|

|

市場調査レポート

商品コード

1752093

ICE・EV用シートベルト材料の世界市場:コンポーネント別、材料別、車両タイプ別、地域別 - 予測(~2032年)ICE & EV Seatbelt Material Market by Component (Retractor, Buckle, Anchor, and Others), Type of Component by Material (Steel/Aluminum, Polycarbonate, and Nylon), and Vehicle Type (Passenger Car, LCV, and HCV), and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| ICE・EV用シートベルト材料の世界市場:コンポーネント別、材料別、車両タイプ別、地域別 - 予測(~2032年) |

|

出版日: 2025年06月11日

発行: MarketsandMarkets

ページ情報: 英文 256 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

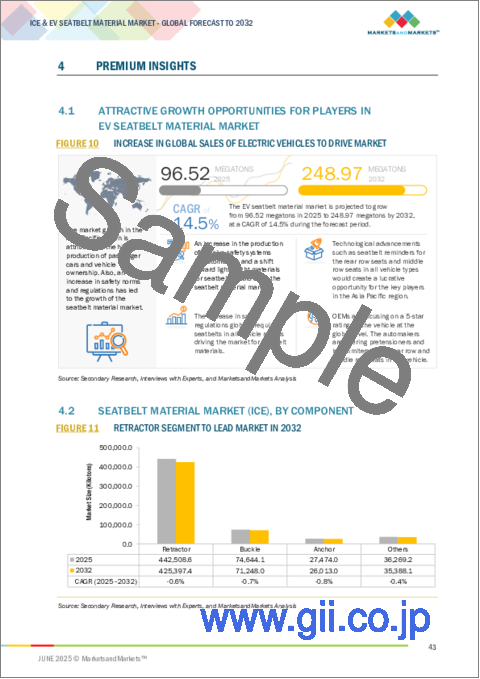

世界のBEV用シートベルト材料の市場規模は、2025年に96.52メガトン、2032年までに248.97メガトンに達すると推定され、予測期間にCAGRで14.5%の成長が見込まれます。

自動車メーカーが、進化する安全基準を満たすためにプリテンショナー、ロードリミッター(前席と後席)、スマートリマインダーシステムのような先進のシートベルト技術の採用を余儀なくされていることから、特に規制の強化や消費者の意識の高まりを通じて、自動車の安全性向上に向けた動きがシートベルト材料市場の大きな促進要因となっています。この動向は、コンパクトサイズとフルサイズの両方でSUVの売上が伸びていることでさらに加速しています。SUVは自動車全体の生産台数を増加させるだけでなく、自動車1台当たりの乗員数も増加させるため、高性能で耐久性のあるシートベルト材料への需要が高まっています。その結果、シートベルト材料市場は、あらゆる価格帯の乗用車セグメントの発展に伴い、安定した成長を示しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 数量 |

| セグメント | コンポーネント、材料、車両タイプ、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ |

「大型商用車はシートベルト材料市場でもっとも急成長している車両タイプセグメントです。」

大型商用車(HEV)は、大型トラックとバス・コーチからなります。大型トラックではドライバー用と同乗者用の2つのシートベルトが使用され、バス・コーチではドライバー用の1つのシートベルトが使用されます。大型商用車のシートベルト部品1つの平均重量は通常1.4~1.7kgで、各地域のリトラクター、バックル、アンカーなどのコンポーネントによって異なります。業界の専門家によると、HCVでは過剰な振動があるため、荷重を補うためにリトラクターの重量が増加します。世界の大型トラックに対する需要は、eコマースやロジスティクスへの需要の増加、地域当局によるインフラ投資の拡大、建設・鉱業部門の拡大によって大きく伸びています。シートベルトの採用は、OEMがドライバーと同乗者の安全を重視していることや規制上の義務により、HCVでも普及しつつあります。例えば米国では、National Highway Traffic Safety Administration(NHTSA)が、都市交通バスを含むすべての乗客へのシートベルトの注意喚起を義務付ける規制を施行しました。インドでは、ケララ州が2023年11月から、国営バスを含む大型車のドライバーと前席の乗客にシートベルトの着用を義務付けました。さらに、テレマティクスと車両管理の搭載率が高まっており、シートベルト市場の活性化を促すとみられます。北米では、先進のフリート管理ソフトウェアとテレマティクスと利用ベース保険(UBI)の統合が、ドライバーと同乗者のシートベルト使用に大きな影響を与えています。最新のテレマティクスシステムはシートベルトの着用状況をリアルタイムでモニターおよび記録し、そのデータを運行管理者や保険企業に送信することができます。UBI保険企業はこの情報を使って、シートベルトが常に着用されているかなど、個々の運転行動を評価し、それに応じて保険料を調整します。

「バッテリー電気自動車がシートベルト材料市場で首位のシェアを占めました。」

バッテリー電気自動車の売上は世界中で急成長しており、2021年に675万台程度だった世界の売上は、2024年に前年比25%増の1,710万台に達しました。この売上の増加は、バッテリーコストの低下、モデルの選択肢の拡大、特に中国、欧州、米国における政府の強力な支援によってもたらされました。ICE乗用車と同様に、純バッテリー電気自動車は、プリテンショナー、ロードリミッター、強化エアバッグシステムなどの先進のパッシブセーフティ機能を統合することが多く、電子アーキテクチャを活用して乗員保護を向上させています。

当レポートでは、世界のICE・EV用シートベルト材料市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- EVシートベルト材料市場における魅力的な成長機会

- シートベルト材料市場(ICE):コンポーネント別

- シートベルトリトラクター市場(ICE):材料別

- シートベルトバックル市場(ICE):材料別

- シートベルトアンカー市場(ICE):材料別

- シートベルト材料市場(ICE):車両タイプ別

- シートベルト材料市場(EV):コンポーネント別

- シートベルトリトラクター市場(EV):材料別

- シートベルトバックル市場(EV):材料別

- シートベルトアンカー市場(EV):材料別

- シートベルト材料市場(ICE):地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 貿易データアナリティクス

- HSコード870821の輸入シナリオ

- HSコード870821の輸出シナリオ

- 顧客ビジネスに影響を与える動向/混乱

- ケーススタディ分析

- 特許分析

- サプライチェーン分析

- エコシステム分析

- 規制情勢

- 規制機関、政府機関、その他の組織

- 主な規制

- 価格分析

- 主なステークホルダーと購入基準

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 主な会議とイベント(2025年~2026年)

- 投資シナリオ

- 2025年の米国関税の影響:概要

- 主な関税率

- 自動車最終製品とコンポーネントに対する各国の関税

- シートベルト材料市場に対する2025年の米国関税の影響

- サプライヤー分析

第6章 シートベルト材料市場(ICE):車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車

- 大型商用車

- 産業考察

第7章 シートベルト材料市場(ICE):コンポーネント別

- イントロダクション

- リトラクター

- バックル

- アンカー

- その他

- 産業考察

第8章 シートベルトバックル市場(ICE):材料別

- イントロダクション

- スチール/アルミニウム

- ポリカーボネート

- ナイロン

- 産業考察

第9章 シートベルトリトラクター市場(ICE):材料別

- イントロダクション

- スチール/アルミニウム

- ポリカーボネート

- ナイロン

- 産業考察

第10章 シートベルトアンカー市場(ICE):材料別

- イントロダクション

- スチール/アルミニウム

- ポリカーボネート

- 産業考察

第11章 シートベルト材料市場(EV):コンポーネント別

- イントロダクション

- リトラクター

- バックル

- アンカー

- その他

- 産業考察

第12章 シートベルトリトラクター市場(EV):材料別

- イントロダクション

- スチール/アルミニウム

- ポリカーボネート

- ナイロン

- 産業考察

第13章 シートベルトアンカー市場(EV):材料別

- イントロダクション

- スチール/アルミニウム

- ポリカーボネート

- 産業考察

第14章 シートベルトバックル市場(EV):材料別

- イントロダクション

- スチール/アルミニウム

- ポリカーボネート

- ナイロン

- 産業考察

第15章 シートベルト材料市場(ICE):地域別

- イントロダクション

- アジア太平洋

- マクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- 欧州

- マクロ経済の見通し

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- 南北アメリカ

- マクロ経済の見通し

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第16章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- シートベルト材料の市場シェア分析(2024年)

- 日本の自動車用シートベルトメーカーの市場シェア(2024年)

- 欧州の自動車用シートベルトメーカーの市場ランキング(2024年)

- 中国の自動車用シートベルトメーカーの市場ランキング(2024年)

- インドの自動車用シートベルトメーカーの市場ランキング(2024年)

- 2025年3月の企業の評価

- 財務指標、2025年2月

- ブランドの比較

- 企業の評価マトリクス:主要企業(2024年)

- 競合シナリオ

第17章 企業プロファイル

- 主要企業

- AUTOLIV

- JOYSON SAFETY SYSTEMS

- ZF FRIEDRICHSHAFEN AG

- TOKAIRIKA, CO, LTD.

- YANFENG

- FAR EUROPE INC.

- GWR SAFETY SYSTEMS

- HOLMBERGS SAFETY SYSTEM HOLDING AB

- ASHIMORI INDUSTRY CO., LTD.

- SAMSONG INDUSTRIES, LTD

- ITW AUTOMOTIVE

- その他の企業

- SS MANUFACTURING PVT LTD.

- BEIJING SHIJIN AUTOMOTIVE COMPONENTS CO., LTD.

- CHONGQING GUANGDA INDUSTRIAL CO., LTD.

- THAI SEATBELT

- GORADIA INDUSTRIES

- SEATBELT SOLUTIONS LLC

- ZHEJIANG SONGYUAN AUTOMOTIVE SAFETY SYSTEMS CO., LTD.

- KINGFISHER AUTOMOTIVE

- APV SAFETY PRODUCTS

- SCHROTH SAFETY PRODUCTS

第18章 MARKETSANDMARKETSによる提言

- 自動車用シートベルト材料の主要市場はアジア太平洋へ

- イノベーションと技術の向上:主要サプライヤー別

- 電気自動車と自動運転車における機会の拡大

- 結論

第19章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 CURRENCY EXCHANGE RATES

- TABLE 3 NUMBER OF SEATBELTS OFFERED IN EACH VEHICLE TYPE

- TABLE 4 SEATBELT-RELATED STANDARDS

- TABLE 5 WORLDWIDE NCAP PROGRAMS AND THEIR IMPACT ON SEATBELT MATERIAL MARKET

- TABLE 6 US: IMPORT DATA FOR HS CODE 870821-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 GERMANY IMPORT DATA FOR HS CODE 870821-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 FRANCE: IMPORT DATA FOR HS CODE 870821-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 SPAIN: IMPORT DATA FOR HS CODE 870821-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 US: EXPORT DATA FOR HS CODE 870821-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 ROMANIA: EXPORT DATA FOR HS CODE 870821-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 FRANCE: EXPORT DATA FOR HS CODE 870821-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 POLAND: EXPORT DATA FOR HS CODE 870821-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 HUNGARY: EXPORT DATA FOR HS CODE 870821-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 GERMANY: EXPORT DATA FOR HS CODE 870821-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 16 MEXICO: EXPORT DATA FOR HS CODE 870821-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 17 PATENT ANALYSIS, 2021-2025

- TABLE 18 ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 19 AMERICAS: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 SAFETY REGULATIONS, BY COUNTRY/REGION

- TABLE 23 NCAP REGULATIONS

- TABLE 24 SEATBELT MATERIAL-RELATED STANDARDS

- TABLE 25 AVERAGE SELLING PRICE TREND OF STEEL, 2020-2024 (USD/KG)

- TABLE 26 AVERAGE SELLING PRICE TREND OF ALUMINUM, 2020-2024 (USD/KG)

- TABLE 27 AVERAGE SELLING PRICE TREND OF POLYCARBONATE, 2020-2024 (USD/KG)

- TABLE 28 AVERAGE SELLING PRICE TREND OF NYLON, 2020-2024 (USD/KG)

- TABLE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TOP 3 COMPONENTS (%)

- TABLE 30 KEY BUYING CRITERIA, BY TOP 3 COMPONENTS

- TABLE 31 NEW MATERIALS FOR SEATBELTS

- TABLE 32 SEATBELT MATERIAL INNOVATIONS BY MANUFACTURERS

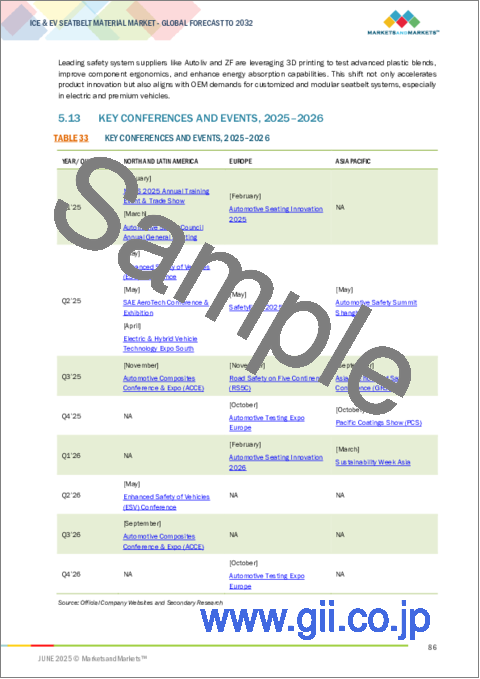

- TABLE 33 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 34 FUNDING DATA, FEBRUARY 2021-FEBRUARY 2025

- TABLE 35 US: TOTAL IMPORTS AND ADJUSTED RECIPROCAL TARIFFS, 2024

- TABLE 36 US: AUTOMOTIVE IMPORTS AND ADJUSTED RECIPROCAL TARIFFS, 2024

- TABLE 37 CHINA'S EXPORTS TO US AND MEXICO, 2022-2024

- TABLE 38 SUPPLIER ANALYSIS FOR SEATBELT COMPONENTS, 2024

- TABLE 39 SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 40 SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 41 PASSENGER CAR: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 42 PASSENGER CAR: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 43 PASSENGER CAR: SEATBELT MARKET (ICE), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 44 PASSENGER CAR: SEATBELT MARKET (ICE), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 45 LIGHT COMMERCIAL VEHICLE: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 46 LIGHT COMMERCIAL VEHICLE: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 47 LIGHT COMMERCIAL VEHICLE: SEATBELT MARKET (ICE), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 48 LIGHT COMMERCIAL VEHICLE: SEATBELT MARKET (ICE), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 49 HEAVY COMMERCIAL VEHICLE: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 50 HEAVY COMMERCIAL VEHICLE: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 51 HEAVY COMMERCIAL VEHICLE: SEATBELT MARKET (ICE), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 52 HEAVY COMMERCIAL VEHICLE: SEATBELT MARKET (ICE), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 53 SEATBELT MATERIAL MARKET (ICE), BY COMPONENT, 2021-2024 (KILOTONS)

