|

|

市場調査レポート

商品コード

1748394

農業用サイロ・貯蔵システムの世界市場:サイロタイプ別、構成材料別、最終用途別、地域別 - 予測(~2030年)Agriculture Silos & Storage Systems Market by Silo Type, Construction Material, End-use Application, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 農業用サイロ・貯蔵システムの世界市場:サイロタイプ別、構成材料別、最終用途別、地域別 - 予測(~2030年) |

|

出版日: 2025年06月05日

発行: MarketsandMarkets

ページ情報: 英文 281 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

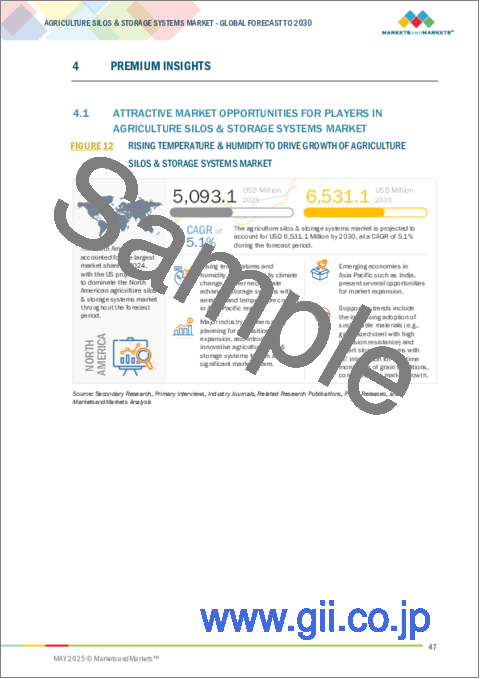

世界の農業用サイロ・貯蔵システムの市場規模は、2025年に推定50億9,000万米ドルであり、2030年までに65億3,000万米ドルに達すると予測され、予測期間にCAGRで5.1%の成長が見込まれます。

人口の増加に伴い、何をどのように食べるかが変化しているため、農業用貯蔵インフラの需要は急増しています。農家や販売業者は、世界中の地域社会に食料を供給するために必要な収穫高の増加に対応するため、穀物貯蔵ソリューションへの投資を増やしています。これらの重要な貯蔵システムは、貴重な作物を保護し、農産物市場がますます複雑化する中でも安定した供給を保証する、食料サプライチェーンにとって極めて重要なものとなっています。生産の変動性の緩和は、市場での競争力を維持しようとする企業にとって、優先的な投資検討事項となっています。優れたモニタリングシステム、自動化、耐久性のある材料など、サイロ技術の進歩により穀物の保存性が向上し、小規模農家から大規模農家まで、サイロの魅力が増しています。特に北米やアジアなどの主要な農業地域における商業的農業の成長も需要を後押ししており、大きな農場では大規模な収穫を効率的に処理するための強力で拡張性のある貯蔵ソリューションが必要とされています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 米ドル |

| セグメント | サイロタイプ、最終用途、構成材料、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

「構成材料別では、金属/スチールセグメントが農業用サイロ・貯蔵システム市場でもっとも急成長すると予測されます。」

金属とスチールは、その強度、耐久性、適応性から、農業用サイロ建設に一般的に使用されています。特に亜鉛メッキ鋼は、風、湿気、温度変化などの環境課題に対して強い耐性を発揮します。スチールサイロは精密に製造され、モジュール部品で輸送され、現場で素早く組み立てられるため、小規模農業にも大規模農業にも適しています。鉄骨構造の利点は、大容量要件への適応性です。スチールサイロは、平底とホッパー底の両方で設計できるため、商品のタイプや貯蔵期間に応じて柔軟に対応できます。ホッパー底のスチールサイロは、粒状飼料、特定の豆類、肥料ペレットなど、完全な重力排出を必要とする製品に特に有効です。

「農業用サイロ・貯蔵システム市場のサイロタイプセグメントでは、平底サイロセグメントが最大の市場シェアを占めています。」

平底の穀物サイロはコンクリートの基礎の上に組み立てられ、大量の穀物を入れることができます。穀物は塔の上部にある特別なハッチから積み込まれます。平底サイロは、穀物の品質を長期にわたって安全に保護し、エンドユーザーに最高品質の穀物を確実に提供する、長期貯蔵への費用対効果の高いソリューションを提供します。平底サイロのサイズは250Tから2万Tの間です。これらの平底サイロは、オーガートランスポーターを使用して、ストレージの底にある管から降ろされます。円錐形のサイロに比べ、平底サイロは貯蔵コストが低いです。したがって、平底サイロは穀物の長期貯蔵にもっとも便利な選択肢の1つです。

欧州が世界の農業用サイロ・貯蔵システム市場で大きなシェアを占めています。

欧州の農業用サイロ・貯蔵システム市場は、持続可能性、厳格な食品安全規制、農業インフラのアップグレードの重視によって定義されます。ドイツ、フランス、オランダのような主要国は、環境基準を満たしながら効率を向上させる先進の貯蔵技術を導入する最前線にいます。欧州連合(EU)のCommon Agricultural Policy(CAP)は、持続可能な農業を奨励するために多額の資金を提供することで大きく寄与しており、間接的に最新の貯蔵システムへの投資を促進しています。

当レポートでは、世界の農業用サイロ・貯蔵システム市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 農業用サイロ・貯蔵システム市場の企業にとって魅力的な市場機会

- 北米の農業用サイロ・貯蔵システム市場:最終用途別、国別

- 農業用サイロ・貯蔵システム市場:最終用途別、地域別

- 農業用サイロ・貯蔵システム市場:サイロタイプ別

- 農業用サイロ・貯蔵システム市場:構成材料別

- 農業用サイロ・貯蔵システム市場:最終用途別

- 農業用サイロ・貯蔵システム市場:主要地域サブマーケットのシェア

第5章 市場の概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 農業用サイロ・貯蔵システム市場における生成AIの影響

- イントロダクション

- 農業用サイロ・貯蔵システムにおける生成AIの活用

- ケーススタディ分析

- 農業用サイロ・貯蔵システム市場に対する影響

第6章 産業動向

- イントロダクション

- サプライチェーン分析

- バリューチェーン分析

- 研究開発

- 原材料調達

- 製造と組立

- 包装と配送

- 最終用途用途

- エコシステムマップ

- デマンドサイド

- サプライサイド

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制

- ポーターのファイブフォース分析

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向/混乱

- 主な会議とイベント(2025年~2026年)

- 特許分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 価格分析

- 農業用サイロ・貯蔵システムの平均販売価格の動向

- 構成材料の平均販売価格の動向:地域別(2021年~2024年)

- 貿易分析

- 輸入シナリオ(HSコード730900)

- 輸出シナリオ(HSコード730900)

- 主なステークホルダーと購入基準

- 投資と資金調達のシナリオ

- 農業用サイロ・貯蔵システム市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 農業用サイロ・貯蔵システムの混乱

- 価格の影響の分析

- さまざまな地域への主な影響

- 最終用途産業レベルに対する影響

第7章 農業用サイロ・貯蔵システム市場:サイロタイプ別

- イントロダクション

- 平底サイロ

- ホッパーサイロ

- 穀物貯蔵庫

- スクエアサイロ

- その他のサイロタイプ

第8章 農業用サイロ・貯蔵システム市場:最終用途別

- イントロダクション

- 食品貯蔵

- 農業製品

- 加工・産業用途

第9章 農業用サイロ・貯蔵システム市場:構成材料別

- イントロダクション

- 金属/スチール

- コンクリートサイロ・タワーサイロ

- その他の構成材料

第10章 農業用サイロ・貯蔵システム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- その他の地域

- アフリカ

- 中東

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析(2022年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標(2024年)

- ブランド/製品の比較

- WESTEEL

- MYSILO

- SUKUP MANUFACTURING

- TORNUM GROUP

- GSI

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- AGI

- PRADO SILOS

- SYMAGA

- AMERICAN INDUSTRIAL PARTNERS

- TORNUM GROUP

- HOFFMANN, INC

- BENTALL その他の地域のLANDS

- MYSILO

- SCE SILO CONSTRUCTION & ENGINEERING

- SUKUP MANUFACTURING

- TSC SILOS

- TRANSIL INTERNATIONAL

- KONSTRUKTIE QUINTYN GEBR.

- SRON SILO ENGINEERING CO.

- INTRANOX

- IPESA

- M.I.P GROUP

- MICHAL ZPUH

- SIOUX STEEL COMPANY

- DEHSETILER MAKINA

- その他の企業

- COBAN SILO

- IPRO INDIA

- OTRIVA SILOS

- TSI STEELS

- TSE SILO

第13章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 農機具レンタル市場

- 市場の定義

- 市場の概要

- 農機具レンタル市場:ドライブ別

- 農業用ロボット市場

- 市場の定義

- 市場の概要

- 農業用ロボット市場:農業環境別

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES CONSIDERED FOR STUDY, 2020-2024

- TABLE 2 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 3 ROLE OF COMPANIES IN AGRICULTURE SILOS & STORAGE SYSTEMS MARKET ECOSYSTEM

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 11 LIST OF MAJOR PATENTS PERTAINING TO AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, 2023-2025

- TABLE 12 AVERAGE SELLING PRICES OF AGRICULTURE SILOS & STORAGE SYSTEMS, BY KEY PLAYER, 2024 (USD/UNIT)

- TABLE 13 AVERAGE SELLING PRICE TREND OF CONSTRUCTION MATERIALS, BY REGION, 2021-2024 (USD/TON)

- TABLE 14 IMPORT SCENARIO OF HS CODE 730900-COMPLIANT PRODUCTS OF TOP 10 IMPORTERS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 IMPORT SCENARIO OF HS CODE 730900-COMPLIANT PRODUCTS OF TOP 10 IMPORTERS, BY KEY COUNTRY, 2020-2024 (TON)

- TABLE 16 EXPORT SCENARIO OF HS CODE 730900-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 17 EXPORT SCENARIO FOR HS CODE 730900-COMPLIANT PRODUCTS OF TOP 10 EXPORTERS, BY KEY COUNTRY, 2020-2024 (TON)

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 4 SILO TYPES

- TABLE 19 KEY BUYING CRITERIA FOR TOP 4 SILO TYPES

- TABLE 20 US: ADJUSTED RECIPROCAL TARIFF RATES, 2024

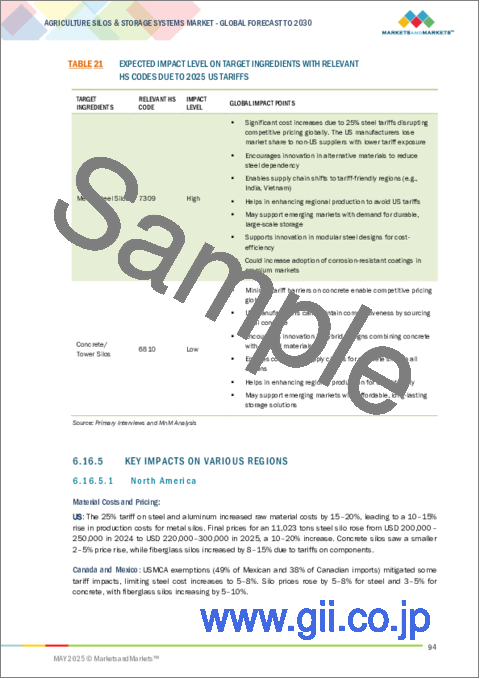

- TABLE 21 EXPECTED IMPACT LEVEL ON TARGET INGREDIENTS WITH RELEVANT HS CODES DUE TO 2025 US TARIFFS

- TABLE 22 EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET

- TABLE 23 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 24 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 25 FLAT BOTTOM: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 FLAT BOTTOM: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 HOPPER SILOS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 HOPPER SILOS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 GRAIN BINS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 GRAIN BINS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 SQUARE SILOS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 SQUARE SILOS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 OTHER SILO TYPES: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 OTHER SILO TYPES: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2020-2024 (USD MILLION)

- TABLE 36 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 37 FOOD STORAGE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 38 FOOD STORAGE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 39 FOOD STORAGE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 FOOD STORAGE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 GRAINS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 GRAINS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 OILSEEDS & PULSES: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 OILSEEDS & PULSES: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 COFFEE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 COFFEE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 FLOURS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 FLOURS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 OTHER FOOD PRODUCTS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 OTHER FOOD PRODUCTS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 FARM PRODUCTS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 52 FARM PRODUCTS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 53 FARM PRODUCTS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 FARM PRODUCTS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 FERTILIZERS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 FERTILIZERS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 ANIMAL FEED: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 ANIMAL FEED: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 PROCESSING & INDUSTRIAL USE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 60 PROCESSING & INDUSTRIAL USE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 61 PROCESSING & INDUSTRIAL USE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 PROCESSING & INDUSTRIAL USE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 FOOD PROCESSING INGREDIENTS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 FOOD PROCESSING INGREDIENTS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 BIOFUEL & BIOMASS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 BIOFUEL & BIOMASS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 SEED PROCESSING & STORAGE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 SEED PROCESSING & STORAGE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL 2020-2024 (USD MILLION)

- TABLE 70 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025-2030 (USD MILLION)

- TABLE 71 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL 2020-2024 (KT)

- TABLE 72 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025-2030 (KT)

- TABLE 73 METAL/STEEL: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 METAL/STEEL: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 CONCRETE/ TOWER SILOS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 CONCRETE/TOWER SILOS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 OTHER CONSTRUCTION MATERIALS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 OTHER CONSTRUCTION MATERIALS: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (KT)

- TABLE 82 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 83 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 84 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2020-2024 (USD MILLION)

- TABLE 88 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2020-2024 (KT)

- TABLE 90 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025-2030 (KT)

- TABLE 91 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2020-2024 (USD MILLION)

- TABLE 92 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FOOD STORAGE, 2020-2024 (USD MILLION)

- TABLE 94 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FOOD STORAGE, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FARM PRODUCT, 2020-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FARM PRODUCT, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY PROCESSING & INDUSTRIAL USE, 2020-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY PROCESSING & INDUSTRIAL USE, 2025-2030 (USD MILLION)

- TABLE 99 US: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 100 US: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 101 CANADA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 102 CANADA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 103 MEXICO: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 104 MEXICO: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 106 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 108 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2020-2024 (USD MILLION)

- TABLE 110 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2020-2024 (KT)

- TABLE 112 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025-2030 (KT)

- TABLE 113 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2020-2024 (USD MILLION)

- TABLE 114 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FOOD STORAGE, 2020-2024 (USD MILLION)

- TABLE 116 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FOOD STORAGE, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FARM PRODUCT, 2020-2024 (USD MILLION)

- TABLE 118 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FARM PRODUCT, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY PROCESSING & INDUSTRIAL USE, 2020-2024 (USD MILLION)

- TABLE 120 EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY PROCESSING & INDUSTRIAL USE, 2025-2030 (USD MILLION)

- TABLE 121 GERMANY: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 122 GERMANY: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 123 FRANCE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 124 FRANCE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 125 UK: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 126 UK: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 127 SPAIN: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 128 SPAIN: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 129 ITALY: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 130 ITALY: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 131 REST OF EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 132 REST OF EUROPE: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2020-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2020-2024 (KT)

- TABLE 140 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025-2030 (KT)

- TABLE 141 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2020-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FOOD STORAGE, 2020-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FOOD STORAGE, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FARM PRODUCT, 2020-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FARM PRODUCT, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY PROCESSING & INDUSTRIAL USE, 2020-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY PROCESSING & INDUSTRIAL USE, 2025-2030 (USD MILLION)

- TABLE 149 CHINA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 150 CHINA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 151 INDIA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 152 INDIA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 153 JAPAN: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 154 JAPAN: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 155 AUSTRALIA & NEW ZEALAND: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 156 AUSTRALIA & NEW ZEALAND: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 159 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 160 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 161 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 162 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 163 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2020-2024 (USD MILLION)

- TABLE 164 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025-2030 (USD MILLION)

- TABLE 165 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2020-2024 (KT)

- TABLE 166 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025-2030 (KT)

- TABLE 167 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2020-2024 (USD MILLION)

- TABLE 168 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FOOD STORAGE, 2020-2024 (USD MILLION)

- TABLE 170 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FOOD STORAGE, 2025-2030 (USD MILLION)

- TABLE 171 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FARM PRODUCT, 2020-2024 (USD MILLION)

- TABLE 172 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FARM PRODUCT, 2025-2030 (USD MILLION)

- TABLE 173 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY PROCESSING & INDUSTRIAL USE, 2020-2024 (USD MILLION)

- TABLE 174 SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY PROCESSING & INDUSTRIAL USE, 2025-2030 (USD MILLION)

- TABLE 175 BRAZIL: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 176 BRAZIL: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 177 ARGENTINA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 178 ARGENTINA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 179 REST OF SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 180 REST OF SOUTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 181 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 182 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 183 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 184 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 185 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2020-2024 (USD MILLION)

- TABLE 186 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025-2030 (USD MILLION)

- TABLE 187 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2020-2024 (KT)

- TABLE 188 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025-2030 (KT)

- TABLE 189 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2020-2024 (USD MILLION)

- TABLE 190 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 191 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FOOD STORAGE, 2020-2024 (USD MILLION)

- TABLE 192 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FOOD STORAGE, 2025-2030 (USD MILLION)

- TABLE 193 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FARM PRODUCT, 2020-2024 (USD MILLION)

- TABLE 194 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY FARM PRODUCT, 2025-2030 (USD MILLION)

- TABLE 195 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY PROCESSING & INDUSTRIAL USE, 2020-2024 (USD MILLION)

- TABLE 196 REST OF THE WORLD: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY PROCESSING & INDUSTRIAL USE, 2025-2030 (USD MILLION)

- TABLE 197 AFRICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 198 AFRICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 199 MIDDLE EAST: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2020-2024 (USD MILLION)

- TABLE 200 MIDDLE EAST: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025-2030 (USD MILLION)

- TABLE 201 OVERVIEW OF STRATEGIES ADOPTED BY KEY AGRICULTURE SILOS & STORAGE SYSTEM MANUFACTURERS

- TABLE 202 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: DEGREE OF COMPETITION

- TABLE 203 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 204 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: SILO TYPE FOOTPRINT, 2024

- TABLE 205 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: CONSTRUCTION MATERIAL FOOTPRINT, 2024

- TABLE 206 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: END-USE APPLICATION FOOTPRINT, 2024

- TABLE 207 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 208 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 209 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: PRODUCT LAUNCHES, JANUARY 2020-APRIL 2025

- TABLE 210 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: DEALS, JANUARY 2020-APRIL 2025

- TABLE 211 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: EXPANSIONS, JANUARY 2020-APRIL 2025

- TABLE 212 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: OTHER DEVELOPMENTS, JANUARY 2020-APRIL 2025

- TABLE 213 AGI: COMPANY OVERVIEW

- TABLE 214 AGI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 AGI: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 216 AGI: DEALS

- TABLE 217 PRADO SILOS: COMPANY OVERVIEW

- TABLE 218 PRADO SILOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 PRADO SILOS: PRODUCT DEVELOPMENTS

- TABLE 220 PRADO SILOS: OTHER DEVELOPMENTS

- TABLE 221 PRADO SILOS: EXPANSIONS

- TABLE 222 SYMAGA: COMPANY OVERVIEW

- TABLE 223 SYMAGA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 SYMAGA: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 225 SYMAGA: DEALS

- TABLE 226 SYMAGA: EXPANSIONS

- TABLE 227 AMERICAN INDUSTRIAL PARTNERS: COMPANY OVERVIEW

- TABLE 228 AMERICAN INDUSTRIAL PARTNERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 AMERICAN INDUSTRIAL PARTNERS: DEALS

- TABLE 230 TORNUM GROUP: COMPANY OVERVIEW

- TABLE 231 TORNUM GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 HOFFMANN, INC.: COMPANY OVERVIEW

- TABLE 233 HOFFMANN, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 BENTALL ROWLANDS: COMPANY OVERVIEW

- TABLE 235 BENTALL ROWLANDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 MYSILO: COMPANY OVERVIEW

- TABLE 237 MYSILO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 SCE SILO CONSTRUCTION & ENGINEERING: COMPANY OVERVIEW

- TABLE 239 SCE SILO CONSTRUCTION & ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 SUKUP MANUFACTURING: COMPANY OVERVIEW

- TABLE 241 SUKUP MANUFACTURING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 SUKUP MANUFACTURING: EXPANSIONS

- TABLE 243 TSC SILOS: COMPANY OVERVIEW

- TABLE 244 TSC SILOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 TRANSIL INTERNATIONAL: COMPANY OVERVIEW

- TABLE 246 TRANSIL INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 KONSTRUKTIE QUINTYN GEBR.: COMPANY OVERVIEW

- TABLE 248 KONSTRUKTIE QUINTYN GEBR : PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 SRON SILO ENGINEERING CO.: COMPANY OVERVIEW

- TABLE 250 SRON SILO ENGINEERING CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 INTRANOX: COMPANY OVERVIEW

- TABLE 252 INTRANOX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 IPESA: COMPANY OVERVIEW

- TABLE 254 IPESA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 M.I.P GROUP: COMPANY OVERVIEW

- TABLE 256 M.I.P GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 M.I.P GROUP: EXPANSIONS

- TABLE 258 MICHAL ZPUH: COMPANY OVERVIEW

- TABLE 259 MICHAL ZPUH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 SIOUX STEEL COMPANY: COMPANY OVERVIEW

- TABLE 261 SIOUX STEEL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 SIOUX STEEL COMPANY: DEALS

- TABLE 263 DEHSETILER MAKINA: COMPANY OVERVIEW

- TABLE 264 DEHSETILER MAKINA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 ADJACENT MARKETS TO AGRICULTURE SILOS & STORAGE SYSTEMS MARKET

- TABLE 266 FARM EQUIPMENT RENTAL MARKET SIZE, BY DRIVE, 2018-2025 (USD MILLION)

- TABLE 267 AGRICULTURE ROBOT MARKET, BY FARMING ENVIRONMENT, 2018-2022 (USD MILLION)

- TABLE 268 AGRICULTURE ROBOT MARKET, BY FARMING ENVIRONMENT, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 SUPPLY-SIDE ANALYSIS: SOURCES OF INFORMATION AT EVERY STEP

- FIGURE 6 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 7 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: DATA TRIANGULATION

- FIGURE 8 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 9 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025 VS. 2030 (USD MILLION)

- FIGURE 10 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET SHARE AND GROWTH RATE, BY REGION

- FIGURE 12 RISING TEMPERATURE & HUMIDITY TO DRIVE GROWTH OF AGRICULTURE SILOS & STORAGE SYSTEMS MARKET

- FIGURE 13 FOOD STORAGE AND US TO ACCOUNT FOR LARGEST SHARE IN NORTH AMERICAN AGRICULTURE SILOS & STORAGE SYSTEMS MARKET IN 2025

- FIGURE 14 FOOD STORAGE END-USE APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 FLAT-BOTTOM SILO TYPE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 METAL/STEEL CONSTRUCTION MATERIAL TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 STORAGE OF GRAINS TO DRIVE MARKET FOR FOOD STORAGE END-USE APPLICATION

- FIGURE 18 US IS ESTIMATED TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 19 CEREAL, MAIZE, SOYBEAN & WHEAT PRODUCTION LEVELS IN DEVELOPING REGIONS, 2020-2013 (MILLION TONS)

- FIGURE 20 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 DISTRIBUTION OF FARMS, ACRES OPERATED AND VALUE OF PRODUCTION BY FARM TYPE, 2023

- FIGURE 22 ADOPTION OF GEN AI IN AGRICULTURE SILOS & STORAGE SYSTEMS

- FIGURE 23 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET MAP

- FIGURE 26 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 29 REGIONAL ANALYSIS OF PATENTS GRANTED FOR AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, 2014-2024

- FIGURE 30 AVERAGE SELLING PRICES OF AGRICULTURE SILOS & STORAGE SYSTEMS, BY KEY PLAYER, 2024 (USD/UNIT)

- FIGURE 31 AVERAGE SELLING PRICE TREND OF CONSTRUCTION MATERIALS, BY REGION, 2021-2024 (USD/TON)

- FIGURE 32 IMPORT DATA FOR HS CODE 730900-COMPLIANT PRODUCTS OF TOP 5 IMPORTERS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 33 EXPORT DATA FOR FOR HS CODE 730900-COMPLIANT PRODUCTS OF TOP 5 EXPORTERS , BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 4 SILO TYPES

- FIGURE 35 KEY BUYING CRITERIA FOR TOP 4 SILO TYPES

- FIGURE 36 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 37 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 38 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 39 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL, 2025 VS. 2030 (USD MILLION)

- FIGURE 40 INDIA TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 41 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS FOR KEY COMPANIES, 2022-2024 (USD MILLION)

- FIGURE 44 SHARE OF LEADING COMPANIES IN AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, 2024

- FIGURE 45 COMPANY VALUATION (USD BILLION), 2024

- FIGURE 46 EV/EBITDA OF MAJOR PLAYERS, 2024

- FIGURE 47 AGRICULTURE SILOS & STORAGE SYSTEM MARKET: BRAND/PRODUCT COMPARISON ANALYSIS, BY PRODUCT BRAND

- FIGURE 48 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 50 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 51 AGI: COMPANY SNAPSHOT

The global market for agriculture silos & storage systems is estimated to be valued at USD 5.09 billion in 2025 and is projected to reach USD 6.53 billion by 2030, at a CAGR of 5.1% during the forecast period. The demand for agricultural storage infrastructure is booming as the growing population transforms what and how it eats. Farmers and distributors are investing more heavily in grain storage solutions to keep pace with the increasing harvests needed to feed communities worldwide. These vital storage systems have become crucial to the food supply chain, protecting precious crops and ensuring consistent availability even as agricultural markets become increasingly complex. Production volatility mitigation has become a priority investment consideration for operations seeking to maintain competitive market positioning. Advances in silo technology, including better monitoring systems, automation, and durable materials, have improved grain preservation and made silos more appealing to both small and large farmers. The growth of commercial farming, especially in major agricultural regions like North America and Asia, is also driving demand, as bigger farms need strong, scalable storage solutions to handle larger harvests efficiently.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) |

| Segments | By Silo Type, End-use Application, Construction Material, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

"Metal/Steel segment is expected to be the fastest-growing by construction material in the agriculture silos & storage systems market."

Metal and steel are commonly used in agricultural silo construction because of their strength, durability, and adaptability. Galvanized steel, in particular, provides strong resistance to environmental challenges like wind, moisture, and temperature changes. Steel silos can be fabricated with precision, transported in modular parts, and assembled quickly on-site, making them ideal for both small and large-scale agricultural operations. The benefit of steel construction is its adaptability to high-capacity requirements. Steel silos can be designed in both flat-bottom and hopper-bottom configurations, allowing for flexibility depending on the type of commodity and storage duration. Hopper-bottom steel silos are especially useful for products that require complete gravity discharge, such as granular feed, certain pulses, or fertilizer pellets.

"The flat bottom silos segment holds the largest market share in the silo type segment of the agriculture silos & storage systems market."

A flat bottom grain silo is assembled on a concrete foundation and can contain grains in a large quantity. Grains are loaded through the special hatch at the top of the tower. Flat bottom silos offer a cost-effective solution for long-term storage, which safely protects the quality of grains for a prolonged period of time and ensures the best quality of grains are offered to end users. The flat bottom silo sizes range between 250 T and 20,000 T. These flat bottom silos are unloaded through the canal at the bottom of the storage by using an auger transporter. As compared to the conical silo, the flat-bottom silo has a lower cost of storing. Thus, the flat bottom silo is one of the most convenient options for long-term grain storage.

Europe holds a significant share in the global agriculture silos & storage systems market.

The agricultural silos and storage systems market in Europe is defined by its focus on sustainability, strict food safety regulations, and the upgrading of farming infrastructure. Leading nations like Germany, France, and the Netherlands are at the forefront of implementing advanced storage technologies that improve efficiency while meeting environmental standards. The European Union's Common Agricultural Policy (CAP) significantly contributes by providing substantial funding to encourage sustainable farming, indirectly driving investment in modern storage systems. Europe has tackled food waste by broadly implementing smart silos with automation and IoT technologies, enabling real-time monitoring and management. Although market growth is slower compared to emerging regions, Europe's emphasis on innovation, quality, and sustainability keeps it a competitive force in the global market.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the agriculture silos & storage systems market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World -10%

Prominent companies in the market include SUKUP MANUFACTURING CO. (US), AGI (Canada), MySilo (Turkey), Prado Silos (Spain), SYMAGA (Spain), TSC SILOS (Netherlands), Bentall Rowlands (UK), American Industries Partners (US), SRON SILO ENGINEERING CO. (China), M.I.P Group (Belgium), KONSTRUKTIE QUINTYN GEBR. (Belgium), and Transil International (Romania).

Other players include TSI Steels (India), Otriva Silos (India), Hoffmann, Inc. (US), Intranox (Spain), TSE Silo (China), IPESA (Peru), IPRO India (India), Dehsetiler Makina (Turkey), Michal ZPUH (Poland), and Coban Silo (China).

Research Coverage:

This research report categorizes the agriculture silos & storage systems market by silo type (flat bottom, hopper silos, grain bins, square silos, other silo types), end-use application (food storage, farm products, processing & industrial use), construction material (metal/steel, concrete/towers, other construction materials), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the agriculture silos & storage systems market. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, service launches, mergers and acquisitions, and recent developments associated with the agriculture silos & storage systems market. Competitive analysis of upcoming startups in the agriculture silos & storage systems market ecosystem is covered in this report. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall agriculture silos & storage systems and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Production of high-quality grains through effective storage and efficient post-harvest management), restraints (High initial investments in equipment and its set up affect their demand across developing regions), opportunities (Rapid advancements and technological developments in attributes of silos to drive market growth), and challenges (addressing supply chain challenges in silo operations) influencing the growth of the agriculture silos & storage systems market.

- Service Launch/Innovation: Detailed insights on research & development activities and service launches in the agriculture silos & storage systems market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the agriculture silos & storage systems market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the agriculture silos & storage systems market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as SUKUP MANUFACTURING CO. (US), AGI (Canada), MySilo (Turkey), Prado Silos (Spain), SYMAGA (Spain), TSC SILOS (Netherlands), Bentall Rowlands (UK), American Industries Partners (US), SRON SILO ENGINEERING CO. (China), and other players in the agriculture silos & storage systems market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.4.1 UNITS CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES FOR PLAYERS IN AGRICULTURE SILOS & STORAGE SYSTEMS MARKET

- 4.2 NORTH AMERICA: AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION AND COUNTRY

- 4.3 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION AND REGION

- 4.4 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE

- 4.5 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL

- 4.6 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION

- 4.7 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INCREASE IN PRODUCTION OF FOOD GRAINS PER FARM IN COUNTRIES TO ENCOURAGE USE OF SILOS FOR EFFICIENT STORAGE

- 5.2.2 RISK OF PEST, INSECT, AND FUNGAL INFESTATIONS TO STORED GRAINS LEAD TO RISE IN DEMAND FOR SILOS

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Production of high-quality grains through effective storage and efficient post-harvest management

- 5.3.1.2 Post-harvest losses and food wastage to increase sales of silos in agriculture industry

- 5.3.2 RESTRAINTS

- 5.3.2.1 High initial investments in equipment and its setup affect their demand across developing regions

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Rapid advancements and technological developments in attributes of silos

- 5.3.3.2 Government initiatives in various countries for setting up grain silos

- 5.3.4 CHALLENGES

- 5.3.4.1 Managing supply chain issues within silo systems

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON AGRICULTURE SILOS & STORAGE SYSTEMS MARKET

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN AGRICULTURE SILOS & STORAGE SYSTEMS

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 AGCO grain & protein's smart storage initiative in Europe and North America

- 5.4.4 IMPACT ON AGRICULTURE SILOS & STORAGE SYSTEMS MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH AND DEVELOPMENT

- 6.3.2 RAW MATERIAL SOURCING

- 6.3.3 MANUFACTURING & ASSEMBLY

- 6.3.4 PACKAGING & DISTRIBUTION

- 6.3.5 END-USE APPLICATIONS

- 6.4 ECOSYSTEM MAP

- 6.4.1 DEMAND SIDE

- 6.4.2 SUPPLY SIDE

- 6.5 REGULATORY LANDSCAPE

- 6.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

- 6.5.2 REGULATIONS

- 6.5.2.1 North America

- 6.5.2.1.1 US

- 6.5.2.1.2 Canada

- 6.5.2.1.3 Mexico

- 6.5.2.2 Europe

- 6.5.2.2.1 European Union

- 6.5.2.3 Asia Pacific

- 6.5.2.3.1 India

- 6.5.2.3.2 Australia

- 6.5.2.3.3 China

- 6.5.2.4 South America

- 6.5.2.4.1 Brazil

- 6.5.2.5 South Africa

- 6.5.2.1 North America

- 6.6 PORTER'S FIVE FORCES ANALYSIS

- 6.6.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.6.2 THREAT OF NEW ENTRANTS

- 6.6.3 THREAT OF SUBSTITUTES

- 6.6.4 BARGAINING POWER OF SUPPLIERS

- 6.6.5 BARGAINING POWER OF BUYERS

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 BUHLER GROUP'S INNOVATIVE GRAIN STORAGE SYSTEM IN NIGERIA HELPS ENHANCE FOOD SECURITY AND EXPORT POTENTIAL

- 6.7.2 AGCO GSI'S ADVANCED STORAGE SYSTEM HELPS TO SIGNIFICANTLY REDUCE WAIT TIMES AND LABOR COSTS WHILE IMPROVING OVERALL HARVEST EFFICIENCY

- 6.7.3 SYMAGA'S SYSTEM HELPED A VIETNAMESE RICE COMPANY MEET EU EXPORT STANDARDS, CUTTING SPOILAGE BY 70%

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 KEY CONFERENCES & EVENTS, 2025-2026

- 6.10 PATENT ANALYSIS

- 6.11 TECHNOLOGY ANALYSIS

- 6.11.1 KEY TECHNOLOGIES

- 6.11.1.1 INTEGRATION OF IOT AND SMART SENSORS FOR REAL-TIME MONITORING

- 6.11.1.2 AUTOMATION AND ROBOTICS FOR GRAIN HANDLING

- 6.11.2 COMPLEMENTARY TECHNOLOGIES

- 6.11.2.1 BLOCKCHAIN FOR TRACEABILITY

- 6.11.3 ADJACENT TECHNOLOGIES

- 6.11.3.1 DRONES FOR FARM MONITORING

- 6.11.1 KEY TECHNOLOGIES

- 6.12 PRICING ANALYSIS

- 6.12.1 AVERAGE SELLING PRICE TREND OF AGRICULTURE SILOS & STORAGE SYSTEMS, BY KEY PLAYER, 2024 (USD/UNIT)

- 6.12.2 AVERAGE SELLING PRICE TREND OF CONSTRUCTION MATERIALS, BY REGION, 2021-2024

- 6.13 TRADE ANALYSIS

- 6.13.1 IMPORT SCENARIO (HS CODE 730900)

- 6.13.2 EXPORT SCENARIO (HS CODE 730900)

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 2025 US TARIFF IMPACT ON AGRICULTURE SILOS & STORAGE SYSTEMS MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 DISRUPTION IN AGRICULTURE SILOS & STORAGE SYSTEMS

- 6.16.4 PRICE IMPACT ANALYSIS

- 6.16.5 KEY IMPACTS ON VARIOUS REGIONS

- 6.16.5.1 North America

- 6.16.5.2 Europe

- 6.16.6 END-USE INDUSTRY-LEVEL IMPACT

7 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY SILO TYPE

- 7.1 INTRODUCTION

- 7.2 FLAT BOTTOM SILOS

- 7.2.1 LARGE STORAGE CAPACITY, EASE OF AERATION, AND COST-EFFECTIVENESS FOR LONG-TERM BULK STORAGE OF GRAINS TO DRIVE MARKET

- 7.3 HOPPER SILOS

- 7.3.1 INCREASE IN USE OF HARVESTERS FOR BETTER CROP YIELDS TO DRIVE MARKET

- 7.4 GRAIN BINS

- 7.4.1 SHIFT TOWARD LARGE-SCALE, COMMERCIAL FARMING, PARTICULARLY IN DEVELOPING REGIONS, TO FUEL DEMAND FOR DURABLE AND SCALABLE GRAIN BINS

- 7.5 SQUARE SILOS

- 7.5.1 RISING SPACE CONSTRAINTS TO DRIVE GLOBAL GROWTH OF SQUARE SILOS

- 7.6 OTHER SILO TYPES

8 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY END-USE APPLICATION

- 8.1 INTRODUCTION

- 8.2 FOOD STORAGE

- 8.2.1 RISING DEMAND FROM MAJOR FOOD EXPORTING COUNTRIES AND COUNTRIES WITH FOOD SELF-SUFFICIENCY GOALS TO DRIVE MARKET

- 8.2.2 GRAINS

- 8.2.3 OILSEEDS & PULSES

- 8.2.4 COFFEE

- 8.2.5 FLOURS

- 8.2.6 OTHER FOOD PRODUCTS

- 8.3 FARM PRODUCTS

- 8.3.1 INCREASING FARMING OPERATIONS AND INVESTMENTS IN AGRICULTURAL INFRASTRUCTURE TO BOOST DEMAND

- 8.3.2 FERTILIZERS

- 8.3.3 ANIMAL FEED

- 8.4 PROCESSING & INDUSTRIAL USE

- 8.4.1 RISING GLOBAL PROCESSED FOOD MARKET AND RENEWABLE ENERGY GOALS TO CONTRIBUTE SIGNIFICANTLY TO MARKET GROWTH

- 8.4.2 FOOD PROCESSING INGREDIENTS

- 8.4.3 BIOFUEL & BIOMASS

- 8.4.4 SEED PROCESSING & STORAGE

9 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY CONSTRUCTION MATERIAL

- 9.1 INTRODUCTION

- 9.2 METAL/STEEL

- 9.2.1 EXCEPTIONAL STRENGTH-TO-WEIGHT RATIO HIGH STORAGE CAPACITY, AND FASTER CONSTRUCTION TIMELINES TO DRIVE MARKET

- 9.3 CONCRETE & TOWER SILOS

- 9.3.1 SUPERIOR THERMAL INSULATION AND DURABILITY TO DRIVE MARKET

- 9.4 OTHER CONSTRUCTION MATERIALS

10 AGRICULTURE SILOS & STORAGE SYSTEMS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Environmental concerns and push for sustainable agriculture to drive adoption of energy-efficient silo designs

- 10.2.2 CANADA

- 10.2.2.1 Increasing demand for advanced grain storage systems to drive market

- 10.2.3 MEXICO

- 10.2.3.1 Growing focus on reducing post-harvest losses and improving food security to drive market

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Decreasing grain yields and production volatility to drive demand for advanced silos

- 10.3.2 FRANCE

- 10.3.2.1 Increasing cereal production to drive market

- 10.3.3 UK

- 10.3.3.1 Adoption of intensive farming for higher grain production to drive market

- 10.3.4 SPAIN

- 10.3.4.1 Rising use of flat bottom silos to drive market

- 10.3.5 ITALY

- 10.3.5.1 Climate-induced challenges in agriculture to drive market

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Increasing adoption of green storage systems to drive market

- 10.4.2 INDIA

- 10.4.2.1 Significant grain production, particularly rice and wheat, to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Increasing adoption of advanced silos to drive market

- 10.4.4 AUSTRALIA & NEW ZEALAND

- 10.4.4.1 Growing practice of storage management to drive sales of advanced silos

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Availability of major wheat and rice inventories to drive market

- 10.5.2 ARGENTINA

- 10.5.2.1 Strong grain production and increasing demand for food products to drive market

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 REST OF THE WORLD

- 10.6.1 AFRICA

- 10.6.1.1 Diverse agricultural needs and rapid consumption increase to drive market

- 10.6.2 MIDDLE EAST

- 10.6.2.1 Improved government support and awareness among farmers to drive market

- 10.6.1 AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 11.5.1 FINANCIAL METRICS, 2024

- 11.6 BRAND/PRODUCT COMPARISON

- 11.6.1 WESTEEL

- 11.6.2 MYSILO

- 11.6.3 SUKUP MANUFACTURING

- 11.6.4 TORNUM GROUP

- 11.6.5 GSI

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Regional footprint

- 11.7.5.3 Silo type footprint

- 11.7.5.4 Construction material footprint

- 11.7.5.5 End-use application footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 AGI

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches and developments

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 PRADO SILOS

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product developments

- 12.1.2.3.2 Other developments

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 SYMAGA

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 AMERICAN INDUSTRIAL PARTNERS

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 TORNUM GROUP

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 HOFFMANN, INC

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.7 BENTALL ROWLANDS

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 MnM view

- 12.1.8 MYSILO

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.9 SCE SILO CONSTRUCTION & ENGINEERING

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.10 SUKUP MANUFACTURING

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Expansions

- 12.1.10.4 MnM view

- 12.1.11 TSC SILOS

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 MnM view

- 12.1.12 TRANSIL INTERNATIONAL

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 MnM view

- 12.1.13 KONSTRUKTIE QUINTYN GEBR.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 MnM view

- 12.1.14 SRON SILO ENGINEERING CO.

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 MnM view

- 12.1.15 INTRANOX

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 MnM view

- 12.1.16 IPESA

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions/Services offered

- 12.1.16.3 MnM view

- 12.1.17 M.I.P GROUP

- 12.1.17.1 Business overview

- 12.1.17.2 Products/Solutions/Services offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Expansions

- 12.1.17.4 MnM view

- 12.1.18 MICHAL ZPUH

- 12.1.18.1 Business overview

- 12.1.18.2 Products/Solutions/Services offered

- 12.1.18.3 MnM view

- 12.1.19 SIOUX STEEL COMPANY

- 12.1.19.1 Business overview

- 12.1.19.2 Products/Solutions/Services offered

- 12.1.19.3 Recent developments

- 12.1.19.3.1 Deals

- 12.1.19.4 MnM view

- 12.1.20 DEHSETILER MAKINA

- 12.1.20.1 Business overview

- 12.1.20.2 Products/Solutions/Services offered

- 12.1.20.3 MnM view

- 12.1.1 AGI

- 12.2 OTHER PLAYERS

- 12.2.1 COBAN SILO

- 12.2.2 IPRO INDIA

- 12.2.3 OTRIVA SILOS

- 12.2.4 TSI STEELS

- 12.2.5 TSE SILO

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 FARM EQUIPMENT RENTAL MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 FARM EQUIPMENT RENTAL MARKET, BY DRIVE

- 13.4 AGRICULTURE ROBOT MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- 13.4.3 AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS