|

|

市場調査レポート

商品コード

1745107

データセンターラックの世界市場 (~2030年):ラックタイプ (オープンフレーム・密閉型)・タイプ (サーバーラック・ネットワークラック)・ラック高さ (42U以下・43U~52U)・ラック幅 (19インチ・23インチ)・データセンタータイプ (エンタープライズ・コロケーション・ハイパースケール) 別Data Center Rack Market by Rack Type (Open Frame, Enclosed), Type (Server Racks, Network Racks), Rack Height (42U & Below, 43U up to 52U), Rack Width (19 Inch, 23 Inch), Data Center Type (Enterprise, Colocation, Hyperscale) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| データセンターラックの世界市場 (~2030年):ラックタイプ (オープンフレーム・密閉型)・タイプ (サーバーラック・ネットワークラック)・ラック高さ (42U以下・43U~52U)・ラック幅 (19インチ・23インチ)・データセンタータイプ (エンタープライズ・コロケーション・ハイパースケール) 別 |

|

出版日: 2025年06月03日

発行: MarketsandMarkets

ページ情報: 英文 359 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のデータセンターラックの市場規模は、2025年の51億7,000万米ドルから、予測期間中はCAGR 12.7%で推移し、2030年には94億2,000万米ドルに成長すると予測されています。

クラウドコンピューティング、IoT、AI、ビッグデータ分析の台頭により、データセンターが国際的に拡大する中で、データセンターラックの使用が広く進んでいます。コロケーションやハイパースケールデータセンターに対する需要の急増が高密度かつエネルギー効率の高いスケーラブルなラックシステムの使用を促進しています。さらに、エッジコンピューティングの台頭により、遠隔地や混雑した場所に適した、コンパクトで柔軟性があり、かつ堅牢なラックが必要とされています。エネルギー効率と持続可能な選択肢への関心の高まりは、組織に対して、エアフローシステムを改善し、先進的な冷却機能を組み合わせたラックの選定を促しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 米ドル(米ドル) |

| 部門別 | 提供製品・タイプ・ラック高さ・ラック幅・データセンター規模・データセンタータイプ・オンプレミス/エンタープライズ・産業別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

”サービス別では、設置・展開部門が予測期間中に最大の市場シェアを占める見通し"

設置・展開部門は、ますます複雑化するインフラのシームレスな統合の必要性が高まっていることから、予測期間中に最大の市場シェアを占めると予想されています。データセンターが高密度コンピューティングやエッジ展開に沿って発展していく中で、組織やコロケーションベンダーは、ラックの構成、ケーブルの配線および管理、エアフローの計画、電力供給の最適化において、プロフェッショナルなサービスに注目しています。

専門家による展開サービスは、ダウンタイムの削減、規制遵守の確保、データセンター運用の市場投入までの時間短縮に貢献し、急速に変化するデジタル経済において極めて重要なものとなっています。さらに、モジュール式およびプレハブ型のデータセンターの利用増加により、効果的な展開サービスへの需要が高まっています。ハイパースケーラー、クラウドサービスプロバイダー、および企業が増加するデータ需要に対応するためにデータセンターの存在感を高め続けている中、設置・展開部門は、効果的でスケーラブル、かつコスト効率の良いインフラ展開を引き続き支える存在となるでしょう。

”地域別では、アジア太平洋地域が予測期間中に最も高いCAGRで成長する見込み”

デジタルトランスフォーメーションの進展、クラウドの急速な採用、5Gおよびエッジインフラの展開を背景に、アジア太平洋地域は、世界的に最も急成長している地域として独自の地位を築いています。中国、インド、日本がこの成長軌道の先頭に立っています。中国は最大の市場であり、国内の大手企業によるハイパースケールデータセンターへの大規模な投資と、New Infrastructure Planなどの政府支援により推進されています。インドは最も急成長している国であり、スタートアップを大規模に支援するDigital Indiaキャンペーンや、グローバル企業によるクラウド展開の拡大が成長を後押ししています。

AIやビッグデータ分析など、高密度のコンピューティングワークロードを支えるために、電力および冷却を統合した密閉型ラックの需要が高まっています。ハイパースケールからエッジに至るさまざまな環境要件に対応するため、モジュール型、耐震型、壁掛け型構成のラックが人気を集めています。さらに、スペース上の制約や環境規制の影響を受けて、シンガポールや日本では、持続可能でエネルギー効率の高いラックソリューションが求められています。

当レポートでは、世界のデータセンターラックの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要・業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界動向

- データセンターラック市場のこれまでの経緯

- 顧客の事業に影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- エコシステム/市場マップ

- 技術分析

- 特許分析

- 貿易分析

- ケーススタディ分析

- 主な会議とイベント

- 現在のビジネスモデルと新興ビジネスモデル

- データセンターラック実装のベストプラクティス

- ツール、フレームワーク、テクニック

- データセンターラック市場の将来情勢

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- 投資と資金調達のシナリオ

- AIと生成AI:イントロダクション

- 2025年の米国関税の影響- 概要

- ラック深度・主要企業別の提供製品の分析

第6章 データセンターラック市場:提供製品別

- ソリューション

- ラックタイプ

- サービス

- デザイン&コンサルティング

- インストール・展開

- サポート・メンテナンス

第7章 データセンターラック市場:タイプ別

- サーバーラック

- ネットワークラック

第8章 データセンターラック市場:ラック高さ別

- 42U以下

- 43U-52U

- 52U超

第9章 データセンターラック市場:ラック幅別

- 19インチ

- 23インチ

- その他

第10章 データセンターラック市場:データセンター規模別

- 小規模・中規模データセンター

- 大規模データセンター

第11章 データセンターラック市場:データセンタータイプ別

- オンプレミス/エンタープライズ

- コロケーション

- ハイパースケール

第12章 オンプレミス/エンタープライズ業界別データセンターラック市場

- BFSI

- IT・通信

- 政府・防衛

- 小売

- 製造

- エネルギー・公益事業

- ヘルスケア

- その他

第13章 地域別データセンター市場

- 北米

- 市場促進要因

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- 市場促進要因

- マクロ経済見通し

- 西欧

- 南欧州

- 北欧

- 東欧

- アジア太平洋

- 市場促進要因

- マクロ経済見通し

- 中国

- 日本

- インド

- 香港

- その他

- 中東・アフリカ

- 市場促進要因

- マクロ経済見通し

- GCC諸国

- 南アフリカ

- その他

- ラテンアメリカ

- 市場促進要因

- マクロ経済見通し

- ブラジル

- メキシコ

- その他

第14章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- ブランド/製品比較

- 企業評価と財務指標

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- SCHNEIDER ELECTRIC

- HPE

- RITTAL

- EATON

- VERTIV

- DELL TECHNOLOGIES

- FUJITSU

- IBM

- LEGRAND

- CISCO

- その他の企業

- COMMSCOPE

- ORACLE

- BELDEN

- PANDUIT

- LENOVO

- BLACK BOX

- HUAWEI

- NEC CORPORATION

- ASUS

- NVENT

- スタートアップ/SME

- GREAT LAKES DATA RACKS & CABINETS

- IMS ENGINEERED PRODUCTS

- CHEVAL

- YOTTA INFRASTRUCTURE

- CHATSWORTH PRODUCTS

- IRON SYSTEMS

- INSPUR SYSTEMS

- RACKBANK DATACENTERS

- VANTAGE DATA CENTERS

- ALIGNED DATA CENTERS

第16章 隣接市場/関連市場

第17章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2021-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY RACK HEIGHT, 2025

- TABLE 4 INDICATIVE PRICING ANALYSIS OF DATA CENTER RACK MARKET

- TABLE 5 DATA CENTER RACK MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 6 LIST OF MAJOR PATENTS

- TABLE 7 EXPORT SCENARIO FOR HS CODE 8471, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 8 IMPORT SCENARIO FOR HS CODE 8471, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 9 DATA CENTER RACK MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- TABLE 10 AVERAGE TARIFF

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 DATA CENTER RACK MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ON-PREMISES/ ENTERPRISE VERTICALS (%)

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE ON-PREMISES/ENTERPRISE VERTICALS

- TABLE 18 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR DATA CENTER RACK

- TABLE 20 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON DATA CENTER RACK MARKET DUE TO TARIFF IMPACT

- TABLE 21 OFFERING BY RACK DEPTH, BY KEY PLAYERS

- TABLE 22 DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 23 DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 24 DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 25 DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 26 SOLUTIONS: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 SOLUTIONS: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 OPEN FRAME: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 OPEN FRAME: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 ENCLOSED: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 ENCLOSED: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 OTHERS: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 OTHERS: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 SERVICES: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 SERVICES: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 DESIGN & CONSULTING SERVICES: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 DESIGN & CONSULTING SERVICES: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 INSTALLATION & DEPLOYMENT SERVICES: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 INSTALLATION & DEPLOYMENT SERVICES: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 SUPPORT & MAINTENANCE SERVICES: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 SUPPORT & MAINTENANCE SERVICES: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 DATA CENTER RACK MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 43 DATA CENTER RACK MARKET, BY TYPE, 2025-2030 (USD MILLION)

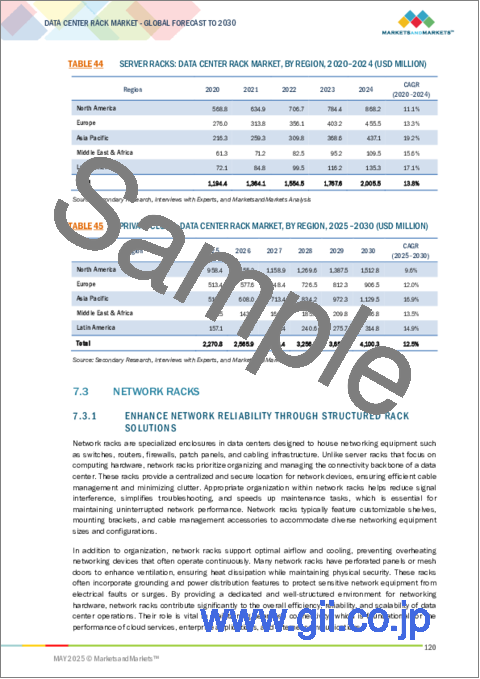

- TABLE 44 SERVER RACKS: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 PRIVATE CLOUD: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 NETWORK RACKS: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 NETWORK RACKS: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 DATA CENTER RACK MARKET, BY RACK HEIGHT, 2020-2024 (USD MILLION)

- TABLE 49 DATA CENTER RACK MARKET, BY RACK HEIGHT, 2025-2030 (USD MILLION)

- TABLE 50 42U AND BELOW: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 42U AND BELOW: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 43U-52U: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 43U-52U: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 ABOVE 52U: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 ABOVE 52U: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 DATA CENTER RACK MARKET, BY RACK WIDTH, 2020-2024 (USD MILLION)

- TABLE 57 DATA CENTER RACK MARKET, BY RACK WIDTH, 2025-2030 (USD MILLION)

- TABLE 58 19 INCHES: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 19 INCHES: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 23 INCHES: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 23 INCHES: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 OTHER RACK WIDTHS: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 OTHER RACK WIDTHS: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 65 DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 66 SMALL & MID-SIZED DATA CENTERS: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 SMALL & MID-SIZED DATA CENTERS: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 LARGE DATA CENTERS: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 LARGE DATA CENTERS: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 DATA CENTER RACK MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 71 DATA CENTER RACK MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 72 ON-PREMISES/ENTERPRISE: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 ON-PREMISES/ENTERPRISE: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 COLOCATION: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 COLOCATION: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 HYPERSCALE: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 HYPERSCALE: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICAL, 2020-2024 (USD MILLION)

- TABLE 79 DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICAL, 2025-2030 (USD MILLION)

- TABLE 80 BFSI: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 BFSI: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 IT & TELECOM: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 IT & TELECOM: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 GOVERNMENT & DEFENSE: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 GOVERNMENT & DEFENSE: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 RETAIL: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 RETAIL: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 MANUFACTURING: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 MANUFACTURING: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 ENERGY & UTILITIES: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 91 ENERGY & UTILITIES: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 HEALTHCARE: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 HEALTHCARE: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 OTHER VERTICALS: DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 95 OTHER VERTICALS: DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 DATA CENTER RACK MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 97 DATA CENTER RACK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: DATA CENTER RACK MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: DATA CENTER RACK MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: DATA CENTER RACK MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 105 NORTH AMERICA: DATA CENTER RACK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: DATA CENTER RACK MARKET, BY RACK HEIGHT, 2020-2024 (USD MILLION)

- TABLE 107 NORTH AMERICA: DATA CENTER RACK MARKET, BY RACK HEIGHT, 2025-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: DATA CENTER RACK MARKET, BY RACK WIDTH, 2020-2024 (USD MILLION)

- TABLE 109 NORTH AMERICA: DATA CENTER RACK MARKET, BY RACK WIDTH, 2025-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 111 NORTH AMERICA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: DATA CENTER RACK MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: DATA CENTER RACK MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICAL, 2020-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICAL, 2025-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: DATA CENTER RACK MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 117 NORTH AMERICA: DATA CENTER RACK MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 US: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 119 US: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 120 US: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 121 US: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 122 US: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 123 US: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 124 CANADA: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 125 CANADA: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 126 CANADA: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 127 CANADA: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 128 CANADA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 129 CANADA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 131 EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 133 EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: DATA CENTER RACK MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 135 EUROPE: DATA CENTER RACK MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: DATA CENTER RACK MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 137 EUROPE: DATA CENTER RACK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: DATA CENTER RACK MARKET, BY RACK HEIGHT, 2020-2024 (USD MILLION)

- TABLE 139 EUROPE: DATA CENTER RACK MARKET, BY RACK HEIGHT, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: DATA CENTER RACK MARKET, BY RACK WIDTH, 2020-2024 (USD MILLION)

- TABLE 141 EUROPE: DATA CENTER RACK MARKET, BY RACK WIDTH, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 143 EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 144 EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 145 EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 146 EUROPE: DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICAL, 2020-2024 (USD MILLION)

- TABLE 147 EUROPE: DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICAL, 2025-2030 (USD MILLION)

