|

|

市場調査レポート

商品コード

1852738

EV・EVインフラ市場:製品タイプ別、消費者タイプ別-2025~2032年の世界予測EV & EV Infrastructure Market by Product Type, Consumer Type - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| EV・EVインフラ市場:製品タイプ別、消費者タイプ別-2025~2032年の世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 197 Pages

納期: 即日から翌営業日

|

概要

EV・EVインフラ市場は、2032年までにCAGR 8.33%で8,297億8,000万米ドルの成長が予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 4,374億7,000万米ドル |

| 推定年2025 | 4,716億米ドル |

| 予測年2032 | 8,297億8,000万米ドル |

| CAGR(%) | 8.33% |

加速する自動車の電動化、インフラ革新、政策転換がモビリティ・エコシステム全体の競争優位性をどのように再定義するかについての戦略的入門書

電動モビリティへの移行は、かつてないスピードと複雑さで、交通システム、産業サプライチェーン、都市エネルギー管理を再構築しています。新たな車両アーキテクチャ、新しいエネルギー貯蔵化学物質、拡大する充電・スワッピングインフラは、新たな価値プールを生み出すと同時に、メーカー、車両運行事業者、公益事業者、自治体にとって、運用や規制上の課題も提起しています。

本サマリーは、エグゼクティブが今日理解すべき戦略的輪郭をまとめたものです。自動車の設計とエネルギー管理に影響を与える技術的軌道、インフラプロバイダーとサービスモデルの進化するエコシステム、政府が展開と国内製造に影響を与えるために展開する政策レバーなどです。競争優位性は、製品の性能やコスト競争力だけでなく、車両システム、エネルギー・ネットワーク、充電・課金・グリッド相互作用を管理するデジタル・プラットフォームの効果的な統合にかかっていることを強調しています。

以下の章では、ハイレベルなシフトを、製品開発、調達、パートナーシップ、規制の影響といった現実的な意味合いに結びつけて説明します。意思決定者は、これらの洞察に基づいて、レジリエンスを高め、ライフサイクルの総コストを低減し、ターゲットとする顧客層への普及を加速させつつ、急速な政策や技術の変化にも対応できるような投資の優先順位を決めるべきです。

テクノロジーの飛躍的進歩とビジネスモデルの進化が、いかにして電動化を加速し、充電サービスの経済性と提供を変革しているか

自動車の電動化と充電インフラの競合情勢と事業環境は、いくつかの革新的なシフトによって再定義されつつあります。バッテリー化学の革新とセルレベルのコスト削減により、バッテリー電気自動車の長距離化と低コスト化が実現し、パワーエレクトロニクスとモジュラーアーキテクチャーの並行的な進歩により、自動車の効率と製造性が向上しています。

同時に、インフラは孤立した充電ポイントから、ハードウェア、ソフトウェア、サービスを組み合わせた統合ネットワークへと進化しています。充電ネットワークには、ユーザー認証、ダイナミックプライシング、フリート管理のためのデジタルサービスが組み込まれつつあり、バッテリースワップや超高速充電技術によって、商用車の稼働時間を優先する代替サービスモデルが開かれつつあります。こうした技術的変革は、エネルギー・アズ・ア・サービスやチャージ・ポイント・アズ・ア・サービスなど、設備投資と運用責任を見直す進化するビジネスモデルと交錯しています。

政策と規制の革新は、インセンティブ、調達基準、排出量目標を通じて導入を加速させる一方、現地調達や安全なサプライチェーンをめぐる業界の対応を促しています。これらのシフトを総合すると、企業は、ますますプラットフォーム化され、ソフトウェア化され、政策に敏感な市場で価値を獲得するために、製品ロードマップ、パートナーシップ、資本配分を再考する必要があります。

最近の関税制度と貿易措置が、電化のバリュー・チェーン全体におけるサプライ・チェーン戦略、現地化の取り組み、調達の選択をどのように変えたかを検証します

2025年の関税と貿易措置の導入と拡大は、EVバリューチェーン全体のサプライチェーンと調達戦略に大きな圧力をかけています。バッテリーセル、重要鉱物、組立部品などの主要投入物を対象とした関税措置は、国境を越えた調達のコストと複雑さを増大させ、メーカーにサプライヤーとの関係を再評価させ、供給の多様化とニアショアリング・イニシアチブを加速させています。

その結果、企業は、重要素材や生産能力へのアクセスを確保するために、垂直統合や戦略的長期パートナーシップを優先するようになっています。この動向はまた、国内での加工やバッテリー製造への投資を促進し、多くの場合、公的インセンティブや産業政策によって支援され、外部貿易の途絶へのエクスポージャーを緩和しています。これと並行して、充電インフラの開発者は、段階的なアップグレードを可能にするモジュール式のハードウェア設計を模索しながら、リードタイムと価格変動を管理するために調達スケジュールとサプライヤー構成を調整してきました。

運用面では、関税によるマージン圧縮が、よりシンプルな車両アーキテクチャや標準化された充電ハードウェアから、バランス・オブ・システム・コストを削減するソフトウェアによる最適化まで、スタック全体のコスト・エンジニアリングを促しています。これらの対応を総合すると、貿易政策の不確実性が続く中、サプライチェーンの強靭化と戦略的現地化を競争上の優先事項の中核とする方向へのより広範なシフトが反映されています。

製品と消費者のセグメンテーションが、電動化製品間で差別化されたエンジニアリングの優先順位、サービスモデル、市場投入戦略をどのように形成しているかを解明します

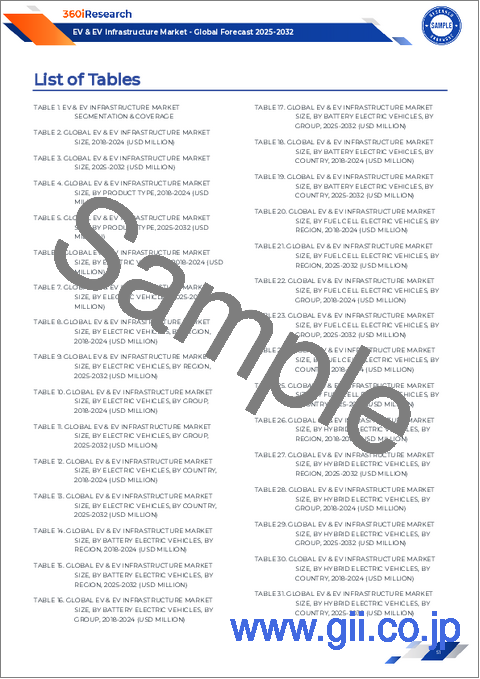

セグメンテーションの洞察により、製品と消費者の区別が、価値提案と展開戦略を調整する上で極めて重要であることが明らかになりました。製品タイプに基づくと、市場は電気自動車とEVインフラに分かれ、電気自動車自体はバッテリー電気自動車、燃料電池電気自動車、ハイブリッド電気自動車、プラグインハイブリッド電気自動車で区別され、インフラはバッテリー交換ステーション、充電装置、充電ネットワーク、充電ステーションに及ぶ。このような製品レベルのセグメンテーションは、エンジニアリングの優先順位、認証要件、サービスモデルが、自動車のパワートレイン・タイプによって、またハードウェア中心のインフラとネットワーク中心のインフラで著しく異なることを意味します。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 世界のリチウムイオン電池需要の増加に対応するため、ギガファクトリーの生産能力を拡大

- 複数のOEM間で相互運用可能なローミングを備えた超高速充電ネットワークの展開

- 自治体の車両電化プログラムにおける車両とグリッド間の双方向充電パイロットの統合

- 電池コストと供給リスクを削減するために、リン酸鉄リチウムと新興の低コバルト化学物質への移行

- 動的オンルート電力伝送を備えた都市電気バス向けワイヤレス充電パッドの実装

- EVセルを商業用据置型ストレージに再利用するセカンドライフバッテリーリサイクルハブの開発

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 EV・EVインフラ市場:製品タイプ別

- 電気自動車

- バッテリー電気自動車

- 燃料電池電気自動車

- ハイブリッド電気自動車

- プラグインハイブリッド電気自動車

- EVインフラ

- バッテリー交換ステーション

- 充電設備

- 充電ネットワーク

- 充電ステーション

第9章 EV・EVインフラ市場:消費者タイプ別

- 企業およびフリートオーナー

- 政府および公共機関

- 個人消費者

第10章 EV・EVインフラ市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第11章 EV・EVインフラ市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第12章 EV・EVインフラ市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第13章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Robert Bosch GmbH

- SAIC Motor Corporation Limited

- Schneider Electric SE

- Siemens AG

- Stellantis NV

- TATA Power

- Tesla, Inc.

- TotalEnergies SE

- Toyota Motor Corporation

- Tritium DCFC Limited

- Wallbox Chargers, S.L.