|

|

市場調査レポート

商品コード

1752096

LNGステーションの世界市場 (~2030年):ソリューション・ステーションタイプ・用途・容量・地域別LNG Station Market by Solution, Station Type, Application, Capacity, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| LNGステーションの世界市場 (~2030年):ソリューション・ステーションタイプ・用途・容量・地域別 |

|

出版日: 2025年06月16日

発行: MarketsandMarkets

ページ情報: 英文 241 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

LNGステーションの市場規模は、2025年の10億2,000万米ドルから、予測期間中はCAGR 9.0%で推移し、2030年には15億6,000万米ドルに達すると予測されています。

排出量の少ない輸送用燃料に対する需要の高まり、特に大型車両や長距離輸送分野における需要の増加が、市場の成長を牽引しています。さらに、LNGインフラへの投資拡大や、持続可能なモビリティに対する関心の高まりが、世界の主要地域における市場の成長軌道をさらに強固なものにしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | ソリューション、ステーションタイプ、容量、用途、モード、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

"用途別では、大型車の部門が最大の市場規模を維持する見込み"

貨物輸送や長距離輸送において、よりクリーンでコスト効率の高い代替燃料への需要が高まっていることから、大型車セグメントはLNGステーション市場において最大の用途であり続けると予想されています。その背景には、貨物輸送や長距離輸送における、よりクリーンでコスト効率の高い燃料の需要の高まりがあります。大型トラックは大量の燃料を消費するため、従来のディーゼルと比べて排出量が少なく、エネルギー密度が高いLNG (液化天然ガス) が魅力的な選択肢となっています。温室効果ガスや汚染物質の排出削減を求める規制が強まる中、フリート事業者にLNG車両への移行を進めており、これが需要を押し上げています。さらに、LNG燃料供給インフラの整備拡大や政府の補助政策も、市場成長を後押ししています。LNGは長距離移動に適した信頼性の高い燃料供給を可能にし、環境負荷を軽減できることから、大型輸送用途での最適な選択肢となっており、予測期間中もこの分野に特化したLNGステーションの需要が持続すると見込まれています。

"欧州はLNGステーション市場で最も急成長する地域となる見込み"

欧州はLNGステーション市場において最も急成長する地域となる見込みであり、その背景には厳しい環境規制と運輸部門全体の二酸化炭素排出量削減に対する政府の強いコミットメントがあります。European Green Deal やFit for 55などの政策がクリーンな燃料への移行を加速させ、大型道路輸送と海運の両分野でLNGの採用拡大を促しています。この地域の脱炭素化への取り組みは、シームレスな物流と貿易を促進する国境を越えた燃料補給回廊の開発など、LNGインフラへの官民による大規模な投資によってさらに後押しされています。さらに、エネルギー源の多様化を推進し、従来型の化石燃料への依存度を低減する欧州の動きも、重要な燃料としてのLNGの役割を強化しています。フリートオペレーター向けのインセンティブや補助金はLNG自動車へのシフトを促し、港湾当局は IMO ( International Maritime Organization) の規制を遵守するためにLNGバンカリング施設に投資しています。これらの要因を総合すると、欧州は重要な成長ハブとして位置づけられ、地域全体のLNGステーションネットワークの急速な拡大を後押ししています。

当レポートでは、世界のLNGステーションの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 主要市場におけるLNGおよびディーゼルの代替としてのCNGの評価

- 顧客の事業に影響を与える動向/混乱

- サプライチェーン分析

- エコシステム分析

- 技術分析

- ケーススタディ分析

- 特許分析

- 2025-2026年の主な会議とイベント

- 価格分析

- 貿易分析

- 規制状況

- 米国関税の影響- 概要

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- 投資と資金調達のシナリオ

- AI/生成AIがLNGステーション市場に与える影響

- 世界のマクロ経済見通し

- LNGおよびCNGトラック

- 欧州のL-CNGステーションの展望

第6章 LNGステーション市場:モードタイプ別

- 高速充填

- 低速充填/ 時間充填

第7章 LNGステーション市場:ステーションタイプ別

- 固定式LNGステーション

- 移動式LNGステーション

- バンカリングLNGステーション

第8章 LNGステーション市場:ソリューション別

- エンジニアリング、調達、建設

- コンポーネント

- LNGタンク

- ポンプ・気化器

- LNGディスペンサー

- 電気制御ボックス

- 沼沼管理システム

- その他

第9章 LNGステーション市場:容量別

- 小規模

- 中規模

- 大規模

第10章 LNGステーション市場:用途別

- 大型車両

- 小型車両

- 船舶

第11章 LNGステーション市場:地域別

- 北米

- 米国

- カナダ

- アジア太平洋

- 中国

- 日本

- インド

- その他

- 欧州

- ドイツ

- イタリア

- スペイン

- フランス

- オランダ

- スウェーデン

- ポーランド

- フィンランド

- ベルギー

- 英国

- ノルウェー

- ポルトガル

- その他

- その他の地域

- ラテンアメリカ

- 中東・アフリカ

第12章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- CNPC

- SHELL PLC

- CHART INDUSTRIES

- JEREH OIL & GAS ENGINEERING CORPORATION

- WESTFALEN

- CRYONORM GROUP

- CRYOSTAR

- DOVER FUELING SOLUTIONS

- GRUPO HAM

- UESTCO ENERGY SYSTEMS

- CLEAN ENERGY FUELS

- INDIAN OIL CORPORATION LTD

- INOX INDIA LIMITED

- BHARAT PETROLEUM CORPORATION LIMITED

- CHONGQING ENDURANCE ENERGY EQUIPMENT INTEGRATION CO., LTD.

- ROLANDE

- FAS FLUSSIGGAS-ANLAGEN GMBH

- その他の企業

- TAYLOR-WHARTON

- AXEGAZ T&T

- GASNET, S.R.O.

- SHIJIAZHUANG ENRIC GAS EQUIPMENT CO., LTD.

- THINK GAS

- BAYWA R.E. AG

- GALILEO TECHNOLOGIES

- YONGJIA WELLDONE MACHINE CO., LTD.

- WENZHOU BLUESKY ENERGY TECHNOLOGY CO., LTD.

- TECNOGAS SRL

第14章 付録

List of Tables

- TABLE 1 LNG STATION MARKET SNAPSHOT

- TABLE 2 EMISSION COMPARISON OF DIESEL VS. LNG/CNG VEHICLES

- TABLE 3 LNG STATION MARKET: ADOPTION OF LNG POLICIES GLOBALLY

- TABLE 4 COMPARATIVE ANALYSIS: CNG VS LNG VS DIESEL

- TABLE 5 ROLE OF COMPANIES IN LNG STATION ECOSYSTEM

- TABLE 6 LIST OF KEY PATENTS, 2019-2023

- TABLE 7 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 8 INDICATIVE PRICING ANALYSIS OF LNG STATION, BY KEY PLAYERS, 2024

- TABLE 9 AVERAGE SELLING PRICE TREND OF LNG STATION, BY REGION, 2022-2024 (USD MILLION)

- TABLE 10 COMPONENT-WISE TURNKEY CAPEX BREAKDOWN (% SHARE)

- TABLE 11 COMPARATIVE ANALYSIS OF PRICING, LNG VS. DIESEL (USD)

- TABLE 12 IMPORT DATA FOR HS CODE 271111-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR HS CODE 271111-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: REGULATORY FRAMEWORK

- TABLE 18 EUROPE: REGULATORY FRAMEWORK

- TABLE 19 ASIA PACIFIC: REGULATORY FRAMEWORK

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 21 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON STATION TYPES DUE TO TARIFF

- TABLE 22 PORTER'S FIVE FORCES ANALYSIS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY STATION TYPE (%)

- TABLE 24 KEY BUYING CRITERIA, BY STATION TYPE

- TABLE 25 COMPARATIVE ANALYSIS: LNG AND CNG TRUCK TRENDS IN US VS EUROPE

- TABLE 26 EUROPE: LNG TRUCK SALES

- TABLE 27 EUROPE: CNG TRUCK SALES

- TABLE 28 EUROPE: LNG AND L-CNG STATION MARKET, 2021-2030 (UNITS)

- TABLE 29 LNG STATION MARKET, BY STATION TYPE, 2021-2024 (USD MILLION)

- TABLE 30 LNG STATION MARKET, BY STATION TYPE, 2025-2030 (USD MILLION)

- TABLE 31 LNG STATION MARKET, BY STATION TYPE, 2021-2024 (UNITS)

- TABLE 32 LNG STATION MARKET, BY STATION TYPE, 2025-2030 (UNITS)

- TABLE 33 FIXED: LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 FIXED: LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 FIXED: LNG STATION MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 36 FIXED: LNG STATION MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 37 MOBILE: LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 MOBILE: LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 MOBILE: LNG STATION MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 40 MOBILE: LNG STATION MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 41 BUNKERING: LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 BUNKERING: LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 BUNKERING: LNG STATION MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 44 BUNKERING: LNG STATION MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 45 LNG STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 46 LNG STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 47 ENGINEERING, PROCUREMENT, AND CONSTRUCTION: LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 ENGINEERING, PROCUREMENT, AND CONSTRUCTION: LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 COMPONENT: LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 COMPONENT: LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 COMPONENTS (BY SOLUTION): LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 COMPONENTS (BY SOLUTION): LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 LNG STATION MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 54 LNG STATION MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 55 SMALL SCALE: LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 SMALL SCALE: LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 MEDIUM-SCALE: LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 MEDIUM-SCALE: LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 LARGE-SCALE: LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 LARGE-SCALE: LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 62 LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 HEAVY-DUTY VEHICLES: LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 HEAVY-DUTY VEHICLES: LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 LIGHT-DUTY VEHICLES: LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 LIGHT-DUTY VEHICLES: LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 MARINE: LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 MARINE: LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 LNG STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 LNG STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 LNG STATION MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 72 LNG STATION MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 73 NORTH AMERICA: LNG STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: LNG STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: LNG STATION MARKET, BY STATION TYPE, 2021-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: LNG STATION MARKET, BY STATION TYPE, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: LNG STATION MARKET, BY STATION TYPE, 2021-2024 (UNITS)

- TABLE 78 NORTH AMERICA: LNG STATION MARKET, BY STATION TYPE, 2025-2030 (UNITS)

- TABLE 79 NORTH AMERICA: LNG STATION MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: LNG STATION MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: LNG STATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 NORTH AMERICA: LNG STATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: LNG STATION MARKET, BY COUNTRY, 2021-2024 (UNIT)

- TABLE 86 NORTH AMERICA: LNG STATION MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 87 US: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 88 US: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 CANADA: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 90 CANADA: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 ASIA PACIFIC: LNG STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 92 ASIA PACIFIC: LNG STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: LNG STATION MARKET, BY STATION TYPE, 2021-2024 (USD MILLION)

- TABLE 94 ASIA PACIFIC: LNG STATION MARKET, BY STATION TYPE, 2025-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: LNG STATION MARKET, BY STATION TYPE, 2021-2024 (UNITS)

- TABLE 96 ASIA PACIFIC: LNG STATION MARKET, BY STATION TYPE, 2025-2030 (UNITS)

- TABLE 97 ASIA PACIFIC: LNG STATION MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 98 ASIA PACIFIC: LNG STATION MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 100 ASIA PACIFIC: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: LNG STATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 ASIA PACIFIC: LNG STATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: LNG STATION MARKET, BY COUNTRY, 2021-2024 (UNIT)

- TABLE 104 ASIA PACIFIC: LNG STATION MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 105 CHINA: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 106 CHINA: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 JAPAN: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 108 JAPAN: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 INDIA: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 110 INDIA: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: LNG STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: LNG STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: LNG STATION MARKET, BY STATION TYPE, 2021-2024 (USD MILLION)

- TABLE 114 EUROPE: LNG STATION MARKET, BY STATION TYPE, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: LNG STATION MARKET, BY STATION TYPE, 2021-2024 (UNITS)

- TABLE 116 EUROPE: LNG STATION MARKET, BY STATION TYPE, 2025-2030 (UNITS)

- TABLE 117 EUROPE: LNG STATION MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: LNG STATION MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 120 EUROPE: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: LNG STATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: LNG STATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: LNG STATION MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 124 EUROPE: LNG STATION MARKET, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 125 GERMANY: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 126 GERMANY: LONG DURATION ENERGY STORAGE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 127 ITALY: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 128 ITALY: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 SPAIN: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 130 SPAIN: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 FRANCE: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 132 FRANCE: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 NETHERLANDS: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 134 NETHERLANDS: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 SWEDEN: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 136 SWEDEN: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 POLAND: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 138 POLAND: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 FINLAND: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 140 FINLAND: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 BELGIUM: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 142 BELGIUM: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 UK: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 144 UK: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 NORWAY: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 NORWAY: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 PORTUGAL: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 148 PORTUGAL: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 REST OF EUROPE: LNG STATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 150 REST OF EUROPE: LNG STATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 LNG STATION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 152 LNG STATION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 153 LNG STATION MARKET: REGION FOOTPRINT

- TABLE 154 LNG STATION MARKET: STATION TYPE FOOTPRINT

- TABLE 155 LNG STATION MARKET: APPLICATION FOOTPRINT

- TABLE 156 LNG STATION MARKET: SOLUTION FOOTPRINT

- TABLE 157 LNG STATION MARKET: KEY STARTUPS/SMES

- TABLE 158 LNG STATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 159 LNG STATION MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 160 LNG STATION MARKET: DEALS, JANUARY 2020-MAY 2025

- TABLE 161 LNG STATION MARKET: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 162 LNG STATION MARKET: OTHER DEVELOPMENTS, JANUARY 2020-MAY 2025

- TABLE 163 CNPC: COMPANY OVERVIEW

- TABLE 164 CNPC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 CNPC: PRODUCT LAUNCHES

- TABLE 166 SHELL PLC: COMPANY OVERVIEW

- TABLE 167 SHELL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 SHELL PLC: EXPANSIONS

- TABLE 169 CHART INDUSTRIES: COMPANY OVERVIEW

- TABLE 170 CHART INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 CHART INDUSTRIES: DEALS

- TABLE 172 JEREH OIL & GAS ENGINEERING CORPORATION: COMPANY OVERVIEW

- TABLE 173 JEREH OIL & GAS ENGINEERING CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 174 JEREH OIL & GAS ENGINEERING CORPORATION: EXPANSIONS

- TABLE 175 WESTFALEN: COMPANY OVERVIEW

- TABLE 176 WESTFALEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 WESTFALEN: DEALS

- TABLE 178 WESTFALEN: EXPANSIONS

- TABLE 179 CRYONORM GROUP: COMPANY OVERVIEW

- TABLE 180 CRYONORM GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 CRYONORM GROUP: EXPANSIONS

- TABLE 182 CRYONORM GROUP: OTHER DEVELOPMENTS

- TABLE 183 CRYOSTAR: COMPANY OVERVIEW

- TABLE 184 CRYOSTAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 CRYOSTAR: PRODUCT LAUNCHES

- TABLE 186 CRYOSTAR: DEALS

- TABLE 187 DOVER FUELING SOLUTIONS: COMPANY OVERVIEW

- TABLE 188 DOVER FUELING SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 DOVER FUELING SOLUTIONS: DEALS

- TABLE 190 GRUPO HAM: COMPANY OVERVIEW

- TABLE 191 GRUPO HAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 GRUPO HAM: DEALS

- TABLE 193 GRUPO HAM: EXPANSIONS

- TABLE 194 UESTCO ENERGY SYSTEMS: COMPANY OVERVIEW

- TABLE 195 UESTCO ENERGY SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 UESTCO ENERGY SYSTEMS: DEALS

- TABLE 197 UESTCO ENERGY SYSTEMS: EXPANSIONS

- TABLE 198 CLEAN ENERGY FUELS: COMPANY OVERVIEW

- TABLE 199 CLEAN ENERGY FUELS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 CLEAN ENERGY FUELS: OTHER DEVELOPMENTS

- TABLE 201 INDIAN OIL CORPORATION LTD: COMPANY OVERVIEW

- TABLE 202 INDIAN OIL CORPORATION LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 INOX INDIA LIMITED: COMPANY OVERVIEW

- TABLE 204 INOX INDIA LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 INOX INDIA LIMITED: PRODUCT LAUNCHES

- TABLE 206 INOX INDIA LIMITED: DEALS

- TABLE 207 INOX INDIA LIMITED: EXPANSIONS

- TABLE 208 BHARAT PETROLEUM CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 209 BHARAT PETROLEUM CORPORATION LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 210 BHARAT PETROLEUM CORPORATION LIMITED: PRODUCT LAUNCHES

- TABLE 211 BHARAT PETROLEUM CORPORATION LIMITED: DEALS

- TABLE 212 CHONGQING ENDURANCE ENERGY EQUIPMENT INTEGRATION CO., LTD.: COMPANY OVERVIEW

- TABLE 213 CHONGQING ENDURANCE ENERGY EQUIPMENT INTEGRATION CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 CHONGQING ENDURANCE ENERGY EQUIPMENT INTEGRATION CO., LTD.: DEALS

- TABLE 215 ROLANDE: COMPANY OVERVIEW

- TABLE 216 ROLANDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 ROLANDE: DEALS

- TABLE 218 ROLANDE: EXPANSIONS

- TABLE 219 FAS FLUSSIGGAS-ANLAGEN GMBH: COMPANY OVERVIEW

- TABLE 220 FAS FLUSSIGGAS-ANLAGEN GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 TAYLOR-WHARTON: COMPANY OVERVIEW

- TABLE 222 AXEGAZ T&T: COMPANY OVERVIEW

- TABLE 223 GASNET, S.R.O.: COMPANY OVERVIEW

- TABLE 224 SHIJIAZHUANG ENRIC GAS EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 225 THINK GAS: COMPANY OVERVIEW

- TABLE 226 BAYWA R.E. AG: COMPANY OVERVIEW

- TABLE 227 GALILEO TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 228 YONGJIA WELLDONE MACHINE CO., LTD.: COMPANY OVERVIEW

- TABLE 229 WENZHOU BLUESKY ENERGY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 230 TECNOGAS SRL: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LNG STATION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 LNG STATION MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARIES

- FIGURE 6 LNG STATION MARKET: BOTTOM-UP APPROACH

- FIGURE 7 LNG STATION MARKET: TOP-DOWN APPROACH

- FIGURE 8 LNG STATION MARKET: DEMAND-SIDE ANALYSIS

- FIGURE 9 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF LNG STATION

- FIGURE 10 LNG STATION MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 11 MARKET SHARE ANALYSIS OF LNG STATION MARKET, 2024

- FIGURE 12 LNG STATION MARKET: DATA TRIANGULATION

- FIGURE 13 EPC SEGMENT TO HOLD LARGER MARKET SHARE FROM 2025 TO 2030

- FIGURE 14 FIXED LNG STATION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 15 SMALL-SCALE SEGMENT TO LEAD MARKET FROM 2025 TO 2030

- FIGURE 16 HEAVY-DUTY VEHICLES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC HELD LARGEST SHARE OF GLOBAL LNG STATION MARKET IN 2024

- FIGURE 18 GROWING DEMAND FOR BIO-LNG INFRASTRUCTURE FOR HEAVY-DUTY TRANSPORT & GOVERNMENT INITIATIVES TO DRIVE MARKET

- FIGURE 19 EUROPE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 EPC SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 21 FIXED LNG STATION SEGMENT TO LEAD MARKET IN 2030

- FIGURE 22 SMALL-SCALE SEGMENT TO HOLD MAJOR SHARE IN 2030

- FIGURE 23 HEAVY-DUTY VEHICLES SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 24 FIXED LNG STATION SEGMENT AND CHINA HELD LARGEST MARKET SHARES OF ASIA PACIFIC IN 2024

- FIGURE 25 LNG STATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 NUMBER OF OPERATIONAL LNG TRUCKS IN EUROPE

- FIGURE 27 LNG-FUELLED SHIP FLEETS ACROSS GLOBAL REGIONS IN 2022 (UNITS)

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 LNG STATION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 30 LNG STATION ECOSYSTEM

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 32 AVERAGE SELLING PRICE TREND OF LNG STATION, BY REGION, 2022-2024

- FIGURE 33 IMPORT DATA FOR HS CODE 271111-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024

- FIGURE 34 EXPORT DATA FOR HS CODE 271111-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 35 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY STATION TYPE

- FIGURE 37 KEY BUYING CRITERIA, BY STATION TYPE

- FIGURE 38 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 39 IMPACT OF AI/GEN AI ON LNG STATION SUPPLY CHAIN, BY REGION

- FIGURE 40 LNG STATION MARKET, BY STATION TYPE, 2024

- FIGURE 41 LNG STATIONS MARKET, BY SOLUTION, 2024

- FIGURE 42 LNG STATION MARKET, BY CAPACITY, 2024

- FIGURE 43 LNG STATION MARKET, BY APPLICATION, 2024

- FIGURE 44 EUROPE TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC: LNG STATION MARKET SNAPSHOT

- FIGURE 46 EUROPE: LNG STATION MARKET SNAPSHOT

- FIGURE 47 LNG STATION MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 48 LNG STATION MARKET SHARE ANALYSIS, 2024

- FIGURE 49 COMPANY VALUATION, 2024

- FIGURE 50 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS, 2024

- FIGURE 51 BRAND/PRODUCT COMPARISON

- FIGURE 52 LNG STATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 LNG STATION MARKET: COMPANY FOOTPRINT

- FIGURE 54 LNG STATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 55 CNPC: COMPANY SNAPSHOT

- FIGURE 56 SHELL PLC: COMPANY SNAPSHOT

- FIGURE 57 CHART INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 58 JEREH OIL & GAS ENGINEERING CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 WESTFALEN: COMPANY SNAPSHOT

- FIGURE 60 CLEAN ENERGY FUELS: COMPANY SNAPSHOT

- FIGURE 61 INDIAN OIL CORPORATION LTD: COMPANY SNAPSHOT

- FIGURE 62 INOX INDIA LIMITED: COMPANY SNAPSHOT

- FIGURE 63 BHARAT PETROLEUM CORPORATION LIMITED: COMPANY SNAPSHOT

The LNG station market is estimated to reach USD 1.56 billion by 2030 from USD 1.02 billion in 2025, at a CAGR of 9.0% during the forecast period. Rising demand for low-emission transportation fuels, especially in heavy-duty and long-haul sectors, is driving the market. Stringent environmental regulations, supportive government policies, and advancements in LNG fueling technologies are accelerating adoption. Increased investments in LNG infrastructure and growing interest in sustainable mobility solutions further strengthen the market's growth trajectory across key global regions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Solution, Station Type, Capacity, Application, Mode, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

"The heavy-duty vehicles segment is expected to remain the largest segment by application."

The heavy-duty vehicles segment is expected to remain the largest application in the LNG station market due to the growing demand for cleaner and more cost-efficient fuel alternatives in freight and long-haul transportation. Heavy-duty trucks consume significant volumes of fuel, making LNG an attractive option thanks to its lower emissions and higher energy density compared to traditional diesel. Increasing regulatory pressure to reduce greenhouse gas and pollutant emissions is encouraging fleet operators to transition toward LNG-powered vehicles. Additionally, the expanding availability of LNG fueling infrastructure and government incentives further support market growth. LNG's ability to provide reliable, long-range fueling with reduced environmental impact makes it the preferred choice for heavy-duty transport, ensuring sustained demand for LNG stations tailored to this sector during the forecast period.

"Europe is expected to be the fastest-growing region in the LNG station market."

Europe is poised to be the fastest-growing region in the LNG station market, driven by stringent environmental regulations and strong governmental commitment to reducing carbon emissions across the transportation sector. Policies such as the European Green Deal and Fit for 55 are accelerating the transition to cleaner fuels, prompting increased adoption of LNG in both heavy-duty road transport and maritime industries. The region's focus on decarbonization is further supported by substantial public and private investments in LNG infrastructure, including the development of cross-border refueling corridors that facilitate seamless logistics and trade. Additionally, Europe's push to diversify energy sources and reduce dependency on traditional fossil fuels is bolstering LNG's role as a critical transitional fuel. Incentives and subsidies aimed at fleet operators encourage the shift to LNG-powered vehicles, while port authorities are investing in LNG bunkering facilities to comply with International Maritime Organization (IMO) regulations. Collectively, these factors position Europe as a key growth hub, driving the rapid expansion of LNG station networks across the region.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

By Designation: C-Level Executives - 30%, Managers - 25%, and Others - 45%

By Region: North America - 12%, Europe - 37%, Asia Pacific - 40%, Latin America - 11%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

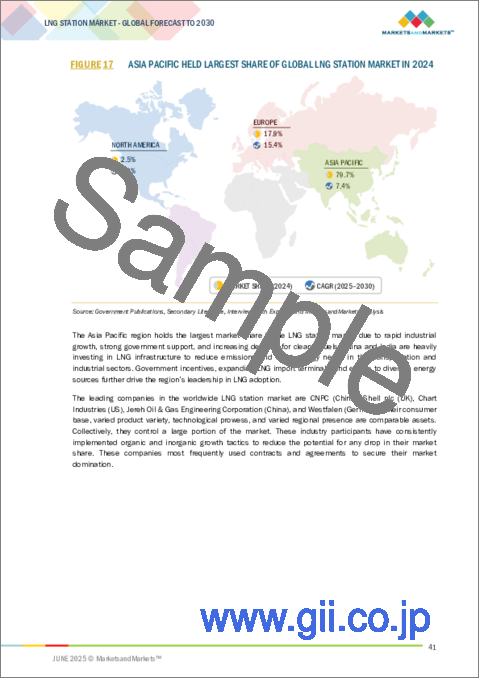

The LNG station market is dominated by a few major players that have a wide regional presence. The leading players in the LNG station market are CNPC (China), Shell Plc (UK), Chart Industries (US), Jereh Oil & Gas Engineering Corporation (China), Westfalen (Germany), Axegaz T&T (France), Cryonorm Group (Netherlands), Cryostar (France), Bharat Petroleum Corporation Limited (India), Indian Oil Corporation Ltd (India), GRUPO HAM (Spain), Rolande (Netherlands), and INOX India Limited (India).

Research Coverage:

The report defines, describes, and forecasts the LNG station market by solution, station type, application, and capacity. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the LNG station market.

Key Benefits of Buying the Report

- The LNG station market is driven by the global shift toward cleaner energy solutions, rising demand for low-emission transport fuels, and the need to reduce greenhouse gas emissions, particularly in heavy-duty and long-haul transportation sectors. As the transportation and logistics industries pursue decarbonization, LNG stations play a vital role by offering cost-effective and environmentally friendly refueling options. Supportive government policies, emissions regulations, and financial incentives are encouraging the adoption of LNG-powered vehicles and vessels across developed and emerging economies. Technological advancements in cryogenic storage, modular station design, and fueling efficiency are further supporting market growth. The expansion of LNG supply chains, growing public-private partnerships, and strategic investments in fueling infrastructure continue to accelerate the development of LNG stations. With a strong focus on sustainable mobility, energy diversification, and reducing dependence on diesel, LNG stations have become a key enabler in the transition toward cleaner transportation. These trends are driving steady growth in the LNG station market on a global scale.

- Product Development/Innovation: The LNG station market is focused on advancing efficiency, safety, and scalability through innovative technologies and system designs. Companies are developing modular and skid-mounted LNG stations for faster deployment and flexibility across diverse locations. Innovations in cryogenic pump technology, automated fueling systems, and real-time monitoring enhance operational reliability and refueling speed. Integration of IoT and data analytics enables predictive maintenance and performance optimization. Materials improvements focus on thermal insulation, durability, and corrosion resistance, extending equipment lifespan. These developments are crucial for enhancing fueling infrastructure and supporting the broader adoption of LNG in clean transportation.

- Market Development: In February 2021, Cryostar launched Dispenser 3.0 to enhance the LNG refueling user experience through design improvements and intuitive features. Developed using feedback from global users, the dispenser offers a modern aesthetic, a multilingual touchscreen with animated refueling instructions, ergonomic button placement, and weather protection.

- Market Diversification: Germany's Westfalen completed its second LNG filling station for trucks in Herford, following its first in Munster. Built in partnership with Cryotek Services of Cryonorm, the station features a 17-meter-high LNG tank.

- Competitive Assessment: Assessment of rankings of some of the key players, including CNPC (China), Shell Plc (UK), Chart Industries (US), Jereh Oil & Gas Engineering Corporation (China), Westfalen (Germany), Axegaz T&T (France), Cryonorm Group (Netherlands), Cryostar (France), and INOX India Limited (India).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 DEMAND-SIDE ANALYSIS

- 2.2.3.1 Assumptions for demand-side analysis

- 2.2.3.2 Calculations for demand-side analysis

- 2.2.4 SUPPLY-SIDE ANALYSIS

- 2.2.4.1 Assumptions for supply-side analysis

- 2.2.4.2 Calculations for supply-side analysis

- 2.2.5 GROWTH FORECAST ASSUMPTIONS

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH LIMITATIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LNG STATION MARKET

- 4.2 LNG STATION MARKET, BY REGION

- 4.3 LNG STATION MARKET, BY SOLUTION

- 4.4 LNG STATION MARKET, BY STATION TYPE

- 4.5 LNG STATION MARKET, BY CAPACITY

- 4.6 LNG STATION MARKET, BY APPLICATION

- 4.7 LNG STATION MARKET IN ASIA PACIFIC, BY STATION TYPE AND COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of LNG as a transportation fuel

- 5.2.1.2 Introduction of regulatory, financial, and infrastructural incentives to transition fleets toward cleaner alternatives

- 5.2.1.3 Expansion of LNG infrastructure and increased industrial involvement

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial capital investment for vehicles

- 5.2.2.2 Complex storage and handling requirements for fuels

- 5.2.2.3 Rising demand for alternative fuels

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of marine and off-grid applications

- 5.2.3.2 Integration of Bio-LNG and e-LNG

- 5.2.3.3 Technological advancements in engine technology, storage systems, and refueling infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory and safety concerns

- 5.2.4.2 Excess supply in the market and increased competition

- 5.2.4.3 Bottlenecks in infrastructure development

- 5.2.1 DRIVERS

- 5.3 ASSESSMENT OF CNG AS AN ALTERNATIVE TO LNG AND DIESEL IN KEY MARKETS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 LNG FUEL PRODUCERS

- 5.5.2 COMPONENT MANUFACTURERS

- 5.5.3 EPC FIRMS

- 5.5.4 LNG STATIONS

- 5.5.5 END USERS

- 5.5.6 AFTERMARKET SERVICE PROVIDERS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 LNG liquefaction

- 5.7.1.2 LNG storage

- 5.7.1.3 LNG dispensing infrastructure

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 LCNG fueling stations

- 5.7.2.2 LNG-fueled engine

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Hydrogen fueling stations

- 5.7.3.2 Battery electric vehicle charging infrastructure

- 5.7.1 KEY TECHNOLOGIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 BUILDING COST-EFFECTIVE LOW-MAINTENANCE LNG STATIONS: A CASE STUDY WITH CHART INC.

- 5.8.2 DRIVING DECARBONIZATION: SHELL'S ROLE IN ADVANCING LNG FUELING STATIONS FOR HEAVY-DUTY TRANSPORT

- 5.8.3 CRYOSTAR ENHANCES ENGINEERING EFFICIENCY AND REDUCES REWORK: HEXAGON'S INTEGRATED SOLUTIONS FOR POWER AND GAS LIQUEFACTION PROJECTS

- 5.9 PATENT ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 PRICING ANALYSIS

- 5.11.1 INDICATIVE PRICING ANALYSIS OF LNG STATION, BY KEY PLAYERS, 2024

- 5.11.2 AVERAGE SELLING PRICE TREND OF LNG STATION, BY REGION, 2022-2024

- 5.11.3 INDICATIVE PRICING ANALYSIS OF TURNKEY SOLUTIONS FOR LNG STATION, 2024

- 5.11.4 LNG VS DIESEL PRICE OUTLOOK IN EUROPE

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 271111)

- 5.12.2 EXPORT SCENARIO (HS CODE 271111)

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATORY FRAMEWORK

- 5.14 IMPACT OF 2025 US TARIFF-OVERVIEW

- 5.14.1 INTRODUCTION

- 5.14.2 KEY TARIFF RATES

- 5.14.3 PRICE IMPACT ANALYSIS

- 5.14.4 IMPACT ON COUNTRIES/REGIONS

- 5.14.4.1 US

- 5.14.4.2 Europe

- 5.14.4.3 Asia Pacific

- 5.14.5 LNG: IMPACT ON IMPORTS/EXPORTS

- 5.14.6 TARIFF SHIFTS AND QATAR ENERGY'S GROWTH IN GLOBAL LNG SPACE

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF SUPPLIERS

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF AI/GEN AI ON LNG STATION MARKET

- 5.18.1 ADOPTION OF AI/GEN AI IN LNG STATION APPLICATIONS

- 5.18.2 IMPACT OF AI/GEN AI ON LNG STATION SUPPLY CHAIN, BY REGION

- 5.19 GLOBAL MACROECONOMIC OUTLOOK

- 5.19.1 INTRODUCTION

- 5.19.2 FOCUS ON LONG-TERM ENERGY SECURITY

- 5.19.3 TECHNOLOGICAL ADVANCEMENTS

- 5.19.4 FINANCING AND GOVERNMENT POLICY SUPPORT

- 5.19.5 HIGH CAPEX AMID INFLATION

- 5.20 LNG AND CNG TRUCKS

- 5.21 L-CNG STATION OUTLOOK IN EUROPE

6 LNG STATION MARKET, BY MODE TYPE

- 6.1 INTRODUCTION

- 6.2 FAST FILLING

- 6.3 SLOW/TIME FILLING

7 LNG STATION MARKET, BY STATION TYPE

- 7.1 INTRODUCTION

- 7.2 FIXED LNG STATION

- 7.2.1 RISING DEMAND FOR CLEAN FUEL AND EMISSION REDUCTION TO DRIVE MARKET

- 7.3 MOBILE LNG STATION

- 7.3.1 RISING DEMAND FOR FLEXIBLE AND SCALABLE LNG INFRASTRUCTURE TO DRIVE MARKET

- 7.4 BUNKERING LNG STATION

- 7.4.1 GROWTH OF LNG BUNKERING STATION MARKET TO BE DRIVEN BY RISING ADOPTION OF LNG-FUELED FLEETS AND LNG-FUELED SHIPS

8 LNG STATION MARKET, BY SOLUTIONS

- 8.1 INTRODUCTION

- 8.2 ENGINEERING, PROCUREMENT, & CONSTRUCTION

- 8.2.1 RISING DEMAND FOR TURNKEY SOLUTIONS AND INFRASTRUCTURE SCALABILITY TO DRIVE MARKET

- 8.3 COMPONENTS

- 8.3.1 RISING DEPLOYMENT OF LNG INFRASTRUCTURE TO DRIVE DEMAND FOR CRYOGENIC COMPONENTS AND INTEGRATED STATION SYSTEMS

- 8.3.2 LNG TANK

- 8.3.3 PUMPS AND VAPORIZERS

- 8.3.4 LNG DISPENSER

- 8.3.5 ELECTRICAL CONTROL BOX

- 8.3.6 BOG MANAGEMENT SYSTEM

- 8.3.7 OTHER COMPONENTS

9 LNG STATION MARKET, BY CAPACITY

- 9.1 INTRODUCTION

- 9.2 SMALL SCALE

- 9.2.1 RISING DEMAND FOR CLEAN FUEL AND EMISSION REDUCTION TO DRIVE MARKET

- 9.3 MEDIUM SCALE

- 9.3.1 COST-EFFECTIVE ALTERNATIVE TO LARGE TERMINALS TO SUPPORT BROADER MEDIUM-SCALE LNG STATION DEPLOYMENT

- 9.4 LARGE SCALE

- 9.4.1 MASSIVE STORAGE AND TRANSPORT CAPABILITIES TO BOOST SCALABLE GLOBAL SUPPLY CHAINS

10 LNG STATION MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 HEAVY-DUTY VEHICLES

- 10.2.1 RISING ADOPTION OF LNG BY LONG-HAUL FLEETS TO ACCELERATE STATION DEPLOYMENT

- 10.3 LIGHT-DUTY VEHICLES

- 10.3.1 RISING DEMAND FOR FLEXIBLE AND SCALABLE INFRASTRUCTURE TO DRIVE MARKET

- 10.4 MARINE

- 10.4.1 SURGE IN LNG-POWERED VESSEL ORDERS TO BOOST DEMAND FOR BUNKERING STATIONS

11 LNG STATION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Export-driven supply strain and competition from hydrogen and renewable alternatives to drive market

- 11.2.2 CANADA

- 11.2.2.1 Expansion and strong potential for future LNG and LCNG infrastructure development to drive market

- 11.2.1 US

- 11.3 ASIA PACIFIC

- 11.3.1 CHINA

- 11.3.1.1 Clean transport policies, rising LNG truck adoption, and energy security initiatives to drive market

- 11.3.2 JAPAN

- 11.3.2.1 Advanced bunkering vessels and expanding global LNG fuel networks for decarbonization to drive market

- 11.3.3 INDIA

- 11.3.3.1 Infrastructure investments and clean energy initiatives from key energy companies to drive market

- 11.3.4 REST OF ASIA PACIFIC

- 11.3.1 CHINA

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Infrastructure funding and the promotion of bio-LNG to drive expansions of LNG stations

- 11.4.2 ITALY

- 11.4.2.1 Strategic expansion of LNG refueling infrastructure to drive market

- 11.4.3 SPAIN

- 11.4.3.1 Rising adoption of LNG in heavy-duty transport to accelerate market growth

- 11.4.4 FRANCE

- 11.4.4.1 Rising demand for low-emission transport fuels to drive market

- 11.4.5 NETHERLANDS

- 11.4.5.1 Government incentives and green logistics to boost demand

- 11.4.6 SWEDEN

- 11.4.6.1 Shift toward decarbonizing heavy transport to drive expansion of LNG stations

- 11.4.7 POLAND

- 11.4.7.1 Rising cross-border freight and energy diversification efforts to drive market

- 11.4.8 FINLAND

- 11.4.8.1 Government emission targets, strategic investments, and infrastructure expansion to drive market

- 11.4.9 BELGIUM

- 11.4.9.1 Strategic investments and EU-funded LNG infrastructure to drive market

- 11.4.10 UK

- 11.4.10.1 Strict emission targets and fleet transitions to drive market

- 11.4.11 NORWAY

- 11.4.11.1 Environmental policies and amplification in bio-LNG stations to drive market

- 11.4.12 PORTUGAL

- 11.4.12.1 Cleaner fuel adoption and transition to sustainable transportation to drive market

- 11.4.13 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 REST OF THE WORLD

- 11.5.1 LATIN AMERICA

- 11.5.2 MIDDLE EAST AND AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT, KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Station type footprint

- 12.7.5.4 Application footprint

- 12.7.5.5 Solution footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed List of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 CNPC

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM View

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SHELL PLC

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Expansions

- 13.1.2.4 MnM View

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 CHART INDUSTRIES

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 JEREH OIL & GAS ENGINEERING CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Expansions

- 13.1.4.4 MnM View

- 13.1.4.4.1 Key Strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 WESTFALEN

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 CRYONORM GROUP

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.6.3.2 Other developments

- 13.1.7 CRYOSTAR

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.8 DOVER FUELING SOLUTIONS

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 GRUPO HAM

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Expansions

- 13.1.10 UESTCO ENERGY SYSTEMS

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.3.2 Expansions

- 13.1.11 CLEAN ENERGY FUELS

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Other developments

- 13.1.12 INDIAN OIL CORPORATION LTD

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 INOX INDIA LIMITED

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches

- 13.1.13.3.2 Deals

- 13.1.13.3.3 Expansions

- 13.1.14 BHARAT PETROLEUM CORPORATION LIMITED

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Product launches

- 13.1.14.3.2 Deals

- 13.1.15 CHONGQING ENDURANCE ENERGY EQUIPMENT INTEGRATION CO., LTD.

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Deals

- 13.1.16 ROLANDE

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Deals

- 13.1.16.3.2 Expansions

- 13.1.17 FAS FLUSSIGGAS-ANLAGEN GMBH

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.1 CNPC

- 13.2 OTHER PLAYERS

- 13.2.1 TAYLOR-WHARTON

- 13.2.2 AXEGAZ T&T

- 13.2.3 GASNET, S.R.O.

- 13.2.4 SHIJIAZHUANG ENRIC GAS EQUIPMENT CO., LTD.

- 13.2.5 THINK GAS

- 13.2.6 BAYWA R.E. AG

- 13.2.7 GALILEO TECHNOLOGIES

- 13.2.8 YONGJIA WELLDONE MACHINE CO., LTD.

- 13.2.9 WENZHOU BLUESKY ENERGY TECHNOLOGY CO., LTD.

- 13.2.10 TECNOGAS SRL

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS