|

|

市場調査レポート

商品コード

1748396

バイオディフェンスの世界市場:技術別、製品別、用途別、地域別 - 予測(~2030年)Biodefense Market by Technology (GHz-band Wave, Microwave Heating, RF-EMR, Cold Plasma, Gamma, UV), Product (Decontamination (Sterilization Devices, Disinfection Units), Biosensors, AI Surveillance), Application, Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| バイオディフェンスの世界市場:技術別、製品別、用途別、地域別 - 予測(~2030年) |

|

出版日: 2025年06月06日

発行: MarketsandMarkets

ページ情報: 英文 218 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のバイオディフェンスの市場規模は、2025年に推定8億9,000万米ドルであり、2030年までに18億1,000万米ドルに達すると予測され、予測期間にCAGRで15.1%の成長が見込まれます。

技術の進歩と市場環境の変化がバイオディフェンス市場の主要促進要因です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 技術、製品、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「製品別では、除染下の滅菌器が2025年に最大の市場シェアを占めると推定されます。」

製品に基づき、除染は消毒装置と滅菌器に分類されます。滅菌器は、医療、防衛、研究所環境における広範な生物学的病原体の除去に不可欠な機能であるため、2025年に最大の市場シェアを占めると予測されています。低温滅菌器、過酸化水素蒸気システム、マイクロ波滅菌器、ガンマ線照射ソリューションに対するニーズの高まりにより、医療機器、実験室の表面、デリケートな機器を除染するための安定した有効な処置を見つける組織へのニーズが増加しています。これらの機器は、高性能、規制承認、複雑で熱に敏感な材料との互換性を提供し、病院、研究施設、移動式生物学的封じ込め装置におけるバイオセーフティ規制に不可欠です。

「技術別では、バイオセンサーベース技術セグメントが2025年に最大の市場シェアを占めると推定されます。」

技術別では、バイオセンサーベース技術が、生物学的脅威のリアルタイムかつ正確な分散型センシングを提供する極めて重要な機能により、2025年までにバイオディフェンス市場で最大の市場規模を占めると推定されます。バイオセンサーベース技術は、炭疽菌、リシン、新型ウイルスなどの病原体を検出する高感度かつ迅速な反応により、病院、防衛軍、国境管理、公衆衛生機関などで広く使用されています。ポイントオブケア診断の登場と、バイオディフェンス用途における早期警戒システムへの需要の増加は、バイオセンサー技術の利用を大きく促進しています。軍の野戦から都市部の病院や移動研究室まで、さまざまな環境における汎用性が、バイオセンサー技術をバイオディフェンス市場にとって価値あるものにしています。

「欧州が2025年に第2位の市場シェアを占めると推定されます。」

欧州は、バイオセキュリティとパンデミックへの備えを強化する政府の取り組みが拡大しているため、バイオディフェンス市場で2番目に大きなシェアを占めると推定されます。同地域では、バイオサーベイランスインフラや除染技術への投資が増加しています。ドイツ、フランス、英国などの国々は、強力な公衆衛生システムと国レベルのバイオディフェンス戦略で最前線にあります。

それに加え、防衛機関、バイオテクノロジー企業、研究機関の強固なパートナーシップが、移動式生物学的封じ込め装置、バイオセンサー、AIベース脅威検知といった技術の革新を後押ししています。Horizon EuropeのようなEU全体の取り組みからの支援や、European Centre for Disease Prevention and Control(ECDC)との協力は、地域の即応性をさらに高めています。

当レポートでは、世界のバイオディフェンス市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- バイオディフェンス市場の企業にとって魅力的な機会

- バイオディフェンス市場:製品別

- バイオディフェンス市場:技術別

- バイオディフェンス市場:用途別

- バイオディフェンス市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向と混乱

- バリューチェーン分析

- 研究開発(約10~20%)

- 原材料メーカー(約20~40%)

- 製品製造(約40~60%)

- テスト・品質保証(約60~80%)

- エンドユーザー(約80~100%)

- エコシステム分析

- 著名企業

- 民間企業と中小企業

- エンドユーザー

- 関税と規制情勢

- 貿易データ

- 輸入シナリオ

- 輸出シナリオ

- 主なステークホルダーと購入基準

- ユースケース分析

- 主な会議とイベント(2025年~2026年)

- 価格分析

- バイオディフェンス製品の平均販売価格:地域別

- バイオディフェンス市場におけるコストに影響を与える要因

- バイオディフェンス技術の参考価格分析:主要企業別(2025年)

- 投資と資金調達のシナリオ

- バイオディフェンス市場に対するAI/生成AIの影響

- 予測的バイオサーベイランス

- 次世代バイオセンサー

- 迅速な病原体同定

- 画像・信号解析

- 合成データ生成

- マクロ経済の見通し

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東

- ラテンアメリカ

- アフリカ

- ビジネスモデル

- 技術ロードマップ

第6章 産業動向

- イントロダクション

- 技術動向

- ナノテクノロジーを活用したバイオセンサー

- デジタルヘルスツールとモバイルバイオサーベイランス

- 生物学的脅威の検知と識別に用いるリモートセンシング

- デジタルツイン・シミュレーション技術

- メガトレンドの影響

- 生物学的脅威の検出に用いるAIと機械学習

- サプライチェーンとデータ整合性に用いるブロックチェーン

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

第7章 バイオディフェンス市場:製品別

- イントロダクション

- 検出・監視

- 除染システム

- その他

第8章 バイオディフェンス市場:技術別

- イントロダクション

- GHz帯電波放射による空気感染ウイルスの不活化

- UVベース技術

- マイクロ波加熱

- 高周波(RF-EMR)加熱

- 冷プラズマによる病原体の不活化

- ガンマ線

- バイオセンサー技術

- AI技術

- その他

第9章 バイオディフェンス市場:用途別

- イントロダクション

- 軍事

- 国土安全保障

- 公共インフラ

- 病院・医療機関

- その他

第10章 バイオディフェンス市場:地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- アジア太平洋

- PESTLE分析

- インド

- オーストラリア

- 中国

- 日本

- その他のアジア太平洋

- 欧州

- PESTLE分析

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- その他の地域

- PESTLE分析

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2020年~2025年)

- バイオディフェンス市場の収益分析(2020年~2025年)

- バイオディフェンスの市場シェア分析(2024年)

- バイオディフェンス市場企業の評価マトリクス:主要企業(2024年)

- バイオディフェンス市場企業の評価マトリクス:スタートアップ/中小企業(2024年)

- ブランド/製品の比較

- 企業の評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- STERIS

- ASP INTERNATIONAL GMBH

- USHIO INC.

- SOTERA HEALTH COMPANY

- BIOQUELL, AN ECOLAB SOLUTION

- THERMO FISHER SCIENTIFIC INC.

- SMITHS DETECTION GROUP LTD

- E4LIFE SRL.

- SYNEXIS

- BLUEDOT INC.

- XENEX DISINFECTION SERVICES INC.

- SKAN AG

- MICROSOFT

- BIO-RAD LABORATORIES, INC.

- AIRBOSS DEFENSE GROUP, INC.

- その他の企業

- IONISOS

- AQUISENSE

- GERMFREE

- PATHOGENFOCUS

- UV LIGHT TECHNOLOGY LTD-PART OF DARO GROUP

- BERTIN TECHNOLOGIES

- FAR UV TECHNOLOGIES, INC.

- PURE AQUA, INC.

- PALANTIR TECHNOLOGIES INC.

- PUSCHNER MICROWAVE POWER SYSTEMS

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2024

- TABLE 2 BIODEFENSE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 3 IMPACT OF TECHNOLOGICAL ADVANCEMENTS ON BIODEFENSE MARKET: COMPARISON OF TRADITIONAL VS. MODERN APPROACHES

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TOP 3 APPLICATIONS (%)

- TABLE 12 KEY BUYING CRITERIA, BY TOP 3 APPLICATIONS

- TABLE 13 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 AVERAGE SELLING PRICE OF BIODEFENSE PRODUCTS, BY REGION, 2024 (USD)

- TABLE 15 INDICATIVE PRICING OF BIODEFENSE TECHNOLOGIES, BY KEY PLAYERS, 2025

- TABLE 16 COMPARISON BETWEEN DIFFERENT BUSINESS MODELS

- TABLE 17 LIST OF MAJOR PATENTS FOR BIODEFENSE, 2023-2025

- TABLE 18 BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 19 BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 20 BIODEFENSE MARKET FOR DETECTION & SURVEILLANCE PRODUCT TYPES, 2021-2024 (USD MILLION)

- TABLE 21 BIODEFENSE MARKET FOR DETECTION & SURVEILLANCE PRODUCT TYPES, 2025-2030 (USD MILLION)

- TABLE 22 DETECTION & SURVEILLANCE: BIODEFENSE MARKET, BY BIOSENSOR PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 23 DETECTION & SURVEILLANCE: BIODEFENSE MARKET, BY BIOSENSOR PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 24 SMITH DETECTION GROUP LTD: BIOFLASH BIOLOGICAL IDENTIFIER: SPECIFICATIONS

- TABLE 25 DETECTION & SURVEILLANCE: BIODEFENSE MARKET, BY AI-BASED PLATFORM TYPE, 2021-2024 (USD MILLION)

- TABLE 26 DETECTION & SURVEILLANCE: BIODEFENSE MARKET, BY AI-BASED PLATFORM TYPE, 2025-2030 (USD MILLION)

- TABLE 27 KRAKEN SENSE PRODUCT: KRAKEN(TM) PATHOGEN RISK DETECTION SYSTEM: SPECIFICATIONS

- TABLE 28 BIODEFENSE MARKET, BY DECONTAMINATION SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 29 BIODEFENSE MARKET, BY DECONTAMINATION SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 30 BIODEFENSE DISINFECTION UNITS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 31 BIODEFENSE DISINFECTION UNITS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 32 DRDO PRODUCT: UV BLASTER-AREA UV DISINFECTION SYSTEM: SPECIFICATIONS

- TABLE 33 BIODEFENSE STERILIZATION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 34 BIODEFENSE STERILIZATION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 35 STERIS PLC PRODUCT: STERIS VHP M100 BIODECONTAMINATION UNIT: SPECIFICATIONS

- TABLE 36 BIODEFENSE MARKET, BY OTHER PRODUCTS, 2021-2024 (USD MILLION)

- TABLE 37 BIODEFENSE MARKET, BY OTHER PRODUCTS, 2025-2030 (USD MILLION)

- TABLE 38 BIODEFENSE PURIFICATION UNITS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 39 BIODEFENSE PURIFICATION UNITS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 40 CASTELLEX PRODUCT: AIR 40 BIO FILTRATION UNIT WITH UV LIGHT: SPECIFICATIONS

- TABLE 41 BIODEFENSE CONTAINMENT & ISOLATION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 42 BIODEFENSE CONTAINMENT & ISOLATION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 43 EPIGUARD PRODUCT: EPISHUTTLE-MEDICAL ISOLATION AND TRANSPORT UNIT: SPECIFICATIONS

- TABLE 44 BIODEFENSE MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 45 BIODEFENSE MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 46 BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 47 BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 48 BIODEFENSE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 BIODEFENSE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: BIODEFENSE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 51 NORTH AMERICA: BIODEFENSE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 53 NORTH AMERICA: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: BIODEFENSE MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 55 NORTH AMERICA: BIODEFENSE MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 57 NORTH AMERICA: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 58 US: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 59 US: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 60 US: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 61 US: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 62 CANADA: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 63 CANADA: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 64 CANADA: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 65 CANADA: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 66 ASIA PACIFIC: BIODEFENSE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 67 ASIA PACIFIC: BIODEFENSE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 68 ASIA PACIFIC: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 69 ASIA PACIFIC: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: BIODEFENSE MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 71 ASIA PACIFIC: BIODEFENSE MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 73 ASIA PACIFIC: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 74 INDIA: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 75 INDIA: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 76 INDIA: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 77 INDIA: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 78 AUSTRALIA: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 79 AUSTRALIA: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 80 AUSTRALIA: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 81 AUSTRALIA: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 CHINA: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 83 CHINA: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 84 CHINA: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 85 CHINA: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 86 JAPAN: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 87 JAPAN: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 88 JAPAN: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 89 JAPAN: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: BIODEFENSE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 95 EUROPE: BIODEFENSE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 97 EUROPE: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 98 EUROPE: BIODEFENSE MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 99 EUROPE: BIODEFENSE MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 100 EUROPE: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 101 EUROPE: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 102 GERMANY: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 103 GERMANY: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 104 GERMANY: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 GERMANY: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 UK: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 107 UK: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 108 UK: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 109 UK: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 FRANCE: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 111 FRANCE: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 112 FRANCE: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 113 FRANCE: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 ITALY: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 115 ITALY: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 116 ITALY: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 117 ITALY: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 REST OF EUROPE: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 119 REST OF EUROPE: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 120 REST OF EUROPE: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 121 REST OF EUROPE: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 REST OF THE WORLD: BIODEFENSE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 123 REST OF THE WORLD: BIODEFENSE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 REST OF THE WORLD: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 125 REST OF THE WORLD: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 126 REST OF THE WORLD: BIODEFENSE MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 127 REST OF THE WORLD: BIODEFENSE MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 128 REST OF THE WORLD: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 129 REST OF THE WORLD: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION

- TABLE 133 MIDDLE EAST & AFRICA: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 LATIN AMERICA: BIODEFENSE MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 135 LATIN AMERICA: BIODEFENSE MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 136 LATIN AMERICA: BIODEFENSE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 LATIN AMERICA: BIODEFENSE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 139 BIODEFENSE MARKET: DEGREE OF COMPETITION

- TABLE 140 BIODEFENSE MARKET: PRODUCT FOOTPRINT

- TABLE 141 BIODEFENSE MARKET: TECHNOLOGY FOOTPRINT

- TABLE 142 BIODEFENSE MARKET: APPLICATION FOOTPRINT

- TABLE 143 BIODEFENSE MARKET: REGION FOOTPRINT

- TABLE 144 BIODEFENSE MARKET: LIST OF STARTUPS/SMES

- TABLE 145 BIODEFENSE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 146 BIODEFENSE MARKET: DEALS, 2020-2025

- TABLE 147 BIODEFENSE MARKET: OTHER DEVELOPMENTS, 2020-2025

- TABLE 148 STERIS: COMPANY OVERVIEW

- TABLE 149 STERIS: PRODUCTS OFFERED

- TABLE 150 STERIS: DEALS

- TABLE 151 ASP INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 152 ASP INTERNATIONAL GMBH: PRODUCTS OFFERED

- TABLE 153 USHIO INC.: COMPANY OVERVIEW

- TABLE 154 USHIO INC.: PRODUCTS OFFERED

- TABLE 155 USHIO INC.: DEALS

- TABLE 156 SOTERA HEALTH COMPANY: COMPANY OVERVIEW

- TABLE 157 SOTERA HEALTH COMPANY: PRODUCTS OFFERED

- TABLE 158 BIOQUELL, AN ECOLAB SOLUTION: COMPANY OVERVIEW

- TABLE 159 BIOQUELL, AN ECOLAB SOLUTION: PRODUCTS OFFERED

- TABLE 160 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 161 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 162 THERMO FISHER SCIENTIFIC INC.: DEALS

- TABLE 163 SMITHS DETECTION GROUP LTD: COMPANY OVERVIEW

- TABLE 164 SMITHS DETECTION GROUP LTD: PRODUCTS OFFERED

- TABLE 165 SMITHS DETECTION GROUP LTD: DEALS

- TABLE 166 E4LIFE SRL.: COMPANY OVERVIEW

- TABLE 167 E4LIFE SRL.: PRODUCTS OFFERED

- TABLE 168 SYNEXIS: COMPANY OVERVIEW

- TABLE 169 SYNEXIS: PRODUCTS OFFERED

- TABLE 170 SYNEXIS: DEALS

- TABLE 171 BLUEDOT INC.: COMPANY OVERVIEW

- TABLE 172 BLUEDOT INC.: PRODUCTS OFFERED

- TABLE 173 BLUEDOT INC.: DEALS

- TABLE 174 XENEX DISINFECTION SERVICES INC.: COMPANY OVERVIEW

- TABLE 175 XENEX DISINFECTION SERVICES INC.: PRODUCTS OFFERED

- TABLE 176 XENEX DISINFECTION SERVICES INC.: OTHER DEVELOPMENTS

- TABLE 177 SKAN AG: COMPANY OVERVIEW

- TABLE 178 SKAN AG: PRODUCTS OFFERED

- TABLE 179 SKAN AG : DEALS

- TABLE 180 MICROSOFT: COMPANY OVERVIEW

- TABLE 181 MICROSOFT: PRODUCTS OFFERED

- TABLE 182 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 183 BIO-RAD LABORATORIES, INC.: PRODUCTS OFFERED

- TABLE 184 AIRBOSS DEFENSE GROUP, INC.: COMPANY OVERVIEW

- TABLE 185 AIRBOSS DEFENSE GROUP, INC.: PRODUCTS OFFERED

- TABLE 186 AIRBOSS DEFENSE GROUP, INC.: DEALS

- TABLE 187 IONISOS: COMPANY OVERVIEW

- TABLE 188 AQUISENSE: COMPANY OVERVIEW

- TABLE 189 GERMFREE: COMPANY OVERVIEW

- TABLE 190 PATHOGENFOCUS: COMPANY OVERVIEW

- TABLE 191 UV LIGHT TECHNOLOGY LTD - PART OF DARO GROUP: COMPANY OVERVIEW

- TABLE 192 BERTIN TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 193 FAR UV TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 194 PURE AQUA, INC.: COMPANY OVERVIEW

- TABLE 195 PALANTIR TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 196 PUSCHNER MICROWAVE POWER SYSTEMS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 BIODEFENSE MARKET: RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 4 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 DECONTAMINATION SYSTEMS TO BE LEADING PRODUCT SEGMENT OF BIODEFENSE MARKET IN 2030

- FIGURE 8 AI TECHNOLOGIES TO REGISTER DECENT CAGR DURING FORECAST PERIOD

- FIGURE 9 HOSPITALS & MEDICAL INSTITUTES TO BE LEADING APPLICATION OF BIODEFENSE IN 2025

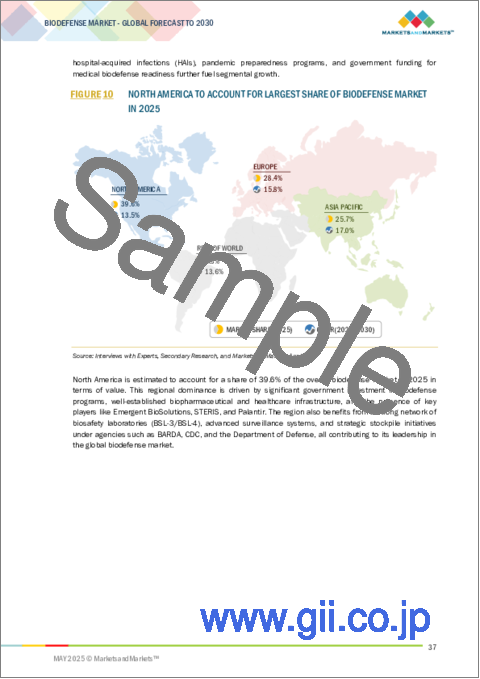

- FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF BIODEFENSE MARKET IN 2025

- FIGURE 11 INCREASING ADVANCEMENTS IN BIODEFENSE TECHNOLOGIES TO DRIVE GROWTH

- FIGURE 12 DECONTAMINATION SYSTEMS SEGMENT TO LEAD BIODEFENSE MARKET IN 2025

- FIGURE 13 AI TECHNOLOGIES SEGMENT TO LEAD BIODEFENSE MARKET IN 2025

- FIGURE 14 HOSPITALS & MEDICAL INSTITUTES SEGMENT TO LEAD BIODEFENSE MARKET IN 2025

- FIGURE 15 AUSTRALIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 BIODEFENSE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 18 VALUE CHAIN ANALYSIS

- FIGURE 19 ECOSYSTEM ANALYSIS

- FIGURE 20 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 21 EXPORT DATA FOR HS CODE 901890, 2020-2024 (USD THOUSAND)

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TOP 3 APPLICATIONS

- FIGURE 23 KEY BUYING CRITERIA, BY TOP 3 APPLICATIONS

- FIGURE 24 AVERAGE SELLING PRICE OF BIODEFENSE PRODUCTS, BY REGION

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 26 BIODEFENSE MARKET: IMPACT OF AI/GEN AI

- FIGURE 27 BUSINESS MODELS IN BIODEFENSE MARKET

- FIGURE 28 EVOLUTION OF TECHNOLOGY IN BIODEFENSE MARKET

- FIGURE 29 TECHNOLOGY ROADMAP

- FIGURE 30 LIST OF MAJOR PATENTS RELATED TO BIODEFENSE, 2014-2025

- FIGURE 31 DECONTAMINATION SYSTEMS SEGMENT TO LEAD BIODEFENSE MARKET DURING FORECAST PERIOD

- FIGURE 32 AI TECHNOLOGIES SEGMENT TO LEAD BIODEFENSE MARKET IN 2030

- FIGURE 33 HOSPITALS & MEDICAL INSTITUTES SEGMENT TO LEAD BIODEFENSE MARKET DURING FORECAST PERIOD

- FIGURE 34 BIODEFENSE MARKET, BY REGION, 2025-2030

- FIGURE 35 NORTH AMERICA: BIODEFENSE MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: BIODEFENSE MARKET SNAPSHOT

- FIGURE 37 EUROPE: BIODEFENSE MARKET SNAPSHOT

- FIGURE 38 REST OF THE WORLD: BIODEFENSE MARKET SNAPSHOT

- FIGURE 39 BIODEFENSE MARKET REVENUE ANALYSIS OF TOP 5 PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 40 BIODEFENSE MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 41 BIODEFENSE MARKET COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 BIODEFENSE MARKET: COMPANY FOOTPRINT

- FIGURE 43 BIODEFENSE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 BRAND/PRODUCT COMPARISON

- FIGURE 45 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- FIGURE 46 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 47 STERIS: COMPANY SNAPSHOT

- FIGURE 48 ASP INTERNATIONAL GMBH: COMPANY SNAPSHOT

- FIGURE 49 USHIO INC.: COMPANY SNAPSHOT

- FIGURE 50 SOTERA HEALTH COMPANY: COMPANY SNAPSHOT

- FIGURE 51 BIOQUELL, AN ECOLAB SOLUTION: COMPANY SNAPSHOT

- FIGURE 52 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 53 SKAN AG: COMPANY SNAPSHOT

- FIGURE 54 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 55 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

- FIGURE 56 AIRBOSS DEFENSE GROUP, INC.: COMPANY SNAPSHOT

The biodefense market is estimated at USD 0.89 billion in 2025 and is projected to reach USD 1.81 billion by 2030 at a CAGR of 15.1% during the forecast period. Technological advancements and changing market conditions are the key drivers of the biodefense market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Product, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Based on product, sterilization devices under decontamination is estimated to hold the largest market share in 2025."

Based on product, decontamination is categorized into disinfection units and sterilization devices. Sterilization devices are expected to account for the largest market share in 2025 due to their indispensable function in eliminating a broad biological agent in healthcare, defense, and laboratory environments. The growing need for low-temperature sterilizers, hydrogen peroxide vapor systems, microwave sterilizer units, and gamma irradiation solutions has increased the need for organizations to find stable, validated procedures for decontaminating medical equipment, laboratory surfaces, and delicate equipment. These instruments provide high performance, regulatory approval, and compatibility with intricate and heat-sensitive materials, which are critical to biosafety regulations in hospitals, research facilities, and mobile bio-containment units.

"Biosensor-based technologies segment is estimated to hold the largest market share in 2025 by technology."

Based on technology, biosensor-based technologies are estimated to account for the largest market in the biodefense market by 2025 due to their pivotal function in providing real-time, precise, and decentralized sensing of biological threats. Biosensor-based technologies are being widely used in hospitals, defense forces, border control, and public health organizations for their high sensitivity and quick response to detecting pathogens like anthrax, ricin, and new viruses. The emergence of point-of-care diagnostics and increasing demand for early warning systems in biodefense applications have considerably enhanced the usage of biosensor technologies. Their versatility in varied environments, ranging from military field operations to urban hospitals and mobile laboratories, makes them valuable to the biodefense market.

"Europe is estimated to hold the second-largest market share in 2025."

Europe is estimated to have the second-largest share of the biodefense market due to growing government efforts to enhance biosecurity and pandemic preparedness. The region has witnessed increased investment in biosurveillance infrastructure and decontamination technologies. Countries such as Germany, France, and the UK are at the forefront with strong public health systems and country-level biodefense strategies.

Besides that, robust partnerships among defense agencies, biotech firms, and research organizations have boosted innovation in technologies like mobile biocontainment units, biosensors, and AI-based threat detection. Support from EU-wide initiatives such as Horizon Europe and cooperation with the European Centre for Disease Prevention and Control (ECDC) further boost regional readiness.

The break-up of the profile of primary participants in the biodefense market:

- By Company Type: Tier 1 - 35%, Tier 2 - 54%, and Tier 3 - 20%

- By Designation: Directors- 55%, Managers - 27%, Others - 18%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 30%, Rest of the World - 10%

STERIS (US), ASP International GmbH (US), Ushio Inc. (Japan), Sotera Health Company (US), and Bioquell, An Ecolab Solution (UK) are the key market players that offer connectivity applicable to various sectors and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, and the Rest of the World.

Research Coverage:

The study covers the biodefense market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on product, application, technology, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

This report segments the biodefense market across five key regions: North America, Europe, Asia Pacific, and the Rest of the World and their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the biodefense market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, product launches, contracts, expansions, acquisitions, and partnerships associated with the biodefense market.

Reasons to buy this report:

This report serves as a valuable resource for market leaders and newcomers in the biodefense market, offering data that closely approximates revenue figures for both the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulating effective go-to-market strategies. The report imparts valuable insights into the market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights into the following pointers:

- Analysis of Key Drivers: Rising threat of bioterrorism, high government funding, strategic national stockpiling, and increasing technological advancements

- Market Penetration: Comprehensive information on biodefense solutions offered by the top players in the market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the biodefense market

- Market Development: Comprehensive information about lucrative markets; the report analyses the biodefense market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the biodefense market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the biodefense market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 BIODEFENSE MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY AND PRICING

- 1.5 INCLUSIONS AND EXCLUSIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Company revenue estimation approach

- 2.3.1.2 Growth rate projections

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Market assessment by region and country

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BIODEFENSE MARKET

- 4.2 BIODEFENSE MARKET, BY PRODUCT

- 4.3 BIODEFENSE MARKET, BY TECHNOLOGY

- 4.4 BIODEFENSE MARKET, BY APPLICATION

- 4.5 BIODEFENSE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising threat of bioterrorism

- 5.2.1.2 Increase in government funding and strategic national stockpiling

- 5.2.1.3 Technological advancements and innovations

- 5.2.1.4 Growing geopolitical tensions and biological warfare risks

- 5.2.2 RESTRAINTS

- 5.2.2.1 High R&D costs and long approval times

- 5.2.2.2 Lack of global standardization in biodefense protocols

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of AI-powered biosurveillance & predictive analytics

- 5.2.3.2 Emergence of nanotechnology-based biosensors

- 5.2.4 CHALLENGES

- 5.2.4.1 Infrastructure shortages in low-resource areas

- 5.2.4.2 Cybersecurity risks in connected biodefense systems

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH & DEVELOPMENT (~10-20%)

- 5.4.2 RAW MATERIAL PRODUCERS (~20-40%)

- 5.4.3 PRODUCT MANUFACTURING (~40-60%)

- 5.4.4 TESTING & QUALITY ASSURANCE (~60-80%)

- 5.4.5 END USERS (~80-100%)

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 TARIFF AND REGULATORY LANDSCAPE

- 5.7 TRADE DATA

- 5.7.1 IMPORT SCENARIO

- 5.7.2 EXPORT SCENARIO

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 USE CASE ANALYSIS

- 5.9.1 USE CASE 1: REAL-TIME PATHOGEN DETECTION AT TORONTO PEARSON INTERNATIONAL AIRPORT

- 5.9.2 USE CASE 2: US-UK STRATEGIC DIALOGUE ON BIOLOGICAL SECURITY

- 5.9.3 USE CASE 3: ENHANCED REMOTE DETECTION OF AEROSOL AND VAPOR THREATS WITH MX908 BEACON

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE OF BIODEFENSE PRODUCTS, BY REGION

- 5.11.2 FACTORS IMPACTING COST IN BIODEFENSE MARKET

- 5.11.3 INDICATIVE PRICING ANALYSIS OF BIODEFENSE TECHNOLOGIES, BY KEY PLAYERS, 2025

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 IMPACT OF AI/ GENERATIVE AI ON BIODEFENSE MARKET

- 5.13.1 PREDICTIVE BIOSURVEILLANCE

- 5.13.2 NEXT-GENERATION BIOSENSORS

- 5.13.3 RAPID PATHOGEN IDENTIFICATION

- 5.13.4 IMAGE & SIGNAL ANALYSIS

- 5.13.5 SYNTHETIC DATA GENERATION

- 5.14 MACROECONOMIC OUTLOOK

- 5.14.1 INTRODUCTION

- 5.14.2 NORTH AMERICA

- 5.14.3 EUROPE

- 5.14.4 ASIA PACIFIC

- 5.14.5 MIDDLE EAST

- 5.14.6 LATIN AMERICA

- 5.14.7 AFRICA

- 5.15 BUSINESS MODELS

- 5.15.1 BUSINESS MODELS IN BIODEFENSE MARKET

- 5.16 TECHNOLOGY ROADMAP

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 NANOTECHNOLOGY-ENABLED BIOSENSORS

- 6.2.2 DIGITAL HEALTH TOOLS & MOBILE BIOSURVEILLANCE

- 6.2.3 REMOTE SENSING FOR DETECTION AND IDENTIFICATION OF BIOLOGICAL THREATS

- 6.2.4 DIGITAL TWINS & SIMULATION TECHNOLOGY

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING FOR BIOTHREAT DETECTION

- 6.3.2 BLOCKCHAIN FOR SUPPLY CHAIN AND DATA INTEGRITY

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 KEY TECHNOLOGIES

- 6.4.1.1 Real-time aerosol detectors

- 6.4.1.2 Mass spectrometry

- 6.4.2 COMPLEMENTARY TECHNOLOGIES

- 6.4.2.1 Decision support systems

- 6.4.2.2 Geospatial information systems

- 6.4.3 ADJACENT TECHNOLOGIES

- 6.4.3.1 High-throughput screening

- 6.4.3.2 Digital identity and biometric authentication

- 6.4.1 KEY TECHNOLOGIES

- 6.5 PATENT ANALYSIS

7 BIODEFENSE MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 DETECTION & SURVEILLANCE

- 7.2.1 INCREASING THREAT OF EMERGING INFECTIOUS DISEASES AND BIOTERRORISM TO DRIVE SEGMENTAL GROWTH

- 7.2.2 BIOSENSOR SYSTEMS

- 7.2.3 AI-BASED PLATFORMS

- 7.3 DECONTAMINATION SYSTEMS

- 7.3.1 RISING GOVERNMENT AND DEFENSE SECTOR INVESTMENTS IN BIOSECURITY INFRASTRUCTURE TO DRIVE SEGMENTAL GROWTH

- 7.3.2 DISINFECTION UNITS

- 7.3.3 STERILIZATION DEVICES

- 7.4 OTHERS

- 7.4.1 PURIFICATION UNITS

- 7.4.2 CONTAINMENT & ISOLATION DEVICES

8 BIODEFENSE MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 GHZ-BAND WAVE EMISSION FOR AIRBORNE VIRAL INACTIVATION

- 8.2.1 CHEMICAL-FREE AND RAPID DECONTAMINATION FEATURE TO DRIVE GROWTH

- 8.3 UV-BASED TECHNOLOGIES

- 8.3.1 GROWING NEED TO REDUCE SPREAD OF AIRBORNE OR SURFACE-DEPOSITED PATHOGENS IN HIGH-RISK AREAS TO DRIVE GROWTH

- 8.4 MICROWAVE HEATING

- 8.4.1 ABILITY TO QUICKLY DISINFECT CONFINED SPACES OR CRITICAL SURFACES EXPOSED TO AIRBORNE BIOTERROR AGENTS TO DRIVE GROWTH

- 8.5 RADIOFREQUENCY (RF-EMR) HEATING

- 8.5.1 STERILIZATION AND DISINFECTION APPLICATIONS TO DRIVE GROWTH

- 8.6 COLD PLASMA-BASED PATHOGEN INACTIVATION

- 8.6.1 BROAD-SPECTRUM PATHOGEN INACTIVATION TO DRIVE GROWTH

- 8.7 GAMMA RADIATION

- 8.7.1 LONG-RANGE AND HIGH-VOLUME APPLICATION TO DRIVE GROWTH

- 8.8 BIOSENSOR TECHNOLOGIES

- 8.8.1 IMMEDIATE THREAT IDENTIFICATION WITHOUT FULL LABORATORY SUPPORT TO DRIVE GROWTH

- 8.8.1.1 Electrochemical biosensors

- 8.8.1.2 Optical biosensors

- 8.8.1.3 Piezoelectric biosensors

- 8.8.1.4 Thermal biosensors

- 8.8.1.5 Nanomechanical biosensors

- 8.8.1 IMMEDIATE THREAT IDENTIFICATION WITHOUT FULL LABORATORY SUPPORT TO DRIVE GROWTH

- 8.9 AI TECHNOLOGIES

- 8.9.1 ABILITY TO PREDICT OUTBREAKS AND IDENTIFY EMERGING THREATS IN REAL TIME TO DRIVE GROWTH

- 8.9.1.1 Machine learning for outbreak prediction

- 8.9.1.2 AI integration with surveillance networks

- 8.9.1 ABILITY TO PREDICT OUTBREAKS AND IDENTIFY EMERGING THREATS IN REAL TIME TO DRIVE GROWTH

- 8.10 OTHERS

9 BIODEFENSE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 MILITARY

- 9.2.1 THREAT OF BIOLOGICAL WARFARE TO DRIVE DEMAND

- 9.3 HOMELAND SECURITY

- 9.3.1 INCREASING NEED FOR DETECTION AND EARLY WARNING BIODEFENSE SYSTEMS TO DRIVE DEMAND

- 9.4 PUBLIC INFRASTRUCTURE

- 9.4.1 HIGH NEED FOR SAFEGUARDING CITIZENS AND ENSURING RESILIENCE IN FACE OF BIOLOGICAL RISKS TO DRIVE DEMAND

- 9.5 HOSPITALS & MEDICAL INSTITUTES

- 9.5.1 GROWING NEED FOR HEALTHCARE SYSTEM RESILIENCE TO DRIVE DEMAND

- 9.6 OTHERS

10 BIODEFENSE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS

- 10.2.2 US

- 10.2.2.1 Rise in global geopolitical tensions due to concerns about bioterrorism and state-sponsored biological programs to drive market

- 10.2.3 CANADA

- 10.2.3.1 Government's focus on enhancing public health infrastructure to drive market

- 10.3 ASIA PACIFIC

- 10.3.1 PESTLE ANALYSIS

- 10.3.2 INDIA

- 10.3.2.1 Growing national security concerns considering strained relations with neighboring countries to drive market

- 10.3.3 AUSTRALIA

- 10.3.3.1 Increasing government initiatives and investments to drive market

- 10.3.4 CHINA

- 10.3.4.1 Focus on strengthening biosecurity and strategic biotechnology development to drive market

- 10.3.5 JAPAN

- 10.3.5.1 Heightened awareness of biological threats to drive market

- 10.3.6 REST OF ASIA PACIFIC

- 10.4 EUROPE

- 10.4.1 PESTLE ANALYSIS

- 10.4.2 GERMANY

- 10.4.2.1 Comprehensive biosecurity programs and institutional collaboration to drive market

- 10.4.3 UK

- 10.4.3.1 Growing focus on biosurveillance to drive market

- 10.4.4 FRANCE

- 10.4.4.1 Increasing government investment in bioproduction infrastructure and public health preparedness to drive market

- 10.4.5 ITALY

- 10.4.5.1 Increasing focus on building biodefense infrastructure to drive market

- 10.4.6 REST OF EUROPE

- 10.5 REST OF THE WORLD (ROW)

- 10.5.1 PESTLE ANALYSIS

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 Increasing need for preparedness for emerging biological threats to drive market

- 10.5.3 LATIN AMERICA

- 10.5.3.1 International collaborations to strengthen national biodefense efforts to drive market

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 11.3 BIODEFENSE MARKET REVENUE ANALYSIS, 2020-2025

- 11.4 BIODEFENSE MARKET SHARE ANALYSIS, 2024

- 11.5 BIODEFENSE MARKET COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Product footprint

- 11.5.5.3 Technology footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 Region footprint

- 11.6 BIODEFENSE MARKET COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING

- 11.6.5.1 List of startups/SMEs

- 11.6.5.2 Competitive benchmarking of startups/SMEs

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 STERIS

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 ASP INTERNATIONAL GMBH

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Key strengths

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 USHIO INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 SOTERA HEALTH COMPANY

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 BIOQUELL, AN ECOLAB SOLUTION

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 THERMO FISHER SCIENTIFIC INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 SMITHS DETECTION GROUP LTD

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 E4LIFE SRL.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 SYNEXIS

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 BLUEDOT INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.11 XENEX DISINFECTION SERVICES INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Other developments

- 12.1.12 SKAN AG

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.13 MICROSOFT

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 BIO-RAD LABORATORIES, INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 AIRBOSS DEFENSE GROUP, INC.

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.1 STERIS

- 12.2 OTHER PLAYERS

- 12.2.1 IONISOS

- 12.2.2 AQUISENSE

- 12.2.3 GERMFREE

- 12.2.4 PATHOGENFOCUS

- 12.2.5 UV LIGHT TECHNOLOGY LTD - PART OF DARO GROUP

- 12.2.6 BERTIN TECHNOLOGIES

- 12.2.7 FAR UV TECHNOLOGIES, INC.

- 12.2.8 PURE AQUA, INC.

- 12.2.9 PALANTIR TECHNOLOGIES INC.

- 12.2.10 PUSCHNER MICROWAVE POWER SYSTEMS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 COMPANY LONG LIST

- 13.6 AUTHOR DETAILS