- TABLE 148 EUROPE: DATA CENTER RACK MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 149 EUROPE: DATA CENTER RACK MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 WESTERN EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 151 WESTERN EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 152 WESTERN EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 153 WESTERN EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 154 WESTERN EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 155 WESTERN EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 156 WESTERN EUROPE: DATA CENTER RACK MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 157 WESTERN EUROPE: DATA CENTER RACK MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 158 UK: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 159 UK: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 160 UK: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 161 UK: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 162 UK: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 163 UK: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 164 GERMANY: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 165 GERMANY: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 166 GERMANY: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 167 GERMANY: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 168 GERMANY: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 169 GERMANY: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 170 FRANCE: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 171 FRANCE: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 172 FRANCE: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 173 FRANCE: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 174 FRANCE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 175 FRANCE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 176 REST OF WESTERN EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 177 REST OF WESTERN EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 178 REST OF WESTERN EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 179 REST OF WESTERN EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 180 REST OF WESTERN EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 181 REST OF WESTERN EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 182 SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 183 SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 184 SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 185 SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 186 SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 187 SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 188 SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 189 SOUTHERN EUROPE: DATA CENTER RACK MARKET, COUNTRY, 2025-2030 (USD MILLION)

- TABLE 190 ITALY: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 191 ITALY: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 192 ITALY: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 193 ITALY: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 194 ITALY: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 195 ITALY: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 196 REST OF SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 197 REST OF SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 198 REST OF SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 199 REST OF SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 200 REST OF SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 201 REST OF SOUTHERN EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 202 NORTHERN EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 203 NORTHERN EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 204 NORTHERN EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 205 NORTHERN EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 206 NORTHERN EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 207 NORTHERN EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 208 EASTERN EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 209 EASTERN EUROPE: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 210 EASTERN EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 211 EASTERN EUROPE: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 212 EASTERN EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 213 EASTERN EUROPE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 214 ASIA PACIFIC: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 215 ASIA PACIFIC: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 216 ASIA PACIFIC: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 217 ASIA PACIFIC: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 218 ASIA PACIFIC: DATA CENTER RACK MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 219 ASIA PACIFIC: DATA CENTER RACK MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 220 ASIA PACIFIC: DATA CENTER RACK MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 221 ASIA PACIFIC: DATA CENTER RACK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 222 ASIA PACIFIC: DATA CENTER RACK MARKET, BY RACK HEIGHT, 2020-2024 (USD MILLION)

- TABLE 223 ASIA PACIFIC: DATA CENTER RACK MARKET, BY RACK HEIGHT, 2025-2030 (USD MILLION)

- TABLE 224 ASIA PACIFIC: DATA CENTER RACK MARKET, BY RACK WIDTH, 2020-2024 (USD MILLION)

- TABLE 225 ASIA PACIFIC: DATA CENTER RACK MARKET, BY RACK WIDTH, 2025-2030 (USD MILLION)

- TABLE 226 ASIA PACIFIC: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 227 ASIA PACIFIC: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 228 ASIA PACIFIC: DATA CENTER RACK MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 229 ASIA PACIFIC: DATA CENTER RACK MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 230 ASIA PACIFIC: DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICAL, 2020-2024 (USD MILLION)

- TABLE 231 ASIA PACIFIC: DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICAL, 2025-2030 (USD MILLION)

- TABLE 232 ASIA PACIFIC: DATA CENTER RACK MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 233 ASIA PACIFIC: DATA CENTER RACK MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 234 CHINA: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 235 CHINA: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 236 CHINA: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 237 CHINA: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 238 CHINA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 239 CHINA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 240 JAPAN: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 241 JAPAN: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 242 JAPAN: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 243 JAPAN: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 244 JAPAN: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 245 JAPAN: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 246 INDIA: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 247 INDIA: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 248 INDIA: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 249 INDIA: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 250 INDIA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 251 INDIA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 252 HONG KONG: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 253 HONG KONG: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 254 HONG KONG: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 255 HONG KONG: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 256 HONG KONG: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 257 HONG KONG: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 258 REST OF ASIA PACIFIC: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 259 REST OF ASIA PACIFIC: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 260 REST OF ASIA PACIFIC: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 261 REST OF ASIA PACIFIC: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 262 REST OF ASIA PACIFIC: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 263 REST OF ASIA PACIFIC: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 268 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 270 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 271 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 272 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY RACK HEIGHT, 2020-2024 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY RACK HEIGHT, 2025-2030 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY RACK WIDTH, 2020-2024 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY RACK WIDTH, 2025-2030 (USD MILLION)

- TABLE 276 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICAL, 2020-2024 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICAL, 2025-2030 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 284 GCC COUNTRIES: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 285 GCC COUNTRIES: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 286 GCC COUNTRIES: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 287 GCC COUNTRIES: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 288 GCC COUNTRIES: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 289 GCC COUNTRIES: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 290 GCC COUNTRIES: DATA CENTER RACK MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 291 GCC COUNTRIES: DATA CENTER RACK MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 292 KSA: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 293 KSA: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 294 KSA: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 295 KSA: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 296 KSA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 297 KSA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 298 UAE: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 299 UAE: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 300 UAE: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 301 UAE: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 302 UAE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 303 UAE: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 304 REST OF GCC: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 305 REST OF GCC: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 306 REST OF GCC: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 307 REST OF GCC: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 308 REST OF GCC: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 309 REST OF GCC: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 310 SOUTH AFRICA: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 311 SOUTH AFRICA: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 312 SOUTH AFRICA: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 313 SOUTH AFRICA: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 314 SOUTH AFRICA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 315 SOUTH AFRICA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 316 REST OF MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 317 REST OF MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 318 REST OF MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 319 REST OF MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 320 REST OF MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 321 REST OF MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 322 LATIN AMERICA: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 323 LATIN AMERICA: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 324 LATIN AMERICA: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 325 LATIN AMERICA: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 326 LATIN AMERICA: DATA CENTER RACK MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 327 LATIN AMERICA: DATA CENTER RACK MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 328 LATIN AMERICA: DATA CENTER RACK MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 329 LATIN AMERICA: DATA CENTER RACK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 330 LATIN AMERICA: DATA CENTER RACK MARKET, BY RACK HEIGHT, 2020-2024 (USD MILLION)

- TABLE 331 LATIN AMERICA: DATA CENTER RACK MARKET, BY RACK HEIGHT, 2025-2030 (USD MILLION)

- TABLE 332 LATIN AMERICA: DATA CENTER RACK MARKET, BY RACK WIDTH, 2020-2024 (USD MILLION)

- TABLE 333 LATIN AMERICA: DATA CENTER RACK MARKET, BY RACK WIDTH, 2025-2030 (USD MILLION)

- TABLE 334 LATIN AMERICA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 335 LATIN AMERICA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 336 LATIN AMERICA: DATA CENTER RACK MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 337 LATIN AMERICA: DATA CENTER RACK MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 338 LATIN AMERICA: DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICAL, 2020-2024 (USD MILLION)

- TABLE 339 LATIN AMERICA: DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICAL, 2025-2030 (USD MILLION)

- TABLE 340 LATIN AMERICA: DATA CENTER RACK MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 341 LATIN AMERICA: DATA CENTER RACK MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 342 BRAZIL: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 343 BRAZIL: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 344 BRAZIL: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 345 BRAZIL: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 346 BRAZIL: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 347 BRAZIL: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 348 MEXICO: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 349 MEXICO: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 350 MEXICO: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 351 MEXICO: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 352 MEXICO: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 353 MEXICO: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 354 REST OF LATIN AMERICA: DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 355 REST OF LATIN AMERICA: DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 356 REST OF LATIN AMERICA: DATA CENTER RACK MARKET, BY RACK TYPE, 2020-2024 (USD MILLION)

- TABLE 357 REST OF LATIN AMERICA: DATA CENTER RACK MARKET, BY RACK TYPE, 2025-2030 (USD MILLION)

- TABLE 358 REST OF LATIN AMERICA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 359 REST OF LATIN AMERICA: DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 360 DATA CENTER RACK MARKET: DEGREE OF COMPETITION

- TABLE 361 REGION FOOTPRINT

- TABLE 362 RACK TYPE FOOTPRINT

- TABLE 363 RACK HEIGHT FOOTPRINT

- TABLE 364 ON-PREMISES/ENTERPRISE FOOTPRINT

- TABLE 365 DATA CENTER RACK MARKET: DETAILED LIST OF STARTUPS/SMES

- TABLE 366 DATA CENTER RACK MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 367 DATA CENTER RACK MARKET: PRODUCT LAUNCHES, JANUARY 2021-APRIL 2025

- TABLE 368 DATA CENTER RACK MARKET: DEALS, JANUARY 2021-APRIL 2025

- TABLE 369 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 370 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 371 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 372 SCHNEIDER ELECTRIC: DEALS

- TABLE 373 HPE: COMPANY OVERVIEW

- TABLE 374 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 375 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 376 HPE: DEALS

- TABLE 377 RITTAL: COMPANY OVERVIEW

- TABLE 378 RITTAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 379 RITTAL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 380 RITTAL: DEALS

- TABLE 381 EATON: COMPANY OVERVIEW

- TABLE 382 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 383 EATON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 384 EATON: DEALS

- TABLE 385 VERTIV: COMPANY OVERVIEW

- TABLE 386 VERTIV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 387 VERTIV: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 388 VERTIV: DEALS

- TABLE 389 DELL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 390 DELL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 391 DELL TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 392 DELL TECHNOLOGIES: DEALS

- TABLE 393 FUJITSU: COMPANY OVERVIEW

- TABLE 394 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 395 FUJITSU: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 396 FUJITSU: DEALS

- TABLE 397 IBM: COMPANY OVERVIEW

- TABLE 398 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 399 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 400 LEGRAND: COMPANY OVERVIEW

- TABLE 401 LEGRAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 402 LEGRAND: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 403 LEGRAND: DEALS

- TABLE 404 CISCO: COMPANY OVERVIEW

- TABLE 405 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 406 ADJACENT MARKETS AND FORECASTS

- TABLE 407 MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 408 MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 409 MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2019-2023 (USD MILLION)

- TABLE 410 MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2024-2030 (USD MILLION)

- TABLE 411 MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2019-2023 (USD MILLION)

- TABLE 412 MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2024-2030 (USD MILLION)

- TABLE 413 MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2019-2023 (USD MILLION)

- TABLE 414 MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2024-2030 (USD MILLION)

- TABLE 415 MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 416 MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2024-2030 (USD MILLION)

- TABLE 417 MODULAR DATA CENTER MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 418 MODULAR DATA CENTER MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 419 MODULAR DATA CENTER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 420 MODULAR DATA CENTER MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 421 DATA CENTER RACK SERVER MARKET, BY FORM FACTOR, 2017-2024 (USD BILLION)

- TABLE 422 DATA CENTER RACK SERVER MARKET, BY SERVICE, 2017-2024 (USD BILLION)

- TABLE 423 DATA CENTER RACK SERVER MARKET, BY TIER TYPE, 2017-2024 (USD BILLION)

- TABLE 424 DATA CENTER RACK SERVER MARKET, BY DATA CENTER TYPE, 2017-2024 (USD MILLION)

- TABLE 425 DATA CENTER RACK SERVER MARKET, BY VERTICAL, 2017-2024 (USD BILLION)

- TABLE 426 DATA CENTER RACK SERVER MARKET, BY REGION, 2017-2024 (USD BILLION)

List of Figures

- FIGURE 1 DATA CENTER RACK MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 DATA CENTER RACK MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE ANALYSIS): REVENUE FROM SERVICES IN DATA CENTER RACK MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE ANALYSIS): COLLECTIVE REVENUE FROM ALL SERVICES IN DATA CENTER RACK MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE ANALYSIS): COLLECTIVE REVENUE FROM ALL SERVICES IN DATA CENTER RACK MARKET

- FIGURE 8 DATA CENTER RACK MARKET, 2023-2030 (USD MILLION)

- FIGURE 9 DATA CENTER RACK MARKET, BY REGION, 2025

- FIGURE 10 RISING DEMAND FOR HYPERSCALE AND DATA CENTERS DRIVEN BY CLOUD COMPUTING, AI, & BIG DATA ANALYTICS

- FIGURE 11 SOLUTIONS AND US TO ACCOUNT FOR SIGNIFICANT SHARE IN 2025

- FIGURE 12 SOLUTIONS AND CHINA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2025

- FIGURE 13 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 14 ENCLOSED SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 15 SERVER RACKS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 16 INSTALLATION & DEPLOYMENT RACKS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 17 42U & BELOW SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 18 19 INCHES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 19 LARGE DATA CENTERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 20 ON-PREMISES/ENTERPRISE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 21 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DATA CENTER RACK MARKET

- FIGURE 23 BRIEF HISTORY OF DATA CENTER RACK MARKET

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY RACK HEIGHT, 2025

- FIGURE 26 DATA CENTER RACK MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 DATA CENTER RACK MARKET: ECOSYSTEM

- FIGURE 28 LIST OF MAJOR PATENTS FOR DATA CENTER RACK MARKET

- FIGURE 29 EXPORT SCENARIO FOR HS CODE 8471

- FIGURE 30 IMPORT SCENARIO FOR HS CODE 8471

- FIGURE 31 DATA CENTER RACK MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ON-PREMISES/ENTERPRISE VERTICALS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE ON-PREMISES/ENTERPRISE VERTICALS

- FIGURE 34 USE CASES OF GENERATIVE AI IN DATA CENTER RACK

- FIGURE 35 SOLUTIONS SEGMENT TO HOLD MAJOR SHARE DURING FORECAST PERIOD

- FIGURE 36 ENCLOSED RACK SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 37 INSTALLATION & DEPLOYMENT SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- FIGURE 38 SERVER RACK SEGMENT TO HOLD MAJOR SHARE DURING FORECAST PERIOD

- FIGURE 39 42U AND BELOW SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 40 19 INCHES SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 LARGE ENTERPRISE SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 42 ON-PREMISES/ENTERPRISE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 43 BFSI SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET BY 2030

- FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 47 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 48 SHARE OF LEADING COMPANIES IN DATA CENTER RACK MARKET, 2024

- FIGURE 49 DATA CENTER RACK MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 COMPANY FOOTPRINT

- FIGURE 51 DATA CENTER RACK MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 BRAND/PRODUCT COMPARISON

- FIGURE 53 COMPANY VALUATION

- FIGURE 54 VALUATION AND FINANCIAL METRICS OF KEY DATA CENTER RACK PLAYERS

- FIGURE 55 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 56 HPE: COMPANY SNAPSHOT

- FIGURE 57 EATON: COMPANY SNAPSHOT

- FIGURE 58 VERTIV: COMPANY SNAPSHOT

- FIGURE 59 DELL TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 60 FUJITSU: COMPANY SNAPSHOT

- FIGURE 61 IBM: COMPANY SNAPSHOT

- FIGURE 62 LEGRAND: COMPANY SNAPSHOT

- FIGURE 63 CISCO: COMPANY SNAPSHOT

The global data center rack market will grow from USD 5.17 billion in 2025 to USD 9.42 billion by 2030 at a compounded annual growth rate (CAGR) of 12.7% during the forecast period. Data center racks are widely used as data centers grow internationally, with the rise of cloud computing, IoT, AI, and big data analytics. The surging demand for colocation and hyperscale data centers boosts the use of high-density and energy-efficient scalable rack systems. Furthermore, the rise in edge computing is making it necessary for compact, flexible, and strong racks appropriate for remote or crowded locations. More attention to energy efficiency and using sustainable options leads organizations to choose racks that improve their airflow systems and combine advanced cooling.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Billion) |

| Segments | By Offering, Type, Rack Height, Rack Width, Data Center Size, Data Center Type, On-premises/Enterprise Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

A major restraint in this sector is the high cost for small and medium-sized firms to start with even basic advanced racks. Many companies find their data centers overcrowded and lack the infrastructure for updated systems. Integration with existing IT, supply chain issues, and thermal management in high-density systems also hinders market growth. Nonetheless, innovations in modular and intelligent racks are promoting expansion.

Based on services, the installation & deployment segment is expected to hold the largest market share during the forecast period

The installation & deployment segment is expected to hold the largest market share in the data center rack market during the forecast period due to the growing need for seamless integration of increasingly complex infrastructure. With data centers developing according to high-density computing and edge deployments, organizations and colocation vendors focus on professional services to correct rack configuration, cable routing and management, airflow planning, and power delivery.

Professional deployment services help reduce downtime, ensure regulatory compliance, and offer faster time-to-market for data center operations, making them extremely important in the fast-moving digital economy. In addition, the growing use of modular and prefabricated data centers has fueled demand for effective deployment services. As hyperscalers, cloud service providers, and enterprises continue to increase their data center presence to address the rising data demand, the installation & deployment segment will continue to facilitate effective, scalable, and affordable infrastructure deployment.

Based on the rack type, the server rack segment is expected to grow at the highest CAGR during the forecast period

The server rack segment is expected to grow at the highest CAGR during the forecast period due to the increasing demand for high-density computing and scalable IT infrastructure. With enterprises and hyperscale data centers increasing their IT operations for handling AI, big data analytics, and cloud computing, efficient and stable server deployment becomes a high-priority requirement. Server racks provide organized, secure, and space-efficient enclosures to install multiple servers, which results in better airflow management, easier maintenance, and better power distribution.

The rising need for edge computing and modular data centers drives demand for efficient, flexible, and space-saving server rack solutions with fast deployment. In addition, continued developments of rack designs to accommodate increasing power densities and cable management integration boost the attractiveness of server racks over other forms, making them a key growth factor within the changing data center environment.

Asia Pacific is expected to grow at the highest CAGR during the forecast period

Considering the boom in digital transformation, rapid adoption of the cloud, and the deployment of 5G and edge infrastructure, the Asia Pacific data center rack market is carving out a unique identity as the fastest-growing regional segment globally. China, India, and Japan are at the helm of this growth trajectory. China is the largest market, undergoing huge investments in hyperscale data centers by domestic giants and backed with government protocols such as the New Infrastructure Plan. India is the fastest-growing country, along with the Digital India campaign, which benefits startups on a large scale and the growing cloud footprint of global players.

There is an increasing demand for enclosed racks with integrated power and cooling to support high-density computing workloads such as AI and big data analytics. Modular, seismic-resistant, and wall-mount configuration racks are gaining popularity to cater to the requirements of various environments extending from hyperscale to the edge. Moreover, due to space constraints and environmental regulations, Singapore and Japan aim for sustainable and energy-efficient rack solutions.

Breakdown of primaries

We interviewed Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant data center rack market companies.

- By Company: Tier I: 35%, Tier II: 40%, and Tier III: 25%

- By Designation: C-Level Executives: 35%, Director Level: 25%, and Others: 40%

- By Region: North America: 30%, Europe: 25%, Asia Pacific: 35%, Rest of World: 10%

Some of the significant data center rack market vendors are Schneider Electric (France), HPE (US), Rittal (Germany), Eaton (Ireland), Vertiv (US), Dell Technologies (US), Fujitsu (Japan), IBM (US), Cisco (US) and Legrand (France).

Research coverage:

The market report covered the data center rack market across segments. We estimated the market size and growth potential for many segments based on offerings, rack type, rack height, rack width, data center size, data center type, and on-premises/enterprise verticals and regions. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product and service offerings, current trends, and critical market strategies.

Reasons to buy this report:

With information on the most accurate revenue estimates for the whole data center rack industry and its subsegments, the research will benefit market leaders and recent newcomers. Stakeholders will benefit from this report's understanding of the competitive environment, which will help them better position their companies and develop go-to-market strategies. The research offers information on the main market drivers, constraints, opportunities, and challenges, as well as aids players in understanding the pulse of the industry.

The report provides insights on the following pointers:

Analysis of key drivers (rapid growth in data generation and storage need from cloud computing, AI and IoT, Adoption of modular and edge data centers, driving demand for flexible rack systems, Rise in number of data center facilities across geographies, Increasing server density), restraints (space and power limitation in legacy data centers, high initial setup cost associated with advanced rack infrastructure), opportunities (innovation in thermal management and smart rack technologies, innovation in thermal management and smart rack technologies, Increasing hyperscale deployment), and challenges (integration with legacy infrastructure and backward capability, ensures physical security and compliance with data protection regulations), influencing the growth of the data center rack market.

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the data center rack market.

- Market Development: In-depth details regarding profitable markets: the paper examines the global data center rack market.

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, new goods and services, and the data center rack market.

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and service portfolios of the top competitors in the data center rack industry, such as Schneider Electric (France), HPE (US), IBM (US), Eaton (Ireland), Rittal (Germany), Dell Technologies (US), Fujitsu (China), Vertiv (US), Cisco (US), Legrand (France), CommScope (US), Oracle (US), Belden (US), Panduit (US), Huawei (China), NEC Corporation (Japan), Asus (Taiwan), Lenovo (Hong Kong), Great Lakes Data Racks & Cabinets (US), IMS Engineered Products (US), Black Box (US), Chatsworth Products (US), Cheval (Thailand), Iron Systems (US), Vantage Data Centers (US), Aligned Data Centers (US), Yotta Infrastructure (India), RackBank Datacenters (India), Inspur Systems (China), and nVent (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 GROWTH FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DATA CENTER RACK MARKET

- 4.2 NORTH AMERICA: DATA CENTER RACK MARKET, BY OFFERING & COUNTRY, 2025

- 4.3 ASIA PACIFIC: DATA CENTER RACK MARKET, BY OFFERING & COUNTRY, 2025

- 4.4 DATA CENTER RACK MARKET, BY OFFERING

- 4.5 DATA CENTER RACK MARKET, BY RACK TYPE

- 4.6 DATA CENTER RACK MARKET, BY TYPE

- 4.7 DATA CENTER RACK MARKET, BY SERVICES

- 4.8 DATA CENTER RACK MARKET, BY RACK HEIGHT

- 4.9 DATA CENTER RACK MARKET, BY RACK WIDTH

- 4.10 DATA CENTER RACK MARKET, BY DATA CENTER SIZE

- 4.11 DATA CENTER RACK MARKET, BY DATA CENTER TYPE

- 4.12 DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICALS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for data generation and storage needs from cloud computing, AI, and IoT

- 5.2.1.2 Adoption of modular and edge data centers

- 5.2.1.3 Surge in data center facilities across geographies

- 5.2.1.4 Increase in server and storage density

- 5.2.2 RESTRAINTS

- 5.2.2.1 Space and power limitations in legacy data centers

- 5.2.2.2 High initial setup cost associated with advanced rack infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Innovations in thermal management and smart rack technologies

- 5.2.3.2 Rising adoption of AI & ML workload, requiring optimized rack infrastructure

- 5.2.3.3 Surge in hyperscale deployment

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration of modular racks with legacy infrastructure and backward compatibility

- 5.2.4.2 Ensuring physical security and compliance with data protection regulations

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 BRIEF HISTORY OF DATA CENTER RACK MARKET

- 5.3.1.1 1990-2000

- 5.3.1.2 2000-2010

- 5.3.1.3 2010-2020

- 5.3.1.4 2020 to Present

- 5.3.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.3 PRICING ANALYSIS

- 5.3.3.1 Average selling price trend of key players, by rack height, 2025

- 5.3.3.2 Indicative pricing analysis of data center rack market, by rack height, 2025

- 5.3.4 SUPPLY CHAIN ANALYSIS

- 5.3.5 ECOSYSTEM/MARKET MAP

- 5.3.6 TECHNOLOGY ANALYSIS

- 5.3.6.1 Key technologies

- 5.3.6.1.1 Rack enclosures

- 5.3.6.1.2 Power distribution units

- 5.3.6.1.3 Cable management system

- 5.3.6.2 Complementary technologies

- 5.3.6.2.1 Uninterruptible Power Supplies (UPS)

- 5.3.6.2.2 Data center infrastructure management (DCIM) software

- 5.3.6.3 Adjacent technologies

- 5.3.6.3.1 Edge computing

- 5.3.6.3.2 Artificial intelligence (AI) & machine learning (ML)

- 5.3.6.3.3 Virtualization & cloud migration

- 5.3.6.1 Key technologies

- 5.3.7 PATENT ANALYSIS

- 5.3.7.1 Methodology

- 5.3.8 TRADE ANALYSIS

- 5.3.8.1 Export scenario

- 5.3.8.2 Import scenario

- 5.3.9 CASE STUDY ANALYSIS

- 5.3.9.1 AWC Inc. uses Rittal's custom rack to meet its clients' demand

- 5.3.9.2 SAGA powers telecom efficiency with Vertiv's integrated solutions

- 5.3.9.3 Riot Games reinvents Esports viewing experience with Cisco Solutions

- 5.3.10 KEY CONFERENCES & EVENTS, 2024-2025

- 5.3.11 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.11.1 Current business models

- 5.3.11.2 Emerging business models

- 5.3.12 BEST PRACTICES TO IMPLEMENT DATA CENTER RACKS

- 5.3.13 TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.3.14 FUTURE LANDSCAPE OF DATA CENTER RACK MARKET

- 5.3.14.1 Data center rack market roadmap till 2030

- 5.3.14.2 Short-term roadmap (2025-2026)

- 5.3.14.3 Mid-term roadmap (2027-2028)

- 5.3.14.4 Long-term roadmap (2029-2030)

- 5.3.15 TARRIF & REGULATORY LANDSCAPE

- 5.3.15.1 Tariff related to HS Code 8471

- 5.3.15.2 Regulatory bodies, government agencies, and other organizations

- 5.3.15.3 American National Standards Institute

- 5.3.15.4 Electronic Industries Alliance

- 5.3.15.5 Telecommunications Industry Association

- 5.3.15.6 National Electrical Manufacturers Association

- 5.3.16 PORTER'S FIVE FORCES ANALYSIS

- 5.3.16.1 Threat of new entrants

- 5.3.16.2 Threat of substitutes

- 5.3.16.3 Bargaining power of buyers

- 5.3.16.4 Bargaining power of suppliers

- 5.3.16.5 Intensity of competitive rivalry

- 5.3.17 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.17.1 Key stakeholders in buying process

- 5.3.17.2 Buying criteria

- 5.3.18 INVESTMENT AND FUNDING SCENARIO

- 5.3.19 INTRODUCTION TO ARTIFICIAL INTELLIGENCE AND GENERATIVE AI

- 5.3.19.1 Impact of generative AI on data center racks

- 5.3.19.2 Use cases of generative AI in data center racks

- 5.3.19.3 Future of generative AI in data center rack market

- 5.3.20 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.3.20.1 Introduction

- 5.3.20.2 Key tariff rates

- 5.3.20.3 Price impact analysis

- 5.3.20.4 Impact on country/region

- 5.3.20.4.1 North America

- 5.3.20.4.1.1 United States

- 5.3.20.4.1.2 Canada

- 5.3.20.4.1.3 Mexico

- 5.3.20.4.2 Europe

- 5.3.20.4.2.1 Germany

- 5.3.20.4.2.2 France

- 5.3.20.4.2.3 United Kingdom

- 5.3.20.4.3 Asia Pacific

- 5.3.20.4.3.1 China

- 5.3.20.4.3.2 India

- 5.3.20.4.3.3 Australia

- 5.3.20.4.1 North America

- 5.3.21 ANALYSIS OF OFFERING BY RACK DEPTH, BY KEY PLAYERS

- 5.3.1 BRIEF HISTORY OF DATA CENTER RACK MARKET

6 DATA CENTER RACK MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: DATA CENTER RACK MARKET DRIVERS

- 6.2 SOLUTION

- 6.2.1 RACK TYPE

- 6.2.1.1 Data center rack leveraged for efficient utilization in data centers

- 6.2.1.2 Open frame

- 6.2.1.2.1 Help in cooling and operational agility in large-scale infrastructure

- 6.2.1.3 Enclosed

- 6.2.1.3.1 Improve cooling and noise control in data centers

- 6.2.1.4 Others

- 6.2.1 RACK TYPE

- 6.3 SERVICES

- 6.3.1 DESIGN & CONSULTING

- 6.3.1.1 Enhancing efficiency in data center rack deployment

- 6.3.2 INSTALLATION & DEPLOYMENT

- 6.3.2.1 Optimizing performance through professional rack deployment services

- 6.3.3 SUPPORT & MAINTENANCE

- 6.3.3.1 Maximizing lifespan and efficiency through rack support services

- 6.3.1 DESIGN & CONSULTING

7 DATA CENTER RACK MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.1.1 TYPE: DATA CENTER RACK MARKET DRIVERS

- 7.2 SERVER RACKS

- 7.2.1 ENHANCE SERVER MANAGEMENT BY UTILIZING RACK SOLUTIONS

- 7.3 NETWORK RACKS

- 7.3.1 ENHANCE NETWORK RELIABILITY THROUGH STRUCTURED RACK SOLUTIONS

8 DATA CENTER RACK MARKET, BY RACK HEIGHT

- 8.1 INTRODUCTION

- 8.1.1 RACK HEIGHT: DATA CENTER RACK MARKET DRIVERS

- 8.2 42U AND BELOW

- 8.2.1 INCREASING DEMAND IN MEDIUM-SIZED DATA CENTERS, REMOTE OFFICES, AND EDGE COMPUTING ENVIRONMENTS

- 8.3 43U-52U

- 8.3.1 WIDE DEPLOYMENT IN ENTERPRISE AND COLOCATION DATA CENTERS

- 8.4 ABOVE 52U

- 8.4.1 RISING DEMAND IN HYPERSCALE, CLOUD, AND LARGE ENTERPRISE ENVIRONMENTS WITH ADVANCED THERMAL DESIGNS

9 DATA CENTER RACK MARKET, BY RACK WIDTH

- 9.1 INTRODUCTION

- 9.1.1 RACK WIDTH: DATA CENTER RACK MARKET DRIVERS

- 9.2 19 INCHES

- 9.2.1 ENHANCING INTEROPERABILITY BUILDING SCALABLE AND FLEXIBLE IT ENVIRONMENTS

- 9.3 23 INCHES

- 9.3.1 SURGING DEMAND IN TELECOMMUNICATIONS AND NETWORK ENVIRONMENTS

- 9.4 OTHER RACK WIDTHS

10 DATA CENTER RACK MARKET, BY DATA CENTER SIZE

- 10.1 INTRODUCTION

- 10.1.1 DATA CENTER SIZE: DATA CENTER RACK MARKET DRIVERS

- 10.2 SMALL & MID-SIZED DATA CENTERS

- 10.2.1 RISING NEED FOR COMPACT RACKS IN REMOTE OFFICES OR EDGE COMPUTING DEPLOYMENTS

- 10.3 LARGE DATA CENTERS

- 10.3.1 SUPPORTING HIGH-PERFORMANCE WORKLOADS WITH ROBUST RACK ARCHITECTURE

11 DATA CENTER RACK MARKET, BY DATA CENTER TYPE

- 11.1 INTRODUCTION

- 11.1.1 DATA CENTER TYPE: DATA CENTER RACK MARKET DRIVERS

- 11.2 ON-PREMISES/ENTERPRISE

- 11.2.1 ENHANCE PERFORMANCE, INTEGRATION, AND SECURITY

- 11.3 COLOCATION

- 11.3.1 PROVIDE MODULAR RACK INFRASTRUCTURE, EMPHASIZING SCALABILITY AND STANDARDIZATION

- 11.4 HYPERSCALE

- 11.4.1 DEPLOY HIGH-DENSITY, MODULAR RACKS FOR AI-DRIVEN HYPERSCALE WORKLOADS

12 DATA CENTER RACK MARKET, BY ON-PREMISES/ENTERPRISE VERTICALS

- 12.1 INTRODUCTION

- 12.1.1 ON-PREMISES/ENTERPRISE VERTICAL: DATA CENTER RACK MARKET DRIVERS

- 12.2 BFSI

- 12.2.1 HIGH-DENSITY, HIGH-SECURITY RACK SOLUTIONS POWERING IT INFRASTRUCTURE

- 12.2.2 USE CASES: CORE BANKING INFRASTRUCTURE

- 12.2.3 USE CASES: DATA ENCRYPTION & SECURITY APPLICANCE

- 12.3 IT & TELECOM

- 12.3.1 FLEXIBLE DATA CENTER RACKS FOR RAPIDLY EVOLVING IT & TELECOM NETWORKS

- 12.3.2 USE CASES: NETWORK INFRASTRUCTURE HOSTING

- 12.3.3 USE CASES: EDGE COMPUTING & DISTRIBUTED DATA CENTERS

- 12.4 GOVERNMENT & DEFENSE

- 12.4.1 MODULAR AND SCALABLE RACKS SUPPORTING SECURE GOVERNMENT AND DEFENSE WORKLOADS

- 12.4.2 USE CASES: CLASSIFIED DATA STORAGE & PROCESSING

- 12.4.3 USE CASES: DISASTER RECOVERY & CONTINUITY OF OPERATIONS

- 12.5 RETAIL

- 12.5.1 SCALABLE AND SECURE RACK SOLUTIONS ENSURING UPTIME AND PERFORMANCE FOR RETAIL E-COMMERCE AND POS SYSTEMS

- 12.5.2 USE CASES: E-COMMERCE PLATFORM HOSTING

- 12.5.3 USE CASES: INVENTORY & SUPPLY CHAIN MANAGEMENT

- 12.6 MANUFACTURING

- 12.6.1 DURABLE AND EFFICIENT RACKS SUPPORTING INDUSTRIAL IT INFRASTRUCTURE

- 12.6.2 USE CASES: INDUSTRIAL IOT AND SENSOR DATA PROCESSING

- 12.6.3 USE CASES: PREDICTIVE MAINTENANCE & ASSET MANAGEMENT

- 12.7 ENERGY & UTILITIES

- 12.7.1 MODULAR DESIGNS FOR ENHANCED ENERGY INFRASTRUCTURE MANAGEMENT

- 12.7.2 USE CASES: SUPERVISORY CONTROL & DATA ACQUISITION

- 12.7.3 USE CASES: INVENTORY & SUPPLY CHAIN MANAGEMENT

- 12.8 HEALTHCARE

- 12.8.1 DATA CENTER RACKS ENSURING CONTINUOUS UPTIME FOR MEDICAL APPLICATIONS

- 12.8.2 USE CASES: ELECTRONIC HEALTH RECORD MANAGEMENT

- 12.8.3 USE CASES: MEDICAL IMAGING & DIAGNOSTICS

- 12.9 OTHER VERTICALS

13 DATA CENTER MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: DATA CENTER RACK MARKET DRIVERS

- 13.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 13.2.3 US

- 13.2.3.1 Public-Private initiatives to demand advanced racks for sustainability

- 13.2.4 CANADA

- 13.2.4.1 55H expansion highlights surge in demand for high-density data center racks

- 13.3 EUROPE

- 13.3.1 EUROPE: DATA CENTER RACK MARKET DRIVERS

- 13.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 13.3.3 WESTERN EUROPE

- 13.3.3.1 UK

- 13.3.3.1.1 Government backing to boost use of data center racks

- 13.3.3.2 Germany

- 13.3.3.2.1 Building 24MW+ data center to boost demand for high-density racks

- 13.3.3.3 France

- 13.3.3.3.1 Eclairion and BSO to lead demand for high-density data center racks

- 13.3.3.4 Rest of Western Europe

- 13.3.3.1 UK

- 13.3.4 SOUTHERN EUROPE

- 13.3.4.1 Italy

- 13.3.4.1.1 Need for specialized racks in AI, 5G, and quantum computing to drive market

- 13.3.4.2 Rest of Southern Europe

- 13.3.4.1 Italy

- 13.3.5 NORTHERN EUROPE

- 13.3.5.1 Rising investments in AI and high-performance computing to drive market

- 13.3.6 EASTERN EUROPE

- 13.3.6.1 Microsoft's Poland investment to fuel demand for data centers

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: DATA CENTER RACK MARKET DRIVERS

- 13.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 13.4.3 CHINA

- 13.4.3.1 Data center investment project to increase demand in new infrastructure

- 13.4.4 JAPAN

- 13.4.4.1 Rising demand for high-performance computing to drive market

- 13.4.5 INDIA

- 13.4.5.1 NSE to construct large data center equipped with 1,500 racks to facilitate faster trading

- 13.4.6 HONG KONG

- 13.4.6.1 Leveraging modular rack systems to support Cloud and AI expansion

- 13.4.7 REST OF ASIA PACIFIC

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 MIDDLE EAST & AFRICA: DATA CENTER RACK MARKET DRIVERS

- 13.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 13.5.3 GCC COUNTRIES

- 13.5.3.1 KSA

- 13.5.3.1.1 Deployment of ultra-dense GPU platforms and rack-scale total liquid cooling solutions to drive market

- 13.5.3.2 UAE

- 13.5.3.2.1 Rising demand for modular and high-density racks to drive market

- 13.5.3.3 Rest of GCC countries

- 13.5.3.1 KSA

- 13.5.4 SOUTH AFRICA

- 13.5.4.1 Major infrastructure investments and energy-efficient innovations to drive demand for rack deployment

- 13.5.5 REST OF MIDDLE EAST & AFRICA

- 13.6 LATIN AMERICA

- 13.6.1 LATIN AMERICA: DATA CENTER RACK MARKET DRIVERS

- 13.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 13.6.3 BRAZIL

- 13.6.3.1 OData's renewable energy commitment to boost demand for sustainable racks

- 13.6.4 MEXICO

- 13.6.4.1 Major infrastructure projects to drive market

- 13.6.5 REST OF LATIN AMERICA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 14.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY DATA CENTER RACK PLAYERS

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Rack type footprint

- 14.5.5.4 Rack height footprint

- 14.5.5.5 On-premises/Enterprise vertical footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.6.5.1 Detailed list of key Startups/SMEs

- 14.6.5.2 Competitive benchmarking of Startups/SMEs

- 14.7 BRAND/PRODUCT COMPARISON

- 14.8 COMPANY VALUATION AND FINANCIAL METRICS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS

- 15.2.1 SCHNEIDER ELECTRIC

- 15.2.1.1 Business overview

- 15.2.1.2 Products/Solutions/Services offered

- 15.2.1.3 Recent developments

- 15.2.1.3.1 Product launches and enhancements

- 15.2.1.3.2 Deals

- 15.2.1.4 MnM view

- 15.2.1.4.1 Right to win

- 15.2.1.4.2 Strategic choices

- 15.2.1.4.3 Weaknesses and competitive threats

- 15.2.2 HPE

- 15.2.2.1 Business overview

- 15.2.2.2 Products/Solutions/Services offered

- 15.2.2.3 Recent developments

- 15.2.2.3.1 Product launches and enhancements

- 15.2.2.3.2 Deals

- 15.2.2.4 MnM view

- 15.2.2.4.1 Right to win

- 15.2.2.4.2 Strategic choices

- 15.2.2.4.3 Weaknesses and competitive threats

- 15.2.3 RITTAL

- 15.2.3.1 Business overview

- 15.2.3.2 Products/Solutions/Services offered

- 15.2.3.3 Recent developments

- 15.2.3.3.1 Product launches and enhancements

- 15.2.3.3.2 Deals

- 15.2.3.4 MnM view

- 15.2.3.4.1 Right to win

- 15.2.3.4.2 Strategic choices

- 15.2.3.4.3 Weaknesses and competitive threats

- 15.2.4 EATON

- 15.2.4.1 Business overview

- 15.2.4.2 Products/Solutions/Services offered

- 15.2.4.3 Recent developments

- 15.2.4.3.1 Product launches and enhancements

- 15.2.4.3.2 Deals

- 15.2.4.4 MnM view

- 15.2.4.4.1 Right to win

- 15.2.4.4.2 Strategic choices

- 15.2.4.4.3 Weaknesses and competitive threats

- 15.2.5 VERTIV

- 15.2.5.1 Business overview

- 15.2.5.2 Products/Solutions/Services offered

- 15.2.5.3 Recent developments

- 15.2.5.3.1 Product launches and enhancements

- 15.2.5.3.2 Deals

- 15.2.5.4 MnM view

- 15.2.5.4.1 Right to win

- 15.2.5.4.2 Strategic choices

- 15.2.5.4.3 Weaknesses and competitive threats

- 15.2.6 DELL TECHNOLOGIES

- 15.2.6.1 Business overview

- 15.2.6.2 Products/Solutions/Services offered

- 15.2.6.3 Recent developments

- 15.2.6.3.1 Product launches and enhancements

- 15.2.6.3.2 Deals

- 15.2.7 FUJITSU

- 15.2.7.1 Business overview

- 15.2.7.2 Products/Solutions/Services offered

- 15.2.7.3 Recent developments

- 15.2.7.3.1 Product launches and enhancements

- 15.2.7.3.2 Deals

- 15.2.8 IBM

- 15.2.8.1 Business overview

- 15.2.8.2 Products/Solutions/Services offered

- 15.2.8.3 Recent developments

- 15.2.8.3.1 Product launches and enhancements

- 15.2.9 LEGRAND

- 15.2.9.1 Business overview

- 15.2.9.2 Products/Solutions/Services offered

- 15.2.9.3 Recent developments

- 15.2.9.3.1 Product launches and enhancements

- 15.2.9.3.2 Deals

- 15.2.10 CISCO

- 15.2.10.1 Business overview

- 15.2.10.2 Products/Solutions/Services offered

- 15.2.1 SCHNEIDER ELECTRIC

- 15.3 OTHER PLAYERS

- 15.3.1 COMMSCOPE

- 15.3.2 ORACLE

- 15.3.3 BELDEN

- 15.3.4 PANDUIT

- 15.3.5 LENOVO

- 15.3.6 BLACK BOX

- 15.3.7 HUAWEI

- 15.3.8 NEC CORPORATION

- 15.3.9 ASUS

- 15.3.10 NVENT

- 15.4 STARTUP/SMES

- 15.4.1 GREAT LAKES DATA RACKS & CABINETS

- 15.4.2 IMS ENGINEERED PRODUCTS

- 15.4.3 CHEVAL

- 15.4.4 YOTTA INFRASTRUCTURE

- 15.4.5 CHATSWORTH PRODUCTS

- 15.4.6 IRON SYSTEMS

- 15.4.7 INSPUR SYSTEMS

- 15.4.8 RACKBANK DATACENTERS

- 15.4.9 VANTAGE DATA CENTERS

- 15.4.10 ALIGNED DATA CENTERS

16 ADJACENT/RELATED MARKETS

- 16.1 INTRODUCTION TO ADJACENT MARKETS

- 16.2 LIMITATIONS

- 16.3 MODULAR DATA CENTER MARKET

- 16.3.1 MARKET DEFINITION

- 16.4 DATA CENTER RACK SERVER MARKET

- 16.4.1 MARKET DEFINITION

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS