|

|

市場調査レポート

商品コード

1752394

商業用セキュリティシステムの世界市場:ハードウェア別、ソフトウェア別、サービス別、エンドユーザー別、地域別 - 2030年までの予測Commercial Security System Market by Fire Protection, Video Surveillance, Access Control, Biometric, RFID, VSaaS, ACaaS, Building Management - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 商業用セキュリティシステムの世界市場:ハードウェア別、ソフトウェア別、サービス別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月12日

発行: MarketsandMarkets

ページ情報: 英文 483 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

商業用セキュリティシステムの市場規模は、2025年の2,228億6,000万米ドルから2030年には3,816億6,000万米ドルに成長し、CAGRは11.4%になると予測されています。

商業用セキュリティシステム市場は、スマート技術、IoT接続、AIベースの監視によって成長し、牽引されています。都市化とスマートシティは、リアルタイムの監視とアクセス管理のための高度なセキュリティインフラへの投資を促しています。クラウドベースのシステムはスケーラブルな遠隔管理を提供し、ソフトウェアベンダーやサービスプロバイダーにビジネスチャンスをもたらしています。さらに、ヘルスケア、金融、小売の各分野では、法規制への対応が包括的なセキュリティ・ソリューションへの需要を高めています。北米とアジア太平洋地域は、インフラ整備が進み、データと物理的セキュリティへの関心が高まっているため、特に有望です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | ハードウェア別、ソフトウェア別、サービス別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

ビル管理システム(BMS)市場におけるプロフェッショナルサービス分野は、統合スマートビルインフラの複雑化により、予測期間中に最も高いCAGRを記録する見込みです。組織がHVAC、照明、エネルギー、入退室管理、セキュリティ機能を統合する高度なBMSプラットフォームを採用するにつれて、専門家によるコンサルティング、システム設計、展開、継続的サポートの必要性が高まっています。BMSの設計、統合、試運転、サイバーセキュリティには、病院、オフィスビル、データセンター、製造施設などの商業スペースの厳しい運用上の要求を満たすための高度な技術スキルが不可欠です。IoT対応やクラウドベースのBMSソリューションへの移行は、ネットワーク・アーキテクチャ、データ分析、リモート・アクセス・セットアップの専門知識に対する需要をさらに高めています。規制圧力とグリーン認証要件も、エネルギー使用を最適化し、持続可能性を高めるサービスの必要性を強化しています。さらに、予知保全と居住者の快適性向上のためにAIと機械学習を統合することで、専門サービス・プロバイダーへの依存が加速しています。カスタマイズされた将来対応可能なBMS設置へのこのシフトは、予測期間を通じて専門サービスの力強い成長を促進し続けると思われます。

病院、診療所、研究所、研究機関などのヘルスケア分野では、貴重な資産や機密性の高い患者情報を保護するために高度なセキュリティシステムが必要とされています。防火対策が重要であることに変わりはありませんが、医療機器や患者の記録を保護するためには、より広範なセキュリティ対策が不可欠です。入退室管理システムは、スタッフや患者の安全を確保する上で重要な役割を担っており、バイオメトリック技術はその高い信頼性と衛生面での利点から支持を集めています。指紋や手のひらスキャナーよりも顔や虹彩認証の方が、物理的な接触や病気感染のリスクを減らすことができるため、ますます好まれています。バイオメトリクスは患者の安全性を高め、正確な本人確認をサポートし、スタッフの出勤を監視するのに役立ちます。高度にデジタル化され、規制された環境では、これらのシステムは医療IDの盗難を防ぎ、個人の健康情報を保護し、許可された担当者のみが機密データにアクセスできるようにします。さらに、ヘルスケア施設では、物理的セキュリティを強化するために、監視カメラ、デジタルロック、アラームシステムを導入しています。生体認証ソリューションとACaaS(Access Control as a Service)を統合することで、拡張性のあるクラウドベースのセキュリティ・インフラが実現します。業界がデータ・セキュリティ、規制コンプライアンス、患者の安全を優先し続ける中、バイオメトリクスはヘルスケアのセキュリティに不可欠であり続け、業務の完全性と患者ケアの向上を促進します。

予測期間中、アジア太平洋地域は、都市化の進展、広範なインフラ開拓、地域全体でのスマートシティプロジェクトへの投資の増加により、商業用セキュリティシステム市場を独占します。中国、インド、日本、韓国では、小売複合施設、企業オフィス、データセンター、ヘルスケア施設、交通ターミナルなどの商業ビルが急成長しており、これらのビルでは監視、入退室管理、消火などの高度なセキュリティシステムが必要とされています。公共の安全、重要インフラの保護、商業安全コンプライアンスに関する厳格な規制方針が、市場の成長をさらに後押ししています。さらに、犯罪、テロリズム、データ漏洩の脅威の増大により、公共および私的な領域におけるセキュリティに対する意識が高まり、積極的なセキュリティ対策が必要となっています。低コストのセキュリティ・ハードウェアの存在、IoTとAI技術の普及、クラウドベースとモバイル対応のソリューションの利用拡大が、この地域のリーダーシップに拍車をかけています。さらに、地域および現地のセキュリティ・ソリューション・プロバイダーは、市場ニーズに合わせた手頃な価格で拡張可能なシステムを提供し、サービス拡大に大きく貢献しています。アジア太平洋地域の巨大な人口増加と商業環境のデジタル化は、統合されたスマートで適応性の高いセキュリティ・システムに対する高い需要を後押ししています。このような活気あるシナリオにより、予測期間中、アジア太平洋地域は商業用セキュリティ・システムの世界市場をリードしていくと思われます。

当レポートでは、世界の商業用セキュリティシステム市場について調査し、ハードウェア別、ソフトウェア別、サービス別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 関税と規制状況

- 特許分析、2015年~2024年

- 2025年~2026年の主な会議とイベント

- 2025年の米国関税が商業用セキュリティシステム市場に与える影響

第6章 商業用セキュリティシステム市場(ハードウェア別)

- イントロダクション

- 防火システム

- ビデオ監視システム

- アクセス制御システム

- 生体認証システム

- ビル管理システム

- RFID

第7章 商業用セキュリティシステム市場(ソフトウェア別)

- イントロダクション

- 防火ソフトウェア

- ビデオ監視ソフトウェア

- アクセス制御ソフトウェア

- ビル管理ソフトウェア

- RFIDソフトウェア

- 生体認証ソフトウェア

第8章 商業用セキュリティシステム市場(サービス別)

- イントロダクション

- 防火サービス

- ビデオ監視サービス

- アクセス制御サービス

- ビル管理サービス

- RFIDサービス

第9章 商業用セキュリティシステム市場(エンドユーザー別)

- イントロダクション

- 商業ビル

- 政府

- 自動車・輸送

- 小売、物流、倉庫

- BFSI

- 工業および製造業

- エネルギー・ユーティリティ

- 教育

- スポーツとレジャー

- ヘルスケア

第10章 商業用セキュリティシステム市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標、2024年

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要参入企業

- HONEYWELL INTERNATIONAL INC.

- ROBERT BOSCH(BOSCH SICHERHEITSSYSTEME GMBH)

- NEC CORPORATION

- JOHNSON CONTROLS

- THALES

- AXIS COMMUNICATIONS AB.

- ASSA ABLOY

- IDEMIA

- TELEDYNE TECHNOLOGIES INCORPORATED

- IDENTIV, INC.

- NEDAP N.V.

- SUPREMA INC.

- HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- DAHUA TECHNOLOGY CO., LTD.

- HANWHA VISION CO., LTD.

- DORMAKABA GROUP

- ALLEGION PLC

- FUJITSU

- ZEBRA TECHNOLOGIES CORP.

- AVERY DENNISON CORPORATION

- HID GLOBAL CORPORATION

- DATALOGIC S.P.A.

- その他の企業

- CARRIER

- SIEMENS

- EATON

- GENTEX CORPORATION

- HALMA PLC

- HOCHIKI CORPORATION

- MOTOROLA SOLUTIONS, INC.

- I-PRO

- ZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.

- PRECISE BIOMETRICS

- SECUNET SECURITY NETWORKS AG

- ANVIZ GLOBAL INC.

第13章 付録

List of Tables

- TABLE 1 COMMERCIAL SECURITY SYSTEM MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 COMMERCIAL SECURITY SYSTEM MARKET: RISK ANALYSIS

- TABLE 3 COMMERCIAL SECURITY SYSTEM MARKET: ECOSYSTEM ANALYSIS

- TABLE 4 PRICING RANGE OF VIDEO SURVEILLANCE CAMERAS OFFERED BY PLAYERS, BY END USER, 2023 (USD)

- TABLE 5 PRICING RANGE TREND OF VIDEO SURVEILLANCE CAMERAS, BY END USER, 2021-2024 (USD)

- TABLE 6 PRICING RANGE TREND OF VIDEO SURVEILLANCE CAMERAS, BY REGION, 2021-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF RFID TAGS OFFERED BY KEY PLAYERS, 2021-2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF RFID READERS OFFERED BY KEY PLAYERS, 2021-2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF RFID TAGS, BY REGION, 2021-2024 (USD)

- TABLE 10 AVERAGE SELLING PRICE TREND OF RFID READERS, BY REGION, 2021-2024 (USD)

- TABLE 11 COMMERCIAL SECURITY SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 14 IMPORT DATA FOR HS CODE 853110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 15 EXPORT DATA FOR HS CODE 853110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 16 MFN TARIFF FOR HS CODE 853110-COMPLIANT PRODUCTS EXPORTED BY US, 2023

- TABLE 17 MFN TARIFF FOR HS CODE 853110-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2023

- TABLE 18 MFN TARIFF FOR HS CODE 853110-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2023

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 COMMERCIAL SECURITY SYSTEM MARKET: KEY PATENTS

- TABLE 24 COMMERCIAL SECURITY SYSTEM MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 25 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 26 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFF

- TABLE 27 COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 28 COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 29 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 30 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 31 RFID: COMMERCIAL SECURITY SYSTEM MARKET, BY TAG TYPE, 2021-2024 (MILLION UNITS)

- TABLE 32 RFID: COMMERCIAL SECURITY SYSTEM MARKET, BY TAG TYPE, 2025-2030 (MILLION UNITS)

- TABLE 33 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 34 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 35 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 36 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 37 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL BUILDINGS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL BUILDINGS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR GOVERNMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR GOVERNMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR RETAIL, LOGISTICS, AND WAREHOUSE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR RETAIL, LOGISTICS, AND WAREHOUSE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL & MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL & MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR ENERGY & UTILITY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR ENERGY & UTILITY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 FIRE PROTECTION SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 ADVANTAGES AND DISADVANTAGES OF WET FIRE SPRINKLER SYSTEMS

- TABLE 54 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 55 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 56 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 57 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 58 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL BUILDINGS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL BUILDINGS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL & MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL & MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR GOVERNMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR GOVERNMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 VIDEO SURVEILLANCE SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 IP CAMERA VS. ANALOG CAMERA

- TABLE 67 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 68 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 69 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 70 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 71 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL BUILDINGS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL BUILDINGS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR GOVERNMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR GOVERNMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL & MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL & MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR EDUCATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR EDUCATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 ACCESS CONTROL SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

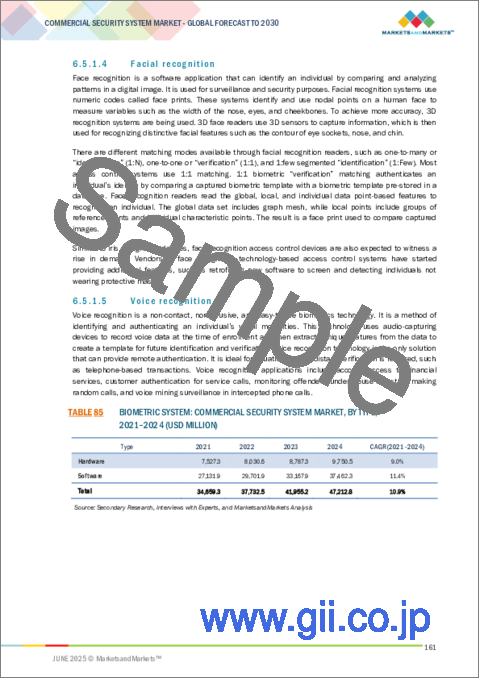

- TABLE 85 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 86 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 87 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL BUILDINGS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL BUILDINGS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR GOVERNMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR GOVERNMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR RETAIL, LOGISTICS, AND WAREHOUSE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR RETAIL, LOGISTICS, AND WAREHOUSE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR BFSI, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR BFSI, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL & MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL & MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR SPORTS & LEISURE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR SPORTS & LEISURE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 BIOMETRIC SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 106 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 108 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 109 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL BUILDINGS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL BUILDINGS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR RETAIL, LOGISTICS, AND WAREHOUSE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR RETAIL, LOGISTICS, AND WAREHOUSE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL & MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL & MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR SPORTS & LEISURE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR SPORTS & LEISURE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 122 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 RFID: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 124 RFID: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 125 RFID: COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 126 RFID: COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 127 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL BUILDINGS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL BUILDINGS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR GOVERNMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 130 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR GOVERNMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 131 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR RETAIL, LOGISTICS, AND WAREHOUSE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR RETAIL, LOGISTICS, AND WAREHOUSE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL & MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 136 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL & MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 137 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR SPORTS & LEISURE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 138 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR SPORTS & LEISURE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 139 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 140 RFID: COMMERCIAL SECURITY SYSTEM MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 141 RFID: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 142 RFID: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 143 COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 144 COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 145 FIRE PROTECTION SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 146 FIRE PROTECTION SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 147 VIDEO SURVEILLANCE SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 148 VIDEO SURVEILLANCE SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 149 VIDEO SURVEILLANCE SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 150 VIDEO SURVEILLANCE SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 151 ACCESS CONTROL SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 152 ACCESS CONTROL SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 153 BUILDING MANAGEMENT SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 154 BUILDING MANAGEMENT SYSTEM: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 155 RFID SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 156 RFID SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 157 BIOMETRIC SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 158 BIOMETRIC SOFTWARE: COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 159 COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 160 COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 161 FIRE PROTECTION SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 162 FIRE PROTECTION SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 163 VIDEO SURVEILLANCE SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 164 VIDEO SURVEILLANCE SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 165 VIDEO SURVEILLANCE SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 166 VIDEO SURVEILLANCE SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE 2025-2030 (USD MILLION)

- TABLE 167 ACCESS CONTROL SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 168 ACCESS CONTROL SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 169 ACCESS CONTROL SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 170 ACCESS CONTROL SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY TYPE 2025-2030 (USD MILLION)

- TABLE 171 BUILDING MANAGEMENT SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 172 BUILDING MANAGEMENT SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 173 RFID SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 174 RFID SERVICES: COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 175 COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 176 COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 177 COMMERCIAL BUILDINGS: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 178 COMMERCIAL BUILDINGS: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 179 COMMERCIAL BUILDINGS: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 180 COMMERCIAL BUILDINGS: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 181 COMMERCIAL BUILDINGS: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 COMMERCIAL BUILDINGS: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 COMMERCIAL BUILDINGS: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 184 COMMERCIAL BUILDINGS: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 185 COMMERCIAL BUILDINGS: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 186 COMMERCIAL BUILDINGS: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 187 GOVERNMENT: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 188 GOVERNMENT: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 189 GOVERNMENT: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 190 GOVERNMENT: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 191 GOVERNMENT: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 192 GOVERNMENT: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 193 GOVERNMENT: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 194 GOVERNMENT: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 195 GOVERNMENT: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 196 GOVERNMENT: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 197 AUTOMOTIVE & TRANSPORTATION: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 198 AUTOMOTIVE & TRANSPORTATION: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 199 AUTOMOTIVE & TRANSPORTATION: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 200 AUTOMOTIVE & TRANSPORTATION: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 201 AUTOMOTIVE & TRANSPORTATION: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 202 AUTOMOTIVE & TRANSPORTATION: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 203 AUTOMOTIVE & TRANSPORTATION: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 204 AUTOMOTIVE & TRANSPORTATION: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 205 AUTOMOTIVE & TRANSPORTATION: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 206 AUTOMOTIVE & TRANSPORTATION: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 207 RETAIL, LOGISTICS, AND WAREHOUSE: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 208 RETAIL, LOGISTICS, AND WAREHOUSE: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 209 RETAIL, LOGISTICS, AND WAREHOUSE: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 210 RETAIL, LOGISTICS, AND WAREHOUSE: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 211 RETAIL, LOGISTICS, AND WAREHOUSE: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 212 RETAIL, LOGISTICS, AND WAREHOUSE: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 213 RETAIL, LOGISTICS, AND WAREHOUSE: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 214 RETAIL, LOGISTICS, AND WAREHOUSE: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 215 RETAIL, LOGISTICS, AND WAREHOUSE: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 216 RETAIL, LOGISTICS, AND WAREHOUSE: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 217 BFSI: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 218 BFSI: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 219 BFSI: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 220 BFSI: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 221 BFSI: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 222 BFSI: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 223 BFSI: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 224 BFSI: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 225 BFSI: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 226 BFSI: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 227 INDUSTRIAL & MANUFACTURING: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 228 INDUSTRIAL & MANUFACTURING: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 229 INDUSTRIAL & MANUFACTURING: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 230 INDUSTRIAL & MANUFACTURING: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 231 INDUSTRIAL & MANUFACTURING: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 232 INDUSTRIAL & MANUFACTURING: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 233 INDUSTRIAL & MANUFACTURING: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 234 INDUSTRIAL & MANUFACTURING: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 235 INDUSTRIAL & MANUFACTURING: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 236 INDUSTRIAL & MANUFACTURING: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 237 ENERGY & UTILITY: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 238 ENERGY & UTILITY: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 239 ENERGY & UTILITY: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 240 ENERGY & UTILITY: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 241 ENERGY & UTILITY: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 242 ENERGY & UTILITY: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 243 ENERGY & UTILITY: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 244 ENERGY & UTILITY: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 245 ENERGY & UTILITY: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 246 ENERGY & UTILITY: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 247 EDUCATION: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 248 EDUCATION: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 249 EDUCATION: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 250 EDUCATION: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 251 EDUCATION: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 252 EDUCATION: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 253 EDUCATION: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 254 EDUCATION: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 255 EDUCATION: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 256 EDUCATION: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 257 SPORTS & LEISURE: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 258 SPORTS & LEISURE: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 259 SPORTS & LEISURE: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 260 SPORTS & LEISURE: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 261 SPORTS & LEISURE: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 262 SPORTS & LEISURE: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 263 SPORTS & LEISURE: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 264 SPORTS & LEISURE: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 265 SPORTS & LEISURE: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 266 SPORTS & LEISURE: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 267 HEALTHCARE: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 268 HEALTHCARE: COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 269 HEALTHCARE: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 270 HEALTHCARE: COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 271 HEALTHCARE: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 272 HEALTHCARE: COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 273 HEALTHCARE: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 274 HEALTHCARE: COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 275 HEALTHCARE: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 276 HEALTHCARE: COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 277 COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 278 COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 279 COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 280 COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 281 COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY END USER, 2021-2024 (USD MILLION)

- TABLE 282 COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY END USER, 2025-2030 (USD MILLION)

- TABLE 283 US: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 284 US: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 285 CANADA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 286 CANADA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 287 MEXICO: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 288 MEXICO: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 289 COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 290 COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 291 COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY END USER, 2021-2024 (USD MILLION)

- TABLE 292 COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 293 UK: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 294 UK: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 295 GERMANY: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 296 GERMANY: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 297 FRANCE: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 298 FRANCE: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 299 SPAIN: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 300 SPAIN: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 301 ITALY: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 302 ITALY: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 303 POLAND: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 304 POLAND: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 305 NORDICS: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 306 NORDICS: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 307 REST OF EUROPE: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 308 REST OF EUROPE: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 309 COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 310 COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 311 COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 312 COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 313 CHINA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 314 CHINA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 315 JAPAN: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 316 JAPAN: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 317 SOUTH KOREA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 318 SOUTH KOREA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 319 INDIA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 320 INDIA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 321 AUSTRALIA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 322 AUSTRALIA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 323 INDONESIA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 324 INDONESIA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 325 MALAYSIA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 326 MALAYSIA: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 327 THAILAND: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 328 THAILAND: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 329 VIETNAM: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 330 VIETNAM: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 331 REST OF ASIA PACIFIC: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 332 REST OF ASIA PACIFIC: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 333 COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 334 COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 335 COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY END USER, 2021-2024 (USD MILLION)

- TABLE 336 COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY END USER, 2025-2030 (USD MILLION)

- TABLE 337 MIDDLE EAST: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 338 MIDDLE EAST: COMMERCIAL SECURITY SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 339 MIDDLE EAST: COMMERCIAL SECURITY SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 340 MIDDLE EAST: COMMERCIAL SECURITY SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 341 AFRICA: COMMERCIAL SECURITY SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 342 AFRICA: COMMERCIAL SECURITY SYSTEM MARKET FOR, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 343 OVERVIEW OF MAJOR STRATEGIES DEPLOYED BY KEY PLAYERS IN COMMERCIAL SECURITY SYSTEM MARKET

- TABLE 344 COMMERCIAL SECURITY SYSTEM MARKET: DEGREE OF COMPETITION

- TABLE 345 COMMERCIAL SECURITY SYSTEM MARKET: REGION FOOTPRINT

- TABLE 346 COMMERCIAL SECURITY SYSTEM MARKET: HARDWARE FOOTPRINT

- TABLE 347 COMMERCIAL SECURITY SYSTEM MARKET: SOFTWARE FOOTPRINT

- TABLE 348 COMMERCIAL SECURITY SYSTEM MARKET: SERVICE FOOTPRINT

- TABLE 349 COMMERCIAL SECURITY SYSTEM MARKET: END USER FOOTPRINT

- TABLE 350 COMMERCIAL SECURITY SYSTEM MARKET (VIDEO SURVEILLANCE): LIST OF KEY STARTUPS/SMES

- TABLE 351 COMMERCIAL SECURITY SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 352 COMMERCIAL SECURITY SYSTEM MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 353 COMMERCIAL SECURITY SYSTEM MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 354 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 355 HONEYWELL INTERNATIONAL INC. PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 356 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 357 ROBERT BOSCH GMBH (BOSCH SICHERHEITSSYSTEME GMBH): COMPANY OVERVIEW

- TABLE 358 ROBERT BOSCH GMBH (BOSCH SICHERHEITSSYSTEME GMBH): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 ROBERT BOSCH GMBH (BOSCH SICHERHEITSSYSTEME GMBH): PRODUCT LAUNCHES

- TABLE 360 ROBERT BOSCH GMBH (BOSCH SICHERHEITSSYSTEME GMBH): DEALS

- TABLE 361 ROBERT BOSCH GMBH (BOSCH SICHERHEITSSYSTEME GMBH): OTHER DEVELOPMENTS

- TABLE 362 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 363 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 364 NEC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 365 NEC CORPORATION: DEALS

- TABLE 366 NEC CORPORATION: OTHER DEVELOPMENTS

- TABLE 367 JOHNSON CONTROLS: COMPANY OVERVIEW

- TABLE 368 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 369 JOHNSON CONTROLS: PRODUCT LAUNCHES

- TABLE 370 JOHNSON CONTROLS: DEALS

- TABLE 371 THALES: COMPANY OVERVIEW

- TABLE 372 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 373 THALES: PRODUCT LAUNCHES

- TABLE 374 THALES: DEALS

- TABLE 375 THALES: EXPANSIONS

- TABLE 376 THALES: OTHER DEVELOPMENTS

- TABLE 377 AXIS COMMUNICATIONS AB.: COMPANY OVERVIEW

- TABLE 378 AXIS COMMUNICATIONS AB.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 379 AXIS COMMUNICATIONS AB.: PRODUCT LAUNCHES

- TABLE 380 AXIS COMMUNICATIONS AB.: DEALS

- TABLE 381 AXIS COMMUNICATIONS AB.: OTHER DEVELOPMENTS

- TABLE 382 ASSA ABLOY: COMPANY OVERVIEW

- TABLE 383 ASSA ABLOY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 384 ASSA ABLOY: DEALS

- TABLE 385 IDEMIA: COMPANY OVERVIEW

- TABLE 386 IDEMIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 387 IDEMIA: PRODUCT LAUNCHES

- TABLE 388 IDEMIA: DEALS

- TABLE 389 IDEMIA: OTHER DEVELOPMENTS

- TABLE 390 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 391 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 392 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

- TABLE 393 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

- TABLE 394 IDENTIV INC.: COMPANY OVERVIEW

- TABLE 395 IDENTIV INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 396 IDENTIV INC.: PRODUCT LAUNCHES

- TABLE 397 IDENTIV INC.: DEALS

- TABLE 398 NEDAP N.V.: COMPANY OVERVIEW

- TABLE 399 NEDAP N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 400 NEDAP N.V.: PRODUCT LAUNCHES

- TABLE 401 NEDAP N.V.: DEALS

- TABLE 402 SUPREMA INC.: COMPANY OVERVIEW

- TABLE 403 SUPREMA INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 404 SUPREMA INC.: PRODUCT LAUNCHES

- TABLE 405 SUPREMA INC.: DEALS

- TABLE 406 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 407 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 408 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 409 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: DEALS

- TABLE 410 DAHUA TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 411 DAHUA TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 412 DAHUA TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 413 HANWHA VISION CO., LTD.: COMPANY OVERVIEW

- TABLE 414 HANWHA VISION CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 415 HANWHA VISION CO., LTD.: PRODUCT LAUNCHES

- TABLE 416 HANWHA VISION CO., LTD.: DEALS

- TABLE 417 HANWHA VISION CO., LTD.: EXPANSIONS

- TABLE 418 DORMAKABA GROUP: COMPANY OVERVIEW

- TABLE 419 DORMAKABA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 420 DORMAKABA GROUP: PRODUCT LAUNCHES

- TABLE 421 DORMAKABA GROUP: DEALS

- TABLE 422 ALLEGION PLC: COMPANY OVERVIEW

- TABLE 423 ALLEGION PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 424 ALLEGION PLC: DEALS

- TABLE 425 FUJITSU: COMPANY OVERVIEW

- TABLE 426 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 427 FUJITSU: PRODUCT LAUNCHES

- TABLE 428 FUJITSU: DEALS

- TABLE 429 ZEBRA TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 430 ZEBRA TECHNOLOGIES CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 431 ZEBRA TECHNOLOGIES CORP.: PRODUCT LAUNCHES

- TABLE 432 ZEBRA TECHNOLOGIES CORP.: DEALS

- TABLE 433 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

- TABLE 434 AVERY DENNISON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 435 AVERY DENNISON CORPORATION: PRODUCT LAUNCHES

- TABLE 436 AVERY DENNISON CORPORATION: DEALS

- TABLE 437 AVERY DENNISON CORPORATION: EXPANSIONS

- TABLE 438 HID GLOBAL CORPORATION: COMPANY OVERVIEW

- TABLE 439 HID GLOBAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 440 HID GLOBAL CORPORATION: PRODUCT LAUNCHES

- TABLE 441 HID GLOBAL CORPORATION: DEALS

- TABLE 442 DATALOGIC S.P.A.: COMPANY OVERVIEW

- TABLE 443 DATALOGIC S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 COMMERCIAL SECURITY SYSTEM MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 COMMERCIAL SECURITY SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 COMMERCIAL SECURITY SYSTEM MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 COMMERCIAL SECURITY SYSTEM MARKET: ESTIMATION OF MARKET SIZE FOR BIOMETRIC SYSTEMS (SUPPLY SIDE)

- FIGURE 7 COMMERCIAL SECURITY SYSTEM MARKET: DATA TRIANGULATION

- FIGURE 8 COMMERCIAL SECURITY SYSTEM MARKET: RESEARCH LIMITATIONS

- FIGURE 9 BUILDING MANAGEMENT SYSTEM TO EXHIBIT HIGHEST CAGR IN HARDWARE SEGMENT OF COMMERCIAL SECURITY SYSTEM MARKET

- FIGURE 10 BIOMETRIC TO ACCOUNT FOR LARGEST SHARE IN SOFTWARE SEGMENT DURING FORECAST PERIOD

- FIGURE 11 FIRE PROTECTION TO DOMINATE IN SERVICE SEGMENT OF COMMERCIAL SECURITY SYSTEM MARKET BETWEEN 2025 AND 2030

- FIGURE 12 COMMERCIAL BUILDINGS TO ACCOUNT FOR LARGEST MARKET SHARE BETWEEN 2025 AND 2030

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN COMMERCIAL SECURITY SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 14 EMPHASIS ON BUILDING MANAGEMENT SYSTEM TO OFFER LUCRATIVE OPPORTUNITIES FOR PLAYERS IN COMMERCIAL SECURITY SYSTEM MARKET

- FIGURE 15 FIRE PROTECTION SYSTEM TO LEAD COMMERCIAL SECURITY SYSTEM MARKET BETWEEN 2025 AND 2030

- FIGURE 16 BIOMETRIC SOFTWARE TO DOMINATE MARKET IN 2025

- FIGURE 17 US DOMINATED COMMERCIAL SECURITY SYSTEM MARKET IN NORTH AMERICA IN 2024

- FIGURE 18 FIRE PROTECTION SERVICES HELD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 19 COMMERCIAL BUILDINGS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 20 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL COMMERCIAL SECURITY SYSTEM MARKET FROM 2025 TO 2030

- FIGURE 21 COMMERCIAL SECURITY SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 COMMERCIAL SECURITY SYSTEM MARKET DRIVERS: IMPACT ANALYSIS

- FIGURE 23 COMMERCIAL SECURITY SYSTEM MARKET RESTRAINTS: IMPACT ANALYSIS

- FIGURE 24 COMMERCIAL SECURITY SYSTEM MARKET OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 25 COMMERCIAL SECURITY SYSTEM MARKET CHALLENGES: IMPACT ANALYSIS

- FIGURE 26 VALUE CHAIN ANALYSIS: COMMERCIAL SECURITY SYSTEM MARKET

- FIGURE 27 KEY STAKEHOLDERS IN COMMERCIAL SECURITY SYSTEM MARKET ECOSYSTEM

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO

- FIGURE 29 REVENUE SHIFT FOR PLAYERS IN COMMERCIAL SECURITY SYSTEM MARKET

- FIGURE 30 PRICING RANGE OF VIDEO SURVEILLANCE CAMERAS OFFERED BY PLAYERS FOR TOP TWO END USERS, 2023

- FIGURE 31 PRICING RANGE OF VIDEO SURVEILLANCE CAMERAS, BY END USERS, 2021-2024

- FIGURE 32 AVERAGE SELLING PRICE TREND OF VIDEO SURVEILLANCE CAMERAS, BY REGION, 2021-2024

- FIGURE 33 AVERAGE SELLING PRICE TREND OF RFID TAGS OFFERED BY KEY PLAYERS, 2021-2024

- FIGURE 34 AVERAGE SELLING PRICE TREND OF RFID READERS OFFERED BY KEY PLAYERS, 2021-2024

- FIGURE 35 AVERAGE SELLING PRICE TREND OF RFID TAGS, BY REGION, 2021-2024

- FIGURE 36 AVERAGE SELLING PRICE TREND OF RFID READERS, BY REGION, 2021-2024

- FIGURE 37 IMPACT OF AI/GEN AI ON COMMERCIAL SECURITY SYSTEM MARKET

- FIGURE 38 PORTER'S FIVE FORCES ANALYSIS: COMMERCIAL SECURITY SYSTEM MARKET

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 40 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 41 IMPORT SCENARIO FOR HS CODE 853110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 42 EXPORT SCENARIO FOR HS CODE 853110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 43 NUMBER OF PATENTS GRANTED FOR COMMERCIAL SECURITY SYSTEM PRODUCTS, 2015-2024

- FIGURE 44 BUILDING MANAGEMENT SYSTEM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 BIOMETRIC SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 46 FIRE PROTECTION SERVICES TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 47 COMMERCIAL BUILDINGS SEGMENT ACCOUNTS FOR LARGEST SHARE OF OVERALL COMMERCIAL SECURITY SYSTEM MARKET

- FIGURE 48 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN COMMERCIAL SECURITY SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: COMMERCIAL SECURITY SYSTEM MARKET SNAPSHOT

- FIGURE 50 US TO REGISTER HIGHEST CAGR IN COMMERCIAL SECURITY SYSTEM MARKET IN NORTH AMERICA DURING FORECAST PERIOD

- FIGURE 51 EUROPE: COMMERCIAL SECURITY SYSTEM MARKET SNAPSHOT

- FIGURE 52 GERMANY TO ACCOUNT FOR LARGEST MARKET SHARE IN EUROPE DURING FORECAST PERIOD

- FIGURE 53 ASIA PACIFIC: COMMERCIAL SECURITY SYSTEM MARKET SNAPSHOT

- FIGURE 54 INDIA TO REGISTER HIGHEST CAGR IN ASIA PACIFIC COMMERCIAL SECURITY SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 55 ROW: COMMERCIAL SECURITY SYSTEM MARKET SNAPSHOT

- FIGURE 56 MIDDLE EAST TO REGISTER HIGHEST CAGR IN COMMERCIAL SECURITY SYSTEM MARKET IN REST OF THE WORLD

- FIGURE 57 REVENUE ANALYSIS OF TOP FIVE COMPANIES, 2019-2023

- FIGURE 58 COMMERCIAL SECURITY SYSTEM: MARKET SHARE ANALYSIS (2023)

- FIGURE 59 COMPANY VALUATION, 2024

- FIGURE 60 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 61 COMMERCIAL SECURITY SYSTEM MARKET: TOP TRENDING BRANDS/PRODUCTS

- FIGURE 62 COMMERCIAL SECURITY SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 63 COMMERCIAL SECURITY SYSTEM MARKET: COMPANY FOOTPRINT

- FIGURE 64 COMMERCIAL SECURITY SYSTEM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 65 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 66 ROBERT BOSCH GMBH (BOSCH SICHERHEITSSYSTEME GMBH): COMPANY SNAPSHOT

- FIGURE 67 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 69 THALES: COMPANY SNAPSHOT

- FIGURE 70 AXIS COMMUNICATIONS AB.: COMPANY SNAPSHOT

- FIGURE 71 ASSA ABLOY: COMPANY SNAPSHOT

- FIGURE 72 IDEMIA: COMPANY SNAPSHOT

- FIGURE 73 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 74 IDENTIV INC.: COMPANY SNAPSHOT

- FIGURE 75 NEDAP N.V.: COMPANY SNAPSHOT

- FIGURE 76 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 77 DAHUA TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 78 DORMAKABA GROUP: COMPANY SNAPSHOT

- FIGURE 79 ALLEGION PLC: COMPANY SNAPSHOT

- FIGURE 80 FUJITSU: COMPANY SNAPSHOT

- FIGURE 81 ZEBRA TECHNOLOGIES CORP.: COMPANY SNAPSHOT

- FIGURE 82 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

- FIGURE 83 DATALOGIC S.P.A.: COMPANY SNAPSHOT

The commercial security system market is projected to grow from USD 222.86 billion in 2025 to USD 381.66 billion by 2030, at a CAGR of 11.4%. The market for commercial security systems is growing and is driven by smart technologies, IoT connectivity, and AI-based surveillance. Urbanization and smart cities are prompting investments in advanced security infrastructure for real-time monitoring and access management. Cloud-based systems provide scalable remote management, creating opportunities for software vendors and service providers. Additionally, regulatory compliance in healthcare, finance, and retail sectors is increasing demand for comprehensive security solutions. North America and Asia Pacific are particularly promising due to infrastructure development and heightened data and physical security concerns.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Hardware, By Software, By Services, By Vertical, and By Region |

| Regions covered | North America, Europe, APAC, RoW |

"Market for professional services in building management system segment to grow at highest CAGR during forecast period."

The professional services segment in the building management system (BMS) market is expected to register the highest CAGR during the forecast period, driven by the increasing complexity of integrated smart building infrastructure. As organizations adopt advanced BMS platforms that unify HVAC, lighting, energy, access control, and security functions, the need for expert consultation, system design, deployment, and ongoing support is intensifying. Sophisticated technical skills are essential for BMS design, integration, commissioning, and cybersecurity to meet the rigorous operational demands of commercial spaces such as hospitals, office buildings, data centers, and manufacturing facilities. The transition toward IoT-enabled and cloud-based BMS solutions further elevates the demand for expertise in network architecture, data analytics, and remote access setup. Regulatory pressure and green certification requirements also reinforce the need for services that optimize energy use and enhance sustainability. Additionally, integrating AI and machine learning for predictive maintenance and improved occupant comfort is accelerating reliance on specialized service providers. This shift toward customized, future-ready BMS installations will continue to fuel robust growth in professional services throughout the forecast period.

.

"Healthcare segment to exhibit highest CAGR in commercial security system market, by end user, during forecast period"

The healthcare sector-including hospitals, clinics, laboratories, and research institutes-requires advanced security systems to safeguard valuable assets and sensitive patient information. While fire protection remains critical, broader security measures are essential to protect medical equipment and patient records. Access control systems play a key role in securing staff and patients, with biometric technologies gaining traction for their high reliability and hygiene benefits. Face and iris recognition are increasingly preferred over fingerprint or palm scanners, as they reduce physical contact and the risk of disease transmission. Biometrics enhance patient safety, support accurate identification, and help monitor staff attendance. In a highly digital and regulated environment, these systems prevent medical identity theft, protect personal health information, and ensure only authorized personnel can access confidential data. Additionally, healthcare facilities are deploying surveillance cameras, digital locks, and alarm systems to bolster physical security. Integrating biometric solutions with Access Control as a Service (ACaaS) supports a scalable, cloud-based security infrastructure. As the industry continues prioritizing data security, regulatory compliance, and patient safety, biometrics will remain vital to healthcare security, driving improvements in operational integrity and patient care.

"Asia Pacific to capture largest market share throughout forecast period."

During the forecast period, Asia Pacific will dominate the market for commercial security systems due to increasing urbanization, extensive infrastructure development, and growing investments in smart city projects across the region. China, India, Japan, and South Korea are experiencing rapid growth in commercial buildings, including retail complexes, corporate offices, data centers, healthcare facilities, and transportation terminals-all of which require advanced security systems for monitoring, access control, and fire suppression. Public safety, protection of critical infrastructure, and stringent regulatory policies for commercial safety compliance are further driving market growth. Moreover, the growing menace of crime, terrorism, and data breaches has increased awareness and proactive security in public and private domains. The presence of low-cost security hardware, the spread of IoT and AI technologies, and the growing use of cloud-based and mobile-enabled solutions add to the region's leadership. Moreover, regional and local security solution providers are making significant efforts to expand their offerings, providing affordable and scalable systems tailored to meet market needs. Asia Pacific's gigantic and increasing population and the digitalization of commercial environments drive high demand for converged, smart, and adaptive security systems. Such a vibrant scenario is likely to set the region as a leader in the global market for commercial security systems during the forecast period.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the commercial security system marketplace. The breakup of the profile of primary participants in the commercial security system market is as follows:

- By Company Type: Tier 1 - 38%, Tier 2 - 28%, and Tier 3 - 34%

- By Designation: C-level Executives - 40%, Directors - 30%, and Others - 30%

- By Region: North America - 35%, Europe - 35%, Asia Pacific - 20%, and RoW - 10%

Honeywell International Inc. (US), Bosch Sicherheitssysteme GmbH (Germany), NEC Corporation (Japan), Johnson Controls (US), Thales (France), Axis Communications AB (Sweden), ASSA ABLOY (Sweden), IDEMIA (France), Teledyne Technologies Incorporated (US), and Identiv, Inc. (US) are some major players in the commercial security system market.

The study includes an in-depth competitive analysis of these key players in the commercial security system market, with their company profiles, recent developments, and key market strategies. Research Coverage: This research report categorizes the commercial security system market by hardware (fire protection system, video surveillance system, access control system, biometric system, building management system, RFID), software (fire protection software, video surveillance software, access control software, building management software, RFID software), service (fire protection services, video surveillance services, access control services, building management services, and RFID services), end user (commercial buildings, government, automotive, retail, logistics, BFSI, industrial, energy, education, sports, healthcare), and region (North America, Europe, Asia Pacific, RoW). It analyzes major factors influencing market growth, including drivers, restraints, challenges, and opportunities. The report also provides insights into key industry players, their strategies, contract activities, and recent developments, along with a competitive analysis of emerging startups in the market..

Reasons to Buy This Report The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall commercial security system market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report:

- Analysis of key drivers (Increasing terrorism and organized crime; expanding construction industry; rising use of IP cameras in security applications; enforcement of robust fire protection standards for effective fire security; surging use of IoT-based security systems supported by cloud platforms; reduction in insurance expenses by mitigating security risks; elevating focus on identification and preparation for potential environment disasters), restraints (High setup, maintenance, and ownership costs of commercial security systems; major privacy and security concerns due to potential data breaches and

unauthorized access to sensitive information; resistance to change impeding uptake and efficacy of commercial security systems.), opportunities (Increasing investment in smart city development and city surveillance solutions; rising adoption of ACaaS and VSaaS; pressing need to upgrade fire protection-related regulatory compliances; advancement and adoption of artificial intelligence (AI) and machine learning), and challenges (Cyber threats to commercial security systems; complexity of integrating user interfaces with fire protection systems; supply chain related risks of commercial security systems; rapid evolution of technology) influencing the growth of the commercial security system market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product and service launches in the commercial security system market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the commercial security system market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the commercial security system market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading companies, such as Honeywell International Inc. (US), Bosch Sicherheitssysteme GmbH (Germany), NEC Corporation (Japan), Johnson Controls (US), Thales (France), Axis Communications AB (Sweden), ASSA ABLOY (Sweden), IDEMIA (France), Teledyne Technologies Incorporated (US), and Identiv, Inc. (US) in the commercial security system market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COMMERCIAL SECURITY SYSTEM MARKET

- 4.2 COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE

- 4.3 COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE

- 4.4 COMMERCIAL SECURITY SYSTEM MARKET IN NORTH AMERICA, BY END USER AND COUNTRY

- 4.5 COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE

- 4.6 COMMERCIAL SECURITY SYSTEM MARKET, BY END USER

- 4.7 COMMERCIAL SECURITY SYSTEM MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing terrorism and organized crime

- 5.2.1.2 Expanding construction industry

- 5.2.1.3 Increasing use of IP cameras in security applications

- 5.2.1.4 Implementation of robust fire protection standards for effective fire security

- 5.2.1.5 Growing use of IoT-based security systems supported by cloud platforms

- 5.2.1.6 Reduction in insurance expenses by mitigating security risks

- 5.2.1.7 Enabling identification and preparation for potential environmental disasters

- 5.2.2 RESTRAINTS

- 5.2.2.1 High setup, maintenance, and ownership costs of commercial security systems

- 5.2.2.2 Privacy and security concerns due to potential data breaches and unauthorized access to sensitive information

- 5.2.2.3 Reluctance to adopt new technologies hindering implementation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing investments in smart city development and city surveillance solutions

- 5.2.3.2 Rising adoption of ACaaS and VSaaS

- 5.2.3.3 Need to upgrade fire protection-related regulatory compliances

- 5.2.3.4 Advancement and adoption of artificial intelligence (AI) and machine learning

- 5.2.4 CHALLENGES

- 5.2.4.1 Cyber threats to commercial security systems

- 5.2.4.2 Complexity of integrating user interfaces with fire protection systems

- 5.2.4.3 Supply chain-related risks of commercial security systems

- 5.2.4.4 Rapid evolution of technology

- 5.2.1 DRIVERS

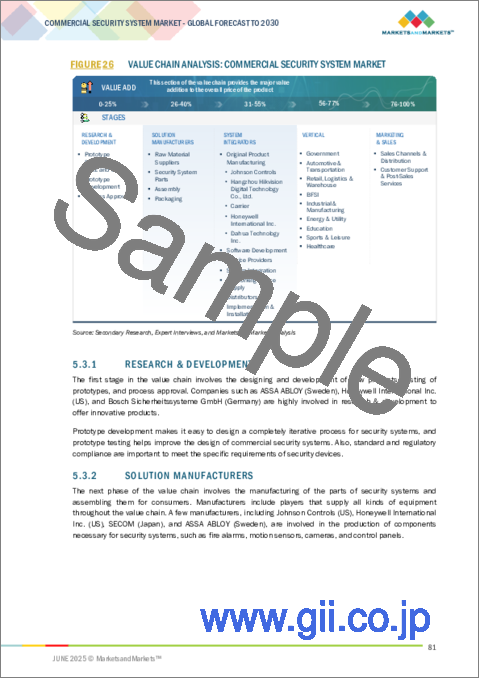

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RESEARCH & DEVELOPMENT

- 5.3.2 SOLUTION MANUFACTURERS

- 5.3.3 SYSTEM INTEGRATORS

- 5.3.4 END USERS

- 5.3.5 MARKETING & SALES

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 PRICING ANALYSIS

- 5.7.1 PRICING RANGE OF VIDEO SURVEILLANCE CAMERAS OFFERED BY KEY PLAYERS, BY END USER

- 5.7.2 PRICING RANGE OF VIDEO SURVEILLANCE CAMERAS, BY END USER

- 5.7.3 AVERAGE SELLING PRICE TREND OF VIDEO SURVEILLANCE CAMERAS, BY REGION

- 5.7.4 AVERAGE SELLING PRICE TREND OF RFID PRODUCTS, BY KEY PLAYERS, 2021-2024

- 5.7.5 AVERAGE SELLING PRICE TREND OF RFID PRODUCTS, BY REGION, 2021-2024

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Internet of Things (IoT)

- 5.8.1.2 Cloud computing

- 5.8.1.3 Video analytics

- 5.8.1.4 Cloud-based biometric system

- 5.8.1.5 Finger-vein recognition

- 5.8.1.6 Real-time location systems

- 5.8.1.7 RFID-enabled sensors and robotics

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Video image smoke and flame detection systems

- 5.8.2.2 Artificial intelligence

- 5.8.2.3 Access control systems

- 5.8.2.4 Cybersecurity solutions

- 5.8.2.5 Big data analytics

- 5.8.2.6 Liveness detection

- 5.8.2.7 Multimodal biometrics

- 5.8.2.8 Cloud-based RFID

- 5.8.2.9 RFID in IoT

- 5.8.2.10 Integration of RFID with blockchain

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Cloud-based solutions

- 5.8.3.2 Drones and aerial surveillance

- 5.8.3.3 Biometric systems

- 5.8.3.4 Building management systems

- 5.8.3.5 Quantum RFID

- 5.8.3.6 Near-field communication and RFID hybrid solutions

- 5.8.3.7 Miniaturized and flexible RFID tags

- 5.8.4 IMPACT OF AI/GEN AI ON COMMERCIAL SECURITY SYSTEM MARKET

- 5.8.5 TOP USE CASES AND MARKET POTENTIAL

- 5.8.5.1 Object detection and tracking

- 5.8.5.2 Crowd management

- 5.8.5.3 Incident detection

- 5.8.5.4 Access control integration

- 5.8.5.5 Retail analytics

- 5.8.5.6 Data-driven detection making

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 THREAT OF NEW ENTRANTS

- 5.9.3 THREAT OF SUBSTITUTES

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 BARGAINING POWER OF SUPPLIERS

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 VYSTAR SELECTED HANWHA VISION CAMERAS TO PROTECT ASSETS, MEMBERS, AND EMPLOYEES

- 5.11.2 GREATER DAYTON SCHOOL ENHANCES CAMPUS SAFETY AND EFFICIENCY THROUGH MOTOROLA SOLUTIONS' AVIGILON CAMERAS

- 5.11.3 EUROPEAN UNION DEPLOYS SBMS TO ENHANCE BORDER SECURITY

- 5.11.4 THALES AND GEMALTO IMPLEMENT ADVANCED BIOMETRIC SOLUTIONS TO ENHANCE ELECTORAL INTEGRITY

- 5.11.5 HERA GROUP LEVERAGES RFID TECHNOLOGY TO STREAMLINE WASTE CONTAINER MANAGEMENT

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS 853110)

- 5.12.2 EXPORT SCENARIO (HS 853110)

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF DATA FOR HS CODE 853110: ELECTRIC SOUND OR VISUAL SIGNALLING APPARATUS (FOR EXAMPLE, BELLS, SIRENS, INDICATOR PANELS, BURGLAR OR FIRE ALARMS), OTHER THAN THOSE OF HEADING 8512 OR 8530 (BURGLAR OR FIRE ALARMS AND SIMILAR APPARATUS)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PATENT ANALYSIS, 2015-2024

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 2025 US TARIFF IMPACT ON COMMERCIAL SECURITY SYSTEM MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON KEY COUNTRIES/REGIONS

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON END-USE INDUSTRIES

6 COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE

- 6.1 INTRODUCTION

- 6.2 FIRE PROTECTION SYSTEM

- 6.2.1 INCREASED SPENDING TO PROTECT ASSETS FROM FIRE HAZARDS TO BOOST GROWTH

- 6.2.2 FIRE DETECTION

- 6.2.2.1 Flame detectors

- 6.2.2.2 Smoke detectors

- 6.2.2.3 Heat detectors

- 6.2.3 FIRE SUPPRESSION

- 6.2.3.1 Fire detectors and control panels

- 6.2.3.2 Fire sprinklers, nozzles, caps, and control heads

- 6.2.3.3 Fire suppressor reagents

- 6.2.3.3.1 Chemical

- 6.2.3.3.2 Gaseous

- 6.2.3.3.3 Water

- 6.2.3.3.4 Foam

- 6.2.4 FIRE SPRINKLER SYSTEMS

- 6.2.4.1 Wet

- 6.2.4.2 Dry

- 6.2.4.3 Pre-action

- 6.2.4.4 Deluge

- 6.2.4.5 Other fire sprinkler systems

- 6.2.5 FIRE RESPONSE SYSTEMS

- 6.2.5.1 Emergency lighting systems

- 6.2.5.2 Voice evacuation and public alert systems

- 6.2.5.3 Secure communication systems

- 6.2.5.4 Fire alarm devices

- 6.3 VIDEO SURVEILLANCE SYSTEM

- 6.3.1 TECHNOLOGICAL ADVANCEMENTS IN SURVEILLANCE CAMERAS TO INCREASE ADOPTION

- 6.3.2 CAMERA

- 6.3.3 MONITOR

- 6.3.4 STORAGE DEVICE

- 6.3.4.1 Digital video recorders

- 6.3.4.2 Network video recorders

- 6.3.5 ACCESSORIES

- 6.3.5.1 Cables

- 6.3.5.2 Encoders

- 6.4 ACCESS CONTROL SYSTEMS

- 6.4.1 NEED FOR MINIMIZING SECURITY RISK OF UNAUTHORIZED ACCESS TO PHYSICAL AND LOGICAL SYSTEMS TO DRIVE DEMAND

- 6.4.2 CARD-BASED READERS

- 6.4.2.1 Magnetic stripe cards and readers

- 6.4.2.2 Proximity cards and readers

- 6.4.2.3 Smart cards and readers

- 6.5 BIOMETRIC SYSTEM

- 6.5.1 GROWING ADOPTION FOR IDENTIFICATION PURPOSES IN VARIOUS INDUSTRIES TO DRIVE MARKET

- 6.5.1.1 Fingerprint recognition

- 6.5.1.2 Palm recognition

- 6.5.1.3 Iris recognition

- 6.5.1.4 Facial recognition

- 6.5.1.5 Voice recognition

- 6.5.2 MULTI-TECHNOLOGY READERS

- 6.5.3 ELECTRONIC LOCKS

- 6.5.4 CONTROLLERS

- 6.5.5 OTHERS

- 6.5.1 GROWING ADOPTION FOR IDENTIFICATION PURPOSES IN VARIOUS INDUSTRIES TO DRIVE MARKET

- 6.6 BUILDING MANAGEMENT SYSTEMS

- 6.6.1 GROWING NEED FOR INTEGRATED SOLUTIONS FOR MODERN FACILITY CONTROL AND OPTIMIZATION TO INCREASE ADOPTION

- 6.7 RFID

- 6.7.1 INTEGRATED SOLUTIONS FOR MODERN FACILITY CONTROL AND OPTIMIZATION

- 6.7.1.1 Fixed

- 6.7.1.2 Handheld

- 6.7.1 INTEGRATED SOLUTIONS FOR MODERN FACILITY CONTROL AND OPTIMIZATION

7 COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE

- 7.1 INTRODUCTION

- 7.2 FIRE PROTECTION SOFTWARE

- 7.2.1 ADVANCEMENTS IN FIRE PROTECTION SOFTWARE FOR ENHANCED DETECTION, PREVENTION, AND RESPONSE TO DRIVE DEMAND

- 7.2.2 FIRE MAPPING AND ANALYSIS SOFTWARE

- 7.2.3 FIRE MODELING AND SIMULATION SOFTWARE

- 7.3 VIDEO SURVEILLANCE SOFTWARE

- 7.3.1 RISING TRENDS OF DEEP LEARNING AND AI TO DRIVE MARKET GROWTH

- 7.3.2 VIDEO ANALYTICS

- 7.3.2.1 Video content analysis (VCA)

- 7.3.2.2 AI-driven video analytics

- 7.3.3 VIDEO MANAGEMENT SOFTWARE

- 7.3.3.1 Non-AI-based

- 7.3.3.2 AI-based

- 7.3.4 SOFTWARE, BY DEPLOYMENT MODE

- 7.3.4.1 On-premises

- 7.3.4.2 Cloud-based

- 7.4 ACCESS CONTROL SOFTWARE

- 7.4.1 GROWING ADOPTION OF VISITOR MANAGEMENT SYSTEMS AND ADVANCED SECURITY SOFTWARE IN ACCESS CONTROL TO DRIVE DEMAND

- 7.4.2 VISITOR MANAGEMENT SYSTEM

- 7.4.2.1 Increasing digitization of security operations to drive demand

- 7.4.3 OTHERS

- 7.5 BUILDING MANAGEMENT SOFTWARE

- 7.5.1 GROWING NEED FOR ENHANCING SECURITY AND EFFICIENCY IN COMMERCIAL SPACES TO INCREASE ADOPTION

- 7.6 RFID SOFTWARE

- 7.6.1 OFFERS ENHANCED BUSINESS OPERATIONS WITH REAL-TIME TRACKING AND VISIBILITY

- 7.7 BIOMETRIC SOFTWARE