- TABLE 54 SEATBELT MATERIAL MARKET (ICE), BY COMPONENT, 2025-2032 (KILOTONS)

- TABLE 55 RETRACTOR: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 56 RETRACTOR: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 57 RETRACTOR: SEATBELT MARKET (ICE), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 58 RETRACTOR: SEATBELT MARKET (ICE), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 59 BUCKLE: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 60 BUCKLE: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 61 BUCKLE: SEATBELT MARKET (ICE), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 62 BUCKLE: SEATBELT MARKET (ICE), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 63 ANCHOR: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 64 ANCHOR: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 65 ANCHOR: SEATBELT MARKET (ICE), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 66 ANCHOR: SEATBELT MARKET (ICE), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 67 OTHERS: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 68 OTHERS: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 69 OTHERS: SEATBELT MARKET (ICE), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 70 OTHERS: SEATBELT MARKET (ICE), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 71 SEATBELT BUCKLE MARKET (ICE), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 72 SEATBELT BUCKLE MARKET (ICE), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 73 STEEL/ALUMINUM: SEATBELT BUCKLE MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 74 STEEL/ALUMINUM: SEATBELT BUCKLE MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 75 POLYCARBONATE: SEATBELT BUCKLE MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 76 POLYCARBONATE: SEATBELT BUCKLE MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 77 NYLON: SEATBELT BUCKLE MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 78 NYLON: SEATBELT BUCKLE MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 79 SEATBELT RETRACTOR MARKET (ICE), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 80 SEATBELT RETRACTOR MARKET (ICE), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 81 STEEL/ALUMINUM: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 82 STEEL/ALUMINUM: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 83 POLYCARBONATE: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 84 POLYCARBONATE: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 85 NYLON: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 86 NYLON: SEATBELT MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 87 SEATBELT ANCHOR MARKET (ICE), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 88 SEATBELT ANCHOR MARKET (ICE), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 89 STEEL/ALUMINUM: SEATBELT ANCHOR MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 90 STEEL/ALUMINUM: SEATBELT ANCHOR MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 91 POLYCARBONATE: SEATBELT ANCHOR MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 92 POLYCARBONATE: SEATBELT ANCHOR MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 93 SEATBELT MATERIAL MARKET (EV), BY COMPONENT, 2021-2024 (KILOTONS)

- TABLE 94 SEATBELT MATERIAL MARKET (EV), BY COMPONENT, 2025-2032 (KILOTONS)

- TABLE 95 SEATBELT RETRACTOR MATERIAL MARKET (EV), BY REGION, 2021-2024 (KILOTONS)

- TABLE 96 SEATBELT RETRACTOR MATERIAL MARKET (EV), BY REGION, 2025-2032 (KILOTONS)

- TABLE 97 SEATBELT RETRACTOR MARKET (EV), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 98 SEATBELT RETRACTOR MARKET (EV), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 99 SEATBELT BUCKLE MATERIAL MARKET (EV), BY REGION, 2021-2024 (KILOTONS)

- TABLE 100 SEATBELT BUCKLE MATERIAL MARKET (EV), BY REGION, 2025-2032 (KILOTONS)

- TABLE 101 SEATBELT BUCKLE MARKET (EV), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 102 SEATBELT BUCKLE MARKET (EV), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 103 SEATBELT ANCHOR MATERIAL MARKET (EV), BY REGION, 2021-2024 (KILOTONS)

- TABLE 104 SEATBELT ANCHOR MATERIAL MARKET (EV), BY REGION, 2025-2032 (KILOTONS)

- TABLE 105 SEATBELT ANCHOR MARKET (EV), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 106 SEATBELT ANCHOR MARKET (EV), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 107 OTHER COMPONENTS: SEATBELT MATERIAL MARKET (EV), BY REGION, 2021-2024 (KILOTONS)

- TABLE 108 OTHER COMPONENTS: SEATBELT MATERIAL MARKET (EV), BY REGION, 2025-2032 (KILOTONS)

- TABLE 109 OTHER COMPONENTS: SEATBELT MARKET (EV), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 110 OTHER COMPONENTS: SEATBELT MARKET (EV), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 111 SEATBELT RETRACTOR MARKET (EV), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 112 SEATBELT RETRACTOR MARKET (EV), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 113 STEEL/ALUMINUM: SEATBELT MATERIAL MARKET (EV), BY REGION, 2021-2024 (KILOTONS)

- TABLE 114 STEEL/ALUMINUM: SEATBELT MATERIAL MARKET (EV), BY REGION, 2025-2032 (KILOTONS)

- TABLE 115 POLYCARBONATE: SEATBELT MATERIAL MARKET (EV), BY REGION, 2021-2024 (KILOTONS)

- TABLE 116 POLYCARBONATE: SEATBELT MATERIAL MARKET (EV), BY REGION, 2025-2032 (KILOTONS)

- TABLE 117 NYLON: SEATBELT MATERIAL MARKET (EV), BY REGION, 2021-2024 (KILOTONS)

- TABLE 118 NYLON: SEATBELT MATERIAL MARKET (EV), BY REGION, 2025-2032 (KILOTONS)

- TABLE 119 SEATBELT ANCHOR MARKET (EV), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 120 SEATBELT BUCKLE MARKET (EV), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 121 STEEL/ALUMINUM: SEATBELT ANCHOR MATERIAL MARKET (EV), BY REGION, 2021-2024 (KILOTONS)

- TABLE 122 STEEL/ALUMINUM: SEATBELT ANCHOR MATERIAL MARKET (EV), BY REGION, 2025-2032 (KILOTONS)

- TABLE 123 POLYCARBONATE: SEATBELT ANCHOR MATERIAL MARKET (EV), BY REGION, 2021-2024 (KILOTONS)

- TABLE 124 POLYCARBONATE: SEATBELT ANCHOR MATERIAL MARKET (EV), BY REGION, 2025-2032 (KILOTONS)

- TABLE 125 SEATBELT BUCKLE MARKET (EV), BY MATERIAL, 2021-2024 (KILOTONS)

- TABLE 126 SEATBELT BUCKLE MARKET (EV), BY MATERIAL, 2025-2032 (KILOTONS)

- TABLE 127 STEEL/ALUMINUM: SEATBELT BUCKLE MATERIAL MARKET (EV), BY REGION, 2021-2024 (KILOTONS)

- TABLE 128 STEEL/ALUMINUM: SEATBELT BUCKLE MATERIAL MARKET (EV), BY REGION, 2025-2032 (KILOTONS)

- TABLE 129 POLYCARBONATE: SEATBELT BUCKLE MATERIAL MARKET (EV), BY REGION, 2021-2024 (KILOTONS)

- TABLE 130 POLYCARBONATE: SEATBELT BUCKLE MATERIAL MARKET (EV), BY REGION, 2025-2032 (KILOTONS)

- TABLE 131 NYLON: SEATBELT BUCKLE MATERIAL MARKET (EV), BY REGION, 2021-2024 (KILOTONS)

- TABLE 132 NYLON: SEATBELT BUCKLE MATERIAL MARKET (EV), BY REGION, 2025-2032 (KILOTONS)

- TABLE 133 SEATBELT MATERIAL MARKET (ICE), BY REGION, 2021-2024 (KILOTONS)

- TABLE 134 SEATBELT MATERIAL MARKET (ICE), BY REGION, 2025-2032 (KILOTONS)

- TABLE 135 ASIA PACIFIC: SEATBELT MATERIAL MARKET (ICE), BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 136 ASIA PACIFIC: SEATBELT MATERIAL MARKET (ICE), BY COUNTRY, 2025-2032 (KILOTONS)

- TABLE 137 CHINA: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 138 CHINA: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 139 JAPAN: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 140 JAPAN: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 141 INDIA: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 142 INDIA: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 143 SOUTH KOREA: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 144 SOUTH KOREA: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 145 EUROPE: SEATBELT MATERIAL MARKET (ICE), BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 146 EUROPE: SEATBELT MATERIAL MARKET (ICE), BY COUNTRY, 2025-2032 (KILOTONS)

- TABLE 147 GERMANY: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 148 GERMANY: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 149 FRANCE: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 150 FRANCE: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 151 UK: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 152 UK: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 153 SPAIN: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 154 SPAIN: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 155 ITALY: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 156 ITALY: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 157 AMERICAS: SEATBELT MATERIAL MARKET (ICE), BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 158 AMERICAS: SEATBELT MATERIAL MARKET (ICE), BY COUNTRY, 2025-2032 (KILOTONS)

- TABLE 159 US: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 160 US: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 161 CANADA: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 162 CANADA: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 163 MEXICO: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 164 MEXICO: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 165 BRAZIL: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 166 BRAZIL: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 167 ARGENTINA: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2021-2024 (KILOTONS)

- TABLE 168 ARGENTINA: SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025-2032 (KILOTONS)

- TABLE 169 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SEATBELT MATERIAL MARKET

- TABLE 170 DEGREE OF COMPETITION, 2024

- TABLE 171 RANKING OF KEY PLAYERS IN SEATBELT MATERIAL MARKET IN EUROPE, 2024

- TABLE 172 RANKING OF KEY PLAYERS IN SEATBELT MATERIAL MARKET IN CHINA, 2024

- TABLE 173 RANKING OF KEY PLAYERS IN SEATBELT MATERIAL MARKET IN INDIA, 2024

- TABLE 174 SEATBELT MATERIAL MARKET: REGION FOOTPRINT, 2024

- TABLE 175 SEATBELT MATERIAL MARKET: COMPONENT FOOTPRINT, 2024

- TABLE 176 SEATBELT MATERIAL MARKET: VEHICLE TYPE FOOTPRINT, 2024

- TABLE 177 SEATBELT MATERIAL MARKET: PRODUCT LAUNCHES, DECEMBER 2024

- TABLE 178 SEATBELT MATERIAL MARKET: DEALS, MARCH 2024-JANUARY 2025

- TABLE 179 SEATBELT MATERIAL MARKET: EXPANSIONS, JULY 2024

- TABLE 180 SEATBELT MATERIAL MARKET: OTHER DEVELOPMENTS, MAY 2023-FEBRUARY 2025

- TABLE 181 AUTOLIV: COMPANY OVERVIEW

- TABLE 182 AUTOLIV: PRODUCTS OFFERED

- TABLE 183 AUTOLIV: DEALS

- TABLE 184 AUTOLIV: OTHER DEVELOPMENTS

- TABLE 185 JOYSON SAFETY SYSTEMS: COMPANY OVERVIEW

- TABLE 186 JOYSON SAFETY SYSTEMS: PRODUCTS OFFERED

- TABLE 187 JOYSON SAFETY SYSTEMS: DEALS

- TABLE 188 JOYSON SAFETY SYSTEMS: OTHER DEVELOPMENTS

- TABLE 189 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 190 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

- TABLE 191 ZF FRIEDRICHSHAFEN AG: PRODUCT LAUNCHES/UPGRADES

- TABLE 192 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 193 ZF FRIEDRICHSHAFEN AG: EXPANSIONS

- TABLE 194 ZF FRIEDRICHSHAFEN AG: OTHER DEVELOPMENTS

- TABLE 195 TOKAIRIKA, CO, LTD.: COMPANY OVERVIEW

- TABLE 196 TOKAIRIKA, CO, LTD.: PRODUCTS OFFERED

- TABLE 197 TOKAIRIKA, CO, LTD.: DEALS

- TABLE 198 YANFENG: COMPANY OVERVIEW

- TABLE 199 YANFENG: PRODUCTS OFFERED

- TABLE 200 YANFENG: DEALS

- TABLE 201 YANFENG: EXPANSIONS

- TABLE 202 FAR EUROPE INC.: COMPANY OVERVIEW

- TABLE 203 FAR EUROPE INC.: PRODUCTS OFFERED

- TABLE 204 GWR SAFETY SYSTEMS: COMPANY OVERVIEW

- TABLE 205 GWR SAFETY SYSTEMS: PRODUCTS OFFERED

- TABLE 206 HOLMBERGS SAFETY SYSTEM HOLDING AB: COMPANY OVERVIEW

- TABLE 207 HOLMBERGS SAFETY SYSTEM HOLDING AB: PRODUCTS OFFERED

- TABLE 208 HOLMBERGS SAFETY SYSTEM HOLDING AB: OTHER DEVELOPMENTS

- TABLE 209 ASHIMORI INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 210 ASHIMORI INDUSTRY CO., LTD.: PRODUCTS OFFERED

- TABLE 211 ASHIMORI INDUSTRY CO., LTD.: DEALS

- TABLE 212 SAMSONG INDUSTRIES, LTD: COMPANY OVERVIEW

- TABLE 213 SAMSONG INDUSTRIES, LTD: PRODUCTS OFFERED

- TABLE 214 ITW AUTOMOTIVE: COMPANY OVERVIEW

- TABLE 215 ITW AUTOMOTIVE: PRODUCTS OFFERED

- TABLE 216 SS MANUFACTURING PVT LTD.: COMPANY OVERVIEW

- TABLE 217 BEIJING SHIJIN AUTOMOTIVE COMPONENTS CO., LTD.: COMPANY OVERVIEW

- TABLE 218 CHONGQING GUANGDA INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 219 THAI SEATBELT: COMPANY OVERVIEW

- TABLE 220 GORADIA INDUSTRIES: COMPANY OVERVIEW

- TABLE 221 SEATBELT SOLUTIONS LLC: COMPANY OVERVIEW

- TABLE 222 ZHEJIANG SONGYUAN AUTOMOTIVE SAFETY SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 223 KINGFISHER AUTOMOTIVE: COMPANY OVERVIEW

- TABLE 224 APV SAFETY PRODUCTS: COMPANY OVERVIEW

- TABLE 225 SCHROTH SAFETY PRODUCTS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AUTOMOTIVE SEATBELT MATERIAL MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 BOTTOM-UP APPROACH, BY VEHICLE, BY MATERIAL TYPE, AND REGION

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 REPORT SUMMARY

- FIGURE 9 AUTOMOTIVE SEATBELT MATERIAL MARKET (ICE), BY REGION, 2025 VS. 2032 (KILOTONS)

- FIGURE 10 INCREASE IN GLOBAL SALES OF ELECTRIC VEHICLES TO DRIVE MARKET

- FIGURE 11 RETRACTOR SEGMENT TO LEAD MARKET IN 2032

- FIGURE 12 STEEL/ALUMINUM SEGMENT TO DOMINATE MARKET IN 2032

- FIGURE 13 STEEL/ALUMINUM TO HAVE LARGEST MARKET SHARE IN 2032

- FIGURE 14 STEEL/ALUMINUM MATERIAL SEGMENT TO DOMINATE MARKET IN 2032

- FIGURE 15 PASSENGER CAR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032

- FIGURE 16 RETRACTOR SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2032

- FIGURE 17 STEEL/ALUMINUM MATERIAL TO LEAD MARKET IN 2032

- FIGURE 18 STEEL/ALUMINUM SEGMENT TO DOMINATE MARKET IN 2032

- FIGURE 19 STEEL/ALUMINUM TO BE DOMINANT SEGMENT IN 2032

- FIGURE 20 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 21 SEATBELT MATERIAL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 PATENT ANALYSIS OF SEATBELT MATERIAL MARKET, 2014-2025

- FIGURE 24 LEGAL STATUS OF PATENTS, 2014-2025

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- FIGURE 26 MARKET MAPPING

- FIGURE 27 ECOSYSTEM ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF STEEL, 2020-2024 (USD)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF ALUMINUM, 2020-2024 (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE TREND OF POLYCARBONATE, 2020-2024 (USD/KG)

- FIGURE 31 AVERAGE SELLING PRICE TREND OF NYLON, 2020-2024 (USD/KG)

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TOP 3 COMPONENTS

- FIGURE 33 KEY BUYING CRITERIA, BY TOP 3 COMPONENTS

- FIGURE 34 INVESTMENT SCENARIO, 2021-2025

- FIGURE 35 SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE, 2025 VS. 2032 (KILOTONS)

- FIGURE 36 SEATBELT MATERIAL MARKET (ICE), BY COMPONENT, 2025 VS. 2032 (KILOTONS)

- FIGURE 37 SEATBELT BUCKLE MARKET (ICE), BY MATERIAL, 2025 VS. 2032 (KILOTONS)

- FIGURE 38 SEATBELT RETRACTOR MARKET (ICE), BY MATERIAL, 2025 VS. 2032 (KILOTONS)

- FIGURE 39 SEATBELT ANCHOR MARKET (ICE), BY MATERIAL, 2025 VS. 2032 (KILOTONS)

- FIGURE 40 SEATBELT MATERIAL MARKET (EV), BY COMPONENT, 2025 VS. 2032 (KILOTONS)

- FIGURE 41 SEATBELT RETRACTOR MARKET (EV), BY MATERIAL, 2025 VS. 2032 (KILOTONS)

- FIGURE 42 SEATBELT ANCHOR MARKET (EV), BY MATERIAL, 2025 VS. 2032 (KILOTONS)

- FIGURE 43 SEATBELT BUCKLE MARKET (EV), BY MATERIAL, 2025 VS. 2032 (KILOTONS)

- FIGURE 44 SEATBELT MATERIAL MARKET (ICE) , BY REGION, 2025 VS. 2032 (KILOTONS)

- FIGURE 45 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 46 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 47 ASIA PACIFIC: INFLATION RATE IN TERMS OF AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 48 ASIA PACIFIC: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 49 ASIA PACIFIC: SEATBELT MATERIAL MARKET SNAPSHOT

- FIGURE 50 EUROPE: SEATBELT MATERIAL MARKET (ICE), BY COUNTRY (KILOTONS)

- FIGURE 51 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 52 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 53 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 54 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 55 AMERICAS: SEATBELT MATERIAL MARKET SNAPSHOT

- FIGURE 56 AMERICAS: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 57 AMERICAS: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 58 AMERICAS: CONSUMER PRICE INDEX (CPI) INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 59 AMERICAS: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 60 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020-2024

- FIGURE 61 AUTOMOTIVE SEATBELT MATERIAL MARKET SHARE ANALYSIS, 2024

- FIGURE 62 JAPAN: SEATBELT MATERIAL MARKET SHARE, 2024

- FIGURE 63 COMPANY VALUATION, MARCH 2025 (USD BILLION)

- FIGURE 64 FINANCIAL METRICS, FEBRUARY 2025 (USD BILLION)

- FIGURE 65 BRAND COMPARISON

- FIGURE 66 SEATBELT MATERIAL MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 67 SEATBELT MATERIAL MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 68 AUTOLIV: COMPANY SNAPSHOT, 2024

- FIGURE 69 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT, 2024

- FIGURE 70 TOKAIRIKA, CO, LTD.: COMPANY SNAPSHOT, 2024

- FIGURE 71 ASHIMORI INDUSTRY CO., LTD.: COMPANY SNAPSHOT, 2024

- FIGURE 72 SAMSONG INDUSTRIES, LTD: COMPANY SNAPSHOT, 2024

- FIGURE 73 ITW AUTOMOTIVE: COMPANY SNAPSHOT, 2024

The BEV seatbelt material market is estimated to be at 96.52 megatons in 2025 and reach 248.97 megatons at a CAGR of 14.5% during the forecast period. The push towards increases in vehicle safety, especially through stricter regulations and heightened consumer awareness, is a major driver of the seatbelt material market, as automakers are compelled to adopt advanced seatbelt technologies like pretensioners, load limiters (front and rear seats), and smart reminder systems to meet evolving safety standards. This trend is further amplified by the growing sales of SUVs, both compact and full-size, which not only boost overall vehicle production but also increase the number of occupants per vehicle, thereby increasing the demand for high-performance, durable seatbelt materials. As a result, the seatbelt material market is experiencing steady growth in line with the development of the passenger vehicle segment across all price points.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Kilotons) |

| Segments | Seatbelt Material Market, By Component; Seatbelt Retractor Market, By Material; Seatbelt Buckle Market, By Material; Seatbelt Anchor Market, By Material; Seatbelt Material Market, By Vehicle Type; Seatbelt Material Market, By Components; Seatbelt Retractor Market, By Material; Seatbelt Buckle Market, By Material; Seatbelt Anchor Market, By Material; By Region - Asia Pacific, Europe, and Americas |

| Regions covered | Asia Pacific, North America, Europe, and Middle East & Africa |

"Heavy commercial vehicle is the fastest-growing vehicle type segment of the seatbelt material market."

Heavy commercial vehicles (HEVs) comprise heavy trucks and buses & coaches. Two units of seatbelts are considered in heavy trucks for driver and co-passenger, whereas one seatbelt is for the driver in the buses & coaches. The average weight of a single seatbelt assembly in heavy commercial vehicles typically ranges from 1.4 to 1.7 kg and varies across the retractor, buckle, anchor, and other components in different regions. According to the industrial expert, due to excess vibration in HCVs, the weight of the retractor is increased to compensate the load. The global demand for heavy trucks has risen significantly, driven by increased e-commerce & logistics demand and growing infrastructure investments by regional authorities, leading to heightened construction & mining sectors. The adoption of seatbelts is also becoming popular in HCVs owing to OEMs' focus on driver & co-passenger safety and regulatory mandates. For instance, in the US, the National Highway Traffic Safety Administration (NHTSA) has enforced the rule requiring seat belt warnings for all passengers, including city transport buses. In India, the state of Kerala mandated seatbelt usage for drivers and front-seat passengers in heavy vehicles, including state-run buses, from November 2023. Further, the growing fitment rate of telematics & fleet management would prompt the seatbelt market. In North America, the integration of advanced fleet management software with telematics and usage-based insurance (UBI) has significantly influenced driver and co-passenger seatbelt usage. Modern telematics systems can monitor and record seatbelt status in real time, transmitting this data to fleet managers and insurance providers. UBI insurers use this information to assess individual driving behaviors, including whether seatbelts are consistently worn, and adjust insurance premiums, accordingly, rewarding safer practices with lower rates and penalizing non-compliance. Hence, as the regulatory environments have become more ambitious and harmonized globally concentrated on heavy-duty vehicle segments coupled with technological advancements in telematics and OEMs and fleet operators to prioritize passenger safety, seatbelt manufacturers would invest in advanced seatbelt technologies and materials, fueling the HEV segment of the market.

"Battery electric vehicles hold the leading market share of the seatbelt material market."

Battery electric vehicle sales are experiencing rapid growth worldwide, with global sales reaching 17.1 million in 2024, which was a 25% increase YOY, while in 2021, they were around 6.75 million. This increase in sales was driven by falling battery costs, expanding model choices, and robust government support, particularly in China, Europe, and the US. Similar to ICE passenger cars, pure battery electric cars often integrate advanced passive safety features such as pretensioners, load limiters, and enhanced airbag systems, leveraging the electronic architecture with improved occupant protection.

Considering electric vehicle sales, based on the model mapping, the sedan and hatchback in EV versions contribute 65% of the sales in China, whereas the premium variant in EVs offers captain seats in the rear row, reflecting strong consumer demand for the vehicles. The trend in the Americas is due to an increase in mid-sized electric SUVs and pickup trucks, further boosting the demand for seatbelt components with 2-point and 3-point seatbelts. Moreover, the demand for ADAS features is increasingly being offered as standard or optional equipment in EVs across Europe and the Americas, driven by rising consumer demand for safety, regulatory encouragement, and the broader shift toward autonomous mobility. These advanced systems, ranging from adaptive cruise control and lane-keeping assist to emergency braking and collision warnings, are tightly integrated with automotive seatbelt systems, as ADAS can trigger seatbelt pretensioners or dynamic tension adjustments in anticipation of a potential crash, maximizing occupant protection.

"The Americas is the second-largest market for seatbelt materials globally."

The Americas market is growing rapidly, driven by stringent safety regulations, high consumer awareness, and technological innovation. Recent safety norms include the US National Highway Traffic Safety Administration's (NHTSA) finalized rule mandating enhanced seat belt reminder systems for both front and rear seats in new vehicles. The front seat requirements by September 2026 and rear seat reminders by September 2027, aimed at increasing usage rates and saving lives. In the US, mid-size and large SUVs account for approximately 55-60% of all new vehicle sales, reflecting a strong consumer shift toward larger, multi-row vehicles. This trend is significantly boosting the market for seatbelts, especially for second row and third-row seats, as automakers equip these vehicles with dedicated retractors and advanced restraint systems to ensure safety for all occupants. The rise of SUVs with three-row configurations by leading OEMs is expanding the need for durable webbing, high-strength metal components, and advanced sensors in seatbelt assemblies. As a result, the growing popularity of SUVs and premium vehicles in the Americas is driving sustained growth in the seatbelt material and technology market, with manufacturers responding to both regulatory requirements and consumer expectations for comprehensive safety across all seating positions.

The automakers in the US are making significant investments in occupant safety by introducing new technologies that are more advanced than traditional restraint systems. One notable example is Ford's invention and commercial deployment of inflatable seatbelts, which are offered depending upon the customer's demand for extra safety features in vehicles, as per the trim level. Moreover, the automakers are incorporating advanced seatbelt pretensioners and dynamic load limiters and integrating seatbelt systems with ADAS features such as automatic emergency braking and collision anticipation, further enhancing occupant protection.

The break-up of the profile of primary participants in the seatbelt material market is as follows:

By Companies: Tier I - 30%, Tier II - 70%

By Designation: Manager level - 30%, C-Level Executives - 50%, Others- 20%,

By Region: Americas - 10%, Europe - 20%, and Asia Pacific - 70%

Global players dominate the seatbelt material market, which also comprise several regional players. The key players in the seatbelt material market are Autoliv (Sweden), Joyson Safety Systems (US), ZF Friedrichshafen AG (Germany), Tokairika, Co., Ltd. (Japan), Yanfeng (Japan), Far Europe Inc. (China), GWR Safety System (US), Holmbergs Safety System Holding AB (Sweden), Ashimori Industrial Co. Ltd. (Japan), and Samsong Industries, Ltd, (South Korea).

Research Coverage:

By Components (Retractor, Buckle, Anchor, and Others), Seatbelt Retractor Market (ICE), By material (Steel/Aluminum, Polycarbonate, and Nylon), Seatbelt Buckle Market (ICE), By Material (Steel/Aluminum, Polycarbonate, and Nylon), Seatbelt Anchor Market (ICE), By Material (Steel/Aluminum and Polycarbonate), Seatbelt Material Market (ICE), By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), Seatbelt Retractor Market (BEV), By Material (Steel/Aluminum, Polycarbonate, and Nylon), Seatbelt Buckle Market (BEV), By Material (Steel/Aluminum, Polycarbonate, and Nylon), Seatbelt Material Market (BEV), By Anchor (Steel/Aluminum and Polycarbonate), By Region (Asia Pacific, Europe, and the Americas)

The report's scope covers detailed information regarding the major factors influencing the growth of the seatbelt material market. A thorough analysis of the key industry players has provided insights into their business overview, products, key strategies, contracts, partnerships, agreements, product launches, mergers and acquisitions, recession impact, and recent seatbelt material market developments.

Key Benefits of Buying the Report:

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall seatbelt material market and the sub-segments. It will also help stakeholders understand the competitive landscape, gain insights into positioning their businesses better, and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of critical drivers (increase in stringency in safety standards and growing crash tests), restraints (increase in the development of active safety system), opportunities (lighter and sustainable materials and small textiles), and challenges (chemical compatibility, durability requirement, and production and manufacturing) influencing the growth of the seatbelt material market

- Product Development/Innovation: Detailed insights into upcoming technologies and new products launched in the seatbelt material market

- Market Development: Comprehensive market information - the report analyzes the authentication and brand protection market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the seatbelt material market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the seatbelt material market, such as Autoliv (Sweden), Joyson Safety Systems (US), ZF Friedrichshafen AG (Germany), Tokairika, Co., Ltd. (Japan), and Yanfeng (Japan)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources to estimate base numbers

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary interviews

- 2.1.2.2 Key primary interview participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.3.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.4 RESEARCH ASSUMPTIONS AND RISK ANALYSIS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN EV SEATBELT MATERIAL MARKET

- 4.2 SEATBELT MATERIAL MARKET (ICE), BY COMPONENT

- 4.3 SEATBELT RETRACTOR MARKET (ICE), BY MATERIAL

- 4.4 SEATBELT BUCKLE MARKET (ICE), BY MATERIAL

- 4.5 SEATBELT ANCHOR MARKET (ICE), BY MATERIAL

- 4.6 SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE

- 4.7 SEATBELT MATERIAL MARKET (EV), BY COMPONENT

- 4.8 SEATBELT RETRACTOR MARKET (EV), BY MATERIAL

- 4.9 SEATBELT BUCKLE MARKET (EV), BY MATERIAL

- 4.10 SEATBELT ANCHOR MARKET (EV), BY MATERIAL

- 4.11 SEATBELT MATERIAL MARKET (ICE), BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in stringency in safety standards

- 5.2.1.2 Growing crash tests

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increase in development of active safety systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Shift to lightweight and sustainable materials

- 5.2.3.2 Integration of smart textiles

- 5.2.4 CHALLENGES

- 5.2.4.1 Chemical compatibility

- 5.2.1 DRIVERS

- 5.3 TRADE DATA ANALYSIS

- 5.3.1 IMPORT SCENARIO FOR HS CODE 870821

- 5.3.1.1 US

- 5.3.1.2 Germany

- 5.3.1.3 France

- 5.3.1.4 Spain

- 5.3.2 EXPORT SCENARIO FOR HS CODE 870821

- 5.3.2.1 US

- 5.3.2.2 Romania

- 5.3.2.3 France

- 5.3.2.4 Poland

- 5.3.2.5 Hungary

- 5.3.2.6 Germany

- 5.3.2.7 Mexico

- 5.3.1 IMPORT SCENARIO FOR HS CODE 870821

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 AUTOMOTIVE MANUFACTURERS STRENGTHENED SEATBELT BUCKLES WITH ULTRASONIC WELDING TECHNOLOGY

- 5.5.2 AUTOLIV ENHANCED FIRE RESISTANCE IN SEATBELT WEBBING

- 5.5.3 SUSTAINABILITY-DRIVEN SEATBELT MATERIAL DEVELOPMENT BY TOYOTA-TEIJIN

- 5.5.4 DESIGN DEFECT-SEATBELT UNLATCHING IN ROLLOVER ACCIDENT

- 5.6 PATENT ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 KEY REGULATIONS

- 5.10 PRICING ANALYSIS

- 5.10.1 BY MATERIAL

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Smart seatbelts

- 5.12.1.2 Inflatable seatbelts

- 5.12.1.3 Active or reversible pretensioners

- 5.12.1.4 Advanced materials

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 Advanced coatings and surface treatment

- 5.12.2.2 Force limiters

- 5.12.2.3 Heated seatbelts

- 5.12.2.4 Advanced material offering for automotive seatbelts

- 5.12.2.5 Innovations in seatbelt materials

- 5.12.3 ADJACENT TECHNOLOGIES

- 5.12.3.1 Seatbelt interlock system

- 5.12.3.2 3D printing and rapid prototyping of plastic parts in seatbelt components

- 5.12.1 KEY TECHNOLOGIES

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 INVESTMENT SCENARIO

- 5.14.1 FUNDING SCENARIO

- 5.15 IMPACT OF 2025 US TARIFFS: OVERVIEW

- 5.15.1 KEY TARIFF RATES

- 5.15.2 COUNTRY-WISE TARIFFS ON AUTOMOTIVE END-PRODUCTS AND COMPONENTS

- 5.15.2.1 North America

- 5.15.2.1.1 United States-Mexico-Canada Agreement (USMCA) Countries

- 5.15.2.2 Europe

- 5.15.2.2.1 Germany

- 5.15.2.2.2 UK

- 5.15.2.2.3 Slovakia

- 5.15.2.2.4 Belgium

- 5.15.2.2.5 Other countries

- 5.15.2.3 Asia

- 5.15.2.3.1 China

- 5.15.2.3.2 Japan

- 5.15.2.3.3 South Korea

- 5.15.2.3.4 India

- 5.15.2.1 North America

- 5.15.3 IMPACT OF US 2025 TARIFFS ON SEATBELT MATERIAL MARKET

- 5.15.4 SUPPLIER ANALYSIS

6 SEATBELT MATERIAL MARKET (ICE), BY VEHICLE TYPE

- 6.1 INTRODUCTION

- 6.2 PASSENGER CAR

- 6.2.1 INCREASING VEHICLE SAFETY WITH PASSIVE AND ACTIVE SYSTEMS TO DRIVE MARKET

- 6.3 LIGHT COMMERCIAL VEHICLE

- 6.3.1 INCREASE IN E-COMMERCE AND URBAN LOGISTICS TO DRIVE MARKET

- 6.4 HEAVY COMMERCIAL VEHICLE

- 6.4.1 INCREASE IN INFRASTRUCTURE ACTIVITIES TO DRIVE MARKET

- 6.5 INDUSTRY INSIGHTS

7 SEATBELT MATERIAL MARKET (ICE), BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 RETRACTOR

- 7.2.1 INCREASING SAFETY REGULATIONS TO DRIVE MARKET

- 7.3 BUCKLE

- 7.3.1 RISING CONSUMER AWARENESS OF SAFETY TO DRIVE MARKET

- 7.4 ANCHOR

- 7.4.1 INCREASE IN DEMAND FOR SUVS TO DRIVE MARKET

- 7.5 OTHERS

- 7.6 INDUSTRY INSIGHTS

8 SEATBELT BUCKLE MARKET (ICE), BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 STEEL/ALUMINUM

- 8.2.1 ASIA PACIFIC TO BE LEADING MARKET

- 8.3 POLYCARBONATE

- 8.3.1 SHIFT TOWARD ROBUST PLASTICS TO DRIVE MARKET

- 8.4 NYLON

- 8.4.1 FLEXIBILITY AND EASE OF USE TO DRIVE DEMAND

- 8.5 INDUSTRY INSIGHTS

9 SEATBELT RETRACTOR MARKET (ICE), BY MATERIAL

- 9.1 INTRODUCTION

- 9.2 STEEL/ALUMINUM

- 9.2.1 INCREASING USE OF HIGH-STRENGTH STEEL IN RETRACTORS TO DRIVE MARKET

- 9.3 POLYCARBONATE

- 9.3.1 INCREASING DEMAND FOR LIGHTWEIGHT PARTS TO DRIVE MARKET

- 9.4 NYLON

- 9.4.1 STRINGENT SAFETY REGULATIONS FOR SEATBELTS TO DRIVE MARKET

- 9.5 INDUSTRY INSIGHTS

10 SEATBELT ANCHOR MARKET (ICE), BY MATERIAL

- 10.1 INTRODUCTION

- 10.2 STEEL/ALUMINUM

- 10.2.1 R&D INVESTMENTS BY KEY PLAYERS TO DRIVE MARKET

- 10.3 POLYCARBONATE

- 10.3.1 INNOVATIONS BY KEY PLAYERS TO DRIVE MARKET

- 10.4 INDUSTRY INSIGHTS

11 SEATBELT MATERIAL MARKET (EV), BY COMPONENT

- 11.1 INTRODUCTION

- 11.2 RETRACTOR

- 11.2.1 INCREASE IN DEMAND FOR ACTIVE SAFETY SYSTEMS TO DRIVE GROWTH

- 11.3 BUCKLE

- 11.3.1 RISING DEMAND FOR LIGHTWEIGHT MATERIALS TO DRIVE GROWTH

- 11.4 ANCHOR

- 11.4.1 GROWING DEMAND FOR PREMIUM CARS TO DRIVE GROWTH

- 11.5 OTHERS

- 11.6 INDUSTRY INSIGHTS

12 SEATBELT RETRACTOR MARKET (EV), BY MATERIAL

- 12.1 INTRODUCTION

- 12.2 STEEL/ALUMINUM

- 12.2.1 INCREASING SALES OF SUVS TO DRIVE MARKET

- 12.3 POLYCARBONATE

- 12.3.1 INCREASING DEMAND FOR REDUCED VEHICLE WEIGHT TO DRIVE MARKET

- 12.4 NYLON

- 12.4.1 INNOVATION IN NYLON WEBBING TO DRIVE MARKET

- 12.5 INDUSTRY INSIGHTS

13 SEATBELT ANCHOR MARKET (EV), BY MATERIAL

- 13.1 INTRODUCTION

- 13.2 STEEL/ALUMINUM

- 13.2.1 INTEGRATION WITH ADVANCED SAFETY SYSTEMS TO FUEL MARKET

- 13.3 POLYCARBONATE

- 13.3.1 INCREASE IN SALES OF SUVS TO DRIVE MARKET

- 13.4 INDUSTRY INSIGHTS

14 SEATBELT BUCKLE MARKET (EV), BY MATERIAL

- 14.1 INTRODUCTION

- 14.2 STEEL/ALUMINUM

- 14.2.1 FOCUS ON VEHICLE WEIGHT REDUCTION AND SPACE EFFICIENCY TO DRIVE MARKET

- 14.3 POLYCARBONATE

- 14.3.1 SHIFT TOWARD USE OF LIGHTWEIGHT AND STRONG MATERIALS TO DRIVE MARKET

- 14.4 NYLON

- 14.4.1 INCREASE IN DEMAND FOR COMPACT SUVS IN EMERGING ECONOMIES TO DRIVE MARKET

- 14.5 INDUSTRY INSIGHTS

15 SEATBELT MATERIAL MARKET (ICE), BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 MACROECONOMIC OUTLOOK

- 15.2.2 CHINA

- 15.2.2.1 Increase in demand for mid-sized SUVs and hatchbacks to drive market

- 15.2.3 JAPAN

- 15.2.3.1 Increase in demand for Kei cars and hatchback cars to drive market

- 15.2.4 INDIA

- 15.2.4.1 OEMs offering ADAS features in mid to high variants of cars to drive market

- 15.2.5 SOUTH KOREA

- 15.2.5.1 Rapid growth of light commercial vehicles to drive market

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK

- 15.3.2 GERMANY

- 15.3.2.1 Increasing production of sedans to drive market

- 15.3.3 FRANCE

- 15.3.3.1 Presence of renowned automakers to drive market

- 15.3.4 UK

- 15.3.4.1 Consistent demand for SUVs to drive market

- 15.3.5 SPAIN

- 15.3.5.1 Strict passenger car safety regulations to drive growth

- 15.3.6 ITALY

- 15.3.6.1 Large sales of SUVs to drive growth

- 15.4 AMERICAS

- 15.4.1 MACROECONOMIC OUTLOOK

- 15.4.2 US

- 15.4.2.1 Increasing dominance of SUVs and pickup trucks to drive market

- 15.4.3 CANADA

- 15.4.3.1 Rising investments from Canada Infrastructure Bank to drive market

- 15.4.4 MEXICO

- 15.4.4.1 Surge in demand for sedan cars to drive market

- 15.4.5 BRAZIL

- 15.4.5.1 Consumer demand for hatchback and compact SUVs to drive market

- 15.4.6 ARGENTINA

- 15.4.6.1 Increased new light vehicle sales to drive market

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 REVENUE ANALYSIS, 2020-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.4.1 SEATBELT MATERIAL MARKET SHARE ANALYSIS, 2024

- 16.4.2 JAPAN: MARKET SHARE OF AUTOMOTIVE SEATBELT MANUFACTURERS, 2024

- 16.4.3 EUROPE: MARKET RANKING OF AUTOMOTIVE SEATBELT MANUFACTURERS, 2024

- 16.4.4 CHINA: MARKET RANKING OF AUTOMOTIVE SEATBELT MANUFACTURERS, 2024

- 16.4.5 INDIA: MARKET RANKING OF AUTOMOTIVE SEATBELT MANUFACTURERS, 2024

- 16.5 COMPANY VALUATION, MARCH 2025

- 16.6 FINANCIAL METRICS, FEBRUARY 2025

- 16.7 BRAND COMPARISON

- 16.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.8.1 STARS

- 16.8.2 EMERGING LEADERS

- 16.8.3 PERVASIVE PLAYERS

- 16.8.4 PARTICIPANTS

- 16.8.5 COMPANY FOOTPRINT, KEY PLAYERS, 2024

- 16.8.5.1 Company footprint

- 16.8.5.2 Region footprint

- 16.8.5.3 Component footprint

- 16.8.5.4 Vehicle type Footprint

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES/DEVELOPMENTS, DECEMBER 2024

- 16.9.2 DEALS, MARCH 2024-JANUARY 2025

- 16.9.3 EXPANSIONS, JULY 2024

- 16.9.4 OTHER DEVELOPMENTS, MAY 2023-FEBRUARY 2025

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 AUTOLIV

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Deals

- 17.1.1.3.2 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 JOYSON SAFETY SYSTEMS

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Deals

- 17.1.2.3.2 Other developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 ZF FRIEDRICHSHAFEN AG

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches/upgrades

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Expansions

- 17.1.3.3.4 Other developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 TOKAIRIKA, CO, LTD.

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Deals

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 YANFENG

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Deals

- 17.1.5.3.2 Expansions

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 FAR EUROPE INC.

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.7 GWR SAFETY SYSTEMS

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.8 HOLMBERGS SAFETY SYSTEM HOLDING AB

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Other developments

- 17.1.9 ASHIMORI INDUSTRY CO., LTD.

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Deals

- 17.1.10 SAMSONG INDUSTRIES, LTD

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.11 ITW AUTOMOTIVE

- 17.1.11.1 Business overview

- 17.1.11.2 Products offered

- 17.1.1 AUTOLIV

- 17.2 OTHER PLAYERS

- 17.2.1 SS MANUFACTURING PVT LTD.

- 17.2.2 BEIJING SHIJIN AUTOMOTIVE COMPONENTS CO., LTD.

- 17.2.3 CHONGQING GUANGDA INDUSTRIAL CO., LTD.

- 17.2.4 THAI SEATBELT

- 17.2.5 GORADIA INDUSTRIES

- 17.2.6 SEATBELT SOLUTIONS LLC

- 17.2.7 ZHEJIANG SONGYUAN AUTOMOTIVE SAFETY SYSTEMS CO., LTD.

- 17.2.8 KINGFISHER AUTOMOTIVE

- 17.2.9 APV SAFETY PRODUCTS

- 17.2.10 SCHROTH SAFETY PRODUCTS

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 ASIA PACIFIC TO BE KEY MARKET FOR AUTOMOTIVE SEATBELT MATERIALS

- 18.2 INCREASE IN INNOVATION AND TECHNOLOGY BY KEY SUPPLIERS

- 18.3 RISING OPPORTUNITIES IN ELECTRIC VEHICLES AND AUTONOMOUS VEHICLES

- 18.4 CONCLUSION

19 APPENDIX

- 19.1 INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 SEATBELT MATERIAL MARKET, BY PILLAR LOOP

- 19.4.1.1 Polycarbonate

- 19.4.1.2 Steel/Aluminum

- 19.4.2 SEATBELT MATERIAL MARKET, BY LATCH PLATE

- 19.4.2.1 Steel/Aluminum

- 19.4.2.2 Others

- 19.4.3 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

- 19.4.1 SEATBELT MATERIAL MARKET, BY PILLAR LOOP

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS