising emphasis on advanced data analytics and actionable insights to contribute to market growth

- 7.3.1 SOFTWARE

8 HEALTHCARE DATA MONETIZATION MARKET, BY DATA TYPE

- 8.1 INTRODUCTION

- 8.1.1 CLINICAL DATA

- 8.1.1.1 Rising use of AI and ML to extract actionable insights from clinical data to create opportunities

- 8.1.2 CLINICAL TRIAL DATA

- 8.1.2.1 Growing demand for real-world evidence and AI-driven trial optimization to drive market

- 8.1.3 CLAIMS AND BILLING DATA

- 8.1.3.1 Surging requirement for value-based care and cost transparency to boost segmental growth

- 8.1.4 CONSUMER AND DIGITAL HEALTH DATA

- 8.1.4.1 Elevating demand for chronic disease management and predictive healthcare services to support market growth

- 8.1.5 GENOMIC AND MOLECULAR DATA

- 8.1.5.1 Rising preference for precision and personalized medicines to foster market growth

- 8.1.6 OTHER DATA TYPES

- 8.1.1 CLINICAL DATA

9 HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT

- 9.1 INTRODUCTION

- 9.2 ON-PREMISES

- 9.2.1 EMPHASIS ON MINIMIZING DATA EXPOSURE TO THIRD-PARTY ENVIRONMENTS TO BOOST SEGMENTAL GROWTH

- 9.3 CLOUD-BASED

- 9.3.1 FOCUS ON OPTIMIZING DEPLOYMENT COSTS TO FUEL SEGMENTAL GROWTH

10 HEALTHCARE DATA MONETIZATION MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 10.2.1 RISING USE OF RWD AND RWE TO ACCELERATE MARKET GROWTH

- 10.3 HEALTHCARE PAYERS

- 10.3.1 PRESSING NEED TO DESIGN INNOVATIVE VALUE-BASED CARE MODELS TO CREATE OPPORTUNITIES

- 10.4 HEALTHCARE PROVIDERS

- 10.4.1 URGENT REQUIREMENT TO OPTIMIZE CLINICAL WORKFLOWS AND IDENTIFY HIGH-RISK POPULATIONS TO BOOST MARKET GROWTH

- 10.5 MEDICAL TECHNOLOGY COMPANIES

- 10.5.1 INCREASING PENETRATION OF CONNECTED MEDICAL DEVICES AND WEARABLES TO PROPEL MARKET

- 10.6 OTHER END USERS

11 HEALTHCARE DATA MONETIZATION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Inclination toward value-based care and outcome-focused healthcare models to stimulate demand

- 11.2.3 CANADA

- 11.2.3.1 Growing digitization of healthcare records to boost adoption

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 UK

- 11.3.2.1 Growing use of wearable medical devices to fuel market growth

- 11.3.3 GERMANY

- 11.3.3.1 Government initiatives to develop digital healthcare ecosystem to create opportunities

- 11.3.4 FRANCE

- 11.3.4.1 Government initiatives promoting digital health roadmap to boost demand

- 11.3.5 ITALY

- 11.3.5.1 Focus of healthcare sector on digital transformation to support market growth

- 11.3.6 SPAIN

- 11.3.6.1 Surging demand for predictive analytics and value-based care models to fuel market growth

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Elevating need for effective patient management solutions with increasing geriatric population to drive market

- 11.4.3 CHINA

- 11.4.3.1 High prevalence of chronic diseases to drive demand

- 11.4.4 INDIA

- 11.4.4.1 Government initiatives to create unified digital health ecosystem to foster market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Government initiatives to digitize patient records to boost demand

- 11.5.3 MEXICO

- 11.5.3.1 Rising adoption of telemedicine and mobile health platforms to drive market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC

- 11.6.2.1 National digital health visions and AI-driven healthcare transformation to propel market

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Type footprint

- 12.5.5.4 End user footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7.1 FINANCIAL METRICS

- 12.7.2 COMPANY VALUATION

- 12.8 BRAND/SOFTWARE COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ORACLE

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches & enhancements

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 MICROSOFT

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches & enhancements

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 GOOGLE

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches & enhancements

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 SALESFORCE, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches & enhancements

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 SAS INSTITUTE INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches & enhancements

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 SAP SE

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches & enhancements

- 13.1.6.3.2 Deals

- 13.1.7 TIBCO SOFTWARE INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches & enhancements

- 13.1.7.3.2 Deals

- 13.1.8 SNOWFLAKE INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches & enhancements

- 13.1.8.3.2 Deals

- 13.1.9 QLIKTECH INTERNATIONAL AB

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches & enhancements

- 13.1.9.3.2 Deals

- 13.1.10 INFOSYS LIMITED

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 SISENSE INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches & enhancements

- 13.1.11.3.2 Deals

- 13.1.12 ACCENTURE

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches & enhancements

- 13.1.12.3.2 Deals

- 13.1.13 AVAILITY, LLC

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches & enhancements

- 13.1.13.3.2 Deals

- 13.1.14 DOMO, INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Product launches & enhancements

- 13.1.14.3.2 Deals

- 13.1.15 KOMODO HEALTH, INC.

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches & enhancements

- 13.1.15.3.2 Deals

- 13.1.16 VIRTUSA

- 13.1.16.1 Business overview

- 13.1.16.2 Products offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Product launches & enhancements

- 13.1.16.3.2 Deals

- 13.1.17 DATAVANT

- 13.1.17.1 Business overview

- 13.1.17.2 Products offered

- 13.1.17.3 Recent developments

- 13.1.17.3.1 Product launches & enhancements

- 13.1.17.3.2 Deals

- 13.1.18 INFOR, INC.

- 13.1.18.1 Business overview

- 13.1.18.2 Products offered

- 13.1.18.3 Recent developments

- 13.1.18.3.1 Product launches & enhancements

- 13.1.19 HEALTHVERITY, INC.

- 13.1.19.1 Business overview

- 13.1.19.2 Products offered

- 13.1.19.3 Recent developments

- 13.1.19.3.1 Product launches & enhancements

- 13.1.19.3.2 Deals

- 13.1.20 THOUGHTSPOT INC.

- 13.1.20.1 Business overview

- 13.1.20.2 Products offered

- 13.1.20.3 Recent developments

- 13.1.20.3.1 Product launches & enhancements

- 13.1.20.3.2 Deals

- 13.1.1 ORACLE

- 13.2 OTHER PLAYERS

- 13.2.1 VERATO

- 13.2.2 PARTICLE HEALTH, INC.

- 13.2.3 INNOVACCER, INC.

- 13.2.4 H1

- 13.2.5 MEDABLE INC.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS