|

|

市場調査レポート

商品コード

1747191

熱電発電機の世界市場:タイプ別、材質別、温度別、電力別、用途別、業界別、地域別 - 2030年までの予測Thermoelectric Generator Market Type (Multistage, Single-stage), Temperature (<80, 80-500,> 500), Material (Bismuth Telluride, Lead Telluride), Application (Waste Heat, Energy Harvesting, Direct Power), Power, Industry - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 熱電発電機の世界市場:タイプ別、材質別、温度別、電力別、用途別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月27日

発行: MarketsandMarkets

ページ情報: 英文 281 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界の熱電発電機の市場規模は、予測期間中に6.3%のCAGRで拡大し、2025年の10億3,000万米ドルから2030年には14億1,000万米ドルに成長すると予測されています。

世界の熱電発電機(TEG)市場の主な促進要因は、さまざまな産業でエネルギー効率と廃熱回収が重視されるようになっていることです。自動車、製造、発電などの産業は、廃熱を回収して使用可能な電気に変換し、運用コストと環境への影響を削減するためにTEGシステムを採用しています。さらに、低燃費車に対する需要の高まりと、二酸化炭素排出を制限するための厳しい政府規制が、TEG技術の採用をさらに促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | タイプ別、材質別、温度別、電力別、用途別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

中温セグメント(80°C~500°C)は、大量の廃熱が利用可能な様々な産業用途に適しているため、熱電発電機(TEG)市場を独占すると予想されています。自動車、製造、発電などの産業は、この温度範囲内でかなりの廃熱を発生させるため、TEGはこの熱を使用可能な電気に変換する効果的なソリューションとなります。産業界が省エネルギーと排出削減に注力するにつれて、中温TEGの需要は伸びると予想され、市場での主導的地位を確固たるものにしています。

熱電発電機(TEG)市場は、エネルギー需要の増加と信頼性の高いオフグリッド電力ソリューションの必要性から、通信分野で大きな成長が見込まれています。特に遠隔地や農村部の通信塔は、エネルギーへのアクセスや燃料依存の課題にしばしば直面します。TEGは、ディーゼル発電機や自然の熱源からの廃熱を電気に変換し、燃料消費とメンテナンスの必要性を減らすことで、持続可能な代替案を提供します。これは、二酸化炭素排出量を削減し、非電化地域での無停電電力供給を確保することを目指す電気通信事業者にとって、特に価値のあるものです。その結果、通信産業は世界のTEG市場において有望で急成長している応用分野として浮上しています。

米国は、技術革新、エネルギー効率、産業近代化に力を入れているため、世界の熱電発電機(TEG)市場を独占すると予想されています。特に製造業、石油・ガス、自動車などの重工業では、大量のエネルギーが熱として失われています。さらに、Gentherm、Coherent Corp.、Global Power Technologiesといった大手TEG開発企業が、この国の市場をさらに強化しています。これらの企業は、最先端の熱電材料とシステムの研究開発と商業化に多額の投資を行っています。成熟した産業基盤と技術革新主導のエコシステムは、厳しい規制環境とともに、米国を世界の熱電発電機の主要市場として位置づけています。

当レポートでは、世界の熱電発電機市場について調査し、タイプ別、材質別、温度別、電力別、用途別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 熱電発電機市場へのAIの影響

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- 規制状況

- 2025年の米国関税が熱電発電機市場に与える影響

第6章 熱電発電機市場(タイプ別)

- イントロダクション

- シングルステージ

- マルチステージ

第7章 熱電発電機市場(材質別)

- イントロダクション

- テルル化ビスマス

- テルル化鉛

- その他

第8章 熱電発電機市場(温度別)

- イントロダクション

- 低温(80℃未満)

- 中温(80℃~500℃)

- 高温(500°C超)

第9章 熱電発電機市場(電力別)

- イントロダクション

- 低電力(10W未満)

- 中電力(10W~1KW)

- 高電力(>KW超)

第10章 熱電発電機市場(用途別)

- イントロダクション

- 廃熱回収

- エネルギーハーベスティング

- 直接発電

- コージェネレーション

第11章 熱電発電機市場(業界別)

- イントロダクション

- 自動車・輸送

- 航空宇宙・防衛

- 船舶

- 工

- 消費者

- 石油・ガス

- 医療

- データセンター

第12章 熱電発電機市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年~2025年

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- COHERENT CORP.

- GLOBAL POWER TECHNOLOGIES

- KOMATSU LTD.(KELK LTD.)

- FERROTEC HOLDINGS CORPORATION

- KYOCERA CORPORATION

- RMT LTD.

- RIF

- KRYOTHERM

- TELEDYNE TECHNOLOGIES INCORPORATED

- BENTEK SYSTEMS

- O-FLEXX TECHNOLOGIES GMBH

- EVERREDTRONICS LTD.

- PERPETUA POWER BY GRACE TECHNOLOGIES

- その他の企業

- P&N TECHNOLOGY CO., LTD.

- BRIMROSE CORPORATION

- RGS DEVELOPMENT BV

- PL ENGINEERING LTD.

- MICROPELT

- SHEETAK

- HI-Z TECHNOLOGY

- ALIGN SOURCING LLC

- TEC MICROSYSTEMS GMBH

- ANALOG TECHNOLOGIES INC.

- WELLEN TECHNOLOGY CO., LTD.

- SAME SKY

第15章 付録

List of Tables

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH LIMITATIONS

- TABLE 3 RISK ANALYSIS

- TABLE 4 THERMOELECTRIC GENERATORS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE OF THERMOELECTRIC GENERATORS OFFERED BY MAJOR PLAYERS, BY TEMPERATURE (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF THERMOELECTRIC GENERATORS, BY TEMPERATURE, 2021-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF THERMOELECTRIC GENERATORS, BY REGION, 2021-2024 (USD)

- TABLE 8 THERMOELECTRIC GENERATORS MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 11 IMPORT DATA FOR HS CODE 850131-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 EXPORT DATA FOR HS CODE 850131-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 THERMOELECTRIC GENERATORS MARKET: CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 KEY STANDARDS

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 TABLE 3: EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFF

- TABLE 21 THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 22 THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

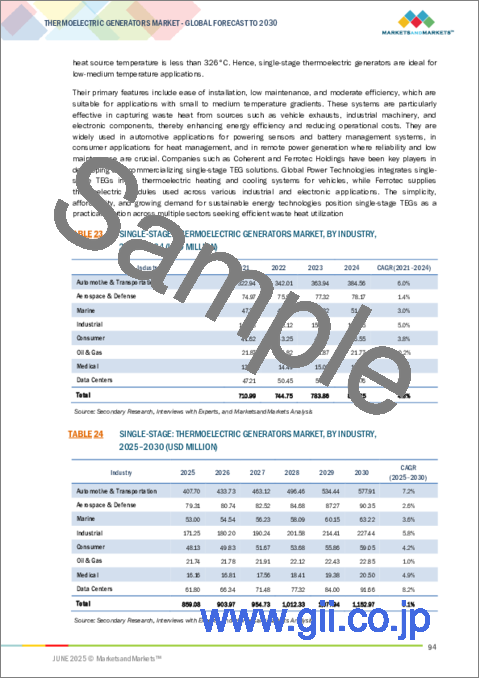

- TABLE 23 SINGLE-STAGE: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 24 SINGLE-STAGE: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 25 MULTI-STAGE: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 26 MULTI-STAGE: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 27 THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 28 THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 29 BISMUTH TELLURIDE: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 30 BISMUTH TELLURIDE: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 31 LEAD TELLURIDE: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 32 LEAD TELLURIDE: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 33 OTHERS: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 34 OTHERS: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 35 THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 36 THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 37 THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2021-2024 (MILLION UNITS)

- TABLE 38 THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2025-2030 (MILLION UNITS)

- TABLE 39 LOW: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 40 LOW: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 41 MEDIUM: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 42 MEDIUM: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 43 HIGH: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 44 HIGH: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45 THERMOELECTRIC GENERATORS MARKET, BY POWER, 2021-2024 (USD MILLION)

- TABLE 46 THERMOELECTRIC GENERATORS MARKET, BY POWER, 2025-2030 (USD MILLION)

- TABLE 47 LOW POWER: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 48 LOW POWER: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 49 MEDIUM POWER: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 50 MEDIUM POWER: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 51 HIGH POWER: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 52 HIGH POWER: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 54 THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 55 WASTE HEAT RECOVERY: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 56 WASTE HEAT RECOVERY: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 57 ENERGY HARVESTING: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 58 ENERGY HARVESTING: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 59 DIRECT POWER GENERATION: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 60 DIRECT POWER GENERATION: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 61 CO-GENERATION: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 62 CO-GENERATION: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 63 THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 64 THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 65 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 66 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 67 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2021-2024 (USD MILLION)

- TABLE 68 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2025-2030 (USD MILLION)

- TABLE 69 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 70 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 71 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 72 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 73 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 74 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 75 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 AUTOMOTIVE & TRANSPORTATION: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 86 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 87 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2021-2024 (USD MILLION)

- TABLE 88 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2025-2030 (USD MILLION)

- TABLE 89 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 90 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 91 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 92 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 93 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 94 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 95 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 100 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 MARINE: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 106 MARINE: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 MARINE: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2021-2024 (USD MILLION)

- TABLE 108 MARINE: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2025-2030 (USD MILLION)

- TABLE 109 MARINE: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 110 MARINE: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 111 MARINE: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 112 MARINE: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 113 MARINE: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 114 MARINE: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 MARINE: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 MARINE: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 MARINE: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 MARINE: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 MARINE: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 120 MARINE: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 MARINE: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 MARINE: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 MARINE: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 MARINE: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 126 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 127 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2021-2024 (USD MILLION)

- TABLE 128 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2025-2030 (USD MILLION)

- TABLE 129 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 130 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 131 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 132 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 133 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 134 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 136 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 137 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 142 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 143 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 144 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 145 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 146 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 147 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2021-2024 (USD MILLION)

- TABLE 148 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2025-2030 (USD MILLION)

- TABLE 149 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 150 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 151 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 152 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 153 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 154 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 155 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 156 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 157 CONSUMER: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 158 CONSUMER: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 159 CONSUMER: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 160 CONSUMER: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 161 CONSUMER: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 162 CONSUMER: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 163 CONSUMER: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 164 CONSUMER: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 165 OIL & GAS: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 166 OIL & GAS: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 OIL & GAS: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2021-2024 (USD MILLION)

- TABLE 168 OIL & GAS: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2025-2030 (USD MILLION)

- TABLE 169 OIL & GAS: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 170 OIL & GAS: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 171 OIL & GAS: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 172 OIL & GAS: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 173 OIL & GAS: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 174 OIL & GAS: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 175 OIL & GAS: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 176 OIL & GAS: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 177 OIL & GAS: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 178 OIL & GAS: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 179 OIL & GAS: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 180 OIL & GAS: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 181 OIL & GAS: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 OIL & GAS: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 OIL & GAS: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 184 OIL & GAS: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 185 MEDICAL: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 186 MEDICAL: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 187 MEDICAL: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2021-2024 (USD MILLION)

- TABLE 188 MEDICAL: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2025-2030 (USD MILLION)

- TABLE 189 MEDICAL: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 190 MEDICAL: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 191 MEDICAL: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 192 MEDICAL: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 193 MEDICAL: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 194 MEDICAL: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 195 MEDICAL: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 196 MEDICAL: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 197 MEDICAL: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 198 MEDICAL: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 199 MEDICAL: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 200 MEDICAL: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 201 MEDICAL: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 202 MEDICAL: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 203 MEDICAL: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 204 MEDICAL: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 205 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 206 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 207 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2021-2024 (USD MILLION)

- TABLE 208 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET, BY POWER, 2025-2030 (USD MILLION)

- TABLE 209 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 210 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 211 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 212 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 213 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 214 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 215 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 216 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 217 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 218 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 219 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 220 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 221 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 222 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 223 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 224 DATA CENTERS: THERMOELECTRIC GENERATORS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 225 THERMOELECTRIC GENERATORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 226 THERMOELECTRIC GENERATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 227 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 228 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 229 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 230 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 231 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 232 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 233 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 234 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 235 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 236 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 237 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 238 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 239 ROW: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 240 ROW: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 241 ROW: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 242 ROW: THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 243 MIDDLE EAST: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 244 MIDDLE EAST: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 245 STRATEGIES ADOPTED BY KEY MARKET PLAYERS, 2022-2025

- TABLE 246 THERMOELECTRIC GENERATORS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 247 THERMOELECTRIC GENERATORS MARKET: REGION FOOTPRINT

- TABLE 248 THERMOELECTRIC GENERATORS MARKET: TYPE FOOTPRINT

- TABLE 249 THERMOELECTRIC GENERATORS MARKET: MATERIAL FOOTPRINT

- TABLE 250 THERMOELECTRIC GENERATORS MARKET: INDUSTRY FOOTPRINT

- TABLE 251 THERMOELECTRIC GENERATORS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 252 THERMOELECTRIC GENERATORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 253 THERMOELECTRIC GENERATORS MARKET: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 254 THERMOELECTRIC GENERATORS MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 255 COHERENT CORP.: COMPANY OVERVIEW

- TABLE 256 COHERENT CORP.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 257 COHERENT CORP.: PRODUCT LAUNCHES

- TABLE 258 COHERENT CORP.: DEALS

- TABLE 259 GLOBAL POWER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 260 GLOBAL POWER TECHNOLOGIES: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 261 GLOBAL POWER TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 262 GLOBAL POWER TECHNOLOGIES: DEALS

- TABLE 263 KOMATSU LTD. (KELK LTD.): COMPANY OVERVIEW

- TABLE 264 KOMATSU LTD. (KELK LTD.): PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 265 FERROTEC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 266 FERROTEC HOLDINGS CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 267 FERROTEC HOLDINGS CORPORATION: DEALS

- TABLE 268 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 269 KYOCERA CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 270 RMT LTD.: COMPANY OVERVIEW

- TABLE 271 RMT LTD.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 272 RIF: COMPANY OVERVIEW

- TABLE 273 RIF: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 274 KRYOTHERM: COMPANY OVERVIEW

- TABLE 275 KRYOTHERM: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 276 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 277 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 278 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

- TABLE 279 BENTEK SYSTEMS: COMPANY OVERVIEW

- TABLE 280 BENTEK SYSTEMS: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 281 O-FLEXX TECHNOLOGIES GMBH: COMPANY OVERVIEW

- TABLE 282 O-FLEXX TECHNOLOGIES GMBH: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 283 EVERREDTRONICS LTD.: COMPANY OVERVIEW

- TABLE 284 EVERREDTRONICS LTD.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 285 PERPETUA POWER BY GRACE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 286 PERPETUA POWER BY GRACE TECHNOLOGIES: PRODUCT/SOLUTIONS/ SERVICES OFFERED

- TABLE 287 P&N TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 288 BRIMROSE CORPORATION: COMPANY OVERVIEW

- TABLE 289 RGS DEVELOPMENT BV: COMPANY OVERVIEW

- TABLE 290 PL ENGINEERING LTD.: COMPANY OVERVIEW

- TABLE 291 MICROPELT: COMPANY OVERVIEW

- TABLE 292 SHEETAK: COMPANY OVERVIEW

- TABLE 293 HI-Z TECHNOLOGY: COMPANY OVERVIEW

- TABLE 294 ALIGN SOURCING LLC: COMPANY OVERVIEW

- TABLE 295 TEC MICROSYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 296 ANALOG TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 297 WELLEN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 298 SAME SKY: COMPANY OVERVIEW

List of Figures

- FIGURE 1 THERMOELECTRIC GENERATORS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 THERMOELECTRIC GENERATORS MARKET: RESEARCH DESIGN

- FIGURE 3 REVENUE GENERATED BY COMPANIES FROM SALES OF THERMOELECTRIC GENERATORS (SUPPLY SIDE)

- FIGURE 4 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION: THERMOELECTRIC GENERATORS MARKET

- FIGURE 8 SINGLE-STAGE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 BISMUTH TELLURIDE SEGMENT TO DOMINATE THERMOELECTRIC GENERATORS MARKET IN 2030

- FIGURE 10 AUTOMOTIVE & TRANSPORTATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 SHIFT IN DEMAND FROM WASTE HEAT RECOVERY TO DIRECT POWER GENERATION TO DRIVE MARKET

- FIGURE 13 MEDIUM TEMPERATURE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 14 MEDIUM POWER SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 15 WASTE HEAT RECOVERY APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR IN THERMOELECTRIC GENERATORS MARKET DURING FORECAST PERIOD

- FIGURE 17 THERMOELECTRIC GENERATORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 CARBON DIOXIDE EMISSIONS, BY REGION, 2011-2021

- FIGURE 19 THERMOELECTRIC GENERATORS MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 20 THERMOELECTRIC GENERATORS MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 21 THERMOELECTRIC GENERATORS MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 22 THERMOELECTRIC GENERATORS MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 23 THERMOELECTRIC GENERATORS MARKET: AI IMPACT ANALYSIS

- FIGURE 24 THERMOELECTRIC GENERATORS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 THERMOELECTRIC GENERATORS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 THERMOELECTRIC GENERATORS MARKET: STAKEHOLDERS IN ECOSYSTEM

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 AVERAGE SELLING PRICE OF THERMOELECTRIC GENERATORS OFFERED BY MAJOR PLAYERS, BY TEMPERATURE

- FIGURE 29 AVERAGE SELLING PRICE TREND OF THERMOELECTRIC GENERATORS, BY TEMPERATURE, 2021-2024

- FIGURE 30 AVERAGE SELLING PRICE TREND OF THERMOELECTRIC GENERATORS, BY REGION, 2021-2024

- FIGURE 31 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 32 THERMOELECTRIC GENERATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 35 IMPORT SCENARIO FOR HS CODE 850131-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRY, 2020-2024

- FIGURE 36 EXPORT DATA FOR HS CODE 850131-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRY, 2020-2024

- FIGURE 37 TOP PATENT APPLICANTS AND OWNERS, 2014-2024

- FIGURE 38 THERMOELECTRIC GENERATORS MARKET, BY TYPE

- FIGURE 39 SINGLE-STAGE SEGMENT TO ACCOUNT FOR LARGER SHARE OF THERMOELECTRIC GENERATORS MARKET DURING FORECAST PERIOD

- FIGURE 40 THERMOELECTRIC GENERATORS MARKET, BY MATERIAL

- FIGURE 41 BISMUTH TELLURIDE TO ACCOUNT FOR LARGEST SHARE OF THERMOELECTRIC GENERATORS MARKET DURING FORECAST PERIOD

- FIGURE 42 THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE

- FIGURE 43 MEDIUM TEMPERATURE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF THERMOELECTRIC GENERATORS MARKET DURING FORECAST PERIOD

- FIGURE 44 THERMOELECTRIC GENERATORS MARKET, BY POWER

- FIGURE 45 MEDIUM POWER TO ACCOUNT FOR LARGEST SHARE OF THERMOELECTRIC GENERATORS MARKET DURING FORECAST PERIOD

- FIGURE 46 THERMOELECTRIC GENERATORS MARKET, BY APPLICATION

- FIGURE 47 WASTE HEAT RECOVERY TO ACCOUNT FOR LARGEST SHARE OF THERMOELECTRIC GENERATORS MARKET DURING FORECAST PERIOD

- FIGURE 48 THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY

- FIGURE 49 AUTOMOTIVE & TRANSPORTATION TO ACCOUNT FOR LARGEST SHARE OF THERMOELECTRIC GENERATORS MARKET DURING FORECAST PERIOD

- FIGURE 50 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF THERMOELECTRIC GENERATORS MARKET DURING FORECAST PERIOD

- FIGURE 51 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET SNAPSHOT

- FIGURE 52 EUROPE: THERMOELECTRIC GENERATORS MARKET SNAPSHOT

- FIGURE 53 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET SNAPSHOT

- FIGURE 54 THERMOELECTRIC GENERATORS MARKET: REVENUE ANALYSIS, 2020-2024

- FIGURE 55 THERMOELECTRIC GENERATORS MARKET SHARE ANALYSIS, 2024

- FIGURE 56 COMPANY VALUATION, 2024

- FIGURE 57 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 58 BRAND/PRODUCT COMPARISON

- FIGURE 59 THERMOELECTRIC GENERATORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 60 THERMOELECTRIC GENERATORS MARKET: COMPANY FOOTPRINT

- FIGURE 61 THERMOELECTRIC GENERATORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 62 COHERENT CORP.: COMPANY SNAPSHOT

- FIGURE 63 KOMATSU LTD. (KELK LTD.): COMPANY SNAPSHOT

- FIGURE 64 KYOCERA CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

The global thermoelectric generator market is expected to grow from USD 1.03 billion in 2025 to USD 1.41 billion in 2030 at a CAGR of 6.3% during the forecast period. The primary driver of the global thermoelectric generator (TEG) market is the increasing emphasis on energy efficiency and waste heat recovery across various industries. Industries such as automotive, manufacturing, and power generation are adopting TEG systems to capture and convert waste heat into usable electricity, reducing operational costs and environmental impact. Additionally, the growing demand for fuel-efficient vehicles and stringent government regulations to limit carbon emissions are further propelling the adoption of TEG technology.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Type, Temperature, Material, Application, Power, Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Medium (80°-500°C) temperature segment is estimated to contribute a significant share to the thermoelectric generator market."

The medium-temperature segment (80°C to 500°C) is anticipated to dominate the thermoelectric generator (TEG) market due to its suitability for various industrial applications where significant waste heat is available. Industries such as automotive, manufacturing, and power generation produce substantial waste heat within this temperature range, making TEGs an effective solution for converting this heat into usable electricity. As industries focus on energy conservation and emission reduction, the demand for medium-temperature TEGs is expected to grow, solidifying their leading position in the market.

"The thermoelectric generator market in the telecom industry is projected to grow significantly during the forecast period."

The thermoelectric generator (TEG) market is poised to experience significant growth in the telecommunications sector due to increasing energy demand and the need for reliable, off-grid power solutions. Telecom towers, especially in remote or rural areas, often face challenges with energy access and fuel dependence. TEGs offer a sustainable alternative by converting waste heat from diesel generators or natural heat sources into electricity, reducing fuel consumption and maintenance requirements. This is particularly valuable for telecom operators aiming to reduce their carbon footprint and ensure uninterrupted power supply in off-grid locations. As a result, the telecommunications industry is emerging as a promising and fast-growing application area within the global TEG market.

"The US is projected to dominate the thermoelectric generator market."

The US is expected to dominate the global thermoelectric generator (TEG) market due to its strong focus on technological innovation, energy efficiency, and industrial modernization. The country's widespread emphasis on waste heat recovery is a major driver, especially across heavy industries such as manufacturing, oil & gas, and automotive, where vast amounts of energy are lost as heat. Moreover, leading TEG developers such as Gentherm, Coherent Corp., and Global Power Technologies further strengthen the country's market. These companies invest heavily in R&D and commercializing advanced thermoelectric materials and systems. The mature industrial base and innovation-driven ecosystem, along with a stringent regulatory environment, position the US as the leading market for thermoelectric generators globally.

In-depth interviews have been conducted with Chief Executive Officers (CEOs), Directors, and other executives from various key organizations operating in the thermoelectric generator market.

- By Company Type: Tier 1 - 42%, Tier 2 - 37%, and Tier 3 - 21%

- By Designation: C-level Executives - 48%, Directors - 33%, and Others - 19%

- By Region: North America - 35%, Europe - 18%, Asia Pacific - 40%, and RoW - 7%

The study includes an in-depth competitive analysis of these key players in the thermoelectric generator market, with their company profiles, recent developments, and key market strategies. The key players in the thermoelectric generator market include Coherent Inc. (US), Global Power Technologies (Canada), Ferrotec Holdings (Japan), Komatsu Ltd. (Japan), and Kyocera Corporation (Japan).

Research Coverage

This research report categorizes the thermoelectric generator market by type, power, temperature, material, application, industry, and region (North America, Europe, Asia Pacific, and RoW). The report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the thermoelectric generator market. This report covers a competitive analysis of upcoming thermoelectric generator market startups.

Reasons to buy this report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the thermoelectric generator market and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for waste heat recovery applications), restraints (High initial cost, low efficiency), opportunities (Incorporation in various sectors), and challenges (Structural complexities) influencing the growth of the thermoelectric generator market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the thermoelectric generator market

- Market Development: Comprehensive information about lucrative markets-the report analyses the thermoelectric generator market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the thermoelectric generator market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the thermoelectric generator market, such as Coherent Inc. (US), Global Power Technologies (Canada), Ferrotec Holdings (Japan), Komatsu Ltd. (Japan), and Kyocera Corporation (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Intended participants and key opinion leaders

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 FACTOR ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN THERMOELECTRIC GENERATORS MARKET

- 4.2 THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE

- 4.3 THERMOELECTRIC GENERATORS MARKET, BY POWER

- 4.4 THERMOELECTRIC GENERATORS MARKET, BY APPLICATION

- 4.5 THERMOELECTRIC GENERATORS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High demand for waste heat recovery and direct power generation

- 5.2.1.2 Need for fuel efficiency amid stringent emission control norms

- 5.2.1.3 Durable and maintenance-free power source

- 5.2.2 RESTRAINTS

- 5.2.2.1 Low efficiency of thermoelectric generators

- 5.2.2.2 High initial cost and lack of skilled personnel

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Ongoing research and development to enhance performance

- 5.2.3.2 Increasing adoption of thermoelectric generators across various sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability of prominent substitutes and structural complexities

- 5.2.1 DRIVERS

- 5.3 AI IMPACT ON THERMOELECTRIC GENERATORS MARKET

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.4.1 RESEARCH AND DEVELOPMENT

- 5.4.2 MANUFACTURERS

- 5.4.3 DISTRIBUTION/RESELLERS

- 5.4.4 ASSEMBLERS/INSTALLERS/INTEGRATORS

- 5.4.5 END USERS

- 5.4.6 AFTER-SALES SERVICES

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TEMPERATURE

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Automotive exhaust thermoelectric generators

- 5.9.1.2 Wearable thermoelectric generators

- 5.9.1.3 Solar thermoelectric generators

- 5.9.1.4 Radioisotope thermoelectric generators

- 5.9.1.5 Advancements in thermoelectric materials

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Flexible thermoelectric materials

- 5.9.2.2 Self-healing wearable thermoelectric devices

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Miniature thermoelectric generators

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 THERMOELECTRIC GENERATORS IN SPACE

- 5.12.2 GLOBAL POWER TECHNOLOGIES DEPLOYS MODEL 1120 TEGS TO LARGE UPSTREAM OPERATOR IN NORTHEASTERN USA

- 5.12.3 DAGARTECH'S CUSTOMIZED GENERATOR SETS FOR LARGEST POWER GENERATOR IN MEXICO

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 850131)

- 5.13.2 EXPORT SCENARIO (HS CODE 850131)

- 5.14 PATENT ANALYSIS

- 5.14.1 LIST OF MAJOR PATENTS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS

- 5.17 2025 US TARIFF IMPACT ON THERMOELECTRIC GENERATORS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 KEY IMPACTS ON VARIOUS COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 THERMOELECTRIC GENERATORS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 SINGLE-STAGE

- 6.2.1 WIDE ADOPTION IN LOW-MEDIUM TEMPERATURE APPLICATIONS TO DRIVE MARKET

- 6.3 MULTI-STAGE

- 6.3.1 HIGH EFFICIENCY AND RELIABILITY IN EXTREME ENVIRONMENTS AND ENERGY RECOVERY APPLICATIONS TO DRIVE DEMAND

7 THERMOELECTRIC GENERATORS MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- 7.2 BISMUTH TELLURIDE

- 7.2.1 WIDE ADOPTION IN WASTE HEAT RECOVERY APPLICATIONS TO DRIVE MARKET

- 7.3 LEAD TELLURIDE

- 7.3.1 HIGH EFFICIENCY, THERMAL STABILITY, AND PERFORMANCE IN INDUSTRIAL AND AEROSPACE APPLICATIONS TO DRIVE MARKET

- 7.4 OTHERS

8 THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE

- 8.1 INTRODUCTION

- 8.2 LOW (<80°C)

- 8.2.1 DEMAND FOR ENERGY HARVESTING IN POWER ELECTRONICS, SENSORS, AND LOW-POWER IOT DEVICES TO DRIVE MARKET

- 8.3 MEDIUM (80°C TO 500°C)

- 8.3.1 GROWING ADOPTION IN AUTOMOTIVE, INDUSTRIAL, AND TELECOM TO RECOVER WASTE HEAT TO DRIVE MARKET GROWTH

- 8.4 HIGH (>500°C)

- 8.4.1 DEMAND FOR EFFICIENT POWER GENERATION IN SPACE MISSIONS, NUCLEAR FACILITIES, AND HIGH-HEAT INDUSTRIAL PROCESSES TO FUEL GROWTH

9 THERMOELECTRIC GENERATORS MARKET, BY POWER

- 9.1 INTRODUCTION

- 9.2 LOW POWER (<10W)

- 9.2.1 ADOPTION IN IOT DEVICES, WEARABLES, AND REMOTE SENSORS TO DRIVE MARKET

- 9.3 MEDIUM POWER (10W TO 1KW)

- 9.3.1 NEED FOR COST-EFFECTIVE ENERGY RECOVERY IN AUTOMOTIVE AND RENEWABLE ENERGY SECTORS TO SUPPORT MARKET GROWTH

- 9.4 HIGH POWER (>1KW)

- 9.4.1 NEED FOR LARGE-SCALE WASTE HEAT RECOVERY, ENERGY EFFICIENCY, AND POWER GENERATION IN HEAVY INDUSTRIES TO DRIVE DEMAND

10 THERMOELECTRIC GENERATORS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 WASTE HEAT RECOVERY

- 10.2.1 ADOPTION IN AUTOMOTIVE AND INDUSTRIAL SECTORS TO DRIVE MARKET

- 10.3 ENERGY HARVESTING

- 10.3.1 RISING DEMAND FOR SUSTAINABLE ENERGY AND ABILITY TO CONVERT AMBIENT HEAT INTO POWER TO DRIVE MARKET GROWTH

- 10.4 DIRECT POWER GENERATION

- 10.4.1 NEED FOR MAINTENANCE-FREE POWER IN REMOTE AND OFF-GRID LOCATIONS TO DRIVE DEMAND

- 10.5 CO-GENERATION

- 10.5.1 NEED FOR EFFICIENT ENERGY IN VARIOUS INDUSTRIAL SETTING TO DRIVE GROWTH

11 THERMOELECTRIC GENERATORS MARKET, BY INDUSTRY

- 11.1 INTRODUCTION

- 11.2 AUTOMOTIVE & TRANSPORTATION

- 11.2.1 NEED FOR THERMOELECTRIC WASTE HEAT RECOVERY DEVICES TO IMPROVE FUEL ECONOMY TO DRIVE DEMAND

- 11.2.2 ICE-POWERED VEHICLES

- 11.2.3 ELECTRIC VEHICLES

- 11.3 AEROSPACE & DEFENSE

- 11.3.1 INCREASING ADOPTION IN MILITARY AND COMMERCIAL APPLICATIONS TO FUEL MARKET GROWTH

- 11.3.2 AVIATION

- 11.3.2.1 Civil aircraft

- 11.3.2.2 Military aircraft

- 11.3.2.3 Unmanned aerial vehicles

- 11.3.2.4 Defense

- 11.4 MARINE

- 11.4.1 NEED FOR WASTE HEAT ENERGY RECOVERY TO POWER SENSORS AND ELECTRONICS CONTROL ON SHIPS TO DRIVE MARKET

- 11.4.2 MILITARY SHIPS

- 11.4.3 COMMERCIAL SHIPS

- 11.5 INDUSTRIAL

- 11.5.1 MANUFACTURING AND CHEMICAL PROCESSING APPLICATIONS TO DRIVE MARKET GROWTH

- 11.5.2 CHEMICAL PROCESSING

- 11.5.3 ALUMINUM & STEEL FOUNDRY

- 11.5.4 GLASS & METAL CASTING FOUNDRY

- 11.5.5 MINING

- 11.6 CONSUMER

- 11.6.1 GROWING DEMAND FOR HEART MONITORING DEVICES TO INCREASE ADOPTION

- 11.6.2 WEARABLES

- 11.6.3 CONSUMER ELECTRONICS

- 11.7 OIL & GAS

- 11.7.1 DEMAND FOR POWER SOURCES IN REMOTE AREAS TO FUEL MARKET GROWTH

- 11.8 MEDICAL

- 11.8.1 INCREASED ADOPTION IN MEDICAL DEVICES TO HARVEST AMBIENT HEAT TO SUPPORT MARKET GROWTH

- 11.8.2 IMPLANTABLE 175 11.8.3 WEARABLES

- 11.9 DATA CENTERS

- 11.9.1 INCREASING FOCUS ON ENHANCING SUSTAINABILITY TO FUEL DEMAND

12 THERMOELECTRIC GENERATORS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Significant growth in telecom, aerospace, and automotive industries to fuel demand

- 12.2.3 CANADA

- 12.2.3.1 Need for waste heat recovery in industrial and medical sectors fuelling market growth

- 12.2.4 MEXICO

- 12.2.4.1 Growing industrial and energy sectors fueling demand for thermoelectric generators

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Growing automotive industry to fuel demand

- 12.3.3 UK

- 12.3.3.1 Expanding manufacturing & processing sector driving demand for thermoelectric generators

- 12.3.4 FRANCE

- 12.3.4.1 Government initiatives for digital transformation to support market growth

- 12.3.5 ITALY

- 12.3.5.1 Government initiatives to expand manufacturing sector boosting demand

- 12.3.6 SPAIN

- 12.3.6.1 Increasing production capacity of automotive sector to boost adoption

- 12.3.7 POLAND

- 12.3.7.1 Focus on sustainability across various sectors boosting demand

- 12.3.8 NORDICS

- 12.3.8.1 Strong regional focus on energy efficiency, sustainability, and technological innovation to fuel growth

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Rising demand from manufacturing sector to boost market

- 12.4.3 JAPAN

- 12.4.3.1 Growing focus on energy efficiency and carbon neutrality to drive market

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Presence of established consumer, automotive, and other industries to drive demand

- 12.4.5 INDIA

- 12.4.5.1 Government initiatives and industrialization to drive market

- 12.4.6 AUSTRALIA

- 12.4.6.1 Strong emphasis on development of renewable sector to support market growth

- 12.4.7 INDONESIA

- 12.4.7.1 Rapid advancements in healthcare and manufacturing sectors to increase adoption

- 12.4.8 MALAYSIA

- 12.4.8.1 Expansion in manufacturing, chemical processing, and oil & gas sectors to drive market

- 12.4.9 THAILAND

- 12.4.9.1 Rapidly expanding renewable energy sector to fuel demand

- 12.4.10 VIETNAM

- 12.4.10.1 Rapid industrial growth and increasing energy needs to increase demand

- 12.4.11 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Bahrain

- 12.5.2.1.1 Government initiative to modernize industries fueling growth

- 12.5.2.2 Kuwait

- 12.5.2.2.1 Expanding energy sector fueling market growth

- 12.5.2.3 Oman

- 12.5.2.3.1 Focus on diversifying energy mix and achieving sustainability goals to support market growth

- 12.5.2.4 Qatar

- 12.5.2.4.1 Diversification of energy sector to increase adoption

- 12.5.2.5 Saudi Arabia

- 12.5.2.5.1 Increasing focus on renewable energy sector to fuel adoption

- 12.5.2.6 UAE

- 12.5.2.6.1 Growing industrial sector to fuel demand

- 12.5.2.7 Rest of Middle East

- 12.5.2.1 Bahrain

- 12.5.3 AFRICA

- 12.5.3.1 South Africa

- 12.5.3.1.1 Presence of diverse industrial landscape to support market growth

- 12.5.3.2 Rest of Africa

- 12.5.3.1 South Africa

- 12.5.4 SOUTH AMERICA

- 12.5.4.1 Expansion of industrial sector to propel market

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 13.3 REVENUE ANALYSIS, 2021-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Type footprint

- 13.7.5.4 Material footprint

- 13.7.5.5 Industry footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 COHERENT CORP.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MNM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 GLOBAL POWER TECHNOLOGIES

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.4 MNM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 KOMATSU LTD. (KELK LTD.)

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MNM view

- 14.1.3.3.1 Key strengths

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses and competitive threats

- 14.1.4 FERROTEC HOLDINGS CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MNM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 KYOCERA CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MNM view

- 14.1.5.3.1 Key strengths

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 RMT LTD.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.7 RIF

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 KRYOTHERM

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 TELEDYNE TECHNOLOGIES INCORPORATED

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.10 BENTEK SYSTEMS

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.11 O-FLEXX TECHNOLOGIES GMBH

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.12 EVERREDTRONICS LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 PERPETUA POWER BY GRACE TECHNOLOGIES

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.1 COHERENT CORP.

- 14.2 OTHER PLAYERS

- 14.2.1 P&N TECHNOLOGY CO., LTD.

- 14.2.2 BRIMROSE CORPORATION

- 14.2.3 RGS DEVELOPMENT BV

- 14.2.4 PL ENGINEERING LTD.

- 14.2.5 MICROPELT

- 14.2.6 SHEETAK

- 14.2.7 HI-Z TECHNOLOGY

- 14.2.8 ALIGN SOURCING LLC

- 14.2.9 TEC MICROSYSTEMS GMBH

- 14.2.10 ANALOG TECHNOLOGIES INC.

- 14.2.11 WELLEN TECHNOLOGY CO., LTD.

- 14.2.12 SAME SKY

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS