|

|

市場調査レポート

商品コード

1754853

バイオシミラーの世界市場 (~2035年):薬剤クラス (mAbs・GCSF・インスリン・抗凝固薬・rhGH・テリパラチド・GLP-1)・適応症・競合情勢・地域別Biosimilars Market by Drug Class (mAbs, GCSF, Insulin, Anticoagulant, rhGH, Teriparatide, GLP-1), Indication, Competitive Landscape, Region - Global Forecast to 2035 |

||||||

カスタマイズ可能

|

|||||||

| バイオシミラーの世界市場 (~2035年):薬剤クラス (mAbs・GCSF・インスリン・抗凝固薬・rhGH・テリパラチド・GLP-1)・適応症・競合情勢・地域別 |

|

出版日: 2025年06月17日

発行: MarketsandMarkets

ページ情報: 英文 392 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のバイオシミラーの市場規模は、2025年の350億4,000万米ドルから、予測期間中はCAGR 7.5%で推移し、2035年には722億9,000万米ドルの規模に成長すると予測されています。

バイオシミラー市場の拡大には、バイオシミラー製品の安全性、有効性、互換性に関する認識と教育の高まりが大きく寄与しています。さらに、費用対効果の高い生物学的製剤に対する需要の高まりや、官民双方の医療費支払者が実施する有利な保険適用と償還の仕組みが、この成長に重要な役割を果たしています。一方で、市場は製造工程の複雑化や競合の激化といった課題に直面しており、価格面での大きな圧力がさらなる成長を阻害する可能性があります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024-2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2024-2035年 |

| 単位 | 金額 (米ドル) |

| セグメント | 薬剤クラス・適応症・地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

モノクローナル抗体の部門が予測期間中に最も高いCAGRで成長する見通し

インフリキシマブ、リツキシマブ、アダリムマブ、トラスツズマブ、ペムブロリズマブ、デュピルマブ、ウステキヌマブ、リサンキズマブなどのモノクローナル抗体 (mAb) は、自己免疫疾患、さまざまな癌、慢性疾患、特定の感染症の治療に主に使用されています。患者数の増加に加え、mAbの採用率の上昇や、主要なバイオ医薬品の特許切れが迫っていることなどから、この部門の需要が今後さらに高まると予測されています。これらの治療薬は、がん、関節リウマチ、乾癬、炎症性腸疾患などの慢性かつ命に関わる疾患の管理に広く使われており、これらの疾患は高齢化や生活習慣によるリスク要因の増加により、世界的に有病率が上昇しています。また、mAbのバイオシミラーの登場は、医療費の抑制と治療アクセスの向上に貢献する可能性があります。今後10年以内に10~15の主要なmAbが特許満了を迎える見込みであり、競争は激化することが予想され、製薬会社の関心がこの市場に集中しています。特に、がんおよび自己免疫治療分野において、バイオシミラーの手頃な価格と幅広い適応が今後の市場成長に大きく寄与すると考えられています。

米国が予測期間中に最も高いCAGRで成長する見通し

米国の急成長は、いくつかのブロックバスター生物製剤の特許が切れたことや、BPCIA (Biologics Price Competition and Innovation Act) によって確立された規制環境がますます有利になっていることが主な要因です。今後10年間で、米国ではキイトルーダ (ペムブロリズマブ)、ステラーラ (ウステキヌマブ)、エイレア (アフリベルセプト) など、数十億米ドル規模の主要な生物製剤のバイオシミラーの参入が見込まれています。これらの上市により、特にがん、免疫、眼科領域において、バイオシミラー医薬品の対処可能な市場が大幅に拡大することになります。さらに、米国の医療システムにおいてバイオシミラーの支払者と医療提供者の受け入れが進んでいることも、バイオシミラーの普及を加速させています。

当レポートでは、世界のバイオシミラーの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、パイプラインの分析、法規制・償還環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 技術分析

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- 特許分析

- パイプライン分析

- 規制分析

- 償還シナリオ分析

- 価格分析

- 主な会議とイベント

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- 投資と資金調達のシナリオ

- AI/生成AIがバイオシミラー市場に与える影響

- 米国関税がバイオシミラー市場に与える影響

第6章 バイオシミラー市場:薬剤クラス別

- モノクローナル抗体

- リツキシマブ

- インフリキシマブ

- アダリムマブ

- トラスツズマブ

- ペンブロリズマブ

- デュピルマブ

- ウステキヌマブ

- リサンキズマブ

- その他

- 顆粒球コロニー刺激因子

- インスリン

- エリスロポエチン

- 組み換えヒト成長ホルモン

- エタネルセプト

- フォリトロピン

- テリパラチド

- インターフェロン

- 抗凝固薬

- アフリベルセプト

- GLP-1拮抗薬

- その他

第7章 バイオシミラー市場:適応症別

- 腫瘍

- 炎症性疾患・自己免疫疾患

- 慢性疾患

- 血液疾患

- 成長ホルモン欠乏症

- 感染症

- 2型糖尿病

- 肥満

- その他

第8章 バイオシミラー市場:地域別

- 欧州

- マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- マクロ経済見通し

- 日本

- 中国

- インド

- 韓国

- オーストラリア

- その他

- 北米

- マクロ経済見通し

- 米国

- カナダ

- ラテンアメリカ

- マクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東

- マクロ経済見通し

- GCC諸国

- その他中東

- アフリカ

- マクロ経済見通し

第9章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第10章 企業プロファイル

- 主要企業

- SANDOZ GROUP AG

- PFIZER INC.

- AMGEN INC.

- CELLTRION INC.

- BIOCON

- DR. REDDY'S LABORATORIES LTD.

- ELI LILLY AND COMPANY

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- FRESENIUS KABI AG

- STADA ARZNEIMITTEL AG

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- SAMSUNG BIOLOGICS

- AMNEAL PHARMACEUTICALS LLC

- COHERUS BIOSCIENCES

- BIO THERA SOLUTIONS

- APROGEN

- SHANGHAI HENLINUS BIOTECH, INC.

- その他の企業

- ALVOTECH

- AMEGA BIOTECH

- BIOCAD

- PROBIOMED S.A. DE C.V.

- FUJIFILM KYOWA KIRIN BIOLOGICS CO., LTD.

- POLPHARMA BIOLOGICS GROUP

- NEUCLONE

- XENTRIA

- YL BIOLOGICS

- KASHIV BIOSCIENCES, LLC

- NANOGEN PHARMACEUTICAL BIOTECHNOLOGY JSC

- SYNERMORE BIOLOGICS (SUZHOU) CO., LTD.

- CURATEQ BIOLOGICS PVT. LTD.

第11章 付録

List of Tables

- TABLE 1 BIOSIMILARS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 IMPACT ANALYSIS OF SUPPLY- AND DEMAND-SIDE FACTORS

- TABLE 3 BIOSIMILARS MARKET: RISK ANALYSIS

- TABLE 4 BIOSIMILARS MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 5 LIST OF KEY BIOSIMILARS APPROVED BY MAJOR PLAYERS, 2023-2025

- TABLE 6 LIST OF IMPENDING AND ONGOING PATENT EXPIRIES OF BLOCKBUSTER BIOLOGICS, 2023-2035

- TABLE 7 COMPARISON AMONG DIFFERENT DRUG TYPES, INVESTMENTS, APPROVAL TIMES, AND NUMBER OF PATIENTS IN STUDIES

- TABLE 8 BIOSIMILARS MARKET: ROLE IN ECOSYSTEM

- TABLE 9 BIOSIMILARS MARKET: NUMBER OF PATENTS FILED (APPLIED/GRANTED), 2014-2024

- TABLE 10 BIOSIMILARS MARKET: INDICATIVE LIST OF KEY PATENTS, 2024

- TABLE 11 BIOSIMILARS MARKET: PRODUCTS IN CLINICAL PIPELINE

- TABLE 12 BIOSIMILARS MARKET: LIST OF KEY BIOLOGICS TO GO OFF-PATENT, 2025-2035

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 BIOSIMILARS MARKET: COUNTRY/REGION-WISE REGULATORY FRAMEWORK

- TABLE 18 US: REIMBURSEMENT SCENARIO FOR RECENTLY LAUNCHED BIOSIMILARS, 2024-2025

- TABLE 19 US: REIMBURSEMENT CODES FOR BIOSIMILAR PRODUCTS

- TABLE 20 AVERAGE SELLING PRICE TREND OF BIOSIMILAR PRODUCTS, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 21 AVERAGE SELLING PRICE TREND OF BIOSIMILAR PRODUCTS, BY REGION, 2022-2024 (USD)

- TABLE 22 BIOSIMILARS MARKET: DETAILED LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 23 BIOSIMILARS MARKET: PORTER'S FIVE FORCES

- TABLE 24 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY DRUG CLASS (%)

- TABLE 25 KEY BUYING CRITERIA FOR BIOSIMILAR PRODUCTS, BY END USER

- TABLE 26 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 27 BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 28 BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 29 BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY REGION, 2023-2035 (USD MILLION)

- TABLE 30 NORTH AMERICA: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 31 EUROPE: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 32 ASIA PACIFIC: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 33 LATIN AMERICA: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 34 MIDDLE EAST: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY REGION, 2023-2035 (USD MILLION)

- TABLE 35 RITUXIMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 36 NORTH AMERICA: RITUXIMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 37 EUROPE: RITUXIMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 38 ASIA PACIFIC: RITUXIMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 39 LATIN AMERICA: RITUXIMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 40 MIDDLE EAST: RITUXIMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 41 INFLIXIMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 42 NORTH AMERICA: INFLIXIMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 43 EUROPE: INFLIXIMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 44 ASIA PACIFIC: INFLIXIMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 45 LATIN AMERICA: INFLIXIMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 46 MIDDLE EAST: INFLIXIMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 47 ADALIMUMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 48 NORTH AMERICA: ADALIMUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 49 EUROPE: ADALIMUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 50 ASIA PACIFIC: ADALIMUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 51 LATIN AMERICA: ADALIMUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 52 MIDDLE EAST: ADALIMUMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 53 TRASTUZUMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 54 NORTH AMERICA: TRASTUZUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 55 EUROPE: TRASTUZUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 56 ASIA PACIFIC: TRASTUZUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 57 LATIN AMERICA: TRASTUZUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 58 MIDDLE EAST: TRASTUZUMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 59 PEMBROLIZUMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 60 NORTH AMERICA: PEMBROLIZUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 61 EUROPE: PEMBROLIZUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 62 ASIA PACIFIC: PEMBROLIZUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 63 LATIN AMERICA: PEMBROLIZUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 64 MIDDLE EAST: PEMBROLIZUMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 65 DUPILUMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 66 NORTH AMERICA: DUPILUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 67 EUROPE: DUPILUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 68 ASIA PACIFIC: DUPILUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 69 LATIN AMERICA: DUPILUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 70 MIDDLE EAST: DUPILUMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 71 USTEKINUMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 72 NORTH AMERICA: USTEKINUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

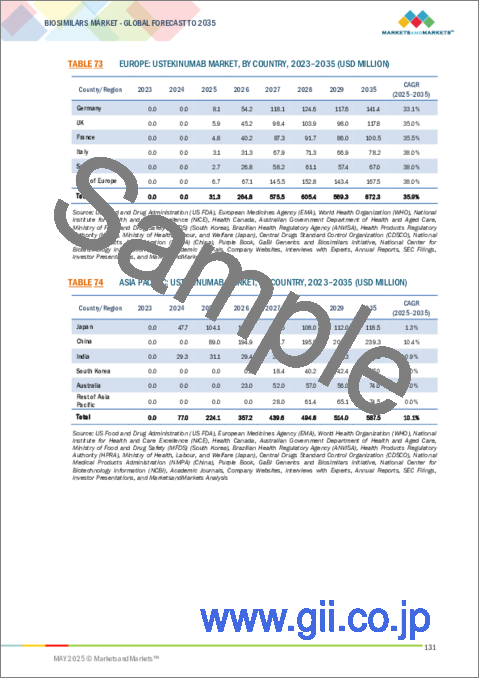

- TABLE 73 EUROPE: USTEKINUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 74 ASIA PACIFIC: USTEKINUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 75 LATIN AMERICA: USTEKINUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 76 MIDDLE EAST: USTEKINUMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 77 RISANKIZUMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 78 NORTH AMERICA: RISANKIZUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 79 EUROPE: RISANKIZUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 80 ASIA PACIFIC: RISANKIZUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 81 LATIN AMERICA: RISANKIZUMAB MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 82 MIDDLE EAST: RISANKIZUMAB MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 83 OTHER MONOCLONAL ANTIBODIES MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 84 NORTH AMERICA: OTHER MONOCLONAL ANTIBODIES MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 85 EUROPE: OTHER MONOCLONAL ANTIBODIES MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 86 ASIA PACIFIC: OTHER MONOCLONAL ANTIBODIES MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 87 LATIN AMERICA: OTHER MONOCLONAL ANTIBODIES MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 88 MIDDLE EAST: OTHER MONOCLONAL ANTIBODIES MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 89 LIST OF APPROVED BIOSIMILARS FOR GRANULOCYTE COLONY- STIMULATING FACTOR (G-CSF)

- TABLE 90 BIOSIMILARS MARKET FOR GRANULOCYTE COLONY-STIMULATING FACTOR, BY REGION, 2023-2035 (USD MILLION)

- TABLE 91 NORTH AMERICA: BIOSIMILARS MARKET FOR GRANULOCYTE COLONY-STIMULATING FACTOR, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 92 EUROPE: BIOSIMILARS MARKET FOR GRANULOCYTE COLONY-STIMULATING FACTOR, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 93 ASIA PACIFIC: BIOSIMILARS MARKET FOR GRANULOCYTE COLONY-STIMULATING FACTOR, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 94 LATIN AMERICA: BIOSIMILARS MARKET FOR GRANULOCYTE COLONY-STIMULATING FACTOR, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 95 MIDDLE EAST: BIOSIMILARS MARKET FOR GRANULOCYTE COLONY-STIMULATING FACTOR, BY REGION, 2023-2035 (USD MILLION)

- TABLE 96 BIOSIMILARS MARKET FOR INSULIN, BY REGION, 2023-2035 (USD MILLION)

- TABLE 97 NORTH AMERICA: BIOSIMILARS MARKET FOR INSULIN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 98 EUROPE: BIOSIMILARS MARKET FOR INSULIN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 99 ASIA PACIFIC: BIOSIMILARS MARKET FOR INSULIN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 100 LATIN AMERICA: BIOSIMILARS MARKET FOR INSULIN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 101 MIDDLE EAST: BIOSIMILARS MARKET FOR INSULIN, BY REGION, 2023-2035 (USD MILLION)

- TABLE 102 LIST OF APPROVED BIOSIMILARS FOR ERYTHROPOIETIN

- TABLE 103 BIOSIMILARS MARKET FOR ERYTHROPOIETIN, BY REGION, 2023-2035 (USD MILLION)

- TABLE 104 NORTH AMERICA: BIOSIMILARS MARKET FOR ERYTHROPOIETIN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 105 EUROPE: BIOSIMILARS MARKET FOR ERYTHROPOIETIN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 106 ASIA PACIFIC: BIOSIMILARS MARKET FOR ERYTHROPOIETIN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 107 LATIN AMERICA: BIOSIMILARS MARKET FOR ERYTHROPOIETIN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 108 MIDDLE EAST: BIOSIMILARS MARKET FOR ERYTHROPOIETIN, BY REGION, 2023-2035 (USD MILLION)

- TABLE 109 BIOSIMILARS MARKET FOR RECOMBINANT HUMAN GROWTH HORMONE, BY REGION, 2023-2035 (USD MILLION)

- TABLE 110 NORTH AMERICA: BIOSIMILARS MARKET FOR RECOMBINANT HUMAN GROWTH HORMONE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 111 EUROPE: BIOSIMILARS MARKET FOR RECOMBINANT HUMAN GROWTH HORMONE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 112 ASIA PACIFIC: BIOSIMILARS MARKET FOR RECOMBINANT HUMAN GROWTH HORMONE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 113 LATIN AMERICA: BIOSIMILARS MARKET FOR RECOMBINANT HUMAN GROWTH HORMONE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 114 MIDDLE EAST: BIOSIMILARS MARKET FOR RECOMBINANT HUMAN GROWTH HORMONE, BY REGION, 2023-2035 (USD MILLION)

- TABLE 115 BIOSIMILARS MARKET FOR ETANERCEPT, BY REGION, 2023-2035 (USD MILLION)

- TABLE 116 NORTH AMERICA: BIOSIMILARS MARKET FOR ETANERCEPT, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 117 EUROPE: BIOSIMILARS MARKET FOR ETANERCEPT, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 118 ASIA PACIFIC: BIOSIMILARS MARKET FOR ETANERCEPT, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 119 LATIN AMERICA: BIOSIMILARS MARKET FOR ETANERCEPT, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 120 MIDDLE EAST: BIOSIMILARS MARKET FOR ETANERCEPT, BY REGION, 2023-2035 (USD MILLION)

- TABLE 121 BIOSIMILARS MARKET FOR FOLLITROPIN, BY REGION, 2023-2035 (USD MILLION)

- TABLE 122 NORTH AMERICA: BIOSIMILARS MARKET FOR FOLLITROPIN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 123 EUROPE: BIOSIMILARS MARKET FOR FOLLITROPIN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 124 ASIA PACIFIC: BIOSIMILARS MARKET FOR FOLLITROPIN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 125 LATIN AMERICA: BIOSIMILARS MARKET FOR FOLLITROPIN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 126 MIDDLE EAST: BIOSIMILARS MARKET FOR FOLLITROPIN, BY REGION, 2023-2035 (USD MILLION)

- TABLE 127 BIOSIMILARS MARKET FOR TERIPARATIDE, BY REGION, 2023-2035 (USD MILLION)

- TABLE 128 NORTH AMERICA: BIOSIMILARS MARKET FOR TERIPARATIDE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 129 EUROPE: BIOSIMILARS MARKET FOR TERIPARATIDE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 130 ASIA PACIFIC: BIOSIMILARS MARKET FOR TERIPARATIDE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 131 LATIN AMERICA: BIOSIMILARS MARKET FOR TERIPARATIDE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 132 MIDDLE EAST: BIOSIMILARS MARKET FOR TERIPARATIDE, BY REGION, 2023-2035 (USD MILLION)

- TABLE 133 BIOSIMILARS MARKET FOR INTERFERONS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 134 NORTH AMERICA: BIOSIMILARS MARKET FOR INTERFERONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 135 EUROPE: BIOSIMILARS MARKET FOR INTERFERONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 136 ASIA PACIFIC: BIOSIMILARS MARKET FOR INTERFERONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 137 LATIN AMERICA: BIOSIMILARS MARKET FOR INTERFERONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 138 MIDDLE EAST: BIOSIMILARS MARKET FOR INTERFERONS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 139 BIOSIMILARS MARKET FOR ANTICOAGULANTS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 140 NORTH AMERICA: BIOSIMILARS MARKET FOR ANTICOAGULANTS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 141 EUROPE: BIOSIMILARS MARKET FOR ANTICOAGULANTS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 142 ASIA PACIFIC: BIOSIMILARS MARKET FOR ANTICOAGULANTS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 143 LATIN AMERICA: BIOSIMILARS MARKET FOR ANTICOAGULANTS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 144 MIDDLE EAST: BIOSIMILARS MARKET FOR ANTICOAGULANTS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 145 BIOSIMILARS MARKET FOR AFLIBERCEPT, BY REGION, 2023-2035 (USD MILLION)

- TABLE 146 NORTH AMERICA: BIOSIMILARS MARKET FOR AFLIBERCEPT, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 147 EUROPE: BIOSIMILARS MARKET FOR AFLIBERCEPT, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 148 ASIA PACIFIC: BIOSIMILARS MARKET FOR AFLIBERCEPT, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 149 LATIN AMERICA: BIOSIMILARS MARKET FOR AFLIBERCEPT, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 150 MIDDLE EAST: BIOSIMILARS MARKET FOR AFLIBERCEPT, BY REGION, 2023-2035 (USD MILLION)

- TABLE 151 BIOSIMILARS MARKET FOR GLP-1 ANTAGONIST, BY REGION, 2023-2035 (USD MILLION)

- TABLE 152 NORTH AMERICA: BIOSIMILARS MARKET FOR GLP-1 ANTAGONIST, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 153 EUROPE: BIOSIMILARS MARKET FOR GLP-1 ANTAGONIST, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 154 ASIA PACIFIC: BIOSIMILARS MARKET FOR GLP-1 ANTAGONIST, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 155 LATIN AMERICA: BIOSIMILARS MARKET FOR GLP-1 ANTAGONIST, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 156 MIDDLE EAST: BIOSIMILARS MARKET FOR GLP-1 ANTAGONIST, BY REGION, 2023-2035 (USD MILLION)

- TABLE 157 BIOSIMILARS MARKET FOR OTHER DRUG CLASSES, BY REGION, 2023-2035 (USD MILLION)

- TABLE 158 NORTH AMERICA: BIOSIMILARS MARKET FOR OTHER DRUG CLASSES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 159 EUROPE: BIOSIMILARS MARKET FOR OTHER DRUG CLASSES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 160 ASIA PACIFIC: BIOSIMILARS MARKET FOR OTHER DRUG CLASSES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 161 LATIN AMERICA: BIOSIMILARS MARKET FOR OTHER DRUG CLASSES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 162 MIDDLE EAST: BIOSIMILARS MARKET FOR OTHER DRUG CLASSES, BY REGION, 2023-2035 (USD MILLION)

- TABLE 163 BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 164 BIOSIMILARS MARKET FOR ONCOLOGY, BY REGION, 2023-2035 (USD MILLION)

- TABLE 165 NORTH AMERICA: BIOSIMILARS MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 166 EUROPE: BIOSIMILARS MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 167 ASIA PACIFIC: BIOSIMILARS MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 168 LATIN AMERICA: BIOSIMILARS MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 169 MIDDLE EAST: BIOSIMILARS MARKET FOR ONCOLOGY, BY REGION, 2023-2035 (USD MILLION)

- TABLE 170 BIOSIMILARS MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY REGION, 2023-2035 (USD MILLION)

- TABLE 171 NORTH AMERICA: BIOSIMILARS MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 172 EUROPE: BIOSIMILARS MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 173 ASIA PACIFIC: BIOSIMILARS MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 174 LATIN AMERICA: BIOSIMILARS MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 175 MIDDLE EAST: BIOSIMILARS MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY REGION, 2023-2035 (USD MILLION)

- TABLE 176 BIOSIMILARS MARKET FOR CHRONIC DISEASES, BY REGION, 2023-2035 (USD MILLION)

- TABLE 177 NORTH AMERICA: BIOSIMILARS MARKET FOR CHRONIC DISEASES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 178 EUROPE: BIOSIMILARS MARKET FOR CHRONIC DISEASES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 179 ASIA PACIFIC: BIOSIMILARS MARKET FOR CHRONIC DISEASES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 180 LATIN AMERICA: BIOSIMILARS MARKET FOR CHRONIC DISEASES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 181 MIDDLE EAST: BIOSIMILARS MARKET FOR CHRONIC DISEASES, BY REGION, 2023-2035 (USD MILLION)

- TABLE 182 BIOSIMILARS MARKET FOR BLOOD DISORDERS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 183 NORTH AMERICA: BIOSIMILARS MARKET FOR BLOOD DISORDERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 184 EUROPE: BIOSIMILARS MARKET FOR BLOOD DISORDERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 185 ASIA PACIFIC: BIOSIMILARS MARKET FOR BLOOD DISORDERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 186 LATIN AMERICA: BIOSIMILARS MARKET FOR BLOOD DISORDERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 187 MIDDLE EAST: BIOSIMILARS MARKET FOR BLOOD DISORDERS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 188 BIOSIMILARS MARKET FOR GROWTH HORMONE DEFICIENCY, BY REGION, 2023-2035 (USD MILLION)

- TABLE 189 NORTH AMERICA: BIOSIMILARS MARKET FOR GROWTH HORMONE DEFICIENCY, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 190 EUROPE: BIOSIMILARS MARKET FOR GROWTH HORMONE DEFICIENCY, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 191 ASIA PACIFIC: BIOSIMILARS MARKET FOR GROWTH HORMONE DEFICIENCY, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 192 LATIN AMERICA: BIOSIMILARS MARKET FOR GROWTH HORMONE DEFICIENCY, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 193 MIDDLE EAST: BIOSIMILARS MARKET FOR GROWTH HORMONE DEFICIENCY, BY REGION, 2023-2035 (USD MILLION)

- TABLE 194 BIOSIMILARS MARKET FOR INFECTIOUS DISEASES, BY REGION, 2023-2035 (USD MILLION)

- TABLE 195 NORTH AMERICA: BIOSIMILARS MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 196 EUROPE: BIOSIMILARS MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 197 ASIA PACIFIC: BIOSIMILARS MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 198 LATIN AMERICA: BIOSIMILARS MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 199 MIDDLE EAST: BIOSIMILARS MARKET FOR INFECTIOUS DISEASES, BY REGION, 2023-2035 (USD MILLION)

- TABLE 200 BIOSIMILARS MARKET FOR TYPE II DIABETES, BY REGION, 2023-2035 (USD MILLION)

- TABLE 201 NORTH AMERICA: BIOSIMILARS MARKET FOR TYPE II DIABETES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 202 EUROPE: BIOSIMILARS MARKET FOR TYPE II DIABETES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 203 ASIA PACIFIC: BIOSIMILARS MARKET FOR TYPE II DIABETES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 204 LATIN AMERICA: BIOSIMILARS MARKET FOR TYPE II DIABETES, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 205 MIDDLE EAST: BIOSIMILARS MARKET FOR TYPE II DIABETES, BY REGION, 2023-2035 (USD MILLION)

- TABLE 206 BIOSIMILARS MARKET FOR OBESITY, BY REGION, 2023-2035 (USD MILLION)

- TABLE 207 NORTH AMERICA: BIOSIMILARS MARKET FOR OBESITY, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 208 EUROPE: BIOSIMILARS MARKET FOR OBESITY, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 209 ASIA PACIFIC: BIOSIMILARS MARKET FOR OBESITY, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 210 LATIN AMERICA: BIOSIMILARS MARKET FOR OBESITY, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 211 MIDDLE EAST: BIOSIMILARS MARKET FOR OBESITY, BY REGION, 2023-2035 (USD MILLION)

- TABLE 212 BIOSIMILARS MARKET FOR OTHER INDICATIONS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 213 NORTH AMERICA: BIOSIMILARS MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 214 EUROPE: BIOSIMILARS MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 215 ASIA PACIFIC: BIOSIMILARS MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 216 LATIN AMERICA: BIOSIMILARS MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 217 MIDDLE EAST: BIOSIMILARS MARKET FOR OTHER INDICATIONS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 218 BIOSIMILARS MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 219 EUROPE: KEY MACROINDICATORS

- TABLE 220 EUROPE: LIST OF APPROVED BIOSIMILARS, 2022-2025

- TABLE 221 EUROPE: BIOSIMILARS MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 222 EUROPE: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 223 EUROPE: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 224 EUROPE: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 225 GERMANY: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 226 GERMANY: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 227 GERMANY: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 228 UK: LIST OF APPROVED BIOSIMILARS, 2022-2025

- TABLE 229 UK: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 230 UK: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 231 UK: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 232 FRANCE: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 233 FRANCE: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 234 FRANCE: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 235 ITALY: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 236 ITALY: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 237 ITALY: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 238 SPAIN: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 239 SPAIN: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 240 SPAIN: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 241 REST OF EUROPE: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 242 REST OF EUROPE: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 243 REST OF EUROPE: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 244 ASIA PACIFIC: KEY MACROINDICATORS

- TABLE 245 ASIA PACIFIC: BIOSIMILARS MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 246 ASIA PACIFIC: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 247 ASIA PACIFIC: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 248 ASIA PACIFIC: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 249 JAPAN: LIST OF APPROVED BIOSIMILARS, 2022-2025

- TABLE 250 JAPAN: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 251 JAPAN: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 252 JAPAN: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 253 CHINA: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 254 CHINA: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 255 CHINA: BIOSIMILARS MARKET, BY INDICATION, 2023-2025 (USD MILLION)

- TABLE 256 INDIA: BIOSIMILARS APPROVED AND MARKETED, 2022-2025

- TABLE 257 INDIA: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 258 INDIA: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 259 INDIA: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 260 SOUTH KOREA: LIST OF APPROVED BIOSIMILARS, 2022-2025

- TABLE 261 SOUTH KOREA: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 262 SOUTH KOREA: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 263 SOUTH KOREA: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 264 AUSTRALIA: LIST OF APPROVED BIOSIMILARS, 2022-2025

- TABLE 265 AUSTRALIA: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 266 AUSTRALIA: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 267 AUSTRALIA: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 268 NEW ZEALAND: LIST OF APPROVED BIOSIMILARS, 2022-2025

- TABLE 269 MALAYSIA: LIST OF APPROVED BIOSIMILARS, 2022-2025

- TABLE 270 REST OF ASIA PACIFIC: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 271 REST OF ASIA PACIFIC: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 272 REST OF ASIA PACIFIC: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 273 NORTH AMERICA: KEY MACROINDICATORS

- TABLE 274 NORTH AMERICA: BIOSIMILARS MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 275 NORTH AMERICA: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 276 NORTH AMERICA: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 277 NORTH AMERICA: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 278 US: LIST OF APPROVED BIOSIMILARS, 2022-2025

- TABLE 279 US: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 280 US: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 281 US: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 282 CANADA: LIST OF APPROVED BIOSIMILARS, 2022-2025

- TABLE 283 CANADA: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 284 CANADA: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 285 CANADA: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 286 LATIN AMERICA: KEY MACROINDICATORS

- TABLE 287 LATIN AMERICA: BIOSIMILARS MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 288 LATIN AMERICA: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 289 LATIN AMERICA: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 290 LATIN AMERICA: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 291 BRAZIL: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 292 BRAZIL: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 293 BRAZIL: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 294 MEXICO: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 295 MEXICO: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 296 MEXICO: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 297 REST OF LATIN AMERICA: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 298 REST OF LATIN AMERICA: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 299 REST OF LATIN AMERICA: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 300 MIDDLE EAST: KEY MACROINDICATORS

- TABLE 301 MIDDLE EAST: BIOSIMILARS MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 302 MIDDLE EAST: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 303 MIDDLE EAST: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 304 MIDDLE EAST: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 305 GCC COUNTRIES: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 306 GCC COUNTRIES: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 307 GCC COUNTRIES: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 308 REST OF MIDDLE EAST: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 309 REST OF MIDDLE EAST: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 310 REST OF MIDDLE EAST: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 311 AFRICA: KEY MACROINDICATORS

- TABLE 312 AFRICA: BIOSIMILARS MARKET, BY DRUG CLASS, 2023-2035 (USD MILLION)

- TABLE 313 AFRICA: BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2023-2035 (USD MILLION)

- TABLE 314 AFRICA: BIOSIMILARS MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 315 OVERVIEW OF MAJOR STRATEGIES DEPLOYED BY KEY PLAYERS IN BIOSIMILARS MARKET, 2022-2024

- TABLE 316 BIOSIMILARS MARKET: DEGREE OF COMPETITION

- TABLE 317 BIOSIMILARS MARKET: REGION FOOTPRINT

- TABLE 318 BIOSIMILARS MARKET: DRUG CLASS FOOTPRINT

- TABLE 319 BIOSIMILARS MARKET: INDICATION FOOTPRINT

- TABLE 320 BIOSIMILARS MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 321 BIOSIMILARS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS, 2024

- TABLE 322 BIOSIMILARS MARKET: PRODUCT APPROVALS AND LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 323 BIOSIMILARS MARKET: DEALS, JANUARY 2022-APRIL 2025

- TABLE 324 BIOSIMILARS MARKET: EXPANSIONS, JANUARY 2022- APRIL 2025

- TABLE 325 SANDOZ GROUP AG: COMPANY OVERVIEW

- TABLE 326 SANDOZ GROUP AG: PRODUCTS OFFERED

- TABLE 327 SANDOZ GROUP AG: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 328 SANDOZ GROUP AG: DEALS, JANUARY 2022-APRIL 2025

- TABLE 329 SANDOZ GROUP AG: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 330 SANDOZ GROUP AG: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 331 PFIZER INC.: COMPANY OVERVIEW

- TABLE 332 PFIZER INC.: PRODUCTS OFFERED

- TABLE 333 PFIZER INC.: PRODUCT APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 334 PFIZER INC.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 335 AMGEN INC.: COMPANY OVERVIEW

- TABLE 336 AMGEN INC.: PRODUCTS OFFERED

- TABLE 337 AMGEN INC.: PRODUCTS IN PIPELINE

- TABLE 338 AMGEN INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 339 AMGEN INC.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 340 AMGEN INC.: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 341 CELLTRION INC.: COMPANY OVERVIEW

- TABLE 342 CELLTRION INC.: PRODUCTS OFFERED

- TABLE 343 CELLTRION INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 344 CELLTRION INC.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 345 BIOCON: COMPANY OVERVIEW

- TABLE 346 BIOCON: PRODUCTS OFFERED

- TABLE 347 BIOCON: PRODUCT APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 348 BIOCON: DEALS, JANUARY 2022-APRIL 2025

- TABLE 349 BIOCON: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 350 DR. REDDY'S LABORATORIES LTD.: COMPANY OVERVIEW

- TABLE 351 DR. REDDY'S LABORATORIES LTD.: PRODUCTS OFFERED

- TABLE 352 DR. REDDY'S LABORATORIES LTD.: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 353 DR. REDDY'S LABORATORIES LTD.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 354 DR. REDDY'S LABORATORIES LTD.: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 355 ELI LILLY AND COMPANY: COMPANY OVERVIEW

- TABLE 356 ELI LILLY AND COMPANY: PRODUCTS OFFERED

- TABLE 357 ELI LILLY AND COMPANY: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 358 ELI LILLY AND COMPANY: DEALS, JANUARY 2022-APRIL 2025

- TABLE 359 ELI LILLY AND COMPANY: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 360 TEVA PHARMACEUTICAL INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 361 TEVA PHARMACEUTICAL INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 362 TEVA PHARMACEUTICAL INDUSTRIES LTD.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 363 TEVA PHARMACEUTICAL INDUSTRIES LTD.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 364 TEVA PHARMACEUTICAL INDUSTRIES LTD.: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 365 FRESENIUS KABI AG: COMPANY OVERVIEW

- TABLE 366 FRESENIUS KABI AG: PRODUCTS OFFERED

- TABLE 367 FRESENIUS KABI AG: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 368 FRESENIUS KABI AG: DEALS, JANUARY 2022-APRIL 2025

- TABLE 369 STADA ARZEIMITTEL AG: COMPANY OVERVIEW

- TABLE 370 STADA ARZEIMITTEL AG: PRODUCTS OFFERED

- TABLE 371 STADA ARZEIMITTEL AG: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 372 STADA ARZEIMITTEL AG: DEALS, JANUARY 2022-APRIL 2025

- TABLE 373 STADA ARZEIMITTEL AG: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 374 STADA ARZEIMITTEL AG: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 375 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 376 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: PRODUCTS OFFERED

- TABLE 377 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: PRODUCT APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 378 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: DEALS, JANUARY 2022-APRIL 2025

- TABLE 379 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 380 SAMSUNG BIOLOGICS: COMPANY OVERVIEW

- TABLE 381 SAMSUNG BIOLOGICS: PRODUCTS OFFERED

- TABLE 382 SAMSUNG BIOLOGICS: PRODUCT APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 383 SAMSUNG BIOLOGICS: DEALS, JANUARY 2022-APRIL 2025

- TABLE 384 SAMSUNG BIOLOGICS: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 385 AMNEAL PHARMACEUTICALS LLC: COMPANY OVERVIEW

- TABLE 386 AMNEAL PHARMACEUTICALS LLC: PRODUCTS OFFERED

- TABLE 387 AMNEAL PHARMACEUTICALS LLC: PRODUCT APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 388 AMNEAL PHARMACEUTICALS LLC: DEALS, JANUARY 2022-APRIL 2025

- TABLE 389 AMNEAL PHARMACEUTICALS LLC: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 390 COHERUS BIOSCIENCES: COMPANY OVERVIEW

- TABLE 391 COHERUS BIOSCIENCES: PRODUCTS OFFERED

- TABLE 392 COHERUS BIOSCIENCES: DEALS, JANUARY 2022-APRIL 2025

- TABLE 393 COHERUS BIOSCIENCES: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 394 BIO THERA SOLUTIONS: COMPANY OVERVIEW

- TABLE 395 BIO THERA SOLUTIONS: PRODUCTS OFFERED

- TABLE 396 BIO THERA SOLUTIONS: PRODUCT APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 397 BIO THERA SOLUTIONS: DEALS, JANUARY 2022-APRIL 2025

- TABLE 398 APROGEN: COMPANY OVERVIEW

- TABLE 399 APROGEN: PRODUCTS OFFERED

- TABLE 400 APROGEN: PRODUCT APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 401 APROGEN: PRODUCTS IN PIPELINE

- TABLE 402 SHANGHAI HENLINUS BIOTECH, INC.: COMPANY OVERVIEW

- TABLE 403 SHANGHAI HENLINUS BIOTECH, INC.: PRODUCTS OFFERED

- TABLE 404 SHANGHAI HENLINUS BIOTECH, INC.: PRODUCTS IN PIPELINE

- TABLE 405 SHANGHAI HENLINUS BIOTECH, INC.: PRODUCT APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 406 SHANGHAI HENLINUS BIOTECH, INC.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 407 SHANGHAI HENLINUS BIOTECH, INC.: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 408 ALVOTECH: COMPANY OVERVIEW

- TABLE 409 AMGEGA BIOTECH: COMPANY OVERVIEW

- TABLE 410 BIOCAD: COMPANY OVERVIEW

- TABLE 411 PROBIOMED S.A. DE C.V.: COMPANY OVERVIEW

- TABLE 412 FUJIFILM KYOWA KIRIN BIOLOGICS CO., LTD.: COMPANY OVERVIEW

- TABLE 413 POLPHARMA BIOLOGICS GROUP: COMPANY OVERVIEW

- TABLE 414 NEUCLONE: COMPANY OVERVIEW

- TABLE 415 XENTRIA: COMPANY OVERVIEW

- TABLE 416 YL BIOLOGICS: COMPANY OVERVIEW

- TABLE 417 KASHIV BIOSCIENCES, LLC: COMPANY OVERVIEW

- TABLE 418 NANOGEN PHARMACEUTICAL BIOTECHNOLOGY JSC: COMPANY OVERVIEW

- TABLE 419 SYNERMORE BIOLOGICS (SUZHOU) CO., LTD.: COMPANY OVERVIEW

- TABLE 420 CURATEQ BIOLOGICS PVT. LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 BIOSIMILARS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 BIOSIMILARS MARKET: YEARS CONSIDERED

- FIGURE 3 BIOSIMILARS MARKET: RESEARCH DESIGN

- FIGURE 4 BIOSIMILARS MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 BIOSIMILARS MARKET: BREAKDOWN OF PRIMARIES (SUPPLY- AND DEMAND-SIDE PARTICIPANTS)

- FIGURE 6 BIOSIMILARS MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2024

- FIGURE 7 COMPANY REVENUE ANALYSIS-BASED ESTIMATION: BOTTOM-UP APPROACH (2024)

- FIGURE 8 REVENUE SHARE ANALYSIS OF SANDOZ GROUP AG (2024)

- FIGURE 9 BIOSIMILARS MARKET SIZE VALIDATION FROM PRIMARY EXPERTS

- FIGURE 10 BIOSIMILARS MARKET: TOP-DOWN APPROACH

- FIGURE 11 BIOSIMILARS MARKET: CAGR PROJECTIONS

- FIGURE 12 BIOSIMILARS MARKET: DATA TRIANGULATION

- FIGURE 13 BIOSIMILARS MARKET, BY DRUG CLASS, 2025 VS. 2035 (USD MILLION)

- FIGURE 14 BIOSIMILARS MARKET FOR MONOCLONAL ANTIBODIES, BY TYPE, 2025 VS. 2035 (USD MILLION)

- FIGURE 15 BIOSIMILARS MARKET, BY INDICATION, 2025 VS. 2035 (USD MILLION)

- FIGURE 16 REGIONAL SNAPSHOT OF BIOSIMILARS MARKET

- FIGURE 17 INCREASING INVESTMENTS IN BIOSIMILAR RESEARCH AND GROWING DEMAND FOR COST-EFFECTIVE TREATMENT OPTIONS TO DRIVE MARKET

- FIGURE 18 US AND MONOCLONAL ANTIBODIES ARE EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 19 REST OF EUROPE TO REGISTER HIGHEST CAGR FROM 2025 TO 2035

- FIGURE 20 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING STUDY PERIOD

- FIGURE 21 BIOSIMILARS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 BIOSIMILARS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 23 BIOSIMILARS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 BIOSIMILARS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 BIOSIMILARS MARKET: PATENT PUBLICATION TRENDS, JURISDICTION, AND TOP APPLICANT ANALYSIS (JANUARY 2014-DECEMBER 2024)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF BIOSIMILAR PRODUCTS, 2022-2024 (USD)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF BIOSIMILAR PRODUCTS, BY REGION, 2022-2024 (USD)

- FIGURE 28 BIOSIMILARS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY DRUG CLASS

- FIGURE 30 KEY BUYING CRITERIA FOR BIOSIMILAR PRODUCTS, BY END USER

- FIGURE 31 BIOSIMILARS MARKET: INVESTMENT & FUNDING SCENARIO, 2023-2025

- FIGURE 32 BIOSIMILARS MARKET: IMPACT OF AI/GEN AI

- FIGURE 33 EUROPE: BIOSIMILARS MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA: BIOSIMILARS MARKET SNAPSHOT

- FIGURE 35 REVENUE ANALYSIS OF KEY PLAYERS IN BIOSIMILARS MARKET, 2020-2024 (USD MILLION)

- FIGURE 36 MARKET SHARE ANALYSIS OF KEY PLAYERS IN BIOSIMILARS MARKET (2024)

- FIGURE 37 BIOSIMILARS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 38 BIOSIMILARS MARKET: COMPANY FOOTPRINT

- FIGURE 39 BIOSIMILARS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 40 EV/EBITDA OF KEY VENDORS

- FIGURE 41 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 42 BIOSIMILARS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 43 SANDOZ GROUP AG: COMPANY SNAPSHOT

- FIGURE 44 PFIZER INC.: COMPANY SNAPSHOT

- FIGURE 45 AMGEN INC.: COMPANY SNAPSHOT

- FIGURE 46 CELLTRION INC.: COMPANY SNAPSHOT

- FIGURE 47 BIOCON: COMPANY SNAPSHOT

- FIGURE 48 DR. REDDY'S LABORATORIES LTD.: COMPANY SNAPSHOT

- FIGURE 49 ELI LILLY AND COMPANY: COMPANY SNAPSHOT

- FIGURE 50 TEVA PHARMACEUTICAL INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 51 FRESENIUS KABI AG: COMPANY SNAPSHOT

- FIGURE 52 STADA ARZEIMITTEL AG: COMPANY SNAPSHOT

- FIGURE 53 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: COMPANY SNAPSHOT

- FIGURE 54 SAMSUNG BIOLOGICS: COMPANY SNAPSHOT

- FIGURE 55 AMNEAL PHARMACEUTICALS LLC: COMPANY SNAPSHOT

- FIGURE 56 COHERUS BIOSCIENCES: COMPANY SNAPSHOT

- FIGURE 57 BIO THERA SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 58 SHANGHAI HENLINUS BIOTECH, INC.: COMPANY SNAPSHOT

The global biosimilars market is projected to reach USD 72.29 billion by 2035 from USD 35.04 billion in 2025, at a CAGR of 7.5% during the forecast period. The expansion of the biosimilars market has been predominantly fueled by heightened awareness and education regarding the safety, efficacy, and interchangeability of biosimilar products. Additionally, favorable insurance coverage and reimbursement structures implemented by both public and private payers have played a crucial role in this growth, alongside an increasing demand for cost-effective biologic therapies. Nonetheless, the market faces challenges from escalating complexities in the manufacturing processes and intensifying competition, leading to significant pricing pressures that may hinder further growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2035 |

| Units Considered | Value (USD billion) |

| Segments | Drug Class, Indication, Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

The monoclonal antibodies segment is expected to grow at the highest CAGR during the study period.

Monoclonal antibodies (mAbs) such as infliximab, rituximab, adalimumab, trastuzumab, pembrolizumab, dupilumab, Ustekinumab, Risankizumab, and others are primarily utilized for the treatment of autoimmune disorders, various cancers, chronic illnesses, and select infectious diseases. The anticipated rise in patient demographics, coupled with increasing adoption rates and the impending patent expirations of several key biologics, is projected to drive demand in the mAb sector. These therapeutics are extensively employed in managing chronic and life-threatening conditions, notably cancer, rheumatoid arthritis, psoriasis, and inflammatory bowel disease, which are experiencing heightened global prevalence due to an aging populace and lifestyle-related risk factors. The emergence of biosimilars for these mAbs offers an opportunity to mitigate healthcare expenditures and improve access to essential therapies. With over 10-15 leading mAbs facing patent expirations within the next decade, competition is poised to intensify, piquing the interest of pharmaceutical companies in the mAb market. The affordability and extensive applicability of mAb biosimilars, particularly in oncology and autoimmune therapies, are likely to significantly contribute to future market growth.

The US is expected to grow at the highest CAGR in the global biosimilars market from 2025 to 2035.

The United States is projected to experience the highest compound annual growth rate (CAGR) in the global biosimilars market between 2025 and 2035. This rapid growth is largely driven by the expiration of patents on several blockbuster biologics and the increasingly favorable regulatory environment established by the Biologics Price Competition and Innovation Act (BPCIA). Over the next decade, the US is expected to see biosimilar entries for major biologics such as Keytruda (pembrolizumab), Stelara (ustekinumab), and Eylea (aflibercept), which are all multi-billion-dollar products. These launches will significantly expand the addressable market for biosimilars, particularly in oncology, immunology, and ophthalmology. Additionally, the growing payer and provider acceptance of biosimilars in the US healthcare system is accelerating uptake. For instance, biosimilars of adalimumab (Humira), the highest-selling biologic in the US for over a decade, began launching in 2023 with multiple entrants such as Amgen, Boehringer Ingelheim, and Sandoz. Early signs show that competitive pricing is starting to drive formulary access and payer adoption. Moreover, legislative and policy efforts, including Medicare reforms and price transparency regulations, are expected to further incentivize biosimilar use, leading to cost savings and greater market penetration. As more biosimilars gain interchangeable status, market dynamics are likely to mirror those seen in generics, thus supporting sustained growth in the US biosimilars sector over the next decade.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side-70% and Demand Side-30%

- By Designation: Managers-45%, CXO and Directors-30%, and Executives-25%

- By Region: North America-40%, Europe-25%, the Asia Pacific-25%, Latin America-5%, and the Middle East & Africa-5%

List of Key Companies Profiled in the Report:

Sandoz Group AG (Switzerland), Pfizer Inc. (US), Amgen Inc. (US), Celltrion, Inc. (South Korea), Biocon (India), Dr. Reddy's Laboratories Ltd. (India), Eli Lilly and Company (US), Teva Pharmaceutical Industries Ltd. (Israel), Fresenius Kabi AG (Germany), STADA Arzneimittel AG (Germany), Boehringer Ingelheim International GmbH (Germany), Samsung Biologics Co., Ltd. (South Korea), Amneal Pharmaceuticals LLC (US), Coherus BioSciences, Inc. (US), Bio-Thera Solutions, Ltd. (China), Aprogen Inc. (South Korea), Shanghai Henlius Biopharmaceuticals, Inc. (China).

Research Coverage:

This research report categorizes the biosimilars market by biosimilars market, by drug class [monoclonal antibodies (rituximab, infliximab, adalimumab, trastuzumab, Pembrolizumab, Dupilumab, Ustekinumab, Risankizumab, and other monoclonal antibodies), granulocyte colony-stimulating factor, insulin, erythropoietin, recombinant human growth hormone, etanercept, follitropin, teriparatide, interferons, anticoagulants, Aflibercept, GLP-1 antagonist, and other products), By indication (oncology, inflammatory and autoimmune diseases, chronic diseases, blood disorders, growth hormone deficiency, infectious diseases, type II diabetes, obesity, and other indications) and by region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa).

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the biosimilars market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, solutions, key strategies, collaborations, partnerships, and agreements. New approvals/launches, collaborations, acquisitions, and recent developments associated with the biosimilars market.

Key Benefits of Buying the Report:

The report will help market leaders and new entrants by providing them with the closest approximations of the revenue numbers for the overall biosimilars market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their businesses and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (rising global demand for affordable alternatives to expensive biologic therapies, increasing number of biosimilar launches and approvals, Impending and ongoing patent expiry of blockbuster biologics, entry of emerging players with cost-efficient manufacturing capabilities), restraints (manufacturing complexities and high cost of biosimilars, intense competition, and pricing pressure among market players), opportunities (launch of GLP-1 biosimilars, increasing strategic partnerships and collaborations among biosimilar manufacturers, and growing focus on advanced R&D operating models), and Challenges (increased market competition between biosimilar manufacturers and originator biologic companies).

- Product Development/Innovation: Detailed insights on upcoming products, research and development activities, and new product approvals/launches in the biosimilars market.

- Market Development: Comprehensive information about lucrative markets; the report analyses the market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the biosimilars market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players. A detailed analysis of the key industry players has been done to provide insights into their key strategies, product launches/ approvals, pipeline analysis, acquisitions, partnerships, agreements, collaborations, other recent developments, investment and funding activities, brand/product comparative analysis, and vendor valuation and financial metrics of the biosimilars market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Objectives of secondary research

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objective of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.1.1.1 Revenue share analysis of Sandoz Group AG

- 2.2.1.2 MnM repository analysis

- 2.2.1.3 Primary interviews

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.2 INSIGHTS FROM PRIMARY EXPERTS

- 2.2.3 SEGMENTAL MARKET SIZE ESTIMATION (TOP-DOWN APPROACH)

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.3 MARKET GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 BIOSIMILARS MARKET OVERVIEW

- 4.2 NORTH AMERICA: BIOSIMILARS MARKET, BY DRUG CLASS AND COUNTRY

- 4.3 BIOSIMILARS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 BIOSIMILARS MARKET: EMERGING VS. DEVELOPED MARKETS, 2025 VS. 2035 (USD MILLION)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising global demand for affordable alternatives to expensive biologic therapies

- 5.2.1.2 Increasing number of biosimilar launches and approvals

- 5.2.1.3 Impending and ongoing patent expiry of blockbuster biologics

- 5.2.1.4 Entry of emerging players with cost-efficient manufacturing capabilities

- 5.2.2 RESTRAINTS

- 5.2.2.1 Manufacturing complexities and high cost of biosimilars

- 5.2.2.2 Intense competition and pricing pressure among market players

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Launch of GLP-1 biosimilars

- 5.2.3.2 Increasing strategic partnerships and collaborations among biosimilar manufacturers

- 5.2.3.3 Growing focus on advanced R&D operating models

- 5.2.4 CHALLENGES

- 5.2.4.1 Increased market competition between biosimilar manufacturers and originator biologic companies

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Advanced bioprocessing & manufacturing technologies

- 5.3.1.2 Analytical & characterization techniques

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 AI & ML

- 5.3.2.2 Lab automation & robotics

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Microbial fermentation

- 5.3.3.2 3D bioprinting & high-density cell culture

- 5.3.1 KEY TECHNOLOGIES

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 ROLE IN ECOSYSTEM

- 5.7 PATENT ANALYSIS

- 5.7.1 LIST OF KEY PATENTS

- 5.8 PIPELINE ANALYSIS

- 5.8.1 BIOSIMILAR PRODUCTS IN CLINICAL PIPELINE

- 5.8.2 LIST OF KEY BIOLOGICS TO GO OFF-PATENT

- 5.9 REGULATORY ANALYSIS

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATORY FRAMEWORK

- 5.10 REIMBURSEMENT SCENARIO ANALYSIS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND OF BIOSIMILAR PRODUCTS, BY KEY PLAYER, 2022-2024

- 5.11.2 AVERAGE SELLING PRICE TREND OF BIOSIMILAR PRODUCTS, BY REGION, 2022-2024

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 KEY BUYING CRITERIA

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI ON BIOSIMILARS MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON BIOSIMILARS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 North America

- 5.17.4.1.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.4.1 North America

- 5.17.5 IMPACT ON UPSTREAM MANUFACTURING INDUSTRIES

6 BIOSIMILARS MARKET, BY DRUG CLASS

- 6.1 INTRODUCTION

- 6.2 MONOCLONAL ANTIBODIES

- 6.2.1 RITUXIMAB

- 6.2.1.1 Rising incidences of autoimmune diseases and cancer to boost segment growth

- 6.2.2 INFLIXIMAB

- 6.2.2.1 Loss of patent exclusivity to fuel adoption for treating autoimmune diseases

- 6.2.3 ADALIMUMAB

- 6.2.3.1 Cost-effectiveness and improved patient access to support segment growth

- 6.2.4 TRASTUZUMAB

- 6.2.4.1 Rising incidence of breast cancer to spur market growth

- 6.2.5 PEMBROLIZUMAB

- 6.2.5.1 Expansion of immunotherapy in oncology to propel segment growth

- 6.2.6 DUPILUMAB

- 6.2.6.1 High cost of originator therapy and ongoing label expansions to increase demand for affordable biosimilars

- 6.2.7 USTEKINUMAB

- 6.2.7.1 High annual treatment costs of original drug to augment segment growth

- 6.2.8 RISANKIZUMAB

- 6.2.8.1 Increased biologic-naive patient growth and high demand for targeted immunotherapies to fuel adoption

- 6.2.9 OTHER MONOCLONAL ANTIBODIES

- 6.2.1 RITUXIMAB

- 6.3 GRANULOCYTE COLONY-STIMULATING FACTOR

- 6.3.1 RISING GLOBAL CANCER BURDEN AND INCREASING INVESTMENTS BY PHARMA COMPANIES TO PROPEL MARKET GROWTH

- 6.4 INSULIN

- 6.4.1 HIGH PREVALENCE OF DIABETES TO BOOST MARKET GROWTH

- 6.5 ERYTHROPOIETIN

- 6.5.1 RISING INCIDENCE OF BLOOD DISEASES TO AUGMENT MARKET GROWTH

- 6.6 RECOMBINANT HUMAN GROWTH HORMONE

- 6.6.1 RISING INCIDENCE OF CACHEXIA AND LIVER DISEASES TO FUEL MARKET GROWTH

- 6.7 ETANERCEPT

- 6.7.1 RISING INCIDENCE OF AUTOIMMUNE DISEASES TO DRIVE APPROVAL AND COMMERCIALIZATION OF ETANERCEPT BIOSIMILARS

- 6.8 FOLLITROPIN

- 6.8.1 POPULARITY OF FOLLITROPIN IN INFERTILITY TREATMENT TO SPUR MARKET GROWTH

- 6.9 TERIPARATIDE

- 6.9.1 INCREASING INCIDENCE OF OSTEOPOROSIS TO BOOST MARKET DEMAND

- 6.10 INTERFERONS

- 6.10.1 GROWING PREVALENCE OF INFECTIOUS DISEASES TO SUPPORT MARKET GROWTH

- 6.11 ANTICOAGULANTS

- 6.11.1 RISING PREVALENCE OF CARDIOVASCULAR DISEASES TO FUEL MARKET GROWTH

- 6.12 AFLIBERCEPT

- 6.12.1 HIGH COST OF ORIGINATOR DRUG AND INCREASED PREVALENCE OF AGE-RELATED EYE DISEASES TO DRIVE SEGMENT

- 6.13 GLP-1 ANTAGONIST

- 6.13.1 HIGH PREVALENCE OF DIABETES AND OBESITY TO AID MARKET GROWTH

- 6.14 OTHER DRUG CLASSES

7 BIOSIMILARS MARKET, BY INDICATION

- 7.1 INTRODUCTION

- 7.2 ONCOLOGY

- 7.2.1 HIGH PREVALENCE OF CANCER TO DRIVE MARKET

- 7.3 INFLAMMATORY & AUTOIMMUNE DISEASES

- 7.3.1 RISING LIFE EXPECTANCY AND GROWING GERIATRIC POPULATION TO AUGMENT MARKET GROWTH

- 7.4 CHRONIC DISEASES

- 7.4.1 HIGH BURDEN OF CARDIOVASCULAR DISEASES TO FUEL UPTAKE OF BIOSIMILARS

- 7.5 BLOOD DISORDERS

- 7.5.1 INCREASING INCIDENCE OF BLOOD DISORDERS TO BOOST BIOSIMILAR DEMAND

- 7.6 GROWTH HORMONE DEFICIENCY

- 7.6.1 INCREASING CASES OF GROWTH HORMONE DEFICIENCY AMONG ADULTS TO INCREASE DEMAND FOR BIOSIMILARS

- 7.7 INFECTIOUS DISEASES

- 7.7.1 HIGH POPULATION DENSITY AND INDUSTRIALIZATION OF FOOD PRODUCTION TO DRIVE PREVALENCE IN EMERGING ECONOMIES

- 7.8 TYPE II DIABETES

- 7.8.1 COST-EFFECTIVENESS AND HIGH EFFICACY TO DRIVE BIOSIMILAR ADOPTION FOR DIABETES

- 7.9 OBESITY

- 7.9.1 INCREASING SEDENTARY LIFESTYLE AMONG ADULTS TO PROPEL MARKET GROWTH

- 7.10 OTHER INDICATIONS

8 BIOSIMILARS MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 EUROPE

- 8.2.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 8.2.2 GERMANY

- 8.2.2.1 Acceptance of biosimilars by physicians over originator products to propel market growth

- 8.2.3 UK

- 8.2.3.1 Rising prevalence of life-threatening diseases to fuel demand for low-priced biosimilars

- 8.2.4 FRANCE

- 8.2.4.1 Increased government R&D investments for biosimilar drugs to augment market growth

- 8.2.5 ITALY

- 8.2.5.1 Favorable government regulations and reimbursement policies to propel market growth

- 8.2.6 SPAIN

- 8.2.6.1 Favorable patient incentives and high healthcare R&D expenditure to promote biosimilar use

- 8.2.7 REST OF EUROPE

- 8.3 ASIA PACIFIC

- 8.3.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 8.3.2 JAPAN

- 8.3.2.1 High demand for affordable biologics and recent patent expiries of blockbuster biologics to drive market

- 8.3.3 CHINA

- 8.3.3.1 Increasing investments in pharmaceutical R&D and innovation to augment market growth

- 8.3.4 INDIA

- 8.3.4.1 Need for government healthcare expenditure reduction to propel adoption of biosimilars

- 8.3.5 SOUTH KOREA

- 8.3.5.1 Favourable government incentives to promote biosimilar use in clinical practice

- 8.3.6 AUSTRALIA

- 8.3.6.1 Launch of biosimilar-switching programs in healthcare settings to aid market adoption

- 8.3.7 REST OF ASIA PACIFIC

- 8.4 NORTH AMERICA

- 8.4.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 8.4.2 US

- 8.4.2.1 US to dominate North American biosimilars market during forecast period

- 8.4.3 CANADA

- 8.4.3.1 Favorable government initiatives to drive growth in biopharma research and manufacturing facilities

- 8.5 LATIN AMERICA

- 8.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 8.5.2 BRAZIL

- 8.5.2.1 Increased government pharmaceutical R&D investments for biosimilars to aid market growth

- 8.5.3 MEXICO

- 8.5.3.1 Well-developed regulatory landscape and high demand for chronic disease treatment to fuel biosimilar uptake

- 8.5.4 REST OF LATIN AMERICA

- 8.6 MIDDLE EAST

- 8.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 8.6.2 GCC COUNTRIES

- 8.6.2.1 Focus on local pharmaceutical R&D to augment market growth

- 8.6.3 REST OF MIDDLE EAST

- 8.7 AFRICA

- 8.7.1 INCREASED CANCER BURDEN AND NEED FOR AFFORDABLE ALTERNATIVES TO HIGH-COST BIOLOGICS TO BOOST ADOPTION

- 8.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 9.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN BIOSIMILARS MARKET, 2022-2024

- 9.3 REVENUE ANALYSIS, 2020-2024

- 9.4 MARKET SHARE ANALYSIS, 2024

- 9.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- 9.5.5 COMPETITIVE BENCHMARKING: KEY PLAYERS, 2024

- 9.5.5.1 Company footprint

- 9.5.5.2 Region footprint

- 9.5.5.3 Drug class footprint

- 9.5.5.4 Indication footprint

- 9.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 RESPONSIVE COMPANIES

- 9.6.3 DYNAMIC COMPANIES

- 9.6.4 STARTING BLOCKS

- 9.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 9.6.5.1 Detailed list of key startups/SMEs

- 9.6.5.2 Competitive benchmarking of key startups/SMEs

- 9.7 COMPANY VALUATION & FINANCIAL METRICS

- 9.7.1 FINANCIAL METRICS

- 9.7.2 COMPANY VALUATION

- 9.8 BRAND/PRODUCT COMPARISON

- 9.9 COMPETITIVE SCENARIO

- 9.9.1 PRODUCT LAUNCHES AND APPROVALS

- 9.9.2 DEALS

- 9.9.3 EXPANSIONS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 SANDOZ GROUP AG

- 10.1.1.1 Business overview

- 10.1.1.2 Products offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Product launches and approvals

- 10.1.1.3.2 Deals

- 10.1.1.3.3 Expansions

- 10.1.1.3.4 Other developments

- 10.1.1.4 MnM view

- 10.1.1.4.1 Key strengths

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses & competitive threats

- 10.1.2 PFIZER INC.

- 10.1.2.1 Business overview

- 10.1.2.2 Products offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Product approvals

- 10.1.2.3.2 Deals

- 10.1.2.4 MnM view

- 10.1.2.4.1 Key strengths

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses & competitive threats

- 10.1.3 AMGEN INC.

- 10.1.3.1 Business overview

- 10.1.3.2 Products offered

- 10.1.3.3 Products in pipeline

- 10.1.3.4 Recent developments

- 10.1.3.4.1 Product launches and approvals

- 10.1.3.4.2 Deals

- 10.1.3.4.3 Expansions

- 10.1.3.5 MnM view

- 10.1.3.5.1 Key strengths

- 10.1.3.5.2 Strategic choices

- 10.1.3.5.3 Weaknesses & competitive threats

- 10.1.4 CELLTRION INC.

- 10.1.4.1 Business overview

- 10.1.4.2 Products offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Product launches and approvals

- 10.1.4.3.2 Deals

- 10.1.4.4 MnM view

- 10.1.4.4.1 Key strengths

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses & competitive threats

- 10.1.5 BIOCON

- 10.1.5.1 Business overview

- 10.1.5.2 Products offered

- 10.1.5.3 Recent developments

- 10.1.5.3.1 Product approvals

- 10.1.5.3.2 Deals

- 10.1.5.3.3 Other developments

- 10.1.5.4 MnM view

- 10.1.5.4.1 Key strengths

- 10.1.5.4.2 Strategic choices

- 10.1.5.4.3 Weaknesses & competitive threats

- 10.1.6 DR. REDDY'S LABORATORIES LTD.

- 10.1.6.1 Business overview

- 10.1.6.2 Products offered

- 10.1.6.3 Recent developments

- 10.1.6.3.1 Product launches

- 10.1.6.3.2 Deals

- 10.1.6.3.3 Other developments

- 10.1.7 ELI LILLY AND COMPANY

- 10.1.7.1 Business overview

- 10.1.7.2 Products offered

- 10.1.7.3 Recent developments

- 10.1.7.3.1 Product launches

- 10.1.7.3.2 Deals

- 10.1.7.3.3 Expansions

- 10.1.8 TEVA PHARMACEUTICAL INDUSTRIES LTD.

- 10.1.8.1 Business overview

- 10.1.8.2 Products offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 Product launches and approvals

- 10.1.8.3.2 Deals

- 10.1.8.3.3 Other developments

- 10.1.9 FRESENIUS KABI AG

- 10.1.9.1 Business overview

- 10.1.9.2 Products offered

- 10.1.9.3 Recent developments

- 10.1.9.3.1 Product launches and approvals

- 10.1.9.3.2 Deals

- 10.1.10 STADA ARZNEIMITTEL AG

- 10.1.10.1 Business overview

- 10.1.10.2 Products offered

- 10.1.10.3 Recent developments

- 10.1.10.3.1 Product launches

- 10.1.10.3.2 Deals

- 10.1.10.3.3 Expansions

- 10.1.10.3.4 Other developments

- 10.1.11 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- 10.1.11.1 Business overview

- 10.1.11.2 Products offered

- 10.1.11.3 Recent developments

- 10.1.11.3.1 Product approvals

- 10.1.11.3.2 Deals

- 10.1.11.3.3 Expansions

- 10.1.12 SAMSUNG BIOLOGICS

- 10.1.12.1 Business overview

- 10.1.12.2 Products offered

- 10.1.12.3 Recent developments

- 10.1.12.3.1 Product approvals

- 10.1.12.3.2 Deals

- 10.1.12.3.3 Expansions

- 10.1.13 AMNEAL PHARMACEUTICALS LLC

- 10.1.13.1 Business overview

- 10.1.13.2 Products offered

- 10.1.13.3 Recent developments

- 10.1.13.3.1 Product approvals

- 10.1.13.3.2 Deals

- 10.1.13.3.3 Other developments

- 10.1.14 COHERUS BIOSCIENCES

- 10.1.14.1 Business overview

- 10.1.14.2 Products offered

- 10.1.14.3 Recent developments

- 10.1.14.3.1 Deals

- 10.1.14.3.2 Other developments

- 10.1.15 BIO THERA SOLUTIONS

- 10.1.15.1 Business overview

- 10.1.15.2 Products offered

- 10.1.15.3 Recent developments

- 10.1.15.3.1 Product approvals

- 10.1.15.3.2 Deals

- 10.1.16 APROGEN

- 10.1.16.1 Business overview

- 10.1.16.2 Products offered

- 10.1.16.3 Recent developments

- 10.1.16.3.1 Product approvals

- 10.1.16.4 Products in pipeline

- 10.1.17 SHANGHAI HENLINUS BIOTECH, INC.

- 10.1.17.1 Business overview

- 10.1.17.2 Products offered

- 10.1.17.3 Products in pipeline

- 10.1.17.4 Recent developments

- 10.1.17.4.1 Product approvals

- 10.1.17.4.2 Deals

- 10.1.17.4.3 Other developments

- 10.1.1 SANDOZ GROUP AG

- 10.2 OTHER PLAYERS

- 10.2.1 ALVOTECH

- 10.2.2 AMEGA BIOTECH

- 10.2.3 BIOCAD

- 10.2.4 PROBIOMED S.A. DE C.V.

- 10.2.5 FUJIFILM KYOWA KIRIN BIOLOGICS CO., LTD.

- 10.2.6 POLPHARMA BIOLOGICS GROUP

- 10.2.7 NEUCLONE

- 10.2.8 XENTRIA

- 10.2.9 YL BIOLOGICS

- 10.2.10 KASHIV BIOSCIENCES, LLC

- 10.2.11 NANOGEN PHARMACEUTICAL BIOTECHNOLOGY JSC

- 10.2.12 SYNERMORE BIOLOGICS (SUZHOU) CO., LTD.

- 10.2.13 CURATEQ BIOLOGICS PVT. LTD.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS